LAWS20060 Taxation Law of Australia Assignment: Term 1, 2019

VerifiedAdded on 2022/12/26

|12

|3385

|68

Homework Assignment

AI Summary

This taxation law assignment explores various aspects of Australian tax law. It addresses depreciation of assets based on Taxation Ruling TR 2018/4, tax offsets, and the top tax rate for residents in 2018/19. The assignment examines tax exemptions for permanent residents, CGT events, and the computation of income tax under the Income Tax Assessment Act 1997. It delves into tax deductions, distinguishing between average and marginal tax rates, and defining consumption tax. The assignment then analyzes specific scenarios, such as deductible expenses for business loans, mobile phone usage, and childcare costs, as well as capital gains tax events (CGT F2 and B1). The final section includes a capital gains tax computation for Chris, detailing the sale of BHP and Wesfarmers shares.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Author Note

Taxation Law

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Q. 1.

a)

The life of the assets that can be depreciated is covered under the Taxation Ruling TR

2018/41. This ruling provides for the method that the commissioner needs to follow while

computing the depreciation of such assets for the tax purposes.

b)

The tax offsets that are available to a person has been provided under division 13 of the

Act2.

c)

54,097 with an additional of 45% for 180, 001 or above is the top rate of tax that is

available to a resident taxpayer in the year 2108/19.

d)

permanent resident of a person paying the tax is exempt from tax under section 118.10 of

the Act3.

e)

The CGT event B1, as provided under section 104.15 of the Act4, subjects the right of a

person relating to the enjoyment and utilisation of a CGT asset to tax even before the actual

passing over of the title of ownership.

1 The Taxation Ruling TR 2018/4

2 The Income Tax Assessment Act 1997 (Cth), div 13

3 The Income Tax Assessment Act 1997 (Cth), s 118.10

4 The Income Tax Assessment Act 1997 (Cth), s 104.15

Q. 1.

a)

The life of the assets that can be depreciated is covered under the Taxation Ruling TR

2018/41. This ruling provides for the method that the commissioner needs to follow while

computing the depreciation of such assets for the tax purposes.

b)

The tax offsets that are available to a person has been provided under division 13 of the

Act2.

c)

54,097 with an additional of 45% for 180, 001 or above is the top rate of tax that is

available to a resident taxpayer in the year 2108/19.

d)

permanent resident of a person paying the tax is exempt from tax under section 118.10 of

the Act3.

e)

The CGT event B1, as provided under section 104.15 of the Act4, subjects the right of a

person relating to the enjoyment and utilisation of a CGT asset to tax even before the actual

passing over of the title of ownership.

1 The Taxation Ruling TR 2018/4

2 The Income Tax Assessment Act 1997 (Cth), div 13

3 The Income Tax Assessment Act 1997 (Cth), s 118.10

4 The Income Tax Assessment Act 1997 (Cth), s 104.15

2TAXATION LAW

f)

The computation of the income tax of a person has been provided under section 4.10(3) of

the Act5. This section requires the product of income multiplied by the rate of tax by the tax

offsets.

g)

It has been held in the case of FC of T v Day 2008 ATC 20-0646 that the losses or costs

that a person making the payment of tax makes in the generation of income, which is taxable

will be allowed as a deduction by virtue of section 8.1 of the Act7. In this regard, it needs to

be contended that the deduction is only allowed to the person, if the cost has been playing a

role in the generation of his taxable income. In the background of this decision, the expenses

that has been incurred by the taxpayer for the with a domestic essence was being construed as

an expense not allowed as a deduction. However, with this case, the assessment of the same

as a contribution to the generation of profit is required to be considered.

h)

To draw the differences existing among average tax rate and marginal tax rate, the

implementation of the same is required to be considered. Average tax rate is computed with

respect to the entire income of the taxpayer, which is taxable. But marginal tax rate is needed

to be assessed with respect to the increments that occurs in the taxable income of the person

paying the tax. In this context, it can be said that for the determination of average tax rate the

taxable income in its entirety needs to be taken. However, for the purpose of the marginal tax

rate, only that part of the income will be considered, that has been occurred as an increment

to the already existing taxable income. Hence, it can be stated that marginal rate of tax is

concerned towards the increment or any escalation that has occurred in the total income of a

5 The Income Tax Assessment Act 1997 (Cth), s 4.10(3)

6 FC of T v Day 2008 ATC 20-064

7 The Income Tax Assessment Act 1997 (Cth), s 8.1

f)

The computation of the income tax of a person has been provided under section 4.10(3) of

the Act5. This section requires the product of income multiplied by the rate of tax by the tax

offsets.

g)

It has been held in the case of FC of T v Day 2008 ATC 20-0646 that the losses or costs

that a person making the payment of tax makes in the generation of income, which is taxable

will be allowed as a deduction by virtue of section 8.1 of the Act7. In this regard, it needs to

be contended that the deduction is only allowed to the person, if the cost has been playing a

role in the generation of his taxable income. In the background of this decision, the expenses

that has been incurred by the taxpayer for the with a domestic essence was being construed as

an expense not allowed as a deduction. However, with this case, the assessment of the same

as a contribution to the generation of profit is required to be considered.

h)

To draw the differences existing among average tax rate and marginal tax rate, the

implementation of the same is required to be considered. Average tax rate is computed with

respect to the entire income of the taxpayer, which is taxable. But marginal tax rate is needed

to be assessed with respect to the increments that occurs in the taxable income of the person

paying the tax. In this context, it can be said that for the determination of average tax rate the

taxable income in its entirety needs to be taken. However, for the purpose of the marginal tax

rate, only that part of the income will be considered, that has been occurred as an increment

to the already existing taxable income. Hence, it can be stated that marginal rate of tax is

concerned towards the increment or any escalation that has occurred in the total income of a

5 The Income Tax Assessment Act 1997 (Cth), s 4.10(3)

6 FC of T v Day 2008 ATC 20-064

7 The Income Tax Assessment Act 1997 (Cth), s 8.1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

person, which is taxable. But the average tax rate is required to be concerned with the whole

amount of taxable income that a person has earned in an income year. The target of the

average rate of tax is the total taxable income of a taxpayer. But the target of the marginal

rate of tax is the increment for the escalation in the income that has occurred in the total

taxable income of a person.

i)

Consumption tax implies a tax, which is levied upon the goods or services, that a consumer has

consumed. It is to be noticed that the consumption tax is levied upon the consumption and not on the

goods or services. This kind of tax includes excise duties, sales tax and other duties and taxes that a

consumer availing services or goods is required to pay. This kind of taxes are levied over the price of

the goods or services availed. It can be paid directly or it can also be paid indirectly.

Q. 2.

a)

The losses or costs that person making the payment of tax makes in the generation of

income, which is taxable will be allowed as a deduction by virtue of section 8.1 of the Act8.

In this regard, it needs to be contended that the deduction is only allowed to the person, if the

cost has been playing a role in the generation of his taxable income. In the present situation,

the interest that he has incurred as an expense for the loan that he has taken for making

payment to the employees with respect to wages needed to be treated as a cost that has been

incurred for the purpose of business, which will earn him taxable income. The loan was

secured with respect to his personal home will not be considered in this case as the loan has

been availed for the purpose of generating income, the cost will be allowed as deduction

under the section.

8 The Income Tax Assessment Act 1997 (Cth), s 8.1

person, which is taxable. But the average tax rate is required to be concerned with the whole

amount of taxable income that a person has earned in an income year. The target of the

average rate of tax is the total taxable income of a taxpayer. But the target of the marginal

rate of tax is the increment for the escalation in the income that has occurred in the total

taxable income of a person.

i)

Consumption tax implies a tax, which is levied upon the goods or services, that a consumer has

consumed. It is to be noticed that the consumption tax is levied upon the consumption and not on the

goods or services. This kind of tax includes excise duties, sales tax and other duties and taxes that a

consumer availing services or goods is required to pay. This kind of taxes are levied over the price of

the goods or services availed. It can be paid directly or it can also be paid indirectly.

Q. 2.

a)

The losses or costs that person making the payment of tax makes in the generation of

income, which is taxable will be allowed as a deduction by virtue of section 8.1 of the Act8.

In this regard, it needs to be contended that the deduction is only allowed to the person, if the

cost has been playing a role in the generation of his taxable income. In the present situation,

the interest that he has incurred as an expense for the loan that he has taken for making

payment to the employees with respect to wages needed to be treated as a cost that has been

incurred for the purpose of business, which will earn him taxable income. The loan was

secured with respect to his personal home will not be considered in this case as the loan has

been availed for the purpose of generating income, the cost will be allowed as deduction

under the section.

8 The Income Tax Assessment Act 1997 (Cth), s 8.1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

b)

The losses and expenses that can be claimed as a deduction under section 8.1 of the Act9

will be extended do a person paying the tax, only if the same has made a contribution for the

generation of income. Costs and expenditure is incurred for personal purposes cannot be

claimed as a deduction. However, if a particular expense can be said to have contributed to

both personal benefit and income purpose, then that part of the expense, which has been used

for the income earning purpose will be allowed as deduction. In the present case Julie has

incurred expense of $500 on the mobile phone. However, she contended that she used the

mobile, 60% for making business calls and the rest for her personal use. Hence, she will be

allowed for deduction of $300 only and the rest will not be allowed as deduction.

c)

The losses and expenses that can be claimed as a deduction under section 8.1 of the Act10

will be extended do a person paying the tax, only if the same has made a contribution for the

generation of income. Costs and expenditure is incurred for personal purposes cannot be

claimed as a deduction. Any expense that a person paying the tax incurs for a domestic

purpose, will not be treated as a deduction. In the present case, Sally made a payment of

$1200 to her babysitter for minding her children, so that she can go to work carefree. This

cannot be treated as an expenditure, which has been made in the furtherance of income

generation and hence it will not be allowed as deduction under the section.

d)

Any loss that a tax payer suffers with respect to his financial resources, having the effect

of reducing the same will be allowed as a deduction under section 8.1 of the Act11. A stolen

property of the taxpayer will also be considered to be a loss and will also be allowed as a

9 The Income Tax Assessment Act 1997 (Cth), s 8.1

10 The Income Tax Assessment Act 1997 (Cth), s 8.1

11 The Income Tax Assessment Act 1997 (Cth), s 8.1

b)

The losses and expenses that can be claimed as a deduction under section 8.1 of the Act9

will be extended do a person paying the tax, only if the same has made a contribution for the

generation of income. Costs and expenditure is incurred for personal purposes cannot be

claimed as a deduction. However, if a particular expense can be said to have contributed to

both personal benefit and income purpose, then that part of the expense, which has been used

for the income earning purpose will be allowed as deduction. In the present case Julie has

incurred expense of $500 on the mobile phone. However, she contended that she used the

mobile, 60% for making business calls and the rest for her personal use. Hence, she will be

allowed for deduction of $300 only and the rest will not be allowed as deduction.

c)

The losses and expenses that can be claimed as a deduction under section 8.1 of the Act10

will be extended do a person paying the tax, only if the same has made a contribution for the

generation of income. Costs and expenditure is incurred for personal purposes cannot be

claimed as a deduction. Any expense that a person paying the tax incurs for a domestic

purpose, will not be treated as a deduction. In the present case, Sally made a payment of

$1200 to her babysitter for minding her children, so that she can go to work carefree. This

cannot be treated as an expenditure, which has been made in the furtherance of income

generation and hence it will not be allowed as deduction under the section.

d)

Any loss that a tax payer suffers with respect to his financial resources, having the effect

of reducing the same will be allowed as a deduction under section 8.1 of the Act11. A stolen

property of the taxpayer will also be considered to be a loss and will also be allowed as a

9 The Income Tax Assessment Act 1997 (Cth), s 8.1

10 The Income Tax Assessment Act 1997 (Cth), s 8.1

11 The Income Tax Assessment Act 1997 (Cth), s 8.1

5TAXATION LAW

deduction as this has the effect of reducing his resources. In this case, the property worth

$20000 belonging to Jerry has been stolen by an employee of his. This property has belonged

to his business, hence, the loss incurred will be treated as a deduction.

e)

Any expense incurred by taxpayer while preparing for a particular endeavour or business,

which has the prospect of earning income will not be allowed or permitted as a deduction

under section 8.1 of the Act12. In this case, the taxpayer has incurred an expenditure for

contesting local government election. The expense amounted to $5,000 along with $2000 that

he has spent on a big party contesting in the election. This needs to be viewed as an expense

incurred for the preparation of a venture for business and will not be allowed under this

section as a deduction.

Q. 3.

a)

When the ground is rented on a lease by the owner of the same, the event falls within the

CGT event F2. This also include subleasing, grant, renewal or even an extension with respect

to a long-term lease. It will be considered as an event to CGT event F2 and will not be e

eligible for the 50% discount under Div 115 of the Act13. In the case, Andy is the owner of

the land and he has rented his land to Brian on a lease for a premium amounting to $5000.

Being the owner of the land, the proceeds of the lease will be treated under taxation as a CGT

event F2 and no 50% discount will be applicable.

b)

12 The Income Tax Assessment Act 1997 (Cth), s 8.1

13 The Income Tax Assessment Act 1997 (Cth), div 115

deduction as this has the effect of reducing his resources. In this case, the property worth

$20000 belonging to Jerry has been stolen by an employee of his. This property has belonged

to his business, hence, the loss incurred will be treated as a deduction.

e)

Any expense incurred by taxpayer while preparing for a particular endeavour or business,

which has the prospect of earning income will not be allowed or permitted as a deduction

under section 8.1 of the Act12. In this case, the taxpayer has incurred an expenditure for

contesting local government election. The expense amounted to $5,000 along with $2000 that

he has spent on a big party contesting in the election. This needs to be viewed as an expense

incurred for the preparation of a venture for business and will not be allowed under this

section as a deduction.

Q. 3.

a)

When the ground is rented on a lease by the owner of the same, the event falls within the

CGT event F2. This also include subleasing, grant, renewal or even an extension with respect

to a long-term lease. It will be considered as an event to CGT event F2 and will not be e

eligible for the 50% discount under Div 115 of the Act13. In the case, Andy is the owner of

the land and he has rented his land to Brian on a lease for a premium amounting to $5000.

Being the owner of the land, the proceeds of the lease will be treated under taxation as a CGT

event F2 and no 50% discount will be applicable.

b)

12 The Income Tax Assessment Act 1997 (Cth), s 8.1

13 The Income Tax Assessment Act 1997 (Cth), div 115

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

The CGT event B1, as provided under section 104.15 of the Act14, subjects the right of a

person relating to the enjoyment and utilisation of a CGT asset to tax even before the actual

passing over of the title of ownership. Under this event, the taxpayer can also claim the 50%

discount under Div 115 of the Act15. In this case, John has granted Farm Ltd with a chance to

buy his 100-acre farm for just $800000 for an additional payment of $40,000. This farm has

been bought by John 10 years ago. Hence, this will be taxed as a CGT event B1 and the

discount of 50% will be available.

c)

A permanent residence of a taxpayer is exempted from capital gain tax under section

118.10 of the Act16. For the purpose of claiming this exemption, the person paying the tax

needs to have resided in that property. The renting and leasing of the same will not help him

for availing the exemption. The sale proceeds of such a house will be exempted from

taxation. In this case, Olivia and Jamie bought the house in 2006. After that, they rented it for

2 years and travelled. In 2008, they started living in the house as their main residence.

However, in 2018, they decided to sell the house. The proceed of $300000 has been gained

from that sale. It can be construed that, this house has been treated as a resident for certain

period and as a rented house for certain period. Hence, the part of the proceeds will be

exempted from being taxed and the part of the proceeds will be taxed and will be allowed the

discount of 50% under Div 115 of the Act17.

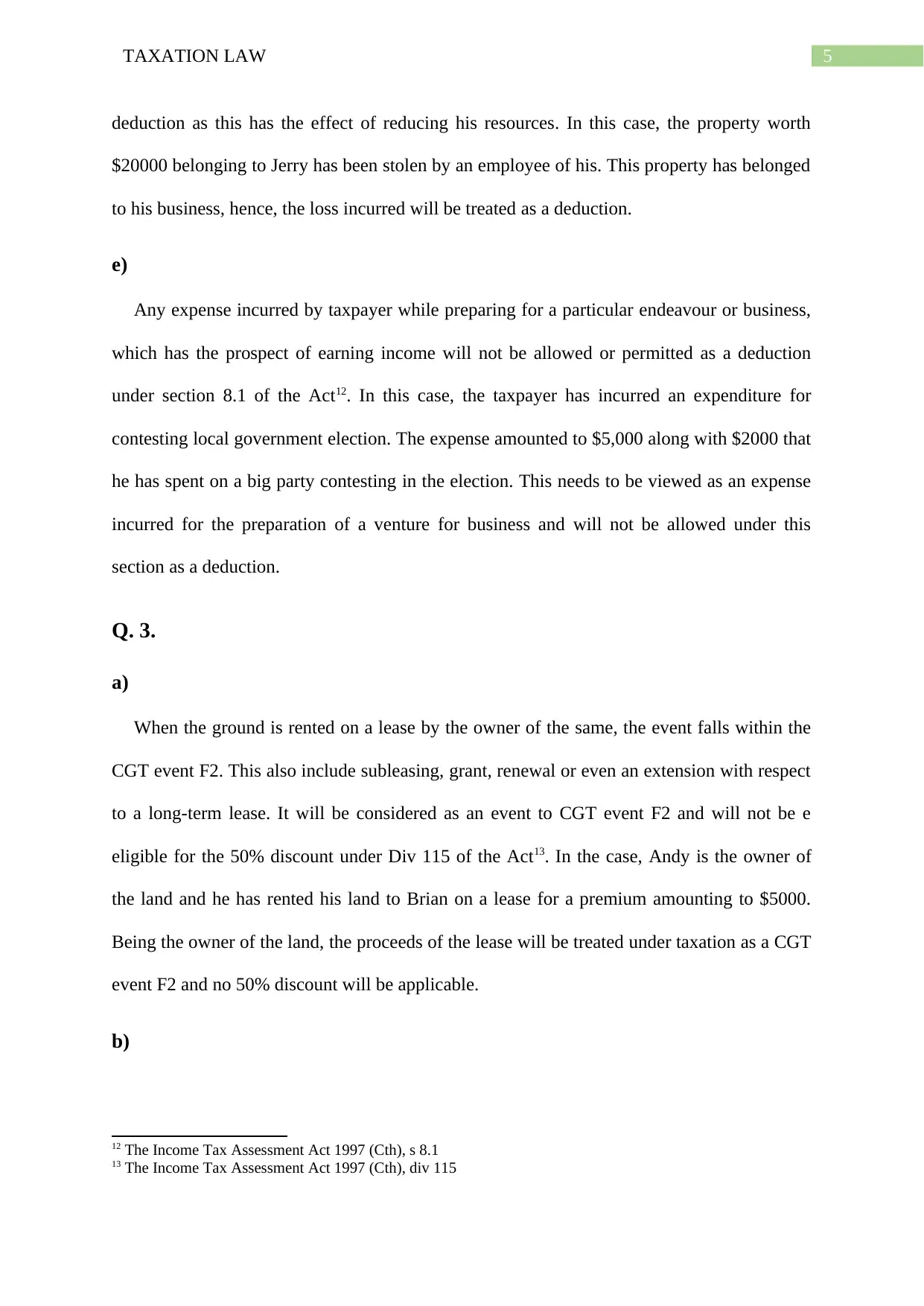

d)

Capital Gain Tax Computation

In the Books of Chris

14 The Income Tax Assessment Act 1997 (Cth), s 104.15

15 The Income Tax Assessment Act 1997 (Cth), div 115

16 The Income Tax Assessment Act 1997 (Cth), s 118.10

17 The Income Tax Assessment Act 1997 (Cth), div 115

The CGT event B1, as provided under section 104.15 of the Act14, subjects the right of a

person relating to the enjoyment and utilisation of a CGT asset to tax even before the actual

passing over of the title of ownership. Under this event, the taxpayer can also claim the 50%

discount under Div 115 of the Act15. In this case, John has granted Farm Ltd with a chance to

buy his 100-acre farm for just $800000 for an additional payment of $40,000. This farm has

been bought by John 10 years ago. Hence, this will be taxed as a CGT event B1 and the

discount of 50% will be available.

c)

A permanent residence of a taxpayer is exempted from capital gain tax under section

118.10 of the Act16. For the purpose of claiming this exemption, the person paying the tax

needs to have resided in that property. The renting and leasing of the same will not help him

for availing the exemption. The sale proceeds of such a house will be exempted from

taxation. In this case, Olivia and Jamie bought the house in 2006. After that, they rented it for

2 years and travelled. In 2008, they started living in the house as their main residence.

However, in 2018, they decided to sell the house. The proceed of $300000 has been gained

from that sale. It can be construed that, this house has been treated as a resident for certain

period and as a rented house for certain period. Hence, the part of the proceeds will be

exempted from being taxed and the part of the proceeds will be taxed and will be allowed the

discount of 50% under Div 115 of the Act17.

d)

Capital Gain Tax Computation

In the Books of Chris

14 The Income Tax Assessment Act 1997 (Cth), s 104.15

15 The Income Tax Assessment Act 1997 (Cth), div 115

16 The Income Tax Assessment Act 1997 (Cth), s 118.10

17 The Income Tax Assessment Act 1997 (Cth), div 115

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

For the year ended 2019

Particulars Amount Amount

BHP shares sale proceed (CGT Event A1) 18720

Acquisition Cost 5400

Taxable Capital Gain 13320

Wesfarmers shares sale proceed (CGT Event A1) 10500

Acquisition Cost 26000

Loss on Sale 15500

Net Capital Loss 2180

In this case, the gain from the sale of shares amounting to $13320 will be taxed as a capital

gain and will not be applied with the 50% discount as the shares are not held for more than 12

months under Div 115 of the Act18. Again, the capital loss will be carried forward to be

treated in the subsequent year.

Q. 4.

a)

Prize money obtained by way of winnings will not be treated to be an income for person

paying the tax. But, if the prize money has been received by the person paying the tax while

generating his taxable income, it needs to be treated as a taxable income. This can be

illustrated with the case of Kelly v FCT 85 ATC 428319. In the present case, the prize money

has been received by virtue of a TV advertisement that has been pursued by the taxpayer

while promoting his business and this business will accrue income, which will be subjected to

tax. Hence, this price money will be e text under section 6.5 of the act20.

18 The Income Tax Assessment Act 1997 (Cth), div 115

19 Kelly v FCT 85 ATC 4283

20 The Income Tax Assessment Act 1997 (Cth), s 6.5

For the year ended 2019

Particulars Amount Amount

BHP shares sale proceed (CGT Event A1) 18720

Acquisition Cost 5400

Taxable Capital Gain 13320

Wesfarmers shares sale proceed (CGT Event A1) 10500

Acquisition Cost 26000

Loss on Sale 15500

Net Capital Loss 2180

In this case, the gain from the sale of shares amounting to $13320 will be taxed as a capital

gain and will not be applied with the 50% discount as the shares are not held for more than 12

months under Div 115 of the Act18. Again, the capital loss will be carried forward to be

treated in the subsequent year.

Q. 4.

a)

Prize money obtained by way of winnings will not be treated to be an income for person

paying the tax. But, if the prize money has been received by the person paying the tax while

generating his taxable income, it needs to be treated as a taxable income. This can be

illustrated with the case of Kelly v FCT 85 ATC 428319. In the present case, the prize money

has been received by virtue of a TV advertisement that has been pursued by the taxpayer

while promoting his business and this business will accrue income, which will be subjected to

tax. Hence, this price money will be e text under section 6.5 of the act20.

18 The Income Tax Assessment Act 1997 (Cth), div 115

19 Kelly v FCT 85 ATC 4283

20 The Income Tax Assessment Act 1997 (Cth), s 6.5

8TAXATION LAW

b)

The income that an employee earns while being employed by the employer with respect to

the services rendered by him towards employment would be construed as a taxable income.

This will include salaries wages allowances and other perquisites. In the present situation, the

money received as a travelling cost to be present in the workplace cannot be treated as an

income. This is because, it is more a reimbursement of expenditure in nature as compared to

an income and hence it will not be subjected to tax

c)

Gifts are not to be assessed as a taxable receipt. On the other hand, if such a gift has been

received within the scope of the business, then it needs to be construed as taxable income.

This can be illustrated with the case of Atkinson v Federal Commissioner of Taxation [1951]

HCA 2164. In this case, the iPhone received from the client cannot be said to have accrued for

the purpose of a business transaction. Hence, it will not be assessed as an income for tax

purposes.

d)

Lump sums when gained by a taxpayer is assessed as a capital gain for the purpose of

taxation. But section 118.37 of the Act22 does not recognise any lump sum received against

any personal injury by the taxpayer to be assessed as taxable income. In this case, the

damages of $10000 received by the taxpayer by virtue of a car accident that has caused a

personal injury will not be treated as a taxable income and should not be subject to tax.

21 Atkinson v Federal Commissioner of Taxation [1951] HCA

22 The Income Tax Assessment Act 1997 (Cth), s 118.37

b)

The income that an employee earns while being employed by the employer with respect to

the services rendered by him towards employment would be construed as a taxable income.

This will include salaries wages allowances and other perquisites. In the present situation, the

money received as a travelling cost to be present in the workplace cannot be treated as an

income. This is because, it is more a reimbursement of expenditure in nature as compared to

an income and hence it will not be subjected to tax

c)

Gifts are not to be assessed as a taxable receipt. On the other hand, if such a gift has been

received within the scope of the business, then it needs to be construed as taxable income.

This can be illustrated with the case of Atkinson v Federal Commissioner of Taxation [1951]

HCA 2164. In this case, the iPhone received from the client cannot be said to have accrued for

the purpose of a business transaction. Hence, it will not be assessed as an income for tax

purposes.

d)

Lump sums when gained by a taxpayer is assessed as a capital gain for the purpose of

taxation. But section 118.37 of the Act22 does not recognise any lump sum received against

any personal injury by the taxpayer to be assessed as taxable income. In this case, the

damages of $10000 received by the taxpayer by virtue of a car accident that has caused a

personal injury will not be treated as a taxable income and should not be subject to tax.

21 Atkinson v Federal Commissioner of Taxation [1951] HCA

22 The Income Tax Assessment Act 1997 (Cth), s 118.37

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

e)

In the present case the shares has been bought for $5, which has escalated to 7.5 dollars.

This is an income, which is to be anticipated but not yet realised. Hence, it cannot be treated

as a taxable income as it has not been earned yet.

Q. 5.

Issue

The issue in the instant scenario is whether Nishu has the status of a resident in Australia

for tax purposes pertaining to the year of income 2018-19.

Rule

The definition of a resident in Australia has been provided under the ITAA 36, under

section 6(1)23. For the purpose of assessing the residency of a person in Australia for tax

purposes, four tests has been assigned by the section. Firstly, a person needs to clear the

resides test for being a resident in Australia. This requires him to reside in Australia. The

second test, which will be applied, after the satisfaction of the first test, is the domicile test.

Under this test, a person needs to ensure that his domicile is situated in Australia for the

purpose of achieving the status of resident in Australia. This test has been laid down in the

tax ruling 265024. Again, it can be said that it has been made evident that the permanent place

of abode of a person is situated outside the purview of Australia, then this test will not be

applicable. This can be illustrated with the case of I.R.C. v. Lysaght (1928) A.C.234.

When the domicile test has been cleared by the taxpayer he will be required to applied

with the 183 day test for the purpose of achieving the status of a resident in Australia. This

test will require the taxpayer to be present in Australia and staying there for a period of 183

days or more. This can be illustrated with the case of FC of T v. Miller (1946) 73 CLR 93.

23 The Income Tax Assessment Act 1936 (Cth), s 6(1)

24 The Tax Ruling 2650

e)

In the present case the shares has been bought for $5, which has escalated to 7.5 dollars.

This is an income, which is to be anticipated but not yet realised. Hence, it cannot be treated

as a taxable income as it has not been earned yet.

Q. 5.

Issue

The issue in the instant scenario is whether Nishu has the status of a resident in Australia

for tax purposes pertaining to the year of income 2018-19.

Rule

The definition of a resident in Australia has been provided under the ITAA 36, under

section 6(1)23. For the purpose of assessing the residency of a person in Australia for tax

purposes, four tests has been assigned by the section. Firstly, a person needs to clear the

resides test for being a resident in Australia. This requires him to reside in Australia. The

second test, which will be applied, after the satisfaction of the first test, is the domicile test.

Under this test, a person needs to ensure that his domicile is situated in Australia for the

purpose of achieving the status of resident in Australia. This test has been laid down in the

tax ruling 265024. Again, it can be said that it has been made evident that the permanent place

of abode of a person is situated outside the purview of Australia, then this test will not be

applicable. This can be illustrated with the case of I.R.C. v. Lysaght (1928) A.C.234.

When the domicile test has been cleared by the taxpayer he will be required to applied

with the 183 day test for the purpose of achieving the status of a resident in Australia. This

test will require the taxpayer to be present in Australia and staying there for a period of 183

days or more. This can be illustrated with the case of FC of T v. Miller (1946) 73 CLR 93.

23 The Income Tax Assessment Act 1936 (Cth), s 6(1)

24 The Tax Ruling 2650

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

The Superannuation test is another test, which is required to be applied to certain

employees belonging to the Australian government and it includes your families for tax

purposes.

Application

Nishu has arrived in Australia for the purpose of studies. During his course of study, he

has availed a part-time job and has rented an accommodation with other students. He also

joined the soccer team and made a few friends. Although he has been residing in Australia

but this is not enough to render him a resident in Australia for the purpose of taxation. This is

because the first condition that requires a person for the purpose of being rendered resident in

Australia is the permanent place of abode test. It is evident from the given scenario that the

permanent place of abode of Nisu is not in Australia, but it is located in Nepal. Hence, he will

not be eligible for any of the test for the purpose of taxation to be rendered as a resident.

Hence, Nisu is not a resident in Australia.

Conclusion

Nishu does not have the status of a resident in Australia for tax purposes pertaining to the

year of income 2018-19.

The Superannuation test is another test, which is required to be applied to certain

employees belonging to the Australian government and it includes your families for tax

purposes.

Application

Nishu has arrived in Australia for the purpose of studies. During his course of study, he

has availed a part-time job and has rented an accommodation with other students. He also

joined the soccer team and made a few friends. Although he has been residing in Australia

but this is not enough to render him a resident in Australia for the purpose of taxation. This is

because the first condition that requires a person for the purpose of being rendered resident in

Australia is the permanent place of abode test. It is evident from the given scenario that the

permanent place of abode of Nisu is not in Australia, but it is located in Nepal. Hence, he will

not be eligible for any of the test for the purpose of taxation to be rendered as a resident.

Hence, Nisu is not a resident in Australia.

Conclusion

Nishu does not have the status of a resident in Australia for tax purposes pertaining to the

year of income 2018-19.

11TAXATION LAW

Reference

Atkinson v Federal Commissioner of Taxation [1951] HCA

FC of T v Day 2008 ATC 20-064

FC of T v. Miller (1946) 73 CLR 93

I.R.C. v. Lysaght (1928) A.C.234

Kelly v FCT 85 ATC 4283

Taxation Ruling TR 2018/4

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Tax Ruling 2650

Reference

Atkinson v Federal Commissioner of Taxation [1951] HCA

FC of T v Day 2008 ATC 20-064

FC of T v. Miller (1946) 73 CLR 93

I.R.C. v. Lysaght (1928) A.C.234

Kelly v FCT 85 ATC 4283

Taxation Ruling TR 2018/4

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Tax Ruling 2650

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.