Taxation Law Practice Assignment for ACC304 - May 2019, Uni

VerifiedAdded on 2023/03/20

|11

|1683

|89

Homework Assignment

AI Summary

This assignment solution addresses a taxation law problem set for ACC304. Part A provides a letter of advice on residency status, analyzing the case of Jack Johnson using the statutory definition, ordinary concepts test, domicile test, 183-day test, and superannuation test under Australian tax law, concluding he is a non-resident. Part B calculates the net income of a partnership and presents a distribution statement. Part C includes a video transcript summarizing the key arguments and referencing relevant sections of the Income Tax Assessment Act 1936 and case law. The solution demonstrates application of tax principles to real-world scenarios and provides a detailed analysis of the relevant legal and factual considerations.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Part A:........................................................................................................................................2

Private and Confidential: Letter of Advice............................................................................2

Part B:.........................................................................................................................................6

Net Income of Partnership:....................................................................................................6

Distribution Statement:..........................................................................................................7

Part C: Video Transcript:...........................................................................................................8

References:.................................................................................................................................9

Table of Contents

Part A:........................................................................................................................................2

Private and Confidential: Letter of Advice............................................................................2

Part B:.........................................................................................................................................6

Net Income of Partnership:....................................................................................................6

Distribution Statement:..........................................................................................................7

Part C: Video Transcript:...........................................................................................................8

References:.................................................................................................................................9

2TAXATION LAW

Part A:

Private and Confidential: Letter of Advice

To Jack Johnson

From: Roma Tax Consultancy

Date: 6th May 2019

Dear Jack

We have below summarized the opinion in respect of the matters relating to the

residency status. If you feel any facts or assumptions to be incorrect or not as per your

understanding, you can immediately contact us to understand the impact of the advice given.

The advice is based on the tax laws, cases and rulings as we understand their application in

determining your residency status. We have below outlined the responses in relation to each

of the specific events that effects your residency.

Statutory definition:

The word resident implies under “subsection 6 (1), ITAA 1936” that person apart

from the company that are living in Australia and involves the person that has their domicile

in Australia, unless the taxation commissioner is content that his permanent place of

residence is out of Australia (Woellner et al. 2016). It also includes person that has originally

been living in Australia for six months of the income year whether on continuous basis or

intermittently excluding when the commissioner is content that the taxpayer usual abode is

outside Australia and no intention of residing in Australia (Robin and Barkoczy 2019). In

response to your information that is shared we have applied the four relevant test in your

situation. This includes the following;

a. Ordinary concepts test or Resides Test

Part A:

Private and Confidential: Letter of Advice

To Jack Johnson

From: Roma Tax Consultancy

Date: 6th May 2019

Dear Jack

We have below summarized the opinion in respect of the matters relating to the

residency status. If you feel any facts or assumptions to be incorrect or not as per your

understanding, you can immediately contact us to understand the impact of the advice given.

The advice is based on the tax laws, cases and rulings as we understand their application in

determining your residency status. We have below outlined the responses in relation to each

of the specific events that effects your residency.

Statutory definition:

The word resident implies under “subsection 6 (1), ITAA 1936” that person apart

from the company that are living in Australia and involves the person that has their domicile

in Australia, unless the taxation commissioner is content that his permanent place of

residence is out of Australia (Woellner et al. 2016). It also includes person that has originally

been living in Australia for six months of the income year whether on continuous basis or

intermittently excluding when the commissioner is content that the taxpayer usual abode is

outside Australia and no intention of residing in Australia (Robin and Barkoczy 2019). In

response to your information that is shared we have applied the four relevant test in your

situation. This includes the following;

a. Ordinary concepts test or Resides Test

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

b. The Domicile Test

c. The 183-Day Test

d. Superannuation Test

Ordinary concepts Test:

The dictionary meaning explains that to reside here in Australia permanently or for

considerable time. The court in “IRC v Lysaght (1928)” explained that if the person is

visiting Australian, then the frequency, regularity and the duration of visit should be

considered (Barkoczy, 2016). The courts have also considered the factors such as maintaining

the place of home in Australia for use of taxpayers is also relevant. Jack, in your case we

have found that from June 2017 you left Australia for work purpose in Bahrain. You have

sold all the belongings which you held in Australia. Even if you are having the residential

home in Australia and your family is residing there, these factors is not very much

significant. You were also not physically present in Australia for the considerable period of

time in the income year. Though you returned to Bahrain following the short stay in Australia

with the objective of settling with your wife but you cannot be considered as the Australian

resident under the ordinary concept test.

Domicile Test:

To advise you regarding your residency status we have referred to Domicile test as

well. Under the domicile test a person is only considered to be resident of Australia if the

person is having their domicile in Australia (Freudenberg et al. 2017). To determine the

domicile of an individual in accordance with the Domicile Act 1982 an individual’s domicile

of their origin during birth or the domicile of the country of choice is generally considered.

As per the “IT ruling 2650” the taxation commissioner takes into the account numerous

factors whether the person has the permanent place of residence outside Australia (Jones

b. The Domicile Test

c. The 183-Day Test

d. Superannuation Test

Ordinary concepts Test:

The dictionary meaning explains that to reside here in Australia permanently or for

considerable time. The court in “IRC v Lysaght (1928)” explained that if the person is

visiting Australian, then the frequency, regularity and the duration of visit should be

considered (Barkoczy, 2016). The courts have also considered the factors such as maintaining

the place of home in Australia for use of taxpayers is also relevant. Jack, in your case we

have found that from June 2017 you left Australia for work purpose in Bahrain. You have

sold all the belongings which you held in Australia. Even if you are having the residential

home in Australia and your family is residing there, these factors is not very much

significant. You were also not physically present in Australia for the considerable period of

time in the income year. Though you returned to Bahrain following the short stay in Australia

with the objective of settling with your wife but you cannot be considered as the Australian

resident under the ordinary concept test.

Domicile Test:

To advise you regarding your residency status we have referred to Domicile test as

well. Under the domicile test a person is only considered to be resident of Australia if the

person is having their domicile in Australia (Freudenberg et al. 2017). To determine the

domicile of an individual in accordance with the Domicile Act 1982 an individual’s domicile

of their origin during birth or the domicile of the country of choice is generally considered.

As per the “IT ruling 2650” the taxation commissioner takes into the account numerous

factors whether the person has the permanent place of residence outside Australia (Jones

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

2018). This generally involves the intention as well as the actual length of stay in the

overseas country. It also includes the intention of living in the foreign country either on

permanent basis or the temporarily basis. According to the taxation commissioners views

factors such as durability and continuity of the presence in foreign country is necessary as

well. The federal commissioner in “Applegate v FCT (1979)” held that permanent does not

signifies forever and the taxpayer’s objectivity is measured every year (Lam 2018).

With respect to the above explanation it is noticed that you have evidently expressed

that your domicile of choice is out of Australia. The circumstances that has been gathered

states that your permanent place of abode is in Bahrain and you did not intend to return to

Australia for at least indefinitely. Your motive of joining your family following the

completion of your employment contract is not conclusive as well. Furthermore, your actions

of selling all your belongings indicate that you intend to remain absent from Australia for an

indefinite time. You only visited twice to Australia during the last twelve months and this add

up to the weight from the conclusion drawn above. Therefore, you cannot be considered

Australian resident under the domicile test.

183-Day Test:

A person under the 183-day test is observed as the Australian occupant when his or

her physical presence in Australia is for a minimum of six months or a total of 183 days

during the income year (Butler 2019). Certain exception such as the commissioner is satisfied

that the taxpayer has the usual place of residence outside the Australia. In light of the

conclusion that is drawn from the above explained two test, Jack we have noticed that you

were only present in Australia for two months during your visit in November 2017 and April

2018. You have also established your home outside of Australia in Bahrain. Therefore, you

are not an Australian resident under the 183-day test.

2018). This generally involves the intention as well as the actual length of stay in the

overseas country. It also includes the intention of living in the foreign country either on

permanent basis or the temporarily basis. According to the taxation commissioners views

factors such as durability and continuity of the presence in foreign country is necessary as

well. The federal commissioner in “Applegate v FCT (1979)” held that permanent does not

signifies forever and the taxpayer’s objectivity is measured every year (Lam 2018).

With respect to the above explanation it is noticed that you have evidently expressed

that your domicile of choice is out of Australia. The circumstances that has been gathered

states that your permanent place of abode is in Bahrain and you did not intend to return to

Australia for at least indefinitely. Your motive of joining your family following the

completion of your employment contract is not conclusive as well. Furthermore, your actions

of selling all your belongings indicate that you intend to remain absent from Australia for an

indefinite time. You only visited twice to Australia during the last twelve months and this add

up to the weight from the conclusion drawn above. Therefore, you cannot be considered

Australian resident under the domicile test.

183-Day Test:

A person under the 183-day test is observed as the Australian occupant when his or

her physical presence in Australia is for a minimum of six months or a total of 183 days

during the income year (Butler 2019). Certain exception such as the commissioner is satisfied

that the taxpayer has the usual place of residence outside the Australia. In light of the

conclusion that is drawn from the above explained two test, Jack we have noticed that you

were only present in Australia for two months during your visit in November 2017 and April

2018. You have also established your home outside of Australia in Bahrain. Therefore, you

are not an Australian resident under the 183-day test.

5TAXATION LAW

Commonwealth Superannuation Test:

This is entirely an objectivity test. A person is only held to be Australian resident if

the taxpayer is having membership with the fund and the taxpayer is making contribution in

the superannuation fund (Morgan, Mortimer and Pinto 2018). As you do not have any

membership with the superannuation fund. Hence, this test is irrelevant in your situation.

In view of above mentioned analysis none of the residency test is applicable in your

situation. As a result, you will be treated as non-resident of Australian or foreign resident for

the year 2017/18.

Accordingly, once you have gone over the advice and satisfied to move further we

will prepare the response to the ATO based on the points highlighted above. If you wish to

discuss further the above matters, you are free to reach us any time you want.

Yours sincerely

Associate Taxation

Roma Tax Consultancy

Commonwealth Superannuation Test:

This is entirely an objectivity test. A person is only held to be Australian resident if

the taxpayer is having membership with the fund and the taxpayer is making contribution in

the superannuation fund (Morgan, Mortimer and Pinto 2018). As you do not have any

membership with the superannuation fund. Hence, this test is irrelevant in your situation.

In view of above mentioned analysis none of the residency test is applicable in your

situation. As a result, you will be treated as non-resident of Australian or foreign resident for

the year 2017/18.

Accordingly, once you have gone over the advice and satisfied to move further we

will prepare the response to the ATO based on the points highlighted above. If you wish to

discuss further the above matters, you are free to reach us any time you want.

Yours sincerely

Associate Taxation

Roma Tax Consultancy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

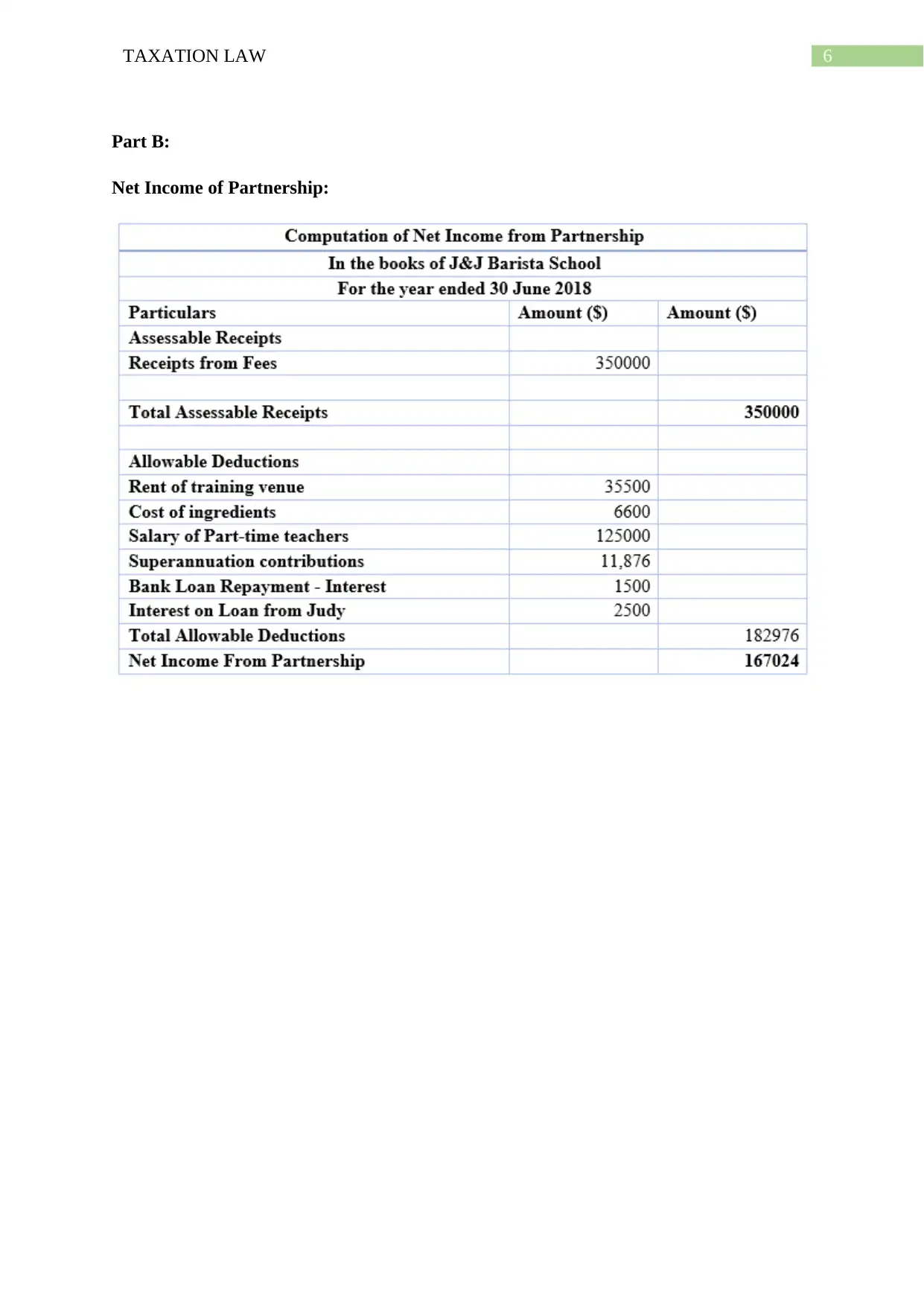

Part B:

Net Income of Partnership:

Part B:

Net Income of Partnership:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

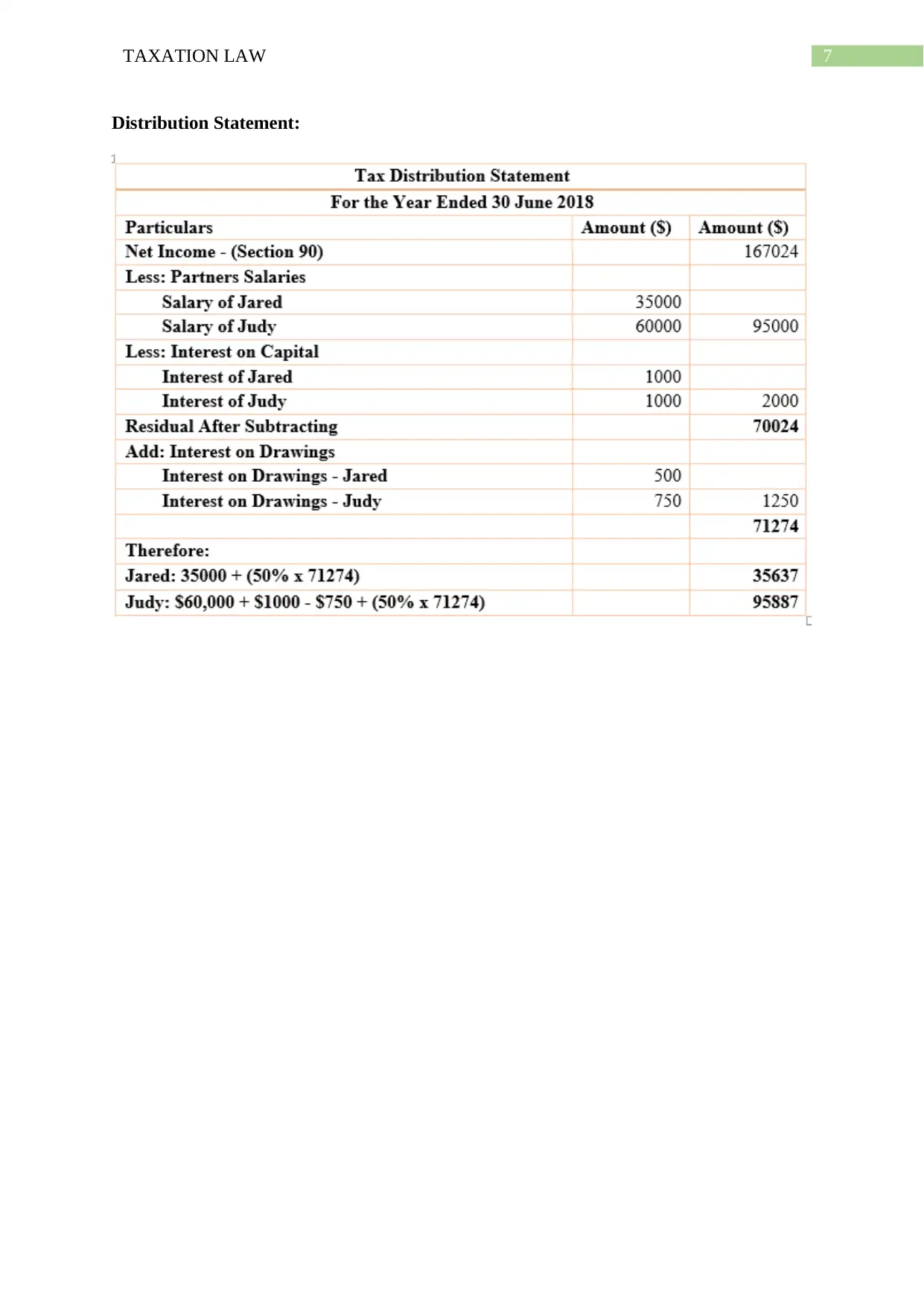

7TAXATION LAW

Distribution Statement:

Distribution Statement:

8TAXATION LAW

Part C: Video Transcript:

To determine the Jack Residency Status, I have referred to the statutory definition of

resident that is given under “subsection 6 (1), ITAA 1936”. Based on the case facts obtained

I also applied the four relevant test of residential status to ascertain whether Jack was the

resident of Australia or not. I found under the Resides test that Jack not physically present in

Australia for the considerable period of time in the income year.

Later in the Domicile Test I used the famous case of “Applegate v FCT (1979)” to

determine whether Jack was the resident of Australia. By reading the circumstances that has

been gathered states that Jack’s permanent place of abode is in Bahrain and he did not intend

to return to Australia for at least indefinitely. While the 183-day test and superannuation test

were applied in the situation of Jack but the test were irrelevant because neither Jack was

present for six months of income nor he has any membership with superannuation scheme.

So I understood that Jack was non-resident under “subsection 6 (1), ITAA 1936”.

In determining the Net income of Partnership I referred to the “section 90” to

calculate the net income. Whereas to distribute the net income or loss partnership I referred to

“section 92 of ITAA 1936”.

Part C: Video Transcript:

To determine the Jack Residency Status, I have referred to the statutory definition of

resident that is given under “subsection 6 (1), ITAA 1936”. Based on the case facts obtained

I also applied the four relevant test of residential status to ascertain whether Jack was the

resident of Australia or not. I found under the Resides test that Jack not physically present in

Australia for the considerable period of time in the income year.

Later in the Domicile Test I used the famous case of “Applegate v FCT (1979)” to

determine whether Jack was the resident of Australia. By reading the circumstances that has

been gathered states that Jack’s permanent place of abode is in Bahrain and he did not intend

to return to Australia for at least indefinitely. While the 183-day test and superannuation test

were applied in the situation of Jack but the test were irrelevant because neither Jack was

present for six months of income nor he has any membership with superannuation scheme.

So I understood that Jack was non-resident under “subsection 6 (1), ITAA 1936”.

In determining the Net income of Partnership I referred to the “section 90” to

calculate the net income. Whereas to distribute the net income or loss partnership I referred to

“section 92 of ITAA 1936”.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Butler, D., 2019. Who can provide taxation advice?. Taxation in Australia, 53(7), p.381.

Freudenberg, B., Chardon, T., Brimble, M. and Isle, M.B., 2017. Tax literacy of Australian

small businesses. J. Austl. Tax'n, 19, p.21.

Jones, D., 2018. Complexity of tax residency attracts review. Taxation in Australia, 53(6),

p.296.

Lam, D., 2018. What you need to know about managing Australian and foreign tax residency

status. Equity, 32(9), p.10.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin and Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.), 2019. Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Butler, D., 2019. Who can provide taxation advice?. Taxation in Australia, 53(7), p.381.

Freudenberg, B., Chardon, T., Brimble, M. and Isle, M.B., 2017. Tax literacy of Australian

small businesses. J. Austl. Tax'n, 19, p.21.

Jones, D., 2018. Complexity of tax residency attracts review. Taxation in Australia, 53(6),

p.296.

Lam, D., 2018. What you need to know about managing Australian and foreign tax residency

status. Equity, 32(9), p.10.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin and Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.), 2019. Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.