Taxation Law Assignment: Residency, Partnership, and Tax Implications

VerifiedAdded on 2023/03/17

|8

|1423

|31

Homework Assignment

AI Summary

This Taxation Law assignment, prepared for ACC304, provides a comprehensive analysis of an individual's residency status and the tax implications of a partnership's net income and distribution. Part A offers a detailed letter of advice to Jack, analyzing his residency based on the resides test, domicile test, 183-day test, and superannuation test, referencing relevant legislation (ITAA 1997, Domicile Act 1982) and case law (IRC v Lysaght, FCT v Applegate). Part B focuses on the calculation of a partnership's net income and presents a distribution statement outlining how profits or losses are allocated among partners. The assignment demonstrates an understanding of Australian tax law, including residency determination and partnership taxation, supported by appropriate citations and references.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Part A:........................................................................................................................................2

Letter of Advice.........................................................................................................................2

Part B:.........................................................................................................................................5

Net Income of Partnership:........................................................................................................5

Distribution Statement:..............................................................................................................6

References:.................................................................................................................................7

Table of Contents

Part A:........................................................................................................................................2

Letter of Advice.........................................................................................................................2

Part B:.........................................................................................................................................5

Net Income of Partnership:........................................................................................................5

Distribution Statement:..............................................................................................................6

References:.................................................................................................................................7

2TAXATION LAW

Part A:

Letter of Advice

To Jack

From: ABC Tax Consultancy Agency

Date: 9th May 2019

Dear Jack

The present letter strives to provide you with the advice regarding your residency

status based on the residency test that is applied in your case. The letter seeks to provide you

with the information that a person is only held resident for tax purpose when the person has

the domicile in here in Australia. As explained in the “section 6 (1), ITAA 1997” an

individual is considered as resident of Australia if they are existent in Australian and their

domicile is in Australia. The definition requires an individual to be satisfy only one test in

order to be held as Australian resident (King 2016). To decide whether you are Australian

resident we will be applying four relevant test based on the information furnished by you.

Resides Test:

The rest test is better known as the ordinary concept test. It means living in Australia

on permanent basis for the significant time period. The decision made in “IRC v Lysaght

(1928)” took into the account the necessary factors particularly the frequency, regularity and

duration of visit by the individual who visits Australia (Miller and Oats 2016). It also

comprises of maintaining the residence in Australia for the taxpayers use.

With respect to the information that is acquired we found that you have moved to

Saudi Arabia for the work purpose. The determination of the residency is entirely based on

Part A:

Letter of Advice

To Jack

From: ABC Tax Consultancy Agency

Date: 9th May 2019

Dear Jack

The present letter strives to provide you with the advice regarding your residency

status based on the residency test that is applied in your case. The letter seeks to provide you

with the information that a person is only held resident for tax purpose when the person has

the domicile in here in Australia. As explained in the “section 6 (1), ITAA 1997” an

individual is considered as resident of Australia if they are existent in Australian and their

domicile is in Australia. The definition requires an individual to be satisfy only one test in

order to be held as Australian resident (King 2016). To decide whether you are Australian

resident we will be applying four relevant test based on the information furnished by you.

Resides Test:

The rest test is better known as the ordinary concept test. It means living in Australia

on permanent basis for the significant time period. The decision made in “IRC v Lysaght

(1928)” took into the account the necessary factors particularly the frequency, regularity and

duration of visit by the individual who visits Australia (Miller and Oats 2016). It also

comprises of maintaining the residence in Australia for the taxpayers use.

With respect to the information that is acquired we found that you have moved to

Saudi Arabia for the work purpose. The determination of the residency is entirely based on

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

the extent of fact and degree (Jones and Rhoades-Catanach 2015). This involves the time a

person has spent physically in Australia. It also involves the frequency, regularity and the

duration of the visit. In addition to this, the courts have also considered the factors such as the

maintaining the place of abode in Australia for the use of taxpayer.

We found that you have maintained your residence outside Australia despite the fact

that you come to Australia to look after your children and family. Therefore, this factor

cannot alone be considered significant. Citing “IRC v Lysaght (1928)” despite the fact that

you came to Australian but this alone is not the significant in determining your residency

status (Kenny, Blissenden and Villios 2015). You were also present in Australia for short

time period and returned to Saudi Arabia for work purpose. As a result, you did not meet the

resides test and you are not a resident of Australia under this test.

Domicile Test:

In accordance with the “Domicile Act 1982” the domicile of an individual is

ascertained. This mainly involves whether the person is an Australian resident when he or she

acquires the domicile of birth nation or adopts the domicile by way of choice in another

country (Sharkey 2016). As per the test, where a person is maintaining their place of home in

Australia then the person is said to be Australian resident only when the officer of tax is

satisfied that an individual is having the permanent home in foreign nation. Referring to

“FCT v Applegate (1979)” the taxation commissioner considered the taxpayer to be non-

resident of Australian even though the taxpayer had the domicile in Australia because the

taxpayer had established the permanent home outside Australia.

After you separated from your wife you have sold all your belongings in Australia and

you decided to move in Bahrain by taking up a single bedroom apartment. Your behaviour

does not signifies to be consistent with residing in Australian and conclusively validates that

the extent of fact and degree (Jones and Rhoades-Catanach 2015). This involves the time a

person has spent physically in Australia. It also involves the frequency, regularity and the

duration of the visit. In addition to this, the courts have also considered the factors such as the

maintaining the place of abode in Australia for the use of taxpayer.

We found that you have maintained your residence outside Australia despite the fact

that you come to Australia to look after your children and family. Therefore, this factor

cannot alone be considered significant. Citing “IRC v Lysaght (1928)” despite the fact that

you came to Australian but this alone is not the significant in determining your residency

status (Kenny, Blissenden and Villios 2015). You were also present in Australia for short

time period and returned to Saudi Arabia for work purpose. As a result, you did not meet the

resides test and you are not a resident of Australia under this test.

Domicile Test:

In accordance with the “Domicile Act 1982” the domicile of an individual is

ascertained. This mainly involves whether the person is an Australian resident when he or she

acquires the domicile of birth nation or adopts the domicile by way of choice in another

country (Sharkey 2016). As per the test, where a person is maintaining their place of home in

Australia then the person is said to be Australian resident only when the officer of tax is

satisfied that an individual is having the permanent home in foreign nation. Referring to

“FCT v Applegate (1979)” the taxation commissioner considered the taxpayer to be non-

resident of Australian even though the taxpayer had the domicile in Australia because the

taxpayer had established the permanent home outside Australia.

After you separated from your wife you have sold all your belongings in Australia and

you decided to move in Bahrain by taking up a single bedroom apartment. Your behaviour

does not signifies to be consistent with residing in Australian and conclusively validates that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

you have adopted the domicile of your choice in Bahrain. Corresponding to the judgement

made by court in “FCT v Applegate (1979)” you successfully managed to pass the test

because you have set up your fixed home in Saudi Arabia (Hardie 2016). Though you have

returned to Australia to see your family but this is not the occlusive factor in treating you as

Australian resident. You also moved to single bedroom apartment which also demonstrates

you intend to remain absent from Australia for an indefinite period. The frequency of your

visit to Australia additionally adds weightage to the conclusion that you are not the resident

of Australia. In light of the above stated information you cease to be resident of Australia

under the Domicile Test since you took the domicile of your own choice in Bahrain and now

your permanent place of residence is now out of Australia.

183-day Test:

As defined in the 183-days test, someone who has been for at least one half of the

income year has been in Australia and proves the taxation officer that he or she has no such

intention of taking up the residency in Australia, then they will be treated as the Australian

resident (Sadiq 2019). By applying the 183-day test in your case we have noticed that, for the

income year of 2017/18 you were not in Australia physically for a minimum of six months or

one half of the income year. Furthermore, you also proved that your fixed location of home is

out of Australia and you have no intention of returning Australia. Conclusively, you are not

an Australian resident under the 183-day test.

Superannuation Test:

The superannuation test is entirely an objective test. The test is applied to those

people that have the membership with the commonwealth superannuation funds (Morgan,

Mortimer and Pinto 2018). As per this test, an individual is considered as the Australian

resident if they have made contribution in this fund for taxation purpose. As you have no

you have adopted the domicile of your choice in Bahrain. Corresponding to the judgement

made by court in “FCT v Applegate (1979)” you successfully managed to pass the test

because you have set up your fixed home in Saudi Arabia (Hardie 2016). Though you have

returned to Australia to see your family but this is not the occlusive factor in treating you as

Australian resident. You also moved to single bedroom apartment which also demonstrates

you intend to remain absent from Australia for an indefinite period. The frequency of your

visit to Australia additionally adds weightage to the conclusion that you are not the resident

of Australia. In light of the above stated information you cease to be resident of Australia

under the Domicile Test since you took the domicile of your own choice in Bahrain and now

your permanent place of residence is now out of Australia.

183-day Test:

As defined in the 183-days test, someone who has been for at least one half of the

income year has been in Australia and proves the taxation officer that he or she has no such

intention of taking up the residency in Australia, then they will be treated as the Australian

resident (Sadiq 2019). By applying the 183-day test in your case we have noticed that, for the

income year of 2017/18 you were not in Australia physically for a minimum of six months or

one half of the income year. Furthermore, you also proved that your fixed location of home is

out of Australia and you have no intention of returning Australia. Conclusively, you are not

an Australian resident under the 183-day test.

Superannuation Test:

The superannuation test is entirely an objective test. The test is applied to those

people that have the membership with the commonwealth superannuation funds (Morgan,

Mortimer and Pinto 2018). As per this test, an individual is considered as the Australian

resident if they have made contribution in this fund for taxation purpose. As you have no

5TAXATION LAW

such membership with the commonwealth superannuation fund it can be stated that Jack you

are not the Australian resident under this test.

With respect to the analysis performed above the letter seeks to inform explain you

that, you are not the Australian resident within the definition of “section 6 (1), ITAA 1997”.

You also proved that you have adopted the domicile in outside Australia with no intention of

returning back. We hope that the advice has helped you in resolving your residential status

issues and look forward to hear from you soon.

Thank You

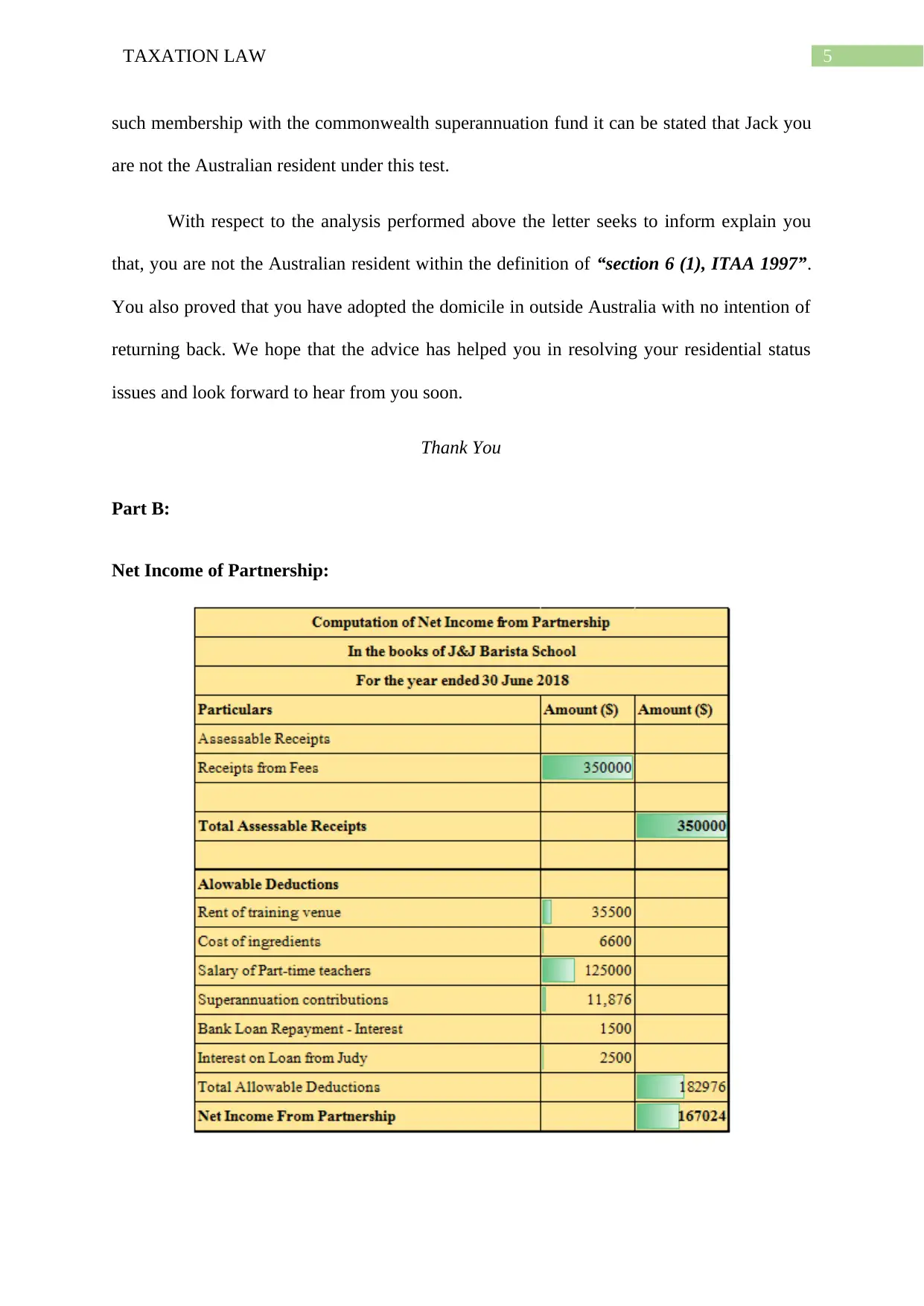

Part B:

Net Income of Partnership:

such membership with the commonwealth superannuation fund it can be stated that Jack you

are not the Australian resident under this test.

With respect to the analysis performed above the letter seeks to inform explain you

that, you are not the Australian resident within the definition of “section 6 (1), ITAA 1997”.

You also proved that you have adopted the domicile in outside Australia with no intention of

returning back. We hope that the advice has helped you in resolving your residential status

issues and look forward to hear from you soon.

Thank You

Part B:

Net Income of Partnership:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

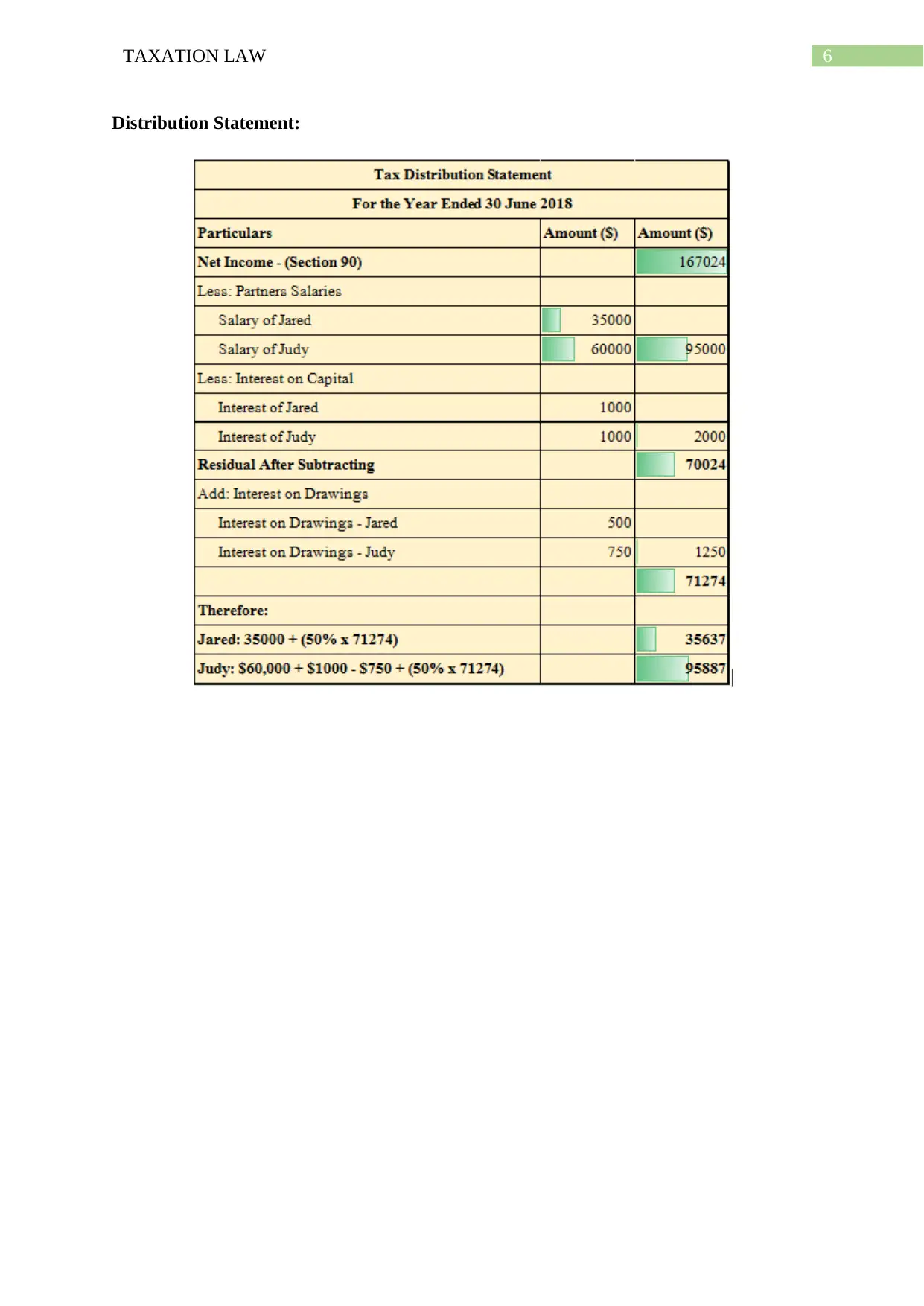

6TAXATION LAW

Distribution Statement:

Distribution Statement:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

References:

Hardie, J.A., 2016. A critical and comparative analysis of the expression" ordinarily

resident" as a criterion for determining the place of residence of an individual in the context

of income tax legislation in South Africa and certain other juristictions(Doctoral

dissertation).

Jones, S. and Rhoades-Catanach, S., 2015. Principles of Taxation for Business and

Investment Planning 2016 Edition. McGraw-Hill Education.

Kenny, P., Blissenden, M. and Villios, S., 2015. Residency and Australians working

overseas: can be an expensive lesson in tax Law.

King, A., 2016. Mid market focus: The new attribution tax regime for MITs: Part 1. Taxation

in Australia, 50(10), p.590.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

Sharkey, N., 2016. Departing Australia: A complex tax situation with possible benefits and

hidden traps. Tax Specialist, 19(5), p.180.

References:

Hardie, J.A., 2016. A critical and comparative analysis of the expression" ordinarily

resident" as a criterion for determining the place of residence of an individual in the context

of income tax legislation in South Africa and certain other juristictions(Doctoral

dissertation).

Jones, S. and Rhoades-Catanach, S., 2015. Principles of Taxation for Business and

Investment Planning 2016 Edition. McGraw-Hill Education.

Kenny, P., Blissenden, M. and Villios, S., 2015. Residency and Australians working

overseas: can be an expensive lesson in tax Law.

King, A., 2016. Mid market focus: The new attribution tax regime for MITs: Part 1. Taxation

in Australia, 50(10), p.590.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

Sharkey, N., 2016. Departing Australia: A complex tax situation with possible benefits and

hidden traps. Tax Specialist, 19(5), p.180.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.