University Taxation Law Individual Assignment LAWS20060, Term 1, 2019

VerifiedAdded on 2023/03/17

|17

|4039

|47

Homework Assignment

AI Summary

This document presents a comprehensive solution to a Taxation Law assignment, addressing key concepts within Australian tax law. The assignment covers a range of topics, including the application of the Income Tax Assessment Act 1997 (ITAA 1997) to various scenarios, such as determining depreciating assets, claiming tax offsets, and calculating taxable income. It delves into Capital Gains Tax (CGT) events and their implications, providing detailed explanations of CGT event B1 and F2, as well as the main residence exemption. The solution also analyzes tax deductions, including interest on loans, mobile phone expenses, and pre-commencement expenses, referencing relevant case law like FCT v Roberts and Smith (1992) and Lodge v FC of T (1972). Furthermore, the assignment addresses the taxability of prizes and winnings, and explores the concepts of marginal and average tax rates, and consumption tax. The document offers detailed answers to various questions, providing a thorough understanding of the topics.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................3

Answer A:..............................................................................................................................3

Answer B:...............................................................................................................................3

Answer C:...............................................................................................................................3

Answer D:..............................................................................................................................3

Answer E................................................................................................................................4

Answer F:...............................................................................................................................4

Answer to G:..........................................................................................................................4

Answer H:..............................................................................................................................5

Answer I:................................................................................................................................5

Answer to question 2:.................................................................................................................6

Answer A:..............................................................................................................................6

Answer B:...............................................................................................................................6

Answer C:...............................................................................................................................7

Answer D:..............................................................................................................................7

Answer E:...............................................................................................................................8

Answer to question 3:.................................................................................................................8

Answer A:..............................................................................................................................8

Answer B:...............................................................................................................................9

Answer C:...............................................................................................................................9

Answer D:............................................................................................................................10

Table of Contents

Answer to question 1:.................................................................................................................3

Answer A:..............................................................................................................................3

Answer B:...............................................................................................................................3

Answer C:...............................................................................................................................3

Answer D:..............................................................................................................................3

Answer E................................................................................................................................4

Answer F:...............................................................................................................................4

Answer to G:..........................................................................................................................4

Answer H:..............................................................................................................................5

Answer I:................................................................................................................................5

Answer to question 2:.................................................................................................................6

Answer A:..............................................................................................................................6

Answer B:...............................................................................................................................6

Answer C:...............................................................................................................................7

Answer D:..............................................................................................................................7

Answer E:...............................................................................................................................8

Answer to question 3:.................................................................................................................8

Answer A:..............................................................................................................................8

Answer B:...............................................................................................................................9

Answer C:...............................................................................................................................9

Answer D:............................................................................................................................10

2TAXATION LAW

Answer to Question 4...............................................................................................................10

Answer A.............................................................................................................................10

Answer B..............................................................................................................................11

Answer C..............................................................................................................................11

Answer D.............................................................................................................................12

Answer E..............................................................................................................................12

Answer to Question 5...............................................................................................................13

Issues....................................................................................................................................13

Laws.....................................................................................................................................13

Application...........................................................................................................................14

Conclusions..........................................................................................................................14

References:...............................................................................................................................15

Answer to Question 4...............................................................................................................10

Answer A.............................................................................................................................10

Answer B..............................................................................................................................11

Answer C..............................................................................................................................11

Answer D.............................................................................................................................12

Answer E..............................................................................................................................12

Answer to Question 5...............................................................................................................13

Issues....................................................................................................................................13

Laws.....................................................................................................................................13

Application...........................................................................................................................14

Conclusions..........................................................................................................................14

References:...............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Answer to question 1:

Answer A:

The ruling is associated with the methodology given by the commissioner of taxation

to determine the depreciating assets effective life within the section 40-100, ITAA 1997. The

ruling is effective in computing the decline in value of the depreciating assets.

Answer B:

The taxpayers are provided with the information regarding the entitlement of claiming

tax offsets under the “Division 13, ITAA 1997”.

Answer C:

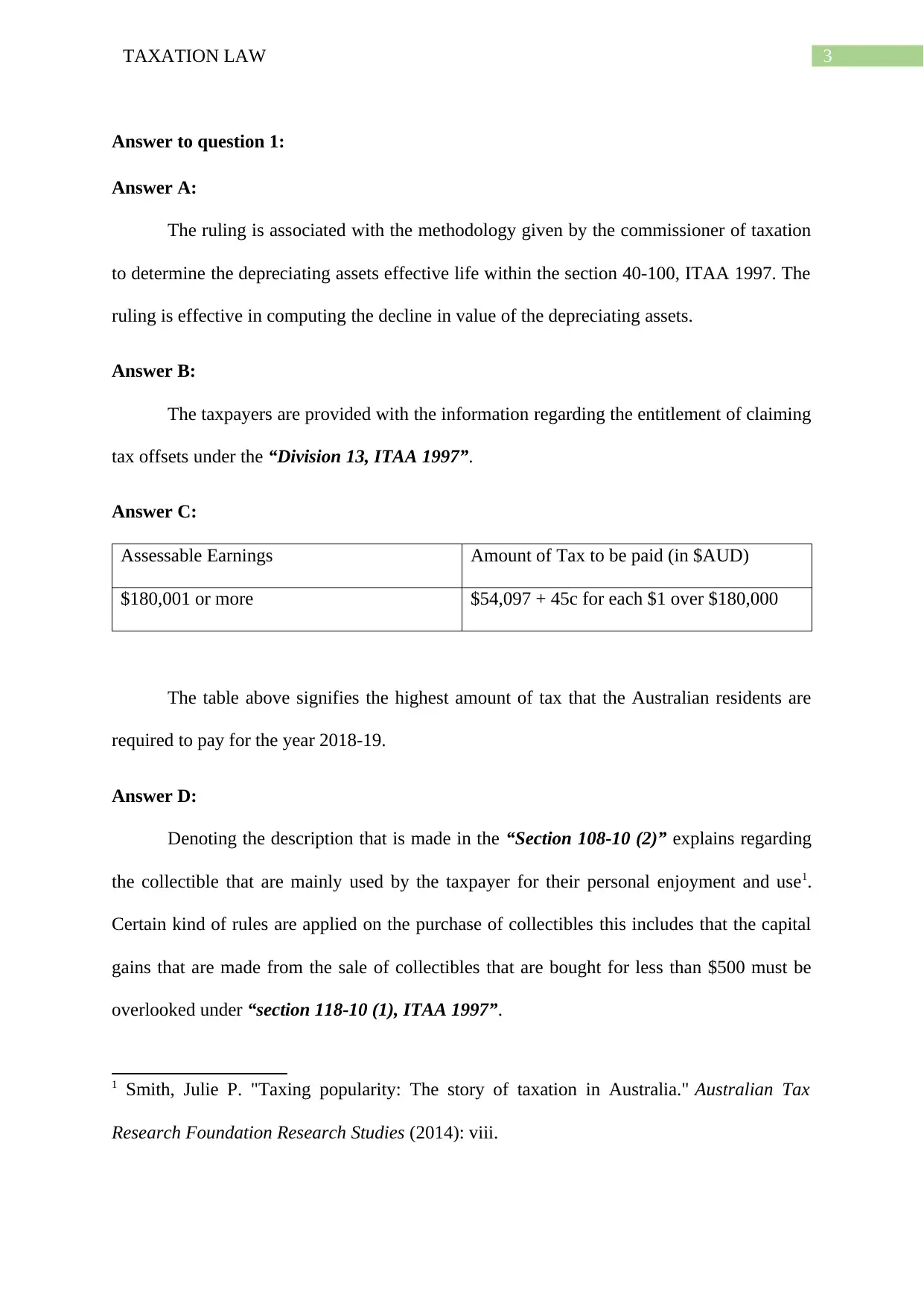

Assessable Earnings Amount of Tax to be paid (in $AUD)

$180,001 or more $54,097 + 45c for each $1 over $180,000

The table above signifies the highest amount of tax that the Australian residents are

required to pay for the year 2018-19.

Answer D:

Denoting the description that is made in the “Section 108-10 (2)” explains regarding

the collectible that are mainly used by the taxpayer for their personal enjoyment and use1.

Certain kind of rules are applied on the purchase of collectibles this includes that the capital

gains that are made from the sale of collectibles that are bought for less than $500 must be

overlooked under “section 118-10 (1), ITAA 1997”.

1 Smith, Julie P. "Taxing popularity: The story of taxation in Australia." Australian Tax

Research Foundation Research Studies (2014): viii.

Answer to question 1:

Answer A:

The ruling is associated with the methodology given by the commissioner of taxation

to determine the depreciating assets effective life within the section 40-100, ITAA 1997. The

ruling is effective in computing the decline in value of the depreciating assets.

Answer B:

The taxpayers are provided with the information regarding the entitlement of claiming

tax offsets under the “Division 13, ITAA 1997”.

Answer C:

Assessable Earnings Amount of Tax to be paid (in $AUD)

$180,001 or more $54,097 + 45c for each $1 over $180,000

The table above signifies the highest amount of tax that the Australian residents are

required to pay for the year 2018-19.

Answer D:

Denoting the description that is made in the “Section 108-10 (2)” explains regarding

the collectible that are mainly used by the taxpayer for their personal enjoyment and use1.

Certain kind of rules are applied on the purchase of collectibles this includes that the capital

gains that are made from the sale of collectibles that are bought for less than $500 must be

overlooked under “section 118-10 (1), ITAA 1997”.

1 Smith, Julie P. "Taxing popularity: The story of taxation in Australia." Australian Tax

Research Foundation Research Studies (2014): viii.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

Answer E:

The CGT event B1 is largely associated with the use of title before the title of the

asset passes away under the “section 104-15, ITAA 1997”2. A CGT event B1 happens if the

taxpayer enters in the agreement with the another entity based on conditions that;

a. The right of using and enjoying the CGT asset that is owed to them is passed to some

another individual

b. The title that is contained in the asset may be passed to another individual prior to or

before the end of the agreement.

Answer F:

The “section 4-10 (3)” is important in working out the amount of tax for the financial

year. The formula is given below;

Income Tax = (Taxable Income x Rate) – Tax Offsets

Answer to G:

The respondent in the case of “FC of T v Day 2008 ATC 20-064” was the public

officer and within the legislative provision of “section 8-1, ITAA 1997” the expenditure that

was occurred by the taxpayer in defending the legal charges were not permissible as

deductible expenditure3. This is because the numerous charges that were levied on the

2 Pope, Jeff. "The compliance costs of taxation in Australia and tax simplification: The

issues." Australian Journal of Management 18.1 (2013): 69-89.

3 Long, Brendan, Jon Campbell, and Carolyn Kelshaw. "The justice lens on taxation policy in

Australia." St Mark's Review235 (2016): 94.

Answer E:

The CGT event B1 is largely associated with the use of title before the title of the

asset passes away under the “section 104-15, ITAA 1997”2. A CGT event B1 happens if the

taxpayer enters in the agreement with the another entity based on conditions that;

a. The right of using and enjoying the CGT asset that is owed to them is passed to some

another individual

b. The title that is contained in the asset may be passed to another individual prior to or

before the end of the agreement.

Answer F:

The “section 4-10 (3)” is important in working out the amount of tax for the financial

year. The formula is given below;

Income Tax = (Taxable Income x Rate) – Tax Offsets

Answer to G:

The respondent in the case of “FC of T v Day 2008 ATC 20-064” was the public

officer and within the legislative provision of “section 8-1, ITAA 1997” the expenditure that

was occurred by the taxpayer in defending the legal charges were not permissible as

deductible expenditure3. This is because the numerous charges that were levied on the

2 Pope, Jeff. "The compliance costs of taxation in Australia and tax simplification: The

issues." Australian Journal of Management 18.1 (2013): 69-89.

3 Long, Brendan, Jon Campbell, and Carolyn Kelshaw. "The justice lens on taxation policy in

Australia." St Mark's Review235 (2016): 94.

5TAXATION LAW

taxpayer were as a result of his own concern of disciplinary charges. Therefore, the legal

expenditure was not allowed as deduction under “section 8-1, ITAA 1997”.

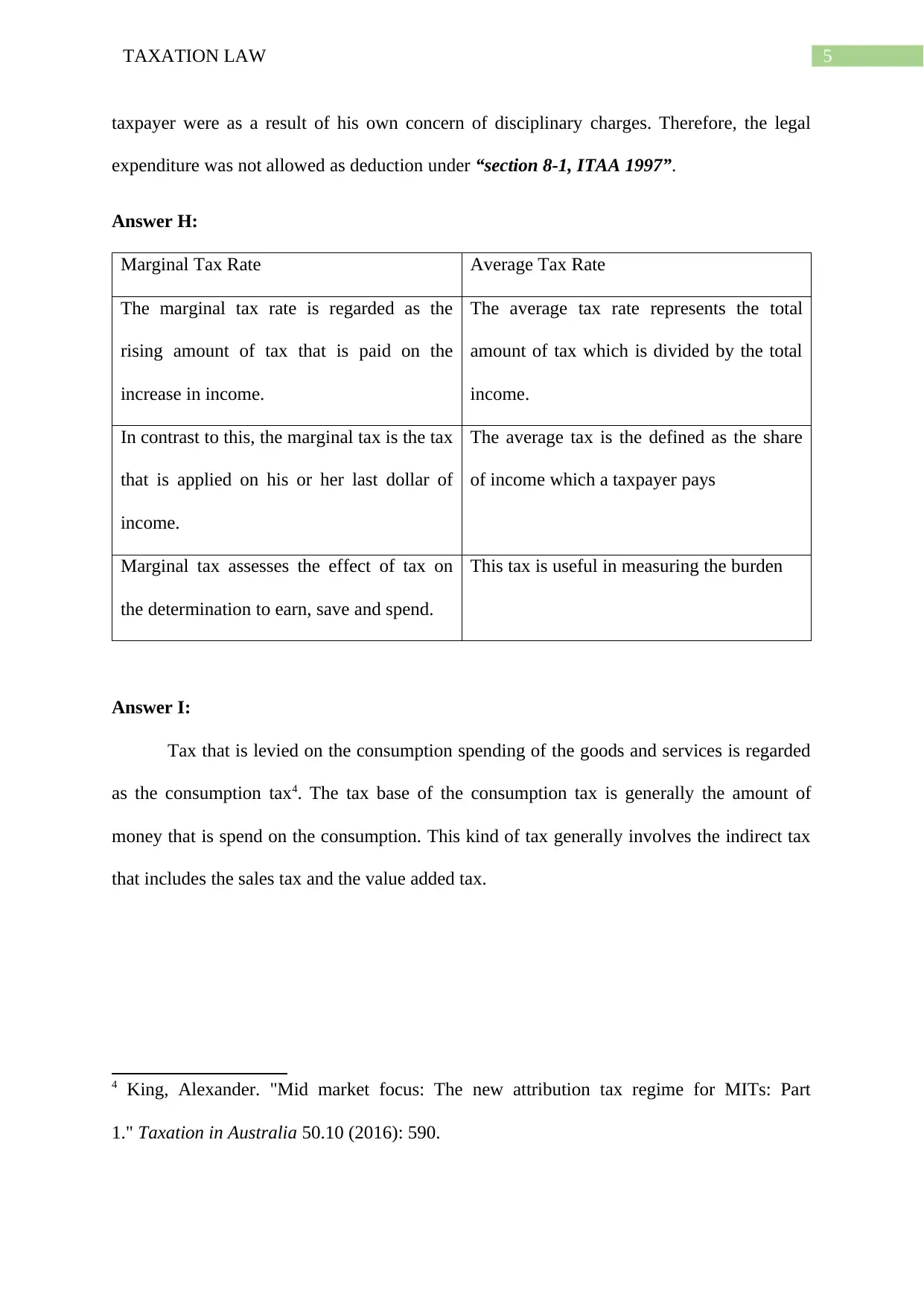

Answer H:

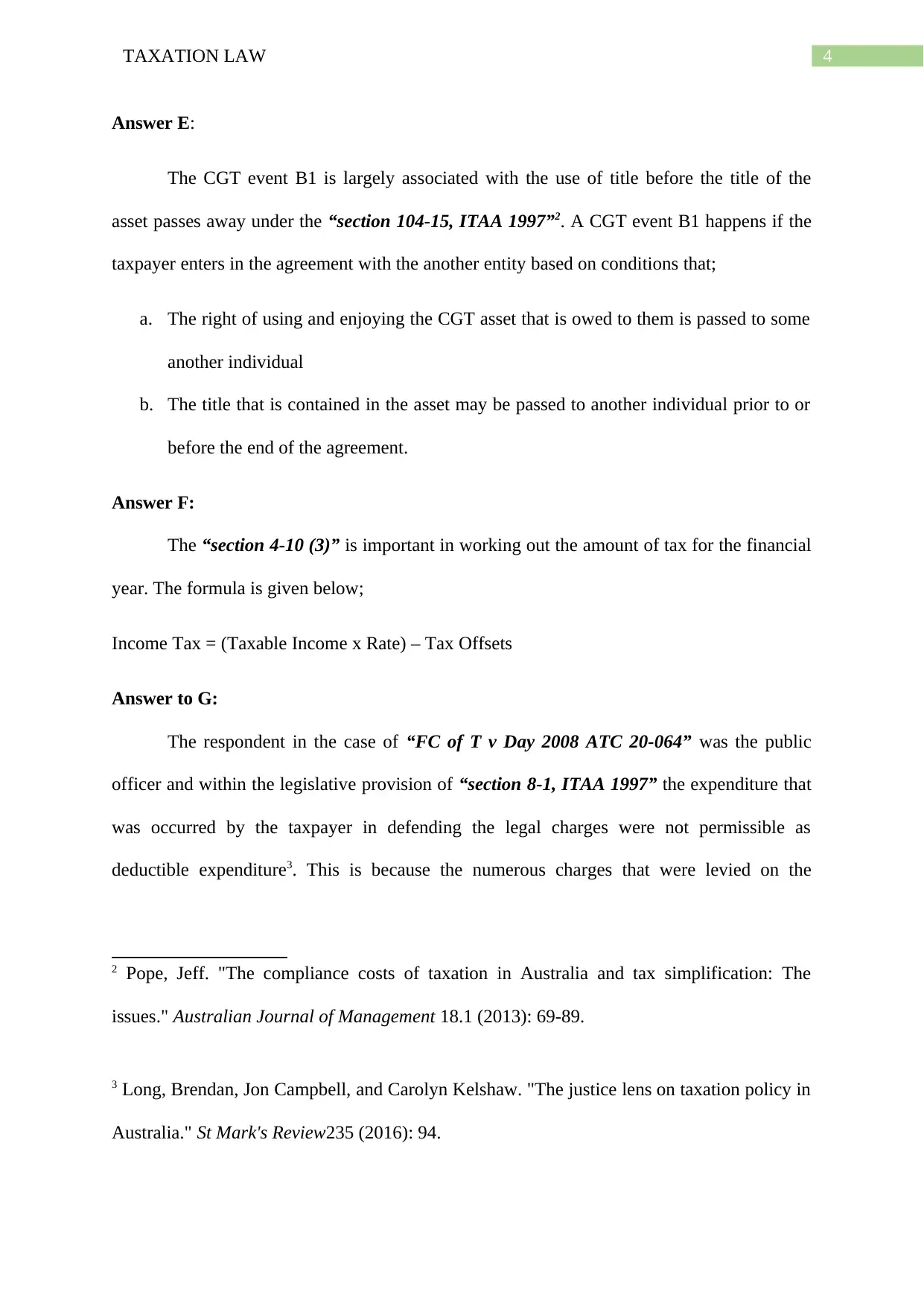

Marginal Tax Rate Average Tax Rate

The marginal tax rate is regarded as the

rising amount of tax that is paid on the

increase in income.

The average tax rate represents the total

amount of tax which is divided by the total

income.

In contrast to this, the marginal tax is the tax

that is applied on his or her last dollar of

income.

The average tax is the defined as the share

of income which a taxpayer pays

Marginal tax assesses the effect of tax on

the determination to earn, save and spend.

This tax is useful in measuring the burden

Answer I:

Tax that is levied on the consumption spending of the goods and services is regarded

as the consumption tax4. The tax base of the consumption tax is generally the amount of

money that is spend on the consumption. This kind of tax generally involves the indirect tax

that includes the sales tax and the value added tax.

4 King, Alexander. "Mid market focus: The new attribution tax regime for MITs: Part

1." Taxation in Australia 50.10 (2016): 590.

taxpayer were as a result of his own concern of disciplinary charges. Therefore, the legal

expenditure was not allowed as deduction under “section 8-1, ITAA 1997”.

Answer H:

Marginal Tax Rate Average Tax Rate

The marginal tax rate is regarded as the

rising amount of tax that is paid on the

increase in income.

The average tax rate represents the total

amount of tax which is divided by the total

income.

In contrast to this, the marginal tax is the tax

that is applied on his or her last dollar of

income.

The average tax is the defined as the share

of income which a taxpayer pays

Marginal tax assesses the effect of tax on

the determination to earn, save and spend.

This tax is useful in measuring the burden

Answer I:

Tax that is levied on the consumption spending of the goods and services is regarded

as the consumption tax4. The tax base of the consumption tax is generally the amount of

money that is spend on the consumption. This kind of tax generally involves the indirect tax

that includes the sales tax and the value added tax.

4 King, Alexander. "Mid market focus: The new attribution tax regime for MITs: Part

1." Taxation in Australia 50.10 (2016): 590.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Answer to question 2:

Answer A:

Claiming deduction on interest is largely dependent on satisfying the provision of

“section 8-1, ITAA 1997” which is capable of representing that the expenses are occurred in

producing the assessable income of taxpayer5. The judgement made in “FCT v Roberts and

Smith (1992)” interest expenditure is allowed to deduction when the expenses are directly

associated to the derivation of taxpayer’s assessable income.

An interest on loan has been occurred by Brett for paying the employee wages for the

loan taken out by him. Referring to “FCT v Roberts and Smith (1992)” the interest on loan

that was taken by the Brett is allowed as deduction under “section 8-1, ITAA 1997”.

Answer B:

As stated by the ATO at the time of filing return, deduction is allowed to individual

taxpayer for outgoings occurred directly in generating assessable income. It is necessary

apportion the outgoings that are incurred by the taxpayer for dual purpose. Citing “Ronpibon

Tin NL v FC of T (1949)” it is held that expenses occurred by taxpayer in generating

assessable income is allowed as deduction under “section 8-1, ITAA 1997”6.

The mobile phone expenses were incurred by Julie that were for dual purpose. Noting

the decision in “Ronpibon Tin NL v FC of T (1949)” mobile phone bill expenses is only

5 Edmonds, Richard. "Resource Capital Fund IV LP: the issues on appeal?." Taxation in

Australia 53.1 (2018): 22.

6 Butler, Daniel. "Who can provide taxation advice?." Taxation in Australia 53.7 (2019): 381.

Answer to question 2:

Answer A:

Claiming deduction on interest is largely dependent on satisfying the provision of

“section 8-1, ITAA 1997” which is capable of representing that the expenses are occurred in

producing the assessable income of taxpayer5. The judgement made in “FCT v Roberts and

Smith (1992)” interest expenditure is allowed to deduction when the expenses are directly

associated to the derivation of taxpayer’s assessable income.

An interest on loan has been occurred by Brett for paying the employee wages for the

loan taken out by him. Referring to “FCT v Roberts and Smith (1992)” the interest on loan

that was taken by the Brett is allowed as deduction under “section 8-1, ITAA 1997”.

Answer B:

As stated by the ATO at the time of filing return, deduction is allowed to individual

taxpayer for outgoings occurred directly in generating assessable income. It is necessary

apportion the outgoings that are incurred by the taxpayer for dual purpose. Citing “Ronpibon

Tin NL v FC of T (1949)” it is held that expenses occurred by taxpayer in generating

assessable income is allowed as deduction under “section 8-1, ITAA 1997”6.

The mobile phone expenses were incurred by Julie that were for dual purpose. Noting

the decision in “Ronpibon Tin NL v FC of T (1949)” mobile phone bill expenses is only

5 Edmonds, Richard. "Resource Capital Fund IV LP: the issues on appeal?." Taxation in

Australia 53.1 (2018): 22.

6 Butler, Daniel. "Who can provide taxation advice?." Taxation in Australia 53.7 (2019): 381.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

allowed up to 60% for deduction because it is associated with Julie income producing

activities7.

Answer C:

Outgoings occurred for private nature is not permitted for deduction under “section 8-

1, ITAA 1997”. The court in “Lodge v FC of T (1972)” held that child care expenses was not

deductible since it was not relevant in the derivation of assessable income8.

Sally incurred the baby sitter expenses so that she can attend work. Mentioning

“Lodge v FC of T (1972)” no deduction for baby sitter expense is allowed to Sally because it

is not relevant in producing income.

Answer D:

Within the legislation of “section 8-1, ITAA 1997” deduction for financial resources

loss is permitted to taxpayer that depletes financial position of taxpayer. The law court in

“Charles Moore & Co (WA) Pty Ltd v FCT (1965)” allowed deduction for theft of money to

taxpayer because it depleted financial position of taxpayer9.

7 Pinto, Dale, and Michelle Evans. "Returning income taxation revenue to the states: back to

the future." (2018).

8 McCluskey, William J., and Riël CD Franzsen. Land value taxation: An applied analysis.

Routledge, 2017.

9 Tan, Denise. "Discretionary trusts and landholder duty: Part 1." Taxation in Australia 53.7

(2019): 378.

allowed up to 60% for deduction because it is associated with Julie income producing

activities7.

Answer C:

Outgoings occurred for private nature is not permitted for deduction under “section 8-

1, ITAA 1997”. The court in “Lodge v FC of T (1972)” held that child care expenses was not

deductible since it was not relevant in the derivation of assessable income8.

Sally incurred the baby sitter expenses so that she can attend work. Mentioning

“Lodge v FC of T (1972)” no deduction for baby sitter expense is allowed to Sally because it

is not relevant in producing income.

Answer D:

Within the legislation of “section 8-1, ITAA 1997” deduction for financial resources

loss is permitted to taxpayer that depletes financial position of taxpayer. The law court in

“Charles Moore & Co (WA) Pty Ltd v FCT (1965)” allowed deduction for theft of money to

taxpayer because it depleted financial position of taxpayer9.

7 Pinto, Dale, and Michelle Evans. "Returning income taxation revenue to the states: back to

the future." (2018).

8 McCluskey, William J., and Riël CD Franzsen. Land value taxation: An applied analysis.

Routledge, 2017.

9 Tan, Denise. "Discretionary trusts and landholder duty: Part 1." Taxation in Australia 53.7

(2019): 378.

8TAXATION LAW

Jerry is permitted to claim deduction allowable deduction under the “section 8-1,

ITAA 1997” for the goods valuing $20,000 stolen by employee because it resulted in loss of

financial position for the Jerry.

Answer E:

Denoting the explanation made in “8-1, ITAA 1997” deduction for expenses that are

pre-commencement to income generating activities is non-deductible since it is not occurred

during the income producing course. Citing “Maddalena v FCT (1971)” deduction for pre-

commencement expenses were not deductible because it incurred a point too soon10.

Expenses for fighting the elections and expenses associated to political party spending

by the taxpayer is regarded as the pre-commencement expenses. In light of “Maddalena v

FCT (1971)” the expenses are not allowed for deduction under section “8-1, ITAA 1997”

because it is not in the course of producing income.

Answer to question 3:

Answer A:

CGT event F2 only happens when the taxpayer as the land owner provides the land on

long term lease, or renews the lease. The event is applicable when the taxpayer is the land

owner and sub-lease the land. Nonetheless, taxpayers are provided to apply CGT discount

under the CGT event F211.

10 Brown, Katrina E. "Related party LRBAs and PCG 2016/5: Recommendations for trustees

for smooth sailing." Taxation in Australia 50.11 (2016): 670.

11 Mangioni, Vince. Land Tax in Australia: Fiscal reform of sub-national government.

Routledge, 2015.

Jerry is permitted to claim deduction allowable deduction under the “section 8-1,

ITAA 1997” for the goods valuing $20,000 stolen by employee because it resulted in loss of

financial position for the Jerry.

Answer E:

Denoting the explanation made in “8-1, ITAA 1997” deduction for expenses that are

pre-commencement to income generating activities is non-deductible since it is not occurred

during the income producing course. Citing “Maddalena v FCT (1971)” deduction for pre-

commencement expenses were not deductible because it incurred a point too soon10.

Expenses for fighting the elections and expenses associated to political party spending

by the taxpayer is regarded as the pre-commencement expenses. In light of “Maddalena v

FCT (1971)” the expenses are not allowed for deduction under section “8-1, ITAA 1997”

because it is not in the course of producing income.

Answer to question 3:

Answer A:

CGT event F2 only happens when the taxpayer as the land owner provides the land on

long term lease, or renews the lease. The event is applicable when the taxpayer is the land

owner and sub-lease the land. Nonetheless, taxpayers are provided to apply CGT discount

under the CGT event F211.

10 Brown, Katrina E. "Related party LRBAs and PCG 2016/5: Recommendations for trustees

for smooth sailing." Taxation in Australia 50.11 (2016): 670.

11 Mangioni, Vince. Land Tax in Australia: Fiscal reform of sub-national government.

Routledge, 2015.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Andy being the land owner provides Brian with land by granting the lease of land for

a premium of $5,000. Andy can apply the CGT event F2 while granting the lease of land

however no CGT discount is applied to Andy in this case.

Answer B:

Where the landowner forms the agreement with another individual by passing the

right and title of land to another person or entity then the CGT event B1 happens under

“subsection 104-15 (1), ITAA 1997”. Upon the end of the contract the title is eventually

passed to the new owner of land.

An option was exercised by John to grant the Farm Ltd to purchase the land in

exchange for the sum of $800,000. The title of land is passed by John to Farm Ltd which

ultimately resulted in CGT event B1 within the legislation of subsection 104-15 (1), ITAA

1997. In this circumstances a 50% CGT discount is allowed to John relating to capital gains

made from the asset.

Answer C:

The ATO explains that taxpayers are permitted to claim exemption from the CGT

where the main residence is used by taxpayer for residence use only under “section 118-110

(1), ITAA 1997”12. When the taxpayer uses the dwelling for producing income then only

partial main residence exemption is allowed for CGT. The taxpayer here purchased the

property in 2006 and it was put on rent for two years. The house was reoccupied for using its

main residence and finally selling it in 2018 where the capital gains of $300,000 was made.

Jamie and Olivia is allowed to claim partial main residence exemption because they used

their dwelling for business purpose. Additionally, they will also be allowed to a 50% CGT

12 Freebairn, John. "Taxation of housing." Australian Economic Review 49.3 (2016): 307-316.

Andy being the land owner provides Brian with land by granting the lease of land for

a premium of $5,000. Andy can apply the CGT event F2 while granting the lease of land

however no CGT discount is applied to Andy in this case.

Answer B:

Where the landowner forms the agreement with another individual by passing the

right and title of land to another person or entity then the CGT event B1 happens under

“subsection 104-15 (1), ITAA 1997”. Upon the end of the contract the title is eventually

passed to the new owner of land.

An option was exercised by John to grant the Farm Ltd to purchase the land in

exchange for the sum of $800,000. The title of land is passed by John to Farm Ltd which

ultimately resulted in CGT event B1 within the legislation of subsection 104-15 (1), ITAA

1997. In this circumstances a 50% CGT discount is allowed to John relating to capital gains

made from the asset.

Answer C:

The ATO explains that taxpayers are permitted to claim exemption from the CGT

where the main residence is used by taxpayer for residence use only under “section 118-110

(1), ITAA 1997”12. When the taxpayer uses the dwelling for producing income then only

partial main residence exemption is allowed for CGT. The taxpayer here purchased the

property in 2006 and it was put on rent for two years. The house was reoccupied for using its

main residence and finally selling it in 2018 where the capital gains of $300,000 was made.

Jamie and Olivia is allowed to claim partial main residence exemption because they used

their dwelling for business purpose. Additionally, they will also be allowed to a 50% CGT

12 Freebairn, John. "Taxation of housing." Australian Economic Review 49.3 (2016): 307-316.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

discount from the capital gains made since the asset was under their ownership for 12

months.

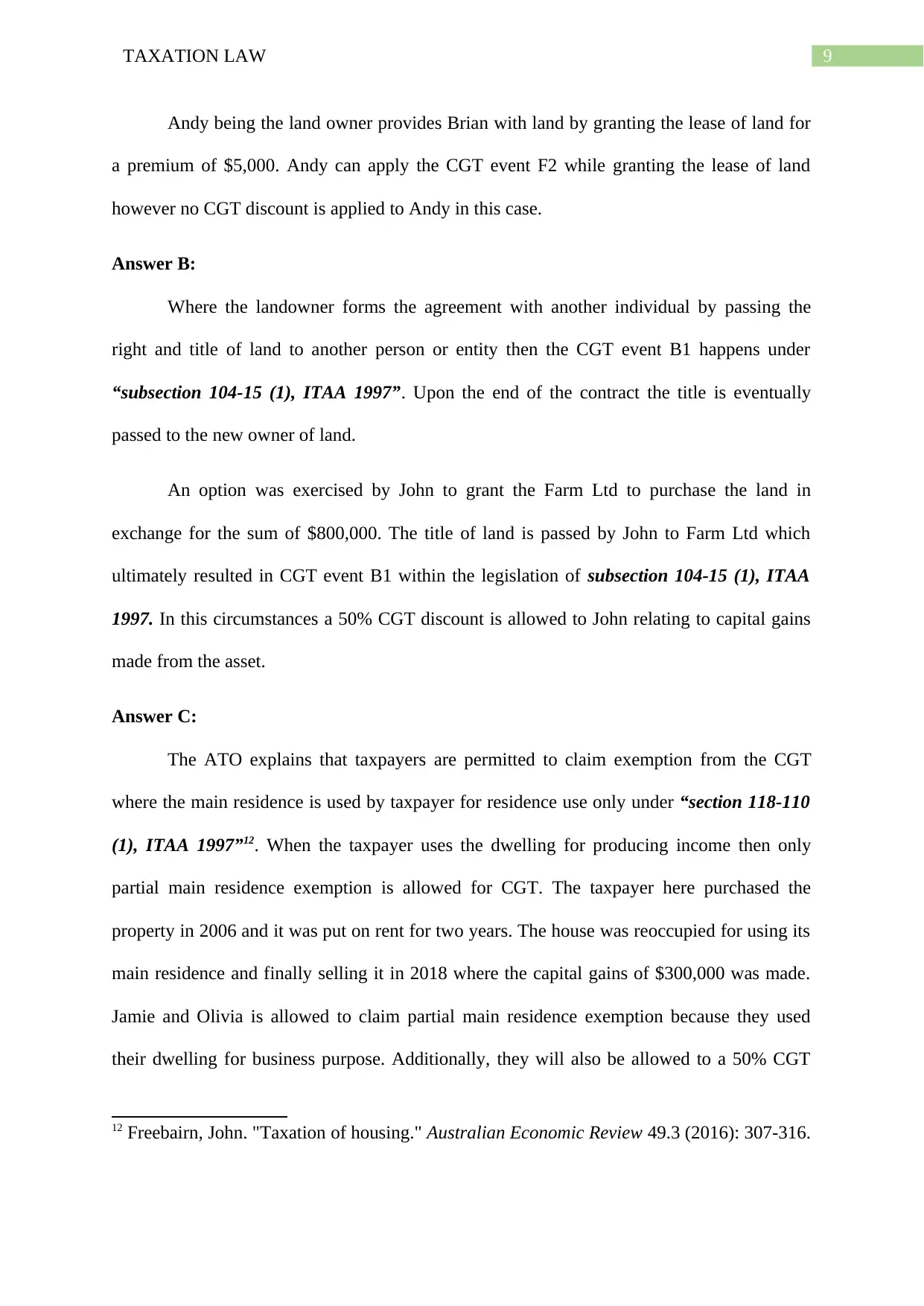

Answer D:

Particulars Amount (AUD$) Amount (AUD$)

Proceeds from the sale of BHP Shares (CGT Event A1 (section 104-10(1)) 18720

Element 1: Cost of Acquisition (section 110-25(1)) 5400

Taxable Capital gains 13320

Proceeds from the sale of Wesfarmers Shares (CGT Event A1 (section 104-

10(1)) 10500

Element 1: Cost of Acquisition (section 110-25(1)) 26000

Loss on Sale -15500

Net capital loss -2180

Calculation of Capital Gains Tax

In the Books of Chris

For the year ended 2019

Chris is only allowed to include in his taxable income the gains made from BHP share

and should ignore the capital loss from Wesfarmers shares. No CGT discount method is

applicable because Chris did not hold the asset for 12 months.

Answer to Question 4

Answer A

Prizes and winnings which are of uncertain nature are considered to be not taxable if

the same are generated by chance. In case of prizes which are related to application of

personal skills and development would be considered as ordinary income in the nature of the

business. The case laws of “Kelly v FCT (1985)” shows that winnings from professional

sports people are considered as taxable income which is derived from personal skills13.

As per the case shows that the tax payer received $ 2000 for the best TV

advertisement which would be considered as ordinary income under “section 6-5, ITAA

13 Devos, Ken, and Marcus Zackrisson. "Tax compliance and the public disclosure of tax

information: An Australia/Norway comparison." eJTR 13 (2015): 108.

discount from the capital gains made since the asset was under their ownership for 12

months.

Answer D:

Particulars Amount (AUD$) Amount (AUD$)

Proceeds from the sale of BHP Shares (CGT Event A1 (section 104-10(1)) 18720

Element 1: Cost of Acquisition (section 110-25(1)) 5400

Taxable Capital gains 13320

Proceeds from the sale of Wesfarmers Shares (CGT Event A1 (section 104-

10(1)) 10500

Element 1: Cost of Acquisition (section 110-25(1)) 26000

Loss on Sale -15500

Net capital loss -2180

Calculation of Capital Gains Tax

In the Books of Chris

For the year ended 2019

Chris is only allowed to include in his taxable income the gains made from BHP share

and should ignore the capital loss from Wesfarmers shares. No CGT discount method is

applicable because Chris did not hold the asset for 12 months.

Answer to Question 4

Answer A

Prizes and winnings which are of uncertain nature are considered to be not taxable if

the same are generated by chance. In case of prizes which are related to application of

personal skills and development would be considered as ordinary income in the nature of the

business. The case laws of “Kelly v FCT (1985)” shows that winnings from professional

sports people are considered as taxable income which is derived from personal skills13.

As per the case shows that the tax payer received $ 2000 for the best TV

advertisement which would be considered as ordinary income under “section 6-5, ITAA

13 Devos, Ken, and Marcus Zackrisson. "Tax compliance and the public disclosure of tax

information: An Australia/Norway comparison." eJTR 13 (2015): 108.

11TAXATION LAW

1997”. Referring to the case of “Kelly v FCT (1985)” the amount which is received would be

held taxable as it is related to the skills.

Answer B

As per the provisions of “section 6-1 of the ITAA 1936” income earned by an

employee of the business consists of allowances, salaries, wages or retirements benefits etc.

However, reimbursement of expenses from the employer should not be considered as

income14. As per the case which is provided the employee has received $ 500 as travel

allowance for travel which from workplace to Sydney where the office is situated. Therefore,

the same would be considered as taxable income as it is of ordinary income nature and would

be covered under “section 6-5, ITAA 1997”.

Answer C

The gifts which are received by Taxpayer would not be considered as income in

relation to ordinary income under the meaning of “section 6-5, ITAA 1997”. The case of

“Scott v FCT (1966)” shows that the gifts received from personal relations with the parties

would not be considered as income.

As per the case, the taxpayer received iphone as a gift from the client which has a

value of $ 1000. The decisions which was given in “Scott v FCT (1966)” guides that gifts are

not considered as income in ordinary sense as per “section 6-5, ITAA 1997” because the

same is not related to the business activities or generation of income for the taxpayer.

14 Walrut, Bernie, John Tucker, and Paul Ingram. "Tax files: A submission on the proposed

review of SA's tax laws." Bulletin (Law Society of South Australia) 37.4 (2015): 36.

1997”. Referring to the case of “Kelly v FCT (1985)” the amount which is received would be

held taxable as it is related to the skills.

Answer B

As per the provisions of “section 6-1 of the ITAA 1936” income earned by an

employee of the business consists of allowances, salaries, wages or retirements benefits etc.

However, reimbursement of expenses from the employer should not be considered as

income14. As per the case which is provided the employee has received $ 500 as travel

allowance for travel which from workplace to Sydney where the office is situated. Therefore,

the same would be considered as taxable income as it is of ordinary income nature and would

be covered under “section 6-5, ITAA 1997”.

Answer C

The gifts which are received by Taxpayer would not be considered as income in

relation to ordinary income under the meaning of “section 6-5, ITAA 1997”. The case of

“Scott v FCT (1966)” shows that the gifts received from personal relations with the parties

would not be considered as income.

As per the case, the taxpayer received iphone as a gift from the client which has a

value of $ 1000. The decisions which was given in “Scott v FCT (1966)” guides that gifts are

not considered as income in ordinary sense as per “section 6-5, ITAA 1997” because the

same is not related to the business activities or generation of income for the taxpayer.

14 Walrut, Bernie, John Tucker, and Paul Ingram. "Tax files: A submission on the proposed

review of SA's tax laws." Bulletin (Law Society of South Australia) 37.4 (2015): 36.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.