UTS Taxation Law: Income, Deductions & CGT Event Analysis

VerifiedAdded on 2023/04/26

|12

|2196

|177

Report

AI Summary

This assignment provides a detailed analysis of various taxation law concepts related to income and deductions, focusing on a hypothetical case involving Sarah, an interior design consultant. The analysis covers the tax implications of her salary, home office expenses, design equipment depreciation, membership subscriptions, travel expenses, clothing expenses, self-education expenses, and the sale of personal use assets, specifically a furniture set. By applying relevant sections of the ITAA 1997 and referencing key case laws, the assignment determines whether Sarah is entitled to claim deductions for certain expenses and addresses the capital gains tax implications of selling her furniture. The conclusion summarizes which expenses are deductible and highlights the non-deductibility of ordinary clothing, self-education costs, and travel to her part-time teaching job, while also addressing the CGT event arising from the sale of personal use assets.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Headings:................................................................................................................................2

Issues:.....................................................................................................................................2

Rule:.......................................................................................................................................2

Applications:..........................................................................................................................5

Conclusion:............................................................................................................................9

References:...............................................................................................................................10

Table of Contents

Answer to question 1:.................................................................................................................2

Headings:................................................................................................................................2

Issues:.....................................................................................................................................2

Rule:.......................................................................................................................................2

Applications:..........................................................................................................................5

Conclusion:............................................................................................................................9

References:...............................................................................................................................10

2TAXATION LAW

Answer to question 1:

Headings:

The current problem is associated to the ascertainment of the total chargeable earnings

that is earned by the taxpayer during the year and treatment of tax for the items occurred

during the year.

Issues:

The case study introduces the issues of ascertaining whether the receipts that is made

all through the year will be considered for taxation purpose under “Sec 6-5, ITA Act 1997”.

The case study also brings forward the issues of whether the taxpayer is entitled to an

allowable income tax deduction for outgoings under “Sec 8-1, ITA Act 1997”.

Rule:

When a person obtains a receipts from the employment and from providing personal

services it will be subjected to income tax for the employees. As per “Sec 6-1, ITA Act 1936”

earnings from the personal exertion represents the earnings from remuneration from

employment, wages, fees, superannuation, allowances etc. that is obtained from employment

or revenue obtained from the business.

As the general rule, “sec 6-5, ITAA 1997” majority of the earnings received by

taxpayer is ordinary income. In “Scott v CT (1935)” income is not the word of art and needs

the implementation of necessary principles to treat the receipts as ordinary income1. As held

in “Dean v FCT (1997)” retention payment made to employee as the consideration of to be

employment for additional twelve months is taken as ordinary income.

1 Barkoczy, Stephen, Foundations Of Taxation Law 2014

Answer to question 1:

Headings:

The current problem is associated to the ascertainment of the total chargeable earnings

that is earned by the taxpayer during the year and treatment of tax for the items occurred

during the year.

Issues:

The case study introduces the issues of ascertaining whether the receipts that is made

all through the year will be considered for taxation purpose under “Sec 6-5, ITA Act 1997”.

The case study also brings forward the issues of whether the taxpayer is entitled to an

allowable income tax deduction for outgoings under “Sec 8-1, ITA Act 1997”.

Rule:

When a person obtains a receipts from the employment and from providing personal

services it will be subjected to income tax for the employees. As per “Sec 6-1, ITA Act 1936”

earnings from the personal exertion represents the earnings from remuneration from

employment, wages, fees, superannuation, allowances etc. that is obtained from employment

or revenue obtained from the business.

As the general rule, “sec 6-5, ITAA 1997” majority of the earnings received by

taxpayer is ordinary income. In “Scott v CT (1935)” income is not the word of art and needs

the implementation of necessary principles to treat the receipts as ordinary income1. As held

in “Dean v FCT (1997)” retention payment made to employee as the consideration of to be

employment for additional twelve months is taken as ordinary income.

1 Barkoczy, Stephen, Foundations Of Taxation Law 2014

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

As per “sect 8-1, ITA Act 1997” the deduction for home office expenditure is reliant

on whether the taxpayer is using the home office as the genuine home office or home is used

for convenience purpose2. Typically, “sec 8-1, ITA Act 1997” allows taxpayers deduction

relating to running and occupancy expenses for home office purpose. As held in “Swinford v

FCT (1984) 15 ATR 1154” the self-employed scriptwriter was permitted deduction up to a

portion of the rent that is paid for the flat where the taxpayer has dedicated a separate room in

the flat for study purpose. The taxpayer does not have separate business place and wrote

script from the room.

According to “sec 40-25 (1)” a person is permitted to claim deduction for the amount

which is equivalent to depreciation amount of the depreciating asset for an asset held all

through the year. Furthermore, “sec 40-25 (2)”, states that deduction is lowered for the

declining value which is attributable to the use of personal purpose beside the assessable

purpose. Beside this, a taxpayer under “section 25-55, ITAA 1997” a taxpayer is permitted

for deduction relating to subscriptions and membership fees paid to any business trade or

journals.

The statutory position of “sec 25-100, ITA Act 1997” explains that deduction is

permitted for travelling directly amid two place of work where the taxpayer is presently

involved in generating income. Travel on work such as travelling salesperson, self-employed

builder that are travelling for giving quotes is allowed for deduction3. The verdict in “FCT v

Wiener (1978) ATC 4006” stated that the commissioner of taxation permitted the taxpayer to

2 Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

3 Kenny, Paul, Australian Tax 2013 (LexisNexis Butterworths, 2013)

As per “sect 8-1, ITA Act 1997” the deduction for home office expenditure is reliant

on whether the taxpayer is using the home office as the genuine home office or home is used

for convenience purpose2. Typically, “sec 8-1, ITA Act 1997” allows taxpayers deduction

relating to running and occupancy expenses for home office purpose. As held in “Swinford v

FCT (1984) 15 ATR 1154” the self-employed scriptwriter was permitted deduction up to a

portion of the rent that is paid for the flat where the taxpayer has dedicated a separate room in

the flat for study purpose. The taxpayer does not have separate business place and wrote

script from the room.

According to “sec 40-25 (1)” a person is permitted to claim deduction for the amount

which is equivalent to depreciation amount of the depreciating asset for an asset held all

through the year. Furthermore, “sec 40-25 (2)”, states that deduction is lowered for the

declining value which is attributable to the use of personal purpose beside the assessable

purpose. Beside this, a taxpayer under “section 25-55, ITAA 1997” a taxpayer is permitted

for deduction relating to subscriptions and membership fees paid to any business trade or

journals.

The statutory position of “sec 25-100, ITA Act 1997” explains that deduction is

permitted for travelling directly amid two place of work where the taxpayer is presently

involved in generating income. Travel on work such as travelling salesperson, self-employed

builder that are travelling for giving quotes is allowed for deduction3. The verdict in “FCT v

Wiener (1978) ATC 4006” stated that the commissioner of taxation permitted the taxpayer to

2 Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

3 Kenny, Paul, Australian Tax 2013 (LexisNexis Butterworths, 2013)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

permissible deduction for travelling between the schools and also for travel amid the home

till the last school that was attended by the taxpayer.

The general rule given under “Lunney v FCT (1958)” stated that travel between the

home and the regular location of work is non-deductible. In “Payne v FCT (2001)”, travel

between unrelated workplace is not permitted for deduction under section “sec 8-1, ITA Act

1997”.

As per “sec 8-1”, conventional clothing is not permitted for deduction since it is not

occurred in gaining or generating the taxable income and they are held as personal or

domestic clothing. As held in “Mansfield v FCT 96 ATC 4001” ordinary clothing or articles

of apparel is not permitted for deduction, irrespective whether the outlays are vital in keeping

a proper appearance in a job4.

The self-education expenses are allowed for deduction if there is sufficient connection

with the revenue producing of the taxpayer taxable income. Nexus is established in the self-

education expenses if the expense is occurred in improving the prospect of income5. While

the taxpayer must bear in mind that self-education outgoings concerning an occupation in

which the taxpayer is not involved presently is not allowed for deduction since the nexus test

is not met.

Denoting the description in “section 104-10 (1)” a CGT event A1 takes place when

the CGT asset is disposed by the taxpayer. As per section 108-20(2) personal use assets

means assets that is mainly used or kept for the personal enjoyment. As defined in “section

4 Jover-Ledesma, Geralyn, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

5 Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

permissible deduction for travelling between the schools and also for travel amid the home

till the last school that was attended by the taxpayer.

The general rule given under “Lunney v FCT (1958)” stated that travel between the

home and the regular location of work is non-deductible. In “Payne v FCT (2001)”, travel

between unrelated workplace is not permitted for deduction under section “sec 8-1, ITA Act

1997”.

As per “sec 8-1”, conventional clothing is not permitted for deduction since it is not

occurred in gaining or generating the taxable income and they are held as personal or

domestic clothing. As held in “Mansfield v FCT 96 ATC 4001” ordinary clothing or articles

of apparel is not permitted for deduction, irrespective whether the outlays are vital in keeping

a proper appearance in a job4.

The self-education expenses are allowed for deduction if there is sufficient connection

with the revenue producing of the taxpayer taxable income. Nexus is established in the self-

education expenses if the expense is occurred in improving the prospect of income5. While

the taxpayer must bear in mind that self-education outgoings concerning an occupation in

which the taxpayer is not involved presently is not allowed for deduction since the nexus test

is not met.

Denoting the description in “section 104-10 (1)” a CGT event A1 takes place when

the CGT asset is disposed by the taxpayer. As per section 108-20(2) personal use assets

means assets that is mainly used or kept for the personal enjoyment. As defined in “section

4 Jover-Ledesma, Geralyn, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

5 Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

5TAXATION LAW

108-25 (2), ITAA 1997” personal use assets are held as single personal asset and each

disposal is held as the part of assets6.

Applications:

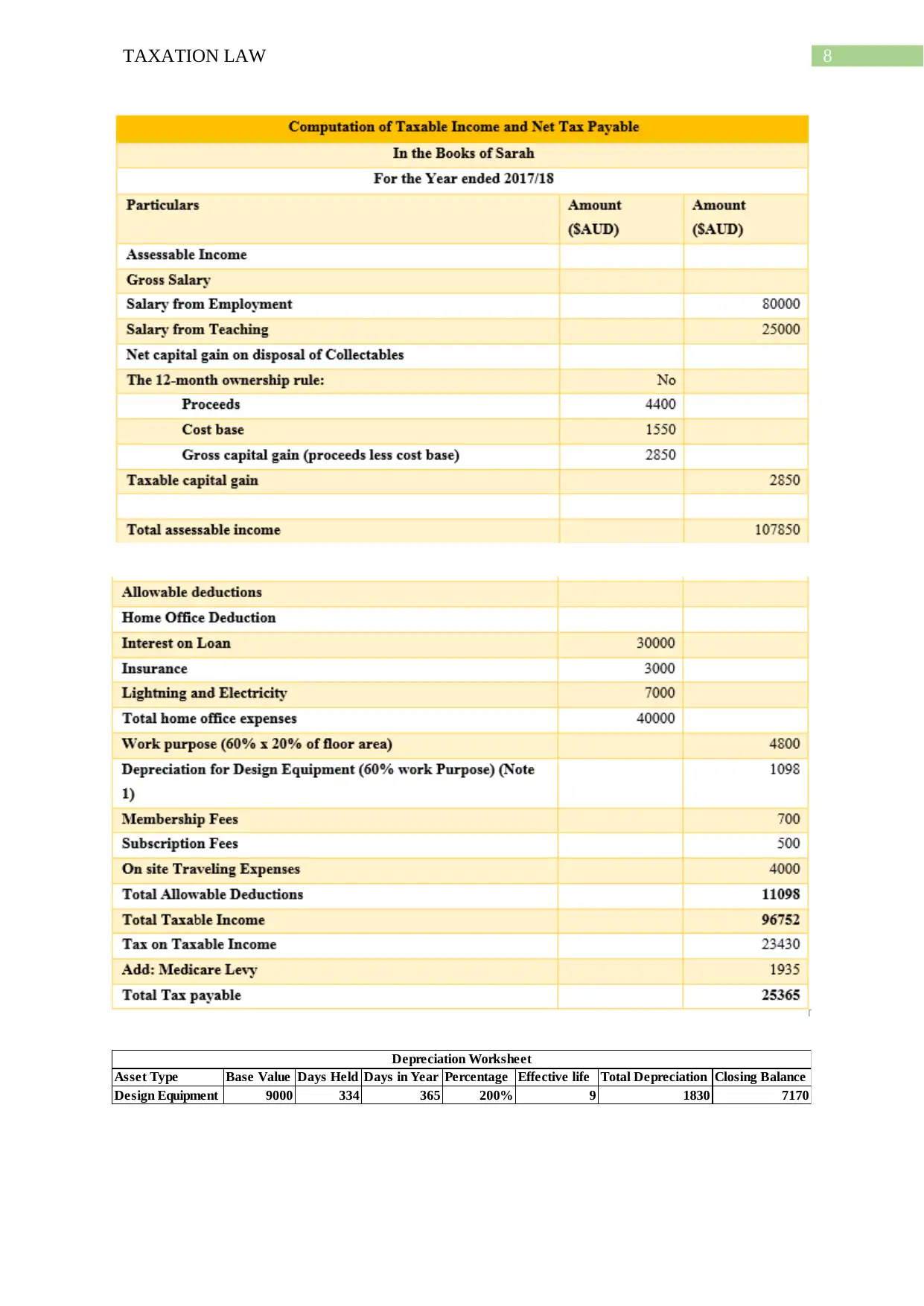

The case evidently brings forward that Sarah is working as the interior designer in full

time and also worked as the part time teach in a community college. Citing the event of

“Dean v FCT (1997)” the gross salary from both the employment is the receipt from

employment and personal services under “sect 6-1, ITA Act 1936”. Citing the event of “Scott

v CT (1935)” the salary constitutes ordinary income under the general rule of “sec 6-5, ITAA

1997”.

Sarah reported the expenses for her home office purpose where she has dedicated a

portion of house so that she can use it as the base for operations. Quoting the verdict of

“Swinford v FCT (1984) 15 ATR 1154” an allowable deduction is permitted to Sarah for the

running and occupancy of her spare room in her house under “section 8-1, ITA Act 1997”7.

The expenses include the home loan interest, electricity and insurance of her house. The

expenses are deductible because Sarah was not provided by her employer an office for work

and she did not have any other place but to use her home for work purpose. Sarah is entitled

to deduction of 60% of home office expense for the 20% floor area of her house.

A new design equipment was bought by Sarah which she used for other purpose other

than taxable purpose. Quoting “section 40-25 (1), ITAA 1997” Sarah is permitted to claim

6 Mankiw, N. Gregory, Ronald D Kneebone and Kenneth J McKenzie, Principles Of Taxation

2015.

7 Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

108-25 (2), ITAA 1997” personal use assets are held as single personal asset and each

disposal is held as the part of assets6.

Applications:

The case evidently brings forward that Sarah is working as the interior designer in full

time and also worked as the part time teach in a community college. Citing the event of

“Dean v FCT (1997)” the gross salary from both the employment is the receipt from

employment and personal services under “sect 6-1, ITA Act 1936”. Citing the event of “Scott

v CT (1935)” the salary constitutes ordinary income under the general rule of “sec 6-5, ITAA

1997”.

Sarah reported the expenses for her home office purpose where she has dedicated a

portion of house so that she can use it as the base for operations. Quoting the verdict of

“Swinford v FCT (1984) 15 ATR 1154” an allowable deduction is permitted to Sarah for the

running and occupancy of her spare room in her house under “section 8-1, ITA Act 1997”7.

The expenses include the home loan interest, electricity and insurance of her house. The

expenses are deductible because Sarah was not provided by her employer an office for work

and she did not have any other place but to use her home for work purpose. Sarah is entitled

to deduction of 60% of home office expense for the 20% floor area of her house.

A new design equipment was bought by Sarah which she used for other purpose other

than taxable purpose. Quoting “section 40-25 (1), ITAA 1997” Sarah is permitted to claim

6 Mankiw, N. Gregory, Ronald D Kneebone and Kenneth J McKenzie, Principles Of Taxation

2015.

7 Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

deduction for the amount which is equivalent to depreciation amount of the new equipment

for an asset held all through the year. As the equipment was used for both personal and

private purpose only 60% of the deprecation is attributable for deduction under “section 40-

25 (2), ITAA 1997”8. Beside this, Sarah is entitled to an allowable deduction for membership

expenses and subscriptions of annual design under section 25-55, ITAA 1997”.

Outgoings on travelling was occurred by Sarah while visiting client for onsite

assistance. Mentioning “section 25-100, ITAA 1997”, this constitutes travelling on work by

Sarah. Referring to “FCT v Wiener (1978) ATC 4006” a permissible deduction is allowed to

Sarah as it occurred for the purpose of work.

There was also clothing expenses incurred for skirt, trousers and tops during client

meetings. Referring to in “Mansfield v FCT 96 ATC 4001” the clothing expenses occurred by

Sarah is ordinary clothing which is not permitted for deduction under “sec 8-1” irrespective

whether it is vital in keeping a proper appearance in during client meetings9.

Later while performing her part time employment of teaching a travelling expenses

was occurred from her home to the community college. Referring to “Lunney v FCT (1958)”

the travelling from home to community college by Sarah is non-deductible10. Referring to

“Payne v FCT (2001)”, the travelling done by Sarah from her home to college is not allowed

for income tax deduction under “sec 8-1, ITA Act 1997”.

8 Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2013 (Lawbook

Co./Thomson Reuters, 2013)

9 Sadiq, Kerrie et al, Principles Of Taxation Law 2014

10 Tax, Law And Development (Edward Elgar, 2013)

deduction for the amount which is equivalent to depreciation amount of the new equipment

for an asset held all through the year. As the equipment was used for both personal and

private purpose only 60% of the deprecation is attributable for deduction under “section 40-

25 (2), ITAA 1997”8. Beside this, Sarah is entitled to an allowable deduction for membership

expenses and subscriptions of annual design under section 25-55, ITAA 1997”.

Outgoings on travelling was occurred by Sarah while visiting client for onsite

assistance. Mentioning “section 25-100, ITAA 1997”, this constitutes travelling on work by

Sarah. Referring to “FCT v Wiener (1978) ATC 4006” a permissible deduction is allowed to

Sarah as it occurred for the purpose of work.

There was also clothing expenses incurred for skirt, trousers and tops during client

meetings. Referring to in “Mansfield v FCT 96 ATC 4001” the clothing expenses occurred by

Sarah is ordinary clothing which is not permitted for deduction under “sec 8-1” irrespective

whether it is vital in keeping a proper appearance in during client meetings9.

Later while performing her part time employment of teaching a travelling expenses

was occurred from her home to the community college. Referring to “Lunney v FCT (1958)”

the travelling from home to community college by Sarah is non-deductible10. Referring to

“Payne v FCT (2001)”, the travelling done by Sarah from her home to college is not allowed

for income tax deduction under “sec 8-1, ITA Act 1997”.

8 Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2013 (Lawbook

Co./Thomson Reuters, 2013)

9 Sadiq, Kerrie et al, Principles Of Taxation Law 2014

10 Tax, Law And Development (Edward Elgar, 2013)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Sarah also reported a self-education expenses for her MBA programme which also

included expenses on books and course fees11. The expenses occurred by Sarah for Self-

education fails to meet the nexus test because the self-education course in which she enrolled

was not related to work in which she is presently employed and hence these expenses are

non-deductible under “section 8-1, ITAA 1997”.

The furniture set bought by Sarah constitute personal use asset under “section 108-20

(2), ITAA 1997” because it was entirely for her personal enjoyment. Later the furniture was

sold which led to “CGT event A1” under “section 104-10 (1)”12.

Under section “section 108-25 (2), ITAA 1997” the disposal of furniture by Sarah is

considered as set and every sale under that set forms the part of asset. However, the asset was

only held for less than 12 months therefore under section “section 115-40, ITAA 1997” no

discounted method will be applicable for Sarah.

11 Bankman, Joseph, et al. Federal Income Taxation. Aspen Casebook, 2018.

12 Woellner, R. H, Australian Taxation Law 2012 (CCH Australia, 2013)

Sarah also reported a self-education expenses for her MBA programme which also

included expenses on books and course fees11. The expenses occurred by Sarah for Self-

education fails to meet the nexus test because the self-education course in which she enrolled

was not related to work in which she is presently employed and hence these expenses are

non-deductible under “section 8-1, ITAA 1997”.

The furniture set bought by Sarah constitute personal use asset under “section 108-20

(2), ITAA 1997” because it was entirely for her personal enjoyment. Later the furniture was

sold which led to “CGT event A1” under “section 104-10 (1)”12.

Under section “section 108-25 (2), ITAA 1997” the disposal of furniture by Sarah is

considered as set and every sale under that set forms the part of asset. However, the asset was

only held for less than 12 months therefore under section “section 115-40, ITAA 1997” no

discounted method will be applicable for Sarah.

11 Bankman, Joseph, et al. Federal Income Taxation. Aspen Casebook, 2018.

12 Woellner, R. H, Australian Taxation Law 2012 (CCH Australia, 2013)

8TAXATION LAW

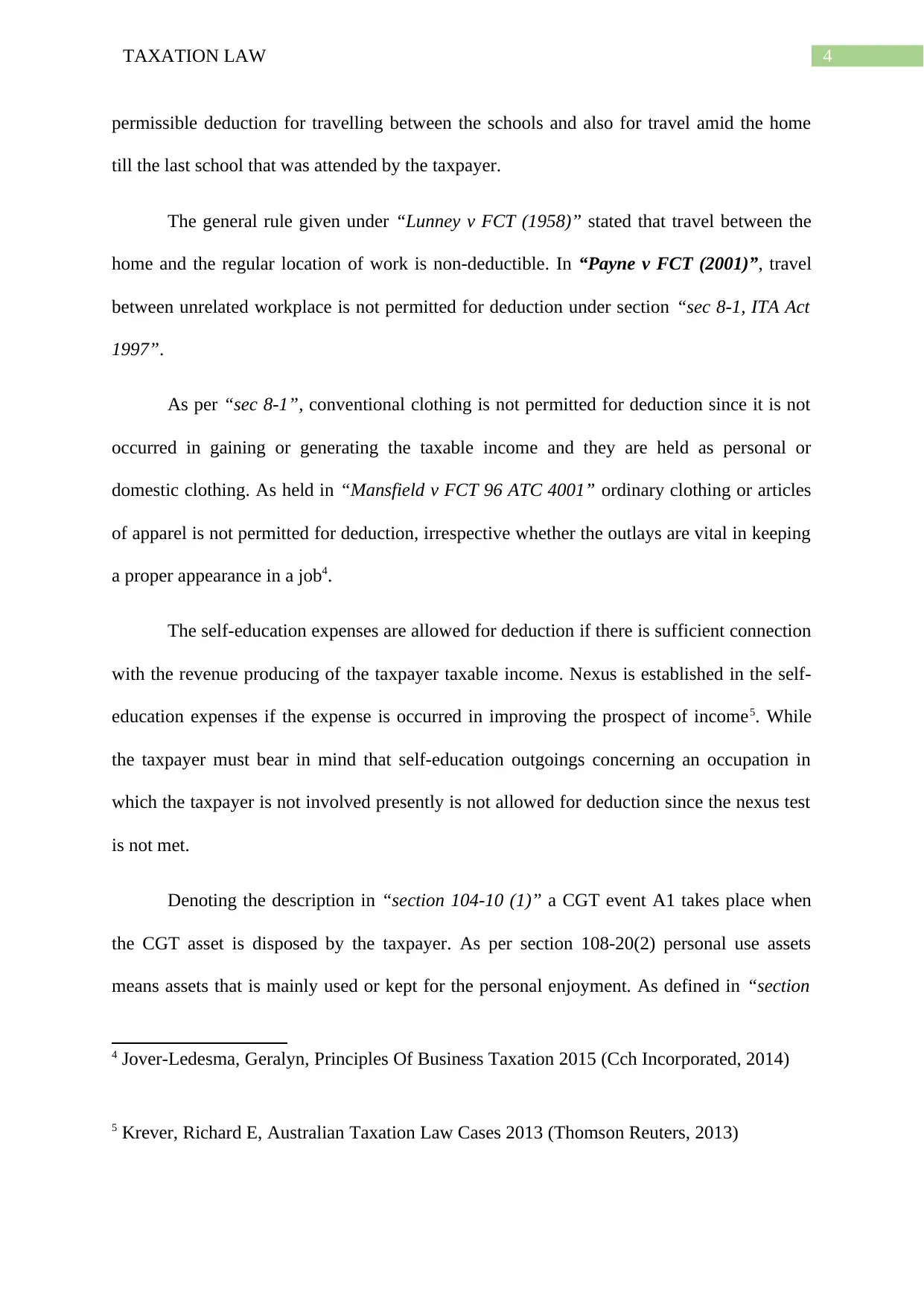

Asset Type Base Value Days Held Days in Year Percentage Effective life Total Depreciation Closing Balance

Design Equipment 9000 334 365 200% 9 1830 7170

Depreciation Worksheet

Asset Type Base Value Days Held Days in Year Percentage Effective life Total Depreciation Closing Balance

Design Equipment 9000 334 365 200% 9 1830 7170

Depreciation Worksheet

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Conclusion:

The employment income will be included for taxation purpose under the ordinary

concepts “sec 6-5, ITA Act 1997”. The allowable deduction includes the travelling expense

for visiting clients. However, no deduction is permitted under “section 8-1” for ordinary

clothing, self-education and traveling to community college.

Conclusion:

The employment income will be included for taxation purpose under the ordinary

concepts “sec 6-5, ITA Act 1997”. The allowable deduction includes the travelling expense

for visiting clients. However, no deduction is permitted under “section 8-1” for ordinary

clothing, self-education and traveling to community college.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

References:

Bankman, Joseph, et al. Federal Income Taxation. Aspen Casebook, 2018.

Barkoczy, Stephen, Foundations Of Taxation Law 2014

Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

Jover-Ledesma, Geralyn, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

Kenny, Paul, Australian Tax 2013 (LexisNexis Butterworths, 2013)

Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

Mankiw, N. Gregory, Ronald D Kneebone and Kenneth J McKenzie, Principles Of Taxation

2015.

Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2013 (Lawbook

Co./Thomson Reuters, 2013)

Sadiq, Kerrie et al, Principles Of Taxation Law 2014

Tax, Law And Development (Edward Elgar, 2013)

Woellner, R. H, Australian Taxation Law 2012 (CCH Australia, 2013)

References:

Bankman, Joseph, et al. Federal Income Taxation. Aspen Casebook, 2018.

Barkoczy, Stephen, Foundations Of Taxation Law 2014

Grange, Janet, Geralyn A Jover-Ledesma and Gary L Maydew, 2014 Principles Of Business

Taxation

Jover-Ledesma, Geralyn, Principles Of Business Taxation 2015 (Cch Incorporated, 2014)

Kenny, Paul, Australian Tax 2013 (LexisNexis Butterworths, 2013)

Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

Mankiw, N. Gregory, Ronald D Kneebone and Kenneth J McKenzie, Principles Of Taxation

2015.

Morgan, Annette, Colleen Mortimer and Dale Pinto, A Practical Introduction To Australian

Taxation Law (CCH Australia, 2013)

Sadiq, Kerrie and Cynthia Coleman, Principles Of Taxation Law 2013 (Lawbook

Co./Thomson Reuters, 2013)

Sadiq, Kerrie et al, Principles Of Taxation Law 2014

Tax, Law And Development (Edward Elgar, 2013)

Woellner, R. H, Australian Taxation Law 2012 (CCH Australia, 2013)

11TAXATION LAW

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.