ACC5TAX Taxation Law Case Study: Analysis and Application

VerifiedAdded on 2022/10/15

|6

|917

|222

Case Study

AI Summary

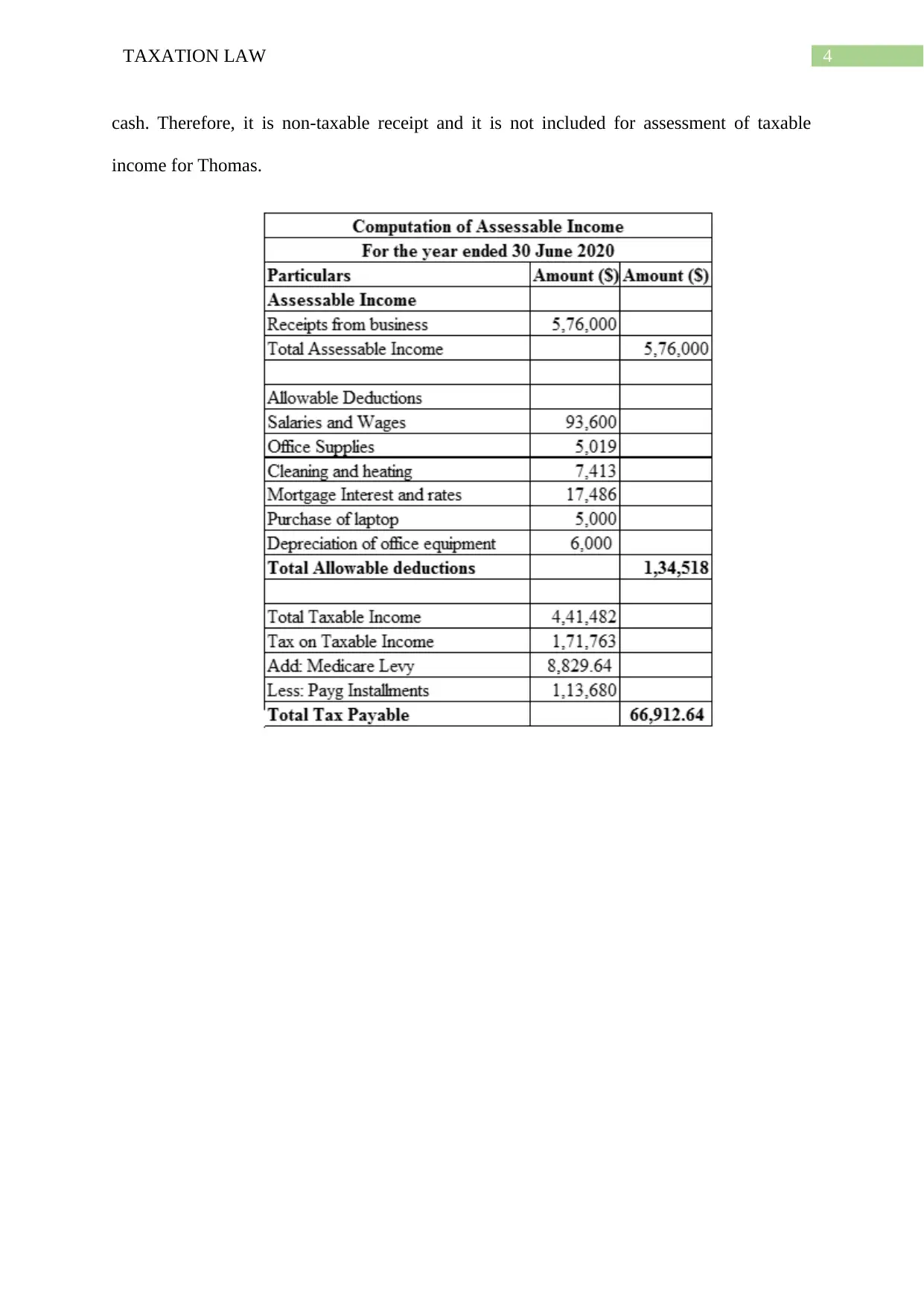

This case study analyzes a taxation law scenario involving Thomas Hawks, a tax and accounting professional. The assignment requires an assessment of his assessable income, including income from personal services, business receipts, and compensation payments. It delves into the application of relevant sections of the Income Tax Assessment Act 1936 and 1997, such as those related to personal service income, ordinary earnings, and the receipts method. Furthermore, the case examines the deductibility of business expenses incurred from a home office, depreciation of assets, and the tax treatment of non-cash benefits. The case also covers the tax implications of compensation received for personal injury and the treatment of photography equipment. The analysis incorporates relevant case law and taxation rulings to determine the correct tax treatment of various income and expense items. The assignment aims to provide a comprehensive understanding of taxation principles in the context of a real-world scenario.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)