Objections to Disallowance of Deductions

VerifiedAdded on 2023/01/12

|13

|3640

|48

AI Summary

This article discusses the objections that can be made against the disallowance of deductions in taxation laws. It covers the process and time frames for objections, and also addresses the question of including administrative fees in income tax returns. The article also provides a case study on residency tests for income tax purposes.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAXATION LAWS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

PART A...........................................................................................................................................1

PART B...........................................................................................................................................2

1) Objections to be made against disallowance of deductions...................................................4

2). The objection process, and any relevant time frames of which Julie should be aware..........7

3). Julie should include the administrative fees charged by the property manager of her rental

property in her 2018 income tax return.......................................................................................8

REFERENCES..............................................................................................................................11

TABLE OF CONTENTS................................................................................................................2

PART A...........................................................................................................................................1

PART B...........................................................................................................................................2

1) Objections to be made against disallowance of deductions...................................................4

2). The objection process, and any relevant time frames of which Julie should be aware..........7

3). Julie should include the administrative fees charged by the property manager of her rental

property in her 2018 income tax return.......................................................................................8

REFERENCES..............................................................................................................................11

PART A

Rachel is born is Canadian resident who moved to Australia in year 2006 with her family an

husband. She admitted her sons in the local primary school for their education. Rachel and her

husband bought jointly a house in Australia and also opened a joint account in Australian for

having salary from the job. She moved to Australia due to her job. She maintained the Australia

account along with the bank account in Canada. Her husband did not found suitable job in

Australia.

As the Brisbane was very hot she decided of not raising the children in Australia. Also she

was not getting satisfaction from her job and also was missing her family. Due to these reasons

she secured a job in Canada in 2018 and left for her job on 1st July of 2018. That means mean the

first of starting of financial year. She left Australia nearly 11 years after residing in Australia

with her family. She left but her children and husband lived for completing their schooling year.

She returned to Australia on visit for 1 month in December and left with whole family on 1

January 2019. She left by selling her home in Australia. She did not return back to Australia in

the year and settled back in Canada.

For checking the residency of Rachel for the income tax purpose residency tax will be

applied. Residency will be assessed for the assessment year 2019-20.

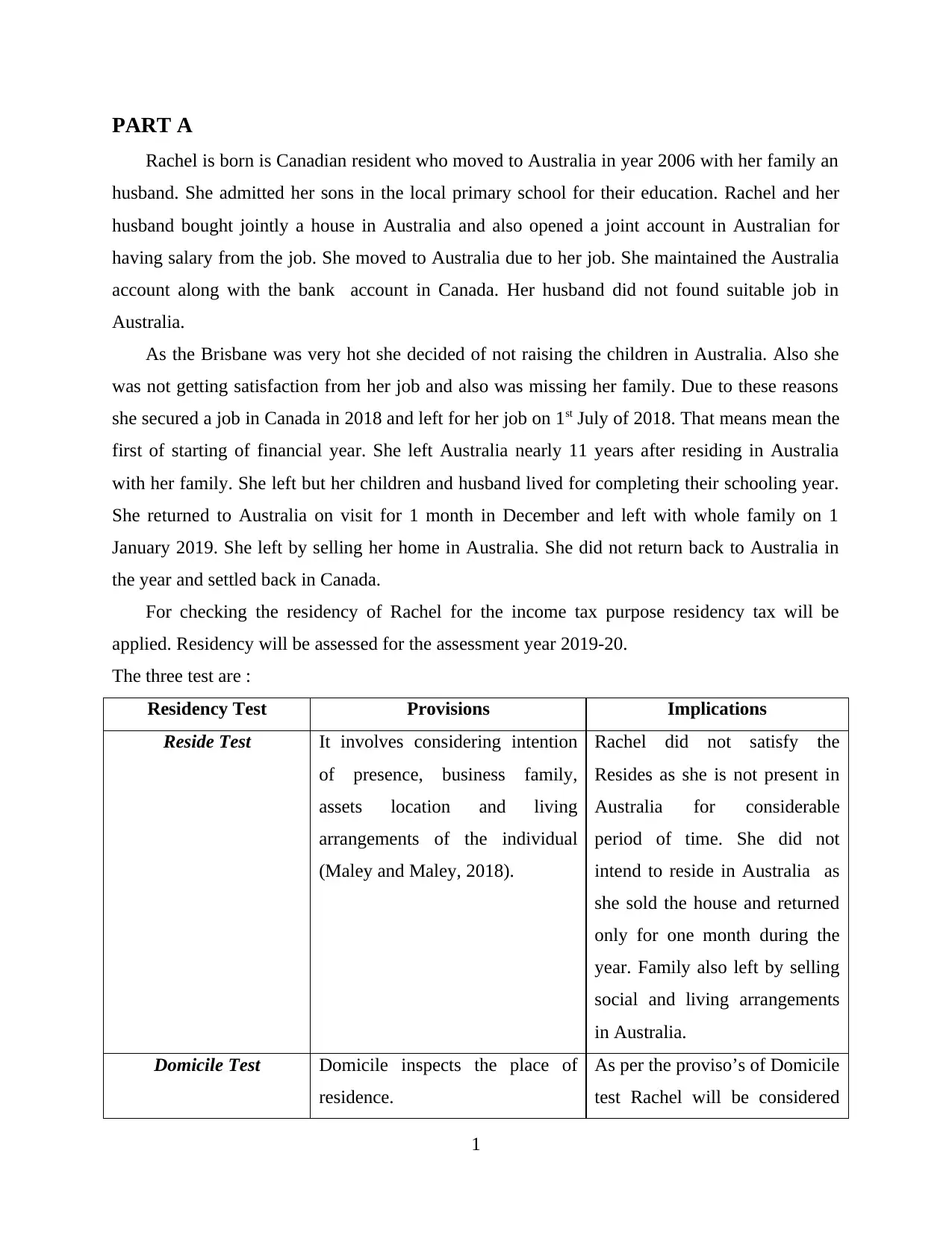

The three test are :

Residency Test Provisions Implications

Reside Test It involves considering intention

of presence, business family,

assets location and living

arrangements of the individual

(Maley and Maley, 2018).

Rachel did not satisfy the

Resides as she is not present in

Australia for considerable

period of time. She did not

intend to reside in Australia as

she sold the house and returned

only for one month during the

year. Family also left by selling

social and living arrangements

in Australia.

Domicile Test Domicile inspects the place of

residence.

As per the proviso’s of Domicile

test Rachel will be considered

1

Rachel is born is Canadian resident who moved to Australia in year 2006 with her family an

husband. She admitted her sons in the local primary school for their education. Rachel and her

husband bought jointly a house in Australia and also opened a joint account in Australian for

having salary from the job. She moved to Australia due to her job. She maintained the Australia

account along with the bank account in Canada. Her husband did not found suitable job in

Australia.

As the Brisbane was very hot she decided of not raising the children in Australia. Also she

was not getting satisfaction from her job and also was missing her family. Due to these reasons

she secured a job in Canada in 2018 and left for her job on 1st July of 2018. That means mean the

first of starting of financial year. She left Australia nearly 11 years after residing in Australia

with her family. She left but her children and husband lived for completing their schooling year.

She returned to Australia on visit for 1 month in December and left with whole family on 1

January 2019. She left by selling her home in Australia. She did not return back to Australia in

the year and settled back in Canada.

For checking the residency of Rachel for the income tax purpose residency tax will be

applied. Residency will be assessed for the assessment year 2019-20.

The three test are :

Residency Test Provisions Implications

Reside Test It involves considering intention

of presence, business family,

assets location and living

arrangements of the individual

(Maley and Maley, 2018).

Rachel did not satisfy the

Resides as she is not present in

Australia for considerable

period of time. She did not

intend to reside in Australia as

she sold the house and returned

only for one month during the

year. Family also left by selling

social and living arrangements

in Australia.

Domicile Test Domicile inspects the place of

residence.

As per the proviso’s of Domicile

test Rachel will be considered

1

This applies where the period of

stay is lengthy outside Australia

and the resides test is failed. It

identifies the permanent place of

abode and with factors such as

home overseas, residence in

Australia and financial ties.

Person is considered resident of if

there is no place of residence

abode and is moving constantly

within country.

Australian resident as she was

not having permanent place of

abode in Canada on leaving

Australia and was also having

financial ties in Australia

(Sadiq, 2019). The family was

living in Australia and the house

was sold in December.

183 day Test This test requires to satisfy that

usual abode place is out of

Australia. This requires the person

to be present for period of 183

days in financial year if the place

of abode is out of Australia.

This test does not apply as

Rachel is having permanent

residence in Australia in the

financial year.

Conclusion

Rachel is considered to be resident of Australia for the income tax purpose as she satisfies the

domicile test under the income tax residency tests.

PART B

MEMO

123 Accounting Pty Ltd

To : Douglas Park

From :

Date : 25th April 2020

Subject : Objection to Amended Assessment notice for 2018.

2

stay is lengthy outside Australia

and the resides test is failed. It

identifies the permanent place of

abode and with factors such as

home overseas, residence in

Australia and financial ties.

Person is considered resident of if

there is no place of residence

abode and is moving constantly

within country.

Australian resident as she was

not having permanent place of

abode in Canada on leaving

Australia and was also having

financial ties in Australia

(Sadiq, 2019). The family was

living in Australia and the house

was sold in December.

183 day Test This test requires to satisfy that

usual abode place is out of

Australia. This requires the person

to be present for period of 183

days in financial year if the place

of abode is out of Australia.

This test does not apply as

Rachel is having permanent

residence in Australia in the

financial year.

Conclusion

Rachel is considered to be resident of Australia for the income tax purpose as she satisfies the

domicile test under the income tax residency tests.

PART B

MEMO

123 Accounting Pty Ltd

To : Douglas Park

From :

Date : 25th April 2020

Subject : Objection to Amended Assessment notice for 2018.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Background

Julie is 27 year old resident of the Australia who is working on full time basis as personal

assistant of the executive editor of well known fashion magazine. Job was started on 1st july 2015

with a monthly payment of $10000 that is received on 3rd of next month. Due to this she received

payment for June in July.

July has also a hobby of up-cycling clothes and therefore doing the job is same field. She

moved to her neighbourhood with number of Op shops where she made purchases number of

times in a week. She also turns the unwanted clothes into the fashion masterpieces. Seeing the

talent and interested she was suggested to start her own Facebook page where she could sell the

creations of her own. She received high demand of her work and kept accurate records for all the

incomes and expenses. The expenses for the business totalled $16000 and the receipts totalled

$9000. The business page was advertised in different groups on Facebeook. The business was

being performed without obtaining the ABN as the motive was not of earning profit she was doing

out of interest.

The employment required to have quality clothes for daily use and was required to attend

the evening functions once every month. Express condition was not there regarding the purchase

of any specific outfits but was required to dress in defined manner for the work and events. She

made purchases related to these clothing outfits that cost $6000.

She takes laptop to home for the work related with her employment. As her job is

demanding she is required to work even after the usual office hours. She works in kitchen for the

office work as the apartment is small. Cost of running the work from her apartment is totalling to

$300.

During the year, she received rental income of $12000 from her residential property. For

inspection she travelled to the property when the tenants vacated property. travel expenses to the

property amounted to $500. She purchased a dish washer that was repaired by her for $200. She

also incurred administrative expenses of $20 per week.

She filed the annual return with the taxable income of 107250 which with all the above

mentioned expenses and income. The stated income and expenses have not been accepted by the

assessment officers and the taxable income was amended to $140,250. Adjustments have been

made in the income and also all the major deduction were dismissed by the company. Julie wants

3

Julie is 27 year old resident of the Australia who is working on full time basis as personal

assistant of the executive editor of well known fashion magazine. Job was started on 1st july 2015

with a monthly payment of $10000 that is received on 3rd of next month. Due to this she received

payment for June in July.

July has also a hobby of up-cycling clothes and therefore doing the job is same field. She

moved to her neighbourhood with number of Op shops where she made purchases number of

times in a week. She also turns the unwanted clothes into the fashion masterpieces. Seeing the

talent and interested she was suggested to start her own Facebook page where she could sell the

creations of her own. She received high demand of her work and kept accurate records for all the

incomes and expenses. The expenses for the business totalled $16000 and the receipts totalled

$9000. The business page was advertised in different groups on Facebeook. The business was

being performed without obtaining the ABN as the motive was not of earning profit she was doing

out of interest.

The employment required to have quality clothes for daily use and was required to attend

the evening functions once every month. Express condition was not there regarding the purchase

of any specific outfits but was required to dress in defined manner for the work and events. She

made purchases related to these clothing outfits that cost $6000.

She takes laptop to home for the work related with her employment. As her job is

demanding she is required to work even after the usual office hours. She works in kitchen for the

office work as the apartment is small. Cost of running the work from her apartment is totalling to

$300.

During the year, she received rental income of $12000 from her residential property. For

inspection she travelled to the property when the tenants vacated property. travel expenses to the

property amounted to $500. She purchased a dish washer that was repaired by her for $200. She

also incurred administrative expenses of $20 per week.

She filed the annual return with the taxable income of 107250 which with all the above

mentioned expenses and income. The stated income and expenses have not been accepted by the

assessment officers and the taxable income was amended to $140,250. Adjustments have been

made in the income and also all the major deduction were dismissed by the company. Julie wants

3

to know the actual amendments that are applicable to the case. She also wants to know the time

frame within which the issues are required to be addressed. She also wants to know the procedure

for charging the expenses after the return has been filed.

1) Objections to be made against disallowance of deductions.

Tax Commissioner under Section 170.70 is allowed for making amendments to the

deduction and disallow the deductions which are claimed by the taxpayer. However the tax payer

are allowed to object the amendment on the basis of strong ground in relevance to the sections that

the deductions are permissible by presenting required evidence related with the expenditure of

being incurred and is allowed by the Income Tax Assessment Act, 1997.

The objection against the deduction is required to be made within time for making the

amendments in the tax returns. After the deductions are clarified tax will be charged on the tax

liability agreed by the Commissioner of Income Tax.

Salary

Julie has declared salary income for 11 months as the payment for June will be received in

July 2019. The objection of Commissioner is viable as the salary is required to be reported for the

whole of 12 months by the individual tax payer. Section 86.80 of ITAA, 97 provides that the

salaries or income received before 14th of July will be considered as received on 30th of June. By

this provision Commissioner is right at this point and Julie is required to declare the salary for

June received in July. It is also to be noted that Julie has not received the payment as on 3rd of July

and if she does not receive the salary before 14th of July than the income will be taxed in the next

assessment year (Braithwaite and Reinhart, 2019). In such case she will be declaring income for

only 11 months and not for whole year. Hence the objection of Commissioner and Julie is

dependent on the date on which she receives salary for the Month of June (ITAA. 1997, 2019).

Bank Interest

Bank Interest is chargeable as ordinary income though received from any of the sources.

The interest received from bank will be charged as ordinary income in the income tax return as

per Section 6, ITAA,97. No amendment is made in bank interest.

Income from Facebook business.

It is important for determining whether the business is carried on separate from pursuing

hobby, sports or recreational activity and is not producing any assessable income. There are

4

frame within which the issues are required to be addressed. She also wants to know the procedure

for charging the expenses after the return has been filed.

1) Objections to be made against disallowance of deductions.

Tax Commissioner under Section 170.70 is allowed for making amendments to the

deduction and disallow the deductions which are claimed by the taxpayer. However the tax payer

are allowed to object the amendment on the basis of strong ground in relevance to the sections that

the deductions are permissible by presenting required evidence related with the expenditure of

being incurred and is allowed by the Income Tax Assessment Act, 1997.

The objection against the deduction is required to be made within time for making the

amendments in the tax returns. After the deductions are clarified tax will be charged on the tax

liability agreed by the Commissioner of Income Tax.

Salary

Julie has declared salary income for 11 months as the payment for June will be received in

July 2019. The objection of Commissioner is viable as the salary is required to be reported for the

whole of 12 months by the individual tax payer. Section 86.80 of ITAA, 97 provides that the

salaries or income received before 14th of July will be considered as received on 30th of June. By

this provision Commissioner is right at this point and Julie is required to declare the salary for

June received in July. It is also to be noted that Julie has not received the payment as on 3rd of July

and if she does not receive the salary before 14th of July than the income will be taxed in the next

assessment year (Braithwaite and Reinhart, 2019). In such case she will be declaring income for

only 11 months and not for whole year. Hence the objection of Commissioner and Julie is

dependent on the date on which she receives salary for the Month of June (ITAA. 1997, 2019).

Bank Interest

Bank Interest is chargeable as ordinary income though received from any of the sources.

The interest received from bank will be charged as ordinary income in the income tax return as

per Section 6, ITAA,97. No amendment is made in bank interest.

Income from Facebook business.

It is important for determining whether the business is carried on separate from pursuing

hobby, sports or recreational activity and is not producing any assessable income. There are

4

various rulings of the courts for the purpose of determining the activities as business such as

commercial purpose or character, undertaken for producing profits, having characteristic of

industry, is of considerable scale and size. However these are not decisive factors for determining

business. It is not having characteristic of business as per guidelines of ATO.

Julie is not operating page with the motive of earning profit but to have space from her job.

She is not having business of sufficient size and scale satisfying the other factors. Taxation

Ruling 97/11 states activity done as part of her enjoyment is not business and also she is not

earning any significant profits from carrying out the page (Lam and Whitney, 2016). Therefore,

she is not required to disclose the income from Facebook page as assessable income.

Rental Income

As per the guidelines of Australian taxation office rental income earned by Julie is taxable

as ordinary income and will be taxed on basic tax rates.

Deductions

Work Related clothing expense.

Taxation Ruling 97/12 has clarified that fact that requirement or expectation of the employer

from the tax payer of wearing specific type or style of the conventional clothing will not be

making cost of clothing as deductible. Case of (FC of T v. Cooper (1991) 29 FCR 17) gives more

clarification. Also if taxpayer perceives dressing style or conventional clothing as essential for

success will not make it deductible. Example: Case 16/93 93 ATC 208 at 214; AAT Case

8658 (1993). On the basis of this Julie is not allowed to claim deductions for expenditure of

clothing for office and attending evening functions (TR 97/12, 2019).

Home Office Deductions

As per taxation ruling 2020/1 provides for the deduction of work expenses. It provides that

deduction under Section 8 of ITAA 97 could be claimed if the tax payer satisfies positive test and

negative tests. July has satisfied the elements of both positive and negative test. Expenditure is

incurred for producing assessable income and is not reimbursed by the employer. Also it is not

incurred for producing exempt income and the expenses are claimed only for relating to the

proportion of work (Barkoczy, 2016). Julie can raise the objection for deduction of home office

expenses under general deduction as per TR 2020/1 after complying with record keeping

requirements of Div 900 ITAA, 1997.

Work Related Travel expense

5

commercial purpose or character, undertaken for producing profits, having characteristic of

industry, is of considerable scale and size. However these are not decisive factors for determining

business. It is not having characteristic of business as per guidelines of ATO.

Julie is not operating page with the motive of earning profit but to have space from her job.

She is not having business of sufficient size and scale satisfying the other factors. Taxation

Ruling 97/11 states activity done as part of her enjoyment is not business and also she is not

earning any significant profits from carrying out the page (Lam and Whitney, 2016). Therefore,

she is not required to disclose the income from Facebook page as assessable income.

Rental Income

As per the guidelines of Australian taxation office rental income earned by Julie is taxable

as ordinary income and will be taxed on basic tax rates.

Deductions

Work Related clothing expense.

Taxation Ruling 97/12 has clarified that fact that requirement or expectation of the employer

from the tax payer of wearing specific type or style of the conventional clothing will not be

making cost of clothing as deductible. Case of (FC of T v. Cooper (1991) 29 FCR 17) gives more

clarification. Also if taxpayer perceives dressing style or conventional clothing as essential for

success will not make it deductible. Example: Case 16/93 93 ATC 208 at 214; AAT Case

8658 (1993). On the basis of this Julie is not allowed to claim deductions for expenditure of

clothing for office and attending evening functions (TR 97/12, 2019).

Home Office Deductions

As per taxation ruling 2020/1 provides for the deduction of work expenses. It provides that

deduction under Section 8 of ITAA 97 could be claimed if the tax payer satisfies positive test and

negative tests. July has satisfied the elements of both positive and negative test. Expenditure is

incurred for producing assessable income and is not reimbursed by the employer. Also it is not

incurred for producing exempt income and the expenses are claimed only for relating to the

proportion of work (Barkoczy, 2016). Julie can raise the objection for deduction of home office

expenses under general deduction as per TR 2020/1 after complying with record keeping

requirements of Div 900 ITAA, 1997.

Work Related Travel expense

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 900 of ITAA, 97 specifically provides for the deductions related to work.

Deductions are allowed by the Commissioners for work related travel expense.

Expenses of Facebook business.

After the recreation activities are classified as hobby individual cannot claim the expenses

related to the hobby. The recreational activities are classified as hobby as she does not have the

intent of making profits. As per the guidelines of ATO expenses that are related to the hobby

cannot be claimed as deductions. (Business Tax Deductions, 2019.). It is more beneficial to

consider it as hobby as Julie would not be claim deduction according to Section 35.1 of ITAA

1997 for non commercial activities. Claiming it as business will cause the Julie to pay tax on

Facebook business income of $900 without any deduction for expenses.

Trip for inspecting Rental property

Julie cannot claim the expenses for travel to the residential properties for inspection as per

Section 26.31 of ITAA, 1997. Further it is clarified by the guidelines provided by the Taxation

office that an individual that is not in business of letting out rental properties cannot claim

deduction related to residential property (Berg and Davidson, 2016). The amendment for this

deduction cannot be objected against the Commissioner as the Julie is not a corporate entity or

trust in business of letting out.

Repairing the Dishwasher

The deduction disallowed for the dishwasher cannot be objected by Julie as she had

purchased the dishwasher for the residential properly for producing assessable income. But in the

present case Julie has incurred the expenses of repair on the initial stage on purchase therefore

they will be considered part of capital expenditure and not revenue expenditure. Section 25 of

ITAA,97 disallow deduction for repairs incurred as capital expenditures. Taxation Ruling 97/23

further clarifies the repairs to be of capital expenditure as incurred on purchase.

Administrative Expenses.

Administrative expenses paid by Julie per week for the rental residential property could be

claimed as deduction as they are incurred for producing assessable income as per Section 8, ITAA

1997 for general deductions.

Amended Return

Julie will be required to file revised or amended return after the all the amendments are clarified

6

Deductions are allowed by the Commissioners for work related travel expense.

Expenses of Facebook business.

After the recreation activities are classified as hobby individual cannot claim the expenses

related to the hobby. The recreational activities are classified as hobby as she does not have the

intent of making profits. As per the guidelines of ATO expenses that are related to the hobby

cannot be claimed as deductions. (Business Tax Deductions, 2019.). It is more beneficial to

consider it as hobby as Julie would not be claim deduction according to Section 35.1 of ITAA

1997 for non commercial activities. Claiming it as business will cause the Julie to pay tax on

Facebook business income of $900 without any deduction for expenses.

Trip for inspecting Rental property

Julie cannot claim the expenses for travel to the residential properties for inspection as per

Section 26.31 of ITAA, 1997. Further it is clarified by the guidelines provided by the Taxation

office that an individual that is not in business of letting out rental properties cannot claim

deduction related to residential property (Berg and Davidson, 2016). The amendment for this

deduction cannot be objected against the Commissioner as the Julie is not a corporate entity or

trust in business of letting out.

Repairing the Dishwasher

The deduction disallowed for the dishwasher cannot be objected by Julie as she had

purchased the dishwasher for the residential properly for producing assessable income. But in the

present case Julie has incurred the expenses of repair on the initial stage on purchase therefore

they will be considered part of capital expenditure and not revenue expenditure. Section 25 of

ITAA,97 disallow deduction for repairs incurred as capital expenditures. Taxation Ruling 97/23

further clarifies the repairs to be of capital expenditure as incurred on purchase.

Administrative Expenses.

Administrative expenses paid by Julie per week for the rental residential property could be

claimed as deduction as they are incurred for producing assessable income as per Section 8, ITAA

1997 for general deductions.

Amended Return

Julie will be required to file revised or amended return after the all the amendments are clarified

6

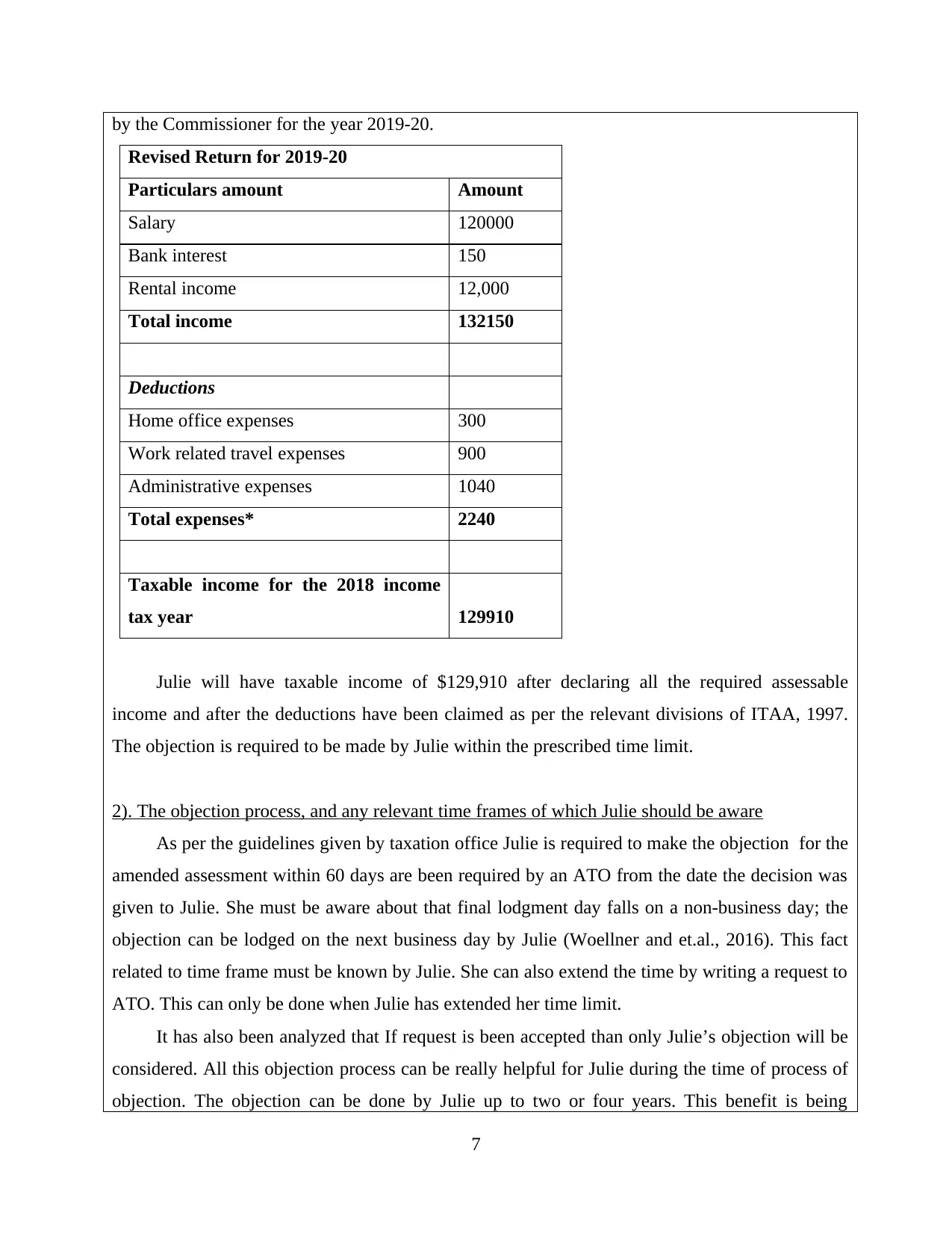

by the Commissioner for the year 2019-20.

Revised Return for 2019-20

Particulars amount Amount

Salary 120000

Bank interest 150

Rental income 12,000

Total income 132150

Deductions

Home office expenses 300

Work related travel expenses 900

Administrative expenses 1040

Total expenses* 2240

Taxable income for the 2018 income

tax year 129910

Julie will have taxable income of $129,910 after declaring all the required assessable

income and after the deductions have been claimed as per the relevant divisions of ITAA, 1997.

The objection is required to be made by Julie within the prescribed time limit.

2). The objection process, and any relevant time frames of which Julie should be aware

As per the guidelines given by taxation office Julie is required to make the objection for the

amended assessment within 60 days are been required by an ATO from the date the decision was

given to Julie. She must be aware about that final lodgment day falls on a non-business day; the

objection can be lodged on the next business day by Julie (Woellner and et.al., 2016). This fact

related to time frame must be known by Julie. She can also extend the time by writing a request to

ATO. This can only be done when Julie has extended her time limit.

It has also been analyzed that If request is been accepted than only Julie’s objection will be

considered. All this objection process can be really helpful for Julie during the time of process of

objection. The objection can be done by Julie up to two or four years. This benefit is being

7

Revised Return for 2019-20

Particulars amount Amount

Salary 120000

Bank interest 150

Rental income 12,000

Total income 132150

Deductions

Home office expenses 300

Work related travel expenses 900

Administrative expenses 1040

Total expenses* 2240

Taxable income for the 2018 income

tax year 129910

Julie will have taxable income of $129,910 after declaring all the required assessable

income and after the deductions have been claimed as per the relevant divisions of ITAA, 1997.

The objection is required to be made by Julie within the prescribed time limit.

2). The objection process, and any relevant time frames of which Julie should be aware

As per the guidelines given by taxation office Julie is required to make the objection for the

amended assessment within 60 days are been required by an ATO from the date the decision was

given to Julie. She must be aware about that final lodgment day falls on a non-business day; the

objection can be lodged on the next business day by Julie (Woellner and et.al., 2016). This fact

related to time frame must be known by Julie. She can also extend the time by writing a request to

ATO. This can only be done when Julie has extended her time limit.

It has also been analyzed that If request is been accepted than only Julie’s objection will be

considered. All this objection process can be really helpful for Julie during the time of process of

objection. The objection can be done by Julie up to two or four years. This benefit is being

7

available to all tax payers. The objection can be started from the 60 days which has been given to

Julie. It has also been analyzed that If the additional information is also been required by Julie

than the objection period can also be extended. All These fact must be known by Julie during the

time of objection process. It will be beneficial for Julie to have an idea about all these processes.

Amended assessment can be done at the end of tax period.

3). Julie should include the administrative fees charged by the property manager of her rental

property in her 2018 income tax return

Julie may make request for an online amendment in order to correct a mistake and to amend

income tax return. Individual can write upon the government linked account in order to amend the

mistake related to tax which has been made by an individual. Julie can only be the person who can

sign request paper. This must be kept in knowledge of Julie. It means no other person that Julie

can sign the paper (Woellner and et.al., 2016). If signed than it will be against law. If Julie has any

tax agent than his or her registered number must also be presented in the request paper. It has been

analyzed that all these procedures if being followed by Julie reduces the risk of administrative

errors that may delay the processing of amendment.

She also needs to fill upon the name and contact information so that she can further be

contacted related to in processing or any type of information that has to be given to Julie in

amendment process. In order to correct the mistake related to existing amount she has to select a

relevant field in which amendment needs to be made. It has been analyzed that Julie’s

administrative expenses are 1040. Julie is only been entitled to income when she is been engaged

in paying correct amount that has been due. The process depends upon whether they were entitled

to receive payment or not.

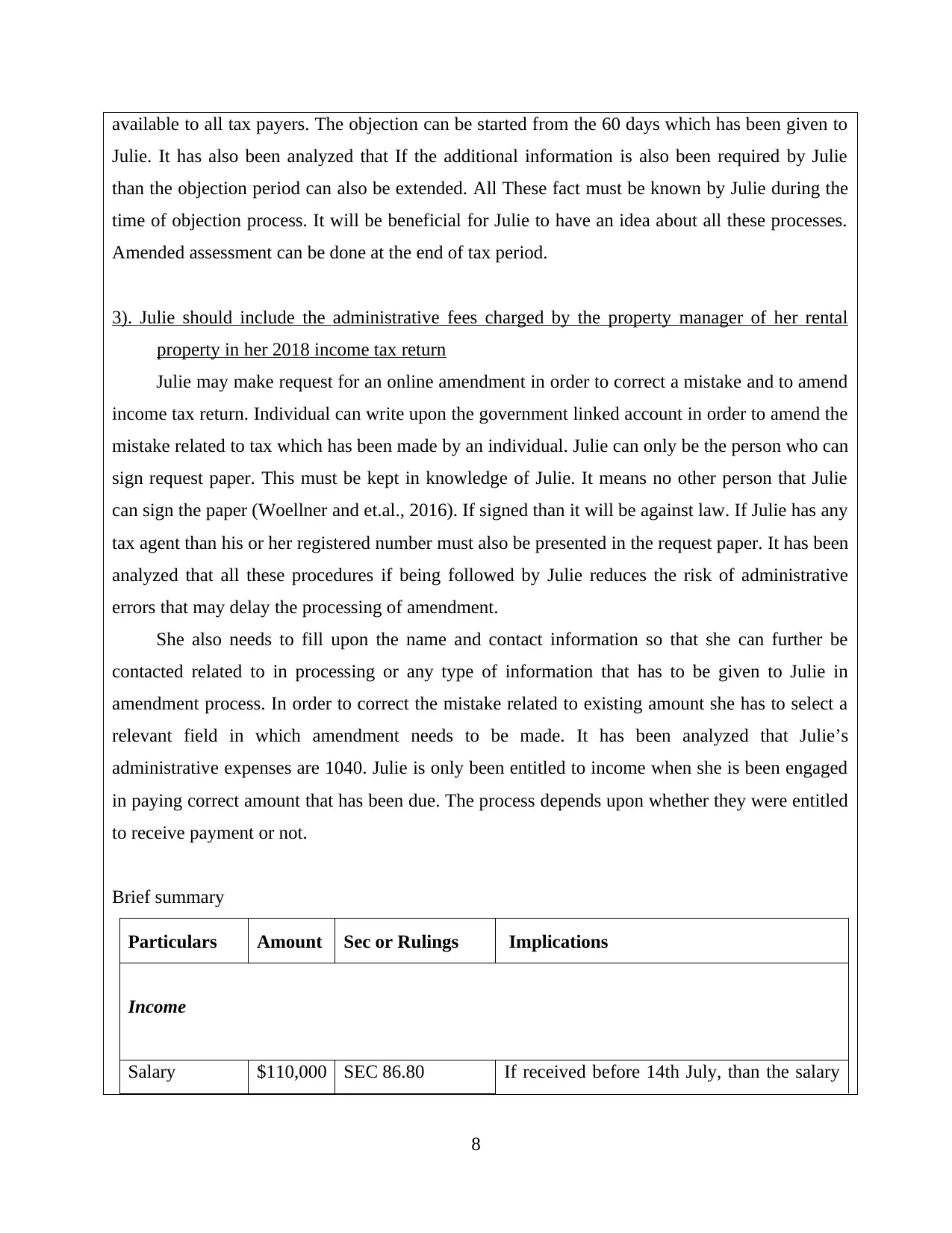

Brief summary

Particulars Amount Sec or Rulings Implications

Income

Salary $110,000 SEC 86.80 If received before 14th July, than the salary

8

Julie. It has also been analyzed that If the additional information is also been required by Julie

than the objection period can also be extended. All These fact must be known by Julie during the

time of objection process. It will be beneficial for Julie to have an idea about all these processes.

Amended assessment can be done at the end of tax period.

3). Julie should include the administrative fees charged by the property manager of her rental

property in her 2018 income tax return

Julie may make request for an online amendment in order to correct a mistake and to amend

income tax return. Individual can write upon the government linked account in order to amend the

mistake related to tax which has been made by an individual. Julie can only be the person who can

sign request paper. This must be kept in knowledge of Julie. It means no other person that Julie

can sign the paper (Woellner and et.al., 2016). If signed than it will be against law. If Julie has any

tax agent than his or her registered number must also be presented in the request paper. It has been

analyzed that all these procedures if being followed by Julie reduces the risk of administrative

errors that may delay the processing of amendment.

She also needs to fill upon the name and contact information so that she can further be

contacted related to in processing or any type of information that has to be given to Julie in

amendment process. In order to correct the mistake related to existing amount she has to select a

relevant field in which amendment needs to be made. It has been analyzed that Julie’s

administrative expenses are 1040. Julie is only been entitled to income when she is been engaged

in paying correct amount that has been due. The process depends upon whether they were entitled

to receive payment or not.

Brief summary

Particulars Amount Sec or Rulings Implications

Income

Salary $110,000 SEC 86.80 If received before 14th July, than the salary

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

for 12 months will be taxable.

Bank interest $150 Sec 6

It is assessable as ordinary income and

taxable.

Income from

Facebook

business page $9,000 TR 97/11

Ruling states this as hobby as not obtained

ABN and not have commercial purpose or

character. Income from hobby is not

assessable.

Rental income $12,000 ATO guidelines

Rental income is assessable as ordinary

income and therefore taxable.

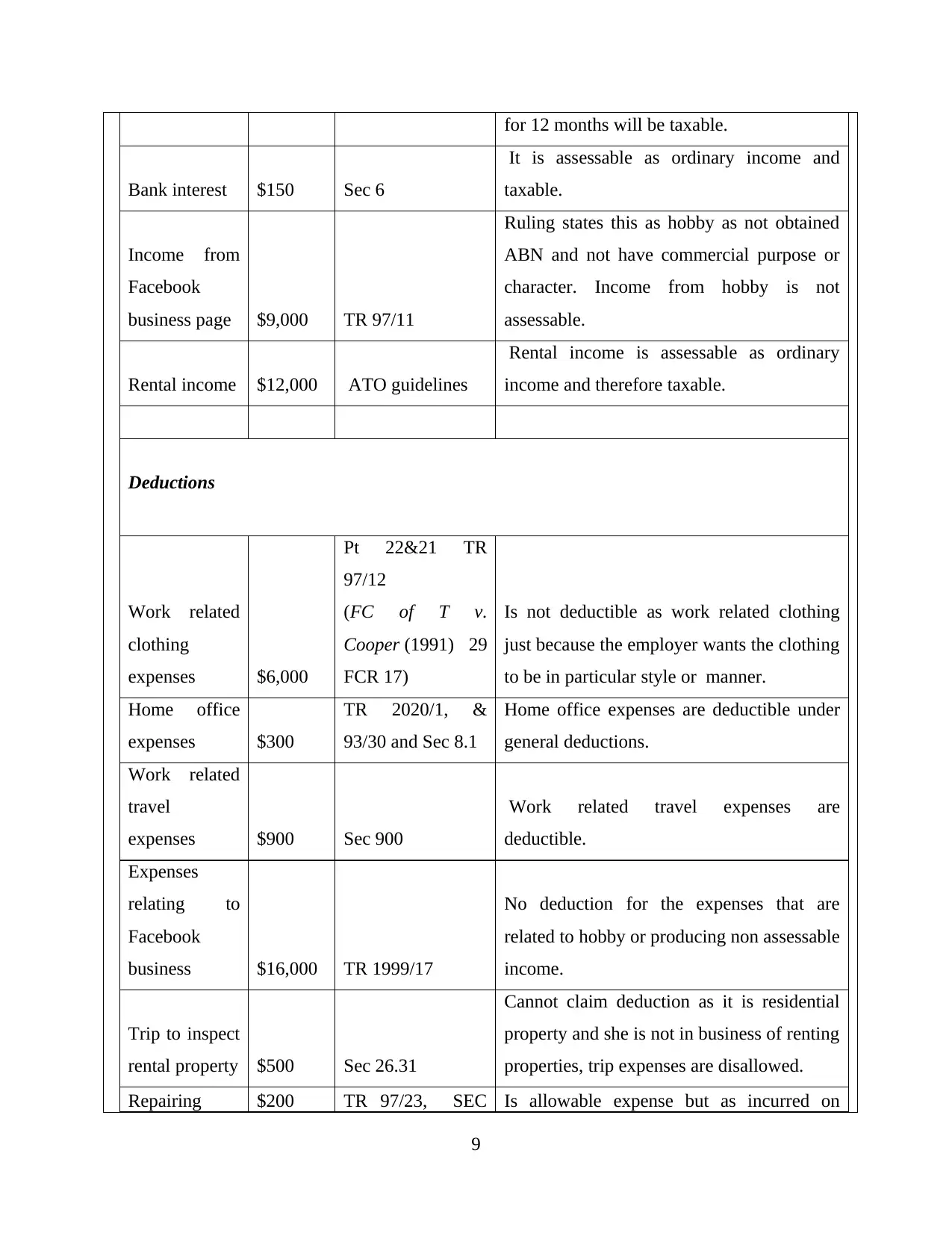

Deductions

Work related

clothing

expenses $6,000

Pt 22&21 TR

97/12

(FC of T v.

Cooper (1991) 29

FCR 17)

Is not deductible as work related clothing

just because the employer wants the clothing

to be in particular style or manner.

Home office

expenses $300

TR 2020/1, &

93/30 and Sec 8.1

Home office expenses are deductible under

general deductions.

Work related

travel

expenses $900 Sec 900

Work related travel expenses are

deductible.

Expenses

relating to

Facebook

business $16,000 TR 1999/17

No deduction for the expenses that are

related to hobby or producing non assessable

income.

Trip to inspect

rental property $500 Sec 26.31

Cannot claim deduction as it is residential

property and she is not in business of renting

properties, trip expenses are disallowed.

Repairing $200 TR 97/23, SEC Is allowable expense but as incurred on

9

Bank interest $150 Sec 6

It is assessable as ordinary income and

taxable.

Income from

business page $9,000 TR 97/11

Ruling states this as hobby as not obtained

ABN and not have commercial purpose or

character. Income from hobby is not

assessable.

Rental income $12,000 ATO guidelines

Rental income is assessable as ordinary

income and therefore taxable.

Deductions

Work related

clothing

expenses $6,000

Pt 22&21 TR

97/12

(FC of T v.

Cooper (1991) 29

FCR 17)

Is not deductible as work related clothing

just because the employer wants the clothing

to be in particular style or manner.

Home office

expenses $300

TR 2020/1, &

93/30 and Sec 8.1

Home office expenses are deductible under

general deductions.

Work related

travel

expenses $900 Sec 900

Work related travel expenses are

deductible.

Expenses

relating to

business $16,000 TR 1999/17

No deduction for the expenses that are

related to hobby or producing non assessable

income.

Trip to inspect

rental property $500 Sec 26.31

Cannot claim deduction as it is residential

property and she is not in business of renting

properties, trip expenses are disallowed.

Repairing $200 TR 97/23, SEC Is allowable expense but as incurred on

9

dishwasher 25.10

initial purchase it will become part of capital

expenditure and therefore no deduction

could be claimed

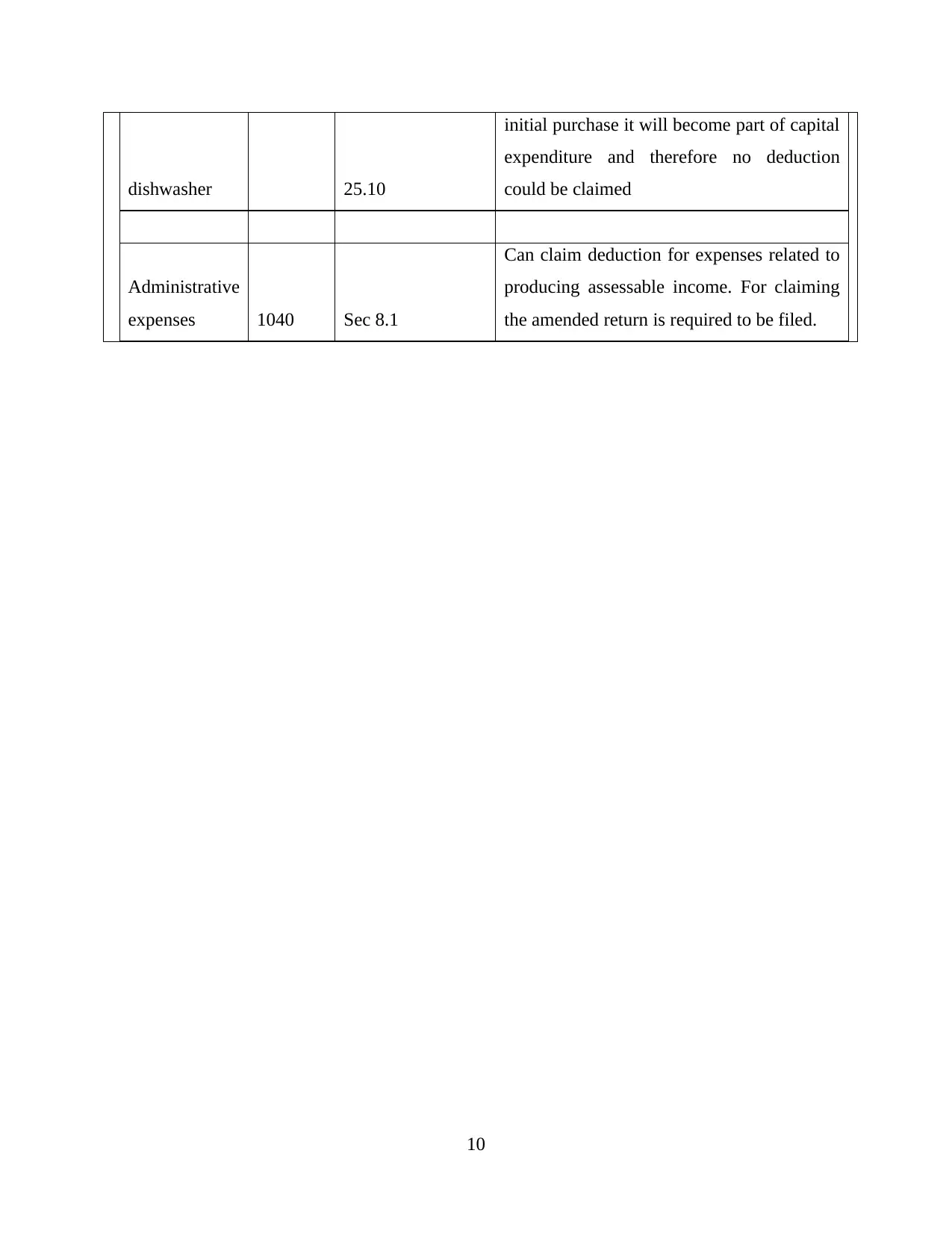

Administrative

expenses 1040 Sec 8.1

Can claim deduction for expenses related to

producing assessable income. For claiming

the amended return is required to be filed.

10

initial purchase it will become part of capital

expenditure and therefore no deduction

could be claimed

Administrative

expenses 1040 Sec 8.1

Can claim deduction for expenses related to

producing assessable income. For claiming

the amended return is required to be filed.

10

REFERENCES

Books and Journals

Woellner, R. and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Woellner, R. and et.al., 2016. Procedural justice and the Australian Taxation Office: A study of

scheme investors. Centre for Tax System Integrity (CTSI), Research School of Social

Sciences, The Australian National University.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

Maley, M.N. and Maley, D.M., 2018. Australian Taxation Office Guidance on the Diverted

Profits Tax.

Braithwaite, V. and Reinhart, M., 2019. The Taxpayers' Charter: Does the Australian Tax Office

comply and who benefits?. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Berg, C. and Davidson, S., 2016. Submission to the House of Representatives Standing

Committee on Tax and Revenue Inquiry into the External Scrutiny of the Australian

Taxation Office.

Lam, D. and Whitney, A., 2016. Taxation and property: Practical aspects of the new foreign

resident CGT witholding tax. LSJ: Law Society of NSW Journal. (21).p.84.

Online

ITAA. 1997. 2019. [Online]. Available through :

<http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/>.

TR 97/12. 2019. [Online]. Available through : <https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9712/NAT/ATO/00001>.

11

Books and Journals

Woellner, R. and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Woellner, R. and et.al., 2016. Procedural justice and the Australian Taxation Office: A study of

scheme investors. Centre for Tax System Integrity (CTSI), Research School of Social

Sciences, The Australian National University.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

Maley, M.N. and Maley, D.M., 2018. Australian Taxation Office Guidance on the Diverted

Profits Tax.

Braithwaite, V. and Reinhart, M., 2019. The Taxpayers' Charter: Does the Australian Tax Office

comply and who benefits?. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Berg, C. and Davidson, S., 2016. Submission to the House of Representatives Standing

Committee on Tax and Revenue Inquiry into the External Scrutiny of the Australian

Taxation Office.

Lam, D. and Whitney, A., 2016. Taxation and property: Practical aspects of the new foreign

resident CGT witholding tax. LSJ: Law Society of NSW Journal. (21).p.84.

Online

ITAA. 1997. 2019. [Online]. Available through :

<http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/>.

TR 97/12. 2019. [Online]. Available through : <https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9712/NAT/ATO/00001>.

11

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.