Western Sydney University: Taxation Law Assignment - Autumn 2018

VerifiedAdded on 2023/06/04

|13

|2236

|212

Homework Assignment

AI Summary

This document presents a detailed analysis of Australian taxation law, specifically addressing the tax implications of share trading and fringe benefits. The assignment begins by examining the tax treatment of a resident individual's losses from share trading, differentiating between holding shares as an investment versus share trading as a business. It references the Income Tax Assessment Act 1997 (ITAA 1997) and relevant ATO guidelines. The second part of the assignment delves into fringe benefits tax (FBT), calculating both an employee's income tax liability and the FBT liability of the employer, Contemporary Clothes Co (CCC). This includes calculations for salary, travel allowances, and various fringe benefits such as loans, car running costs, and clothing provided to the employee. The calculations adhere to the FBT year (April 1 to March 31) and incorporate relevant tax rates and statutory benchmarks. The assignment concludes with a comprehensive list of references.

Running head: TAXATION

Taxation

Name of the Student:

Name of the University:

Authors Note:

Taxation

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

TAXATION

Contents

Introduction:....................................................................................................................................2

Answer 1:.........................................................................................................................................2

Answer 2:.........................................................................................................................................4

References:....................................................................................................................................10

TAXATION

Contents

Introduction:....................................................................................................................................2

Answer 1:.........................................................................................................................................2

Answer 2:.........................................................................................................................................4

References:....................................................................................................................................10

2

TAXATION

Introduction:

Earlier Income Tax Assessment Act, 1936 and now Income Tax Assessment Act, 1997,

here in after to be referred to as ITAA 1996 and ITAA 1997 respectively in this document,

contains all provisions to govern the income tax and related matters. Australian Taxation Office,

a department of the Government of Australia has the responsibility to administer the tax related

matters in the country. In this document a detailed discussion on the liability of a resident

individual in Australia on gains or loss from shared trading activities and the liability of an

employer for fringe benefits provide to employees shall be discussed here.

Answer 1:

Issue:

Having incurring loss to the tune of $50,000 from sale of shares, Simon Krupcheck, an

Australian resident, wants to know the suitable tax treatments for such loss. Hence, the issue is to

discuss the tax treatment for the loss of $50,000 from sale of shares.

Rules:

ITAA 1997 has provided that all income, except exempt income, arising to an individual must be

considered along with acceptable losses to ascertain the taxable income of such individual. As

per Section 615.50 of ITAA 1997, the tax treatment of shares depend on an individual’s nature of

transactions in relation to such shares (Snape & De Souza, 2016). Thus, whether an individual

holding the shares as an investor or as a trader to trade on such shares would be the main

contention in determining the tax implications of share related transactions.

Holding shares as investment:

TAXATION

Introduction:

Earlier Income Tax Assessment Act, 1936 and now Income Tax Assessment Act, 1997,

here in after to be referred to as ITAA 1996 and ITAA 1997 respectively in this document,

contains all provisions to govern the income tax and related matters. Australian Taxation Office,

a department of the Government of Australia has the responsibility to administer the tax related

matters in the country. In this document a detailed discussion on the liability of a resident

individual in Australia on gains or loss from shared trading activities and the liability of an

employer for fringe benefits provide to employees shall be discussed here.

Answer 1:

Issue:

Having incurring loss to the tune of $50,000 from sale of shares, Simon Krupcheck, an

Australian resident, wants to know the suitable tax treatments for such loss. Hence, the issue is to

discuss the tax treatment for the loss of $50,000 from sale of shares.

Rules:

ITAA 1997 has provided that all income, except exempt income, arising to an individual must be

considered along with acceptable losses to ascertain the taxable income of such individual. As

per Section 615.50 of ITAA 1997, the tax treatment of shares depend on an individual’s nature of

transactions in relation to such shares (Snape & De Souza, 2016). Thus, whether an individual

holding the shares as an investor or as a trader to trade on such shares would be the main

contention in determining the tax implications of share related transactions.

Holding shares as investment:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

TAXATION

When an individual holds shares with the objectives of receiving dividend income from such

shares and availing appreciation in the capital value of these shares then, the individual is

holding such shares as investment. In such case the receipts from sale of shares are subjected to

capital gain tax and not as assessable income. Dividend and other similar receipts shall be taken

into consideration to calculate assessable income of the investor (Oates & Schwab, 2015).

Share trading business:

A person who transacts in shares with the purpose to trade in these shares, i.e. to buy and sale the

shares, to earn profit or loss from such transactions will be considered as a trader in shares. Thus,

such individual is a share trader. In such case the ordinary course of operations is to buy and sale

shares. Sale proceeds receipt from sale of shares will constitute assessable income of the share

trader. The cost of acquiring such shares along with other related and incidental expenses

including brokerage and commission shall constitute eligible expenditures of share trading

business (Almeida, Fos & Kronlund, 2016). The assessable income shall be deducted by the

eligible expenditures in share trading business to calculate net gain or loss from share trading

business. The resultant net loss or net gain from share trading operations will be considered for

computing taxable income of the share trader in a particular income year. For a trader in share

loss from share trading is a revenue loss and accordingly, should be recorded in the revenue

account for tax purposes.

Application:

Simon Krupcheck held number of junior executive positions in an Australian listed entity,

Australian Resident Life Insurance Company, and has significant experience in capital market

dealings. With his experience in capital market he invested significant amount of time on

TAXATION

When an individual holds shares with the objectives of receiving dividend income from such

shares and availing appreciation in the capital value of these shares then, the individual is

holding such shares as investment. In such case the receipts from sale of shares are subjected to

capital gain tax and not as assessable income. Dividend and other similar receipts shall be taken

into consideration to calculate assessable income of the investor (Oates & Schwab, 2015).

Share trading business:

A person who transacts in shares with the purpose to trade in these shares, i.e. to buy and sale the

shares, to earn profit or loss from such transactions will be considered as a trader in shares. Thus,

such individual is a share trader. In such case the ordinary course of operations is to buy and sale

shares. Sale proceeds receipt from sale of shares will constitute assessable income of the share

trader. The cost of acquiring such shares along with other related and incidental expenses

including brokerage and commission shall constitute eligible expenditures of share trading

business (Almeida, Fos & Kronlund, 2016). The assessable income shall be deducted by the

eligible expenditures in share trading business to calculate net gain or loss from share trading

business. The resultant net loss or net gain from share trading operations will be considered for

computing taxable income of the share trader in a particular income year. For a trader in share

loss from share trading is a revenue loss and accordingly, should be recorded in the revenue

account for tax purposes.

Application:

Simon Krupcheck held number of junior executive positions in an Australian listed entity,

Australian Resident Life Insurance Company, and has significant experience in capital market

dealings. With his experience in capital market he invested significant amount of time on

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

TAXATION

researching on share price movements and other important aspects to gather necessary

information to acquire shares at relatively low price with the objective of selling these when the

prices of these shares will be high (Cremers & Pareek, 2016). Obviously, it is clear from the facts

that Simon’s intention was to trade in shares and not to hold shares as investments. Thus, as par

the rules provided in the ITAA 1997 and the instructions of ATO, the gain or loss from share

trading operations of shall be taken into consideration in determination of taxable income of

share trader in an income year. For a share trader it is a revenue loss that shall be off set against

income from other sources of the trader, in case any. If the share trader does not have any other

sources of income then the loss of trading of shares can be carried forward in future periods to

set off against income from other sources in the future (Brinkley, 2018).

Conclusion:

Simon has incurred a net loss of $50,000 from share trading operations, it should be recorded in

the revenue account as it is loss from ordinary course of business to the share trader, Simon

Krupcheck.

Answer 2:

In Australia the income tax year is from July 01 of a year to the 30th June of next year

however, for tax purposes in relation fringe benefits provided by an employer to his employees

the year is from April 01 of a year to 31st March of next year. This is also referred to as FBT year

(Tang & Wan, 2015). In John Holland Group Pty Ltd v Commissioner of Taxation, The

Federal Court of Australia mentioned the importance of measuring monetary value of fringe

benefits correctly for FBT purposes.

TAXATION

researching on share price movements and other important aspects to gather necessary

information to acquire shares at relatively low price with the objective of selling these when the

prices of these shares will be high (Cremers & Pareek, 2016). Obviously, it is clear from the facts

that Simon’s intention was to trade in shares and not to hold shares as investments. Thus, as par

the rules provided in the ITAA 1997 and the instructions of ATO, the gain or loss from share

trading operations of shall be taken into consideration in determination of taxable income of

share trader in an income year. For a share trader it is a revenue loss that shall be off set against

income from other sources of the trader, in case any. If the share trader does not have any other

sources of income then the loss of trading of shares can be carried forward in future periods to

set off against income from other sources in the future (Brinkley, 2018).

Conclusion:

Simon has incurred a net loss of $50,000 from share trading operations, it should be recorded in

the revenue account as it is loss from ordinary course of business to the share trader, Simon

Krupcheck.

Answer 2:

In Australia the income tax year is from July 01 of a year to the 30th June of next year

however, for tax purposes in relation fringe benefits provided by an employer to his employees

the year is from April 01 of a year to 31st March of next year. This is also referred to as FBT year

(Tang & Wan, 2015). In John Holland Group Pty Ltd v Commissioner of Taxation, The

Federal Court of Australia mentioned the importance of measuring monetary value of fringe

benefits correctly for FBT purposes.

5

TAXATION

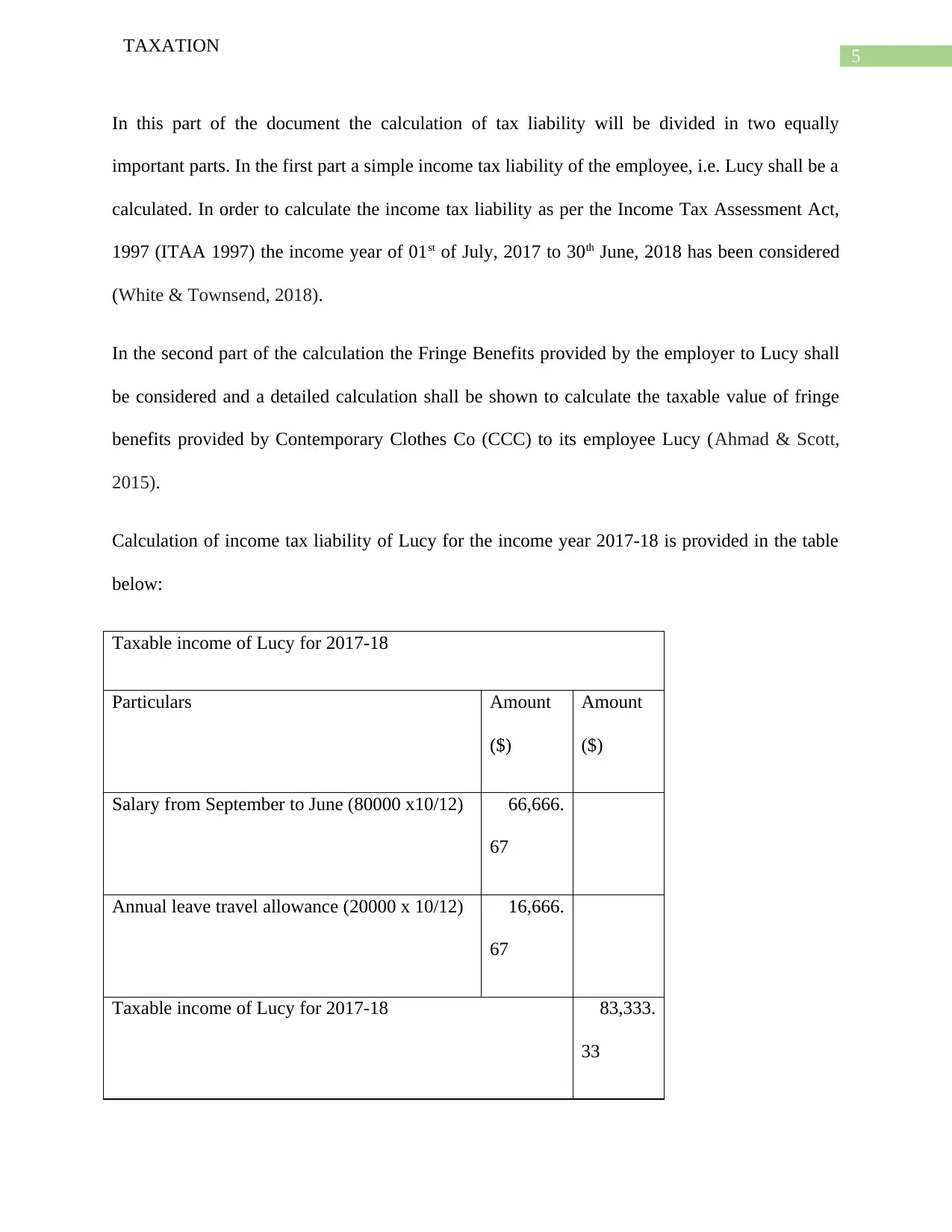

In this part of the document the calculation of tax liability will be divided in two equally

important parts. In the first part a simple income tax liability of the employee, i.e. Lucy shall be a

calculated. In order to calculate the income tax liability as per the Income Tax Assessment Act,

1997 (ITAA 1997) the income year of 01st of July, 2017 to 30th June, 2018 has been considered

(White & Townsend, 2018).

In the second part of the calculation the Fringe Benefits provided by the employer to Lucy shall

be considered and a detailed calculation shall be shown to calculate the taxable value of fringe

benefits provided by Contemporary Clothes Co (CCC) to its employee Lucy (Ahmad & Scott,

2015).

Calculation of income tax liability of Lucy for the income year 2017-18 is provided in the table

below:

Taxable income of Lucy for 2017-18

Particulars Amount

($)

Amount

($)

Salary from September to June (80000 x10/12) 66,666.

67

Annual leave travel allowance (20000 x 10/12) 16,666.

67

Taxable income of Lucy for 2017-18 83,333.

33

TAXATION

In this part of the document the calculation of tax liability will be divided in two equally

important parts. In the first part a simple income tax liability of the employee, i.e. Lucy shall be a

calculated. In order to calculate the income tax liability as per the Income Tax Assessment Act,

1997 (ITAA 1997) the income year of 01st of July, 2017 to 30th June, 2018 has been considered

(White & Townsend, 2018).

In the second part of the calculation the Fringe Benefits provided by the employer to Lucy shall

be considered and a detailed calculation shall be shown to calculate the taxable value of fringe

benefits provided by Contemporary Clothes Co (CCC) to its employee Lucy (Ahmad & Scott,

2015).

Calculation of income tax liability of Lucy for the income year 2017-18 is provided in the table

below:

Taxable income of Lucy for 2017-18

Particulars Amount

($)

Amount

($)

Salary from September to June (80000 x10/12) 66,666.

67

Annual leave travel allowance (20000 x 10/12) 16,666.

67

Taxable income of Lucy for 2017-18 83,333.

33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

TAXATION

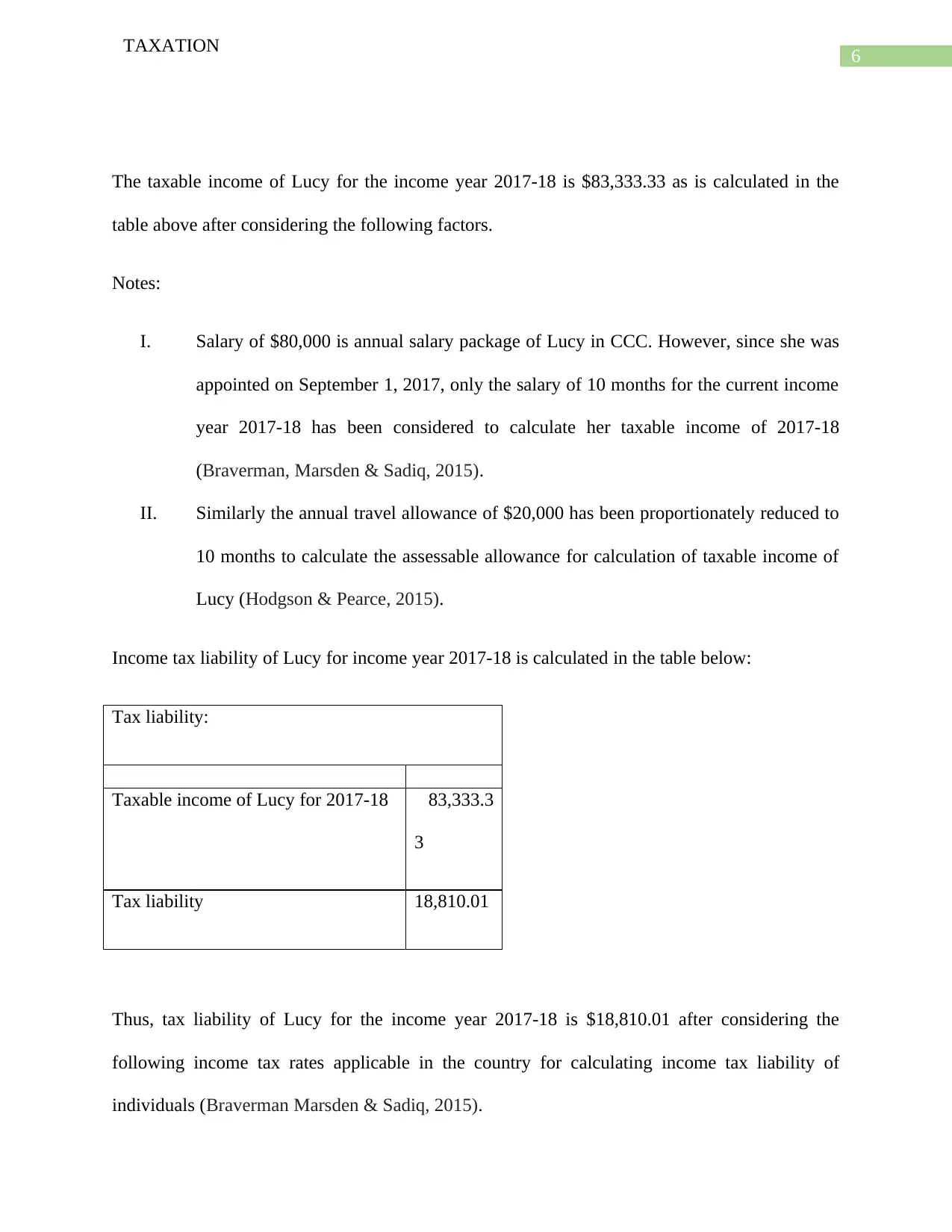

The taxable income of Lucy for the income year 2017-18 is $83,333.33 as is calculated in the

table above after considering the following factors.

Notes:

I. Salary of $80,000 is annual salary package of Lucy in CCC. However, since she was

appointed on September 1, 2017, only the salary of 10 months for the current income

year 2017-18 has been considered to calculate her taxable income of 2017-18

(Braverman, Marsden & Sadiq, 2015).

II. Similarly the annual travel allowance of $20,000 has been proportionately reduced to

10 months to calculate the assessable allowance for calculation of taxable income of

Lucy (Hodgson & Pearce, 2015).

Income tax liability of Lucy for income year 2017-18 is calculated in the table below:

Tax liability:

Taxable income of Lucy for 2017-18 83,333.3

3

Tax liability 18,810.01

Thus, tax liability of Lucy for the income year 2017-18 is $18,810.01 after considering the

following income tax rates applicable in the country for calculating income tax liability of

individuals (Braverman Marsden & Sadiq, 2015).

TAXATION

The taxable income of Lucy for the income year 2017-18 is $83,333.33 as is calculated in the

table above after considering the following factors.

Notes:

I. Salary of $80,000 is annual salary package of Lucy in CCC. However, since she was

appointed on September 1, 2017, only the salary of 10 months for the current income

year 2017-18 has been considered to calculate her taxable income of 2017-18

(Braverman, Marsden & Sadiq, 2015).

II. Similarly the annual travel allowance of $20,000 has been proportionately reduced to

10 months to calculate the assessable allowance for calculation of taxable income of

Lucy (Hodgson & Pearce, 2015).

Income tax liability of Lucy for income year 2017-18 is calculated in the table below:

Tax liability:

Taxable income of Lucy for 2017-18 83,333.3

3

Tax liability 18,810.01

Thus, tax liability of Lucy for the income year 2017-18 is $18,810.01 after considering the

following income tax rates applicable in the country for calculating income tax liability of

individuals (Braverman Marsden & Sadiq, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

TAXATION

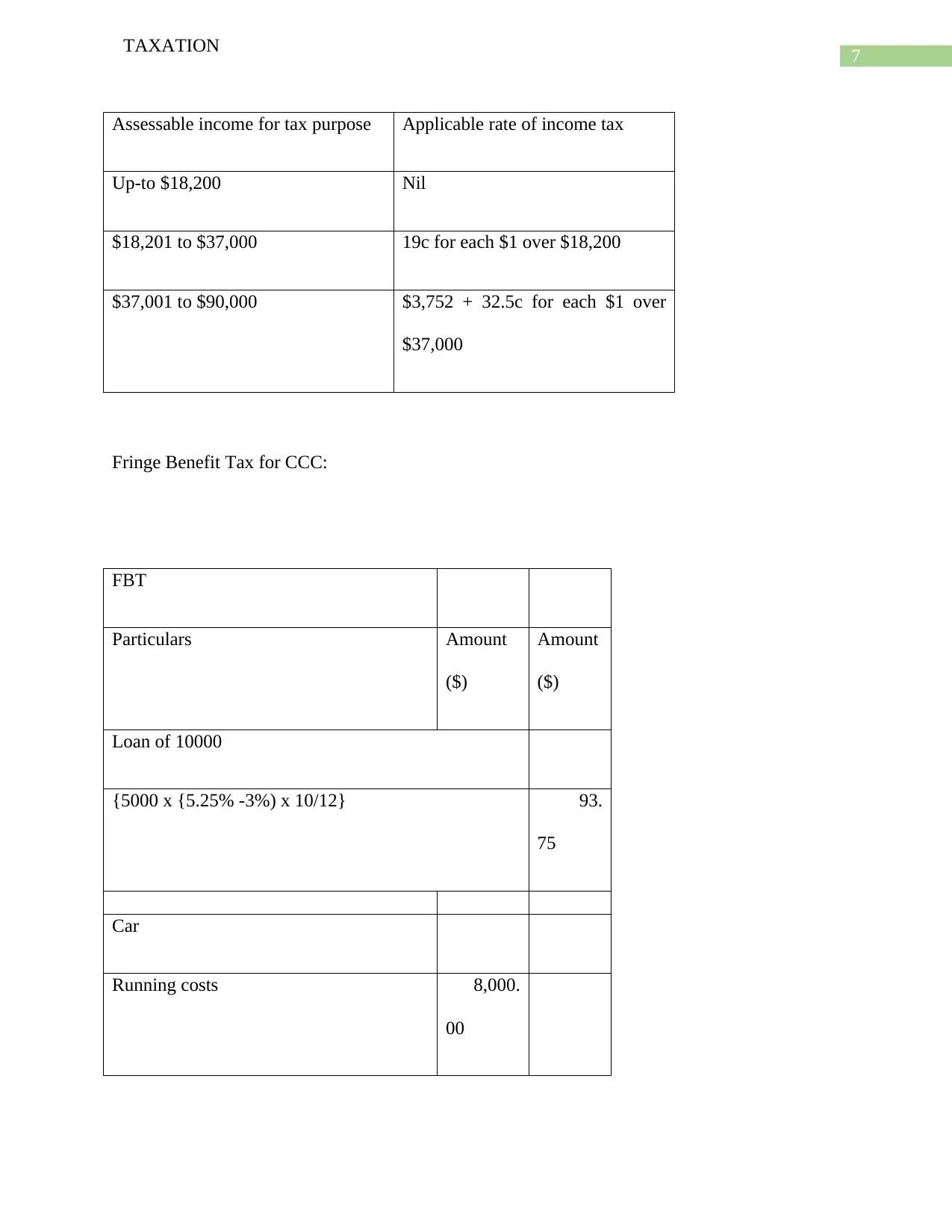

Assessable income for tax purpose Applicable rate of income tax

Up-to $18,200 Nil

$18,201 to $37,000 19c for each $1 over $18,200

$37,001 to $90,000 $3,752 + 32.5c for each $1 over

$37,000

Fringe Benefit Tax for CCC:

FBT

Particulars Amount

($)

Amount

($)

Loan of 10000

{5000 x {5.25% -3%) x 10/12} 93.

75

Car

Running costs 8,000.

00

TAXATION

Assessable income for tax purpose Applicable rate of income tax

Up-to $18,200 Nil

$18,201 to $37,000 19c for each $1 over $18,200

$37,001 to $90,000 $3,752 + 32.5c for each $1 over

$37,000

Fringe Benefit Tax for CCC:

FBT

Particulars Amount

($)

Amount

($)

Loan of 10000

{5000 x {5.25% -3%) x 10/12} 93.

75

Car

Running costs 8,000.

00

8

TAXATION

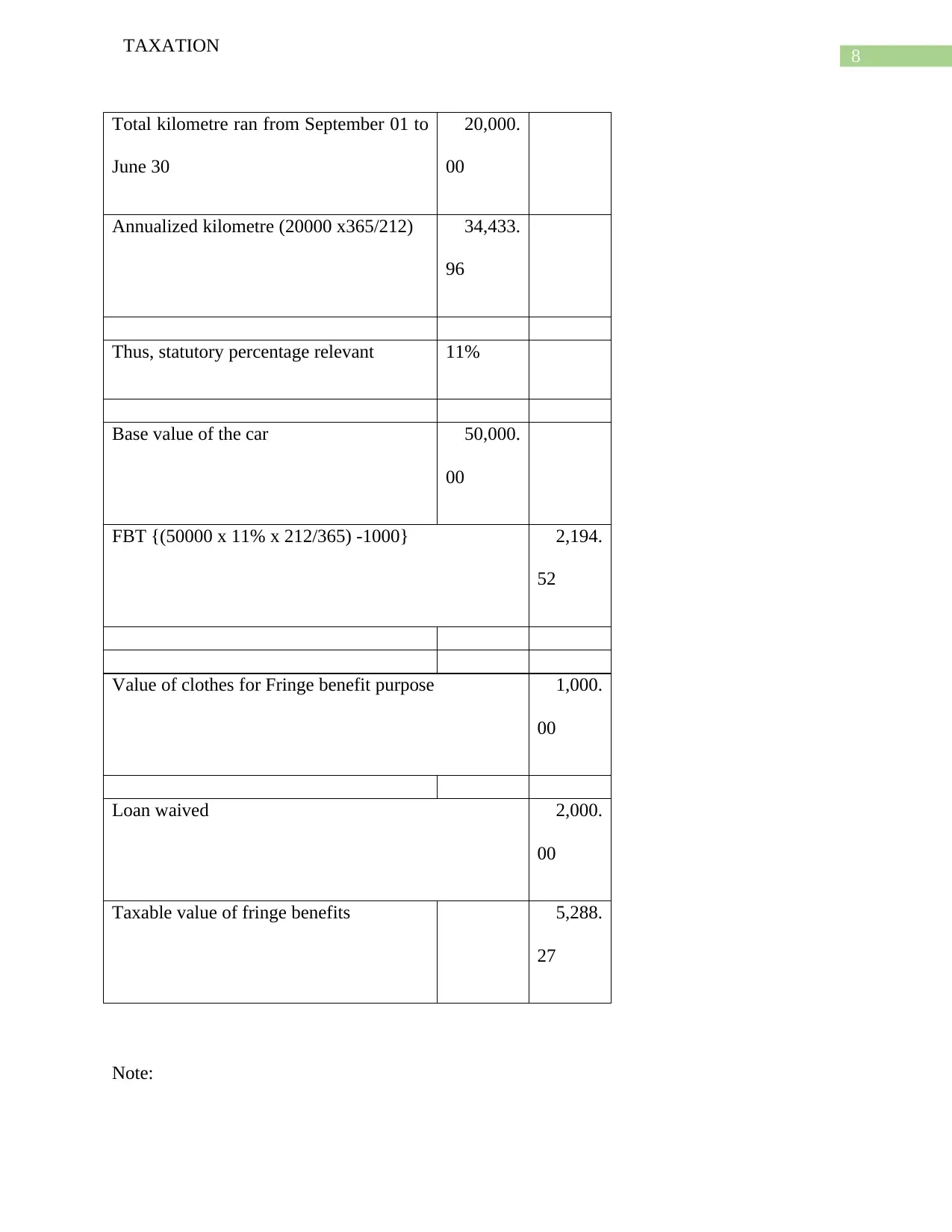

Total kilometre ran from September 01 to

June 30

20,000.

00

Annualized kilometre (20000 x365/212) 34,433.

96

Thus, statutory percentage relevant 11%

Base value of the car 50,000.

00

FBT {(50000 x 11% x 212/365) -1000} 2,194.

52

Value of clothes for Fringe benefit purpose 1,000.

00

Loan waived 2,000.

00

Taxable value of fringe benefits 5,288.

27

Note:

TAXATION

Total kilometre ran from September 01 to

June 30

20,000.

00

Annualized kilometre (20000 x365/212) 34,433.

96

Thus, statutory percentage relevant 11%

Base value of the car 50,000.

00

FBT {(50000 x 11% x 212/365) -1000} 2,194.

52

Value of clothes for Fringe benefit purpose 1,000.

00

Loan waived 2,000.

00

Taxable value of fringe benefits 5,288.

27

Note:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

TAXATION

I. For valuing taxable value of fringe benefits of loan the difference between the

statutory benchmark interest rate, i.e. 5.25% and the concessional rate, i.e. 3% of

interest on the loan provided by the employer shall be considered (Dixon & Nassios,

2016).

II. In case of loan waiver of $2,000 it has been assumed that the interest was paid by

Lucy’s husband as per statutory bench mark interest rate.

III. To calculate taxable value of fringe benefit for the statutory percentage method has

been used instead of operating cost method as this has reduced the taxable value of

fringe benefit for the car (Tang & Wan, 2015).

IV. The cloths provided by CCC shall be valued at cost to value the taxable fringe

benefit. Hence, $1,000 has been considered for calculating taxable value of fringe

benefit (Chardon, Freudenberg& Brimble, 2016).

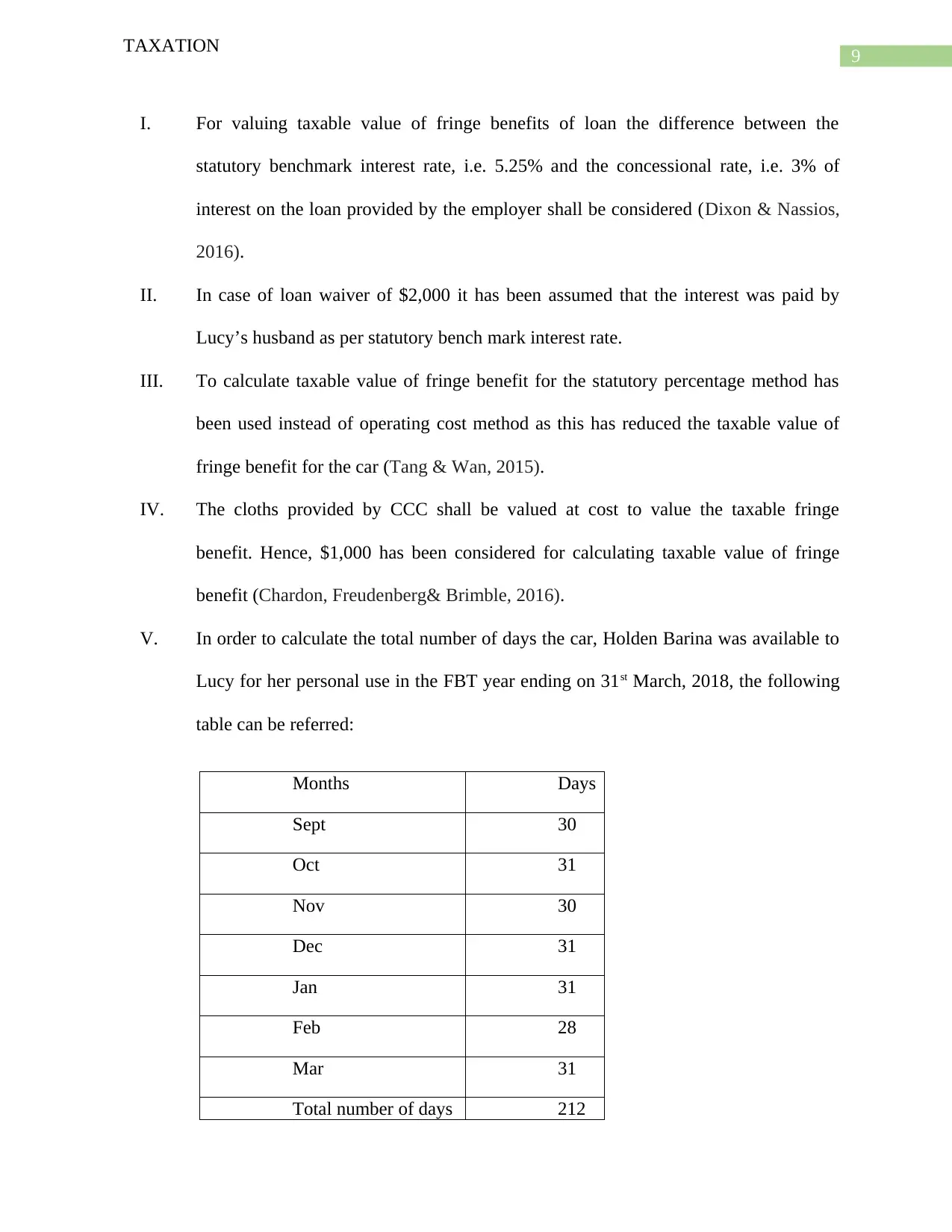

V. In order to calculate the total number of days the car, Holden Barina was available to

Lucy for her personal use in the FBT year ending on 31st March, 2018, the following

table can be referred:

Months Days

Sept 30

Oct 31

Nov 30

Dec 31

Jan 31

Feb 28

Mar 31

Total number of days 212

TAXATION

I. For valuing taxable value of fringe benefits of loan the difference between the

statutory benchmark interest rate, i.e. 5.25% and the concessional rate, i.e. 3% of

interest on the loan provided by the employer shall be considered (Dixon & Nassios,

2016).

II. In case of loan waiver of $2,000 it has been assumed that the interest was paid by

Lucy’s husband as per statutory bench mark interest rate.

III. To calculate taxable value of fringe benefit for the statutory percentage method has

been used instead of operating cost method as this has reduced the taxable value of

fringe benefit for the car (Tang & Wan, 2015).

IV. The cloths provided by CCC shall be valued at cost to value the taxable fringe

benefit. Hence, $1,000 has been considered for calculating taxable value of fringe

benefit (Chardon, Freudenberg& Brimble, 2016).

V. In order to calculate the total number of days the car, Holden Barina was available to

Lucy for her personal use in the FBT year ending on 31st March, 2018, the following

table can be referred:

Months Days

Sept 30

Oct 31

Nov 30

Dec 31

Jan 31

Feb 28

Mar 31

Total number of days 212

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

TAXATION

TAXATION

11

TAXATION

References:

Ahmad, R., & Scott, N. (2015). Fringe benefits and organisational commitment: the case of

Langkawi hotels. Tourism review, 70(1), 13-23.

Almeida, H., Fos, V., & Kronlund, M. (2016). The real effects of share repurchases. Journal of

Financial Economics, 119(1), 168-185.

Braverman, D., Marsden, S., & Sadiq, K. (2015). Assessing Taxpayer Response to Legislative

Changes: A Case Study of In-House Fringe Benefits Rules. J. Austl. Tax'n, 17, 1.

Brinkley, C. (2018). Fringe benefits: adding rugosity to the urban interface in theory and

practice. Journal of Planning Literature, 33(2), 143-154.

Chardon, T., Freudenberg, B., & Brimble, M. (2016). Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, 321.

Cremers, M., & Pareek, A. (2016). Patient capital outperformance: The investment skill of high

active share managers who trade infrequently. Journal of Financial Economics, 122(2),

288-306.

Dixon, J. M., & Nassios, J. (2016). Modelling the impacts of a cut to company tax in Australia.

Centre for Policy Studies, Victoria University.

Hodgson, H., & Pearce, P. (2015). TravelSmart or travel tax breaks: is the fringe benefits tax a

barrier to active commuting in Australia? 1. eJournal of Tax Research, 13(3), 819.

Oates, W. E., & Schwab, R. M. (2015). The window tax: A case study in excess burden. Journal

of Economic Perspectives, 29(1), 163-80.

TAXATION

References:

Ahmad, R., & Scott, N. (2015). Fringe benefits and organisational commitment: the case of

Langkawi hotels. Tourism review, 70(1), 13-23.

Almeida, H., Fos, V., & Kronlund, M. (2016). The real effects of share repurchases. Journal of

Financial Economics, 119(1), 168-185.

Braverman, D., Marsden, S., & Sadiq, K. (2015). Assessing Taxpayer Response to Legislative

Changes: A Case Study of In-House Fringe Benefits Rules. J. Austl. Tax'n, 17, 1.

Brinkley, C. (2018). Fringe benefits: adding rugosity to the urban interface in theory and

practice. Journal of Planning Literature, 33(2), 143-154.

Chardon, T., Freudenberg, B., & Brimble, M. (2016). Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, 321.

Cremers, M., & Pareek, A. (2016). Patient capital outperformance: The investment skill of high

active share managers who trade infrequently. Journal of Financial Economics, 122(2),

288-306.

Dixon, J. M., & Nassios, J. (2016). Modelling the impacts of a cut to company tax in Australia.

Centre for Policy Studies, Victoria University.

Hodgson, H., & Pearce, P. (2015). TravelSmart or travel tax breaks: is the fringe benefits tax a

barrier to active commuting in Australia? 1. eJournal of Tax Research, 13(3), 819.

Oates, W. E., & Schwab, R. M. (2015). The window tax: A case study in excess burden. Journal

of Economic Perspectives, 29(1), 163-80.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.