Analyzing Corporate Fringe Benefits and Charitable Tax Strategies

VerifiedAdded on 2020/07/22

|10

|2765

|28

Essay

AI Summary

The assignment delves into the complexities of corporate taxation concerning fringe benefits offered to employees. It explores various forms of non-wage compensation, such as company cars and health insurance, discussing their tax implications and strategies that companies might employ to mitigate tax liabilities associated with these perks. Additionally, it investigates how corporations can leverage charitable contributions for tax relief. The paper incorporates theoretical frameworks and real-world examples to elucidate the benefits and challenges in corporate taxation practices. By examining relevant literature and case studies, the essay aims to provide a comprehensive understanding of strategic financial management within the context of corporate taxation policies.

Taxation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1..................................................................................................................................1

Issue.............................................................................................................................................1

Rule..............................................................................................................................................1

Application..................................................................................................................................1

Conclusion...................................................................................................................................2

QUESTION 2..................................................................................................................................2

Issue.............................................................................................................................................2

Rule..............................................................................................................................................2

Application..................................................................................................................................3

Conclusion...................................................................................................................................3

QUESTION 3..................................................................................................................................4

Issue.............................................................................................................................................4

Rule..............................................................................................................................................4

Application..................................................................................................................................4

Conclusion...................................................................................................................................4

QUESTION 4..................................................................................................................................5

Issue.............................................................................................................................................5

Rule..............................................................................................................................................5

Application..................................................................................................................................5

Conclusion...................................................................................................................................5

QUESTION 5..................................................................................................................................6

Issue.............................................................................................................................................6

Rule..............................................................................................................................................6

Application..................................................................................................................................6

Conclusion...................................................................................................................................6

REFERENCES................................................................................................................................7

QUESTION 1..................................................................................................................................1

Issue.............................................................................................................................................1

Rule..............................................................................................................................................1

Application..................................................................................................................................1

Conclusion...................................................................................................................................2

QUESTION 2..................................................................................................................................2

Issue.............................................................................................................................................2

Rule..............................................................................................................................................2

Application..................................................................................................................................3

Conclusion...................................................................................................................................3

QUESTION 3..................................................................................................................................4

Issue.............................................................................................................................................4

Rule..............................................................................................................................................4

Application..................................................................................................................................4

Conclusion...................................................................................................................................4

QUESTION 4..................................................................................................................................5

Issue.............................................................................................................................................5

Rule..............................................................................................................................................5

Application..................................................................................................................................5

Conclusion...................................................................................................................................5

QUESTION 5..................................................................................................................................6

Issue.............................................................................................................................................6

Rule..............................................................................................................................................6

Application..................................................................................................................................6

Conclusion...................................................................................................................................6

REFERENCES................................................................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

QUESTION 1

Issue

In given case, Eric had acquired many assets and for that his net capital gain or loss has

been calculated for the year that how much he liable to pay. The issue has been arising that

whether Eric has gain capital profit or not.

Rule

Capital gain tax is the form of taxation which is levied by Australian government. It

arises whenever any transaction take place. This tax is charge on any capital gain which is

arising from the sale or disposal of any assets has been brought or acquired by person (Harding,

2013).

According to provision of Income Tax Assessment Act 1997, capital gain is difference

from the capital proceeds and cost is based on CGT assets (Piketty and Zucman, 2014). All

assets which has been acquired by individual are liable for paying CGT since 20 September

1985. But it includes some assets;

Some of the personal assets which are exempt from CGT which includes home, car

personal use assets.

It also doesn’t apply to depreciating assets which are solely taxable purposes.

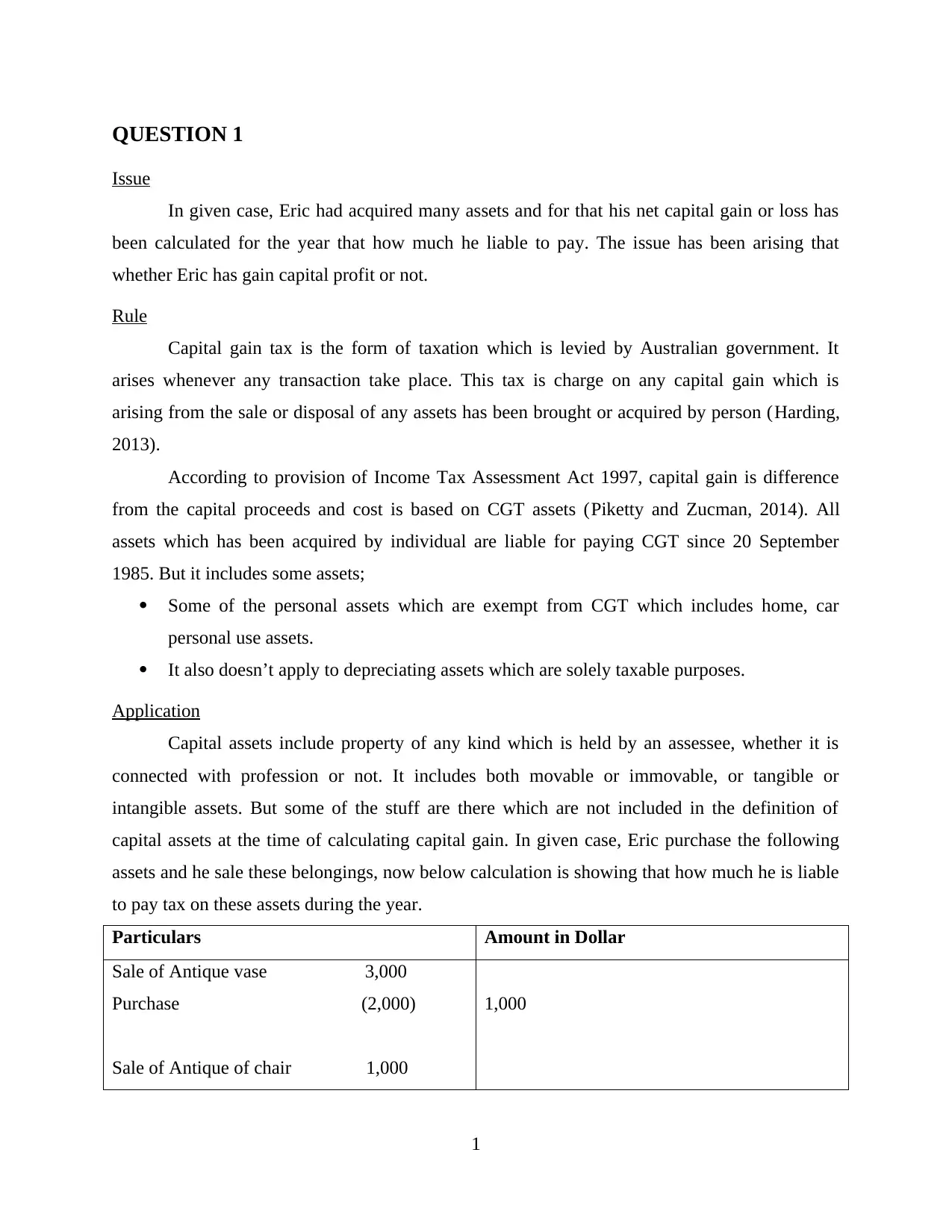

Application

Capital assets include property of any kind which is held by an assessee, whether it is

connected with profession or not. It includes both movable or immovable, or tangible or

intangible assets. But some of the stuff are there which are not included in the definition of

capital assets at the time of calculating capital gain. In given case, Eric purchase the following

assets and he sale these belongings, now below calculation is showing that how much he is liable

to pay tax on these assets during the year.

Particulars Amount in Dollar

Sale of Antique vase 3,000

Purchase (2,000)

Sale of Antique of chair 1,000

1,000

1

Issue

In given case, Eric had acquired many assets and for that his net capital gain or loss has

been calculated for the year that how much he liable to pay. The issue has been arising that

whether Eric has gain capital profit or not.

Rule

Capital gain tax is the form of taxation which is levied by Australian government. It

arises whenever any transaction take place. This tax is charge on any capital gain which is

arising from the sale or disposal of any assets has been brought or acquired by person (Harding,

2013).

According to provision of Income Tax Assessment Act 1997, capital gain is difference

from the capital proceeds and cost is based on CGT assets (Piketty and Zucman, 2014). All

assets which has been acquired by individual are liable for paying CGT since 20 September

1985. But it includes some assets;

Some of the personal assets which are exempt from CGT which includes home, car

personal use assets.

It also doesn’t apply to depreciating assets which are solely taxable purposes.

Application

Capital assets include property of any kind which is held by an assessee, whether it is

connected with profession or not. It includes both movable or immovable, or tangible or

intangible assets. But some of the stuff are there which are not included in the definition of

capital assets at the time of calculating capital gain. In given case, Eric purchase the following

assets and he sale these belongings, now below calculation is showing that how much he is liable

to pay tax on these assets during the year.

Particulars Amount in Dollar

Sale of Antique vase 3,000

Purchase (2,000)

Sale of Antique of chair 1,000

1,000

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

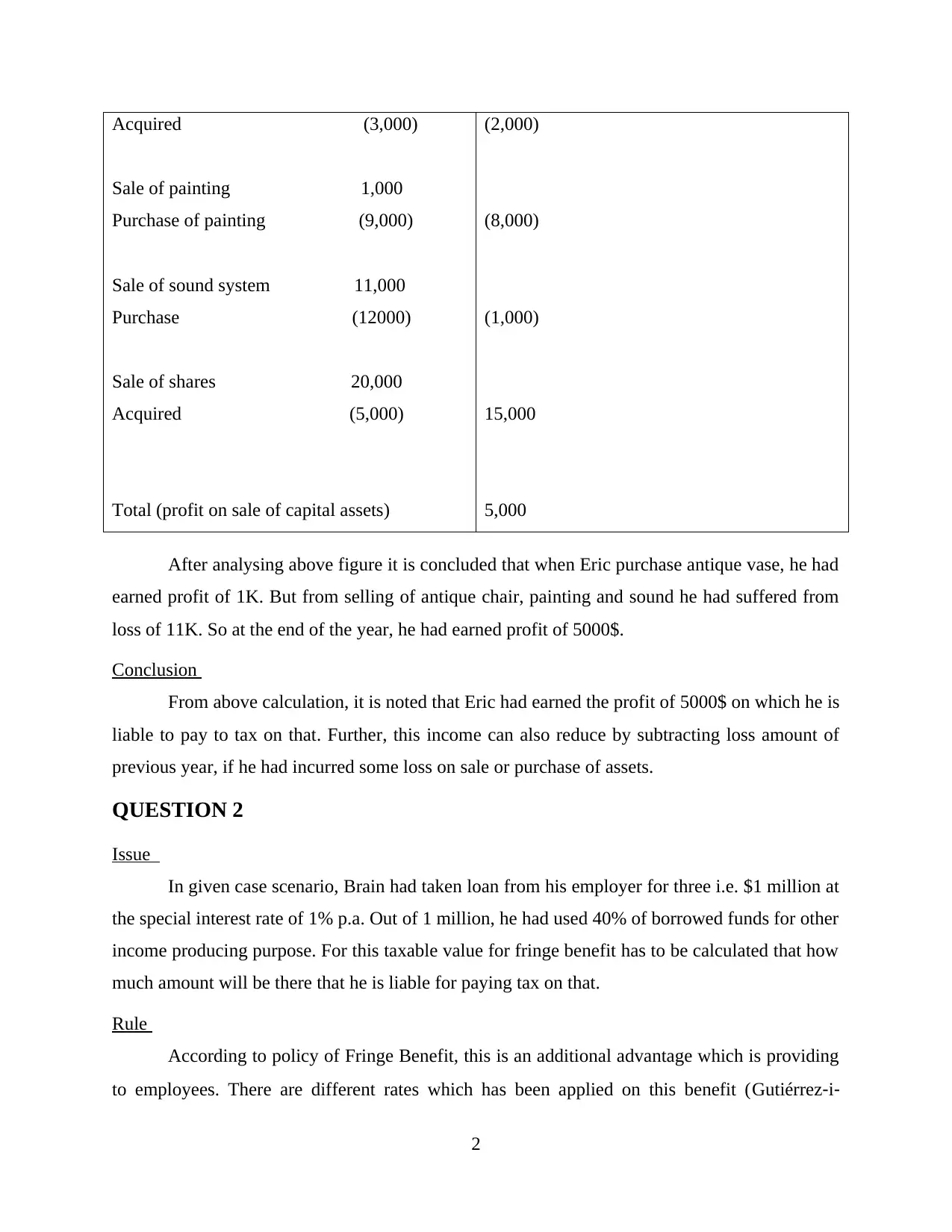

Acquired (3,000)

Sale of painting 1,000

Purchase of painting (9,000)

Sale of sound system 11,000

Purchase (12000)

Sale of shares 20,000

Acquired (5,000)

Total (profit on sale of capital assets)

(2,000)

(8,000)

(1,000)

15,000

5,000

After analysing above figure it is concluded that when Eric purchase antique vase, he had

earned profit of 1K. But from selling of antique chair, painting and sound he had suffered from

loss of 11K. So at the end of the year, he had earned profit of 5000$.

Conclusion

From above calculation, it is noted that Eric had earned the profit of 5000$ on which he is

liable to pay to tax on that. Further, this income can also reduce by subtracting loss amount of

previous year, if he had incurred some loss on sale or purchase of assets.

QUESTION 2

Issue

In given case scenario, Brain had taken loan from his employer for three i.e. $1 million at

the special interest rate of 1% p.a. Out of 1 million, he had used 40% of borrowed funds for other

income producing purpose. For this taxable value for fringe benefit has to be calculated that how

much amount will be there that he is liable for paying tax on that.

Rule

According to policy of Fringe Benefit, this is an additional advantage which is providing

to employees. There are different rates which has been applied on this benefit (Gutiérrez‐i‐

2

Sale of painting 1,000

Purchase of painting (9,000)

Sale of sound system 11,000

Purchase (12000)

Sale of shares 20,000

Acquired (5,000)

Total (profit on sale of capital assets)

(2,000)

(8,000)

(1,000)

15,000

5,000

After analysing above figure it is concluded that when Eric purchase antique vase, he had

earned profit of 1K. But from selling of antique chair, painting and sound he had suffered from

loss of 11K. So at the end of the year, he had earned profit of 5000$.

Conclusion

From above calculation, it is noted that Eric had earned the profit of 5000$ on which he is

liable to pay to tax on that. Further, this income can also reduce by subtracting loss amount of

previous year, if he had incurred some loss on sale or purchase of assets.

QUESTION 2

Issue

In given case scenario, Brain had taken loan from his employer for three i.e. $1 million at

the special interest rate of 1% p.a. Out of 1 million, he had used 40% of borrowed funds for other

income producing purpose. For this taxable value for fringe benefit has to be calculated that how

much amount will be there that he is liable for paying tax on that.

Rule

According to policy of Fringe Benefit, this is an additional advantage which is providing

to employees. There are different rates which has been applied on this benefit (Gutiérrez‐i‐

2

Puigarnau and Van Ommeren, 2011). It depends upon the amount on which it has been provided

such as on car, private health care. For several fringe benefit more than prescribes methods are

there for determining taxable value. Fringe benefit tax is levied on non-cash benefits which are

provided by employer to employee in terms of employment. This tax is imposed on employer,

not on employee. There are different kinds on statutory norms in which different kinds of

benefits are provided to employees (Shortt and Warren, 2012).

Application

Brain is getting additional benefit from employer in terms of interest rate if it is compared

with statutory benchmark rate. Actual interest rate is 5.65% per annum for the previous year

which is commencing on 1 April 2016. But employer had given loan @ 1%. It means that he is

getting advantage of 4.65% from paying tax amount (Lumley and et. al., 2011). Below mention

is calculation of taxable value on fringe benefit which has to be paid for the year 2016/17.

Phase 1: Assessable value on which fringe benefit is given to Brain as a loan

Calculation of interest rate as per statutory norms: $1,000,000*5.65% = $56,500

Calculating interest rate as per company rules: $1,000,000*1% = $10,000

Hence, actual fringe benefit will be $56500-$10000 = $46,500.

Phase 2: Taxable amount on fringe benefit if it is given provided without charging any

interest amount

$1,000,000*5.65% = $56,500

Phase 3: If Brain will pay interest as per standard rate on the amount of 40% which is used

by him for other purpose

$1,000,000*40%*5.65% = $22,600

Phase 4: Payment of interest amount according to income tax permissible

$10,000*40% = 4000

Phase 5: Now, subtracting 4 from 3 to calculating actual taxable value

$22,600-$4000 = 18600

In second scenario, no answer will not be different if interest will pay at the end of year

rather than monthly instalments. Further, in third scenario, if bank impose on Brain in repaying

the interest, he will be liable for paying tax on $22,600.

3

such as on car, private health care. For several fringe benefit more than prescribes methods are

there for determining taxable value. Fringe benefit tax is levied on non-cash benefits which are

provided by employer to employee in terms of employment. This tax is imposed on employer,

not on employee. There are different kinds on statutory norms in which different kinds of

benefits are provided to employees (Shortt and Warren, 2012).

Application

Brain is getting additional benefit from employer in terms of interest rate if it is compared

with statutory benchmark rate. Actual interest rate is 5.65% per annum for the previous year

which is commencing on 1 April 2016. But employer had given loan @ 1%. It means that he is

getting advantage of 4.65% from paying tax amount (Lumley and et. al., 2011). Below mention

is calculation of taxable value on fringe benefit which has to be paid for the year 2016/17.

Phase 1: Assessable value on which fringe benefit is given to Brain as a loan

Calculation of interest rate as per statutory norms: $1,000,000*5.65% = $56,500

Calculating interest rate as per company rules: $1,000,000*1% = $10,000

Hence, actual fringe benefit will be $56500-$10000 = $46,500.

Phase 2: Taxable amount on fringe benefit if it is given provided without charging any

interest amount

$1,000,000*5.65% = $56,500

Phase 3: If Brain will pay interest as per standard rate on the amount of 40% which is used

by him for other purpose

$1,000,000*40%*5.65% = $22,600

Phase 4: Payment of interest amount according to income tax permissible

$10,000*40% = 4000

Phase 5: Now, subtracting 4 from 3 to calculating actual taxable value

$22,600-$4000 = 18600

In second scenario, no answer will not be different if interest will pay at the end of year

rather than monthly instalments. Further, in third scenario, if bank impose on Brain in repaying

the interest, he will be liable for paying tax on $22,600.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

From above case, $18600 was taxable value if loan amount is taken by employer. Apart

from this, if loan is taken from bank, then $22,600 will be taxable value.

QUESTION 3

Issue

In given case scenario, Jack and Jill had acquired a one rental property as joint tenant.

This agreement was done in written and provided some rights of both persons. These are Jack

will be entitled for 10% of profit and Jill will 90% from the property. This agreement is also

providing that if any loss has been incurred from rental house, then Jack is liable for 100%. The

issues were arising that the loss which has been arose of $10K, then who is liable to bear that.

Rule

As per provision of Australian Taxation Policies, an individual is not allowed to take

deduction on unnecessary expenses which is generating by them from any property. They are

allowed only for those expenses which are specified in law. If capital loss is there, then person is

allowed to set off this amount through capital gain in upcoming year. Capital gain tax is applying

to all individuals on which they are earning profits from assets by acquiring or selling. But there

is some specific exemption which are available to individual. If there is capital loss, then

individual is having authority to set-off these losses from capital gain (Desai and Jin, 2011).

Application

According to provision of taxation policy of Australia, here, Jill is dependent on Jack so

she is not liable for paying any tax amount whether profit or loss has been incurred. Apart from

this, according to rules and regulation of taxation it can also see that both persons had entered in

single agreement to evade tax from government. An individual is allowed if capital loss is there

during disposing of assets, then they can set off this amount from capital gain but in same

financial year. Else if CG is not there, then they are allowed to adjust this transaction in

upcoming year (Slemrod, 2013). Moreover, person is not allowed to deduct these capital losses

from other sources of income.

In given case scenario, loss had been incurred from rental property i.e. of $10K and this

will be considered as capital loss. This amount will be detected from Jack income. If Jack and

4

From above case, $18600 was taxable value if loan amount is taken by employer. Apart

from this, if loan is taken from bank, then $22,600 will be taxable value.

QUESTION 3

Issue

In given case scenario, Jack and Jill had acquired a one rental property as joint tenant.

This agreement was done in written and provided some rights of both persons. These are Jack

will be entitled for 10% of profit and Jill will 90% from the property. This agreement is also

providing that if any loss has been incurred from rental house, then Jack is liable for 100%. The

issues were arising that the loss which has been arose of $10K, then who is liable to bear that.

Rule

As per provision of Australian Taxation Policies, an individual is not allowed to take

deduction on unnecessary expenses which is generating by them from any property. They are

allowed only for those expenses which are specified in law. If capital loss is there, then person is

allowed to set off this amount through capital gain in upcoming year. Capital gain tax is applying

to all individuals on which they are earning profits from assets by acquiring or selling. But there

is some specific exemption which are available to individual. If there is capital loss, then

individual is having authority to set-off these losses from capital gain (Desai and Jin, 2011).

Application

According to provision of taxation policy of Australia, here, Jill is dependent on Jack so

she is not liable for paying any tax amount whether profit or loss has been incurred. Apart from

this, according to rules and regulation of taxation it can also see that both persons had entered in

single agreement to evade tax from government. An individual is allowed if capital loss is there

during disposing of assets, then they can set off this amount from capital gain but in same

financial year. Else if CG is not there, then they are allowed to adjust this transaction in

upcoming year (Slemrod, 2013). Moreover, person is not allowed to deduct these capital losses

from other sources of income.

In given case scenario, loss had been incurred from rental property i.e. of $10K and this

will be considered as capital loss. This amount will be detected from Jack income. If Jack and

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Jill decided to sale the property, if there is profit then it will be considered as capital gain

otherwise capital loss will consider.

Conclusion

It is comprehended from above case that loss of $10,000 will be bear by Jack in future.

QUESTION 4

Issue

In Duke of Westminster’s case, issue was that Duke employed a gardener. Duke

promised him to pay salary on monthly basis but he did not full his promise. Moreover, he has

paid salary to gardener on yearly basis in order to reduce his tax amount also.

Rule

Tax avoidance is an illegal practice which is done by person, corporation or any

organisation. These practices are done by people when they want to pay less tax and intention is

there to avoid in paying taxes from their actual tax liability. When these are caught by

government, then some penalties will be imposed by them or it can be considered as criminal

charges. Tax avoidance is different from tax evasion (Hoopes, Mescall and Pittman, 2012). As it

reduces government revenue. As per principle of Ramsay, transaction will be considered as void

and person is liable to pay on whole amount.

Application

According to provision of income tax, if any person found with that they are avoiding

taxes, then they are liable for paying some extra penalty amount to government. In case of IRC v.

Duke of Westminster [1936] A.C. 1. Decision of court was held that every person is liable to

save their income by paying less amount taxes. If he succeeds in ordering them to secure result,

then commissioner of IRC. Person is allowed to save their income in any way. After a period of

time different rules were made and it is effecting to all decision which are given court (Blaylock,

Shevlin and Wilson, 2011). One of the Ramsay principle was established which states that if any

transaction is found with pre-arranged artificial step rather than to save tax, then whole

transaction will give considered as tax avoidance and person will liable to pay tax on whole

amount.

5

otherwise capital loss will consider.

Conclusion

It is comprehended from above case that loss of $10,000 will be bear by Jack in future.

QUESTION 4

Issue

In Duke of Westminster’s case, issue was that Duke employed a gardener. Duke

promised him to pay salary on monthly basis but he did not full his promise. Moreover, he has

paid salary to gardener on yearly basis in order to reduce his tax amount also.

Rule

Tax avoidance is an illegal practice which is done by person, corporation or any

organisation. These practices are done by people when they want to pay less tax and intention is

there to avoid in paying taxes from their actual tax liability. When these are caught by

government, then some penalties will be imposed by them or it can be considered as criminal

charges. Tax avoidance is different from tax evasion (Hoopes, Mescall and Pittman, 2012). As it

reduces government revenue. As per principle of Ramsay, transaction will be considered as void

and person is liable to pay on whole amount.

Application

According to provision of income tax, if any person found with that they are avoiding

taxes, then they are liable for paying some extra penalty amount to government. In case of IRC v.

Duke of Westminster [1936] A.C. 1. Decision of court was held that every person is liable to

save their income by paying less amount taxes. If he succeeds in ordering them to secure result,

then commissioner of IRC. Person is allowed to save their income in any way. After a period of

time different rules were made and it is effecting to all decision which are given court (Blaylock,

Shevlin and Wilson, 2011). One of the Ramsay principle was established which states that if any

transaction is found with pre-arranged artificial step rather than to save tax, then whole

transaction will give considered as tax avoidance and person will liable to pay tax on whole

amount.

5

Conclusion

It has been concluded that if any anyone found with that they are avoiding tax, then it will

not consider as a crime. But in modern era, doing tax avoidance is considered as serious crime

due to different judgement has been given in several courts from last decades.

QUESTION 5

Issue

Nowadays, it is difficult to assess the income of individual from any sale of assets.

Government had framed different rules and regulations in context of agriculture income in order

to generate revenue (Tretola, Villios and Callea, 2012). With reference to given case scenario,

Bill is having own land where tall pine of trees is there. He intends to use this land for grazing

sheep so he wants to clean that land. For this he agreed with logging company to clean the

garden and paying $1K for every 100 metres.

Rule

As per provision of taxation ruling 95/6, it states that while selling of timber will be

considered as assessable income, whether taxpayer is involved in forest industry or not. Along

with this, deduction will allow according to their income (Bach, 2015).

Application

In given case, if Bill want to clean the land, then his income will not be considered in the

computation of capital gain. Apart from this, if he agrees to take $50K from logging company,

then his income will be considered for calculating taxable amount. The income which is gained

by Bill while selling the timber will be considered at the time of filing the return. So for this he

found that there is a logging company who will clean the land and Bill can easily graze the

sheep. For this, Bill will receive $1000 for every 100 meter and this will not be included at the

time of filling the tax return. Whereas, if Logging company is paying $50K as lump sum amount,

then his income will be considered for the calculation of tax because his purpose was to earn

profit. Besides this, $50K income will be considered as royalty so section of capital gain will

apply here.

6

It has been concluded that if any anyone found with that they are avoiding tax, then it will

not consider as a crime. But in modern era, doing tax avoidance is considered as serious crime

due to different judgement has been given in several courts from last decades.

QUESTION 5

Issue

Nowadays, it is difficult to assess the income of individual from any sale of assets.

Government had framed different rules and regulations in context of agriculture income in order

to generate revenue (Tretola, Villios and Callea, 2012). With reference to given case scenario,

Bill is having own land where tall pine of trees is there. He intends to use this land for grazing

sheep so he wants to clean that land. For this he agreed with logging company to clean the

garden and paying $1K for every 100 metres.

Rule

As per provision of taxation ruling 95/6, it states that while selling of timber will be

considered as assessable income, whether taxpayer is involved in forest industry or not. Along

with this, deduction will allow according to their income (Bach, 2015).

Application

In given case, if Bill want to clean the land, then his income will not be considered in the

computation of capital gain. Apart from this, if he agrees to take $50K from logging company,

then his income will be considered for calculating taxable amount. The income which is gained

by Bill while selling the timber will be considered at the time of filing the return. So for this he

found that there is a logging company who will clean the land and Bill can easily graze the

sheep. For this, Bill will receive $1000 for every 100 meter and this will not be included at the

time of filling the tax return. Whereas, if Logging company is paying $50K as lump sum amount,

then his income will be considered for the calculation of tax because his purpose was to earn

profit. Besides this, $50K income will be considered as royalty so section of capital gain will

apply here.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

From above case it is concluded that it depends upon the deal that for what purpose it has

been done. If intention of assess is to earn profit, then they are liable to pay tax under capital gain

otherwise not.

7

From above case it is concluded that it depends upon the deal that for what purpose it has

been done. If intention of assess is to earn profit, then they are liable to pay tax under capital gain

otherwise not.

7

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.