UK Taxation Law and Practice

VerifiedAdded on 2020/06/03

|18

|5214

|42

AI Summary

This assignment delves into the intricate world of UK taxation law and practice. It examines various aspects of the UK tax system, including income tax, corporation tax, capital gains tax, and VAT. The analysis draws upon relevant legislation such as the Taxation on Chargeable Gains Act 1992, Capital Allowances Act 2001, and Corporation Tax Act 2009. Additionally, it explores ethical considerations faced by tax practitioners and the influence of public pressure on corporate tax behavior. Real-world examples and case studies are used to illustrate key concepts and provide practical insights into UK taxation.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAXATION

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explaining tax environment of UK..................................................................................1

1.2 Explaining role and responsibility of tax practitioner......................................................2

1.3 Describing obligations and Non compliance of tax payers..............................................3

M1 Judgement relevant with the roles and responsibilities of tax practitioner......................6

D 3 Ideas and decision to understand the roles and duties of tax practitioners......................6

TASK 2............................................................................................................................................6

2.1 Calculations for Susan's income expenses and allowances..............................................6

2.2 Susan's taxable amount for income generated by various sources...................................8

2.3 Related documents for tax return of Susan.......................................................................9

M 3 Logical development of principle and concepts in analysing tax liabilities.................10

D 2 Managing activities for calculating tax liabilities..........................................................10

TASK 3..........................................................................................................................................11

3.1 Calculations for chargeable income of Aldi stores.........................................................11

3.2 Measuring tax liabilities for the Aldi stores...................................................................12

3.3 Explaining the income tax deductions............................................................................13

4.1 Identification of chargeable income...............................................................................13

4.2 Calculations for capital gains and losses........................................................................14

4.3 Calculations for tax payable on capital gains.................................................................14

M2 Applying techniques for measuring corporate tax.........................................................14

D1 Ideas to measure the Corporate tax Liabilities Capital gain payable.............................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explaining tax environment of UK..................................................................................1

1.2 Explaining role and responsibility of tax practitioner......................................................2

1.3 Describing obligations and Non compliance of tax payers..............................................3

M1 Judgement relevant with the roles and responsibilities of tax practitioner......................6

D 3 Ideas and decision to understand the roles and duties of tax practitioners......................6

TASK 2............................................................................................................................................6

2.1 Calculations for Susan's income expenses and allowances..............................................6

2.2 Susan's taxable amount for income generated by various sources...................................8

2.3 Related documents for tax return of Susan.......................................................................9

M 3 Logical development of principle and concepts in analysing tax liabilities.................10

D 2 Managing activities for calculating tax liabilities..........................................................10

TASK 3..........................................................................................................................................11

3.1 Calculations for chargeable income of Aldi stores.........................................................11

3.2 Measuring tax liabilities for the Aldi stores...................................................................12

3.3 Explaining the income tax deductions............................................................................13

4.1 Identification of chargeable income...............................................................................13

4.2 Calculations for capital gains and losses........................................................................14

4.3 Calculations for tax payable on capital gains.................................................................14

M2 Applying techniques for measuring corporate tax.........................................................14

D1 Ideas to measure the Corporate tax Liabilities Capital gain payable.............................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

UK as world most powerful economy has maintained the fame with the help of various

rules and regulations imposed over citizens. Taxation and acts facilitates the guidelines in

making a beneficiary regulation regarding taxes imposed on income generated by citizens as well

as corporate industries. In the present assessment, there will be explanation regarding the concept

of UK government in taxation. The role and responsibilities of tax practitioners, tax payers as

well as agents will be described with the help of HMRC rules and regulations. The capital gains

and calculations for the assessable income can be measured in various statements as well as

analysing the deduction or allowances awarded for such transactions.

TASK 1

1.1 Explaining tax environment of UK

Taxation levied by the UK government in consideration with collecting reserves or

revenue that will be utilised in the welfare of society. They facilitate health and safety to their

citizens and utilise such funds in promoting research and development. Monetary benefits will be

provided to enhancing the educational sector and facilitating students with scholarships which

helps them in further studies (Hasseldine ed., 2017). In context with developing the nation's

economy the industrial sector as well as agriculture sectors will be benefited with the new

technology and reforms in the developing crops as well as manufacturing gods or services.

UK has different taxation policies as compare with other nations. Collection of taxes on

the basis of various legislations or taxes such as Income tax, Corporate tax, Capital gain tax etc.

which helps in collection of funds from individuals as well as industrial units (Budd, 2016).

Main revenue can be collected by HMRC as they are Central government of UK and the other

taxations will be collected by Local government in UK which works as state government in

county and handle local operations. Income tax, corporate tax and value added tax will be

calculated by central government. Indirect taxes such as parking charges as well as several small

taxes will be collected by local government.

Taxes can be levied by HMRC legislation by several methods including various acts such

as:

1

UK as world most powerful economy has maintained the fame with the help of various

rules and regulations imposed over citizens. Taxation and acts facilitates the guidelines in

making a beneficiary regulation regarding taxes imposed on income generated by citizens as well

as corporate industries. In the present assessment, there will be explanation regarding the concept

of UK government in taxation. The role and responsibilities of tax practitioners, tax payers as

well as agents will be described with the help of HMRC rules and regulations. The capital gains

and calculations for the assessable income can be measured in various statements as well as

analysing the deduction or allowances awarded for such transactions.

TASK 1

1.1 Explaining tax environment of UK

Taxation levied by the UK government in consideration with collecting reserves or

revenue that will be utilised in the welfare of society. They facilitate health and safety to their

citizens and utilise such funds in promoting research and development. Monetary benefits will be

provided to enhancing the educational sector and facilitating students with scholarships which

helps them in further studies (Hasseldine ed., 2017). In context with developing the nation's

economy the industrial sector as well as agriculture sectors will be benefited with the new

technology and reforms in the developing crops as well as manufacturing gods or services.

UK has different taxation policies as compare with other nations. Collection of taxes on

the basis of various legislations or taxes such as Income tax, Corporate tax, Capital gain tax etc.

which helps in collection of funds from individuals as well as industrial units (Budd, 2016).

Main revenue can be collected by HMRC as they are Central government of UK and the other

taxations will be collected by Local government in UK which works as state government in

county and handle local operations. Income tax, corporate tax and value added tax will be

calculated by central government. Indirect taxes such as parking charges as well as several small

taxes will be collected by local government.

Taxes can be levied by HMRC legislation by several methods including various acts such

as:

1

Capital gain tax: HMRC charged the taxes over revenue generated on purchasing and

selling of assets. If the purchasing value of the asset is lower than the selling price than there will

be capital gain generated by the owner of such asset, than he will be liable to make taxation over

it (Ehrlich and Radulescu, 2017). If the owner generated loss over article than it will be capital

loss. These transactions will be exempted as per the conditions or as per norms set by the

HMRC1 legislations. It follows taxation act of TCGA2 1992.

Corporate tax: These taxes are collected through the corporate business, industries and

firms over turnover generated by them (Basak, 2016). HMRC collects taxes through various

modes like imposing custom duties, import and export taxes, transportation taxes etc. The taxes

can be collected through various acts and laws such as CAA3, 2001, CTA4, 2009 and ICTA5

1988.

Income tax: HMRC collected taxes on the basis of income generated by individuals from

several sources. Taxes can be imposed over the income generated through, employment, self

governed business, pension, dividends as well as from rental property (Kemmerling, 2016).

Collection of revenue from government through taxes by various acts such as CAA 2001,

ITTOIA6 2005, ITEPA7, 2003 and ITA8, 2007.

1.2 Explaining role and responsibility of tax practitioner

Taxes paid by tax practitioners on behalf of tax payers on their assessable income will be

responsible for disclosure of informations to HMRC. They must be aware with following the

various roles and responsibilities such as they must acquired the certificate or license of tax

practitioners (Haffner and Winters, 2016). They must be registered under HMRC norms and

have gain authority to measure taxation of citizens. Tax practitioners will be agents, charted

accountant as well as the accounting professional in any company. They must acquired the good

1 Her majesty revenue and customs

2 Taxation on chargeable gains act, 1992

3 Capital allowance act, 2001

4 Corporation Tax act, 2009

5 Income and corporation Act, 1988

6 Income tax (trading and other income) act, 2005

7 Income tax Earning and Pension Act, 2003

8 Income tax act, 2007

2

selling of assets. If the purchasing value of the asset is lower than the selling price than there will

be capital gain generated by the owner of such asset, than he will be liable to make taxation over

it (Ehrlich and Radulescu, 2017). If the owner generated loss over article than it will be capital

loss. These transactions will be exempted as per the conditions or as per norms set by the

HMRC1 legislations. It follows taxation act of TCGA2 1992.

Corporate tax: These taxes are collected through the corporate business, industries and

firms over turnover generated by them (Basak, 2016). HMRC collects taxes through various

modes like imposing custom duties, import and export taxes, transportation taxes etc. The taxes

can be collected through various acts and laws such as CAA3, 2001, CTA4, 2009 and ICTA5

1988.

Income tax: HMRC collected taxes on the basis of income generated by individuals from

several sources. Taxes can be imposed over the income generated through, employment, self

governed business, pension, dividends as well as from rental property (Kemmerling, 2016).

Collection of revenue from government through taxes by various acts such as CAA 2001,

ITTOIA6 2005, ITEPA7, 2003 and ITA8, 2007.

1.2 Explaining role and responsibility of tax practitioner

Taxes paid by tax practitioners on behalf of tax payers on their assessable income will be

responsible for disclosure of informations to HMRC. They must be aware with following the

various roles and responsibilities such as they must acquired the certificate or license of tax

practitioners (Haffner and Winters, 2016). They must be registered under HMRC norms and

have gain authority to measure taxation of citizens. Tax practitioners will be agents, charted

accountant as well as the accounting professional in any company. They must acquired the good

1 Her majesty revenue and customs

2 Taxation on chargeable gains act, 1992

3 Capital allowance act, 2001

4 Corporation Tax act, 2009

5 Income and corporation Act, 1988

6 Income tax (trading and other income) act, 2005

7 Income tax Earning and Pension Act, 2003

8 Income tax act, 2007

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

knowledge related with fluctuations in the taxation rates and ever changing government policies.

Taxes levied on the income or profit generated by an individual on the basis of various tax slabs.

Thus, this taxation slabs changes every year.

There will be various roles and responsibilities of the tax practitioners in UK.

They must follow the rules and regulations imposed by the governmental body in UK

which are related with the taxation of Income tax, corporate taxes, capital gain taxes and

value added taxes.

They must include all the informations regarding with income, expenses, gains as well as

deduction claimed by the individuals.

They must comply all informations with proper listed rule, laws and acts. That helps

taxation authority in UK to make the proper decisions regarding taxes levied on the

particular tasks.

There will be punishments or penalties over providing wrong or false information to

HMRC related with computation of taxable income of an individual.

They help consumers in claiming deductions over the expenses and revenue occurred in

particular transaction, which will provide them benefits in reducing the taxable amount.

They must provide necessary informations related with changes in the tax rates by

HMRC as well as changing policies to tax payers and they will be aware with the tax

procedure used by practitioners.

1.3 Describing obligations and Non compliance of tax payers

Obligations: Tax payer will be obliged to the various rule and regulations imposed by

HMRC. They must follows such laws and acts which are used in calculating the taxable income

of individuals (Farnsworth and Fooks, 2015). They must provide as well as responsible for

disclosing all necessary informations related with income and expenditures occurred in the

assessment year. There will be various obligations listed below which are need to be followed by

the tax payers: Documentation: Tax payer are obliged to disclose the proper documents related with the

expense, claims, revenue and allowable deductions over the income as well as expense

3

Taxes levied on the income or profit generated by an individual on the basis of various tax slabs.

Thus, this taxation slabs changes every year.

There will be various roles and responsibilities of the tax practitioners in UK.

They must follow the rules and regulations imposed by the governmental body in UK

which are related with the taxation of Income tax, corporate taxes, capital gain taxes and

value added taxes.

They must include all the informations regarding with income, expenses, gains as well as

deduction claimed by the individuals.

They must comply all informations with proper listed rule, laws and acts. That helps

taxation authority in UK to make the proper decisions regarding taxes levied on the

particular tasks.

There will be punishments or penalties over providing wrong or false information to

HMRC related with computation of taxable income of an individual.

They help consumers in claiming deductions over the expenses and revenue occurred in

particular transaction, which will provide them benefits in reducing the taxable amount.

They must provide necessary informations related with changes in the tax rates by

HMRC as well as changing policies to tax payers and they will be aware with the tax

procedure used by practitioners.

1.3 Describing obligations and Non compliance of tax payers

Obligations: Tax payer will be obliged to the various rule and regulations imposed by

HMRC. They must follows such laws and acts which are used in calculating the taxable income

of individuals (Farnsworth and Fooks, 2015). They must provide as well as responsible for

disclosing all necessary informations related with income and expenditures occurred in the

assessment year. There will be various obligations listed below which are need to be followed by

the tax payers: Documentation: Tax payer are obliged to disclose the proper documents related with the

expense, claims, revenue and allowable deductions over the income as well as expense

3

over their taxable income (Dyreng, Hoopes and Wilde, 2016). All documents must be

legal and authenticated and which will be disclosed to HMRC as it will be helpful for

them in collecting favourable data or record of each tax payer in country. Deadlines: Tax payers must be concern about filing such documents on time and pay the

tax returns over their income before deadline (Frecknall-Hughes, and et.al., 2016). As per

norms and regulations set by HMRC there will be payment of taxes for 2 times in a year

such as Half year or full year payments. Tax payer must complete the process before the

ending of such time. Te full year assessment period ends on 30th June each year as well as

on 31st January of each year is the half year payments for taxes. Honesty: Tax payer must provide legal informations to the HMRC and the tax legislative

departments in UK (Harju and Matikka, 2016). They should submit the related

documents with proper honesty and such informations must be reliable as well as true.

They must disclose all informations such sources of generating funds or areas of

expenses. Penalties and punishments: There will be strong action against the tax payer if they

disclose any unlawful or false documents to HMRC. As accordance with Agents or

charted accountants are making the tax payments for the individual and they are showing

the void documents to HMRC than their licenses will be abandon by the Government and

they will have to pay penalties over it (Understand your Self-Assessment tax bill, 2017).

Punishments of imposing higher tax rates over assessable income generated by an

individual as if delayed the transaction of making tax payments to taxation authority in

UK.

Corporation: Tax payers are obliged to inform or provide all data as well as documents

to the tax practitioners, agents, accountants with proper honesty. They must share all the

legal informations about selling and purchasing of the assets or property as well as

sources from with make gains (Klumpes, Komarev and Eleftheriou, 2016). It helps them

in making the fair taxable balance to them as well as also helps in calming the deductions

for the taxes.

4

legal and authenticated and which will be disclosed to HMRC as it will be helpful for

them in collecting favourable data or record of each tax payer in country. Deadlines: Tax payers must be concern about filing such documents on time and pay the

tax returns over their income before deadline (Frecknall-Hughes, and et.al., 2016). As per

norms and regulations set by HMRC there will be payment of taxes for 2 times in a year

such as Half year or full year payments. Tax payer must complete the process before the

ending of such time. Te full year assessment period ends on 30th June each year as well as

on 31st January of each year is the half year payments for taxes. Honesty: Tax payer must provide legal informations to the HMRC and the tax legislative

departments in UK (Harju and Matikka, 2016). They should submit the related

documents with proper honesty and such informations must be reliable as well as true.

They must disclose all informations such sources of generating funds or areas of

expenses. Penalties and punishments: There will be strong action against the tax payer if they

disclose any unlawful or false documents to HMRC. As accordance with Agents or

charted accountants are making the tax payments for the individual and they are showing

the void documents to HMRC than their licenses will be abandon by the Government and

they will have to pay penalties over it (Understand your Self-Assessment tax bill, 2017).

Punishments of imposing higher tax rates over assessable income generated by an

individual as if delayed the transaction of making tax payments to taxation authority in

UK.

Corporation: Tax payers are obliged to inform or provide all data as well as documents

to the tax practitioners, agents, accountants with proper honesty. They must share all the

legal informations about selling and purchasing of the assets or property as well as

sources from with make gains (Klumpes, Komarev and Eleftheriou, 2016). It helps them

in making the fair taxable balance to them as well as also helps in calming the deductions

for the taxes.

4

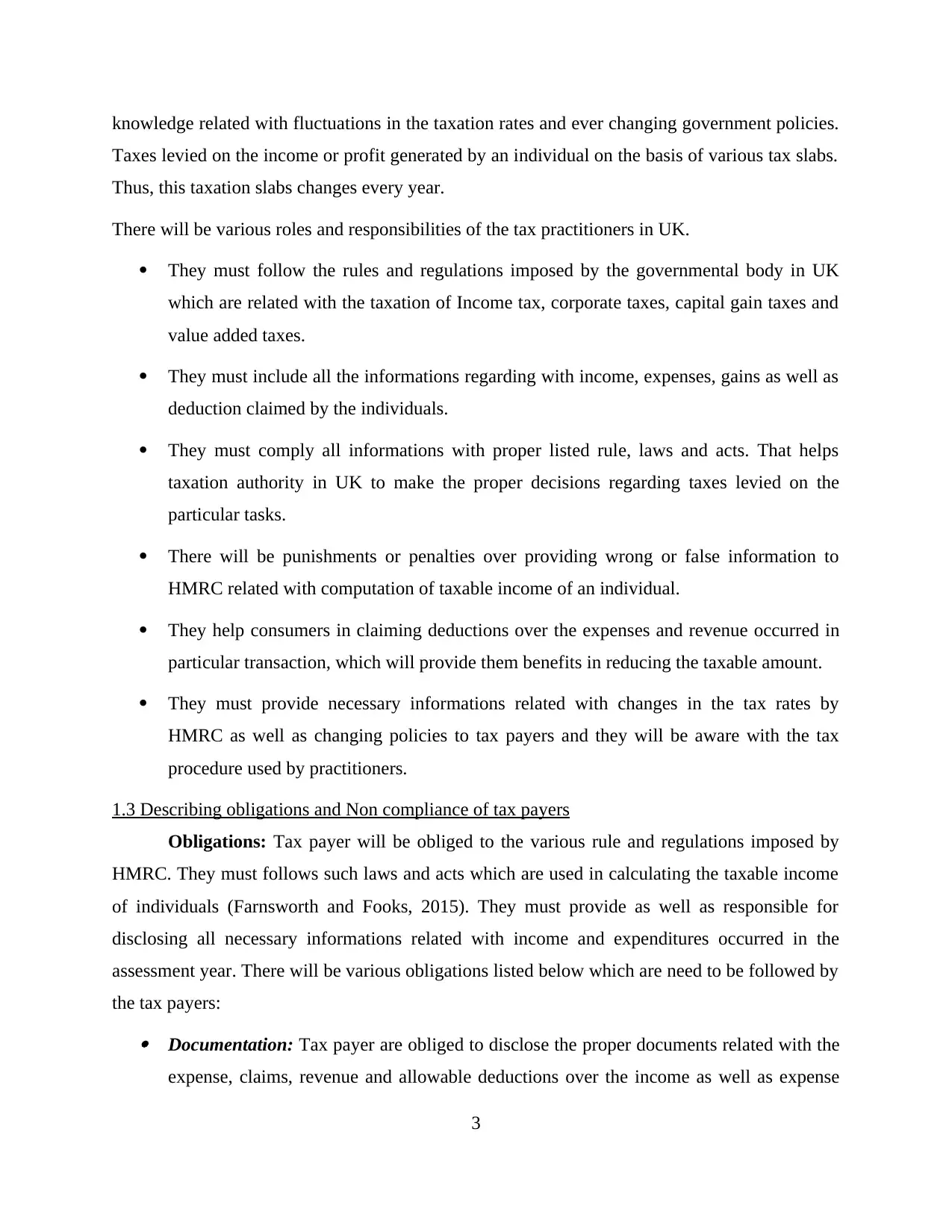

Non- compliances implication by tax payers: Tax payers will be charged penalty if

they found breaching the rules and regulations of the non compliance of the tax events (Lee,

2017). The ramification occurred on the tax payments by individual will be punished as per the

rules set by HMRC. These penalties will be charged over them such as:

Tax payer will be punished for no meeting the deadline or making payments of taxes on

the expected dates. They will also be punished for non payment of taxes may be past due

payments they will have to pay penalties over that.

They will be punished as they do not inform HMRC regarding with tax payable by them

as well as disclosure of documents. In the following table there is list of how HMRC

make penalties over tax payers.

Illustration 1: source: (Klumpes, Komarev and Eleftheriou, 2016)

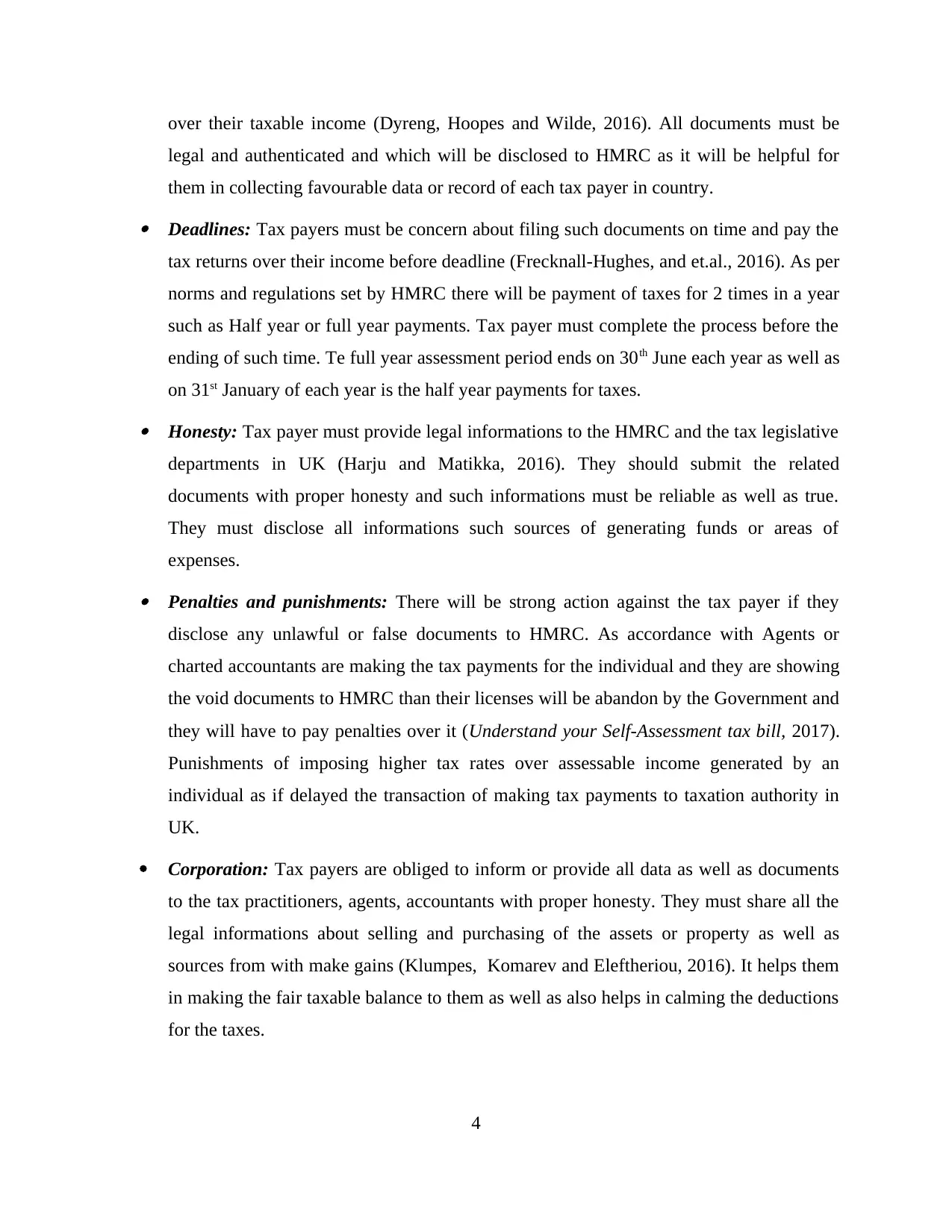

Interpretation: As per the above list the penalties will be charged over the non

compliance of the tasks through several failures. Non- deliberate transactions made by the tax

payer will be punished for making payment of 30% of potential revenue. 70% of the revenue will

be penalised as if the tax payer is Deliberate but not concealed. 100% of the income will be

punished for the individual who is conceals as well as deliberate. The rage of charging the

penalties will be shown at the table such as:

5

they found breaching the rules and regulations of the non compliance of the tax events (Lee,

2017). The ramification occurred on the tax payments by individual will be punished as per the

rules set by HMRC. These penalties will be charged over them such as:

Tax payer will be punished for no meeting the deadline or making payments of taxes on

the expected dates. They will also be punished for non payment of taxes may be past due

payments they will have to pay penalties over that.

They will be punished as they do not inform HMRC regarding with tax payable by them

as well as disclosure of documents. In the following table there is list of how HMRC

make penalties over tax payers.

Illustration 1: source: (Klumpes, Komarev and Eleftheriou, 2016)

Interpretation: As per the above list the penalties will be charged over the non

compliance of the tasks through several failures. Non- deliberate transactions made by the tax

payer will be punished for making payment of 30% of potential revenue. 70% of the revenue will

be penalised as if the tax payer is Deliberate but not concealed. 100% of the income will be

punished for the individual who is conceals as well as deliberate. The rage of charging the

penalties will be shown at the table such as:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M1 Judgement relevant with the roles and responsibilities of tax practitioner

In accordance with the various legislations facilitated by HMRC over the duties and

responsibilities of a tax practitioner or agent which helps in facilitating the legal transaction.

Hence, it can be said that, such laws and acts helps in understanding the moral value of paying

taxes in the legal manners as well as corporatising government in rising the funds.

D 3 Ideas and decision to understand the roles and duties of tax practitioners

In order to have adequate understanding in relation with tax practitioners duties and

responsibilities, there are several guidelines are issued from HMRC and the legal authority of

UK. Hence, such duties have importance in making fair tax returns as well as adequate

transaction in UK environment.

TASK 2

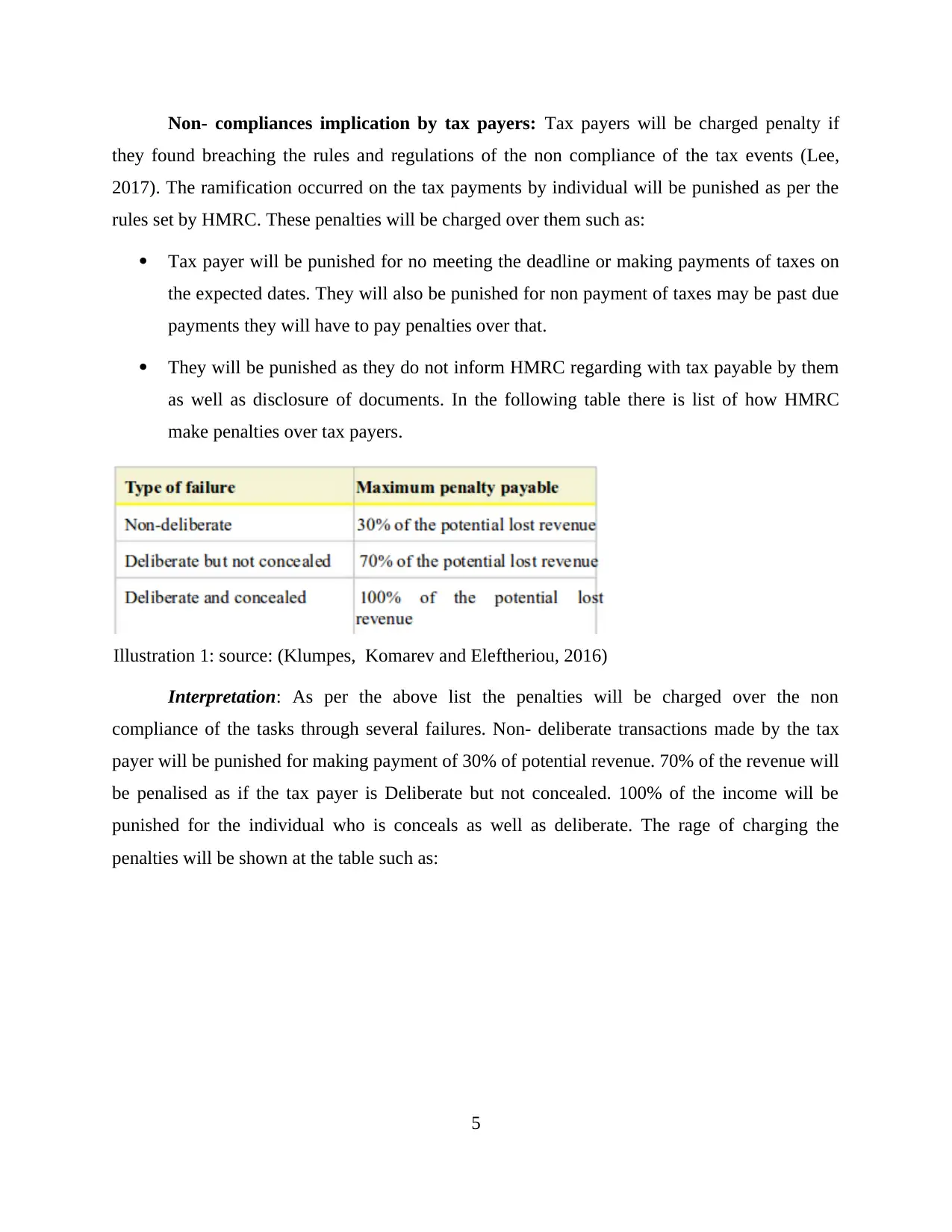

2.1 Calculations for Susan's income expenses and allowances

Assessable income of Susan on employment in supermarket

particulars Amount (£)

Amount

(£)

Revenue 28000

less: allowable expenditures

Car 192

Telephone 540

Uniform 250

6

In accordance with the various legislations facilitated by HMRC over the duties and

responsibilities of a tax practitioner or agent which helps in facilitating the legal transaction.

Hence, it can be said that, such laws and acts helps in understanding the moral value of paying

taxes in the legal manners as well as corporatising government in rising the funds.

D 3 Ideas and decision to understand the roles and duties of tax practitioners

In order to have adequate understanding in relation with tax practitioners duties and

responsibilities, there are several guidelines are issued from HMRC and the legal authority of

UK. Hence, such duties have importance in making fair tax returns as well as adequate

transaction in UK environment.

TASK 2

2.1 Calculations for Susan's income expenses and allowances

Assessable income of Susan on employment in supermarket

particulars Amount (£)

Amount

(£)

Revenue 28000

less: allowable expenditures

Car 192

Telephone 540

Uniform 250

6

Dividends 5420* 7.5% 406.5

Total allowable expenses 1388.5

Add: Taxable or disallowed expenses

fuel expenses 3024

Total disallowed expenses 3024

NP 23587.5

Less: personal allowance 2050

Total allowances 2050

Taxable income 21537.5

Allowances awarded to Susan over her employment in Supermarket:

Particulars Amount (£)

Car expense 192

Telephone 540

Uniform 250

Dividends 406.5

Personal allowances 2050

Total allowances 3438.5

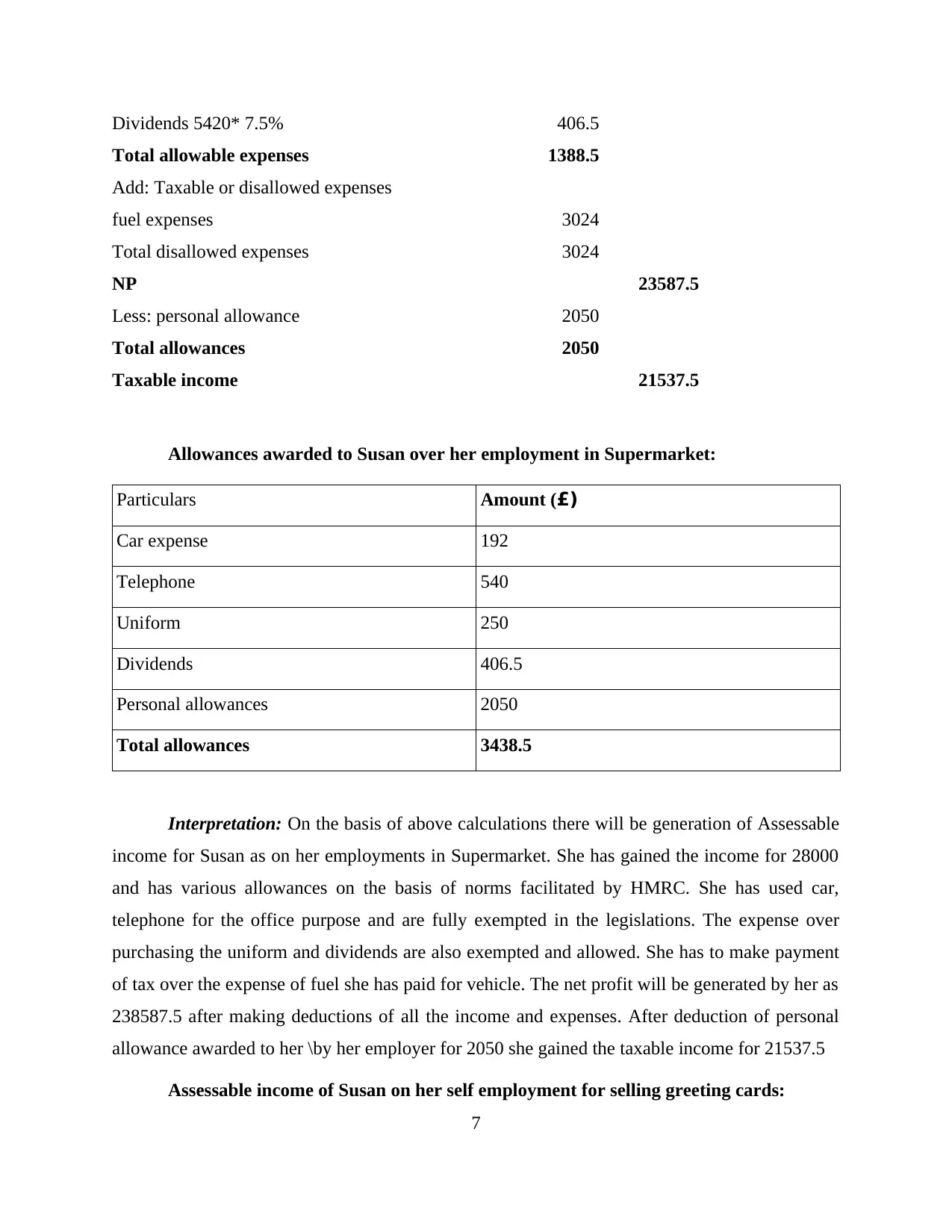

Interpretation: On the basis of above calculations there will be generation of Assessable

income for Susan as on her employments in Supermarket. She has gained the income for 28000

and has various allowances on the basis of norms facilitated by HMRC. She has used car,

telephone for the office purpose and are fully exempted in the legislations. The expense over

purchasing the uniform and dividends are also exempted and allowed. She has to make payment

of tax over the expense of fuel she has paid for vehicle. The net profit will be generated by her as

238587.5 after making deductions of all the income and expenses. After deduction of personal

allowance awarded to her \by her employer for 2050 she gained the taxable income for 21537.5

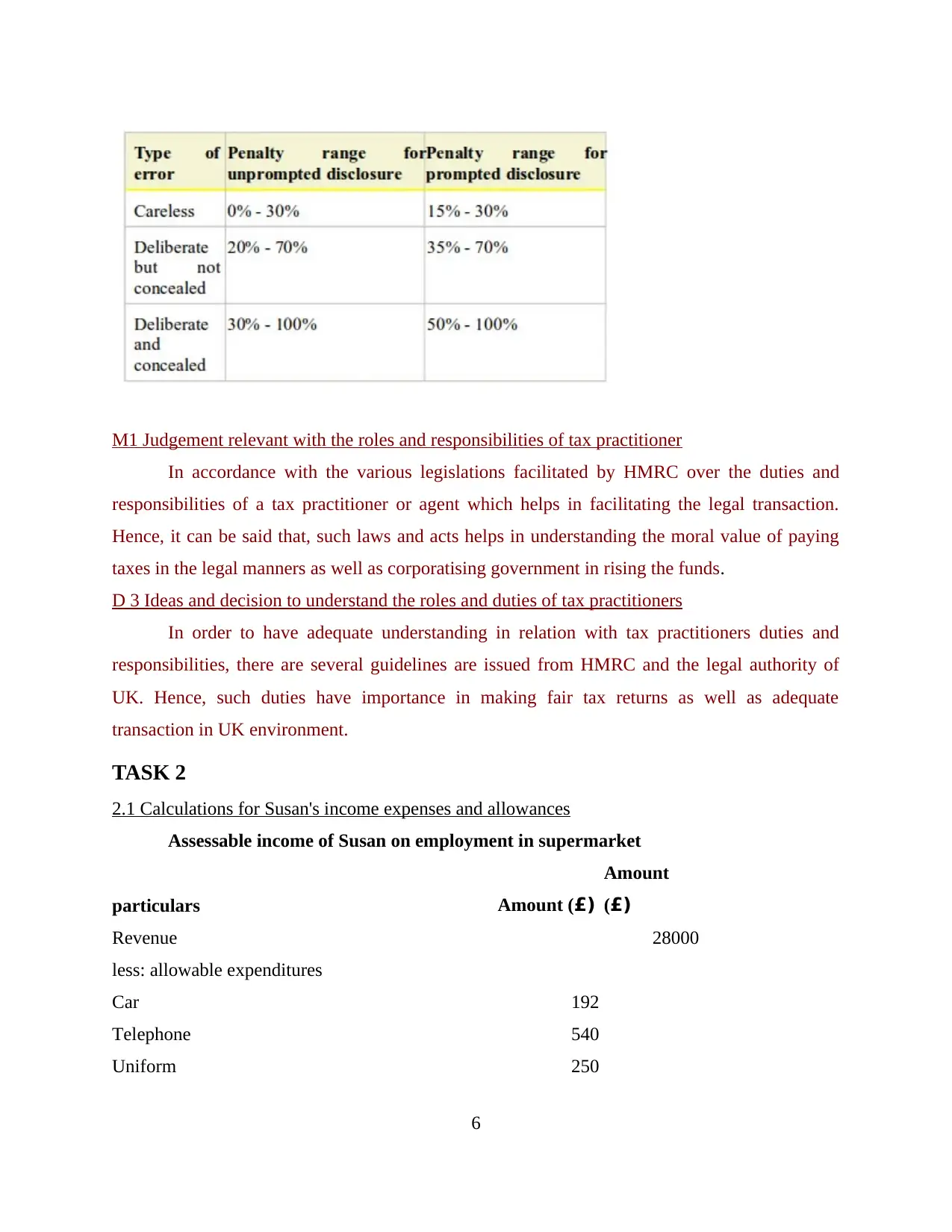

Assessable income of Susan on her self employment for selling greeting cards:

7

Total allowable expenses 1388.5

Add: Taxable or disallowed expenses

fuel expenses 3024

Total disallowed expenses 3024

NP 23587.5

Less: personal allowance 2050

Total allowances 2050

Taxable income 21537.5

Allowances awarded to Susan over her employment in Supermarket:

Particulars Amount (£)

Car expense 192

Telephone 540

Uniform 250

Dividends 406.5

Personal allowances 2050

Total allowances 3438.5

Interpretation: On the basis of above calculations there will be generation of Assessable

income for Susan as on her employments in Supermarket. She has gained the income for 28000

and has various allowances on the basis of norms facilitated by HMRC. She has used car,

telephone for the office purpose and are fully exempted in the legislations. The expense over

purchasing the uniform and dividends are also exempted and allowed. She has to make payment

of tax over the expense of fuel she has paid for vehicle. The net profit will be generated by her as

238587.5 after making deductions of all the income and expenses. After deduction of personal

allowance awarded to her \by her employer for 2050 she gained the taxable income for 21537.5

Assessable income of Susan on her self employment for selling greeting cards:

7

Self employment income generated by Susan

particulars Amount (£)

Amount

(£)

Income 40000

less: allowable expenditures

Travel expenses 2300

Rent 410

Insurance 1050

Printing machinery 728

Total allowable expenses 4488

Add: Taxable or disallowed expenses

Depreciation 495

Total disallowed expenses 495

NP 36007

Less: personal allowance

Trading loss 4000

Total allowances 4000

Taxable income 32007

Allowances Awarded to Susan on her self governed business:

Particulars Amount (£)

Travel expense 2300

Rent 410

Insurance 1050

Printing machinery 728

Trading loss 4000

Total allowances 8488

8

particulars Amount (£)

Amount

(£)

Income 40000

less: allowable expenditures

Travel expenses 2300

Rent 410

Insurance 1050

Printing machinery 728

Total allowable expenses 4488

Add: Taxable or disallowed expenses

Depreciation 495

Total disallowed expenses 495

NP 36007

Less: personal allowance

Trading loss 4000

Total allowances 4000

Taxable income 32007

Allowances Awarded to Susan on her self governed business:

Particulars Amount (£)

Travel expense 2300

Rent 410

Insurance 1050

Printing machinery 728

Trading loss 4000

Total allowances 8488

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

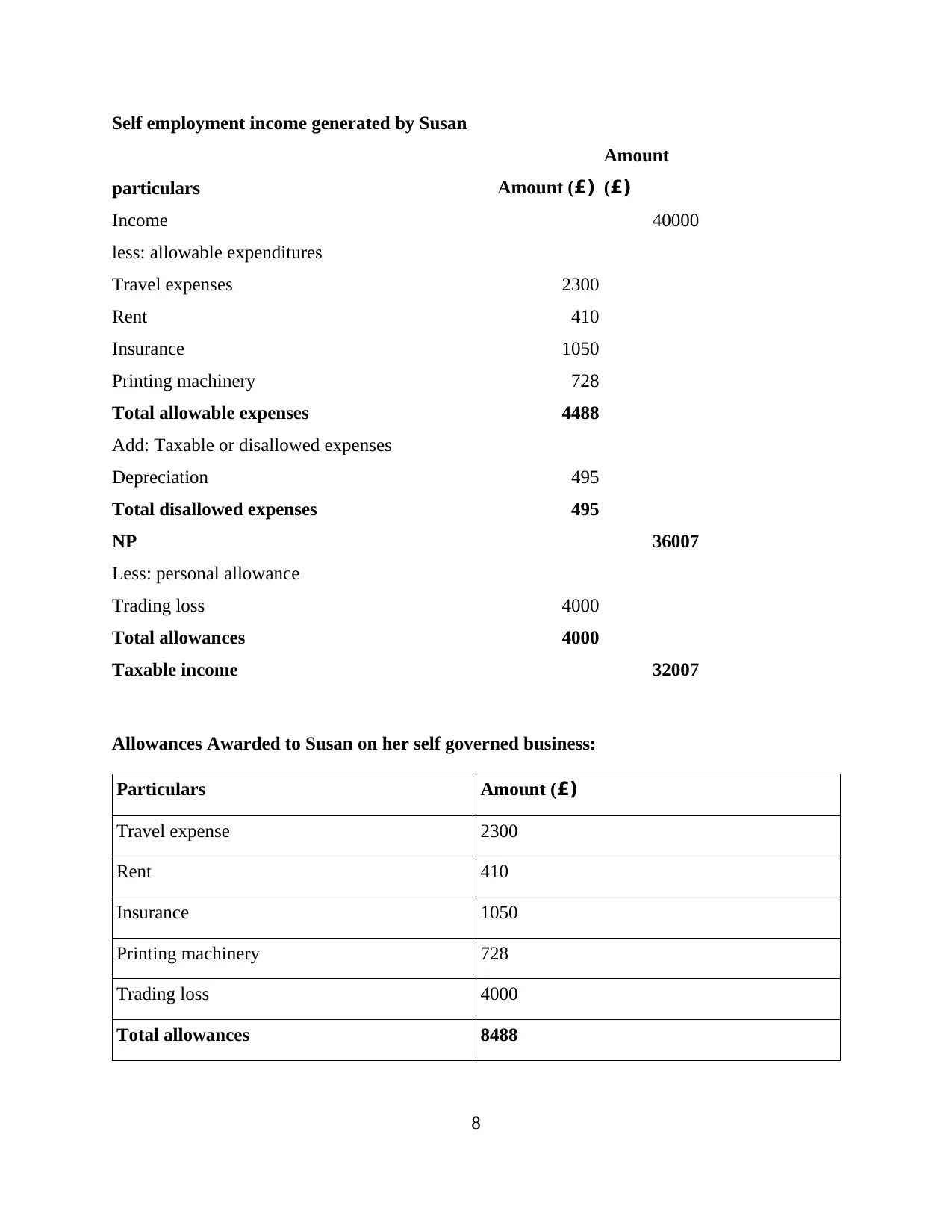

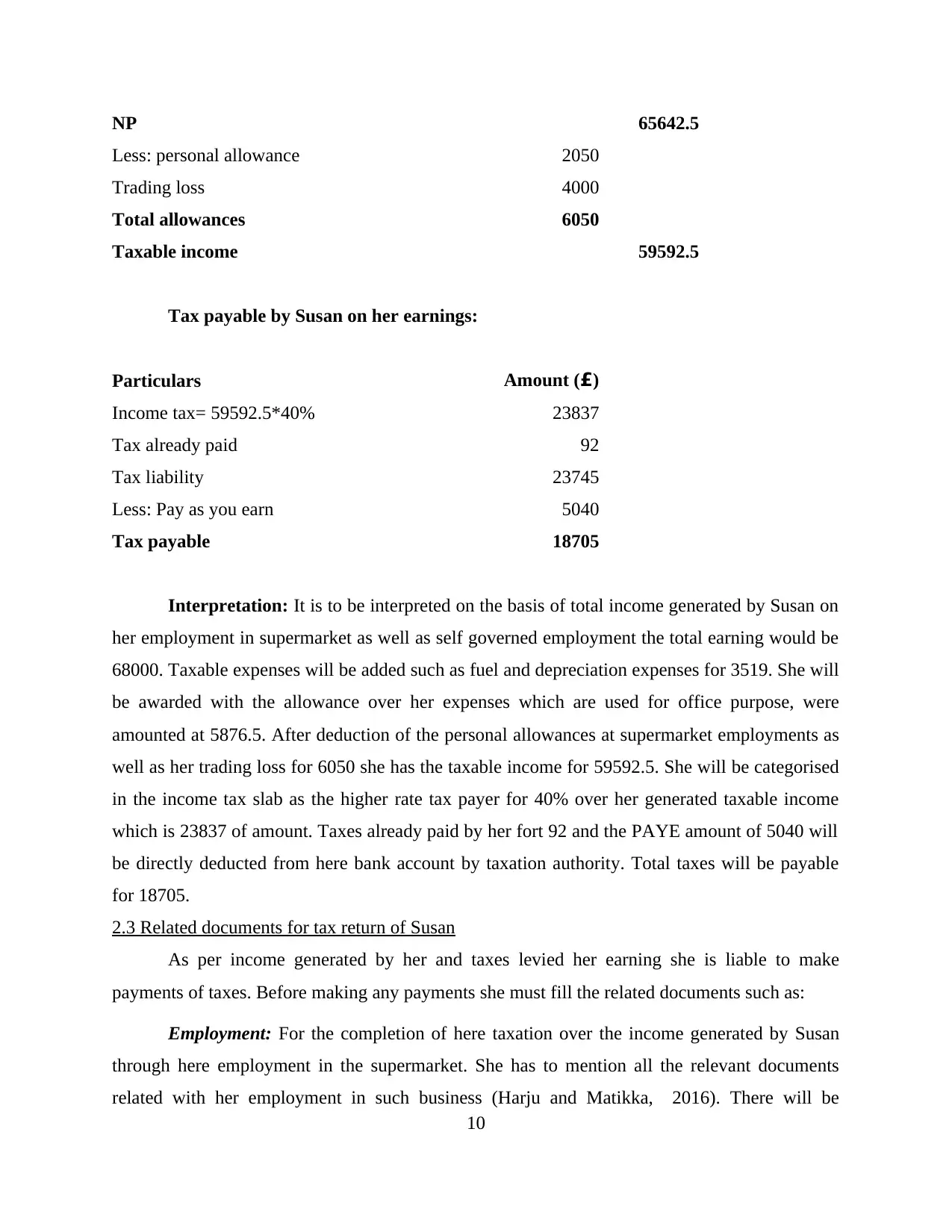

Interpretation: It will be interpreted on the Susan's earning through her self employed

business of preparing greeting cards. She has made earning of 40000 through such job and made

various expenses. She has allowable expenses which are deducted as per conditions in tax

legislations such as travel expenses, rent, purchasing of printing machinery and insurance. There

will be various taxable income which have to be charged taxes such as depreciation on the assets.

After deduction or addition of all the deductible and non-deductible expenses there is the net

profit generated by Susan such as 36007 on which she has claimed personal allowances for 4000.

After deduction of her personal allowance she has the taxable amount for 8488.

2.2 Susan's taxable amount for income generated by various sources

Income generated by Susan from employment as well as self governed business

Income statement of Susan

particulars Amount (£)

Amount

(£)

Income from supermarket 28000

Income from self- employment 40000

Total income 68000

Add: Taxable Expenses

fuel expenses 3024

Depreciation 495

Total taxable expense 3519

less: allowable expenditures

Travel expenses 2300

Rent 410

Insurance 1050

Printing machinery 728

Car 192

Telephone 540

Uniform 250

Dividends 5420* 7.5% 406.5

Total allowable expenses 5876.5

9

business of preparing greeting cards. She has made earning of 40000 through such job and made

various expenses. She has allowable expenses which are deducted as per conditions in tax

legislations such as travel expenses, rent, purchasing of printing machinery and insurance. There

will be various taxable income which have to be charged taxes such as depreciation on the assets.

After deduction or addition of all the deductible and non-deductible expenses there is the net

profit generated by Susan such as 36007 on which she has claimed personal allowances for 4000.

After deduction of her personal allowance she has the taxable amount for 8488.

2.2 Susan's taxable amount for income generated by various sources

Income generated by Susan from employment as well as self governed business

Income statement of Susan

particulars Amount (£)

Amount

(£)

Income from supermarket 28000

Income from self- employment 40000

Total income 68000

Add: Taxable Expenses

fuel expenses 3024

Depreciation 495

Total taxable expense 3519

less: allowable expenditures

Travel expenses 2300

Rent 410

Insurance 1050

Printing machinery 728

Car 192

Telephone 540

Uniform 250

Dividends 5420* 7.5% 406.5

Total allowable expenses 5876.5

9

NP 65642.5

Less: personal allowance 2050

Trading loss 4000

Total allowances 6050

Taxable income 59592.5

Tax payable by Susan on her earnings:

Particulars Amount (£)

Income tax= 59592.5*40% 23837

Tax already paid 92

Tax liability 23745

Less: Pay as you earn 5040

Tax payable 18705

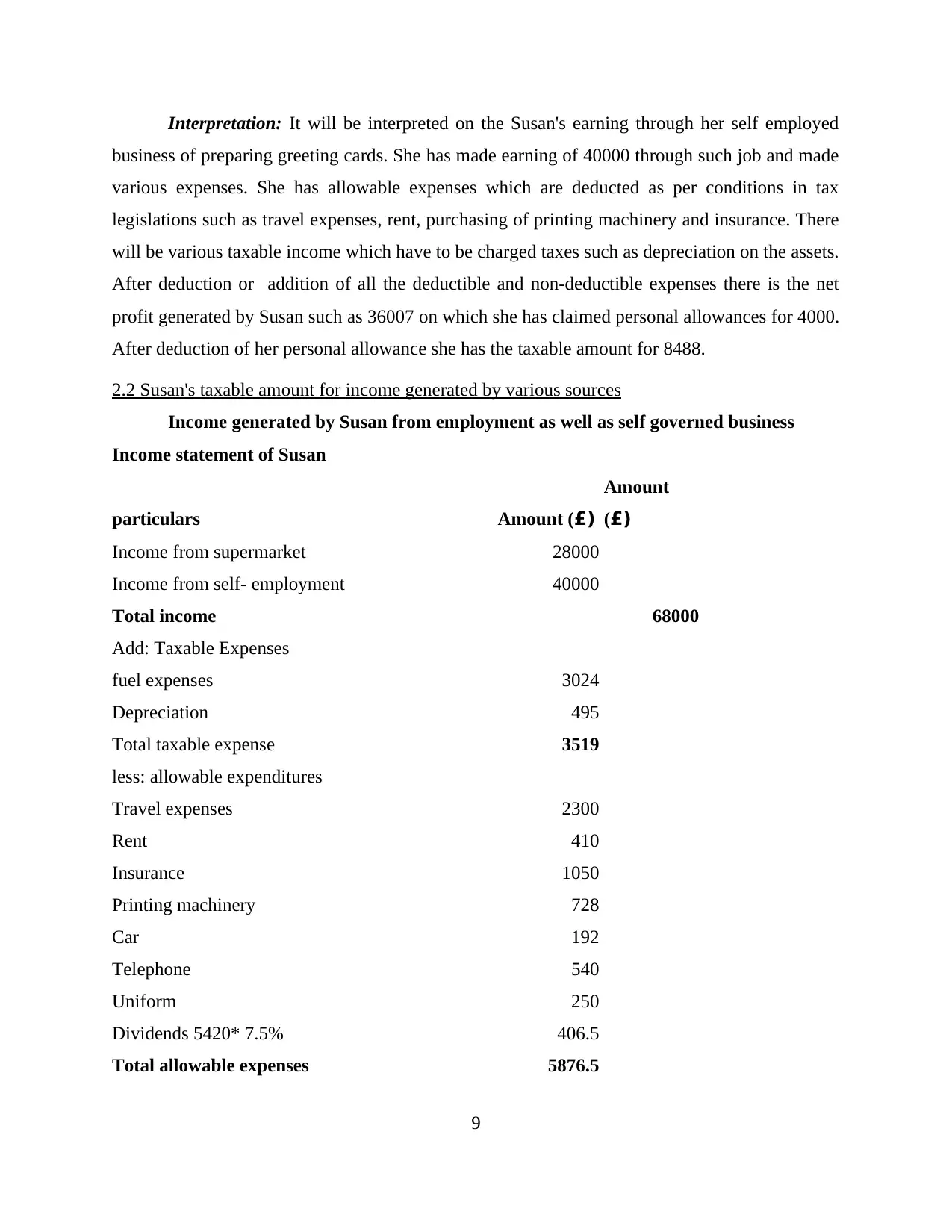

Interpretation: It is to be interpreted on the basis of total income generated by Susan on

her employment in supermarket as well as self governed employment the total earning would be

68000. Taxable expenses will be added such as fuel and depreciation expenses for 3519. She will

be awarded with the allowance over her expenses which are used for office purpose, were

amounted at 5876.5. After deduction of the personal allowances at supermarket employments as

well as her trading loss for 6050 she has the taxable income for 59592.5. She will be categorised

in the income tax slab as the higher rate tax payer for 40% over her generated taxable income

which is 23837 of amount. Taxes already paid by her fort 92 and the PAYE amount of 5040 will

be directly deducted from here bank account by taxation authority. Total taxes will be payable

for 18705.

2.3 Related documents for tax return of Susan

As per income generated by her and taxes levied her earning she is liable to make

payments of taxes. Before making any payments she must fill the related documents such as:

Employment: For the completion of here taxation over the income generated by Susan

through here employment in the supermarket. She has to mention all the relevant documents

related with her employment in such business (Harju and Matikka, 2016). There will be

10

Less: personal allowance 2050

Trading loss 4000

Total allowances 6050

Taxable income 59592.5

Tax payable by Susan on her earnings:

Particulars Amount (£)

Income tax= 59592.5*40% 23837

Tax already paid 92

Tax liability 23745

Less: Pay as you earn 5040

Tax payable 18705

Interpretation: It is to be interpreted on the basis of total income generated by Susan on

her employment in supermarket as well as self governed employment the total earning would be

68000. Taxable expenses will be added such as fuel and depreciation expenses for 3519. She will

be awarded with the allowance over her expenses which are used for office purpose, were

amounted at 5876.5. After deduction of the personal allowances at supermarket employments as

well as her trading loss for 6050 she has the taxable income for 59592.5. She will be categorised

in the income tax slab as the higher rate tax payer for 40% over her generated taxable income

which is 23837 of amount. Taxes already paid by her fort 92 and the PAYE amount of 5040 will

be directly deducted from here bank account by taxation authority. Total taxes will be payable

for 18705.

2.3 Related documents for tax return of Susan

As per income generated by her and taxes levied her earning she is liable to make

payments of taxes. Before making any payments she must fill the related documents such as:

Employment: For the completion of here taxation over the income generated by Susan

through here employment in the supermarket. She has to mention all the relevant documents

related with her employment in such business (Harju and Matikka, 2016). There will be

10

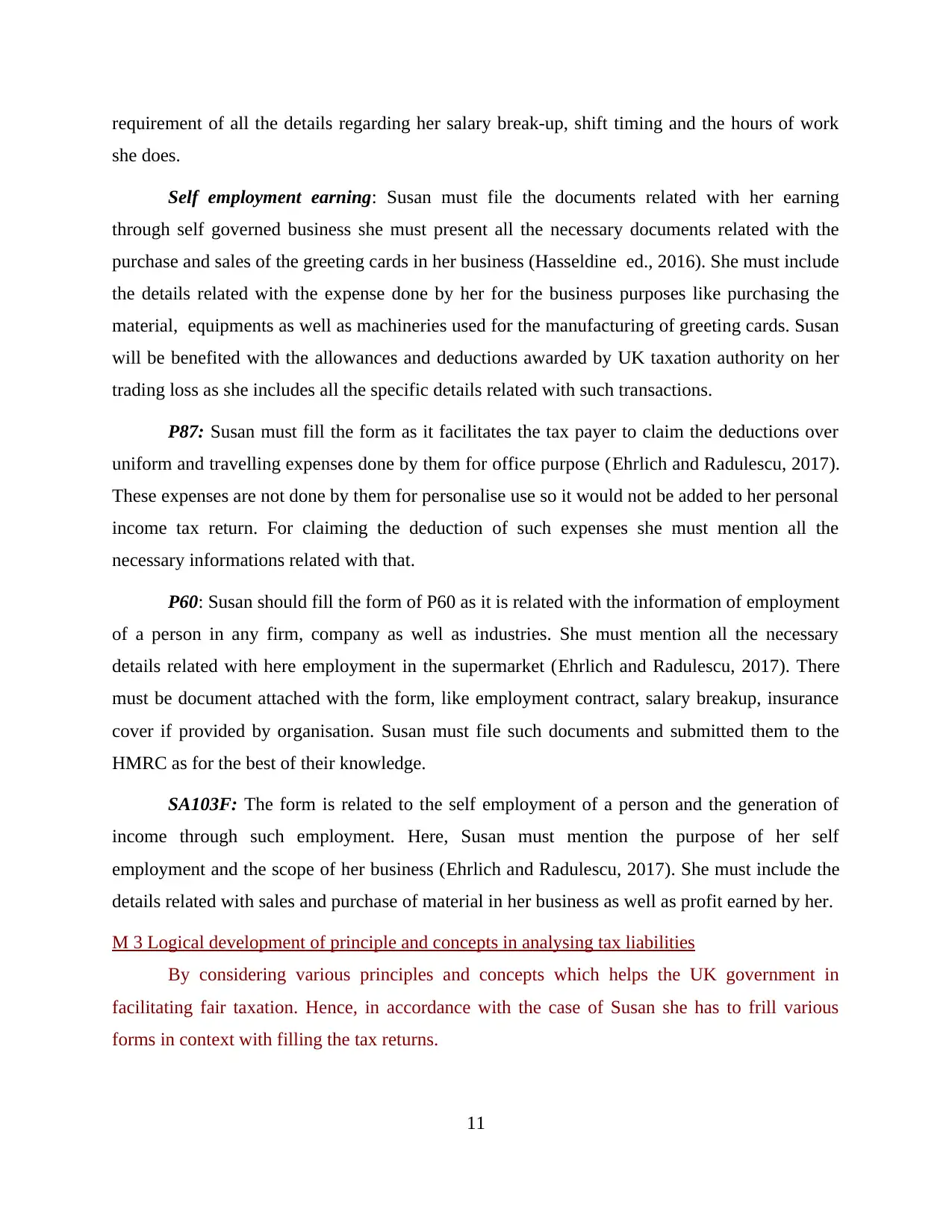

requirement of all the details regarding her salary break-up, shift timing and the hours of work

she does.

Self employment earning: Susan must file the documents related with her earning

through self governed business she must present all the necessary documents related with the

purchase and sales of the greeting cards in her business (Hasseldine ed., 2016). She must include

the details related with the expense done by her for the business purposes like purchasing the

material, equipments as well as machineries used for the manufacturing of greeting cards. Susan

will be benefited with the allowances and deductions awarded by UK taxation authority on her

trading loss as she includes all the specific details related with such transactions.

P87: Susan must fill the form as it facilitates the tax payer to claim the deductions over

uniform and travelling expenses done by them for office purpose (Ehrlich and Radulescu, 2017).

These expenses are not done by them for personalise use so it would not be added to her personal

income tax return. For claiming the deduction of such expenses she must mention all the

necessary informations related with that.

P60: Susan should fill the form of P60 as it is related with the information of employment

of a person in any firm, company as well as industries. She must mention all the necessary

details related with here employment in the supermarket (Ehrlich and Radulescu, 2017). There

must be document attached with the form, like employment contract, salary breakup, insurance

cover if provided by organisation. Susan must file such documents and submitted them to the

HMRC as for the best of their knowledge.

SA103F: The form is related to the self employment of a person and the generation of

income through such employment. Here, Susan must mention the purpose of her self

employment and the scope of her business (Ehrlich and Radulescu, 2017). She must include the

details related with sales and purchase of material in her business as well as profit earned by her.

M 3 Logical development of principle and concepts in analysing tax liabilities

By considering various principles and concepts which helps the UK government in

facilitating fair taxation. Hence, in accordance with the case of Susan she has to frill various

forms in context with filling the tax returns.

11

she does.

Self employment earning: Susan must file the documents related with her earning

through self governed business she must present all the necessary documents related with the

purchase and sales of the greeting cards in her business (Hasseldine ed., 2016). She must include

the details related with the expense done by her for the business purposes like purchasing the

material, equipments as well as machineries used for the manufacturing of greeting cards. Susan

will be benefited with the allowances and deductions awarded by UK taxation authority on her

trading loss as she includes all the specific details related with such transactions.

P87: Susan must fill the form as it facilitates the tax payer to claim the deductions over

uniform and travelling expenses done by them for office purpose (Ehrlich and Radulescu, 2017).

These expenses are not done by them for personalise use so it would not be added to her personal

income tax return. For claiming the deduction of such expenses she must mention all the

necessary informations related with that.

P60: Susan should fill the form of P60 as it is related with the information of employment

of a person in any firm, company as well as industries. She must mention all the necessary

details related with here employment in the supermarket (Ehrlich and Radulescu, 2017). There

must be document attached with the form, like employment contract, salary breakup, insurance

cover if provided by organisation. Susan must file such documents and submitted them to the

HMRC as for the best of their knowledge.

SA103F: The form is related to the self employment of a person and the generation of

income through such employment. Here, Susan must mention the purpose of her self

employment and the scope of her business (Ehrlich and Radulescu, 2017). She must include the

details related with sales and purchase of material in her business as well as profit earned by her.

M 3 Logical development of principle and concepts in analysing tax liabilities

By considering various principles and concepts which helps the UK government in

facilitating fair taxation. Hence, in accordance with the case of Susan she has to frill various

forms in context with filling the tax returns.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D 2 Managing activities for calculating tax liabilities

There is need to appoint the tax practitioner or agents to file the tax returns. Hnece, in

accordance with making tax payments the organisation and the individual person need to

gathered all the records of the monetary transactions such as income and expenses. Thus, such

sources will be deductible as according to several conditions or law implicated by legislative

authority of UK.

TASK 3

3.1 Calculations for chargeable income of Aldi stores

Chargeable income of Aldi company will be calculated on the basis of purchase and sales

made by the organisation in the assessment year.

Operating profit 100000

Add: Disallowed expenses

Depreciation of asset 10170

Amortization of lease hold property 3000

Total disallowed expenses 113170

Less:

Debenture interest payable 67200

allowable deduction for lease premium 2255

capital allowance 27520

16195

Profit of overseas branch 30000

Trading profit 46195

profit from property business 30000

Interest income 10000

Chargeable gain 50000

Taxable profit 136195

Interpretation: As per the above calculation it can be interpreted that Aldi stores has

made the revenue on the profit earned by them for 100000. All the taxable expense will be added

such as Depreciation over purchase and sales of assets, Amortization over property which brings

the total taxable expenses for 113170. There will be deduction of allowable expenses such as

Debentures, premium on lease hold property and the capital allowances for 27520. These brings

the total deduction for the expenses as 16195. After adding all the chargeable income an

expenditure of Aldi stores the amount of 136195 will be calculated as the tax payable amount.

WN: Lease premium deduction to Aldi stores

12

There is need to appoint the tax practitioner or agents to file the tax returns. Hnece, in

accordance with making tax payments the organisation and the individual person need to

gathered all the records of the monetary transactions such as income and expenses. Thus, such

sources will be deductible as according to several conditions or law implicated by legislative

authority of UK.

TASK 3

3.1 Calculations for chargeable income of Aldi stores

Chargeable income of Aldi company will be calculated on the basis of purchase and sales

made by the organisation in the assessment year.

Operating profit 100000

Add: Disallowed expenses

Depreciation of asset 10170

Amortization of lease hold property 3000

Total disallowed expenses 113170

Less:

Debenture interest payable 67200

allowable deduction for lease premium 2255

capital allowance 27520

16195

Profit of overseas branch 30000

Trading profit 46195

profit from property business 30000

Interest income 10000

Chargeable gain 50000

Taxable profit 136195

Interpretation: As per the above calculation it can be interpreted that Aldi stores has

made the revenue on the profit earned by them for 100000. All the taxable expense will be added

such as Depreciation over purchase and sales of assets, Amortization over property which brings

the total taxable expenses for 113170. There will be deduction of allowable expenses such as

Debentures, premium on lease hold property and the capital allowances for 27520. These brings

the total deduction for the expenses as 16195. After adding all the chargeable income an

expenditure of Aldi stores the amount of 136195 will be calculated as the tax payable amount.

WN: Lease premium deduction to Aldi stores

12

Premium received 110000

less deduction 110000*0.02*(10-1) 19800

Amount assessed on the landlord 90200

Allowances on income as per UK taxation.

WN: Allowable deduction for Aldi stores

Amount assessed on the landlord tire life span 90200

deduction for this year (90200/10)*3/12 2255

3.2 Measuring tax liabilities for the Aldi stores

Tax liabilities can be denoted as the amount which has to be paid by an individual as well

as any corporation unit. These are decided by the norms set by HMRC for the fair taxation in

UK. Thus, there will be calculations for the income generated by Aldi stores in the assessment

year the tax liabilities occurs on the same.

13

less deduction 110000*0.02*(10-1) 19800

Amount assessed on the landlord 90200

Allowances on income as per UK taxation.

WN: Allowable deduction for Aldi stores

Amount assessed on the landlord tire life span 90200

deduction for this year (90200/10)*3/12 2255

3.2 Measuring tax liabilities for the Aldi stores

Tax liabilities can be denoted as the amount which has to be paid by an individual as well

as any corporation unit. These are decided by the norms set by HMRC for the fair taxation in

UK. Thus, there will be calculations for the income generated by Aldi stores in the assessment

year the tax liabilities occurs on the same.

13

P e r c e n t a g e T a x a b l e p r o fi t v a l u e o f t a x

C o rp o ra t e t a x 2 4 . 0 0 % 1 3 6 1 9 5 3 2 6 8 6 . 8

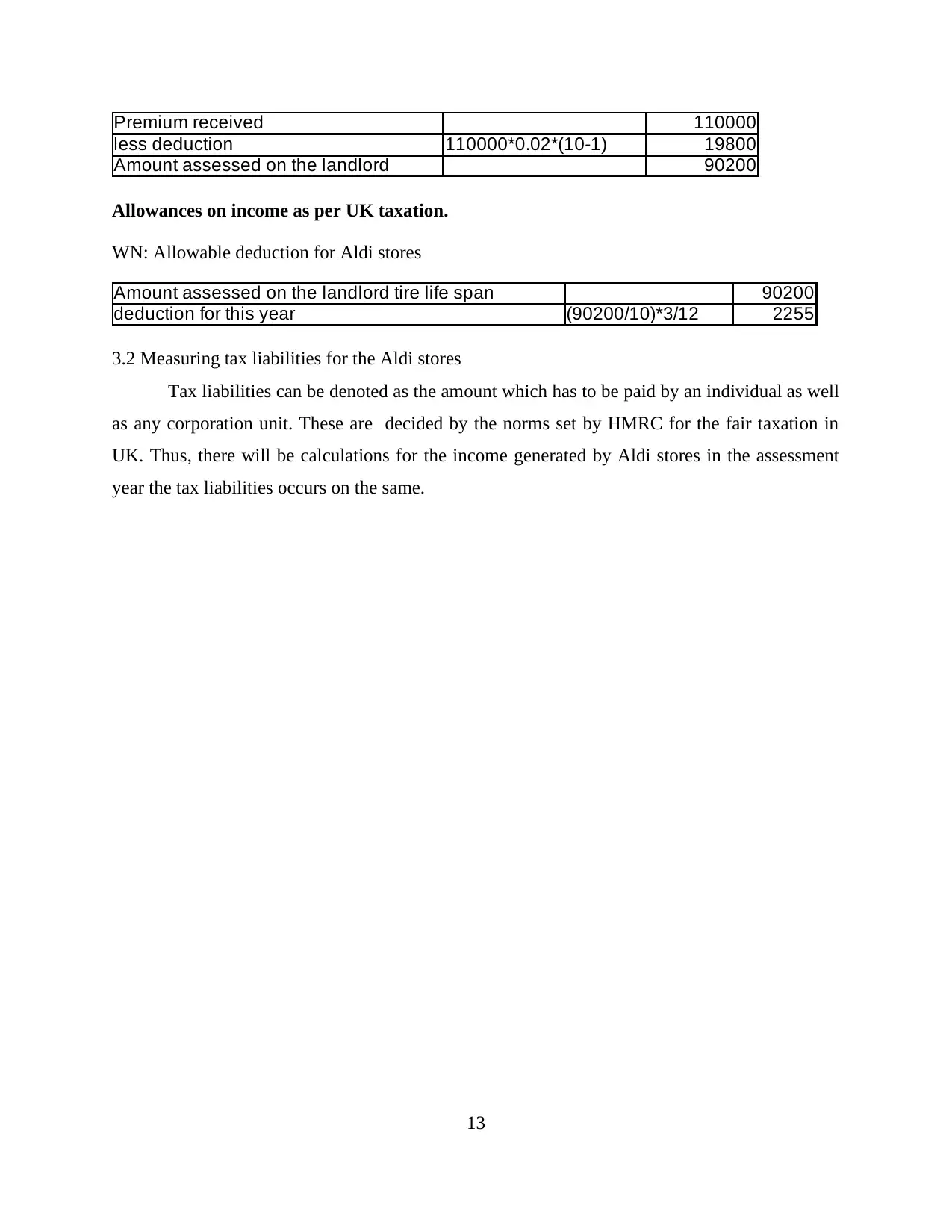

Interpretation: As per the above calculations it will be interpreted that Aldi has earned

100000 of the profit from the assessment year. After addition all the taxable expenses made by

the organisation for 113170 the allowance were deducted. There has been profit earned by the

organisation on trading for 46195 as well as relevant gains were added to the taxable income

generated by the company. After making favourable calculations for the income and expenditure

14

C o rp o ra t e t a x 2 4 . 0 0 % 1 3 6 1 9 5 3 2 6 8 6 . 8

Interpretation: As per the above calculations it will be interpreted that Aldi has earned

100000 of the profit from the assessment year. After addition all the taxable expenses made by

the organisation for 113170 the allowance were deducted. There has been profit earned by the

organisation on trading for 46195 as well as relevant gains were added to the taxable income

generated by the company. After making favourable calculations for the income and expenditure

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the net taxable income will be gathered by firm for 25706.3 which will be taxed. There must be

payments for the corporate tax over the profit of 136195 at the rate of 24% as it is set by the

taxation authority I UK. The taxes will be paid by Aldi for 32686.8.

3.3 Explaining the income tax deductions

Exemption will be awarded to a person or a corporation unit as per their earning capacity.

There will be exemptions for the person who has earning for less than 25 thousand year related

with gifts, grants, insurance cover etc. these are to be claimed or deducted. HMRC has facilitated

various deductions over the income and expenses done by the individual not for personal use

such as travelling expenses, purchase of uniform as well as rent of the property which is used for

office purpose (Kemmerling, 2016). These helps them in making the favourable amount of profit

over the revenue generated and the lower taxation rates. HMRC has facilitated the citizens of UK

with the PAYE scheme as they will be generate taxes by directly deducting tpo the account

holder;s account. It helps government in generating the income as per regular earning made by

account holder. The taxes will be gathered and it creates the revenue for government which will

be utilised for the welfare of the citizens in the field of education, medical, agriculture,

technology as well as research and development.

4.1 Identification of chargeable income

All the assets will be chargeable as per rules and regulations set by HMRC in UK

taxation. Taxes levied on the assets whether it is situated in UK or out of country such as shares,

bonds, debenture, land and building as well as stock (Kemmerling, 2016). These assets will be

taxable and there will be no exception allowed over them. There will be charges levied on the

income or gains generated by an individual on the purchase and sales of such assets. The person

will be awarded with the deductions over vehicle used for the office purpose or he has acquired

the insurance policies and government bonds or shares.

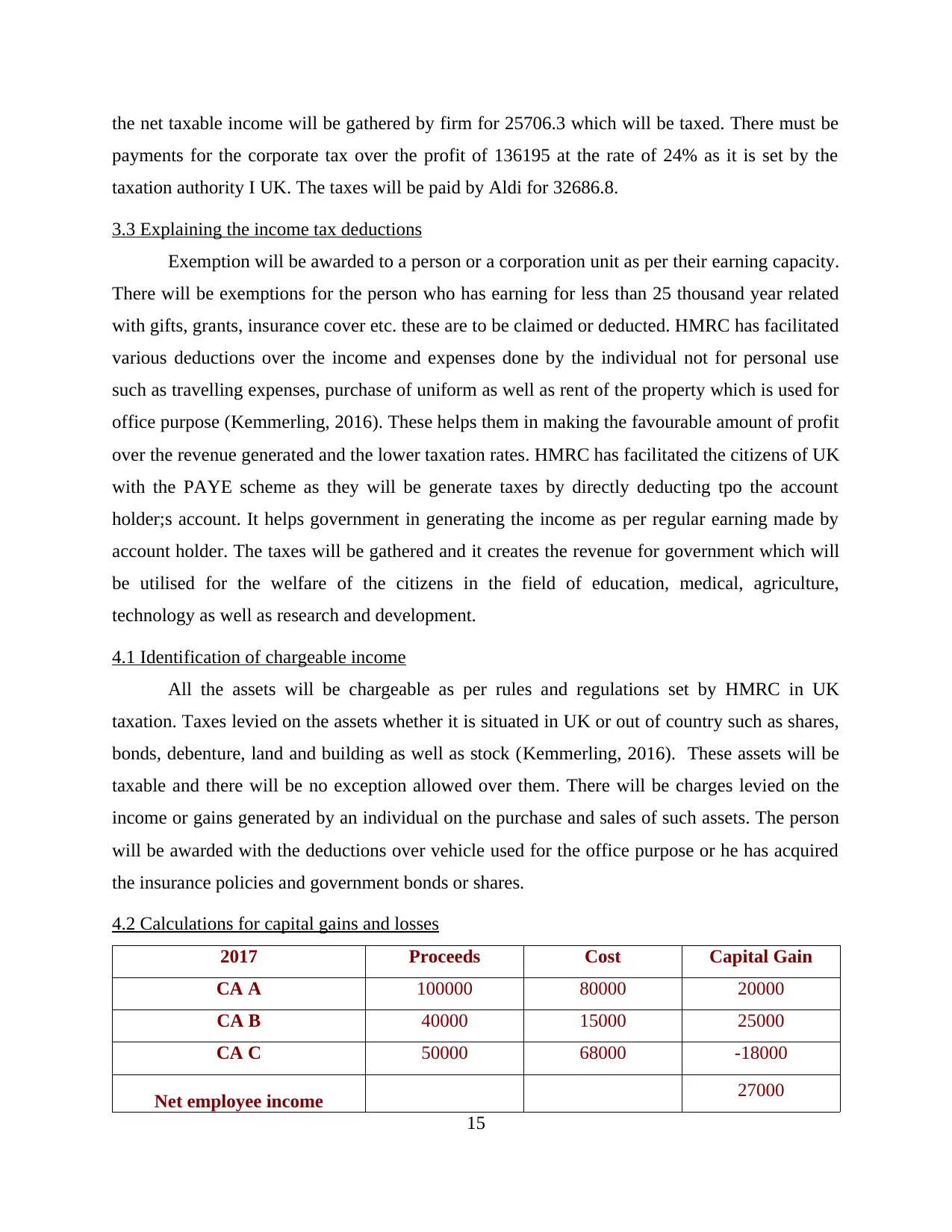

4.2 Calculations for capital gains and losses

2017 Proceeds Cost Capital Gain

CA A 100000 80000 20000

CA B 40000 15000 25000

CA C 50000 68000 -18000

Net employee income 27000

15

payments for the corporate tax over the profit of 136195 at the rate of 24% as it is set by the

taxation authority I UK. The taxes will be paid by Aldi for 32686.8.

3.3 Explaining the income tax deductions

Exemption will be awarded to a person or a corporation unit as per their earning capacity.

There will be exemptions for the person who has earning for less than 25 thousand year related

with gifts, grants, insurance cover etc. these are to be claimed or deducted. HMRC has facilitated

various deductions over the income and expenses done by the individual not for personal use

such as travelling expenses, purchase of uniform as well as rent of the property which is used for

office purpose (Kemmerling, 2016). These helps them in making the favourable amount of profit

over the revenue generated and the lower taxation rates. HMRC has facilitated the citizens of UK

with the PAYE scheme as they will be generate taxes by directly deducting tpo the account

holder;s account. It helps government in generating the income as per regular earning made by

account holder. The taxes will be gathered and it creates the revenue for government which will

be utilised for the welfare of the citizens in the field of education, medical, agriculture,

technology as well as research and development.

4.1 Identification of chargeable income

All the assets will be chargeable as per rules and regulations set by HMRC in UK

taxation. Taxes levied on the assets whether it is situated in UK or out of country such as shares,

bonds, debenture, land and building as well as stock (Kemmerling, 2016). These assets will be

taxable and there will be no exception allowed over them. There will be charges levied on the

income or gains generated by an individual on the purchase and sales of such assets. The person

will be awarded with the deductions over vehicle used for the office purpose or he has acquired

the insurance policies and government bonds or shares.

4.2 Calculations for capital gains and losses

2017 Proceeds Cost Capital Gain

CA A 100000 80000 20000

CA B 40000 15000 25000

CA C 50000 68000 -18000

Net employee income 27000

15

UK allowable taxation

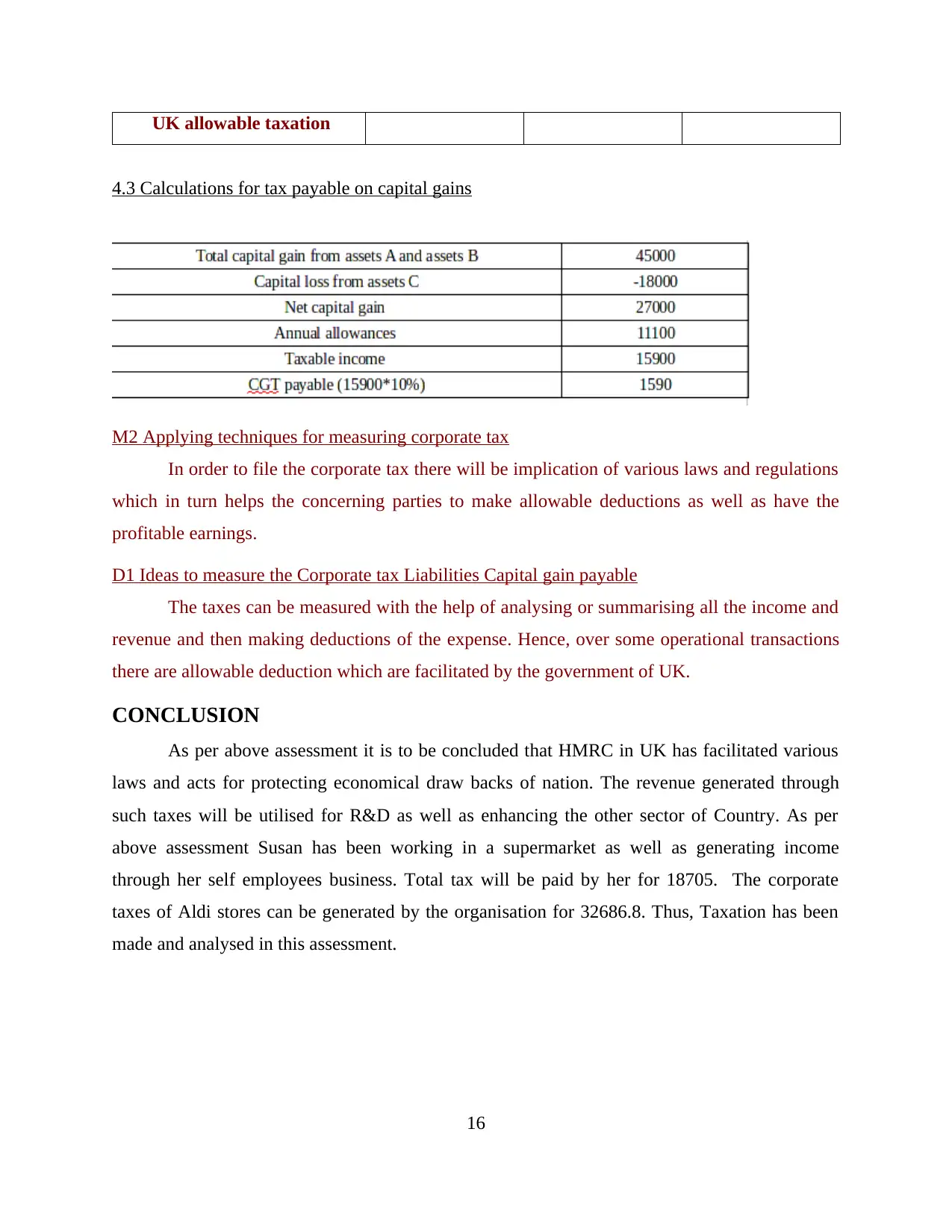

4.3 Calculations for tax payable on capital gains

M2 Applying techniques for measuring corporate tax

In order to file the corporate tax there will be implication of various laws and regulations

which in turn helps the concerning parties to make allowable deductions as well as have the

profitable earnings.

D1 Ideas to measure the Corporate tax Liabilities Capital gain payable

The taxes can be measured with the help of analysing or summarising all the income and

revenue and then making deductions of the expense. Hence, over some operational transactions

there are allowable deduction which are facilitated by the government of UK.

CONCLUSION

As per above assessment it is to be concluded that HMRC in UK has facilitated various

laws and acts for protecting economical draw backs of nation. The revenue generated through

such taxes will be utilised for R&D as well as enhancing the other sector of Country. As per

above assessment Susan has been working in a supermarket as well as generating income

through her self employees business. Total tax will be paid by her for 18705. The corporate

taxes of Aldi stores can be generated by the organisation for 32686.8. Thus, Taxation has been

made and analysed in this assessment.

16

4.3 Calculations for tax payable on capital gains

M2 Applying techniques for measuring corporate tax

In order to file the corporate tax there will be implication of various laws and regulations

which in turn helps the concerning parties to make allowable deductions as well as have the

profitable earnings.

D1 Ideas to measure the Corporate tax Liabilities Capital gain payable

The taxes can be measured with the help of analysing or summarising all the income and

revenue and then making deductions of the expense. Hence, over some operational transactions

there are allowable deduction which are facilitated by the government of UK.

CONCLUSION

As per above assessment it is to be concluded that HMRC in UK has facilitated various

laws and acts for protecting economical draw backs of nation. The revenue generated through

such taxes will be utilised for R&D as well as enhancing the other sector of Country. As per

above assessment Susan has been working in a supermarket as well as generating income

through her self employees business. Total tax will be paid by her for 18705. The corporate

taxes of Aldi stores can be generated by the organisation for 32686.8. Thus, Taxation has been

made and analysed in this assessment.

16

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.