Questions-Answers on Taxation

VerifiedAdded on 2022/08/29

|16

|2179

|37

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: TAXATION

Tax

Name:

Institution:

Date:

Tax

Name:

Institution:

Date:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TAXATION

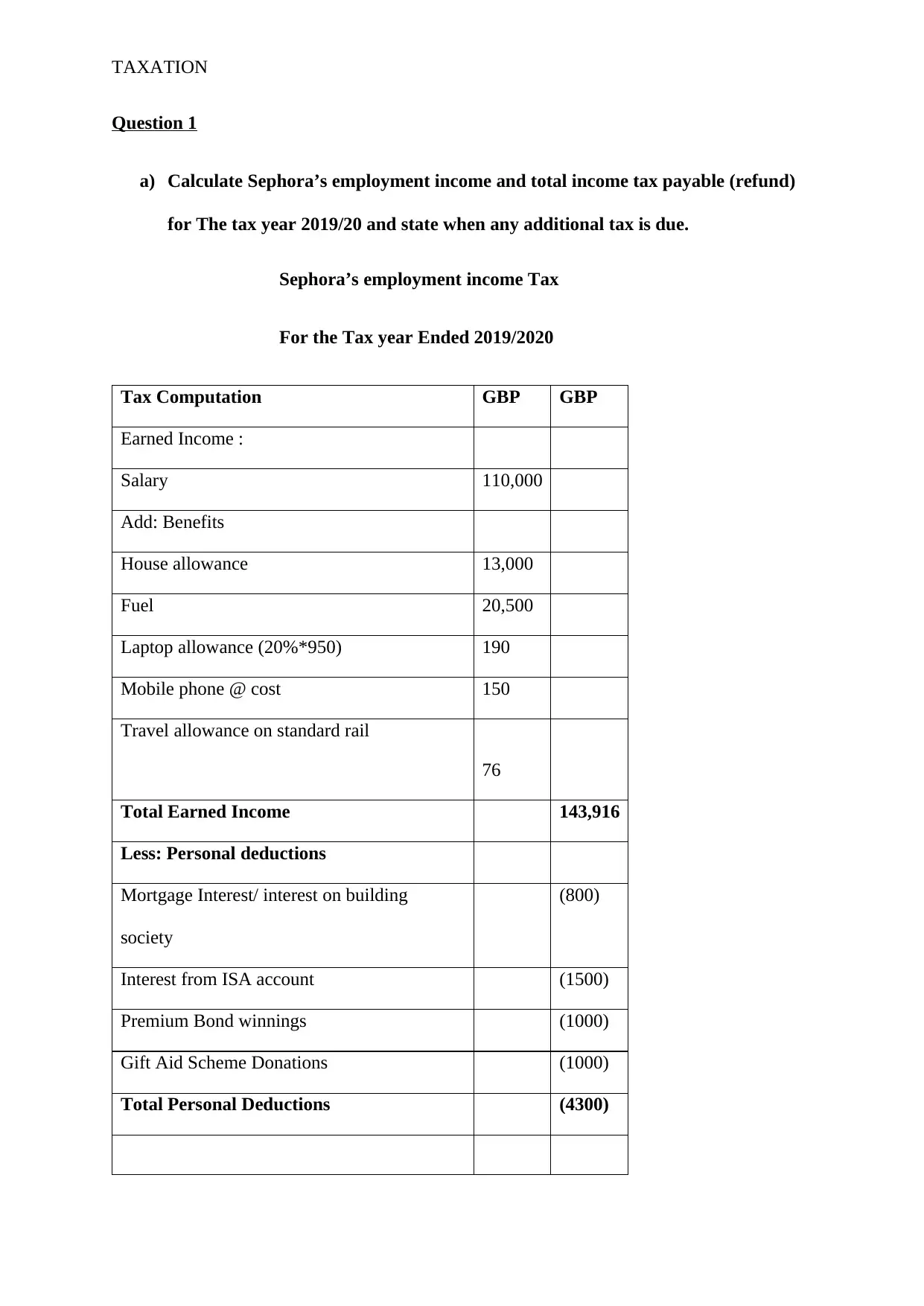

Question 1

a) Calculate Sephora’s employment income and total income tax payable (refund)

for The tax year 2019/20 and state when any additional tax is due.

Sephora’s employment income Tax

For the Tax year Ended 2019/2020

Tax Computation GBP GBP

Earned Income :

Salary 110,000

Add: Benefits

House allowance 13,000

Fuel 20,500

Laptop allowance (20%*950) 190

Mobile phone @ cost 150

Travel allowance on standard rail

76

Total Earned Income 143,916

Less: Personal deductions

Mortgage Interest/ interest on building

society

(800)

Interest from ISA account (1500)

Premium Bond winnings (1000)

Gift Aid Scheme Donations (1000)

Total Personal Deductions (4300)

Question 1

a) Calculate Sephora’s employment income and total income tax payable (refund)

for The tax year 2019/20 and state when any additional tax is due.

Sephora’s employment income Tax

For the Tax year Ended 2019/2020

Tax Computation GBP GBP

Earned Income :

Salary 110,000

Add: Benefits

House allowance 13,000

Fuel 20,500

Laptop allowance (20%*950) 190

Mobile phone @ cost 150

Travel allowance on standard rail

76

Total Earned Income 143,916

Less: Personal deductions

Mortgage Interest/ interest on building

society

(800)

Interest from ISA account (1500)

Premium Bond winnings (1000)

Gift Aid Scheme Donations (1000)

Total Personal Deductions (4300)

TAXATION

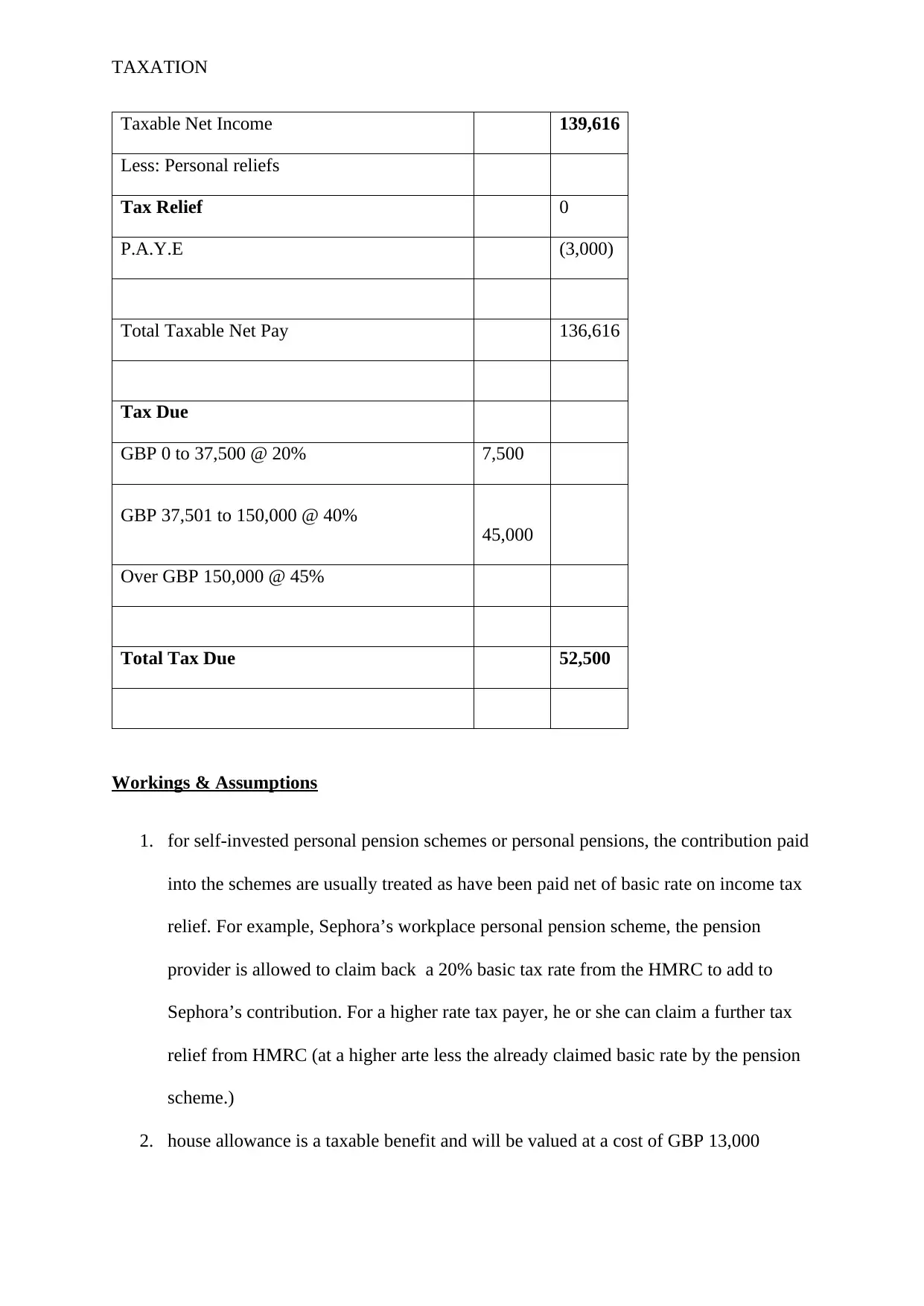

Taxable Net Income 139,616

Less: Personal reliefs

Tax Relief 0

P.A.Y.E (3,000)

Total Taxable Net Pay 136,616

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

Total Tax Due 52,500

Workings & Assumptions

1. for self-invested personal pension schemes or personal pensions, the contribution paid

into the schemes are usually treated as have been paid net of basic rate on income tax

relief. For example, Sephora’s workplace personal pension scheme, the pension

provider is allowed to claim back a 20% basic tax rate from the HMRC to add to

Sephora’s contribution. For a higher rate tax payer, he or she can claim a further tax

relief from HMRC (at a higher arte less the already claimed basic rate by the pension

scheme.)

2. house allowance is a taxable benefit and will be valued at a cost of GBP 13,000

Taxable Net Income 139,616

Less: Personal reliefs

Tax Relief 0

P.A.Y.E (3,000)

Total Taxable Net Pay 136,616

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

Total Tax Due 52,500

Workings & Assumptions

1. for self-invested personal pension schemes or personal pensions, the contribution paid

into the schemes are usually treated as have been paid net of basic rate on income tax

relief. For example, Sephora’s workplace personal pension scheme, the pension

provider is allowed to claim back a 20% basic tax rate from the HMRC to add to

Sephora’s contribution. For a higher rate tax payer, he or she can claim a further tax

relief from HMRC (at a higher arte less the already claimed basic rate by the pension

scheme.)

2. house allowance is a taxable benefit and will be valued at a cost of GBP 13,000

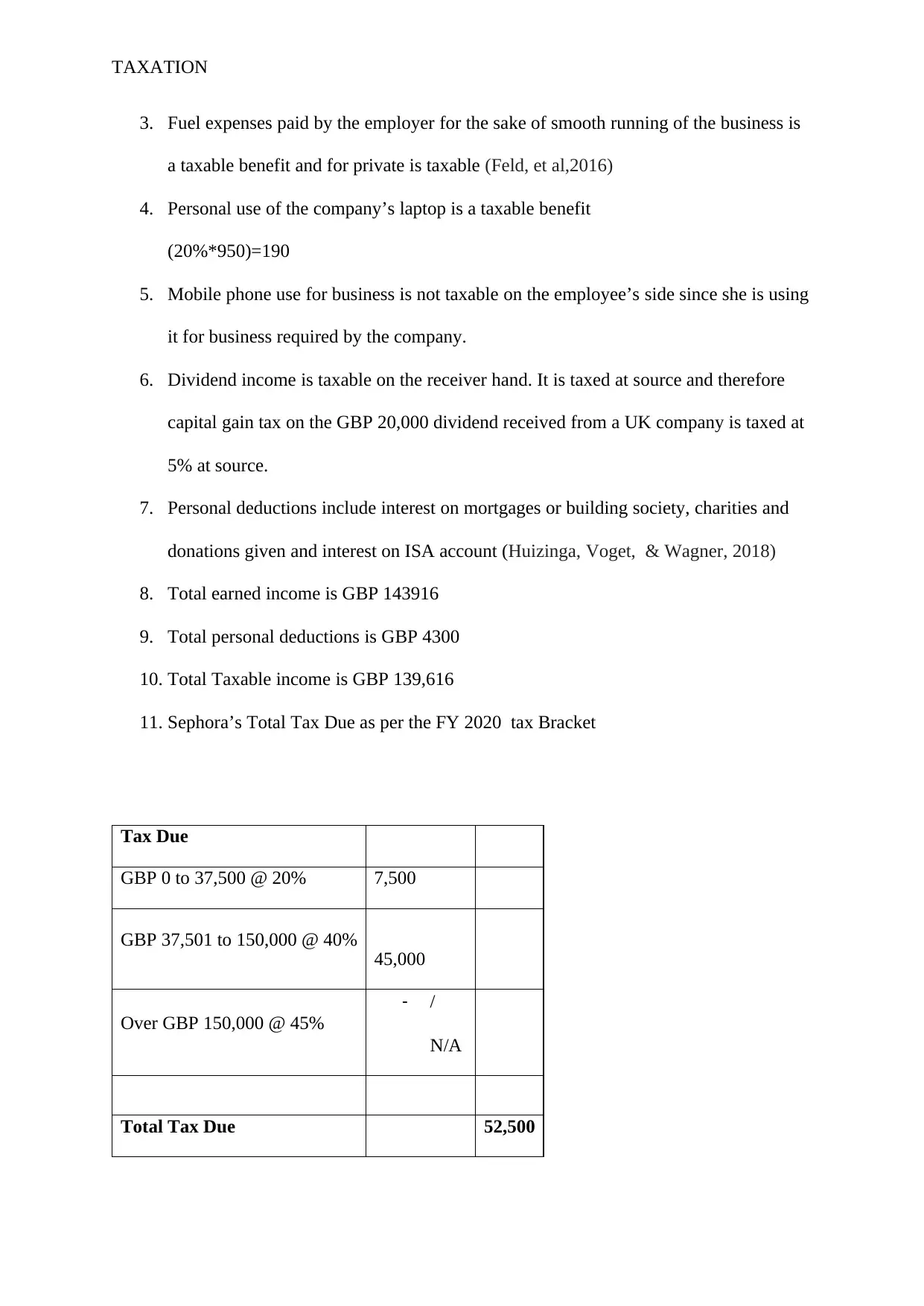

TAXATION

3. Fuel expenses paid by the employer for the sake of smooth running of the business is

a taxable benefit and for private is taxable (Feld, et al,2016)

4. Personal use of the company’s laptop is a taxable benefit

(20%*950)=190

5. Mobile phone use for business is not taxable on the employee’s side since she is using

it for business required by the company.

6. Dividend income is taxable on the receiver hand. It is taxed at source and therefore

capital gain tax on the GBP 20,000 dividend received from a UK company is taxed at

5% at source.

7. Personal deductions include interest on mortgages or building society, charities and

donations given and interest on ISA account (Huizinga, Voget, & Wagner, 2018)

8. Total earned income is GBP 143916

9. Total personal deductions is GBP 4300

10. Total Taxable income is GBP 139,616

11. Sephora’s Total Tax Due as per the FY 2020 tax Bracket

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

- /

N/A

Total Tax Due 52,500

3. Fuel expenses paid by the employer for the sake of smooth running of the business is

a taxable benefit and for private is taxable (Feld, et al,2016)

4. Personal use of the company’s laptop is a taxable benefit

(20%*950)=190

5. Mobile phone use for business is not taxable on the employee’s side since she is using

it for business required by the company.

6. Dividend income is taxable on the receiver hand. It is taxed at source and therefore

capital gain tax on the GBP 20,000 dividend received from a UK company is taxed at

5% at source.

7. Personal deductions include interest on mortgages or building society, charities and

donations given and interest on ISA account (Huizinga, Voget, & Wagner, 2018)

8. Total earned income is GBP 143916

9. Total personal deductions is GBP 4300

10. Total Taxable income is GBP 139,616

11. Sephora’s Total Tax Due as per the FY 2020 tax Bracket

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

- /

N/A

Total Tax Due 52,500

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TAXATION

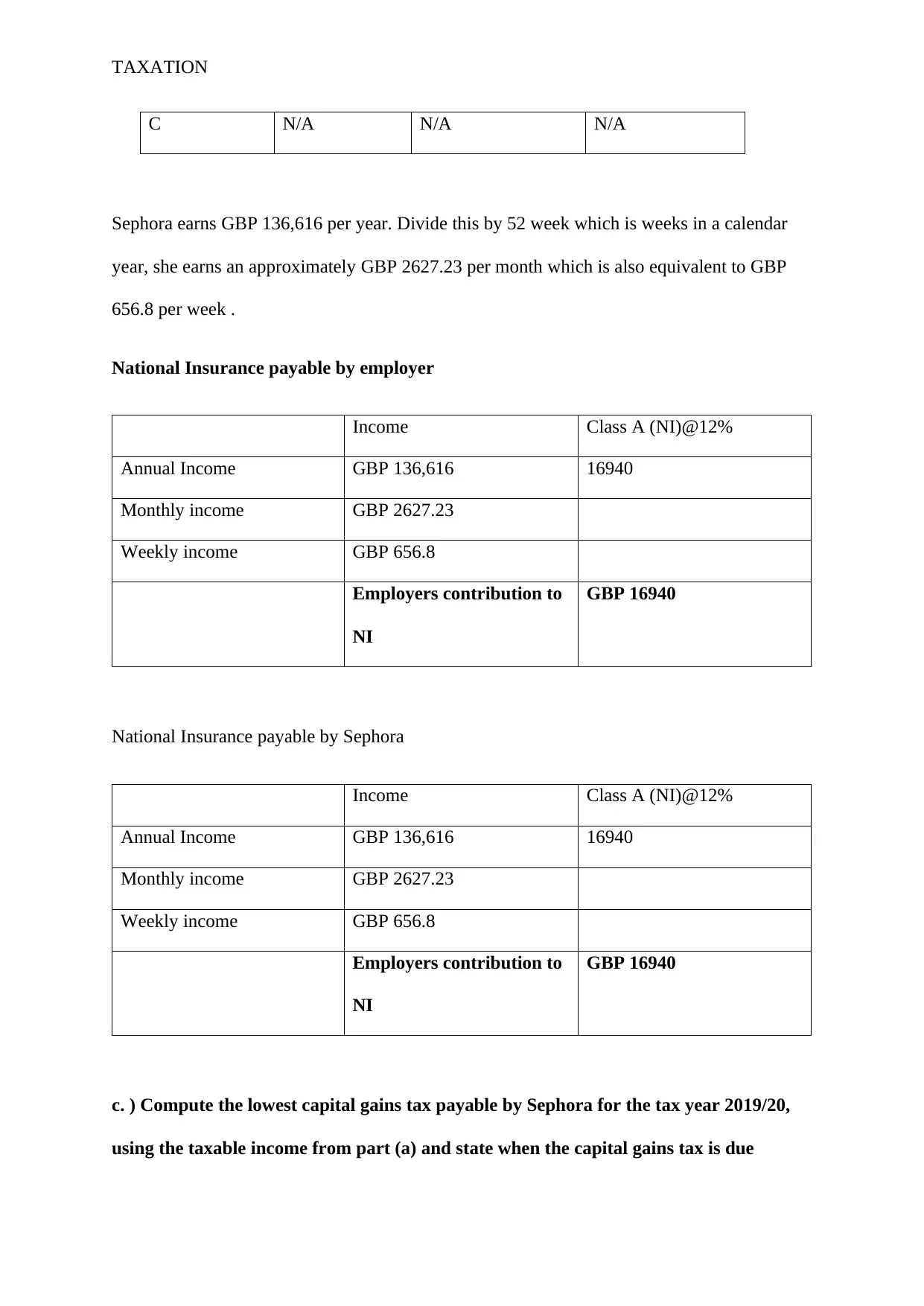

b) Calculate the national insurance payable by Sephora and her employer.

National insurance is the total tax on earnings from employment and also self-

employment earnings. National insurance paid by both the employer and Sephora is paid into

a pool of collection or a fund from which some schemes benefit, for example the pension

fund, the statutory maternity leave or sick leave pay, or any other unemployment benefit

accrued or that is important.

In the UK, National insurance (NI) contributions is payable if one earns more than GBP 166

per week. One is obliged to pay 12% of their earning if they earning is more than the limit

stipulated and up to a maximum of GBP 962 per week. Beyond this limit, the rate drops to

2% for the FY 2019/2020 if the earnings exceed GBP 962 per week (Lei,, & Xu, 2019).

Contribution Rates

For an employee (Sephora) Class 1 contributions on National Insurance is made up of

1. Deductions from their pay( employee National Insurance )

2. Deductions paid by the employer ( employers national insurance)

Contributions depend on

1. Category letter by National Insurance to the employee

2. How much earnings of the employees fall in each category

Category Letter 0-166 per week 166.01-962 per week Over 962 per week

A 0% 12% 2%

B 0% 5.85% 2%

b) Calculate the national insurance payable by Sephora and her employer.

National insurance is the total tax on earnings from employment and also self-

employment earnings. National insurance paid by both the employer and Sephora is paid into

a pool of collection or a fund from which some schemes benefit, for example the pension

fund, the statutory maternity leave or sick leave pay, or any other unemployment benefit

accrued or that is important.

In the UK, National insurance (NI) contributions is payable if one earns more than GBP 166

per week. One is obliged to pay 12% of their earning if they earning is more than the limit

stipulated and up to a maximum of GBP 962 per week. Beyond this limit, the rate drops to

2% for the FY 2019/2020 if the earnings exceed GBP 962 per week (Lei,, & Xu, 2019).

Contribution Rates

For an employee (Sephora) Class 1 contributions on National Insurance is made up of

1. Deductions from their pay( employee National Insurance )

2. Deductions paid by the employer ( employers national insurance)

Contributions depend on

1. Category letter by National Insurance to the employee

2. How much earnings of the employees fall in each category

Category Letter 0-166 per week 166.01-962 per week Over 962 per week

A 0% 12% 2%

B 0% 5.85% 2%

TAXATION

C N/A N/A N/A

Sephora earns GBP 136,616 per year. Divide this by 52 week which is weeks in a calendar

year, she earns an approximately GBP 2627.23 per month which is also equivalent to GBP

656.8 per week .

National Insurance payable by employer

Income Class A (NI)@12%

Annual Income GBP 136,616 16940

Monthly income GBP 2627.23

Weekly income GBP 656.8

Employers contribution to

NI

GBP 16940

National Insurance payable by Sephora

Income Class A (NI)@12%

Annual Income GBP 136,616 16940

Monthly income GBP 2627.23

Weekly income GBP 656.8

Employers contribution to

NI

GBP 16940

c. ) Compute the lowest capital gains tax payable by Sephora for the tax year 2019/20,

using the taxable income from part (a) and state when the capital gains tax is due

C N/A N/A N/A

Sephora earns GBP 136,616 per year. Divide this by 52 week which is weeks in a calendar

year, she earns an approximately GBP 2627.23 per month which is also equivalent to GBP

656.8 per week .

National Insurance payable by employer

Income Class A (NI)@12%

Annual Income GBP 136,616 16940

Monthly income GBP 2627.23

Weekly income GBP 656.8

Employers contribution to

NI

GBP 16940

National Insurance payable by Sephora

Income Class A (NI)@12%

Annual Income GBP 136,616 16940

Monthly income GBP 2627.23

Weekly income GBP 656.8

Employers contribution to

NI

GBP 16940

c. ) Compute the lowest capital gains tax payable by Sephora for the tax year 2019/20,

using the taxable income from part (a) and state when the capital gains tax is due

TAXATION

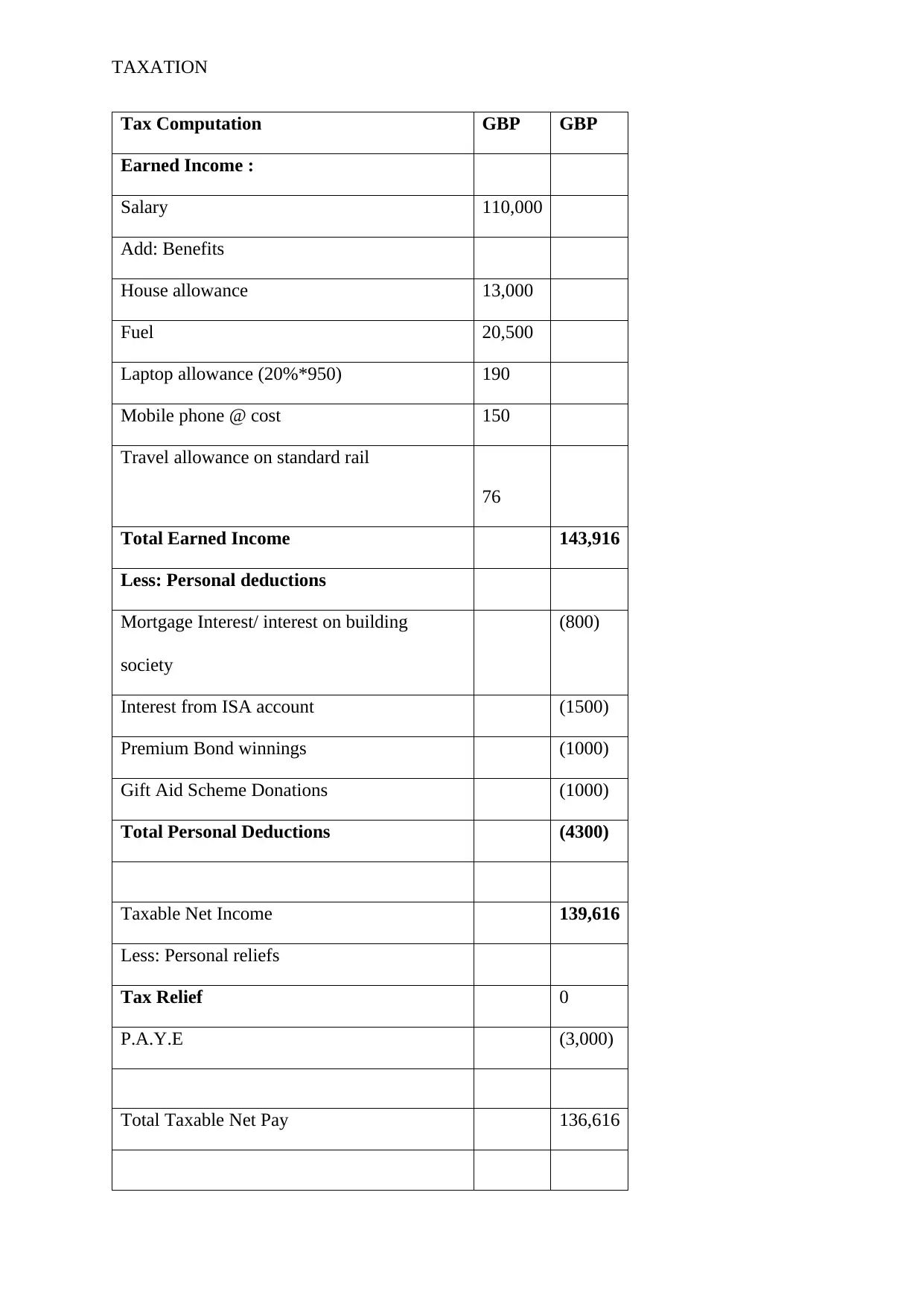

Tax Computation GBP GBP

Earned Income :

Salary 110,000

Add: Benefits

House allowance 13,000

Fuel 20,500

Laptop allowance (20%*950) 190

Mobile phone @ cost 150

Travel allowance on standard rail

76

Total Earned Income 143,916

Less: Personal deductions

Mortgage Interest/ interest on building

society

(800)

Interest from ISA account (1500)

Premium Bond winnings (1000)

Gift Aid Scheme Donations (1000)

Total Personal Deductions (4300)

Taxable Net Income 139,616

Less: Personal reliefs

Tax Relief 0

P.A.Y.E (3,000)

Total Taxable Net Pay 136,616

Tax Computation GBP GBP

Earned Income :

Salary 110,000

Add: Benefits

House allowance 13,000

Fuel 20,500

Laptop allowance (20%*950) 190

Mobile phone @ cost 150

Travel allowance on standard rail

76

Total Earned Income 143,916

Less: Personal deductions

Mortgage Interest/ interest on building

society

(800)

Interest from ISA account (1500)

Premium Bond winnings (1000)

Gift Aid Scheme Donations (1000)

Total Personal Deductions (4300)

Taxable Net Income 139,616

Less: Personal reliefs

Tax Relief 0

P.A.Y.E (3,000)

Total Taxable Net Pay 136,616

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAXATION

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

Total Tax Due 52,500

For capital gain tax

Sephora matters on capital gain tax

Sale of share –Tawny Owl Plc on 31 January 2020

Transaction

Date

Number of shares Cost of share purchase

1/1/2009 1500 £6,300

19/6/2010 1050 £4,425

31/12/2016 1802 £8,430

11/9/2019 400 £2,100

(i) On 31 January 2020, she sold some of her shares in Tawny Owl plc, a listed

company. The shares had been acquired as follows:

Date of transaction Number of shares Purchase cost of shares

Tax Due

GBP 0 to 37,500 @ 20% 7,500

GBP 37,501 to 150,000 @ 40%

45,000

Over GBP 150,000 @ 45%

Total Tax Due 52,500

For capital gain tax

Sephora matters on capital gain tax

Sale of share –Tawny Owl Plc on 31 January 2020

Transaction

Date

Number of shares Cost of share purchase

1/1/2009 1500 £6,300

19/6/2010 1050 £4,425

31/12/2016 1802 £8,430

11/9/2019 400 £2,100

(i) On 31 January 2020, she sold some of her shares in Tawny Owl plc, a listed

company. The shares had been acquired as follows:

Date of transaction Number of shares Purchase cost of shares

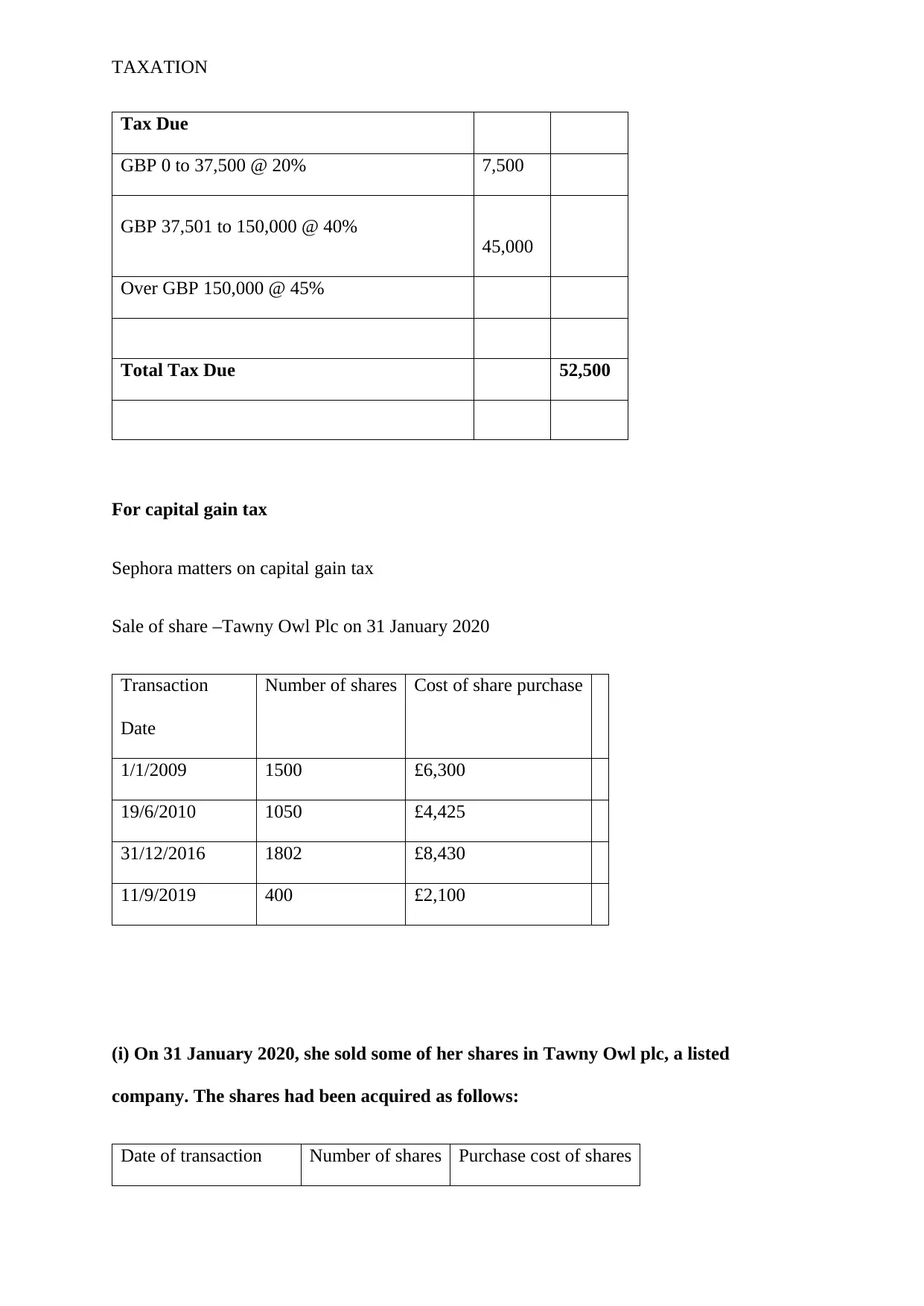

TAXATION

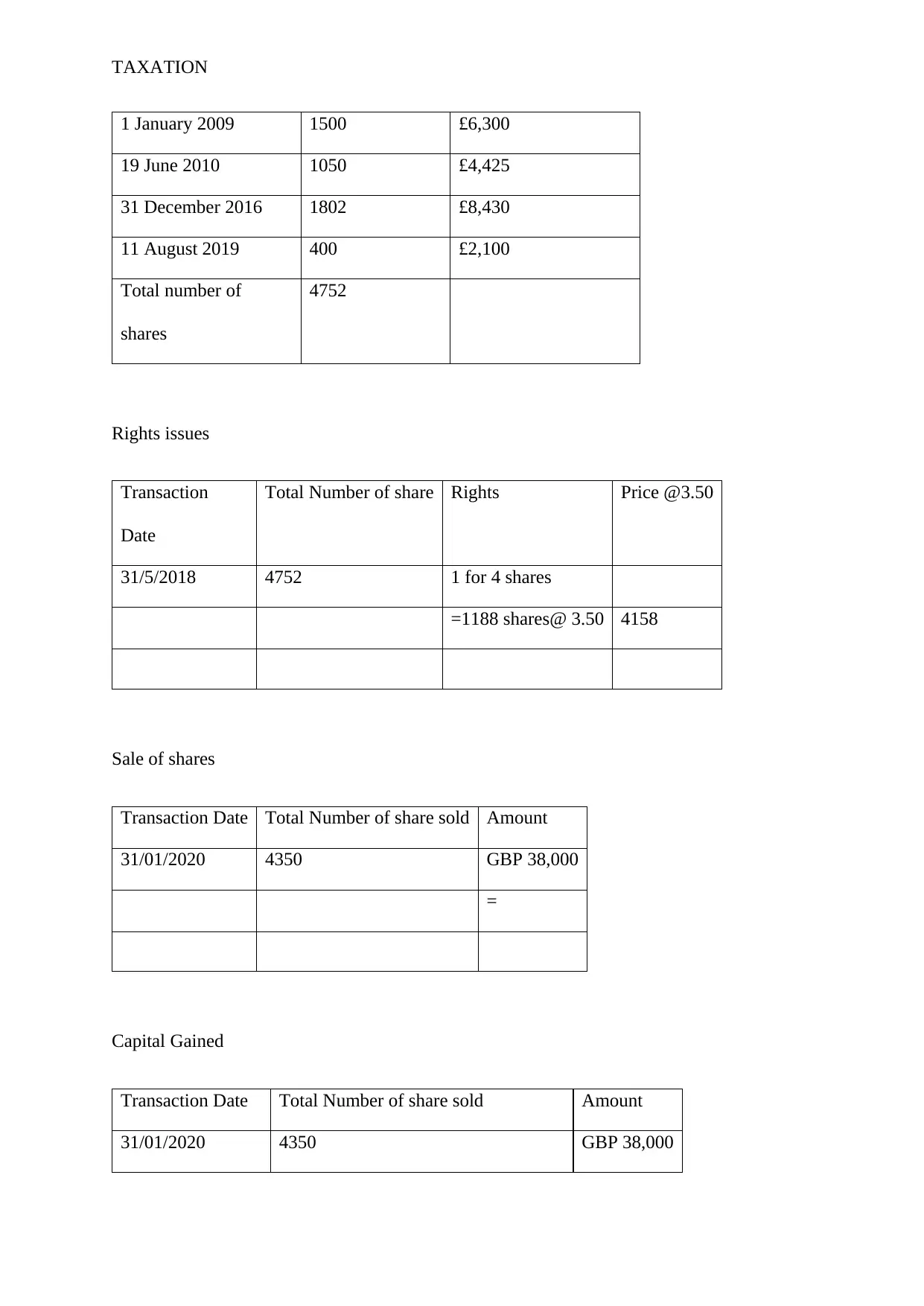

1 January 2009 1500 £6,300

19 June 2010 1050 £4,425

31 December 2016 1802 £8,430

11 August 2019 400 £2,100

Total number of

shares

4752

Rights issues

Transaction

Date

Total Number of share Rights Price @3.50

31/5/2018 4752 1 for 4 shares

=1188 shares@ 3.50 4158

Sale of shares

Transaction Date Total Number of share sold Amount

31/01/2020 4350 GBP 38,000

=

Capital Gained

Transaction Date Total Number of share sold Amount

31/01/2020 4350 GBP 38,000

1 January 2009 1500 £6,300

19 June 2010 1050 £4,425

31 December 2016 1802 £8,430

11 August 2019 400 £2,100

Total number of

shares

4752

Rights issues

Transaction

Date

Total Number of share Rights Price @3.50

31/5/2018 4752 1 for 4 shares

=1188 shares@ 3.50 4158

Sale of shares

Transaction Date Total Number of share sold Amount

31/01/2020 4350 GBP 38,000

=

Capital Gained

Transaction Date Total Number of share sold Amount

31/01/2020 4350 GBP 38,000

TAXATION

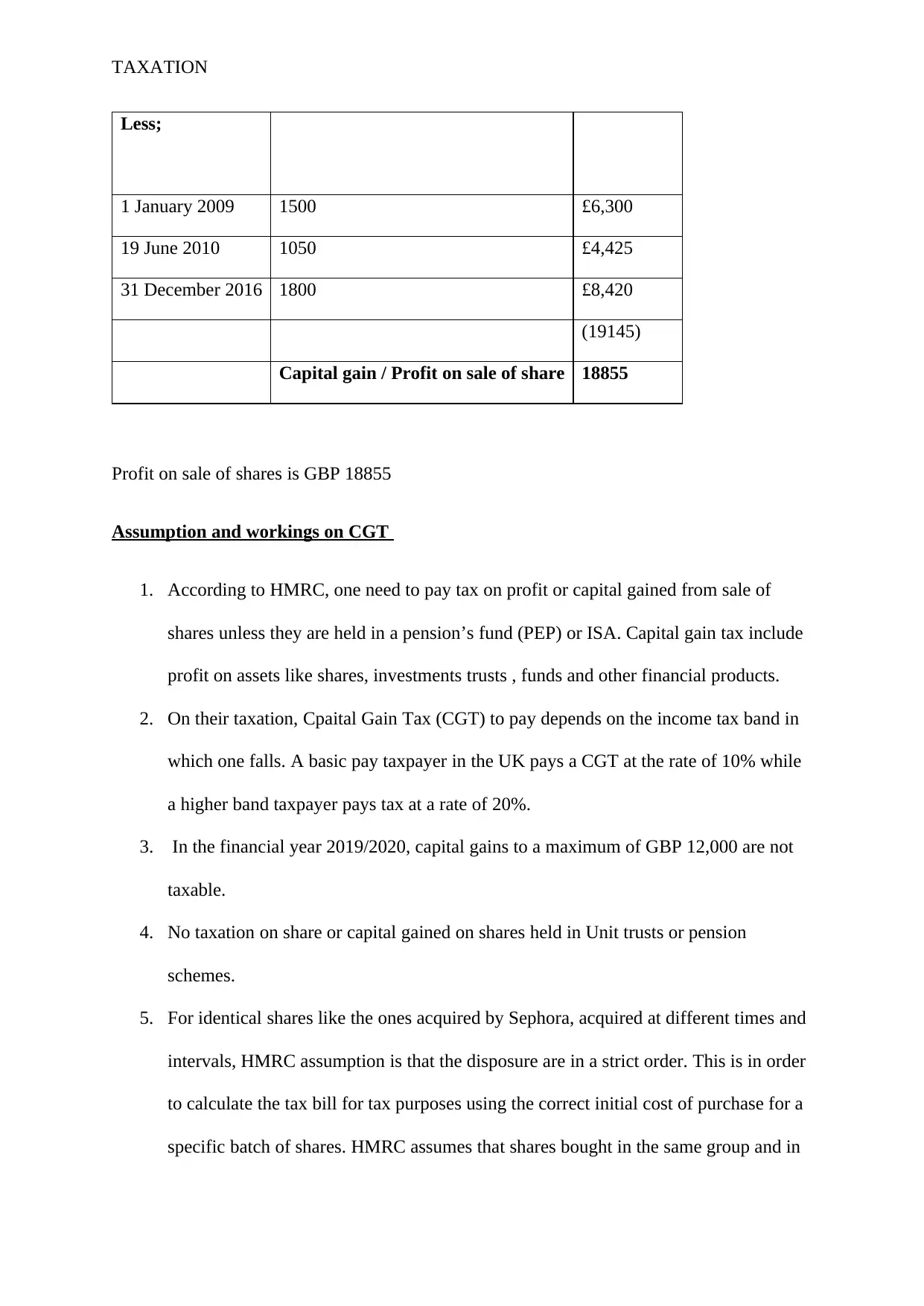

Less;

1 January 2009 1500 £6,300

19 June 2010 1050 £4,425

31 December 2016 1800 £8,420

(19145)

Capital gain / Profit on sale of share 18855

Profit on sale of shares is GBP 18855

Assumption and workings on CGT

1. According to HMRC, one need to pay tax on profit or capital gained from sale of

shares unless they are held in a pension’s fund (PEP) or ISA. Capital gain tax include

profit on assets like shares, investments trusts , funds and other financial products.

2. On their taxation, Cpaital Gain Tax (CGT) to pay depends on the income tax band in

which one falls. A basic pay taxpayer in the UK pays a CGT at the rate of 10% while

a higher band taxpayer pays tax at a rate of 20%.

3. In the financial year 2019/2020, capital gains to a maximum of GBP 12,000 are not

taxable.

4. No taxation on share or capital gained on shares held in Unit trusts or pension

schemes.

5. For identical shares like the ones acquired by Sephora, acquired at different times and

intervals, HMRC assumption is that the disposure are in a strict order. This is in order

to calculate the tax bill for tax purposes using the correct initial cost of purchase for a

specific batch of shares. HMRC assumes that shares bought in the same group and in

Less;

1 January 2009 1500 £6,300

19 June 2010 1050 £4,425

31 December 2016 1800 £8,420

(19145)

Capital gain / Profit on sale of share 18855

Profit on sale of shares is GBP 18855

Assumption and workings on CGT

1. According to HMRC, one need to pay tax on profit or capital gained from sale of

shares unless they are held in a pension’s fund (PEP) or ISA. Capital gain tax include

profit on assets like shares, investments trusts , funds and other financial products.

2. On their taxation, Cpaital Gain Tax (CGT) to pay depends on the income tax band in

which one falls. A basic pay taxpayer in the UK pays a CGT at the rate of 10% while

a higher band taxpayer pays tax at a rate of 20%.

3. In the financial year 2019/2020, capital gains to a maximum of GBP 12,000 are not

taxable.

4. No taxation on share or capital gained on shares held in Unit trusts or pension

schemes.

5. For identical shares like the ones acquired by Sephora, acquired at different times and

intervals, HMRC assumption is that the disposure are in a strict order. This is in order

to calculate the tax bill for tax purposes using the correct initial cost of purchase for a

specific batch of shares. HMRC assumes that shares bought in the same group and in

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TAXATION

the same day and the ones bought within the next 30 days are the same batch of share

or are in the same group (Plakhtii, Fedoryshyna, & Tomchuk, 2019)..

6. Buying of shares or exercising a rights issue does not attract any capital gained tax.

For capital gain tax, in disposition of Sephora’s shares. The first batch and the second batch

were disposed first. The third batch had more share by two so I disposed 1800 shares bought

on 31 December 2016.

CGT on Sephora’s Share sale

Shares Profit from sale of

shares

CGT (10%

Profit 18,855

Less: threshold (0% CGT to a maximum of

12,000)

(12,000)

Taxable amount on CGT 6,855 CGT= GBP

685.5

Item Capital gained

Antique dress 7,400

Speed boat 3,000

Capital losses b/f (2,000)

the same day and the ones bought within the next 30 days are the same batch of share

or are in the same group (Plakhtii, Fedoryshyna, & Tomchuk, 2019)..

6. Buying of shares or exercising a rights issue does not attract any capital gained tax.

For capital gain tax, in disposition of Sephora’s shares. The first batch and the second batch

were disposed first. The third batch had more share by two so I disposed 1800 shares bought

on 31 December 2016.

CGT on Sephora’s Share sale

Shares Profit from sale of

shares

CGT (10%

Profit 18,855

Less: threshold (0% CGT to a maximum of

12,000)

(12,000)

Taxable amount on CGT 6,855 CGT= GBP

685.5

Item Capital gained

Antique dress 7,400

Speed boat 3,000

Capital losses b/f (2,000)

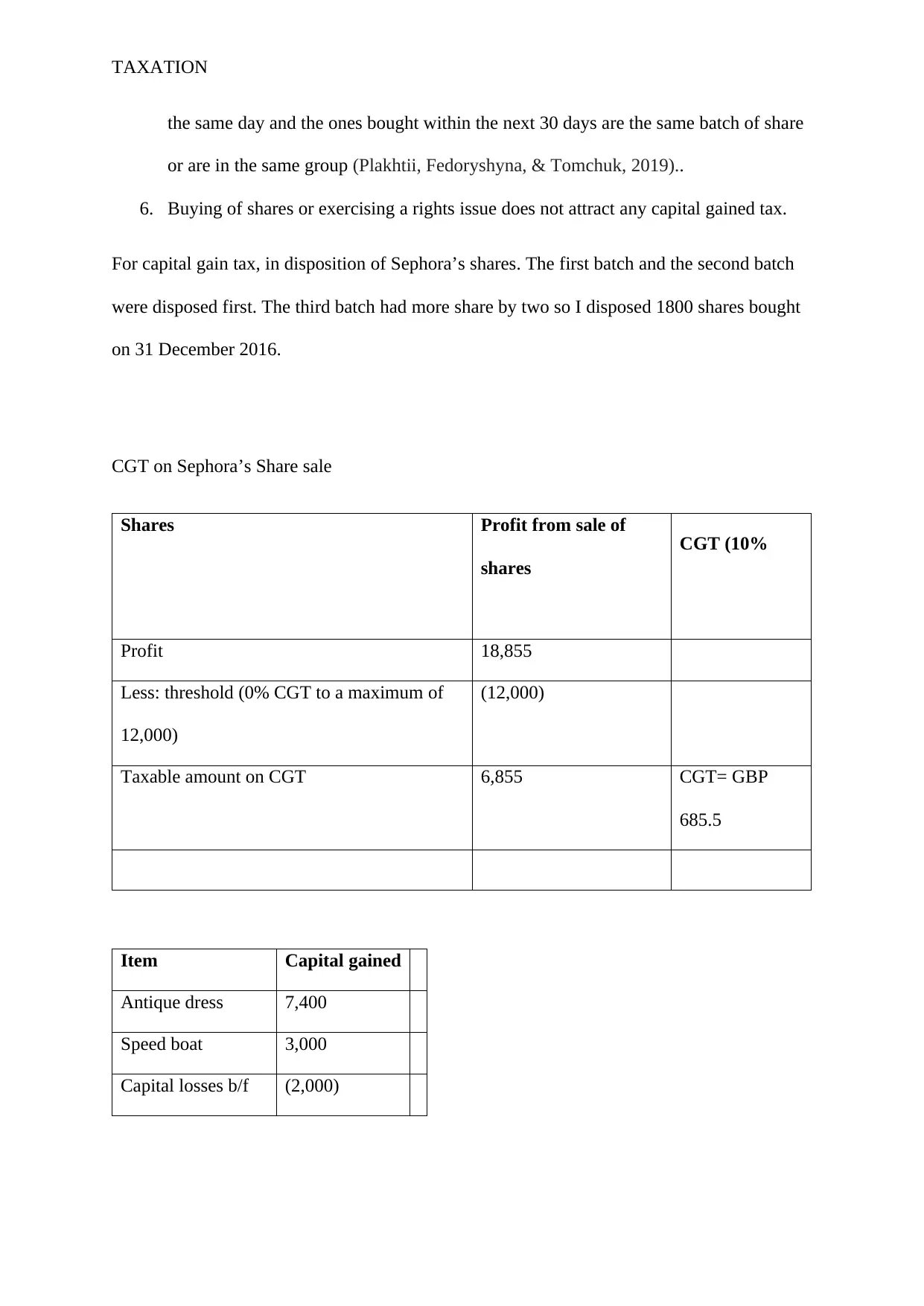

TAXATION

Total capital

gained

8,400

CGT nil

Payable at the end of taxable year 2020/2021

d) Inheritance tax due in the UK, inheritance tax rate stands at 40%. However, it is

only charged above the estate threshold

Estate value /

item

GBP GBP@40%

Net estate worth 337,000

House 198,000

Net estate value 139,000 55,600

Question 2

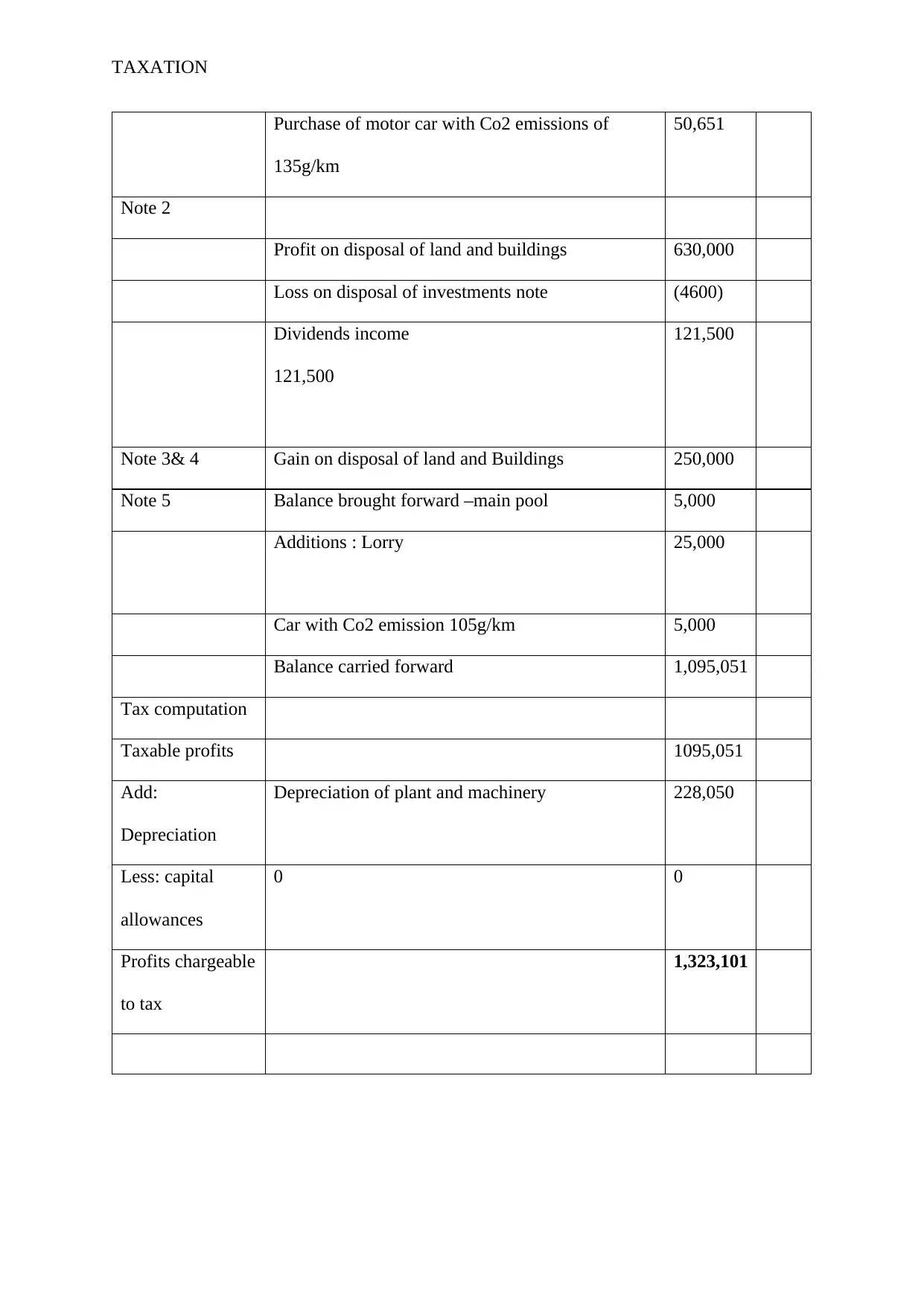

a) Calculate the capital allowance for Elvis Ltd for the Year ended 30march 2020

Elvis Ltd Capital Allowance Schedule

For the year Ended 30the March 2020

Item Capital allowance pool GBP GBP

Note 1 Addition: New conditioning system 12,500

Total capital

gained

8,400

CGT nil

Payable at the end of taxable year 2020/2021

d) Inheritance tax due in the UK, inheritance tax rate stands at 40%. However, it is

only charged above the estate threshold

Estate value /

item

GBP GBP@40%

Net estate worth 337,000

House 198,000

Net estate value 139,000 55,600

Question 2

a) Calculate the capital allowance for Elvis Ltd for the Year ended 30march 2020

Elvis Ltd Capital Allowance Schedule

For the year Ended 30the March 2020

Item Capital allowance pool GBP GBP

Note 1 Addition: New conditioning system 12,500

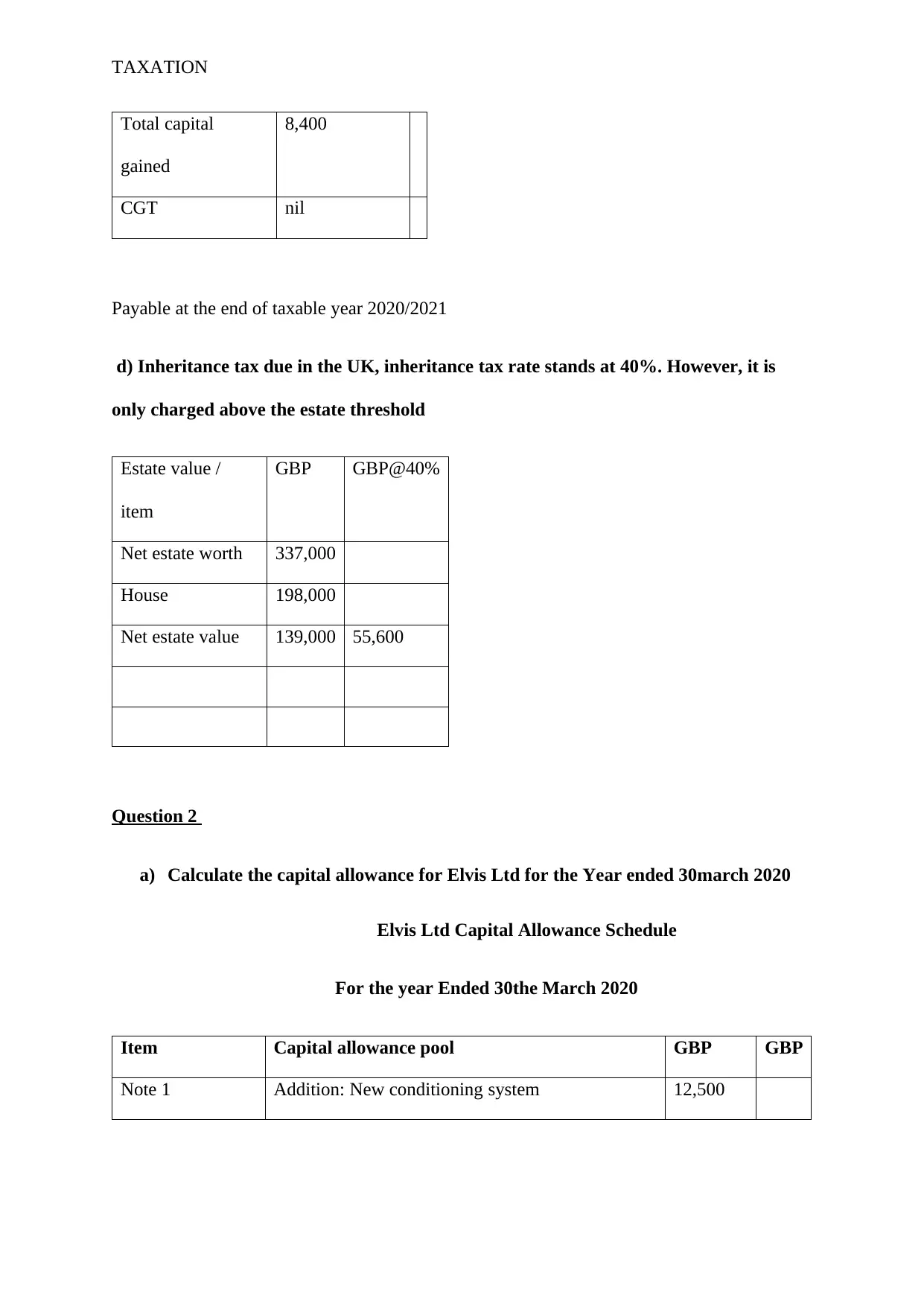

TAXATION

Purchase of motor car with Co2 emissions of

135g/km

50,651

Note 2

Profit on disposal of land and buildings 630,000

Loss on disposal of investments note (4600)

Dividends income

121,500

121,500

Note 3& 4 Gain on disposal of land and Buildings 250,000

Note 5 Balance brought forward –main pool 5,000

Additions : Lorry 25,000

Car with Co2 emission 105g/km 5,000

Balance carried forward 1,095,051

Tax computation

Taxable profits 1095,051

Add:

Depreciation

Depreciation of plant and machinery 228,050

Less: capital

allowances

0 0

Profits chargeable

to tax

1,323,101

Purchase of motor car with Co2 emissions of

135g/km

50,651

Note 2

Profit on disposal of land and buildings 630,000

Loss on disposal of investments note (4600)

Dividends income

121,500

121,500

Note 3& 4 Gain on disposal of land and Buildings 250,000

Note 5 Balance brought forward –main pool 5,000

Additions : Lorry 25,000

Car with Co2 emission 105g/km 5,000

Balance carried forward 1,095,051

Tax computation

Taxable profits 1095,051

Add:

Depreciation

Depreciation of plant and machinery 228,050

Less: capital

allowances

0 0

Profits chargeable

to tax

1,323,101

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TAXATION

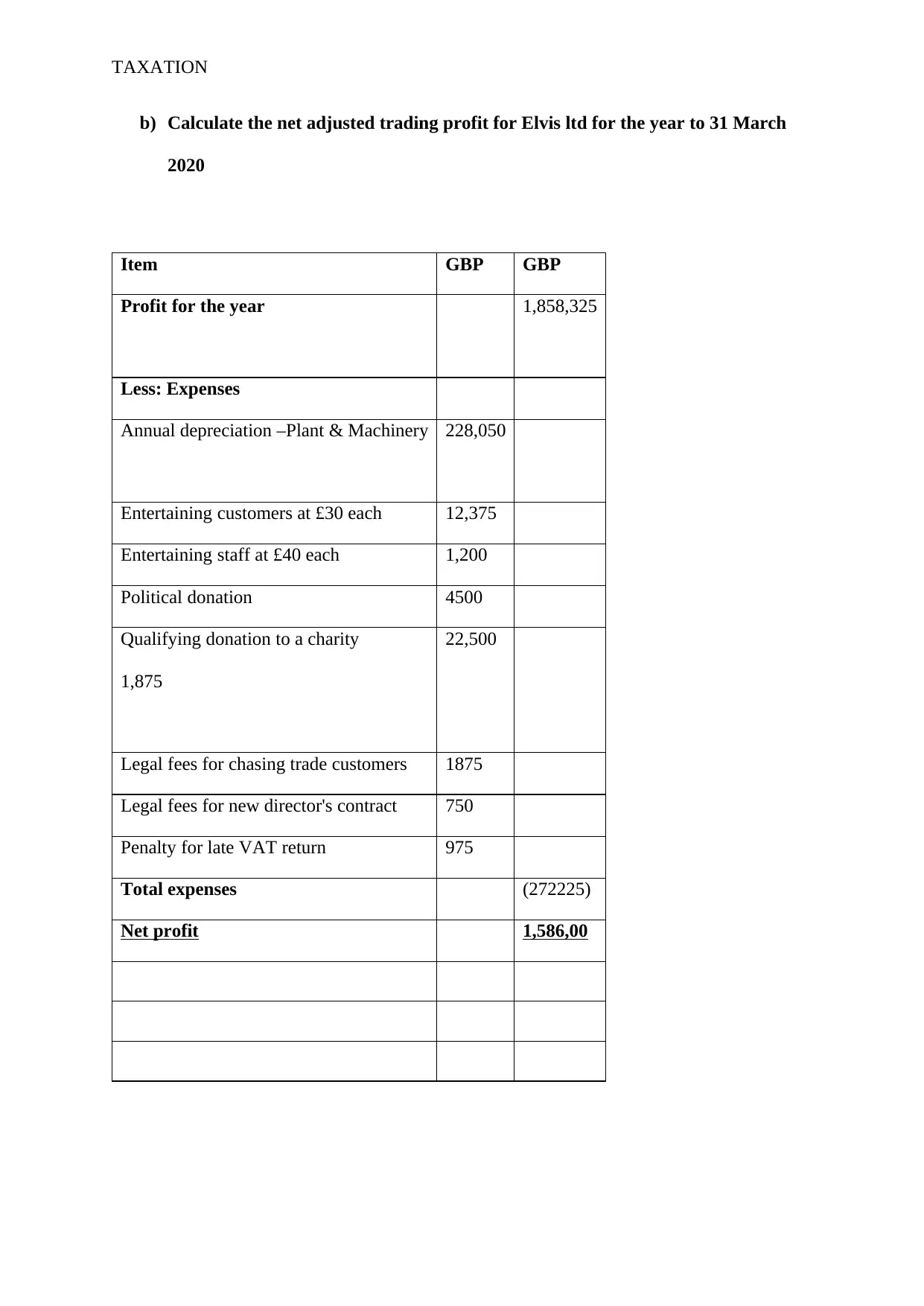

b) Calculate the net adjusted trading profit for Elvis ltd for the year to 31 March

2020

Item GBP GBP

Profit for the year 1,858,325

Less: Expenses

Annual depreciation –Plant & Machinery 228,050

Entertaining customers at £30 each 12,375

Entertaining staff at £40 each 1,200

Political donation 4500

Qualifying donation to a charity

1,875

22,500

Legal fees for chasing trade customers 1875

Legal fees for new director's contract 750

Penalty for late VAT return 975

Total expenses (272225)

Net profit 1,586,00

b) Calculate the net adjusted trading profit for Elvis ltd for the year to 31 March

2020

Item GBP GBP

Profit for the year 1,858,325

Less: Expenses

Annual depreciation –Plant & Machinery 228,050

Entertaining customers at £30 each 12,375

Entertaining staff at £40 each 1,200

Political donation 4500

Qualifying donation to a charity

1,875

22,500

Legal fees for chasing trade customers 1875

Legal fees for new director's contract 750

Penalty for late VAT return 975

Total expenses (272225)

Net profit 1,586,00

TAXATION

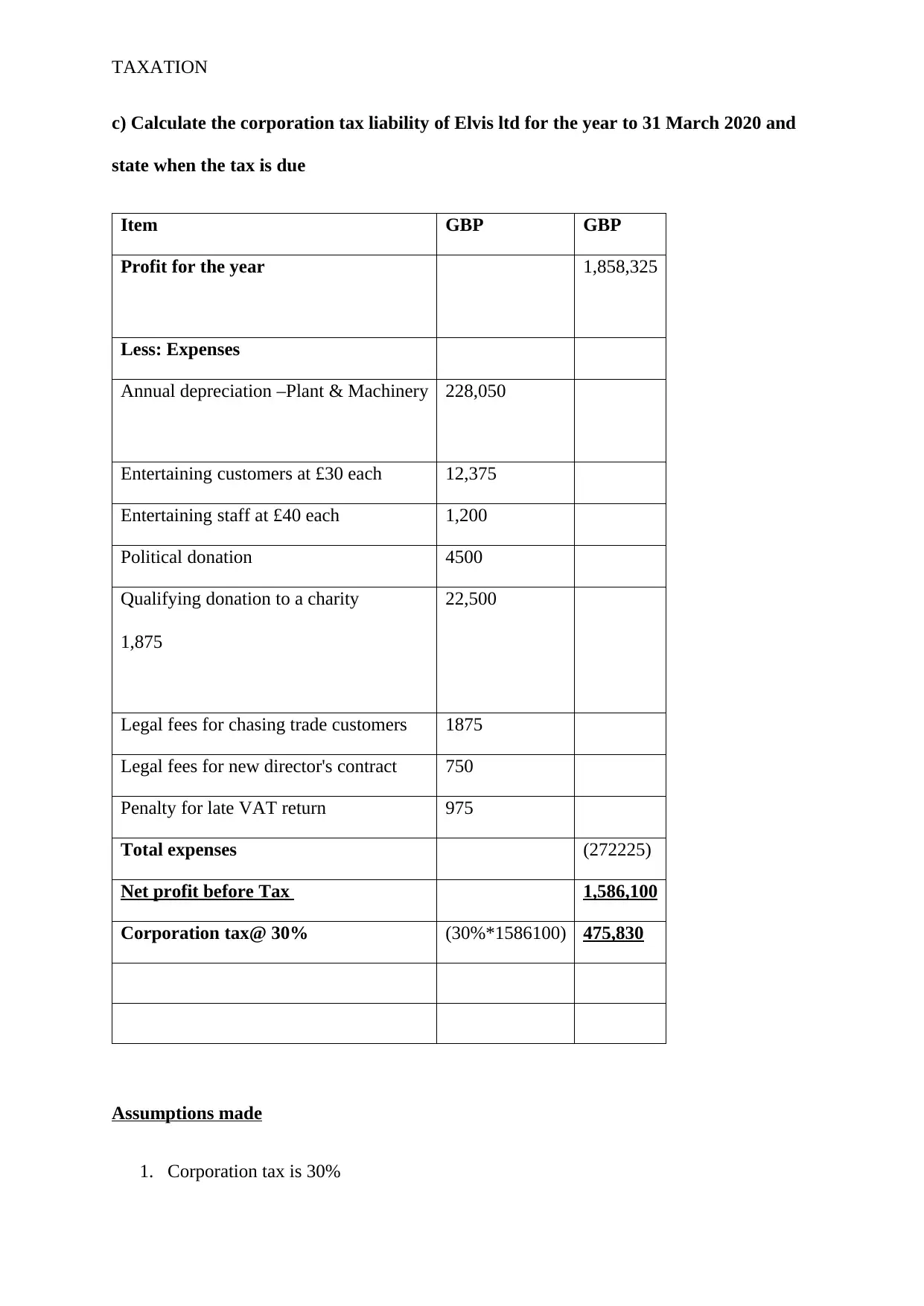

c) Calculate the corporation tax liability of Elvis ltd for the year to 31 March 2020 and

state when the tax is due

Item GBP GBP

Profit for the year 1,858,325

Less: Expenses

Annual depreciation –Plant & Machinery 228,050

Entertaining customers at £30 each 12,375

Entertaining staff at £40 each 1,200

Political donation 4500

Qualifying donation to a charity

1,875

22,500

Legal fees for chasing trade customers 1875

Legal fees for new director's contract 750

Penalty for late VAT return 975

Total expenses (272225)

Net profit before Tax 1,586,100

Corporation tax@ 30% (30%*1586100) 475,830

Assumptions made

1. Corporation tax is 30%

c) Calculate the corporation tax liability of Elvis ltd for the year to 31 March 2020 and

state when the tax is due

Item GBP GBP

Profit for the year 1,858,325

Less: Expenses

Annual depreciation –Plant & Machinery 228,050

Entertaining customers at £30 each 12,375

Entertaining staff at £40 each 1,200

Political donation 4500

Qualifying donation to a charity

1,875

22,500

Legal fees for chasing trade customers 1875

Legal fees for new director's contract 750

Penalty for late VAT return 975

Total expenses (272225)

Net profit before Tax 1,586,100

Corporation tax@ 30% (30%*1586100) 475,830

Assumptions made

1. Corporation tax is 30%

TAXATION

2. Depreciation is annual and not accumulated depreciation (Spiritus, & Boadway, 2017)

References

Feld, L. P., Ruf, M., Schreiber, U., Todtenhaupt, M., & Voget, J. (2016). Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

Huizinga, H., Voget, J., & Wagner, W. (2018). Capital gains taxation and the cost of capital:

Evidence from unanticipated cross-border transfers of tax base. Journal of Financial

Economics, 129(2), 306-328.

Lei, Y., & Xu, J. (2019). Inflation, Taxation, and Capital Gains Indexation: Portfolio Choice

and Welfare Implications. Available at SSRN 3483399.

Plakhtii, T., Fedoryshyna, L., & Tomchuk, O. (2019). Socio-economic component of

preferential taxation of individual income. Baltic Journal of Economic Studies, 5(2),

171-175.

Spiritus, K., & Boadway, R. (2017). The Optimal Taxation of Risky Capital Income: The

Rate of Return Allowance.

2. Depreciation is annual and not accumulated depreciation (Spiritus, & Boadway, 2017)

References

Feld, L. P., Ruf, M., Schreiber, U., Todtenhaupt, M., & Voget, J. (2016). Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

Huizinga, H., Voget, J., & Wagner, W. (2018). Capital gains taxation and the cost of capital:

Evidence from unanticipated cross-border transfers of tax base. Journal of Financial

Economics, 129(2), 306-328.

Lei, Y., & Xu, J. (2019). Inflation, Taxation, and Capital Gains Indexation: Portfolio Choice

and Welfare Implications. Available at SSRN 3483399.

Plakhtii, T., Fedoryshyna, L., & Tomchuk, O. (2019). Socio-economic component of

preferential taxation of individual income. Baltic Journal of Economic Studies, 5(2),

171-175.

Spiritus, K., & Boadway, R. (2017). The Optimal Taxation of Risky Capital Income: The

Rate of Return Allowance.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.