FBT and CGT Liability Analysis: Taxation Law Assignment (HA3042)

VerifiedAdded on 2022/11/18

|9

|2487

|265

Homework Assignment

AI Summary

This assignment delves into the intricacies of Australian taxation law, specifically focusing on Fringe Benefits Tax (FBT) and Capital Gains Tax (CGT). The first part of the assignment involves calculating the FBT liability for Spiceco Pty Ltd, considering the provision of a car for personal use to an employee, Lucinda. This includes determining depreciation, interest, total operating costs, and the taxable value of the car, using both the cost basis and statutory formula methods. The second part of the assignment analyzes the CGT implications for Daniel, who has made several transactions involving the disposal of capital assets. This section examines the sale of Daniel's house (main residence exemption), a painting (collectibles), a private luxury yacht (personal use asset), and BHP shares. It calculates capital gains or losses for each transaction and considers the application of the discount method for long-term assets. Furthermore, the assignment considers the adjustment of prior year capital losses and the final computation of net capital gains, culminating in the determination of Daniel's CGT liability.

TAXATION

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

Fringe Benefits Tax (FBT) liability of Spiceco Pty Ltd needs to be calculated on the

account of the car provided for personal utilization to one of its employee Lucinda.

There are host of elements which need to be determined in wake of the given

information so as to find the net FBT liability.

List of necessary elements:

Depreciation

Interest

Total operating cost

Taxable value

Grossed up taxable value of car

Fringe benefits tax liability

A brief discussion about each of the above shown elements along with the

necessary variables of computation is shown below.

Element 1: Depreciation

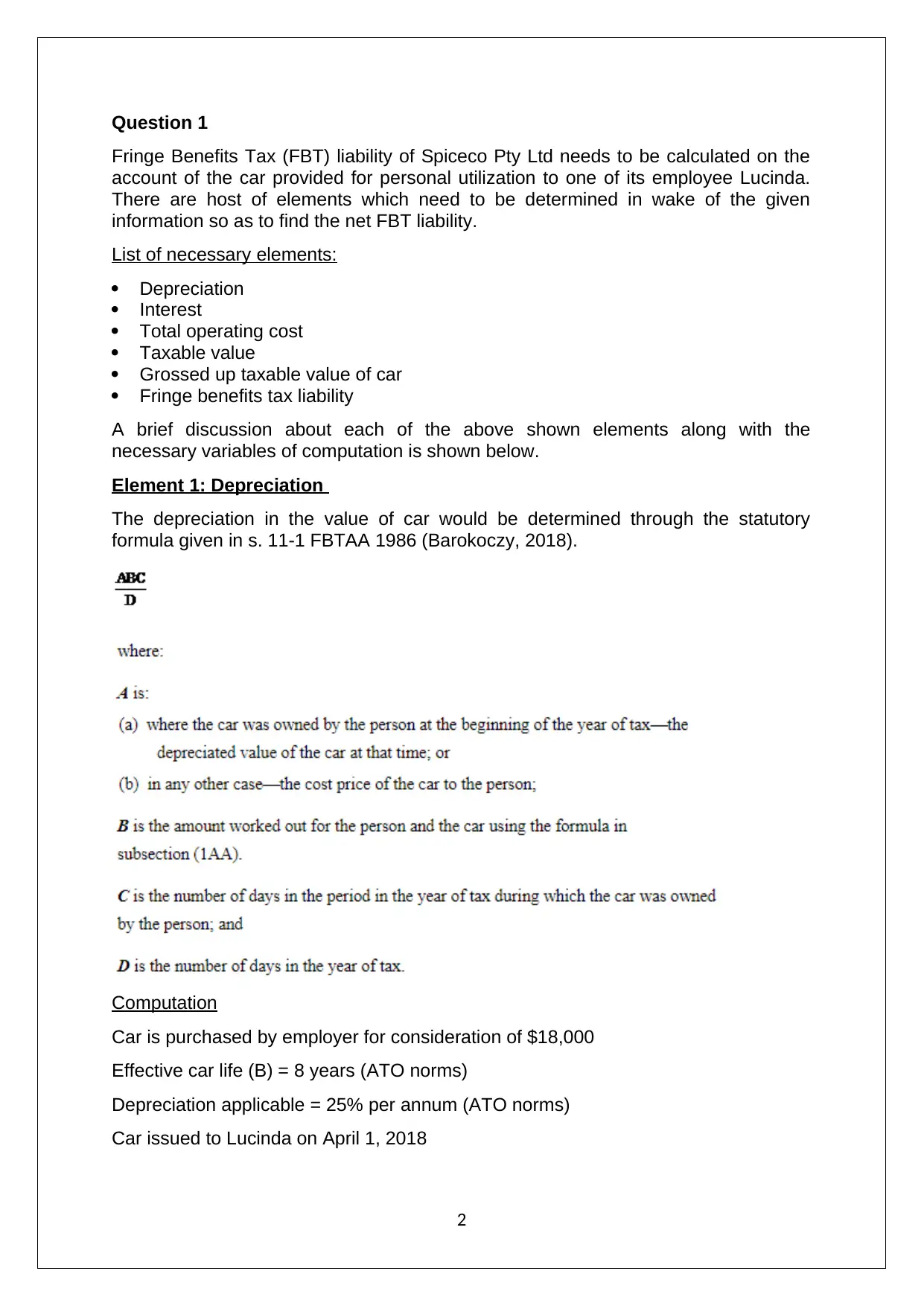

The depreciation in the value of car would be determined through the statutory

formula given in s. 11-1 FBTAA 1986 (Barokoczy, 2018).

Computation

Car is purchased by employer for consideration of $18,000

Effective car life (B) = 8 years (ATO norms)

Depreciation applicable = 25% per annum (ATO norms)

Car issued to Lucinda on April 1, 2018

2

Fringe Benefits Tax (FBT) liability of Spiceco Pty Ltd needs to be calculated on the

account of the car provided for personal utilization to one of its employee Lucinda.

There are host of elements which need to be determined in wake of the given

information so as to find the net FBT liability.

List of necessary elements:

Depreciation

Interest

Total operating cost

Taxable value

Grossed up taxable value of car

Fringe benefits tax liability

A brief discussion about each of the above shown elements along with the

necessary variables of computation is shown below.

Element 1: Depreciation

The depreciation in the value of car would be determined through the statutory

formula given in s. 11-1 FBTAA 1986 (Barokoczy, 2018).

Computation

Car is purchased by employer for consideration of $18,000

Effective car life (B) = 8 years (ATO norms)

Depreciation applicable = 25% per annum (ATO norms)

Car issued to Lucinda on April 1, 2018

2

Period (C and D) would be same = 365 days assuming that the car was available for

private use for all days of the year.

Depreciation on the car for 2018-2019 = 18000*(0.25)*(365/365) = $4,500

Element 2: Interest

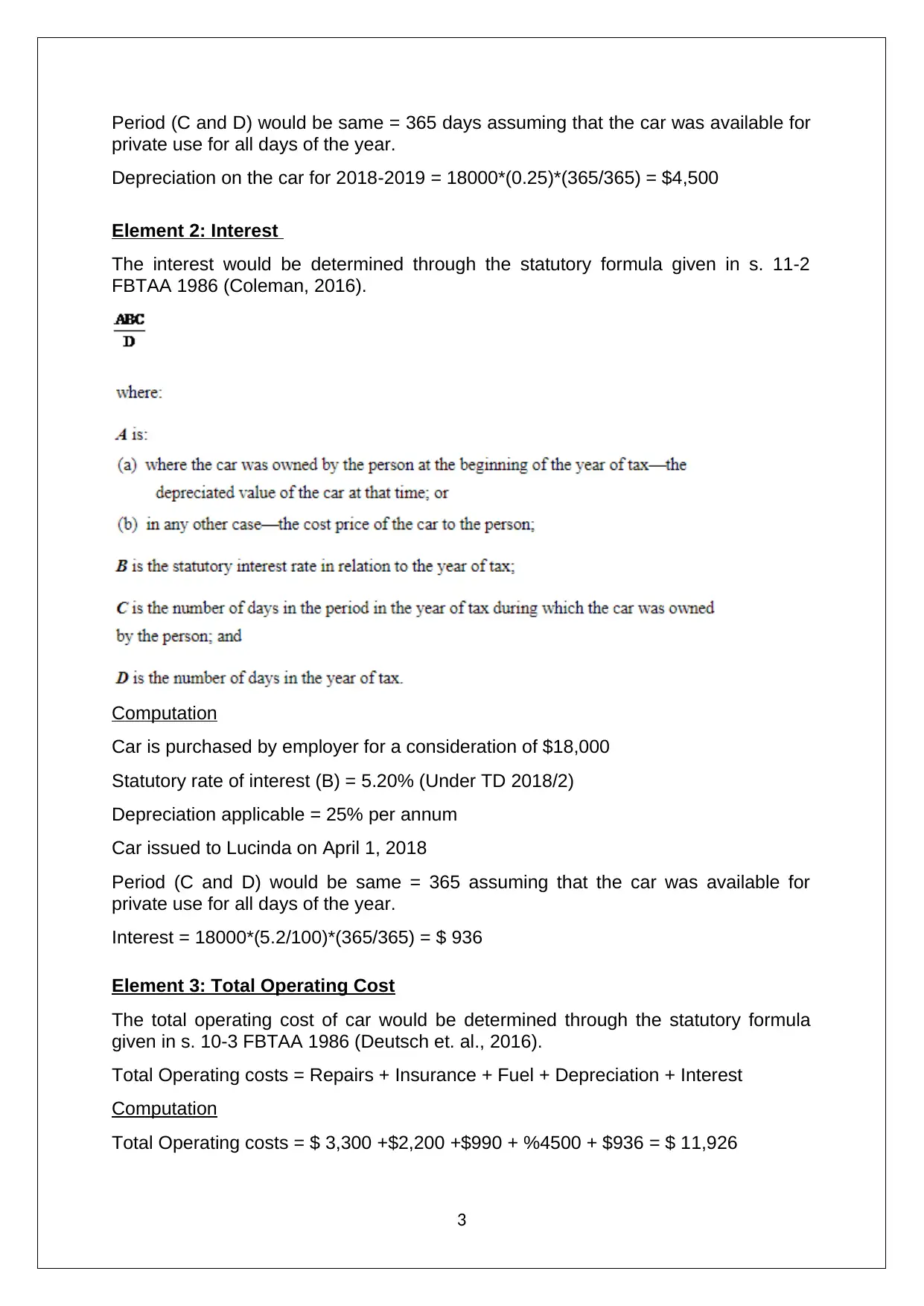

The interest would be determined through the statutory formula given in s. 11-2

FBTAA 1986 (Coleman, 2016).

Computation

Car is purchased by employer for a consideration of $18,000

Statutory rate of interest (B) = 5.20% (Under TD 2018/2)

Depreciation applicable = 25% per annum

Car issued to Lucinda on April 1, 2018

Period (C and D) would be same = 365 assuming that the car was available for

private use for all days of the year.

Interest = 18000*(5.2/100)*(365/365) = $ 936

Element 3: Total Operating Cost

The total operating cost of car would be determined through the statutory formula

given in s. 10-3 FBTAA 1986 (Deutsch et. al., 2016).

Total Operating costs = Repairs + Insurance + Fuel + Depreciation + Interest

Computation

Total Operating costs = $ 3,300 +$2,200 +$990 + %4500 + $936 = $ 11,926

3

private use for all days of the year.

Depreciation on the car for 2018-2019 = 18000*(0.25)*(365/365) = $4,500

Element 2: Interest

The interest would be determined through the statutory formula given in s. 11-2

FBTAA 1986 (Coleman, 2016).

Computation

Car is purchased by employer for a consideration of $18,000

Statutory rate of interest (B) = 5.20% (Under TD 2018/2)

Depreciation applicable = 25% per annum

Car issued to Lucinda on April 1, 2018

Period (C and D) would be same = 365 assuming that the car was available for

private use for all days of the year.

Interest = 18000*(5.2/100)*(365/365) = $ 936

Element 3: Total Operating Cost

The total operating cost of car would be determined through the statutory formula

given in s. 10-3 FBTAA 1986 (Deutsch et. al., 2016).

Total Operating costs = Repairs + Insurance + Fuel + Depreciation + Interest

Computation

Total Operating costs = $ 3,300 +$2,200 +$990 + %4500 + $936 = $ 11,926

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Element 4: Taxable value of car

Two methods are taken into account to find the taxable value of car. However, the

method which results in lower taxable value of car would be preferable because it

would lower the total FBT liability of the employer.

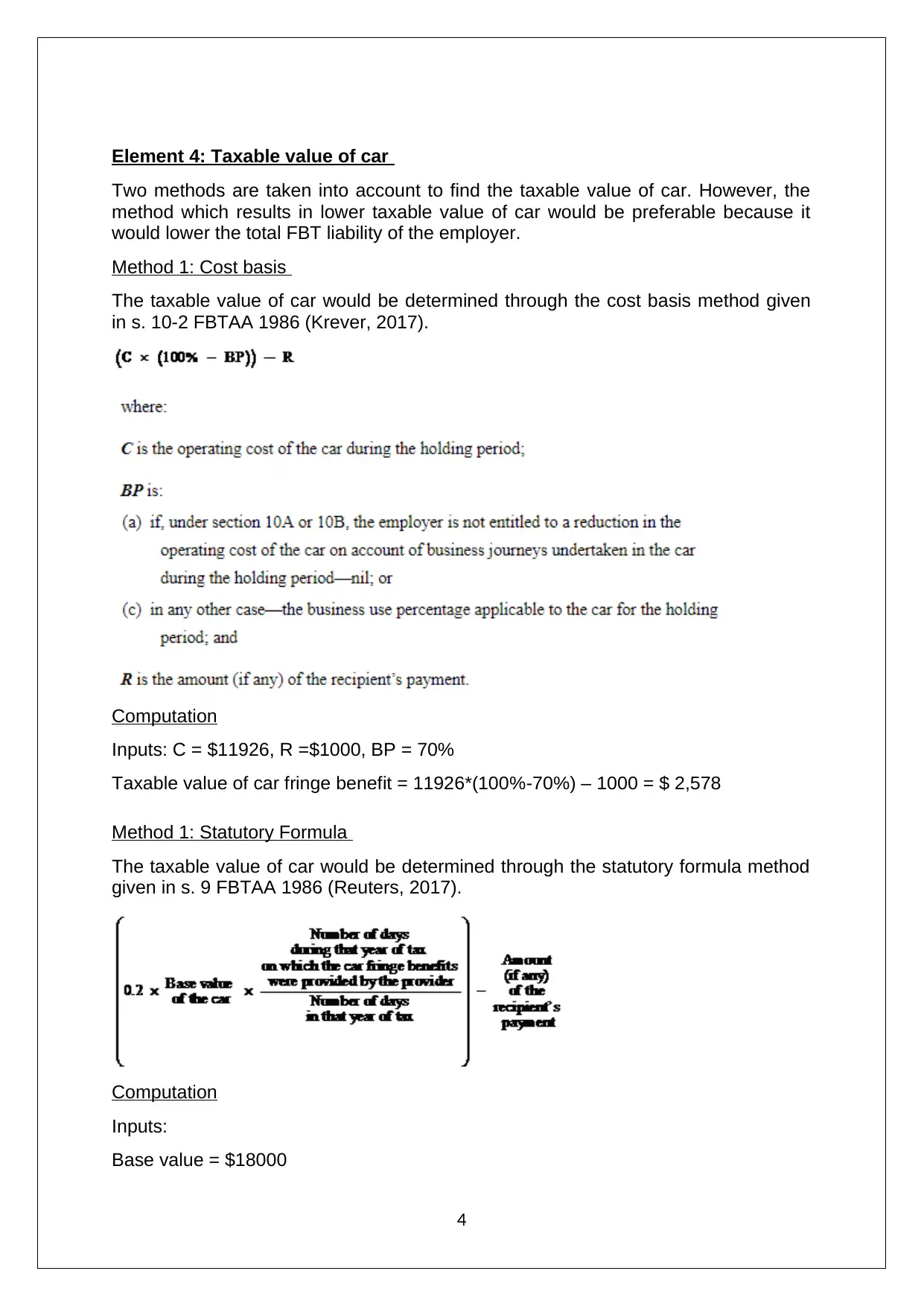

Method 1: Cost basis

The taxable value of car would be determined through the cost basis method given

in s. 10-2 FBTAA 1986 (Krever, 2017).

Computation

Inputs: C = $11926, R =$1000, BP = 70%

Taxable value of car fringe benefit = 11926*(100%-70%) – 1000 = $ 2,578

Method 1: Statutory Formula

The taxable value of car would be determined through the statutory formula method

given in s. 9 FBTAA 1986 (Reuters, 2017).

Computation

Inputs:

Base value = $18000

4

Two methods are taken into account to find the taxable value of car. However, the

method which results in lower taxable value of car would be preferable because it

would lower the total FBT liability of the employer.

Method 1: Cost basis

The taxable value of car would be determined through the cost basis method given

in s. 10-2 FBTAA 1986 (Krever, 2017).

Computation

Inputs: C = $11926, R =$1000, BP = 70%

Taxable value of car fringe benefit = 11926*(100%-70%) – 1000 = $ 2,578

Method 1: Statutory Formula

The taxable value of car would be determined through the statutory formula method

given in s. 9 FBTAA 1986 (Reuters, 2017).

Computation

Inputs:

Base value = $18000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Number of days during year when car was issued to employee for personal use =

365

Number of days in the given FBT year =365

Amount contributed by employee = $1000

Taxable value of the car fringe benefit =(0.2*18,000*(365/365)) - $ 1,000 = $ 2,600

As indicated above, taxable value is lower when cost basis method is applied and

therefore, this method would be considered as most appropriate method.

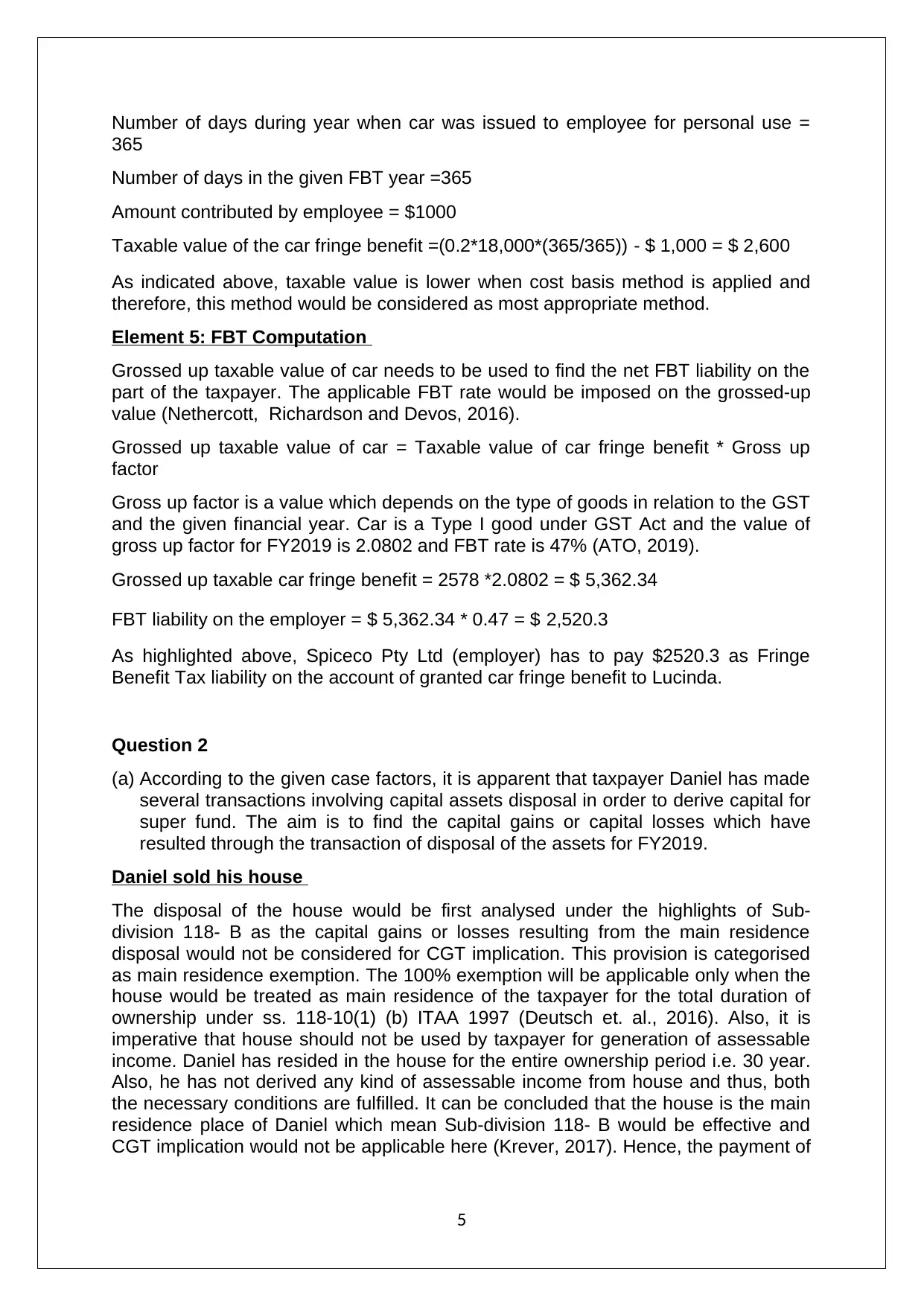

Element 5: FBT Computation

Grossed up taxable value of car needs to be used to find the net FBT liability on the

part of the taxpayer. The applicable FBT rate would be imposed on the grossed-up

value (Nethercott, Richardson and Devos, 2016).

Grossed up taxable value of car = Taxable value of car fringe benefit * Gross up

factor

Gross up factor is a value which depends on the type of goods in relation to the GST

and the given financial year. Car is a Type I good under GST Act and the value of

gross up factor for FY2019 is 2.0802 and FBT rate is 47% (ATO, 2019).

Grossed up taxable car fringe benefit = 2578 *2.0802 = $ 5,362.34

FBT liability on the employer = $ 5,362.34 * 0.47 = $ 2,520.3

As highlighted above, Spiceco Pty Ltd (employer) has to pay $2520.3 as Fringe

Benefit Tax liability on the account of granted car fringe benefit to Lucinda.

Question 2

(a) According to the given case factors, it is apparent that taxpayer Daniel has made

several transactions involving capital assets disposal in order to derive capital for

super fund. The aim is to find the capital gains or capital losses which have

resulted through the transaction of disposal of the assets for FY2019.

Daniel sold his house

The disposal of the house would be first analysed under the highlights of Sub-

division 118- B as the capital gains or losses resulting from the main residence

disposal would not be considered for CGT implication. This provision is categorised

as main residence exemption. The 100% exemption will be applicable only when the

house would be treated as main residence of the taxpayer for the total duration of

ownership under ss. 118-10(1) (b) ITAA 1997 (Deutsch et. al., 2016). Also, it is

imperative that house should not be used by taxpayer for generation of assessable

income. Daniel has resided in the house for the entire ownership period i.e. 30 year.

Also, he has not derived any kind of assessable income from house and thus, both

the necessary conditions are fulfilled. It can be concluded that the house is the main

residence place of Daniel which mean Sub-division 118- B would be effective and

CGT implication would not be applicable here (Krever, 2017). Hence, the payment of

5

365

Number of days in the given FBT year =365

Amount contributed by employee = $1000

Taxable value of the car fringe benefit =(0.2*18,000*(365/365)) - $ 1,000 = $ 2,600

As indicated above, taxable value is lower when cost basis method is applied and

therefore, this method would be considered as most appropriate method.

Element 5: FBT Computation

Grossed up taxable value of car needs to be used to find the net FBT liability on the

part of the taxpayer. The applicable FBT rate would be imposed on the grossed-up

value (Nethercott, Richardson and Devos, 2016).

Grossed up taxable value of car = Taxable value of car fringe benefit * Gross up

factor

Gross up factor is a value which depends on the type of goods in relation to the GST

and the given financial year. Car is a Type I good under GST Act and the value of

gross up factor for FY2019 is 2.0802 and FBT rate is 47% (ATO, 2019).

Grossed up taxable car fringe benefit = 2578 *2.0802 = $ 5,362.34

FBT liability on the employer = $ 5,362.34 * 0.47 = $ 2,520.3

As highlighted above, Spiceco Pty Ltd (employer) has to pay $2520.3 as Fringe

Benefit Tax liability on the account of granted car fringe benefit to Lucinda.

Question 2

(a) According to the given case factors, it is apparent that taxpayer Daniel has made

several transactions involving capital assets disposal in order to derive capital for

super fund. The aim is to find the capital gains or capital losses which have

resulted through the transaction of disposal of the assets for FY2019.

Daniel sold his house

The disposal of the house would be first analysed under the highlights of Sub-

division 118- B as the capital gains or losses resulting from the main residence

disposal would not be considered for CGT implication. This provision is categorised

as main residence exemption. The 100% exemption will be applicable only when the

house would be treated as main residence of the taxpayer for the total duration of

ownership under ss. 118-10(1) (b) ITAA 1997 (Deutsch et. al., 2016). Also, it is

imperative that house should not be used by taxpayer for generation of assessable

income. Daniel has resided in the house for the entire ownership period i.e. 30 year.

Also, he has not derived any kind of assessable income from house and thus, both

the necessary conditions are fulfilled. It can be concluded that the house is the main

residence place of Daniel which mean Sub-division 118- B would be effective and

CGT implication would not be applicable here (Krever, 2017). Hence, the payment of

5

transaction i.e. $8500 that would result capital gains to Daniel will not attract any

CGT liability.

Daniel sold his painting

In accordance with ss. 149-10 ITAA 1997, CGT liability will not be imposed on the

capital gains or losses which has been derived from the disposal of pre-CGT asset

(purchased before September 20,1985) (Austlii, 2019a). Painting is classified under

the asset category called “Collectibles” under the provisions of ss. 108-10(15) ITAA

1997 and collectibles are termed as CGT assets (Austlii, 2019b). The transaction

incurred in context of disposal of such asset is A1 CGT event in accordance with ss.

104-5 ITAA 1997. Further, the process of determination of capital gains or capital

losses is described in ss. 104-10 ITAA 1997. It comprises two main factors which are

sale proceeds and cost base of asset. The difference of these two factors results in

capital gains or losses from the disposal of capital asset (Barkoczy, 2018). Daniel

has purchased the painting well after September 20, 1985 which implies that it is not

classified under pre-CGT asset. The net capital gains/losses are calculated as given

below.

Sale proceeds (painting) = $125,000

Cost base (painting) = $15,000

Capital gains realised on painting disposal = $125,000 - $15,000 = $ 110,000

Further, only half of the capital gains would be used to find the CGT liability when the

capital gains is categorised as long-term asset of taxpayer in accordance with

Discount method stated in Division 15 ITAA 1997. This can easily be determined by

considering the holding period of the respective asset. If the asset’s holding period

exceeded 1 year then the derive capital gains would be classified as long-term. Also,

it is noteworthy that the capital losses (current or unadjusted from past year) must be

balanced with the derived capital gains before applying the discount method

(Wollner, 2014).

Daniel sold his private luxury yacht

If the taxpayer has not realised the underlying asset for business purposes and has

used it for personal use and enjoyment, then it would be considered as personal use

asset under ss. 108-20(1) ITAA1997. Capital losses derived through the sale of a

personal use asset of taxpayer do not attract CGT liability on the taxpayer. Also, it is

essential to note that capital gains would be subjected for CGT implication when the

personal use asset has been acquired for more than $10,000. Hence, it is a pre-

requisite to determine whether the asset would be a private use asset of taxpayer or

not (Reuters, 2017). Further, the process of determination of capital gains or capital

losses is described in ss. 104-10 ITAA 1997. It comprises that the difference of sale

proceeds and cost base of asset would give capital gains or losses. Daniel has

purchased a yacht after September 20, 1985 which implies that it is not pre-CGT

asset and also, never use it for business purposes with the intent of deriving

assessable income and thus, it is a personal use asset of Daniel. Also, the price

exceeds $10,000 which means the necessary condition is also fulfilled. The

computation of capital gains or losses is represented below.

Sale proceeds (yacht) = $60,000

6

CGT liability.

Daniel sold his painting

In accordance with ss. 149-10 ITAA 1997, CGT liability will not be imposed on the

capital gains or losses which has been derived from the disposal of pre-CGT asset

(purchased before September 20,1985) (Austlii, 2019a). Painting is classified under

the asset category called “Collectibles” under the provisions of ss. 108-10(15) ITAA

1997 and collectibles are termed as CGT assets (Austlii, 2019b). The transaction

incurred in context of disposal of such asset is A1 CGT event in accordance with ss.

104-5 ITAA 1997. Further, the process of determination of capital gains or capital

losses is described in ss. 104-10 ITAA 1997. It comprises two main factors which are

sale proceeds and cost base of asset. The difference of these two factors results in

capital gains or losses from the disposal of capital asset (Barkoczy, 2018). Daniel

has purchased the painting well after September 20, 1985 which implies that it is not

classified under pre-CGT asset. The net capital gains/losses are calculated as given

below.

Sale proceeds (painting) = $125,000

Cost base (painting) = $15,000

Capital gains realised on painting disposal = $125,000 - $15,000 = $ 110,000

Further, only half of the capital gains would be used to find the CGT liability when the

capital gains is categorised as long-term asset of taxpayer in accordance with

Discount method stated in Division 15 ITAA 1997. This can easily be determined by

considering the holding period of the respective asset. If the asset’s holding period

exceeded 1 year then the derive capital gains would be classified as long-term. Also,

it is noteworthy that the capital losses (current or unadjusted from past year) must be

balanced with the derived capital gains before applying the discount method

(Wollner, 2014).

Daniel sold his private luxury yacht

If the taxpayer has not realised the underlying asset for business purposes and has

used it for personal use and enjoyment, then it would be considered as personal use

asset under ss. 108-20(1) ITAA1997. Capital losses derived through the sale of a

personal use asset of taxpayer do not attract CGT liability on the taxpayer. Also, it is

essential to note that capital gains would be subjected for CGT implication when the

personal use asset has been acquired for more than $10,000. Hence, it is a pre-

requisite to determine whether the asset would be a private use asset of taxpayer or

not (Reuters, 2017). Further, the process of determination of capital gains or capital

losses is described in ss. 104-10 ITAA 1997. It comprises that the difference of sale

proceeds and cost base of asset would give capital gains or losses. Daniel has

purchased a yacht after September 20, 1985 which implies that it is not pre-CGT

asset and also, never use it for business purposes with the intent of deriving

assessable income and thus, it is a personal use asset of Daniel. Also, the price

exceeds $10,000 which means the necessary condition is also fulfilled. The

computation of capital gains or losses is represented below.

Sale proceeds (yacht) = $60,000

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost base (yacht) = $110,000

Capital losses realized from Yacht disposal = $60000 - $110000 = -$50,000

Clearly, yacht has resulted capital losses to Daniel from the disposal of personal use

yacht and therefore, the losses of tune -$50,000 will be ignored. As a result of this,

no CGT liability will be validated on Daniel for this transaction of sale.

Daniel sold BHP Shares

Sale of shares also attracts CGT liability on generated capital gains or losses in

terms of A1 CGT event under ss. 104-5 ITAA 1997. Further, the process of

determination of capital gains or capital losses is described in ss. 104-10 ITAA 1997.

It comprises that the difference of sale proceeds and cost base of asset would give

capital gains or losses. Five key factors will be used to determine the cost base of

asset which are described in details in s. 110-25 ITAA 1997 (Deutsch et. al., 2016).

Price paid to acquire asset

Incidental cost paid such as legal fees, stamp duties and so forth (mainly during

selling or buying process)

Capital expenses paid in the process of retaining the title of asset

Capital expenses paid in the work of increasing the net worth of asset

Cost paid so as to retain the ownership of asset such as various taxes and

interest payments

Daniel also sold BHP shares that he has purchased after the commencement of

CGT (September 20, 1985) and therefore, these shares would not be classified

under the pre-CGT asset of Daniel.

Sale proceeds (shares) = $80,000

Cost base (shares) = $75,000 + $250+$750+$5000 = $81,000

Where, $250 and $750 are incidental cost, $75000 basic purchasing cost of shares

and $5,000 as the cost paid to retain the ownership in the form of interest.

Capital losses realised on shares disposal = $80,000 - $81,000 = -$1000

Final computation of capital gains or losses from all the given transaction of

sales of Daniel

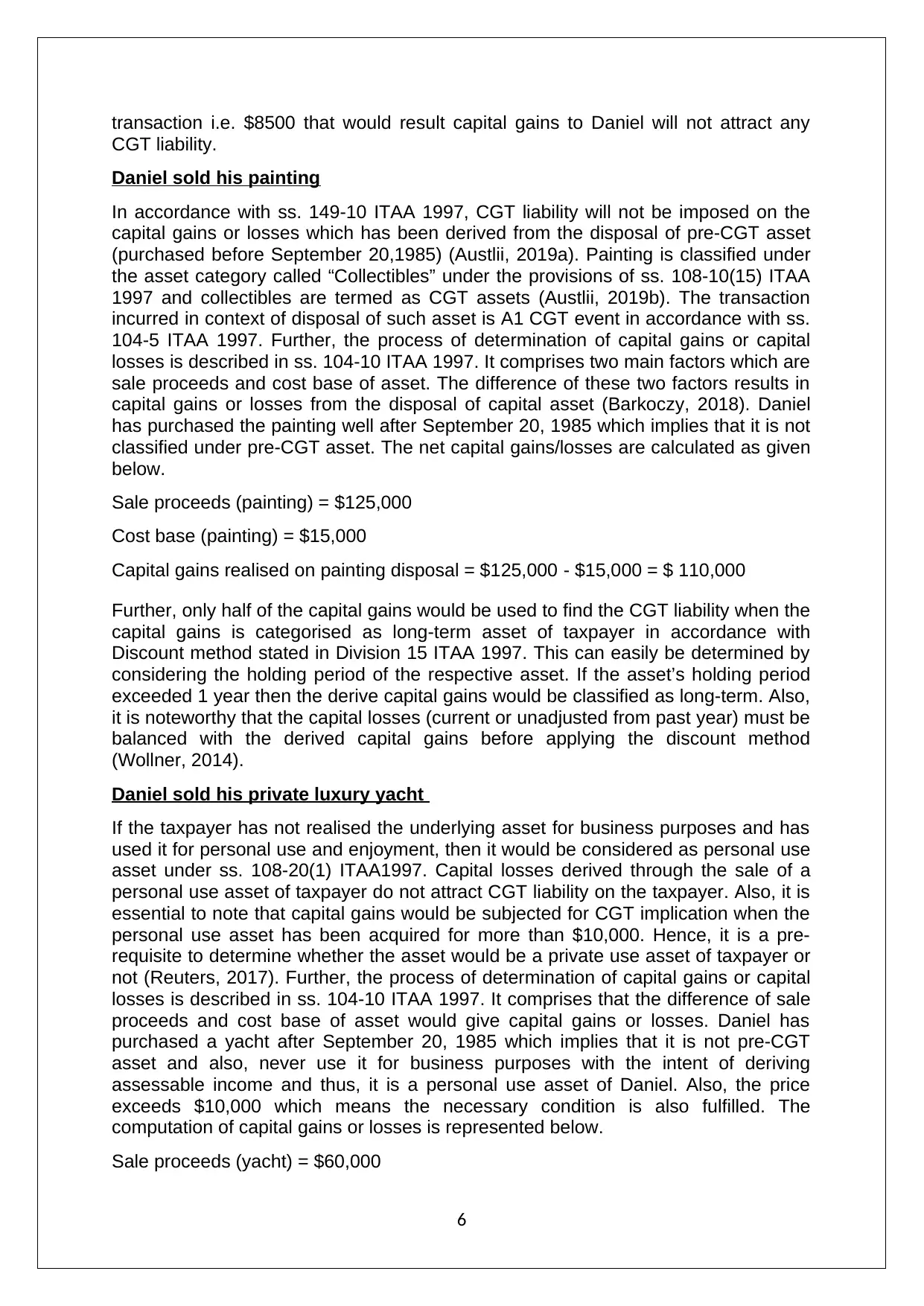

Summary table

Capital gains /losses House No (Exempted)

Capital gains Painting $110,000

Capital losses Yacht -$50,000 (Ignored)

Capital losses Shares -$1000

Capital gains/losses =$110000-$1000 =$109,000 (Capital

Gains)

Daniel also has unadjusted previous years capital losses from the sale of AZJ shares

(FY2018) of tune $10,000 which needs to be adjusted with the current year’s capital

gains.

7

Capital losses realized from Yacht disposal = $60000 - $110000 = -$50,000

Clearly, yacht has resulted capital losses to Daniel from the disposal of personal use

yacht and therefore, the losses of tune -$50,000 will be ignored. As a result of this,

no CGT liability will be validated on Daniel for this transaction of sale.

Daniel sold BHP Shares

Sale of shares also attracts CGT liability on generated capital gains or losses in

terms of A1 CGT event under ss. 104-5 ITAA 1997. Further, the process of

determination of capital gains or capital losses is described in ss. 104-10 ITAA 1997.

It comprises that the difference of sale proceeds and cost base of asset would give

capital gains or losses. Five key factors will be used to determine the cost base of

asset which are described in details in s. 110-25 ITAA 1997 (Deutsch et. al., 2016).

Price paid to acquire asset

Incidental cost paid such as legal fees, stamp duties and so forth (mainly during

selling or buying process)

Capital expenses paid in the process of retaining the title of asset

Capital expenses paid in the work of increasing the net worth of asset

Cost paid so as to retain the ownership of asset such as various taxes and

interest payments

Daniel also sold BHP shares that he has purchased after the commencement of

CGT (September 20, 1985) and therefore, these shares would not be classified

under the pre-CGT asset of Daniel.

Sale proceeds (shares) = $80,000

Cost base (shares) = $75,000 + $250+$750+$5000 = $81,000

Where, $250 and $750 are incidental cost, $75000 basic purchasing cost of shares

and $5,000 as the cost paid to retain the ownership in the form of interest.

Capital losses realised on shares disposal = $80,000 - $81,000 = -$1000

Final computation of capital gains or losses from all the given transaction of

sales of Daniel

Summary table

Capital gains /losses House No (Exempted)

Capital gains Painting $110,000

Capital losses Yacht -$50,000 (Ignored)

Capital losses Shares -$1000

Capital gains/losses =$110000-$1000 =$109,000 (Capital

Gains)

Daniel also has unadjusted previous years capital losses from the sale of AZJ shares

(FY2018) of tune $10,000 which needs to be adjusted with the current year’s capital

gains.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Capital gains/losses = $109000 - $10,000 = $99,000 (Capital Gains)

The capital gains are long-term because the holding period of the asset is more than

12 months which implies that 50% rebate would be used on capital gains (Coleman,

2016).

Taxable capital gains for Daniel in 2018-2019 = (50/100)*99,000 = $ 44,500

(b) If after the relevant computations, net capital gains are derived, then capital gains

tax would be levied on the same. The tax for the same would be same as the

marginal tax rate applicable for Daniel. In this regards, the capital gains

computed can be revised to a lower value through the use of two methods

namely the discount method and cost indexation. Both methods have their own

conditions to be fulfilled so as to applicable. The application of discount method

has been demonstrated for Daniel since all the asset are essentially long term

assets (Barkoczy, 2018).

(c) In case of capital losses, then the same must not be adjusted against any

revenue receipts that the taxpayer receives in the same year or future tax years.

These must necessarily be adjusted against the capital gains realised from the

sale of assets which may be done in the current year or in future years. However,

for certain asset classes, there are special norms. One of these is that any capital

losses related to personal use assets ought to be ignored. Additionally, for

collectible assets, the losses can be offset only against collectible based capital

gains (Nethercott, Richardson and Devos, 2016).

8

The capital gains are long-term because the holding period of the asset is more than

12 months which implies that 50% rebate would be used on capital gains (Coleman,

2016).

Taxable capital gains for Daniel in 2018-2019 = (50/100)*99,000 = $ 44,500

(b) If after the relevant computations, net capital gains are derived, then capital gains

tax would be levied on the same. The tax for the same would be same as the

marginal tax rate applicable for Daniel. In this regards, the capital gains

computed can be revised to a lower value through the use of two methods

namely the discount method and cost indexation. Both methods have their own

conditions to be fulfilled so as to applicable. The application of discount method

has been demonstrated for Daniel since all the asset are essentially long term

assets (Barkoczy, 2018).

(c) In case of capital losses, then the same must not be adjusted against any

revenue receipts that the taxpayer receives in the same year or future tax years.

These must necessarily be adjusted against the capital gains realised from the

sale of assets which may be done in the current year or in future years. However,

for certain asset classes, there are special norms. One of these is that any capital

losses related to personal use assets ought to be ignored. Additionally, for

collectible assets, the losses can be offset only against collectible based capital

gains (Nethercott, Richardson and Devos, 2016).

8

References

ATO (2019) Fringe benefits tax – rates and thresholds, [online] Available at

https://www.ato.gov.au/Rates/FBT/[Assessed May 31, 2019]

Austlii (2019a) , INCOME TAX ASSESSMENT ACT 1997 - SECT 149.10, [online]

available at http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/

s149.10.html[Accessed May 31, 2019]

Austlii (2019b) , INCOME TAX ASSESSMENT ACT 1997 - SECT 105.10, [online]

available at http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/

s105.10.html [Accessed May 31, 2019]

Barkoczy, S. (2018), Foundation of Taxation Law 2018, 9thed.,NorthRyde: CCH

Publications

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters

(Professional) Australia

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2016), Australian

tax handbook 8th ed., Pymont: Thomson Reuters,

Nethercott, L., Richardson, G. and Devos, K. (2016), Australian Taxation Study

Manual 2016, 4th ed., Sydney: Oxford University Press,

Krever, R. (2017) Australian Taxation Law Cases 2017.2nd ed. Brisbane: THOMSON

LAWBOOK Company,

Reuters, T. (2017) Australian Tax Legislation (2017).4th ed. Sydney.THOMSON

REUTERS,

Woellner, R (2014), Australian taxation law 2014, 7th ed., North Ryde: CCH Australia

9

ATO (2019) Fringe benefits tax – rates and thresholds, [online] Available at

https://www.ato.gov.au/Rates/FBT/[Assessed May 31, 2019]

Austlii (2019a) , INCOME TAX ASSESSMENT ACT 1997 - SECT 149.10, [online]

available at http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/

s149.10.html[Accessed May 31, 2019]

Austlii (2019b) , INCOME TAX ASSESSMENT ACT 1997 - SECT 105.10, [online]

available at http://classic.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/

s105.10.html [Accessed May 31, 2019]

Barkoczy, S. (2018), Foundation of Taxation Law 2018, 9thed.,NorthRyde: CCH

Publications

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters

(Professional) Australia

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2016), Australian

tax handbook 8th ed., Pymont: Thomson Reuters,

Nethercott, L., Richardson, G. and Devos, K. (2016), Australian Taxation Study

Manual 2016, 4th ed., Sydney: Oxford University Press,

Krever, R. (2017) Australian Taxation Law Cases 2017.2nd ed. Brisbane: THOMSON

LAWBOOK Company,

Reuters, T. (2017) Australian Tax Legislation (2017).4th ed. Sydney.THOMSON

REUTERS,

Woellner, R (2014), Australian taxation law 2014, 7th ed., North Ryde: CCH Australia

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.