Taxable Amount and Capital Gain Tax Exemption

VerifiedAdded on 2019/12/03

|20

|4991

|140

Report

AI Summary

The provided content discusses the UK taxation system, focusing on individual and business taxes. It explains the working of HMRC, a tax collection agency in the UK, and the roles and responsibilities of tax practitioners. The report also provides examples of calculating tax liabilities for individuals and businesses, including capital gains tax. Additionally, it references various academic articles and online sources to support its findings.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAXATION

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION................................................................................................................................4

TASK 1 DUTIES AND RESPONSIBILITIES OF TAX PRACTITIONER.......................................4

1.1 UK tax environment..............................................................................................................4

1.2 Role and responsibilities of the tax practitioner....................................................................6

1.3 Tax obligations of tax payers or their agents and the implications of non- compliance.......7

TASK 2: PERSONAL TAX LIABILITIES - INDIVIDUALS &PARTNERSHIPS............................7

2.1 Calculation of relevant income, expenses and allowances...................................................7

2.2 Calculation of taxable amount and tax payable for employed and self-employed, payment

date..............................................................................................................................................9

Taxable income and tax payable of individual............................................................................9

2.3 Documentation and tax.......................................................................................................10

returns.......................................................................................................................................10

TASK 3: CORPORATION TAX LIABILITIES................................................................................11

3.1 Calculation of chargeable profits........................................................................................11

3.2 Calculation of tax liabilities and due payment dates...........................................................12

3.3 Explanation of adjustment of income tax deductions.........................................................13

TASK 4: CAPITAL GAINS TAX FOR INDIVIDUALS AND BUSINESSES.................................14

4.1 Chargeable assets................................................................................................................14

4.2 Calculation of capital gains and losses................................................................................14

4.3 Calculation of capital gains tax payable..............................................................................15

CONCLUSION..................................................................................................................................16

REFERENCES...................................................................................................................................17

2

INTRODUCTION................................................................................................................................4

TASK 1 DUTIES AND RESPONSIBILITIES OF TAX PRACTITIONER.......................................4

1.1 UK tax environment..............................................................................................................4

1.2 Role and responsibilities of the tax practitioner....................................................................6

1.3 Tax obligations of tax payers or their agents and the implications of non- compliance.......7

TASK 2: PERSONAL TAX LIABILITIES - INDIVIDUALS &PARTNERSHIPS............................7

2.1 Calculation of relevant income, expenses and allowances...................................................7

2.2 Calculation of taxable amount and tax payable for employed and self-employed, payment

date..............................................................................................................................................9

Taxable income and tax payable of individual............................................................................9

2.3 Documentation and tax.......................................................................................................10

returns.......................................................................................................................................10

TASK 3: CORPORATION TAX LIABILITIES................................................................................11

3.1 Calculation of chargeable profits........................................................................................11

3.2 Calculation of tax liabilities and due payment dates...........................................................12

3.3 Explanation of adjustment of income tax deductions.........................................................13

TASK 4: CAPITAL GAINS TAX FOR INDIVIDUALS AND BUSINESSES.................................14

4.1 Chargeable assets................................................................................................................14

4.2 Calculation of capital gains and losses................................................................................14

4.3 Calculation of capital gains tax payable..............................................................................15

CONCLUSION..................................................................................................................................16

REFERENCES...................................................................................................................................17

2

INTRODUCTION

The UK government aims to make its taxation system as one of the simpler and transparent

to suit with the environment under globalization and modern business practices. It is for the purpose

of making the system more of an asset rather than a liability on companies and individuals. The

following report is prepared to gain understanding on the tax system in UK with focus on tax

collection methods, types of taxes, obligations and implications of non compliance. The report also

includes calculation of tax liabilities for employed and self employed individuals along with

payment dates. Furthermore, incomes, expenses and tax liabilities as well as deductions for

companies are also calculated.

TASK 1 DUTIES AND RESPONSIBILITIES OF TAX PRACTITIONER

1.1 UK tax environment

Purpose and types of taxes

The purpose of tax collection is for three important reasons - to raise revenue, to promote

redistribution of income and wealth as well as to study the production and consumption of goods in

context with negative externalities (Abdo, 2010). Taxes are the sources of revenue for the

government which are used for the economic development of the country. It is a compulsory

contribution levied by the national government on individual, firms, properties. The tax is collected

through direct and direct methods. Direct taxes are paid on income earned while indirect taxes are

levied on the expenditure. The tax payment system in UK is divided into four major types

description of which is as follows-

Income tax

Income tax is chargeable on the income or profits earned by the individual through

commercial or employment activities. General rate of income tax is 20% but it is proportionate in

nature. It is because, 40% tax is payable on income more than 31785. However, individuals are

entitled to take benefit of personal allowance to reduce tax obligation.

Corporation tax

Corporation tax is payable by companies having separate legal entity on the chargeable

profits earned by them through business activities. In provisions of corporation tax association,

unincorporated entities, clubs and societies are covered.

Capital gain tax

This tax is payable on transfer of movable or immovable property by one party to the

another. In order to avoid double taxation, amount of profit is considered for tax instead of revenue

3

The UK government aims to make its taxation system as one of the simpler and transparent

to suit with the environment under globalization and modern business practices. It is for the purpose

of making the system more of an asset rather than a liability on companies and individuals. The

following report is prepared to gain understanding on the tax system in UK with focus on tax

collection methods, types of taxes, obligations and implications of non compliance. The report also

includes calculation of tax liabilities for employed and self employed individuals along with

payment dates. Furthermore, incomes, expenses and tax liabilities as well as deductions for

companies are also calculated.

TASK 1 DUTIES AND RESPONSIBILITIES OF TAX PRACTITIONER

1.1 UK tax environment

Purpose and types of taxes

The purpose of tax collection is for three important reasons - to raise revenue, to promote

redistribution of income and wealth as well as to study the production and consumption of goods in

context with negative externalities (Abdo, 2010). Taxes are the sources of revenue for the

government which are used for the economic development of the country. It is a compulsory

contribution levied by the national government on individual, firms, properties. The tax is collected

through direct and direct methods. Direct taxes are paid on income earned while indirect taxes are

levied on the expenditure. The tax payment system in UK is divided into four major types

description of which is as follows-

Income tax

Income tax is chargeable on the income or profits earned by the individual through

commercial or employment activities. General rate of income tax is 20% but it is proportionate in

nature. It is because, 40% tax is payable on income more than 31785. However, individuals are

entitled to take benefit of personal allowance to reduce tax obligation.

Corporation tax

Corporation tax is payable by companies having separate legal entity on the chargeable

profits earned by them through business activities. In provisions of corporation tax association,

unincorporated entities, clubs and societies are covered.

Capital gain tax

This tax is payable on transfer of movable or immovable property by one party to the

another. In order to avoid double taxation, amount of profit is considered for tax instead of revenue

3

earned by them.

Inheritance tax

This tax is payable when property or other monetary benefit is received by the individual on

the account of death on any person. However, this tax liability is supported by various exemptions

and tax brackets.

Different methods of tax collection

Description of different methods of tax collection is enumerated below- PAYE Tax - individual receiving pension through employers to other sources entitled for tax

payment. This tax is automatically deducted from the pay.

Self Assessment tax return - Individual need to pay taxes if they are -

self employed as a business partner, director, trustee

rental income

taxable foreign income

receiving other untaxed income

Tax legislation

UK tax legislation is set by the government and HMRC through Acts of Parliament and

Statutory Instruments. Her Majesty's Revenue and Customs (HMRC) is responsible for tax

collection in UK. The non ministerial unit of government of UK is also responsible for payment of

state support and administration of regulations. The department is authorised to collect all forms of

tax payment and to ensure the safe flow of money through collection, compliance and enforcement

of laws and regulations. It was established with the purpose to ensure availability of money for

public services in UK and to help individuals and families in terms of financial support (Leicester,

2006). HMRC works on six main objectives which are as follows -

To maximise the revenue for public services and for increasing the credits and payment to

individuals and businesses.

To maximise the return to tax payers against their payments.

To improve the customer experience and business environment in UK through cost

reduction.

To improve the performance of IT service.

To improve relation with stakeholders.

To improve the capacity and build a healthy business environment for HMRC (Parry and

Small, 2005).

4

Inheritance tax

This tax is payable when property or other monetary benefit is received by the individual on

the account of death on any person. However, this tax liability is supported by various exemptions

and tax brackets.

Different methods of tax collection

Description of different methods of tax collection is enumerated below- PAYE Tax - individual receiving pension through employers to other sources entitled for tax

payment. This tax is automatically deducted from the pay.

Self Assessment tax return - Individual need to pay taxes if they are -

self employed as a business partner, director, trustee

rental income

taxable foreign income

receiving other untaxed income

Tax legislation

UK tax legislation is set by the government and HMRC through Acts of Parliament and

Statutory Instruments. Her Majesty's Revenue and Customs (HMRC) is responsible for tax

collection in UK. The non ministerial unit of government of UK is also responsible for payment of

state support and administration of regulations. The department is authorised to collect all forms of

tax payment and to ensure the safe flow of money through collection, compliance and enforcement

of laws and regulations. It was established with the purpose to ensure availability of money for

public services in UK and to help individuals and families in terms of financial support (Leicester,

2006). HMRC works on six main objectives which are as follows -

To maximise the revenue for public services and for increasing the credits and payment to

individuals and businesses.

To maximise the return to tax payers against their payments.

To improve the customer experience and business environment in UK through cost

reduction.

To improve the performance of IT service.

To improve relation with stakeholders.

To improve the capacity and build a healthy business environment for HMRC (Parry and

Small, 2005).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1.2 Role and responsibilities of the tax practitioner

The tax practitioner plays an important role in maintaining the tax compliance. Description

of their roles of responsibilities is as follows- Dealing with inland revenue- The tax practitioner should comply with all the requirements

set by HMRC. For this aspect, they deal with the inland revenue on the behalf of their

clients. Advisory services- The roles and responsibilities of tax payers includes advising on regular

tax payment as per the rules and availing benefits in the form of tax relief and deductions.

It is because; the tax practitioner is acting as an agent for the tax payer. They guide tax

payers on tax saving methods in order to increase their income and to reduce liability

(Devereux, Griffith and Klemm, 2004). Computation of tax obligation of tax payer- The practitioner must act in professional

manner to maintain the due diligence of rules and accuracy of tax liabilities for their clients

(Finney, 2010). By considering their financial information, tax practitioners are required to

compute tax obligation. Tax payers are required to maintain and follow ethics as well as

duties while calculating tax liabilities for their clients.

Confidentiality- Tax practitioners must not use information of tax payer for unethical

aspect or to earn unjust profit.

He is not the one to be held liable for late submission or late payments but he has to record and

store all the paper filled.

1.3 Tax obligations of tax payers or their agents and the implications of non- compliance

Obligation of tax payer

The individuals and businesses are responsible to ensure that they prepare and maintain

records of financial transactions to calculate the tax liability. They must act as a responsible, honest

and knowledgeable citizen to fulfil liabilities due on their part. The obligations of tax payers range

from maintaining proper records and calculation of correct tax liabilities while also availing the

benefits of tax deductions, allowance and reliefs (Abdo, 2010). It is also their liability to inform the

department or officials if any of their known individual or businesses comes under the tax liability

but is not paying the due return.

Obligation of tax agent

To be honest with their tax payments.

To maintain the appropriate records.

To pay regular tax as they due upon.

5

The tax practitioner plays an important role in maintaining the tax compliance. Description

of their roles of responsibilities is as follows- Dealing with inland revenue- The tax practitioner should comply with all the requirements

set by HMRC. For this aspect, they deal with the inland revenue on the behalf of their

clients. Advisory services- The roles and responsibilities of tax payers includes advising on regular

tax payment as per the rules and availing benefits in the form of tax relief and deductions.

It is because; the tax practitioner is acting as an agent for the tax payer. They guide tax

payers on tax saving methods in order to increase their income and to reduce liability

(Devereux, Griffith and Klemm, 2004). Computation of tax obligation of tax payer- The practitioner must act in professional

manner to maintain the due diligence of rules and accuracy of tax liabilities for their clients

(Finney, 2010). By considering their financial information, tax practitioners are required to

compute tax obligation. Tax payers are required to maintain and follow ethics as well as

duties while calculating tax liabilities for their clients.

Confidentiality- Tax practitioners must not use information of tax payer for unethical

aspect or to earn unjust profit.

He is not the one to be held liable for late submission or late payments but he has to record and

store all the paper filled.

1.3 Tax obligations of tax payers or their agents and the implications of non- compliance

Obligation of tax payer

The individuals and businesses are responsible to ensure that they prepare and maintain

records of financial transactions to calculate the tax liability. They must act as a responsible, honest

and knowledgeable citizen to fulfil liabilities due on their part. The obligations of tax payers range

from maintaining proper records and calculation of correct tax liabilities while also availing the

benefits of tax deductions, allowance and reliefs (Abdo, 2010). It is also their liability to inform the

department or officials if any of their known individual or businesses comes under the tax liability

but is not paying the due return.

Obligation of tax agent

To be honest with their tax payments.

To maintain the appropriate records.

To pay regular tax as they due upon.

5

To be cooperative with government departments and official for requirement of any

documents and records (Bond, Devereux and Klemm, 2005).

Implications of non-compliance

The implication for non compliance of tax payment and for the fulfilment of tax liabilities

results in the form of strict actions by HMRC. The government department take enforcement action

for the non payment of tax payment (Feng and et.al., 2010). The action can be taken in any of the

following manner -

Due tax can be collected from the earnings or pension.

Take the help of debt collection agencies.

Take the ownership of asset owned by the tax payer.

Take legal action.

Declare the individual or business as solvent.

A tax year runs from 6th of April to 5th of April next year. There are due dates as 31 October or 31

January only on line. If the tax return is filled late than £100 fine is to be paid if no later than 3

months. You are liable to pay more if tax return is sent at a later date or if you pay your tax bill late.

TASK 2: PERSONAL TAX LIABILITIES - INDIVIDUALS &PARTNERSHIPS

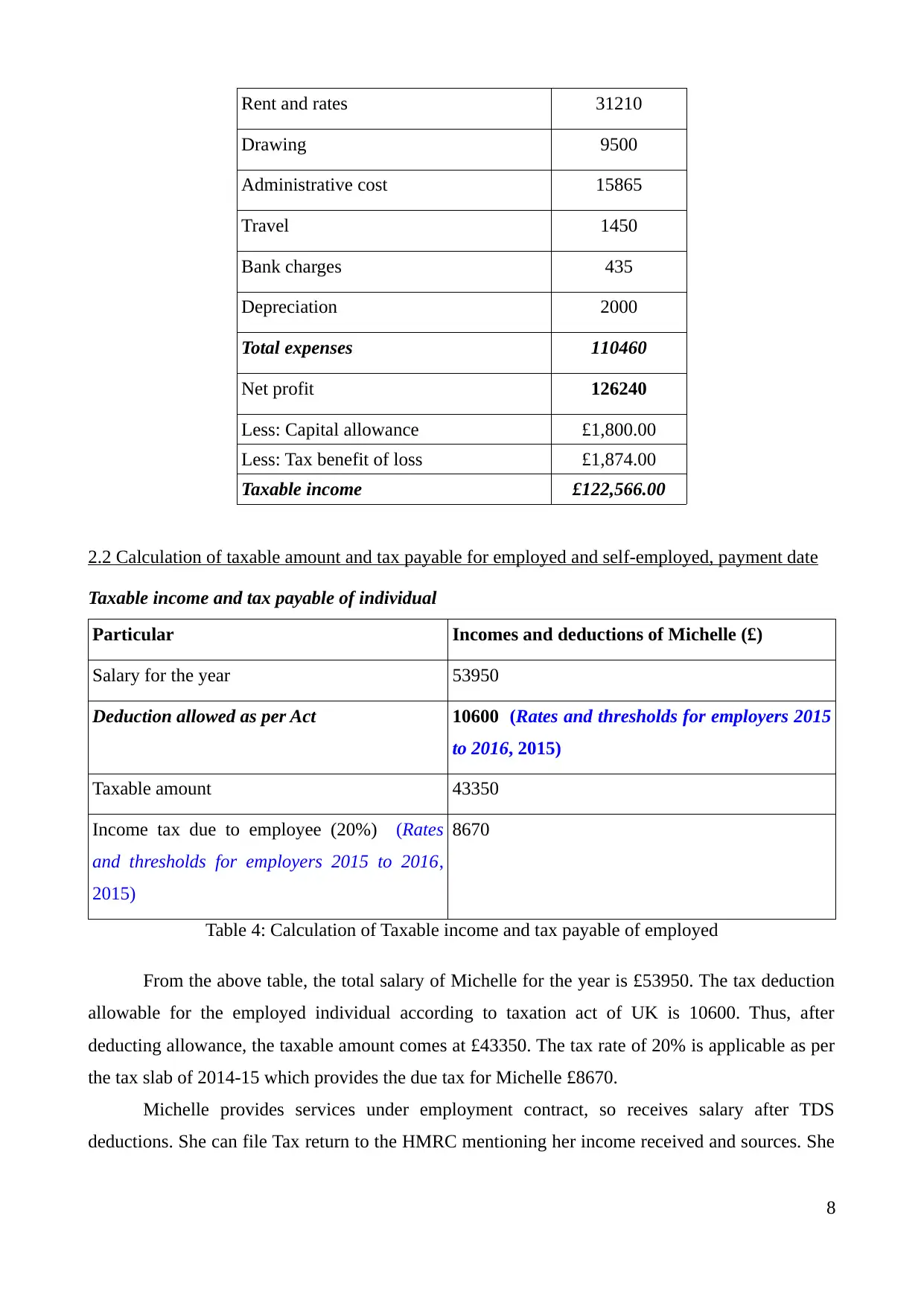

2.1 Calculation of relevant income, expenses and allowances

Case example for employed

Ms. Michelle is working full time for a consultancy. She received compensation on weekly

hour basis as 41.50 at £25 per hour.

In this case, the only income source for Michelle is income from employment in two

categories - salary and allowances. The full amount of salary is taxable under the individual tax

bracket. But the allowances are not taxable and thus deducted from the total amount.

Calculation of relevant income and allowances for individuals

Particulars Calculations Amount (£)

Income of Ms. Michelle = 41.50*25*52 53950

Table 1: Calculation of income and allowances for employed

Case example for self - employed

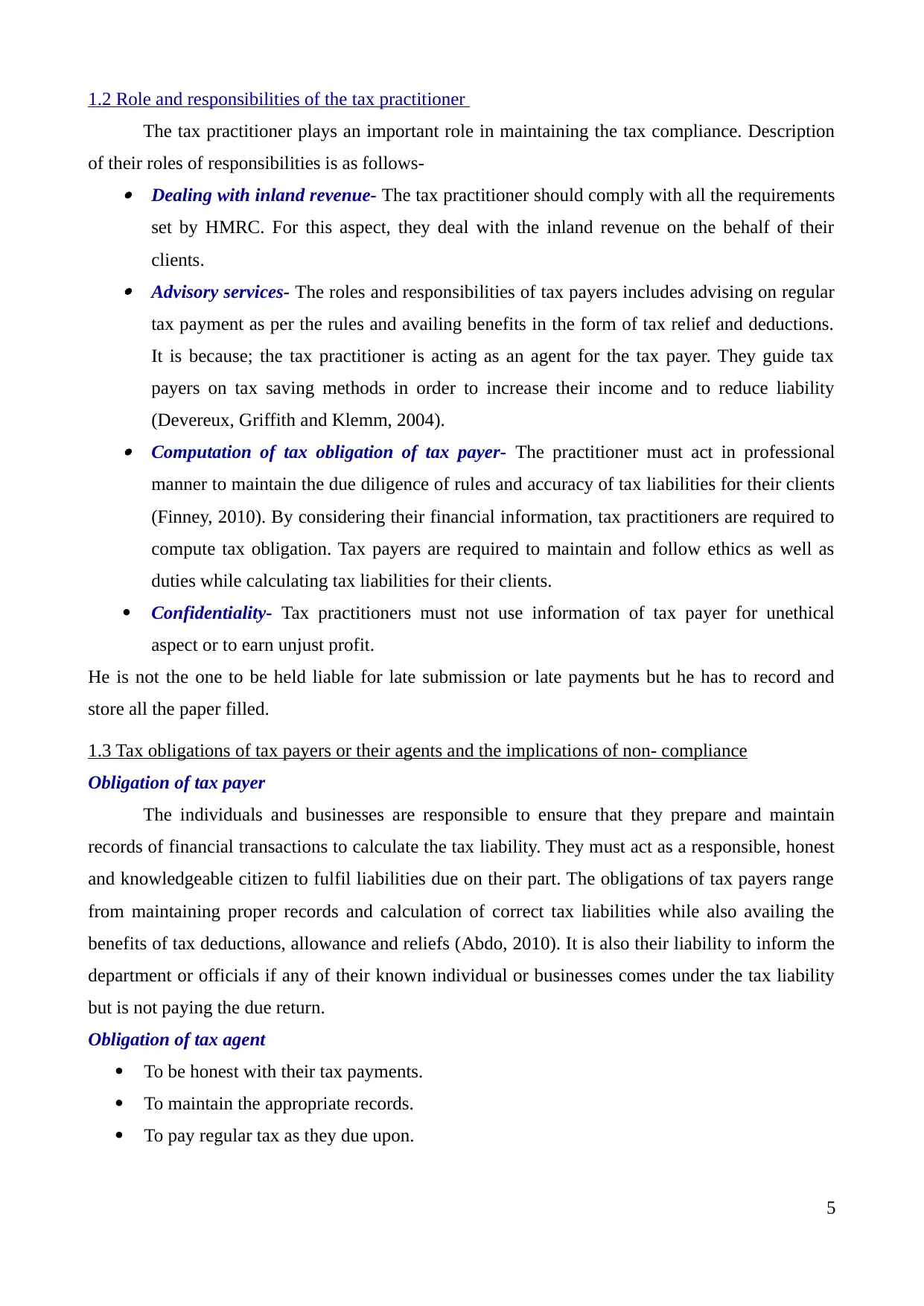

Mr. John is self employed and running two retail shops. The financial transactions for shop 1

and 2 for the year ended 2014 are as follows -

Particulars Amount (£)

6

documents and records (Bond, Devereux and Klemm, 2005).

Implications of non-compliance

The implication for non compliance of tax payment and for the fulfilment of tax liabilities

results in the form of strict actions by HMRC. The government department take enforcement action

for the non payment of tax payment (Feng and et.al., 2010). The action can be taken in any of the

following manner -

Due tax can be collected from the earnings or pension.

Take the help of debt collection agencies.

Take the ownership of asset owned by the tax payer.

Take legal action.

Declare the individual or business as solvent.

A tax year runs from 6th of April to 5th of April next year. There are due dates as 31 October or 31

January only on line. If the tax return is filled late than £100 fine is to be paid if no later than 3

months. You are liable to pay more if tax return is sent at a later date or if you pay your tax bill late.

TASK 2: PERSONAL TAX LIABILITIES - INDIVIDUALS &PARTNERSHIPS

2.1 Calculation of relevant income, expenses and allowances

Case example for employed

Ms. Michelle is working full time for a consultancy. She received compensation on weekly

hour basis as 41.50 at £25 per hour.

In this case, the only income source for Michelle is income from employment in two

categories - salary and allowances. The full amount of salary is taxable under the individual tax

bracket. But the allowances are not taxable and thus deducted from the total amount.

Calculation of relevant income and allowances for individuals

Particulars Calculations Amount (£)

Income of Ms. Michelle = 41.50*25*52 53950

Table 1: Calculation of income and allowances for employed

Case example for self - employed

Mr. John is self employed and running two retail shops. The financial transactions for shop 1

and 2 for the year ended 2014 are as follows -

Particulars Amount (£)

6

SHOP 1

Sales 759850

Cost of Sales 523150

Wages 50000

Rent and rates 31210

Drawing 9500

Administrative cost 15865

Travel 1450

Charitable donation 157

Bank charges 435

Depreciation 2000

Capital Allowance 1800

SHOP 2

Tax Losses 1874

Table 2: Financial information of self employed

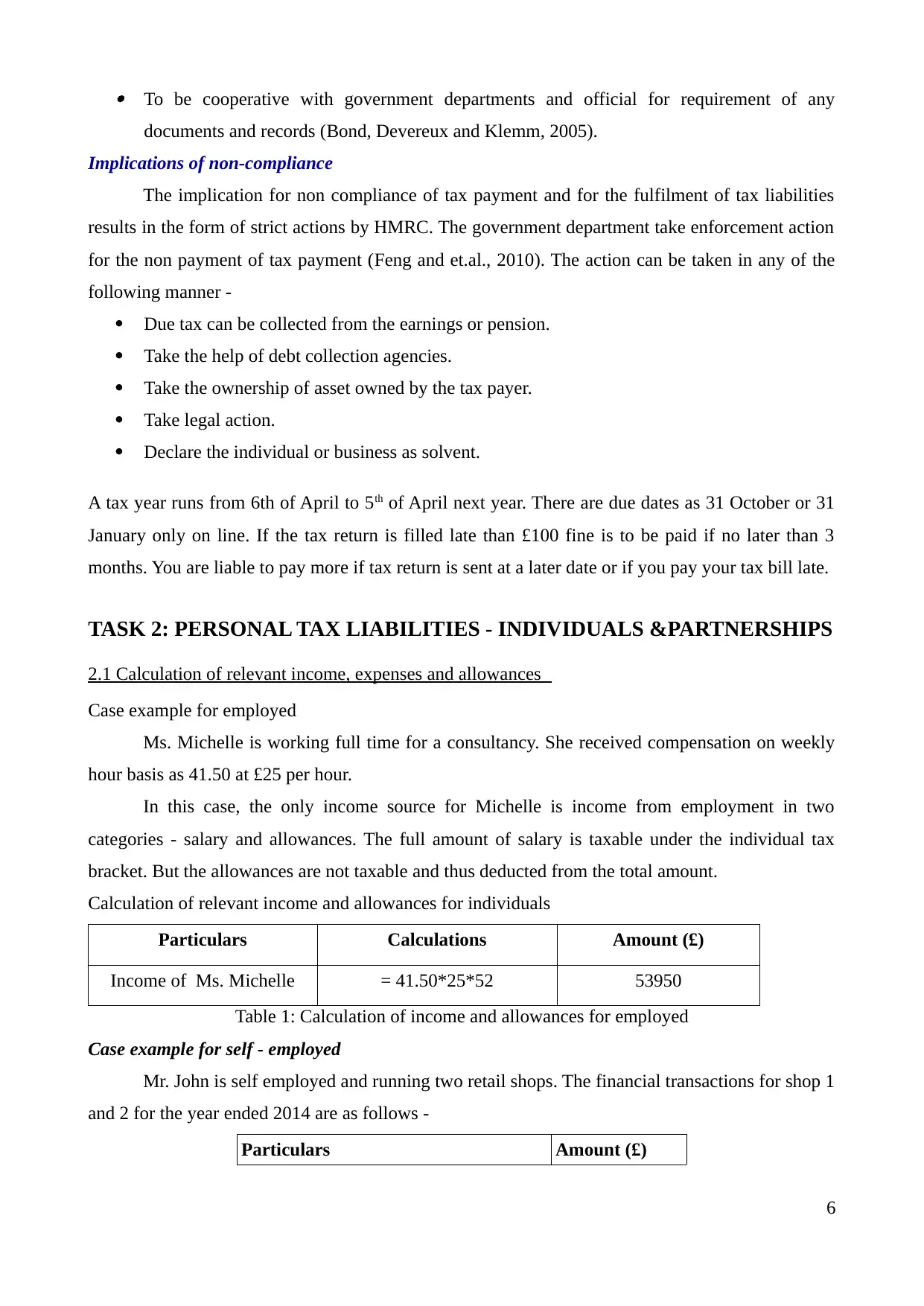

Calculation of relevant income, expenses and allowances for self-employed

Table 3: Calculation of income, expenses and allowances for self-employed

Particulars Amount (£)

Incomes

Sales 759850

Less: Cost of Sales 523150

Operating profit 236700

Expenses

Wages 50000

7

Sales 759850

Cost of Sales 523150

Wages 50000

Rent and rates 31210

Drawing 9500

Administrative cost 15865

Travel 1450

Charitable donation 157

Bank charges 435

Depreciation 2000

Capital Allowance 1800

SHOP 2

Tax Losses 1874

Table 2: Financial information of self employed

Calculation of relevant income, expenses and allowances for self-employed

Table 3: Calculation of income, expenses and allowances for self-employed

Particulars Amount (£)

Incomes

Sales 759850

Less: Cost of Sales 523150

Operating profit 236700

Expenses

Wages 50000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Rent and rates 31210

Drawing 9500

Administrative cost 15865

Travel 1450

Bank charges 435

Depreciation 2000

Total expenses 110460

Net profit 126240

Less: Capital allowance £1,800.00

Less: Tax benefit of loss £1,874.00

Taxable income £122,566.00

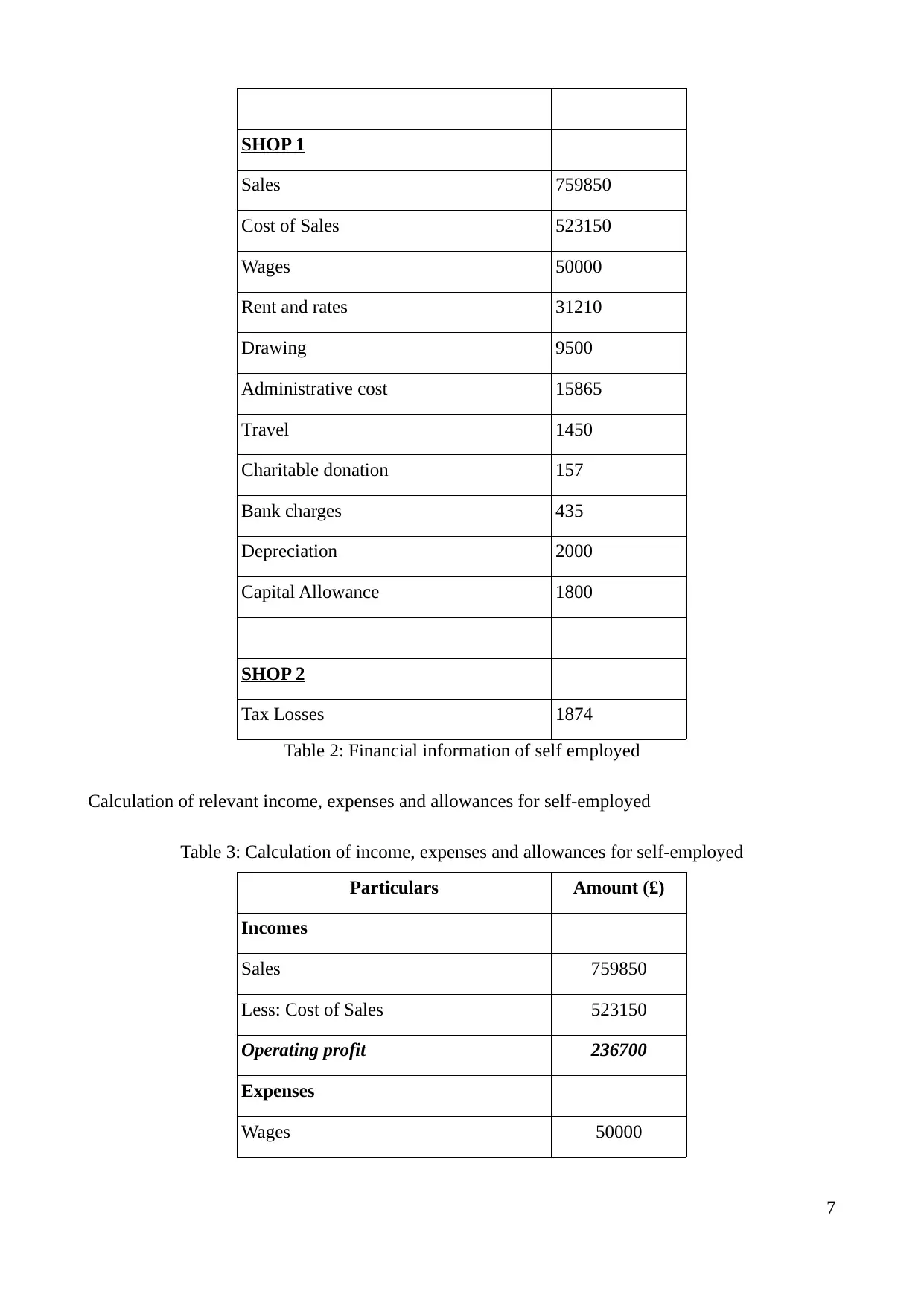

2.2 Calculation of taxable amount and tax payable for employed and self-employed, payment date

Taxable income and tax payable of individual

Particular Incomes and deductions of Michelle (£)

Salary for the year 53950

Deduction allowed as per Act 10600 (Rates and thresholds for employers 2015

to 2016, 2015)

Taxable amount 43350

Income tax due to employee (20%) (Rates

and thresholds for employers 2015 to 2016,

2015)

8670

Table 4: Calculation of Taxable income and tax payable of employed

From the above table, the total salary of Michelle for the year is £53950. The tax deduction

allowable for the employed individual according to taxation act of UK is 10600. Thus, after

deducting allowance, the taxable amount comes at £43350. The tax rate of 20% is applicable as per

the tax slab of 2014-15 which provides the due tax for Michelle £8670.

Michelle provides services under employment contract, so receives salary after TDS

deductions. She can file Tax return to the HMRC mentioning her income received and sources. She

8

Drawing 9500

Administrative cost 15865

Travel 1450

Bank charges 435

Depreciation 2000

Total expenses 110460

Net profit 126240

Less: Capital allowance £1,800.00

Less: Tax benefit of loss £1,874.00

Taxable income £122,566.00

2.2 Calculation of taxable amount and tax payable for employed and self-employed, payment date

Taxable income and tax payable of individual

Particular Incomes and deductions of Michelle (£)

Salary for the year 53950

Deduction allowed as per Act 10600 (Rates and thresholds for employers 2015

to 2016, 2015)

Taxable amount 43350

Income tax due to employee (20%) (Rates

and thresholds for employers 2015 to 2016,

2015)

8670

Table 4: Calculation of Taxable income and tax payable of employed

From the above table, the total salary of Michelle for the year is £53950. The tax deduction

allowable for the employed individual according to taxation act of UK is 10600. Thus, after

deducting allowance, the taxable amount comes at £43350. The tax rate of 20% is applicable as per

the tax slab of 2014-15 which provides the due tax for Michelle £8670.

Michelle provides services under employment contract, so receives salary after TDS

deductions. She can file Tax return to the HMRC mentioning her income received and sources. She

8

has no other income sources. So if TDS is deducted at a higher amount, the difference will be paid

to her.

In case of Mr John who is elf employed, income earned and sources are required to be

mentioned in the tax payment to HMRC. Tax assessment will be conducted to assess the taxable

amount which is required to be paid by John.

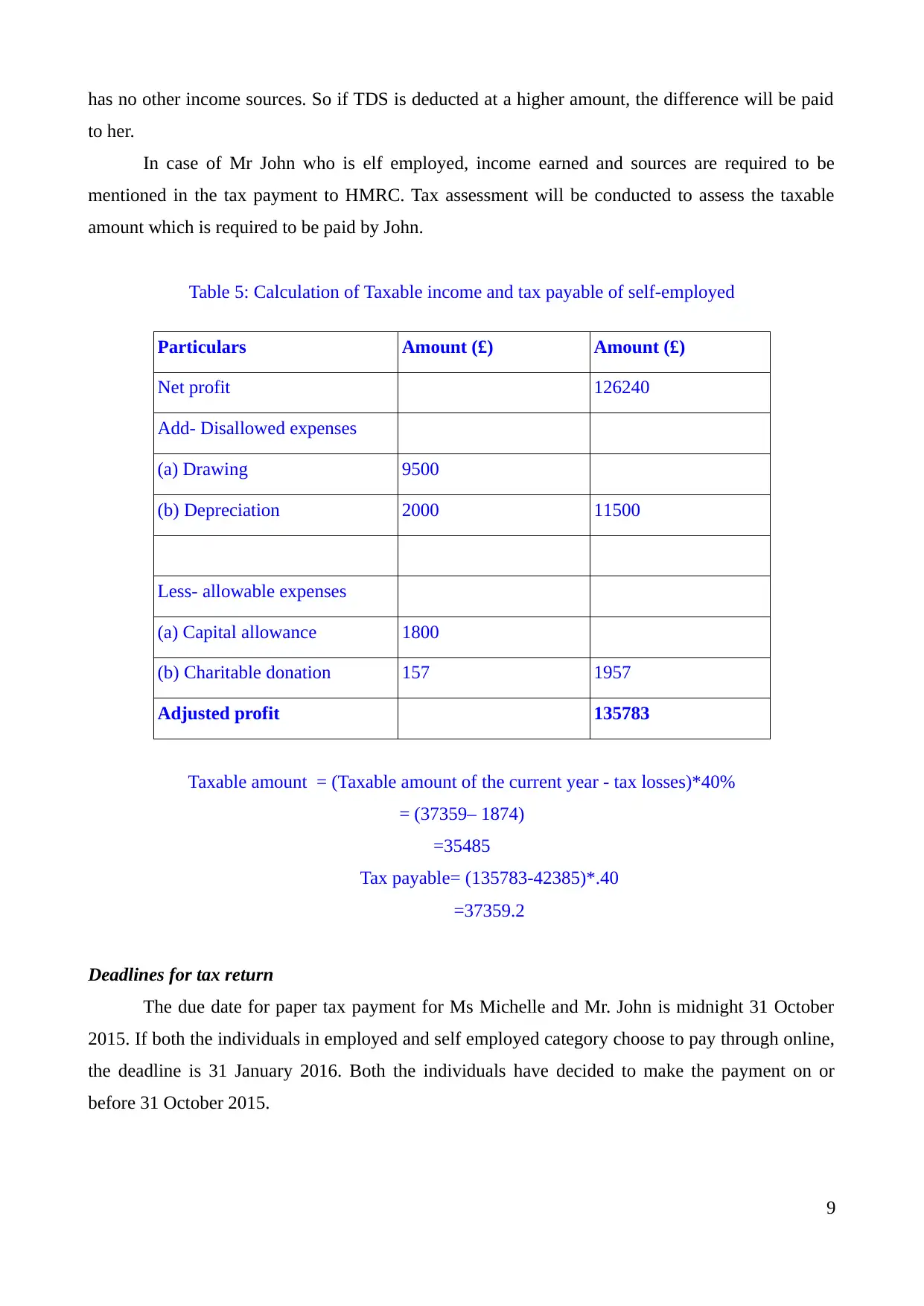

Table 5: Calculation of Taxable income and tax payable of self-employed

Particulars Amount (£) Amount (£)

Net profit 126240

Add- Disallowed expenses

(a) Drawing 9500

(b) Depreciation 2000 11500

Less- allowable expenses

(a) Capital allowance 1800

(b) Charitable donation 157 1957

Adjusted profit 135783

Taxable amount = (Taxable amount of the current year - tax losses)*40%

= (37359– 1874)

=35485

Tax payable= (135783-42385)*.40

=37359.2

Deadlines for tax return

The due date for paper tax payment for Ms Michelle and Mr. John is midnight 31 October

2015. If both the individuals in employed and self employed category choose to pay through online,

the deadline is 31 January 2016. Both the individuals have decided to make the payment on or

before 31 October 2015.

9

to her.

In case of Mr John who is elf employed, income earned and sources are required to be

mentioned in the tax payment to HMRC. Tax assessment will be conducted to assess the taxable

amount which is required to be paid by John.

Table 5: Calculation of Taxable income and tax payable of self-employed

Particulars Amount (£) Amount (£)

Net profit 126240

Add- Disallowed expenses

(a) Drawing 9500

(b) Depreciation 2000 11500

Less- allowable expenses

(a) Capital allowance 1800

(b) Charitable donation 157 1957

Adjusted profit 135783

Taxable amount = (Taxable amount of the current year - tax losses)*40%

= (37359– 1874)

=35485

Tax payable= (135783-42385)*.40

=37359.2

Deadlines for tax return

The due date for paper tax payment for Ms Michelle and Mr. John is midnight 31 October

2015. If both the individuals in employed and self employed category choose to pay through online,

the deadline is 31 January 2016. Both the individuals have decided to make the payment on or

before 31 October 2015.

9

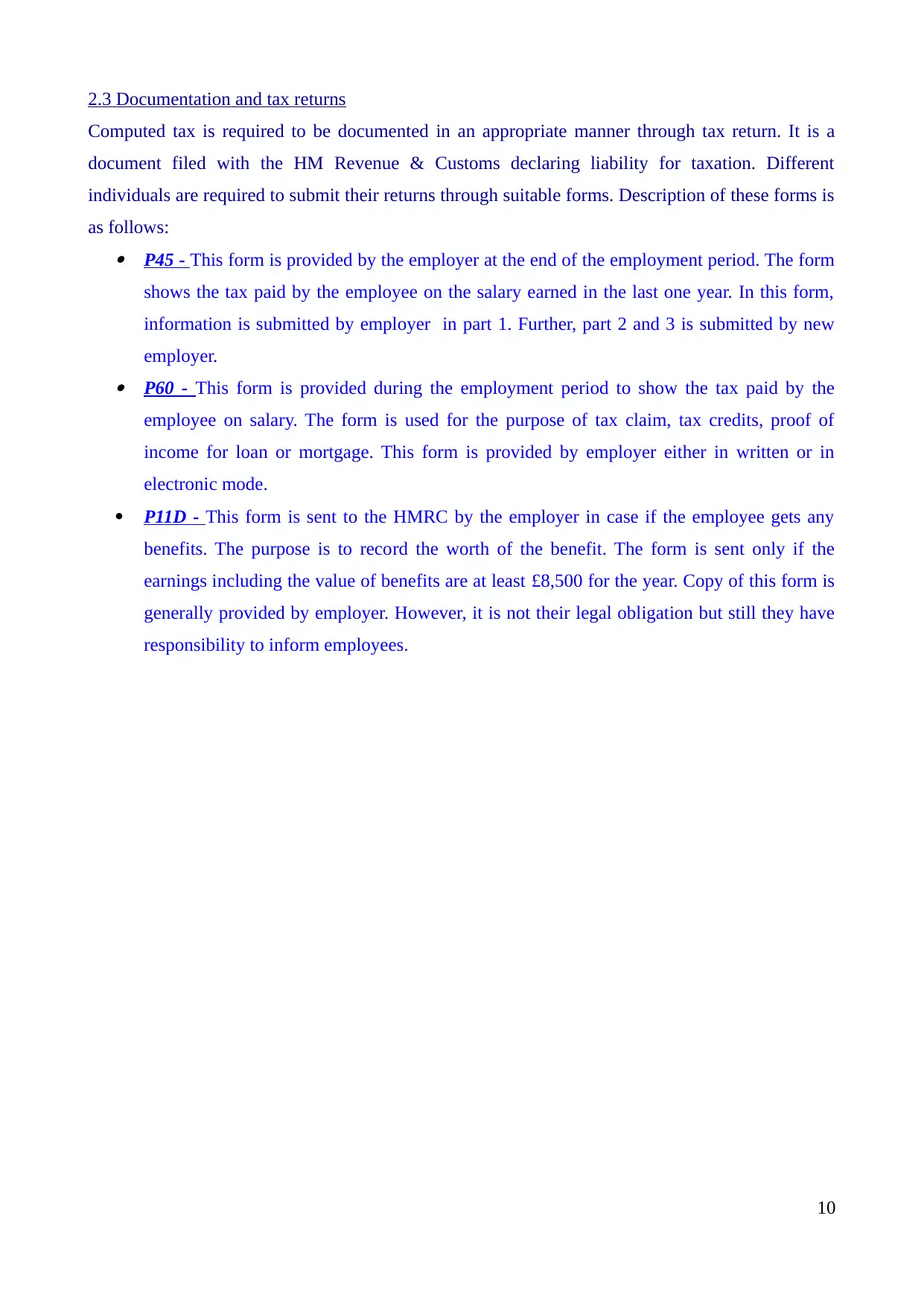

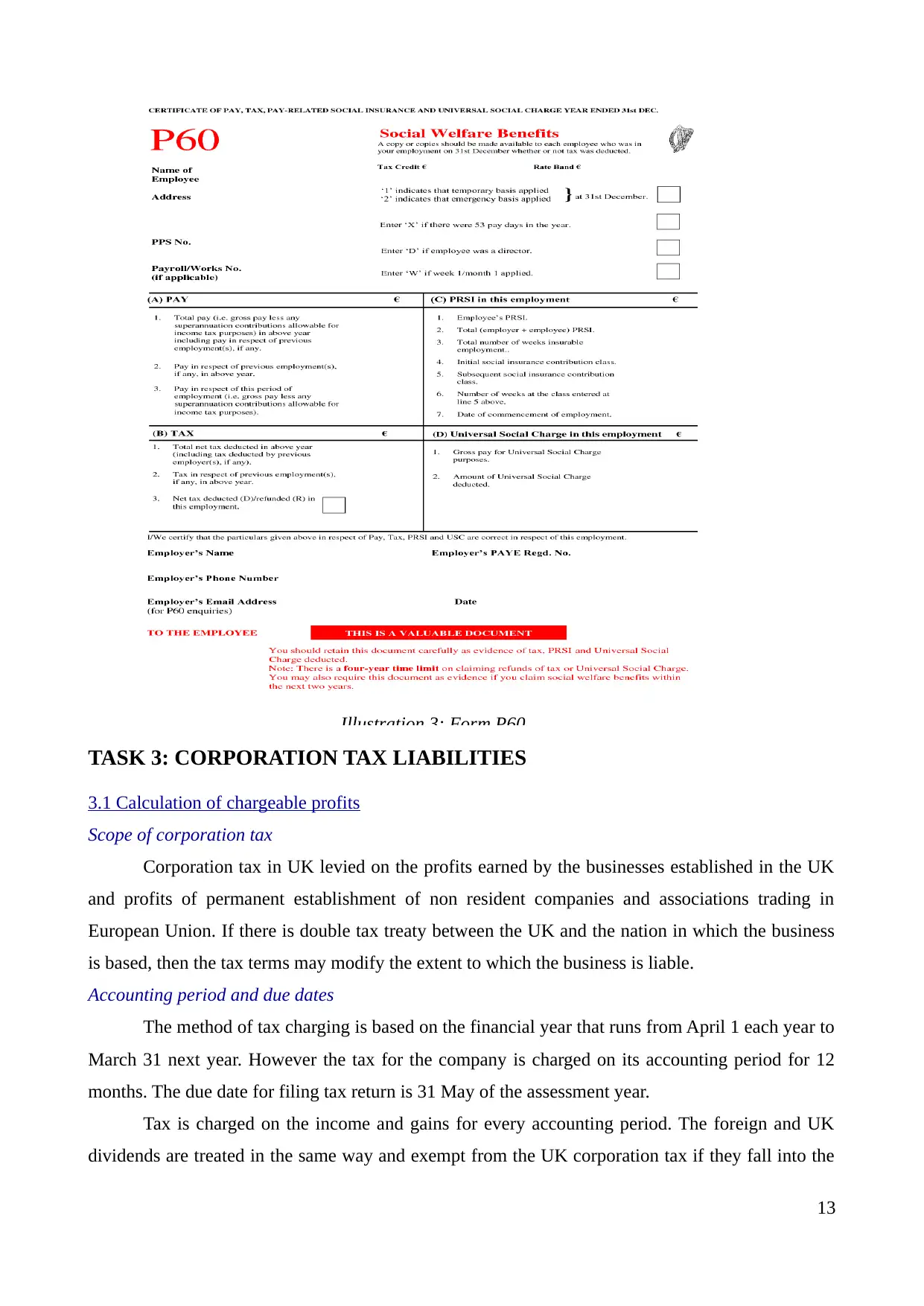

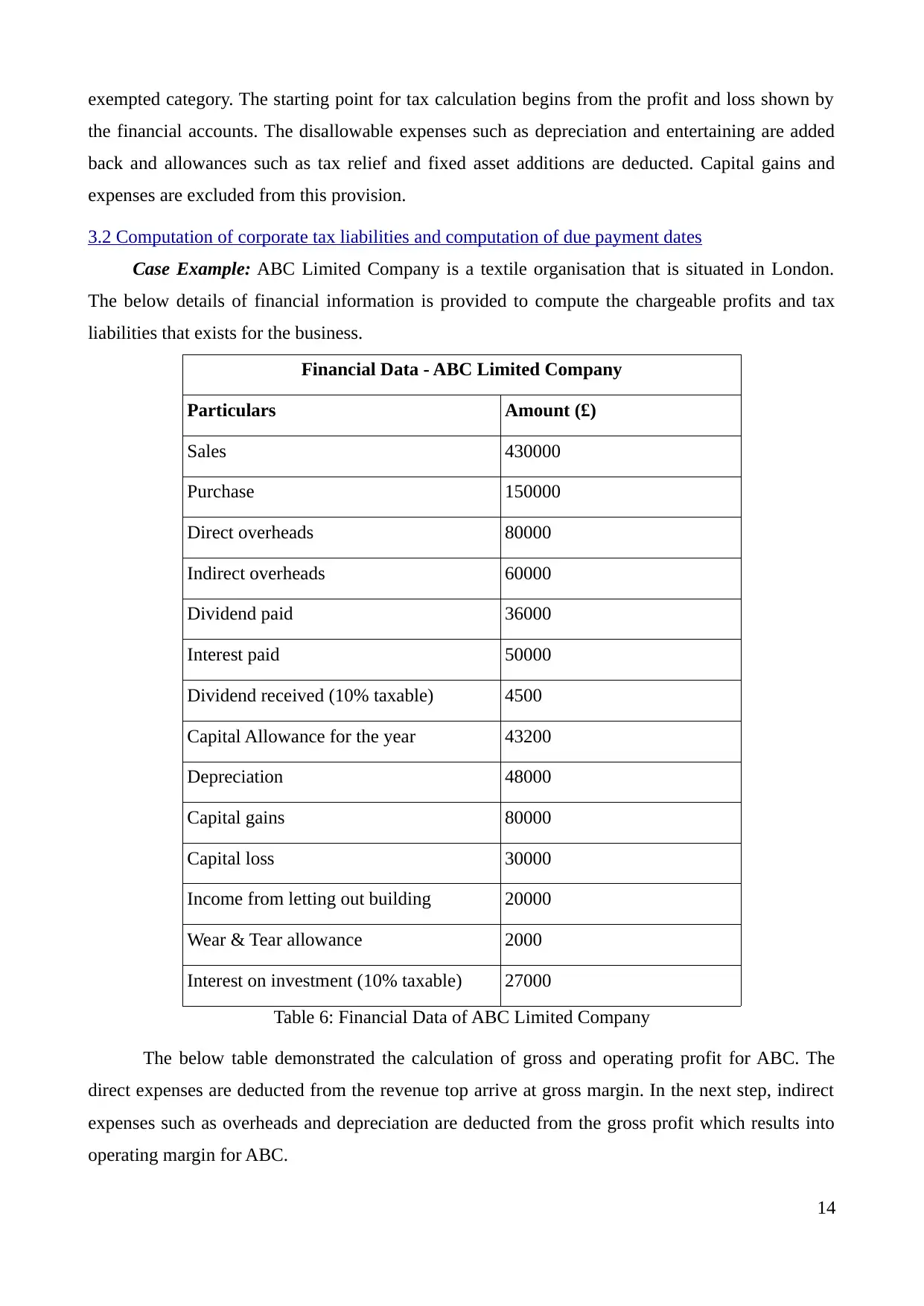

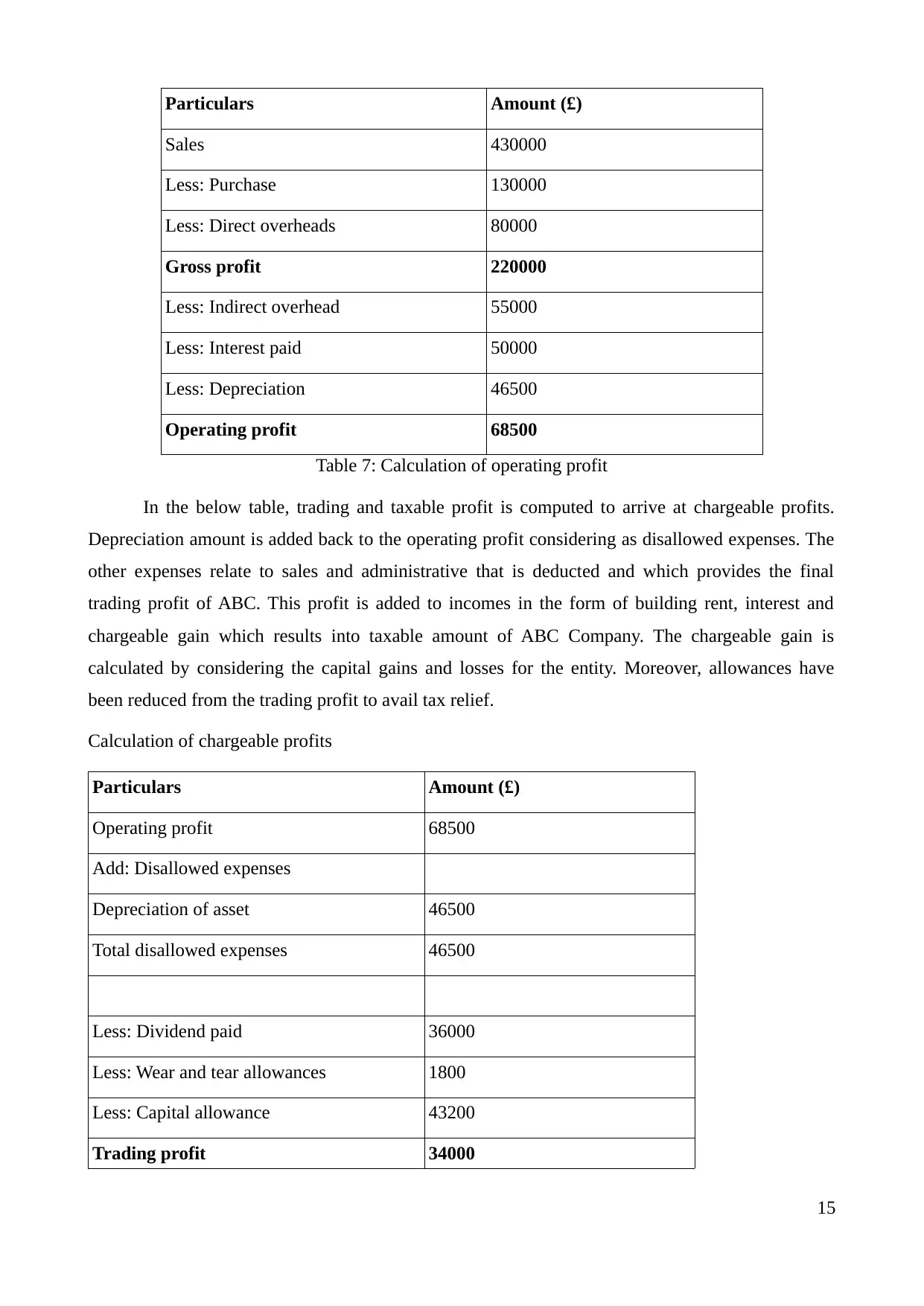

2.3 Documentation and tax returns

Computed tax is required to be documented in an appropriate manner through tax return. It is a

document filed with the HM Revenue & Customs declaring liability for taxation. Different

individuals are required to submit their returns through suitable forms. Description of these forms is

as follows: P45 - This form is provided by the employer at the end of the employment period. The form

shows the tax paid by the employee on the salary earned in the last one year. In this form,

information is submitted by employer in part 1. Further, part 2 and 3 is submitted by new

employer. P60 - This form is provided during the employment period to show the tax paid by the

employee on salary. The form is used for the purpose of tax claim, tax credits, proof of

income for loan or mortgage. This form is provided by employer either in written or in

electronic mode.

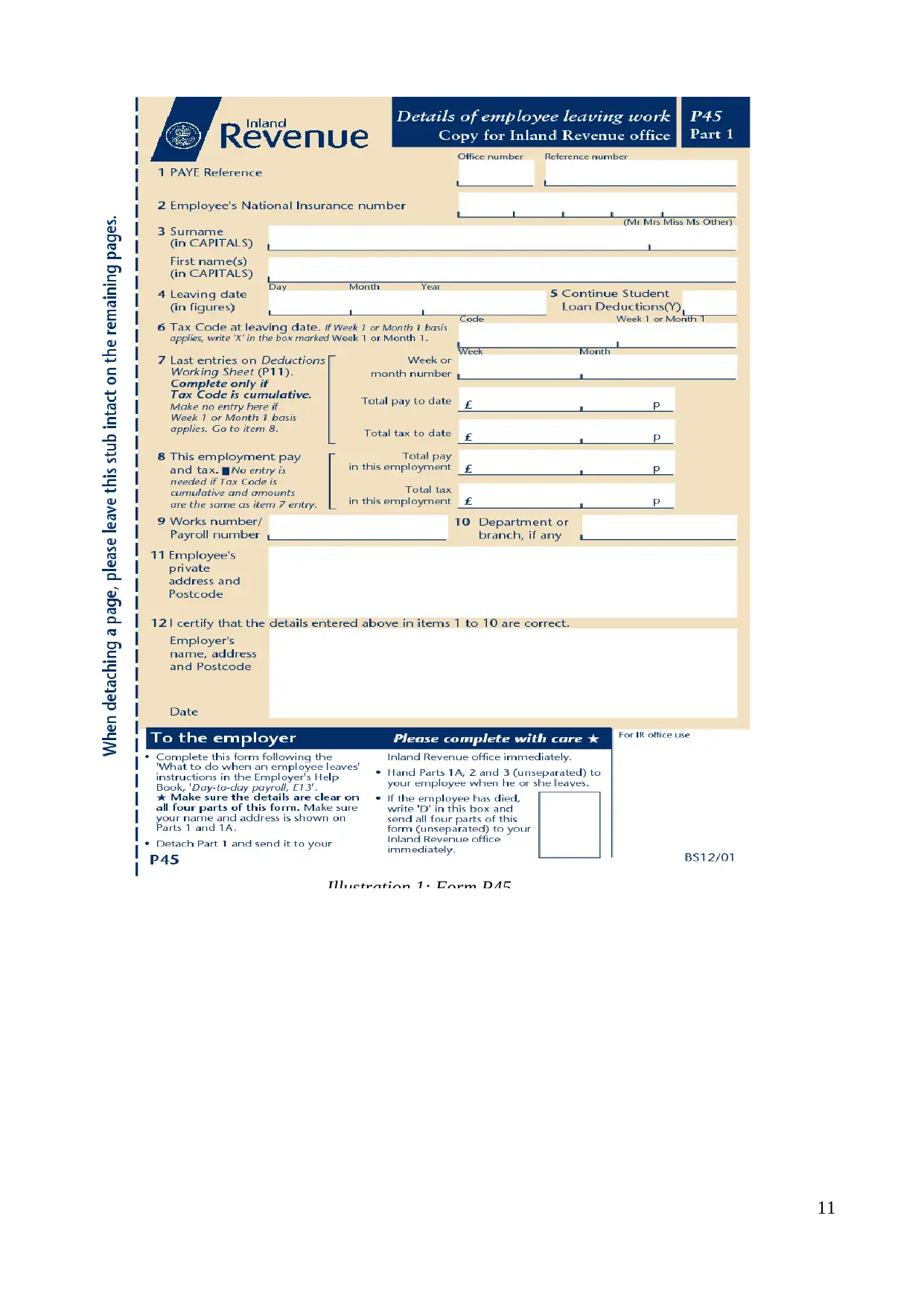

P11D - This form is sent to the HMRC by the employer in case if the employee gets any

benefits. The purpose is to record the worth of the benefit. The form is sent only if the

earnings including the value of benefits are at least £8,500 for the year. Copy of this form is

generally provided by employer. However, it is not their legal obligation but still they have

responsibility to inform employees.

10

Computed tax is required to be documented in an appropriate manner through tax return. It is a

document filed with the HM Revenue & Customs declaring liability for taxation. Different

individuals are required to submit their returns through suitable forms. Description of these forms is

as follows: P45 - This form is provided by the employer at the end of the employment period. The form

shows the tax paid by the employee on the salary earned in the last one year. In this form,

information is submitted by employer in part 1. Further, part 2 and 3 is submitted by new

employer. P60 - This form is provided during the employment period to show the tax paid by the

employee on salary. The form is used for the purpose of tax claim, tax credits, proof of

income for loan or mortgage. This form is provided by employer either in written or in

electronic mode.

P11D - This form is sent to the HMRC by the employer in case if the employee gets any

benefits. The purpose is to record the worth of the benefit. The form is sent only if the

earnings including the value of benefits are at least £8,500 for the year. Copy of this form is

generally provided by employer. However, it is not their legal obligation but still they have

responsibility to inform employees.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Illustration 1: Form P45

11

11

Illustration 2: Form 11D

12

12

Illustration 3: Form P60

TASK 3: CORPORATION TAX LIABILITIES

3.1 Calculation of chargeable profits

Scope of corporation tax

Corporation tax in UK levied on the profits earned by the businesses established in the UK

and profits of permanent establishment of non resident companies and associations trading in

European Union. If there is double tax treaty between the UK and the nation in which the business

is based, then the tax terms may modify the extent to which the business is liable.

Accounting period and due dates

The method of tax charging is based on the financial year that runs from April 1 each year to

March 31 next year. However the tax for the company is charged on its accounting period for 12

months. The due date for filing tax return is 31 May of the assessment year.

Tax is charged on the income and gains for every accounting period. The foreign and UK

dividends are treated in the same way and exempt from the UK corporation tax if they fall into the

13

TASK 3: CORPORATION TAX LIABILITIES

3.1 Calculation of chargeable profits

Scope of corporation tax

Corporation tax in UK levied on the profits earned by the businesses established in the UK

and profits of permanent establishment of non resident companies and associations trading in

European Union. If there is double tax treaty between the UK and the nation in which the business

is based, then the tax terms may modify the extent to which the business is liable.

Accounting period and due dates

The method of tax charging is based on the financial year that runs from April 1 each year to

March 31 next year. However the tax for the company is charged on its accounting period for 12

months. The due date for filing tax return is 31 May of the assessment year.

Tax is charged on the income and gains for every accounting period. The foreign and UK

dividends are treated in the same way and exempt from the UK corporation tax if they fall into the

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

exempted category. The starting point for tax calculation begins from the profit and loss shown by

the financial accounts. The disallowable expenses such as depreciation and entertaining are added

back and allowances such as tax relief and fixed asset additions are deducted. Capital gains and

expenses are excluded from this provision.

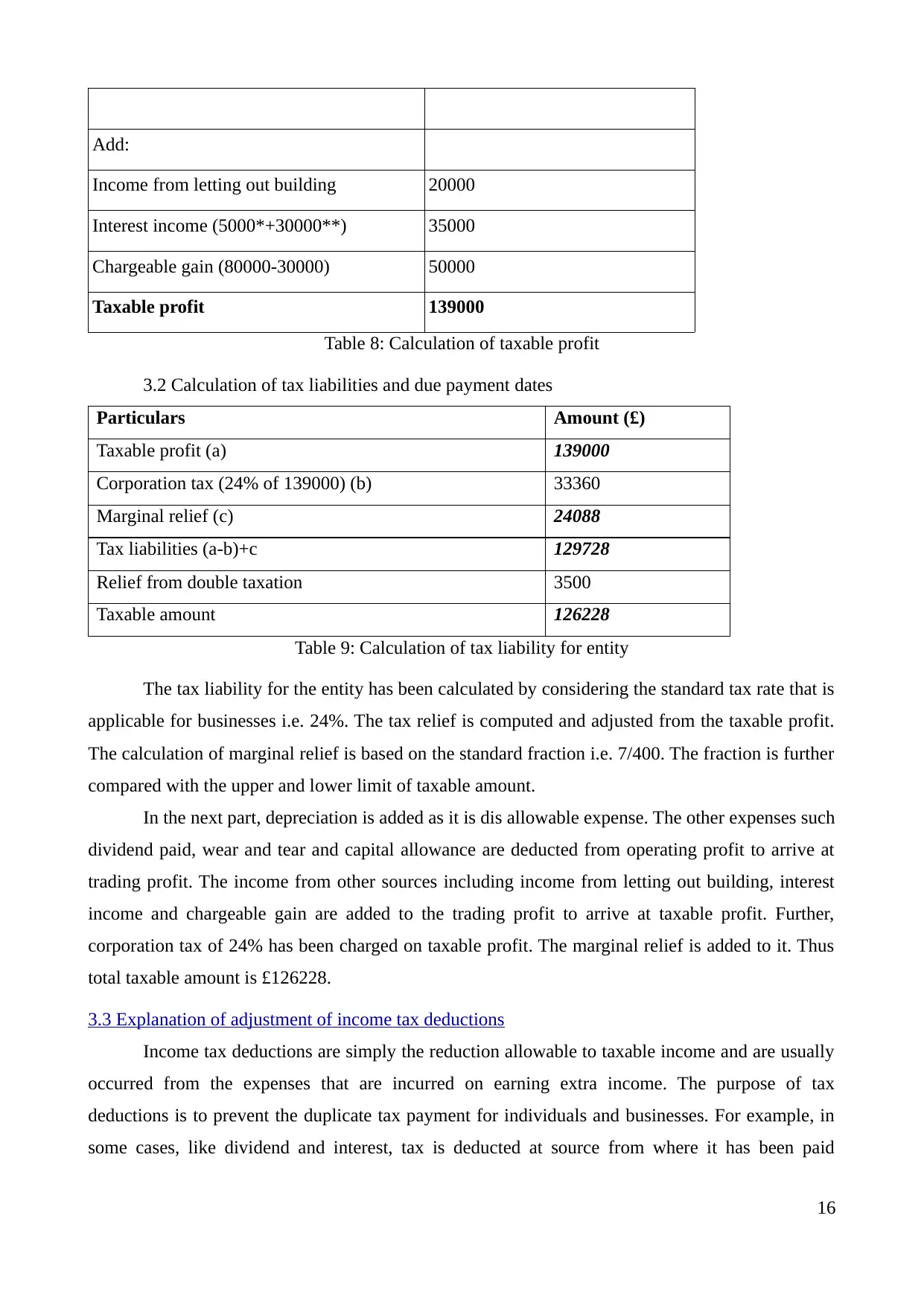

3.2 Computation of corporate tax liabilities and computation of due payment dates

Case Example: ABC Limited Company is a textile organisation that is situated in London.

The below details of financial information is provided to compute the chargeable profits and tax

liabilities that exists for the business.

Financial Data - ABC Limited Company

Particulars Amount (£)

Sales 430000

Purchase 150000

Direct overheads 80000

Indirect overheads 60000

Dividend paid 36000

Interest paid 50000

Dividend received (10% taxable) 4500

Capital Allowance for the year 43200

Depreciation 48000

Capital gains 80000

Capital loss 30000

Income from letting out building 20000

Wear & Tear allowance 2000

Interest on investment (10% taxable) 27000

Table 6: Financial Data of ABC Limited Company

The below table demonstrated the calculation of gross and operating profit for ABC. The

direct expenses are deducted from the revenue top arrive at gross margin. In the next step, indirect

expenses such as overheads and depreciation are deducted from the gross profit which results into

operating margin for ABC.

14

the financial accounts. The disallowable expenses such as depreciation and entertaining are added

back and allowances such as tax relief and fixed asset additions are deducted. Capital gains and

expenses are excluded from this provision.

3.2 Computation of corporate tax liabilities and computation of due payment dates

Case Example: ABC Limited Company is a textile organisation that is situated in London.

The below details of financial information is provided to compute the chargeable profits and tax

liabilities that exists for the business.

Financial Data - ABC Limited Company

Particulars Amount (£)

Sales 430000

Purchase 150000

Direct overheads 80000

Indirect overheads 60000

Dividend paid 36000

Interest paid 50000

Dividend received (10% taxable) 4500

Capital Allowance for the year 43200

Depreciation 48000

Capital gains 80000

Capital loss 30000

Income from letting out building 20000

Wear & Tear allowance 2000

Interest on investment (10% taxable) 27000

Table 6: Financial Data of ABC Limited Company

The below table demonstrated the calculation of gross and operating profit for ABC. The

direct expenses are deducted from the revenue top arrive at gross margin. In the next step, indirect

expenses such as overheads and depreciation are deducted from the gross profit which results into

operating margin for ABC.

14

Particulars Amount (£)

Sales 430000

Less: Purchase 130000

Less: Direct overheads 80000

Gross profit 220000

Less: Indirect overhead 55000

Less: Interest paid 50000

Less: Depreciation 46500

Operating profit 68500

Table 7: Calculation of operating profit

In the below table, trading and taxable profit is computed to arrive at chargeable profits.

Depreciation amount is added back to the operating profit considering as disallowed expenses. The

other expenses relate to sales and administrative that is deducted and which provides the final

trading profit of ABC. This profit is added to incomes in the form of building rent, interest and

chargeable gain which results into taxable amount of ABC Company. The chargeable gain is

calculated by considering the capital gains and losses for the entity. Moreover, allowances have

been reduced from the trading profit to avail tax relief.

Calculation of chargeable profits

Particulars Amount (£)

Operating profit 68500

Add: Disallowed expenses

Depreciation of asset 46500

Total disallowed expenses 46500

Less: Dividend paid 36000

Less: Wear and tear allowances 1800

Less: Capital allowance 43200

Trading profit 34000

15

Sales 430000

Less: Purchase 130000

Less: Direct overheads 80000

Gross profit 220000

Less: Indirect overhead 55000

Less: Interest paid 50000

Less: Depreciation 46500

Operating profit 68500

Table 7: Calculation of operating profit

In the below table, trading and taxable profit is computed to arrive at chargeable profits.

Depreciation amount is added back to the operating profit considering as disallowed expenses. The

other expenses relate to sales and administrative that is deducted and which provides the final

trading profit of ABC. This profit is added to incomes in the form of building rent, interest and

chargeable gain which results into taxable amount of ABC Company. The chargeable gain is

calculated by considering the capital gains and losses for the entity. Moreover, allowances have

been reduced from the trading profit to avail tax relief.

Calculation of chargeable profits

Particulars Amount (£)

Operating profit 68500

Add: Disallowed expenses

Depreciation of asset 46500

Total disallowed expenses 46500

Less: Dividend paid 36000

Less: Wear and tear allowances 1800

Less: Capital allowance 43200

Trading profit 34000

15

Add:

Income from letting out building 20000

Interest income (5000*+30000**) 35000

Chargeable gain (80000-30000) 50000

Taxable profit 139000

Table 8: Calculation of taxable profit

3.2 Calculation of tax liabilities and due payment dates

Particulars Amount (£)

Taxable profit (a) 139000

Corporation tax (24% of 139000) (b) 33360

Marginal relief (c) 24088

Tax liabilities (a-b)+c 129728

Relief from double taxation 3500

Taxable amount 126228

Table 9: Calculation of tax liability for entity

The tax liability for the entity has been calculated by considering the standard tax rate that is

applicable for businesses i.e. 24%. The tax relief is computed and adjusted from the taxable profit.

The calculation of marginal relief is based on the standard fraction i.e. 7/400. The fraction is further

compared with the upper and lower limit of taxable amount.

In the next part, depreciation is added as it is dis allowable expense. The other expenses such

dividend paid, wear and tear and capital allowance are deducted from operating profit to arrive at

trading profit. The income from other sources including income from letting out building, interest

income and chargeable gain are added to the trading profit to arrive at taxable profit. Further,

corporation tax of 24% has been charged on taxable profit. The marginal relief is added to it. Thus

total taxable amount is £126228.

3.3 Explanation of adjustment of income tax deductions

Income tax deductions are simply the reduction allowable to taxable income and are usually

occurred from the expenses that are incurred on earning extra income. The purpose of tax

deductions is to prevent the duplicate tax payment for individuals and businesses. For example, in

some cases, like dividend and interest, tax is deducted at source from where it has been paid

16

Income from letting out building 20000

Interest income (5000*+30000**) 35000

Chargeable gain (80000-30000) 50000

Taxable profit 139000

Table 8: Calculation of taxable profit

3.2 Calculation of tax liabilities and due payment dates

Particulars Amount (£)

Taxable profit (a) 139000

Corporation tax (24% of 139000) (b) 33360

Marginal relief (c) 24088

Tax liabilities (a-b)+c 129728

Relief from double taxation 3500

Taxable amount 126228

Table 9: Calculation of tax liability for entity

The tax liability for the entity has been calculated by considering the standard tax rate that is

applicable for businesses i.e. 24%. The tax relief is computed and adjusted from the taxable profit.

The calculation of marginal relief is based on the standard fraction i.e. 7/400. The fraction is further

compared with the upper and lower limit of taxable amount.

In the next part, depreciation is added as it is dis allowable expense. The other expenses such

dividend paid, wear and tear and capital allowance are deducted from operating profit to arrive at

trading profit. The income from other sources including income from letting out building, interest

income and chargeable gain are added to the trading profit to arrive at taxable profit. Further,

corporation tax of 24% has been charged on taxable profit. The marginal relief is added to it. Thus

total taxable amount is £126228.

3.3 Explanation of adjustment of income tax deductions

Income tax deductions are simply the reduction allowable to taxable income and are usually

occurred from the expenses that are incurred on earning extra income. The purpose of tax

deductions is to prevent the duplicate tax payment for individuals and businesses. For example, in

some cases, like dividend and interest, tax is deducted at source from where it has been paid

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(Devereux, Griffith and Klemm, 2004).

Tax deductions are available for pension plan payment by employees.

Tax relief is allowed for UK charities.

Tax deductions at source in UK for non residents are

Dividend - 0%

Royalties - 20%

Interest - 20% The due date for filing tax return is 31 May of the assessment year.

Marginal relief

=Fraction x (U – A) x N / A

In this formula:

U = Upper profit limit

A = “Profits”

N = Total Profits

Lower profit limit = Lower profit limit * fraction for period = £300,000 x 12/12 = £450000

Upper profit limit = Lower profit limit * fraction for period = £1,500,000 x 12/12 = £2,250,000

Fraction = Standard fraction =7/400

Marginal relief = ((7/400)*(1500000-300000)*(39000/34000))

=24088

Total profits = Total profits + the grossed-up dividends received

=34000 + (4500*100/90)

=34000+5000

=39000

TASK 4: CAPITAL GAINS TAX FOR INDIVIDUALS AND BUSINESSES

4.1 Chargeable assets

Chargeable persons

Individuals and businesses pay capital gain tax on the disposal of -

Personal possessions that amount to equal or more than £6,000.

Home that has been left and is used for the business purpose. If house is very big, the sale

processed is taxable.

Shares that are not held in ISA, NISA or PEP. Business assets

17

Tax deductions are available for pension plan payment by employees.

Tax relief is allowed for UK charities.

Tax deductions at source in UK for non residents are

Dividend - 0%

Royalties - 20%

Interest - 20% The due date for filing tax return is 31 May of the assessment year.

Marginal relief

=Fraction x (U – A) x N / A

In this formula:

U = Upper profit limit

A = “Profits”

N = Total Profits

Lower profit limit = Lower profit limit * fraction for period = £300,000 x 12/12 = £450000

Upper profit limit = Lower profit limit * fraction for period = £1,500,000 x 12/12 = £2,250,000

Fraction = Standard fraction =7/400

Marginal relief = ((7/400)*(1500000-300000)*(39000/34000))

=24088

Total profits = Total profits + the grossed-up dividends received

=34000 + (4500*100/90)

=34000+5000

=39000

TASK 4: CAPITAL GAINS TAX FOR INDIVIDUALS AND BUSINESSES

4.1 Chargeable assets

Chargeable persons

Individuals and businesses pay capital gain tax on the disposal of -

Personal possessions that amount to equal or more than £6,000.

Home that has been left and is used for the business purpose. If house is very big, the sale

processed is taxable.

Shares that are not held in ISA, NISA or PEP. Business assets

17

Assets and disposals

Chargeable asset includes any asset that requires the assessment of capital gains tax upon its

disposal. The exempted assets under this category include - cars, private residence, government

securities and investment in personal equity plan (Piggott and Whalley, 2009).

There are also various tax reliefs which are available depending on the type of assets to reduce tax

burden. Textile Machinery - The machinery is assumed to be of capital nature and is not covered

under operating transactions. Moreover, these assets provide service benefit to business for

more than one year, thus it is considered as chargeable assets are taxable (Stephens and

Ward-Batts, 2004). Account Receivable and Inventory - The transactions are operating in nature as they belong

to routine business activities. Also, they are meant to complete after a certain time period.

These transactions are thus taxable for the enterprises.

Payment dates

Chargeable person is required to pay tax charges on 5th April after the end of accounting

year. Further, general due date of capital gain tax liability is 31st January after the taxation year.

4.2 Calculation of capital gains and losses

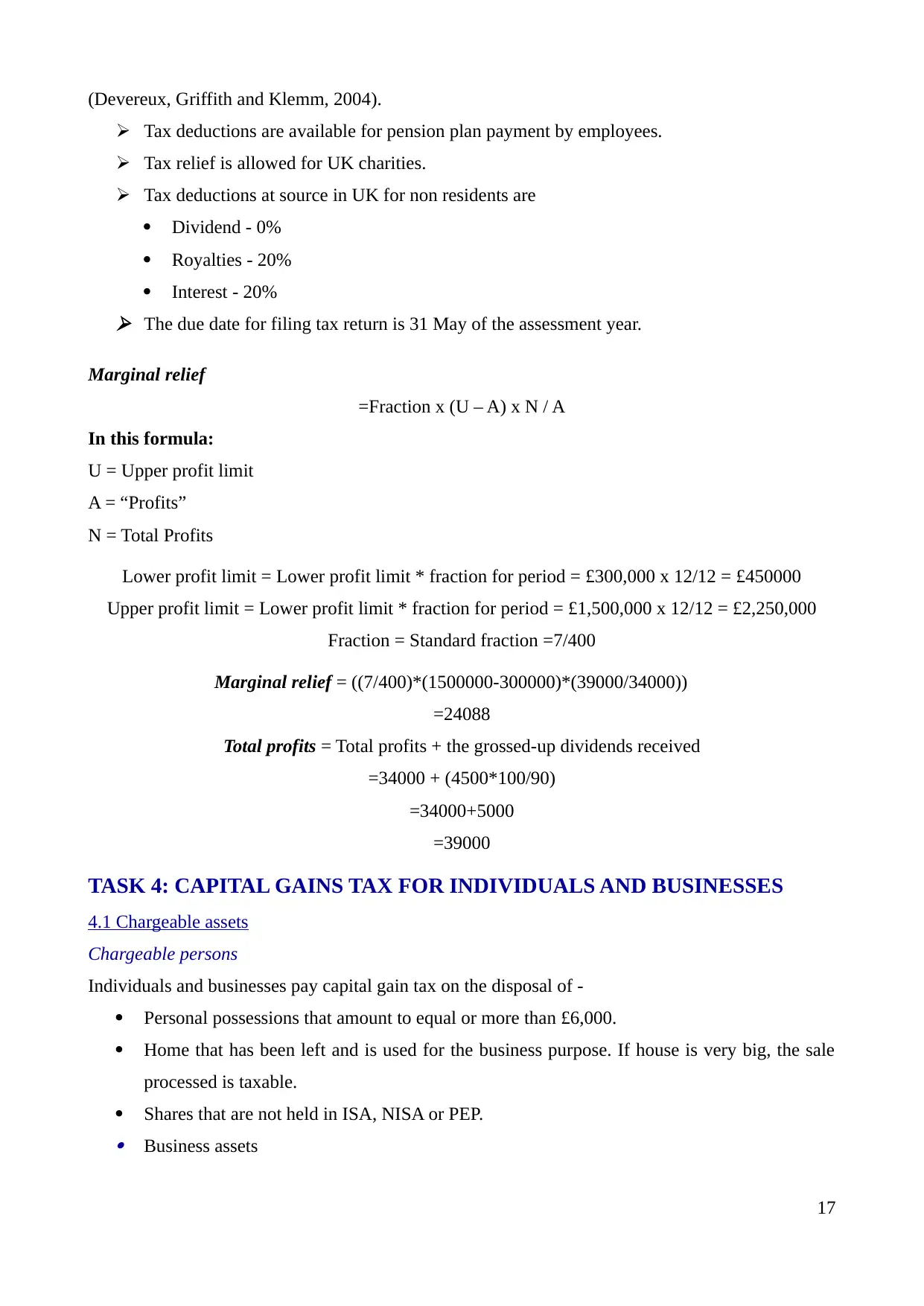

Case Example: Mr. James is self employed and financial information for the year 2013-14 is

given below. The owner uses straight line depreciation method for his non-current assets. The

depreciation method is 20%.

Extracted Financial Information - Mr. James

Particulars Amount (£)

Trading Profit 57100

Accounts Receivables 29400

Inventory 14200

Textile Machinery bought as on 16th August 2013 58000

Equipment bought at discounted price on 1st May 2013 35000

Sale of above equipment on dated 31st March 2014 43000

Capital gains tax exemption 10900

Table 10: Financial Information of Mr. James

18

Chargeable asset includes any asset that requires the assessment of capital gains tax upon its

disposal. The exempted assets under this category include - cars, private residence, government

securities and investment in personal equity plan (Piggott and Whalley, 2009).

There are also various tax reliefs which are available depending on the type of assets to reduce tax

burden. Textile Machinery - The machinery is assumed to be of capital nature and is not covered

under operating transactions. Moreover, these assets provide service benefit to business for

more than one year, thus it is considered as chargeable assets are taxable (Stephens and

Ward-Batts, 2004). Account Receivable and Inventory - The transactions are operating in nature as they belong

to routine business activities. Also, they are meant to complete after a certain time period.

These transactions are thus taxable for the enterprises.

Payment dates

Chargeable person is required to pay tax charges on 5th April after the end of accounting

year. Further, general due date of capital gain tax liability is 31st January after the taxation year.

4.2 Calculation of capital gains and losses

Case Example: Mr. James is self employed and financial information for the year 2013-14 is

given below. The owner uses straight line depreciation method for his non-current assets. The

depreciation method is 20%.

Extracted Financial Information - Mr. James

Particulars Amount (£)

Trading Profit 57100

Accounts Receivables 29400

Inventory 14200

Textile Machinery bought as on 16th August 2013 58000

Equipment bought at discounted price on 1st May 2013 35000

Sale of above equipment on dated 31st March 2014 43000

Capital gains tax exemption 10900

Table 10: Financial Information of Mr. James

18

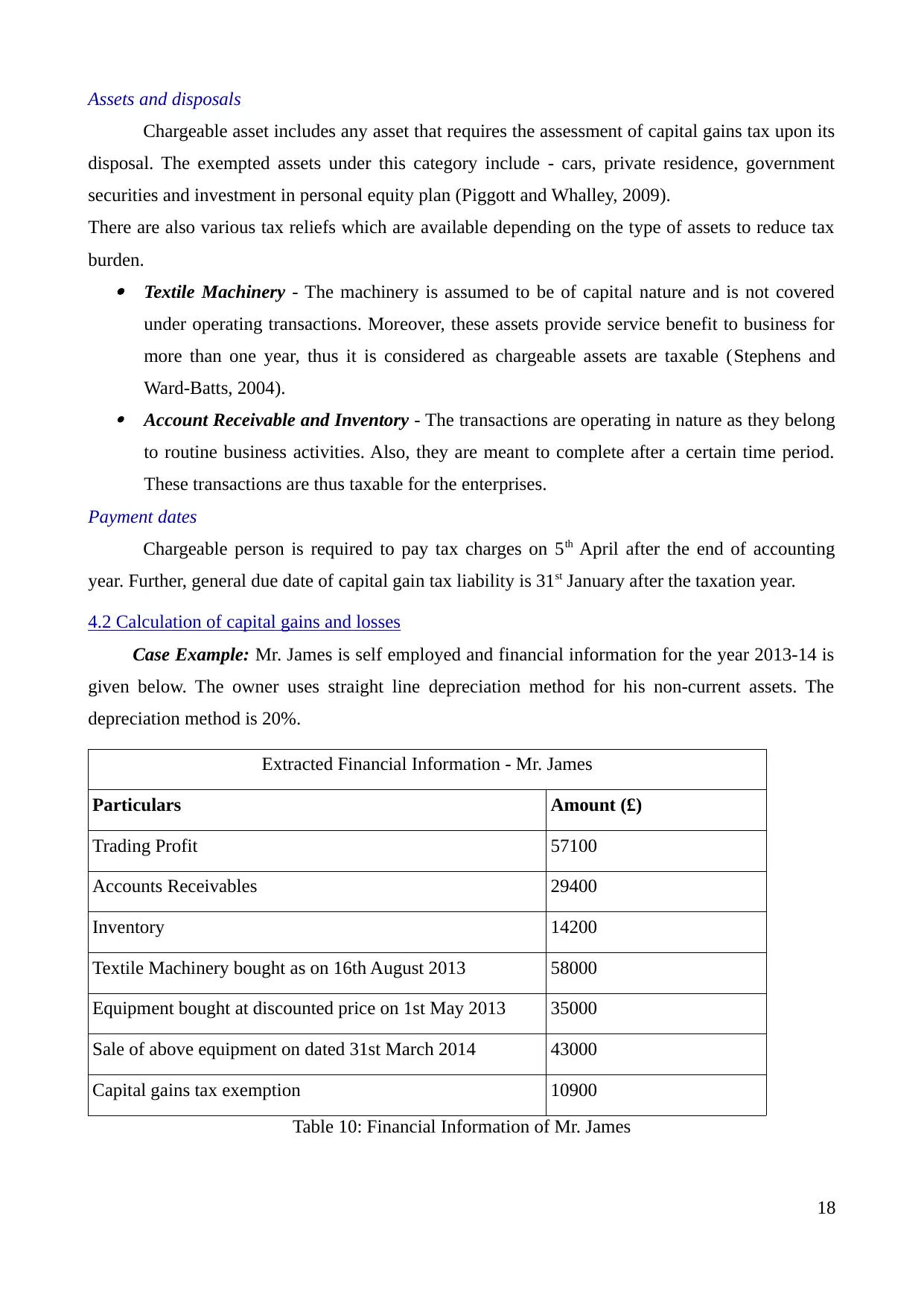

Calculation of chargeable assets for capital gain/loss for tax is as under -

Particulars Amount (£)

Sale value of asset 43000

Cost of Textile Machinery (58000-7250) 50750

Equipment bought at discounted price

(33000-6050)

26950

Capital loss 34700

Table 11: Calculation of chargeable assets of Mr. James

Depreciation is calculated as follows -

Machine 1=58000*20%*7.5/12=7250

Machine 2=33000*20%*11/12=6050

Taxable amount

The entity is not entitled to pay tax for the above transactions because of the loss incurred.

Moreover, it is eligible for tax deduction by adjusting the capital loss in the profit amount. Thus,

taxable amount for Mr. James will be calculated as follows -

Particulars Amount (£)

Trading profit 57100

Less: Capital loss 34700

Capital loss 22400

Table 12: Calculation of capital gains of Mr. James

The benefit of capital gain tax exemption is not allowed for the entity because the amount

can only be adjusted against the capital gain tax.

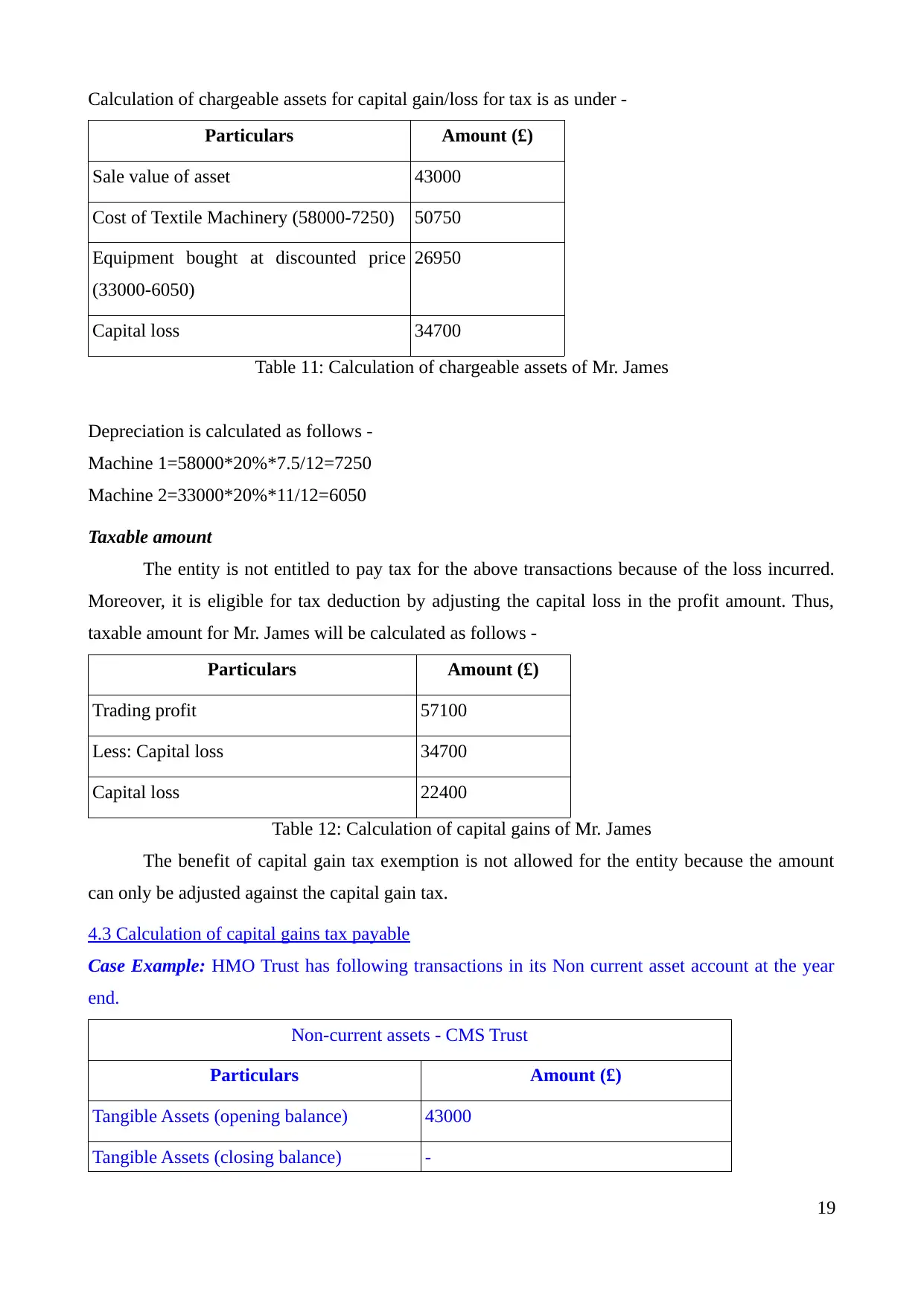

4.3 Calculation of capital gains tax payable

Case Example: HMO Trust has following transactions in its Non current asset account at the year

end.

Non-current assets - CMS Trust

Particulars Amount (£)

Tangible Assets (opening balance) 43000

Tangible Assets (closing balance) -

19

Particulars Amount (£)

Sale value of asset 43000

Cost of Textile Machinery (58000-7250) 50750

Equipment bought at discounted price

(33000-6050)

26950

Capital loss 34700

Table 11: Calculation of chargeable assets of Mr. James

Depreciation is calculated as follows -

Machine 1=58000*20%*7.5/12=7250

Machine 2=33000*20%*11/12=6050

Taxable amount

The entity is not entitled to pay tax for the above transactions because of the loss incurred.

Moreover, it is eligible for tax deduction by adjusting the capital loss in the profit amount. Thus,

taxable amount for Mr. James will be calculated as follows -

Particulars Amount (£)

Trading profit 57100

Less: Capital loss 34700

Capital loss 22400

Table 12: Calculation of capital gains of Mr. James

The benefit of capital gain tax exemption is not allowed for the entity because the amount

can only be adjusted against the capital gain tax.

4.3 Calculation of capital gains tax payable

Case Example: HMO Trust has following transactions in its Non current asset account at the year

end.

Non-current assets - CMS Trust

Particulars Amount (£)

Tangible Assets (opening balance) 43000

Tangible Assets (closing balance) -

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales proceed received

Table 13: Financial information of HMO

More Information -

The trust had brought as asset worth £580000 five years ago.

It was using straight line depreciation method.

The capital gain tax exemption for trust is £5,450 for 2013-14.

From the above details, the capital gain/loss calculated for HMO Trust is as follows -

Particulars Amount (£)

Sale value of asset 116000

Cost of Textile Machinery ((580000-

43000)/5)

107400

Capital loss 8600

Table 14: Calculation of capital gains for HMO

In this situation there is capital profit of to the HMO trust of £8600. Capital gain tax liability will be

computed in following manner:

=£8600*18%

=£1548

CONCLUSION

The above report provides a detailed overview of the UK taxation system with major focus

on the types of taxes which are liveried on individuals and businesses. It also explains the working

of HMRC which acts as tax collection agency in UK and holds the authority to take strict actions

against the non compliance of tax liabilities. The major roles and responsibilities of tax practitioners

are also explained with focus on proper information and maintenance of record. The report also

provides examples of calculation of tax liabilities for individual and businesses.

20

Table 13: Financial information of HMO

More Information -

The trust had brought as asset worth £580000 five years ago.

It was using straight line depreciation method.

The capital gain tax exemption for trust is £5,450 for 2013-14.

From the above details, the capital gain/loss calculated for HMO Trust is as follows -

Particulars Amount (£)

Sale value of asset 116000

Cost of Textile Machinery ((580000-

43000)/5)

107400

Capital loss 8600

Table 14: Calculation of capital gains for HMO

In this situation there is capital profit of to the HMO trust of £8600. Capital gain tax liability will be

computed in following manner:

=£8600*18%

=£1548

CONCLUSION

The above report provides a detailed overview of the UK taxation system with major focus

on the types of taxes which are liveried on individuals and businesses. It also explains the working

of HMRC which acts as tax collection agency in UK and holds the authority to take strict actions

against the non compliance of tax liabilities. The major roles and responsibilities of tax practitioners

are also explained with focus on proper information and maintenance of record. The report also

provides examples of calculation of tax liabilities for individual and businesses.

20

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.