LAWS20060 - Australian Taxation Law: Legal Analysis & Applications

VerifiedAdded on 2023/01/03

|12

|3332

|45

Report

AI Summary

This assignment provides a detailed analysis of various aspects of Australian taxation law, focusing on key concepts and their applications. It covers topics such as the determination of when a company is engaged in business, the deductibility of gifts and contributions, and the highest rate of tax. It also discusses exemptions related to capital gains tax, the treatment of lost or demolished articles, and the tax-free income threshold. Furthermore, the assignment examines the significance of the Hayes v FCT case in relation to capital gains taxation, differentiates between ordinary and statutory income, and explains the differences between the Medicare Levy and the Medicare Levy Surcharge. It delves into the residency tests, focusing on the concepts of 'permanent place of abode' and 'usual place of abode'. Additionally, the assignment analyzes deductible and non-deductible outgoings, including expenses related to HECS-HELP, travel, accounting books, childcare, fridge repairs, workplace clothing, and employment contract signing costs. Finally, it discusses the F2 category of capital gain events in the context of property rentals.

Running head: TAXATION

Taxation

Name of the Student

Name of the University

Author Note

Taxation

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION

1.

a)

TR 2019/11: deals with the fact that at what time a company is indulge into business.

b)

ITA Act 97, div 302: deals with treatment that gifts and contributions are required to be given as

deductible expenses.

c)

Highest Rate of Tax (2019/20): $54097 + 45% on excess of 180,0003.

d)

ITA Act 97, s 118.54: motorcycle along with card are eligible for being rendered as exemption

with respect to capital gain tax.

e)

ITA Act 97, s 104.205: any lost or demolished article owned by an individual is to be inferred as

capital gain event of C1 category.

f)

Tax Free Income Threshold: $18200 is the earning below which a person is not liable to be

imposed with taxation.

g)

1 TR 2019/1

2 The Income Tax Assessment Act 1997 (Cth), div 30

3 www.ato.gov.au, "Individual Income Tax Rates", Ato.Gov.Au (Webpage, 2019)

<https://www.ato.gov.au/Rates/Individual-income-tax-rates/>.

4 The Income Tax Assessment Act 1997 (Cth), s 118.5

5 The Income Tax Assessment Act 1997 (Cth), s 104.20

1.

a)

TR 2019/11: deals with the fact that at what time a company is indulge into business.

b)

ITA Act 97, div 302: deals with treatment that gifts and contributions are required to be given as

deductible expenses.

c)

Highest Rate of Tax (2019/20): $54097 + 45% on excess of 180,0003.

d)

ITA Act 97, s 118.54: motorcycle along with card are eligible for being rendered as exemption

with respect to capital gain tax.

e)

ITA Act 97, s 104.205: any lost or demolished article owned by an individual is to be inferred as

capital gain event of C1 category.

f)

Tax Free Income Threshold: $18200 is the earning below which a person is not liable to be

imposed with taxation.

g)

1 TR 2019/1

2 The Income Tax Assessment Act 1997 (Cth), div 30

3 www.ato.gov.au, "Individual Income Tax Rates", Ato.Gov.Au (Webpage, 2019)

<https://www.ato.gov.au/Rates/Individual-income-tax-rates/>.

4 The Income Tax Assessment Act 1997 (Cth), s 118.5

5 The Income Tax Assessment Act 1997 (Cth), s 104.20

2TAXATION

Significance of Hayes v FCT (1956) 96 CLR 476: it has been ruled out in this proceeding that the

monetary value received by a person who has been employed for the services rendered while employed

towards the former employer and extended by him would imply the receipt to be taxable as a capital asset.

Hence, capital gain taxation would apply upon any earnings that has been received by an employee

subsequent to the continuity of his employment and paid by the employer with whom the employee has

been previously employed with. This can be viewed as contrary to the fact that all the earnings produced

by application of personal toil or labour will be made assessable as income from personal exertion and

would come under the head of ordinary income. However, the reasoning extended by the court in this

context is that the amount has been extended by a past employer for the past services extended towards

previous employment. This depicts the fact that the earning has been accrued at a previous date but has

not yet been received by the taxpayer. It has been extended to the employee on a later date and this

timespan points towards its conversion into an asset of CGT regime. This explains the decision of the

court of rendering such an amount to be included while computing the capital gain taxation liability.

However, there are two probabilities that are required to be considered while making such as a function of

including such amount in in the tax computation of CGT. The first consideration is the intention with

which the money has been extended by employer. Consideration should also be given towards the

intention of the employee while accepting such an amount from a former employer.

h)

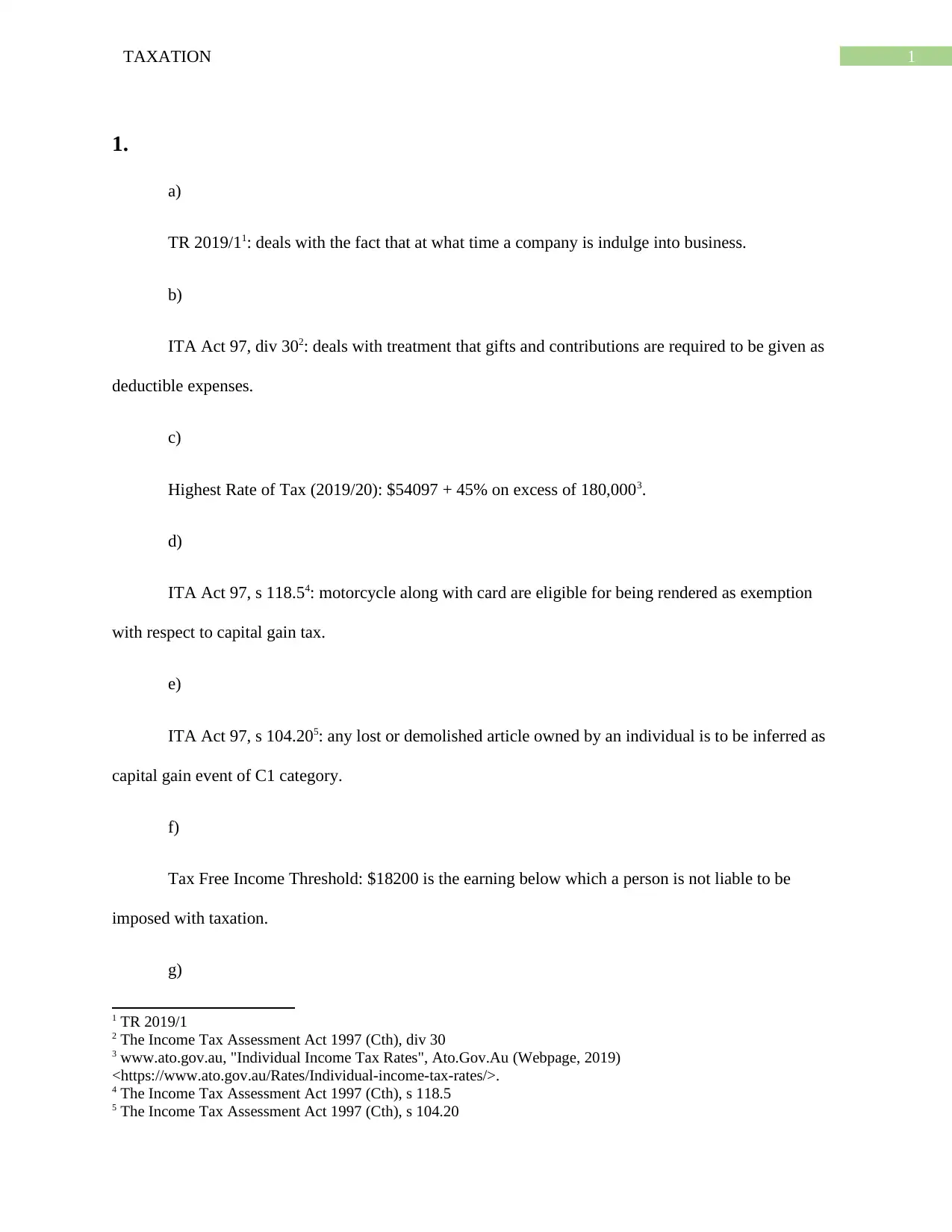

Difference between Ordinary Income and Statutory Income

Ordinary Income Statutory Income

It is an income by virtue of the ordinary meaning

prevailing with respect to income.

It is an income by virtue of the statutory provision

rendering it to be an income.

This form of income does not require a

recognition of the statute for being rendered as an

income.

This form of income needs to be mandated by the

statute to be recognized as an income.

6 Hayes v FCT (1956) 96 CLR 47

Significance of Hayes v FCT (1956) 96 CLR 476: it has been ruled out in this proceeding that the

monetary value received by a person who has been employed for the services rendered while employed

towards the former employer and extended by him would imply the receipt to be taxable as a capital asset.

Hence, capital gain taxation would apply upon any earnings that has been received by an employee

subsequent to the continuity of his employment and paid by the employer with whom the employee has

been previously employed with. This can be viewed as contrary to the fact that all the earnings produced

by application of personal toil or labour will be made assessable as income from personal exertion and

would come under the head of ordinary income. However, the reasoning extended by the court in this

context is that the amount has been extended by a past employer for the past services extended towards

previous employment. This depicts the fact that the earning has been accrued at a previous date but has

not yet been received by the taxpayer. It has been extended to the employee on a later date and this

timespan points towards its conversion into an asset of CGT regime. This explains the decision of the

court of rendering such an amount to be included while computing the capital gain taxation liability.

However, there are two probabilities that are required to be considered while making such as a function of

including such amount in in the tax computation of CGT. The first consideration is the intention with

which the money has been extended by employer. Consideration should also be given towards the

intention of the employee while accepting such an amount from a former employer.

h)

Difference between Ordinary Income and Statutory Income

Ordinary Income Statutory Income

It is an income by virtue of the ordinary meaning

prevailing with respect to income.

It is an income by virtue of the statutory provision

rendering it to be an income.

This form of income does not require a

recognition of the statute for being rendered as an

income.

This form of income needs to be mandated by the

statute to be recognized as an income.

6 Hayes v FCT (1956) 96 CLR 47

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION

Even in the absence of any legislation giving

recognition to it as an income, it would not lose its

recognition as an income.

In the absence of any statutory mandate giving

recognition to it as an income, it will lose its

identification as an income.

The taxability of the same is a universal concept. The taxability of the same is a statutory concept.

This income is taxable even without the authority

of the statute.

This income needs authority of the statute to be

considered for taxation.

Example: salary income, business income. Example: capital gain taxation.

i)

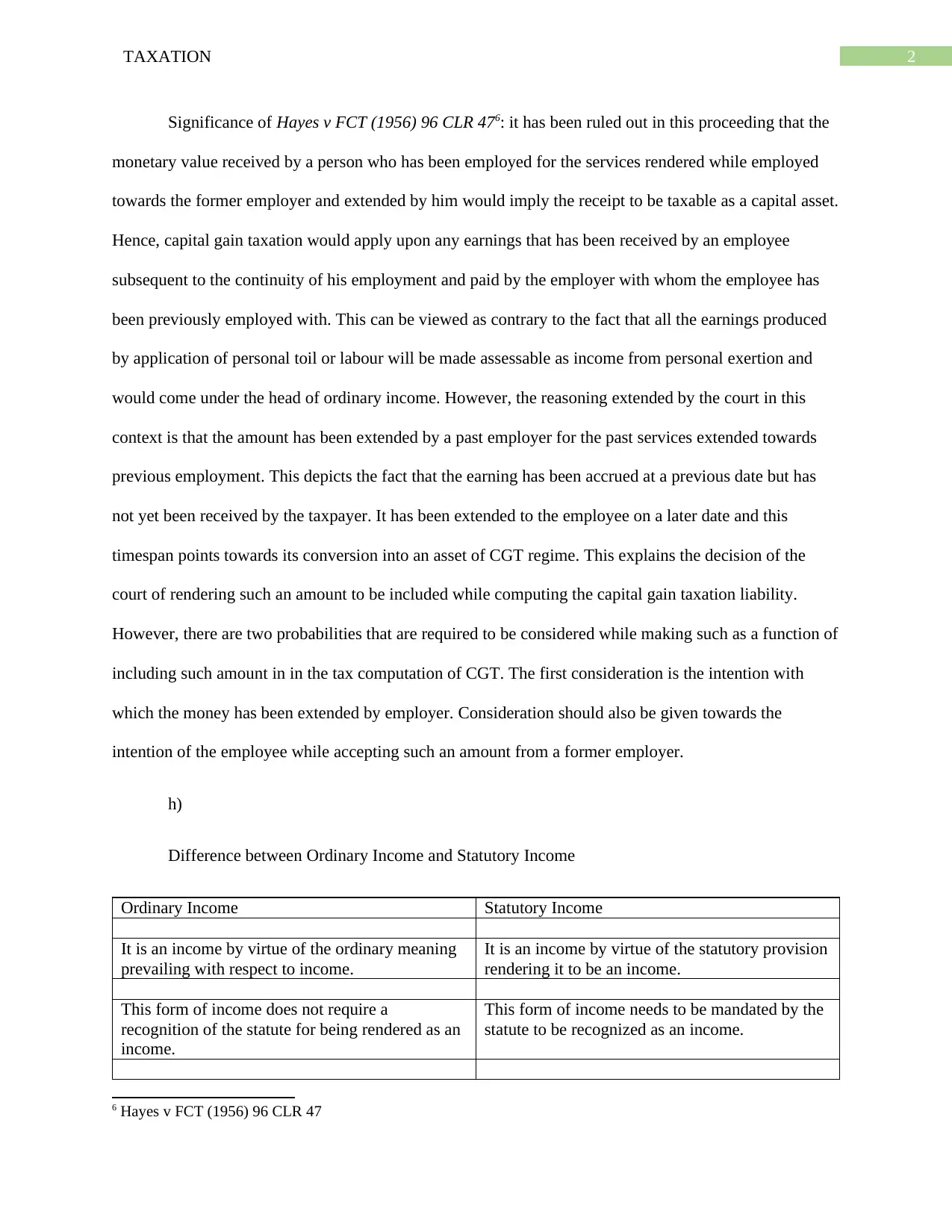

The difference between Medicare Levy and the Medicare Levy Surcharge

Medicare Levy Medicare Levy Surcharge

It is an additional levy upon income tax. It is an additional levy upon the summation of the

income tax and the fringe benefit tax.

It has been introduced for an assistance to be

extended towards the Medicare that regulates the

health system of the public within the boundaries

of Australia.

It has been introduced for the purpose for

diminishing the load that has been falling upon

the Medicare in the absence of this system.

The rate applicable in case of this form of levy is

2%.

The rate applicable in this form of levy is 1%,

1.25% and 1.5%.

It is regulated by the Medicare Levy Act 19867

and the ITAA 368.

It is regulated by the Medicare Levy Act 19869.

It needs to be applied on individuals exceeding

the minimum threshold.

It needs to be applied upon the individuals

belonging to the higher brackets of taxation.

To applied to the individuals to be considered for

Medicare.

The individuals who does not have any private

health insurance.

7 The Medicare Levy Act 1986

8 The Income Tax Assessment Act 1936 (Cth)

9 The Medicare Levy Act 1986

Even in the absence of any legislation giving

recognition to it as an income, it would not lose its

recognition as an income.

In the absence of any statutory mandate giving

recognition to it as an income, it will lose its

identification as an income.

The taxability of the same is a universal concept. The taxability of the same is a statutory concept.

This income is taxable even without the authority

of the statute.

This income needs authority of the statute to be

considered for taxation.

Example: salary income, business income. Example: capital gain taxation.

i)

The difference between Medicare Levy and the Medicare Levy Surcharge

Medicare Levy Medicare Levy Surcharge

It is an additional levy upon income tax. It is an additional levy upon the summation of the

income tax and the fringe benefit tax.

It has been introduced for an assistance to be

extended towards the Medicare that regulates the

health system of the public within the boundaries

of Australia.

It has been introduced for the purpose for

diminishing the load that has been falling upon

the Medicare in the absence of this system.

The rate applicable in case of this form of levy is

2%.

The rate applicable in this form of levy is 1%,

1.25% and 1.5%.

It is regulated by the Medicare Levy Act 19867

and the ITAA 368.

It is regulated by the Medicare Levy Act 19869.

It needs to be applied on individuals exceeding

the minimum threshold.

It needs to be applied upon the individuals

belonging to the higher brackets of taxation.

To applied to the individuals to be considered for

Medicare.

The individuals who does not have any private

health insurance.

7 The Medicare Levy Act 1986

8 The Income Tax Assessment Act 1936 (Cth)

9 The Medicare Levy Act 1986

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION

2.

There are two ideas that can be conceived from the test of determining residency of a person

namely the resides test and the domicile as provided in ITA Act 97, 6.1. One of them is the ‘permanent

place of abode' and the other is the ‘usual place of abode'. The striking similarity of these two ideas can

be noticed from the ordinary meaning of the same but there is a difference existing between these two

ideas. However, the concept of place of abode is to be understood before discussing the differences

between these two ideas. Place of abode is any e property that has been utilised for the purpose of day to

day dwelling of a person as has been mentioned in the case of Levene v IRC (1928) AC 217 10. For

defining the concept of ‘permanent place of abode' analysis of the case of FC of T v Applegate 79 ATC

430711 is required. Although this is a place where a person jewels on a daily basis but the permanency

needs to be accrued from the motive of the person in continuing to live there for a considerable length the

period. This period does not demarcate forever, but it points towards the motive of the individual living

there until a foreseeable future. Again, the expression ‘usual place of abode’ is to be constituted from the

concepts of customary and habitual. This is a place where a person has residing and has became used to it.

As has been contained in the case of F.C. of T. v. Jenkins 82 ATC 409812, an accommodation obtained on

lease can also be brought under the concept of ‘usual place of abode’

3.

a)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.113. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

10 Levene v IRC (1928) AC 217

11 FC of T v Applegate 79 ATC 4307

12 F.C. of T. v. Jenkins 82 ATC 4098

13 The Income Tax Assessment Act 1997 (Cth), s 8.1

2.

There are two ideas that can be conceived from the test of determining residency of a person

namely the resides test and the domicile as provided in ITA Act 97, 6.1. One of them is the ‘permanent

place of abode' and the other is the ‘usual place of abode'. The striking similarity of these two ideas can

be noticed from the ordinary meaning of the same but there is a difference existing between these two

ideas. However, the concept of place of abode is to be understood before discussing the differences

between these two ideas. Place of abode is any e property that has been utilised for the purpose of day to

day dwelling of a person as has been mentioned in the case of Levene v IRC (1928) AC 217 10. For

defining the concept of ‘permanent place of abode' analysis of the case of FC of T v Applegate 79 ATC

430711 is required. Although this is a place where a person jewels on a daily basis but the permanency

needs to be accrued from the motive of the person in continuing to live there for a considerable length the

period. This period does not demarcate forever, but it points towards the motive of the individual living

there until a foreseeable future. Again, the expression ‘usual place of abode’ is to be constituted from the

concepts of customary and habitual. This is a place where a person has residing and has became used to it.

As has been contained in the case of F.C. of T. v. Jenkins 82 ATC 409812, an accommodation obtained on

lease can also be brought under the concept of ‘usual place of abode’

3.

a)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.113. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

10 Levene v IRC (1928) AC 217

11 FC of T v Applegate 79 ATC 4307

12 F.C. of T. v. Jenkins 82 ATC 4098

13 The Income Tax Assessment Act 1997 (Cth), s 8.1

5TAXATION

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 514. The

payment towards HECS-HELP has been made with respect to a student loan that has been revealed by the

taxpayer. This needs to be constituted as a personal outgoing and will not be deductible from assessable

income.

b) The experience of outgoings that occurs while travelling in the direction of workplace renders

the outgoing to be considered as deductible outgoing according to ITA Act 97, s 25.10015. The outgoing

incurred while traveling to workplace from University amounting to recognition as an outgoing of

deductible nature.

c)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.116. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 517. The books

on the subject accounting has been purchased for the enlightment of the taxpayer with respect to the

professional skills and the amount incurred for the same of $200 is to be construed as deductible because

of its direct link with his profession.

d)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.118. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

14 Lunney v Commissioner of Taxation [1958] HCA 5

15 The Income Tax Assessment Act 1997 (Cth), s 25.100

16 The Income Tax Assessment Act 1997 (Cth), s 8.1

17 Lunney v Commissioner of Taxation [1958] HCA 5

18 The Income Tax Assessment Act 1997 (Cth), s 8.1

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 514. The

payment towards HECS-HELP has been made with respect to a student loan that has been revealed by the

taxpayer. This needs to be constituted as a personal outgoing and will not be deductible from assessable

income.

b) The experience of outgoings that occurs while travelling in the direction of workplace renders

the outgoing to be considered as deductible outgoing according to ITA Act 97, s 25.10015. The outgoing

incurred while traveling to workplace from University amounting to recognition as an outgoing of

deductible nature.

c)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.116. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 517. The books

on the subject accounting has been purchased for the enlightment of the taxpayer with respect to the

professional skills and the amount incurred for the same of $200 is to be construed as deductible because

of its direct link with his profession.

d)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.118. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

14 Lunney v Commissioner of Taxation [1958] HCA 5

15 The Income Tax Assessment Act 1997 (Cth), s 25.100

16 The Income Tax Assessment Act 1997 (Cth), s 8.1

17 Lunney v Commissioner of Taxation [1958] HCA 5

18 The Income Tax Assessment Act 1997 (Cth), s 8.1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 519. Child care

expenses during the evening classes of the taxpayer amount into $80 will not be included in the

deductions as it has been connected with personal use.

e)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.120. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 521. Fridge

repair expenses kept at home of the taxpayer amount into $250 will not be included in the deductions as it

has been connected with personal use.

f)

The acquisition of workplace clothing should not be included in the deductions under ITA Act

97, s 8.122. Hence, the amount of 145 dollars experience for availing shirt and black trousers will not be a

deduction.

g)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.123. The cost of signing employment contract is and expense towards

foundation of income earning procedure and not an income on a procedure in itself has the same will not

be deductible.

19 Lunney v Commissioner of Taxation [1958] HCA 5

20 The Income Tax Assessment Act 1997 (Cth), s 8.1

21 Lunney v Commissioner of Taxation [1958] HCA 5

22 The Income Tax Assessment Act 1997 (Cth), s 8.1

23 Ibid.

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 519. Child care

expenses during the evening classes of the taxpayer amount into $80 will not be included in the

deductions as it has been connected with personal use.

e)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.120. Again, if it can be established that the outgoing has been linked with the

private use pertaining to the taxpayer it would require treatment of a non-deductible outgoing as for the

principles enumerated in the decision of Lunney v Commissioner of Taxation [1958] HCA 521. Fridge

repair expenses kept at home of the taxpayer amount into $250 will not be included in the deductions as it

has been connected with personal use.

f)

The acquisition of workplace clothing should not be included in the deductions under ITA Act

97, s 8.122. Hence, the amount of 145 dollars experience for availing shirt and black trousers will not be a

deduction.

g)

Any monetary outgoings that can be established as incidental with respect to the process of

gathering earnings included in the assessment of taxation is needed to be input as deduction as for the

provision in ITA Act 97, s 8.123. The cost of signing employment contract is and expense towards

foundation of income earning procedure and not an income on a procedure in itself has the same will not

be deductible.

19 Lunney v Commissioner of Taxation [1958] HCA 5

20 The Income Tax Assessment Act 1997 (Cth), s 8.1

21 Lunney v Commissioner of Taxation [1958] HCA 5

22 The Income Tax Assessment Act 1997 (Cth), s 8.1

23 Ibid.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION

4.

a)

In cases where owner of a property rents out the property on a lease his situation will come under

the concept of F2 category of capital gain event. This can be a new lease, extension of existing lease,

renewal of a lease or any other events relating to a lease. Moreover this category would imposed with

50% discount. Therefore, as John is the owner and leased out his property to David for a premium of

$7000, it will be regarded as F2 category of capital gain event and needs to be applied with a discount of

50%24.

b)

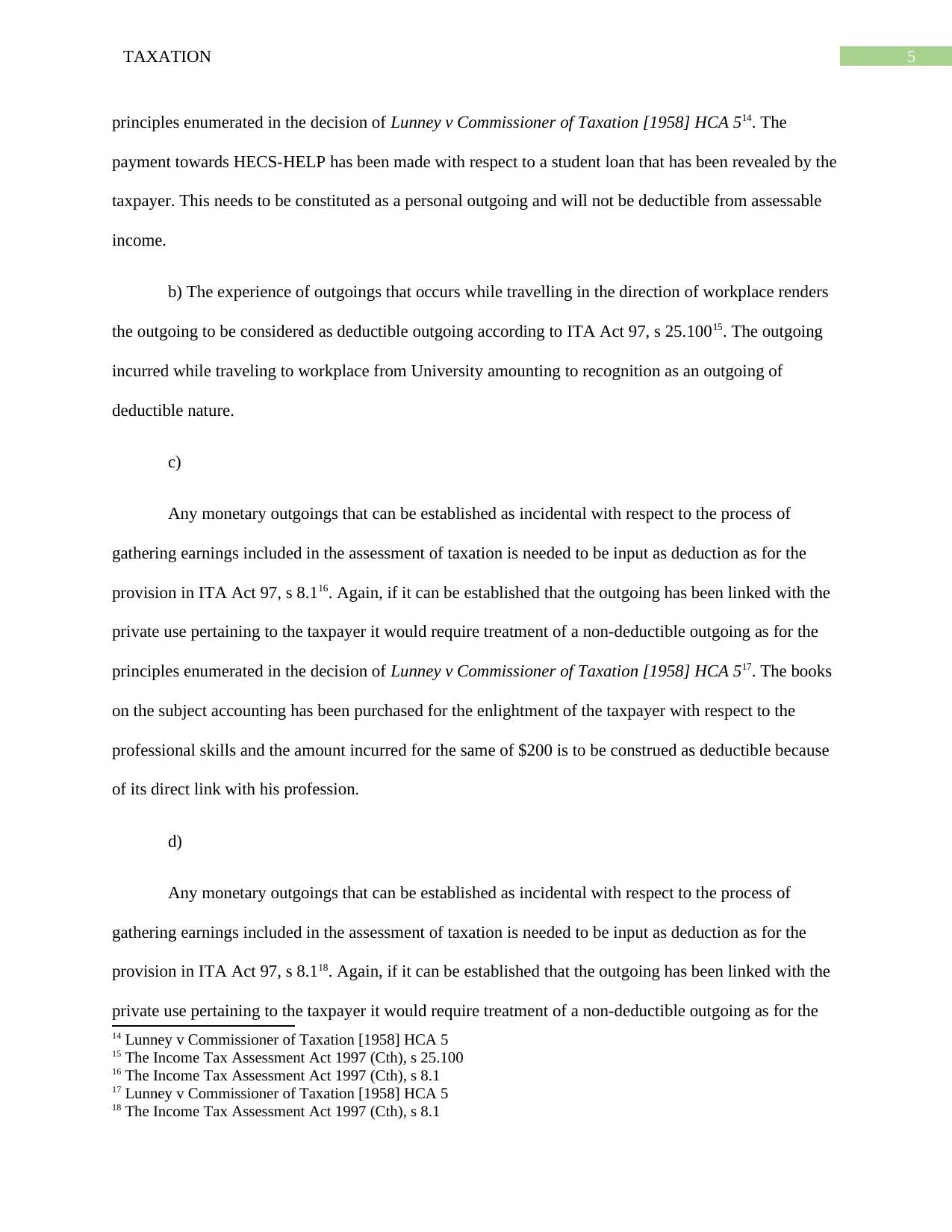

CGT liability

Item AUD$ AUD$

Transaction of IOOF Shares

Capital gain 1200

CP 6700

CB 5500

Transaction of Greencross Shares

Capital gain 5880

CP 14160

CB 20040

Capital Loss

4580

c)

The income earned by disposing of a property, which has been used as the main residence of a

person will be treated as exempt from CGT gain as per ITA Act 97, 118.10025. again if that property has

been used for any scheme that is expecting profit would not be rendered as exemption from CGT. In case

24 Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016)

25 The Income Tax Assessment Act 1997 (Cth), s 118.100

4.

a)

In cases where owner of a property rents out the property on a lease his situation will come under

the concept of F2 category of capital gain event. This can be a new lease, extension of existing lease,

renewal of a lease or any other events relating to a lease. Moreover this category would imposed with

50% discount. Therefore, as John is the owner and leased out his property to David for a premium of

$7000, it will be regarded as F2 category of capital gain event and needs to be applied with a discount of

50%24.

b)

CGT liability

Item AUD$ AUD$

Transaction of IOOF Shares

Capital gain 1200

CP 6700

CB 5500

Transaction of Greencross Shares

Capital gain 5880

CP 14160

CB 20040

Capital Loss

4580

c)

The income earned by disposing of a property, which has been used as the main residence of a

person will be treated as exempt from CGT gain as per ITA Act 97, 118.10025. again if that property has

been used for any scheme that is expecting profit would not be rendered as exemption from CGT. In case

24 Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016)

25 The Income Tax Assessment Act 1997 (Cth), s 118.100

8TAXATION

part of the property has been used by the taxpayer as main residence and the other part for profit making

the scheme needs to be applied to that part only for which it has been used for business purpose. Capital

gain = $ (700000 + 400000) * 20% = $ 60000.

d)

Cost base as defined in ITA Act 97, s 110.2526, is the cost suffered in in acquiring an asset of

capital nature and comprises of the acquiring cost, cost for holding the asset, cost of disposing off, cost of

preserving the asset and incidental costs. On the other hand, reduced cost base as defined in ITA Act 97, s

110.5527 is the calculation with respect to the event of capital nature that is not disclosing any profit. This

needs to be computed for the purpose of discovering any hidden loss within the transaction.

5.

a)

Any earnings incoming from happenings that are unlawful and not executed as a business

arrangement will not achieve inclusion within the earnings, which are taxable. This contention has

involved as per the decision arrived in FC of T v La Rosa 2003 ATC 451028. Owing to the non inclusion of

the earnings from activities which are unlawful within the assessable earnings, it can be contended the

outgoing suffered as a consequence of such unlawful activities should not be given recognition as

outgoings of deductible nature.

b)

Any amount received as interest by virtue of a lump sum volume of cash will require recognition

as earning of ordinary nature by virtue of fruit and the three concepts which renders the cash or property

as the tree from which arises the fruit called interest. Any earnings that can be produced by exploiting a

property need recognition as earning of ordinary nature under the same concept. As per the principles

26 The Income Tax Assessment Act 1997 (Cth), s 110.25

27 The Income Tax Assessment Act 1997 (Cth), s 110.55

28 FC of T v La Rosa 2003 ATC 4510

part of the property has been used by the taxpayer as main residence and the other part for profit making

the scheme needs to be applied to that part only for which it has been used for business purpose. Capital

gain = $ (700000 + 400000) * 20% = $ 60000.

d)

Cost base as defined in ITA Act 97, s 110.2526, is the cost suffered in in acquiring an asset of

capital nature and comprises of the acquiring cost, cost for holding the asset, cost of disposing off, cost of

preserving the asset and incidental costs. On the other hand, reduced cost base as defined in ITA Act 97, s

110.5527 is the calculation with respect to the event of capital nature that is not disclosing any profit. This

needs to be computed for the purpose of discovering any hidden loss within the transaction.

5.

a)

Any earnings incoming from happenings that are unlawful and not executed as a business

arrangement will not achieve inclusion within the earnings, which are taxable. This contention has

involved as per the decision arrived in FC of T v La Rosa 2003 ATC 451028. Owing to the non inclusion of

the earnings from activities which are unlawful within the assessable earnings, it can be contended the

outgoing suffered as a consequence of such unlawful activities should not be given recognition as

outgoings of deductible nature.

b)

Any amount received as interest by virtue of a lump sum volume of cash will require recognition

as earning of ordinary nature by virtue of fruit and the three concepts which renders the cash or property

as the tree from which arises the fruit called interest. Any earnings that can be produced by exploiting a

property need recognition as earning of ordinary nature under the same concept. As per the principles

26 The Income Tax Assessment Act 1997 (Cth), s 110.25

27 The Income Tax Assessment Act 1997 (Cth), s 110.55

28 FC of T v La Rosa 2003 ATC 4510

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION

arising from Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 129, gambling

related earnings or earnings from windfall games will not achieve inclusion within the assessable income

of a person and the inclusion is only possible when the same has not been continue as an amusement. This

non-inclusion of such income can be best explain with the case of Evans v. F.C. of T. 89 ATC 454030.

Therefore it can be stated that $500 earned as interest from Bank mark out the same as income of ordinary

nature as per ITA Act 36, s 6.531; earnings from casino needs non recognition as assessable income owing

to its nature pointing towards an amusement and rent received as an earning from house is an ordinary

income as it involves exploiting property. Hence, Net Taxable Value = 500+2000 = $2500.

c)

The allowance that might be received by an employee by virtue of his employment for the

services he performed as has been paid by the employer is to be subjected to taxation as per ITA Act 97, s

15.232. Hence, the sum of $500 as earned by the employee as an allowance should be taken into

consideration as taxable in the hands of the taxpayer.

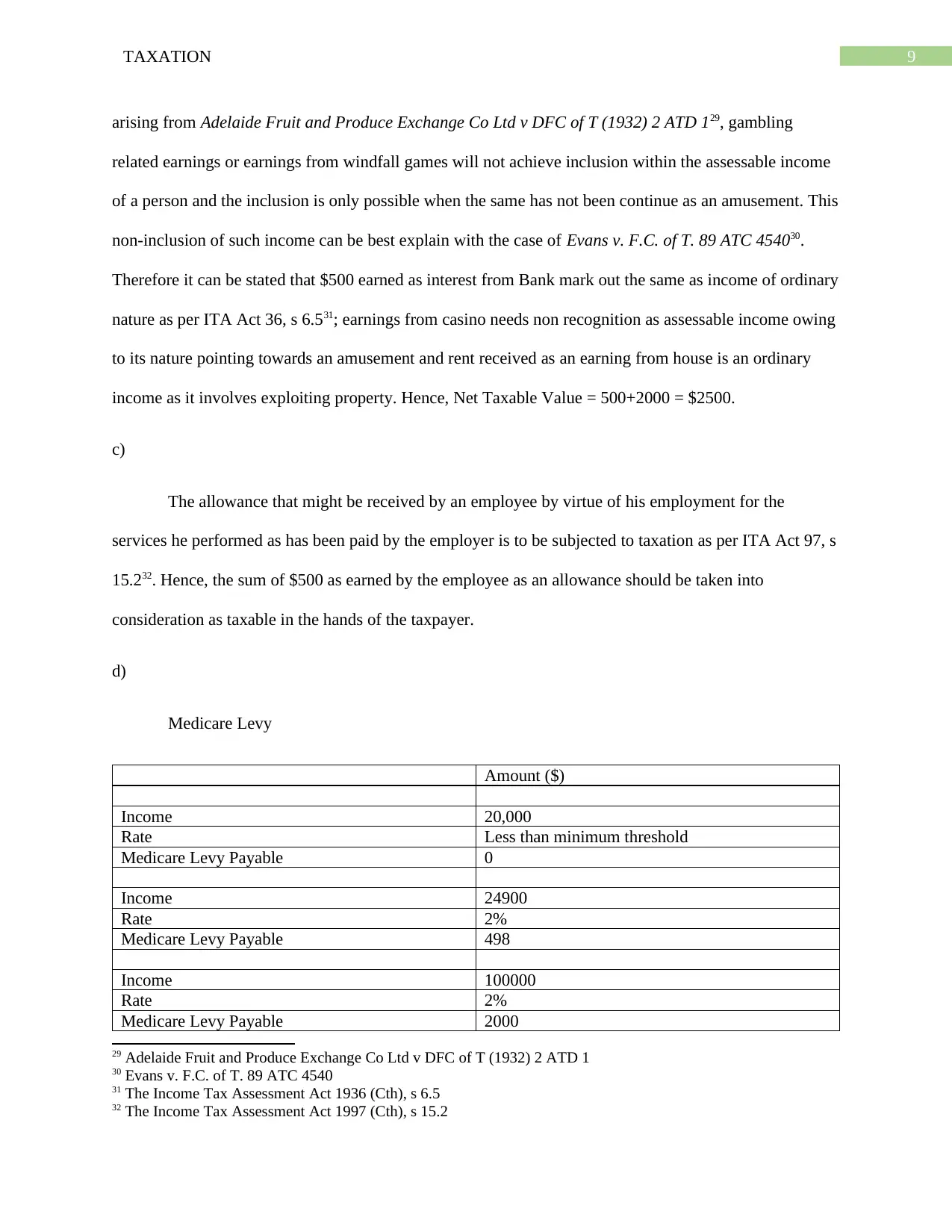

d)

Medicare Levy

Amount ($)

Income 20,000

Rate Less than minimum threshold

Medicare Levy Payable 0

Income 24900

Rate 2%

Medicare Levy Payable 498

Income 100000

Rate 2%

Medicare Levy Payable 2000

29 Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 1

30 Evans v. F.C. of T. 89 ATC 4540

31 The Income Tax Assessment Act 1936 (Cth), s 6.5

32 The Income Tax Assessment Act 1997 (Cth), s 15.2

arising from Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 129, gambling

related earnings or earnings from windfall games will not achieve inclusion within the assessable income

of a person and the inclusion is only possible when the same has not been continue as an amusement. This

non-inclusion of such income can be best explain with the case of Evans v. F.C. of T. 89 ATC 454030.

Therefore it can be stated that $500 earned as interest from Bank mark out the same as income of ordinary

nature as per ITA Act 36, s 6.531; earnings from casino needs non recognition as assessable income owing

to its nature pointing towards an amusement and rent received as an earning from house is an ordinary

income as it involves exploiting property. Hence, Net Taxable Value = 500+2000 = $2500.

c)

The allowance that might be received by an employee by virtue of his employment for the

services he performed as has been paid by the employer is to be subjected to taxation as per ITA Act 97, s

15.232. Hence, the sum of $500 as earned by the employee as an allowance should be taken into

consideration as taxable in the hands of the taxpayer.

d)

Medicare Levy

Amount ($)

Income 20,000

Rate Less than minimum threshold

Medicare Levy Payable 0

Income 24900

Rate 2%

Medicare Levy Payable 498

Income 100000

Rate 2%

Medicare Levy Payable 2000

29 Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 1

30 Evans v. F.C. of T. 89 ATC 4540

31 The Income Tax Assessment Act 1936 (Cth), s 6.5

32 The Income Tax Assessment Act 1997 (Cth), s 15.2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION

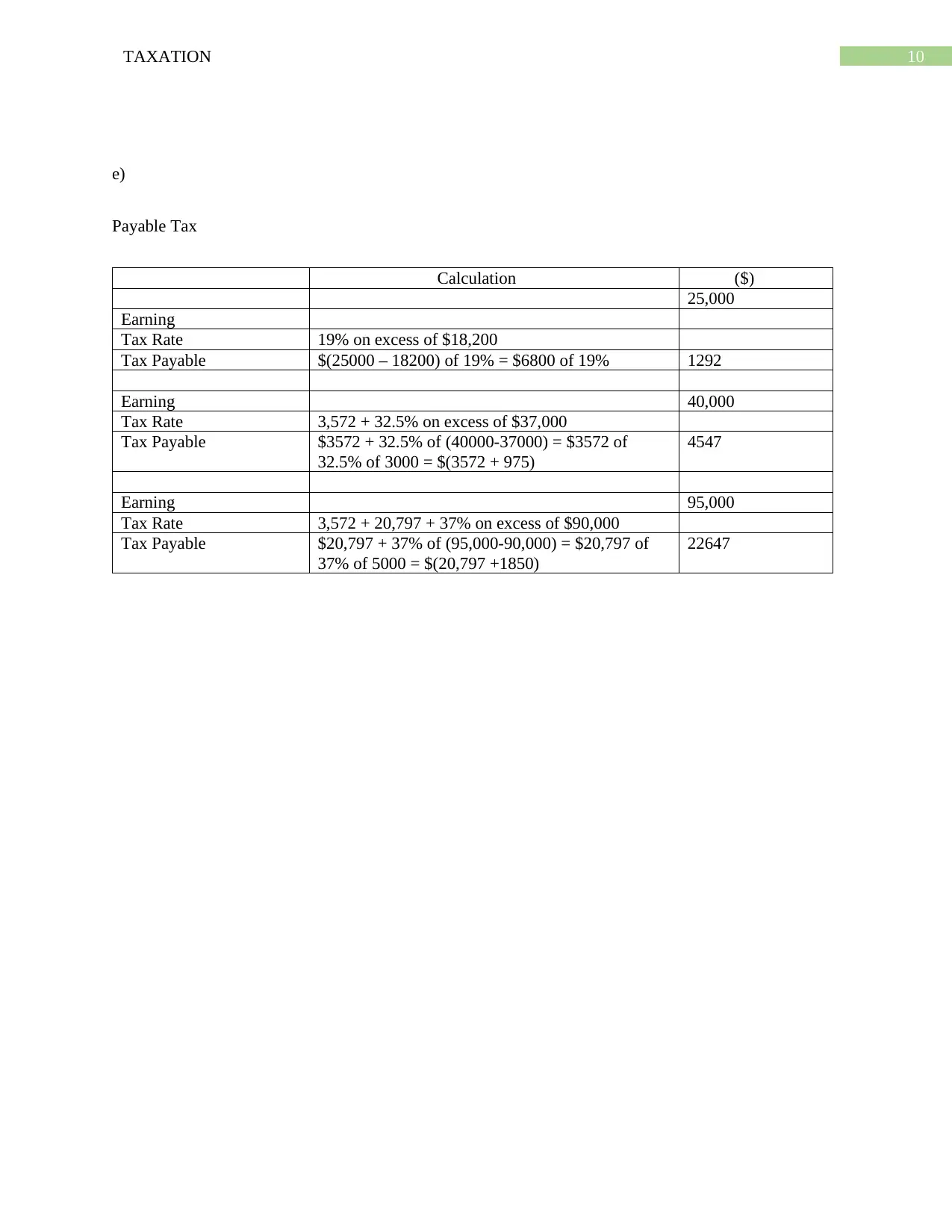

e)

Payable Tax

Calculation ($)

25,000

Earning

Tax Rate 19% on excess of $18,200

Tax Payable $(25000 – 18200) of 19% = $6800 of 19% 1292

Earning 40,000

Tax Rate 3,572 + 32.5% on excess of $37,000

Tax Payable $3572 + 32.5% of (40000-37000) = $3572 of

32.5% of 3000 = $(3572 + 975)

4547

Earning 95,000

Tax Rate 3,572 + 20,797 + 37% on excess of $90,000

Tax Payable $20,797 + 37% of (95,000-90,000) = $20,797 of

37% of 5000 = $(20,797 +1850)

22647

e)

Payable Tax

Calculation ($)

25,000

Earning

Tax Rate 19% on excess of $18,200

Tax Payable $(25000 – 18200) of 19% = $6800 of 19% 1292

Earning 40,000

Tax Rate 3,572 + 32.5% on excess of $37,000

Tax Payable $3572 + 32.5% of (40000-37000) = $3572 of

32.5% of 3000 = $(3572 + 975)

4547

Earning 95,000

Tax Rate 3,572 + 20,797 + 37% on excess of $90,000

Tax Payable $20,797 + 37% of (95,000-90,000) = $20,797 of

37% of 5000 = $(20,797 +1850)

22647

11TAXATION

Bibliography

Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 1

Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016).

Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016).

Evans v. F.C. of T. 89 ATC 4540

F.C. of T. v. Jenkins 82 ATC 4098

FC of T v Applegate 79 ATC 4307

FC of T v La Rosa 2003 ATC 4510

Hayes v FCT (1956) 96 CLR 47

Levene v IRC (1928) AC 217

Lunney v Commissioner of Taxation [1958] HCA 5

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Medicare Levy Act 1986

TR 2019/1

www.ato.gov.au, "Individual Income Tax Rates", Ato.Gov.Au (Webpage, 2019)

https://www.ato.gov.au/Rates/Individual-income-tax-rates/

Bibliography

Adelaide Fruit and Produce Exchange Co Ltd v DFC of T (1932) 2 ATD 1

Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016).

Barkoczy, Stephen. "Foundations of taxation law 2016." (OUP Catalogue 2016).

Evans v. F.C. of T. 89 ATC 4540

F.C. of T. v. Jenkins 82 ATC 4098

FC of T v Applegate 79 ATC 4307

FC of T v La Rosa 2003 ATC 4510

Hayes v FCT (1956) 96 CLR 47

Levene v IRC (1928) AC 217

Lunney v Commissioner of Taxation [1958] HCA 5

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Medicare Levy Act 1986

TR 2019/1

www.ato.gov.au, "Individual Income Tax Rates", Ato.Gov.Au (Webpage, 2019)

https://www.ato.gov.au/Rates/Individual-income-tax-rates/

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.