Taxation Assignment: FBT, Capital Gains, Superannuation - Analysis

VerifiedAdded on 2023/03/31

|13

|2434

|376

Homework Assignment

AI Summary

This assignment provides a detailed analysis of taxation principles, focusing on two key questions. The first question addresses the Fringe Benefit Tax (FBT) liability for a company providing a car to an employee, calculating the FBT using both the statutory formula method and the log book method, and concluding which method minimizes the liability. The second question explores Capital Gains Tax (CGT) implications for an individual, examining the CGT events related to the sale of a house (including forfeiture of a deposit), a painting, a luxury yacht, and shares. It includes calculations for capital gains and losses, considering relevant tax regulations and exemptions. The assignment also briefly touches upon superannuation contributions as part of retirement planning, providing a comprehensive overview of tax-related financial considerations.

Running head: TAXATION

Taxation

Name of the Student

Name of the University

Author’s Note

Taxation

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................6

Part [a].........................................................................................................................................6

Part [b].......................................................................................................................................10

Part [c].......................................................................................................................................10

References......................................................................................................................................11

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................6

Part [a].........................................................................................................................................6

Part [b].......................................................................................................................................10

Part [c].......................................................................................................................................10

References......................................................................................................................................11

2TAXATION

Answer to Question 1

Issues – The issue in this case is related to the tax liability of the fringe benefit to the employee

provided the employer regarding employment.

Rules – One should note fringe benefit as payment provided to the employees when it is

different from salaries or wages. As per the FBT legislation, one should view fringe benefit as a

benefit that the employees receive regarding the release of employment relationship. As per

‘Section 136 (1), FBTAA 1986’, employee receive these benefit because they are the employees.

As per the fringe benefit tax, the accountability of the fringe benefit tax is to the employer in

case the employee, other officer or company directors receive the payment from the employer

and thus, this obligation needs to be maintained or the employees receive the benefit regarding

these payments (Sowa et al. 2018).

The employers, irrespective of trustee, sole trader, government authority or partnership,

are required to make the payments of fringe benefit tax. This tax needs to be paid irrespective of

the fact that the fringe benefit is provided by wither the employer or any other party. Fringe

benefit tax needs to be paid whether or not the employer has the liability to pay other taxes like

income tax. The employers have the right for claiming income tax deduction for cost of

providing benefits along with the payable fringe benefit tax amount (Young and Miles 2015).

According to “Section 7 (1) of FBTAA 18986”, a fringe benefit related to car takes place

when the employer makes the car available for the private use of the employee. The car is made

available for the private use of the employee by the employer on any given day in case the

employee generally uses the car for private purpose or the car is made available for the

Answer to Question 1

Issues – The issue in this case is related to the tax liability of the fringe benefit to the employee

provided the employer regarding employment.

Rules – One should note fringe benefit as payment provided to the employees when it is

different from salaries or wages. As per the FBT legislation, one should view fringe benefit as a

benefit that the employees receive regarding the release of employment relationship. As per

‘Section 136 (1), FBTAA 1986’, employee receive these benefit because they are the employees.

As per the fringe benefit tax, the accountability of the fringe benefit tax is to the employer in

case the employee, other officer or company directors receive the payment from the employer

and thus, this obligation needs to be maintained or the employees receive the benefit regarding

these payments (Sowa et al. 2018).

The employers, irrespective of trustee, sole trader, government authority or partnership,

are required to make the payments of fringe benefit tax. This tax needs to be paid irrespective of

the fact that the fringe benefit is provided by wither the employer or any other party. Fringe

benefit tax needs to be paid whether or not the employer has the liability to pay other taxes like

income tax. The employers have the right for claiming income tax deduction for cost of

providing benefits along with the payable fringe benefit tax amount (Young and Miles 2015).

According to “Section 7 (1) of FBTAA 18986”, a fringe benefit related to car takes place

when the employer makes the car available for the private use of the employee. The car is made

available for the private use of the employee by the employer on any given day in case the

employee generally uses the car for private purpose or the car is made available for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION

employee’s private use. The general rule says that it is considered as the private use of the car

when it is used to travel from home to work place (Harding 2014).

Two methods are there for the calculation of the fringe benefit related to a car; they are

the statutory formula method and operating cost method. It is compulsory for a taxpayer to

choose the method of statutory formula unless the operating cost method is chosen by them. The

operating cost method might be chosen by a taxpayer for all cars or any cars irrespective of

which method they adopted in the earlier year. “Section 7 (8) of FVTAA 1986” puts the

obligation of using the log book to maintain records for the use of operating cost method

(Hemmings and Tuske 2015).

Application – In the application of the above-mentioned rules, it needs to be mentioned that

XYZ Pty Ltd provided its employee Devika with a car for the purpose of private use and the car

was available for the private use of Devika throughout the FBT year of 2018/19. It is noteworthy

to mention that XYZ Pty Ltd provided the car to Devika in respect of her employment with the

company. In accordance with “Section 136 (1) of FBTAA 1986”, Devika received the benefit

from her employer during the taxation year in relation to employment (Hodne et al. 2013).

XYZ Pty Ltd made the car available for Devika for the purpose of her private use along

with the purpose of business use. Devika travelled a total of 20,000 kilometer. Among this,

Devika travelled 70% of the total distance for the purpose of business use while she travelled the

rest parts for the purpose of private use. Thus, as per “Section 7 (1) of FBTAA 1986”, fringe

benefit related to the car arises due to make the car available for the private use of Devika

(Voßmerbäumer 2013).

employee’s private use. The general rule says that it is considered as the private use of the car

when it is used to travel from home to work place (Harding 2014).

Two methods are there for the calculation of the fringe benefit related to a car; they are

the statutory formula method and operating cost method. It is compulsory for a taxpayer to

choose the method of statutory formula unless the operating cost method is chosen by them. The

operating cost method might be chosen by a taxpayer for all cars or any cars irrespective of

which method they adopted in the earlier year. “Section 7 (8) of FVTAA 1986” puts the

obligation of using the log book to maintain records for the use of operating cost method

(Hemmings and Tuske 2015).

Application – In the application of the above-mentioned rules, it needs to be mentioned that

XYZ Pty Ltd provided its employee Devika with a car for the purpose of private use and the car

was available for the private use of Devika throughout the FBT year of 2018/19. It is noteworthy

to mention that XYZ Pty Ltd provided the car to Devika in respect of her employment with the

company. In accordance with “Section 136 (1) of FBTAA 1986”, Devika received the benefit

from her employer during the taxation year in relation to employment (Hodne et al. 2013).

XYZ Pty Ltd made the car available for Devika for the purpose of her private use along

with the purpose of business use. Devika travelled a total of 20,000 kilometer. Among this,

Devika travelled 70% of the total distance for the purpose of business use while she travelled the

rest parts for the purpose of private use. Thus, as per “Section 7 (1) of FBTAA 1986”, fringe

benefit related to the car arises due to make the car available for the private use of Devika

(Voßmerbäumer 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION

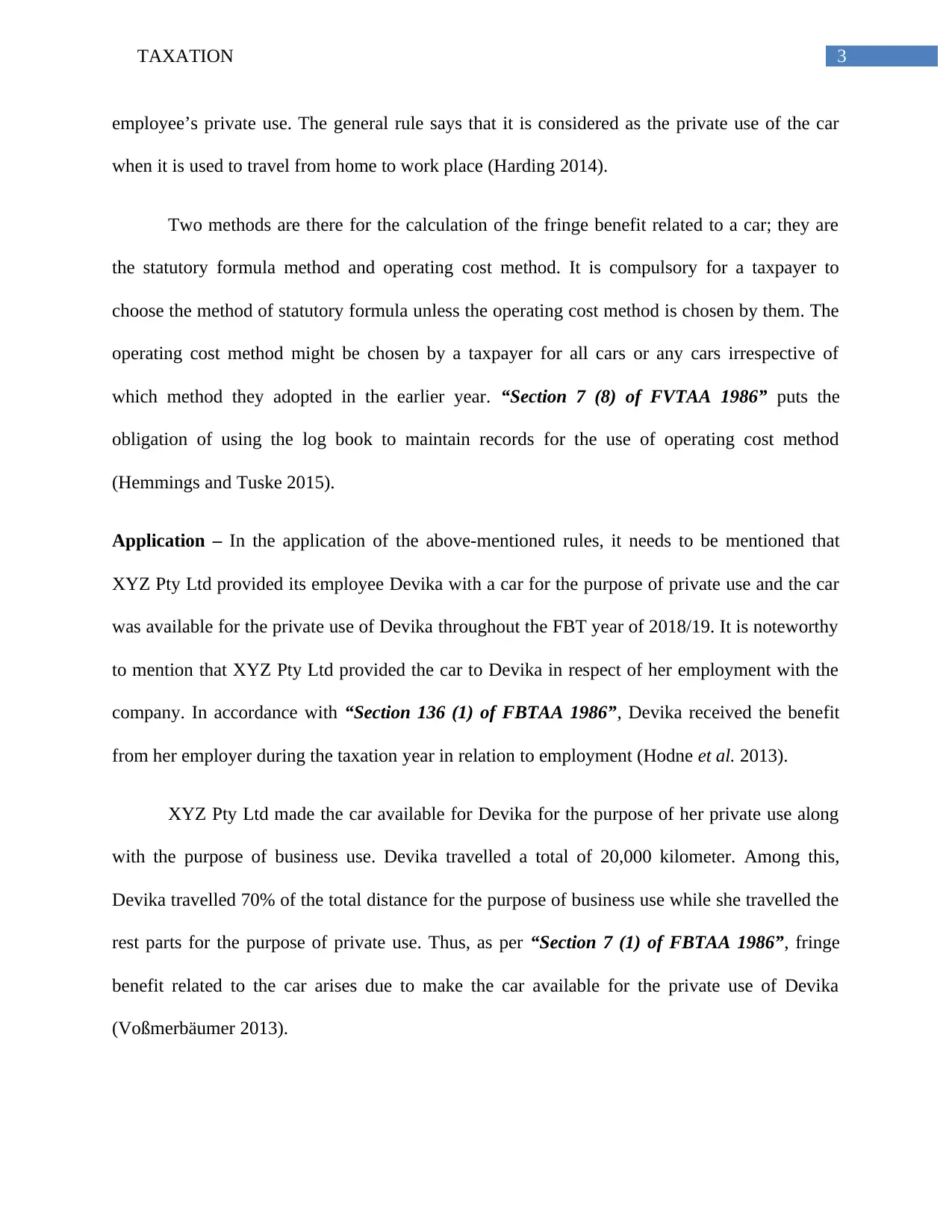

Statutory method along with the cost benefit method is followed for the determination of

the taxable value of the car’s fringe benefit. As per the case scenario, Devika travelled a total of

20,000 kilometers. By considering this information, a statutory rate of 20% is applied in the case

of XYZ Pty Ltd for the calculation of fringe benefit tax. The base value of the car is multiplied

by the statutory percentage with the FBT year’s number of days and the number of days the

employee held the card under her ownership. In addition, the employer contribution has been

substance here for the computation of net amount of taxable fringe benefit as per the statutory

method (Edmonds 2015).

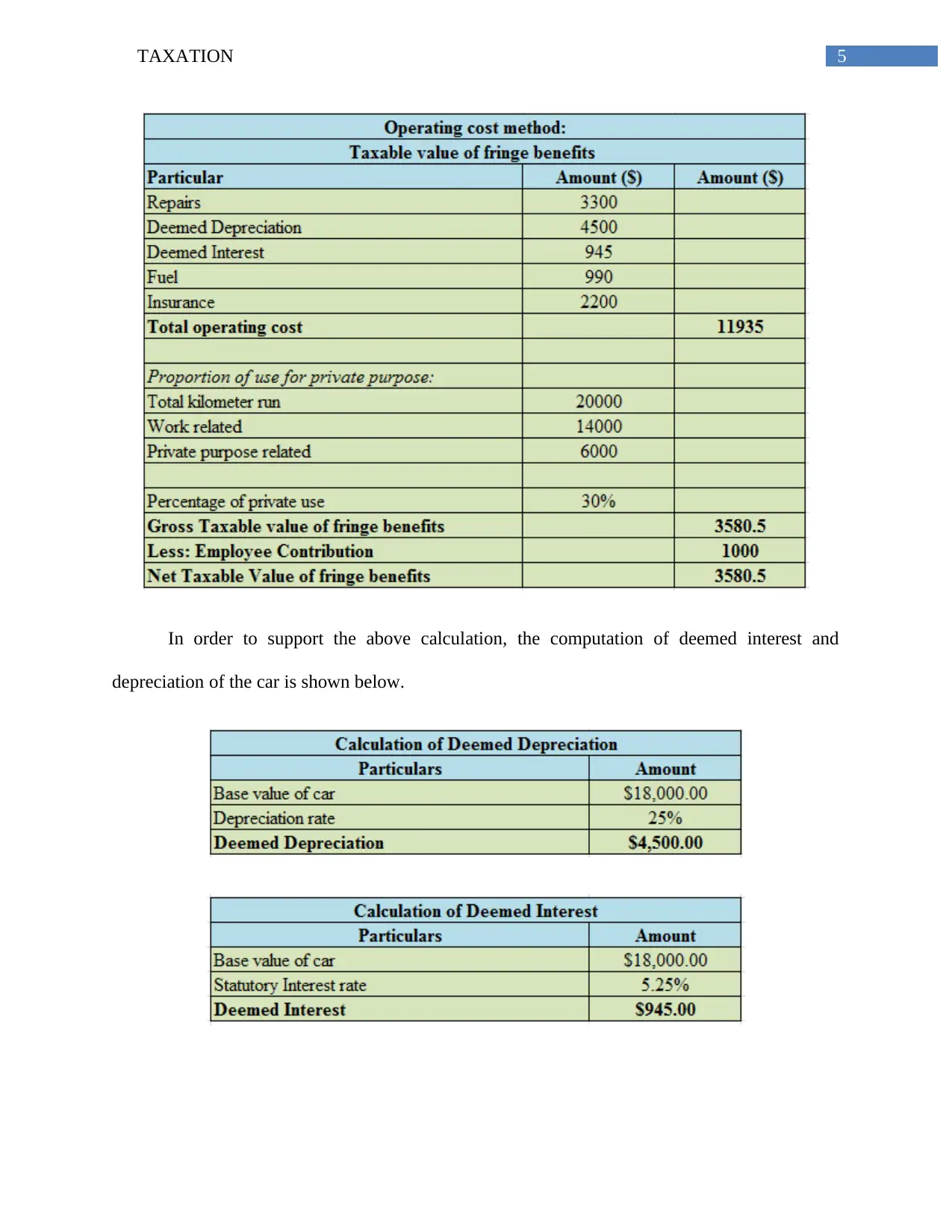

The log book method is also utilized for XYZ Pty Ltd for the computation of fringe

benefits tax. As per the log book method, the portion of business use of the car needs to be

divided by the total travelled distance for the purpose of business from the total distance and

then, it is multiplied by 100 for determining the percentage of business use. The computation

under the log book method is shown below.

Statutory method along with the cost benefit method is followed for the determination of

the taxable value of the car’s fringe benefit. As per the case scenario, Devika travelled a total of

20,000 kilometers. By considering this information, a statutory rate of 20% is applied in the case

of XYZ Pty Ltd for the calculation of fringe benefit tax. The base value of the car is multiplied

by the statutory percentage with the FBT year’s number of days and the number of days the

employee held the card under her ownership. In addition, the employer contribution has been

substance here for the computation of net amount of taxable fringe benefit as per the statutory

method (Edmonds 2015).

The log book method is also utilized for XYZ Pty Ltd for the computation of fringe

benefits tax. As per the log book method, the portion of business use of the car needs to be

divided by the total travelled distance for the purpose of business from the total distance and

then, it is multiplied by 100 for determining the percentage of business use. The computation

under the log book method is shown below.

5TAXATION

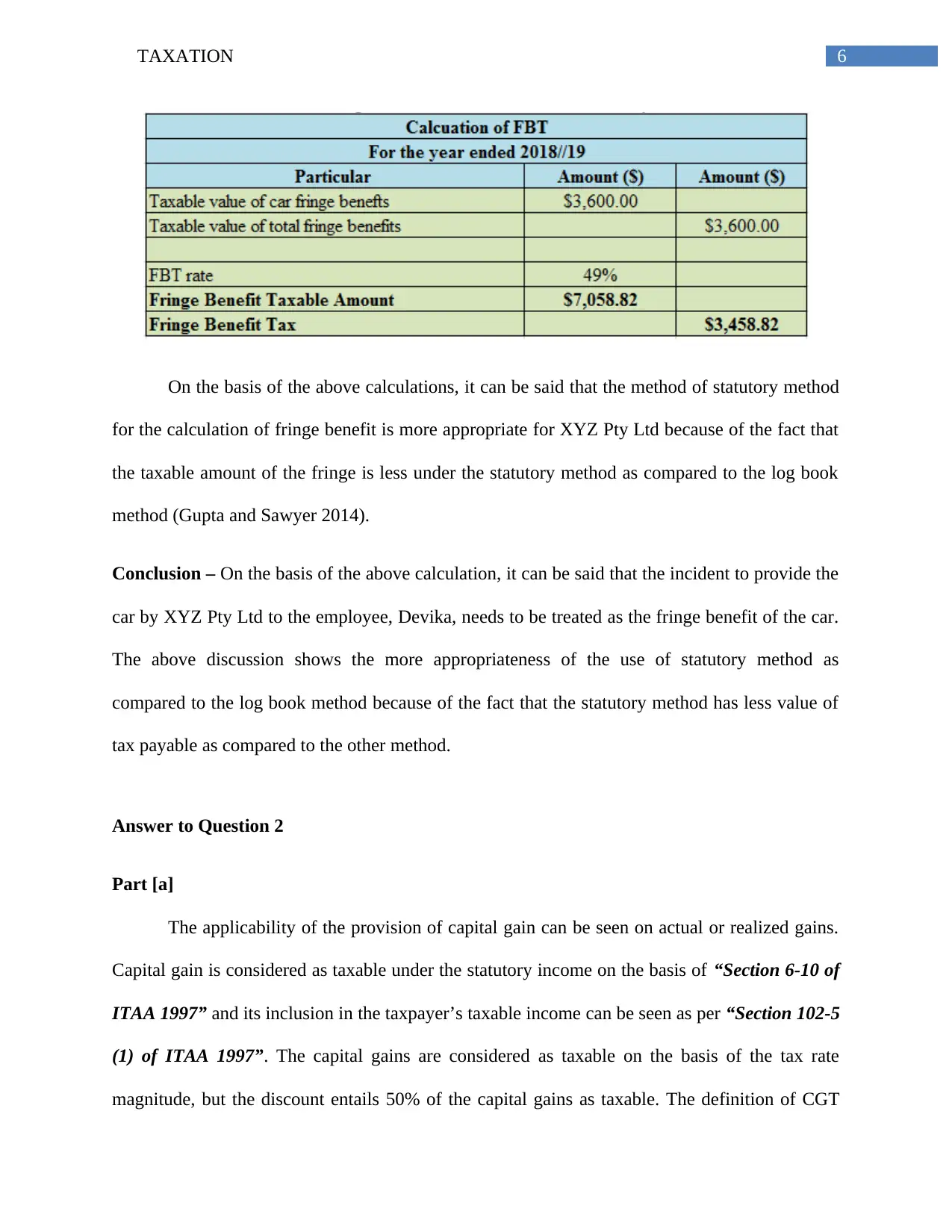

In order to support the above calculation, the computation of deemed interest and

depreciation of the car is shown below.

In order to support the above calculation, the computation of deemed interest and

depreciation of the car is shown below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION

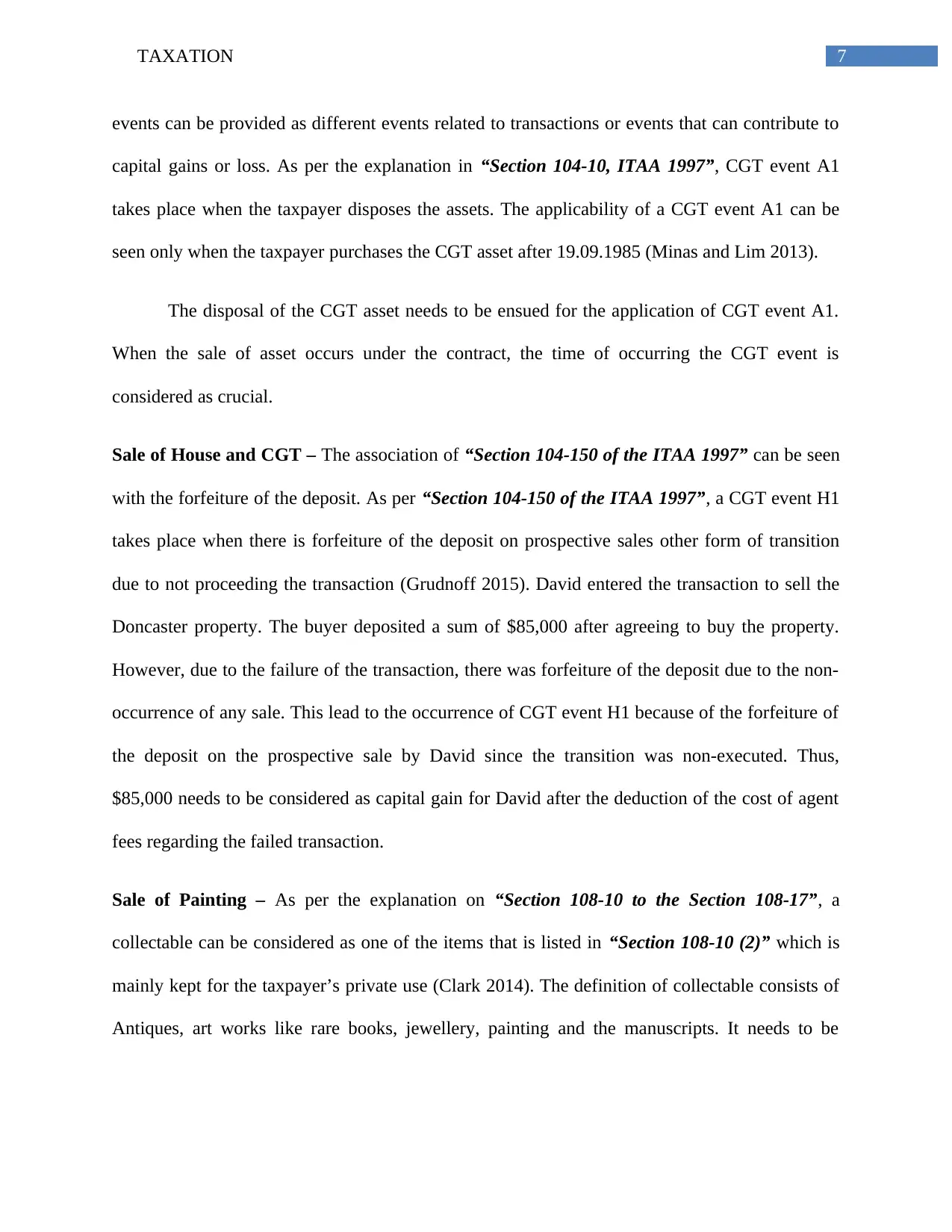

On the basis of the above calculations, it can be said that the method of statutory method

for the calculation of fringe benefit is more appropriate for XYZ Pty Ltd because of the fact that

the taxable amount of the fringe is less under the statutory method as compared to the log book

method (Gupta and Sawyer 2014).

Conclusion – On the basis of the above calculation, it can be said that the incident to provide the

car by XYZ Pty Ltd to the employee, Devika, needs to be treated as the fringe benefit of the car.

The above discussion shows the more appropriateness of the use of statutory method as

compared to the log book method because of the fact that the statutory method has less value of

tax payable as compared to the other method.

Answer to Question 2

Part [a]

The applicability of the provision of capital gain can be seen on actual or realized gains.

Capital gain is considered as taxable under the statutory income on the basis of “Section 6-10 of

ITAA 1997” and its inclusion in the taxpayer’s taxable income can be seen as per “Section 102-5

(1) of ITAA 1997”. The capital gains are considered as taxable on the basis of the tax rate

magnitude, but the discount entails 50% of the capital gains as taxable. The definition of CGT

On the basis of the above calculations, it can be said that the method of statutory method

for the calculation of fringe benefit is more appropriate for XYZ Pty Ltd because of the fact that

the taxable amount of the fringe is less under the statutory method as compared to the log book

method (Gupta and Sawyer 2014).

Conclusion – On the basis of the above calculation, it can be said that the incident to provide the

car by XYZ Pty Ltd to the employee, Devika, needs to be treated as the fringe benefit of the car.

The above discussion shows the more appropriateness of the use of statutory method as

compared to the log book method because of the fact that the statutory method has less value of

tax payable as compared to the other method.

Answer to Question 2

Part [a]

The applicability of the provision of capital gain can be seen on actual or realized gains.

Capital gain is considered as taxable under the statutory income on the basis of “Section 6-10 of

ITAA 1997” and its inclusion in the taxpayer’s taxable income can be seen as per “Section 102-5

(1) of ITAA 1997”. The capital gains are considered as taxable on the basis of the tax rate

magnitude, but the discount entails 50% of the capital gains as taxable. The definition of CGT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION

events can be provided as different events related to transactions or events that can contribute to

capital gains or loss. As per the explanation in “Section 104-10, ITAA 1997”, CGT event A1

takes place when the taxpayer disposes the assets. The applicability of a CGT event A1 can be

seen only when the taxpayer purchases the CGT asset after 19.09.1985 (Minas and Lim 2013).

The disposal of the CGT asset needs to be ensued for the application of CGT event A1.

When the sale of asset occurs under the contract, the time of occurring the CGT event is

considered as crucial.

Sale of House and CGT – The association of “Section 104-150 of the ITAA 1997” can be seen

with the forfeiture of the deposit. As per “Section 104-150 of the ITAA 1997”, a CGT event H1

takes place when there is forfeiture of the deposit on prospective sales other form of transition

due to not proceeding the transaction (Grudnoff 2015). David entered the transaction to sell the

Doncaster property. The buyer deposited a sum of $85,000 after agreeing to buy the property.

However, due to the failure of the transaction, there was forfeiture of the deposit due to the non-

occurrence of any sale. This lead to the occurrence of CGT event H1 because of the forfeiture of

the deposit on the prospective sale by David since the transition was non-executed. Thus,

$85,000 needs to be considered as capital gain for David after the deduction of the cost of agent

fees regarding the failed transaction.

Sale of Painting – As per the explanation on “Section 108-10 to the Section 108-17”, a

collectable can be considered as one of the items that is listed in “Section 108-10 (2)” which is

mainly kept for the taxpayer’s private use (Clark 2014). The definition of collectable consists of

Antiques, art works like rare books, jewellery, painting and the manuscripts. It needs to be

events can be provided as different events related to transactions or events that can contribute to

capital gains or loss. As per the explanation in “Section 104-10, ITAA 1997”, CGT event A1

takes place when the taxpayer disposes the assets. The applicability of a CGT event A1 can be

seen only when the taxpayer purchases the CGT asset after 19.09.1985 (Minas and Lim 2013).

The disposal of the CGT asset needs to be ensued for the application of CGT event A1.

When the sale of asset occurs under the contract, the time of occurring the CGT event is

considered as crucial.

Sale of House and CGT – The association of “Section 104-150 of the ITAA 1997” can be seen

with the forfeiture of the deposit. As per “Section 104-150 of the ITAA 1997”, a CGT event H1

takes place when there is forfeiture of the deposit on prospective sales other form of transition

due to not proceeding the transaction (Grudnoff 2015). David entered the transaction to sell the

Doncaster property. The buyer deposited a sum of $85,000 after agreeing to buy the property.

However, due to the failure of the transaction, there was forfeiture of the deposit due to the non-

occurrence of any sale. This lead to the occurrence of CGT event H1 because of the forfeiture of

the deposit on the prospective sale by David since the transition was non-executed. Thus,

$85,000 needs to be considered as capital gain for David after the deduction of the cost of agent

fees regarding the failed transaction.

Sale of Painting – As per the explanation on “Section 108-10 to the Section 108-17”, a

collectable can be considered as one of the items that is listed in “Section 108-10 (2)” which is

mainly kept for the taxpayer’s private use (Clark 2014). The definition of collectable consists of

Antiques, art works like rare books, jewellery, painting and the manuscripts. It needs to be

8TAXATION

mentioned that it is needed to separate the capital loss from collectables and the capital loss is

authorized for offsetting from the capital gains made from different other collectables.

As per the provided scenario, David purchased an arctic painting on 20.09.1985 for

$15,000. It is needed to consider the paining as a post-CGT asset since its purchase occurred

after CGT regime introduced. On 31.05.2019, David disposed off the painting for a sale value of

$125,000. Capital gain occurred due to the sale of this painting. This capital gain occurred from

the painting needs to be treated as statutory income and it needs to be included into the net

income of David’s taxable earnings.

Sale of Luxury Yacht – The explanation of the personal use assets can be seen in “Section 108-

20 to 108-30 of the ITAA 1997” which shows that the taxpayers keep the assets for their

personal enjoyment. These types of assets consist of boats, furniture, racehorse and others. It is

necessary to mention that the capital gains occurred from the personal assets sales need to be

ignored in case the cost of acquisition of the assets is less than $10,000. On the contrary, as

described in “Section 108-20 (1) of ITAA 1997”, the capital loss needs to be completely ignored

when it takes place from the sale of personal use asset (Evans, Minas and Lim 2015).

In 2004, David acquired a luxury yacht for $110,000 and David sold the sale luxury yacht

in 01.06.2019 for $60,000. This led to the occurrence of capital loss. Based on “Section 108-20

(1), ITAA 1997”, the capital loss due to the sale of the luxury yacht needs to be ignored from

David’s personal use assets.

Sale of Shares – According to “Section 108-5 of the ITAA 1997”, shares in the listed

companies is also needed to be considered as CGT assets. As per the explanation of the ATO, it

mentioned that it is needed to separate the capital loss from collectables and the capital loss is

authorized for offsetting from the capital gains made from different other collectables.

As per the provided scenario, David purchased an arctic painting on 20.09.1985 for

$15,000. It is needed to consider the paining as a post-CGT asset since its purchase occurred

after CGT regime introduced. On 31.05.2019, David disposed off the painting for a sale value of

$125,000. Capital gain occurred due to the sale of this painting. This capital gain occurred from

the painting needs to be treated as statutory income and it needs to be included into the net

income of David’s taxable earnings.

Sale of Luxury Yacht – The explanation of the personal use assets can be seen in “Section 108-

20 to 108-30 of the ITAA 1997” which shows that the taxpayers keep the assets for their

personal enjoyment. These types of assets consist of boats, furniture, racehorse and others. It is

necessary to mention that the capital gains occurred from the personal assets sales need to be

ignored in case the cost of acquisition of the assets is less than $10,000. On the contrary, as

described in “Section 108-20 (1) of ITAA 1997”, the capital loss needs to be completely ignored

when it takes place from the sale of personal use asset (Evans, Minas and Lim 2015).

In 2004, David acquired a luxury yacht for $110,000 and David sold the sale luxury yacht

in 01.06.2019 for $60,000. This led to the occurrence of capital loss. Based on “Section 108-20

(1), ITAA 1997”, the capital loss due to the sale of the luxury yacht needs to be ignored from

David’s personal use assets.

Sale of Shares – According to “Section 108-5 of the ITAA 1997”, shares in the listed

companies is also needed to be considered as CGT assets. As per the explanation of the ATO, it

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION

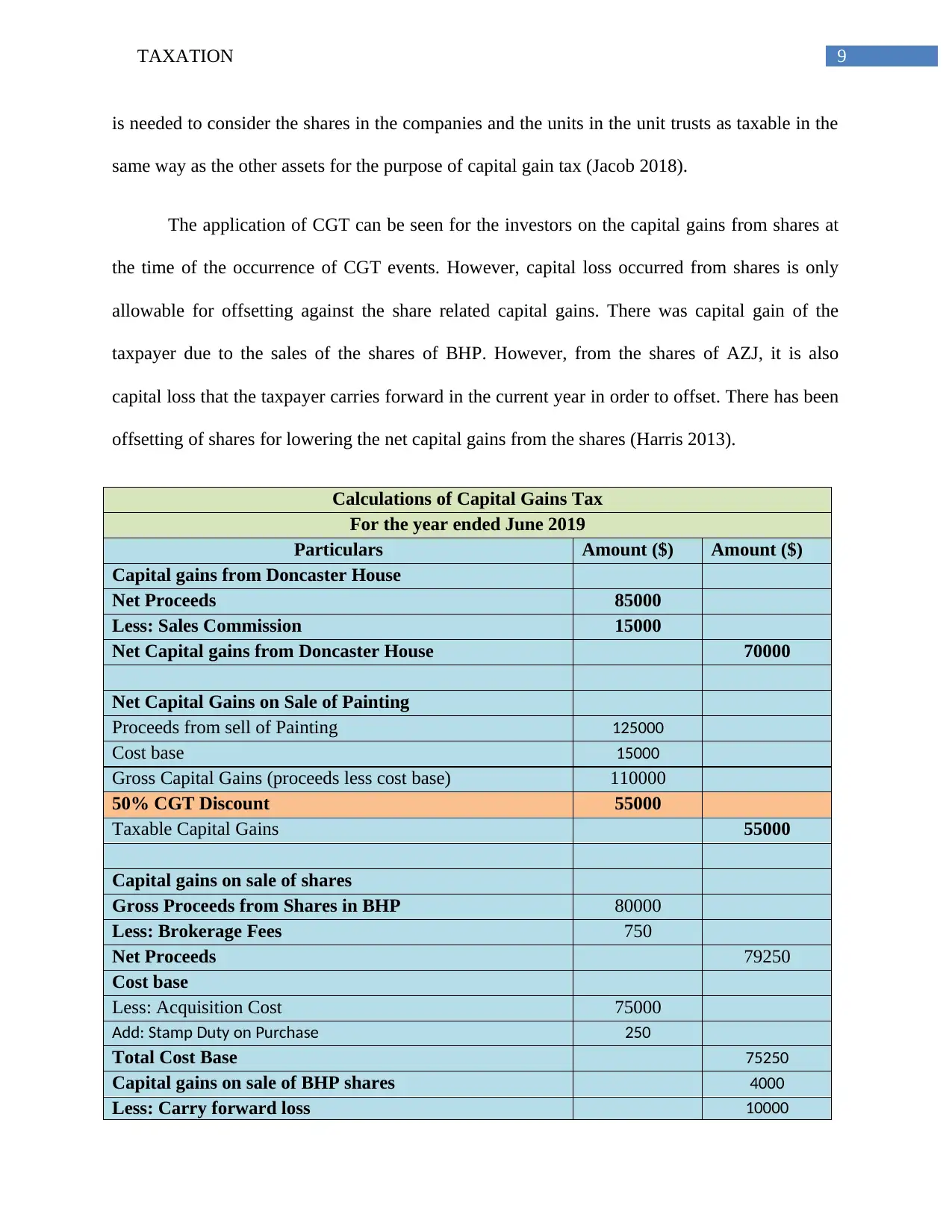

is needed to consider the shares in the companies and the units in the unit trusts as taxable in the

same way as the other assets for the purpose of capital gain tax (Jacob 2018).

The application of CGT can be seen for the investors on the capital gains from shares at

the time of the occurrence of CGT events. However, capital loss occurred from shares is only

allowable for offsetting against the share related capital gains. There was capital gain of the

taxpayer due to the sales of the shares of BHP. However, from the shares of AZJ, it is also

capital loss that the taxpayer carries forward in the current year in order to offset. There has been

offsetting of shares for lowering the net capital gains from the shares (Harris 2013).

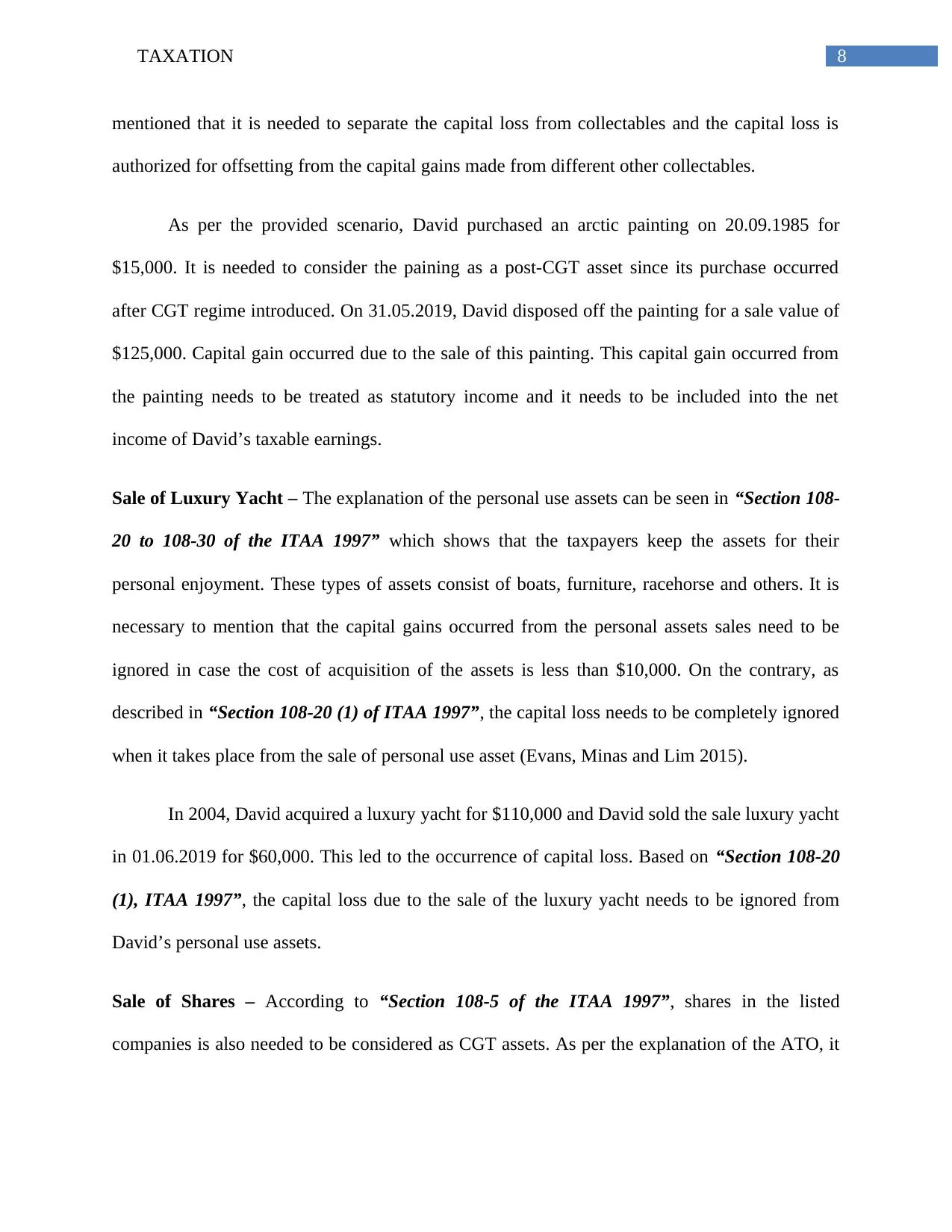

Calculations of Capital Gains Tax

For the year ended June 2019

Particulars Amount ($) Amount ($)

Capital gains from Doncaster House

Net Proceeds 85000

Less: Sales Commission 15000

Net Capital gains from Doncaster House 70000

Net Capital Gains on Sale of Painting

Proceeds from sell of Painting 125000

Cost base 15000

Gross Capital Gains (proceeds less cost base) 110000

50% CGT Discount 55000

Taxable Capital Gains 55000

Capital gains on sale of shares

Gross Proceeds from Shares in BHP 80000

Less: Brokerage Fees 750

Net Proceeds 79250

Cost base

Less: Acquisition Cost 75000

Add: Stamp Duty on Purchase 250

Total Cost Base 75250

Capital gains on sale of BHP shares 4000

Less: Carry forward loss 10000

is needed to consider the shares in the companies and the units in the unit trusts as taxable in the

same way as the other assets for the purpose of capital gain tax (Jacob 2018).

The application of CGT can be seen for the investors on the capital gains from shares at

the time of the occurrence of CGT events. However, capital loss occurred from shares is only

allowable for offsetting against the share related capital gains. There was capital gain of the

taxpayer due to the sales of the shares of BHP. However, from the shares of AZJ, it is also

capital loss that the taxpayer carries forward in the current year in order to offset. There has been

offsetting of shares for lowering the net capital gains from the shares (Harris 2013).

Calculations of Capital Gains Tax

For the year ended June 2019

Particulars Amount ($) Amount ($)

Capital gains from Doncaster House

Net Proceeds 85000

Less: Sales Commission 15000

Net Capital gains from Doncaster House 70000

Net Capital Gains on Sale of Painting

Proceeds from sell of Painting 125000

Cost base 15000

Gross Capital Gains (proceeds less cost base) 110000

50% CGT Discount 55000

Taxable Capital Gains 55000

Capital gains on sale of shares

Gross Proceeds from Shares in BHP 80000

Less: Brokerage Fees 750

Net Proceeds 79250

Cost base

Less: Acquisition Cost 75000

Add: Stamp Duty on Purchase 250

Total Cost Base 75250

Capital gains on sale of BHP shares 4000

Less: Carry forward loss 10000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION

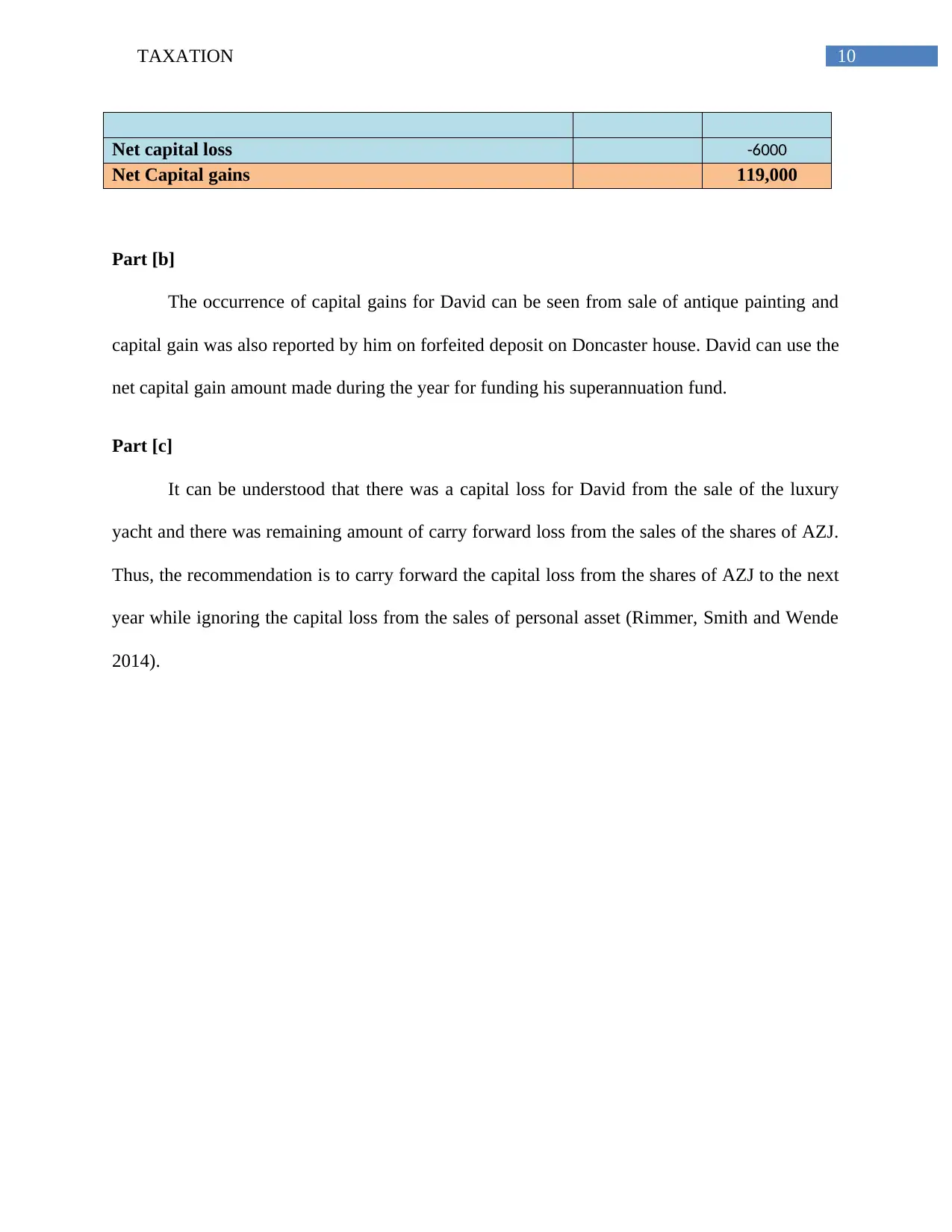

Net capital loss -6000

Net Capital gains 119,000

Part [b]

The occurrence of capital gains for David can be seen from sale of antique painting and

capital gain was also reported by him on forfeited deposit on Doncaster house. David can use the

net capital gain amount made during the year for funding his superannuation fund.

Part [c]

It can be understood that there was a capital loss for David from the sale of the luxury

yacht and there was remaining amount of carry forward loss from the sales of the shares of AZJ.

Thus, the recommendation is to carry forward the capital loss from the shares of AZJ to the next

year while ignoring the capital loss from the sales of personal asset (Rimmer, Smith and Wende

2014).

Net capital loss -6000

Net Capital gains 119,000

Part [b]

The occurrence of capital gains for David can be seen from sale of antique painting and

capital gain was also reported by him on forfeited deposit on Doncaster house. David can use the

net capital gain amount made during the year for funding his superannuation fund.

Part [c]

It can be understood that there was a capital loss for David from the sale of the luxury

yacht and there was remaining amount of carry forward loss from the sales of the shares of AZJ.

Thus, the recommendation is to carry forward the capital loss from the shares of AZJ to the next

year while ignoring the capital loss from the sales of personal asset (Rimmer, Smith and Wende

2014).

11TAXATION

References

Clark, J., 2014. Capital gains tax: historical trends and forecasting frameworks. Economic

Round-up, (2), p.35.

Edmonds, R., 2015. Structural tax reform: What should be brought to the table. Austl. Tax F., 30,

p.393.

Evans, C., Minas, J. and Lim, Y., 2015. Taxing personal capital gains in Australia: an alternative

way forward. Austl. Tax F., 30, p.735.

Grudnoff, M., 2015. Top gears: how negative gearing and the capital gains tax discount benefit

the top 10 per cent and drive up house prices.

Gupta, R. and Sawyer, A., 2014, January. Tax compliance costs for small businesses in New

Zealand: Some recent findings. In Australasian Tax Teachers’ Association Conference, Griffith

University, January.

Harding, M., 2014. Personal tax treatment of company cars and commuting expenses.

Harris, P., 2013. Corporate tax law: structure, policy and practice. Cambridge University Press.

Hemmings, P. and Tuske, A., 2015. Improving Taxes and Transfers in Australia.

Hodne, N., Murphy, S., Ottenbacher, M. and Ruggles, T., 2013. Australia and the United States:

A comparison and contrast of corporate governance Practices. Drake Management Review, 3(1),

pp.58-80.

References

Clark, J., 2014. Capital gains tax: historical trends and forecasting frameworks. Economic

Round-up, (2), p.35.

Edmonds, R., 2015. Structural tax reform: What should be brought to the table. Austl. Tax F., 30,

p.393.

Evans, C., Minas, J. and Lim, Y., 2015. Taxing personal capital gains in Australia: an alternative

way forward. Austl. Tax F., 30, p.735.

Grudnoff, M., 2015. Top gears: how negative gearing and the capital gains tax discount benefit

the top 10 per cent and drive up house prices.

Gupta, R. and Sawyer, A., 2014, January. Tax compliance costs for small businesses in New

Zealand: Some recent findings. In Australasian Tax Teachers’ Association Conference, Griffith

University, January.

Harding, M., 2014. Personal tax treatment of company cars and commuting expenses.

Harris, P., 2013. Corporate tax law: structure, policy and practice. Cambridge University Press.

Hemmings, P. and Tuske, A., 2015. Improving Taxes and Transfers in Australia.

Hodne, N., Murphy, S., Ottenbacher, M. and Ruggles, T., 2013. Australia and the United States:

A comparison and contrast of corporate governance Practices. Drake Management Review, 3(1),

pp.58-80.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.