Taxation Theory, Practice & Law Assignment: Analysis of Tax Principles

VerifiedAdded on 2020/04/07

|9

|2420

|389

Report

AI Summary

This report provides a comprehensive analysis of several key areas within Australian taxation law. It begins by addressing capital gains tax, illustrating the computation of capital gains and losses based on different holding periods of assets. The report then delves into fringe benefits tax, specifically examining a scenario involving a loan provided to an employee and calculating the taxable value of the fringe benefit. The analysis continues with a discussion of loss allocation in rental property situations, considering the implications of agreements between joint tenants. Furthermore, the report explores the principle established in IRC v Duke of Westminster [1936] AC 1, evaluating its relevance in the Australian context, and discusses tax avoidance. Finally, the report examines the taxation of income derived from timber, considering scenarios involving the sale of timber and the granting of rights to remove timber from land. The report concludes with a list of references used to support the analysis.

Taxation Theory, Practice & Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

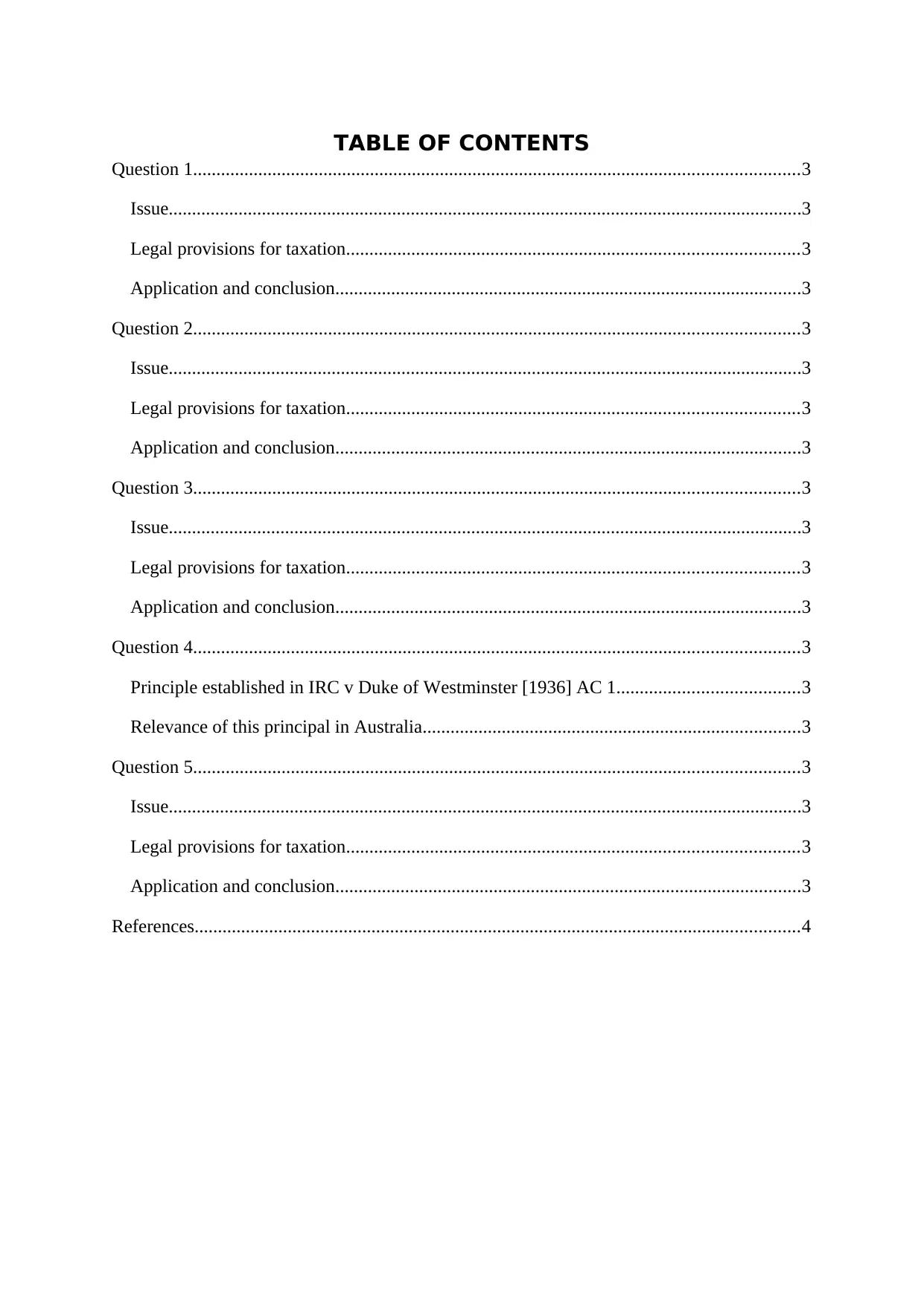

TABLE OF CONTENTS

Question 1..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 2..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 3..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 4..................................................................................................................................3

Principle established in IRC v Duke of Westminster [1936] AC 1.......................................3

Relevance of this principal in Australia.................................................................................3

Question 5..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

References..................................................................................................................................4

Question 1..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 2..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 3..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

Question 4..................................................................................................................................3

Principle established in IRC v Duke of Westminster [1936] AC 1.......................................3

Relevance of this principal in Australia.................................................................................3

Question 5..................................................................................................................................3

Issue........................................................................................................................................3

Legal provisions for taxation.................................................................................................3

Application and conclusion....................................................................................................3

References..................................................................................................................................4

QUESTION 1

Issue

In the described scenario, Eric was engaged in purchase and sale of various capital assets. By

considering those transactions computation of capital taxation is done in this part.

Legal provisions for taxation

In accordance with the capital taxation provisions of Australia different method is applicable

on the basis of holding period of asset(Faccioand Xu, 2015). Description and condition of its

applicability is as follows: Indexation and discounting method: One of these methods is applied if assesse hold

capital assets for more than twelve months. Other method: This method is applied if assesse hold capital assets for less than

twelve months(Jacob, 2016).

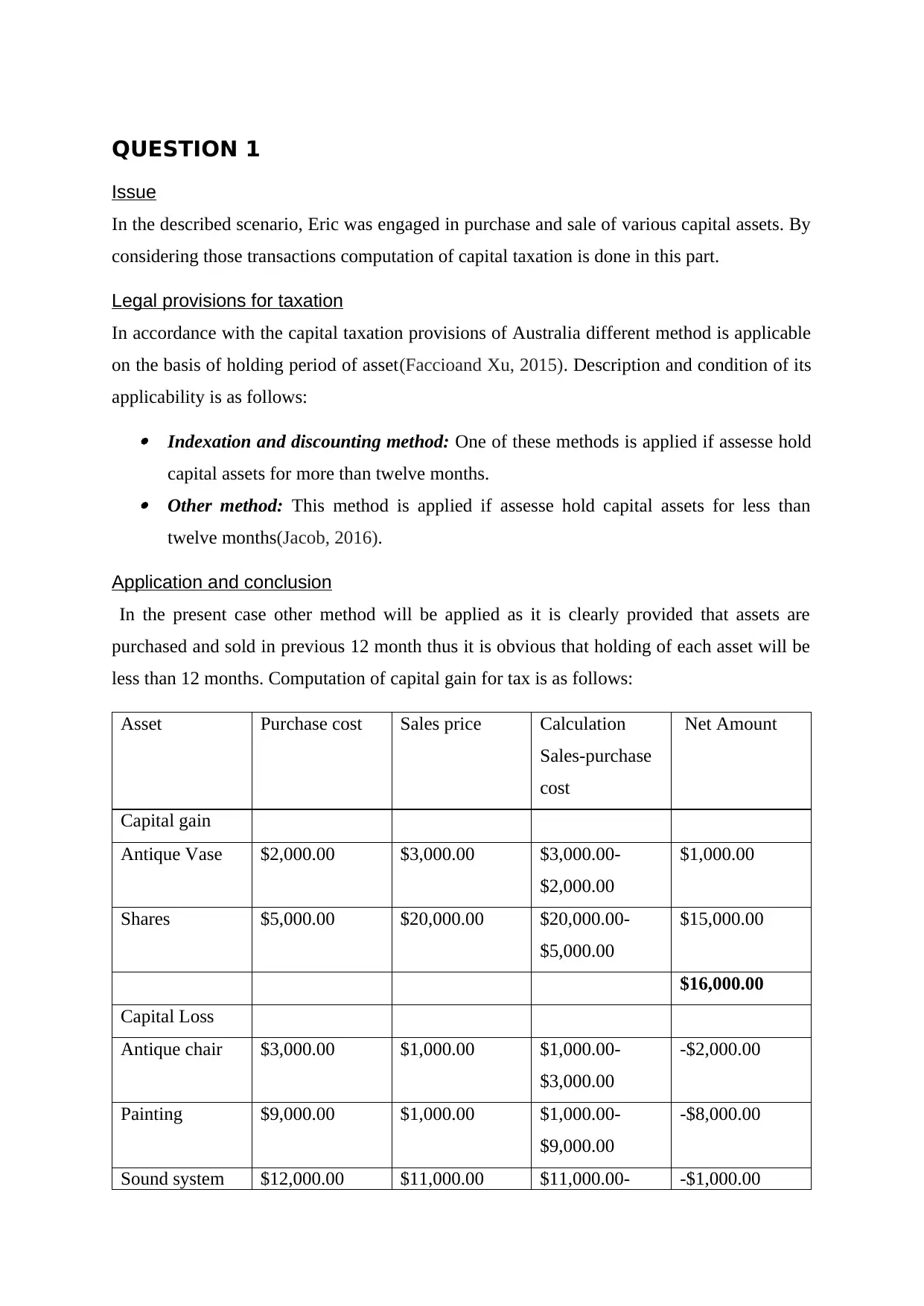

Application and conclusion

In the present case other method will be applied as it is clearly provided that assets are

purchased and sold in previous 12 month thus it is obvious that holding of each asset will be

less than 12 months. Computation of capital gain for tax is as follows:

Asset Purchase cost Sales price Calculation

Sales-purchase

cost

Net Amount

Capital gain

Antique Vase $2,000.00 $3,000.00 $3,000.00-

$2,000.00

$1,000.00

Shares $5,000.00 $20,000.00 $20,000.00-

$5,000.00

$15,000.00

$16,000.00

Capital Loss

Antique chair $3,000.00 $1,000.00 $1,000.00-

$3,000.00

-$2,000.00

Painting $9,000.00 $1,000.00 $1,000.00-

$9,000.00

-$8,000.00

Sound system $12,000.00 $11,000.00 $11,000.00- -$1,000.00

Issue

In the described scenario, Eric was engaged in purchase and sale of various capital assets. By

considering those transactions computation of capital taxation is done in this part.

Legal provisions for taxation

In accordance with the capital taxation provisions of Australia different method is applicable

on the basis of holding period of asset(Faccioand Xu, 2015). Description and condition of its

applicability is as follows: Indexation and discounting method: One of these methods is applied if assesse hold

capital assets for more than twelve months. Other method: This method is applied if assesse hold capital assets for less than

twelve months(Jacob, 2016).

Application and conclusion

In the present case other method will be applied as it is clearly provided that assets are

purchased and sold in previous 12 month thus it is obvious that holding of each asset will be

less than 12 months. Computation of capital gain for tax is as follows:

Asset Purchase cost Sales price Calculation

Sales-purchase

cost

Net Amount

Capital gain

Antique Vase $2,000.00 $3,000.00 $3,000.00-

$2,000.00

$1,000.00

Shares $5,000.00 $20,000.00 $20,000.00-

$5,000.00

$15,000.00

$16,000.00

Capital Loss

Antique chair $3,000.00 $1,000.00 $1,000.00-

$3,000.00

-$2,000.00

Painting $9,000.00 $1,000.00 $1,000.00-

$9,000.00

-$8,000.00

Sound system $12,000.00 $11,000.00 $11,000.00- -$1,000.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

$12,000.00

-$11,000.00

Net Capital

gain

Total Capital gain - Total Capital loss

$16,000.00--$11,000.00

$5,000.00

QUESTION 2

Issue

Brian is recruited as an executive in a banking institution. Coming to his remuneration

package, Brian’s employer offered him a 3 year loan of total amount of $1m as well with a

special rate of interest of 1% per annum and must be paid in monthly basis. On the date 1

April 2016 the loan was offered, brain made use of 40 percent of its borrowed funds for the

purpose of income generation and meet all its requirements as per the interest payments.

Present question is focused on computation Loan Fringe Benefits provided to Brian by

considering the given case facts.

Legal provisions for taxation

Fringe benefits act as an important part in the business and it can use as a means of attracting

experienced and superior staff. Conversely, if company is providing fringe benefits to their

staff, then it is must get self-awareness regarding their own obligations of tax(Woellner and

et.al, 2016). Fringe Benefits Tax or FBT is amount to be paid as tax by the employers,

purposefully for the benefit of employee, by replacing wages and salaries. This tax payable is

a separated part and is measured on the tax value of the FBT provided(Pearceand Pinto,

2015). By considering the provisions of fringe benefit tax on loan on special rate tax is to be

provided on difference amount of tax rate charged and statutory interest rate. According to

Australian Taxation Office;Benchmark Interest Rates for Loan Fringe Benefits is 5.65% for

2016.

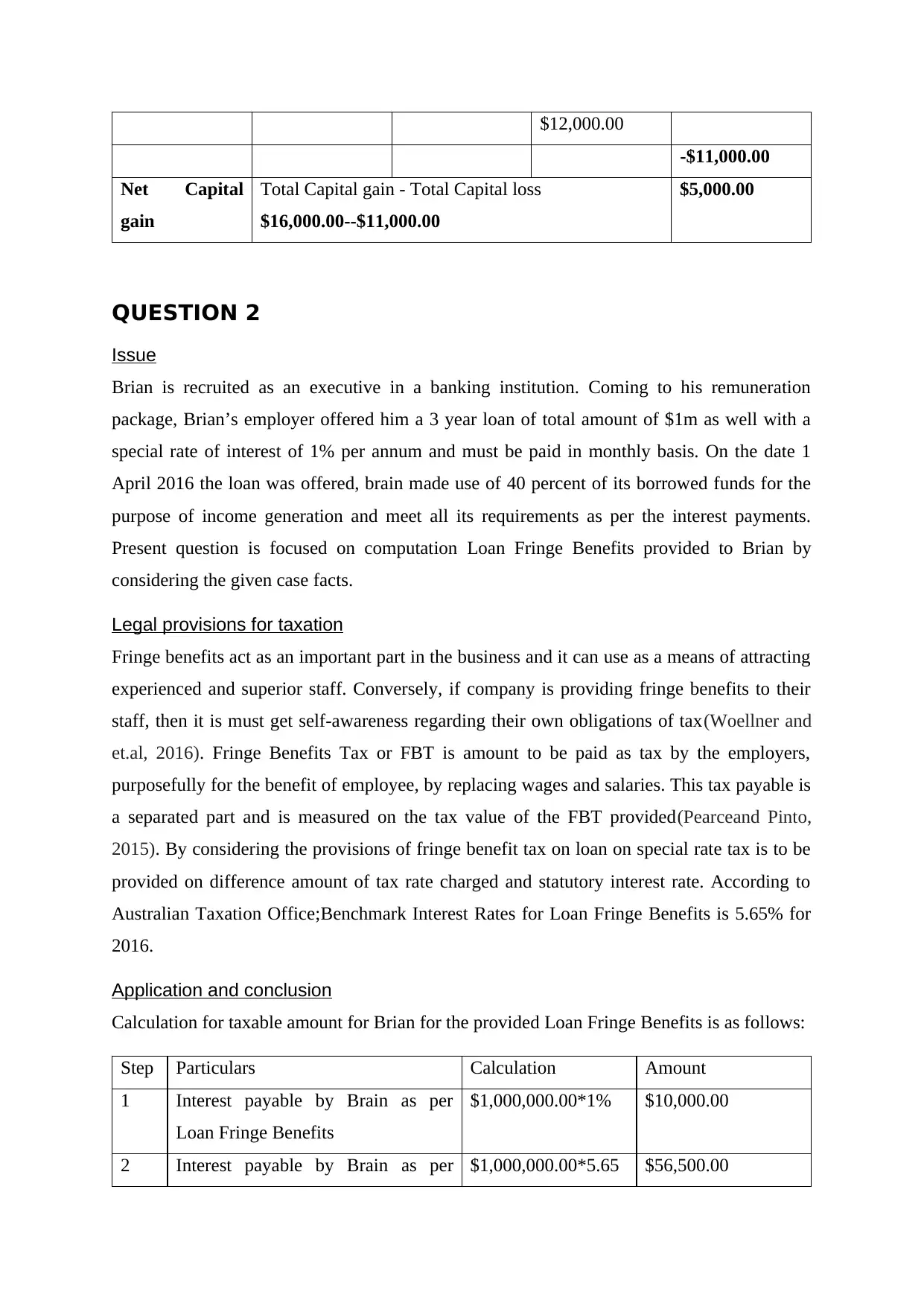

Application and conclusion

Calculation for taxable amount for Brian for the provided Loan Fringe Benefits is as follows:

Step Particulars Calculation Amount

1 Interest payable by Brain as per

Loan Fringe Benefits

$1,000,000.00*1% $10,000.00

2 Interest payable by Brain as per $1,000,000.00*5.65 $56,500.00

-$11,000.00

Net Capital

gain

Total Capital gain - Total Capital loss

$16,000.00--$11,000.00

$5,000.00

QUESTION 2

Issue

Brian is recruited as an executive in a banking institution. Coming to his remuneration

package, Brian’s employer offered him a 3 year loan of total amount of $1m as well with a

special rate of interest of 1% per annum and must be paid in monthly basis. On the date 1

April 2016 the loan was offered, brain made use of 40 percent of its borrowed funds for the

purpose of income generation and meet all its requirements as per the interest payments.

Present question is focused on computation Loan Fringe Benefits provided to Brian by

considering the given case facts.

Legal provisions for taxation

Fringe benefits act as an important part in the business and it can use as a means of attracting

experienced and superior staff. Conversely, if company is providing fringe benefits to their

staff, then it is must get self-awareness regarding their own obligations of tax(Woellner and

et.al, 2016). Fringe Benefits Tax or FBT is amount to be paid as tax by the employers,

purposefully for the benefit of employee, by replacing wages and salaries. This tax payable is

a separated part and is measured on the tax value of the FBT provided(Pearceand Pinto,

2015). By considering the provisions of fringe benefit tax on loan on special rate tax is to be

provided on difference amount of tax rate charged and statutory interest rate. According to

Australian Taxation Office;Benchmark Interest Rates for Loan Fringe Benefits is 5.65% for

2016.

Application and conclusion

Calculation for taxable amount for Brian for the provided Loan Fringe Benefits is as follows:

Step Particulars Calculation Amount

1 Interest payable by Brain as per

Loan Fringe Benefits

$1,000,000.00*1% $10,000.00

2 Interest payable by Brain as per $1,000,000.00*5.65 $56,500.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

statutory interest rate %

3 Taxable value of loan fringe benefit Step 2 - Step 1

$56,500.00-

$10,000.00

$46,500.00

As per computation taxable amount is $46,500.00 and taxable amount will not be

affected even only 40% is used for income producing purpose.

Taxability will not be affected even if interest payment is made end of the loan

instead of monthly

In case where Brian is exempted from paying interest then taxable amount will be

$56,500.00.

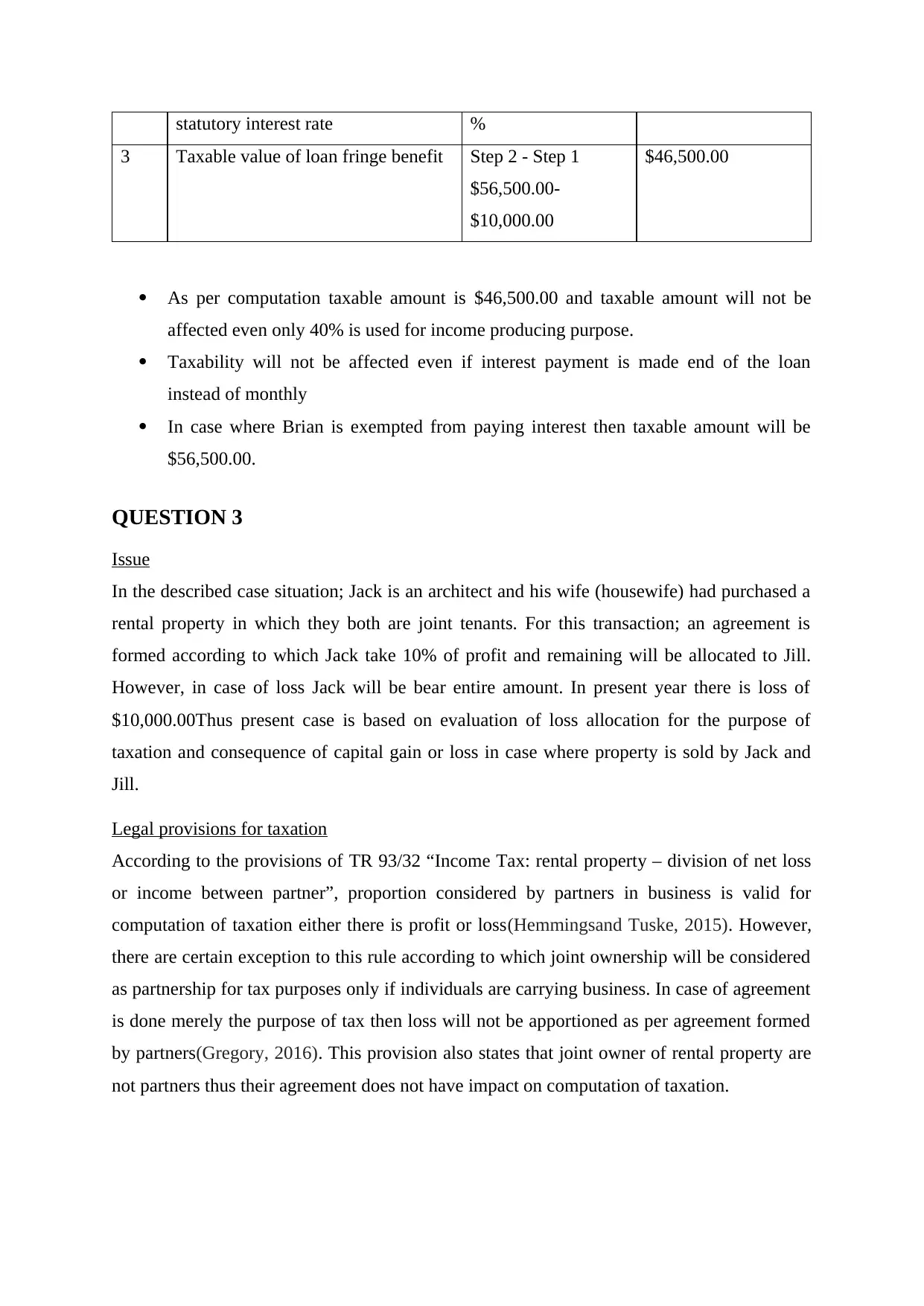

QUESTION 3

Issue

In the described case situation; Jack is an architect and his wife (housewife) had purchased a

rental property in which they both are joint tenants. For this transaction; an agreement is

formed according to which Jack take 10% of profit and remaining will be allocated to Jill.

However, in case of loss Jack will be bear entire amount. In present year there is loss of

$10,000.00Thus present case is based on evaluation of loss allocation for the purpose of

taxation and consequence of capital gain or loss in case where property is sold by Jack and

Jill.

Legal provisions for taxation

According to the provisions of TR 93/32 “Income Tax: rental property – division of net loss

or income between partner”, proportion considered by partners in business is valid for

computation of taxation either there is profit or loss(Hemmingsand Tuske, 2015). However,

there are certain exception to this rule according to which joint ownership will be considered

as partnership for tax purposes only if individuals are carrying business. In case of agreement

is done merely the purpose of tax then loss will not be apportioned as per agreement formed

by partners(Gregory, 2016). This provision also states that joint owner of rental property are

not partners thus their agreement does not have impact on computation of taxation.

3 Taxable value of loan fringe benefit Step 2 - Step 1

$56,500.00-

$10,000.00

$46,500.00

As per computation taxable amount is $46,500.00 and taxable amount will not be

affected even only 40% is used for income producing purpose.

Taxability will not be affected even if interest payment is made end of the loan

instead of monthly

In case where Brian is exempted from paying interest then taxable amount will be

$56,500.00.

QUESTION 3

Issue

In the described case situation; Jack is an architect and his wife (housewife) had purchased a

rental property in which they both are joint tenants. For this transaction; an agreement is

formed according to which Jack take 10% of profit and remaining will be allocated to Jill.

However, in case of loss Jack will be bear entire amount. In present year there is loss of

$10,000.00Thus present case is based on evaluation of loss allocation for the purpose of

taxation and consequence of capital gain or loss in case where property is sold by Jack and

Jill.

Legal provisions for taxation

According to the provisions of TR 93/32 “Income Tax: rental property – division of net loss

or income between partner”, proportion considered by partners in business is valid for

computation of taxation either there is profit or loss(Hemmingsand Tuske, 2015). However,

there are certain exception to this rule according to which joint ownership will be considered

as partnership for tax purposes only if individuals are carrying business. In case of agreement

is done merely the purpose of tax then loss will not be apportioned as per agreement formed

by partners(Gregory, 2016). This provision also states that joint owner of rental property are

not partners thus their agreement does not have impact on computation of taxation.

Application and conclusion

By applying provisions TR 93/32 “Income Tax: rental property – division of net loss or

income between partner” in the given case it can be said that partnership of Jack and Jill is

merely for the purpose of tax evasion and they are not carrying business thus their agreement

will not be applicable for computation of tax and loss will be allocate in 50:50. Similar

provision will be applicable in situation where property is sold by Jack and Jill for treatment

of capital gain or loss.

QUESTION 4

Case scenario

According to the give case scenario, a gardener was employed by The Duke of Westminster

who was paid from the Duke's substantial post-tax income. With an intention to reduce tax,

liability, Duke stopped paying wages to gardener; however, the Duke drew up a covenant

agreeing to pay an equivalent amount (Likhovski, 2006). As per the laws of tax applicable at

that time, Duke was eligible to claim a deduction so that tax liability and surtax can be

reduced.

Principle established in IRC v Duke of Westminster [1936] AC 1

The facts revealed that Inland Revenue Commissioners (IRC) lost their case against the

Duke. This case was of tax avoidance, which has been a main issue in the Australia

nowadays. In the words of Lord Tomlin, an individual is entitled to order his affairs, for the

purpose of tax attaching under the appropriate Acts, which are less than it. In case the person

is successful in ordering them so as of secure tax result. Nonetheless, the case was of

ungrateful the Commissioners of Inland Revenue or the fellow tax-payers is too clever, but he

is not allowed to pay an increased tax (Hayward, 2014).

This tactic adopted in the case might attract others who are seeking to avoid tax legally

through making complex structures; but the case has become very weak after subsequent

cases in which courts have make decisions while reviewing overall effect. For an example,

“Ramsay principle” established by court is a restrictive approach taken against such frauds

(Simpson, 2005). According to this principle, in case a transaction is a pre-arranged artificial

step that is served for no commercial purpose rather than saving tax than a legal action could

be taken.

By applying provisions TR 93/32 “Income Tax: rental property – division of net loss or

income between partner” in the given case it can be said that partnership of Jack and Jill is

merely for the purpose of tax evasion and they are not carrying business thus their agreement

will not be applicable for computation of tax and loss will be allocate in 50:50. Similar

provision will be applicable in situation where property is sold by Jack and Jill for treatment

of capital gain or loss.

QUESTION 4

Case scenario

According to the give case scenario, a gardener was employed by The Duke of Westminster

who was paid from the Duke's substantial post-tax income. With an intention to reduce tax,

liability, Duke stopped paying wages to gardener; however, the Duke drew up a covenant

agreeing to pay an equivalent amount (Likhovski, 2006). As per the laws of tax applicable at

that time, Duke was eligible to claim a deduction so that tax liability and surtax can be

reduced.

Principle established in IRC v Duke of Westminster [1936] AC 1

The facts revealed that Inland Revenue Commissioners (IRC) lost their case against the

Duke. This case was of tax avoidance, which has been a main issue in the Australia

nowadays. In the words of Lord Tomlin, an individual is entitled to order his affairs, for the

purpose of tax attaching under the appropriate Acts, which are less than it. In case the person

is successful in ordering them so as of secure tax result. Nonetheless, the case was of

ungrateful the Commissioners of Inland Revenue or the fellow tax-payers is too clever, but he

is not allowed to pay an increased tax (Hayward, 2014).

This tactic adopted in the case might attract others who are seeking to avoid tax legally

through making complex structures; but the case has become very weak after subsequent

cases in which courts have make decisions while reviewing overall effect. For an example,

“Ramsay principle” established by court is a restrictive approach taken against such frauds

(Simpson, 2005). According to this principle, in case a transaction is a pre-arranged artificial

step that is served for no commercial purpose rather than saving tax than a legal action could

be taken.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Relevance of this principal in Australia

The case discussed in the above section reveals that tax avoidance is significantly allowable if

it follows the statute laws. In respect to the case of Duke of Westminster's, the basic principle

of the format of deed can dramatically reduce the liability of Duke, in case, avoidance of tax

is approved. Furthermore, it is also justified if the claims are made for a single year or as an

annual payment made.

However, it can be worthy to say that if the company uses any device to support the reduction

of taxable profit then it is not permissible. The courts and the Tribunals can also consider that

the fiscal jurisprudence of Australia are now changed and the principle of Duke of

Westminster [1936] AC 1are not going to be applied. Tax planning is intended in respect with

avoidance of tax which is to be struck down by the court and the principles are not applicable.

QUESTION 5

Issue

According to the given case scenario, Bill is the owner of a large parcel of land and the land

is full of tall pine trees, However, Bill now intends to use the land for grazing sheep. It

requires cleaning the land. As a deal he found a logging company which is ready to pay him

$1,000 for every 100 metres of timber taken from land. Now the issue is whether Bill would

be assessed on the receipts from this arrangement or not. What if when logging company

offers a lump sum of $50,000 for granting the right to remove as much timber as required

from his land, in this situation what the action will be.

Legal provisions for taxation

Situation 1: Standing timber’s disposal, and not related to regular business course

The universal rule of taxation under TR 95/, in a case a taxpayer owns ant property for the

disposal of timber; however, the plants must be planted for a reason of sale. This will impact

the value of those trees is to be included in the assessable income of the taxpayer. The

guidelines are stated in subsection 36(1). Nonetheless, the situation is applicable at the time

when disposal will take place (Schofield, 2008). The other situation occurs when taxpayer

operates the business of forest operation, while in the present case taxpayer is running the

business and not any single disposal made through a regular business course. The key aspect

of such things required is that trees must comprise of total asset of business.

The case discussed in the above section reveals that tax avoidance is significantly allowable if

it follows the statute laws. In respect to the case of Duke of Westminster's, the basic principle

of the format of deed can dramatically reduce the liability of Duke, in case, avoidance of tax

is approved. Furthermore, it is also justified if the claims are made for a single year or as an

annual payment made.

However, it can be worthy to say that if the company uses any device to support the reduction

of taxable profit then it is not permissible. The courts and the Tribunals can also consider that

the fiscal jurisprudence of Australia are now changed and the principle of Duke of

Westminster [1936] AC 1are not going to be applied. Tax planning is intended in respect with

avoidance of tax which is to be struck down by the court and the principles are not applicable.

QUESTION 5

Issue

According to the given case scenario, Bill is the owner of a large parcel of land and the land

is full of tall pine trees, However, Bill now intends to use the land for grazing sheep. It

requires cleaning the land. As a deal he found a logging company which is ready to pay him

$1,000 for every 100 metres of timber taken from land. Now the issue is whether Bill would

be assessed on the receipts from this arrangement or not. What if when logging company

offers a lump sum of $50,000 for granting the right to remove as much timber as required

from his land, in this situation what the action will be.

Legal provisions for taxation

Situation 1: Standing timber’s disposal, and not related to regular business course

The universal rule of taxation under TR 95/, in a case a taxpayer owns ant property for the

disposal of timber; however, the plants must be planted for a reason of sale. This will impact

the value of those trees is to be included in the assessable income of the taxpayer. The

guidelines are stated in subsection 36(1). Nonetheless, the situation is applicable at the time

when disposal will take place (Schofield, 2008). The other situation occurs when taxpayer

operates the business of forest operation, while in the present case taxpayer is running the

business and not any single disposal made through a regular business course. The key aspect

of such things required is that trees must comprise of total asset of business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As per the mentioned deed not a single tree is disposable with the sale of a land’s or it’s right.

Furthermore, Subsection 36(1) is not going to be applied in case the trees are planted on

leased land and in the second case if lessee doesn’t contain entire ownership on trees that

were planted of leased property (Feldman, Katuščák and Kawano, 2016).

Rights disposal to standing timber

The law stated that if a tax payer is operating a business of forest operation may sell all the

standing timber through offering a right of removing the standing timber, in case there is not

any right against cutting the standing timber. As per the subsection 25(1), the gains earned

through selling timber re included in assessable income.

Application and conclusion

The regulatory provisions stated as per subsection of 36(1) and 25(1) of TR 95, it can

be stated that Bill will entitled to pay tax in bother the cases, If receives $1000 the income

will be assessed as per the section 36(1) and in case a lump sum amount is paid so the amount

is taxable according to subsection 25(1).

Furthermore, Subsection 36(1) is not going to be applied in case the trees are planted on

leased land and in the second case if lessee doesn’t contain entire ownership on trees that

were planted of leased property (Feldman, Katuščák and Kawano, 2016).

Rights disposal to standing timber

The law stated that if a tax payer is operating a business of forest operation may sell all the

standing timber through offering a right of removing the standing timber, in case there is not

any right against cutting the standing timber. As per the subsection 25(1), the gains earned

through selling timber re included in assessable income.

Application and conclusion

The regulatory provisions stated as per subsection of 36(1) and 25(1) of TR 95, it can

be stated that Bill will entitled to pay tax in bother the cases, If receives $1000 the income

will be assessed as per the section 36(1) and in case a lump sum amount is paid so the amount

is taxable according to subsection 25(1).

REFERENCES

Faccio, M. and Xu, J., 2015. Taxes and capital structure. Journal of Financial and

Quantitative Analysis, 50(3), pp.277-300.

Feldman, N.E., Katuščák, P. and Kawano, L., 2016. Taxpayer confusion: Evidence from the

child tax credit. The American Economic Review, 106(3), pp.807-835.

Gregory, C., 2016. Public law in the age of statutes: Essays in honour of Dennis Pearce

[Book Review]. Bar News: The Journal of the NSW Bar Association, (Winter 2016), p.60.

Hayward, R. ed., 2014. Valuation: principles into practice. Taylor & Francis.

Hemmings, P. and Tuske, A., 2015. Improving Taxes and Transfers in Australia.

Jacob, M., 2016. Tax regimes and capital gains realizations. European Accounting Review,

pp.1-21.

Likhovski, A., 2006. Tax law and public opinion: Explaining IRC v. Duke of Westminster.

Sage

Pearce, P. and Pinto, D., 2015. An evaluation of the case for a congestion tax in

Australia. The Tax Specialist, 18(4), pp.146-153.

Schofield, R., 2008. Taxation under the early Tudors 1485-1547. John Wiley & Sons.

Simpson, E., 2005. The Ramsay Principle: A Curious Incident of Judicial Reticence?. British

Tax Review, 4, p.358.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Faccio, M. and Xu, J., 2015. Taxes and capital structure. Journal of Financial and

Quantitative Analysis, 50(3), pp.277-300.

Feldman, N.E., Katuščák, P. and Kawano, L., 2016. Taxpayer confusion: Evidence from the

child tax credit. The American Economic Review, 106(3), pp.807-835.

Gregory, C., 2016. Public law in the age of statutes: Essays in honour of Dennis Pearce

[Book Review]. Bar News: The Journal of the NSW Bar Association, (Winter 2016), p.60.

Hayward, R. ed., 2014. Valuation: principles into practice. Taylor & Francis.

Hemmings, P. and Tuske, A., 2015. Improving Taxes and Transfers in Australia.

Jacob, M., 2016. Tax regimes and capital gains realizations. European Accounting Review,

pp.1-21.

Likhovski, A., 2006. Tax law and public opinion: Explaining IRC v. Duke of Westminster.

Sage

Pearce, P. and Pinto, D., 2015. An evaluation of the case for a congestion tax in

Australia. The Tax Specialist, 18(4), pp.146-153.

Schofield, R., 2008. Taxation under the early Tudors 1485-1547. John Wiley & Sons.

Simpson, E., 2005. The Ramsay Principle: A Curious Incident of Judicial Reticence?. British

Tax Review, 4, p.358.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.