Taxation Theory, Practice & Law: Capital Gains, Fringe Benefits, & GST

VerifiedAdded on 2020/12/10

|16

|3800

|365

Report

AI Summary

This report provides a comprehensive analysis of Australian taxation, addressing capital gains tax (CGT) and fringe benefits tax (FBT) calculations, along with GST implications. The report examines various scenarios, including the sale of vacant land, antique beds, paintings, and shares, to determine net capital gains or losses. It details the application of different methods like the indexation and discount methods, considering the timing of asset acquisition and disposal. The report also analyzes FBT related to employer-provided cars and other benefits. Furthermore, it incorporates relevant sections of the Income Tax Assessment Act 1936 and 1997, along with the Goods and Services Tax Act 1989, to provide a complete understanding of the tax liabilities and implications. The analysis includes setting off capital losses from past years and current year collectables losses against capital gains. Finally, the report culminates in the determination of the total taxable capital gain/loss for the year ending June 30th.

TAXATION THEORY,

PRACTICE & LAW

PRACTICE & LAW

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Determine Net Capital Gain/Loss for year ended 30th June.......................................................1

QUESTION 2 ..................................................................................................................................9

Employer Provided Car to Employee.........................................................................................9

Calculation of Fringe Benefit as Loan......................................................................................11

FBT charged as goods sold to Jasmine at low cost ..................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Determine Net Capital Gain/Loss for year ended 30th June.......................................................1

QUESTION 2 ..................................................................................................................................9

Employer Provided Car to Employee.........................................................................................9

Calculation of Fringe Benefit as Loan......................................................................................11

FBT charged as goods sold to Jasmine at low cost ..................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Federal Government Levies and collects Taxes in Australia through Australian Taxation

Office. ATO manages all laws and regulations that are levied on the different sections of society.

The Law which covers income tax in Australia is Income Tax Assessment Act 1936 followed by

Tax Assessments Act 1997. Goods and Service tax governed by Goods and Services Tax Act

1989 are taxes that are levied on Sales of Goods and Services, collected by Federal Government.

In this project, the client wants analysis of data given of calculation of taxable capital gain loss

for current year on various assets and also to provide GST' s provisions if applicable. In this case

study, client needs calculation regarding Fringe Benefits that are provided to employees under

FBT Act 1986.

QUESTION 1

Determine Net Capital Gain/Loss for year ended 30th June

Various asset provided by client where capital gain tax, is need to be calculated under

Income Tax Assessment Act 1997. All gains and loss regarding capital asset are levied on

purchase and sales of property (Wilkins, 2015). The law covers various methods to calculate tax

by different basis of utilization of asset.

(a) Vacant Land

Treatment on sales of land depends upon that it is used as a capital asset or is kept for

commercial purpose. Mostly block of land are treated as capital asset so it is charged as CGT but

if they are used as stock in real estate business then any income from that will be ordinary

income and will be charged for taxes as business income (Capital Gains Tax. 2018.).

Land acquired before 11:45 am on 21st September 1999 and is held for more than 12 months then

Indexation Method will be applied and if not then “Discount Method” will be used. To calculate

cost base, we need to include all expenses which are related to acquisition of asset that may be

brokerage, stamp duty etc. (Chardon, 2016).

The Contractual rights of asset are described by Section 104(35) of ITA act 1997.

1. the timing of event will be when you enter into contract or acquiring rights are

created for other persons.

2. Disposing of asset will be deemed as event when owner transfers right to others

person.

1

Federal Government Levies and collects Taxes in Australia through Australian Taxation

Office. ATO manages all laws and regulations that are levied on the different sections of society.

The Law which covers income tax in Australia is Income Tax Assessment Act 1936 followed by

Tax Assessments Act 1997. Goods and Service tax governed by Goods and Services Tax Act

1989 are taxes that are levied on Sales of Goods and Services, collected by Federal Government.

In this project, the client wants analysis of data given of calculation of taxable capital gain loss

for current year on various assets and also to provide GST' s provisions if applicable. In this case

study, client needs calculation regarding Fringe Benefits that are provided to employees under

FBT Act 1986.

QUESTION 1

Determine Net Capital Gain/Loss for year ended 30th June

Various asset provided by client where capital gain tax, is need to be calculated under

Income Tax Assessment Act 1997. All gains and loss regarding capital asset are levied on

purchase and sales of property (Wilkins, 2015). The law covers various methods to calculate tax

by different basis of utilization of asset.

(a) Vacant Land

Treatment on sales of land depends upon that it is used as a capital asset or is kept for

commercial purpose. Mostly block of land are treated as capital asset so it is charged as CGT but

if they are used as stock in real estate business then any income from that will be ordinary

income and will be charged for taxes as business income (Capital Gains Tax. 2018.).

Land acquired before 11:45 am on 21st September 1999 and is held for more than 12 months then

Indexation Method will be applied and if not then “Discount Method” will be used. To calculate

cost base, we need to include all expenses which are related to acquisition of asset that may be

brokerage, stamp duty etc. (Chardon, 2016).

The Contractual rights of asset are described by Section 104(35) of ITA act 1997.

1. the timing of event will be when you enter into contract or acquiring rights are

created for other persons.

2. Disposing of asset will be deemed as event when owner transfers right to others

person.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

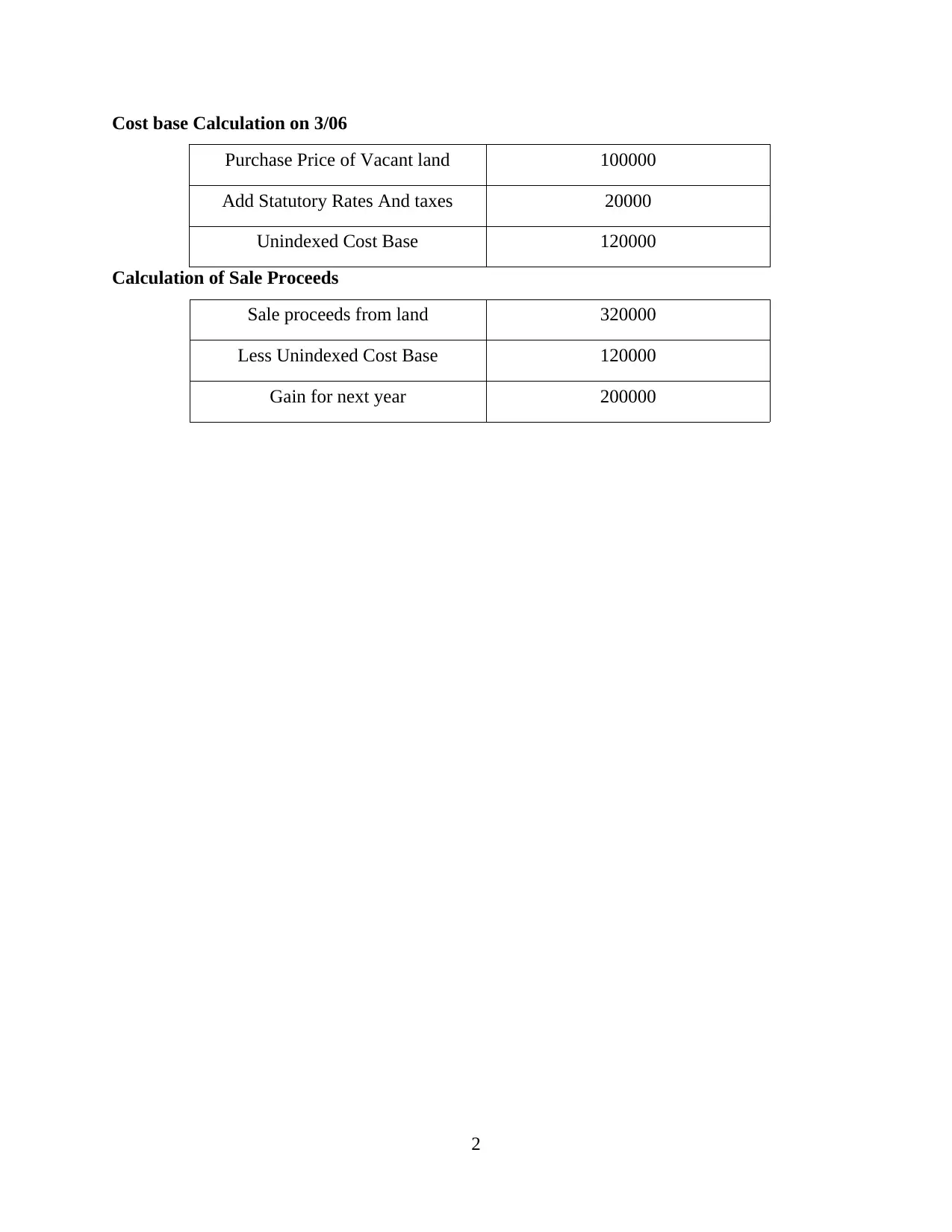

Cost base Calculation on 3/06

Purchase Price of Vacant land 100000

Add Statutory Rates And taxes 20000

Unindexed Cost Base 120000

Calculation of Sale Proceeds

Sale proceeds from land 320000

Less Unindexed Cost Base 120000

Gain for next year 200000

2

Purchase Price of Vacant land 100000

Add Statutory Rates And taxes 20000

Unindexed Cost Base 120000

Calculation of Sale Proceeds

Sale proceeds from land 320000

Less Unindexed Cost Base 120000

Gain for next year 200000

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

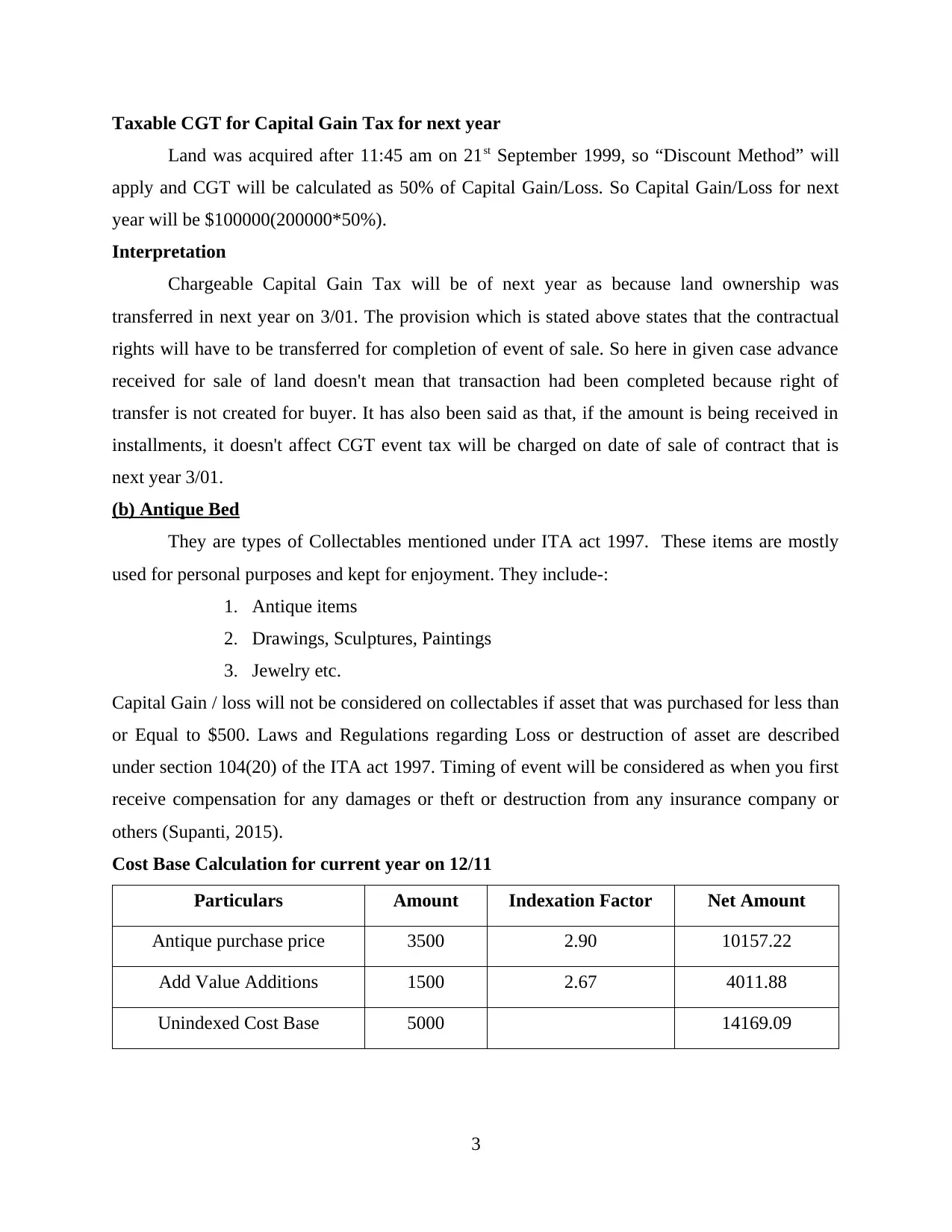

Taxable CGT for Capital Gain Tax for next year

Land was acquired after 11:45 am on 21st September 1999, so “Discount Method” will

apply and CGT will be calculated as 50% of Capital Gain/Loss. So Capital Gain/Loss for next

year will be $100000(200000*50%).

Interpretation

Chargeable Capital Gain Tax will be of next year as because land ownership was

transferred in next year on 3/01. The provision which is stated above states that the contractual

rights will have to be transferred for completion of event of sale. So here in given case advance

received for sale of land doesn't mean that transaction had been completed because right of

transfer is not created for buyer. It has also been said as that, if the amount is being received in

installments, it doesn't affect CGT event tax will be charged on date of sale of contract that is

next year 3/01.

(b) Antique Bed

They are types of Collectables mentioned under ITA act 1997. These items are mostly

used for personal purposes and kept for enjoyment. They include-:

1. Antique items

2. Drawings, Sculptures, Paintings

3. Jewelry etc.

Capital Gain / loss will not be considered on collectables if asset that was purchased for less than

or Equal to $500. Laws and Regulations regarding Loss or destruction of asset are described

under section 104(20) of the ITA act 1997. Timing of event will be considered as when you first

receive compensation for any damages or theft or destruction from any insurance company or

others (Supanti, 2015).

Cost Base Calculation for current year on 12/11

Particulars Amount Indexation Factor Net Amount

Antique purchase price 3500 2.90 10157.22

Add Value Additions 1500 2.67 4011.88

Unindexed Cost Base 5000 14169.09

3

Land was acquired after 11:45 am on 21st September 1999, so “Discount Method” will

apply and CGT will be calculated as 50% of Capital Gain/Loss. So Capital Gain/Loss for next

year will be $100000(200000*50%).

Interpretation

Chargeable Capital Gain Tax will be of next year as because land ownership was

transferred in next year on 3/01. The provision which is stated above states that the contractual

rights will have to be transferred for completion of event of sale. So here in given case advance

received for sale of land doesn't mean that transaction had been completed because right of

transfer is not created for buyer. It has also been said as that, if the amount is being received in

installments, it doesn't affect CGT event tax will be charged on date of sale of contract that is

next year 3/01.

(b) Antique Bed

They are types of Collectables mentioned under ITA act 1997. These items are mostly

used for personal purposes and kept for enjoyment. They include-:

1. Antique items

2. Drawings, Sculptures, Paintings

3. Jewelry etc.

Capital Gain / loss will not be considered on collectables if asset that was purchased for less than

or Equal to $500. Laws and Regulations regarding Loss or destruction of asset are described

under section 104(20) of the ITA act 1997. Timing of event will be considered as when you first

receive compensation for any damages or theft or destruction from any insurance company or

others (Supanti, 2015).

Cost Base Calculation for current year on 12/11

Particulars Amount Indexation Factor Net Amount

Antique purchase price 3500 2.90 10157.22

Add Value Additions 1500 2.67 4011.88

Unindexed Cost Base 5000 14169.09

3

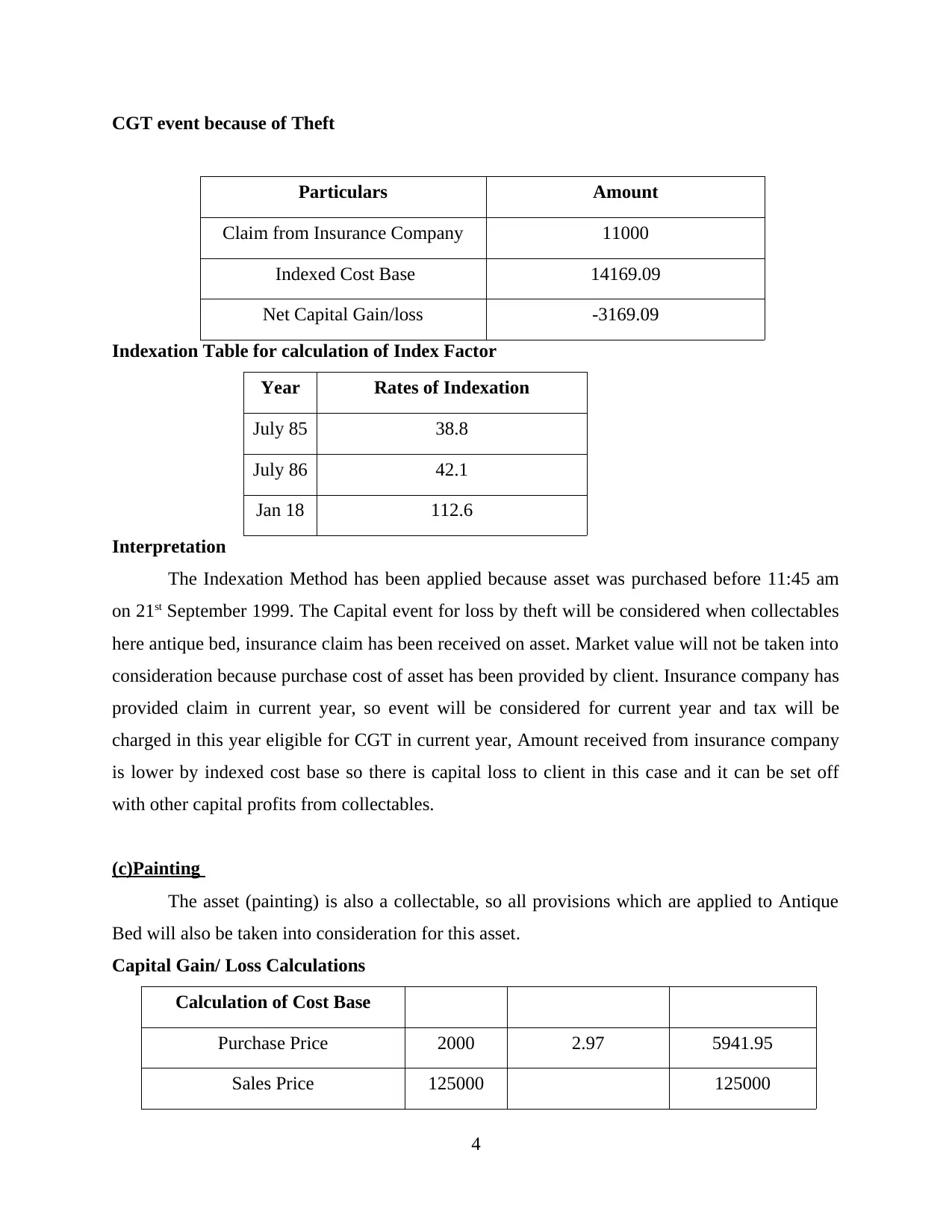

CGT event because of Theft

Particulars Amount

Claim from Insurance Company 11000

Indexed Cost Base 14169.09

Net Capital Gain/loss -3169.09

Indexation Table for calculation of Index Factor

Year Rates of Indexation

July 85 38.8

July 86 42.1

Jan 18 112.6

Interpretation

The Indexation Method has been applied because asset was purchased before 11:45 am

on 21st September 1999. The Capital event for loss by theft will be considered when collectables

here antique bed, insurance claim has been received on asset. Market value will not be taken into

consideration because purchase cost of asset has been provided by client. Insurance company has

provided claim in current year, so event will be considered for current year and tax will be

charged in this year eligible for CGT in current year, Amount received from insurance company

is lower by indexed cost base so there is capital loss to client in this case and it can be set off

with other capital profits from collectables.

(c)Painting

The asset (painting) is also a collectable, so all provisions which are applied to Antique

Bed will also be taken into consideration for this asset.

Capital Gain/ Loss Calculations

Calculation of Cost Base

Purchase Price 2000 2.97 5941.95

Sales Price 125000 125000

4

Particulars Amount

Claim from Insurance Company 11000

Indexed Cost Base 14169.09

Net Capital Gain/loss -3169.09

Indexation Table for calculation of Index Factor

Year Rates of Indexation

July 85 38.8

July 86 42.1

Jan 18 112.6

Interpretation

The Indexation Method has been applied because asset was purchased before 11:45 am

on 21st September 1999. The Capital event for loss by theft will be considered when collectables

here antique bed, insurance claim has been received on asset. Market value will not be taken into

consideration because purchase cost of asset has been provided by client. Insurance company has

provided claim in current year, so event will be considered for current year and tax will be

charged in this year eligible for CGT in current year, Amount received from insurance company

is lower by indexed cost base so there is capital loss to client in this case and it can be set off

with other capital profits from collectables.

(c)Painting

The asset (painting) is also a collectable, so all provisions which are applied to Antique

Bed will also be taken into consideration for this asset.

Capital Gain/ Loss Calculations

Calculation of Cost Base

Purchase Price 2000 2.97 5941.95

Sales Price 125000 125000

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

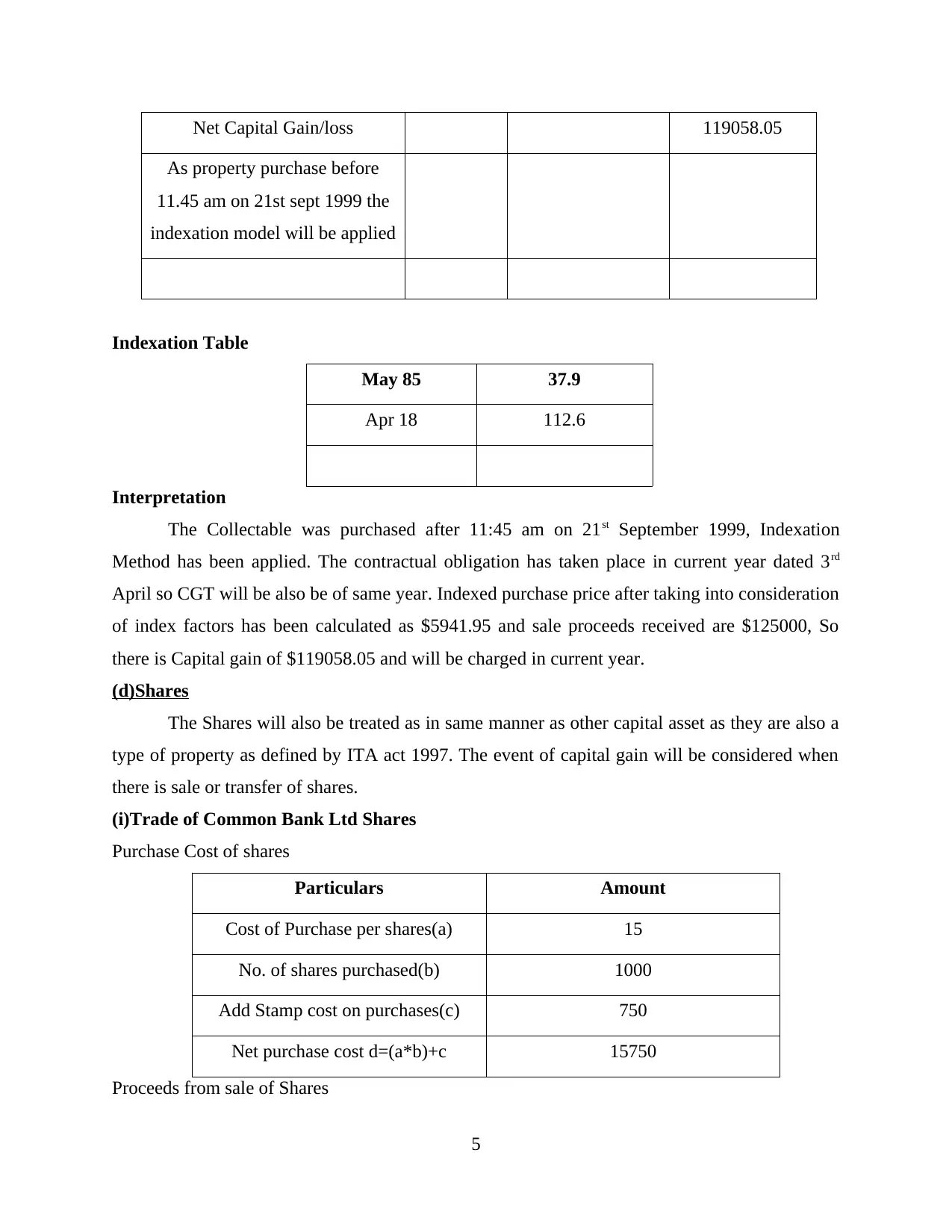

Net Capital Gain/loss 119058.05

As property purchase before

11.45 am on 21st sept 1999 the

indexation model will be applied

Indexation Table

May 85 37.9

Apr 18 112.6

Interpretation

The Collectable was purchased after 11:45 am on 21st September 1999, Indexation

Method has been applied. The contractual obligation has taken place in current year dated 3rd

April so CGT will be also be of same year. Indexed purchase price after taking into consideration

of index factors has been calculated as $5941.95 and sale proceeds received are $125000, So

there is Capital gain of $119058.05 and will be charged in current year.

(d)Shares

The Shares will also be treated as in same manner as other capital asset as they are also a

type of property as defined by ITA act 1997. The event of capital gain will be considered when

there is sale or transfer of shares.

(i)Trade of Common Bank Ltd Shares

Purchase Cost of shares

Particulars Amount

Cost of Purchase per shares(a) 15

No. of shares purchased(b) 1000

Add Stamp cost on purchases(c) 750

Net purchase cost d=(a*b)+c 15750

Proceeds from sale of Shares

5

As property purchase before

11.45 am on 21st sept 1999 the

indexation model will be applied

Indexation Table

May 85 37.9

Apr 18 112.6

Interpretation

The Collectable was purchased after 11:45 am on 21st September 1999, Indexation

Method has been applied. The contractual obligation has taken place in current year dated 3rd

April so CGT will be also be of same year. Indexed purchase price after taking into consideration

of index factors has been calculated as $5941.95 and sale proceeds received are $125000, So

there is Capital gain of $119058.05 and will be charged in current year.

(d)Shares

The Shares will also be treated as in same manner as other capital asset as they are also a

type of property as defined by ITA act 1997. The event of capital gain will be considered when

there is sale or transfer of shares.

(i)Trade of Common Bank Ltd Shares

Purchase Cost of shares

Particulars Amount

Cost of Purchase per shares(a) 15

No. of shares purchased(b) 1000

Add Stamp cost on purchases(c) 750

Net purchase cost d=(a*b)+c 15750

Proceeds from sale of Shares

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

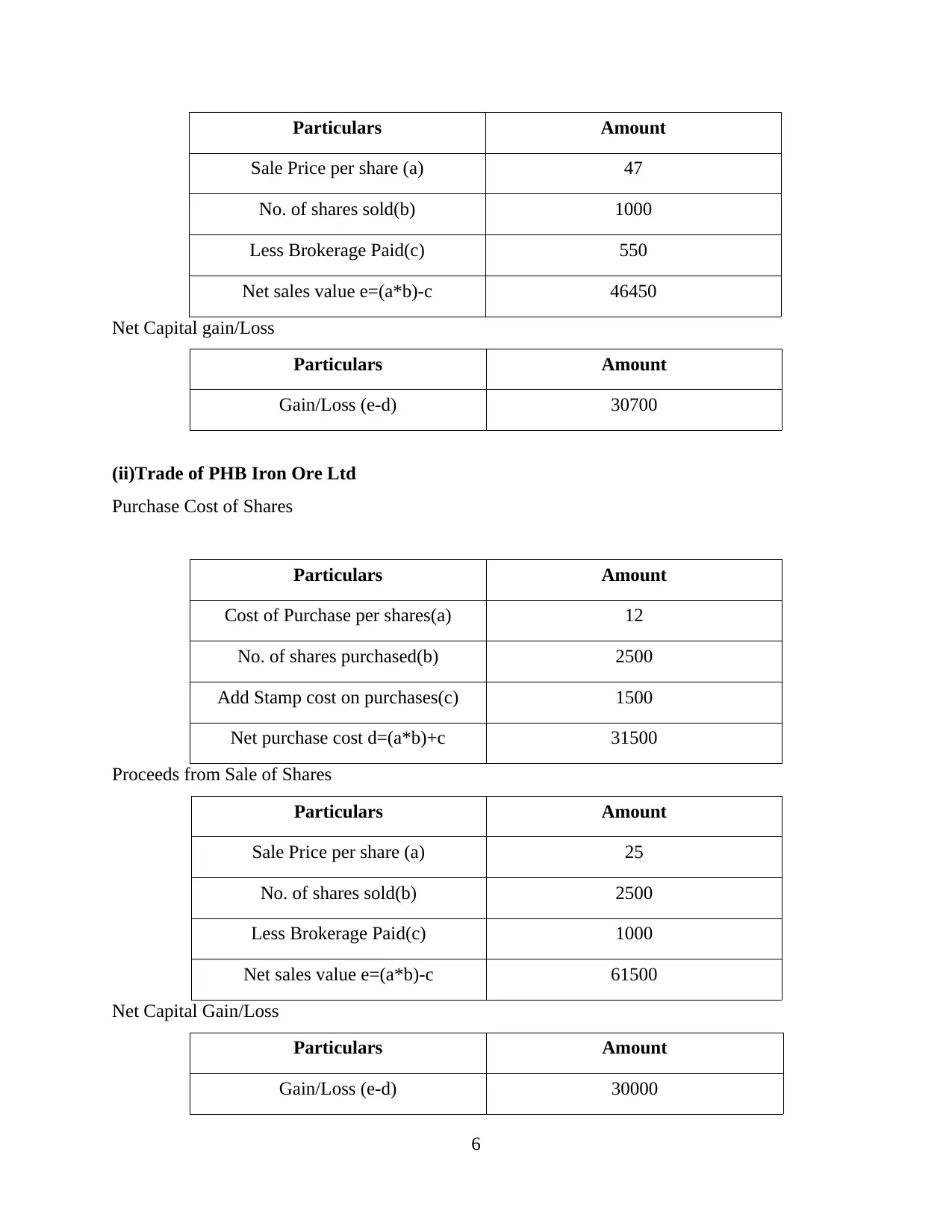

Particulars Amount

Sale Price per share (a) 47

No. of shares sold(b) 1000

Less Brokerage Paid(c) 550

Net sales value e=(a*b)-c 46450

Net Capital gain/Loss

Particulars Amount

Gain/Loss (e-d) 30700

(ii)Trade of PHB Iron Ore Ltd

Purchase Cost of Shares

Particulars Amount

Cost of Purchase per shares(a) 12

No. of shares purchased(b) 2500

Add Stamp cost on purchases(c) 1500

Net purchase cost d=(a*b)+c 31500

Proceeds from Sale of Shares

Particulars Amount

Sale Price per share (a) 25

No. of shares sold(b) 2500

Less Brokerage Paid(c) 1000

Net sales value e=(a*b)-c 61500

Net Capital Gain/Loss

Particulars Amount

Gain/Loss (e-d) 30000

6

Sale Price per share (a) 47

No. of shares sold(b) 1000

Less Brokerage Paid(c) 550

Net sales value e=(a*b)-c 46450

Net Capital gain/Loss

Particulars Amount

Gain/Loss (e-d) 30700

(ii)Trade of PHB Iron Ore Ltd

Purchase Cost of Shares

Particulars Amount

Cost of Purchase per shares(a) 12

No. of shares purchased(b) 2500

Add Stamp cost on purchases(c) 1500

Net purchase cost d=(a*b)+c 31500

Proceeds from Sale of Shares

Particulars Amount

Sale Price per share (a) 25

No. of shares sold(b) 2500

Less Brokerage Paid(c) 1000

Net sales value e=(a*b)-c 61500

Net Capital Gain/Loss

Particulars Amount

Gain/Loss (e-d) 30000

6

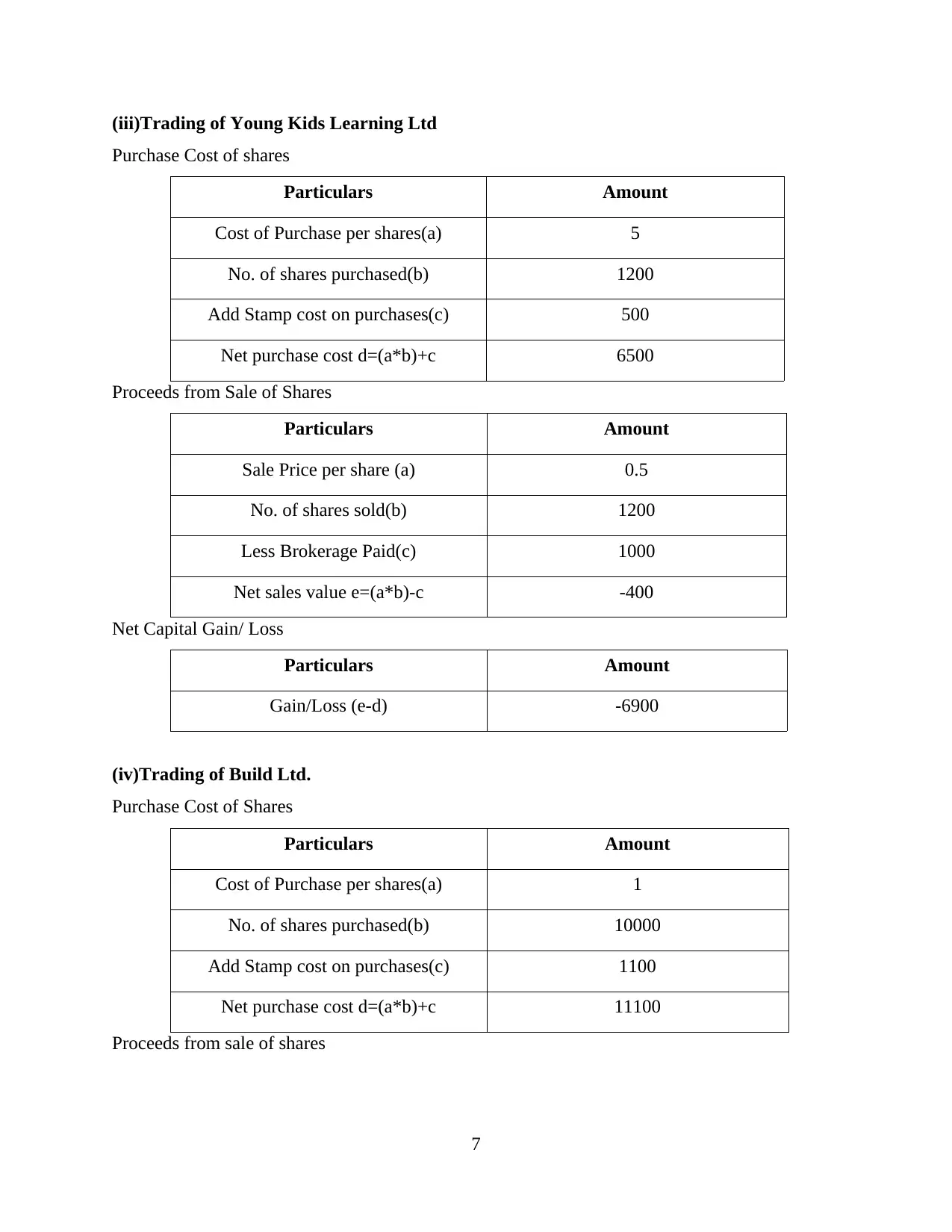

(iii)Trading of Young Kids Learning Ltd

Purchase Cost of shares

Particulars Amount

Cost of Purchase per shares(a) 5

No. of shares purchased(b) 1200

Add Stamp cost on purchases(c) 500

Net purchase cost d=(a*b)+c 6500

Proceeds from Sale of Shares

Particulars Amount

Sale Price per share (a) 0.5

No. of shares sold(b) 1200

Less Brokerage Paid(c) 1000

Net sales value e=(a*b)-c -400

Net Capital Gain/ Loss

Particulars Amount

Gain/Loss (e-d) -6900

(iv)Trading of Build Ltd.

Purchase Cost of Shares

Particulars Amount

Cost of Purchase per shares(a) 1

No. of shares purchased(b) 10000

Add Stamp cost on purchases(c) 1100

Net purchase cost d=(a*b)+c 11100

Proceeds from sale of shares

7

Purchase Cost of shares

Particulars Amount

Cost of Purchase per shares(a) 5

No. of shares purchased(b) 1200

Add Stamp cost on purchases(c) 500

Net purchase cost d=(a*b)+c 6500

Proceeds from Sale of Shares

Particulars Amount

Sale Price per share (a) 0.5

No. of shares sold(b) 1200

Less Brokerage Paid(c) 1000

Net sales value e=(a*b)-c -400

Net Capital Gain/ Loss

Particulars Amount

Gain/Loss (e-d) -6900

(iv)Trading of Build Ltd.

Purchase Cost of Shares

Particulars Amount

Cost of Purchase per shares(a) 1

No. of shares purchased(b) 10000

Add Stamp cost on purchases(c) 1100

Net purchase cost d=(a*b)+c 11100

Proceeds from sale of shares

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Amount

Sale Price per share (a) 2.5

No. of shares sold(b) 10000

Less Brokerage Paid(c) 900

Net sales value e=(a*b)-c 24100

Net Capital gain/Loss

Particulars Amount

Gain/Loss (e-d) 23000

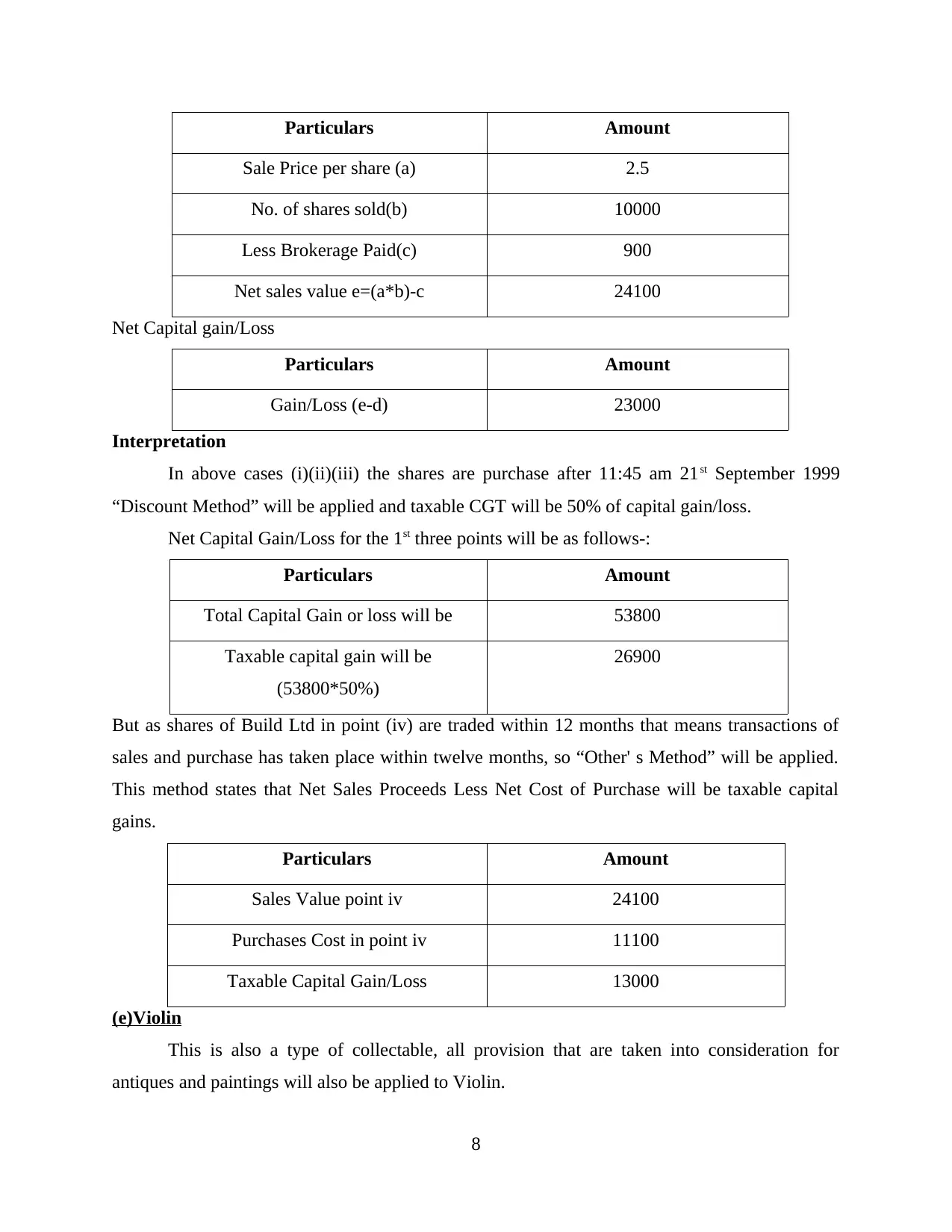

Interpretation

In above cases (i)(ii)(iii) the shares are purchase after 11:45 am 21st September 1999

“Discount Method” will be applied and taxable CGT will be 50% of capital gain/loss.

Net Capital Gain/Loss for the 1st three points will be as follows-:

Particulars Amount

Total Capital Gain or loss will be 53800

Taxable capital gain will be

(53800*50%)

26900

But as shares of Build Ltd in point (iv) are traded within 12 months that means transactions of

sales and purchase has taken place within twelve months, so “Other' s Method” will be applied.

This method states that Net Sales Proceeds Less Net Cost of Purchase will be taxable capital

gains.

Particulars Amount

Sales Value point iv 24100

Purchases Cost in point iv 11100

Taxable Capital Gain/Loss 13000

(e)Violin

This is also a type of collectable, all provision that are taken into consideration for

antiques and paintings will also be applied to Violin.

8

Sale Price per share (a) 2.5

No. of shares sold(b) 10000

Less Brokerage Paid(c) 900

Net sales value e=(a*b)-c 24100

Net Capital gain/Loss

Particulars Amount

Gain/Loss (e-d) 23000

Interpretation

In above cases (i)(ii)(iii) the shares are purchase after 11:45 am 21st September 1999

“Discount Method” will be applied and taxable CGT will be 50% of capital gain/loss.

Net Capital Gain/Loss for the 1st three points will be as follows-:

Particulars Amount

Total Capital Gain or loss will be 53800

Taxable capital gain will be

(53800*50%)

26900

But as shares of Build Ltd in point (iv) are traded within 12 months that means transactions of

sales and purchase has taken place within twelve months, so “Other' s Method” will be applied.

This method states that Net Sales Proceeds Less Net Cost of Purchase will be taxable capital

gains.

Particulars Amount

Sales Value point iv 24100

Purchases Cost in point iv 11100

Taxable Capital Gain/Loss 13000

(e)Violin

This is also a type of collectable, all provision that are taken into consideration for

antiques and paintings will also be applied to Violin.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net Capital gain/ loss will be-:

Particulars Amount Indexation factor Net Amount

Indexed Cost of Purchase 5500 1.65 9093.98

Net Sales Proceeds 12000 12000

Taxable Capital gain 2906.02

Indexation Table

Year Index rates

1999 68.1

2018 112.6

Interpretation

Collectables was purchased before 11:45 am on 21st September 1999, So “Indexation

Method” had been applied. So taxable capital gain after indexing is $2906.02.

Taxable Capital Gain/ Loss

Total Taxable Capital Gain/Loss of Current year before setting off 158694.98

Set of Carried Forward of Losses

Collectables Losses can be set off only by profits of these types of asset that can be even

past year losses and can be carried to infinite no. of years has been prescribed by Section 102 Of

ITA act 1997.

Particulars Amount

Capital losses from past year 7000

Collectables losses of current year 1500

Total Losses that can be set off 8500

Setting off Collectables loss with their profits are priority so firstly they need to set off that

losses.

9

Particulars Amount Indexation factor Net Amount

Indexed Cost of Purchase 5500 1.65 9093.98

Net Sales Proceeds 12000 12000

Taxable Capital gain 2906.02

Indexation Table

Year Index rates

1999 68.1

2018 112.6

Interpretation

Collectables was purchased before 11:45 am on 21st September 1999, So “Indexation

Method” had been applied. So taxable capital gain after indexing is $2906.02.

Taxable Capital Gain/ Loss

Total Taxable Capital Gain/Loss of Current year before setting off 158694.98

Set of Carried Forward of Losses

Collectables Losses can be set off only by profits of these types of asset that can be even

past year losses and can be carried to infinite no. of years has been prescribed by Section 102 Of

ITA act 1997.

Particulars Amount

Capital losses from past year 7000

Collectables losses of current year 1500

Total Losses that can be set off 8500

Setting off Collectables loss with their profits are priority so firstly they need to set off that

losses.

9

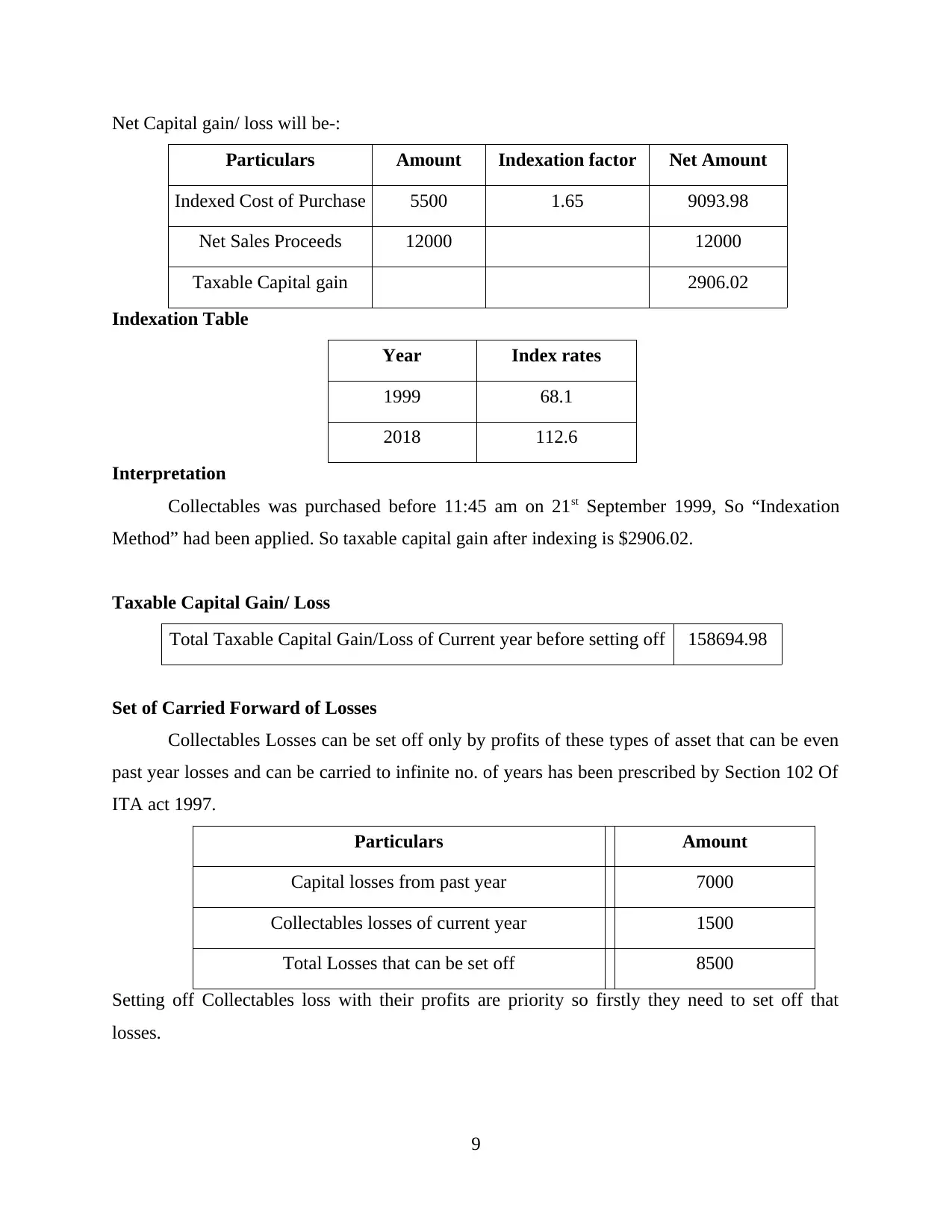

Particulars Amount

Total Capital gain From Collectables in current year 118794.98

Less setting off Capital losses from collectables 1500

Net Taxable Capital gain from Collectables 117294.98

Net Capital gain/Loss after setting off losses from collectables are $157194.98.

Now Past Year Losses can be set off with left over profits-:

Particulars Amount

Net capital gain after setting off losses from

collectables

157194.98

Less setting off Capital losses of past year 7000

Net Taxable Capital Gain 150194.98

Interpretation

After taking into consideration of all provisions of ITA Act 1997 and information given

by client taxable capital gain/loss for current year ending 30th June is $150194.98.

QUESTION 2

Employer Provided Car to Employee

(a) Rapid Heat Pty Ltd. an Electric Heaters Manufacturer provides Fringe Benefits to their

employees. They have provided different benefits so in this question there is need to calculate

Fringe Benefits Tax which is governed by Fringe Benefit Act 1986.

The car provided as benefit will be treated as private use when vehicle is not parked in premises

of business and had been parked at home of employee is mentioned under section 7 of FBTA act

(Car Fringe Benefits Tax. 2018.). The Definition of car is also provided by act. They include-:

1. Vehicle that carry passenger less than 9.

2. Loading Capacity of Vehicle should not be more than 1tonne.

3. Station Wagons, Vans, Motors cars etc.

FBTA act also provides different methods to calculate Fringe Benefits under Section 9, that are-:

1. Cost Method-: Gross taxable Value has been shown as actual value

2. Statutory Method-: Actual value of cars has not been shown as Gross taxable value

10

Total Capital gain From Collectables in current year 118794.98

Less setting off Capital losses from collectables 1500

Net Taxable Capital gain from Collectables 117294.98

Net Capital gain/Loss after setting off losses from collectables are $157194.98.

Now Past Year Losses can be set off with left over profits-:

Particulars Amount

Net capital gain after setting off losses from

collectables

157194.98

Less setting off Capital losses of past year 7000

Net Taxable Capital Gain 150194.98

Interpretation

After taking into consideration of all provisions of ITA Act 1997 and information given

by client taxable capital gain/loss for current year ending 30th June is $150194.98.

QUESTION 2

Employer Provided Car to Employee

(a) Rapid Heat Pty Ltd. an Electric Heaters Manufacturer provides Fringe Benefits to their

employees. They have provided different benefits so in this question there is need to calculate

Fringe Benefits Tax which is governed by Fringe Benefit Act 1986.

The car provided as benefit will be treated as private use when vehicle is not parked in premises

of business and had been parked at home of employee is mentioned under section 7 of FBTA act

(Car Fringe Benefits Tax. 2018.). The Definition of car is also provided by act. They include-:

1. Vehicle that carry passenger less than 9.

2. Loading Capacity of Vehicle should not be more than 1tonne.

3. Station Wagons, Vans, Motors cars etc.

FBTA act also provides different methods to calculate Fringe Benefits under Section 9, that are-:

1. Cost Method-: Gross taxable Value has been shown as actual value

2. Statutory Method-: Actual value of cars has not been shown as Gross taxable value

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.