Taxation Theory, Practice & Law Assignment: Asset Disposal & Benefits

VerifiedAdded on 2023/06/05

|14

|3132

|366

Homework Assignment

AI Summary

This assignment provides a detailed analysis of taxation principles, focusing on the implications of asset disposal and fringe benefits. The first part of the assignment explores capital gains tax (CGT) arising from the disposal of various assets, including vacant land, an antique bed, a painting, shares in multiple companies, and a violin. Each asset's tax implications are examined based on its purchase date, relevant CGT events, cost base calculations, and eligibility for the 50% capital gains concession. The second part of the assignment delves into fringe benefits tax (FBT), specifically car and loan fringe benefits. The car fringe benefit is calculated based on the car's cost, availability, and private use, while the loan fringe benefit considers concessional interest rates. The assignment provides computations and explanations of the relevant tax liabilities for both the employer and the employee, adhering to the relevant sections of the Income Tax Assessment Act 1997 (ITAA 1997) and the Fringe Benefits Tax Assessment Act 1986 (FBTAA).

Taxation Theory, Practice & Law

STUDENT NAME/ID

[Pick the date]

STUDENT NAME/ID

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

In view of the information about the various transactions provided, the key aim is to consult the

client with regard to the potential tax implications arising from the disposal of various assets. A

key piece of information available from the end of client is that neither of these transactions has

been done in the ordinary course of business and hence the underlying client is not involved in

any business any of the given asset is treated as trading stock. Hence, this limits the sphere of tax

discussion to potentially any capital gains that have been realised on the asset liquidation. The

discussion for each of these assets individually has been carried out below.

Asset: Vacant Land Block

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997. The given asset i.e. land

block has been purchased post the cut-off date and is a post-CGT asset and therefore not exempt

from CGT on basis of the purchase date (Wilmot, 2014).

The next step is to identify the relevant CGT event which for land disposal would be A1 as

mentioned in s. 104-5 ITAA 1997 (Krever, 2017). This event also highlights the applicable

formula for computation of any gains or losses made which requires cost base computation

which is deducted from proceeds of asset sale (Austlii, 2018 a). Hence, after identification of the

CGT event, the cost base needs to be computed in accordance with s. 110-25 ITAA 1997.

Subsection 110-25(1) indicates that cost base as a composition of five costs outlined below

(Nethercott, Richardson and Devos, 2016).

1

In view of the information about the various transactions provided, the key aim is to consult the

client with regard to the potential tax implications arising from the disposal of various assets. A

key piece of information available from the end of client is that neither of these transactions has

been done in the ordinary course of business and hence the underlying client is not involved in

any business any of the given asset is treated as trading stock. Hence, this limits the sphere of tax

discussion to potentially any capital gains that have been realised on the asset liquidation. The

discussion for each of these assets individually has been carried out below.

Asset: Vacant Land Block

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997. The given asset i.e. land

block has been purchased post the cut-off date and is a post-CGT asset and therefore not exempt

from CGT on basis of the purchase date (Wilmot, 2014).

The next step is to identify the relevant CGT event which for land disposal would be A1 as

mentioned in s. 104-5 ITAA 1997 (Krever, 2017). This event also highlights the applicable

formula for computation of any gains or losses made which requires cost base computation

which is deducted from proceeds of asset sale (Austlii, 2018 a). Hence, after identification of the

CGT event, the cost base needs to be computed in accordance with s. 110-25 ITAA 1997.

Subsection 110-25(1) indicates that cost base as a composition of five costs outlined below

(Nethercott, Richardson and Devos, 2016).

1

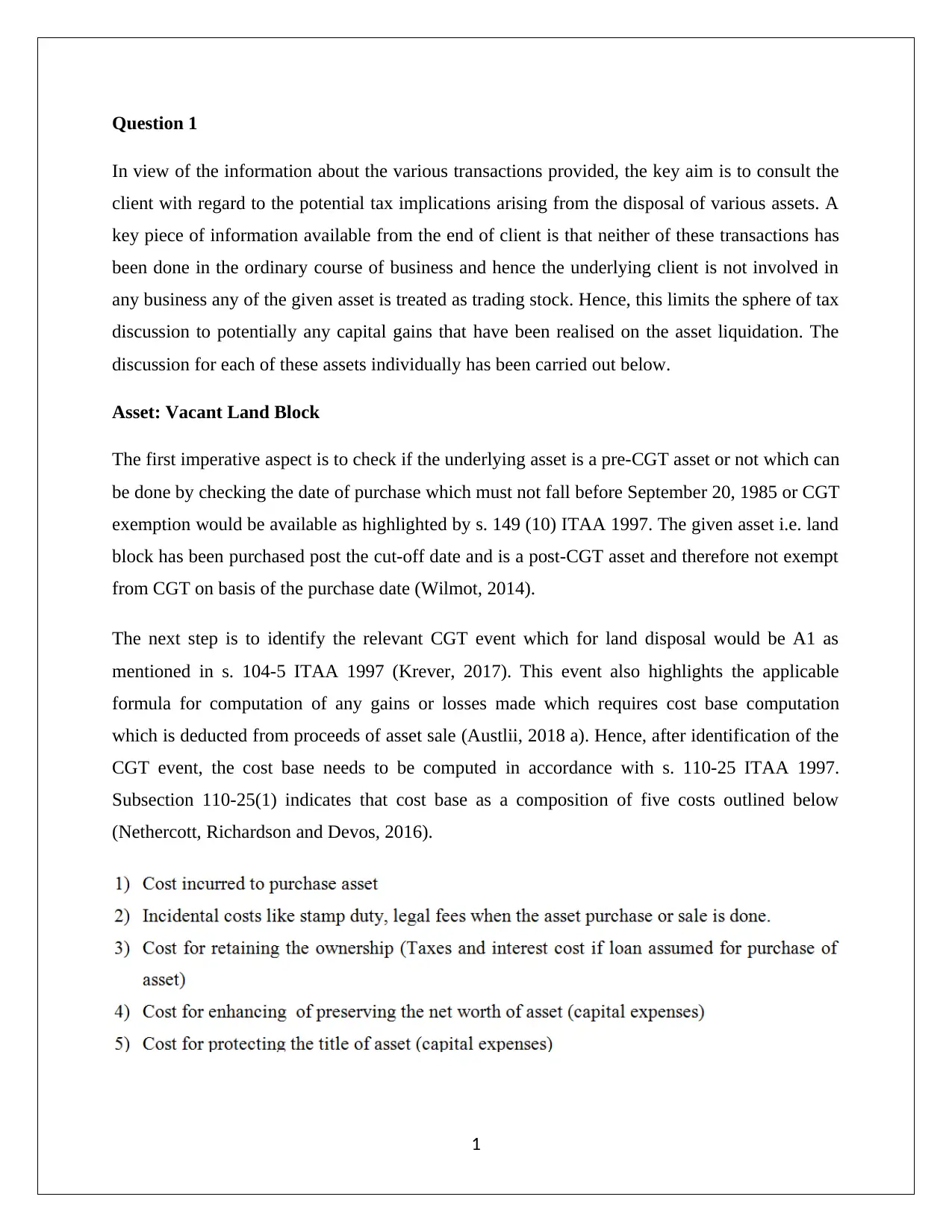

As per s. 102-5 ITAA 1997, any unbalanced capital losses from the past years may be carried

forward to the present and hence the same would have to be adjusted against the capital gains

that arise.

Finally, the capital gains after loss adjustment would be subject to capital gains concession

which would be applied in the form of s. 115-25 ITAA 1997. Under this section, a 50%

concession in the capital gains is available with the condition that the underlying gains should be

long term. In order to ensure that same the underlying holding period should exceed one year.

This is happening in the given case (Woellner, 2017).

A pertinent issue that is relevant for sale of land is that the contract for sale of land has already

been enacted in 2017/2018 but the proceeds would be derived only in 2018/2019. Hence,

confusion arises as to whether the tax ought to be paid on the gains in 2017/2018 or 2018/2019

(Krever, 2017). In this regards, the treatment recommended by tax ruling TR 94/29 would be

adhered to. This tax ruling recommends the taxation liability to be computed in the same year as

contract is enacted without considering the payment of proceeds (Nethercott, Richardson and

Devos, 2016). Therefore, the CGT consequences pertaining to the land sale would be considered

in 2017/2018 only for the client.

The relevant computations of taxable capital gains is demonstrated below.

Block of Land

2

forward to the present and hence the same would have to be adjusted against the capital gains

that arise.

Finally, the capital gains after loss adjustment would be subject to capital gains concession

which would be applied in the form of s. 115-25 ITAA 1997. Under this section, a 50%

concession in the capital gains is available with the condition that the underlying gains should be

long term. In order to ensure that same the underlying holding period should exceed one year.

This is happening in the given case (Woellner, 2017).

A pertinent issue that is relevant for sale of land is that the contract for sale of land has already

been enacted in 2017/2018 but the proceeds would be derived only in 2018/2019. Hence,

confusion arises as to whether the tax ought to be paid on the gains in 2017/2018 or 2018/2019

(Krever, 2017). In this regards, the treatment recommended by tax ruling TR 94/29 would be

adhered to. This tax ruling recommends the taxation liability to be computed in the same year as

contract is enacted without considering the payment of proceeds (Nethercott, Richardson and

Devos, 2016). Therefore, the CGT consequences pertaining to the land sale would be considered

in 2017/2018 only for the client.

The relevant computations of taxable capital gains is demonstrated below.

Block of Land

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

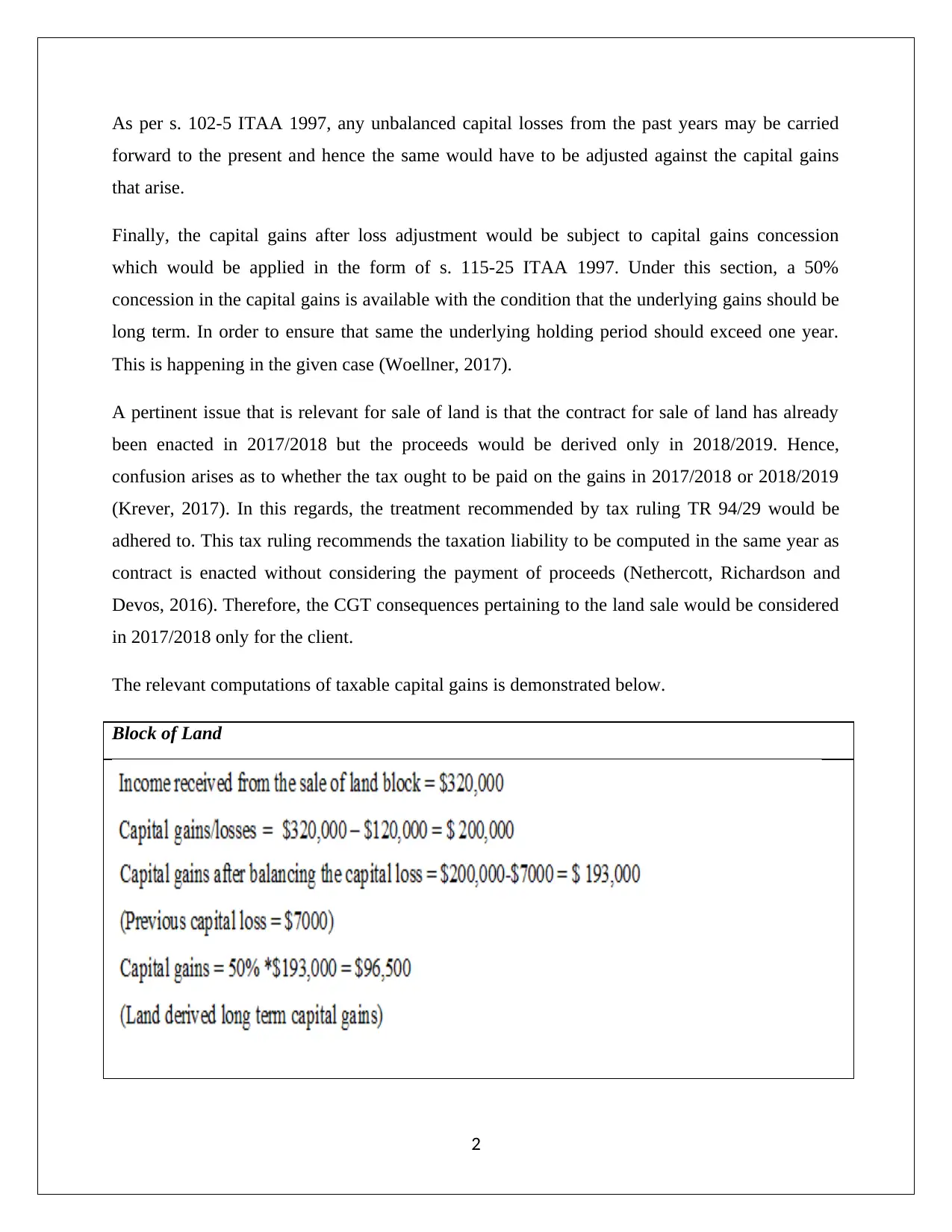

Asset: Antique Bed

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997 (Austlii, 2018 c). The

given asset i.e. antique bed has been purchased post the cut-off date and is a post-CGT asset and

therefore not exempt from CGT on basis of the purchase date (Wilmot, 2014).

The next step is to identify the relevant CGT event which for antique bed disposal would be A1

as mentioned in s. 104-5 ITAA 1997. This event also highlights the applicable formula for

computation of any gains or losses made which requires cost base computation which is

deducted from proceeds of asset sale. In the context of collectables, an addition condition id

levied by s. 118-10, ITAA 1997 whereby capital gains & losses of only those collectables would

be considered whose purchase price exceeds $ 500. For the given antique bed, this condition is

fulfilled and hence CGT exemption would not be available.

A key aspect in this case is that the bed is stolen and insurance proceeds to the extent of $ 11,000

have been received which would be considered as the proceeds from sale for computation of

CGT liability in this case. Finally, the capital gains after loss adjustment would be subject to

capital gains concession which would be applied in the form of s. 115-25 ITAA 1997 (Deutsch,

et.al., 2015).. Under this section, a 50% concession in the capital gains is available with the

condition that the underlying gains should be long term. In order to ensure that same the

underlying holding period should exceed one year. This is happening in the given case.

The relevant computation of taxable capital gains is demonstrated below.

3

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997 (Austlii, 2018 c). The

given asset i.e. antique bed has been purchased post the cut-off date and is a post-CGT asset and

therefore not exempt from CGT on basis of the purchase date (Wilmot, 2014).

The next step is to identify the relevant CGT event which for antique bed disposal would be A1

as mentioned in s. 104-5 ITAA 1997. This event also highlights the applicable formula for

computation of any gains or losses made which requires cost base computation which is

deducted from proceeds of asset sale. In the context of collectables, an addition condition id

levied by s. 118-10, ITAA 1997 whereby capital gains & losses of only those collectables would

be considered whose purchase price exceeds $ 500. For the given antique bed, this condition is

fulfilled and hence CGT exemption would not be available.

A key aspect in this case is that the bed is stolen and insurance proceeds to the extent of $ 11,000

have been received which would be considered as the proceeds from sale for computation of

CGT liability in this case. Finally, the capital gains after loss adjustment would be subject to

capital gains concession which would be applied in the form of s. 115-25 ITAA 1997 (Deutsch,

et.al., 2015).. Under this section, a 50% concession in the capital gains is available with the

condition that the underlying gains should be long term. In order to ensure that same the

underlying holding period should exceed one year. This is happening in the given case.

The relevant computation of taxable capital gains is demonstrated below.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Antique Bed

Asset: Painting

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997 (Wilmot, 2014). The

given asset i.e. painting has been purchased prior to the cut-off date and is a pre-CGT asset and

therefore exempt from CGT on basis of the purchase date.

Asset: Shares

For the shares of the four companies, it has been ascertained that these have been purchased after

the CGT regime has kicked in and hence neither of the shares for the client would be termed as

pre-CGT asset and therefore not liable for CGT exemption under the aegis of s. 149-10 ITAA

1997 (Woellner, 2017). The relevant CGT event which for share disposal would be A1 as

mentioned in s. 104-5 ITAA 1997. This event also highlights the applicable formula for

4

Asset: Painting

The first imperative aspect is to check if the underlying asset is a pre-CGT asset or not which can

be done by checking the date of purchase which must not fall before September 20, 1985 or CGT

exemption would be available as highlighted by s. 149 (10) ITAA 1997 (Wilmot, 2014). The

given asset i.e. painting has been purchased prior to the cut-off date and is a pre-CGT asset and

therefore exempt from CGT on basis of the purchase date.

Asset: Shares

For the shares of the four companies, it has been ascertained that these have been purchased after

the CGT regime has kicked in and hence neither of the shares for the client would be termed as

pre-CGT asset and therefore not liable for CGT exemption under the aegis of s. 149-10 ITAA

1997 (Woellner, 2017). The relevant CGT event which for share disposal would be A1 as

mentioned in s. 104-5 ITAA 1997. This event also highlights the applicable formula for

4

computation of any gains or losses made which requires cost base computation which is

deducted from proceeds of asset sale.

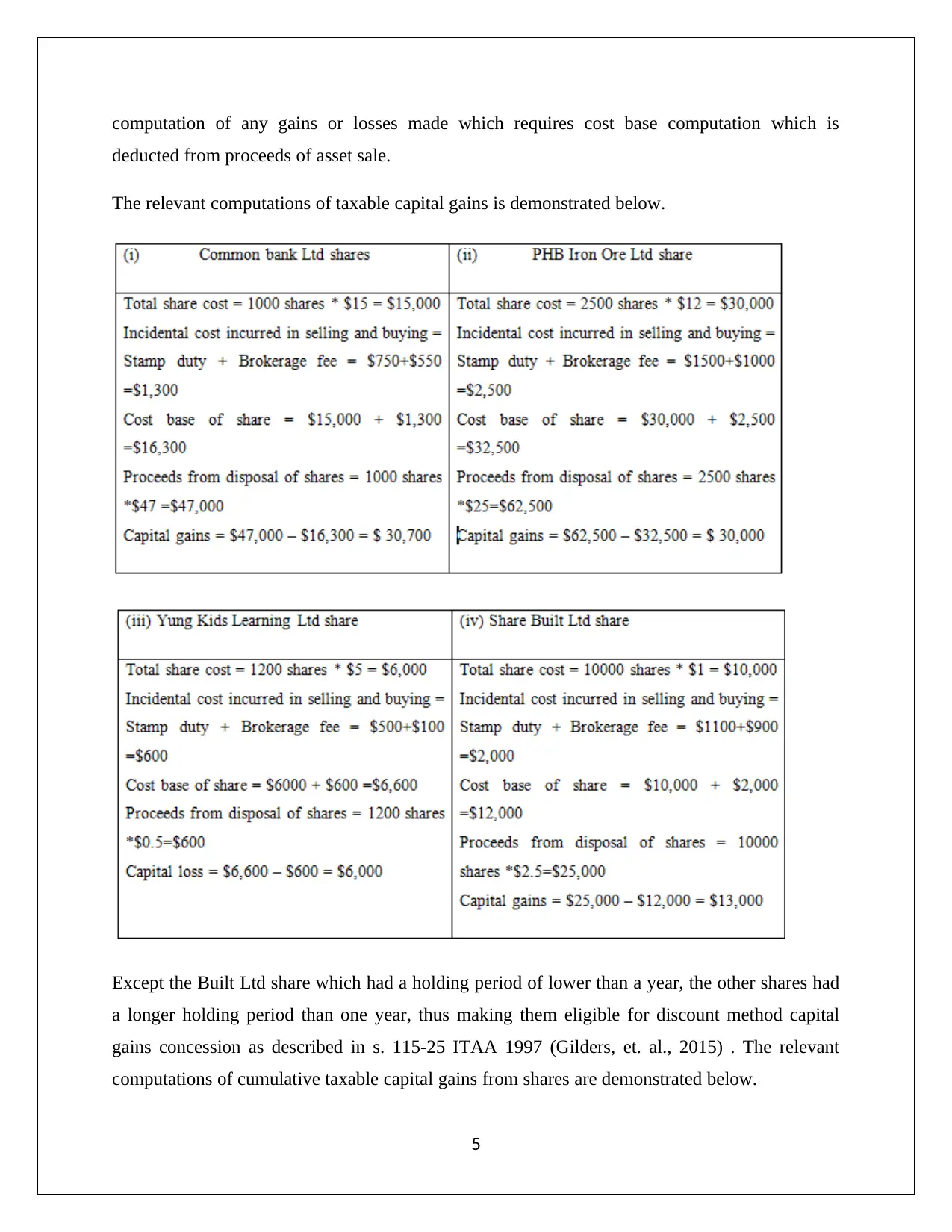

The relevant computations of taxable capital gains is demonstrated below.

Except the Built Ltd share which had a holding period of lower than a year, the other shares had

a longer holding period than one year, thus making them eligible for discount method capital

gains concession as described in s. 115-25 ITAA 1997 (Gilders, et. al., 2015) . The relevant

computations of cumulative taxable capital gains from shares are demonstrated below.

5

deducted from proceeds of asset sale.

The relevant computations of taxable capital gains is demonstrated below.

Except the Built Ltd share which had a holding period of lower than a year, the other shares had

a longer holding period than one year, thus making them eligible for discount method capital

gains concession as described in s. 115-25 ITAA 1997 (Gilders, et. al., 2015) . The relevant

computations of cumulative taxable capital gains from shares are demonstrated below.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Asset: Violin

The key aspect in relation to this asset is the underlying classification. This is imperative since as

per s. 108-20(1) ITAA 1997, if any personal use item has been acquired for $ 10,000 or less, then

the CGT consequences possible on the asset liquidation are not levied since the underlying gains

or losses realised from asset sale are disregarded.

The information provided clearly suggests that the underlying violin is used for entertainment of

the client who happens to be very fond of playing violin and has a collection of violins. These

violins are played on a frequent basis by the taxpayer. Hence, it would be apt to consider the

given violin as a personal use asset. The critical aspect for such an asset is the purchaser price as

has already been outlined above. For the violin which has been sold by the client, the purchase

price could not cross the threshold set at $ 10,000 and hence CGT exemption would be claimed

on the violin.

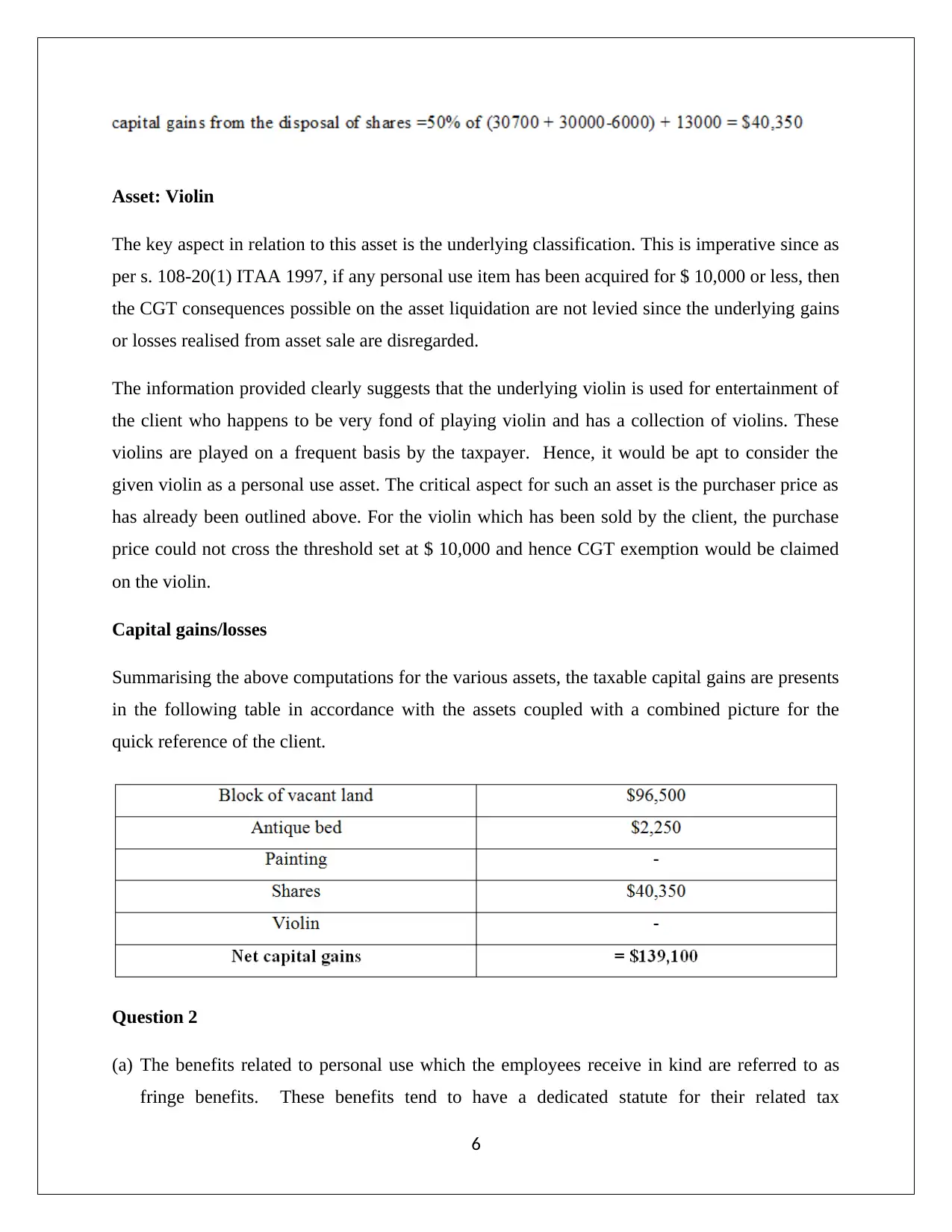

Capital gains/losses

Summarising the above computations for the various assets, the taxable capital gains are presents

in the following table in accordance with the assets coupled with a combined picture for the

quick reference of the client.

Question 2

(a) The benefits related to personal use which the employees receive in kind are referred to as

fringe benefits. These benefits tend to have a dedicated statute for their related tax

6

The key aspect in relation to this asset is the underlying classification. This is imperative since as

per s. 108-20(1) ITAA 1997, if any personal use item has been acquired for $ 10,000 or less, then

the CGT consequences possible on the asset liquidation are not levied since the underlying gains

or losses realised from asset sale are disregarded.

The information provided clearly suggests that the underlying violin is used for entertainment of

the client who happens to be very fond of playing violin and has a collection of violins. These

violins are played on a frequent basis by the taxpayer. Hence, it would be apt to consider the

given violin as a personal use asset. The critical aspect for such an asset is the purchaser price as

has already been outlined above. For the violin which has been sold by the client, the purchase

price could not cross the threshold set at $ 10,000 and hence CGT exemption would be claimed

on the violin.

Capital gains/losses

Summarising the above computations for the various assets, the taxable capital gains are presents

in the following table in accordance with the assets coupled with a combined picture for the

quick reference of the client.

Question 2

(a) The benefits related to personal use which the employees receive in kind are referred to as

fringe benefits. These benefits tend to have a dedicated statute for their related tax

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

implications which is named Fringe Benefits Tax Assessment Act 1986 (FBTAA). This is

not surprising considering the fact that the levying of tax for these benefits is quite different

from other related income sources. This is because unlike other taxes which are levied on the

eventual beneficiary which is the employer, Fringe Benefit Tax (FBT) is levied completely

on the beneficiary provided i.e. employer. There are a variety of fringe benefits that may be

extended to the employee whose taxation treatment has been dealt is relevant provisions of

FBTAA. However, the concern of the given situation is to discuss the following fringe

benefits in wake of the given case.

“Car Fringe Benefits”

In accordance with s. 7, FBTAA 1986, car fringe benefit comes into play when the employer has

the right or permission to use the employer’s car for private or personal use. This permission

may be explicit or tacit. An example of the tacit provision is when the car is parked at the

employee’s garage, it is assumed that that the permission for personal use exists (Nethercott,

Richardson and Devos, 2016).

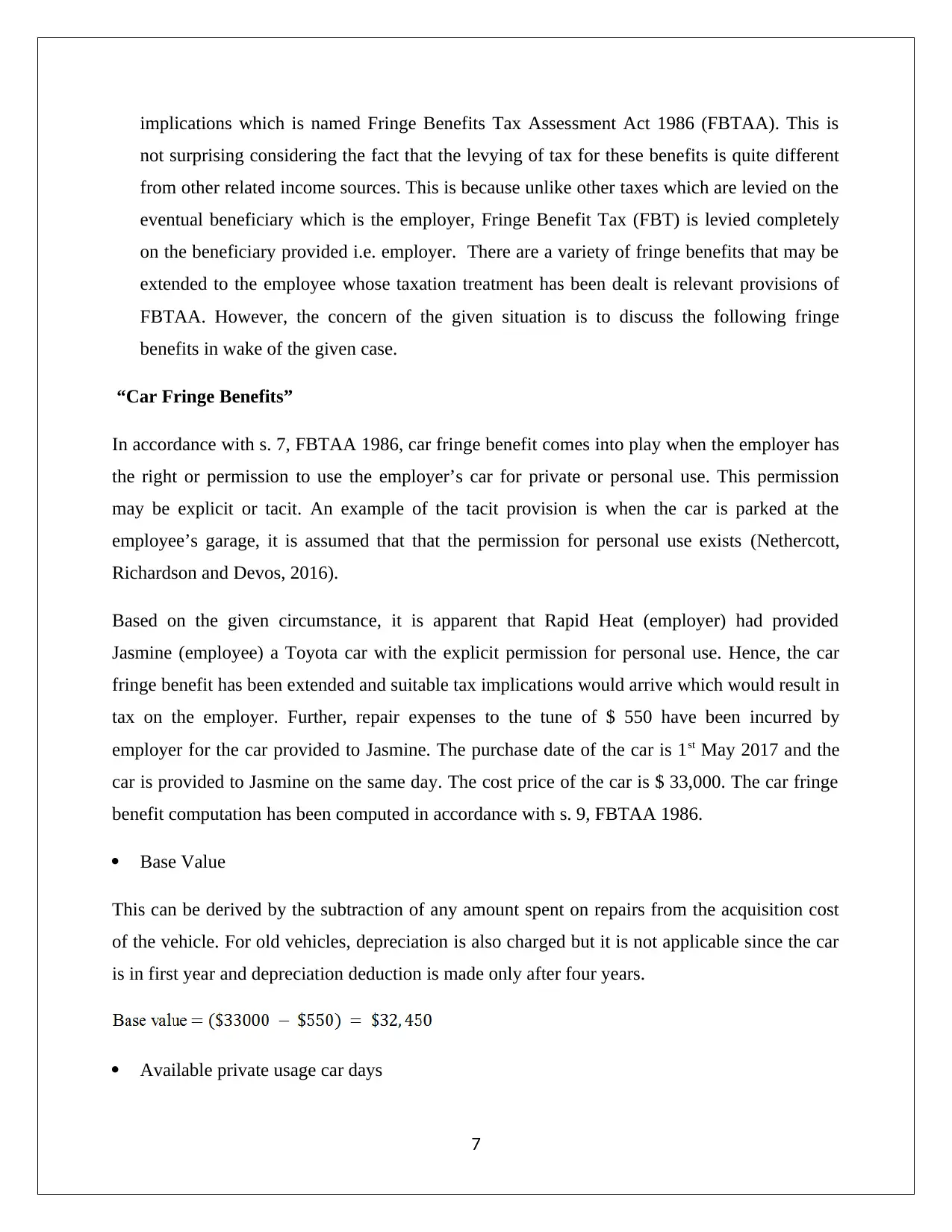

Based on the given circumstance, it is apparent that Rapid Heat (employer) had provided

Jasmine (employee) a Toyota car with the explicit permission for personal use. Hence, the car

fringe benefit has been extended and suitable tax implications would arrive which would result in

tax on the employer. Further, repair expenses to the tune of $ 550 have been incurred by

employer for the car provided to Jasmine. The purchase date of the car is 1st May 2017 and the

car is provided to Jasmine on the same day. The cost price of the car is $ 33,000. The car fringe

benefit computation has been computed in accordance with s. 9, FBTAA 1986.

Base Value

This can be derived by the subtraction of any amount spent on repairs from the acquisition cost

of the vehicle. For old vehicles, depreciation is also charged but it is not applicable since the car

is in first year and depreciation deduction is made only after four years.

Available private usage car days

7

not surprising considering the fact that the levying of tax for these benefits is quite different

from other related income sources. This is because unlike other taxes which are levied on the

eventual beneficiary which is the employer, Fringe Benefit Tax (FBT) is levied completely

on the beneficiary provided i.e. employer. There are a variety of fringe benefits that may be

extended to the employee whose taxation treatment has been dealt is relevant provisions of

FBTAA. However, the concern of the given situation is to discuss the following fringe

benefits in wake of the given case.

“Car Fringe Benefits”

In accordance with s. 7, FBTAA 1986, car fringe benefit comes into play when the employer has

the right or permission to use the employer’s car for private or personal use. This permission

may be explicit or tacit. An example of the tacit provision is when the car is parked at the

employee’s garage, it is assumed that that the permission for personal use exists (Nethercott,

Richardson and Devos, 2016).

Based on the given circumstance, it is apparent that Rapid Heat (employer) had provided

Jasmine (employee) a Toyota car with the explicit permission for personal use. Hence, the car

fringe benefit has been extended and suitable tax implications would arrive which would result in

tax on the employer. Further, repair expenses to the tune of $ 550 have been incurred by

employer for the car provided to Jasmine. The purchase date of the car is 1st May 2017 and the

car is provided to Jasmine on the same day. The cost price of the car is $ 33,000. The car fringe

benefit computation has been computed in accordance with s. 9, FBTAA 1986.

Base Value

This can be derived by the subtraction of any amount spent on repairs from the acquisition cost

of the vehicle. For old vehicles, depreciation is also charged but it is not applicable since the car

is in first year and depreciation deduction is made only after four years.

Available private usage car days

7

The car has been available to Jasmine for the whole tax year 2017/2018 barring the month of

April. Hence, deduction is available for the month of April. Further, the question arises whether

deduction would be available for ten days spent in car parking and five days in garage which

were spent for minor repairs. The answer for both cases would be negative as in accordance with

s. 9, FBTAA 1986, deduction is only available when car goes into garage for major repairs

(Reuters, 2017). Additionally, when car was left in the airport parking, there was availability of

car for use by Jasmine and her associates, but the same was not used since Jasmine was out of

city.

Further, other relevant inputs for computation of FBT liability as applicable for 2017/2018 are

summarised below.

The relevant FBT liability arising for the employer is exhibited as follows.

“Loan Fringe Benefits”

One of the fringe benefits that is provided by the employer to employee is in the form of loan

fringe benefit. As per s. 16, FBTAA 1986, loan fringe benefits are said to be extended to the

employee when the employer provides loans at concessional interest rate or lower interest rate

(ATO, 2018 b). The benchmark interest rate which the employers need to adhere to is provided

by the RBA (Reuters, 2017). Extension of financial help through loans either without any interest

or at rates lower than the above rate would result in extension of benefit as the employee would

8

April. Hence, deduction is available for the month of April. Further, the question arises whether

deduction would be available for ten days spent in car parking and five days in garage which

were spent for minor repairs. The answer for both cases would be negative as in accordance with

s. 9, FBTAA 1986, deduction is only available when car goes into garage for major repairs

(Reuters, 2017). Additionally, when car was left in the airport parking, there was availability of

car for use by Jasmine and her associates, but the same was not used since Jasmine was out of

city.

Further, other relevant inputs for computation of FBT liability as applicable for 2017/2018 are

summarised below.

The relevant FBT liability arising for the employer is exhibited as follows.

“Loan Fringe Benefits”

One of the fringe benefits that is provided by the employer to employee is in the form of loan

fringe benefit. As per s. 16, FBTAA 1986, loan fringe benefits are said to be extended to the

employee when the employer provides loans at concessional interest rate or lower interest rate

(ATO, 2018 b). The benchmark interest rate which the employers need to adhere to is provided

by the RBA (Reuters, 2017). Extension of financial help through loans either without any interest

or at rates lower than the above rate would result in extension of benefit as the employee would

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

save on the interest outflow. Further, the benefit is personal in nature, since the loan amount is

not extended for any work related to the profession (Barkoczy, 2017).

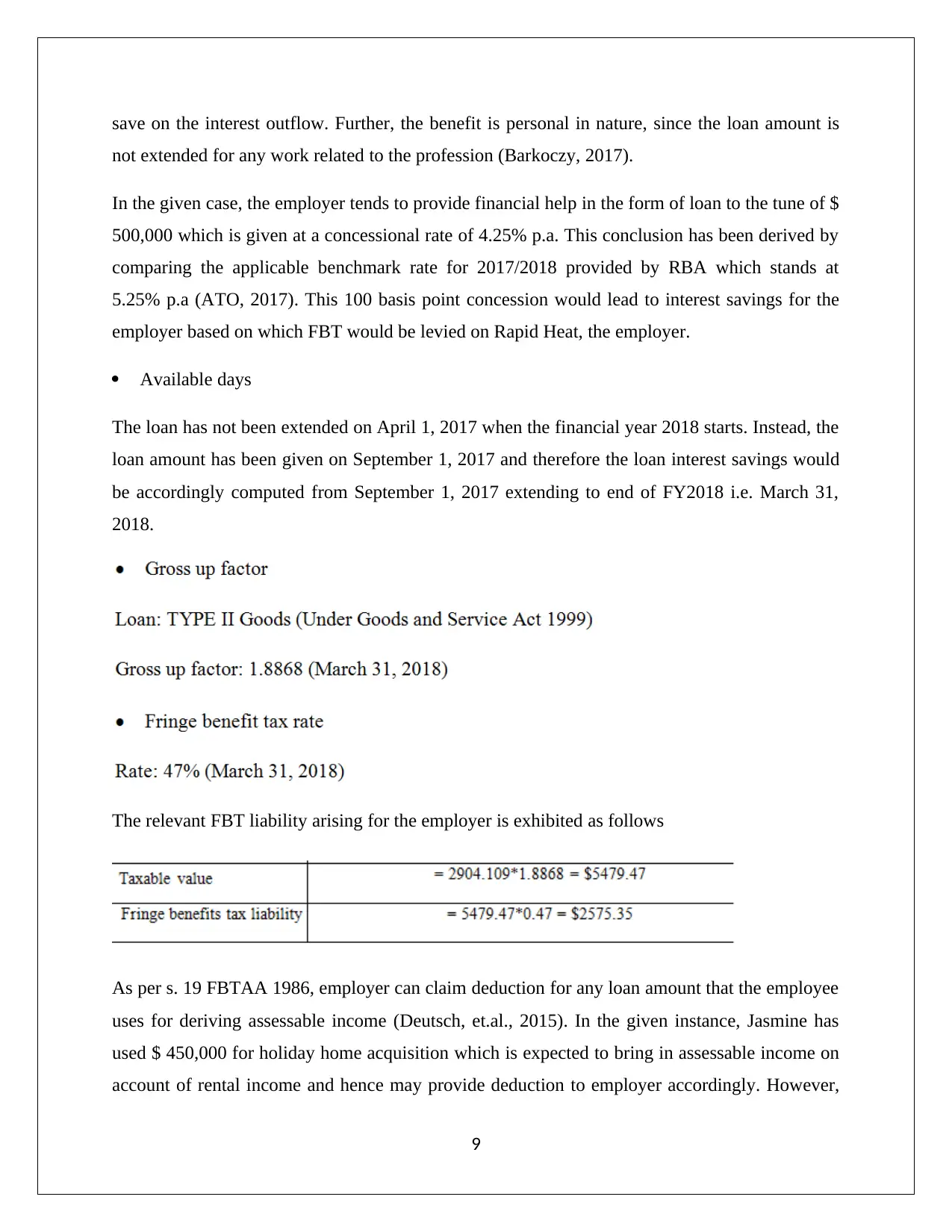

In the given case, the employer tends to provide financial help in the form of loan to the tune of $

500,000 which is given at a concessional rate of 4.25% p.a. This conclusion has been derived by

comparing the applicable benchmark rate for 2017/2018 provided by RBA which stands at

5.25% p.a (ATO, 2017). This 100 basis point concession would lead to interest savings for the

employer based on which FBT would be levied on Rapid Heat, the employer.

Available days

The loan has not been extended on April 1, 2017 when the financial year 2018 starts. Instead, the

loan amount has been given on September 1, 2017 and therefore the loan interest savings would

be accordingly computed from September 1, 2017 extending to end of FY2018 i.e. March 31,

2018.

The relevant FBT liability arising for the employer is exhibited as follows

As per s. 19 FBTAA 1986, employer can claim deduction for any loan amount that the employee

uses for deriving assessable income (Deutsch, et.al., 2015). In the given instance, Jasmine has

used $ 450,000 for holiday home acquisition which is expected to bring in assessable income on

account of rental income and hence may provide deduction to employer accordingly. However,

9

not extended for any work related to the profession (Barkoczy, 2017).

In the given case, the employer tends to provide financial help in the form of loan to the tune of $

500,000 which is given at a concessional rate of 4.25% p.a. This conclusion has been derived by

comparing the applicable benchmark rate for 2017/2018 provided by RBA which stands at

5.25% p.a (ATO, 2017). This 100 basis point concession would lead to interest savings for the

employer based on which FBT would be levied on Rapid Heat, the employer.

Available days

The loan has not been extended on April 1, 2017 when the financial year 2018 starts. Instead, the

loan amount has been given on September 1, 2017 and therefore the loan interest savings would

be accordingly computed from September 1, 2017 extending to end of FY2018 i.e. March 31,

2018.

The relevant FBT liability arising for the employer is exhibited as follows

As per s. 19 FBTAA 1986, employer can claim deduction for any loan amount that the employee

uses for deriving assessable income (Deutsch, et.al., 2015). In the given instance, Jasmine has

used $ 450,000 for holiday home acquisition which is expected to bring in assessable income on

account of rental income and hence may provide deduction to employer accordingly. However,

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the same cannot be said about the $ 50,000 which has been utilised by her husband for assessable

income production from Telstra dividends. Deduction rule under s. 9 provides deduction only for

the amount used by the employee and not any associate (ATO, 2018 a).

“Expenses Fringe Benefits”

The extension of any benefit on part of the employer which seeks to meet some of the personal

expenses of the employer are referred to as expense fringe benefits as per s. 20 FBTAA 1986

(Barkoczy, 2017). In this regards, if the benefit involves that the employer is provider an

internally manufactured product at discounted price, then the underlying fringe benefit would be

internal expense fringe benefit (Deutsch, et.al., 2015).

In the presented scenario, the employer has saved personal expense of employee (Jasmine) by $

1,300 since it has provided an internally manufactured electric heater worth $ 2,600 for $ 1,300

and in the process bore the private expense of employee to the tune of $ 1,300. The GST is

applied on heater (Austlii, 2018 b) .

The relevant FBT liability arising for the employer is exhibited as follows

(b) Instead of the husband buying Telstra shares by the $ 50,000 borrowed from employer, not

the same is being carried out in the name of Jasmine. This would result in additional

10

income production from Telstra dividends. Deduction rule under s. 9 provides deduction only for

the amount used by the employee and not any associate (ATO, 2018 a).

“Expenses Fringe Benefits”

The extension of any benefit on part of the employer which seeks to meet some of the personal

expenses of the employer are referred to as expense fringe benefits as per s. 20 FBTAA 1986

(Barkoczy, 2017). In this regards, if the benefit involves that the employer is provider an

internally manufactured product at discounted price, then the underlying fringe benefit would be

internal expense fringe benefit (Deutsch, et.al., 2015).

In the presented scenario, the employer has saved personal expense of employee (Jasmine) by $

1,300 since it has provided an internally manufactured electric heater worth $ 2,600 for $ 1,300

and in the process bore the private expense of employee to the tune of $ 1,300. The GST is

applied on heater (Austlii, 2018 b) .

The relevant FBT liability arising for the employer is exhibited as follows

(b) Instead of the husband buying Telstra shares by the $ 50,000 borrowed from employer, not

the same is being carried out in the name of Jasmine. This would result in additional

10

deduction for Rapid Heat in accordance with s. 19 FBTAA 1986. The relevant computation

is given below (Barkoczy, 2017).

11

is given below (Barkoczy, 2017).

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.