Ask a question from expert

HI6028 :Taxation Theory, Practice and Law Assignment

Added on 2019-10-30

About This Document

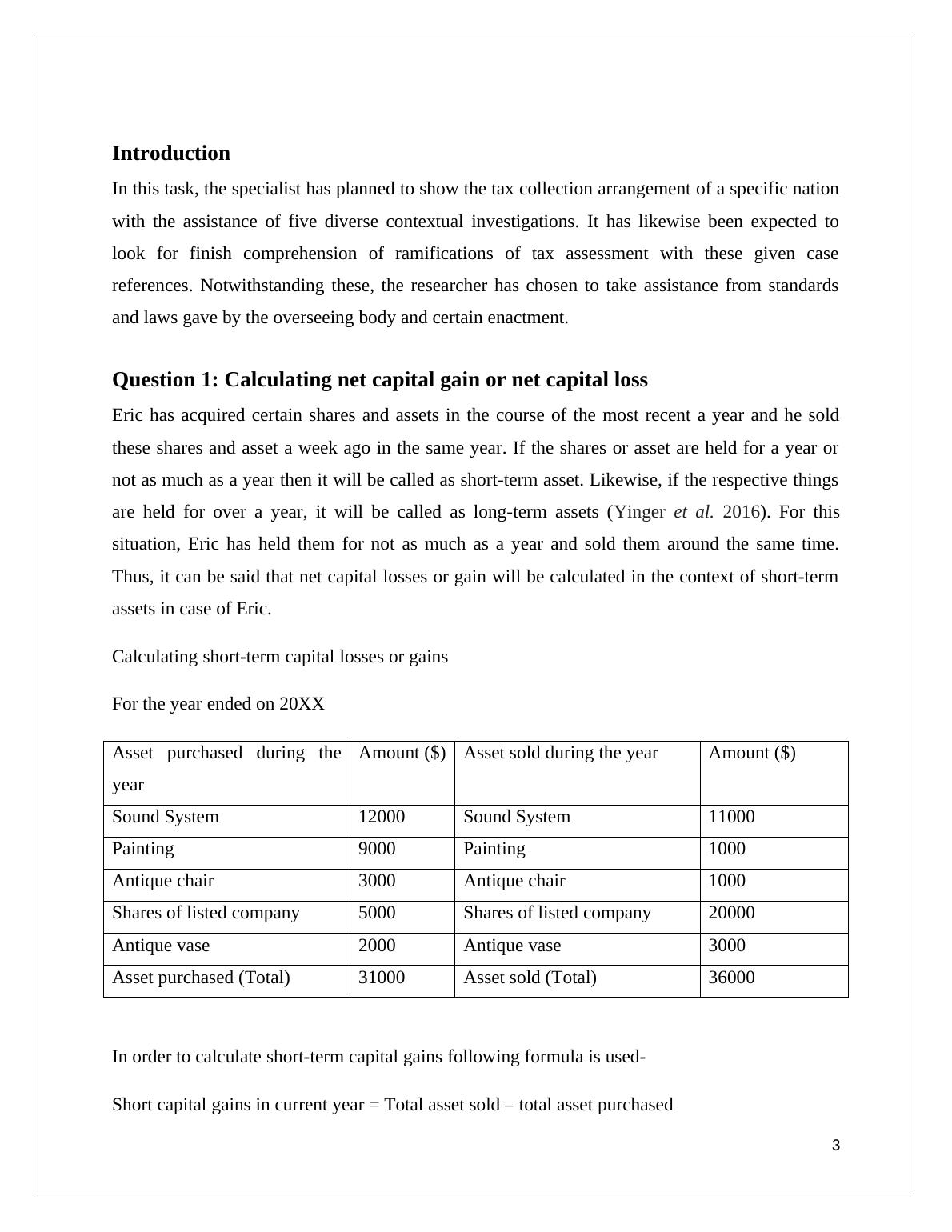

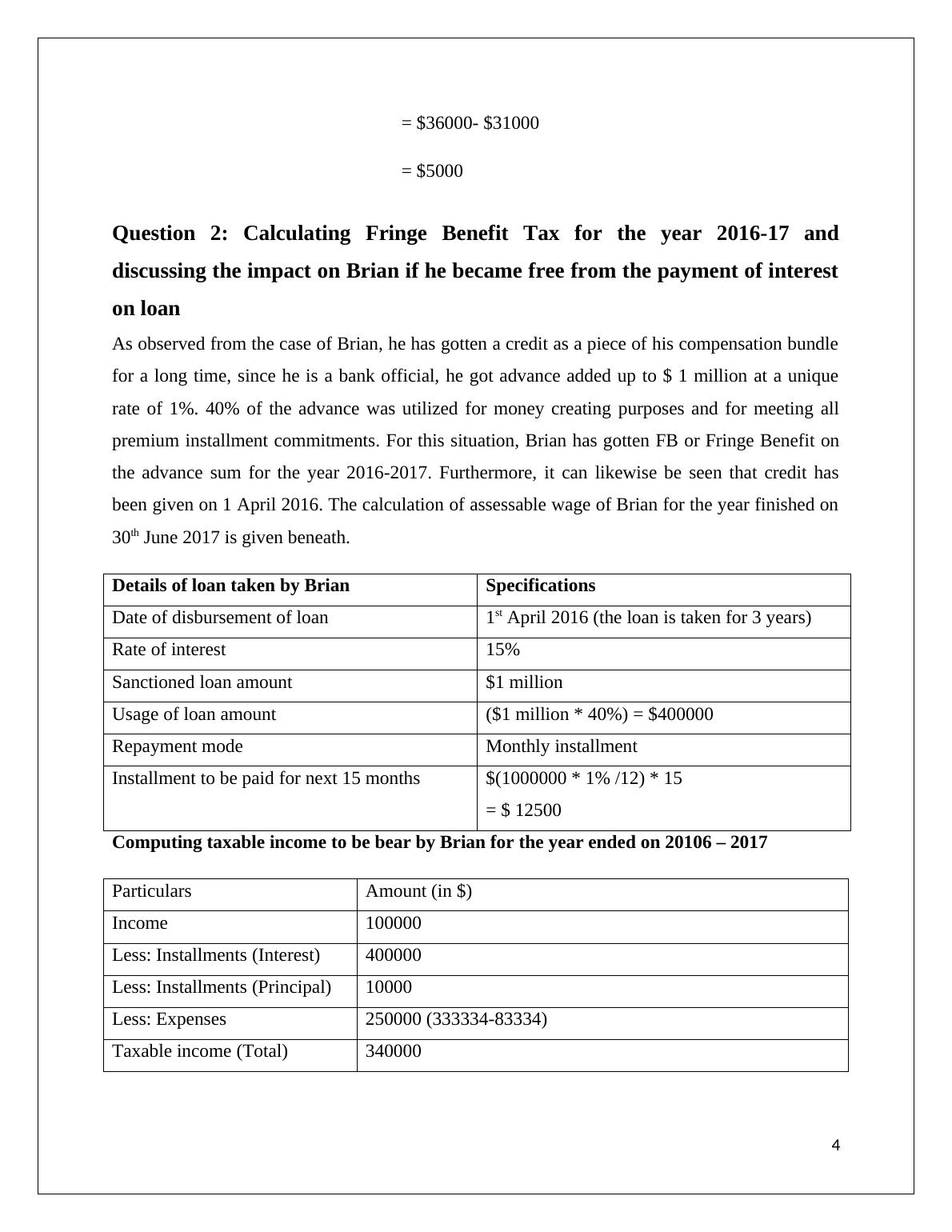

In this report, we are going to study Taxation Principles and Theory and will give the answer the following questions: Question 2: Calculating Fringe Benefits Tax for the year 2016-17 and discussing the impact on Brian if he becomes free from the payment of interest on loan 4 Question 3: Describing the loss allocated for tax purpose in case of Jack and Jill and demonstrating the situation if they decide to sell the property 6 Question 4: Discussing the principle established in IRC v. Duke of Westminister [1936] AC 7 Question 5: Providing advice to Bill related to the capital gains tax issue. You can also check "Sample Assignment on Taxation Law" for a better understanding.

HI6028 :Taxation Theory, Practice and Law Assignment

Added on 2019-10-30

End of preview

Want to access all the pages? Upload your documents or become a member.