Taxation Report: UK Tax Environment, Calculations, and Implications

VerifiedAdded on 2019/12/03

|19

|4226

|153

Report

AI Summary

This report provides a comprehensive overview of the UK tax environment. It begins by describing the different types of taxes, including income tax, corporation tax, capital gains tax, and inheritance tax, and explains the role of HMRC in tax collection and legislation. The report then delves into the roles and responsibilities of tax practitioners, emphasizing their role as mediators and advisors. It outlines the tax obligations of both taxpayers and their agents, along with the implications of non-compliance. The report includes detailed calculations of relevant income, expenses, and allowances for both employed and self-employed individuals. It also covers the calculation of taxable amounts, tax payable, and due payment dates. Furthermore, the report explores the calculation of chargeable profits, tax liabilities, capital gains, and losses, providing practical examples to illustrate key concepts. The report concludes by summarizing the key aspects of the UK tax system and its implications.

TAXATION

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Describe the UK tax environment..........................................................................................4

1.2 Analyse the role and responsibilities of the tax practitioner..................................................6

1.3 Explain the tax obligations of tax payers or their agents and the implications of non-

compliance...................................................................................................................................7

TASK 2............................................................................................................................................8

2.1 Calculate relevant income, expenses and allowances............................................................8

2.2 Calculate taxable amounts and tax payable for employed and self-employed individuals

and payment dates........................................................................................................................9

2.3 Complete relevant documentation and tax returns...............................................................10

TASK 3..........................................................................................................................................11

3.1 Calculate chargeable profits.................................................................................................11

3.2 Calculate tax liabilities and due payment dates...................................................................13

3.3 explain how income tax deductions are dealt with..............................................................13

TASK 4 .........................................................................................................................................14

4.1 Identification of Chargeable assets......................................................................................14

4.2 Computation of capital gains and taxes...............................................................................15

4.3 Computation of tax liability on capital gain tax...................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES .............................................................................................................................18

2

INTRODUCTION ..........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Describe the UK tax environment..........................................................................................4

1.2 Analyse the role and responsibilities of the tax practitioner..................................................6

1.3 Explain the tax obligations of tax payers or their agents and the implications of non-

compliance...................................................................................................................................7

TASK 2............................................................................................................................................8

2.1 Calculate relevant income, expenses and allowances............................................................8

2.2 Calculate taxable amounts and tax payable for employed and self-employed individuals

and payment dates........................................................................................................................9

2.3 Complete relevant documentation and tax returns...............................................................10

TASK 3..........................................................................................................................................11

3.1 Calculate chargeable profits.................................................................................................11

3.2 Calculate tax liabilities and due payment dates...................................................................13

3.3 explain how income tax deductions are dealt with..............................................................13

TASK 4 .........................................................................................................................................14

4.1 Identification of Chargeable assets......................................................................................14

4.2 Computation of capital gains and taxes...............................................................................15

4.3 Computation of tax liability on capital gain tax...................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES .............................................................................................................................18

2

Index of Tables

Table 1: Financial Data of XYZ Limited......................................................................................11

Table 2: Statement showing computation of operating profit......................................................12

Table 3: Statement showing Calculation of taxable profit.............................................................12

3

Table 1: Financial Data of XYZ Limited......................................................................................11

Table 2: Statement showing computation of operating profit......................................................12

Table 3: Statement showing Calculation of taxable profit.............................................................12

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Tax is defined as a financial charge which is imposed to an organizational body or an

individual against the income. Government is entitled to impose tax and its collection so as to

raise funding expenditure. In a general phenomenon, Tax is an obligation for legal and individual

entities against their respective incomes. Main aim of government of United Kingdom is to make

a transparent and easier system (Dowell, 2013). This report deals with the different aspects of

UK tax environment as well as the role and responsibilities of tax practitioners. This report also

represents the types of taxes, obligations and implications of non-compliance with tax liabilities.

Furthermore, various hypothetical examples are quoted in relation to calculate taxable amounts

and tax payable for employed and self-employed individuals as well as computation of

chargeable profits, capital gains and losses.

TASK 1

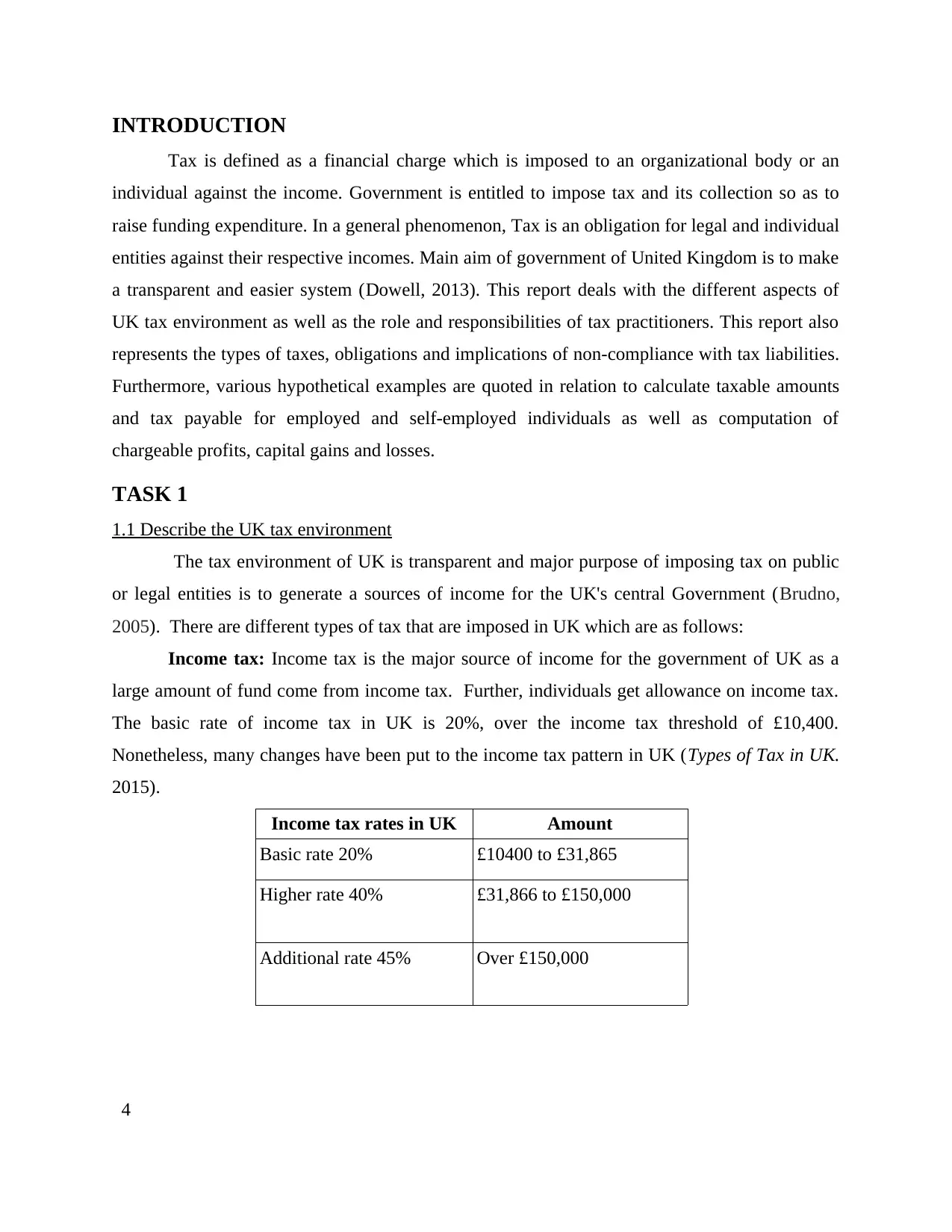

1.1 Describe the UK tax environment

The tax environment of UK is transparent and major purpose of imposing tax on public

or legal entities is to generate a sources of income for the UK's central Government (Brudno,

2005). There are different types of tax that are imposed in UK which are as follows:

Income tax: Income tax is the major source of income for the government of UK as a

large amount of fund come from income tax. Further, individuals get allowance on income tax.

The basic rate of income tax in UK is 20%, over the income tax threshold of £10,400.

Nonetheless, many changes have been put to the income tax pattern in UK (Types of Tax in UK.

2015).

Income tax rates in UK Amount

Basic rate 20% £10400 to £31,865

Higher rate 40% £31,866 to £150,000

Additional rate 45% Over £150,000

4

Tax is defined as a financial charge which is imposed to an organizational body or an

individual against the income. Government is entitled to impose tax and its collection so as to

raise funding expenditure. In a general phenomenon, Tax is an obligation for legal and individual

entities against their respective incomes. Main aim of government of United Kingdom is to make

a transparent and easier system (Dowell, 2013). This report deals with the different aspects of

UK tax environment as well as the role and responsibilities of tax practitioners. This report also

represents the types of taxes, obligations and implications of non-compliance with tax liabilities.

Furthermore, various hypothetical examples are quoted in relation to calculate taxable amounts

and tax payable for employed and self-employed individuals as well as computation of

chargeable profits, capital gains and losses.

TASK 1

1.1 Describe the UK tax environment

The tax environment of UK is transparent and major purpose of imposing tax on public

or legal entities is to generate a sources of income for the UK's central Government (Brudno,

2005). There are different types of tax that are imposed in UK which are as follows:

Income tax: Income tax is the major source of income for the government of UK as a

large amount of fund come from income tax. Further, individuals get allowance on income tax.

The basic rate of income tax in UK is 20%, over the income tax threshold of £10,400.

Nonetheless, many changes have been put to the income tax pattern in UK (Types of Tax in UK.

2015).

Income tax rates in UK Amount

Basic rate 20% £10400 to £31,865

Higher rate 40% £31,866 to £150,000

Additional rate 45% Over £150,000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporation tax: Corporate tax is paid by the people of UK against their profits whether

they are resided or domiciled. In case of legal bodies, if the origination of company are based in

UK or they are going to treated as a resident thus, taken as a scope of the corporation tax.

Capital gains tax : Capital gains tax is said to be a one of the major types of income tax.

This is kind of gain which is achieved through selling and exchanging capital assets such as

stocks and bonds. Furthermore, this is a profit which is earned by trading of real assets against

which individual has to pay tax. This tax is calculated for the companies on the basis of profit

after deducting cost (Types of Tax in UK. 2015).

Inheritance tax- Particular tax is chargeable on the transfer of property after the death

of owner. There are various reliefs and exemptions that are related to this tax. It is particularly

levied in the situation where asset is transfer prior to the death of party in 7 years (Inherent tax.

2015).

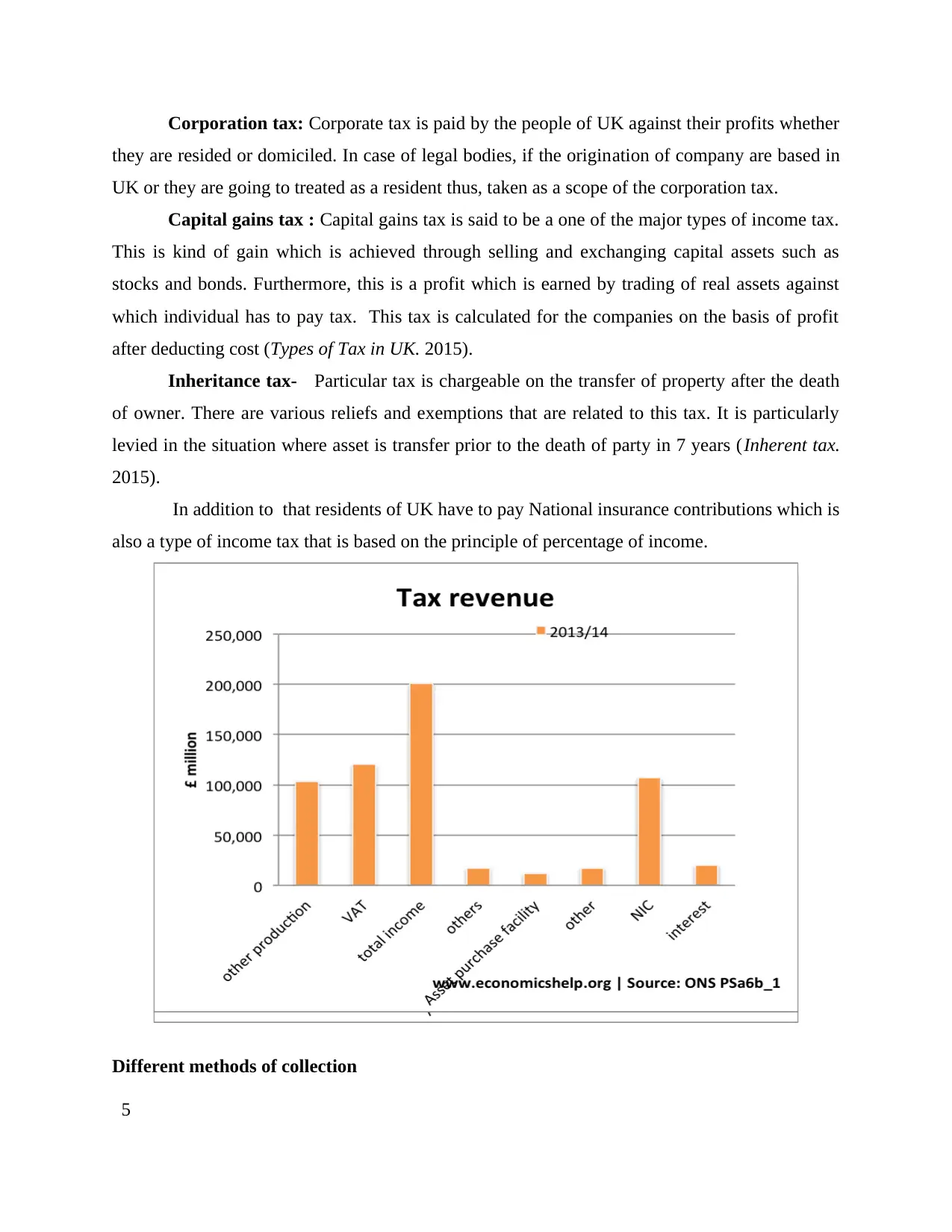

In addition to that residents of UK have to pay National insurance contributions which is

also a type of income tax that is based on the principle of percentage of income.

Different methods of collection

5

they are resided or domiciled. In case of legal bodies, if the origination of company are based in

UK or they are going to treated as a resident thus, taken as a scope of the corporation tax.

Capital gains tax : Capital gains tax is said to be a one of the major types of income tax.

This is kind of gain which is achieved through selling and exchanging capital assets such as

stocks and bonds. Furthermore, this is a profit which is earned by trading of real assets against

which individual has to pay tax. This tax is calculated for the companies on the basis of profit

after deducting cost (Types of Tax in UK. 2015).

Inheritance tax- Particular tax is chargeable on the transfer of property after the death

of owner. There are various reliefs and exemptions that are related to this tax. It is particularly

levied in the situation where asset is transfer prior to the death of party in 7 years (Inherent tax.

2015).

In addition to that residents of UK have to pay National insurance contributions which is

also a type of income tax that is based on the principle of percentage of income.

Different methods of collection

5

The responsibility of collecting tax is of HMRC which collects tax on the behalf of

Government of UK. However, the method of collection is scheme of PAYE but some of the

individuals are obliged to pay tax through self-assessment tax return. In this case earning is

raised from the course of then PAYE comes into existence. This is the stage when tax is

automatically deducted from the earning of employees. There are two different situations in

which payment through self-assessment tax return is required (Business cases, 2010). This

situation arises when individual is self-employed as well as when individual receive rental or

foreign income. Furthermore, when it is difficult to collect tax through PAYE scheme, self-

assessment tax return is used.

Tax legislation

The legislative authority of UK tax environment is HMRC as it is authorised to handle

taxation legislation. This entity is obliged to collect tax amount from the public and legal entities

on the behalf of government. HMRC also provides guidelines for the assessment of tax

practitioners whether they are fulfilling the obligation or not. This authority is also responsible to

provide continuous amendments in taxation system while considering economic environment

(Garrett and Mitchell, 2001).

1.2 Analyse the role and responsibilities of the tax practitioner

Tax practitioners play a role of mediator between assess and taxation authorities. These

people have sufficient knowledge in relation to taxation provisions and relative systems so they

are eligible to guide tax payer for meeting his/her tax obligations. Different role and

responsibilities of these people are as follows:

Dealing with inland revenue- One of the major responsibility of tax payer is of dealing

with inland revenues. Tax payer fills the return on the behalf of their clients. Information related

to amendments are to be communicated to the clients so as they can meet the tax obligations in a

proper manner (Leicester, 2006).

Providing appropriate advise- Tax practitioners are responsible for advising people or

their clients in regard to the requirements that are to be fulfilled through analysing the tax

situation in the most appropriate manner. The case of dispute are to be handled by the tax

practitioners that are with government authorities, on the behalf of client.

6

Government of UK. However, the method of collection is scheme of PAYE but some of the

individuals are obliged to pay tax through self-assessment tax return. In this case earning is

raised from the course of then PAYE comes into existence. This is the stage when tax is

automatically deducted from the earning of employees. There are two different situations in

which payment through self-assessment tax return is required (Business cases, 2010). This

situation arises when individual is self-employed as well as when individual receive rental or

foreign income. Furthermore, when it is difficult to collect tax through PAYE scheme, self-

assessment tax return is used.

Tax legislation

The legislative authority of UK tax environment is HMRC as it is authorised to handle

taxation legislation. This entity is obliged to collect tax amount from the public and legal entities

on the behalf of government. HMRC also provides guidelines for the assessment of tax

practitioners whether they are fulfilling the obligation or not. This authority is also responsible to

provide continuous amendments in taxation system while considering economic environment

(Garrett and Mitchell, 2001).

1.2 Analyse the role and responsibilities of the tax practitioner

Tax practitioners play a role of mediator between assess and taxation authorities. These

people have sufficient knowledge in relation to taxation provisions and relative systems so they

are eligible to guide tax payer for meeting his/her tax obligations. Different role and

responsibilities of these people are as follows:

Dealing with inland revenue- One of the major responsibility of tax payer is of dealing

with inland revenues. Tax payer fills the return on the behalf of their clients. Information related

to amendments are to be communicated to the clients so as they can meet the tax obligations in a

proper manner (Leicester, 2006).

Providing appropriate advise- Tax practitioners are responsible for advising people or

their clients in regard to the requirements that are to be fulfilled through analysing the tax

situation in the most appropriate manner. The case of dispute are to be handled by the tax

practitioners that are with government authorities, on the behalf of client.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Computation of tax liability- Tax practitioners are obliged to calculate the actual tax

liability of a tax payer so that they can fulfil the liabilities of bushiness. In respect with the

business scenario, practitioners are obliged to compute liabilities of the organization as well as

individuals. However, it is required that tax practitioners should have sound educational

background in the field of taxation.

Maintaining and respecting confidentiality of client- This has been witnessed that tax

payment includes some confidential information on the behalf of clients so that maintaining

confidentiality is the ethical and judicial responsibility of the tax practitioners. The tax

practitioner should not disclose the information to the third party (Types of Tax in UK. 2015).

1.3 Explain the tax obligations of tax payers or their agents and the implications of non-

compliance

Major responsibility of tax payer is to meet the tax obligation in a proper manner and

their agents are responsible for guiding them for the same. However, various obligations of tax

payers as well as their agents are shown in the below table:

Obligation of tax payer Obligation of tax agent

Tax payer is obliged to provide the

information to the authorities such as

tax agents so that can properly guide

them for meeting the tax obligations.

They are also obliged to disclose the

material information without any

deception or manipulation.

Tax payer is obliged to act in

accordance with standards that are

described by HMRC simultaneously

considering different aspects of tax

payment such as PAYE.

The major obligation on tax payer is of

Tax agents have to be act in accordance

with the various guidelines that have

been provided by HMRC

These entities are obliged for

promoting tax planning instead of tax

evasion.

Agents are also obliged to render true

and fair information to tax payer

without any misleading guidelines.

7

liability of a tax payer so that they can fulfil the liabilities of bushiness. In respect with the

business scenario, practitioners are obliged to compute liabilities of the organization as well as

individuals. However, it is required that tax practitioners should have sound educational

background in the field of taxation.

Maintaining and respecting confidentiality of client- This has been witnessed that tax

payment includes some confidential information on the behalf of clients so that maintaining

confidentiality is the ethical and judicial responsibility of the tax practitioners. The tax

practitioner should not disclose the information to the third party (Types of Tax in UK. 2015).

1.3 Explain the tax obligations of tax payers or their agents and the implications of non-

compliance

Major responsibility of tax payer is to meet the tax obligation in a proper manner and

their agents are responsible for guiding them for the same. However, various obligations of tax

payers as well as their agents are shown in the below table:

Obligation of tax payer Obligation of tax agent

Tax payer is obliged to provide the

information to the authorities such as

tax agents so that can properly guide

them for meeting the tax obligations.

They are also obliged to disclose the

material information without any

deception or manipulation.

Tax payer is obliged to act in

accordance with standards that are

described by HMRC simultaneously

considering different aspects of tax

payment such as PAYE.

The major obligation on tax payer is of

Tax agents have to be act in accordance

with the various guidelines that have

been provided by HMRC

These entities are obliged for

promoting tax planning instead of tax

evasion.

Agents are also obliged to render true

and fair information to tax payer

without any misleading guidelines.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

maintaining the accounting data for a

time of span.

Implications of non-compliance

The tax payer and their agents are strictly obliged to pay tax in a proper manner as well as

liable to fulfil obligations in a proper manner. In case, if they ignore any of the policy of

regulation to pay tax, then they become liable to pay pay damages of £3,000. the adverse impact

for the business tax agent can be in the form of cancellation of licence (Gallant, 2013).

TASK 2

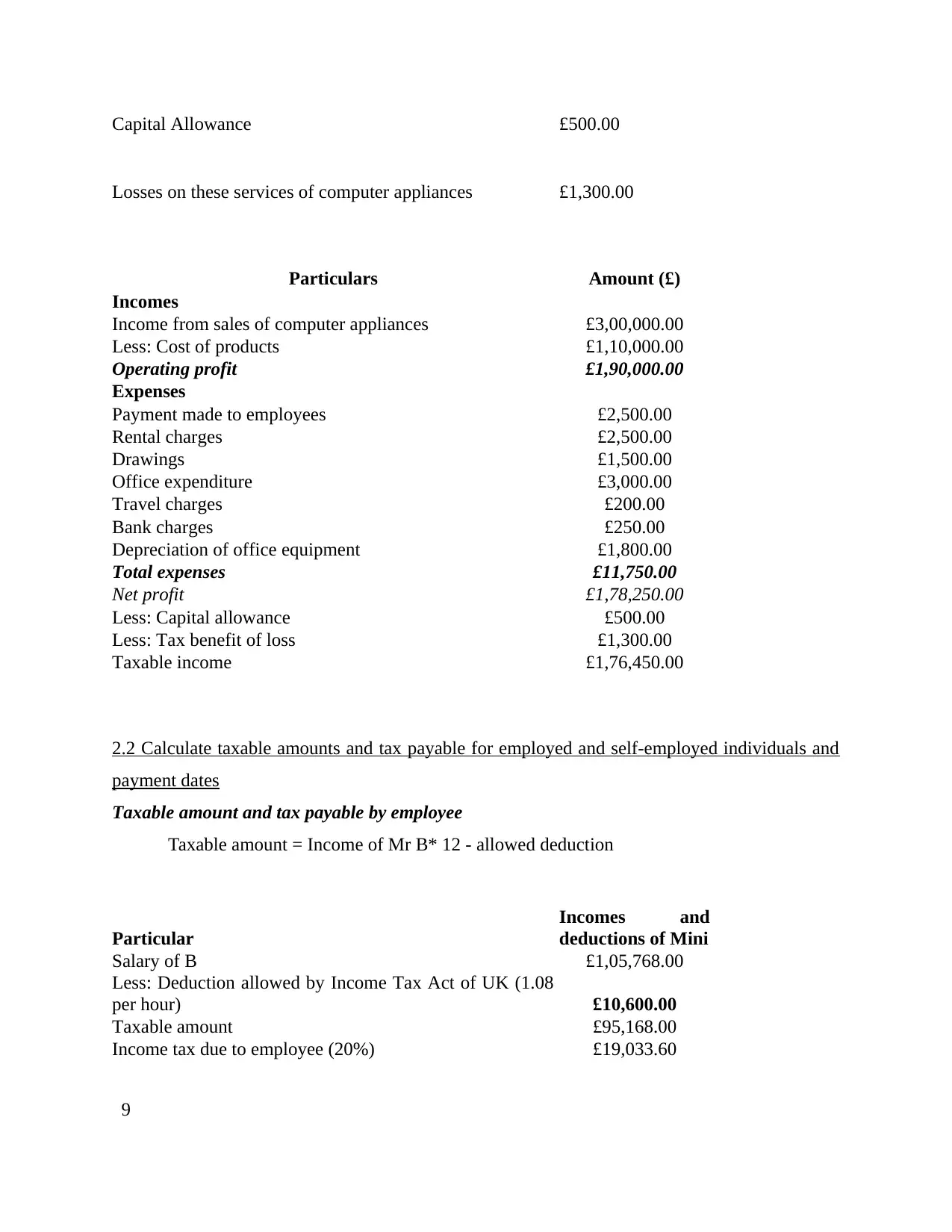

2.1 Calculate relevant income, expenses and allowances

Case example of Calculation of relevant income and allowances for Employee

Mr. C is a full-time worker in a retail organization. For the work, he receives weekly

compensation of 45 per hour. As per the contract, the total working hours of C are 52. Along

with this, he receives allowances of £.20 on weekly basis.

Particulars Calculations Amount (£)

Income of Mr. C 52*45*45 105300

Allowances to Mr. C 52*.20*45 468

Case example of Calculation of relevant income and allowances for self – employed

Mr. B is a self employed in a retail organization, however , the company is not able to

generate returns. Income statement of company is as follows.

Particulars Amount

Income from sales of computer appliances £3,00,000.00

Cost of products £1,10,000.00

Payment made to employees £9,000.00

Rental charges £2,500.00

Drawings £1,500.00

Office expenditure £3,000.00

Travel charges £200.00

Paid for donation £200.00

Bank charges £250.00

Depreciation of office equipment £1,800.00

8

time of span.

Implications of non-compliance

The tax payer and their agents are strictly obliged to pay tax in a proper manner as well as

liable to fulfil obligations in a proper manner. In case, if they ignore any of the policy of

regulation to pay tax, then they become liable to pay pay damages of £3,000. the adverse impact

for the business tax agent can be in the form of cancellation of licence (Gallant, 2013).

TASK 2

2.1 Calculate relevant income, expenses and allowances

Case example of Calculation of relevant income and allowances for Employee

Mr. C is a full-time worker in a retail organization. For the work, he receives weekly

compensation of 45 per hour. As per the contract, the total working hours of C are 52. Along

with this, he receives allowances of £.20 on weekly basis.

Particulars Calculations Amount (£)

Income of Mr. C 52*45*45 105300

Allowances to Mr. C 52*.20*45 468

Case example of Calculation of relevant income and allowances for self – employed

Mr. B is a self employed in a retail organization, however , the company is not able to

generate returns. Income statement of company is as follows.

Particulars Amount

Income from sales of computer appliances £3,00,000.00

Cost of products £1,10,000.00

Payment made to employees £9,000.00

Rental charges £2,500.00

Drawings £1,500.00

Office expenditure £3,000.00

Travel charges £200.00

Paid for donation £200.00

Bank charges £250.00

Depreciation of office equipment £1,800.00

8

Capital Allowance £500.00

Losses on these services of computer appliances £1,300.00

Particulars Amount (£)

Incomes

Income from sales of computer appliances £3,00,000.00

Less: Cost of products £1,10,000.00

Operating profit £1,90,000.00

Expenses

Payment made to employees £2,500.00

Rental charges £2,500.00

Drawings £1,500.00

Office expenditure £3,000.00

Travel charges £200.00

Bank charges £250.00

Depreciation of office equipment £1,800.00

Total expenses £11,750.00

Net profit £1,78,250.00

Less: Capital allowance £500.00

Less: Tax benefit of loss £1,300.00

Taxable income £1,76,450.00

2.2 Calculate taxable amounts and tax payable for employed and self-employed individuals and

payment dates

Taxable amount and tax payable by employee

Taxable amount = Income of Mr B* 12 - allowed deduction

Particular

Incomes and

deductions of Mini

Salary of B £1,05,768.00

Less: Deduction allowed by Income Tax Act of UK (1.08

per hour) £10,600.00

Taxable amount £95,168.00

Income tax due to employee (20%) £19,033.60

9

Losses on these services of computer appliances £1,300.00

Particulars Amount (£)

Incomes

Income from sales of computer appliances £3,00,000.00

Less: Cost of products £1,10,000.00

Operating profit £1,90,000.00

Expenses

Payment made to employees £2,500.00

Rental charges £2,500.00

Drawings £1,500.00

Office expenditure £3,000.00

Travel charges £200.00

Bank charges £250.00

Depreciation of office equipment £1,800.00

Total expenses £11,750.00

Net profit £1,78,250.00

Less: Capital allowance £500.00

Less: Tax benefit of loss £1,300.00

Taxable income £1,76,450.00

2.2 Calculate taxable amounts and tax payable for employed and self-employed individuals and

payment dates

Taxable amount and tax payable by employee

Taxable amount = Income of Mr B* 12 - allowed deduction

Particular

Incomes and

deductions of Mini

Salary of B £1,05,768.00

Less: Deduction allowed by Income Tax Act of UK (1.08

per hour) £10,600.00

Taxable amount £95,168.00

Income tax due to employee (20%) £19,033.60

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

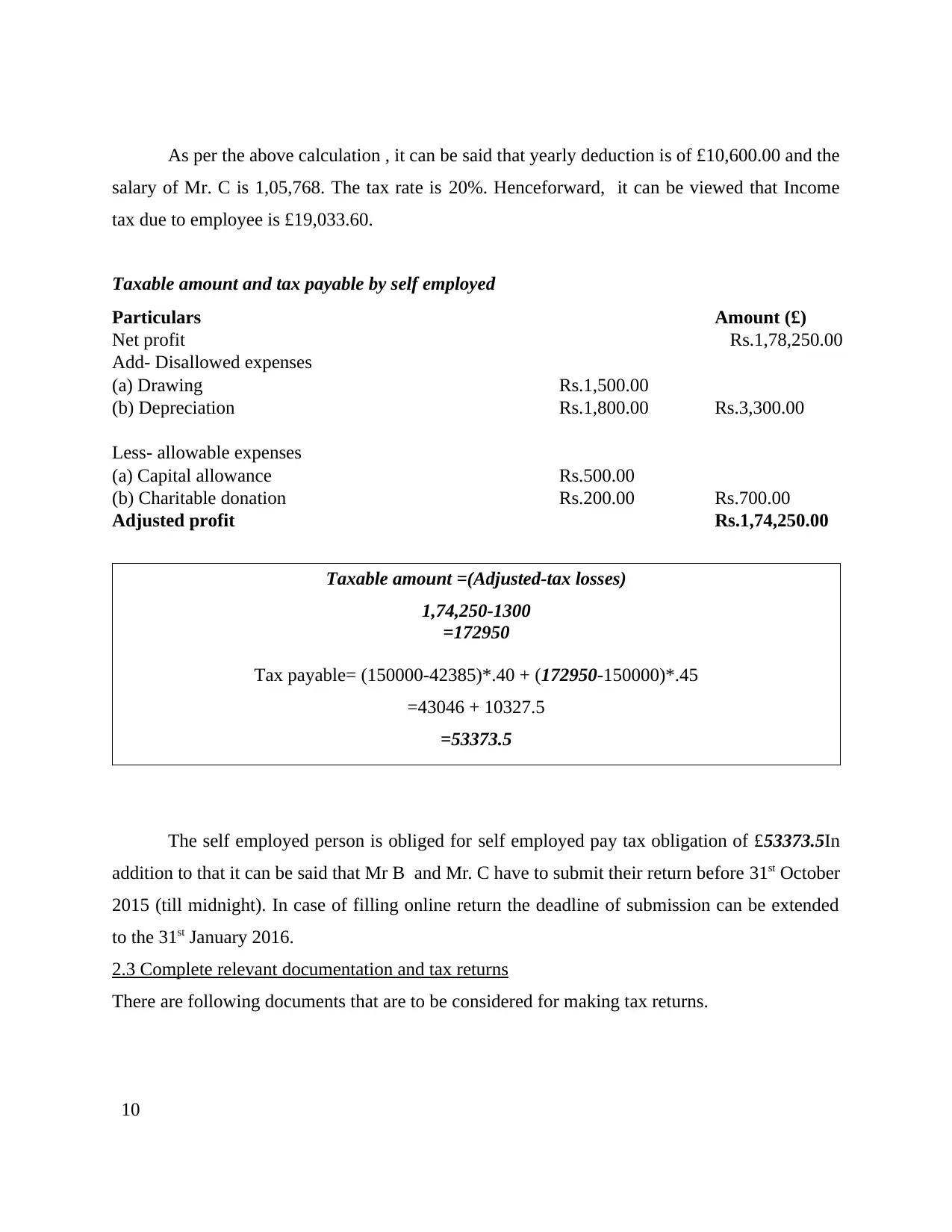

As per the above calculation , it can be said that yearly deduction is of £10,600.00 and the

salary of Mr. C is 1,05,768. The tax rate is 20%. Henceforward, it can be viewed that Income

tax due to employee is £19,033.60.

Taxable amount and tax payable by self employed

Particulars Amount (£)

Net profit Rs.1,78,250.00

Add- Disallowed expenses

(a) Drawing Rs.1,500.00

(b) Depreciation Rs.1,800.00 Rs.3,300.00

Less- allowable expenses

(a) Capital allowance Rs.500.00

(b) Charitable donation Rs.200.00 Rs.700.00

Adjusted profit Rs.1,74,250.00

Taxable amount =(Adjusted-tax losses)

1,74,250-1300

=172950

Tax payable= (150000-42385)*.40 + (172950-150000)*.45

=43046 + 10327.5

=53373.5

The self employed person is obliged for self employed pay tax obligation of £53373.5In

addition to that it can be said that Mr B and Mr. C have to submit their return before 31st October

2015 (till midnight). In case of filling online return the deadline of submission can be extended

to the 31st January 2016.

2.3 Complete relevant documentation and tax returns

There are following documents that are to be considered for making tax returns.

10

salary of Mr. C is 1,05,768. The tax rate is 20%. Henceforward, it can be viewed that Income

tax due to employee is £19,033.60.

Taxable amount and tax payable by self employed

Particulars Amount (£)

Net profit Rs.1,78,250.00

Add- Disallowed expenses

(a) Drawing Rs.1,500.00

(b) Depreciation Rs.1,800.00 Rs.3,300.00

Less- allowable expenses

(a) Capital allowance Rs.500.00

(b) Charitable donation Rs.200.00 Rs.700.00

Adjusted profit Rs.1,74,250.00

Taxable amount =(Adjusted-tax losses)

1,74,250-1300

=172950

Tax payable= (150000-42385)*.40 + (172950-150000)*.45

=43046 + 10327.5

=53373.5

The self employed person is obliged for self employed pay tax obligation of £53373.5In

addition to that it can be said that Mr B and Mr. C have to submit their return before 31st October

2015 (till midnight). In case of filling online return the deadline of submission can be extended

to the 31st January 2016.

2.3 Complete relevant documentation and tax returns

There are following documents that are to be considered for making tax returns.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. P45- In case the tax payer are not willing to continue operational activities so that they

have to fill this document. This is mandate to fill this form so as to provide information

regarding earnings (Lusty, 2003).

2. P60- The individuals are obliged to use this form and have to show their earning

generated from course of employment. This form allows to provide information in

respect to actual tax liability.

3. P11D- The employers are obliged to fill up the forms so as to provide description of

benefits provided to employees such HRA, dearness allowance and so on and has to subit

this form to HMRC (Fox, Grinyer And Russell, 2006).

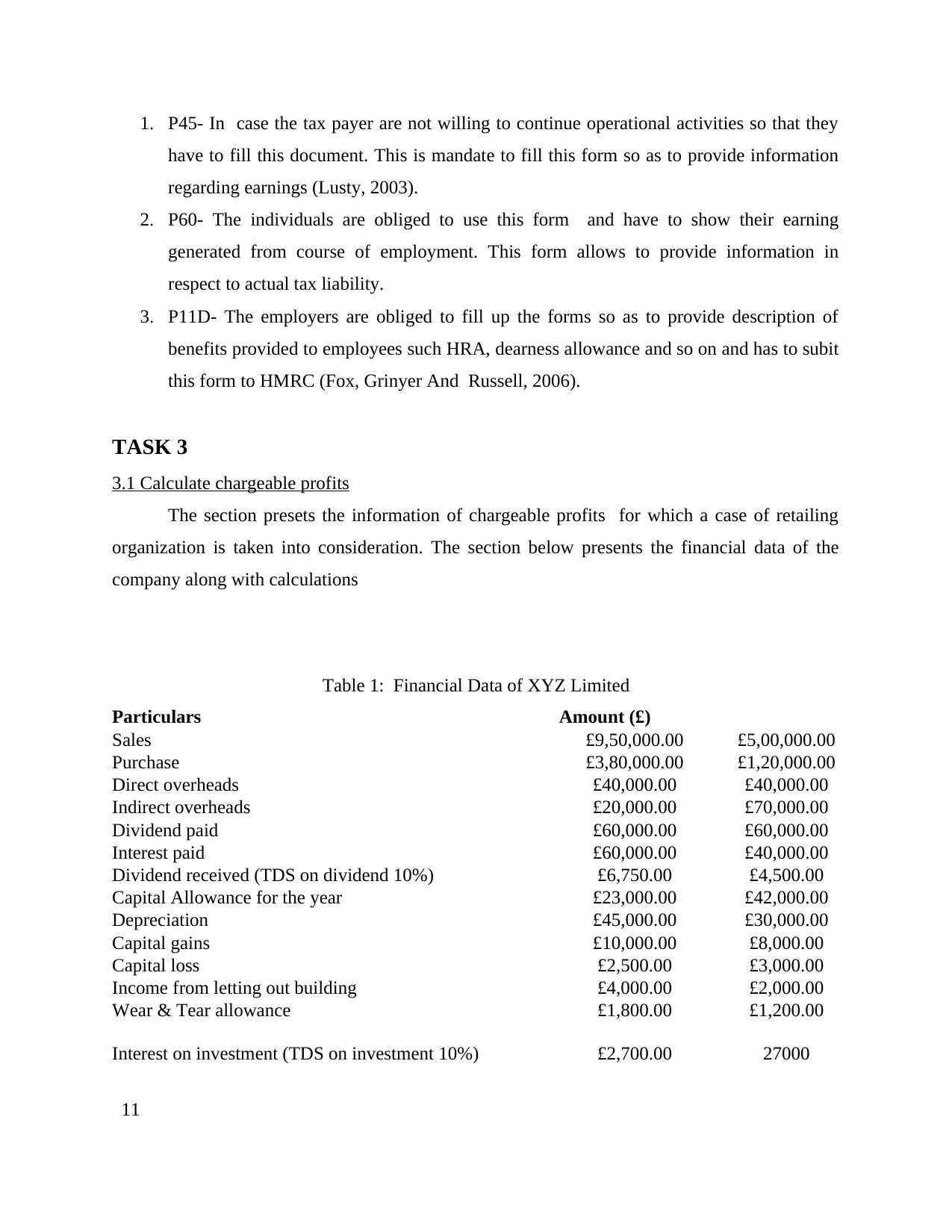

TASK 3

3.1 Calculate chargeable profits

The section presets the information of chargeable profits for which a case of retailing

organization is taken into consideration. The section below presents the financial data of the

company along with calculations

Table 1: Financial Data of XYZ Limited

Particulars Amount (£)

Sales £9,50,000.00 £5,00,000.00

Purchase £3,80,000.00 £1,20,000.00

Direct overheads £40,000.00 £40,000.00

Indirect overheads £20,000.00 £70,000.00

Dividend paid £60,000.00 £60,000.00

Interest paid £60,000.00 £40,000.00

Dividend received (TDS on dividend 10%) £6,750.00 £4,500.00

Capital Allowance for the year £23,000.00 £42,000.00

Depreciation £45,000.00 £30,000.00

Capital gains £10,000.00 £8,000.00

Capital loss £2,500.00 £3,000.00

Income from letting out building £4,000.00 £2,000.00

Wear & Tear allowance £1,800.00 £1,200.00

Interest on investment (TDS on investment 10%) £2,700.00 27000

11

have to fill this document. This is mandate to fill this form so as to provide information

regarding earnings (Lusty, 2003).

2. P60- The individuals are obliged to use this form and have to show their earning

generated from course of employment. This form allows to provide information in

respect to actual tax liability.

3. P11D- The employers are obliged to fill up the forms so as to provide description of

benefits provided to employees such HRA, dearness allowance and so on and has to subit

this form to HMRC (Fox, Grinyer And Russell, 2006).

TASK 3

3.1 Calculate chargeable profits

The section presets the information of chargeable profits for which a case of retailing

organization is taken into consideration. The section below presents the financial data of the

company along with calculations

Table 1: Financial Data of XYZ Limited

Particulars Amount (£)

Sales £9,50,000.00 £5,00,000.00

Purchase £3,80,000.00 £1,20,000.00

Direct overheads £40,000.00 £40,000.00

Indirect overheads £20,000.00 £70,000.00

Dividend paid £60,000.00 £60,000.00

Interest paid £60,000.00 £40,000.00

Dividend received (TDS on dividend 10%) £6,750.00 £4,500.00

Capital Allowance for the year £23,000.00 £42,000.00

Depreciation £45,000.00 £30,000.00

Capital gains £10,000.00 £8,000.00

Capital loss £2,500.00 £3,000.00

Income from letting out building £4,000.00 £2,000.00

Wear & Tear allowance £1,800.00 £1,200.00

Interest on investment (TDS on investment 10%) £2,700.00 27000

11

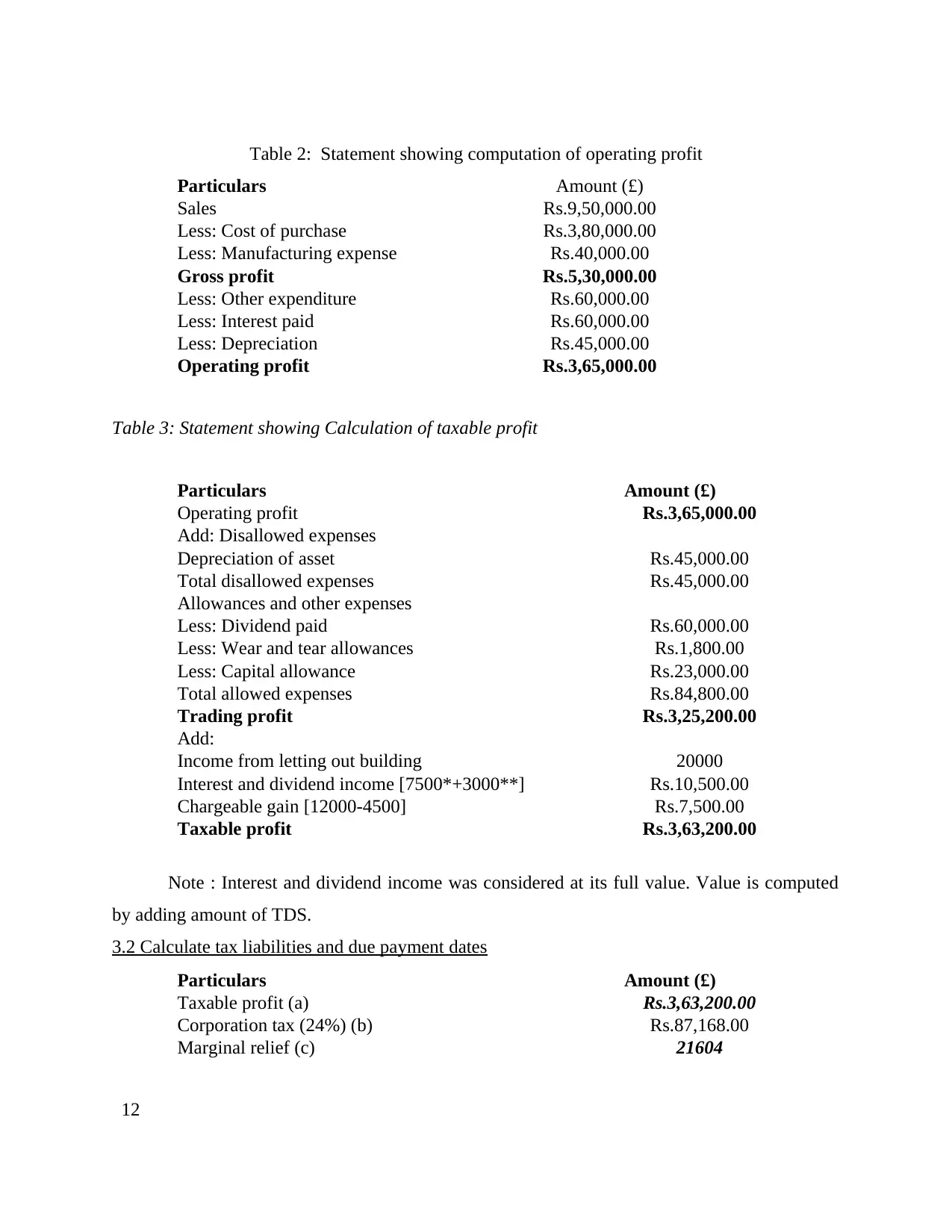

Table 2: Statement showing computation of operating profit

Particulars Amount (£)

Sales Rs.9,50,000.00

Less: Cost of purchase Rs.3,80,000.00

Less: Manufacturing expense Rs.40,000.00

Gross profit Rs.5,30,000.00

Less: Other expenditure Rs.60,000.00

Less: Interest paid Rs.60,000.00

Less: Depreciation Rs.45,000.00

Operating profit Rs.3,65,000.00

Table 3: Statement showing Calculation of taxable profit

Particulars Amount (£)

Operating profit Rs.3,65,000.00

Add: Disallowed expenses

Depreciation of asset Rs.45,000.00

Total disallowed expenses Rs.45,000.00

Allowances and other expenses

Less: Dividend paid Rs.60,000.00

Less: Wear and tear allowances Rs.1,800.00

Less: Capital allowance Rs.23,000.00

Total allowed expenses Rs.84,800.00

Trading profit Rs.3,25,200.00

Add:

Income from letting out building 20000

Interest and dividend income [7500*+3000**] Rs.10,500.00

Chargeable gain [12000-4500] Rs.7,500.00

Taxable profit Rs.3,63,200.00

Note : Interest and dividend income was considered at its full value. Value is computed

by adding amount of TDS.

3.2 Calculate tax liabilities and due payment dates

Particulars Amount (£)

Taxable profit (a) Rs.3,63,200.00

Corporation tax (24%) (b) Rs.87,168.00

Marginal relief (c) 21604

12

Particulars Amount (£)

Sales Rs.9,50,000.00

Less: Cost of purchase Rs.3,80,000.00

Less: Manufacturing expense Rs.40,000.00

Gross profit Rs.5,30,000.00

Less: Other expenditure Rs.60,000.00

Less: Interest paid Rs.60,000.00

Less: Depreciation Rs.45,000.00

Operating profit Rs.3,65,000.00

Table 3: Statement showing Calculation of taxable profit

Particulars Amount (£)

Operating profit Rs.3,65,000.00

Add: Disallowed expenses

Depreciation of asset Rs.45,000.00

Total disallowed expenses Rs.45,000.00

Allowances and other expenses

Less: Dividend paid Rs.60,000.00

Less: Wear and tear allowances Rs.1,800.00

Less: Capital allowance Rs.23,000.00

Total allowed expenses Rs.84,800.00

Trading profit Rs.3,25,200.00

Add:

Income from letting out building 20000

Interest and dividend income [7500*+3000**] Rs.10,500.00

Chargeable gain [12000-4500] Rs.7,500.00

Taxable profit Rs.3,63,200.00

Note : Interest and dividend income was considered at its full value. Value is computed

by adding amount of TDS.

3.2 Calculate tax liabilities and due payment dates

Particulars Amount (£)

Taxable profit (a) Rs.3,63,200.00

Corporation tax (24%) (b) Rs.87,168.00

Marginal relief (c) 21604

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.