Technology for Detecting & Preventing Financial Statement Fraud in UAE

VerifiedAdded on 2023/05/28

|35

|6198

|385

Project

AI Summary

This project investigates the impact of technology on the detection and prevention of financial statement fraud within organizations in the UAE. Data was collected from 125 managerial employees across various UAE organizations through questionnaires and analyzed using regression analysis in SPSS. The study identifies different types of financial statement fraud, evaluates technological improvements in accounting, investigates techniques used for fraud detection, assesses challenges in implementing fraud detection technologies, and analyzes measures to improve fraud detection performance. The findings indicate a significant positive relationship between fraud prevention techniques and the detection of financial statement fraud, supporting the alternative hypothesis that technology has a significant impact on preventing and detecting financial statement fraud in the UAE. The research also references fraud theories such as the fraud triangle and fraud diamond to provide a theoretical underpinning to the practical applications of technology.

1

Technology and Financial Statement Fraud

Technology and Financial Statement Fraud

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Abstract

The aim of the study is to evaluate the effect of technology in the detection and prevention of

financial statement fraud in organizations of UAE. For this purpose, 125 respondents have been

selected from different organizations that consist of managerial position employees. The data has

been collected by the use of desk research method and survey through questionnaire method to

attain valid and credible results for the research study. In addition to this, regression analysis has

been conducted on the data collected through survey through questionnaire method by the help

of SPSS. It is found out that there is an acceptance of alternative hypothesis as there is a presence

of significant relationship among prevention techniques and detect of financial statement fraud in

organizations of UAE. It is also found out that there is a presence of positive correlation between

the dependent and independent variable that is there is a significant impact of technology on

detection and prevention of financial statement fraud.

Abstract

The aim of the study is to evaluate the effect of technology in the detection and prevention of

financial statement fraud in organizations of UAE. For this purpose, 125 respondents have been

selected from different organizations that consist of managerial position employees. The data has

been collected by the use of desk research method and survey through questionnaire method to

attain valid and credible results for the research study. In addition to this, regression analysis has

been conducted on the data collected through survey through questionnaire method by the help

of SPSS. It is found out that there is an acceptance of alternative hypothesis as there is a presence

of significant relationship among prevention techniques and detect of financial statement fraud in

organizations of UAE. It is also found out that there is a presence of positive correlation between

the dependent and independent variable that is there is a significant impact of technology on

detection and prevention of financial statement fraud.

3

Table of Contents

Abstract............................................................................................................................................2

Introduction......................................................................................................................................4

Aim and Objectives.....................................................................................................................4

Hypothesis with Theory...............................................................................................................5

Research Questions......................................................................................................................5

Research Rationale......................................................................................................................5

Literature review..............................................................................................................................6

To identify different types of frauds that occurs in financial statements....................................6

To evaluate various technological improvements in accounting.................................................7

Investigation of different techniques which are being used to detect financial statement fraud. 8

To evaluate the challenges faced by the organizations in implementation of the technologies

for the detection of the financial statement fraud........................................................................8

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud..............................................................................................................9

Literature gap.............................................................................................................................10

Conceptual framework...............................................................................................................11

Research Methodology..................................................................................................................12

Research Limitation...................................................................................................................13

Data analysis and Discussion.........................................................................................................14

Conclusion.....................................................................................................................................28

References......................................................................................................................................29

Appendix........................................................................................................................................31

Questionnaire.............................................................................................................................31

Table of Contents

Abstract............................................................................................................................................2

Introduction......................................................................................................................................4

Aim and Objectives.....................................................................................................................4

Hypothesis with Theory...............................................................................................................5

Research Questions......................................................................................................................5

Research Rationale......................................................................................................................5

Literature review..............................................................................................................................6

To identify different types of frauds that occurs in financial statements....................................6

To evaluate various technological improvements in accounting.................................................7

Investigation of different techniques which are being used to detect financial statement fraud. 8

To evaluate the challenges faced by the organizations in implementation of the technologies

for the detection of the financial statement fraud........................................................................8

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud..............................................................................................................9

Literature gap.............................................................................................................................10

Conceptual framework...............................................................................................................11

Research Methodology..................................................................................................................12

Research Limitation...................................................................................................................13

Data analysis and Discussion.........................................................................................................14

Conclusion.....................................................................................................................................28

References......................................................................................................................................29

Appendix........................................................................................................................................31

Questionnaire.............................................................................................................................31

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

Financial statement fraud refers to making modifications in the financial statements of the

companies by the way of addition or omission of the data related to it for the purpose of

projecting a desired financial strength of the company to its stakeholders which is false in nature.

This fraudulent practice has been carried out by the firms to gain the interest of the investors

from whom they appeal to gain a credit. The Forensic accounting Dubai offer services to detect

and avoid such kind of fraud in the organizations as it has huge repercussions at the time of

detected by the authorities (Van Akkeren and Buckby, 2017). There are several firms that offer

forensic accounting Dubai services in UAE. It is also found out that there are several techniques

and technology that has been used by the firms to detect financial statement fraud such as

password protection, digital analysis and firewall protection and so on. It is found out that

emergence and growth of e-commerce and internet has resulted in increasing the exposure to

fraud.

It is essential for the accountants to ensure that the information or computer network should be

accessible by only legitimate users. Passwords are considered as the oldest technique of

computer defense. Technological advancement has helped in the creation of new forms of

password protection such as use of biological features of the user like retina patterns, fingerprints

and voiceprints to prevent the fraudulent practices carried out in terms of financial statements.

Apart from this, the establishment of firewalls has helped in controlling the unauthorized access

of the financial information related to the organizations in UAE (Rahman and Anwar, 2014).

Aim and Objectives

The main aim of the research is to analyze the effect of technology used to detect and prevent

financial statement fraud in UAE. For the purpose of the attainment of this aim, there is a

requirement to attain the following objectives.

To identify different types of frauds that occurs in financial statements

To evaluate various technological improvements in accounting

Investigation of different techniques which are being used to detect financial statement

fraud

Introduction

Financial statement fraud refers to making modifications in the financial statements of the

companies by the way of addition or omission of the data related to it for the purpose of

projecting a desired financial strength of the company to its stakeholders which is false in nature.

This fraudulent practice has been carried out by the firms to gain the interest of the investors

from whom they appeal to gain a credit. The Forensic accounting Dubai offer services to detect

and avoid such kind of fraud in the organizations as it has huge repercussions at the time of

detected by the authorities (Van Akkeren and Buckby, 2017). There are several firms that offer

forensic accounting Dubai services in UAE. It is also found out that there are several techniques

and technology that has been used by the firms to detect financial statement fraud such as

password protection, digital analysis and firewall protection and so on. It is found out that

emergence and growth of e-commerce and internet has resulted in increasing the exposure to

fraud.

It is essential for the accountants to ensure that the information or computer network should be

accessible by only legitimate users. Passwords are considered as the oldest technique of

computer defense. Technological advancement has helped in the creation of new forms of

password protection such as use of biological features of the user like retina patterns, fingerprints

and voiceprints to prevent the fraudulent practices carried out in terms of financial statements.

Apart from this, the establishment of firewalls has helped in controlling the unauthorized access

of the financial information related to the organizations in UAE (Rahman and Anwar, 2014).

Aim and Objectives

The main aim of the research is to analyze the effect of technology used to detect and prevent

financial statement fraud in UAE. For the purpose of the attainment of this aim, there is a

requirement to attain the following objectives.

To identify different types of frauds that occurs in financial statements

To evaluate various technological improvements in accounting

Investigation of different techniques which are being used to detect financial statement

fraud

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

To evaluate the challenges faced by the organizations in the implementation of the

technologies for the detection of the financial statement fraud

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud

Hypothesis with Theory

The hypothesis for the research study is as follows:

H0: There is no existence of significant relationship between prevention techniques and detect of

financial statement fraud in organizations of UAE.

H1: There is a presence of significant relationship between prevention techniques and detect of

financial statement fraud in organizations of UAE.

The theory of fraud triangle entails the reasoning behind the decision of an employee to commit

fraud. This theory considers three elements that contribute towards the occurrence of fraud such

as pressure, opportunity and rationalization. The pressure on individual in the form of debt

problem, shortfall in revenue and so on encourages employees to commit fraud. The second

stage is the opportunity to commit fraud where the employee considers the clear course of action

through which their position can be abused to solve their aim of committing the fraud (Mansor,

2015). In the last stage, i.e. rationalization, an employee should have an ability to rationalize the

crime in a manner that the employee has a justification for the crime that is acceptable to their

internal and moral compass. In addition to this, Fraud Diamond theory is an extension of Fraud

Triangle theory and include one more element i.e. capability which emphasizes on the fact that

an employee should have the capability to carry out fraud which is considered as a criminal

activity.

Research Questions

The research question for this study is ‘How technology helps in detection and prevention of the

occurrence of financial statement fraud in UAE organizations?’

Research Rationale

This research study is significant for the accounting professionals as it provides the information

related to the different digital technologies that can be implemented or used by the organizations

to detect financial statements fraud in an effective manner. Along with this, it is also important

for the students as it helps them to gather knowledge regarding the emergence of a separate

industry to detect financial statement fraud occurred in different firms in UAE (Anand, Dacin

To evaluate the challenges faced by the organizations in the implementation of the

technologies for the detection of the financial statement fraud

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud

Hypothesis with Theory

The hypothesis for the research study is as follows:

H0: There is no existence of significant relationship between prevention techniques and detect of

financial statement fraud in organizations of UAE.

H1: There is a presence of significant relationship between prevention techniques and detect of

financial statement fraud in organizations of UAE.

The theory of fraud triangle entails the reasoning behind the decision of an employee to commit

fraud. This theory considers three elements that contribute towards the occurrence of fraud such

as pressure, opportunity and rationalization. The pressure on individual in the form of debt

problem, shortfall in revenue and so on encourages employees to commit fraud. The second

stage is the opportunity to commit fraud where the employee considers the clear course of action

through which their position can be abused to solve their aim of committing the fraud (Mansor,

2015). In the last stage, i.e. rationalization, an employee should have an ability to rationalize the

crime in a manner that the employee has a justification for the crime that is acceptable to their

internal and moral compass. In addition to this, Fraud Diamond theory is an extension of Fraud

Triangle theory and include one more element i.e. capability which emphasizes on the fact that

an employee should have the capability to carry out fraud which is considered as a criminal

activity.

Research Questions

The research question for this study is ‘How technology helps in detection and prevention of the

occurrence of financial statement fraud in UAE organizations?’

Research Rationale

This research study is significant for the accounting professionals as it provides the information

related to the different digital technologies that can be implemented or used by the organizations

to detect financial statements fraud in an effective manner. Along with this, it is also important

for the students as it helps them to gather knowledge regarding the emergence of a separate

industry to detect financial statement fraud occurred in different firms in UAE (Anand, Dacin

6

and Murphy, 2015). Apart from this, it is also significant for future researchers as it helps in

creation of the background for the future researches.

Literature review

The literature review has been developed in order to carry out the in-depth analysis of research

issue as effect and use of technology over detecting and preventing the fraud in UAE

organizations.

To identify different types of frauds that occurs in financial statements

In this modern era of technological advancement, technologies have been developed in order to

make the operational process faster and efficient but in limited and the misuse of technology has

emerged. In context to this, the UAE organizations are also found to indulge into the fraudulent

financial statement as they misstate the financial information for its external and internal users

which left a dirty image of country and organizations over the global people and corporate

governance (Narendra, et al., 2016). In recent years, financial scandals have increased as issue

for the corporate governance and the fraudulent activities in presenting financial information has

wiped out the billions of dollars of the values of stakeholders. On the other hand, financial

statement frauds have also resulted into the erosion of confidence of investors in this rapidly

developing financial market. Narendra, et al., (2016) determined that the State Audit Association

has also reported that the liable authorities of UAE have also engaged into the recovery of AED

1 billion due to the fraudulent activities. On the other hand, UAE has also ranked as 21th country

out of the 175 countries that also signs that it has also high level corruption country in the global

level market.

According to the Chen, (2016), in presenting the financial statement, there are several frauds

have been detected with its different nature and consequences. In context to this, it is perceived

that misinterpretation of financial information is one of the major fraud in which the wrong data

and Murphy, 2015). Apart from this, it is also significant for future researchers as it helps in

creation of the background for the future researches.

Literature review

The literature review has been developed in order to carry out the in-depth analysis of research

issue as effect and use of technology over detecting and preventing the fraud in UAE

organizations.

To identify different types of frauds that occurs in financial statements

In this modern era of technological advancement, technologies have been developed in order to

make the operational process faster and efficient but in limited and the misuse of technology has

emerged. In context to this, the UAE organizations are also found to indulge into the fraudulent

financial statement as they misstate the financial information for its external and internal users

which left a dirty image of country and organizations over the global people and corporate

governance (Narendra, et al., 2016). In recent years, financial scandals have increased as issue

for the corporate governance and the fraudulent activities in presenting financial information has

wiped out the billions of dollars of the values of stakeholders. On the other hand, financial

statement frauds have also resulted into the erosion of confidence of investors in this rapidly

developing financial market. Narendra, et al., (2016) determined that the State Audit Association

has also reported that the liable authorities of UAE have also engaged into the recovery of AED

1 billion due to the fraudulent activities. On the other hand, UAE has also ranked as 21th country

out of the 175 countries that also signs that it has also high level corruption country in the global

level market.

According to the Chen, (2016), in presenting the financial statement, there are several frauds

have been detected with its different nature and consequences. In context to this, it is perceived

that misinterpretation of financial information is one of the major fraud in which the wrong data

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

are published by the accounting managers and the colleagues as well. It is also found out that

theft of intellectual property is also a fraud in the financial fraud. It is also revealed that stealing

the financial information from the organizational source is also termed as major challenge for the

modern edge business in UAE. On the other hand, the intentional omission has also occurred as a

financial fraud issue and its main aim to provide benefits to one stakeholder or a single investor.

With this, manipulation with the accounting records is also identified as a fraudulent bustle in the

financial statement.

To evaluate various technological improvements in accounting

Gupta and Gill, (2012), observed that the accounting profession is transforming from traditional

to modern era business because of the optimization of productivity with the emergence of newer

and innovative technologies. The technologies has enable the accountant to prepare the financial

information too quickly and drawn results for effective decision making. It is also described that

accounting technology has sharpen the efficiency and effective data presentation. It is assessed

that artificial intelligence has also developed in advance manner which is valuable carry out the

accurate recording, decreasing operating cost and enhance efficiency as well. With this, cloud

computing is also a technological advancement which assists the accountant to work from any

location of any time along with this, the information can also be delivered through cloud

technology is also easy. Furthermore, the innovation in the tax software has also emerged as the

valuable improvement in the financial presentation and management that is also supportive for

business to reduce the errors of margin which is ultimately resulted into the avoiding tax

penalties that leads to preventing the issues for its stakeholders. Moreover, the Collins, A. and

Halverson, (2018), mobile accounting is also an impulsive technological advancement in which

the accountant can use and share the information. The mobile technology has also bridge the gap

are published by the accounting managers and the colleagues as well. It is also found out that

theft of intellectual property is also a fraud in the financial fraud. It is also revealed that stealing

the financial information from the organizational source is also termed as major challenge for the

modern edge business in UAE. On the other hand, the intentional omission has also occurred as a

financial fraud issue and its main aim to provide benefits to one stakeholder or a single investor.

With this, manipulation with the accounting records is also identified as a fraudulent bustle in the

financial statement.

To evaluate various technological improvements in accounting

Gupta and Gill, (2012), observed that the accounting profession is transforming from traditional

to modern era business because of the optimization of productivity with the emergence of newer

and innovative technologies. The technologies has enable the accountant to prepare the financial

information too quickly and drawn results for effective decision making. It is also described that

accounting technology has sharpen the efficiency and effective data presentation. It is assessed

that artificial intelligence has also developed in advance manner which is valuable carry out the

accurate recording, decreasing operating cost and enhance efficiency as well. With this, cloud

computing is also a technological advancement which assists the accountant to work from any

location of any time along with this, the information can also be delivered through cloud

technology is also easy. Furthermore, the innovation in the tax software has also emerged as the

valuable improvement in the financial presentation and management that is also supportive for

business to reduce the errors of margin which is ultimately resulted into the avoiding tax

penalties that leads to preventing the issues for its stakeholders. Moreover, the Collins, A. and

Halverson, (2018), mobile accounting is also an impulsive technological advancement in which

the accountant can use and share the information. The mobile technology has also bridge the gap

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

in between the accountant and client that helps the accountant to manage the business while on

the move. It is approached that the specialized accounting software are going to be introduced by

the modern age companies which away the accountant from ledge, pen and desk calculator and

the process has also improved.

Investigation of different techniques which are being used to detect financial statement

fraud

In the words of Agathee and Ramen, (2017), the advancement of technology is supportive for the

accounting development and carrying out the process in efficient manner. In addition to this,

there are several techniques have been emerged in order to detect and prevent the fraud which

occurred in the financial statement of organizations. In addition to this, it is also assessed that

the major techniques have been investigated as continual audit of through technical software the

wrong interpreted information can be identified and corrected in effective manner. Wells, (2017),

assessed that the computer aided techniques can be used to assess the risk automatically. It is

also determined that the data mining is also good option for the management or technology to

catch the mistakes in the financial statement presented by the UAE based organizations. Data

mining is useful for detecting the false information from the large size data of financial

information. Along with this, Akkeren and Buckby, (2017), also stated that the audit support

system are also considered as major technological tools which are also useful for the firms in

order to carry out the audit operations efficiently .

To evaluate the challenges faced by the organizations in implementation of the technologies

for the detection of the financial statement fraud

Sadaf, et al., (2018), determined that the fraud detection is a major issue in which it needs proper

tools and efforts and adopting the fraud detection is also an issue because of its different

in between the accountant and client that helps the accountant to manage the business while on

the move. It is approached that the specialized accounting software are going to be introduced by

the modern age companies which away the accountant from ledge, pen and desk calculator and

the process has also improved.

Investigation of different techniques which are being used to detect financial statement

fraud

In the words of Agathee and Ramen, (2017), the advancement of technology is supportive for the

accounting development and carrying out the process in efficient manner. In addition to this,

there are several techniques have been emerged in order to detect and prevent the fraud which

occurred in the financial statement of organizations. In addition to this, it is also assessed that

the major techniques have been investigated as continual audit of through technical software the

wrong interpreted information can be identified and corrected in effective manner. Wells, (2017),

assessed that the computer aided techniques can be used to assess the risk automatically. It is

also determined that the data mining is also good option for the management or technology to

catch the mistakes in the financial statement presented by the UAE based organizations. Data

mining is useful for detecting the false information from the large size data of financial

information. Along with this, Akkeren and Buckby, (2017), also stated that the audit support

system are also considered as major technological tools which are also useful for the firms in

order to carry out the audit operations efficiently .

To evaluate the challenges faced by the organizations in implementation of the technologies

for the detection of the financial statement fraud

Sadaf, et al., (2018), determined that the fraud detection is a major issue in which it needs proper

tools and efforts and adopting the fraud detection is also an issue because of its different

9

consequences of identification and controlling the fraud detection process. It is observed that the

organization faces the challenge of disparate transaction systems in which the data cannot be

shared and transferred in easy manner so it is critical issue for the organization while

implementing the fraud detection technologies. Barghathi, et al., (2018), reviewed that this

system might also not be able to interact with other system this technological system has been

designed in order to operate for the management of large data size. In relation to the fraud

detection technology, piecemeal fraud detection system is also developed but the organization

faces the problems in implementing this fraud identification system by the organization. In

addition to this, up -gradation of this system is also problematic for the organization to get it in

advance manner. On the other hand, there is also need for training and education about the newly

installed system in the organization which has also become a challenge to conduct the training

and development session. It is also revealed that the cost is also a challenge for the organization

because the expenses occur in order to operate the high techno –efficient computer system for

detecting the fraud detection in the financial statement of business (Bammi, et al., 2018).

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud

Chan and Vasarhelyi, (2018), stated that the recent era of fast moving technology, it is essential

and important for the UAE organizations to enable them in efficient manner so the fraud and

financial misstatement can easily be detected in easy manner. The fraud detection is reliable for

organization and stakeholders both as well because it gives the real picture about the

organization. In context to this, organizations need to implement the advanced technology based

system so that the rate of fraud occurrence can be reduced in significant manner. In relation to

this, fraud monitoring can be developed with the support of artificial techniques in the system. It

consequences of identification and controlling the fraud detection process. It is observed that the

organization faces the challenge of disparate transaction systems in which the data cannot be

shared and transferred in easy manner so it is critical issue for the organization while

implementing the fraud detection technologies. Barghathi, et al., (2018), reviewed that this

system might also not be able to interact with other system this technological system has been

designed in order to operate for the management of large data size. In relation to the fraud

detection technology, piecemeal fraud detection system is also developed but the organization

faces the problems in implementing this fraud identification system by the organization. In

addition to this, up -gradation of this system is also problematic for the organization to get it in

advance manner. On the other hand, there is also need for training and education about the newly

installed system in the organization which has also become a challenge to conduct the training

and development session. It is also revealed that the cost is also a challenge for the organization

because the expenses occur in order to operate the high techno –efficient computer system for

detecting the fraud detection in the financial statement of business (Bammi, et al., 2018).

To analyze different measures taken to improve the performance of the detection of the

financial statement fraud

Chan and Vasarhelyi, (2018), stated that the recent era of fast moving technology, it is essential

and important for the UAE organizations to enable them in efficient manner so the fraud and

financial misstatement can easily be detected in easy manner. The fraud detection is reliable for

organization and stakeholders both as well because it gives the real picture about the

organization. In context to this, organizations need to implement the advanced technology based

system so that the rate of fraud occurrence can be reduced in significant manner. In relation to

this, fraud monitoring can be developed with the support of artificial techniques in the system. It

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

is also observed that organization can set up a model of fraud detection at different level as

internal and external parties. In relation to the customer aspects, Huang, et al., (2017), stated that

the transaction monitoring system can be implemented to control the fraud in the customer

solution. On the other hand, it can also be suggested that the organization can also develop its big

data analytics technology in proper manner so that it can improve the fraud detection process. In

addition to this, the data mining techniques can also be developed for the improvement of

performance of technology for identifying the fraud in the financial statements.

Literature gap

This research has been taken into the investigation of effect of technology in order to prevent and

detect the financial statement frauds in the UAE organization. In this study research

methodology has been adopted with the sample size and location. In this literature there is a gap

because the particular organization has not been chosen so that the specific study might not be

leaded in efficient manner (Rose, et al., 2014).

is also observed that organization can set up a model of fraud detection at different level as

internal and external parties. In relation to the customer aspects, Huang, et al., (2017), stated that

the transaction monitoring system can be implemented to control the fraud in the customer

solution. On the other hand, it can also be suggested that the organization can also develop its big

data analytics technology in proper manner so that it can improve the fraud detection process. In

addition to this, the data mining techniques can also be developed for the improvement of

performance of technology for identifying the fraud in the financial statements.

Literature gap

This research has been taken into the investigation of effect of technology in order to prevent and

detect the financial statement frauds in the UAE organization. In this study research

methodology has been adopted with the sample size and location. In this literature there is a gap

because the particular organization has not been chosen so that the specific study might not be

leaded in efficient manner (Rose, et al., 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

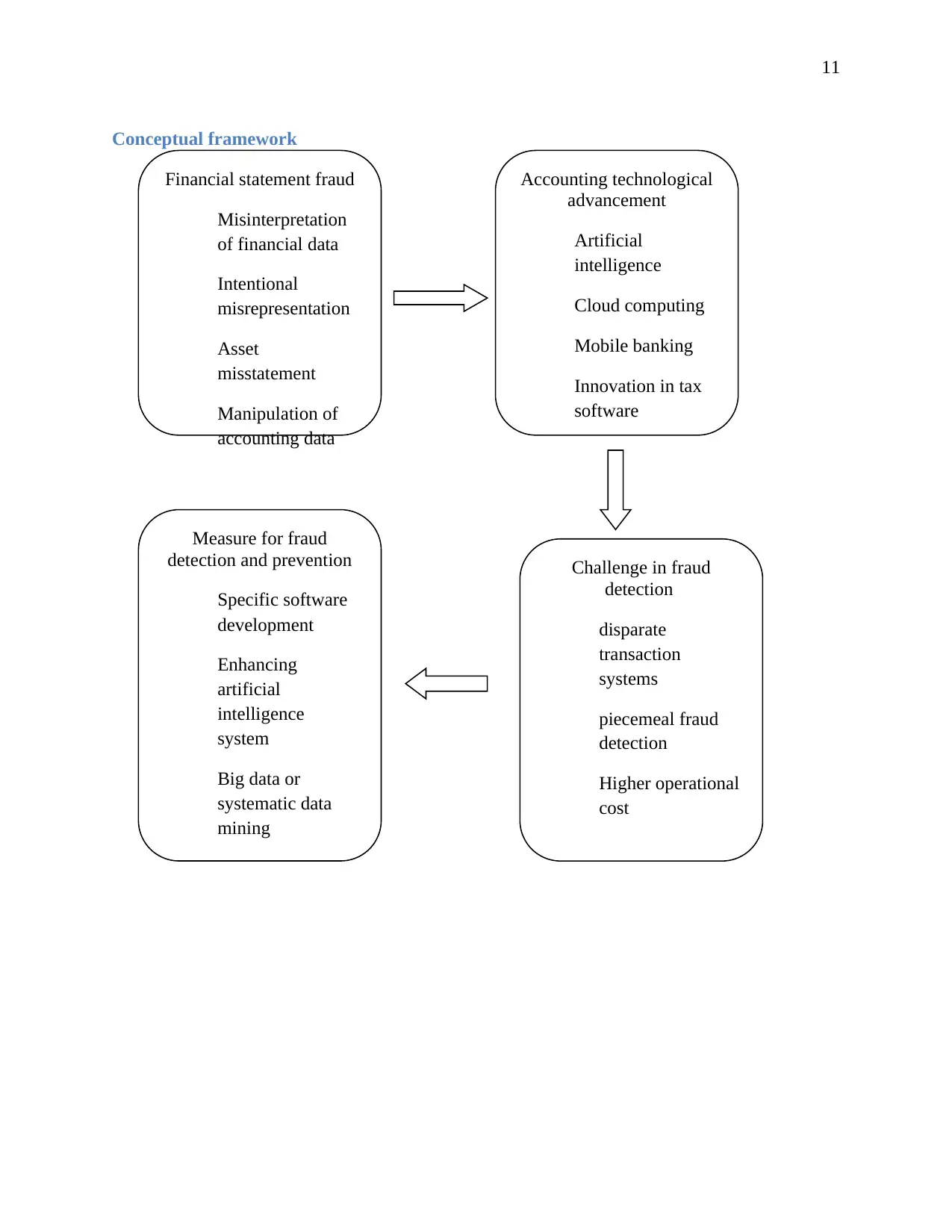

Conceptual framework

Financial statement fraud

Misinterpretation

of financial data

Intentional

misrepresentation

Asset

misstatement

Manipulation of

accounting data

Accounting technological

advancement

Artificial

intelligence

Cloud computing

Mobile banking

Innovation in tax

software

Challenge in fraud

detection

disparate

transaction

systems

piecemeal fraud

detection

Higher operational

cost

Measure for fraud

detection and prevention

Specific software

development

Enhancing

artificial

intelligence

system

Big data or

systematic data

mining

Conceptual framework

Financial statement fraud

Misinterpretation

of financial data

Intentional

misrepresentation

Asset

misstatement

Manipulation of

accounting data

Accounting technological

advancement

Artificial

intelligence

Cloud computing

Mobile banking

Innovation in tax

software

Challenge in fraud

detection

disparate

transaction

systems

piecemeal fraud

detection

Higher operational

cost

Measure for fraud

detection and prevention

Specific software

development

Enhancing

artificial

intelligence

system

Big data or

systematic data

mining

12

Research Methodology

Exploratory and descriptive are two types of research designs that are being used to carry out

most of the research studies. Exploratory research design provides insights related to different

aspects of the research topic by providing the researcher an opportunity to explore the

information related to the research topic. Along with this, descriptive research design as the

name suggests provides the results of the research study in a detailed and comprehensive

manner. Exploratory research design is appropriate for this research study as it facilitates in

gaining information related to the impact of the use of technology on the detection and

prevention of the financial statement fraud in the organizations of UAE (Bell, Bryman and

Harley, 2018).

Positivism and interpretivism are different types of philosophies which are being used to carry

out the research. Interpretivism is a philosophy which takes into consideration the views and

opinions of researcher along with the elements of the research to attain reliable results for the

research study. Positivism is a structured approach that takes into consideration the elements of

the research such as hypothesis, aims and objectives, and research questions to attain valid and

reliable results for the research study (Hair, et.al, 2015).

Positivism philosophy is being used in this research study as for attaining valid and reliable

results, researcher would consider only the elements of the research such as research question,

background, hypothesis, aims and objectives. Besides this, there are two approaches which are

being used by the researchers to carry out the research such as deductive and inductive approach.

Inductive approach refers to the approach in which consideration is being given to specific

information to derive generalized results for the research study (Walliman, 2017). Apart from

this, in deductive approach deductions have been made in the general or broad information

related to the research topic in order to reach to a precise outcome of the research. In relation to

this research study, deductive approach is being used as it helps in attaining the specific outcome

i.e. use of technology to detect and prevent only financial statement fraud by considering general

information i.e. use of technology to detect and prevent different types of frauds.

It is necessary for the researcher to collect relevant data related to the research topic as it helps in

the creation of the foundation for the attainment of the results of the research study. For this

Research Methodology

Exploratory and descriptive are two types of research designs that are being used to carry out

most of the research studies. Exploratory research design provides insights related to different

aspects of the research topic by providing the researcher an opportunity to explore the

information related to the research topic. Along with this, descriptive research design as the

name suggests provides the results of the research study in a detailed and comprehensive

manner. Exploratory research design is appropriate for this research study as it facilitates in

gaining information related to the impact of the use of technology on the detection and

prevention of the financial statement fraud in the organizations of UAE (Bell, Bryman and

Harley, 2018).

Positivism and interpretivism are different types of philosophies which are being used to carry

out the research. Interpretivism is a philosophy which takes into consideration the views and

opinions of researcher along with the elements of the research to attain reliable results for the

research study. Positivism is a structured approach that takes into consideration the elements of

the research such as hypothesis, aims and objectives, and research questions to attain valid and

reliable results for the research study (Hair, et.al, 2015).

Positivism philosophy is being used in this research study as for attaining valid and reliable

results, researcher would consider only the elements of the research such as research question,

background, hypothesis, aims and objectives. Besides this, there are two approaches which are

being used by the researchers to carry out the research such as deductive and inductive approach.

Inductive approach refers to the approach in which consideration is being given to specific

information to derive generalized results for the research study (Walliman, 2017). Apart from

this, in deductive approach deductions have been made in the general or broad information

related to the research topic in order to reach to a precise outcome of the research. In relation to

this research study, deductive approach is being used as it helps in attaining the specific outcome

i.e. use of technology to detect and prevent only financial statement fraud by considering general

information i.e. use of technology to detect and prevent different types of frauds.

It is necessary for the researcher to collect relevant data related to the research topic as it helps in

the creation of the foundation for the attainment of the results of the research study. For this

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 35

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.