Capital Asset Pricing Model (CAPM) Theory Testing and Analysis Report

VerifiedAdded on 2020/01/15

theory

1

Paraphrase This Document

Introduction......................................................................................................................................3

Task 1 and Task 2............................................................................................................................3

Task 3.............................................................................................................................................16

Task 4.............................................................................................................................................17

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

2

The purpose of the report is to test the CAPM theory. For that purpose, one market index

and financial data of 12 companies have been used. Time series regression analysis for each of

the company has been performed. T-statistic for alpha and the R-squared for each company will

be reported. The results and the merits and demerits of CAPM analysis is also have been

performed.

Task 1 and Task 2

T-statistic – Within statistics, the T-statistic is a ratio of the departure of a projected parameter

from its notional value and its standard error. It is mostly used in testing of the hypothesis

(Deegan and Unerman, 2006).

Alpha – Alpha is also known as the significance level in the statistical test. The alpha level is the

probability of rejecting the null hypothesis when the null hypothesis is true.

Beta – Beta is a measure of the volatility or security or systematic risk or a portfolio in

comparison to the market as a whole. It is mostly used in the capital asset pricing model (Jara,

Ebrero and Zapata 2011). It calculates the expected return of an asset on the basis of beta and the

expected market returns.

R-squared – It is a statistical measure of how close the data is with the regression line. It is also

regarded as the coefficient of determination and the coefficient of multiple determination (Keller,

2013).

Banking sector

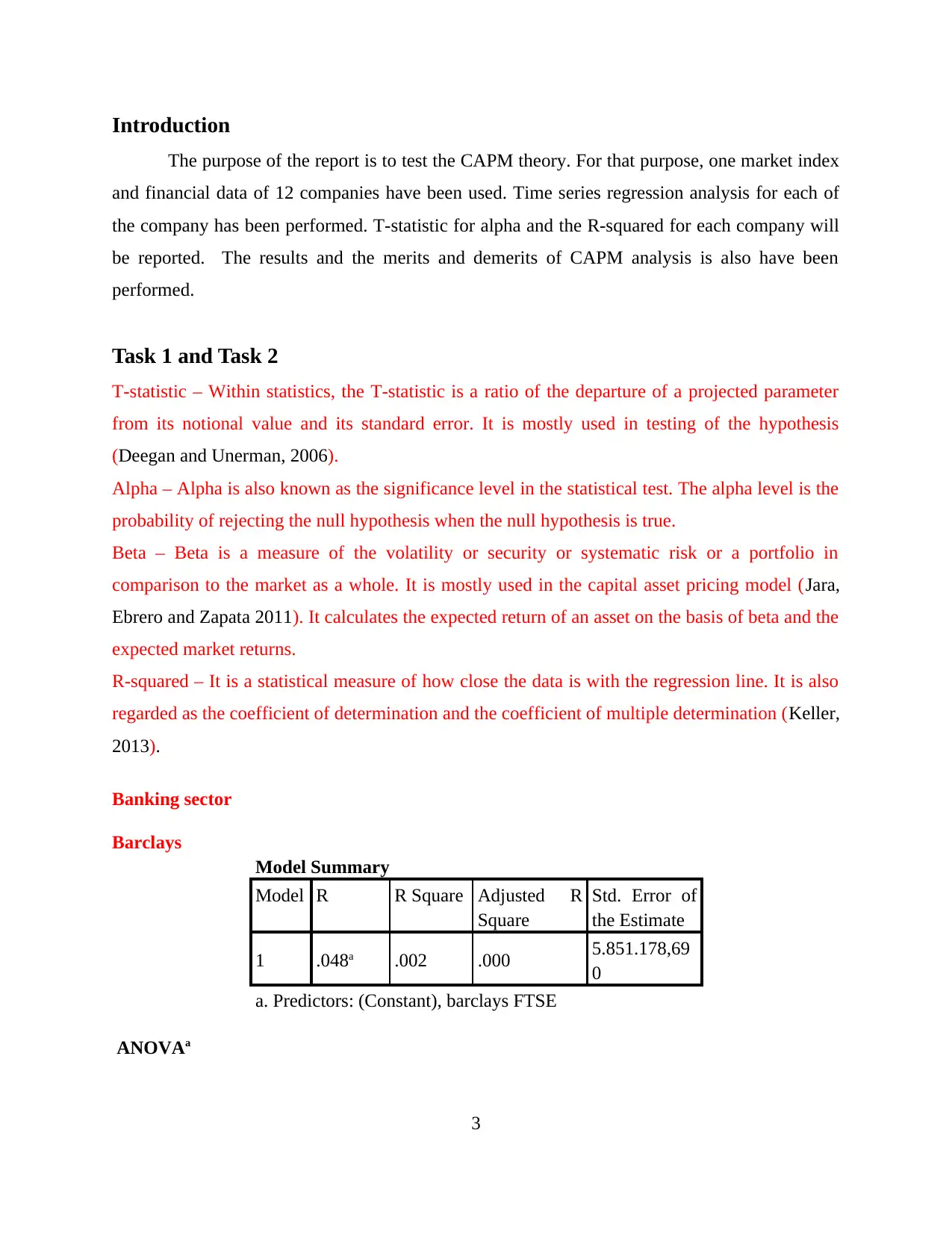

Barclays

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .048a .002 .000 5.851.178,69

0

a. Predictors: (Constant), barclays FTSE

ANOVAa

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Squares

df Mean Square F Sig.

1

Regression 39287708031

849.280 1 39287708031

849.280 1.148 .285b

Residual 17255091196

565016.000 504 34236292056

676.617

Total 17294378904

596866.000 505

a. Dependent Variable: stock return

b. Predictors: (Constant), market return

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 2557414.492 295173.764 8.664 .000

barclays

FTSE 2669.545 2492.024 .048 1.071 .285

a. Dependent Variable: stock return

Interpretation

Method of regression analysis was applied on the given set of data. The dependent

variable is stock return and the independent variable is market return. Here the significance value

is .285 and it shows that there is low level of relationship between the two variables. Hence it

indicates that stock returns are less dependent on market returns in case of Barclays bamk

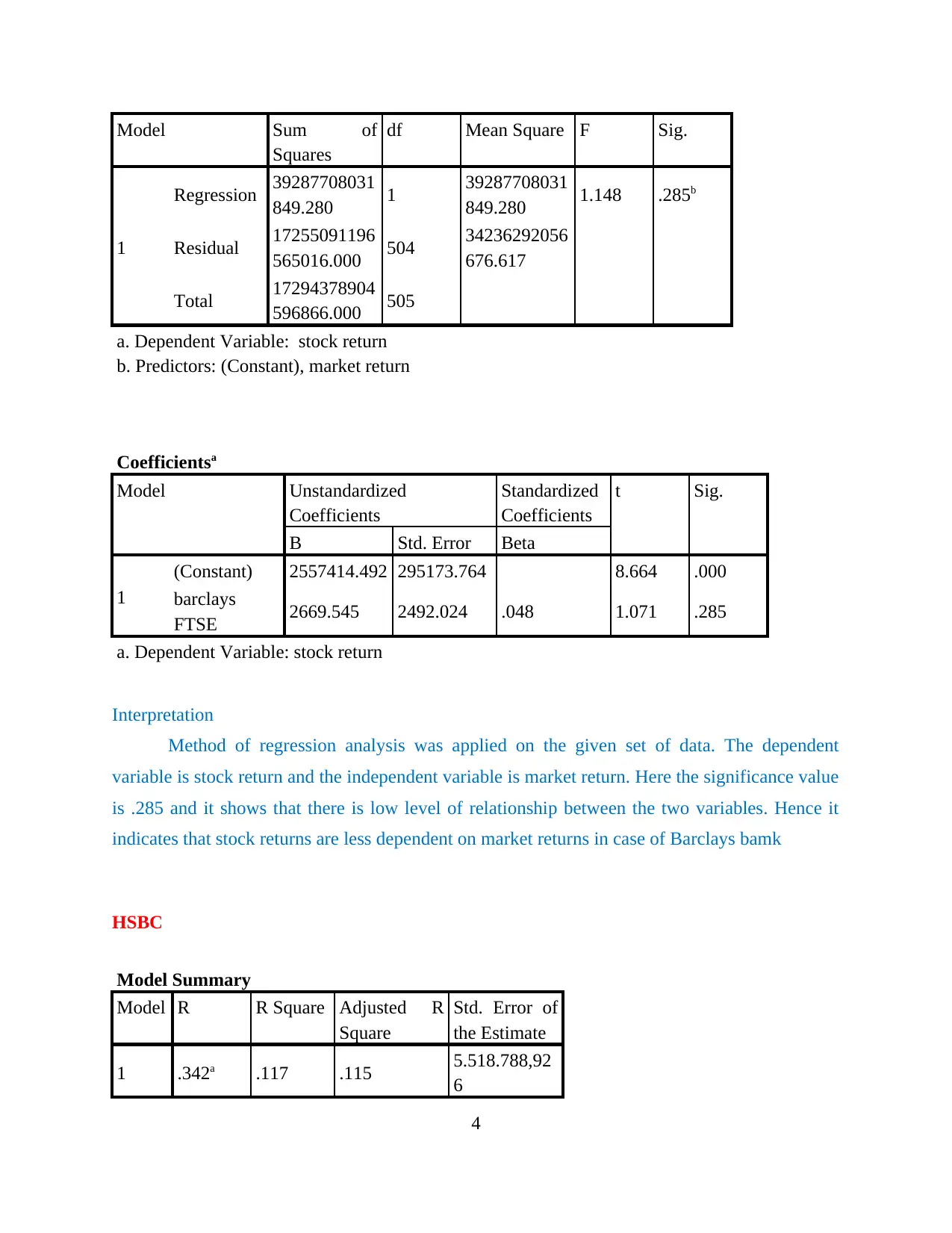

HSBC

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .342a .117 .115 5.518.788,92

6

4

Paraphrase This Document

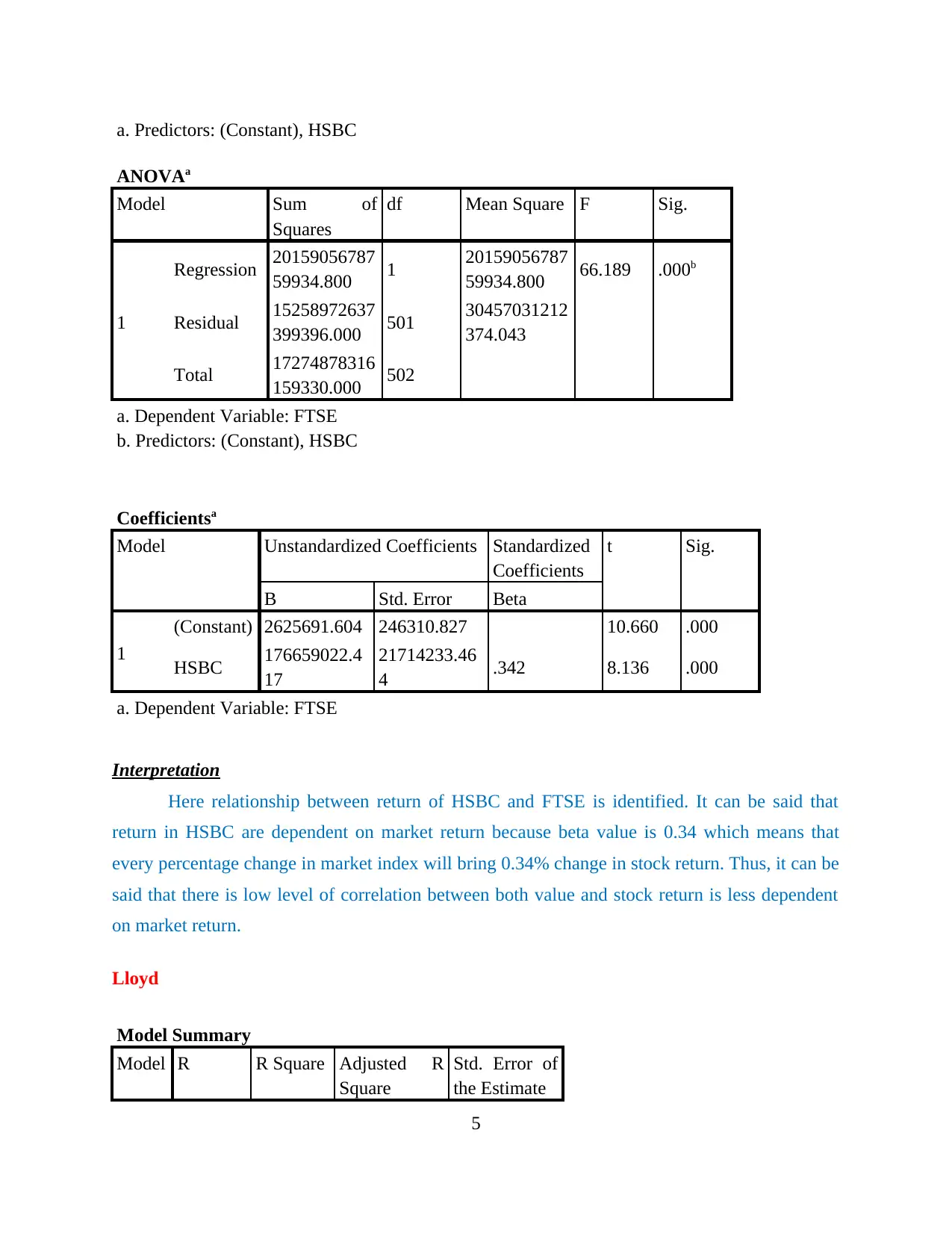

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 20159056787

59934.800 1 20159056787

59934.800 66.189 .000b

Residual 15258972637

399396.000 501 30457031212

374.043

Total 17274878316

159330.000 502

a. Dependent Variable: FTSE

b. Predictors: (Constant), HSBC

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 2625691.604 246310.827 10.660 .000

HSBC 176659022.4

17

21714233.46

4 .342 8.136 .000

a. Dependent Variable: FTSE

Interpretation

Here relationship between return of HSBC and FTSE is identified. It can be said that

return in HSBC are dependent on market return because beta value is 0.34 which means that

every percentage change in market index will bring 0.34% change in stock return. Thus, it can be

said that there is low level of correlation between both value and stock return is less dependent

on market return.

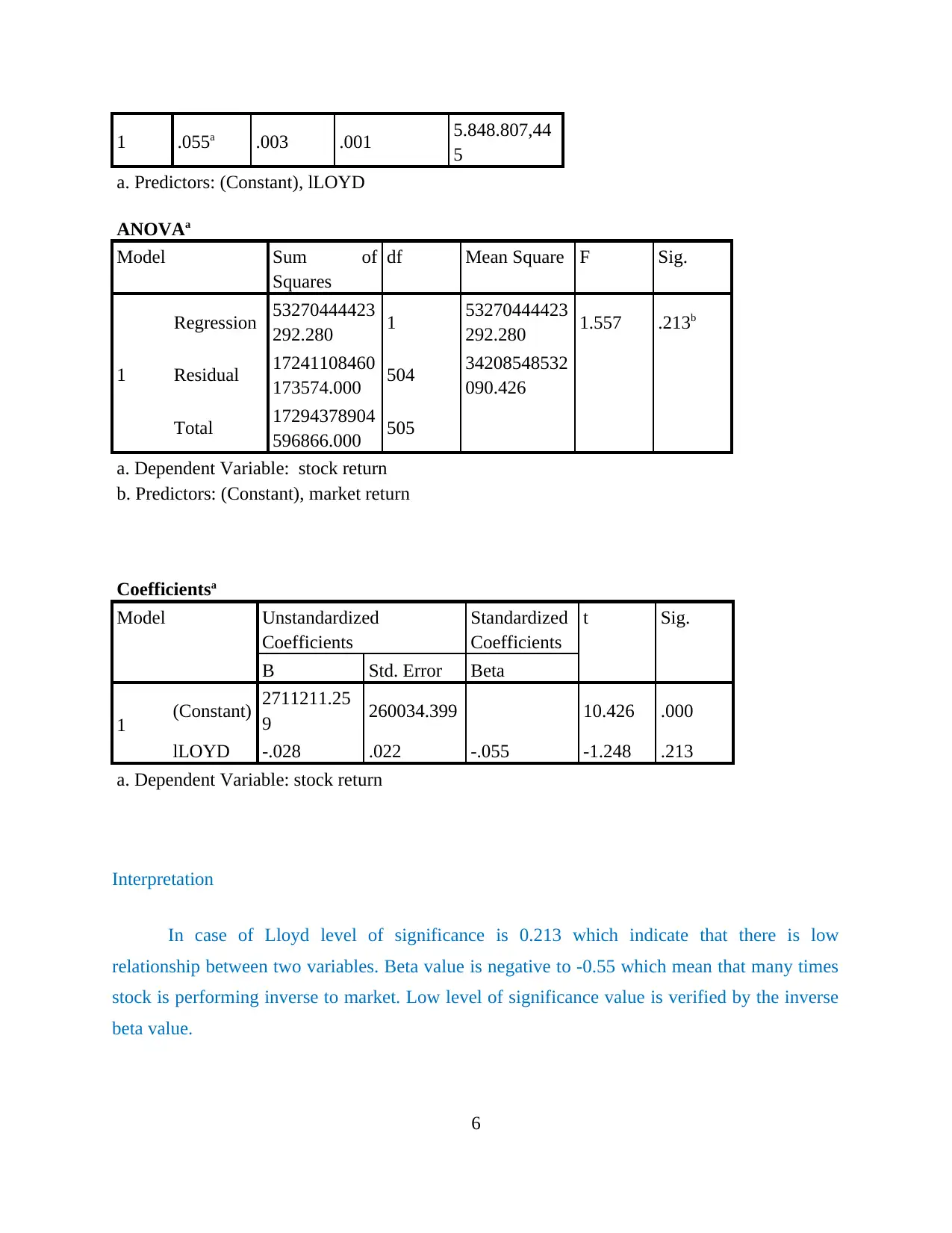

Lloyd

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

5

5

a. Predictors: (Constant), lLOYD

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 53270444423

292.280 1 53270444423

292.280 1.557 .213b

Residual 17241108460

173574.000 504 34208548532

090.426

Total 17294378904

596866.000 505

a. Dependent Variable: stock return

b. Predictors: (Constant), market return

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2711211.25

9 260034.399 10.426 .000

lLOYD -.028 .022 -.055 -1.248 .213

a. Dependent Variable: stock return

Interpretation

In case of Lloyd level of significance is 0.213 which indicate that there is low

relationship between two variables. Beta value is negative to -0.55 which mean that many times

stock is performing inverse to market. Low level of significance value is verified by the inverse

beta value.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

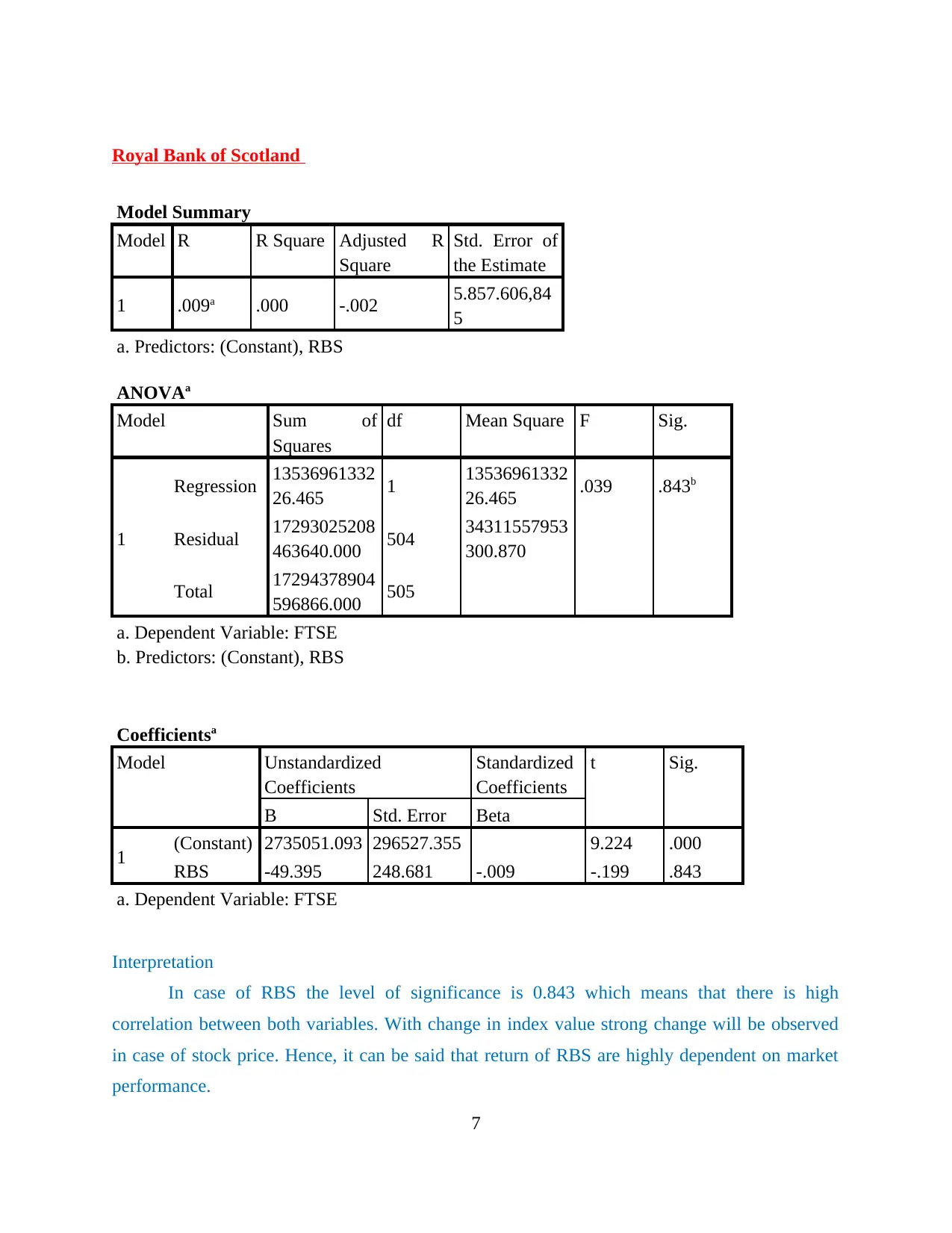

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .009a .000 -.002 5.857.606,84

5

a. Predictors: (Constant), RBS

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 13536961332

26.465 1 13536961332

26.465 .039 .843b

Residual 17293025208

463640.000 504 34311557953

300.870

Total 17294378904

596866.000 505

a. Dependent Variable: FTSE

b. Predictors: (Constant), RBS

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2735051.093 296527.355 9.224 .000

RBS -49.395 248.681 -.009 -.199 .843

a. Dependent Variable: FTSE

Interpretation

In case of RBS the level of significance is 0.843 which means that there is high

correlation between both variables. With change in index value strong change will be observed

in case of stock price. Hence, it can be said that return of RBS are highly dependent on market

performance.

7

Paraphrase This Document

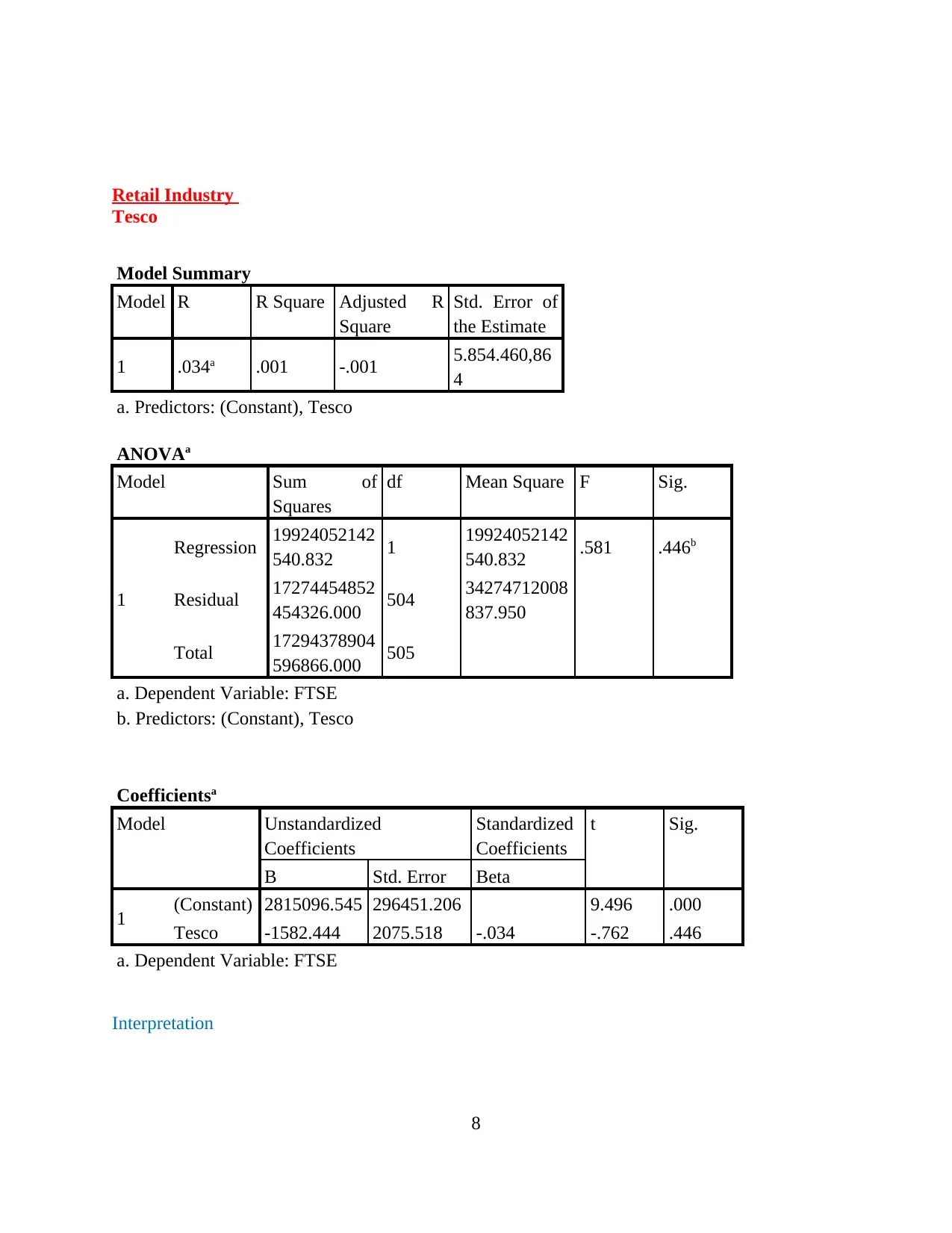

Tesco

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .034a .001 -.001 5.854.460,86

4

a. Predictors: (Constant), Tesco

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 19924052142

540.832 1 19924052142

540.832 .581 .446b

Residual 17274454852

454326.000 504 34274712008

837.950

Total 17294378904

596866.000 505

a. Dependent Variable: FTSE

b. Predictors: (Constant), Tesco

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2815096.545 296451.206 9.496 .000

Tesco -1582.444 2075.518 -.034 -.762 .446

a. Dependent Variable: FTSE

Interpretation

8

mentioned firm are moderately linked to the market performance. It means that if index fall

sharply on single day then moderate change will be observed in case of stock return. An investor

who is prepared to take moderate risk on market return can make investment in Tesco. It has

been observed that high risk we take on investment there become greater chances of profit

earning on shares. Here risk is moderate to change in index value. Hence, investor can make

investment in Tesco in order to earn good amount of profit,

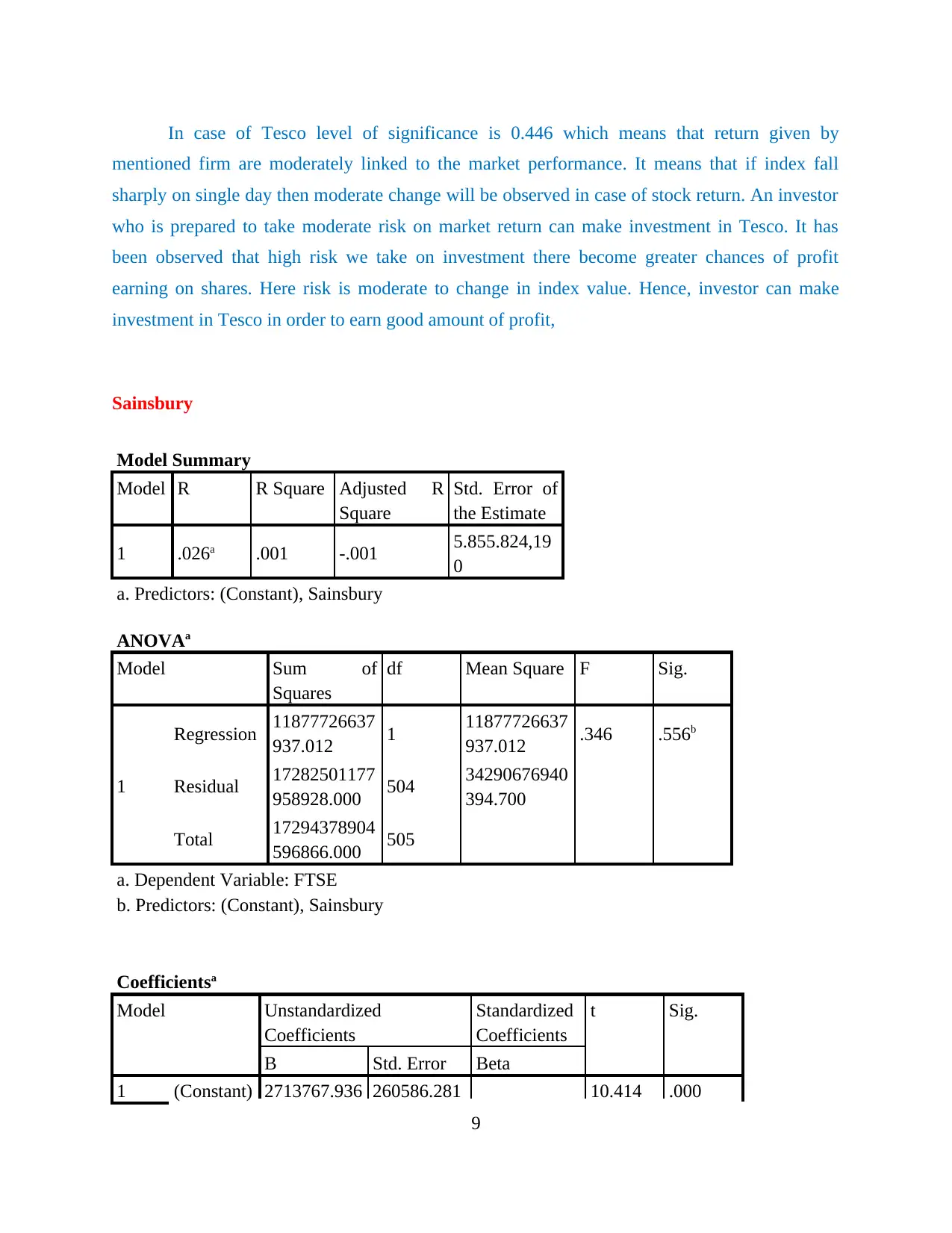

Sainsbury

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .026a .001 -.001 5.855.824,19

0

a. Predictors: (Constant), Sainsbury

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 11877726637

937.012 1 11877726637

937.012 .346 .556b

Residual 17282501177

958928.000 504 34290676940

394.700

Total 17294378904

596866.000 505

a. Dependent Variable: FTSE

b. Predictors: (Constant), Sainsbury

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2713767.936 260586.281 10.414 .000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

a. Dependent Variable: FTSE

Interpretation

Value of level of significance is 0.556 which is very high and this reflects that there is

high dependency of stock return of Sainsbury on performance of index. This means that with

every single positive change in index return big change will be observed in case of stock return.

Hence, investment is very risky in Sainsbury because if index perform poor then Sainsbury

shares will also give poor performance. Thus, proportion of this share in portfolio must be low.

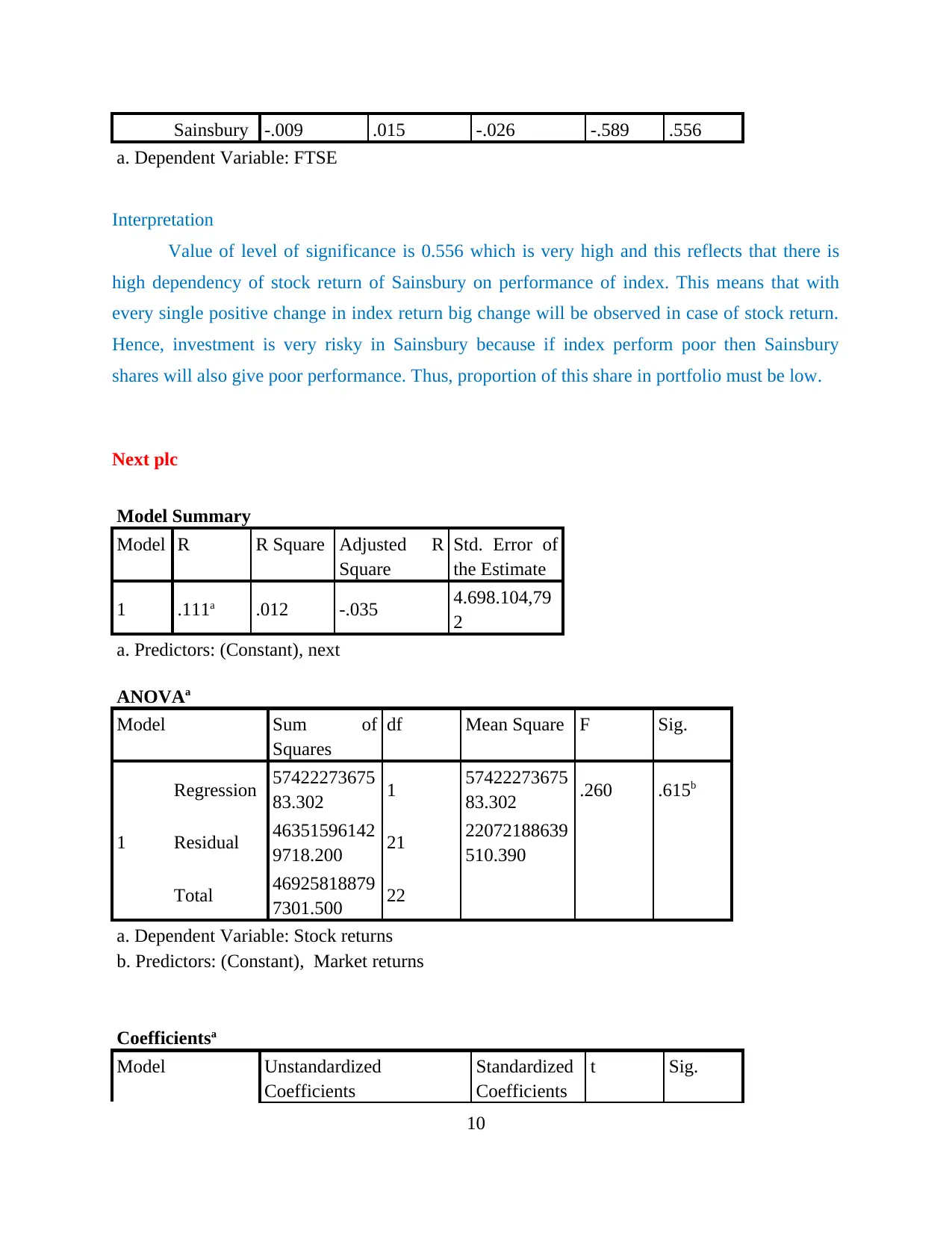

Next plc

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .111a .012 -.035 4.698.104,79

2

a. Predictors: (Constant), next

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 57422273675

83.302 1 57422273675

83.302 .260 .615b

Residual 46351596142

9718.200 21 22072188639

510.390

Total 46925818879

7301.500 22

a. Dependent Variable: Stock returns

b. Predictors: (Constant), Market returns

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

10

Paraphrase This Document

1 (Constant) 2865428.785 994808.550 2.880 .009

next .011 .022 .111 .510 .615

a. Dependent Variable: stock returns

Interpretation

In case of Next plc also there is high value of level of significance. Value 0.615 indicates

that there is high dependency of return given by Next plc on market performance. If market will

give good performance then stock of the mentioned company will also give good performance.

This level of significance reflects that investment in Next plc share is very risky and chances of

earning profit on investment and losing of money both are high with small movement on stock

market index. Hence, on the basis of value of variable it can be said that there is high

dependency of return given by Next plc on market performance.

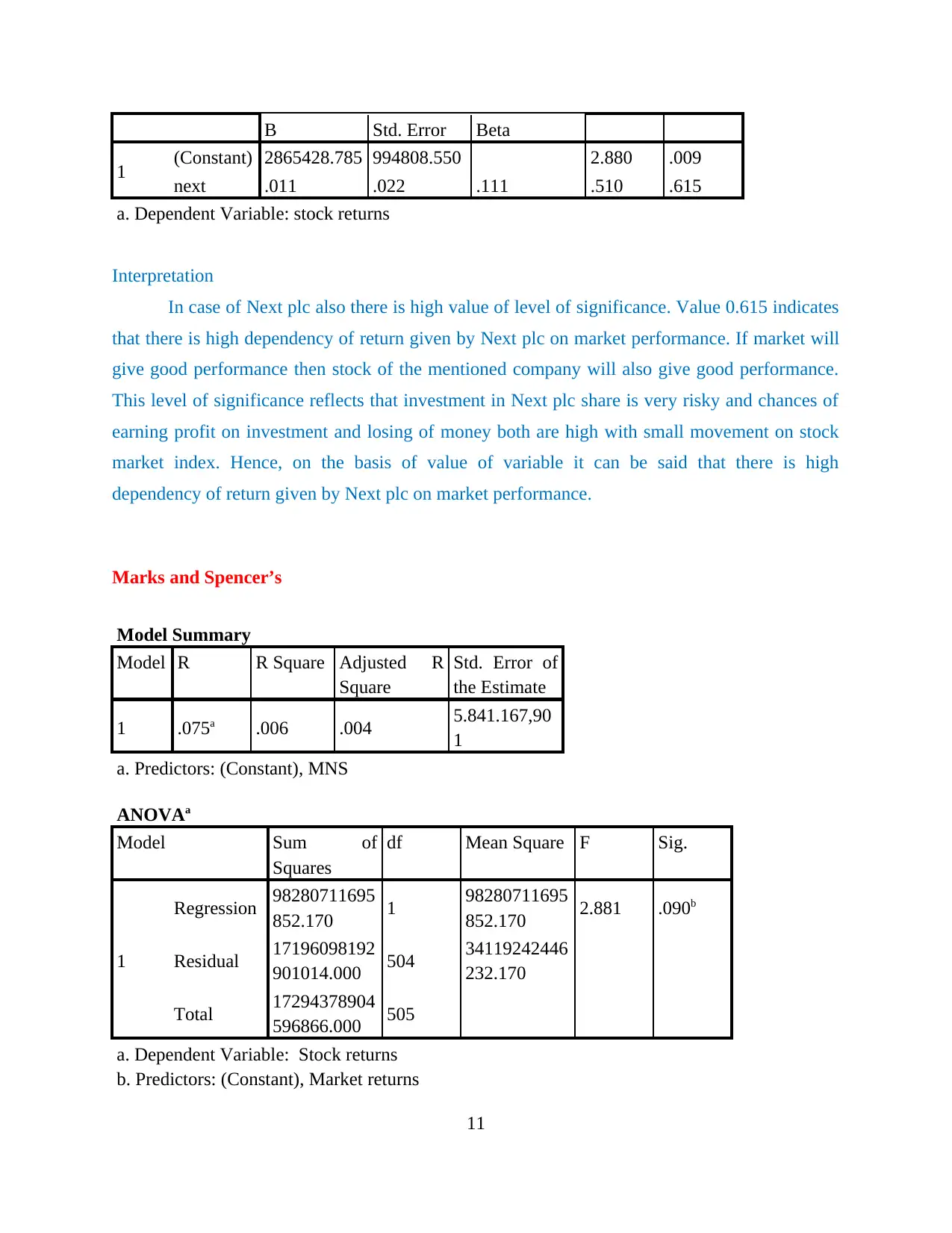

Marks and Spencer’s

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .075a .006 .004 5.841.167,90

1

a. Predictors: (Constant), MNS

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 98280711695

852.170 1 98280711695

852.170 2.881 .090b

Residual 17196098192

901014.000 504 34119242446

232.170

Total 17294378904

596866.000 505

a. Dependent Variable: Stock returns

b. Predictors: (Constant), Market returns

11

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2696907.494 259738.022 10.383 .000

MNS -.033 .019 -.075 -1.697 .090

a. Dependent Variable: Stock returns

Interpretation

Value of level of significance is low in case of Mark and Spencer even it is below 0.1 and

this reflects that return of mentioned firm are very less dependent on the market return. It can be

said that if market decline by sharp rate the share price will of Mark and Spencer will decline by

very low percentage. This means that investment in Mark and Spencer shares is less risky. On

this basis it can be said that investment in this company share to large extent is less risky and risk

averse investors must make investment in same.

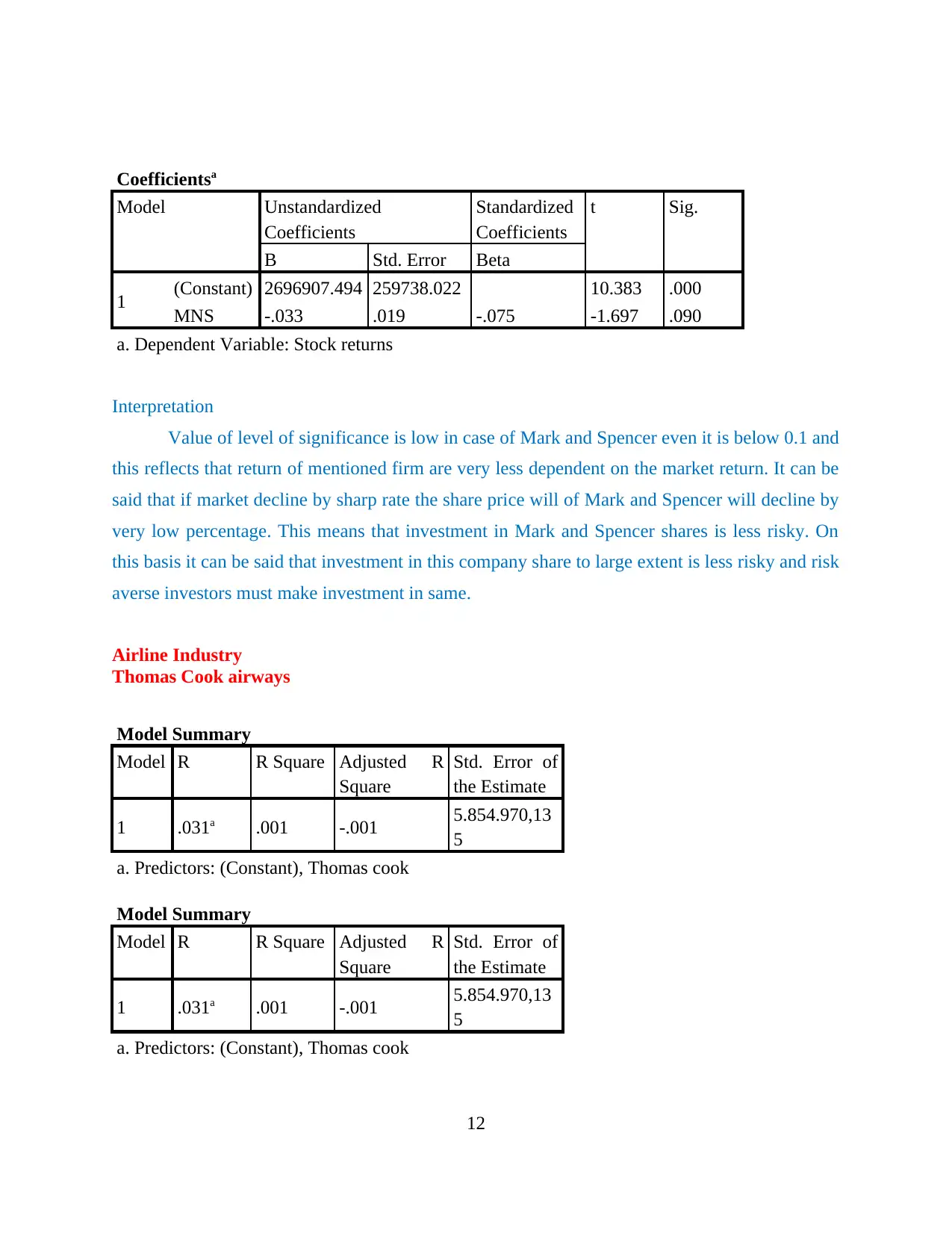

Airline Industry

Thomas Cook airways

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .031a .001 -.001 5.854.970,13

5

a. Predictors: (Constant), Thomas cook

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .031a .001 -.001 5.854.970,13

5

a. Predictors: (Constant), Thomas cook

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

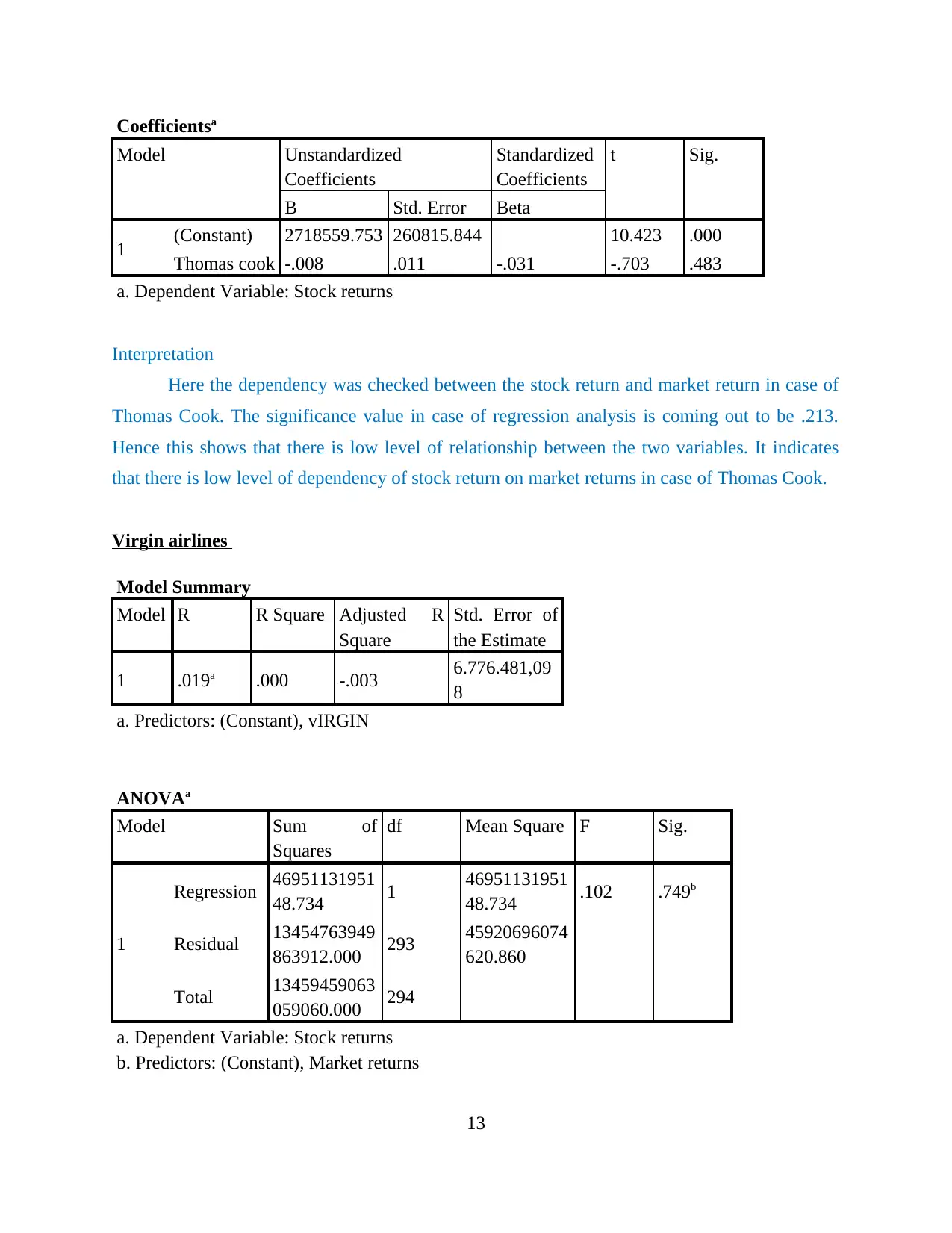

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2718559.753 260815.844 10.423 .000

Thomas cook -.008 .011 -.031 -.703 .483

a. Dependent Variable: Stock returns

Interpretation

Here the dependency was checked between the stock return and market return in case of

Thomas Cook. The significance value in case of regression analysis is coming out to be .213.

Hence this shows that there is low level of relationship between the two variables. It indicates

that there is low level of dependency of stock return on market returns in case of Thomas Cook.

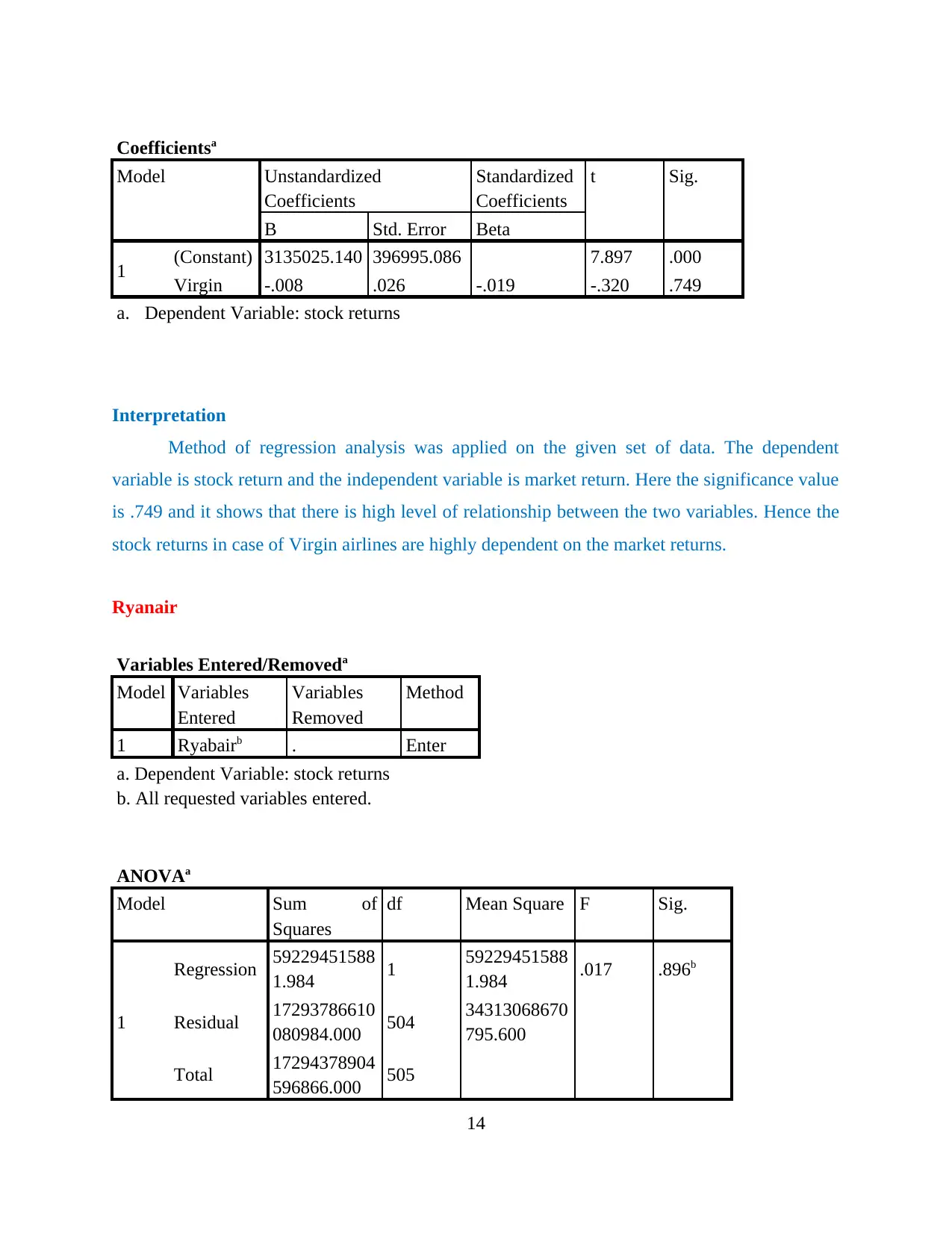

Virgin airlines

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .019a .000 -.003 6.776.481,09

8

a. Predictors: (Constant), vIRGIN

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 46951131951

48.734 1 46951131951

48.734 .102 .749b

Residual 13454763949

863912.000 293 45920696074

620.860

Total 13459459063

059060.000 294

a. Dependent Variable: Stock returns

b. Predictors: (Constant), Market returns

13

Paraphrase This Document

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 3135025.140 396995.086 7.897 .000

Virgin -.008 .026 -.019 -.320 .749

a. Dependent Variable: stock returns

Interpretation

Method of regression analysis was applied on the given set of data. The dependent

variable is stock return and the independent variable is market return. Here the significance value

is .749 and it shows that there is high level of relationship between the two variables. Hence the

stock returns in case of Virgin airlines are highly dependent on the market returns.

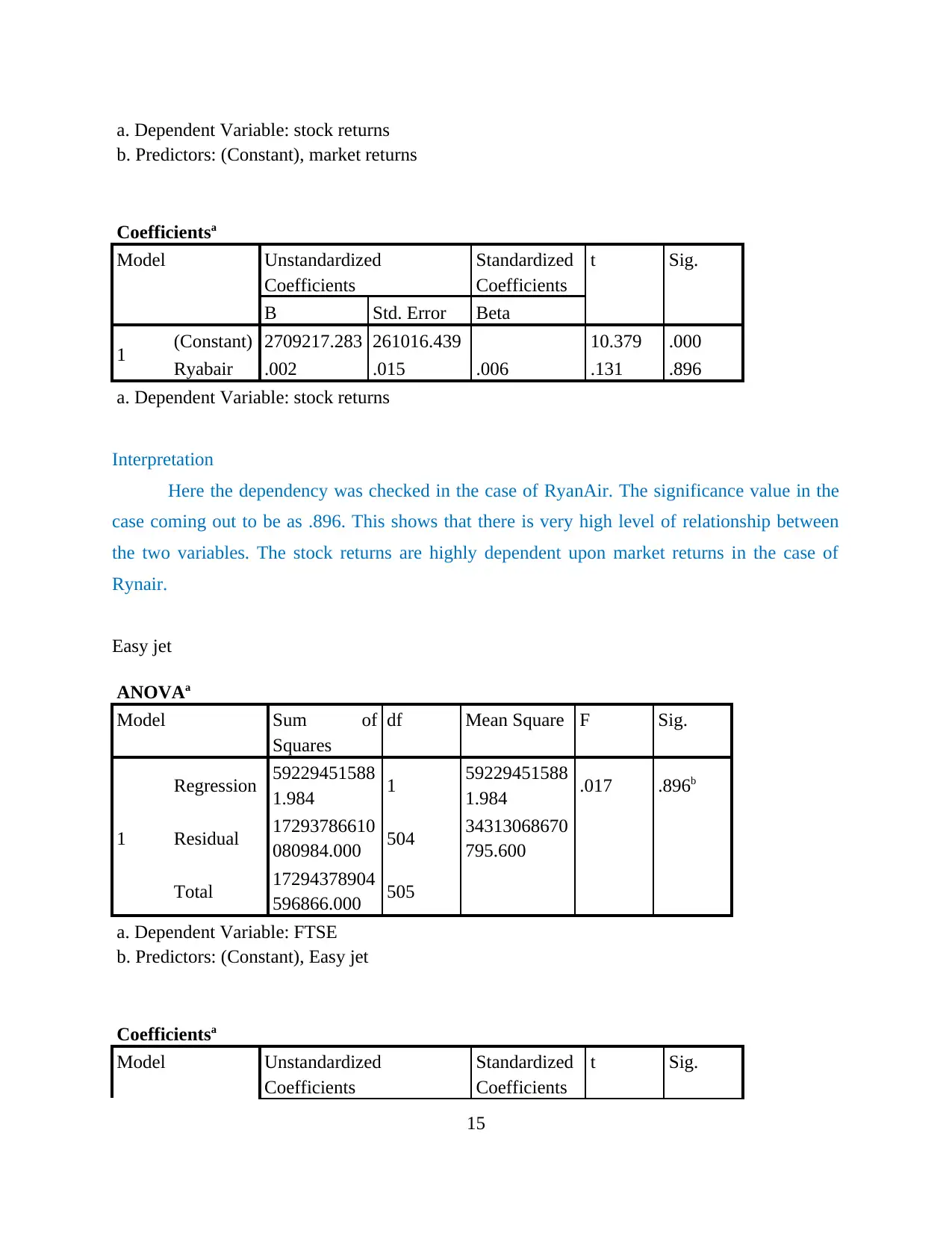

Ryanair

Variables Entered/Removeda

Model Variables

Entered

Variables

Removed

Method

1 Ryabairb . Enter

a. Dependent Variable: stock returns

b. All requested variables entered.

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 59229451588

1.984 1 59229451588

1.984 .017 .896b

Residual 17293786610

080984.000 504 34313068670

795.600

Total 17294378904

596866.000 505

14

b. Predictors: (Constant), market returns

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 2709217.283 261016.439 10.379 .000

Ryabair .002 .015 .006 .131 .896

a. Dependent Variable: stock returns

Interpretation

Here the dependency was checked in the case of RyanAir. The significance value in the

case coming out to be as .896. This shows that there is very high level of relationship between

the two variables. The stock returns are highly dependent upon market returns in the case of

Rynair.

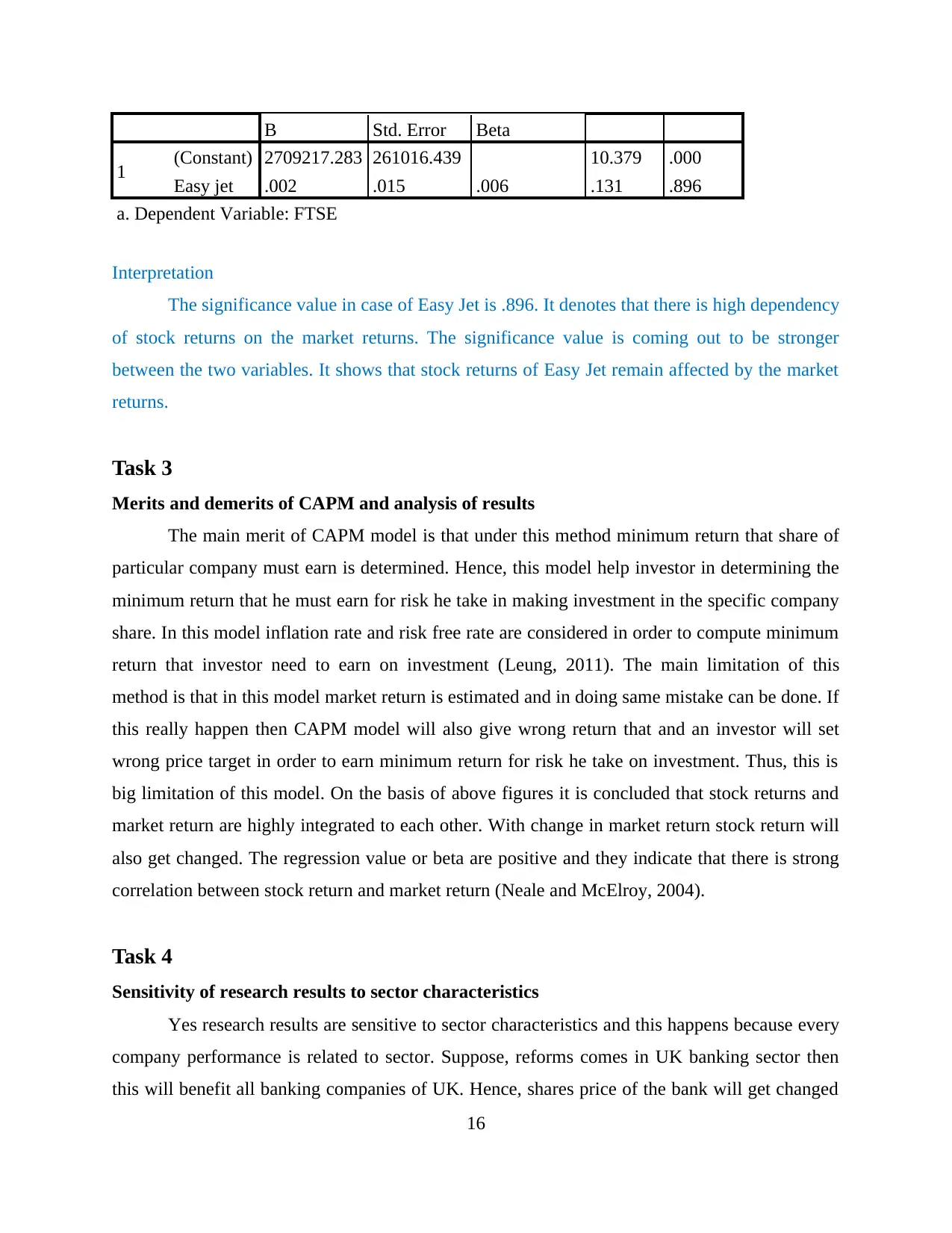

Easy jet

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 59229451588

1.984 1 59229451588

1.984 .017 .896b

Residual 17293786610

080984.000 504 34313068670

795.600

Total 17294378904

596866.000 505

a. Dependent Variable: FTSE

b. Predictors: (Constant), Easy jet

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 (Constant) 2709217.283 261016.439 10.379 .000

Easy jet .002 .015 .006 .131 .896

a. Dependent Variable: FTSE

Interpretation

The significance value in case of Easy Jet is .896. It denotes that there is high dependency

of stock returns on the market returns. The significance value is coming out to be stronger

between the two variables. It shows that stock returns of Easy Jet remain affected by the market

returns.

Task 3

Merits and demerits of CAPM and analysis of results

The main merit of CAPM model is that under this method minimum return that share of

particular company must earn is determined. Hence, this model help investor in determining the

minimum return that he must earn for risk he take in making investment in the specific company

share. In this model inflation rate and risk free rate are considered in order to compute minimum

return that investor need to earn on investment (Leung, 2011). The main limitation of this

method is that in this model market return is estimated and in doing same mistake can be done. If

this really happen then CAPM model will also give wrong return that and an investor will set

wrong price target in order to earn minimum return for risk he take on investment. Thus, this is

big limitation of this model. On the basis of above figures it is concluded that stock returns and

market return are highly integrated to each other. With change in market return stock return will

also get changed. The regression value or beta are positive and they indicate that there is strong

correlation between stock return and market return (Neale and McElroy, 2004).

Task 4

Sensitivity of research results to sector characteristics

Yes research results are sensitive to sector characteristics and this happens because every

company performance is related to sector. Suppose, reforms comes in UK banking sector then

this will benefit all banking companies of UK. Hence, shares price of the bank will get changed

16

Paraphrase This Document

return then minimum return that is determined by the CAPM model. This reflects that research

results are sensitive to sector characteristics. This does not mean that there is no value of

minimum return that is generated by the CAPM model. With change in market conditions actual

return generated by the shares in stock market may be increase or decrease by higher amount

relative to return that is generated by the CAPM model. Thus, it is clear that research results or

return generated by CAPM model are highly sensitive to sector characteristics (Shim and Siegel,

2008).

Conclusion

From the above study it can be concluded that CAPM analysis can be performed by using

regression tool. The main limitation of this CAPM method is that in this model market return is

estimated and in doing same mistake can be done. The results generated from the model are

highly sensitive to the sector characteristics. It is possible that share prices of the company get

changes with the marketing conditions.

17

Deegan, C. and Unerman, J., 2006. Financial accounting theory. Maidenhead: McGraw-Hill

Education.

Jara, G. E., Ebrero, C. A.. and Zapata, E. R., 2011. Effect of international financial reporting

standards on financial information quality. Journal of Financial Reporting and

Accounting. 9(2). pp.176-196.

Keller, A., 2013. Finance and financial management. GRIN Verlag.

Leung, A., 2011. Financial management practices and social reproduction. Qualitative Market

Research: An International Journal. 14(2). pp.218 – 239.

Neale, B. and McElroy, T., 2004. Business Finance- A Value Based Approach. 1st ed. Financial

Times/Prentice Hall.

Price, J. D., 2015. Financing later life: why financial capability agendas may be problematic.

Working with

Shim, K. J. and Siegel, G. J., 2008. Financial Management. 3rd.ed. Barron's Educational Series.

18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.