Financial Accounting Report Analysis and Value Added Tax

VerifiedAdded on 2020/10/05

|24

|4948

|210

AI Summary

The assignment discusses the significance of financial accounting reports in representing a company's financial position. It highlights the importance of adapting accounting concepts like prudent and accrual concepts for preparing financial statements. The analysis also delves into the payment of value-added tax, which is mandatory for registered businesses with sales exceeding a prescribed limit. This process helps enhance business revenue and sales, ultimately contributing to the economy and business growth.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

The Accounting records and Financial

statements

1

statements

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

1-prepare the accounting records and financial statement for Conga, a sole trader toy retailer

business-......................................................................................................................................1

....................................................................................................................................................1

2- Prudent concept and Accrual concept ..................................................................................17

3- In future the government might require VAT on sales then VAT would be recorded in

Conga accounting and report....................................................................................................18

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

INTRODUCTION...........................................................................................................................1

1-prepare the accounting records and financial statement for Conga, a sole trader toy retailer

business-......................................................................................................................................1

....................................................................................................................................................1

2- Prudent concept and Accrual concept ..................................................................................17

3- In future the government might require VAT on sales then VAT would be recorded in

Conga accounting and report....................................................................................................18

CONCLUSION..............................................................................................................................20

REFERENCES..............................................................................................................................21

INTRODUCTION

Financial Accounting is the process of identify , analysis and recording and summarised all

financial transactions are summarised in financial statement it includes income statement ,

balance sheet , cash flow statement and equity shareholder statement. Generally acceptable

accounting principle is standard framework for financial accounting. Financial statement

represent financial position of the company and helps to compare with other company that useful

for internal and external stake holders (Williams and Dobelman, 2017).

Present report based on Conga company which is UK base company and having retail business

of toys.

This report will include accounting records and financial statement like trail balance, income

statement and balance sheet of Conga company. It also includes prudent concept and accrual

concept of financial accounting which adapt while preparing financial statement Further it

prescribes that value added tax is mandatory for all company so Conga company also record

value added tax in accounting reports.

1-prepare the accounting records and financial statement for Conga, a sole trader toy retailer

business-

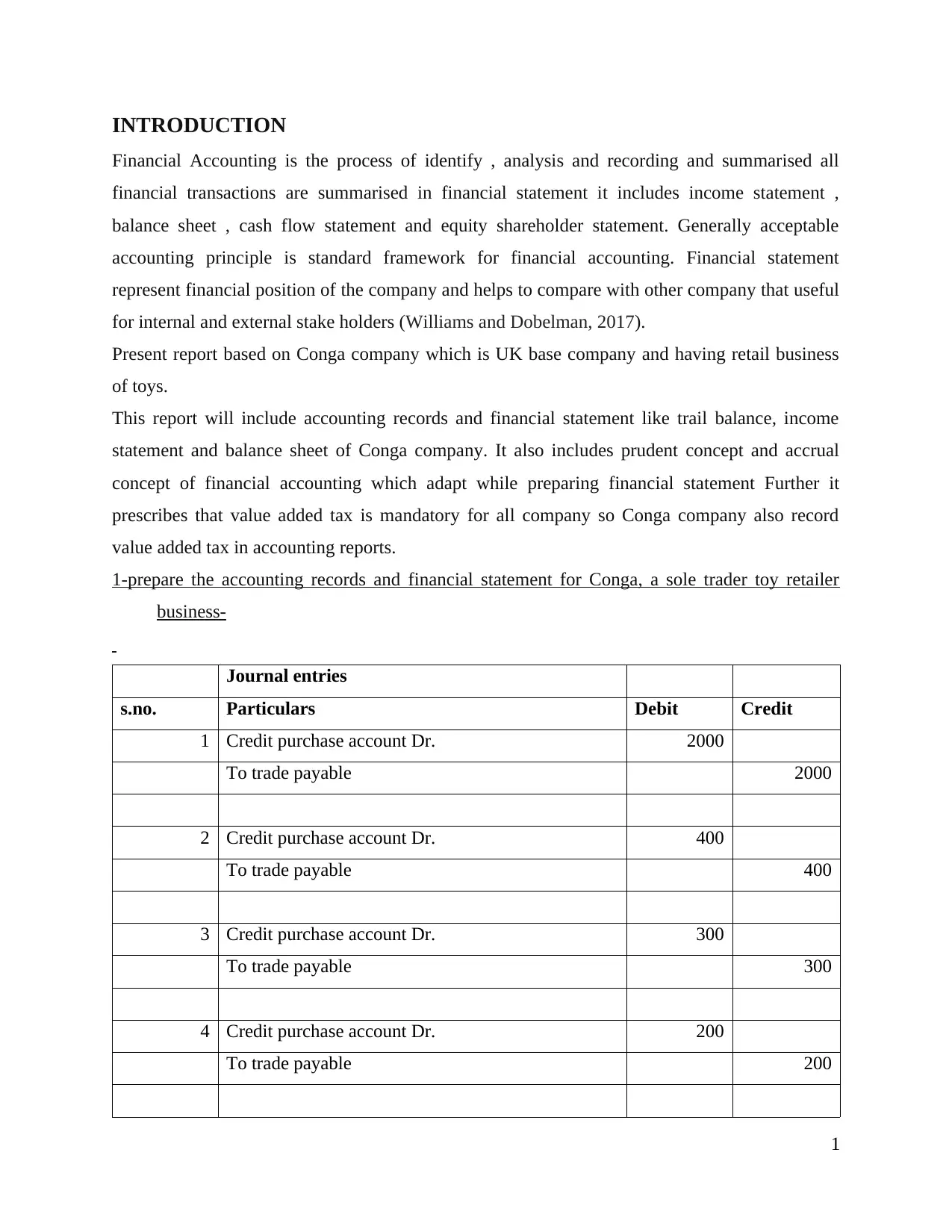

Journal entries

s.no. Particulars Debit Credit

1 Credit purchase account Dr. 2000

To trade payable 2000

2 Credit purchase account Dr. 400

To trade payable 400

3 Credit purchase account Dr. 300

To trade payable 300

4 Credit purchase account Dr. 200

To trade payable 200

1

Financial Accounting is the process of identify , analysis and recording and summarised all

financial transactions are summarised in financial statement it includes income statement ,

balance sheet , cash flow statement and equity shareholder statement. Generally acceptable

accounting principle is standard framework for financial accounting. Financial statement

represent financial position of the company and helps to compare with other company that useful

for internal and external stake holders (Williams and Dobelman, 2017).

Present report based on Conga company which is UK base company and having retail business

of toys.

This report will include accounting records and financial statement like trail balance, income

statement and balance sheet of Conga company. It also includes prudent concept and accrual

concept of financial accounting which adapt while preparing financial statement Further it

prescribes that value added tax is mandatory for all company so Conga company also record

value added tax in accounting reports.

1-prepare the accounting records and financial statement for Conga, a sole trader toy retailer

business-

Journal entries

s.no. Particulars Debit Credit

1 Credit purchase account Dr. 2000

To trade payable 2000

2 Credit purchase account Dr. 400

To trade payable 400

3 Credit purchase account Dr. 300

To trade payable 300

4 Credit purchase account Dr. 200

To trade payable 200

1

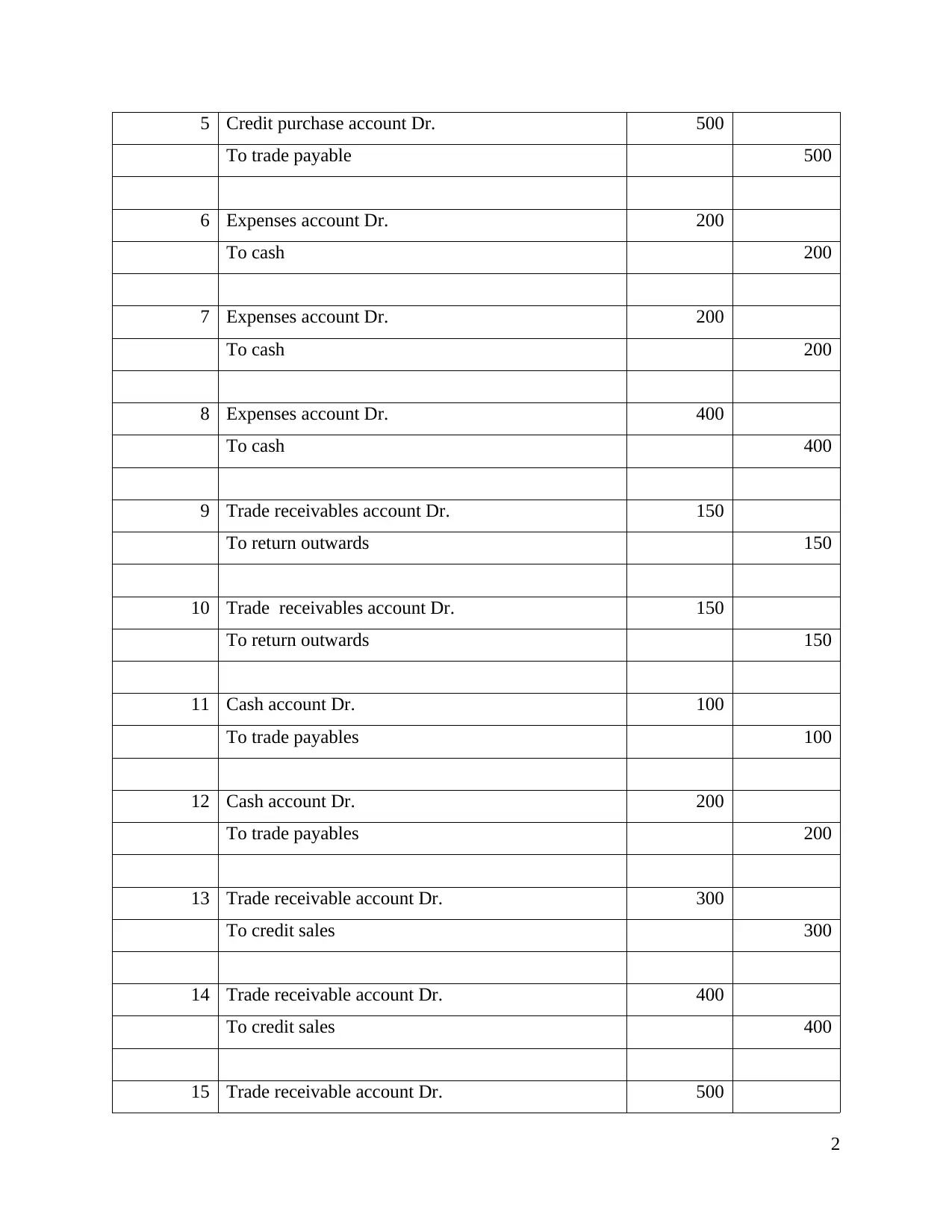

5 Credit purchase account Dr. 500

To trade payable 500

6 Expenses account Dr. 200

To cash 200

7 Expenses account Dr. 200

To cash 200

8 Expenses account Dr. 400

To cash 400

9 Trade receivables account Dr. 150

To return outwards 150

10 Trade receivables account Dr. 150

To return outwards 150

11 Cash account Dr. 100

To trade payables 100

12 Cash account Dr. 200

To trade payables 200

13 Trade receivable account Dr. 300

To credit sales 300

14 Trade receivable account Dr. 400

To credit sales 400

15 Trade receivable account Dr. 500

2

To trade payable 500

6 Expenses account Dr. 200

To cash 200

7 Expenses account Dr. 200

To cash 200

8 Expenses account Dr. 400

To cash 400

9 Trade receivables account Dr. 150

To return outwards 150

10 Trade receivables account Dr. 150

To return outwards 150

11 Cash account Dr. 100

To trade payables 100

12 Cash account Dr. 200

To trade payables 200

13 Trade receivable account Dr. 300

To credit sales 300

14 Trade receivable account Dr. 400

To credit sales 400

15 Trade receivable account Dr. 500

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

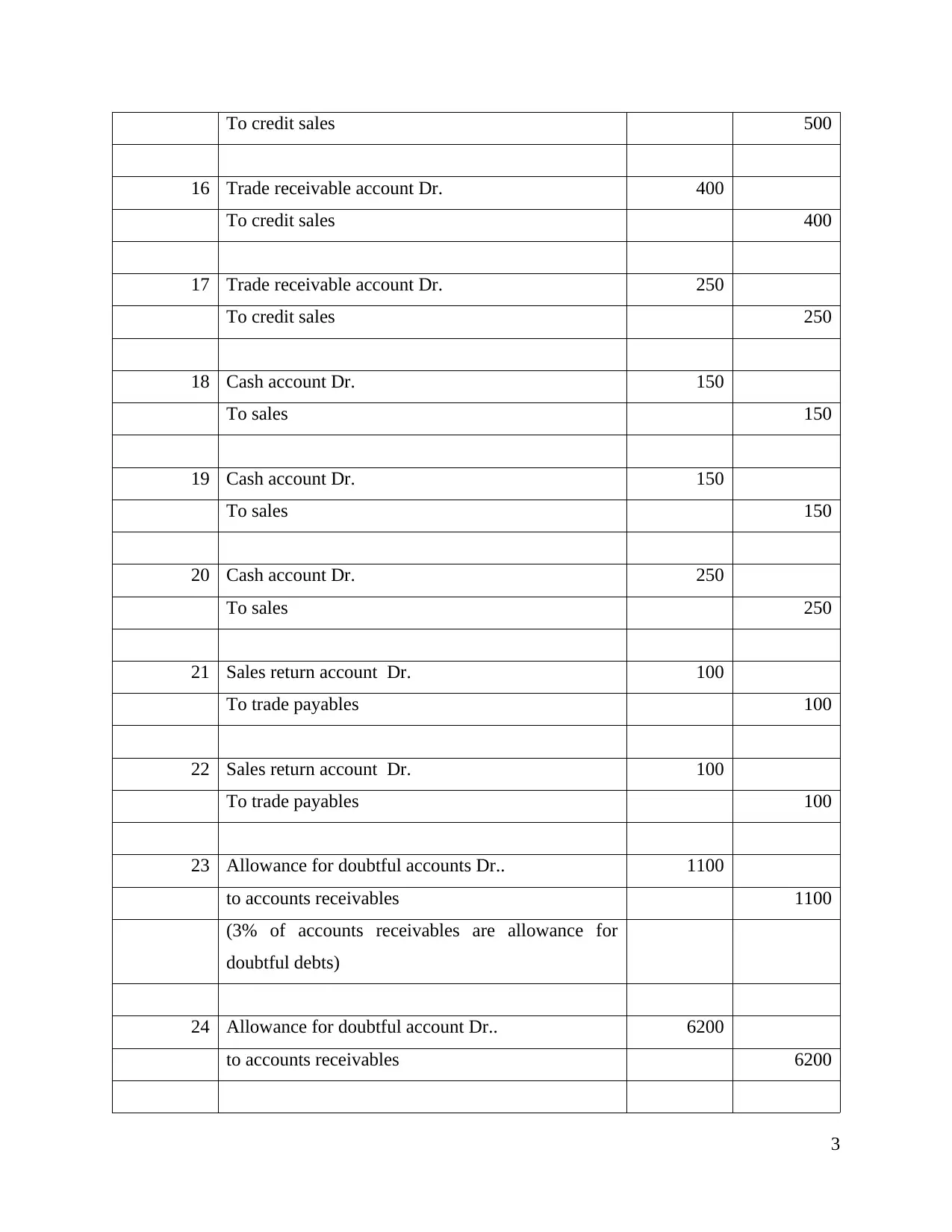

To credit sales 500

16 Trade receivable account Dr. 400

To credit sales 400

17 Trade receivable account Dr. 250

To credit sales 250

18 Cash account Dr. 150

To sales 150

19 Cash account Dr. 150

To sales 150

20 Cash account Dr. 250

To sales 250

21 Sales return account Dr. 100

To trade payables 100

22 Sales return account Dr. 100

To trade payables 100

23 Allowance for doubtful accounts Dr.. 1100

to accounts receivables 1100

(3% of accounts receivables are allowance for

doubtful debts)

24 Allowance for doubtful account Dr.. 6200

to accounts receivables 6200

3

16 Trade receivable account Dr. 400

To credit sales 400

17 Trade receivable account Dr. 250

To credit sales 250

18 Cash account Dr. 150

To sales 150

19 Cash account Dr. 150

To sales 150

20 Cash account Dr. 250

To sales 250

21 Sales return account Dr. 100

To trade payables 100

22 Sales return account Dr. 100

To trade payables 100

23 Allowance for doubtful accounts Dr.. 1100

to accounts receivables 1100

(3% of accounts receivables are allowance for

doubtful debts)

24 Allowance for doubtful account Dr.. 6200

to accounts receivables 6200

3

25 Cash account Dr. 2000

Discount account Dr. 2000

to accounts receivables 4000

26 Trade payable account Dr. 3000

To cash account 2000

To discount receivable account 1000

27 Electricity expenses account Dr. 3000

To cash 3000

28 Rent expenses account Dr.. 5000

To cash 5000

29 Cash account Dr. 45000

To capital 45000

30 Loan account Dr. 40000

Interest account Dr. 20000

To bank account 60000

31 Wages account Dr. 4000

To accrued wages 4000

Total 138700 138700

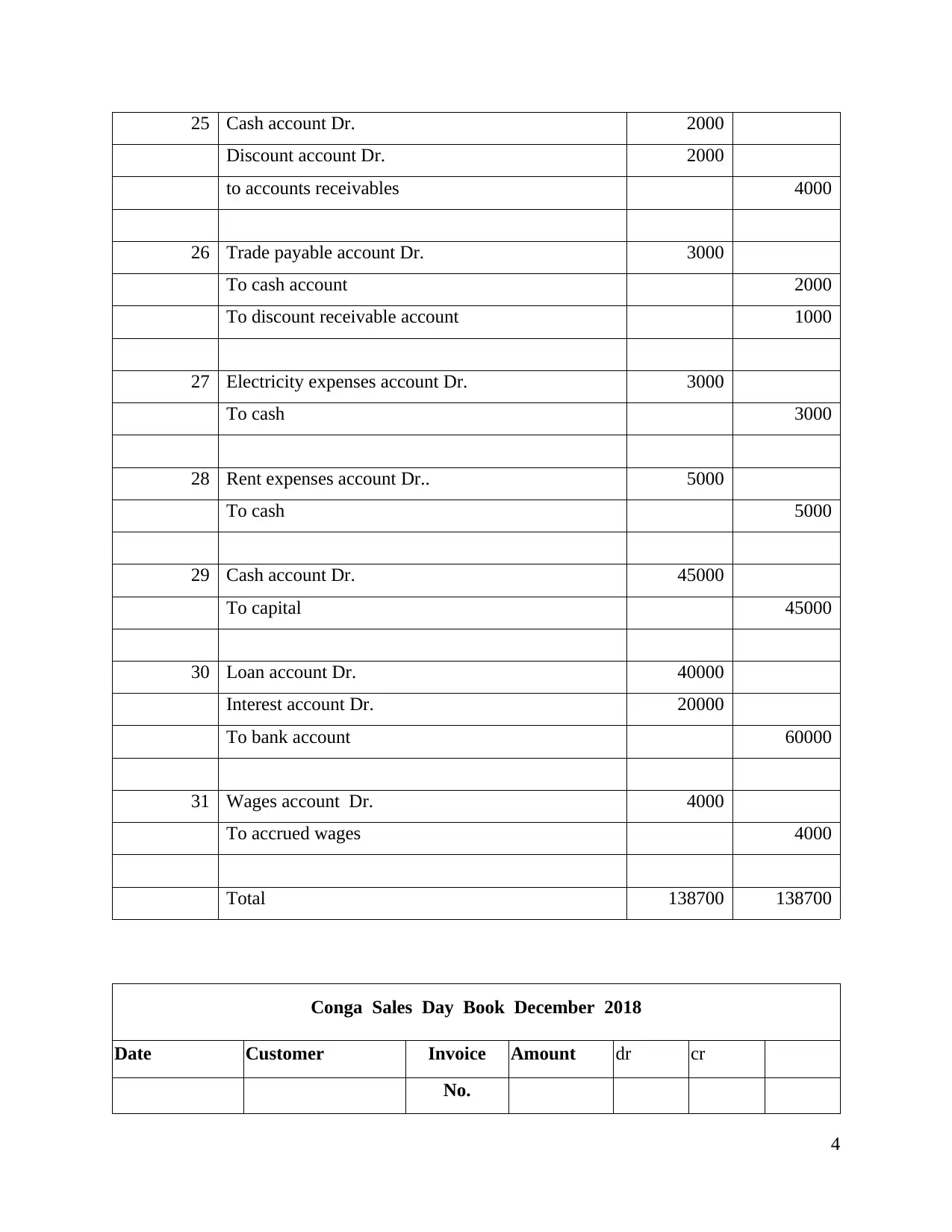

Conga Sales Day Book December 2018

Date Customer Invoice Amount dr cr

No.

4

Discount account Dr. 2000

to accounts receivables 4000

26 Trade payable account Dr. 3000

To cash account 2000

To discount receivable account 1000

27 Electricity expenses account Dr. 3000

To cash 3000

28 Rent expenses account Dr.. 5000

To cash 5000

29 Cash account Dr. 45000

To capital 45000

30 Loan account Dr. 40000

Interest account Dr. 20000

To bank account 60000

31 Wages account Dr. 4000

To accrued wages 4000

Total 138700 138700

Conga Sales Day Book December 2018

Date Customer Invoice Amount dr cr

No.

4

30-Nov-18 sales 390390

31-Dec-18 cash 150

31-Dec-18 cash 150

31-Dec-18 cash 250

31-Dec-18 accounts

receivables 300

31-Dec-18 accounts

receivables 400

31-Dec-18 accounts

receivables 500

31-Dec-18 accounts

receivables 400

31-Dec-18 accounts

receivables 250

Total 392790

Conga Sales Returns Day Book December 2018

Date Customer Invoice Amount

No. dr cr

30-Nov-18 Return inwards 6200

31-Dec-18 trade payables 100

31-Dec-18 trade payables 100

Total 6400

5

31-Dec-18 cash 150

31-Dec-18 cash 150

31-Dec-18 cash 250

31-Dec-18 accounts

receivables 300

31-Dec-18 accounts

receivables 400

31-Dec-18 accounts

receivables 500

31-Dec-18 accounts

receivables 400

31-Dec-18 accounts

receivables 250

Total 392790

Conga Sales Returns Day Book December 2018

Date Customer Invoice Amount

No. dr cr

30-Nov-18 Return inwards 6200

31-Dec-18 trade payables 100

31-Dec-18 trade payables 100

Total 6400

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

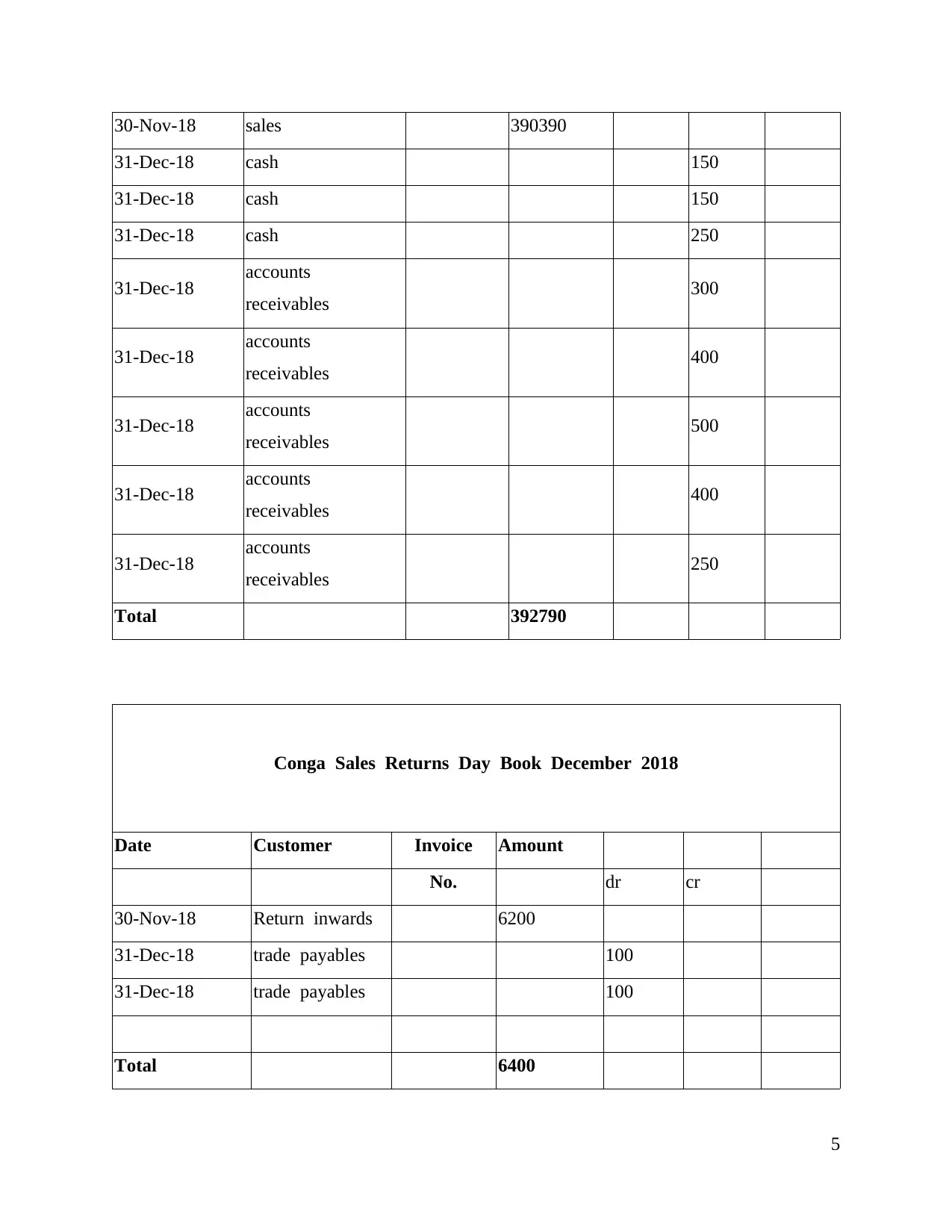

Conga Purchase Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

30-Nov-18 purchases 135500

31-Dec-18 Trade payable 2000

31-Dec-18 Trade payable 400

31-Dec-18 Trade payable 300

31-Dec-18 Trade payable 200

31-Dec-18 Trade payable 500

Total 138900

Conga Purchase Returns Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

31-Dec-18 accounts recievables 150

31-Dec-18 accounts recievables 150

Total 300

6

Date Customer Invoice Amount dr cr

No.

30-Nov-18 purchases 135500

31-Dec-18 Trade payable 2000

31-Dec-18 Trade payable 400

31-Dec-18 Trade payable 300

31-Dec-18 Trade payable 200

31-Dec-18 Trade payable 500

Total 138900

Conga Purchase Returns Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

31-Dec-18 accounts recievables 150

31-Dec-18 accounts recievables 150

Total 300

6

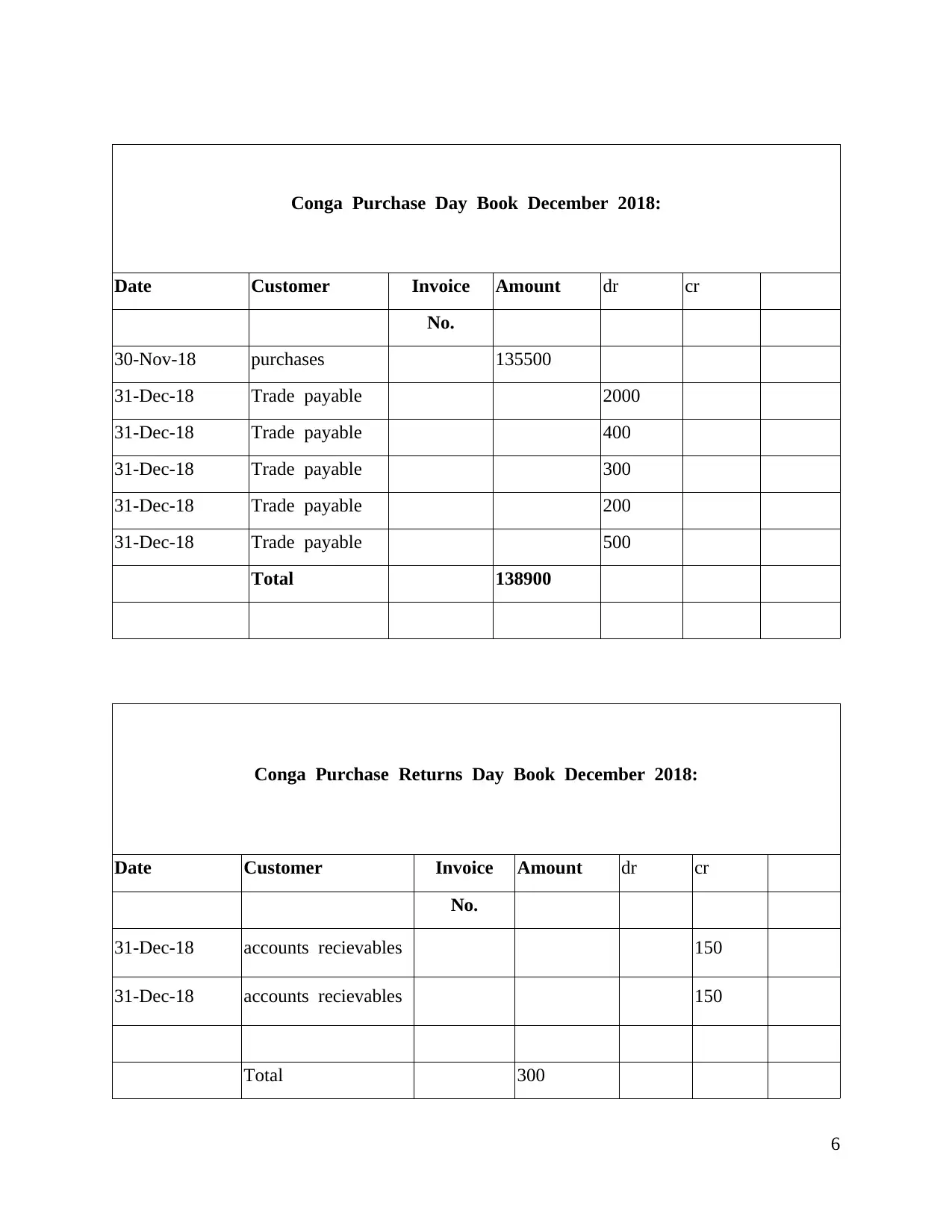

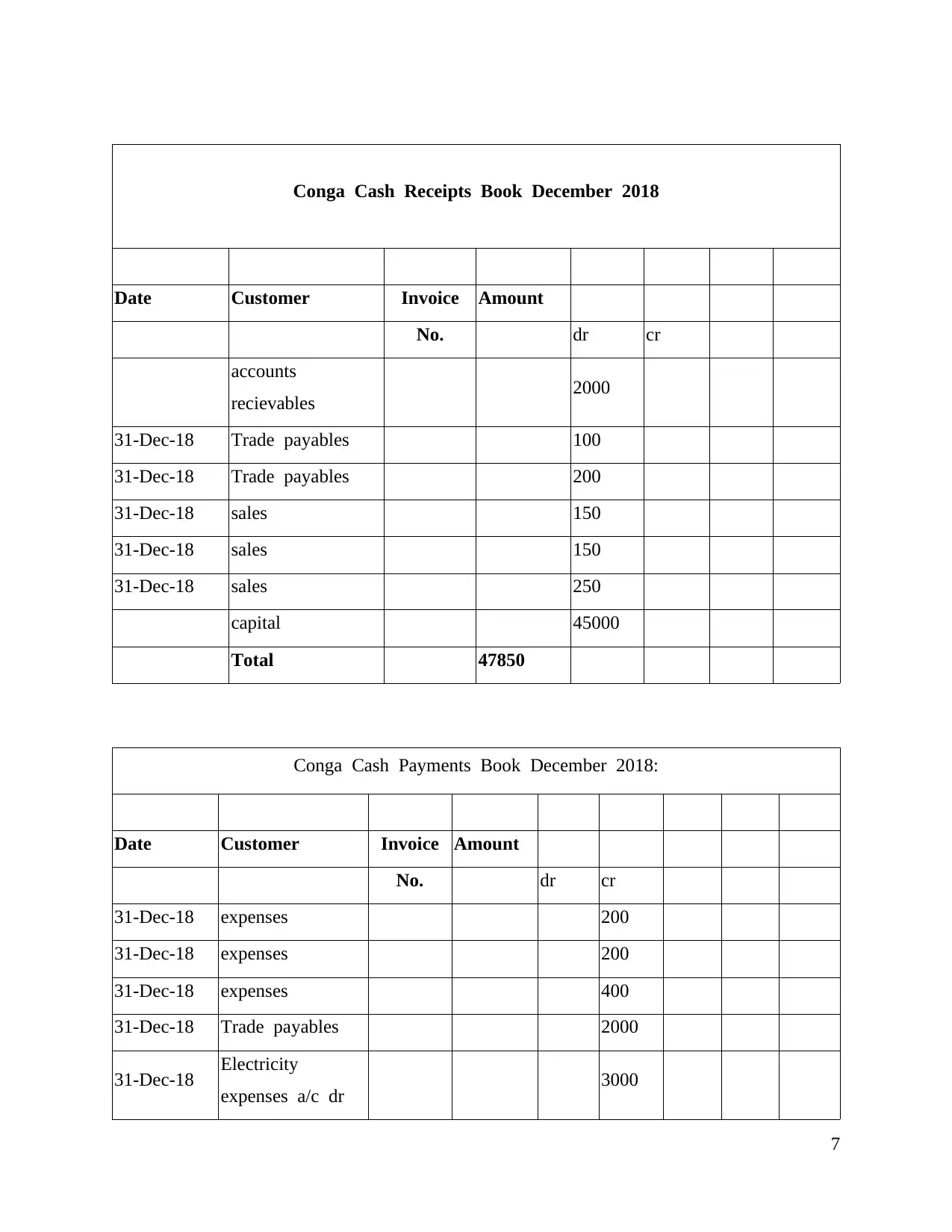

Conga Cash Receipts Book December 2018

Date Customer Invoice Amount

No. dr cr

accounts

recievables 2000

31-Dec-18 Trade payables 100

31-Dec-18 Trade payables 200

31-Dec-18 sales 150

31-Dec-18 sales 150

31-Dec-18 sales 250

capital 45000

Total 47850

Conga Cash Payments Book December 2018:

Date Customer Invoice Amount

No. dr cr

31-Dec-18 expenses 200

31-Dec-18 expenses 200

31-Dec-18 expenses 400

31-Dec-18 Trade payables 2000

31-Dec-18 Electricity

expenses a/c dr 3000

7

Date Customer Invoice Amount

No. dr cr

accounts

recievables 2000

31-Dec-18 Trade payables 100

31-Dec-18 Trade payables 200

31-Dec-18 sales 150

31-Dec-18 sales 150

31-Dec-18 sales 250

capital 45000

Total 47850

Conga Cash Payments Book December 2018:

Date Customer Invoice Amount

No. dr cr

31-Dec-18 expenses 200

31-Dec-18 expenses 200

31-Dec-18 expenses 400

31-Dec-18 Trade payables 2000

31-Dec-18 Electricity

expenses a/c dr 3000

7

31-Dec-18 Rent expenses

a/c dr. 5000

Total 10800

GENERAL LEDGER:

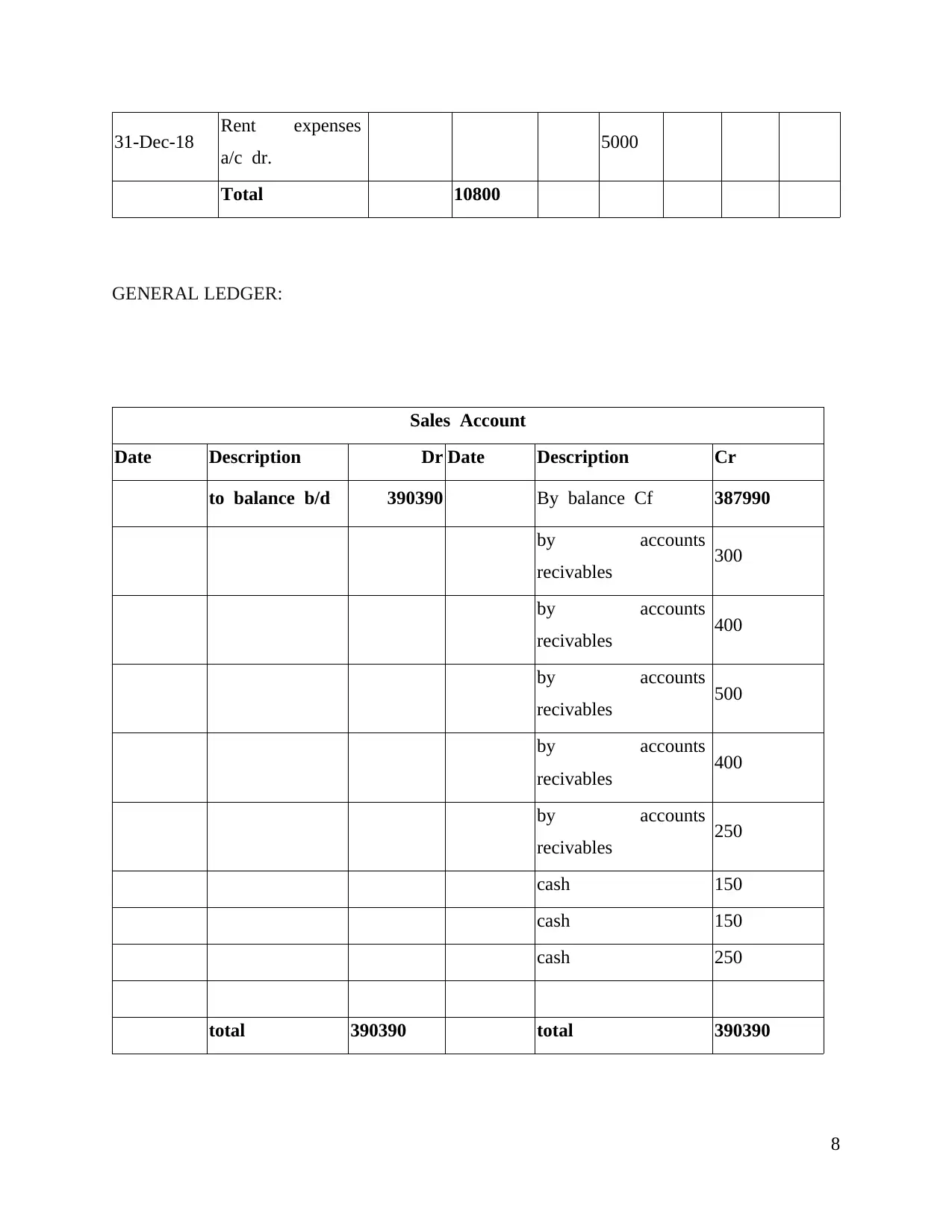

Sales Account

Date Description Dr Date Description Cr

to balance b/d 390390 By balance Cf 387990

by accounts

recivables 300

by accounts

recivables 400

by accounts

recivables 500

by accounts

recivables 400

by accounts

recivables 250

cash 150

cash 150

cash 250

total 390390 total 390390

8

a/c dr. 5000

Total 10800

GENERAL LEDGER:

Sales Account

Date Description Dr Date Description Cr

to balance b/d 390390 By balance Cf 387990

by accounts

recivables 300

by accounts

recivables 400

by accounts

recivables 500

by accounts

recivables 400

by accounts

recivables 250

cash 150

cash 150

cash 250

total 390390 total 390390

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Purchases Account

Date Description Dr Date Description Cr

To trade

payables 2000 By balance b/d 135500

To trade

payables 400

To trade

payables 300

To trade

payables 200

To trade

payables 500

to balance C/f 132100

Total 135500 total 135500

Expenses Account

Date Description Dr Date Description Cr

To cash 200

To cash 200 By balance c/f 800

To cash 400

Total 800 Total 800

9

Date Description Dr Date Description Cr

To trade

payables 2000 By balance b/d 135500

To trade

payables 400

To trade

payables 300

To trade

payables 200

To trade

payables 500

to balance C/f 132100

Total 135500 total 135500

Expenses Account

Date Description Dr Date Description Cr

To cash 200

To cash 200 By balance c/f 800

To cash 400

Total 800 Total 800

9

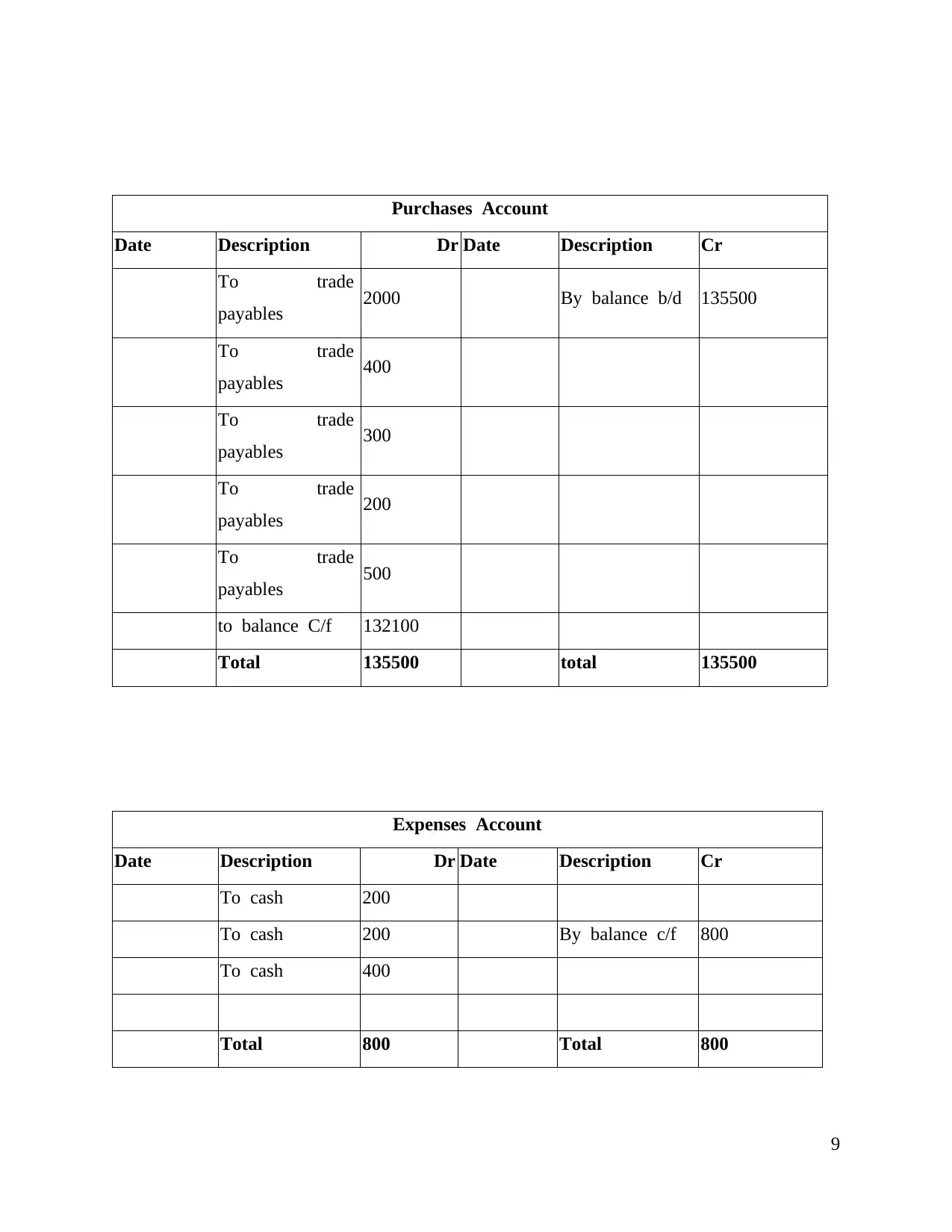

accounts recievables Account

Date Description Dr Date Description Cr

to retuern

outwards 150 allowance for doubtfull

debts 1100

to retuern

outwards 150 allowance for doubtfull

debts 6200

to credit sales 300 cash 2000

to credit sales 400 discount allowed 2000

to credit sales 500 By balance b/d 36660

to credit sales 400

to credit sales 250

To balance c/f 45810

Total 47960 Total 47960

Trade payables Account

Date Description Dr Date Description Cr

to cash 2000 by cash 100

to discount

received 1000 by cash 200

to balance b/d 30900 return inward 100

return inward 100

By balance

c/f 33400

10

Date Description Dr Date Description Cr

to retuern

outwards 150 allowance for doubtfull

debts 1100

to retuern

outwards 150 allowance for doubtfull

debts 6200

to credit sales 300 cash 2000

to credit sales 400 discount allowed 2000

to credit sales 500 By balance b/d 36660

to credit sales 400

to credit sales 250

To balance c/f 45810

Total 47960 Total 47960

Trade payables Account

Date Description Dr Date Description Cr

to cash 2000 by cash 100

to discount

received 1000 by cash 200

to balance b/d 30900 return inward 100

return inward 100

By balance

c/f 33400

10

Total 33900 Total 33900

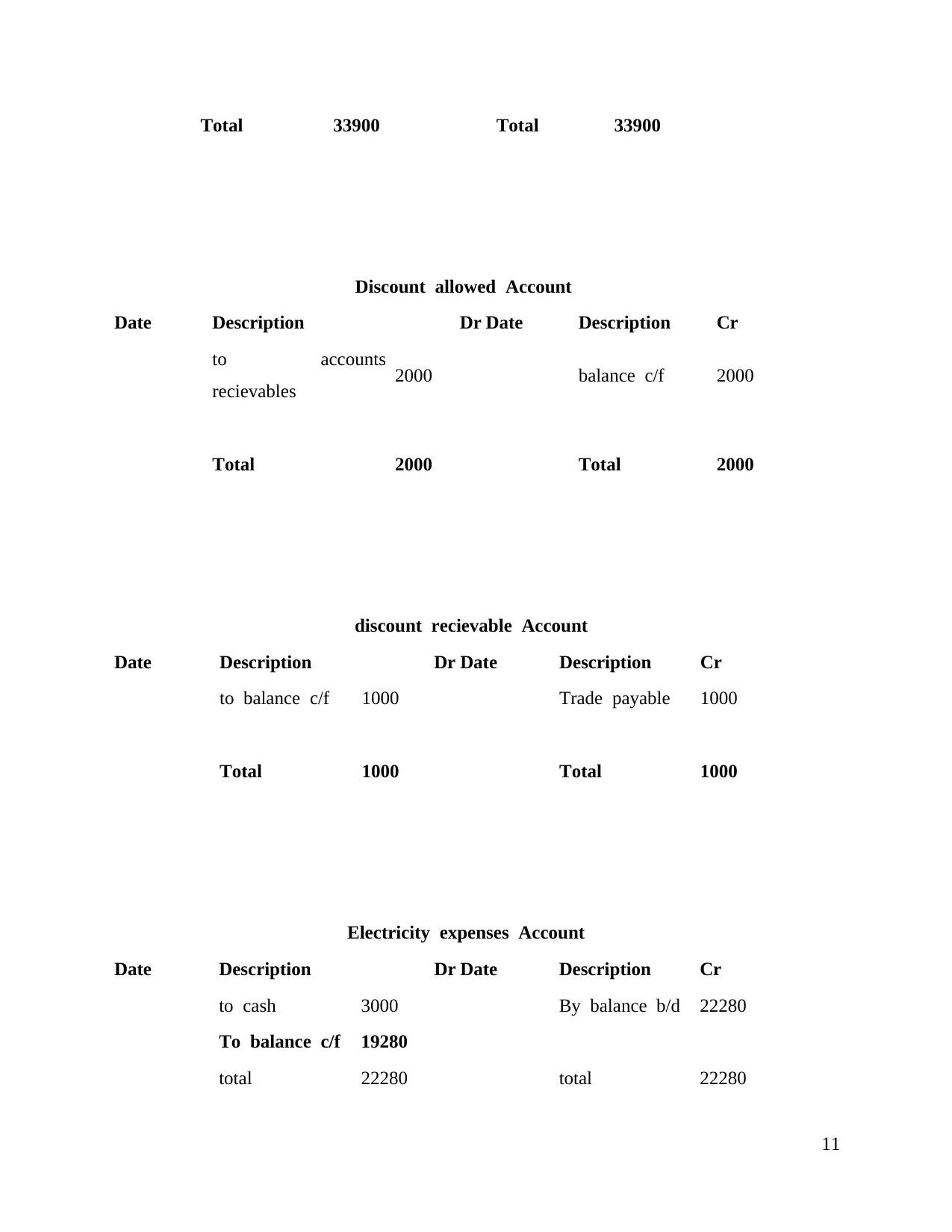

Discount allowed Account

Date Description Dr Date Description Cr

to accounts

recievables 2000 balance c/f 2000

Total 2000 Total 2000

discount recievable Account

Date Description Dr Date Description Cr

to balance c/f 1000 Trade payable 1000

Total 1000 Total 1000

Electricity expenses Account

Date Description Dr Date Description Cr

to cash 3000 By balance b/d 22280

To balance c/f 19280

total 22280 total 22280

11

Discount allowed Account

Date Description Dr Date Description Cr

to accounts

recievables 2000 balance c/f 2000

Total 2000 Total 2000

discount recievable Account

Date Description Dr Date Description Cr

to balance c/f 1000 Trade payable 1000

Total 1000 Total 1000

Electricity expenses Account

Date Description Dr Date Description Cr

to cash 3000 By balance b/d 22280

To balance c/f 19280

total 22280 total 22280

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

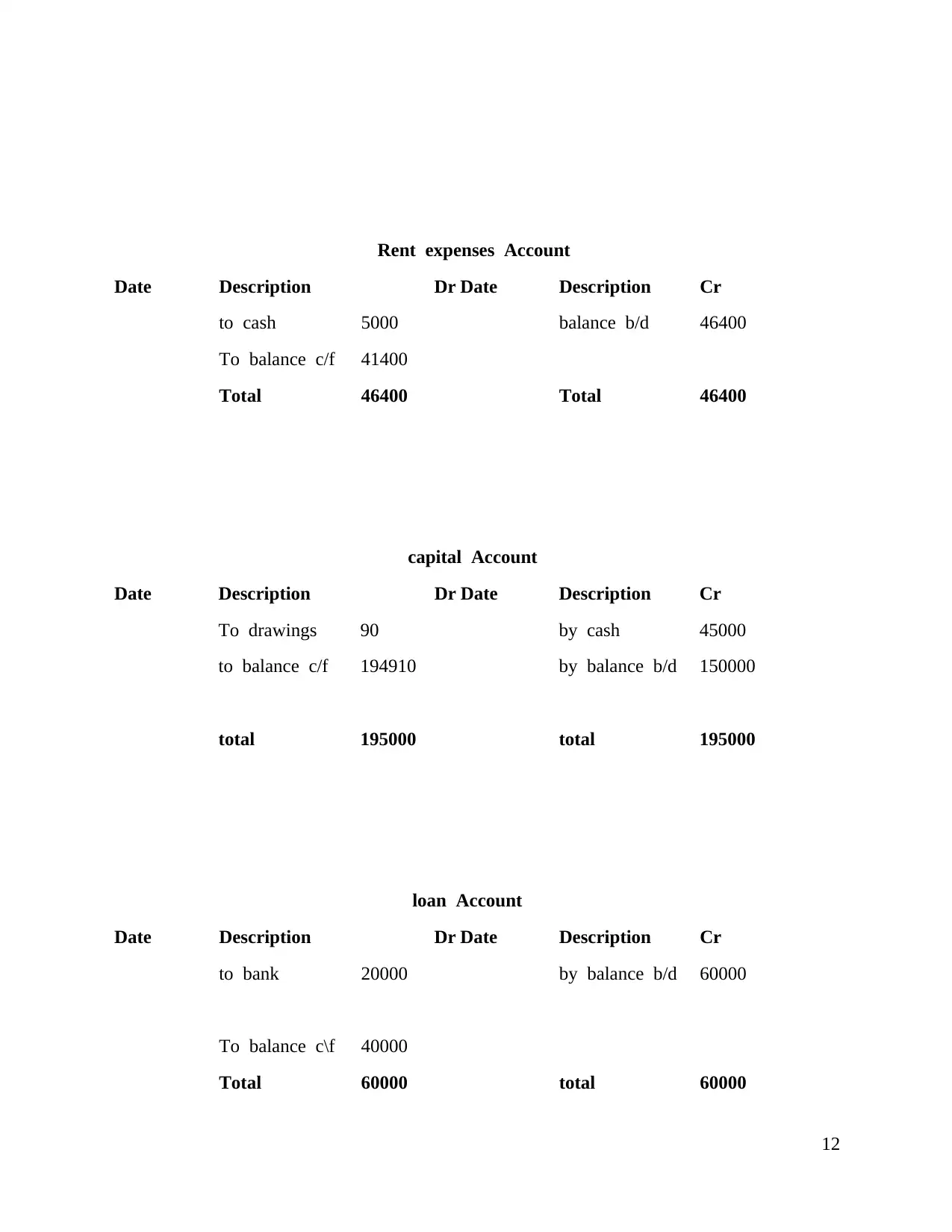

Rent expenses Account

Date Description Dr Date Description Cr

to cash 5000 balance b/d 46400

To balance c/f 41400

Total 46400 Total 46400

capital Account

Date Description Dr Date Description Cr

To drawings 90 by cash 45000

to balance c/f 194910 by balance b/d 150000

total 195000 total 195000

loan Account

Date Description Dr Date Description Cr

to bank 20000 by balance b/d 60000

To balance c\f 40000

Total 60000 total 60000

12

Date Description Dr Date Description Cr

to cash 5000 balance b/d 46400

To balance c/f 41400

Total 46400 Total 46400

capital Account

Date Description Dr Date Description Cr

To drawings 90 by cash 45000

to balance c/f 194910 by balance b/d 150000

total 195000 total 195000

loan Account

Date Description Dr Date Description Cr

to bank 20000 by balance b/d 60000

To balance c\f 40000

Total 60000 total 60000

12

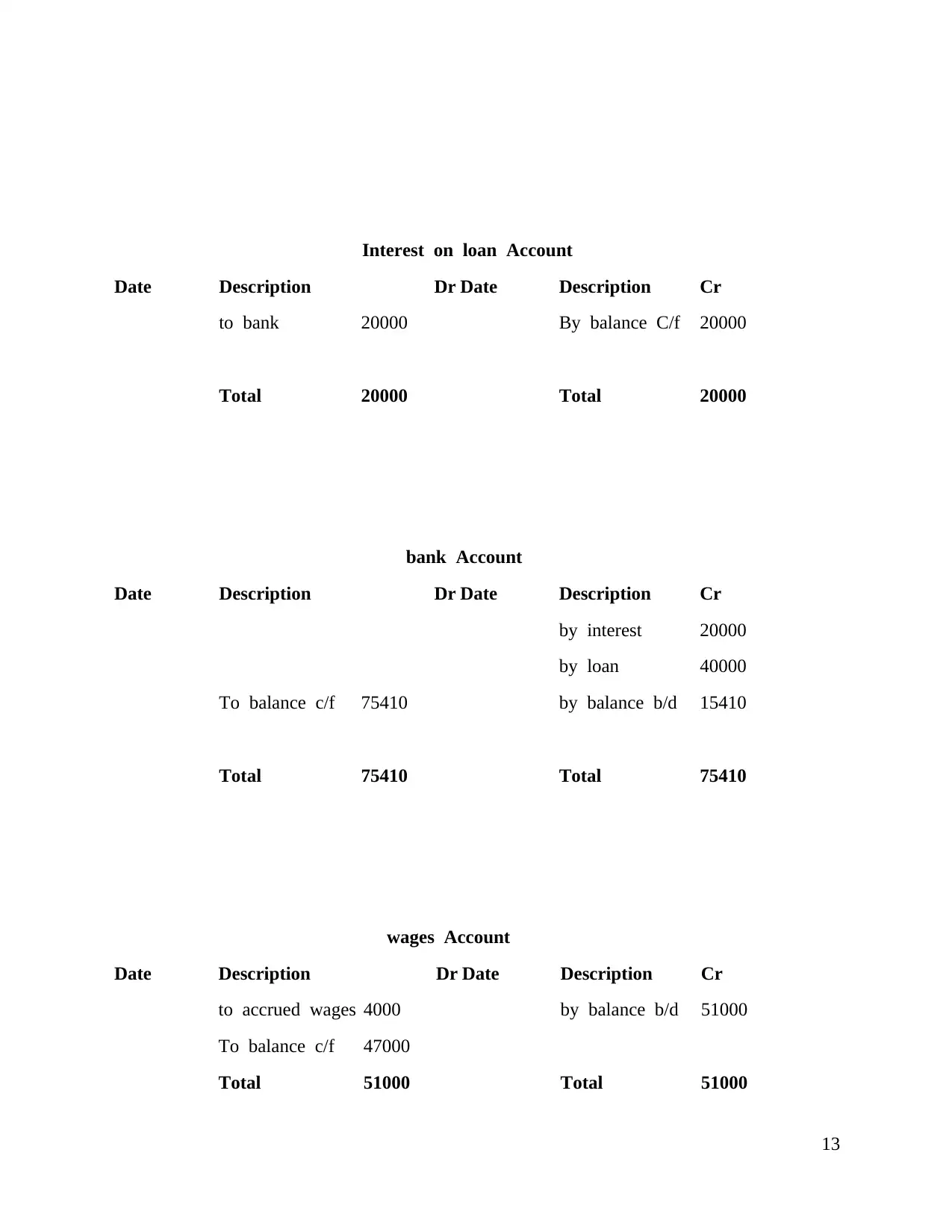

Interest on loan Account

Date Description Dr Date Description Cr

to bank 20000 By balance C/f 20000

Total 20000 Total 20000

bank Account

Date Description Dr Date Description Cr

by interest 20000

by loan 40000

To balance c/f 75410 by balance b/d 15410

Total 75410 Total 75410

wages Account

Date Description Dr Date Description Cr

to accrued wages 4000 by balance b/d 51000

To balance c/f 47000

Total 51000 Total 51000

13

Date Description Dr Date Description Cr

to bank 20000 By balance C/f 20000

Total 20000 Total 20000

bank Account

Date Description Dr Date Description Cr

by interest 20000

by loan 40000

To balance c/f 75410 by balance b/d 15410

Total 75410 Total 75410

wages Account

Date Description Dr Date Description Cr

to accrued wages 4000 by balance b/d 51000

To balance c/f 47000

Total 51000 Total 51000

13

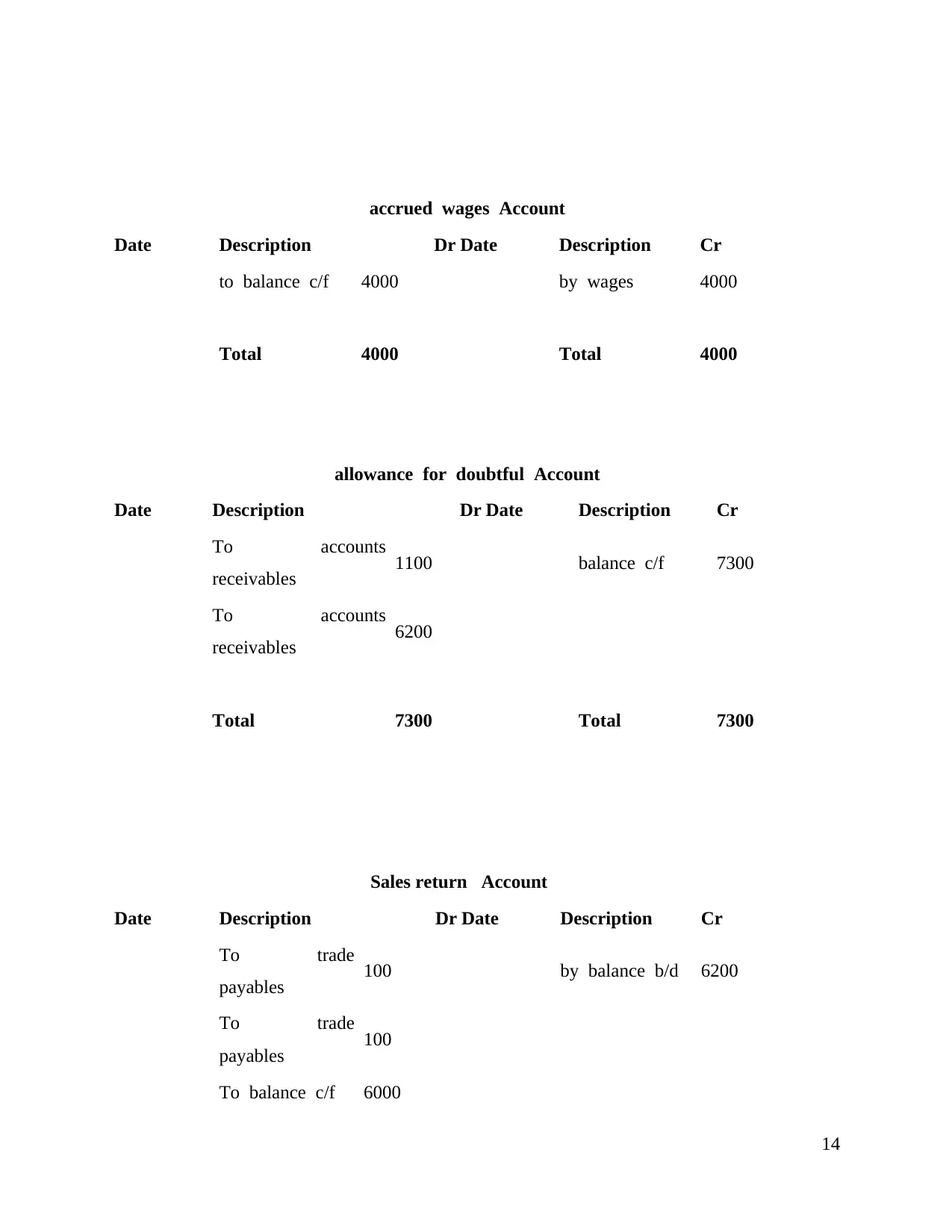

accrued wages Account

Date Description Dr Date Description Cr

to balance c/f 4000 by wages 4000

Total 4000 Total 4000

allowance for doubtful Account

Date Description Dr Date Description Cr

To accounts

receivables 1100 balance c/f 7300

To accounts

receivables 6200

Total 7300 Total 7300

Sales return Account

Date Description Dr Date Description Cr

To trade

payables 100 by balance b/d 6200

To trade

payables 100

To balance c/f 6000

14

Date Description Dr Date Description Cr

to balance c/f 4000 by wages 4000

Total 4000 Total 4000

allowance for doubtful Account

Date Description Dr Date Description Cr

To accounts

receivables 1100 balance c/f 7300

To accounts

receivables 6200

Total 7300 Total 7300

Sales return Account

Date Description Dr Date Description Cr

To trade

payables 100 by balance b/d 6200

To trade

payables 100

To balance c/f 6000

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

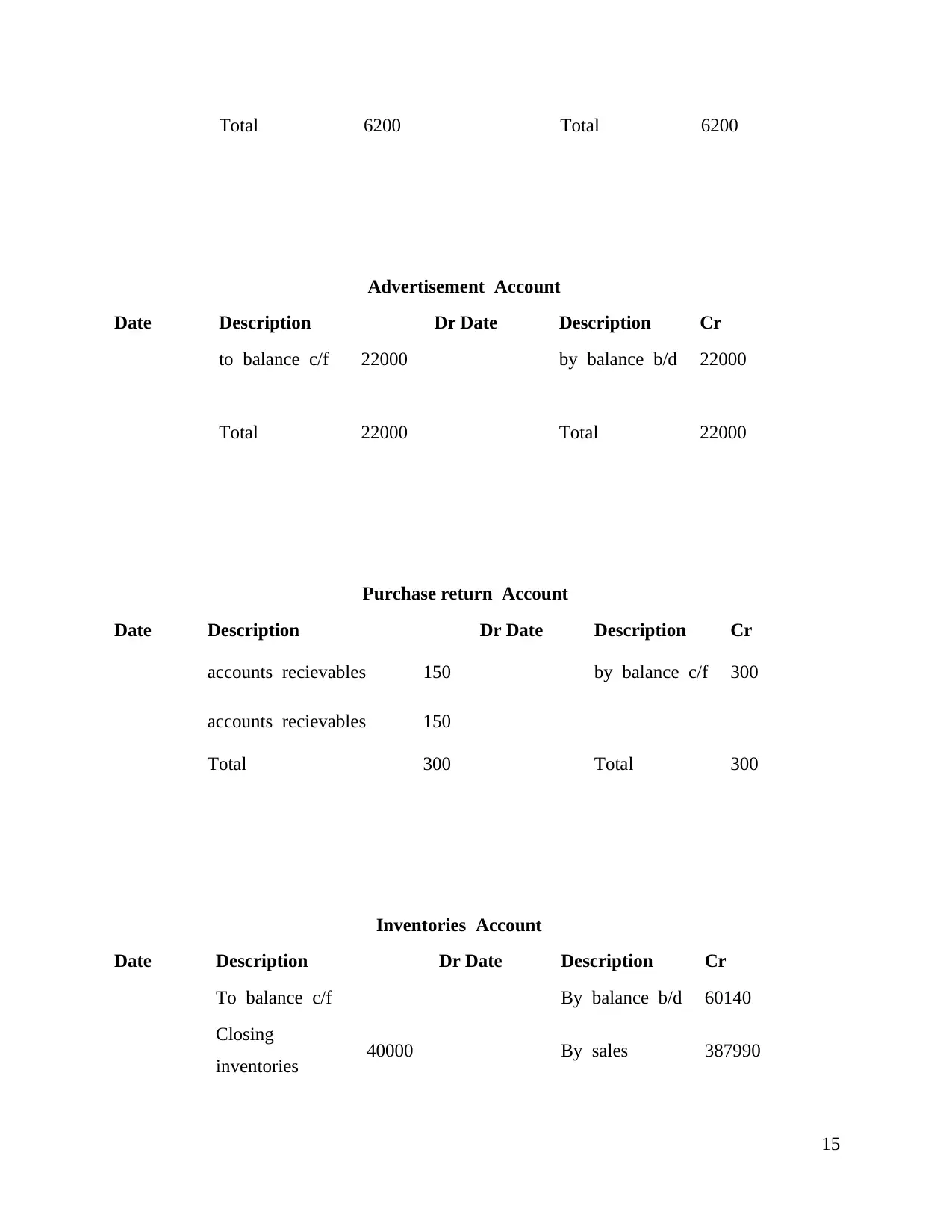

Total 6200 Total 6200

Advertisement Account

Date Description Dr Date Description Cr

to balance c/f 22000 by balance b/d 22000

Total 22000 Total 22000

Purchase return Account

Date Description Dr Date Description Cr

accounts recievables 150 by balance c/f 300

accounts recievables 150

Total 300 Total 300

Inventories Account

Date Description Dr Date Description Cr

To balance c/f By balance b/d 60140

Closing

inventories 40000 By sales 387990

15

Advertisement Account

Date Description Dr Date Description Cr

to balance c/f 22000 by balance b/d 22000

Total 22000 Total 22000

Purchase return Account

Date Description Dr Date Description Cr

accounts recievables 150 by balance c/f 300

accounts recievables 150

Total 300 Total 300

Inventories Account

Date Description Dr Date Description Cr

To balance c/f By balance b/d 60140

Closing

inventories 40000 By sales 387990

15

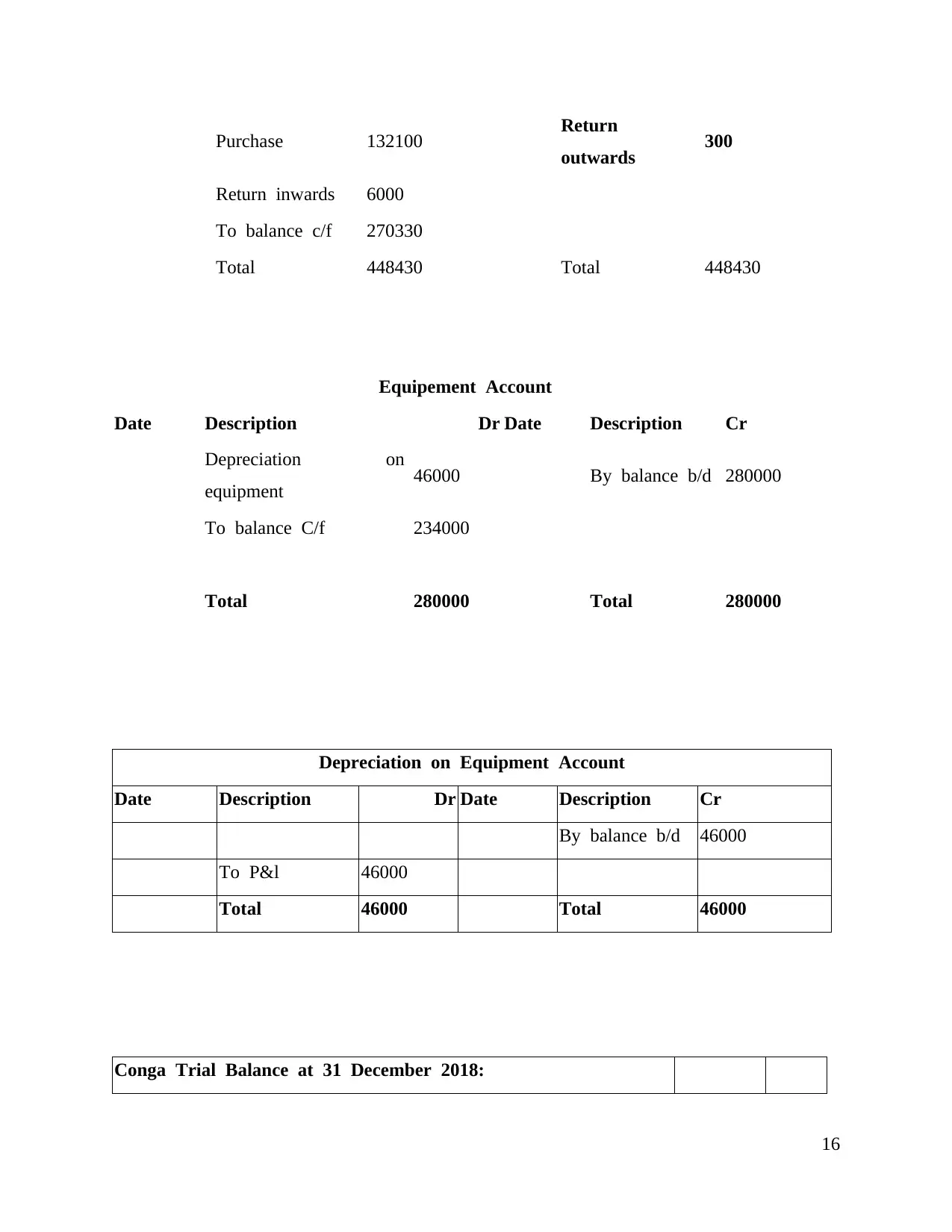

Purchase 132100 Return

outwards 300

Return inwards 6000

To balance c/f 270330

Total 448430 Total 448430

Equipement Account

Date Description Dr Date Description Cr

Depreciation on

equipment 46000 By balance b/d 280000

To balance C/f 234000

Total 280000 Total 280000

Depreciation on Equipment Account

Date Description Dr Date Description Cr

By balance b/d 46000

To P&l 46000

Total 46000 Total 46000

Conga Trial Balance at 31 December 2018:

16

outwards 300

Return inwards 6000

To balance c/f 270330

Total 448430 Total 448430

Equipement Account

Date Description Dr Date Description Cr

Depreciation on

equipment 46000 By balance b/d 280000

To balance C/f 234000

Total 280000 Total 280000

Depreciation on Equipment Account

Date Description Dr Date Description Cr

By balance b/d 46000

To P&l 46000

Total 46000 Total 46000

Conga Trial Balance at 31 December 2018:

16

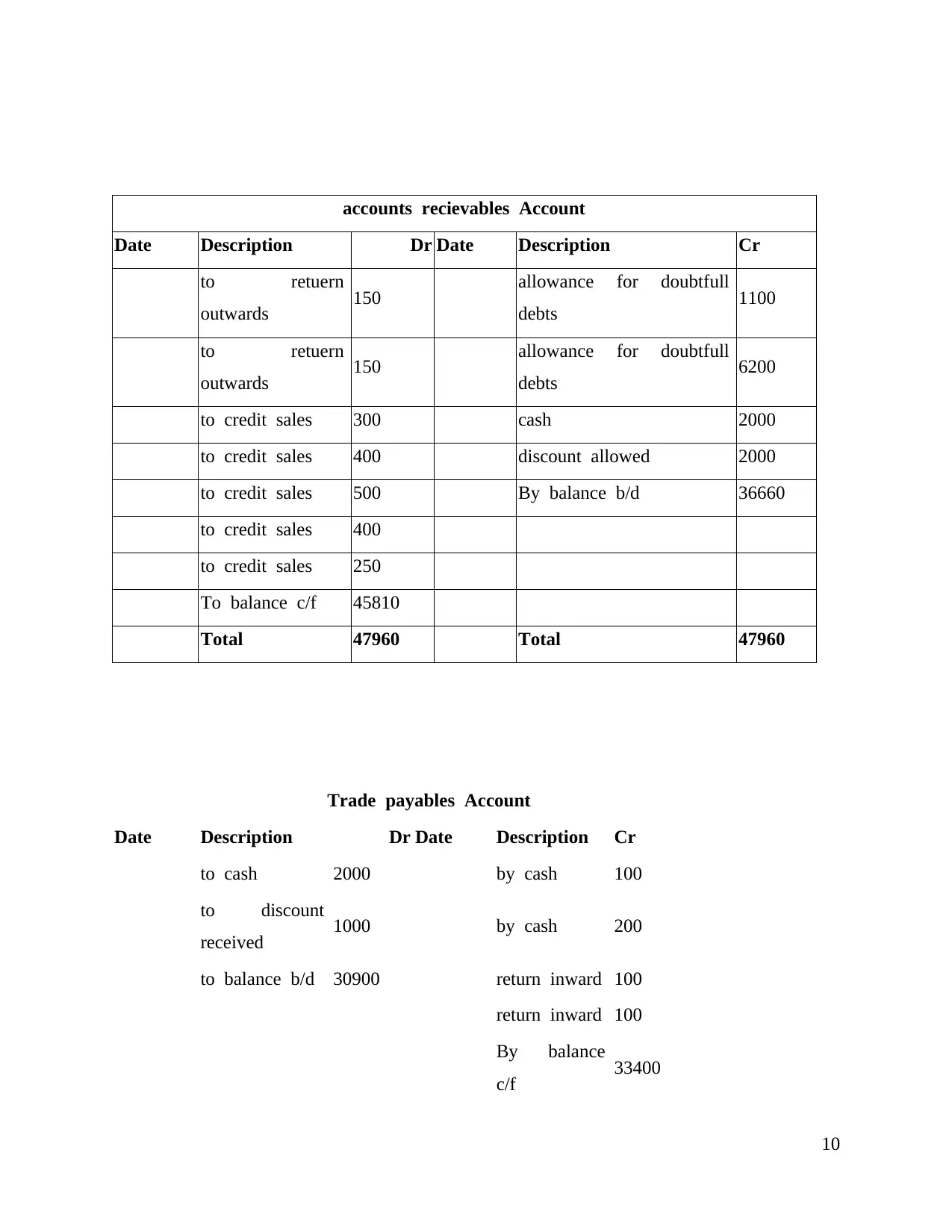

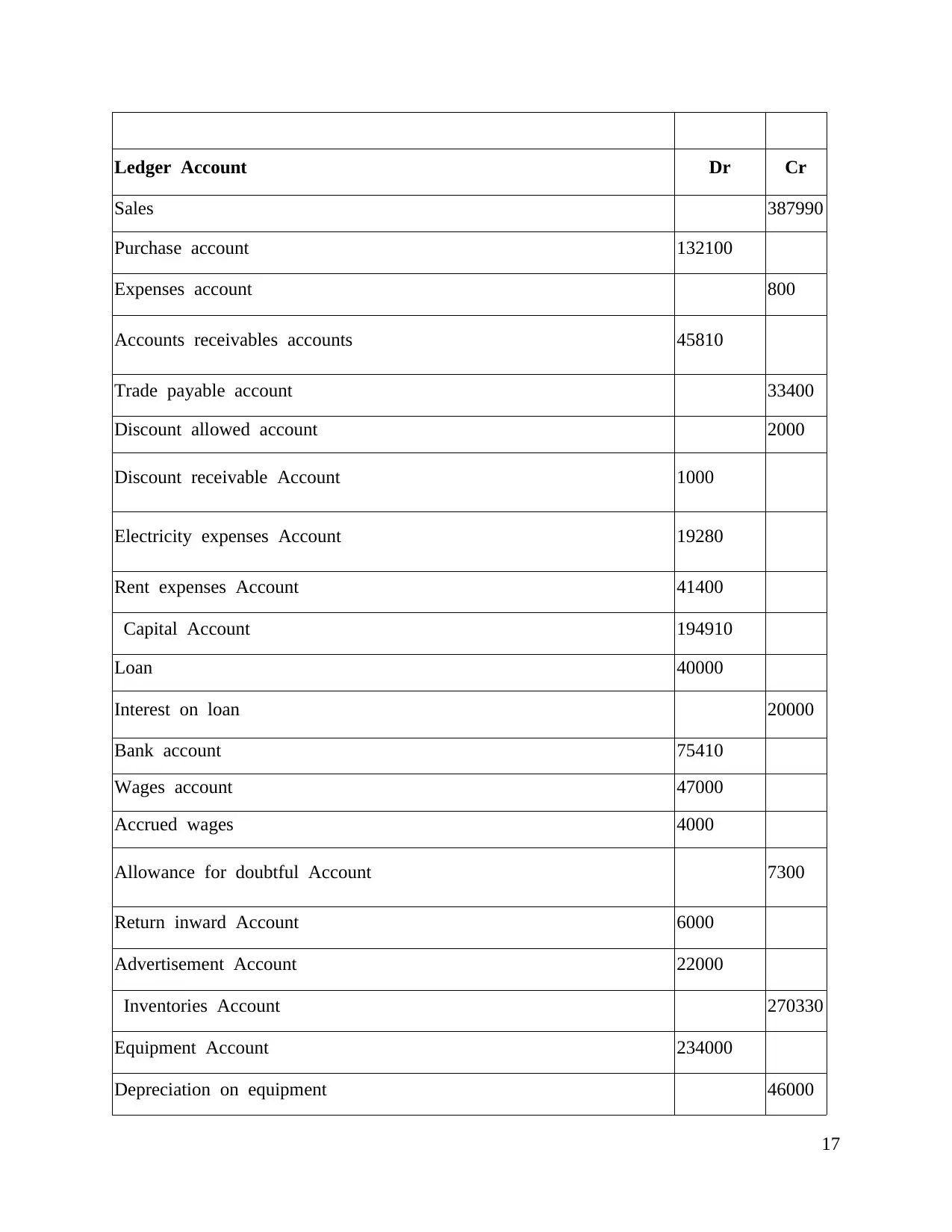

Ledger Account Dr Cr

Sales 387990

Purchase account 132100

Expenses account 800

Accounts receivables accounts 45810

Trade payable account 33400

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

Capital Account 194910

Loan 40000

Interest on loan 20000

Bank account 75410

Wages account 47000

Accrued wages 4000

Allowance for doubtful Account 7300

Return inward Account 6000

Advertisement Account 22000

Inventories Account 270330

Equipment Account 234000

Depreciation on equipment 46000

17

Sales 387990

Purchase account 132100

Expenses account 800

Accounts receivables accounts 45810

Trade payable account 33400

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

Capital Account 194910

Loan 40000

Interest on loan 20000

Bank account 75410

Wages account 47000

Accrued wages 4000

Allowance for doubtful Account 7300

Return inward Account 6000

Advertisement Account 22000

Inventories Account 270330

Equipment Account 234000

Depreciation on equipment 46000

17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

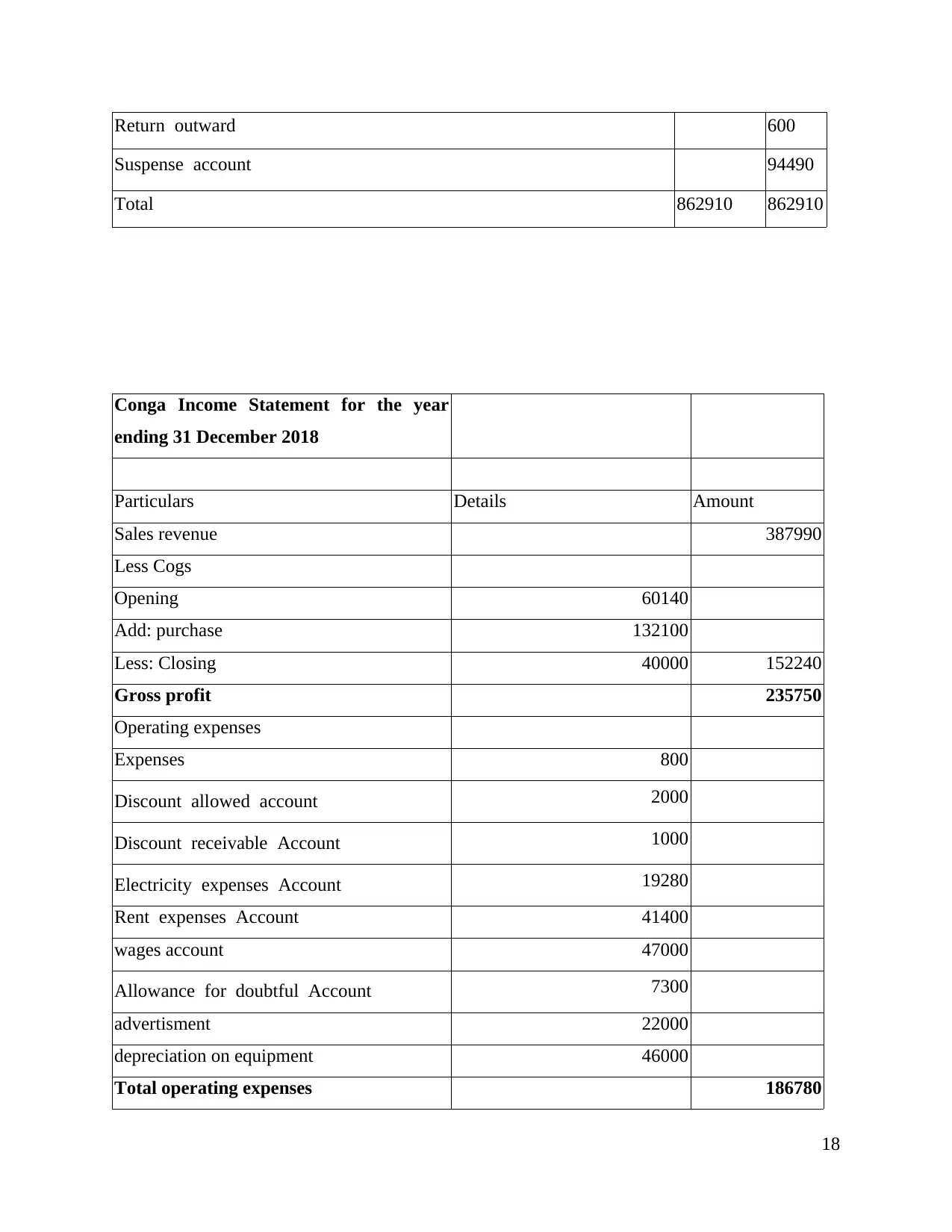

Return outward 600

Suspense account 94490

Total 862910 862910

Conga Income Statement for the year

ending 31 December 2018

Particulars Details Amount

Sales revenue 387990

Less Cogs

Opening 60140

Add: purchase 132100

Less: Closing 40000 152240

Gross profit 235750

Operating expenses

Expenses 800

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

wages account 47000

Allowance for doubtful Account 7300

advertisment 22000

depreciation on equipment 46000

Total operating expenses 186780

18

Suspense account 94490

Total 862910 862910

Conga Income Statement for the year

ending 31 December 2018

Particulars Details Amount

Sales revenue 387990

Less Cogs

Opening 60140

Add: purchase 132100

Less: Closing 40000 152240

Gross profit 235750

Operating expenses

Expenses 800

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

wages account 47000

Allowance for doubtful Account 7300

advertisment 22000

depreciation on equipment 46000

Total operating expenses 186780

18

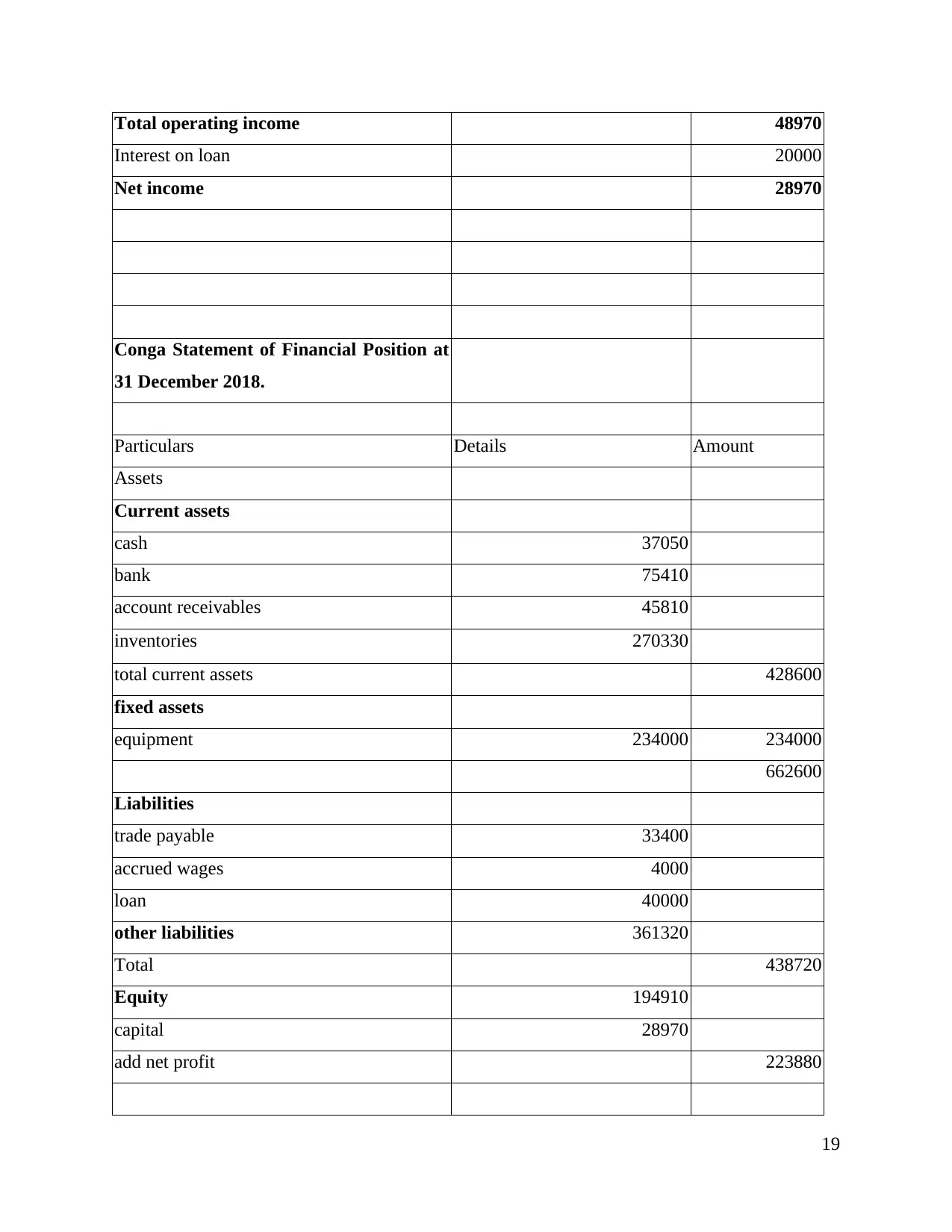

Total operating income 48970

Interest on loan 20000

Net income 28970

Conga Statement of Financial Position at

31 December 2018.

Particulars Details Amount

Assets

Current assets

cash 37050

bank 75410

account receivables 45810

inventories 270330

total current assets 428600

fixed assets

equipment 234000 234000

662600

Liabilities

trade payable 33400

accrued wages 4000

loan 40000

other liabilities 361320

Total 438720

Equity 194910

capital 28970

add net profit 223880

19

Interest on loan 20000

Net income 28970

Conga Statement of Financial Position at

31 December 2018.

Particulars Details Amount

Assets

Current assets

cash 37050

bank 75410

account receivables 45810

inventories 270330

total current assets 428600

fixed assets

equipment 234000 234000

662600

Liabilities

trade payable 33400

accrued wages 4000

loan 40000

other liabilities 361320

Total 438720

Equity 194910

capital 28970

add net profit 223880

19

662600

2- Prudent concept and Accrual concept

Prudent concept – It is a significant accounting principle which is useful for effective judgement

while manager adapting accounting policies of the company. Sometimes Conga company

business transactions are uncertain then company follows this concept. Prudent concept describe

that company must record all expenses and losses as soon as possible but all revenue and assets

records in the books of accounts on the time of realised (Basu,Ma and Tran, 2018). This concept

helps to provide better and realistic position of the company and all profits are not anticipated

over the expenses, losses and liability. This concept also known conservative concept of

accounting. By using this concept Conga company get all accurate information which is useful

for preparing financial statement. Conga Company should never underestimate the expenses and

liability such as wages, rent , depreciation , trade payable electricity expenses , loans that would

helps in minimising the losses, liability and financial risk of the Conga company. Accountant

should never overstate profits like trade receivable ,bank balance and net profits of the company.

Further reason for adopting this concept because it records all losses as soon possible that help to

company for preparing meet out the obligations that will improve financial position of the

company and enhance market share, profitability of the company. Conga company evaluate

performance of the company that helps to take decision and making polices for accomplish goals

and objective of the company (Robinson and et.al., 2015).

Accrual concept - Conga company adapt accounting concept of the accounting that refers to all

revenues and income record when they are realised, not to be recorded on the time of receive in

cash. All losses and expenses record when they are incurred , not on the time of paid in cash

form. Accrual concept is important because it over all impact on income statement and balance

sheet that is used to depict liabilities and company non cash assets. It is scientific tool which is

used to compare to cash basis. This concept is also known as matching concept because it

focuses on all expenses and revenue match in the end of accounting period. Conga company

keeps all trade receivable and trade payable over a particular time period that helps to make all

payment and reducing the liabilities. Company can ascertain about the future growth and

opportunities by ensuring the best policies and optimise use of scare resources like human

20

2- Prudent concept and Accrual concept

Prudent concept – It is a significant accounting principle which is useful for effective judgement

while manager adapting accounting policies of the company. Sometimes Conga company

business transactions are uncertain then company follows this concept. Prudent concept describe

that company must record all expenses and losses as soon as possible but all revenue and assets

records in the books of accounts on the time of realised (Basu,Ma and Tran, 2018). This concept

helps to provide better and realistic position of the company and all profits are not anticipated

over the expenses, losses and liability. This concept also known conservative concept of

accounting. By using this concept Conga company get all accurate information which is useful

for preparing financial statement. Conga Company should never underestimate the expenses and

liability such as wages, rent , depreciation , trade payable electricity expenses , loans that would

helps in minimising the losses, liability and financial risk of the Conga company. Accountant

should never overstate profits like trade receivable ,bank balance and net profits of the company.

Further reason for adopting this concept because it records all losses as soon possible that help to

company for preparing meet out the obligations that will improve financial position of the

company and enhance market share, profitability of the company. Conga company evaluate

performance of the company that helps to take decision and making polices for accomplish goals

and objective of the company (Robinson and et.al., 2015).

Accrual concept - Conga company adapt accounting concept of the accounting that refers to all

revenues and income record when they are realised, not to be recorded on the time of receive in

cash. All losses and expenses record when they are incurred , not on the time of paid in cash

form. Accrual concept is important because it over all impact on income statement and balance

sheet that is used to depict liabilities and company non cash assets. It is scientific tool which is

used to compare to cash basis. This concept is also known as matching concept because it

focuses on all expenses and revenue match in the end of accounting period. Conga company

keeps all trade receivable and trade payable over a particular time period that helps to make all

payment and reducing the liabilities. Company can ascertain about the future growth and

opportunities by ensuring the best policies and optimise use of scare resources like human

20

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

resources, capital etc. company reduce all operating losses from the profits and receivable for

calculating net profit (Demmer, Pronobis, and Yohn, 2018). It recognises surplus amount and

deficit amount of the company that helps to analysis that they have sufficient profits for meet out

its short term liabilities and long term liabilities. Further it evaluates performance that will helps

to enhance profitability and growth. Manager of the Conga company effectively and efficient

communicate accurate all financial information to its end users that helps to increase in sales

sand reduce expenditure.

3- In future the government might require VAT on sales then VAT would be recorded in Conga

accounting and report

Value added tax is indirect tax which lived on sales of goods and services provided by registered

company (Senteney, Stowe and Stowe, 2019). VAT is consumption based tax because indirectly

buyers are responsible to pay tax. Sellers collect tax from buyers to pay UK government.

Regulations regarding Value added tax-

UK government decide standard tax rate recently it is 20% which is applied on purchase

of product. Government can change standard tax according to economy and their

priorities. This rate is applied on such product like alcoholic drink, chocolate , cloths and

footwear etc.

Second is reduce tax recently it is 5% which is apply on products like energy saving

material , smoking products , gas , electricity , heating oil etc.

Third is zero rate which is decided by UK government this rate is applied on necessary

goods like food, books , children's cloths etc and this rate is recorded in value added

return (Schenk, Thuronyi and Cui, 2015).

Forth is exempted which is applied to cultural events, financial services , funeral plan

insurance , postage stamp and sports activities. This does not count in sales taxable

turnover and business can voluntary registered for value added tax.

Company have turnover more than 85000 pound then registered company have to pay

value added tax to government.

Business collect tax from its customers then pay to HM revenue and customers When

they file value added tax record.

Value added tax return usually due every months.

21

calculating net profit (Demmer, Pronobis, and Yohn, 2018). It recognises surplus amount and

deficit amount of the company that helps to analysis that they have sufficient profits for meet out

its short term liabilities and long term liabilities. Further it evaluates performance that will helps

to enhance profitability and growth. Manager of the Conga company effectively and efficient

communicate accurate all financial information to its end users that helps to increase in sales

sand reduce expenditure.

3- In future the government might require VAT on sales then VAT would be recorded in Conga

accounting and report

Value added tax is indirect tax which lived on sales of goods and services provided by registered

company (Senteney, Stowe and Stowe, 2019). VAT is consumption based tax because indirectly

buyers are responsible to pay tax. Sellers collect tax from buyers to pay UK government.

Regulations regarding Value added tax-

UK government decide standard tax rate recently it is 20% which is applied on purchase

of product. Government can change standard tax according to economy and their

priorities. This rate is applied on such product like alcoholic drink, chocolate , cloths and

footwear etc.

Second is reduce tax recently it is 5% which is apply on products like energy saving

material , smoking products , gas , electricity , heating oil etc.

Third is zero rate which is decided by UK government this rate is applied on necessary

goods like food, books , children's cloths etc and this rate is recorded in value added

return (Schenk, Thuronyi and Cui, 2015).

Forth is exempted which is applied to cultural events, financial services , funeral plan

insurance , postage stamp and sports activities. This does not count in sales taxable

turnover and business can voluntary registered for value added tax.

Company have turnover more than 85000 pound then registered company have to pay

value added tax to government.

Business collect tax from its customers then pay to HM revenue and customers When

they file value added tax record.

Value added tax return usually due every months.

21

Faster Payment to be done in the mode of debit card , BACS and other mode when HM

revenue and custom accept value added tax payment (Edmonds, Smith and Stallings,

2018).

Invoice must be clear and record all information such as invoice number , date , name of

the buyer and sellers , value added tax registration number , amount , quantity , discount

amount (Imhof, Seavey and Watanabe, 2018).

Inclusive price of value added tax to be calculated by

value added tax standard rate is 20 % multiply by price then exclude value added tax by 1.2.

value added tax reducing rate is 5% multiply by price then excluded value added tax by 1.05.

company also calculate exclusive price -

price excluded standard rate that is 20% divided by price including value added tax rate by 1.2

price excluded reducing rate of value added tax divided by including value added tax by 1.05.

When person give gift which value is less than 50 within twelve months then value

added tax will not chargeable.

Conga company's selling is more than 8500 pound so that company is liable to pay tax to

government (Majeed, Yan and Tauni, 2018). As per UK regulations of value added tax Reduce

rate of value added tax to be charged because Conga company have toy business. If company

pay tax then it will helps to generate constant revenue on low tax rate of value added tax and it

is benefit for growth of the country.

CONCLUSION

Financial accounting report concluded accounting and preparation of financial accounting is

important because it represents financial position of the company. It is useful to manager ,

investors, customers get all information which helps to take decision of investments. This report

also concluded that company have to adapt accounting concept like prudent concept and accrual

concept for preparing the financial statement. By analysing financial statement manager can take

decision to achieve short term goals and long term goals of the company. Further report

described payment of value added tax is mandatory to all registered business whose sale is more

than prescribe limit it helps to enhance business revenue and sales . Ultimately value added tax

pay to government which is important for economy and business.

22

revenue and custom accept value added tax payment (Edmonds, Smith and Stallings,

2018).

Invoice must be clear and record all information such as invoice number , date , name of

the buyer and sellers , value added tax registration number , amount , quantity , discount

amount (Imhof, Seavey and Watanabe, 2018).

Inclusive price of value added tax to be calculated by

value added tax standard rate is 20 % multiply by price then exclude value added tax by 1.2.

value added tax reducing rate is 5% multiply by price then excluded value added tax by 1.05.

company also calculate exclusive price -

price excluded standard rate that is 20% divided by price including value added tax rate by 1.2

price excluded reducing rate of value added tax divided by including value added tax by 1.05.

When person give gift which value is less than 50 within twelve months then value

added tax will not chargeable.

Conga company's selling is more than 8500 pound so that company is liable to pay tax to

government (Majeed, Yan and Tauni, 2018). As per UK regulations of value added tax Reduce

rate of value added tax to be charged because Conga company have toy business. If company

pay tax then it will helps to generate constant revenue on low tax rate of value added tax and it

is benefit for growth of the country.

CONCLUSION

Financial accounting report concluded accounting and preparation of financial accounting is

important because it represents financial position of the company. It is useful to manager ,

investors, customers get all information which helps to take decision of investments. This report

also concluded that company have to adapt accounting concept like prudent concept and accrual

concept for preparing the financial statement. By analysing financial statement manager can take

decision to achieve short term goals and long term goals of the company. Further report

described payment of value added tax is mandatory to all registered business whose sale is more

than prescribe limit it helps to enhance business revenue and sales . Ultimately value added tax

pay to government which is important for economy and business.

22

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.