Recording Sales on Value Added Tax

VerifiedAdded on 2020/11/12

|18

|4089

|252

AI Summary

This assignment discusses the importance of recording sales on value added tax (VAT) in a company's accounting. It explains that VAT is a type of consumption tax levied on each stage of the supply chain, from production to sales. The assignment highlights three bookkeeping accounts needed for recording VAT: VAT on Input, VAT on Transactions, and VAT Debit and Credit. It emphasizes the need for accurate reporting and compliance with government regulations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

THE ACCOUNTING RECORDS AND FINANCIAL STATEMENTS FOR CONGA

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

QUESTION.........................................................................................................................................3

Prepare the accounting records and financial statements for Conga, a sole trader toy retailer business, as

explained overleaf........................................................................................................................3

Explain the prudence concept and accruals (matching) concept......................................................17

3. Explanation on recording of sales on value added tax................................................................18

REFERENCES...................................................................................................................................19

QUESTION.........................................................................................................................................3

Prepare the accounting records and financial statements for Conga, a sole trader toy retailer business, as

explained overleaf........................................................................................................................3

Explain the prudence concept and accruals (matching) concept......................................................17

3. Explanation on recording of sales on value added tax................................................................18

REFERENCES...................................................................................................................................19

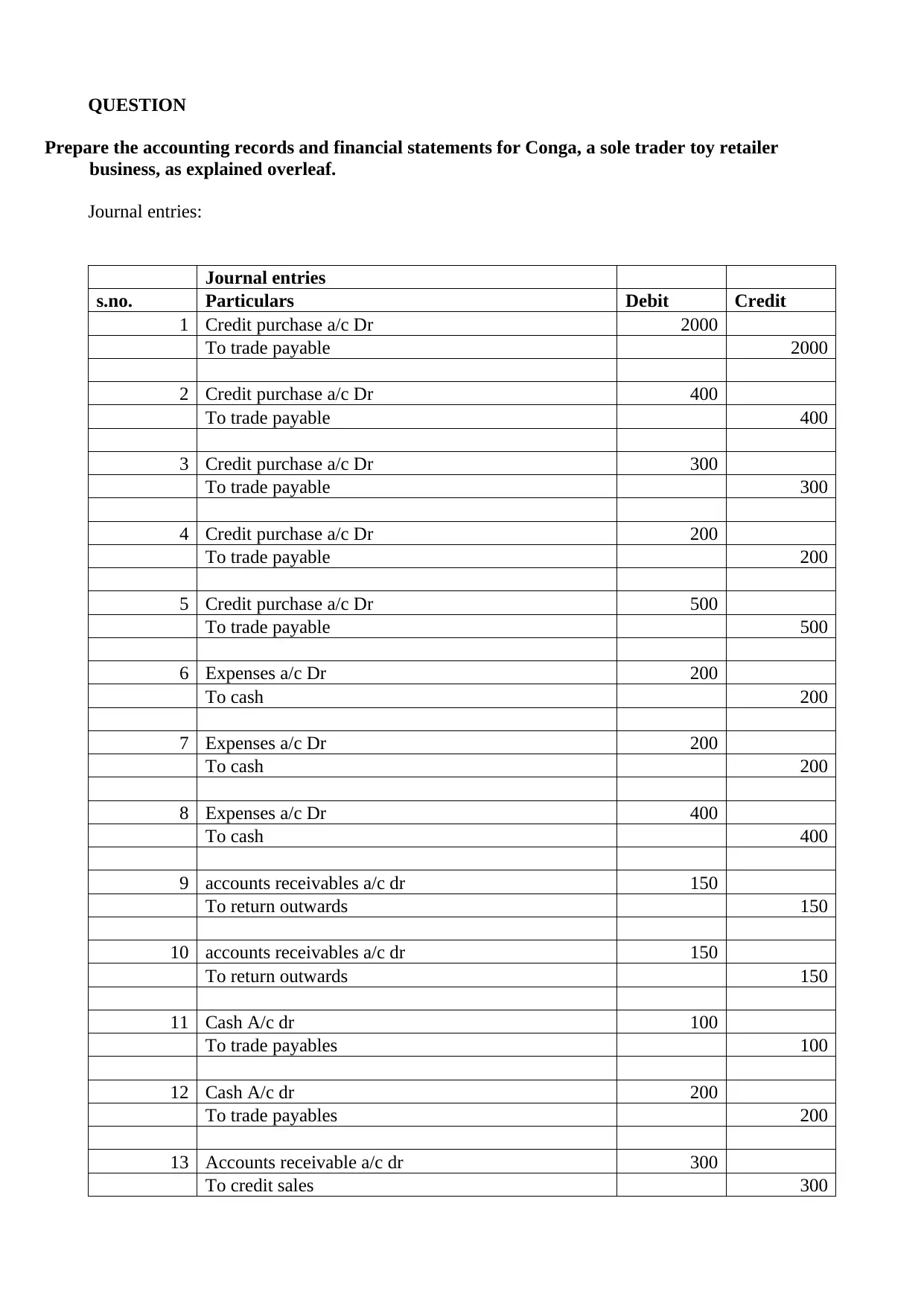

QUESTION

Prepare the accounting records and financial statements for Conga, a sole trader toy retailer

business, as explained overleaf.

Journal entries:

Journal entries

s.no. Particulars Debit Credit

1 Credit purchase a/c Dr 2000

To trade payable 2000

2 Credit purchase a/c Dr 400

To trade payable 400

3 Credit purchase a/c Dr 300

To trade payable 300

4 Credit purchase a/c Dr 200

To trade payable 200

5 Credit purchase a/c Dr 500

To trade payable 500

6 Expenses a/c Dr 200

To cash 200

7 Expenses a/c Dr 200

To cash 200

8 Expenses a/c Dr 400

To cash 400

9 accounts receivables a/c dr 150

To return outwards 150

10 accounts receivables a/c dr 150

To return outwards 150

11 Cash A/c dr 100

To trade payables 100

12 Cash A/c dr 200

To trade payables 200

13 Accounts receivable a/c dr 300

To credit sales 300

Prepare the accounting records and financial statements for Conga, a sole trader toy retailer

business, as explained overleaf.

Journal entries:

Journal entries

s.no. Particulars Debit Credit

1 Credit purchase a/c Dr 2000

To trade payable 2000

2 Credit purchase a/c Dr 400

To trade payable 400

3 Credit purchase a/c Dr 300

To trade payable 300

4 Credit purchase a/c Dr 200

To trade payable 200

5 Credit purchase a/c Dr 500

To trade payable 500

6 Expenses a/c Dr 200

To cash 200

7 Expenses a/c Dr 200

To cash 200

8 Expenses a/c Dr 400

To cash 400

9 accounts receivables a/c dr 150

To return outwards 150

10 accounts receivables a/c dr 150

To return outwards 150

11 Cash A/c dr 100

To trade payables 100

12 Cash A/c dr 200

To trade payables 200

13 Accounts receivable a/c dr 300

To credit sales 300

14 Accounts receivable a/c dr 400

To credit sales 400

15 Accounts receivable a/c dr 500

To credit sales 500

16 Accounts receivable a/c dr 400

To credit sales 400

17 Accounts receivable a/c dr 250

To credit sales 250

18 Cash a/c dr 150

To sales 150

19 Cash a/c dr 150

To sales 150

20 Cash a/c dr 250

To sales 250

21 Return inwards ac/dr 100

To trade payables 100

22 Return inwards ac/dr 100

To trade payables 100

23 Allowance for doubtful accounts DR. 1100

to accounts receivables 1100

(3% of accounts receivables are allowance for

doubtful debts)

24 Allowance for doubtful accounts DR. 6200

to accounts receivables 6200

25 Cash a/c dr 2000

Discount a/c dr 2000

to accounts receivables 4000

26 Trade payable account dr 3000

To cash a/c 2000

To discount receivable a/c 1000

27 Electricity expenses a/c dr 3000

To cash 3000

28 Rent expenses a/c dr. 5000

To credit sales 400

15 Accounts receivable a/c dr 500

To credit sales 500

16 Accounts receivable a/c dr 400

To credit sales 400

17 Accounts receivable a/c dr 250

To credit sales 250

18 Cash a/c dr 150

To sales 150

19 Cash a/c dr 150

To sales 150

20 Cash a/c dr 250

To sales 250

21 Return inwards ac/dr 100

To trade payables 100

22 Return inwards ac/dr 100

To trade payables 100

23 Allowance for doubtful accounts DR. 1100

to accounts receivables 1100

(3% of accounts receivables are allowance for

doubtful debts)

24 Allowance for doubtful accounts DR. 6200

to accounts receivables 6200

25 Cash a/c dr 2000

Discount a/c dr 2000

to accounts receivables 4000

26 Trade payable account dr 3000

To cash a/c 2000

To discount receivable a/c 1000

27 Electricity expenses a/c dr 3000

To cash 3000

28 Rent expenses a/c dr. 5000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

To cash 5000

29 Cash a/c dr 45000

To capital 45000

30 Loan account DR 40000

Interest a/c dr 20000

To bank account 60000

31 Wages a/c dr 4000

To accrued wages 4000

Total 138700 138700

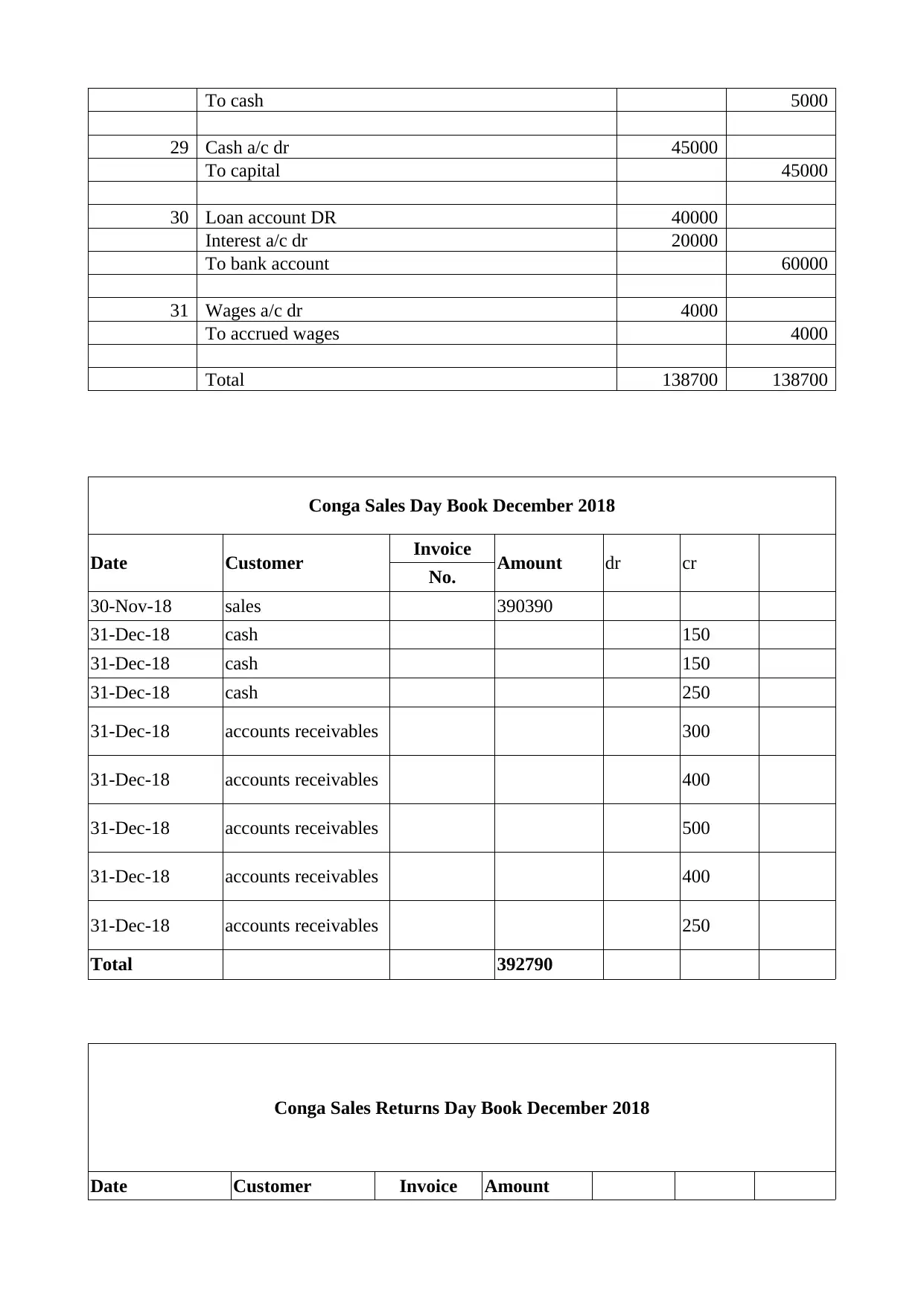

Conga Sales Day Book December 2018

Date Customer Invoice Amount dr cr

No.

30-Nov-18 sales 390390

31-Dec-18 cash 150

31-Dec-18 cash 150

31-Dec-18 cash 250

31-Dec-18 accounts receivables 300

31-Dec-18 accounts receivables 400

31-Dec-18 accounts receivables 500

31-Dec-18 accounts receivables 400

31-Dec-18 accounts receivables 250

Total 392790

Conga Sales Returns Day Book December 2018

Date Customer Invoice Amount

29 Cash a/c dr 45000

To capital 45000

30 Loan account DR 40000

Interest a/c dr 20000

To bank account 60000

31 Wages a/c dr 4000

To accrued wages 4000

Total 138700 138700

Conga Sales Day Book December 2018

Date Customer Invoice Amount dr cr

No.

30-Nov-18 sales 390390

31-Dec-18 cash 150

31-Dec-18 cash 150

31-Dec-18 cash 250

31-Dec-18 accounts receivables 300

31-Dec-18 accounts receivables 400

31-Dec-18 accounts receivables 500

31-Dec-18 accounts receivables 400

31-Dec-18 accounts receivables 250

Total 392790

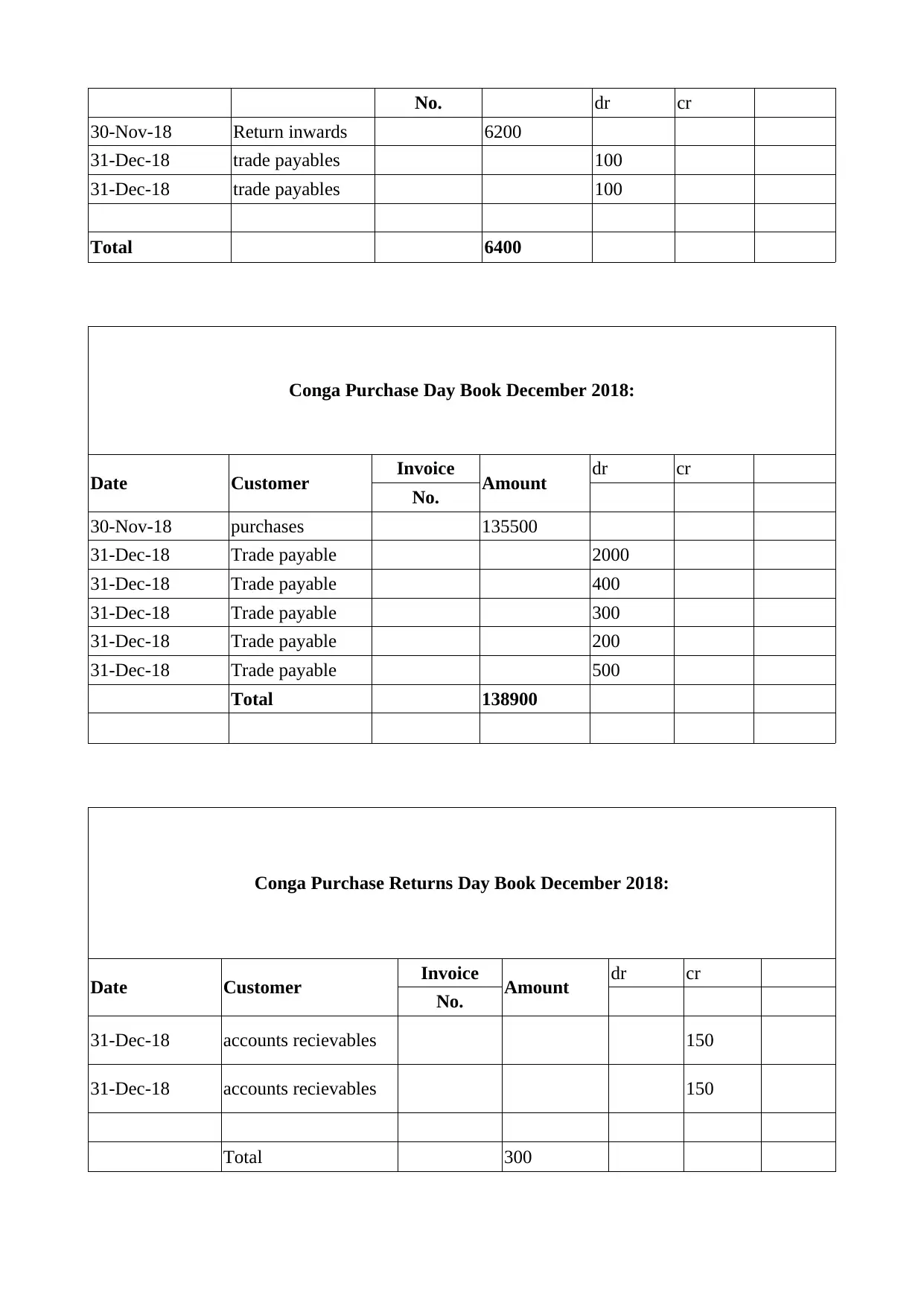

Conga Sales Returns Day Book December 2018

Date Customer Invoice Amount

No. dr cr

30-Nov-18 Return inwards 6200

31-Dec-18 trade payables 100

31-Dec-18 trade payables 100

Total 6400

Conga Purchase Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

30-Nov-18 purchases 135500

31-Dec-18 Trade payable 2000

31-Dec-18 Trade payable 400

31-Dec-18 Trade payable 300

31-Dec-18 Trade payable 200

31-Dec-18 Trade payable 500

Total 138900

Conga Purchase Returns Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

31-Dec-18 accounts recievables 150

31-Dec-18 accounts recievables 150

Total 300

30-Nov-18 Return inwards 6200

31-Dec-18 trade payables 100

31-Dec-18 trade payables 100

Total 6400

Conga Purchase Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

30-Nov-18 purchases 135500

31-Dec-18 Trade payable 2000

31-Dec-18 Trade payable 400

31-Dec-18 Trade payable 300

31-Dec-18 Trade payable 200

31-Dec-18 Trade payable 500

Total 138900

Conga Purchase Returns Day Book December 2018:

Date Customer Invoice Amount dr cr

No.

31-Dec-18 accounts recievables 150

31-Dec-18 accounts recievables 150

Total 300

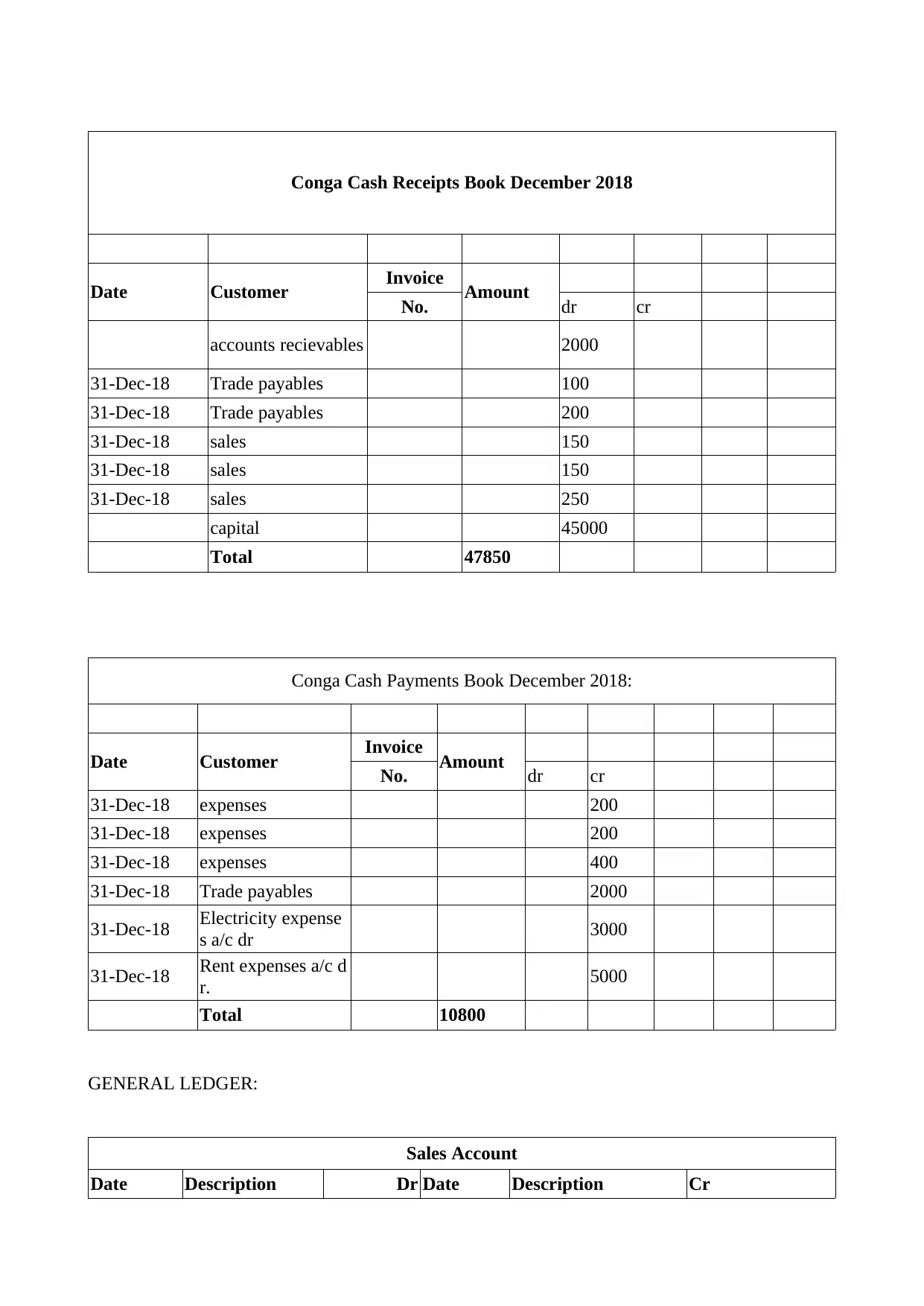

Conga Cash Receipts Book December 2018

Date Customer Invoice Amount

No. dr cr

accounts recievables 2000

31-Dec-18 Trade payables 100

31-Dec-18 Trade payables 200

31-Dec-18 sales 150

31-Dec-18 sales 150

31-Dec-18 sales 250

capital 45000

Total 47850

Conga Cash Payments Book December 2018:

Date Customer Invoice Amount

No. dr cr

31-Dec-18 expenses 200

31-Dec-18 expenses 200

31-Dec-18 expenses 400

31-Dec-18 Trade payables 2000

31-Dec-18 Electricity expense

s a/c dr 3000

31-Dec-18 Rent expenses a/c d

r. 5000

Total 10800

GENERAL LEDGER:

Sales Account

Date Description Dr Date Description Cr

Date Customer Invoice Amount

No. dr cr

accounts recievables 2000

31-Dec-18 Trade payables 100

31-Dec-18 Trade payables 200

31-Dec-18 sales 150

31-Dec-18 sales 150

31-Dec-18 sales 250

capital 45000

Total 47850

Conga Cash Payments Book December 2018:

Date Customer Invoice Amount

No. dr cr

31-Dec-18 expenses 200

31-Dec-18 expenses 200

31-Dec-18 expenses 400

31-Dec-18 Trade payables 2000

31-Dec-18 Electricity expense

s a/c dr 3000

31-Dec-18 Rent expenses a/c d

r. 5000

Total 10800

GENERAL LEDGER:

Sales Account

Date Description Dr Date Description Cr

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

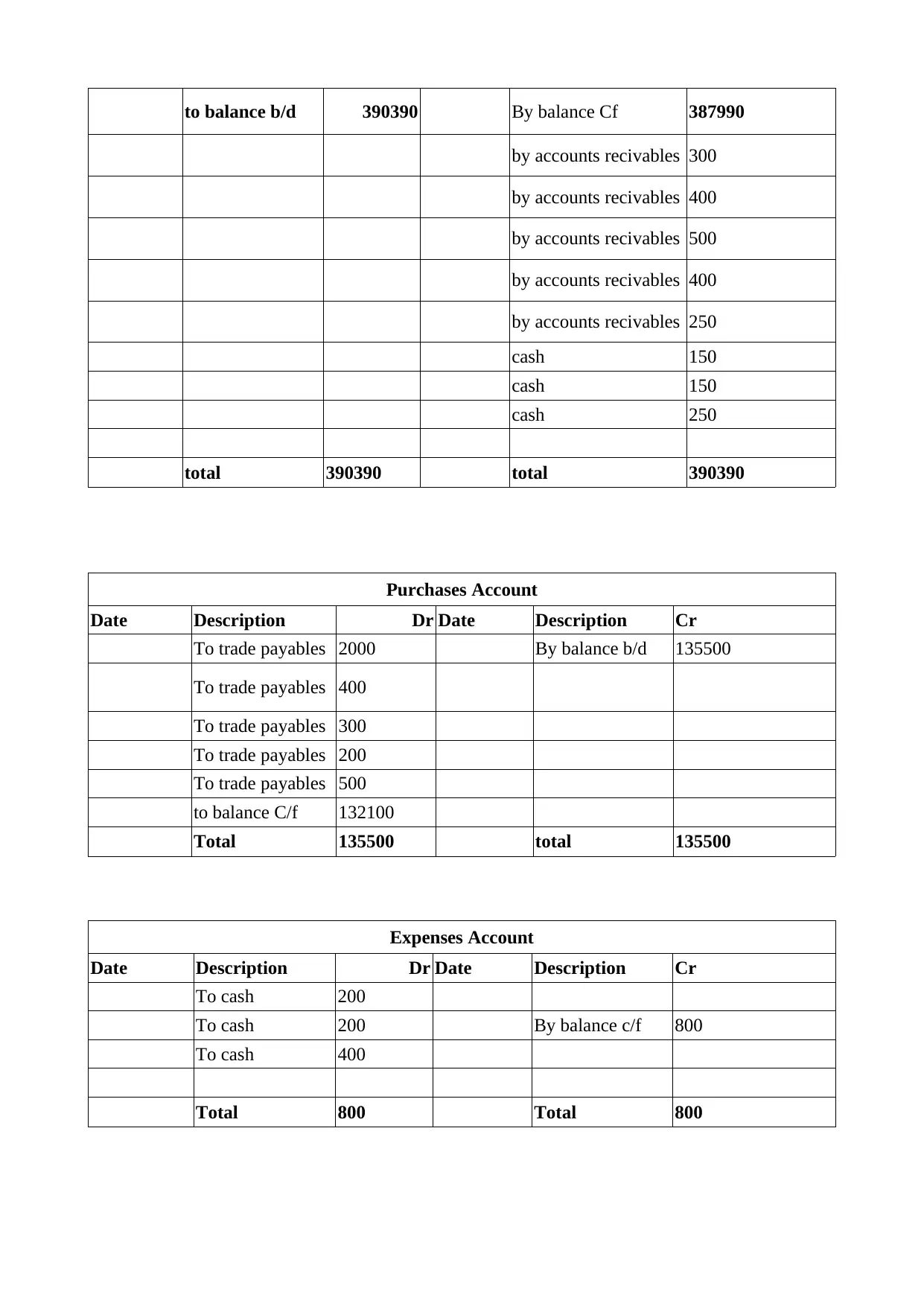

to balance b/d 390390 By balance Cf 387990

by accounts recivables 300

by accounts recivables 400

by accounts recivables 500

by accounts recivables 400

by accounts recivables 250

cash 150

cash 150

cash 250

total 390390 total 390390

Purchases Account

Date Description Dr Date Description Cr

To trade payables 2000 By balance b/d 135500

To trade payables 400

To trade payables 300

To trade payables 200

To trade payables 500

to balance C/f 132100

Total 135500 total 135500

Expenses Account

Date Description Dr Date Description Cr

To cash 200

To cash 200 By balance c/f 800

To cash 400

Total 800 Total 800

by accounts recivables 300

by accounts recivables 400

by accounts recivables 500

by accounts recivables 400

by accounts recivables 250

cash 150

cash 150

cash 250

total 390390 total 390390

Purchases Account

Date Description Dr Date Description Cr

To trade payables 2000 By balance b/d 135500

To trade payables 400

To trade payables 300

To trade payables 200

To trade payables 500

to balance C/f 132100

Total 135500 total 135500

Expenses Account

Date Description Dr Date Description Cr

To cash 200

To cash 200 By balance c/f 800

To cash 400

Total 800 Total 800

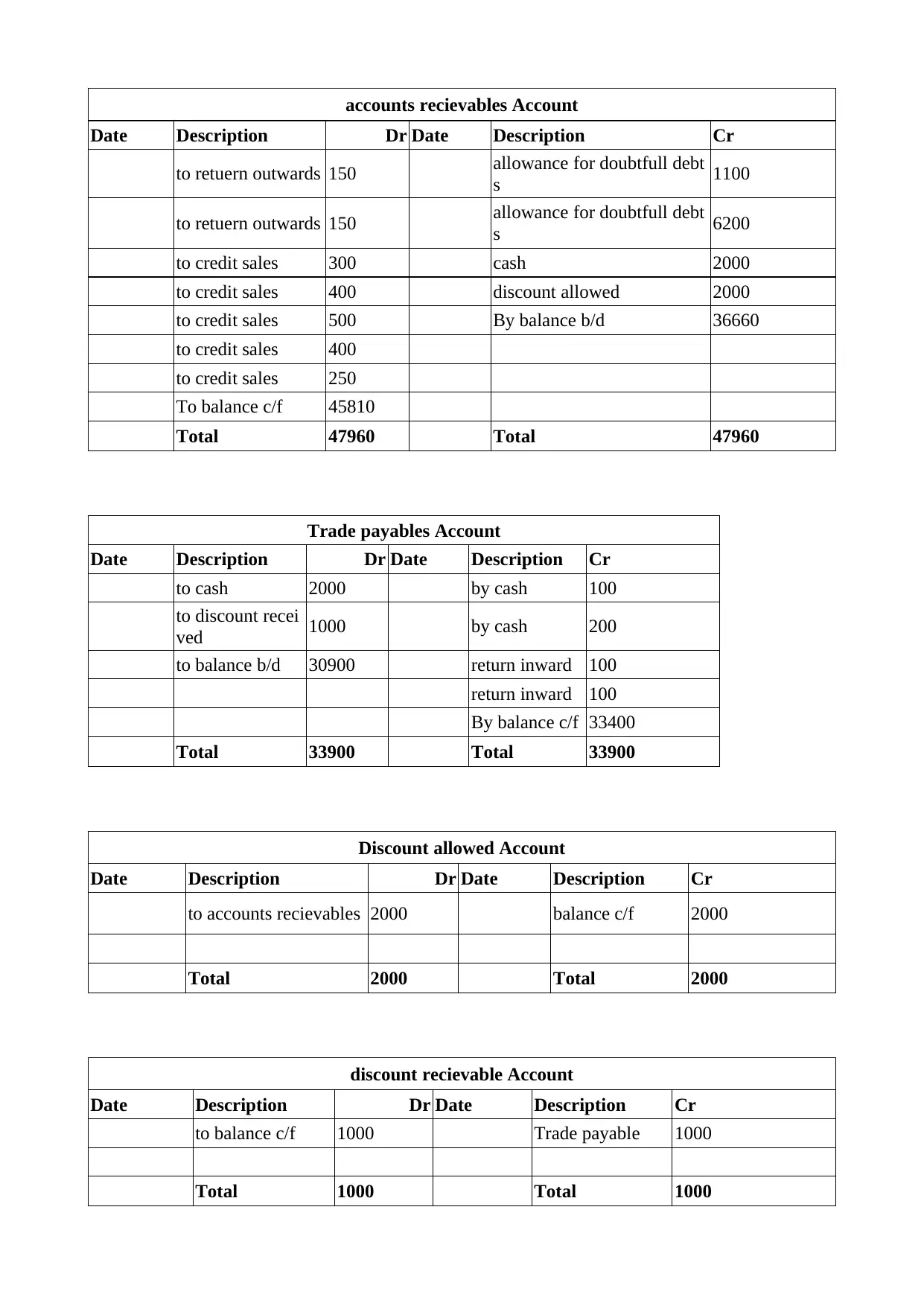

accounts recievables Account

Date Description Dr Date Description Cr

to retuern outwards 150 allowance for doubtfull debt

s 1100

to retuern outwards 150 allowance for doubtfull debt

s 6200

to credit sales 300 cash 2000

to credit sales 400 discount allowed 2000

to credit sales 500 By balance b/d 36660

to credit sales 400

to credit sales 250

To balance c/f 45810

Total 47960 Total 47960

Trade payables Account

Date Description Dr Date Description Cr

to cash 2000 by cash 100

to discount recei

ved 1000 by cash 200

to balance b/d 30900 return inward 100

return inward 100

By balance c/f 33400

Total 33900 Total 33900

Discount allowed Account

Date Description Dr Date Description Cr

to accounts recievables 2000 balance c/f 2000

Total 2000 Total 2000

discount recievable Account

Date Description Dr Date Description Cr

to balance c/f 1000 Trade payable 1000

Total 1000 Total 1000

Date Description Dr Date Description Cr

to retuern outwards 150 allowance for doubtfull debt

s 1100

to retuern outwards 150 allowance for doubtfull debt

s 6200

to credit sales 300 cash 2000

to credit sales 400 discount allowed 2000

to credit sales 500 By balance b/d 36660

to credit sales 400

to credit sales 250

To balance c/f 45810

Total 47960 Total 47960

Trade payables Account

Date Description Dr Date Description Cr

to cash 2000 by cash 100

to discount recei

ved 1000 by cash 200

to balance b/d 30900 return inward 100

return inward 100

By balance c/f 33400

Total 33900 Total 33900

Discount allowed Account

Date Description Dr Date Description Cr

to accounts recievables 2000 balance c/f 2000

Total 2000 Total 2000

discount recievable Account

Date Description Dr Date Description Cr

to balance c/f 1000 Trade payable 1000

Total 1000 Total 1000

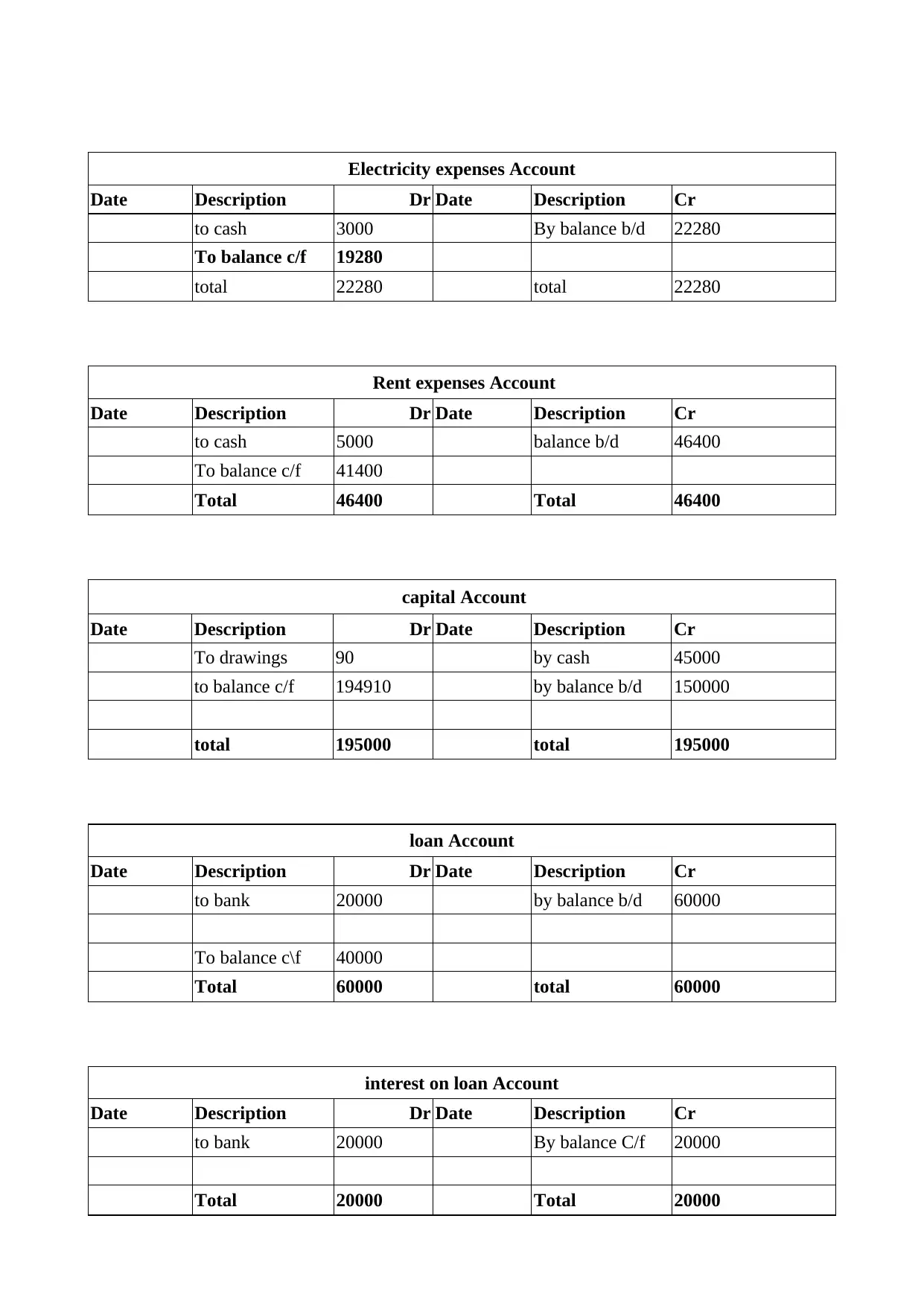

Electricity expenses Account

Date Description Dr Date Description Cr

to cash 3000 By balance b/d 22280

To balance c/f 19280

total 22280 total 22280

Rent expenses Account

Date Description Dr Date Description Cr

to cash 5000 balance b/d 46400

To balance c/f 41400

Total 46400 Total 46400

capital Account

Date Description Dr Date Description Cr

To drawings 90 by cash 45000

to balance c/f 194910 by balance b/d 150000

total 195000 total 195000

loan Account

Date Description Dr Date Description Cr

to bank 20000 by balance b/d 60000

To balance c\f 40000

Total 60000 total 60000

interest on loan Account

Date Description Dr Date Description Cr

to bank 20000 By balance C/f 20000

Total 20000 Total 20000

Date Description Dr Date Description Cr

to cash 3000 By balance b/d 22280

To balance c/f 19280

total 22280 total 22280

Rent expenses Account

Date Description Dr Date Description Cr

to cash 5000 balance b/d 46400

To balance c/f 41400

Total 46400 Total 46400

capital Account

Date Description Dr Date Description Cr

To drawings 90 by cash 45000

to balance c/f 194910 by balance b/d 150000

total 195000 total 195000

loan Account

Date Description Dr Date Description Cr

to bank 20000 by balance b/d 60000

To balance c\f 40000

Total 60000 total 60000

interest on loan Account

Date Description Dr Date Description Cr

to bank 20000 By balance C/f 20000

Total 20000 Total 20000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

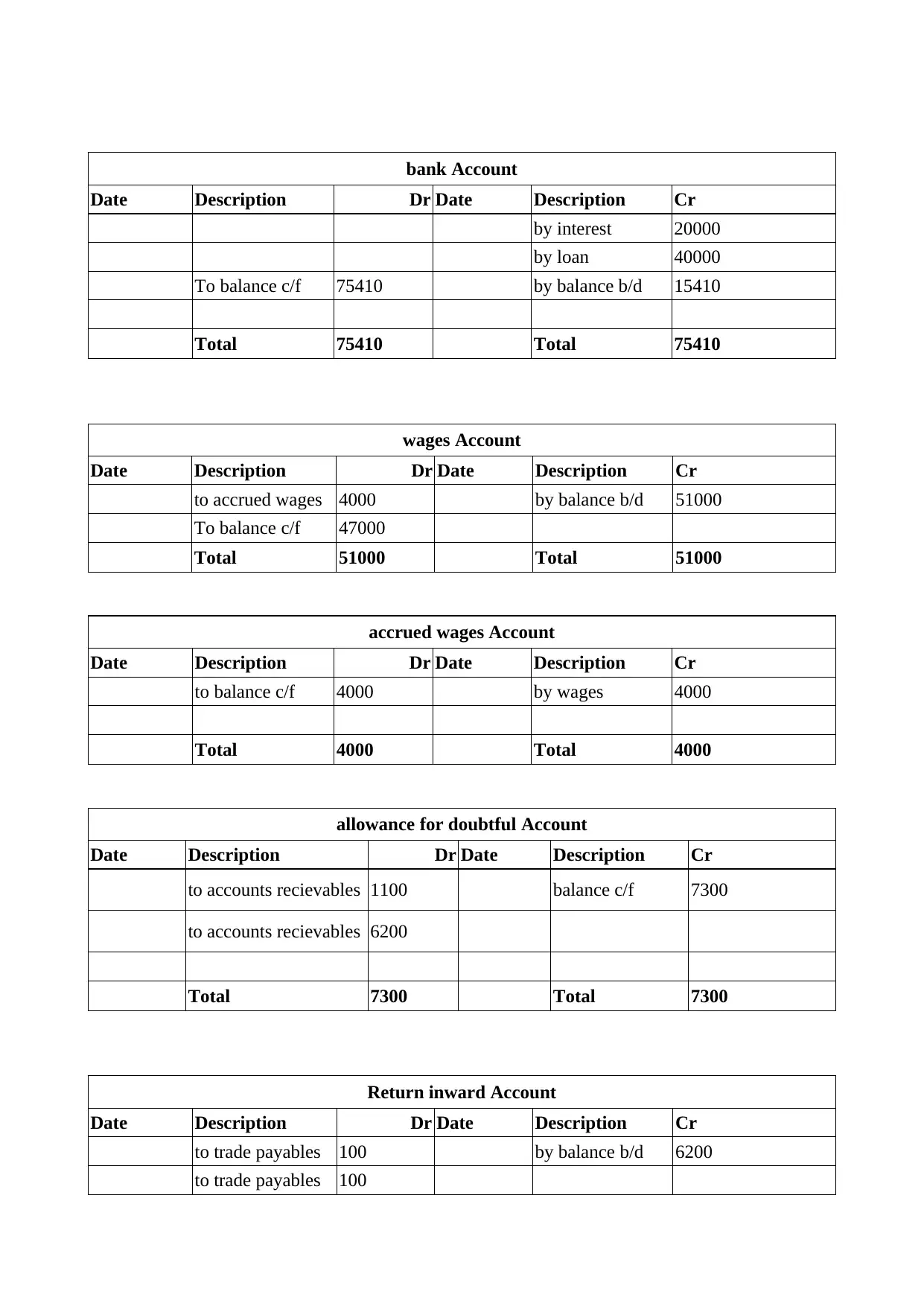

bank Account

Date Description Dr Date Description Cr

by interest 20000

by loan 40000

To balance c/f 75410 by balance b/d 15410

Total 75410 Total 75410

wages Account

Date Description Dr Date Description Cr

to accrued wages 4000 by balance b/d 51000

To balance c/f 47000

Total 51000 Total 51000

accrued wages Account

Date Description Dr Date Description Cr

to balance c/f 4000 by wages 4000

Total 4000 Total 4000

allowance for doubtful Account

Date Description Dr Date Description Cr

to accounts recievables 1100 balance c/f 7300

to accounts recievables 6200

Total 7300 Total 7300

Return inward Account

Date Description Dr Date Description Cr

to trade payables 100 by balance b/d 6200

to trade payables 100

Date Description Dr Date Description Cr

by interest 20000

by loan 40000

To balance c/f 75410 by balance b/d 15410

Total 75410 Total 75410

wages Account

Date Description Dr Date Description Cr

to accrued wages 4000 by balance b/d 51000

To balance c/f 47000

Total 51000 Total 51000

accrued wages Account

Date Description Dr Date Description Cr

to balance c/f 4000 by wages 4000

Total 4000 Total 4000

allowance for doubtful Account

Date Description Dr Date Description Cr

to accounts recievables 1100 balance c/f 7300

to accounts recievables 6200

Total 7300 Total 7300

Return inward Account

Date Description Dr Date Description Cr

to trade payables 100 by balance b/d 6200

to trade payables 100

To balance c/f 6000

Total 6200 Total 6200

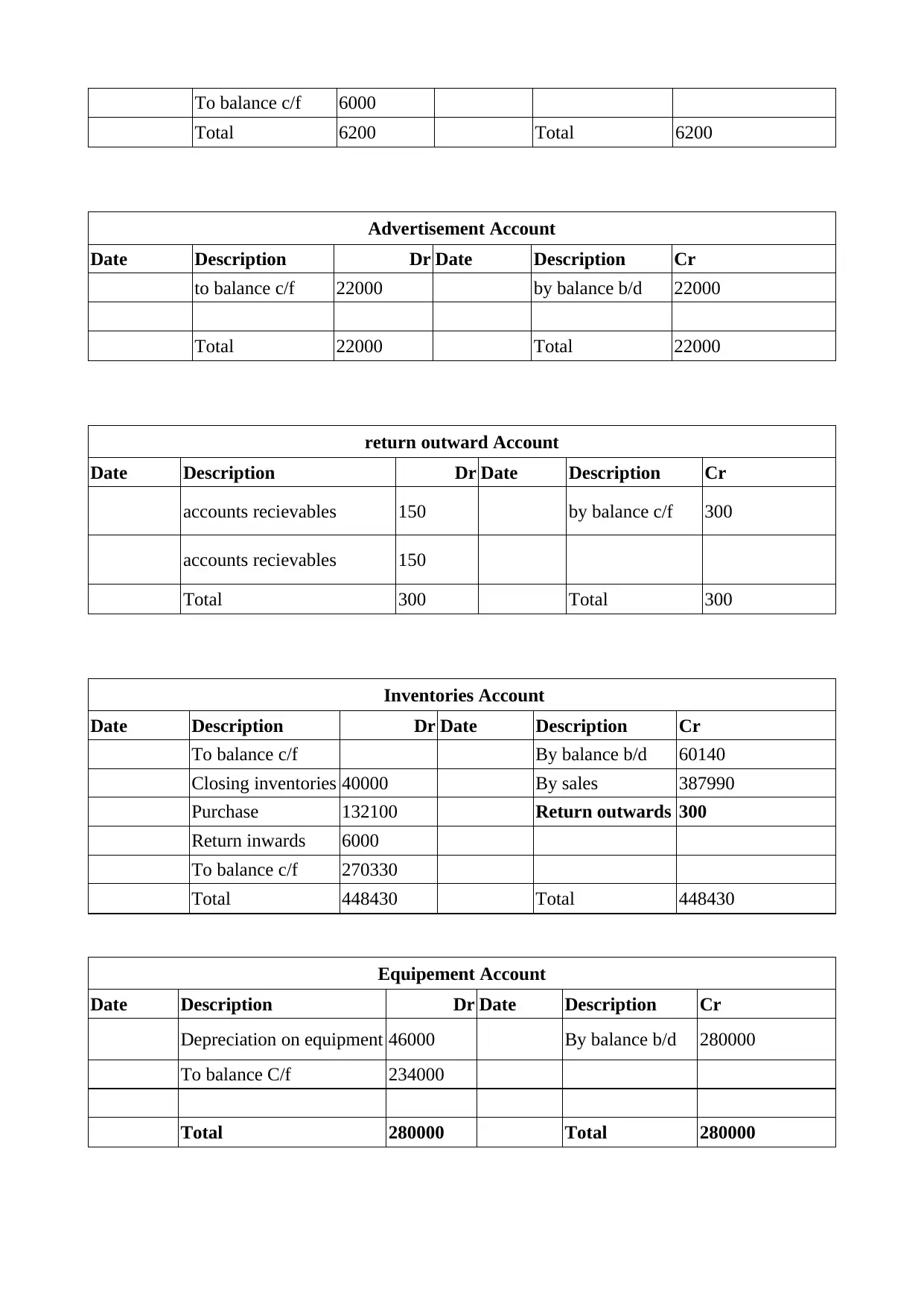

Advertisement Account

Date Description Dr Date Description Cr

to balance c/f 22000 by balance b/d 22000

Total 22000 Total 22000

return outward Account

Date Description Dr Date Description Cr

accounts recievables 150 by balance c/f 300

accounts recievables 150

Total 300 Total 300

Inventories Account

Date Description Dr Date Description Cr

To balance c/f By balance b/d 60140

Closing inventories 40000 By sales 387990

Purchase 132100 Return outwards 300

Return inwards 6000

To balance c/f 270330

Total 448430 Total 448430

Equipement Account

Date Description Dr Date Description Cr

Depreciation on equipment 46000 By balance b/d 280000

To balance C/f 234000

Total 280000 Total 280000

Total 6200 Total 6200

Advertisement Account

Date Description Dr Date Description Cr

to balance c/f 22000 by balance b/d 22000

Total 22000 Total 22000

return outward Account

Date Description Dr Date Description Cr

accounts recievables 150 by balance c/f 300

accounts recievables 150

Total 300 Total 300

Inventories Account

Date Description Dr Date Description Cr

To balance c/f By balance b/d 60140

Closing inventories 40000 By sales 387990

Purchase 132100 Return outwards 300

Return inwards 6000

To balance c/f 270330

Total 448430 Total 448430

Equipement Account

Date Description Dr Date Description Cr

Depreciation on equipment 46000 By balance b/d 280000

To balance C/f 234000

Total 280000 Total 280000

Depreciation on Equipment Account

Date Description Dr Date Description Cr

By balance b/d 46000

To P&l 46000

Total 46000 Total 46000

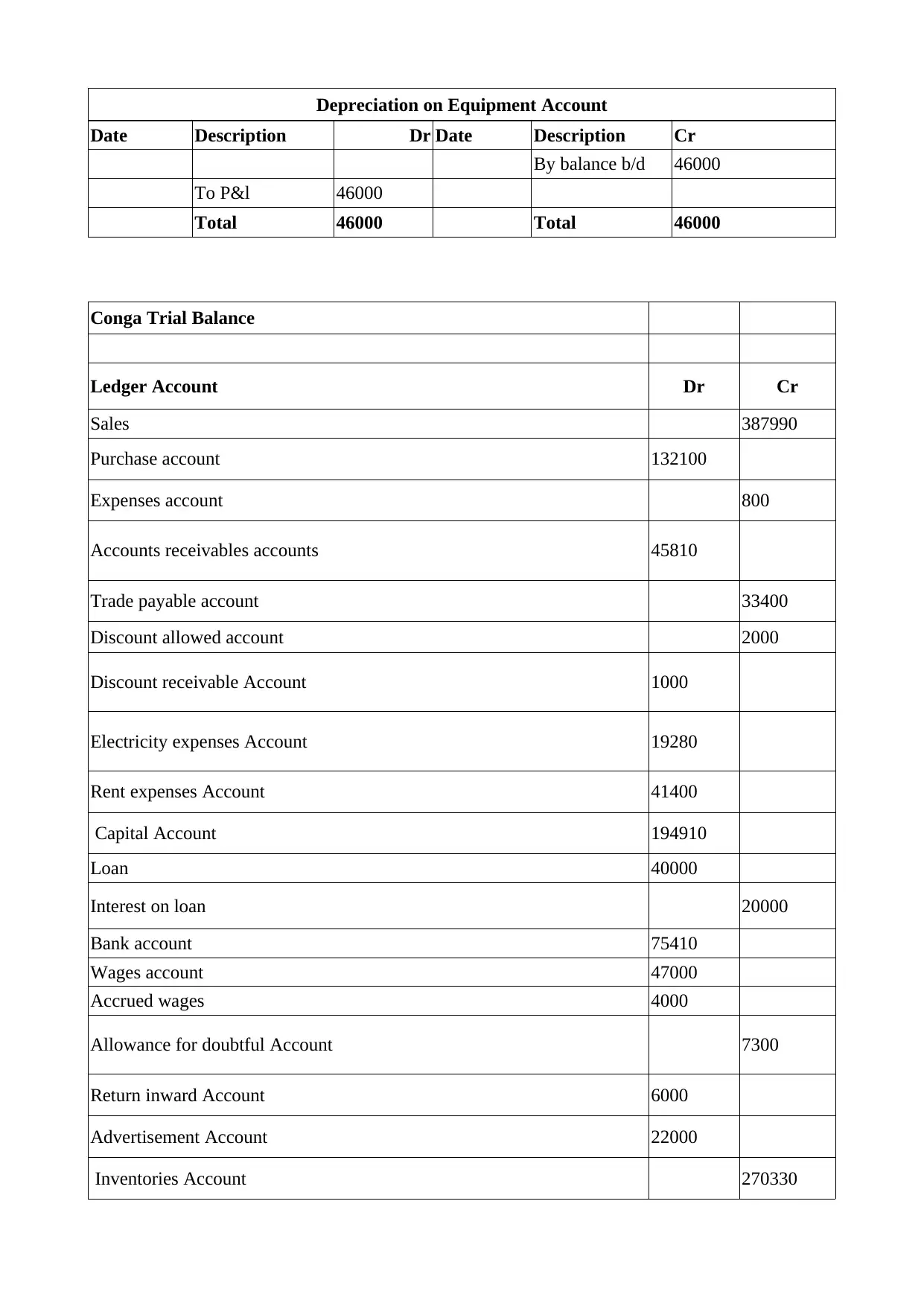

Conga Trial Balance

Ledger Account Dr Cr

Sales 387990

Purchase account 132100

Expenses account 800

Accounts receivables accounts 45810

Trade payable account 33400

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

Capital Account 194910

Loan 40000

Interest on loan 20000

Bank account 75410

Wages account 47000

Accrued wages 4000

Allowance for doubtful Account 7300

Return inward Account 6000

Advertisement Account 22000

Inventories Account 270330

Date Description Dr Date Description Cr

By balance b/d 46000

To P&l 46000

Total 46000 Total 46000

Conga Trial Balance

Ledger Account Dr Cr

Sales 387990

Purchase account 132100

Expenses account 800

Accounts receivables accounts 45810

Trade payable account 33400

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

Capital Account 194910

Loan 40000

Interest on loan 20000

Bank account 75410

Wages account 47000

Accrued wages 4000

Allowance for doubtful Account 7300

Return inward Account 6000

Advertisement Account 22000

Inventories Account 270330

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

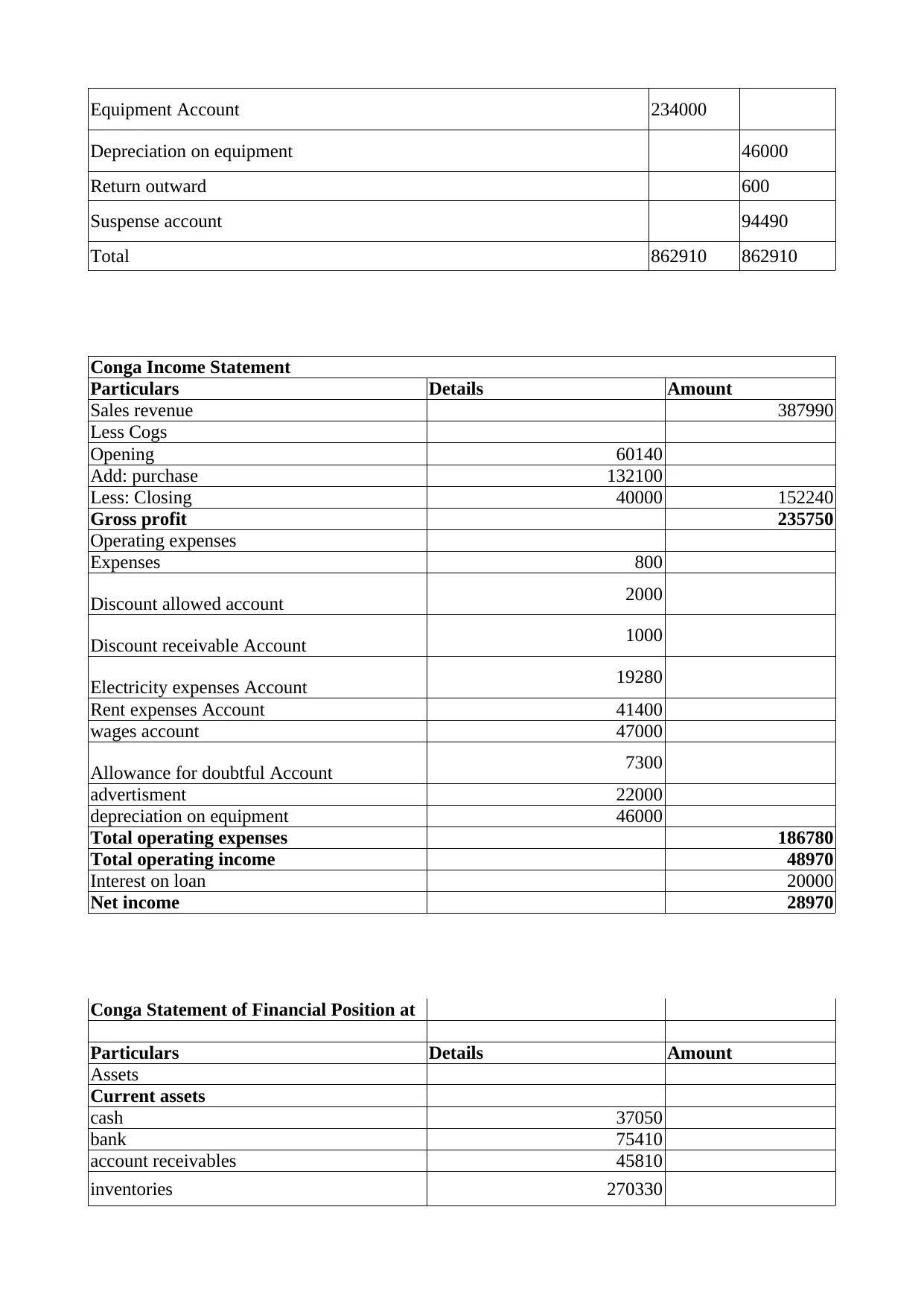

Equipment Account 234000

Depreciation on equipment 46000

Return outward 600

Suspense account 94490

Total 862910 862910

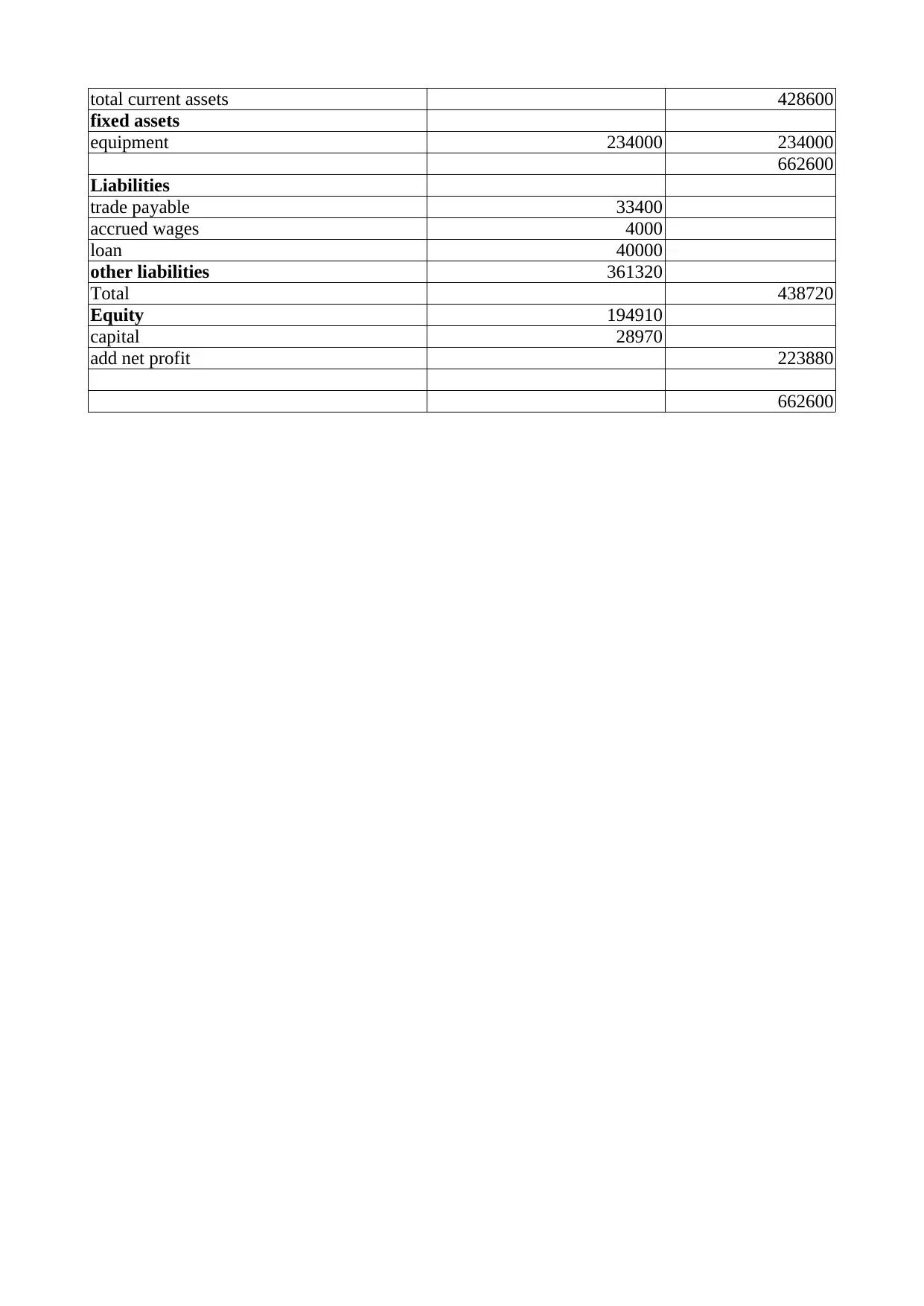

Conga Income Statement

Particulars Details Amount

Sales revenue 387990

Less Cogs

Opening 60140

Add: purchase 132100

Less: Closing 40000 152240

Gross profit 235750

Operating expenses

Expenses 800

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

wages account 47000

Allowance for doubtful Account 7300

advertisment 22000

depreciation on equipment 46000

Total operating expenses 186780

Total operating income 48970

Interest on loan 20000

Net income 28970

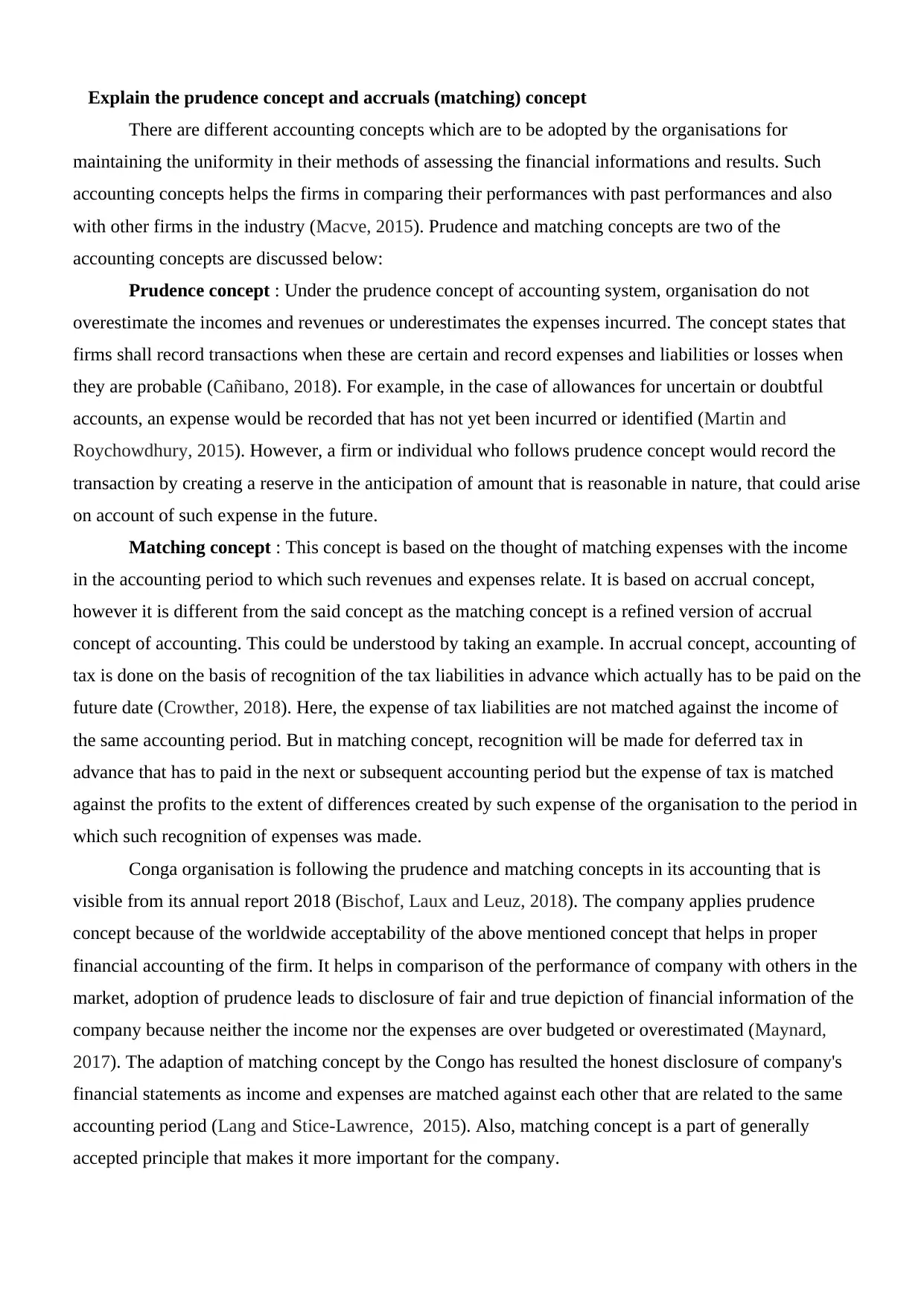

Conga Statement of Financial Position at

Particulars Details Amount

Assets

Current assets

cash 37050

bank 75410

account receivables 45810

inventories 270330

Depreciation on equipment 46000

Return outward 600

Suspense account 94490

Total 862910 862910

Conga Income Statement

Particulars Details Amount

Sales revenue 387990

Less Cogs

Opening 60140

Add: purchase 132100

Less: Closing 40000 152240

Gross profit 235750

Operating expenses

Expenses 800

Discount allowed account 2000

Discount receivable Account 1000

Electricity expenses Account 19280

Rent expenses Account 41400

wages account 47000

Allowance for doubtful Account 7300

advertisment 22000

depreciation on equipment 46000

Total operating expenses 186780

Total operating income 48970

Interest on loan 20000

Net income 28970

Conga Statement of Financial Position at

Particulars Details Amount

Assets

Current assets

cash 37050

bank 75410

account receivables 45810

inventories 270330

total current assets 428600

fixed assets

equipment 234000 234000

662600

Liabilities

trade payable 33400

accrued wages 4000

loan 40000

other liabilities 361320

Total 438720

Equity 194910

capital 28970

add net profit 223880

662600

fixed assets

equipment 234000 234000

662600

Liabilities

trade payable 33400

accrued wages 4000

loan 40000

other liabilities 361320

Total 438720

Equity 194910

capital 28970

add net profit 223880

662600

Explain the prudence concept and accruals (matching) concept

There are different accounting concepts which are to be adopted by the organisations for

maintaining the uniformity in their methods of assessing the financial informations and results. Such

accounting concepts helps the firms in comparing their performances with past performances and also

with other firms in the industry (Macve, 2015). Prudence and matching concepts are two of the

accounting concepts are discussed below:

Prudence concept : Under the prudence concept of accounting system, organisation do not

overestimate the incomes and revenues or underestimates the expenses incurred. The concept states that

firms shall record transactions when these are certain and record expenses and liabilities or losses when

they are probable (Cañibano, 2018). For example, in the case of allowances for uncertain or doubtful

accounts, an expense would be recorded that has not yet been incurred or identified (Martin and

Roychowdhury, 2015). However, a firm or individual who follows prudence concept would record the

transaction by creating a reserve in the anticipation of amount that is reasonable in nature, that could arise

on account of such expense in the future.

Matching concept : This concept is based on the thought of matching expenses with the income

in the accounting period to which such revenues and expenses relate. It is based on accrual concept,

however it is different from the said concept as the matching concept is a refined version of accrual

concept of accounting. This could be understood by taking an example. In accrual concept, accounting of

tax is done on the basis of recognition of the tax liabilities in advance which actually has to be paid on the

future date (Crowther, 2018). Here, the expense of tax liabilities are not matched against the income of

the same accounting period. But in matching concept, recognition will be made for deferred tax in

advance that has to paid in the next or subsequent accounting period but the expense of tax is matched

against the profits to the extent of differences created by such expense of the organisation to the period in

which such recognition of expenses was made.

Conga organisation is following the prudence and matching concepts in its accounting that is

visible from its annual report 2018 (Bischof, Laux and Leuz, 2018). The company applies prudence

concept because of the worldwide acceptability of the above mentioned concept that helps in proper

financial accounting of the firm. It helps in comparison of the performance of company with others in the

market, adoption of prudence leads to disclosure of fair and true depiction of financial information of the

company because neither the income nor the expenses are over budgeted or overestimated (Maynard,

2017). The adaption of matching concept by the Congo has resulted the honest disclosure of company's

financial statements as income and expenses are matched against each other that are related to the same

accounting period (Lang and Stice-Lawrence, 2015). Also, matching concept is a part of generally

accepted principle that makes it more important for the company.

There are different accounting concepts which are to be adopted by the organisations for

maintaining the uniformity in their methods of assessing the financial informations and results. Such

accounting concepts helps the firms in comparing their performances with past performances and also

with other firms in the industry (Macve, 2015). Prudence and matching concepts are two of the

accounting concepts are discussed below:

Prudence concept : Under the prudence concept of accounting system, organisation do not

overestimate the incomes and revenues or underestimates the expenses incurred. The concept states that

firms shall record transactions when these are certain and record expenses and liabilities or losses when

they are probable (Cañibano, 2018). For example, in the case of allowances for uncertain or doubtful

accounts, an expense would be recorded that has not yet been incurred or identified (Martin and

Roychowdhury, 2015). However, a firm or individual who follows prudence concept would record the

transaction by creating a reserve in the anticipation of amount that is reasonable in nature, that could arise

on account of such expense in the future.

Matching concept : This concept is based on the thought of matching expenses with the income

in the accounting period to which such revenues and expenses relate. It is based on accrual concept,

however it is different from the said concept as the matching concept is a refined version of accrual

concept of accounting. This could be understood by taking an example. In accrual concept, accounting of

tax is done on the basis of recognition of the tax liabilities in advance which actually has to be paid on the

future date (Crowther, 2018). Here, the expense of tax liabilities are not matched against the income of

the same accounting period. But in matching concept, recognition will be made for deferred tax in

advance that has to paid in the next or subsequent accounting period but the expense of tax is matched

against the profits to the extent of differences created by such expense of the organisation to the period in

which such recognition of expenses was made.

Conga organisation is following the prudence and matching concepts in its accounting that is

visible from its annual report 2018 (Bischof, Laux and Leuz, 2018). The company applies prudence

concept because of the worldwide acceptability of the above mentioned concept that helps in proper

financial accounting of the firm. It helps in comparison of the performance of company with others in the

market, adoption of prudence leads to disclosure of fair and true depiction of financial information of the

company because neither the income nor the expenses are over budgeted or overestimated (Maynard,

2017). The adaption of matching concept by the Congo has resulted the honest disclosure of company's

financial statements as income and expenses are matched against each other that are related to the same

accounting period (Lang and Stice-Lawrence, 2015). Also, matching concept is a part of generally

accepted principle that makes it more important for the company.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

3. Explanation on recording of sales on value added tax

Value added tax is the type of consumption tax which is placed on the products whenever a value

is added at the stage of supply chain. This tax will be levied on each stage of company which is from

production to its sales (Dutta and Patatoukas, 2016). VAT is included in both the sales and purchases of

the business. As per the given case study Cogna does not add VAT on its sales, however government

might wanted from him to add the VAT on its sales. Therefore, in order to record such tax he has to

calculate the amount of VAT from the sales document.

For the purpose of recording value added tax, three book keeping accounts must be keeps which

are as follows-

The VAT on the Input account- this account will usually show a debit balance from the VAT

authorities which owe money (Martin and Roychowdhury, 2015).

The VAT on Transactions account- This account will usually show a credit balance which is

from the authorities who have received VAT. This money will usually in possession of owner until its

due date.

The VAT debit and credit account- In this accounts Cogna Ltd will post first two accounts.

When the periodic report to VAT for payment will make it will show credit balance and when money

gets returned then it will show a debit balance (Mullinova, 2016).

Value added tax is the type of consumption tax which is placed on the products whenever a value

is added at the stage of supply chain. This tax will be levied on each stage of company which is from

production to its sales (Dutta and Patatoukas, 2016). VAT is included in both the sales and purchases of

the business. As per the given case study Cogna does not add VAT on its sales, however government

might wanted from him to add the VAT on its sales. Therefore, in order to record such tax he has to

calculate the amount of VAT from the sales document.

For the purpose of recording value added tax, three book keeping accounts must be keeps which

are as follows-

The VAT on the Input account- this account will usually show a debit balance from the VAT

authorities which owe money (Martin and Roychowdhury, 2015).

The VAT on Transactions account- This account will usually show a credit balance which is

from the authorities who have received VAT. This money will usually in possession of owner until its

due date.

The VAT debit and credit account- In this accounts Cogna Ltd will post first two accounts.

When the periodic report to VAT for payment will make it will show credit balance and when money

gets returned then it will show a debit balance (Mullinova, 2016).

REFERENCES

Books and Journals

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision, Tool, Or

Threat?. Routledge.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments: recognition and

assessment" for bank financial accounting. Modern European Researches. (1). pp.60-64.

Dutta, S. and Patatoukas, P. N., 2016. Identifying conditional conservatism in financial accounting data:

theory and evidence. The Accounting Review. 92(4). pp.191-216.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Crowther, D., 2018. A Social Critique of Corporate Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting: A Semiotic Analysis of Corporate Financial and

Environmental Reporting. Routledge.

Martin, X. and Roychowdhury, S., 2015. Do financial market developments influence accounting

practices? Credit default swaps and borrowers׳ reporting conservatism. Journal of Accounting

and Economics. 59(1). pp.80-104.

Bischof, J., Laux, C. and Leuz, C., 2018. Accounting for Financial Stability: Lessons From the Financial

Crisis and Future Challenges. Available at SSRN 3319542.

Cañibano, L., 2018. Accounting and intangibles. Revista de Contabilidad-Spanish Accounting

Review. 21(1). pp.1-6.

Lang, M. and Stice-Lawrence, L., 2015. Textual analysis and international financial reporting: Large

sample evidence. Journal of Accounting and Economics. 60(2-3). pp.110-135.

Books and Journals

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision, Tool, Or

Threat?. Routledge.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments: recognition and

assessment" for bank financial accounting. Modern European Researches. (1). pp.60-64.

Dutta, S. and Patatoukas, P. N., 2016. Identifying conditional conservatism in financial accounting data:

theory and evidence. The Accounting Review. 92(4). pp.191-216.

Maynard, J., 2017. Financial accounting, reporting, and analysis. Oxford University Press.

Crowther, D., 2018. A Social Critique of Corporate Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting: A Semiotic Analysis of Corporate Financial and

Environmental Reporting. Routledge.

Martin, X. and Roychowdhury, S., 2015. Do financial market developments influence accounting

practices? Credit default swaps and borrowers׳ reporting conservatism. Journal of Accounting

and Economics. 59(1). pp.80-104.

Bischof, J., Laux, C. and Leuz, C., 2018. Accounting for Financial Stability: Lessons From the Financial

Crisis and Future Challenges. Available at SSRN 3319542.

Cañibano, L., 2018. Accounting and intangibles. Revista de Contabilidad-Spanish Accounting

Review. 21(1). pp.1-6.

Lang, M. and Stice-Lawrence, L., 2015. Textual analysis and international financial reporting: Large

sample evidence. Journal of Accounting and Economics. 60(2-3). pp.110-135.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.