Ask a question from expert

macroeconomic stability of Uzbekistan

11 Pages3917 Words101 Views

Added on 2022-01-18

macroeconomic stability of Uzbekistan

Added on 2022-01-18

BookmarkShareRelated Documents

The analysis in this paper enumerates the determinants of output. The paper organized as follows.

Section I provides general information about the factors that impact on level of output. Section II

describes the data we employed and presents the effect of major determinant of GDP in a given

country. Section III provides some theoretical information about Fiscal policy and impacts of

policy to the France. Section IV provides brief information about secondary determinants of

output. Section V concludes and gives some recommendations in macroeconomic stability of

Uzbekistan. Appendices provide graphs and tables.

Introduction

Section I Brief literature review on the determinants of output

The research papers show that there were done many empirical investigations to test the impact of

consumption, investment, government expenditure, net export to the level of output. This

approach was also proved by classical and Keynesian economists. The classical economic theory

is directed in the concept of leissez-faire economic market, where leissez-faire can be defined as

in the free market there is little or no intervention from the side of government. According to them

the economic resources are allocated based on the desires of individuals and businesses.

Moreover, from the perspective of classical economists, national economic growth is not

influenced by government expenditure to much in comparison with the consumer spending and

business investments (Investopedia, 2018). However, Keynesian economists theories relies on

spending and aggregate demand in the economic marketplace. From Keynesian views

government expenditure plays the major role in the national economic growth and in absence of

consumption and investment, government spending can improve growth of economy

(Investopedia, 2018). There were many researchers who has done empirical research on economic

output determinants. According to their research, there are secondary determinants like FDI,

technological progress population growth that affect on the economic growth of a county. For

example neoclassical economist Solow (1956, p4) notes that the important determinant of short

run economic growth is saving, investment ratio. He also states that technological development

plays vital role in the growth of economy in the long run and seen as exogenous factor of

economic system (cited in Whelan,2005). The simplicity and good fit of data were the main factor

of the model and placed it at the core of most empirical research. Furthermore, Romer(1989) notes

that innovation and knowledge investment in human capital are significant contributors to the

economic growth. Human capital is the main source of growth in several models because the

majority of studies indicates that “human capital” includes itself proxies related to education

(p22). Therefore, educated population is the key determinants of productivity and economic

growth. This extension is in line with Zhang (1999), who established that newly industrialized

countries had been developing due to high investment rates, increasing labor force participation

rates and improvement in education. Yet some other papers shows a considerable impact of

country-specific factors such as the skills and knowledge of population, infrastructure,

impediments to trade and the effectiveness of government policies on GDP per capita (Plossner,

Levine and Renelt,1992, cited in Dritsakis, Varelas and Adamopoulos, 2008,p3). Real-world data

analyzed technological progress and productivity as the major determinants of per capita income

(Mankiw, Romer and Weil, 1992).

1

Section I provides general information about the factors that impact on level of output. Section II

describes the data we employed and presents the effect of major determinant of GDP in a given

country. Section III provides some theoretical information about Fiscal policy and impacts of

policy to the France. Section IV provides brief information about secondary determinants of

output. Section V concludes and gives some recommendations in macroeconomic stability of

Uzbekistan. Appendices provide graphs and tables.

Introduction

Section I Brief literature review on the determinants of output

The research papers show that there were done many empirical investigations to test the impact of

consumption, investment, government expenditure, net export to the level of output. This

approach was also proved by classical and Keynesian economists. The classical economic theory

is directed in the concept of leissez-faire economic market, where leissez-faire can be defined as

in the free market there is little or no intervention from the side of government. According to them

the economic resources are allocated based on the desires of individuals and businesses.

Moreover, from the perspective of classical economists, national economic growth is not

influenced by government expenditure to much in comparison with the consumer spending and

business investments (Investopedia, 2018). However, Keynesian economists theories relies on

spending and aggregate demand in the economic marketplace. From Keynesian views

government expenditure plays the major role in the national economic growth and in absence of

consumption and investment, government spending can improve growth of economy

(Investopedia, 2018). There were many researchers who has done empirical research on economic

output determinants. According to their research, there are secondary determinants like FDI,

technological progress population growth that affect on the economic growth of a county. For

example neoclassical economist Solow (1956, p4) notes that the important determinant of short

run economic growth is saving, investment ratio. He also states that technological development

plays vital role in the growth of economy in the long run and seen as exogenous factor of

economic system (cited in Whelan,2005). The simplicity and good fit of data were the main factor

of the model and placed it at the core of most empirical research. Furthermore, Romer(1989) notes

that innovation and knowledge investment in human capital are significant contributors to the

economic growth. Human capital is the main source of growth in several models because the

majority of studies indicates that “human capital” includes itself proxies related to education

(p22). Therefore, educated population is the key determinants of productivity and economic

growth. This extension is in line with Zhang (1999), who established that newly industrialized

countries had been developing due to high investment rates, increasing labor force participation

rates and improvement in education. Yet some other papers shows a considerable impact of

country-specific factors such as the skills and knowledge of population, infrastructure,

impediments to trade and the effectiveness of government policies on GDP per capita (Plossner,

Levine and Renelt,1992, cited in Dritsakis, Varelas and Adamopoulos, 2008,p3). Real-world data

analyzed technological progress and productivity as the major determinants of per capita income

(Mankiw, Romer and Weil, 1992).

1

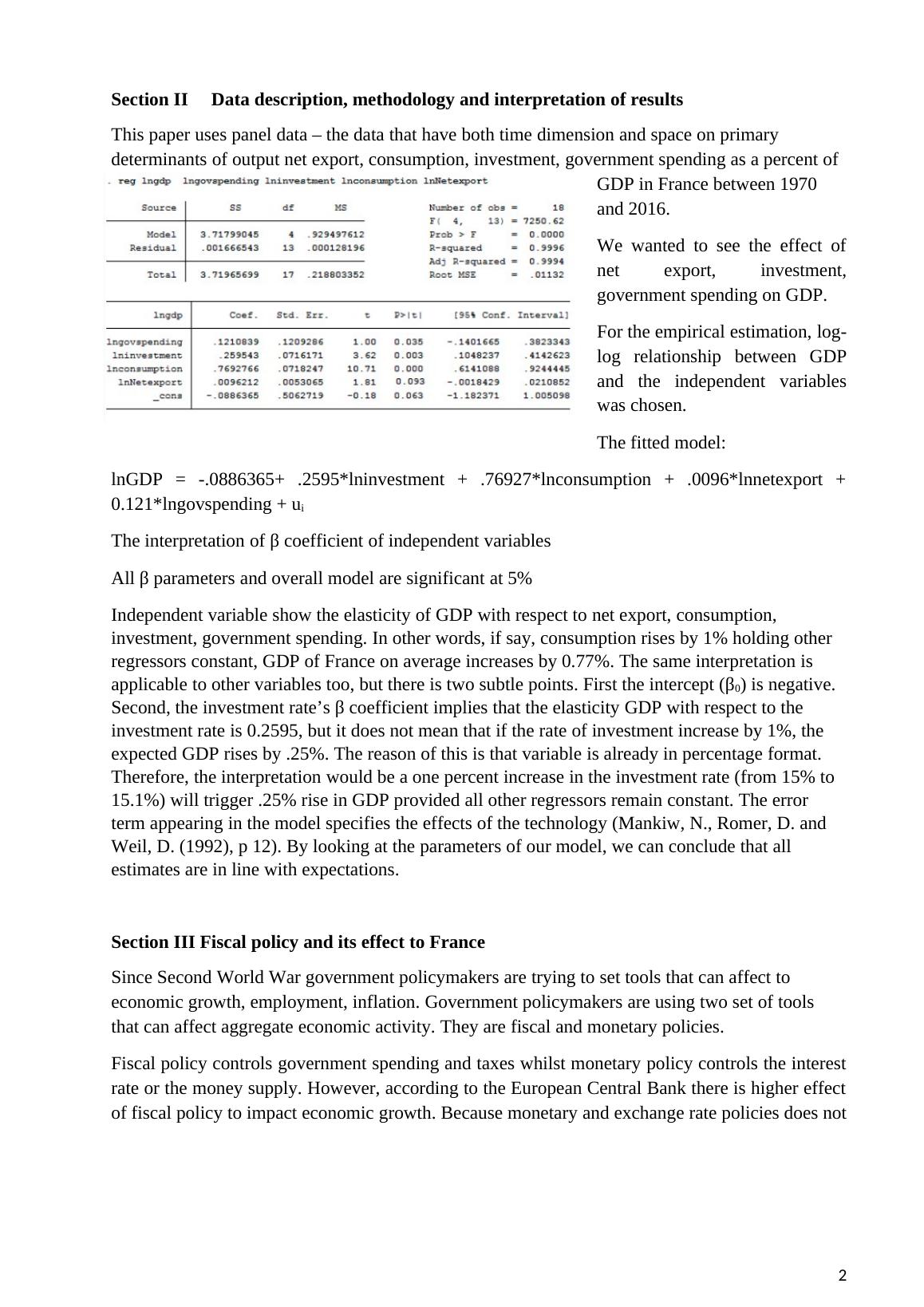

Section II Data description, methodology and interpretation of results

This paper uses panel data – the data that have both time dimension and space on primary

determinants of output net export, consumption, investment, government spending as a percent of

GDP in France between 1970

and 2016.

We wanted to see the effect of

net export, investment,

government spending on GDP.

For the empirical estimation, log-

log relationship between GDP

and the independent variables

was chosen.

The fitted model:

lnGDP = -.0886365+ .2595*lninvestment + .76927*lnconsumption + .0096*lnnetexport +

0.121*lngovspending + ui

The interpretation of β coefficient of independent variables

All β parameters and overall model are significant at 5%

Independent variable show the elasticity of GDP with respect to net export, consumption,

investment, government spending. In other words, if say, consumption rises by 1% holding other

regressors constant, GDP of France on average increases by 0.77%. The same interpretation is

applicable to other variables too, but there is two subtle points. First the intercept (β0) is negative.

Second, the investment rate’s β coefficient implies that the elasticity GDP with respect to the

investment rate is 0.2595, but it does not mean that if the rate of investment increase by 1%, the

expected GDP rises by .25%. The reason of this is that variable is already in percentage format.

Therefore, the interpretation would be a one percent increase in the investment rate (from 15% to

15.1%) will trigger .25% rise in GDP provided all other regressors remain constant. The error

term appearing in the model specifies the effects of the technology (Mankiw, N., Romer, D. and

Weil, D. (1992), p 12). By looking at the parameters of our model, we can conclude that all

estimates are in line with expectations.

Section III Fiscal policy and its effect to France

Since Second World War government policymakers are trying to set tools that can affect to

economic growth, employment, inflation. Government policymakers are using two set of tools

that can affect aggregate economic activity. They are fiscal and monetary policies.

Fiscal policy controls government spending and taxes whilst monetary policy controls the interest

rate or the money supply. However, according to the European Central Bank there is higher effect

of fiscal policy to impact economic growth. Because monetary and exchange rate policies does not

2

This paper uses panel data – the data that have both time dimension and space on primary

determinants of output net export, consumption, investment, government spending as a percent of

GDP in France between 1970

and 2016.

We wanted to see the effect of

net export, investment,

government spending on GDP.

For the empirical estimation, log-

log relationship between GDP

and the independent variables

was chosen.

The fitted model:

lnGDP = -.0886365+ .2595*lninvestment + .76927*lnconsumption + .0096*lnnetexport +

0.121*lngovspending + ui

The interpretation of β coefficient of independent variables

All β parameters and overall model are significant at 5%

Independent variable show the elasticity of GDP with respect to net export, consumption,

investment, government spending. In other words, if say, consumption rises by 1% holding other

regressors constant, GDP of France on average increases by 0.77%. The same interpretation is

applicable to other variables too, but there is two subtle points. First the intercept (β0) is negative.

Second, the investment rate’s β coefficient implies that the elasticity GDP with respect to the

investment rate is 0.2595, but it does not mean that if the rate of investment increase by 1%, the

expected GDP rises by .25%. The reason of this is that variable is already in percentage format.

Therefore, the interpretation would be a one percent increase in the investment rate (from 15% to

15.1%) will trigger .25% rise in GDP provided all other regressors remain constant. The error

term appearing in the model specifies the effects of the technology (Mankiw, N., Romer, D. and

Weil, D. (1992), p 12). By looking at the parameters of our model, we can conclude that all

estimates are in line with expectations.

Section III Fiscal policy and its effect to France

Since Second World War government policymakers are trying to set tools that can affect to

economic growth, employment, inflation. Government policymakers are using two set of tools

that can affect aggregate economic activity. They are fiscal and monetary policies.

Fiscal policy controls government spending and taxes whilst monetary policy controls the interest

rate or the money supply. However, according to the European Central Bank there is higher effect

of fiscal policy to impact economic growth. Because monetary and exchange rate policies does not

2

truly response to the country specific shocks in comparison with fiscal policy (Bank, 2018).

Therefore, fiscal policy is pivotal element of macroeconomic stability and has been seen as a

primary factor that affects the main determinants like consumption, investment and government

expenditure. The fiscal policy helps to manipulate the aggregate demand by changing the

government expenditure and taxes (Ecb.europa.eu, 2018). Government spending affects directly

on the output, whilst changes in taxes effect on consumption expenditure and then influence on

the economic growth. Fiscal policy is categorized into two: expansionary and contractionary.

Expansionary fiscal policy tend to increase aggregate demand by increasing government spending

or decreasing taxes. However, contractionary fiscal policy cause aggregate demand to fall by

decreasing government expenditure and increasing taxes (Investopedia, 2018). This policy can be

explained by IS-LM model. Research shows that in the IS-LM curve aggregate output and interest

rate are negatively related to taxes and positively related to government spending (see figure1).

According to the paper Macroeconomic effects from government purchases and taxes, changes in

taxes has smaller effect on the aggregate demand than equivalent change in government spending

(Barro and Redlick, 2018,p4). Additionally, the graphs that represent shifts of IS-LM curve can be

found in summary table 1. Observations shows that France enters to G7 countries and has higher

GDP. According to the World Bank 2017 report, France GDP constituted 2.465454 mln $US in

2016, which ranked the country in the 6th place in the world (World Bank, 2018). The research

shows that France tried to manipulate output by using fiscal policies and started expansionary

fiscal policy in 2002. According to the research of Flynn (2009), France has experienced high

budget deficit. According to the statistics provided by OECD, government deficit constituted

7.2% of GDP. France could lower this deficit ratio to 3.4% of GDP in 2016 (OECD, 2018). In

2005, French budget started to cut taxes and increased its spending. According to the statistical

research of Flynn(2009) tax cuts of civil sectors, public job sectors, households lead to decrease

budget deficit and increase economic growth rate by 2.5% (p17).These tax cuts attracted inward

and outflow investment. Direct inflow investment rose from 16.4 to 45.3 Bln $US from 1993 to

2003. Likewise, in these decade outflow investment rise from 19.7 to 55.2 Bln $US. Observations

of Flynn(2009) shows that France increased its total tax revenue gradually from 1975 to 2003. In

1975 tax revenue represented 35.9% of GDP, whilst in 2003 it amounted 44.2% of France GDP

(p22).

Section IV Secondary determinants of output

Nowadays, besides primary determinants, some secondary figures also stay at the core of

country’s Gross Domestic Product (GDP). Increase or decrease in these factors can stimulate GDP

or, on the contrary, lead to growth retardation; therefore, it is necessary to measure their

significance each. Within the national economy, these determinants are interconnected links of

chain. All statistical analysis is based on different literature articles and aimed to reckon up how it

does work in the context of France.

One of the secondary determinants is a population growth. Becker,

Glaeser and K. Murphy conducted an empirical analysis comparing countries and concluded that

there is a relation between economic growth, investments in human capital and the level

of economic development. They began analysis from the consideration of

Thomas Malthus theory. According to his model, higher population reduces incomes per

capita through diminishing marginal productivity. However, modern estimations show that

increase in average income per capita caused most likely by accumulation of human capital and

new technology development. Authors argue that poorer economies of agrarian type with a limited

human capital, the simplest technologies and a big population usually experience the downward

tendency of average earnings per capita according to Malthus and neoclassical assumption of

3

Therefore, fiscal policy is pivotal element of macroeconomic stability and has been seen as a

primary factor that affects the main determinants like consumption, investment and government

expenditure. The fiscal policy helps to manipulate the aggregate demand by changing the

government expenditure and taxes (Ecb.europa.eu, 2018). Government spending affects directly

on the output, whilst changes in taxes effect on consumption expenditure and then influence on

the economic growth. Fiscal policy is categorized into two: expansionary and contractionary.

Expansionary fiscal policy tend to increase aggregate demand by increasing government spending

or decreasing taxes. However, contractionary fiscal policy cause aggregate demand to fall by

decreasing government expenditure and increasing taxes (Investopedia, 2018). This policy can be

explained by IS-LM model. Research shows that in the IS-LM curve aggregate output and interest

rate are negatively related to taxes and positively related to government spending (see figure1).

According to the paper Macroeconomic effects from government purchases and taxes, changes in

taxes has smaller effect on the aggregate demand than equivalent change in government spending

(Barro and Redlick, 2018,p4). Additionally, the graphs that represent shifts of IS-LM curve can be

found in summary table 1. Observations shows that France enters to G7 countries and has higher

GDP. According to the World Bank 2017 report, France GDP constituted 2.465454 mln $US in

2016, which ranked the country in the 6th place in the world (World Bank, 2018). The research

shows that France tried to manipulate output by using fiscal policies and started expansionary

fiscal policy in 2002. According to the research of Flynn (2009), France has experienced high

budget deficit. According to the statistics provided by OECD, government deficit constituted

7.2% of GDP. France could lower this deficit ratio to 3.4% of GDP in 2016 (OECD, 2018). In

2005, French budget started to cut taxes and increased its spending. According to the statistical

research of Flynn(2009) tax cuts of civil sectors, public job sectors, households lead to decrease

budget deficit and increase economic growth rate by 2.5% (p17).These tax cuts attracted inward

and outflow investment. Direct inflow investment rose from 16.4 to 45.3 Bln $US from 1993 to

2003. Likewise, in these decade outflow investment rise from 19.7 to 55.2 Bln $US. Observations

of Flynn(2009) shows that France increased its total tax revenue gradually from 1975 to 2003. In

1975 tax revenue represented 35.9% of GDP, whilst in 2003 it amounted 44.2% of France GDP

(p22).

Section IV Secondary determinants of output

Nowadays, besides primary determinants, some secondary figures also stay at the core of

country’s Gross Domestic Product (GDP). Increase or decrease in these factors can stimulate GDP

or, on the contrary, lead to growth retardation; therefore, it is necessary to measure their

significance each. Within the national economy, these determinants are interconnected links of

chain. All statistical analysis is based on different literature articles and aimed to reckon up how it

does work in the context of France.

One of the secondary determinants is a population growth. Becker,

Glaeser and K. Murphy conducted an empirical analysis comparing countries and concluded that

there is a relation between economic growth, investments in human capital and the level

of economic development. They began analysis from the consideration of

Thomas Malthus theory. According to his model, higher population reduces incomes per

capita through diminishing marginal productivity. However, modern estimations show that

increase in average income per capita caused most likely by accumulation of human capital and

new technology development. Authors argue that poorer economies of agrarian type with a limited

human capital, the simplest technologies and a big population usually experience the downward

tendency of average earnings per capita according to Malthus and neoclassical assumption of

3

diminishing marginal productivity with growth of labor supply. In more developed countries, the

Malthusian effects are slight. Moreover, in such economies, the higher population density and

strong urbanization promote job specialization, human capital investments and fast accumulation

of new knowledge, and economic growth. When economy starts booming, people invest in human

capital. The cities are becoming more preferable for population to live. Concentration of people in

the cities is one the most important factors of economic growth as the dense population leads to

market expansion and, as a result, to growth in income per capita. Authors particularly emphasize

that the rate of technology development practically does not depend

on population growth rate (Becker, Glaeser, Murphy, 1999). Applying this to France, gradual

increase in GDP and population with some insignificant fluctuations is observed from 1990 till

2008 (Fig.2, Fig.6). Taking into account the diversified economy with well-developed agriculture

and industry sectors, it is reasonable to assume that population rise together with

other determinants had a positive impact on French GDP. However, from 2009 French economy

has been experiencing long fluctuations caused by the world economic crisis of 2008. In addition,

a big tide of immigrants and refugees coming from North Africa and the Middle East led to the

population explosion, aggravated a situation in the country and brought French economy into

recession.

Not primary, but worth to consider determinant is the ageing of the population. Before starting the

discussion about ageing of the population effects on GDP, this term must be explained briefly.

Ageing of the population stems from the declining fertility rate and excessive life expectancy.

Ageing of the population is the positive indicator of welfare, living standards and health care, but

at the same time, it is considered an economic problem for countries, since people who are getting

old generally lose labor productivity. Ageing of the population is the cause of an increase in the

number of people who are above the retirement age and an increase in the number of pensioners,

which leads to more government spending on pensions, health care and benefits, related to old

age. In the case of France, retirement age is 60 and 25.3 % or 16.9 million of France’s population

is over 60. France is considered to be one of the countries which spends more than 10% of GDP

on pensions and it is almost 14%.

Fast and wide spread of information technology (IT) is another secondary influential

factor of economic growth, and it is closely associated with labor force. The question regarding

the impact of IT development on economy wealth of the countries is quite controversial. Some

researchers believe that innovation impulses economic growth and stimulates it. In

particular, W. Nordhaus and M. Castells have a common view on IT influence. In their literature

works they argue that application of IT to social life and production creates new jobs, promotes

increase of efficiency of a business sector and productivity. However, R. Solow conducted

statistical and empirical analysis by the example of USA, and observed no any economic boom

and productivity during the 1970-90s in the US even if the government spending on IT were going

up by 20-25% every year (Solow, 1987). The growth rates were unsteady and fluctuating from -

2% to 4% at that period (World Bank, 2018). This case is known as

“Solow’s paradox.” Afterwards other scholars could find explanations of this phenomenon. One

of the evident ones belongs to P. David and were known as “David delay hypothesis” (David,

1999). He supposed that country could benefit from IT application after some period just as it

happened during the last technology renewal when impact of power industry on other sectors was

observed in 40 years after beginning of use of electric power. Concerning France,

IT sector provides 5.2% of its GDP, 3.7% of an employment and 7.9% of all value-added

of private sector. French government spends 2-2.5% of GDP every year to develop IT within its

digital development strategy (Fig. 4) (OECD, 2017). Obviously, it is reasonable to state that there

are less quantitative changes than qualitative ones in French economy. For instance, new types of

4

Malthusian effects are slight. Moreover, in such economies, the higher population density and

strong urbanization promote job specialization, human capital investments and fast accumulation

of new knowledge, and economic growth. When economy starts booming, people invest in human

capital. The cities are becoming more preferable for population to live. Concentration of people in

the cities is one the most important factors of economic growth as the dense population leads to

market expansion and, as a result, to growth in income per capita. Authors particularly emphasize

that the rate of technology development practically does not depend

on population growth rate (Becker, Glaeser, Murphy, 1999). Applying this to France, gradual

increase in GDP and population with some insignificant fluctuations is observed from 1990 till

2008 (Fig.2, Fig.6). Taking into account the diversified economy with well-developed agriculture

and industry sectors, it is reasonable to assume that population rise together with

other determinants had a positive impact on French GDP. However, from 2009 French economy

has been experiencing long fluctuations caused by the world economic crisis of 2008. In addition,

a big tide of immigrants and refugees coming from North Africa and the Middle East led to the

population explosion, aggravated a situation in the country and brought French economy into

recession.

Not primary, but worth to consider determinant is the ageing of the population. Before starting the

discussion about ageing of the population effects on GDP, this term must be explained briefly.

Ageing of the population stems from the declining fertility rate and excessive life expectancy.

Ageing of the population is the positive indicator of welfare, living standards and health care, but

at the same time, it is considered an economic problem for countries, since people who are getting

old generally lose labor productivity. Ageing of the population is the cause of an increase in the

number of people who are above the retirement age and an increase in the number of pensioners,

which leads to more government spending on pensions, health care and benefits, related to old

age. In the case of France, retirement age is 60 and 25.3 % or 16.9 million of France’s population

is over 60. France is considered to be one of the countries which spends more than 10% of GDP

on pensions and it is almost 14%.

Fast and wide spread of information technology (IT) is another secondary influential

factor of economic growth, and it is closely associated with labor force. The question regarding

the impact of IT development on economy wealth of the countries is quite controversial. Some

researchers believe that innovation impulses economic growth and stimulates it. In

particular, W. Nordhaus and M. Castells have a common view on IT influence. In their literature

works they argue that application of IT to social life and production creates new jobs, promotes

increase of efficiency of a business sector and productivity. However, R. Solow conducted

statistical and empirical analysis by the example of USA, and observed no any economic boom

and productivity during the 1970-90s in the US even if the government spending on IT were going

up by 20-25% every year (Solow, 1987). The growth rates were unsteady and fluctuating from -

2% to 4% at that period (World Bank, 2018). This case is known as

“Solow’s paradox.” Afterwards other scholars could find explanations of this phenomenon. One

of the evident ones belongs to P. David and were known as “David delay hypothesis” (David,

1999). He supposed that country could benefit from IT application after some period just as it

happened during the last technology renewal when impact of power industry on other sectors was

observed in 40 years after beginning of use of electric power. Concerning France,

IT sector provides 5.2% of its GDP, 3.7% of an employment and 7.9% of all value-added

of private sector. French government spends 2-2.5% of GDP every year to develop IT within its

digital development strategy (Fig. 4) (OECD, 2017). Obviously, it is reasonable to state that there

are less quantitative changes than qualitative ones in French economy. For instance, new types of

4

End of preview

Want to access all the pages? Upload your documents or become a member.

Related Documents

Determinants of Aggregate Expenditurelg...

|7

|1384

|67

Macroeconomics in Keynesialg...

|13

|3701

|42

BMP4003 Business Environment Exam Paper 2021/22lg...

|9

|2824

|210

Analysis of Different Expenditure Components of GDP in Australialg...

|10

|1360

|141

Macroeconomicslg...

|10

|2336

|351

GDP as a Measure of Economic Well-Beinglg...

|6

|1381

|54