Money and Banking: Impacts of the Financial Crisis on US Economy

VerifiedAdded on 2020/07/22

|16

|3872

|239

Essay

AI Summary

This essay delves into the complexities of the US banking and monetary system, emphasizing the influence of banking authorities, particularly the Federal Bank, in shaping economic outcomes during financial crises. The analysis examines the interplay of various economic indicators such as GDP rates and inflation, to understand the impact of monetary circulation and investment trends. The essay explores the causes and consequences of the global financial crisis, including the role of sub-prime mortgages and their negative effects on governmental reserves and small businesses. It further analyzes the impact of financial crises on consumer confidence, governmental debt, and economic growth, highlighting the need for effective governmental policies. The essay uses a table of quarterly data from 2000-2008 to demonstrate the relationship between various economic factors such as PCECTPI_PC1, GDPC1, GDPPOT, inflation, and the Federal Fund Rate (FFR). The analysis concludes by emphasizing the importance of proactive economic and monetary policies to mitigate the negative impacts of financial crises and maintain economic stability.

MONEY AND BANKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

ESSAY.............................................................................................................................................1

REFERENCES..............................................................................................................................13

ESSAY.............................................................................................................................................1

REFERENCES..............................................................................................................................13

ESSAY

To ascertain the banking and monetary system in various nations there has been main

influence of banking authorities to bring the recession and financial crisis. Moreover, in the

present study there will be discussion based on Federal bank in US and the banking policies

implied by them. Moreover, there has been adequate analysis through various operation such as

GDP rates, Inflation etc. Thus, in order to improve the financial conditions there are various filed

which are needed to be improved by the government (Travis, Harris and Larson, 2017). There

has been various impacts of such as huge level of monetary circulation in the market. Consumers

were having interest in investing the money over long term investment plans as the loans and

interest rates were comparatively lower. The banks allowed lower rates as they wanted to meet

the challenges and competition in the market. The impacts as well as influences of financial

crisis were direct and indirect over such economies.

As per analysing the GDP rates during the period 2000 to 2017 there has been huge

variations. Thus, during the crisis there has been downfall of economy which are impacted over

the rise in the prices of commodities (Aaronson and et.al., 2018). Moreover, the main reason

behind the crisis was excessive sub-prime mortgage has been facilitated in the market with lower

returns. Thus, it has negatively impacted over the governmental reserves (Ruhl and Willis,

2017). Banks become bankrupt as there were no money left. It also affecting the increment of

rises of commodities which has bound the consumers in not making expenses which results in

demolish of huge numbers of small businesses (Bernanke, banking crashes and recessions,

2013). Therefore, to analyse the GDP and inflation impacts over the rate of return of banking

sector the below listed table will be helpful in analysing the impacts of financial crisis.

Moreover, in relation with analysing the impacts of Global financial crisis there has been huge

negative fall of the GDP rate of the country. Thus, due to such impacts over economy as it

affects the small scale businesses. Thus, it has effected over reduction in the economic growth

and the circulation of money in the market. There has been reduction in the consumer confidence

index numbers which emphasis over the negative trade practices (Delis, Hasan and Mylonidis,

2017). The governmental policies to overcome with the impacts of GFC in the nation there can

be reduction in the operational activities. Thus, at the time of great depression there has been

increment in the mortgage level. Moreover, people started taking loan and making investments

into the real estate and properties which were having the negative impacts over the increment in

1

To ascertain the banking and monetary system in various nations there has been main

influence of banking authorities to bring the recession and financial crisis. Moreover, in the

present study there will be discussion based on Federal bank in US and the banking policies

implied by them. Moreover, there has been adequate analysis through various operation such as

GDP rates, Inflation etc. Thus, in order to improve the financial conditions there are various filed

which are needed to be improved by the government (Travis, Harris and Larson, 2017). There

has been various impacts of such as huge level of monetary circulation in the market. Consumers

were having interest in investing the money over long term investment plans as the loans and

interest rates were comparatively lower. The banks allowed lower rates as they wanted to meet

the challenges and competition in the market. The impacts as well as influences of financial

crisis were direct and indirect over such economies.

As per analysing the GDP rates during the period 2000 to 2017 there has been huge

variations. Thus, during the crisis there has been downfall of economy which are impacted over

the rise in the prices of commodities (Aaronson and et.al., 2018). Moreover, the main reason

behind the crisis was excessive sub-prime mortgage has been facilitated in the market with lower

returns. Thus, it has negatively impacted over the governmental reserves (Ruhl and Willis,

2017). Banks become bankrupt as there were no money left. It also affecting the increment of

rises of commodities which has bound the consumers in not making expenses which results in

demolish of huge numbers of small businesses (Bernanke, banking crashes and recessions,

2013). Therefore, to analyse the GDP and inflation impacts over the rate of return of banking

sector the below listed table will be helpful in analysing the impacts of financial crisis.

Moreover, in relation with analysing the impacts of Global financial crisis there has been huge

negative fall of the GDP rate of the country. Thus, due to such impacts over economy as it

affects the small scale businesses. Thus, it has effected over reduction in the economic growth

and the circulation of money in the market. There has been reduction in the consumer confidence

index numbers which emphasis over the negative trade practices (Delis, Hasan and Mylonidis,

2017). The governmental policies to overcome with the impacts of GFC in the nation there can

be reduction in the operational activities. Thus, at the time of great depression there has been

increment in the mortgage level. Moreover, people started taking loan and making investments

into the real estate and properties which were having the negative impacts over the increment in

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the level of loans and mortgaged were grant to the consumers. There has been various impacts of

such as huge level of monetary circulation in the market. Consumers were having interest in

investing the money over long term investment plans as the loans and interest rates were

comparatively lower. The banks allowed lower rates as they wanted to meet the challenges and

competition in the market, Thus, due to lower interest rates there will be less collection of money

and at the time of global financial crisis impacts over the national economy, there is no money

left with the banks (Buyl, Boone and Wade, 2017). There has been huge reduction in the

governmental reserves and funds which has eventually lowers down the revenue of citizens.

There has been negative impacts over the growth of economy. Thus, the per capita GDP has the

negative outcomes which indicates that during such period the small or medium size

organisations has negative impacts of the global financial crisis (Laux and Rauter, 2017). This in

turn reduces the economic level as well as living standard of the people.

It has been observed here that the speculative boom was extended due to derivatives in

the global financial crisis which was not in at the time of great depression. The impacts of great

depression was originated from United state there has been major fall in the stock value of

various industries. Therefore, During such a phase there has been reduction in the prices of the

share values of the firm which indicates the downfall of the economy (Bai, Krishnamurthy and

Weymuller, 2018). There are various entities which were bankrupt and have no capital amount to

operate their business activities. Moreover, it has affected the banks with not money to grant

them from better operations in the time. Similarly, the global financial crisis has impacted over

the nation as per the poor banking policies of the government. To meet the competition the

private and public sector of financial authorities has facilitated the loans in the market at lower

returns which indicates economic crisis (Irani and Meisenzahl, 2017). During such period there

are various issues arises such as inflation, fall of GDP rates, unemployment, fall in national

income as well as economic rates. The liquidity and current ability of nations has been

challenged through such variations in the economy.

The banks in United States has started making the excessive Sub prime loans to the

consumers at very lower rate of return. Thus, the motive of these financial institution is to have

better efficiency as to meet the challenges in the market. It has impacted over various economies

such as developing and developed (Aaronson and et.al., 2018). The impacts as well as influences

of financial crisis were direct and indirect. Moreover, due to such regards many of the small

2

such as huge level of monetary circulation in the market. Consumers were having interest in

investing the money over long term investment plans as the loans and interest rates were

comparatively lower. The banks allowed lower rates as they wanted to meet the challenges and

competition in the market, Thus, due to lower interest rates there will be less collection of money

and at the time of global financial crisis impacts over the national economy, there is no money

left with the banks (Buyl, Boone and Wade, 2017). There has been huge reduction in the

governmental reserves and funds which has eventually lowers down the revenue of citizens.

There has been negative impacts over the growth of economy. Thus, the per capita GDP has the

negative outcomes which indicates that during such period the small or medium size

organisations has negative impacts of the global financial crisis (Laux and Rauter, 2017). This in

turn reduces the economic level as well as living standard of the people.

It has been observed here that the speculative boom was extended due to derivatives in

the global financial crisis which was not in at the time of great depression. The impacts of great

depression was originated from United state there has been major fall in the stock value of

various industries. Therefore, During such a phase there has been reduction in the prices of the

share values of the firm which indicates the downfall of the economy (Bai, Krishnamurthy and

Weymuller, 2018). There are various entities which were bankrupt and have no capital amount to

operate their business activities. Moreover, it has affected the banks with not money to grant

them from better operations in the time. Similarly, the global financial crisis has impacted over

the nation as per the poor banking policies of the government. To meet the competition the

private and public sector of financial authorities has facilitated the loans in the market at lower

returns which indicates economic crisis (Irani and Meisenzahl, 2017). During such period there

are various issues arises such as inflation, fall of GDP rates, unemployment, fall in national

income as well as economic rates. The liquidity and current ability of nations has been

challenged through such variations in the economy.

The banks in United States has started making the excessive Sub prime loans to the

consumers at very lower rate of return. Thus, the motive of these financial institution is to have

better efficiency as to meet the challenges in the market. It has impacted over various economies

such as developing and developed (Aaronson and et.al., 2018). The impacts as well as influences

of financial crisis were direct and indirect. Moreover, due to such regards many of the small

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business has demolished as there are no money left wit the bank which will be helpful to them as

per growth and operations. Thus, such impacts in bringing the unemployment in the national

environment (Ruhl and Willis, 2017). Additionally, there are various other nations which were

affected by the impacts of Global Financial crisis.

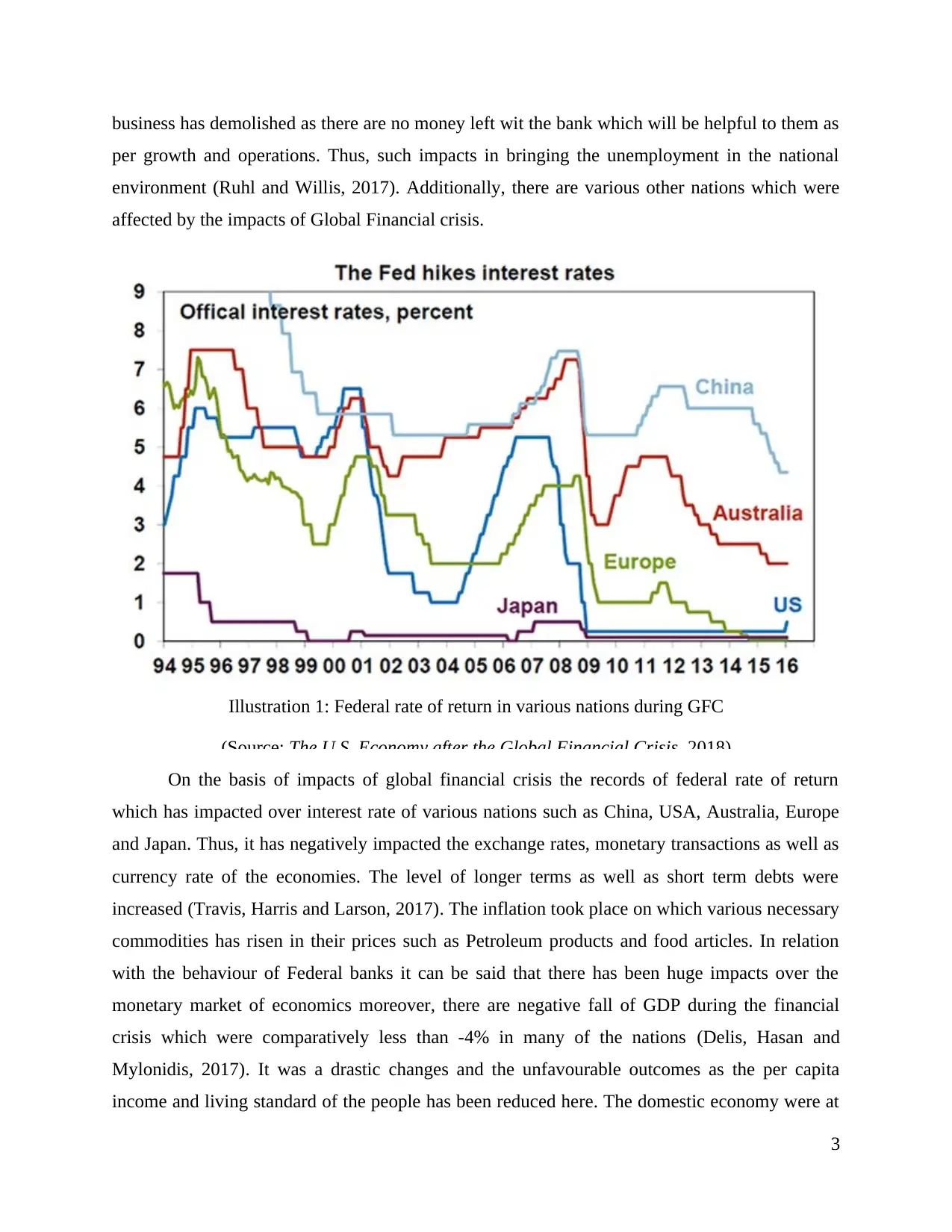

Illustration 1: Federal rate of return in various nations during GFC

(Source: The U.S. Economy after the Global Financial Crisis, 2018)

On the basis of impacts of global financial crisis the records of federal rate of return

which has impacted over interest rate of various nations such as China, USA, Australia, Europe

and Japan. Thus, it has negatively impacted the exchange rates, monetary transactions as well as

currency rate of the economies. The level of longer terms as well as short term debts were

increased (Travis, Harris and Larson, 2017). The inflation took place on which various necessary

commodities has risen in their prices such as Petroleum products and food articles. In relation

with the behaviour of Federal banks it can be said that there has been huge impacts over the

monetary market of economics moreover, there are negative fall of GDP during the financial

crisis which were comparatively less than -4% in many of the nations (Delis, Hasan and

Mylonidis, 2017). It was a drastic changes and the unfavourable outcomes as the per capita

income and living standard of the people has been reduced here. The domestic economy were at

3

per growth and operations. Thus, such impacts in bringing the unemployment in the national

environment (Ruhl and Willis, 2017). Additionally, there are various other nations which were

affected by the impacts of Global Financial crisis.

Illustration 1: Federal rate of return in various nations during GFC

(Source: The U.S. Economy after the Global Financial Crisis, 2018)

On the basis of impacts of global financial crisis the records of federal rate of return

which has impacted over interest rate of various nations such as China, USA, Australia, Europe

and Japan. Thus, it has negatively impacted the exchange rates, monetary transactions as well as

currency rate of the economies. The level of longer terms as well as short term debts were

increased (Travis, Harris and Larson, 2017). The inflation took place on which various necessary

commodities has risen in their prices such as Petroleum products and food articles. In relation

with the behaviour of Federal banks it can be said that there has been huge impacts over the

monetary market of economics moreover, there are negative fall of GDP during the financial

crisis which were comparatively less than -4% in many of the nations (Delis, Hasan and

Mylonidis, 2017). It was a drastic changes and the unfavourable outcomes as the per capita

income and living standard of the people has been reduced here. The domestic economy were at

3

their challenging phase which ascertains that there has been reduction in the operational

activities.

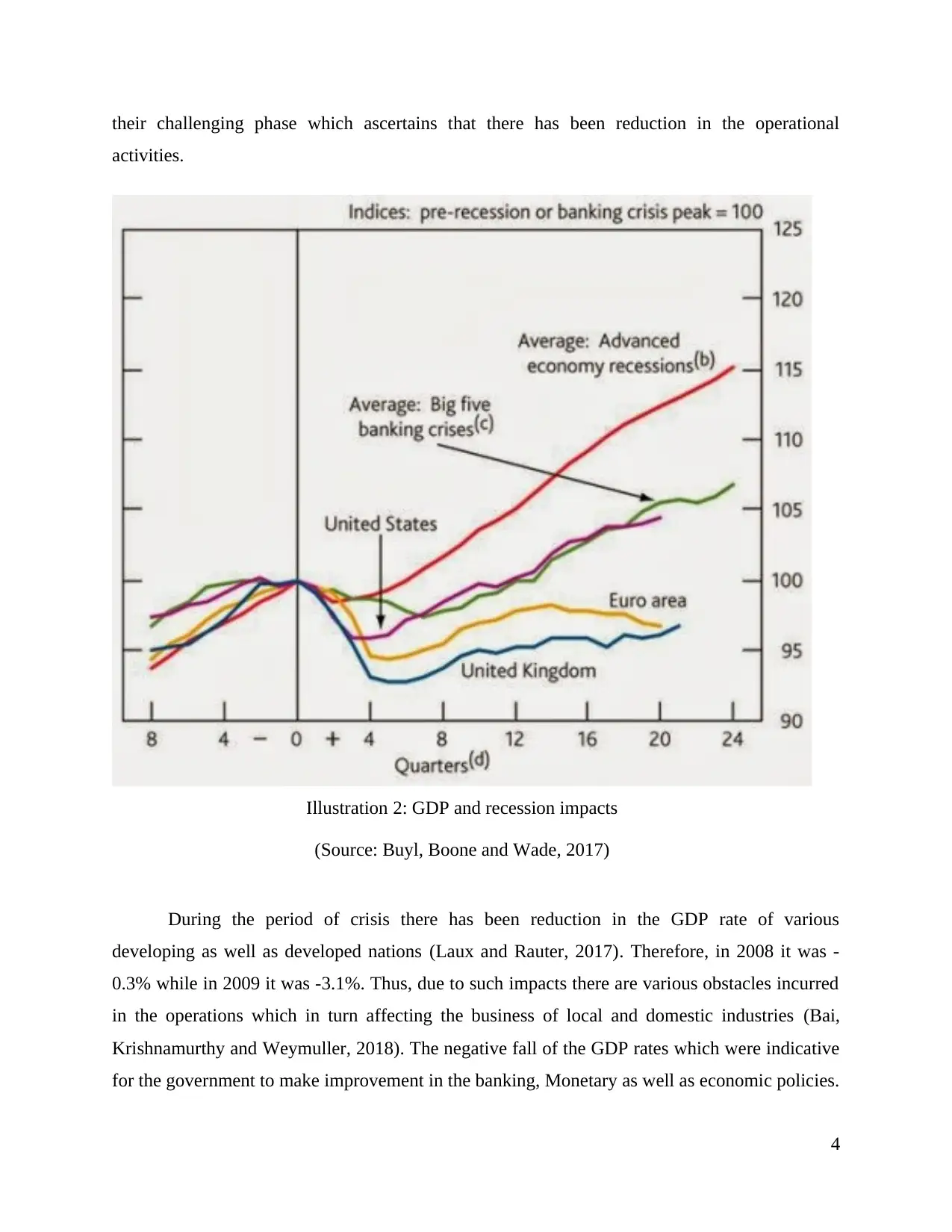

Illustration 2: GDP and recession impacts

(Source: Buyl, Boone and Wade, 2017)

During the period of crisis there has been reduction in the GDP rate of various

developing as well as developed nations (Laux and Rauter, 2017). Therefore, in 2008 it was -

0.3% while in 2009 it was -3.1%. Thus, due to such impacts there are various obstacles incurred

in the operations which in turn affecting the business of local and domestic industries (Bai,

Krishnamurthy and Weymuller, 2018). The negative fall of the GDP rates which were indicative

for the government to make improvement in the banking, Monetary as well as economic policies.

4

activities.

Illustration 2: GDP and recession impacts

(Source: Buyl, Boone and Wade, 2017)

During the period of crisis there has been reduction in the GDP rate of various

developing as well as developed nations (Laux and Rauter, 2017). Therefore, in 2008 it was -

0.3% while in 2009 it was -3.1%. Thus, due to such impacts there are various obstacles incurred

in the operations which in turn affecting the business of local and domestic industries (Bai,

Krishnamurthy and Weymuller, 2018). The negative fall of the GDP rates which were indicative

for the government to make improvement in the banking, Monetary as well as economic policies.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The level of imports were higher than compared to the exports. It has incurred due to no micro

level of economic policies were effective to build the economic standard of the citizens (Irani

and Meisenzahl, 2017). Later on it took time in again stabilised at GDP for the period of 2010 to

13 which was 1.95%. Thus, the rate was not that adequate appropriate as there is need to have

appropriate changes in the governmental policies to improve the financial environment of nations

(Aaronson and et.al., 2018). The impacts of global financial crisis has made reduction in the

economic viability as well as improper management of the financial activities in the economy.

The invitation of the inflation has incurred the big monetary losses to the government as well as

to the small scale enterprises (Travis, Harris and Larson, 2017). Due to impacts of the global

financial crisis there has been negative impacts over the consumer confidence level. Thus, it

impacts over their buying behaviour as the rise in the prices took place due to inflation which

impacts consumers to save their money.

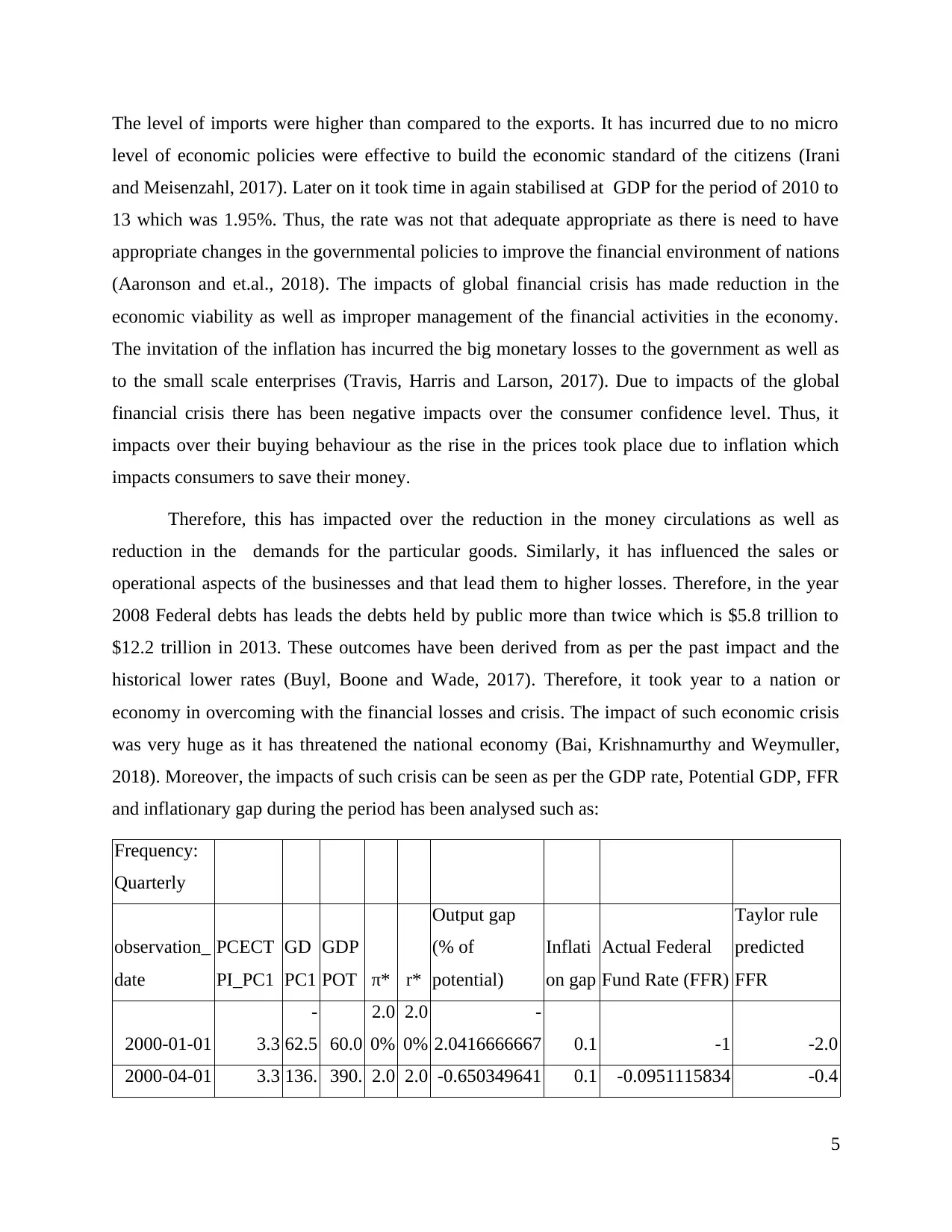

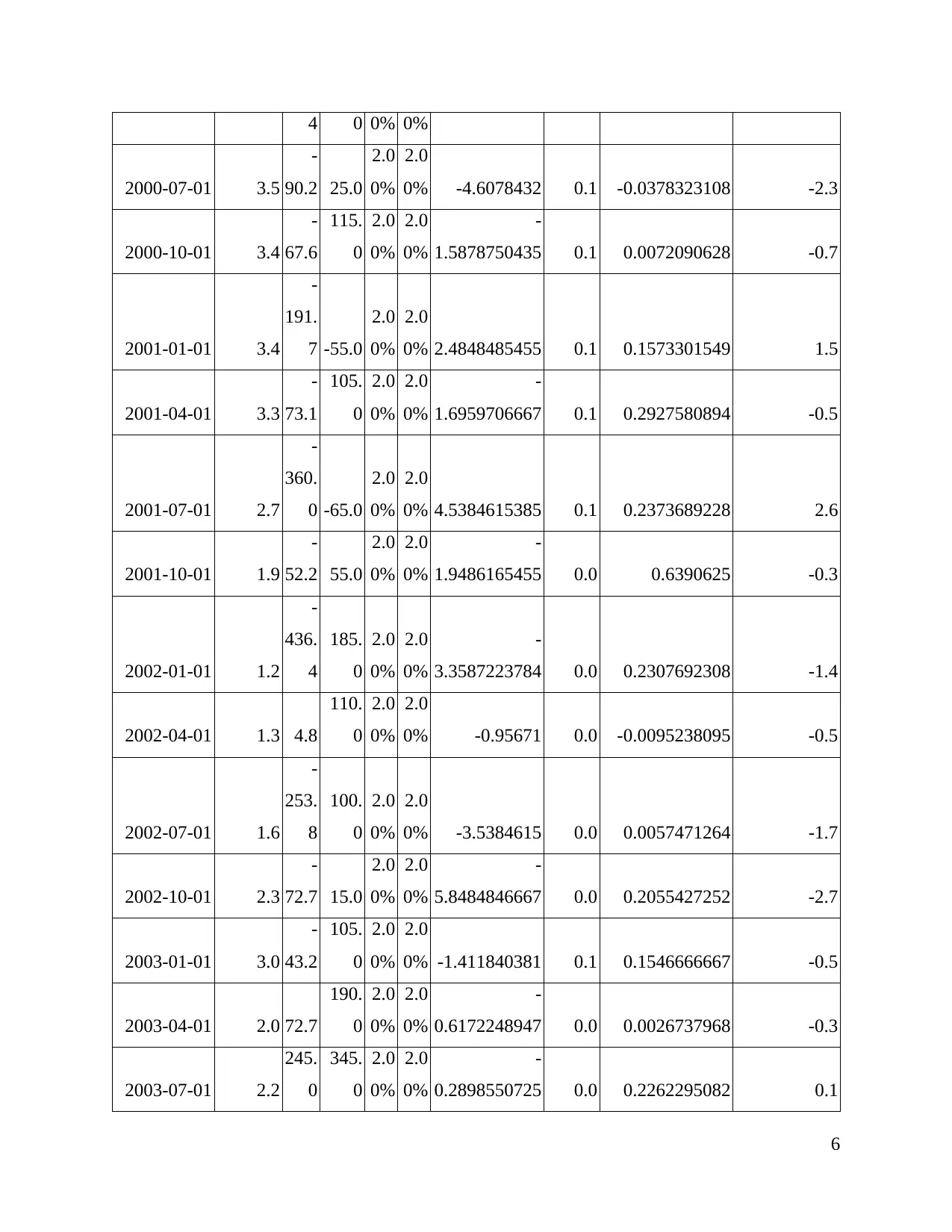

Therefore, this has impacted over the reduction in the money circulations as well as

reduction in the demands for the particular goods. Similarly, it has influenced the sales or

operational aspects of the businesses and that lead them to higher losses. Therefore, in the year

2008 Federal debts has leads the debts held by public more than twice which is $5.8 trillion to

$12.2 trillion in 2013. These outcomes have been derived from as per the past impact and the

historical lower rates (Buyl, Boone and Wade, 2017). Therefore, it took year to a nation or

economy in overcoming with the financial losses and crisis. The impact of such economic crisis

was very huge as it has threatened the national economy (Bai, Krishnamurthy and Weymuller,

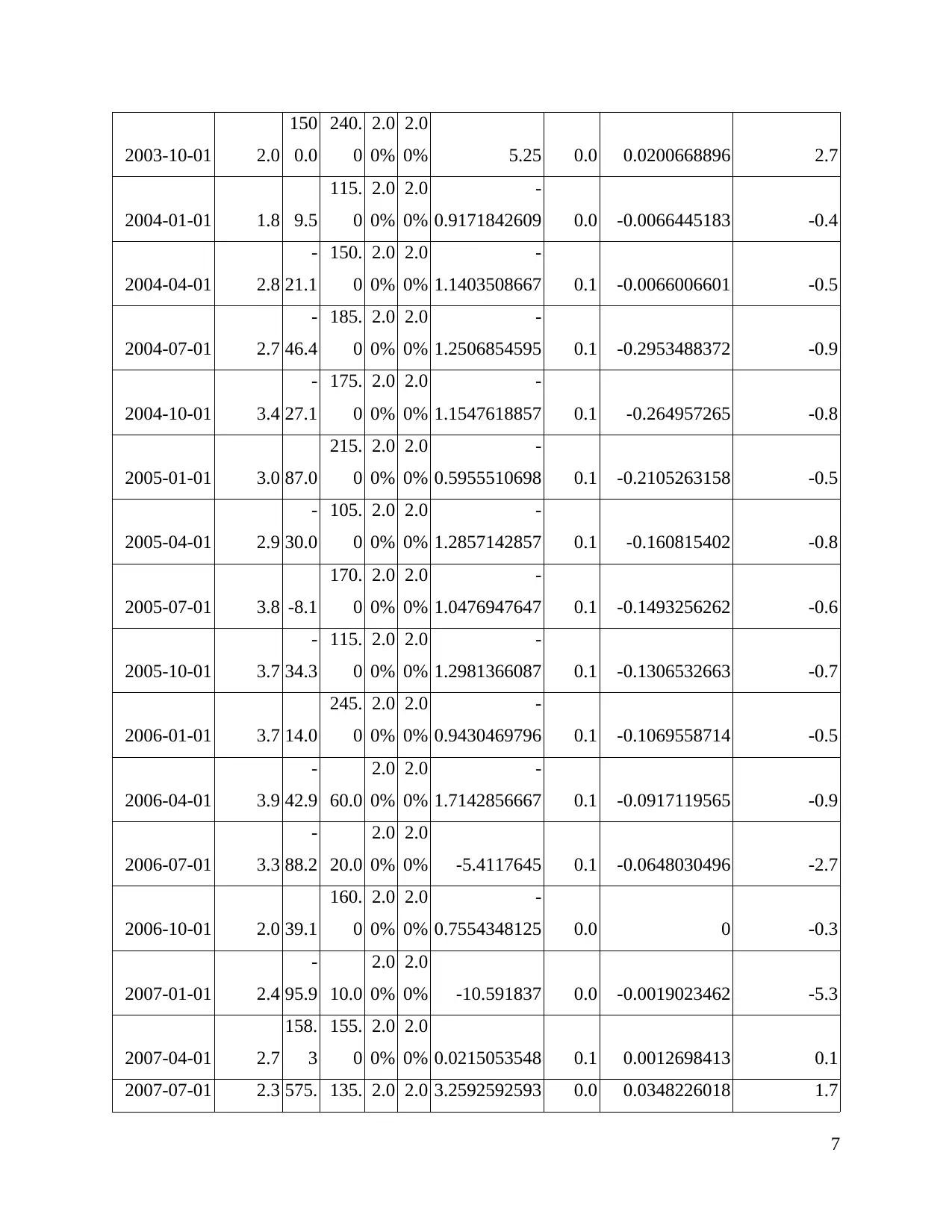

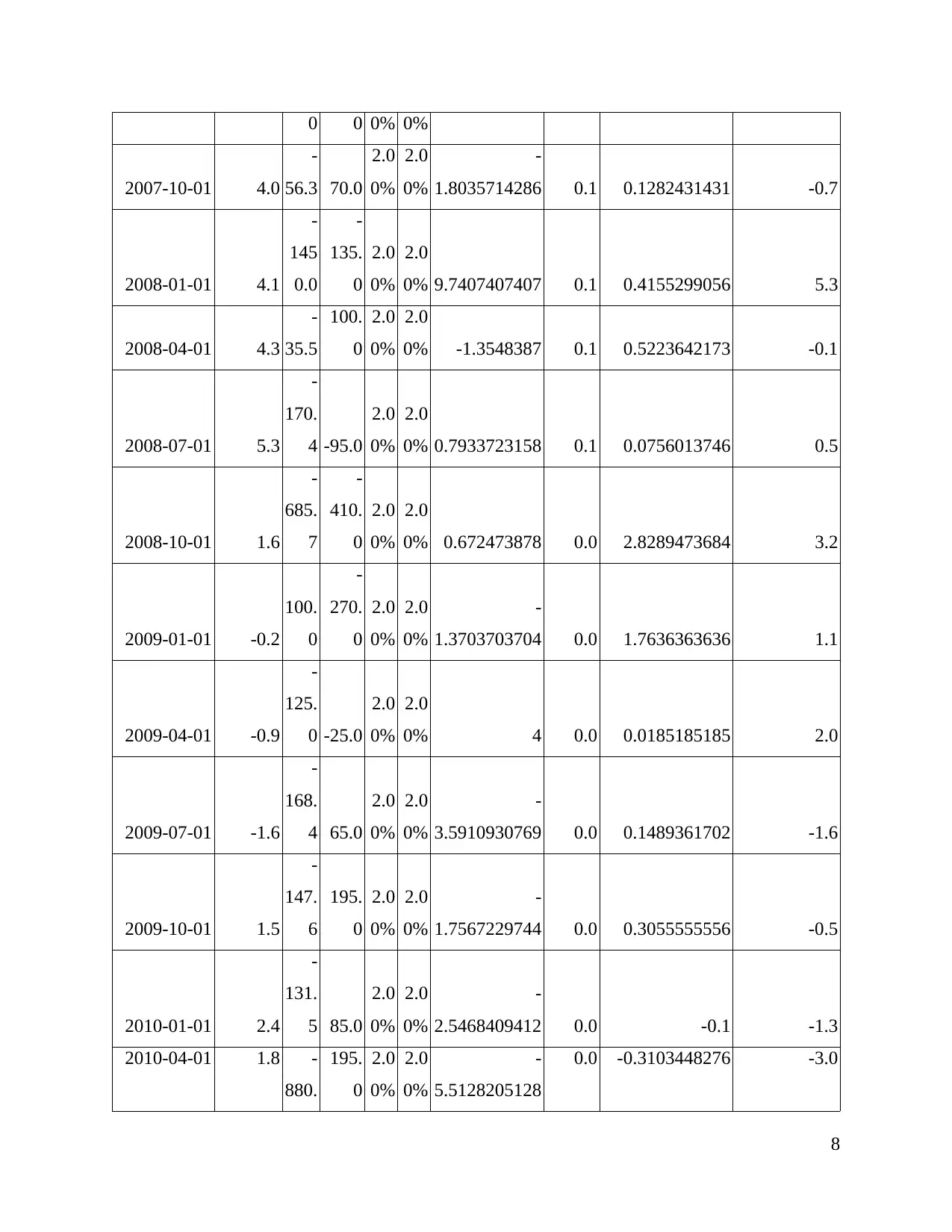

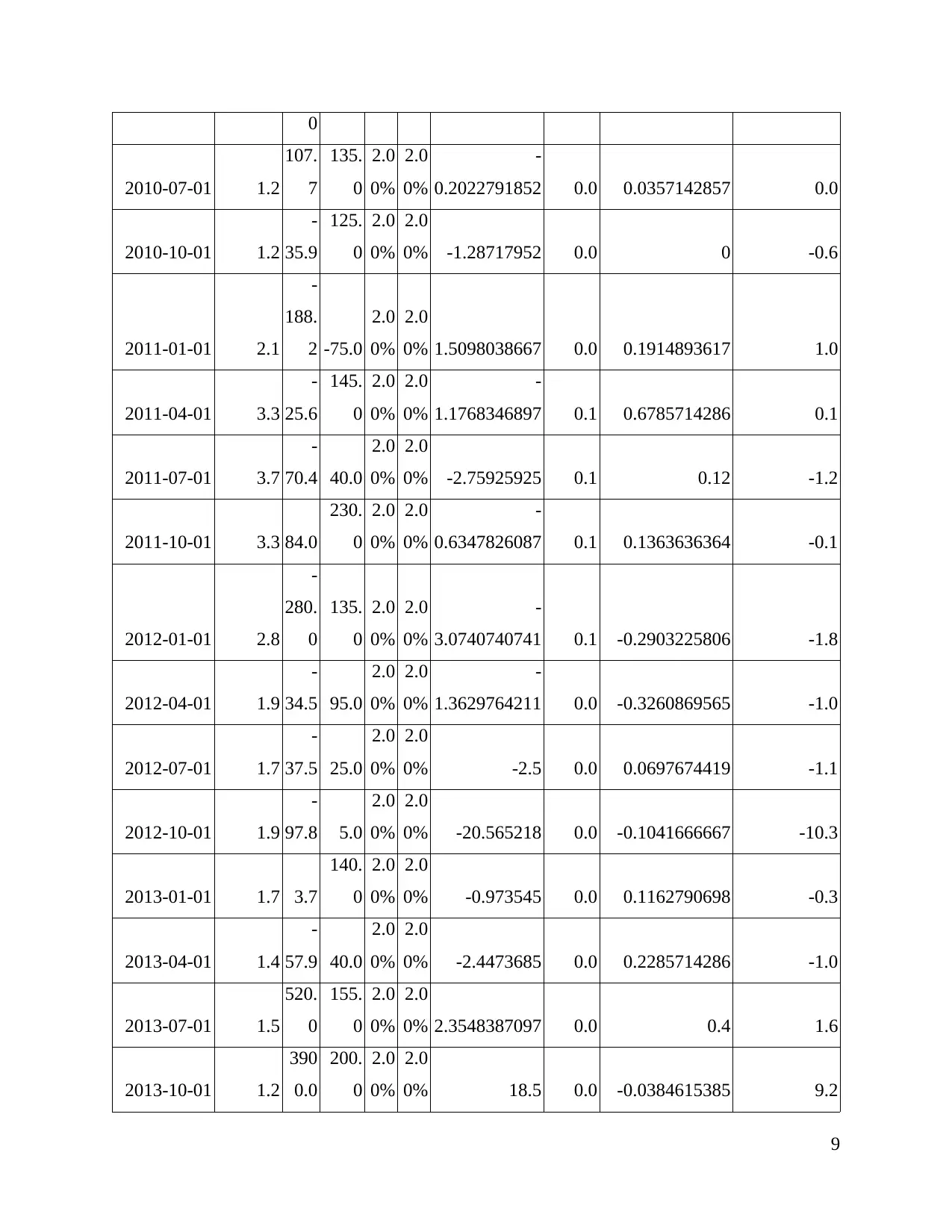

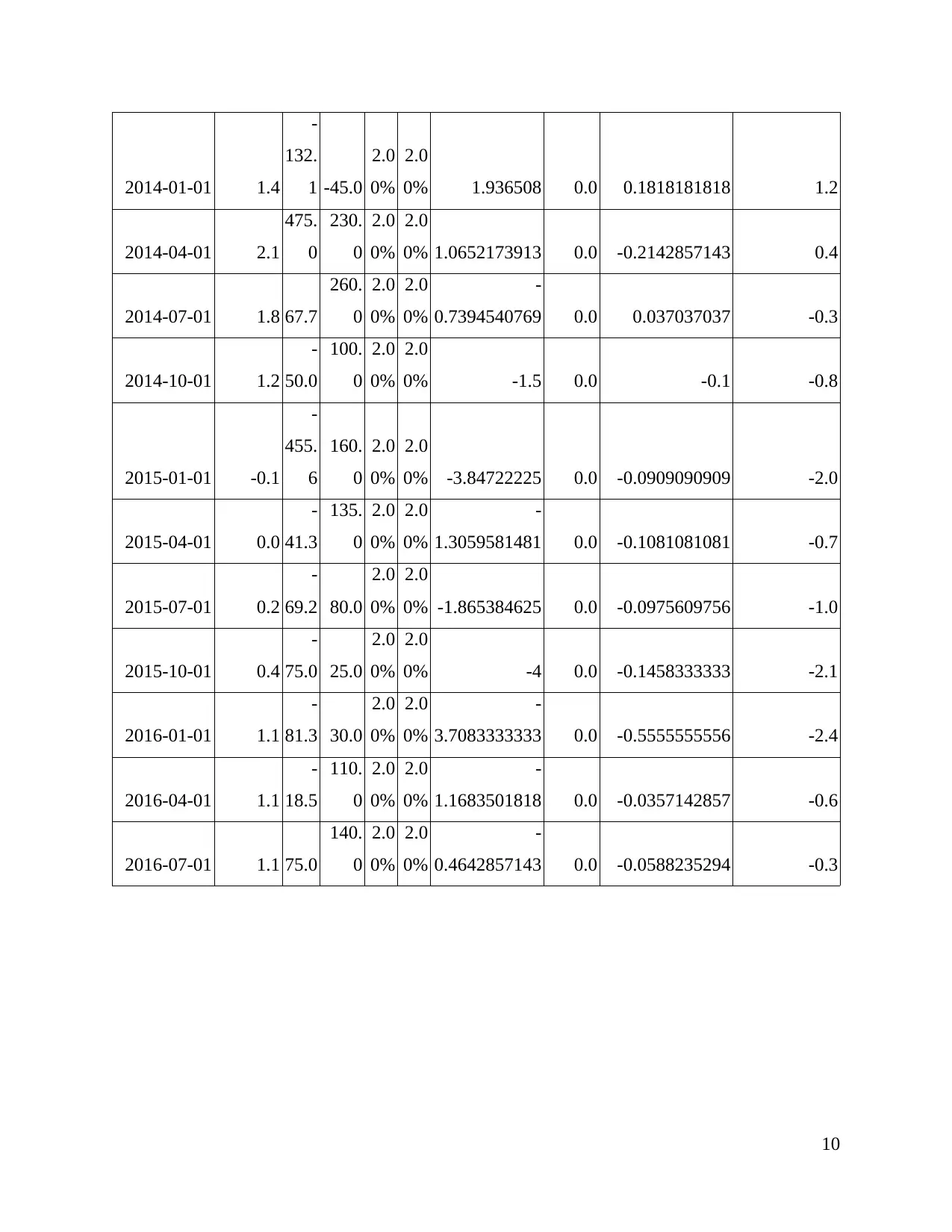

2018). Moreover, the impacts of such crisis can be seen as per the GDP rate, Potential GDP, FFR

and inflationary gap during the period has been analysed such as:

Frequency:

Quarterly

observation_

date

PCECT

PI_PC1

GD

PC1

GDP

POT π* r*

Output gap

(% of

potential)

Inflati

on gap

Actual Federal

Fund Rate (FFR)

Taylor rule

predicted

FFR

2000-01-01 3.3

-

62.5 60.0

2.0

0%

2.0

0%

-

2.0416666667 0.1 -1 -2.0

2000-04-01 3.3 136. 390. 2.0 2.0 -0.650349641 0.1 -0.0951115834 -0.4

5

level of economic policies were effective to build the economic standard of the citizens (Irani

and Meisenzahl, 2017). Later on it took time in again stabilised at GDP for the period of 2010 to

13 which was 1.95%. Thus, the rate was not that adequate appropriate as there is need to have

appropriate changes in the governmental policies to improve the financial environment of nations

(Aaronson and et.al., 2018). The impacts of global financial crisis has made reduction in the

economic viability as well as improper management of the financial activities in the economy.

The invitation of the inflation has incurred the big monetary losses to the government as well as

to the small scale enterprises (Travis, Harris and Larson, 2017). Due to impacts of the global

financial crisis there has been negative impacts over the consumer confidence level. Thus, it

impacts over their buying behaviour as the rise in the prices took place due to inflation which

impacts consumers to save their money.

Therefore, this has impacted over the reduction in the money circulations as well as

reduction in the demands for the particular goods. Similarly, it has influenced the sales or

operational aspects of the businesses and that lead them to higher losses. Therefore, in the year

2008 Federal debts has leads the debts held by public more than twice which is $5.8 trillion to

$12.2 trillion in 2013. These outcomes have been derived from as per the past impact and the

historical lower rates (Buyl, Boone and Wade, 2017). Therefore, it took year to a nation or

economy in overcoming with the financial losses and crisis. The impact of such economic crisis

was very huge as it has threatened the national economy (Bai, Krishnamurthy and Weymuller,

2018). Moreover, the impacts of such crisis can be seen as per the GDP rate, Potential GDP, FFR

and inflationary gap during the period has been analysed such as:

Frequency:

Quarterly

observation_

date

PCECT

PI_PC1

GD

PC1

GDP

POT π* r*

Output gap

(% of

potential)

Inflati

on gap

Actual Federal

Fund Rate (FFR)

Taylor rule

predicted

FFR

2000-01-01 3.3

-

62.5 60.0

2.0

0%

2.0

0%

-

2.0416666667 0.1 -1 -2.0

2000-04-01 3.3 136. 390. 2.0 2.0 -0.650349641 0.1 -0.0951115834 -0.4

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4 0 0% 0%

2000-07-01 3.5

-

90.2 25.0

2.0

0%

2.0

0% -4.6078432 0.1 -0.0378323108 -2.3

2000-10-01 3.4

-

67.6

115.

0

2.0

0%

2.0

0%

-

1.5878750435 0.1 0.0072090628 -0.7

2001-01-01 3.4

-

191.

7 -55.0

2.0

0%

2.0

0% 2.4848485455 0.1 0.1573301549 1.5

2001-04-01 3.3

-

73.1

105.

0

2.0

0%

2.0

0%

-

1.6959706667 0.1 0.2927580894 -0.5

2001-07-01 2.7

-

360.

0 -65.0

2.0

0%

2.0

0% 4.5384615385 0.1 0.2373689228 2.6

2001-10-01 1.9

-

52.2 55.0

2.0

0%

2.0

0%

-

1.9486165455 0.0 0.6390625 -0.3

2002-01-01 1.2

-

436.

4

185.

0

2.0

0%

2.0

0%

-

3.3587223784 0.0 0.2307692308 -1.4

2002-04-01 1.3 4.8

110.

0

2.0

0%

2.0

0% -0.95671 0.0 -0.0095238095 -0.5

2002-07-01 1.6

-

253.

8

100.

0

2.0

0%

2.0

0% -3.5384615 0.0 0.0057471264 -1.7

2002-10-01 2.3

-

72.7 15.0

2.0

0%

2.0

0%

-

5.8484846667 0.0 0.2055427252 -2.7

2003-01-01 3.0

-

43.2

105.

0

2.0

0%

2.0

0% -1.411840381 0.1 0.1546666667 -0.5

2003-04-01 2.0 72.7

190.

0

2.0

0%

2.0

0%

-

0.6172248947 0.0 0.0026737968 -0.3

2003-07-01 2.2

245.

0

345.

0

2.0

0%

2.0

0%

-

0.2898550725 0.0 0.2262295082 0.1

6

2000-07-01 3.5

-

90.2 25.0

2.0

0%

2.0

0% -4.6078432 0.1 -0.0378323108 -2.3

2000-10-01 3.4

-

67.6

115.

0

2.0

0%

2.0

0%

-

1.5878750435 0.1 0.0072090628 -0.7

2001-01-01 3.4

-

191.

7 -55.0

2.0

0%

2.0

0% 2.4848485455 0.1 0.1573301549 1.5

2001-04-01 3.3

-

73.1

105.

0

2.0

0%

2.0

0%

-

1.6959706667 0.1 0.2927580894 -0.5

2001-07-01 2.7

-

360.

0 -65.0

2.0

0%

2.0

0% 4.5384615385 0.1 0.2373689228 2.6

2001-10-01 1.9

-

52.2 55.0

2.0

0%

2.0

0%

-

1.9486165455 0.0 0.6390625 -0.3

2002-01-01 1.2

-

436.

4

185.

0

2.0

0%

2.0

0%

-

3.3587223784 0.0 0.2307692308 -1.4

2002-04-01 1.3 4.8

110.

0

2.0

0%

2.0

0% -0.95671 0.0 -0.0095238095 -0.5

2002-07-01 1.6

-

253.

8

100.

0

2.0

0%

2.0

0% -3.5384615 0.0 0.0057471264 -1.7

2002-10-01 2.3

-

72.7 15.0

2.0

0%

2.0

0%

-

5.8484846667 0.0 0.2055427252 -2.7

2003-01-01 3.0

-

43.2

105.

0

2.0

0%

2.0

0% -1.411840381 0.1 0.1546666667 -0.5

2003-04-01 2.0 72.7

190.

0

2.0

0%

2.0

0%

-

0.6172248947 0.0 0.0026737968 -0.3

2003-07-01 2.2

245.

0

345.

0

2.0

0%

2.0

0%

-

0.2898550725 0.0 0.2262295082 0.1

6

2003-10-01 2.0

150

0.0

240.

0

2.0

0%

2.0

0% 5.25 0.0 0.0200668896 2.7

2004-01-01 1.8 9.5

115.

0

2.0

0%

2.0

0%

-

0.9171842609 0.0 -0.0066445183 -0.4

2004-04-01 2.8

-

21.1

150.

0

2.0

0%

2.0

0%

-

1.1403508667 0.1 -0.0066006601 -0.5

2004-07-01 2.7

-

46.4

185.

0

2.0

0%

2.0

0%

-

1.2506854595 0.1 -0.2953488372 -0.9

2004-10-01 3.4

-

27.1

175.

0

2.0

0%

2.0

0%

-

1.1547618857 0.1 -0.264957265 -0.8

2005-01-01 3.0 87.0

215.

0

2.0

0%

2.0

0%

-

0.5955510698 0.1 -0.2105263158 -0.5

2005-04-01 2.9

-

30.0

105.

0

2.0

0%

2.0

0%

-

1.2857142857 0.1 -0.160815402 -0.8

2005-07-01 3.8 -8.1

170.

0

2.0

0%

2.0

0%

-

1.0476947647 0.1 -0.1493256262 -0.6

2005-10-01 3.7

-

34.3

115.

0

2.0

0%

2.0

0%

-

1.2981366087 0.1 -0.1306532663 -0.7

2006-01-01 3.7 14.0

245.

0

2.0

0%

2.0

0%

-

0.9430469796 0.1 -0.1069558714 -0.5

2006-04-01 3.9

-

42.9 60.0

2.0

0%

2.0

0%

-

1.7142856667 0.1 -0.0917119565 -0.9

2006-07-01 3.3

-

88.2 20.0

2.0

0%

2.0

0% -5.4117645 0.1 -0.0648030496 -2.7

2006-10-01 2.0 39.1

160.

0

2.0

0%

2.0

0%

-

0.7554348125 0.0 0 -0.3

2007-01-01 2.4

-

95.9 10.0

2.0

0%

2.0

0% -10.591837 0.0 -0.0019023462 -5.3

2007-04-01 2.7

158.

3

155.

0

2.0

0%

2.0

0% 0.0215053548 0.1 0.0012698413 0.1

2007-07-01 2.3 575. 135. 2.0 2.0 3.2592592593 0.0 0.0348226018 1.7

7

150

0.0

240.

0

2.0

0%

2.0

0% 5.25 0.0 0.0200668896 2.7

2004-01-01 1.8 9.5

115.

0

2.0

0%

2.0

0%

-

0.9171842609 0.0 -0.0066445183 -0.4

2004-04-01 2.8

-

21.1

150.

0

2.0

0%

2.0

0%

-

1.1403508667 0.1 -0.0066006601 -0.5

2004-07-01 2.7

-

46.4

185.

0

2.0

0%

2.0

0%

-

1.2506854595 0.1 -0.2953488372 -0.9

2004-10-01 3.4

-

27.1

175.

0

2.0

0%

2.0

0%

-

1.1547618857 0.1 -0.264957265 -0.8

2005-01-01 3.0 87.0

215.

0

2.0

0%

2.0

0%

-

0.5955510698 0.1 -0.2105263158 -0.5

2005-04-01 2.9

-

30.0

105.

0

2.0

0%

2.0

0%

-

1.2857142857 0.1 -0.160815402 -0.8

2005-07-01 3.8 -8.1

170.

0

2.0

0%

2.0

0%

-

1.0476947647 0.1 -0.1493256262 -0.6

2005-10-01 3.7

-

34.3

115.

0

2.0

0%

2.0

0%

-

1.2981366087 0.1 -0.1306532663 -0.7

2006-01-01 3.7 14.0

245.

0

2.0

0%

2.0

0%

-

0.9430469796 0.1 -0.1069558714 -0.5

2006-04-01 3.9

-

42.9 60.0

2.0

0%

2.0

0%

-

1.7142856667 0.1 -0.0917119565 -0.9

2006-07-01 3.3

-

88.2 20.0

2.0

0%

2.0

0% -5.4117645 0.1 -0.0648030496 -2.7

2006-10-01 2.0 39.1

160.

0

2.0

0%

2.0

0%

-

0.7554348125 0.0 0 -0.3

2007-01-01 2.4

-

95.9 10.0

2.0

0%

2.0

0% -10.591837 0.0 -0.0019023462 -5.3

2007-04-01 2.7

158.

3

155.

0

2.0

0%

2.0

0% 0.0215053548 0.1 0.0012698413 0.1

2007-07-01 2.3 575. 135. 2.0 2.0 3.2592592593 0.0 0.0348226018 1.7

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0 0 0% 0%

2007-10-01 4.0

-

56.3 70.0

2.0

0%

2.0

0%

-

1.8035714286 0.1 0.1282431431 -0.7

2008-01-01 4.1

-

145

0.0

-

135.

0

2.0

0%

2.0

0% 9.7407407407 0.1 0.4155299056 5.3

2008-04-01 4.3

-

35.5

100.

0

2.0

0%

2.0

0% -1.3548387 0.1 0.5223642173 -0.1

2008-07-01 5.3

-

170.

4 -95.0

2.0

0%

2.0

0% 0.7933723158 0.1 0.0756013746 0.5

2008-10-01 1.6

-

685.

7

-

410.

0

2.0

0%

2.0

0% 0.672473878 0.0 2.8289473684 3.2

2009-01-01 -0.2

100.

0

-

270.

0

2.0

0%

2.0

0%

-

1.3703703704 0.0 1.7636363636 1.1

2009-04-01 -0.9

-

125.

0 -25.0

2.0

0%

2.0

0% 4 0.0 0.0185185185 2.0

2009-07-01 -1.6

-

168.

4 65.0

2.0

0%

2.0

0%

-

3.5910930769 0.0 0.1489361702 -1.6

2009-10-01 1.5

-

147.

6

195.

0

2.0

0%

2.0

0%

-

1.7567229744 0.0 0.3055555556 -0.5

2010-01-01 2.4

-

131.

5 85.0

2.0

0%

2.0

0%

-

2.5468409412 0.0 -0.1 -1.3

2010-04-01 1.8 -

880.

195.

0

2.0

0%

2.0

0%

-

5.5128205128

0.0 -0.3103448276 -3.0

8

2007-10-01 4.0

-

56.3 70.0

2.0

0%

2.0

0%

-

1.8035714286 0.1 0.1282431431 -0.7

2008-01-01 4.1

-

145

0.0

-

135.

0

2.0

0%

2.0

0% 9.7407407407 0.1 0.4155299056 5.3

2008-04-01 4.3

-

35.5

100.

0

2.0

0%

2.0

0% -1.3548387 0.1 0.5223642173 -0.1

2008-07-01 5.3

-

170.

4 -95.0

2.0

0%

2.0

0% 0.7933723158 0.1 0.0756013746 0.5

2008-10-01 1.6

-

685.

7

-

410.

0

2.0

0%

2.0

0% 0.672473878 0.0 2.8289473684 3.2

2009-01-01 -0.2

100.

0

-

270.

0

2.0

0%

2.0

0%

-

1.3703703704 0.0 1.7636363636 1.1

2009-04-01 -0.9

-

125.

0 -25.0

2.0

0%

2.0

0% 4 0.0 0.0185185185 2.0

2009-07-01 -1.6

-

168.

4 65.0

2.0

0%

2.0

0%

-

3.5910930769 0.0 0.1489361702 -1.6

2009-10-01 1.5

-

147.

6

195.

0

2.0

0%

2.0

0%

-

1.7567229744 0.0 0.3055555556 -0.5

2010-01-01 2.4

-

131.

5 85.0

2.0

0%

2.0

0%

-

2.5468409412 0.0 -0.1 -1.3

2010-04-01 1.8 -

880.

195.

0

2.0

0%

2.0

0%

-

5.5128205128

0.0 -0.3103448276 -3.0

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0

2010-07-01 1.2

107.

7

135.

0

2.0

0%

2.0

0%

-

0.2022791852 0.0 0.0357142857 0.0

2010-10-01 1.2

-

35.9

125.

0

2.0

0%

2.0

0% -1.28717952 0.0 0 -0.6

2011-01-01 2.1

-

188.

2 -75.0

2.0

0%

2.0

0% 1.5098038667 0.0 0.1914893617 1.0

2011-04-01 3.3

-

25.6

145.

0

2.0

0%

2.0

0%

-

1.1768346897 0.1 0.6785714286 0.1

2011-07-01 3.7

-

70.4 40.0

2.0

0%

2.0

0% -2.75925925 0.1 0.12 -1.2

2011-10-01 3.3 84.0

230.

0

2.0

0%

2.0

0%

-

0.6347826087 0.1 0.1363636364 -0.1

2012-01-01 2.8

-

280.

0

135.

0

2.0

0%

2.0

0%

-

3.0740740741 0.1 -0.2903225806 -1.8

2012-04-01 1.9

-

34.5 95.0

2.0

0%

2.0

0%

-

1.3629764211 0.0 -0.3260869565 -1.0

2012-07-01 1.7

-

37.5 25.0

2.0

0%

2.0

0% -2.5 0.0 0.0697674419 -1.1

2012-10-01 1.9

-

97.8 5.0

2.0

0%

2.0

0% -20.565218 0.0 -0.1041666667 -10.3

2013-01-01 1.7 3.7

140.

0

2.0

0%

2.0

0% -0.973545 0.0 0.1162790698 -0.3

2013-04-01 1.4

-

57.9 40.0

2.0

0%

2.0

0% -2.4473685 0.0 0.2285714286 -1.0

2013-07-01 1.5

520.

0

155.

0

2.0

0%

2.0

0% 2.3548387097 0.0 0.4 1.6

2013-10-01 1.2

390

0.0

200.

0

2.0

0%

2.0

0% 18.5 0.0 -0.0384615385 9.2

9

2010-07-01 1.2

107.

7

135.

0

2.0

0%

2.0

0%

-

0.2022791852 0.0 0.0357142857 0.0

2010-10-01 1.2

-

35.9

125.

0

2.0

0%

2.0

0% -1.28717952 0.0 0 -0.6

2011-01-01 2.1

-

188.

2 -75.0

2.0

0%

2.0

0% 1.5098038667 0.0 0.1914893617 1.0

2011-04-01 3.3

-

25.6

145.

0

2.0

0%

2.0

0%

-

1.1768346897 0.1 0.6785714286 0.1

2011-07-01 3.7

-

70.4 40.0

2.0

0%

2.0

0% -2.75925925 0.1 0.12 -1.2

2011-10-01 3.3 84.0

230.

0

2.0

0%

2.0

0%

-

0.6347826087 0.1 0.1363636364 -0.1

2012-01-01 2.8

-

280.

0

135.

0

2.0

0%

2.0

0%

-

3.0740740741 0.1 -0.2903225806 -1.8

2012-04-01 1.9

-

34.5 95.0

2.0

0%

2.0

0%

-

1.3629764211 0.0 -0.3260869565 -1.0

2012-07-01 1.7

-

37.5 25.0

2.0

0%

2.0

0% -2.5 0.0 0.0697674419 -1.1

2012-10-01 1.9

-

97.8 5.0

2.0

0%

2.0

0% -20.565218 0.0 -0.1041666667 -10.3

2013-01-01 1.7 3.7

140.

0

2.0

0%

2.0

0% -0.973545 0.0 0.1162790698 -0.3

2013-04-01 1.4

-

57.9 40.0

2.0

0%

2.0

0% -2.4473685 0.0 0.2285714286 -1.0

2013-07-01 1.5

520.

0

155.

0

2.0

0%

2.0

0% 2.3548387097 0.0 0.4 1.6

2013-10-01 1.2

390

0.0

200.

0

2.0

0%

2.0

0% 18.5 0.0 -0.0384615385 9.2

9

2014-01-01 1.4

-

132.

1 -45.0

2.0

0%

2.0

0% 1.936508 0.0 0.1818181818 1.2

2014-04-01 2.1

475.

0

230.

0

2.0

0%

2.0

0% 1.0652173913 0.0 -0.2142857143 0.4

2014-07-01 1.8 67.7

260.

0

2.0

0%

2.0

0%

-

0.7394540769 0.0 0.037037037 -0.3

2014-10-01 1.2

-

50.0

100.

0

2.0

0%

2.0

0% -1.5 0.0 -0.1 -0.8

2015-01-01 -0.1

-

455.

6

160.

0

2.0

0%

2.0

0% -3.84722225 0.0 -0.0909090909 -2.0

2015-04-01 0.0

-

41.3

135.

0

2.0

0%

2.0

0%

-

1.3059581481 0.0 -0.1081081081 -0.7

2015-07-01 0.2

-

69.2 80.0

2.0

0%

2.0

0% -1.865384625 0.0 -0.0975609756 -1.0

2015-10-01 0.4

-

75.0 25.0

2.0

0%

2.0

0% -4 0.0 -0.1458333333 -2.1

2016-01-01 1.1

-

81.3 30.0

2.0

0%

2.0

0%

-

3.7083333333 0.0 -0.5555555556 -2.4

2016-04-01 1.1

-

18.5

110.

0

2.0

0%

2.0

0%

-

1.1683501818 0.0 -0.0357142857 -0.6

2016-07-01 1.1 75.0

140.

0

2.0

0%

2.0

0%

-

0.4642857143 0.0 -0.0588235294 -0.3

10

-

132.

1 -45.0

2.0

0%

2.0

0% 1.936508 0.0 0.1818181818 1.2

2014-04-01 2.1

475.

0

230.

0

2.0

0%

2.0

0% 1.0652173913 0.0 -0.2142857143 0.4

2014-07-01 1.8 67.7

260.

0

2.0

0%

2.0

0%

-

0.7394540769 0.0 0.037037037 -0.3

2014-10-01 1.2

-

50.0

100.

0

2.0

0%

2.0

0% -1.5 0.0 -0.1 -0.8

2015-01-01 -0.1

-

455.

6

160.

0

2.0

0%

2.0

0% -3.84722225 0.0 -0.0909090909 -2.0

2015-04-01 0.0

-

41.3

135.

0

2.0

0%

2.0

0%

-

1.3059581481 0.0 -0.1081081081 -0.7

2015-07-01 0.2

-

69.2 80.0

2.0

0%

2.0

0% -1.865384625 0.0 -0.0975609756 -1.0

2015-10-01 0.4

-

75.0 25.0

2.0

0%

2.0

0% -4 0.0 -0.1458333333 -2.1

2016-01-01 1.1

-

81.3 30.0

2.0

0%

2.0

0%

-

3.7083333333 0.0 -0.5555555556 -2.4

2016-04-01 1.1

-

18.5

110.

0

2.0

0%

2.0

0%

-

1.1683501818 0.0 -0.0357142857 -0.6

2016-07-01 1.1 75.0

140.

0

2.0

0%

2.0

0%

-

0.4642857143 0.0 -0.0588235294 -0.3

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.