Portfolio Risk and Return Analysis

VerifiedAdded on 2020/02/24

|11

|1742

|36

AI Summary

This assignment focuses on evaluating the risk and return of a portfolio consisting of CBA (Commonwealth Bank of Australia) and Rio Tinto stocks. Students calculate holding period returns, determine betas for each stock, and utilize the Capital Asset Pricing Model (CAPM) to estimate expected returns. The analysis also involves constructing a weighted portfolio based on specified proportions and calculating its overall return and beta. The final stage requires students to compare the portfolio's performance against individual stocks and justify an investment decision.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING & FINANCE

Accounting & Finance

Name of the University

Name of the student

Authors note

Accounting & Finance

Name of the University

Name of the student

Authors note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING & FINANCE

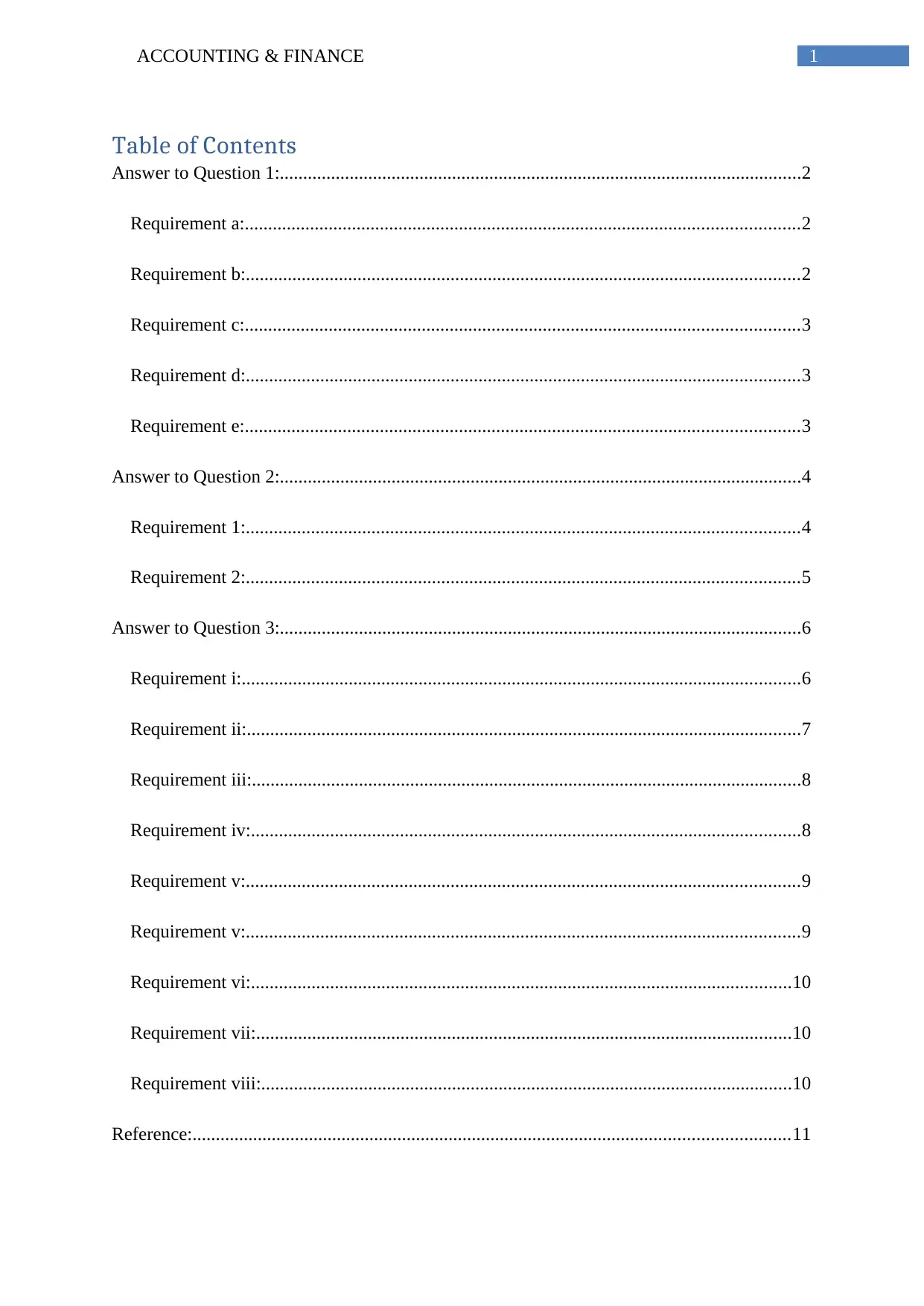

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement b:.......................................................................................................................2

Requirement c:.......................................................................................................................3

Requirement d:.......................................................................................................................3

Requirement e:.......................................................................................................................3

Answer to Question 2:................................................................................................................4

Requirement 1:.......................................................................................................................4

Requirement 2:.......................................................................................................................5

Answer to Question 3:................................................................................................................6

Requirement i:........................................................................................................................6

Requirement ii:.......................................................................................................................7

Requirement iii:......................................................................................................................8

Requirement iv:......................................................................................................................8

Requirement v:.......................................................................................................................9

Requirement v:.......................................................................................................................9

Requirement vi:....................................................................................................................10

Requirement vii:...................................................................................................................10

Requirement viii:..................................................................................................................10

Reference:................................................................................................................................11

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement b:.......................................................................................................................2

Requirement c:.......................................................................................................................3

Requirement d:.......................................................................................................................3

Requirement e:.......................................................................................................................3

Answer to Question 2:................................................................................................................4

Requirement 1:.......................................................................................................................4

Requirement 2:.......................................................................................................................5

Answer to Question 3:................................................................................................................6

Requirement i:........................................................................................................................6

Requirement ii:.......................................................................................................................7

Requirement iii:......................................................................................................................8

Requirement iv:......................................................................................................................8

Requirement v:.......................................................................................................................9

Requirement v:.......................................................................................................................9

Requirement vi:....................................................................................................................10

Requirement vii:...................................................................................................................10

Requirement viii:..................................................................................................................10

Reference:................................................................................................................................11

2ACCOUNTING & FINANCE

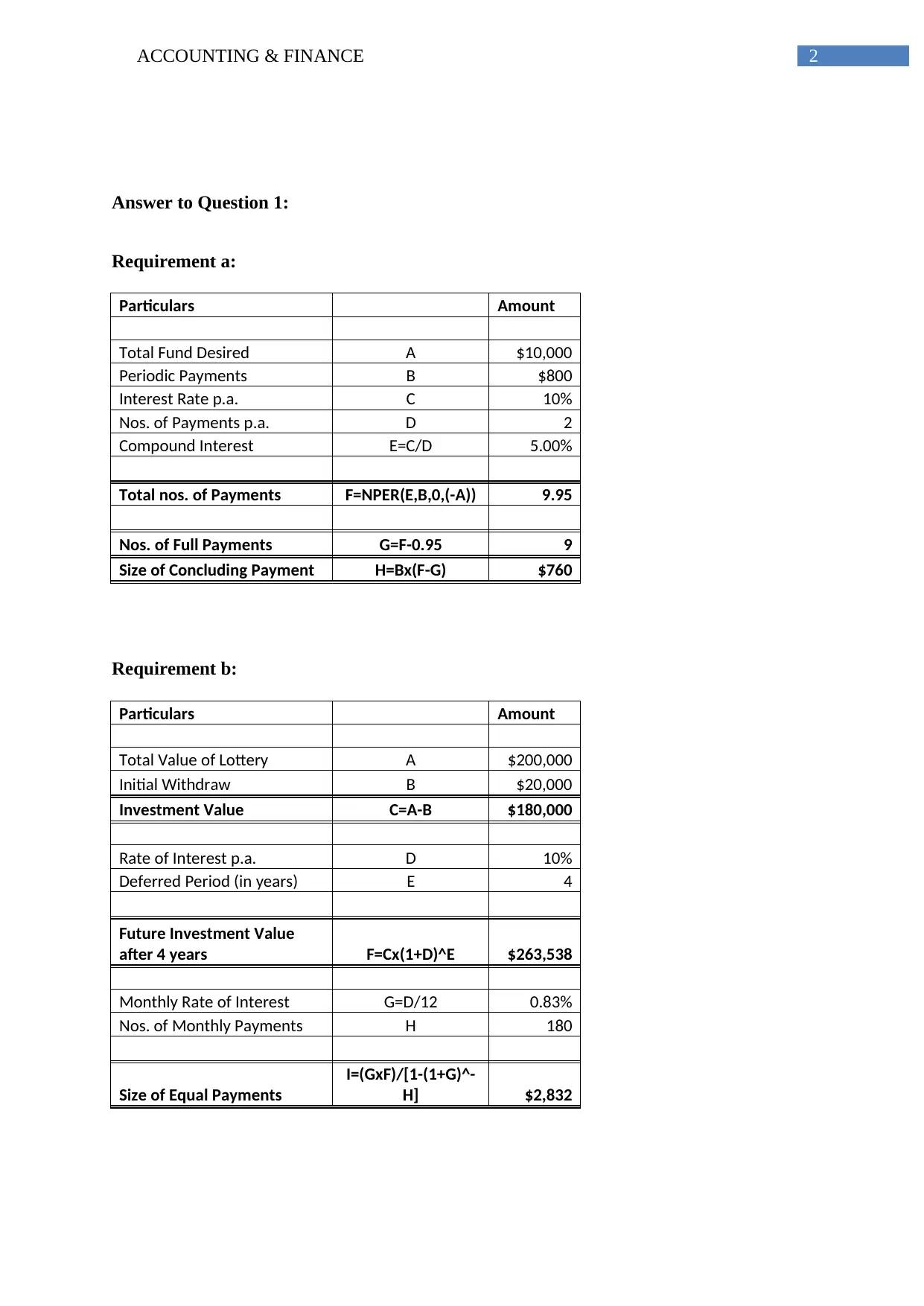

Answer to Question 1:

Requirement a:

Particulars Amount

Total Fund Desired A $10,000

Periodic Payments B $800

Interest Rate p.a. C 10%

Nos. of Payments p.a. D 2

Compound Interest E=C/D 5.00%

Total nos. of Payments F=NPER(E,B,0,(-A)) 9.95

Nos. of Full Payments G=F-0.95 9

Size of Concluding Payment H=Bx(F-G) $760

Requirement b:

Particulars Amount

Total Value of Lottery A $200,000

Initial Withdraw B $20,000

Investment Value C=A-B $180,000

Rate of Interest p.a. D 10%

Deferred Period (in years) E 4

Future Investment Value

after 4 years F=Cx(1+D)^E $263,538

Monthly Rate of Interest G=D/12 0.83%

Nos. of Monthly Payments H 180

Size of Equal Payments

I=(GxF)/[1-(1+G)^-

H] $2,832

Answer to Question 1:

Requirement a:

Particulars Amount

Total Fund Desired A $10,000

Periodic Payments B $800

Interest Rate p.a. C 10%

Nos. of Payments p.a. D 2

Compound Interest E=C/D 5.00%

Total nos. of Payments F=NPER(E,B,0,(-A)) 9.95

Nos. of Full Payments G=F-0.95 9

Size of Concluding Payment H=Bx(F-G) $760

Requirement b:

Particulars Amount

Total Value of Lottery A $200,000

Initial Withdraw B $20,000

Investment Value C=A-B $180,000

Rate of Interest p.a. D 10%

Deferred Period (in years) E 4

Future Investment Value

after 4 years F=Cx(1+D)^E $263,538

Monthly Rate of Interest G=D/12 0.83%

Nos. of Monthly Payments H 180

Size of Equal Payments

I=(GxF)/[1-(1+G)^-

H] $2,832

3ACCOUNTING & FINANCE

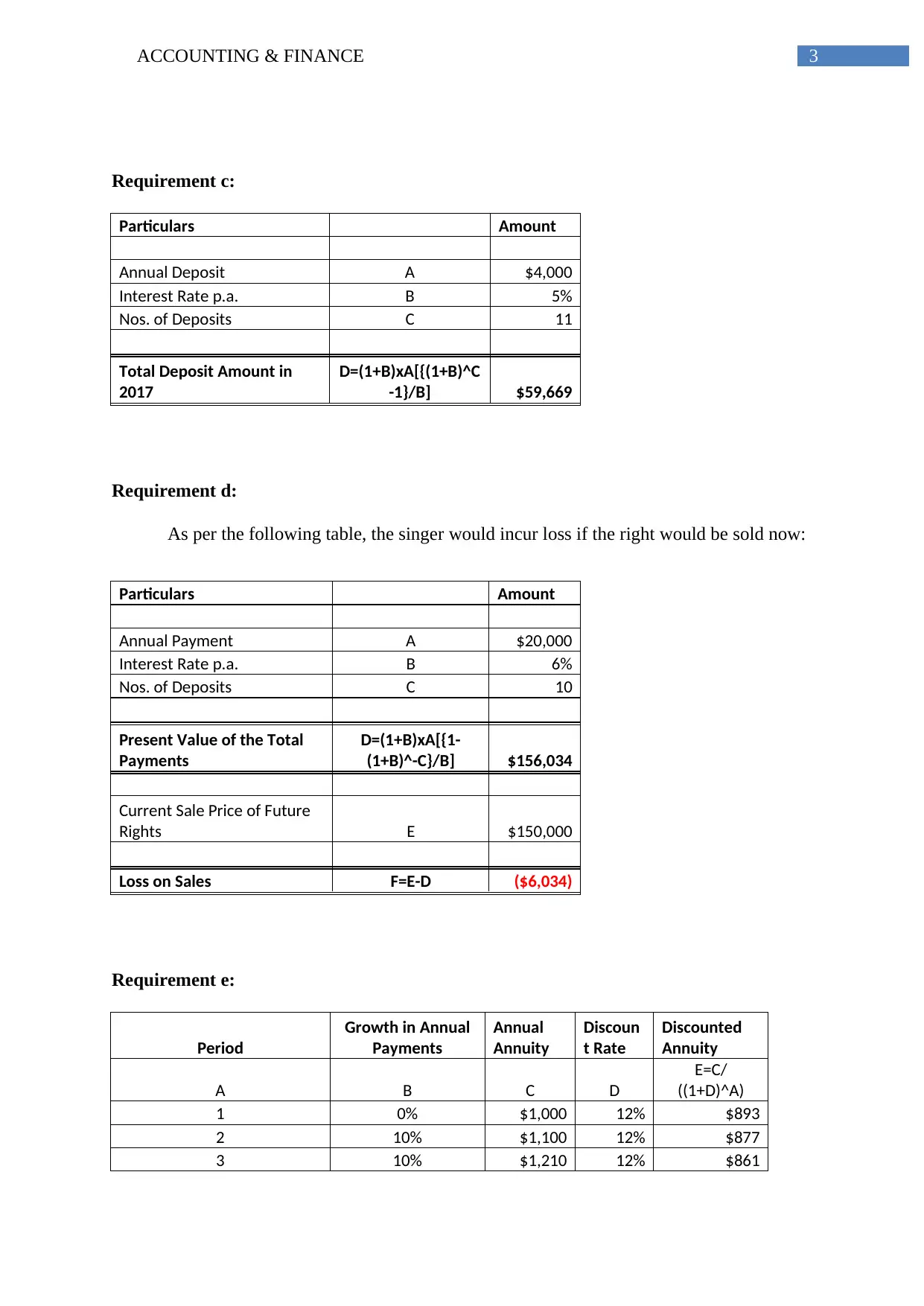

Requirement c:

Particulars Amount

Annual Deposit A $4,000

Interest Rate p.a. B 5%

Nos. of Deposits C 11

Total Deposit Amount in

2017

D=(1+B)xA[{(1+B)^C

-1}/B] $59,669

Requirement d:

As per the following table, the singer would incur loss if the right would be sold now:

Particulars Amount

Annual Payment A $20,000

Interest Rate p.a. B 6%

Nos. of Deposits C 10

Present Value of the Total

Payments

D=(1+B)xA[{1-

(1+B)^-C}/B] $156,034

Current Sale Price of Future

Rights E $150,000

Loss on Sales F=E-D ($6,034)

Requirement e:

Period

Growth in Annual

Payments

Annual

Annuity

Discoun

t Rate

Discounted

Annuity

A B C D

E=C/

((1+D)^A)

1 0% $1,000 12% $893

2 10% $1,100 12% $877

3 10% $1,210 12% $861

Requirement c:

Particulars Amount

Annual Deposit A $4,000

Interest Rate p.a. B 5%

Nos. of Deposits C 11

Total Deposit Amount in

2017

D=(1+B)xA[{(1+B)^C

-1}/B] $59,669

Requirement d:

As per the following table, the singer would incur loss if the right would be sold now:

Particulars Amount

Annual Payment A $20,000

Interest Rate p.a. B 6%

Nos. of Deposits C 10

Present Value of the Total

Payments

D=(1+B)xA[{1-

(1+B)^-C}/B] $156,034

Current Sale Price of Future

Rights E $150,000

Loss on Sales F=E-D ($6,034)

Requirement e:

Period

Growth in Annual

Payments

Annual

Annuity

Discoun

t Rate

Discounted

Annuity

A B C D

E=C/

((1+D)^A)

1 0% $1,000 12% $893

2 10% $1,100 12% $877

3 10% $1,210 12% $861

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING & FINANCE

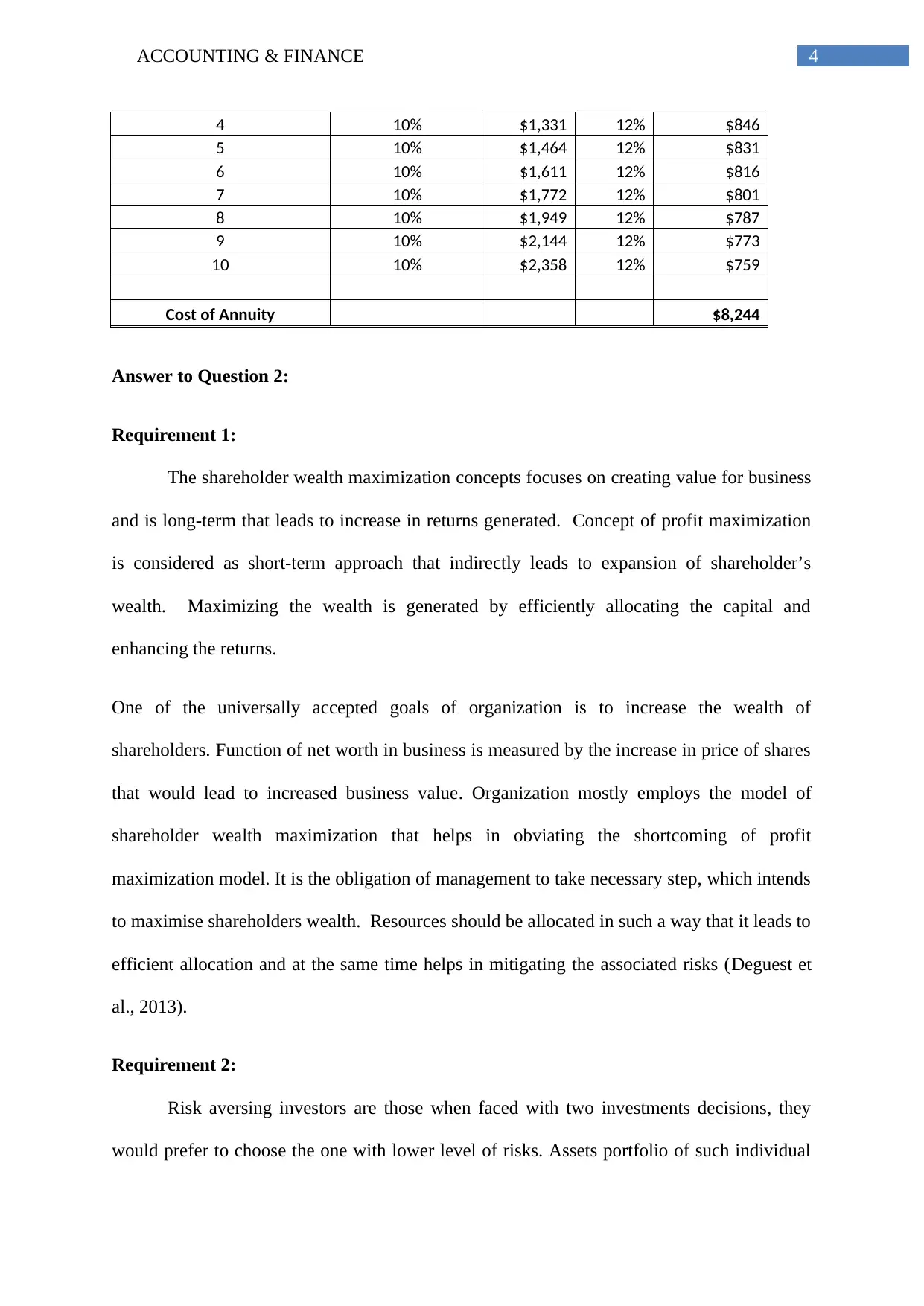

4 10% $1,331 12% $846

5 10% $1,464 12% $831

6 10% $1,611 12% $816

7 10% $1,772 12% $801

8 10% $1,949 12% $787

9 10% $2,144 12% $773

10 10% $2,358 12% $759

Cost of Annuity $8,244

Answer to Question 2:

Requirement 1:

The shareholder wealth maximization concepts focuses on creating value for business

and is long-term that leads to increase in returns generated. Concept of profit maximization

is considered as short-term approach that indirectly leads to expansion of shareholder’s

wealth. Maximizing the wealth is generated by efficiently allocating the capital and

enhancing the returns.

One of the universally accepted goals of organization is to increase the wealth of

shareholders. Function of net worth in business is measured by the increase in price of shares

that would lead to increased business value. Organization mostly employs the model of

shareholder wealth maximization that helps in obviating the shortcoming of profit

maximization model. It is the obligation of management to take necessary step, which intends

to maximise shareholders wealth. Resources should be allocated in such a way that it leads to

efficient allocation and at the same time helps in mitigating the associated risks (Deguest et

al., 2013).

Requirement 2:

Risk aversing investors are those when faced with two investments decisions, they

would prefer to choose the one with lower level of risks. Assets portfolio of such individual

4 10% $1,331 12% $846

5 10% $1,464 12% $831

6 10% $1,611 12% $816

7 10% $1,772 12% $801

8 10% $1,949 12% $787

9 10% $2,144 12% $773

10 10% $2,358 12% $759

Cost of Annuity $8,244

Answer to Question 2:

Requirement 1:

The shareholder wealth maximization concepts focuses on creating value for business

and is long-term that leads to increase in returns generated. Concept of profit maximization

is considered as short-term approach that indirectly leads to expansion of shareholder’s

wealth. Maximizing the wealth is generated by efficiently allocating the capital and

enhancing the returns.

One of the universally accepted goals of organization is to increase the wealth of

shareholders. Function of net worth in business is measured by the increase in price of shares

that would lead to increased business value. Organization mostly employs the model of

shareholder wealth maximization that helps in obviating the shortcoming of profit

maximization model. It is the obligation of management to take necessary step, which intends

to maximise shareholders wealth. Resources should be allocated in such a way that it leads to

efficient allocation and at the same time helps in mitigating the associated risks (Deguest et

al., 2013).

Requirement 2:

Risk aversing investors are those when faced with two investments decisions, they

would prefer to choose the one with lower level of risks. Assets portfolio of such individual

5ACCOUNTING & FINANCE

would involve assets that would generate fixed income and does not carry any risks. Such

types of investment include treasury bills government bonds, fixed deposits that generate

return that is lower as compared to riskier assets. Risk averse investors faced difficulty in

choosing right investment vehicles (Bae et al., 2014).

However, if the investors choose to make investments in riskier assets, return

generated would be much higher than risk free assets. Such investments are generally for

long-term. There is always trade off between risk and return generated by investments.

Therefore, corporate managers should make the proper allocation of money between risky

assets and risk free assets. Investors investing in riskier assets have the apprehension of

falling market value of their stock price.

Answer to Question 3:

Requirement i:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

would involve assets that would generate fixed income and does not carry any risks. Such

types of investment include treasury bills government bonds, fixed deposits that generate

return that is lower as compared to riskier assets. Risk averse investors faced difficulty in

choosing right investment vehicles (Bae et al., 2014).

However, if the investors choose to make investments in riskier assets, return

generated would be much higher than risk free assets. Such investments are generally for

long-term. There is always trade off between risk and return generated by investments.

Therefore, corporate managers should make the proper allocation of money between risky

assets and risk free assets. Investors investing in riskier assets have the apprehension of

falling market value of their stock price.

Answer to Question 3:

Requirement i:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

6ACCOUNTING & FINANCE

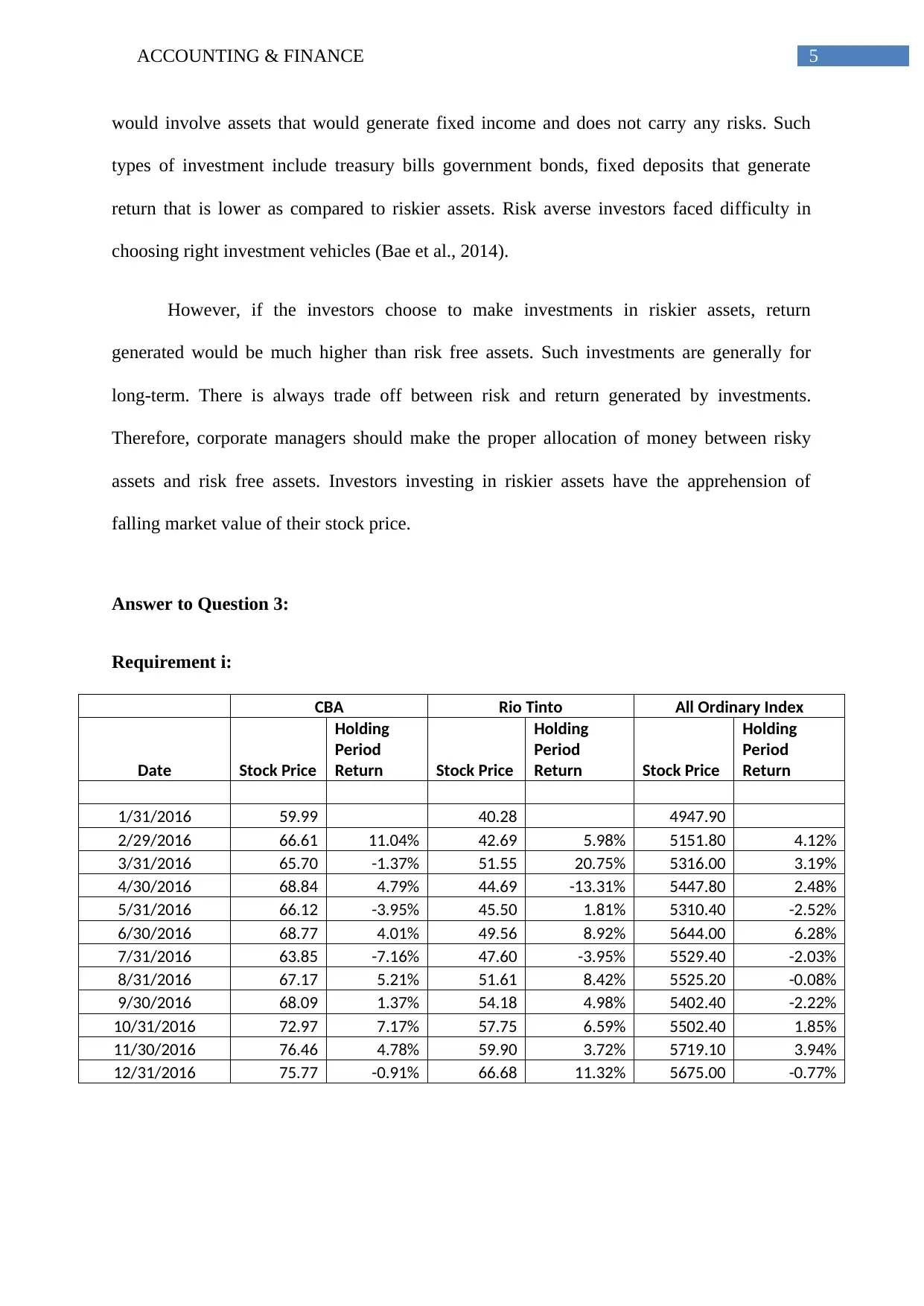

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

-20.00%

-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Holding Period Return

CBA

Rio Tinto

All Ordinary Index

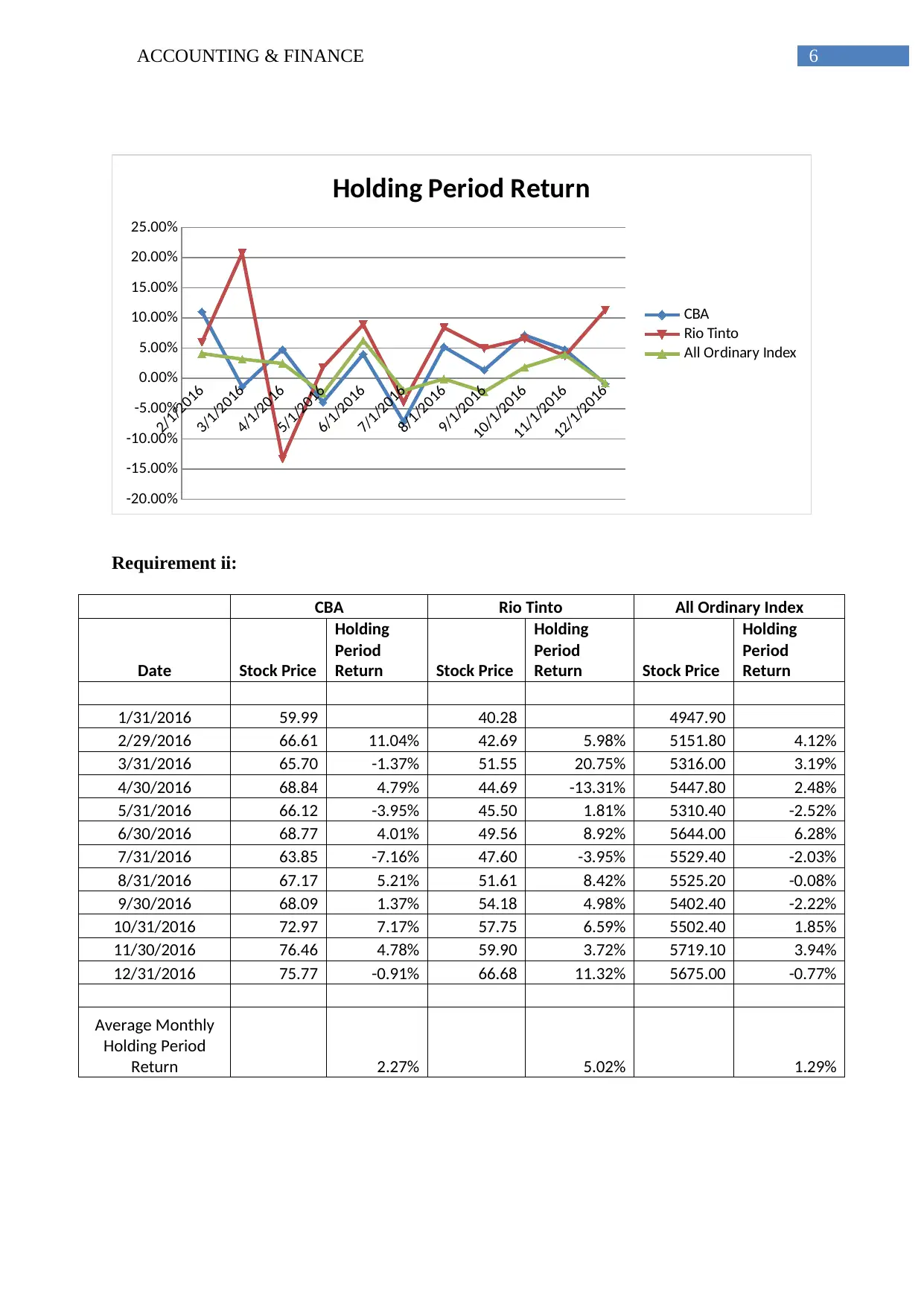

Requirement ii:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Average Monthly

Holding Period

Return 2.27% 5.02% 1.29%

2/1/2016

3/1/2016

4/1/2016

5/1/2016

6/1/2016

7/1/2016

8/1/2016

9/1/2016

10/1/2016

11/1/2016

12/1/2016

-20.00%

-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Holding Period Return

CBA

Rio Tinto

All Ordinary Index

Requirement ii:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Average Monthly

Holding Period

Return 2.27% 5.02% 1.29%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING & FINANCE

Requirement iii:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Annual Holding

Period Return 1.96% 4.29% 1.15%

Requirement iv:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Standard Deviation 5.26% 8.64% 2.99%

Requirement iii:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Annual Holding

Period Return 1.96% 4.29% 1.15%

Requirement iv:

CBA Rio Tinto All Ordinary Index

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

1/31/2016 59.99 40.28 4947.90

2/29/2016 66.61 11.04% 42.69 5.98% 5151.80 4.12%

3/31/2016 65.70 -1.37% 51.55 20.75% 5316.00 3.19%

4/30/2016 68.84 4.79% 44.69 -13.31% 5447.80 2.48%

5/31/2016 66.12 -3.95% 45.50 1.81% 5310.40 -2.52%

6/30/2016 68.77 4.01% 49.56 8.92% 5644.00 6.28%

7/31/2016 63.85 -7.16% 47.60 -3.95% 5529.40 -2.03%

8/31/2016 67.17 5.21% 51.61 8.42% 5525.20 -0.08%

9/30/2016 68.09 1.37% 54.18 4.98% 5402.40 -2.22%

10/31/2016 72.97 7.17% 57.75 6.59% 5502.40 1.85%

11/30/2016 76.46 4.78% 59.90 3.72% 5719.10 3.94%

12/31/2016 75.77 -0.91% 66.68 11.32% 5675.00 -0.77%

Standard Deviation 5.26% 8.64% 2.99%

8ACCOUNTING & FINANCE

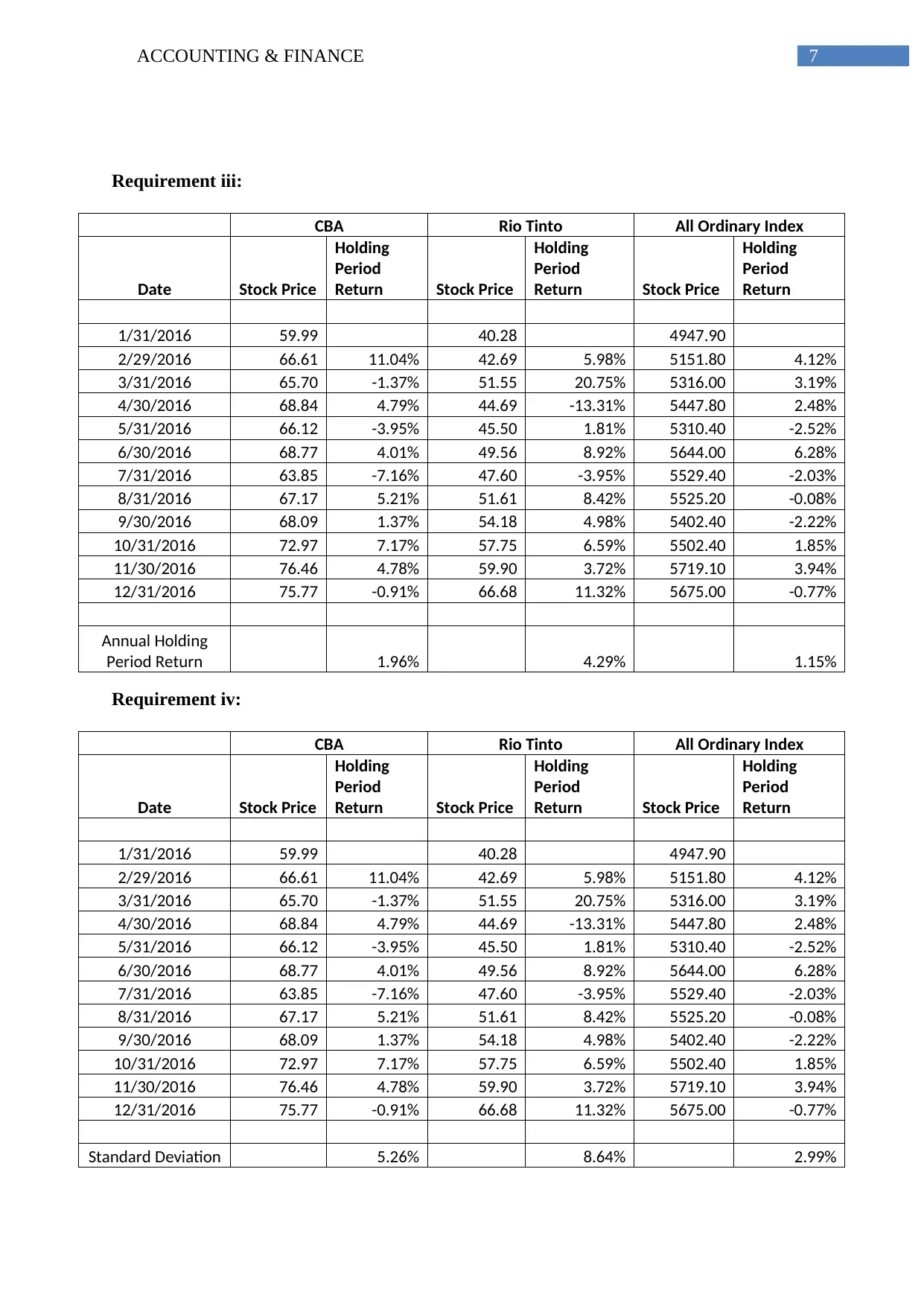

Requirement v:

0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

0%

1%

2%

3%

4%

5%

Series2 CBA Rio Tinto

Requirement v:

CBA Rio Tinto

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

Long Term Market

Return 7% 7%

Risk Free Rate 3.25% 3.25%

Beta 1.1 0.95

Expected Returns 7.38% 6.81%

Requirement v:

0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

0%

1%

2%

3%

4%

5%

Series2 CBA Rio Tinto

Requirement v:

CBA Rio Tinto

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

Long Term Market

Return 7% 7%

Risk Free Rate 3.25% 3.25%

Beta 1.1 0.95

Expected Returns 7.38% 6.81%

9ACCOUNTING & FINANCE

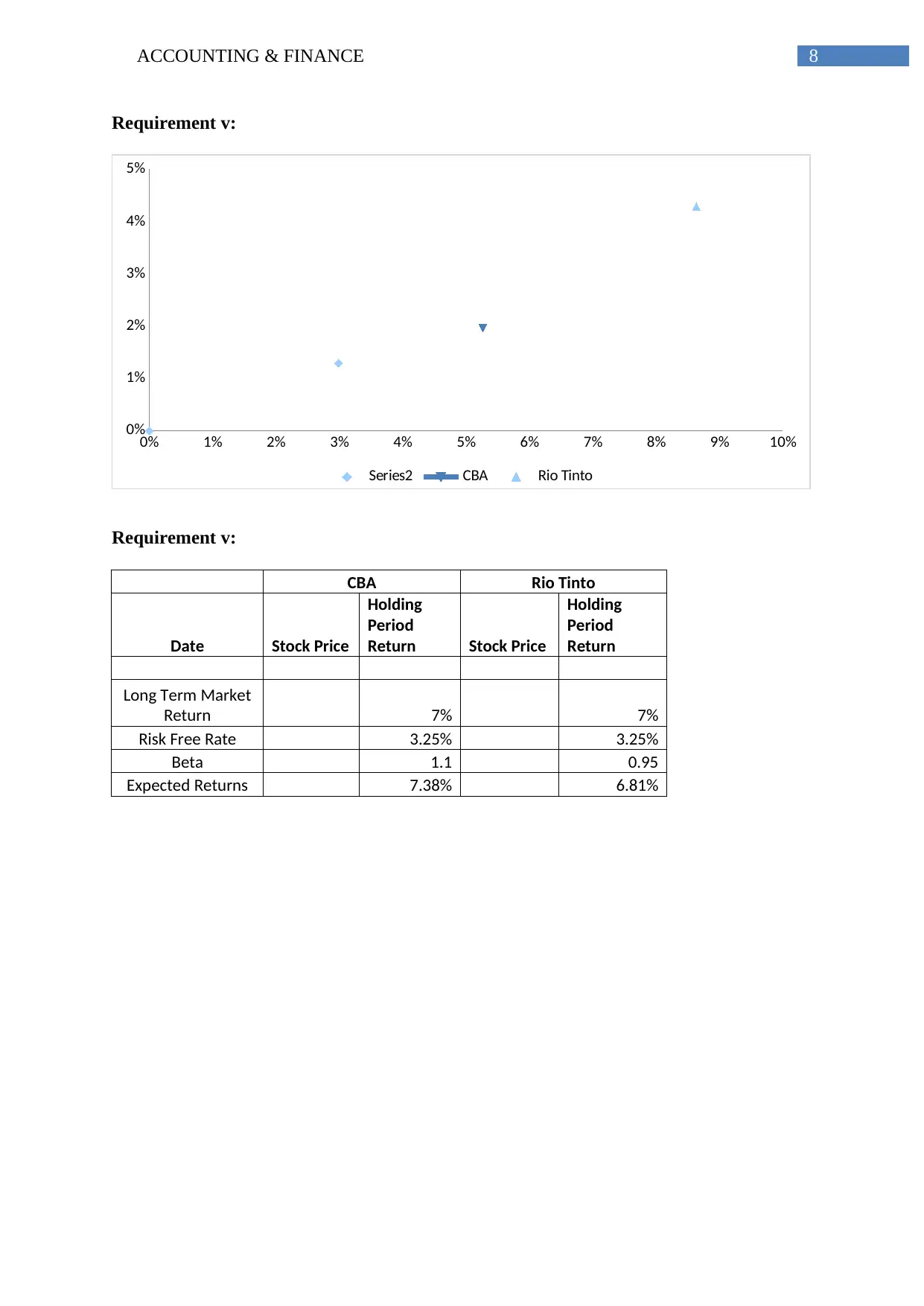

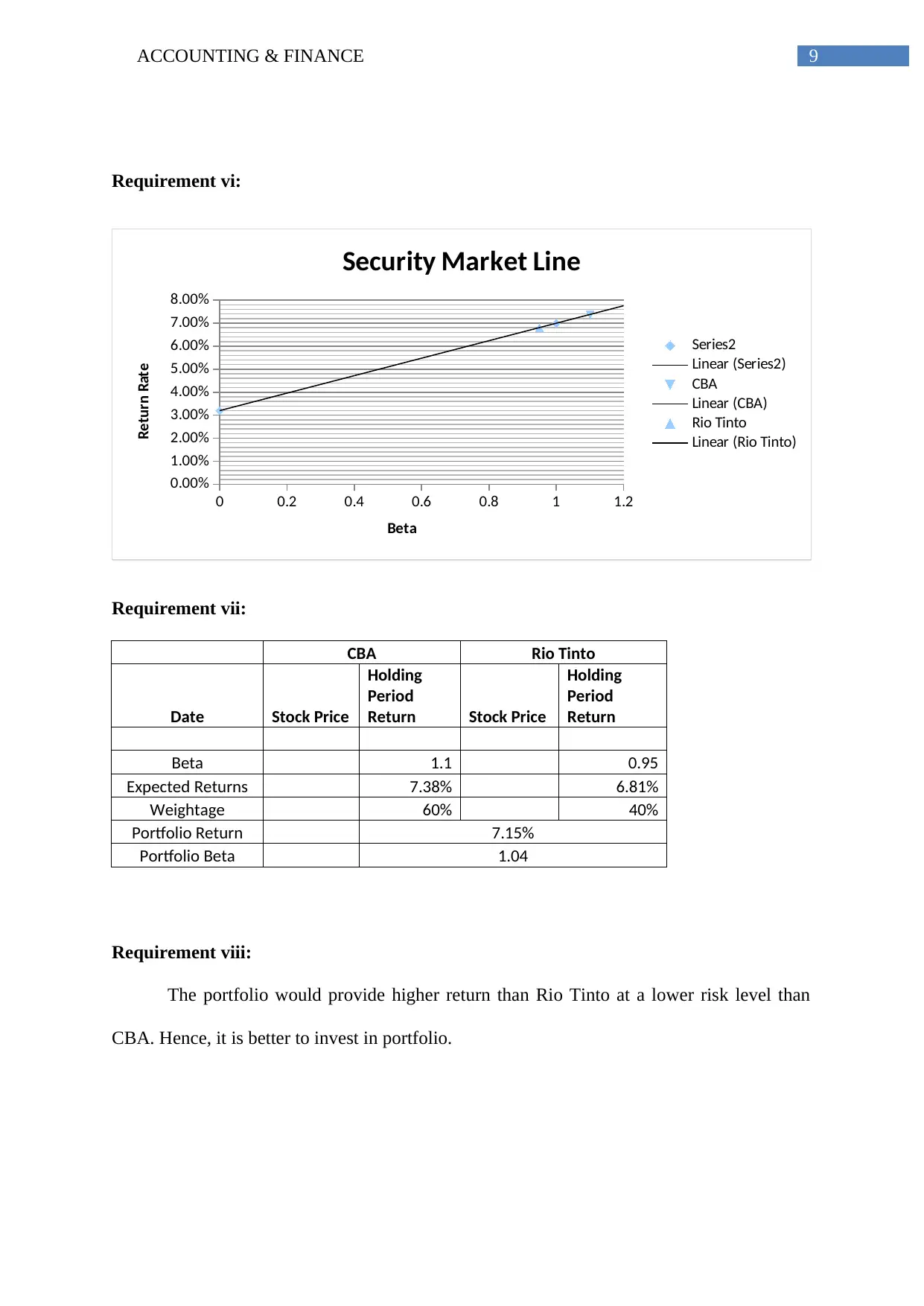

Requirement vi:

0 0.2 0.4 0.6 0.8 1 1.2

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

Security Market Line

Series2

Linear (Series2)

CBA

Linear (CBA)

Rio Tinto

Linear (Rio Tinto)

Beta

Return Rate

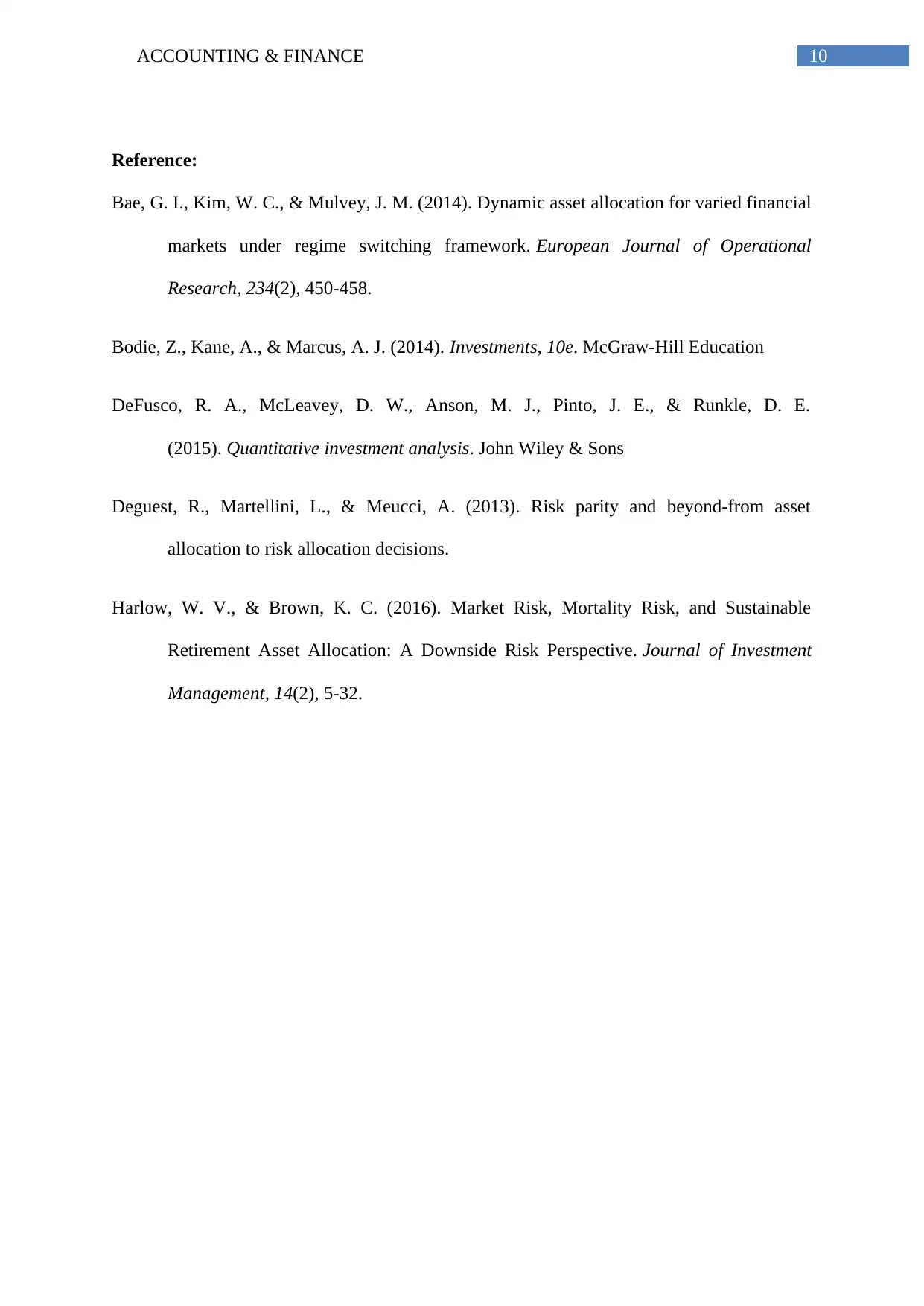

Requirement vii:

CBA Rio Tinto

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

Beta 1.1 0.95

Expected Returns 7.38% 6.81%

Weightage 60% 40%

Portfolio Return 7.15%

Portfolio Beta 1.04

Requirement viii:

The portfolio would provide higher return than Rio Tinto at a lower risk level than

CBA. Hence, it is better to invest in portfolio.

Requirement vi:

0 0.2 0.4 0.6 0.8 1 1.2

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

Security Market Line

Series2

Linear (Series2)

CBA

Linear (CBA)

Rio Tinto

Linear (Rio Tinto)

Beta

Return Rate

Requirement vii:

CBA Rio Tinto

Date Stock Price

Holding

Period

Return Stock Price

Holding

Period

Return

Beta 1.1 0.95

Expected Returns 7.38% 6.81%

Weightage 60% 40%

Portfolio Return 7.15%

Portfolio Beta 1.04

Requirement viii:

The portfolio would provide higher return than Rio Tinto at a lower risk level than

CBA. Hence, it is better to invest in portfolio.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING & FINANCE

Reference:

Bae, G. I., Kim, W. C., & Mulvey, J. M. (2014). Dynamic asset allocation for varied financial

markets under regime switching framework. European Journal of Operational

Research, 234(2), 450-458.

Bodie, Z., Kane, A., & Marcus, A. J. (2014). Investments, 10e. McGraw-Hill Education

DeFusco, R. A., McLeavey, D. W., Anson, M. J., Pinto, J. E., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons

Deguest, R., Martellini, L., & Meucci, A. (2013). Risk parity and beyond-from asset

allocation to risk allocation decisions.

Harlow, W. V., & Brown, K. C. (2016). Market Risk, Mortality Risk, and Sustainable

Retirement Asset Allocation: A Downside Risk Perspective. Journal of Investment

Management, 14(2), 5-32.

Reference:

Bae, G. I., Kim, W. C., & Mulvey, J. M. (2014). Dynamic asset allocation for varied financial

markets under regime switching framework. European Journal of Operational

Research, 234(2), 450-458.

Bodie, Z., Kane, A., & Marcus, A. J. (2014). Investments, 10e. McGraw-Hill Education

DeFusco, R. A., McLeavey, D. W., Anson, M. J., Pinto, J. E., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons

Deguest, R., Martellini, L., & Meucci, A. (2013). Risk parity and beyond-from asset

allocation to risk allocation decisions.

Harlow, W. V., & Brown, K. C. (2016). Market Risk, Mortality Risk, and Sustainable

Retirement Asset Allocation: A Downside Risk Perspective. Journal of Investment

Management, 14(2), 5-32.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.