Analysis of Financial Resources and Decisions for Osborne Terrace

VerifiedAdded on 2019/12/28

|24

|5657

|63

Report

AI Summary

This report analyzes financial resources and decisions, specifically in the context of Osborne Terrace restaurant. Task 1 explores financial sources (internal and external), their implications, and the most appropriate financing options, including working with investors and debt-based financing. The analysis includes the costs associated with equity shares and bank loans, the importance of financial planning, and the information needed to make financing decisions, considering stakeholders like partners, venture capitalists, and finance brokers. Task 2 delves into the key components of financial statements, comparing formats and interpreting the current financial statements of Osborne Terrace using ratios and year-over-year comparisons. The report covers budgeting, working capital management, and the implications of overtrading, providing a comprehensive overview of financial management practices.

Managing Financial resources and

decisions

decisions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Task 1..............................................................................................................................................3

1.1 Financial sources.......................................................................................................................3

1.2 Implications of financial sources...............................................................................................3

2.1 Analyse the costs of the two sources of finance under consideration........................................4

2.2 The importance of financial planning for Osborne Terrace restaurant......................................5

2.3 Assessment of the information that will be needed to make decision on financing the takeover

by......................................................................................................................................6

2.4 Impact of finance on financial statements if Osborne Terrace restaurant.................................6

3.1 Analyses of the cash budget for Osborne Terrace restaurant....................................................7

3.2 How unit costs will be calculated to make pricing decisions....................................................7

3.3 Investment appraisal techniques................................................................................................8

TASK 2..........................................................................................................................................10

4.1 Discuss the key components of financial statements...............................................................10

4.2 Comparing the format used by Osborne Terrace restaurant to presenting their financial statement with that of a

partnership...............................................................................................11

4.3 Interpreting the current money related statement of Osborne Terrace restaurant utilizing proper proportions and making

examination with the earlier year................................................12

REFERENCE.................................................................................................................................14

Task 1..............................................................................................................................................3

1.1 Financial sources.......................................................................................................................3

1.2 Implications of financial sources...............................................................................................3

2.1 Analyse the costs of the two sources of finance under consideration........................................4

2.2 The importance of financial planning for Osborne Terrace restaurant......................................5

2.3 Assessment of the information that will be needed to make decision on financing the takeover

by......................................................................................................................................6

2.4 Impact of finance on financial statements if Osborne Terrace restaurant.................................6

3.1 Analyses of the cash budget for Osborne Terrace restaurant....................................................7

3.2 How unit costs will be calculated to make pricing decisions....................................................7

3.3 Investment appraisal techniques................................................................................................8

TASK 2..........................................................................................................................................10

4.1 Discuss the key components of financial statements...............................................................10

4.2 Comparing the format used by Osborne Terrace restaurant to presenting their financial statement with that of a

partnership...............................................................................................11

4.3 Interpreting the current money related statement of Osborne Terrace restaurant utilizing proper proportions and making

examination with the earlier year................................................12

REFERENCE.................................................................................................................................14

TASK 1

1.1 Financial sources

For government contract as establishing new branch of Osborne restaurant, accountant of the organization is looking for

financial sources. Some of the sources can be expressed as follows:-

Internal Source

Personal savings:- By using personal savings, entrepreneur can establish new entity named as Osborne Terrace restaurant

(Albelda, 2011). In addition to this, he can also take aid from his friends and family members by which effective fund can be

allocated for commencement.

External Sources Bank loan:- Bank advance gives a long haul sort of reserve for a start-up, with the bank communicating the settled period over

which the loan is given (e.g. 6 years), the rate of interest, and the arranging and measure of repayments. The bank will

generally speaking requires that the start-up give some security to the advance, despite the way that this security normally

comes as individual affirmations gave by the business visionary. Bank loans are valuable for financing interest for settled

assets and are generally at a lower rate of premium that a bank overdraft. In any case, they don't give much flexibility (Bowen

and Rajgopal, 2010). Thus, adequate fund can be allocated by taking loan from bank to setting up new branch of Osborne

restaurant.

Bank overdraft:- This is a fleeting kind of reserve which is comprehensively used by new organizations and autonomous

organizations. An overdraft is really a loan office, the bank allows the business "to owe it money" when the bank adjust goes

underneath zero, as a final product of charging a high rate of premium. Consequently, an overdraft is a versatile source of

back, as in it is quite recently used when required (Ehrhardt, 2016). Bank overdrafts are unfathomable for helping a business

1.1 Financial sources

For government contract as establishing new branch of Osborne restaurant, accountant of the organization is looking for

financial sources. Some of the sources can be expressed as follows:-

Internal Source

Personal savings:- By using personal savings, entrepreneur can establish new entity named as Osborne Terrace restaurant

(Albelda, 2011). In addition to this, he can also take aid from his friends and family members by which effective fund can be

allocated for commencement.

External Sources Bank loan:- Bank advance gives a long haul sort of reserve for a start-up, with the bank communicating the settled period over

which the loan is given (e.g. 6 years), the rate of interest, and the arranging and measure of repayments. The bank will

generally speaking requires that the start-up give some security to the advance, despite the way that this security normally

comes as individual affirmations gave by the business visionary. Bank loans are valuable for financing interest for settled

assets and are generally at a lower rate of premium that a bank overdraft. In any case, they don't give much flexibility (Bowen

and Rajgopal, 2010). Thus, adequate fund can be allocated by taking loan from bank to setting up new branch of Osborne

restaurant.

Bank overdraft:- This is a fleeting kind of reserve which is comprehensively used by new organizations and autonomous

organizations. An overdraft is really a loan office, the bank allows the business "to owe it money" when the bank adjust goes

underneath zero, as a final product of charging a high rate of premium. Consequently, an overdraft is a versatile source of

back, as in it is quite recently used when required (Ehrhardt, 2016). Bank overdrafts are unfathomable for helping a business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

handle general instabilities in pay or when the business continues running into at this very moment income issues (e.g. an

imperative customer fails to income on time).

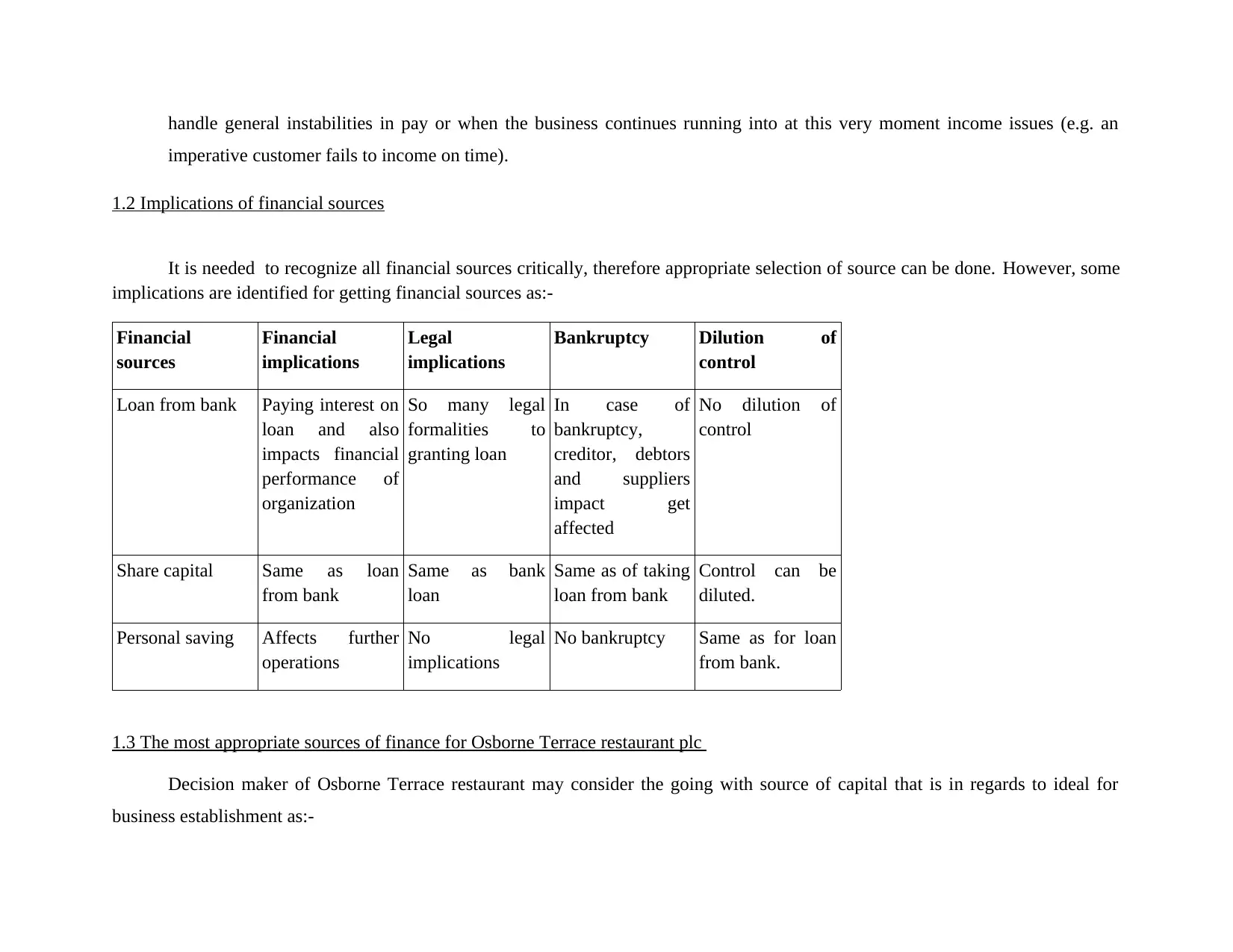

1.2 Implications of financial sources

It is needed to recognize all financial sources critically, therefore appropriate selection of source can be done. However, some

implications are identified for getting financial sources as:-

Financial

sources

Financial

implications

Legal

implications

Bankruptcy Dilution of

control

Loan from bank Paying interest on

loan and also

impacts financial

performance of

organization

So many legal

formalities to

granting loan

In case of

bankruptcy,

creditor, debtors

and suppliers

impact get

affected

No dilution of

control

Share capital Same as loan

from bank

Same as bank

loan

Same as of taking

loan from bank

Control can be

diluted.

Personal saving Affects further

operations

No legal

implications

No bankruptcy Same as for loan

from bank.

1.3 The most appropriate sources of finance for Osborne Terrace restaurant plc

Decision maker of Osborne Terrace restaurant may consider the going with source of capital that is in regards to ideal for

business establishment as:-

imperative customer fails to income on time).

1.2 Implications of financial sources

It is needed to recognize all financial sources critically, therefore appropriate selection of source can be done. However, some

implications are identified for getting financial sources as:-

Financial

sources

Financial

implications

Legal

implications

Bankruptcy Dilution of

control

Loan from bank Paying interest on

loan and also

impacts financial

performance of

organization

So many legal

formalities to

granting loan

In case of

bankruptcy,

creditor, debtors

and suppliers

impact get

affected

No dilution of

control

Share capital Same as loan

from bank

Same as bank

loan

Same as of taking

loan from bank

Control can be

diluted.

Personal saving Affects further

operations

No legal

implications

No bankruptcy Same as for loan

from bank.

1.3 The most appropriate sources of finance for Osborne Terrace restaurant plc

Decision maker of Osborne Terrace restaurant may consider the going with source of capital that is in regards to ideal for

business establishment as:-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Working with Investors:- Contingent upon the traverse of the business and the degree of the improvement plans, the

organization may look out subsidizing financing, or work with a private budgetary speculators to back the expansion. Examiners can

be exceptionally significant to creating private endeavors, since they offer bits of information and experience about developing the

business that the organization would not have in solitude (Floyd, 2005). Regardless, working with budgetary financial specialists

implies surrendering an incentive in the business, and the theorist may request strategies for doing things that don't organize the

arrangements.

Advantages:

Imposes less monetary burden as there is no fund which needs to be repaid over the time frame Cheaper and effectual source of finance

Disadvantages:

In this, firm has to involve shareholders in decision making which in turn creates issue

Time-intensive exercise

Debt Based Financing:- Many business people will bolster their advancement plans through an autonomous venture loan

either from a standard bank or from an option moneylender. The decisions for obligation based expansion financing are as

inconceivable as for some different business needs (Burritt and Schaltegger, 2010).

Advantages:

Offers deduction in tax brackets and thereby enhance profitability It helps in avoiding lenders involvement in the decision making aspect

Disadvantages:

organization may look out subsidizing financing, or work with a private budgetary speculators to back the expansion. Examiners can

be exceptionally significant to creating private endeavors, since they offer bits of information and experience about developing the

business that the organization would not have in solitude (Floyd, 2005). Regardless, working with budgetary financial specialists

implies surrendering an incentive in the business, and the theorist may request strategies for doing things that don't organize the

arrangements.

Advantages:

Imposes less monetary burden as there is no fund which needs to be repaid over the time frame Cheaper and effectual source of finance

Disadvantages:

In this, firm has to involve shareholders in decision making which in turn creates issue

Time-intensive exercise

Debt Based Financing:- Many business people will bolster their advancement plans through an autonomous venture loan

either from a standard bank or from an option moneylender. The decisions for obligation based expansion financing are as

inconceivable as for some different business needs (Burritt and Schaltegger, 2010).

Advantages:

Offers deduction in tax brackets and thereby enhance profitability It helps in avoiding lenders involvement in the decision making aspect

Disadvantages:

Fixed payment in terms of installments and interest amount imposes burden in font of company

Includes several documentary formalities.

Above mentioned, both of two tools as working with investors as shareholders and debt financing are appropriate options for

establishing Osborne restaurant's new entity. It will be suitable for effective expansion and enhancing efficiencies of organization

adequately.

2.1 Analyse the costs of the two sources of finance under consideration

There are different kinds of sources by which decision maker can allocate fund including loan from bank, venture capitalist,

share capital, personal saving and so on. Therefore, it is needed to analyze all sources critically as well making decisions for

establishment of Osborne Terrace restaurant. For share capital, it is required to looking for dividend and potential to start up new

entity. However, its impact on financial position of organization can be recognized through this system (Christ and Burritt, 2013).

Including this, for taking loan from financial institutions like bank, it is needed to look at interest rates and entity's potential to refund

amount. Therefore, cost analyses is created for making decision regarding allocating fund for establishment effectively. From

assessment, it has identified that selected sources of finance impose following cost in front of the business unit: Equity shares: In the case of equity shares, business unit needs to offer dividend to the shareholders in the form of return

whenever it generates enough profit. In this way, such source of finance imposes monetary cost in front of the organization.

Debt or bank loan: Under debt or bank loan, company has to repay amount in the form of installment along with the interest

payment Referring this, it can be presented that bank loan source of finance imposes fixed financial burden on firm.

2.2 The importance of financial planning for Osborne Terrace restaurant

Financial planning is the process which business entity undertakes for managing finance as per the business activities need to be

performed during an accounting year. It helps in effectively utilizing the financial resources of the company to achieve the objectives

of firm.

Includes several documentary formalities.

Above mentioned, both of two tools as working with investors as shareholders and debt financing are appropriate options for

establishing Osborne restaurant's new entity. It will be suitable for effective expansion and enhancing efficiencies of organization

adequately.

2.1 Analyse the costs of the two sources of finance under consideration

There are different kinds of sources by which decision maker can allocate fund including loan from bank, venture capitalist,

share capital, personal saving and so on. Therefore, it is needed to analyze all sources critically as well making decisions for

establishment of Osborne Terrace restaurant. For share capital, it is required to looking for dividend and potential to start up new

entity. However, its impact on financial position of organization can be recognized through this system (Christ and Burritt, 2013).

Including this, for taking loan from financial institutions like bank, it is needed to look at interest rates and entity's potential to refund

amount. Therefore, cost analyses is created for making decision regarding allocating fund for establishment effectively. From

assessment, it has identified that selected sources of finance impose following cost in front of the business unit: Equity shares: In the case of equity shares, business unit needs to offer dividend to the shareholders in the form of return

whenever it generates enough profit. In this way, such source of finance imposes monetary cost in front of the organization.

Debt or bank loan: Under debt or bank loan, company has to repay amount in the form of installment along with the interest

payment Referring this, it can be presented that bank loan source of finance imposes fixed financial burden on firm.

2.2 The importance of financial planning for Osborne Terrace restaurant

Financial planning is the process which business entity undertakes for managing finance as per the business activities need to be

performed during an accounting year. It helps in effectively utilizing the financial resources of the company to achieve the objectives

of firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A) Budgeting:- It is considered as decision making tool for preparing strategies to be implemented for establishment of

Osborne restaurant. In this process, all fund and resources allocation factors are analyzed for starting up new entity as well planning to

operate business operations. In this regard, it is helpful for best use of resources and fund for quality services and improving

efficiencies effectively. Including this, through budgeting process, government plan can be succeed to establishing new entity that

affects nation's effectiveness (DRURY, 2013). However, several ideas are created through this system for forecasting and decision

making related to commencement and increasing all service qualities in systematic manner.

b) Implications of subjection to back acceptably:- Working capital is described as the regular fund utilized by a firm. It is the

organization's present resources less its liabilities. Administering working capital is about ensuring that the business ought to have the

ability to keep up the regular expenses. An Organization n can't work without working capital and, if messed up, it can possibly incite

to the association's destruction. Powerlessness to palatable supervise working capital can exasperate a business' operations and benefit.

Business may wrongly tie up a considerable measure of exchange out the kind of stock (Haiza and Hoque, 2010). This can happen if

the stock is perishable it may accomplish the complete of its time period of reasonable ease of use before it can be sold. If the stock

contains things that rapidly out of form, the stock may lose bigger part or most of its motivation before it can be sold. If over the top

exchange is tied up out stock, it is not open for venture elsewhere in the business.

C) Overtrade:- This exist when a firm tries to do an abundance of too quickly with excessively negligible whole deal capital,

so it is endeavoring to support excessively sweeping trade volume with compelled capital resources. To be sure, even a firm working

in advantage may wind up in authentic conditions since it is in short of money situation. Such liquidity burdens ascend off the beaten

path that it doesn't have enough money to pay off commitment as it falls due. Overtrading happens when a business recognizes work

and tries to fulfill it, however fulfillment requires more unmistakable resources of people, working capital or net assets than the

business has available to it. It is much of the time brought on by sudden events, for instance, deliver or movement taking longer than

anticipated, achieving income being debilitated. Overtrading is a commonplace issue, and it habitually happens to starting late started

Osborne restaurant. In this process, all fund and resources allocation factors are analyzed for starting up new entity as well planning to

operate business operations. In this regard, it is helpful for best use of resources and fund for quality services and improving

efficiencies effectively. Including this, through budgeting process, government plan can be succeed to establishing new entity that

affects nation's effectiveness (DRURY, 2013). However, several ideas are created through this system for forecasting and decision

making related to commencement and increasing all service qualities in systematic manner.

b) Implications of subjection to back acceptably:- Working capital is described as the regular fund utilized by a firm. It is the

organization's present resources less its liabilities. Administering working capital is about ensuring that the business ought to have the

ability to keep up the regular expenses. An Organization n can't work without working capital and, if messed up, it can possibly incite

to the association's destruction. Powerlessness to palatable supervise working capital can exasperate a business' operations and benefit.

Business may wrongly tie up a considerable measure of exchange out the kind of stock (Haiza and Hoque, 2010). This can happen if

the stock is perishable it may accomplish the complete of its time period of reasonable ease of use before it can be sold. If the stock

contains things that rapidly out of form, the stock may lose bigger part or most of its motivation before it can be sold. If over the top

exchange is tied up out stock, it is not open for venture elsewhere in the business.

C) Overtrade:- This exist when a firm tries to do an abundance of too quickly with excessively negligible whole deal capital,

so it is endeavoring to support excessively sweeping trade volume with compelled capital resources. To be sure, even a firm working

in advantage may wind up in authentic conditions since it is in short of money situation. Such liquidity burdens ascend off the beaten

path that it doesn't have enough money to pay off commitment as it falls due. Overtrading happens when a business recognizes work

and tries to fulfill it, however fulfillment requires more unmistakable resources of people, working capital or net assets than the

business has available to it. It is much of the time brought on by sudden events, for instance, deliver or movement taking longer than

anticipated, achieving income being debilitated. Overtrading is a commonplace issue, and it habitually happens to starting late started

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business and to rapidly augmenting Business (Lee, 2011). Money consistently needs to leave the business before more money comes

into it.

Significance of financial planning

Financial planning help in identifying the long term and short term financial needs of the firm.

It also assists in reducing the future risk by formulating various strategies.

It provides benefit to organization by enhancing the performance of firm to increase the profitability of organization.

This helps in making effective decisions to improve the performance of organisation.

2.3 Assessment of the information that will be needed to make decision on financing the takeover by

a) partners:- The Venture capitalist ought to study the update and article of relationship to review the terms and condition

regarding advantage sharing and capital responsibility by Venture capitalist remembering the true objective to review the measure of

capital that every accessory will add to the business.

b) Venture capitalist:- The Venture capitalist should survey the update and article of relationship to audit the terms and

condition as to benefit sharing and capital commitment by Venture capitalist with a specific end goal to audit the measure of capital

that each accomplice will add to the business (Malmi, 2010).

c) Financial speculator (We Finance Limited):- Funding will be excited about assessing the organization yearly answer

to find out the liquidity hazard and valuation of the business with a specific end goal to determine the level of hazard

that We back limited will uncover itself while entering the agreement to give an advance of 20,000.

d) Finance broker:- Since the money related agent is interest with interest on loan, the fundamental data need is the

organization's income statement execution and whether the organization has been a development in benefit after expense each

into it.

Significance of financial planning

Financial planning help in identifying the long term and short term financial needs of the firm.

It also assists in reducing the future risk by formulating various strategies.

It provides benefit to organization by enhancing the performance of firm to increase the profitability of organization.

This helps in making effective decisions to improve the performance of organisation.

2.3 Assessment of the information that will be needed to make decision on financing the takeover by

a) partners:- The Venture capitalist ought to study the update and article of relationship to review the terms and condition

regarding advantage sharing and capital responsibility by Venture capitalist remembering the true objective to review the measure of

capital that every accessory will add to the business.

b) Venture capitalist:- The Venture capitalist should survey the update and article of relationship to audit the terms and

condition as to benefit sharing and capital commitment by Venture capitalist with a specific end goal to audit the measure of capital

that each accomplice will add to the business (Malmi, 2010).

c) Financial speculator (We Finance Limited):- Funding will be excited about assessing the organization yearly answer

to find out the liquidity hazard and valuation of the business with a specific end goal to determine the level of hazard

that We back limited will uncover itself while entering the agreement to give an advance of 20,000.

d) Finance broker:- Since the money related agent is interest with interest on loan, the fundamental data need is the

organization's income statement execution and whether the organization has been a development in benefit after expense each

budgetary period (Nandan, 2010). This is a pointer of business reasonability and setting up the level of liquidity hazard which is

perfect for Finance broker since; it will give a diagram of the degree of hazard draw in with the organization and give the premise of

making loan contract with the organization.

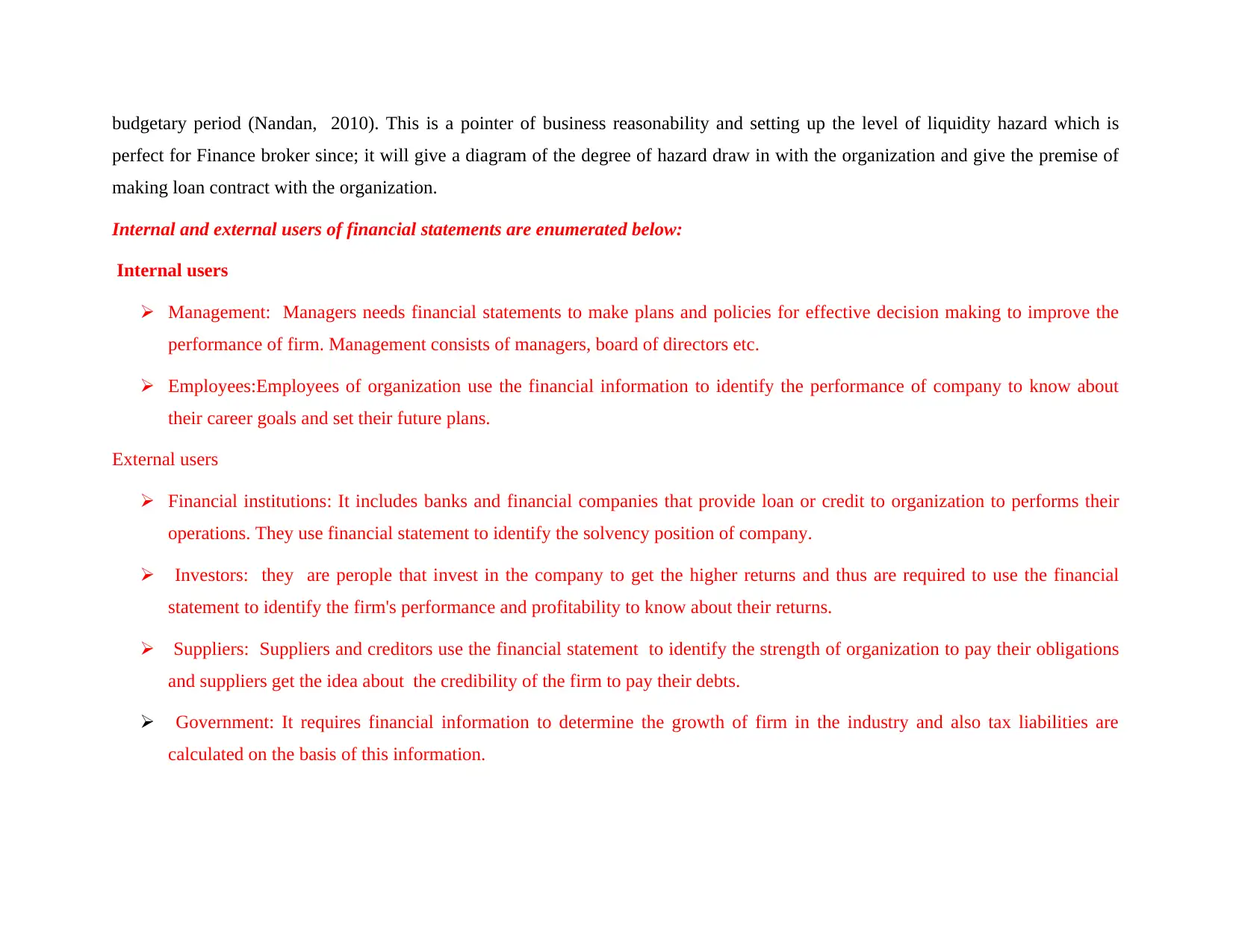

Internal and external users of financial statements are enumerated below:

Internal users

Management: Managers needs financial statements to make plans and policies for effective decision making to improve the

performance of firm. Management consists of managers, board of directors etc.

Employees:Employees of organization use the financial information to identify the performance of company to know about

their career goals and set their future plans.

External users

Financial institutions: It includes banks and financial companies that provide loan or credit to organization to performs their

operations. They use financial statement to identify the solvency position of company.

Investors: they are perople that invest in the company to get the higher returns and thus are required to use the financial

statement to identify the firm's performance and profitability to know about their returns.

Suppliers: Suppliers and creditors use the financial statement to identify the strength of organization to pay their obligations

and suppliers get the idea about the credibility of the firm to pay their debts.

Government: It requires financial information to determine the growth of firm in the industry and also tax liabilities are

calculated on the basis of this information.

perfect for Finance broker since; it will give a diagram of the degree of hazard draw in with the organization and give the premise of

making loan contract with the organization.

Internal and external users of financial statements are enumerated below:

Internal users

Management: Managers needs financial statements to make plans and policies for effective decision making to improve the

performance of firm. Management consists of managers, board of directors etc.

Employees:Employees of organization use the financial information to identify the performance of company to know about

their career goals and set their future plans.

External users

Financial institutions: It includes banks and financial companies that provide loan or credit to organization to performs their

operations. They use financial statement to identify the solvency position of company.

Investors: they are perople that invest in the company to get the higher returns and thus are required to use the financial

statement to identify the firm's performance and profitability to know about their returns.

Suppliers: Suppliers and creditors use the financial statement to identify the strength of organization to pay their obligations

and suppliers get the idea about the credibility of the firm to pay their debts.

Government: It requires financial information to determine the growth of firm in the industry and also tax liabilities are

calculated on the basis of this information.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

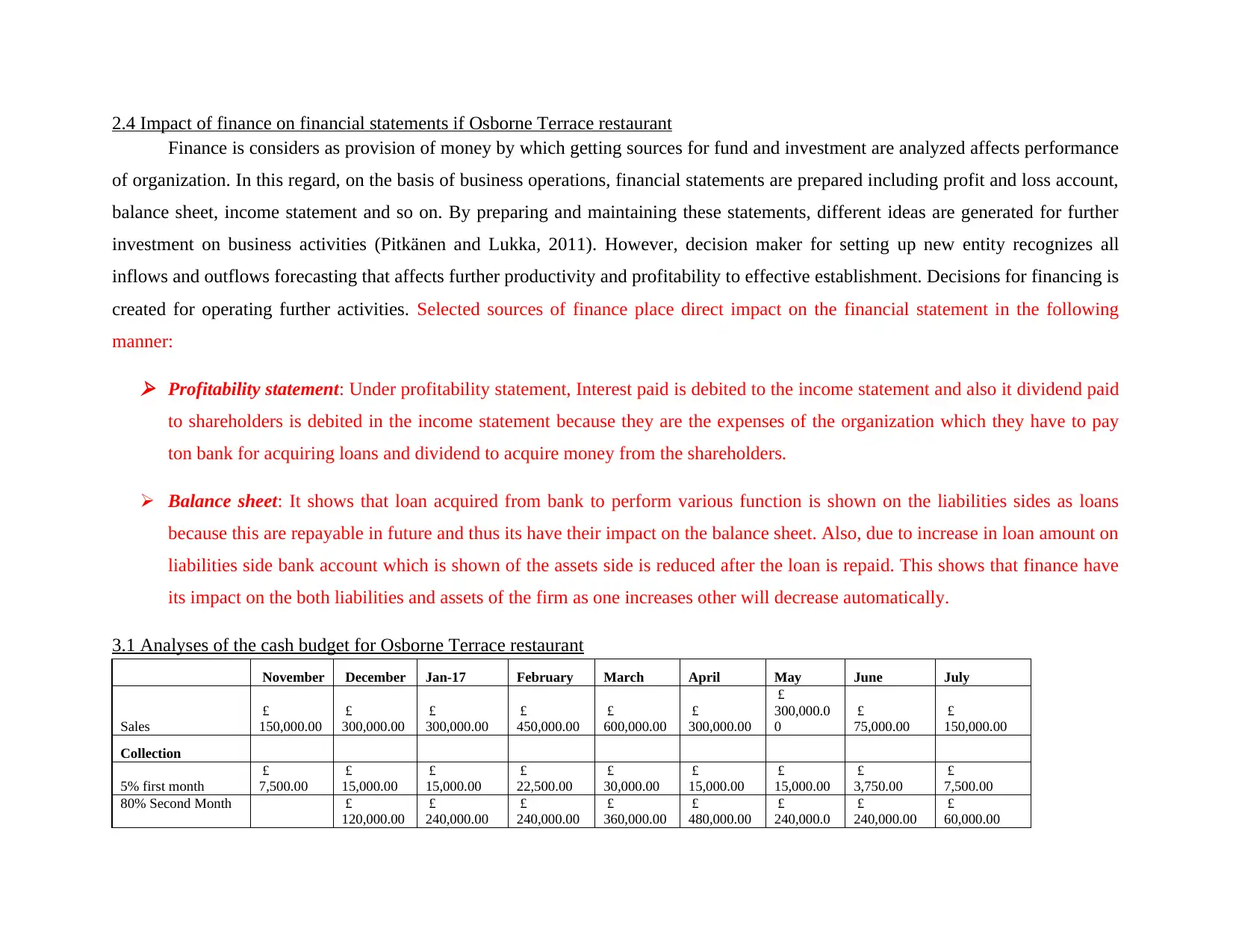

2.4 Impact of finance on financial statements if Osborne Terrace restaurant

Finance is considers as provision of money by which getting sources for fund and investment are analyzed affects performance

of organization. In this regard, on the basis of business operations, financial statements are prepared including profit and loss account,

balance sheet, income statement and so on. By preparing and maintaining these statements, different ideas are generated for further

investment on business activities (Pitkänen and Lukka, 2011). However, decision maker for setting up new entity recognizes all

inflows and outflows forecasting that affects further productivity and profitability to effective establishment. Decisions for financing is

created for operating further activities. Selected sources of finance place direct impact on the financial statement in the following

manner:

Profitability statement: Under profitability statement, Interest paid is debited to the income statement and also it dividend paid

to shareholders is debited in the income statement because they are the expenses of the organization which they have to pay

ton bank for acquiring loans and dividend to acquire money from the shareholders.

Balance sheet: It shows that loan acquired from bank to perform various function is shown on the liabilities sides as loans

because this are repayable in future and thus its have their impact on the balance sheet. Also, due to increase in loan amount on

liabilities side bank account which is shown of the assets side is reduced after the loan is repaid. This shows that finance have

its impact on the both liabilities and assets of the firm as one increases other will decrease automatically.

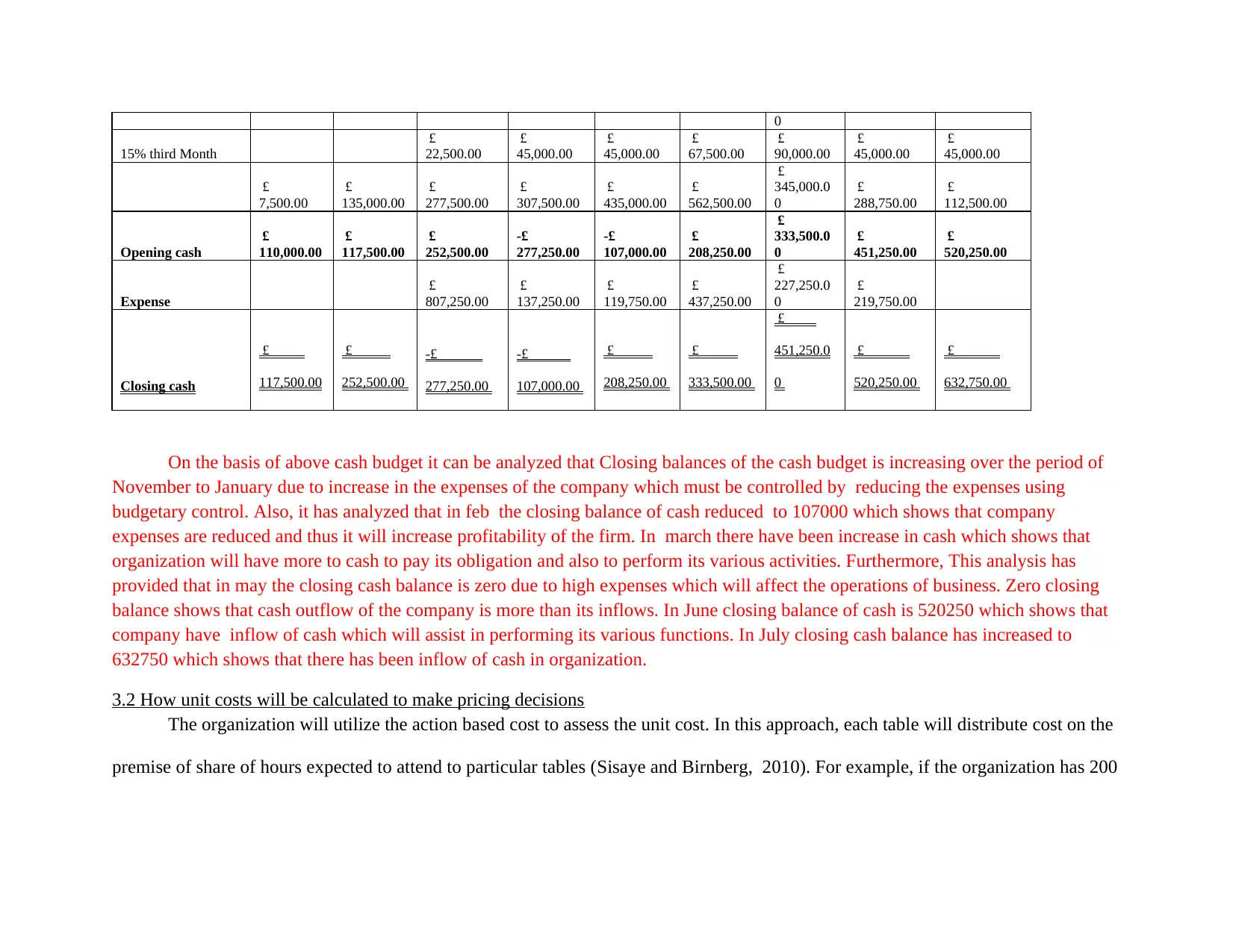

3.1 Analyses of the cash budget for Osborne Terrace restaurant

November December Jan-17 February March April May June July

Sales

£

150,000.00

£

300,000.00

£

300,000.00

£

450,000.00

£

600,000.00

£

300,000.00

£

300,000.0

0

£

75,000.00

£

150,000.00

Collection

5% first month

£

7,500.00

£

15,000.00

£

15,000.00

£

22,500.00

£

30,000.00

£

15,000.00

£

15,000.00

£

3,750.00

£

7,500.00

80% Second Month £

120,000.00

£

240,000.00

£

240,000.00

£

360,000.00

£

480,000.00

£

240,000.0

£

240,000.00

£

60,000.00

Finance is considers as provision of money by which getting sources for fund and investment are analyzed affects performance

of organization. In this regard, on the basis of business operations, financial statements are prepared including profit and loss account,

balance sheet, income statement and so on. By preparing and maintaining these statements, different ideas are generated for further

investment on business activities (Pitkänen and Lukka, 2011). However, decision maker for setting up new entity recognizes all

inflows and outflows forecasting that affects further productivity and profitability to effective establishment. Decisions for financing is

created for operating further activities. Selected sources of finance place direct impact on the financial statement in the following

manner:

Profitability statement: Under profitability statement, Interest paid is debited to the income statement and also it dividend paid

to shareholders is debited in the income statement because they are the expenses of the organization which they have to pay

ton bank for acquiring loans and dividend to acquire money from the shareholders.

Balance sheet: It shows that loan acquired from bank to perform various function is shown on the liabilities sides as loans

because this are repayable in future and thus its have their impact on the balance sheet. Also, due to increase in loan amount on

liabilities side bank account which is shown of the assets side is reduced after the loan is repaid. This shows that finance have

its impact on the both liabilities and assets of the firm as one increases other will decrease automatically.

3.1 Analyses of the cash budget for Osborne Terrace restaurant

November December Jan-17 February March April May June July

Sales

£

150,000.00

£

300,000.00

£

300,000.00

£

450,000.00

£

600,000.00

£

300,000.00

£

300,000.0

0

£

75,000.00

£

150,000.00

Collection

5% first month

£

7,500.00

£

15,000.00

£

15,000.00

£

22,500.00

£

30,000.00

£

15,000.00

£

15,000.00

£

3,750.00

£

7,500.00

80% Second Month £

120,000.00

£

240,000.00

£

240,000.00

£

360,000.00

£

480,000.00

£

240,000.0

£

240,000.00

£

60,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0

15% third Month

£

22,500.00

£

45,000.00

£

45,000.00

£

67,500.00

£

90,000.00

£

45,000.00

£

45,000.00

£

7,500.00

£

135,000.00

£

277,500.00

£

307,500.00

£

435,000.00

£

562,500.00

£

345,000.0

0

£

288,750.00

£

112,500.00

Opening cash

£

110,000.00

£

117,500.00

£

252,500.00

-£

277,250.00

-£

107,000.00

£

208,250.00

£

333,500.0

0

£

451,250.00

£

520,250.00

Expense

£

807,250.00

£

137,250.00

£

119,750.00

£

437,250.00

£

227,250.0

0

£

219,750.00

Closing cash

£

117,500.00

£

252,500.00

-£

277,250.00

-£

107,000.00

£

208,250.00

£

333,500.00

£

451,250.0

0

£

520,250.00

£

632,750.00

On the basis of above cash budget it can be analyzed that Closing balances of the cash budget is increasing over the period of

November to January due to increase in the expenses of the company which must be controlled by reducing the expenses using

budgetary control. Also, it has analyzed that in feb the closing balance of cash reduced to 107000 which shows that company

expenses are reduced and thus it will increase profitability of the firm. In march there have been increase in cash which shows that

organization will have more to cash to pay its obligation and also to perform its various activities. Furthermore, This analysis has

provided that in may the closing cash balance is zero due to high expenses which will affect the operations of business. Zero closing

balance shows that cash outflow of the company is more than its inflows. In June closing balance of cash is 520250 which shows that

company have inflow of cash which will assist in performing its various functions. In July closing cash balance has increased to

632750 which shows that there has been inflow of cash in organization.

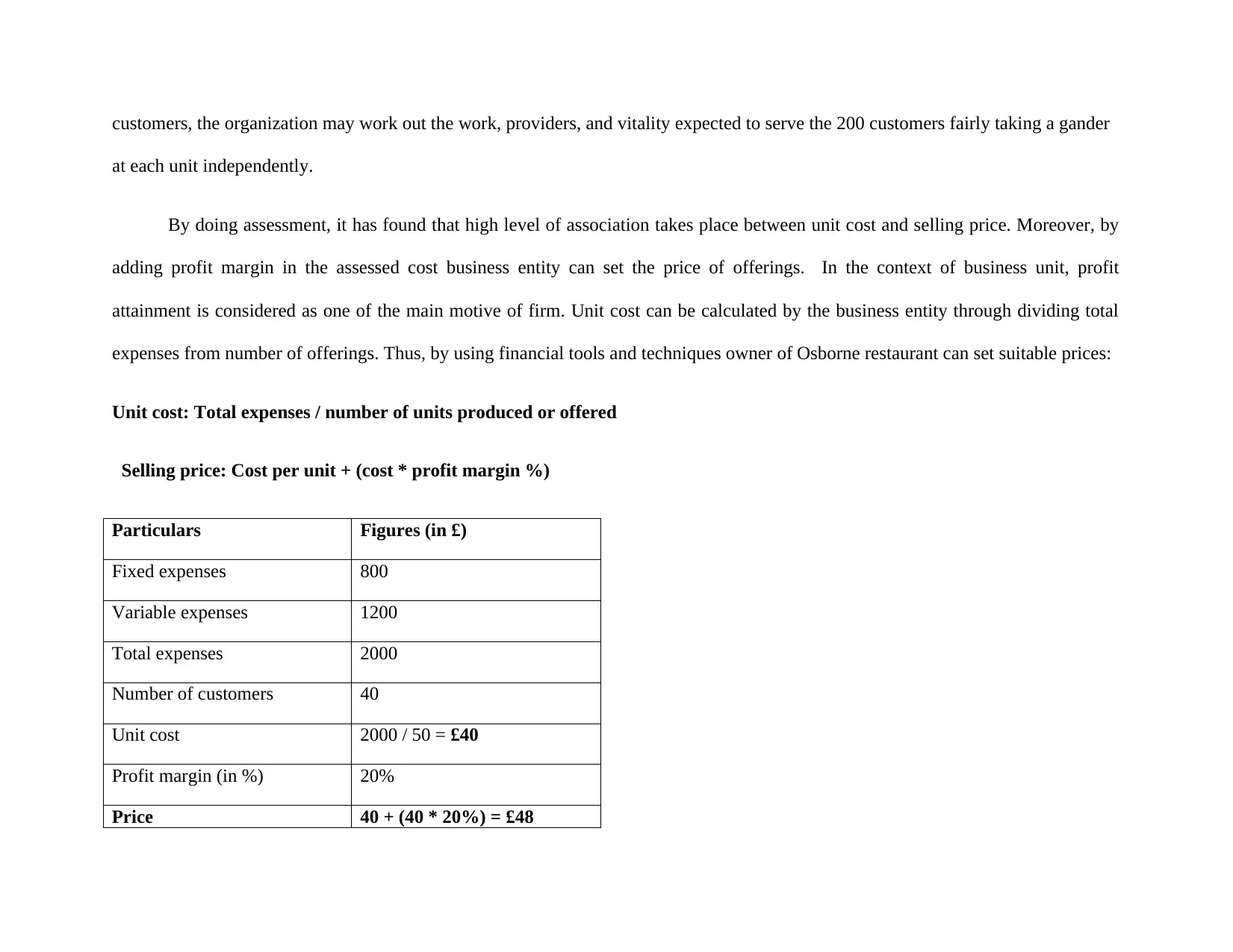

3.2 How unit costs will be calculated to make pricing decisions

The organization will utilize the action based cost to assess the unit cost. In this approach, each table will distribute cost on the

premise of share of hours expected to attend to particular tables (Sisaye and Birnberg, 2010). For example, if the organization has 200

15% third Month

£

22,500.00

£

45,000.00

£

45,000.00

£

67,500.00

£

90,000.00

£

45,000.00

£

45,000.00

£

7,500.00

£

135,000.00

£

277,500.00

£

307,500.00

£

435,000.00

£

562,500.00

£

345,000.0

0

£

288,750.00

£

112,500.00

Opening cash

£

110,000.00

£

117,500.00

£

252,500.00

-£

277,250.00

-£

107,000.00

£

208,250.00

£

333,500.0

0

£

451,250.00

£

520,250.00

Expense

£

807,250.00

£

137,250.00

£

119,750.00

£

437,250.00

£

227,250.0

0

£

219,750.00

Closing cash

£

117,500.00

£

252,500.00

-£

277,250.00

-£

107,000.00

£

208,250.00

£

333,500.00

£

451,250.0

0

£

520,250.00

£

632,750.00

On the basis of above cash budget it can be analyzed that Closing balances of the cash budget is increasing over the period of

November to January due to increase in the expenses of the company which must be controlled by reducing the expenses using

budgetary control. Also, it has analyzed that in feb the closing balance of cash reduced to 107000 which shows that company

expenses are reduced and thus it will increase profitability of the firm. In march there have been increase in cash which shows that

organization will have more to cash to pay its obligation and also to perform its various activities. Furthermore, This analysis has

provided that in may the closing cash balance is zero due to high expenses which will affect the operations of business. Zero closing

balance shows that cash outflow of the company is more than its inflows. In June closing balance of cash is 520250 which shows that

company have inflow of cash which will assist in performing its various functions. In July closing cash balance has increased to

632750 which shows that there has been inflow of cash in organization.

3.2 How unit costs will be calculated to make pricing decisions

The organization will utilize the action based cost to assess the unit cost. In this approach, each table will distribute cost on the

premise of share of hours expected to attend to particular tables (Sisaye and Birnberg, 2010). For example, if the organization has 200

customers, the organization may work out the work, providers, and vitality expected to serve the 200 customers fairly taking a gander

at each unit independently.

By doing assessment, it has found that high level of association takes place between unit cost and selling price. Moreover, by

adding profit margin in the assessed cost business entity can set the price of offerings. In the context of business unit, profit

attainment is considered as one of the main motive of firm. Unit cost can be calculated by the business entity through dividing total

expenses from number of offerings. Thus, by using financial tools and techniques owner of Osborne restaurant can set suitable prices:

Unit cost: Total expenses / number of units produced or offered

Selling price: Cost per unit + (cost * profit margin %)

Particulars Figures (in £)

Fixed expenses 800

Variable expenses 1200

Total expenses 2000

Number of customers 40

Unit cost 2000 / 50 = £40

Profit margin (in %) 20%

Price 40 + (40 * 20%) = £48

at each unit independently.

By doing assessment, it has found that high level of association takes place between unit cost and selling price. Moreover, by

adding profit margin in the assessed cost business entity can set the price of offerings. In the context of business unit, profit

attainment is considered as one of the main motive of firm. Unit cost can be calculated by the business entity through dividing total

expenses from number of offerings. Thus, by using financial tools and techniques owner of Osborne restaurant can set suitable prices:

Unit cost: Total expenses / number of units produced or offered

Selling price: Cost per unit + (cost * profit margin %)

Particulars Figures (in £)

Fixed expenses 800

Variable expenses 1200

Total expenses 2000

Number of customers 40

Unit cost 2000 / 50 = £40

Profit margin (in %) 20%

Price 40 + (40 * 20%) = £48

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.