Foreign Investment Banks' Influence on Australian Capital Markets

VerifiedAdded on 2022/09/25

|12

|2574

|18

Report

AI Summary

This report investigates the influence of foreign investment banks on the Australian capital markets. It begins by outlining the objectives and background of the project, emphasizing Australia's openness to foreign investment since the 1970s and 1980s. The report then reviews academic literature, identifies research problems, and sets specific research objectives, including assessing the impact of foreign investment banks, the current state of the Australian capital market, and the potential effects of the coronavirus outbreak. The research methodology involves secondary data collection from online resources, government websites like the Reserve Bank of Australia, and peer-reviewed journals. Expected outcomes include an analysis of the impact of foreign banks on the Australian economy, considering factors such as capital inflow, credit standards, and the regulatory environment. The report also includes a timeline for completion and a list of resources used. The findings suggest that while foreign banks initially fostered development, the government's focus has shifted to strong risk management frameworks, and the recent pandemic necessitates sustainable policies to support the banking sector and overall economic stability. The report concludes by highlighting the role of the Foreign Investment Review Board (FIRB) in achieving long-term sustainability in the financial sector.

THE INFLUENCE OF FOREIGN INVESTMENT BANKS ON

AUSTRALIAN CAPITAL MARKETS

Page 1 of 12

AUSTRALIAN CAPITAL MARKETS

Page 1 of 12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1.0 Objectives...............................................................................................................3

2.0 Project Background................................................................................................4

3.0 Academic Literature Review...................................................................................5

3.1 Research problem for study................................................................................5

3.2 Specific Research Objectives.............................................................................5

3.3 Scope of the Research........................................................................................6

4.0 Research Design and Strategy..............................................................................6

4.1 Data Collection....................................................................................................6

4.2 Data Analysis......................................................................................................6

5.0 Expected Outcomes of Project...............................................................................7

6.0 Timeline................................................................................................................10

7.0 Resources.............................................................................................................10

References.................................................................................................................11

Page 2 of 12

1.0 Objectives...............................................................................................................3

2.0 Project Background................................................................................................4

3.0 Academic Literature Review...................................................................................5

3.1 Research problem for study................................................................................5

3.2 Specific Research Objectives.............................................................................5

3.3 Scope of the Research........................................................................................6

4.0 Research Design and Strategy..............................................................................6

4.1 Data Collection....................................................................................................6

4.2 Data Analysis......................................................................................................6

5.0 Expected Outcomes of Project...............................................................................7

6.0 Timeline................................................................................................................10

7.0 Resources.............................................................................................................10

References.................................................................................................................11

Page 2 of 12

1.0 Objectives

The financial market of Australia has traditionally been open to the world. As a result,

the financial structure has been favourable for external investors to invest in the

market. Simultaneously, the Australian government including corporate sectors have

borrowed fund from foreign countries due to the liberalized economy. Integration with

the global capital market may be considered to be a double-edged sword. The

Australian corporate houses may get the advantage of borrowing from different

countries at a different rate and thereby leverage their capital structure due to

enough access to the financing provision (Ozkan, Cakan and Kayacan, 2017). On

the other hand, the foreign investment made by Australia in different countries

around the globe may have enabled the investors to diversify their portfolio at an

international level. However, such integrated economy may suffer from a certain

limitation in the form of fluctuation in global market scenario and the corresponding

impact on the domestic economy as well (Geddes, Schmidt and Steffen, 2018).

The investment banks in Australia are known for their huge market capitalisation and

stable growth prospects for years within the national territory of the country. The

impact of foreign direct investment through the banking channel has always been an

interesting aspect to study in the field of business and commerce. As a result, the

same holds true for the purpose of this research paper as well. The primary objective

of the research, therefore, may be considered to be examining the problems that the

Australian government may face due to the operation of foreign investment banks in

the economy. The entire paper will be developed and related topics will be discussed

to meet the research objective as framed herein:

Page 3 of 12

The financial market of Australia has traditionally been open to the world. As a result,

the financial structure has been favourable for external investors to invest in the

market. Simultaneously, the Australian government including corporate sectors have

borrowed fund from foreign countries due to the liberalized economy. Integration with

the global capital market may be considered to be a double-edged sword. The

Australian corporate houses may get the advantage of borrowing from different

countries at a different rate and thereby leverage their capital structure due to

enough access to the financing provision (Ozkan, Cakan and Kayacan, 2017). On

the other hand, the foreign investment made by Australia in different countries

around the globe may have enabled the investors to diversify their portfolio at an

international level. However, such integrated economy may suffer from a certain

limitation in the form of fluctuation in global market scenario and the corresponding

impact on the domestic economy as well (Geddes, Schmidt and Steffen, 2018).

The investment banks in Australia are known for their huge market capitalisation and

stable growth prospects for years within the national territory of the country. The

impact of foreign direct investment through the banking channel has always been an

interesting aspect to study in the field of business and commerce. As a result, the

same holds true for the purpose of this research paper as well. The primary objective

of the research, therefore, may be considered to be examining the problems that the

Australian government may face due to the operation of foreign investment banks in

the economy. The entire paper will be developed and related topics will be discussed

to meet the research objective as framed herein:

Page 3 of 12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.0 Project Background

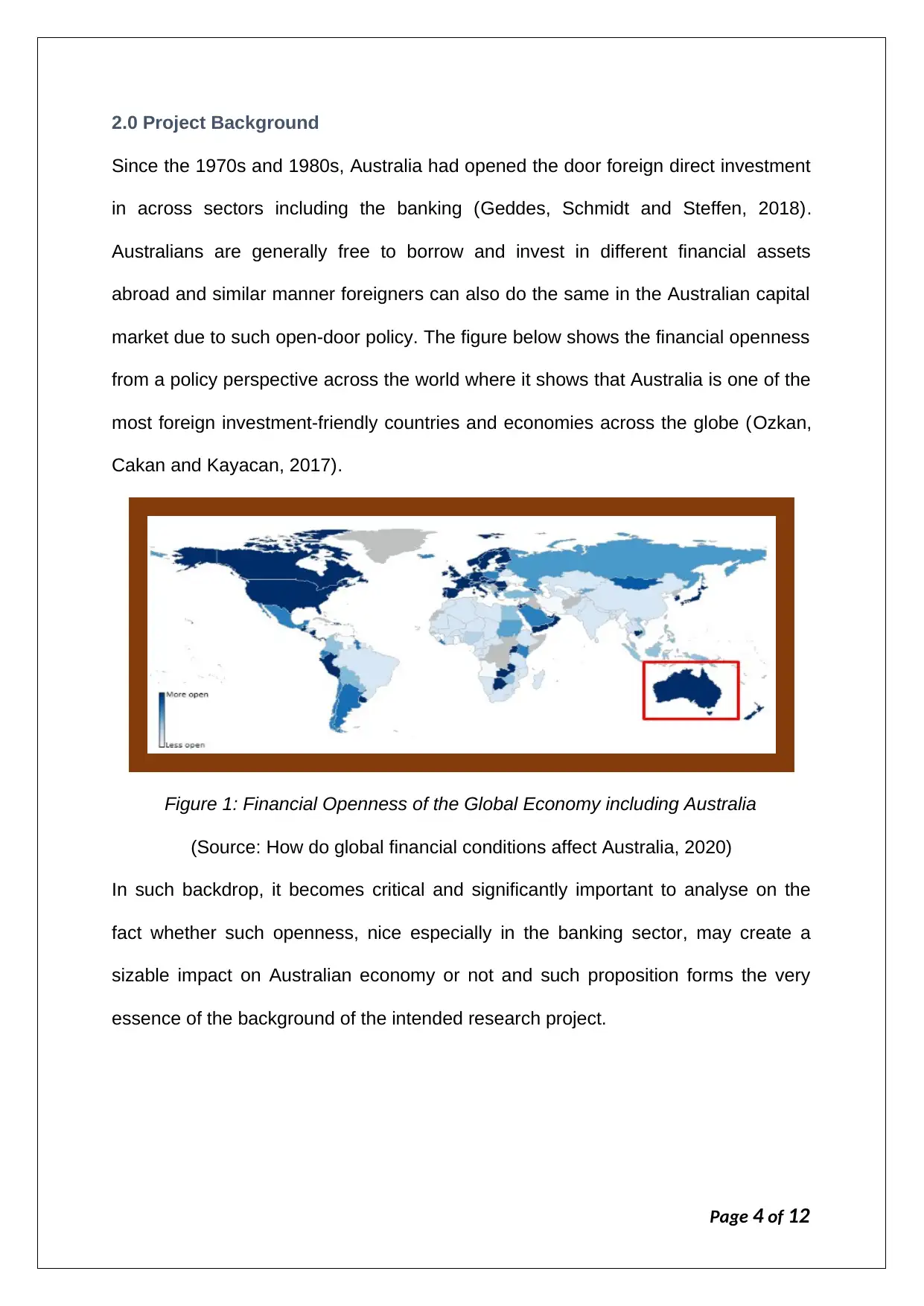

Since the 1970s and 1980s, Australia had opened the door foreign direct investment

in across sectors including the banking (Geddes, Schmidt and Steffen, 2018).

Australians are generally free to borrow and invest in different financial assets

abroad and similar manner foreigners can also do the same in the Australian capital

market due to such open-door policy. The figure below shows the financial openness

from a policy perspective across the world where it shows that Australia is one of the

most foreign investment-friendly countries and economies across the globe (Ozkan,

Cakan and Kayacan, 2017).

Figure 1: Financial Openness of the Global Economy including Australia

(Source: How do global financial conditions affect Australia, 2020)

In such backdrop, it becomes critical and significantly important to analyse on the

fact whether such openness, nice especially in the banking sector, may create a

sizable impact on Australian economy or not and such proposition forms the very

essence of the background of the intended research project.

Page 4 of 12

Since the 1970s and 1980s, Australia had opened the door foreign direct investment

in across sectors including the banking (Geddes, Schmidt and Steffen, 2018).

Australians are generally free to borrow and invest in different financial assets

abroad and similar manner foreigners can also do the same in the Australian capital

market due to such open-door policy. The figure below shows the financial openness

from a policy perspective across the world where it shows that Australia is one of the

most foreign investment-friendly countries and economies across the globe (Ozkan,

Cakan and Kayacan, 2017).

Figure 1: Financial Openness of the Global Economy including Australia

(Source: How do global financial conditions affect Australia, 2020)

In such backdrop, it becomes critical and significantly important to analyse on the

fact whether such openness, nice especially in the banking sector, may create a

sizable impact on Australian economy or not and such proposition forms the very

essence of the background of the intended research project.

Page 4 of 12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3.0 Academic Literature Review

3.1 Research problem for the study

In order to conduct the aforesaid study, the researcher has framed the research plan

which involves the approach towards developing the literature review, identifying the

research method and executing the research afterwards. Since the topic is relevant

in terms of the ever-changing economic backdrop of the world, the significance of the

topic lies on the same. It may be stated that the discussion on Australian current

economic position is an important and relevant topic for the researcher especially, in

the backdrop of coronavirus outbreak pandemic situation which has shaken up not

only Australia but also the global economy as well. In such a scenario, it will be

critical for the researcher to device the research problem accordingly.

3.2 Specific Research Objectives

As stated earlier, the Australian economy is regulated to the extent of foreign

investment as well as foreign borrowings and therefore the economy may be

considered to be volatile to the changes in external financial market across the globe

(Wójcik, Knight, O’Neill and Pažitka, 2018). Also, to put it in simpler terms, it may be

stated that any rate change in the global banking sector may affect the domestic

economy. In a similar manner, Australian investment banks have been primarily

dominated by foreign banks in the given market for few years and therefore any

regulatory change in their respective country or any changes in the global economy

may affect Australian banking sector as well. This volatile scenario forms the

essence of the research problem for the study.

The researcher, in this work, will, therefore, attempt to identify the answer to do the

following to research objectives:

Page 5 of 12

3.1 Research problem for the study

In order to conduct the aforesaid study, the researcher has framed the research plan

which involves the approach towards developing the literature review, identifying the

research method and executing the research afterwards. Since the topic is relevant

in terms of the ever-changing economic backdrop of the world, the significance of the

topic lies on the same. It may be stated that the discussion on Australian current

economic position is an important and relevant topic for the researcher especially, in

the backdrop of coronavirus outbreak pandemic situation which has shaken up not

only Australia but also the global economy as well. In such a scenario, it will be

critical for the researcher to device the research problem accordingly.

3.2 Specific Research Objectives

As stated earlier, the Australian economy is regulated to the extent of foreign

investment as well as foreign borrowings and therefore the economy may be

considered to be volatile to the changes in external financial market across the globe

(Wójcik, Knight, O’Neill and Pažitka, 2018). Also, to put it in simpler terms, it may be

stated that any rate change in the global banking sector may affect the domestic

economy. In a similar manner, Australian investment banks have been primarily

dominated by foreign banks in the given market for few years and therefore any

regulatory change in their respective country or any changes in the global economy

may affect Australian banking sector as well. This volatile scenario forms the

essence of the research problem for the study.

The researcher, in this work, will, therefore, attempt to identify the answer to do the

following to research objectives:

Page 5 of 12

To identify the impact of foreign investment banks on Australian investment

banking

To identify the current situation of the Australian capital market

To identify the potential impact of the coronavirus outbreak in the Australian

capital market

In order to achieve a reasonable explanation and answers to the aforesaid research

objectives, it will be critical for the researcher to resort various analytical process.

3.3 Scope of the Research

For the purpose of research design and strategy, the researcher has undertaken

secondary research through the reference to various online media, books, journals,

publications and several other learning materials are referred. Also, various

government websites are also researched in order to get the relevant data. For the

purpose of the given research, the Australian government website and the website of

Reserve Bank of Australia (RBA) have been also referred and relevant data and

information has been extracted therefrom (Wójcik, Knight, O’Neill and Pažitka,

2018).

4.0 Research Design and Strategy

4.1 Data Collection

A stated earlier, the data will be collected from secondary research using online

resources and the type of research will be qualitative. In order to assess the overall

health of Australian economy data from the website of the Reserve Bank of Australia

has been referred pertaining to the given period under review.

Page 6 of 12

banking

To identify the current situation of the Australian capital market

To identify the potential impact of the coronavirus outbreak in the Australian

capital market

In order to achieve a reasonable explanation and answers to the aforesaid research

objectives, it will be critical for the researcher to resort various analytical process.

3.3 Scope of the Research

For the purpose of research design and strategy, the researcher has undertaken

secondary research through the reference to various online media, books, journals,

publications and several other learning materials are referred. Also, various

government websites are also researched in order to get the relevant data. For the

purpose of the given research, the Australian government website and the website of

Reserve Bank of Australia (RBA) have been also referred and relevant data and

information has been extracted therefrom (Wójcik, Knight, O’Neill and Pažitka,

2018).

4.0 Research Design and Strategy

4.1 Data Collection

A stated earlier, the data will be collected from secondary research using online

resources and the type of research will be qualitative. In order to assess the overall

health of Australian economy data from the website of the Reserve Bank of Australia

has been referred pertaining to the given period under review.

Page 6 of 12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4.2 Data Analysis

Since the proposed research is secondary research and based on qualitative

approach, data from various websites, journals, publications have been referred. No

specific sample size has been chosen in the given case and however, for the

purpose of research last 5 to 7 years’ time span has been considered.

5.0 Expected Outcomes of the Project

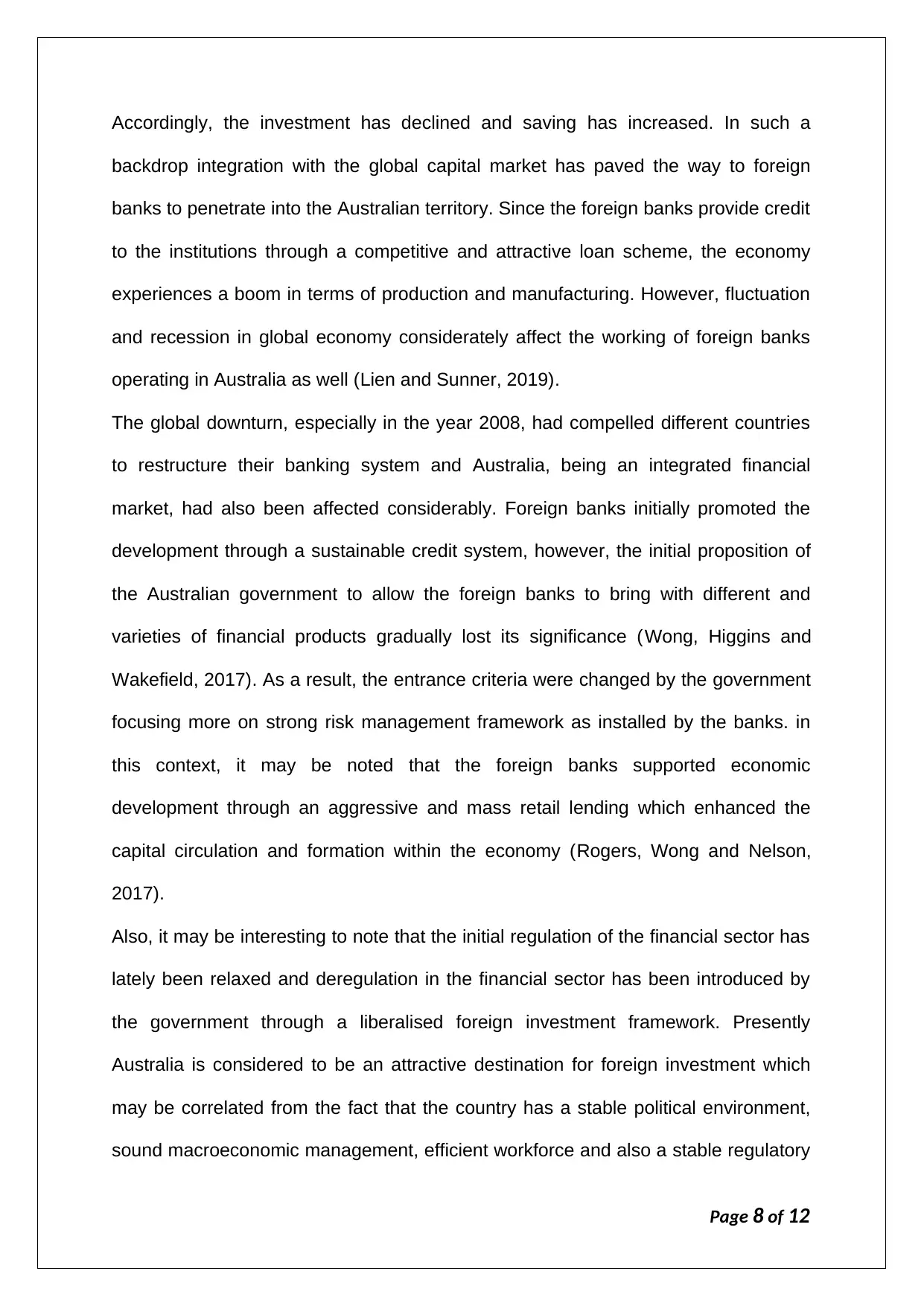

In recent years, the net inflow of capital within the Australian economy has declined.

In initial days, the country used to borrow significant amount from external countries;

however, in recent years, opposite trend has been witnessed and the shift from

external borrowing to invest in foreign countries have been observed. Though, the

net liability position has been increasing on a consistent basis showing a long-term

upward trend, the recent fluctuation, to be more precise, the downturn has indicated

the fact that the economy’s need for an external fund has considerably reduced. the

figure shows the same (Lien and Sunner, 2019).

Figure 2: Australia’s Net Foreign Liability (as % of GDP)

(Source: How do global financial conditions affect Australia, 2020)

Page 7 of 12

Since the proposed research is secondary research and based on qualitative

approach, data from various websites, journals, publications have been referred. No

specific sample size has been chosen in the given case and however, for the

purpose of research last 5 to 7 years’ time span has been considered.

5.0 Expected Outcomes of the Project

In recent years, the net inflow of capital within the Australian economy has declined.

In initial days, the country used to borrow significant amount from external countries;

however, in recent years, opposite trend has been witnessed and the shift from

external borrowing to invest in foreign countries have been observed. Though, the

net liability position has been increasing on a consistent basis showing a long-term

upward trend, the recent fluctuation, to be more precise, the downturn has indicated

the fact that the economy’s need for an external fund has considerably reduced. the

figure shows the same (Lien and Sunner, 2019).

Figure 2: Australia’s Net Foreign Liability (as % of GDP)

(Source: How do global financial conditions affect Australia, 2020)

Page 7 of 12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accordingly, the investment has declined and saving has increased. In such a

backdrop integration with the global capital market has paved the way to foreign

banks to penetrate into the Australian territory. Since the foreign banks provide credit

to the institutions through a competitive and attractive loan scheme, the economy

experiences a boom in terms of production and manufacturing. However, fluctuation

and recession in global economy considerately affect the working of foreign banks

operating in Australia as well (Lien and Sunner, 2019).

The global downturn, especially in the year 2008, had compelled different countries

to restructure their banking system and Australia, being an integrated financial

market, had also been affected considerably. Foreign banks initially promoted the

development through a sustainable credit system, however, the initial proposition of

the Australian government to allow the foreign banks to bring with different and

varieties of financial products gradually lost its significance (Wong, Higgins and

Wakefield, 2017). As a result, the entrance criteria were changed by the government

focusing more on strong risk management framework as installed by the banks. in

this context, it may be noted that the foreign banks supported economic

development through an aggressive and mass retail lending which enhanced the

capital circulation and formation within the economy (Rogers, Wong and Nelson,

2017).

Also, it may be interesting to note that the initial regulation of the financial sector has

lately been relaxed and deregulation in the financial sector has been introduced by

the government through a liberalised foreign investment framework. Presently

Australia is considered to be an attractive destination for foreign investment which

may be correlated from the fact that the country has a stable political environment,

sound macroeconomic management, efficient workforce and also a stable regulatory

Page 8 of 12

backdrop integration with the global capital market has paved the way to foreign

banks to penetrate into the Australian territory. Since the foreign banks provide credit

to the institutions through a competitive and attractive loan scheme, the economy

experiences a boom in terms of production and manufacturing. However, fluctuation

and recession in global economy considerately affect the working of foreign banks

operating in Australia as well (Lien and Sunner, 2019).

The global downturn, especially in the year 2008, had compelled different countries

to restructure their banking system and Australia, being an integrated financial

market, had also been affected considerably. Foreign banks initially promoted the

development through a sustainable credit system, however, the initial proposition of

the Australian government to allow the foreign banks to bring with different and

varieties of financial products gradually lost its significance (Wong, Higgins and

Wakefield, 2017). As a result, the entrance criteria were changed by the government

focusing more on strong risk management framework as installed by the banks. in

this context, it may be noted that the foreign banks supported economic

development through an aggressive and mass retail lending which enhanced the

capital circulation and formation within the economy (Rogers, Wong and Nelson,

2017).

Also, it may be interesting to note that the initial regulation of the financial sector has

lately been relaxed and deregulation in the financial sector has been introduced by

the government through a liberalised foreign investment framework. Presently

Australia is considered to be an attractive destination for foreign investment which

may be correlated from the fact that the country has a stable political environment,

sound macroeconomic management, efficient workforce and also a stable regulatory

Page 8 of 12

framework (Regan, 2017). In the banking sector, the government doesn't impose any

specific restriction with respect to the foreign investment and therefore foreign banks

may operate under the broader purview of the regulated system and specific

supervision of relevant policy framework such as Banking Act 1959 etc (Rogers,

Wong and Nelson, 2017).

Besides, the huge credit flow and capital formation within the system through

sustainable credit practice has brought down the credit standards within the country.

The inadequate risk management and improper assessment of the creditworthiness

of the borrower are some of the major areas of consideration which foreign banks

and the regulators may need to have while strategizing or executing their operations

(Hurst, 2019).

Considering the situation, it may be stated that the recent outbreak of coronavirus

pandemic has caused significant losses to the global economy and Australians are

also no exception to the same. The recent research conducted by United Nation

revealed that the world may experience another depression post-2008, the impact of

which may exceed that of the 2008 recession (Hurst, 2019). In such a scenario it will

be necessary for the policymaker to adopt a sustainable policy set where banks will

be provided sufficient credit for onward transmission to the borrowers and industries

to maintain the production momentum (Atoom, Malkawi and Al Share, 2017). Also,

people will be provided with liquidity so that the economy may get restored within

next few years through consistent consumption (Black, Chapman and Windsor,

2017). In this context, the question may arise whether the foreign direct investment

will be further liberated from its existing liberalised framework or the same should be

controlled in a more stringent manner. In the Australia, Foreign Investment Review

Board (FIRB) overseas the FDI operation across the sector and therefore it may be

Page 9 of 12

specific restriction with respect to the foreign investment and therefore foreign banks

may operate under the broader purview of the regulated system and specific

supervision of relevant policy framework such as Banking Act 1959 etc (Rogers,

Wong and Nelson, 2017).

Besides, the huge credit flow and capital formation within the system through

sustainable credit practice has brought down the credit standards within the country.

The inadequate risk management and improper assessment of the creditworthiness

of the borrower are some of the major areas of consideration which foreign banks

and the regulators may need to have while strategizing or executing their operations

(Hurst, 2019).

Considering the situation, it may be stated that the recent outbreak of coronavirus

pandemic has caused significant losses to the global economy and Australians are

also no exception to the same. The recent research conducted by United Nation

revealed that the world may experience another depression post-2008, the impact of

which may exceed that of the 2008 recession (Hurst, 2019). In such a scenario it will

be necessary for the policymaker to adopt a sustainable policy set where banks will

be provided sufficient credit for onward transmission to the borrowers and industries

to maintain the production momentum (Atoom, Malkawi and Al Share, 2017). Also,

people will be provided with liquidity so that the economy may get restored within

next few years through consistent consumption (Black, Chapman and Windsor,

2017). In this context, the question may arise whether the foreign direct investment

will be further liberated from its existing liberalised framework or the same should be

controlled in a more stringent manner. In the Australia, Foreign Investment Review

Board (FIRB) overseas the FDI operation across the sector and therefore it may be

Page 9 of 12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

concluded that a well-designed policy framework supported by efficient leadership

and governance through FIRB on banking and financial sector will help the country

to achieve a long term goal of sustainability in the financial sector and the economy

as a whole in the most time and cost-efficient manner (Atoom, Malkawi and Al

Share, 2017).

6.0 Timeline

The research has been targeted to be completed within 1 month, the brief timeline is

shown herein:

The first week – Structuring the paper, visualising the concept and

conceptualising the outcome

The second week – Collecting the data and listing of all sources

The third week – Summarising the data collected and performing a literature

review

The fourth week – Reviewing the paper, running sense check, formatting,

grammar checking and referencing etc.

7.0 Resources

For the purpose of research, primarily the website of RBA has been referred.

Besides, few peer-reviewed journal publications have also been referred. Also, some

websites have been referred to get the idea of foreign banks’ operations within the

country. All such references have been listed in the references or bibliography

section below.

Page 10 of 12

and governance through FIRB on banking and financial sector will help the country

to achieve a long term goal of sustainability in the financial sector and the economy

as a whole in the most time and cost-efficient manner (Atoom, Malkawi and Al

Share, 2017).

6.0 Timeline

The research has been targeted to be completed within 1 month, the brief timeline is

shown herein:

The first week – Structuring the paper, visualising the concept and

conceptualising the outcome

The second week – Collecting the data and listing of all sources

The third week – Summarising the data collected and performing a literature

review

The fourth week – Reviewing the paper, running sense check, formatting,

grammar checking and referencing etc.

7.0 Resources

For the purpose of research, primarily the website of RBA has been referred.

Besides, few peer-reviewed journal publications have also been referred. Also, some

websites have been referred to get the idea of foreign banks’ operations within the

country. All such references have been listed in the references or bibliography

section below.

Page 10 of 12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Atoom, R., Malkawi, E. and Al Share, B., 2017. Utilizing australian shareholders'

association (asa): Fifteen top financial ratios to evaluate Jordanian banks'

performance. Journal of Applied Finance and Banking, 7(1), p.119.

Black, S., Chapman, B. and Windsor, C., 2017. Australian Capital Flows. RBA

Bulletin, June, pp.23-34.

Geddes, A., Schmidt, T.S. and Steffen, B., 2018. The multiple roles of state

investment banks in low-carbon energy finance: An analysis of Australia, the UK and

Germany. Energy Policy, 115, pp.158-170.

Hurst, L., 2019. 14. The impact of Chinese state capital during the iron ore

boom. THE CHINESE ECONOMIC TRANSFORMATION, p.287.

Lien, B. and Sunner, D., 2019. Liberalisation of China's Portfolio Flows and the

Renminbi| Bulletin–September Quarter 2019. Bulletin, (September).

Ozkan, N., Cakan, S. and Kayacan, M., 2017. Intellectual capital and financial

performance: A study of the Turkish Banking Sector. Borsa Istanbul Review, 17(3),

pp.190-198.

Regan, M., 2017. Capital markets, infrastructure investment and growth in the Asia

Pacific region. International Journal of Financial Studies, 5(1), p.5.

Reserve Bank of Australia. 2020. How Do Global Financial Conditions Affect

Australia. [online] Available at:

<https://www.rba.gov.au/publications/bulletin/2019/dec/how-do-global-financial-

conditions-affect-australia.html> [Accessed 17 April 2020].

Rogers, D., Wong, A. and Nelson, J., 2017. Public perceptions of foreign and

Chinese real estate investment: intercultural relations in Global Sydney. Australian

Geographer, 48(4), pp.437-455.

Page 11 of 12

Atoom, R., Malkawi, E. and Al Share, B., 2017. Utilizing australian shareholders'

association (asa): Fifteen top financial ratios to evaluate Jordanian banks'

performance. Journal of Applied Finance and Banking, 7(1), p.119.

Black, S., Chapman, B. and Windsor, C., 2017. Australian Capital Flows. RBA

Bulletin, June, pp.23-34.

Geddes, A., Schmidt, T.S. and Steffen, B., 2018. The multiple roles of state

investment banks in low-carbon energy finance: An analysis of Australia, the UK and

Germany. Energy Policy, 115, pp.158-170.

Hurst, L., 2019. 14. The impact of Chinese state capital during the iron ore

boom. THE CHINESE ECONOMIC TRANSFORMATION, p.287.

Lien, B. and Sunner, D., 2019. Liberalisation of China's Portfolio Flows and the

Renminbi| Bulletin–September Quarter 2019. Bulletin, (September).

Ozkan, N., Cakan, S. and Kayacan, M., 2017. Intellectual capital and financial

performance: A study of the Turkish Banking Sector. Borsa Istanbul Review, 17(3),

pp.190-198.

Regan, M., 2017. Capital markets, infrastructure investment and growth in the Asia

Pacific region. International Journal of Financial Studies, 5(1), p.5.

Reserve Bank of Australia. 2020. How Do Global Financial Conditions Affect

Australia. [online] Available at:

<https://www.rba.gov.au/publications/bulletin/2019/dec/how-do-global-financial-

conditions-affect-australia.html> [Accessed 17 April 2020].

Rogers, D., Wong, A. and Nelson, J., 2017. Public perceptions of foreign and

Chinese real estate investment: intercultural relations in Global Sydney. Australian

Geographer, 48(4), pp.437-455.

Page 11 of 12

Wójcik, D., Knight, E., O’Neill, P. and Pažitka, V., 2018. Economic geography of

investment banking since 2008: The geography of shrinkage and shift. Economic

Geography, 94(4), pp.376-399.

Wong, P.Y., Higgins, D. and Wakefield, R., 2017. Foreign real estate investment,

residential tourism and the Australian residential property market. International

Journal of Housing Markets and Analysis.

Page 12 of 12

investment banking since 2008: The geography of shrinkage and shift. Economic

Geography, 94(4), pp.376-399.

Wong, P.Y., Higgins, D. and Wakefield, R., 2017. Foreign real estate investment,

residential tourism and the Australian residential property market. International

Journal of Housing Markets and Analysis.

Page 12 of 12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.