International Finance Report: Barclays Bank's Acquisition of Admiral

VerifiedAdded on 2020/01/28

|11

|3199

|98

Report

AI Summary

This report provides a comprehensive financial analysis of Admiral Insurance Group Plc, a FTSE 100 company, in the context of a potential acquisition by Barclays Bank. The analysis begins with an introduction to the importance of finance in business and the specific scenario involving Barclays' interest in acquiring a FTSE 100 company. The report then delves into Task 1, presenting a detailed comparison of financial ratios between Barclays Bank and Admiral Insurance, including profitability, liquidity, and efficiency ratios. Task 2 explores three valuation methods: Net Asset Value, Price Earning Ratio, and Dividend Valuation Method, outlining their advantages, disadvantages, and application to Admiral Insurance. The report concludes with a recommendation to Barclays Bank based on Admiral's financial position and a summary of the findings. The report uses financial data from 2015 to support its analysis and recommendations, providing a practical application of financial concepts in a real-world business scenario.

INTERNATIONAL

FINANCE

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Financial ratios of FTSE 100 company............................................................................1

TASK 2............................................................................................................................................4

A) Advantages and disadvantages of three valuation methods..............................................4

B) Different valuation methods..............................................................................................5

C) How valuation method help a firm....................................................................................6

D) Risk Exposures..................................................................................................................7

E) Impacts of acquisition on selection of valuation method..................................................7

TASK 3............................................................................................................................................8

3.1 Recommendation to Barclays bank on the basis of the financial position of Admiral

insurance group Plc................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Financial ratios of FTSE 100 company............................................................................1

TASK 2............................................................................................................................................4

A) Advantages and disadvantages of three valuation methods..............................................4

B) Different valuation methods..............................................................................................5

C) How valuation method help a firm....................................................................................6

D) Risk Exposures..................................................................................................................7

E) Impacts of acquisition on selection of valuation method..................................................7

TASK 3............................................................................................................................................8

3.1 Recommendation to Barclays bank on the basis of the financial position of Admiral

insurance group Plc................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Finance is very important component of business, without this business can not exist in

the market. In present case the Barclays bank wants to acquire the FTSE 100 company on the

basis of financial performance. For this the Admiral insurance group is selected which is listed in

FTSE 100 constituent of London Stock Exchange Group. In the report on the basis of ratio

analysis answer of the question is identified whether the Barclays bank should acquire the

targeting firm or not.

TASK 1

1.1 Financial ratios of FTSE 100 company

FTSE 100 is a component of London Stock Exchange Group. For this report the Admiral

Insurance group is selected which is UK based company and operating in the financial service

industry. Main product of the company is insurance where it provides all insurance to the

consumers (Frisari and Stadelmann, 2015). Under this report the Barclays bank wants to acquire

FTSE 100 company on the basis of financial performance.

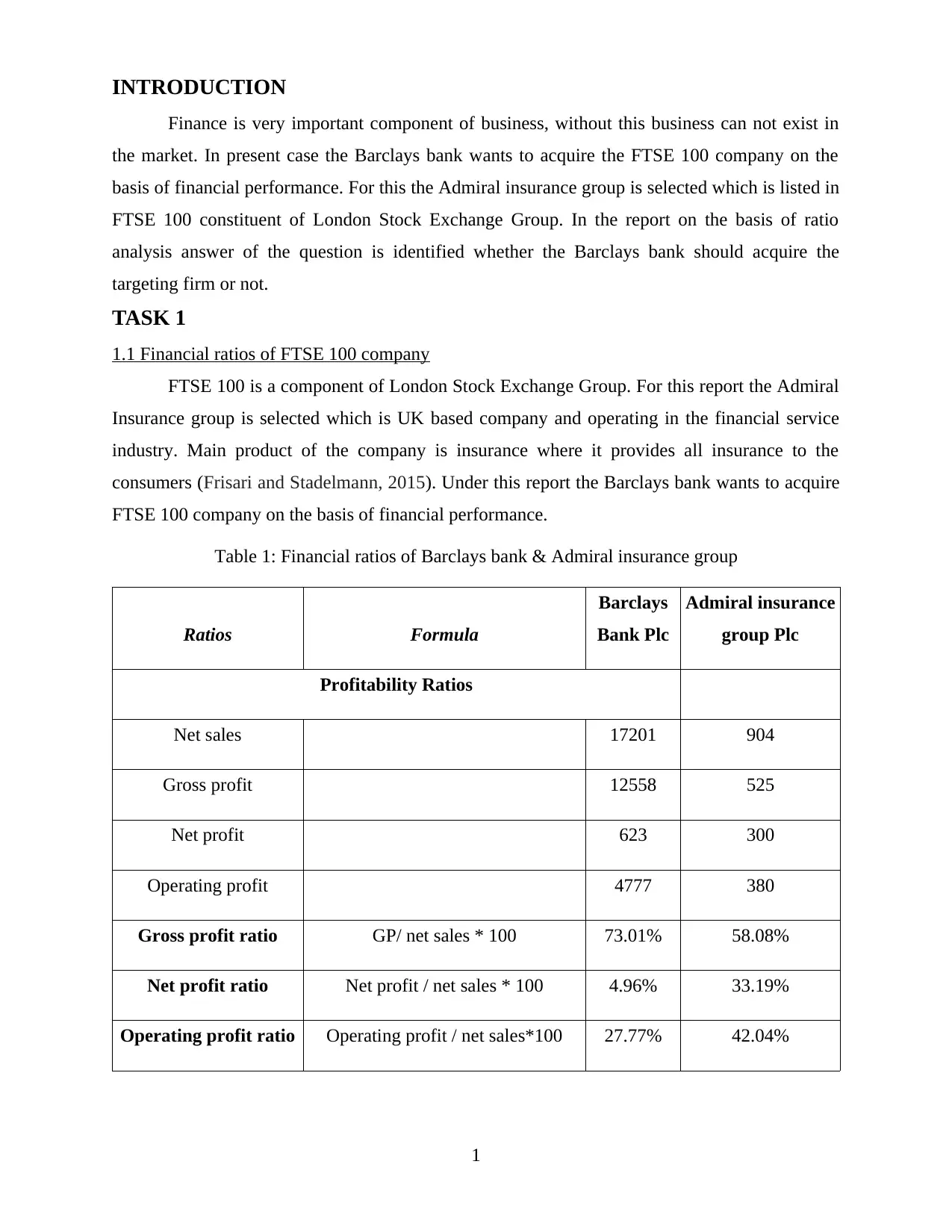

Table 1: Financial ratios of Barclays bank & Admiral insurance group

Ratios Formula

Barclays

Bank Plc

Admiral insurance

group Plc

Profitability Ratios

Net sales 17201 904

Gross profit 12558 525

Net profit 623 300

Operating profit 4777 380

Gross profit ratio GP/ net sales * 100 73.01% 58.08%

Net profit ratio Net profit / net sales * 100 4.96% 33.19%

Operating profit ratio Operating profit / net sales*100 27.77% 42.04%

1

Finance is very important component of business, without this business can not exist in

the market. In present case the Barclays bank wants to acquire the FTSE 100 company on the

basis of financial performance. For this the Admiral insurance group is selected which is listed in

FTSE 100 constituent of London Stock Exchange Group. In the report on the basis of ratio

analysis answer of the question is identified whether the Barclays bank should acquire the

targeting firm or not.

TASK 1

1.1 Financial ratios of FTSE 100 company

FTSE 100 is a component of London Stock Exchange Group. For this report the Admiral

Insurance group is selected which is UK based company and operating in the financial service

industry. Main product of the company is insurance where it provides all insurance to the

consumers (Frisari and Stadelmann, 2015). Under this report the Barclays bank wants to acquire

FTSE 100 company on the basis of financial performance.

Table 1: Financial ratios of Barclays bank & Admiral insurance group

Ratios Formula

Barclays

Bank Plc

Admiral insurance

group Plc

Profitability Ratios

Net sales 17201 904

Gross profit 12558 525

Net profit 623 300

Operating profit 4777 380

Gross profit ratio GP/ net sales * 100 73.01% 58.08%

Net profit ratio Net profit / net sales * 100 4.96% 33.19%

Operating profit ratio Operating profit / net sales*100 27.77% 42.04%

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

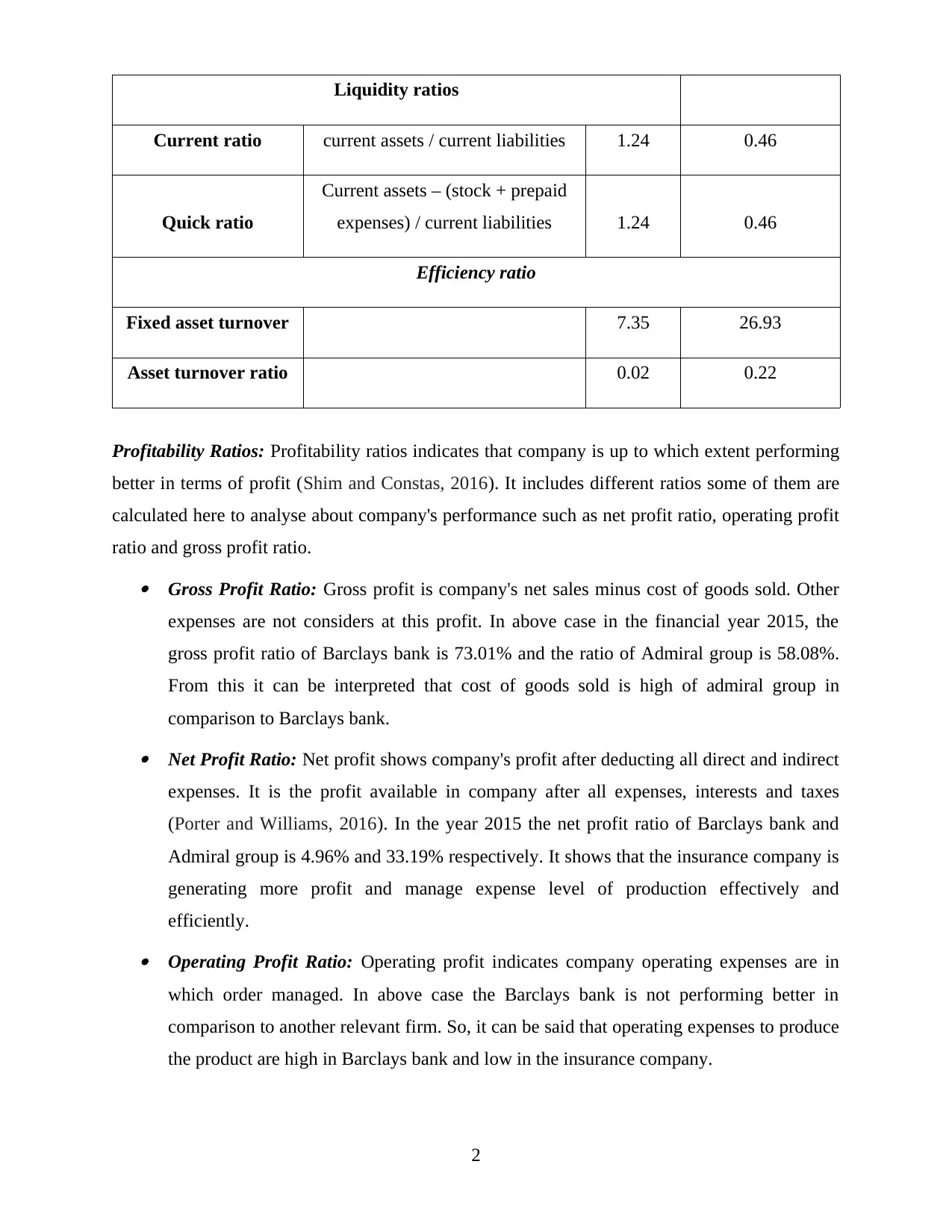

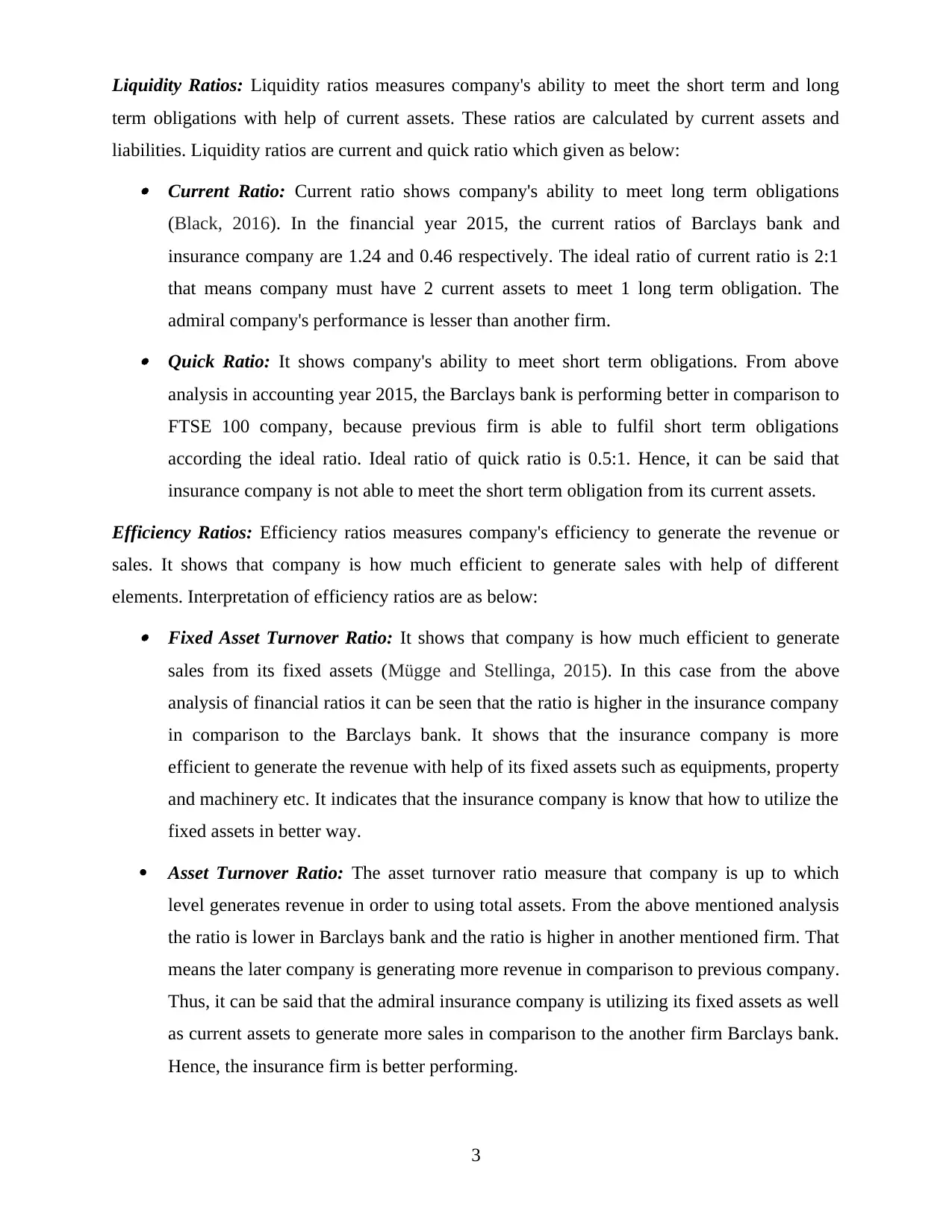

Liquidity ratios

Current ratio current assets / current liabilities 1.24 0.46

Quick ratio

Current assets – (stock + prepaid

expenses) / current liabilities 1.24 0.46

Efficiency ratio

Fixed asset turnover 7.35 26.93

Asset turnover ratio 0.02 0.22

Profitability Ratios: Profitability ratios indicates that company is up to which extent performing

better in terms of profit (Shim and Constas, 2016). It includes different ratios some of them are

calculated here to analyse about company's performance such as net profit ratio, operating profit

ratio and gross profit ratio. Gross Profit Ratio: Gross profit is company's net sales minus cost of goods sold. Other

expenses are not considers at this profit. In above case in the financial year 2015, the

gross profit ratio of Barclays bank is 73.01% and the ratio of Admiral group is 58.08%.

From this it can be interpreted that cost of goods sold is high of admiral group in

comparison to Barclays bank. Net Profit Ratio: Net profit shows company's profit after deducting all direct and indirect

expenses. It is the profit available in company after all expenses, interests and taxes

(Porter and Williams, 2016). In the year 2015 the net profit ratio of Barclays bank and

Admiral group is 4.96% and 33.19% respectively. It shows that the insurance company is

generating more profit and manage expense level of production effectively and

efficiently. Operating Profit Ratio: Operating profit indicates company operating expenses are in

which order managed. In above case the Barclays bank is not performing better in

comparison to another relevant firm. So, it can be said that operating expenses to produce

the product are high in Barclays bank and low in the insurance company.

2

Current ratio current assets / current liabilities 1.24 0.46

Quick ratio

Current assets – (stock + prepaid

expenses) / current liabilities 1.24 0.46

Efficiency ratio

Fixed asset turnover 7.35 26.93

Asset turnover ratio 0.02 0.22

Profitability Ratios: Profitability ratios indicates that company is up to which extent performing

better in terms of profit (Shim and Constas, 2016). It includes different ratios some of them are

calculated here to analyse about company's performance such as net profit ratio, operating profit

ratio and gross profit ratio. Gross Profit Ratio: Gross profit is company's net sales minus cost of goods sold. Other

expenses are not considers at this profit. In above case in the financial year 2015, the

gross profit ratio of Barclays bank is 73.01% and the ratio of Admiral group is 58.08%.

From this it can be interpreted that cost of goods sold is high of admiral group in

comparison to Barclays bank. Net Profit Ratio: Net profit shows company's profit after deducting all direct and indirect

expenses. It is the profit available in company after all expenses, interests and taxes

(Porter and Williams, 2016). In the year 2015 the net profit ratio of Barclays bank and

Admiral group is 4.96% and 33.19% respectively. It shows that the insurance company is

generating more profit and manage expense level of production effectively and

efficiently. Operating Profit Ratio: Operating profit indicates company operating expenses are in

which order managed. In above case the Barclays bank is not performing better in

comparison to another relevant firm. So, it can be said that operating expenses to produce

the product are high in Barclays bank and low in the insurance company.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Liquidity Ratios: Liquidity ratios measures company's ability to meet the short term and long

term obligations with help of current assets. These ratios are calculated by current assets and

liabilities. Liquidity ratios are current and quick ratio which given as below: Current Ratio: Current ratio shows company's ability to meet long term obligations

(Black, 2016). In the financial year 2015, the current ratios of Barclays bank and

insurance company are 1.24 and 0.46 respectively. The ideal ratio of current ratio is 2:1

that means company must have 2 current assets to meet 1 long term obligation. The

admiral company's performance is lesser than another firm. Quick Ratio: It shows company's ability to meet short term obligations. From above

analysis in accounting year 2015, the Barclays bank is performing better in comparison to

FTSE 100 company, because previous firm is able to fulfil short term obligations

according the ideal ratio. Ideal ratio of quick ratio is 0.5:1. Hence, it can be said that

insurance company is not able to meet the short term obligation from its current assets.

Efficiency Ratios: Efficiency ratios measures company's efficiency to generate the revenue or

sales. It shows that company is how much efficient to generate sales with help of different

elements. Interpretation of efficiency ratios are as below: Fixed Asset Turnover Ratio: It shows that company is how much efficient to generate

sales from its fixed assets (Mügge and Stellinga, 2015). In this case from the above

analysis of financial ratios it can be seen that the ratio is higher in the insurance company

in comparison to the Barclays bank. It shows that the insurance company is more

efficient to generate the revenue with help of its fixed assets such as equipments, property

and machinery etc. It indicates that the insurance company is know that how to utilize the

fixed assets in better way.

Asset Turnover Ratio: The asset turnover ratio measure that company is up to which

level generates revenue in order to using total assets. From the above mentioned analysis

the ratio is lower in Barclays bank and the ratio is higher in another mentioned firm. That

means the later company is generating more revenue in comparison to previous company.

Thus, it can be said that the admiral insurance company is utilizing its fixed assets as well

as current assets to generate more sales in comparison to the another firm Barclays bank.

Hence, the insurance firm is better performing.

3

term obligations with help of current assets. These ratios are calculated by current assets and

liabilities. Liquidity ratios are current and quick ratio which given as below: Current Ratio: Current ratio shows company's ability to meet long term obligations

(Black, 2016). In the financial year 2015, the current ratios of Barclays bank and

insurance company are 1.24 and 0.46 respectively. The ideal ratio of current ratio is 2:1

that means company must have 2 current assets to meet 1 long term obligation. The

admiral company's performance is lesser than another firm. Quick Ratio: It shows company's ability to meet short term obligations. From above

analysis in accounting year 2015, the Barclays bank is performing better in comparison to

FTSE 100 company, because previous firm is able to fulfil short term obligations

according the ideal ratio. Ideal ratio of quick ratio is 0.5:1. Hence, it can be said that

insurance company is not able to meet the short term obligation from its current assets.

Efficiency Ratios: Efficiency ratios measures company's efficiency to generate the revenue or

sales. It shows that company is how much efficient to generate sales with help of different

elements. Interpretation of efficiency ratios are as below: Fixed Asset Turnover Ratio: It shows that company is how much efficient to generate

sales from its fixed assets (Mügge and Stellinga, 2015). In this case from the above

analysis of financial ratios it can be seen that the ratio is higher in the insurance company

in comparison to the Barclays bank. It shows that the insurance company is more

efficient to generate the revenue with help of its fixed assets such as equipments, property

and machinery etc. It indicates that the insurance company is know that how to utilize the

fixed assets in better way.

Asset Turnover Ratio: The asset turnover ratio measure that company is up to which

level generates revenue in order to using total assets. From the above mentioned analysis

the ratio is lower in Barclays bank and the ratio is higher in another mentioned firm. That

means the later company is generating more revenue in comparison to previous company.

Thus, it can be said that the admiral insurance company is utilizing its fixed assets as well

as current assets to generate more sales in comparison to the another firm Barclays bank.

Hence, the insurance firm is better performing.

3

TASK 2

A) Advantages and disadvantages of three valuation methods

1. Net Asset Value: The net assets value shows that the company is how much able to

increase the value of business in order to net assets and outstanding shares. In this total

assets and current liabilities can be control because this are internal elements but the

share price can not be control as this considers as an external factor. The net asset value is

one of the important valuation method to derive the value of business. The net asset value

is fluctuated in very short period due to it considers outstanding equity shares price.

Advantage of the net asset value method is that it gives the fair value of the assets in

order to evaluation of business. The method is beneficial in case of merger or takeover of two or

more companies, if the merger process is done by the net asset value (Robinson and Broihahn,

2015). The method is suitable for companies with the heavy tangible investments such as

property, equipment etc.

Disadvantage of the method is that it is not suitable for long period in order to derive the

value of business. The investors are can not take the decision for long term investment in the

company, because it considers the share value. The share price is fluctuated on daily basis so the

value is also fluctuated. Thus, it can be said that in context to limitations that it gives the decision

for very short period.

2. Price Earning Ratio: The price earning ratio is another method of business valuation

which gives an idea to investors that the particular company is suitable for investment or

not. The price earning ratio is derives on the basis of stock price and earning per share of

the company. It shows that the company is over valued or under valued. The ratio is used

to determine worth of the business entity with the help of existing conditions such as

company held equity currently and the share price. It shows the business conditions

clearly by which the more number of customers attract for investment in the company.

Advantages of the price earning ratio is that the ratio gives the clear and transparent

conditions of the business and it attracts more number of customers (Hoberg and Maksimovic,

2015). The another benefit is that it gives the fair value of the business in market. The ratio is

gives and idea to the customers that the company is performing over or less or the company is

over valued or under valued in the industry. With help of this the company can control existing

business positions with highlighting weaknesses of the company.

4

A) Advantages and disadvantages of three valuation methods

1. Net Asset Value: The net assets value shows that the company is how much able to

increase the value of business in order to net assets and outstanding shares. In this total

assets and current liabilities can be control because this are internal elements but the

share price can not be control as this considers as an external factor. The net asset value is

one of the important valuation method to derive the value of business. The net asset value

is fluctuated in very short period due to it considers outstanding equity shares price.

Advantage of the net asset value method is that it gives the fair value of the assets in

order to evaluation of business. The method is beneficial in case of merger or takeover of two or

more companies, if the merger process is done by the net asset value (Robinson and Broihahn,

2015). The method is suitable for companies with the heavy tangible investments such as

property, equipment etc.

Disadvantage of the method is that it is not suitable for long period in order to derive the

value of business. The investors are can not take the decision for long term investment in the

company, because it considers the share value. The share price is fluctuated on daily basis so the

value is also fluctuated. Thus, it can be said that in context to limitations that it gives the decision

for very short period.

2. Price Earning Ratio: The price earning ratio is another method of business valuation

which gives an idea to investors that the particular company is suitable for investment or

not. The price earning ratio is derives on the basis of stock price and earning per share of

the company. It shows that the company is over valued or under valued. The ratio is used

to determine worth of the business entity with the help of existing conditions such as

company held equity currently and the share price. It shows the business conditions

clearly by which the more number of customers attract for investment in the company.

Advantages of the price earning ratio is that the ratio gives the clear and transparent

conditions of the business and it attracts more number of customers (Hoberg and Maksimovic,

2015). The another benefit is that it gives the fair value of the business in market. The ratio is

gives and idea to the customers that the company is performing over or less or the company is

over valued or under valued in the industry. With help of this the company can control existing

business positions with highlighting weaknesses of the company.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Disadvantage of the ratio is that it is not used for long term due to it considers the stock

price. Stock price is daily fluctuates and the earning price per share is also fluctuated quarterly

basis so it can not give the decision to make investment for long term. Another disadvantage is

that if in market there is inflation than also the price earning ratio change.

3. Dividend Valuation Method: Dividend valuation method is another method of business

valuation. Dividend is one of the important factor to attract the customers for make

investment. It is based on the sales and revenue of the company in financial year. Here

the business is valued on the basis of next year dividend, market price per share and

expected growth rate of the business. There are various methods to derive the business

value on in order to dividend valuation method (Ward, 2016). The below mentioned

dividend is derived with help of Gordon's growth model.

Advantage of dividend valuation method is that it is easy to calculate and interpret as

well as it is most commonly used model. It is easier to compare between different companies and

different industries.

Disadvantage of the method is that it not considers all the data of the company so it is not

able to give fair value of company. It based on the expected values and it is not compulsory that

the actual value will be same of expected value.

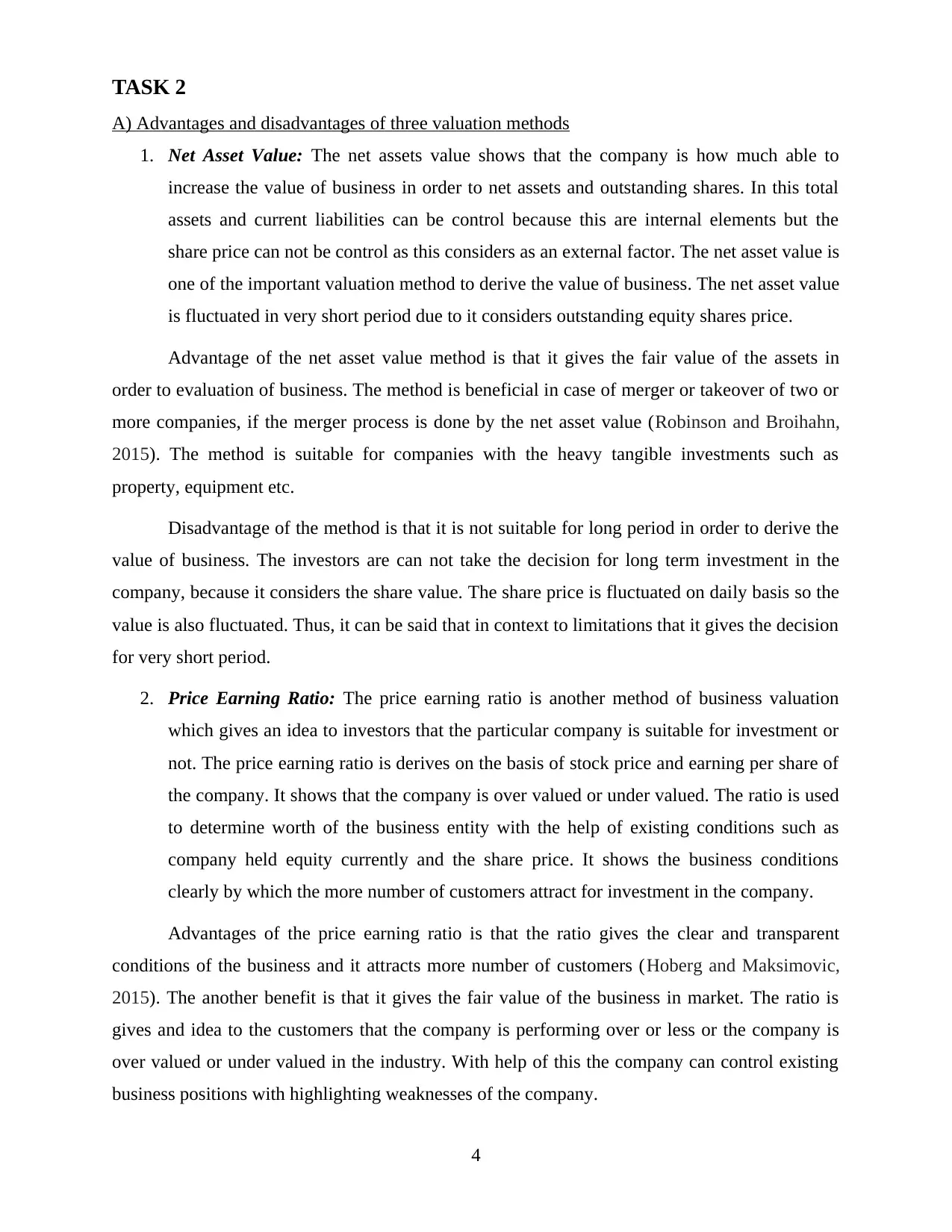

B) Different valuation methods

Table 2: Valuation of Admiral insurance group

Valuation Formula 2015

Net assets 615

Outstanding equity shares 284.35

Net assets value Net assets / outstanding equity shares 2.16

Stock price 5.58

Earning per share 1.08

Price/Earnings ratio Stock price / Earning per share 5.16

5

price. Stock price is daily fluctuates and the earning price per share is also fluctuated quarterly

basis so it can not give the decision to make investment for long term. Another disadvantage is

that if in market there is inflation than also the price earning ratio change.

3. Dividend Valuation Method: Dividend valuation method is another method of business

valuation. Dividend is one of the important factor to attract the customers for make

investment. It is based on the sales and revenue of the company in financial year. Here

the business is valued on the basis of next year dividend, market price per share and

expected growth rate of the business. There are various methods to derive the business

value on in order to dividend valuation method (Ward, 2016). The below mentioned

dividend is derived with help of Gordon's growth model.

Advantage of dividend valuation method is that it is easy to calculate and interpret as

well as it is most commonly used model. It is easier to compare between different companies and

different industries.

Disadvantage of the method is that it not considers all the data of the company so it is not

able to give fair value of company. It based on the expected values and it is not compulsory that

the actual value will be same of expected value.

B) Different valuation methods

Table 2: Valuation of Admiral insurance group

Valuation Formula 2015

Net assets 615

Outstanding equity shares 284.35

Net assets value Net assets / outstanding equity shares 2.16

Stock price 5.58

Earning per share 1.08

Price/Earnings ratio Stock price / Earning per share 5.16

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Next year dividend 33.6

MPS 5.58

G 0.0366

Dividend Value D1/P0+G 60.25

1. Net Asset Value: The value considers net assets value and number of outstanding shares

of the company. In this preference shares and another shares are not considers to measure

the value of the firm. High value is better for the company. In this case the insurance

company's net asset value not good that means it's performance is poor.

2. Price Earning Ratio: The ratio used to measure whether stock price have a fair value or

not. The ratio considers two values i.e. stock price and earning price per share to evaluate

value of the organization. A stock's price earning ratio tells that how many investors are

willing to pay per GBP of earnings. In year 2015, the insurance company's PE ratio is

greater than net asset value.

3. Dividend Valuation Method: The ratio is a method of valuing stock of the company in

order to its future dividend payments as well as discounted back to their present value. To

calculate the ratio the expected dividend, market price per share and expected growth rate

is considered. In this the dividend value is the higher value in comparison to another both

values.

C) How valuation method help a firm

The valuation methods are helpful for the business to derive the value of business. On the

basis of the business value the investors are make an investment in the firm. The valuation

method defines the internal strengths of business to fulfil its future objectives. The valuation

method is important for the every company by which it can know that how it is performing in

market and according to that what strategies it has to used to meet future goal. Valuation

methods helps to business which are given as below: Asset Based Approach: The approach is helpful to business to derive the fair value of its

asset. From this approach company can attract to the customers (Valickova, Havranek

and Horvath, 2015). The objective of an organization to increase the capabilities of

6

MPS 5.58

G 0.0366

Dividend Value D1/P0+G 60.25

1. Net Asset Value: The value considers net assets value and number of outstanding shares

of the company. In this preference shares and another shares are not considers to measure

the value of the firm. High value is better for the company. In this case the insurance

company's net asset value not good that means it's performance is poor.

2. Price Earning Ratio: The ratio used to measure whether stock price have a fair value or

not. The ratio considers two values i.e. stock price and earning price per share to evaluate

value of the organization. A stock's price earning ratio tells that how many investors are

willing to pay per GBP of earnings. In year 2015, the insurance company's PE ratio is

greater than net asset value.

3. Dividend Valuation Method: The ratio is a method of valuing stock of the company in

order to its future dividend payments as well as discounted back to their present value. To

calculate the ratio the expected dividend, market price per share and expected growth rate

is considered. In this the dividend value is the higher value in comparison to another both

values.

C) How valuation method help a firm

The valuation methods are helpful for the business to derive the value of business. On the

basis of the business value the investors are make an investment in the firm. The valuation

method defines the internal strengths of business to fulfil its future objectives. The valuation

method is important for the every company by which it can know that how it is performing in

market and according to that what strategies it has to used to meet future goal. Valuation

methods helps to business which are given as below: Asset Based Approach: The approach is helpful to business to derive the fair value of its

asset. From this approach company can attract to the customers (Valickova, Havranek

and Horvath, 2015). The objective of an organization to increase the capabilities of

6

revenue generate with its assets so by this it can know that in which order assets are to be

use. Income Based Approach: It identified the fair value of business in order to stock price

and income level of the firm. In this there are different variables and considerations by

which the value is derived. So the price earning ratio is also helpful to the firm.

Market Based Approach: The approach is help to the company in order to derive value

on the basis of market situation and stock price. The dividend value is based upon the

capabilities of company's profit generation.

D) Risk Exposures

Various risk exposures which facing by the FTSE 100 company. These are as follows: Market Factor: The market fluctuation is affects to the company in order to derive the

value as well as to the profit from its stock (Kazlauskiene and Christauskas, 2015). The

company is listed in FTSE 100 constituent so it will affect to the company. Legal Factor: The legal factors such taxation policies, rules and regulations of the

government in order to export import are affects to the company.

Foreign Exchange: Foreign exchange is main part to international companies, hence the

exchange rate and other laws and regulations of foreign are also affects to the overall

business entity.

E) Impacts of acquisition on selection of valuation method

Acquisition is the term which affects to the business. In present report acquisition is in

order to acquire a strong firm by a weak firm. Here a strong firm is Admiral insurance group and

a weak firm is Barclays bank plc. There are various circumstances which take place in the firm

as impact of acquisition.

The management structure will affect the acquisition because both companies are follows

different management structure (Black, 2016). In order to that company need to change the

management. Current trading system of resulting firm will also impact by the acquisition because

targeting firm may have different current trading system. The assets which are hold for a greater

return are also different in both companies which affects acquisition. By this all choice of

valuation also differs.

7

use. Income Based Approach: It identified the fair value of business in order to stock price

and income level of the firm. In this there are different variables and considerations by

which the value is derived. So the price earning ratio is also helpful to the firm.

Market Based Approach: The approach is help to the company in order to derive value

on the basis of market situation and stock price. The dividend value is based upon the

capabilities of company's profit generation.

D) Risk Exposures

Various risk exposures which facing by the FTSE 100 company. These are as follows: Market Factor: The market fluctuation is affects to the company in order to derive the

value as well as to the profit from its stock (Kazlauskiene and Christauskas, 2015). The

company is listed in FTSE 100 constituent so it will affect to the company. Legal Factor: The legal factors such taxation policies, rules and regulations of the

government in order to export import are affects to the company.

Foreign Exchange: Foreign exchange is main part to international companies, hence the

exchange rate and other laws and regulations of foreign are also affects to the overall

business entity.

E) Impacts of acquisition on selection of valuation method

Acquisition is the term which affects to the business. In present report acquisition is in

order to acquire a strong firm by a weak firm. Here a strong firm is Admiral insurance group and

a weak firm is Barclays bank plc. There are various circumstances which take place in the firm

as impact of acquisition.

The management structure will affect the acquisition because both companies are follows

different management structure (Black, 2016). In order to that company need to change the

management. Current trading system of resulting firm will also impact by the acquisition because

targeting firm may have different current trading system. The assets which are hold for a greater

return are also different in both companies which affects acquisition. By this all choice of

valuation also differs.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

3.1 Recommendation to Barclays bank on the basis of the financial position of Admiral

insurance group Plc

From above calculation it can be recommended to Barclays bank that it should acquire

the Admiral insurance group on the basis of profitability ratios. In same period 2015, the

insurance company generate more profit compare to another firm. Liquidity position is less in

admiral but it is too much efficient to generate sales and revenue from the fixed and total assets

so it will give positive impact to the Barclays bank after acquiring. On the basis of valuation the

admiral group is better and dividend valuation is sufficiently higher. Hence, it can be

recommended that the bank should acquire the insurance group of FTSE 100 constituent.

CONCLUSION

From the above analysis it can be summarized that the Barclays bank is performing poor

and Admiral insurance group is performing well in the relevant industry. It can be concluded on

the basis of financial performance Barclays bank should acquire Admiral group. Here the

Barclays is a weak firm and Admiral firm is a strong firm. Hence, the acquisition will be

beneficial for the Barclays bank.

8

3.1 Recommendation to Barclays bank on the basis of the financial position of Admiral

insurance group Plc

From above calculation it can be recommended to Barclays bank that it should acquire

the Admiral insurance group on the basis of profitability ratios. In same period 2015, the

insurance company generate more profit compare to another firm. Liquidity position is less in

admiral but it is too much efficient to generate sales and revenue from the fixed and total assets

so it will give positive impact to the Barclays bank after acquiring. On the basis of valuation the

admiral group is better and dividend valuation is sufficiently higher. Hence, it can be

recommended that the bank should acquire the insurance group of FTSE 100 constituent.

CONCLUSION

From the above analysis it can be summarized that the Barclays bank is performing poor

and Admiral insurance group is performing well in the relevant industry. It can be concluded on

the basis of financial performance Barclays bank should acquire Admiral group. Here the

Barclays is a weak firm and Admiral firm is a strong firm. Hence, the acquisition will be

beneficial for the Barclays bank.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books & Journals

Black S.W., 2016. International monetary institutions. In Banking Crises. pp. 192-200. Palgrave

Macmillan UK.

Frisari G. and Stadelmann M., 2015. De-risking concentrated solar power in emerging markets:

The role of policies and international finance institutions. Energy Policy. 82. pp.12-22.

Hoberg G. and Maksimovic V., 2015. Redefining financial constraints: a text-based analysis.

Review of Financial Studies. 28(5). pp.1312-1352.

Kazlauskiene V. and Christauskas C., 2015. Business valuation model based on the analysis of

business value drivers. Engineering Economics. 57(2).

Mügge D. and Stellinga B., 2015. The unstable core of global finance: Contingent valuation and

governance of international accounting standards. Regulation & Governance. 9(1). pp.47-

62.

Porter T. and Williams R., 2016. States, markets and regimes in global finance. Springer.

Robinson and Broihahn M.A., 2015. International financial statement analysis. John Wiley &

Sons.

Shim J.K. and Constas M., 2016. Encyclopedic dictionary of international finance and banking.

CRC Press.

Valickova P., Havranek T. and Horvath R., 2015. Financial Development and Economic

Growth: A Meta‐Analysis. Journal of Economic Surveys. 29(3). pp.506-526.

Online

Ward S., 2016. 3 Business Valuation Methods. [Online]. Available through:

<https://www.thebalance.com/business-valuation-methods-2948478> [Accessed on 2nd

December 2016].

9

Books & Journals

Black S.W., 2016. International monetary institutions. In Banking Crises. pp. 192-200. Palgrave

Macmillan UK.

Frisari G. and Stadelmann M., 2015. De-risking concentrated solar power in emerging markets:

The role of policies and international finance institutions. Energy Policy. 82. pp.12-22.

Hoberg G. and Maksimovic V., 2015. Redefining financial constraints: a text-based analysis.

Review of Financial Studies. 28(5). pp.1312-1352.

Kazlauskiene V. and Christauskas C., 2015. Business valuation model based on the analysis of

business value drivers. Engineering Economics. 57(2).

Mügge D. and Stellinga B., 2015. The unstable core of global finance: Contingent valuation and

governance of international accounting standards. Regulation & Governance. 9(1). pp.47-

62.

Porter T. and Williams R., 2016. States, markets and regimes in global finance. Springer.

Robinson and Broihahn M.A., 2015. International financial statement analysis. John Wiley &

Sons.

Shim J.K. and Constas M., 2016. Encyclopedic dictionary of international finance and banking.

CRC Press.

Valickova P., Havranek T. and Horvath R., 2015. Financial Development and Economic

Growth: A Meta‐Analysis. Journal of Economic Surveys. 29(3). pp.506-526.

Online

Ward S., 2016. 3 Business Valuation Methods. [Online]. Available through:

<https://www.thebalance.com/business-valuation-methods-2948478> [Accessed on 2nd

December 2016].

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.