Econometric Analysis: VAR Model for Monetary Policy Transmission

VerifiedAdded on 2023/06/16

|11

|1401

|415

Report

AI Summary

This assignment focuses on analyzing the transmission mechanism of monetary policy using a Vector Autoregression (VAR) model. The analysis begins by identifying unit roots and stationary points using time series plots and Augmented Dickey-Fuller tests. The VAR model is constructed with a single lag, and three models are generated, including growth rate (GDP), inflation rate, and policy interest rate. The Engle-Granger method is then used to test for cointegration among the variables. The results indicate the presence of statistically significant factors in the monetary policy transmission mechanism, with both growth rate, inflation, and interest rates having statistically important negative and positive signs. The assignment concludes that the residuals are stationary, providing further evidence of cointegration due to the stationary process starting with non-stationary variables. Desklib offers a wealth of similar solved assignments and resources for students.

Running head: TIME SERIES ANALYSIS 1

Time Series Analysis

Name:

Institution:

Time Series Analysis

Name:

Institution:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TIME SERIES ANALYSIS 2

Time Series Analysis

Question 1

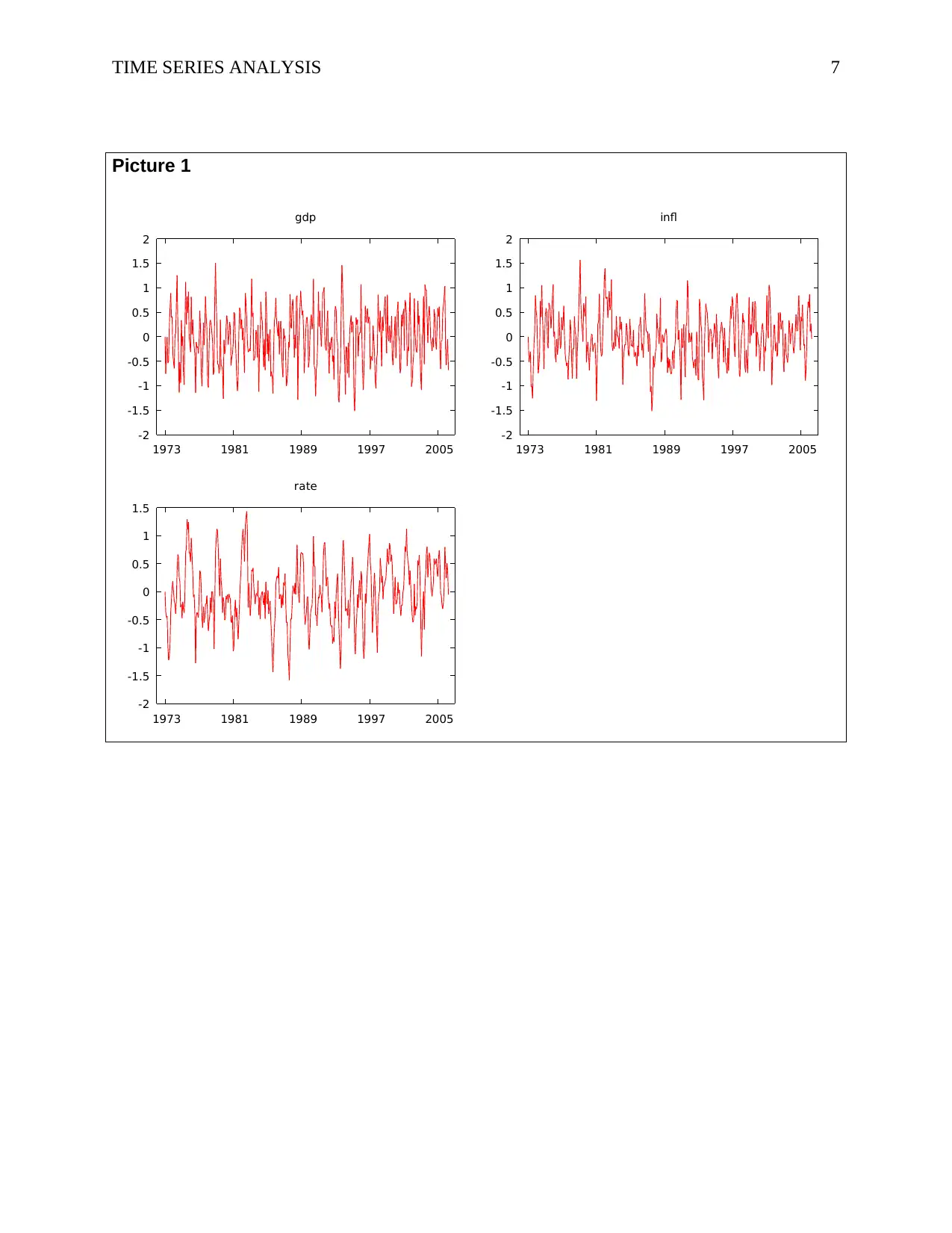

To test the VAR model, it is important to consider which variable needs to be considered for the

model. First, the unit root and stationary points must be identified. Then time series plots are

constructed in separate graphs as shown in picture 1to know if there is any trend or even a drift.

Having done the modeling of the transmission mechanism of the monetary policy as shown in

picture 1, it can be observed that there is no trend and that there is also no drift and also that the

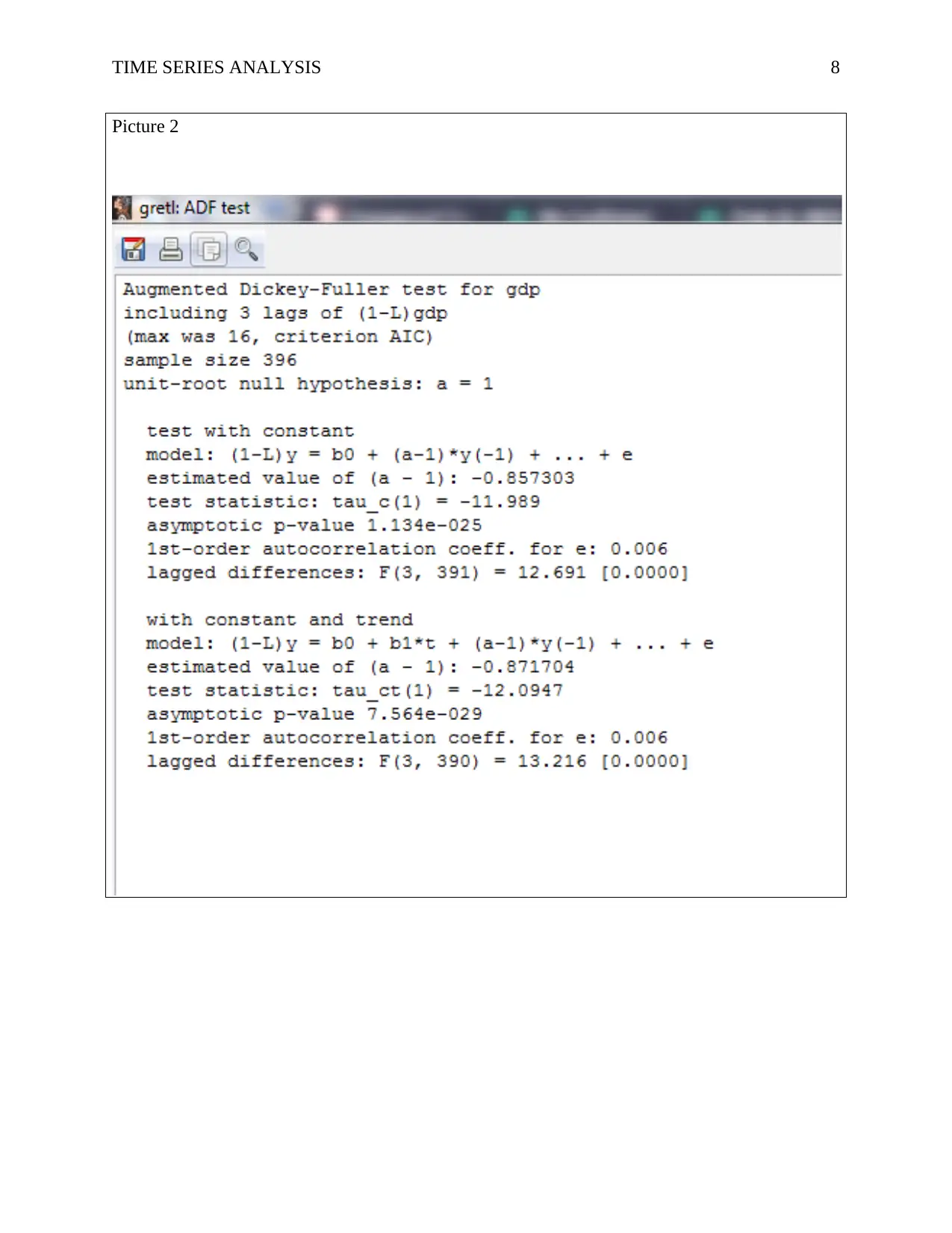

mean is around 0 (refer to picture 1). Next, an Augmented Dickey-Fuller test is performed in

efforts to identify the presence of unit root as shown in picture 2. Therefore, as seen in picture 2,

all the p-values move to zero (0); therefore, rejecting the null hypothesis in favor of the

alternative hypothesis which holds that there is unit root. Thus, there are three roots in the VAR

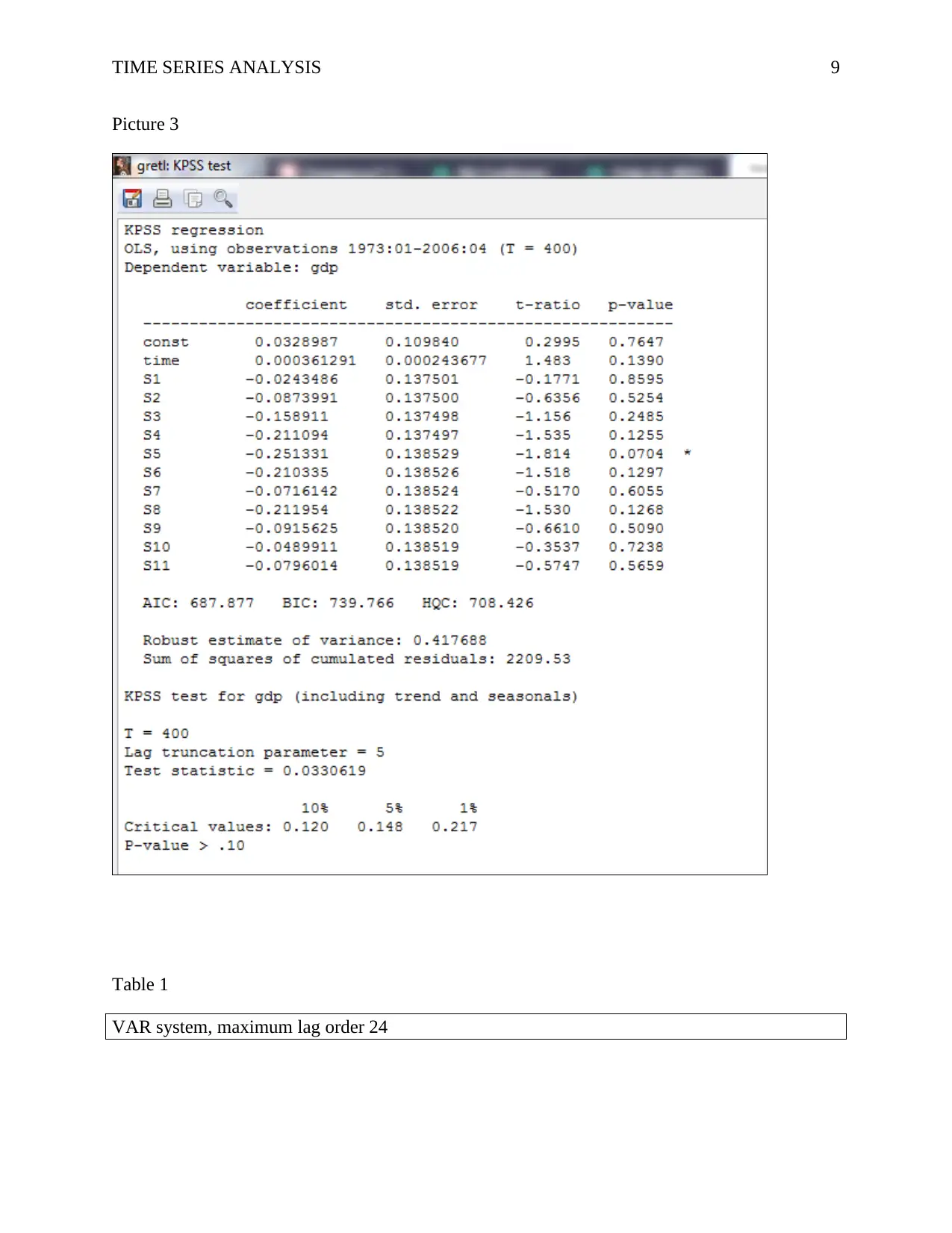

model. Furthermore, in order to clarify this, the KPSS test can be used to confirm as shown in

picture 3.

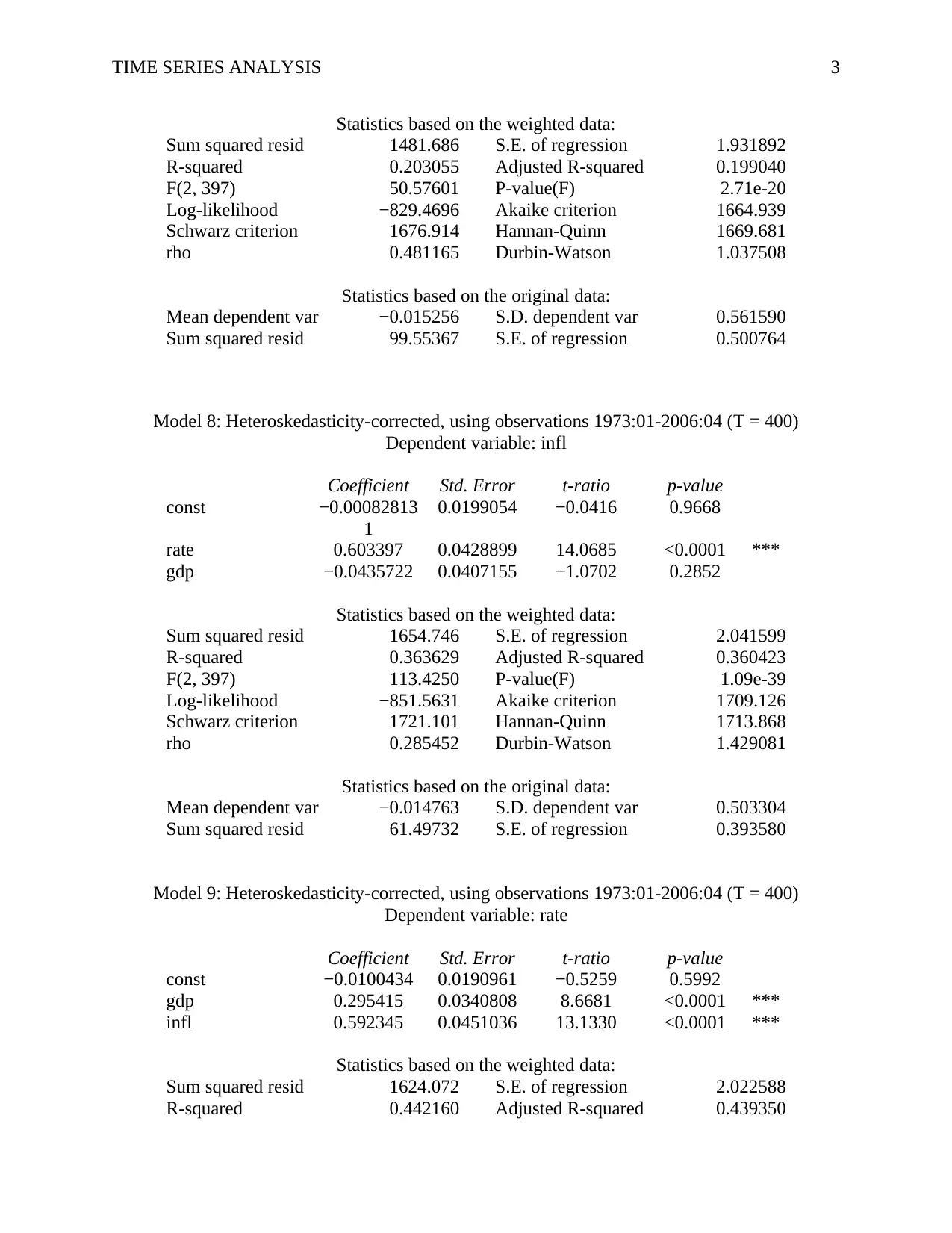

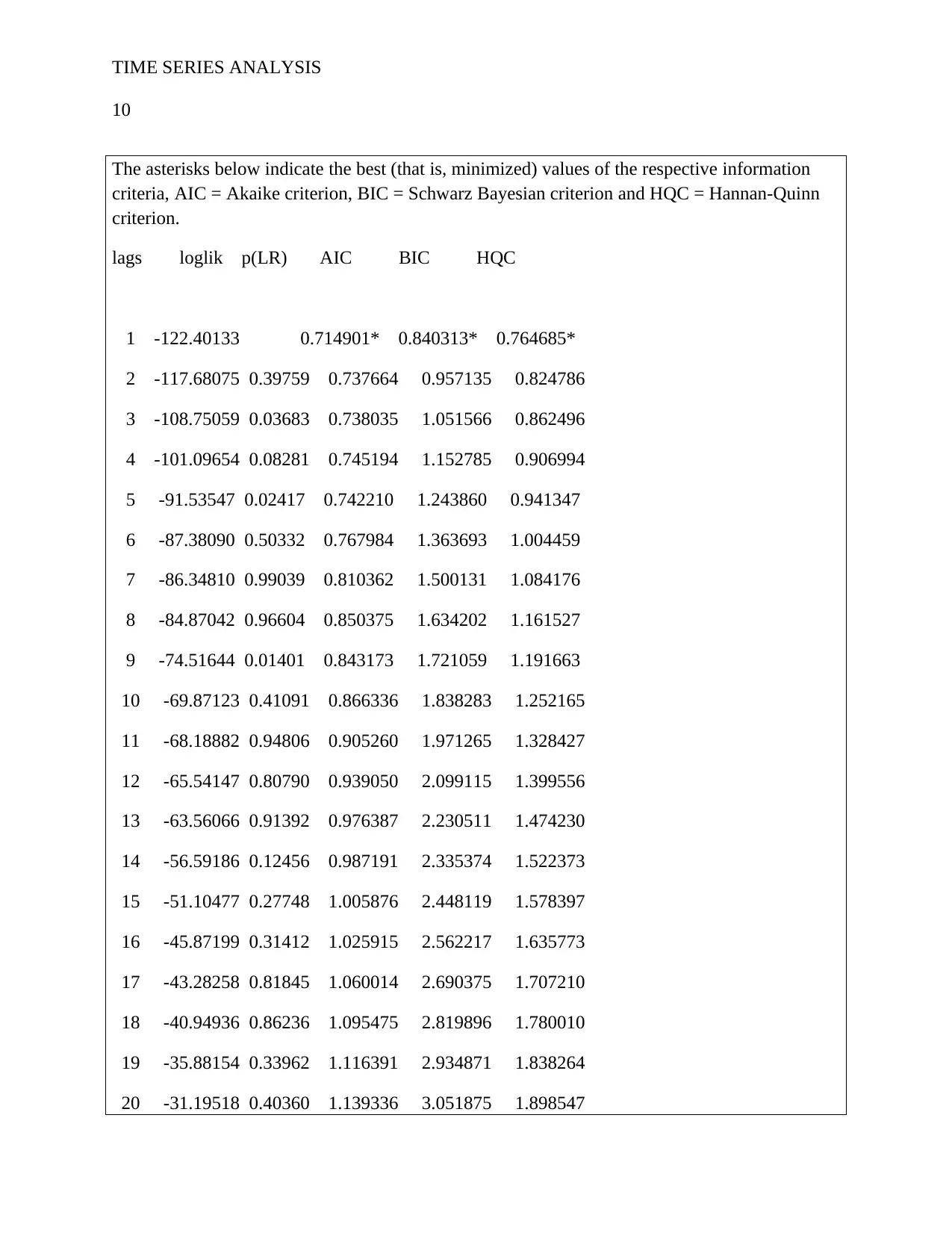

Next, an estimation of the VAR model with single lag is computed. Thus, having worked out

this, it is clear that the VAR model need to be constructed with 1 lag as shown on table 1;

therefore, running this model, offers 3 models including growth rate (gdp), inflation rate (infl) as

well as policy interest rate (rate). This is given below:

Model 7: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: gdp

Coefficient Std. Error t-ratio p-value

const −0.00226586 0.0250289 −0.0905 0.9279

infl −0.0776565 0.0595692 −1.3036 0.1931

rate 0.520195 0.0605574 8.5901 <0.0001 ***

Time Series Analysis

Question 1

To test the VAR model, it is important to consider which variable needs to be considered for the

model. First, the unit root and stationary points must be identified. Then time series plots are

constructed in separate graphs as shown in picture 1to know if there is any trend or even a drift.

Having done the modeling of the transmission mechanism of the monetary policy as shown in

picture 1, it can be observed that there is no trend and that there is also no drift and also that the

mean is around 0 (refer to picture 1). Next, an Augmented Dickey-Fuller test is performed in

efforts to identify the presence of unit root as shown in picture 2. Therefore, as seen in picture 2,

all the p-values move to zero (0); therefore, rejecting the null hypothesis in favor of the

alternative hypothesis which holds that there is unit root. Thus, there are three roots in the VAR

model. Furthermore, in order to clarify this, the KPSS test can be used to confirm as shown in

picture 3.

Next, an estimation of the VAR model with single lag is computed. Thus, having worked out

this, it is clear that the VAR model need to be constructed with 1 lag as shown on table 1;

therefore, running this model, offers 3 models including growth rate (gdp), inflation rate (infl) as

well as policy interest rate (rate). This is given below:

Model 7: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: gdp

Coefficient Std. Error t-ratio p-value

const −0.00226586 0.0250289 −0.0905 0.9279

infl −0.0776565 0.0595692 −1.3036 0.1931

rate 0.520195 0.0605574 8.5901 <0.0001 ***

TIME SERIES ANALYSIS 3

Statistics based on the weighted data:

Sum squared resid 1481.686 S.E. of regression 1.931892

R-squared 0.203055 Adjusted R-squared 0.199040

F(2, 397) 50.57601 P-value(F) 2.71e-20

Log-likelihood −829.4696 Akaike criterion 1664.939

Schwarz criterion 1676.914 Hannan-Quinn 1669.681

rho 0.481165 Durbin-Watson 1.037508

Statistics based on the original data:

Mean dependent var −0.015256 S.D. dependent var 0.561590

Sum squared resid 99.55367 S.E. of regression 0.500764

Model 8: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: infl

Coefficient Std. Error t-ratio p-value

const −0.00082813

1

0.0199054 −0.0416 0.9668

rate 0.603397 0.0428899 14.0685 <0.0001 ***

gdp −0.0435722 0.0407155 −1.0702 0.2852

Statistics based on the weighted data:

Sum squared resid 1654.746 S.E. of regression 2.041599

R-squared 0.363629 Adjusted R-squared 0.360423

F(2, 397) 113.4250 P-value(F) 1.09e-39

Log-likelihood −851.5631 Akaike criterion 1709.126

Schwarz criterion 1721.101 Hannan-Quinn 1713.868

rho 0.285452 Durbin-Watson 1.429081

Statistics based on the original data:

Mean dependent var −0.014763 S.D. dependent var 0.503304

Sum squared resid 61.49732 S.E. of regression 0.393580

Model 9: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: rate

Coefficient Std. Error t-ratio p-value

const −0.0100434 0.0190961 −0.5259 0.5992

gdp 0.295415 0.0340808 8.6681 <0.0001 ***

infl 0.592345 0.0451036 13.1330 <0.0001 ***

Statistics based on the weighted data:

Sum squared resid 1624.072 S.E. of regression 2.022588

R-squared 0.442160 Adjusted R-squared 0.439350

Statistics based on the weighted data:

Sum squared resid 1481.686 S.E. of regression 1.931892

R-squared 0.203055 Adjusted R-squared 0.199040

F(2, 397) 50.57601 P-value(F) 2.71e-20

Log-likelihood −829.4696 Akaike criterion 1664.939

Schwarz criterion 1676.914 Hannan-Quinn 1669.681

rho 0.481165 Durbin-Watson 1.037508

Statistics based on the original data:

Mean dependent var −0.015256 S.D. dependent var 0.561590

Sum squared resid 99.55367 S.E. of regression 0.500764

Model 8: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: infl

Coefficient Std. Error t-ratio p-value

const −0.00082813

1

0.0199054 −0.0416 0.9668

rate 0.603397 0.0428899 14.0685 <0.0001 ***

gdp −0.0435722 0.0407155 −1.0702 0.2852

Statistics based on the weighted data:

Sum squared resid 1654.746 S.E. of regression 2.041599

R-squared 0.363629 Adjusted R-squared 0.360423

F(2, 397) 113.4250 P-value(F) 1.09e-39

Log-likelihood −851.5631 Akaike criterion 1709.126

Schwarz criterion 1721.101 Hannan-Quinn 1713.868

rho 0.285452 Durbin-Watson 1.429081

Statistics based on the original data:

Mean dependent var −0.014763 S.D. dependent var 0.503304

Sum squared resid 61.49732 S.E. of regression 0.393580

Model 9: Heteroskedasticity-corrected, using observations 1973:01-2006:04 (T = 400)

Dependent variable: rate

Coefficient Std. Error t-ratio p-value

const −0.0100434 0.0190961 −0.5259 0.5992

gdp 0.295415 0.0340808 8.6681 <0.0001 ***

infl 0.592345 0.0451036 13.1330 <0.0001 ***

Statistics based on the weighted data:

Sum squared resid 1624.072 S.E. of regression 2.022588

R-squared 0.442160 Adjusted R-squared 0.439350

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TIME SERIES ANALYSIS 4

F(2, 397) 157.3367 P-value(F) 4.81e-51

Log-likelihood −847.8209 Akaike criterion 1701.642

Schwarz criterion 1713.616 Hannan-Quinn 1706.384

rho 0.507999 Durbin-Watson 0.984011

Statistics based on the original data:

Mean dependent var −0.024936 S.D. dependent var 0.535993

Sum squared resid 58.80561 S.E. of regression 0.384870

It is evident that there are three statistically significant factors that are considered in the

transmission mechanism of the monetary policy and the same logic also applies to the other two

variables, including growth rate (gdp), inflation rate (infl) as well as policy interest rate (rate),

with both growth rate, inflation and rate of interest having statistically important negative and

positive signs.

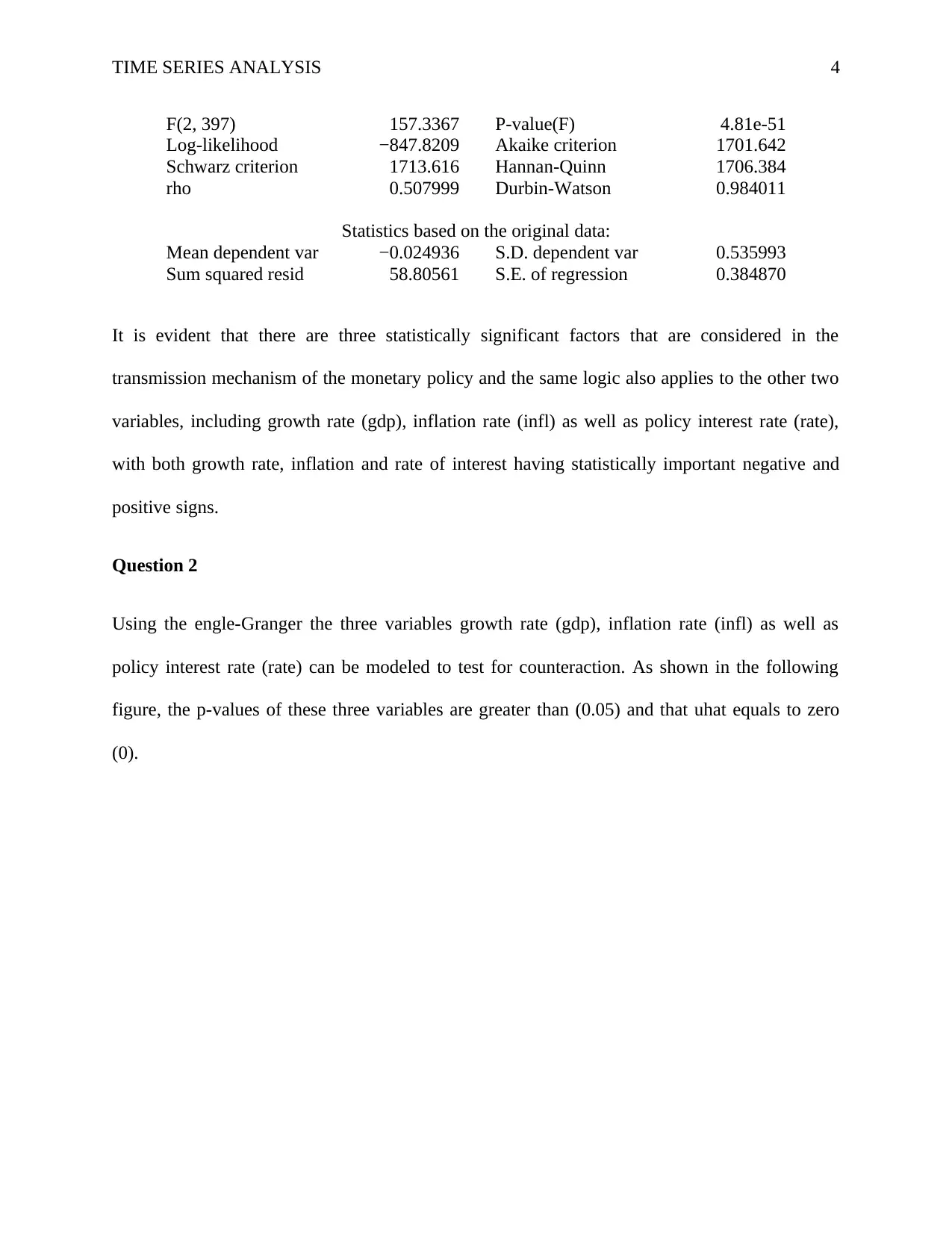

Question 2

Using the engle-Granger the three variables growth rate (gdp), inflation rate (infl) as well as

policy interest rate (rate) can be modeled to test for counteraction. As shown in the following

figure, the p-values of these three variables are greater than (0.05) and that uhat equals to zero

(0).

F(2, 397) 157.3367 P-value(F) 4.81e-51

Log-likelihood −847.8209 Akaike criterion 1701.642

Schwarz criterion 1713.616 Hannan-Quinn 1706.384

rho 0.507999 Durbin-Watson 0.984011

Statistics based on the original data:

Mean dependent var −0.024936 S.D. dependent var 0.535993

Sum squared resid 58.80561 S.E. of regression 0.384870

It is evident that there are three statistically significant factors that are considered in the

transmission mechanism of the monetary policy and the same logic also applies to the other two

variables, including growth rate (gdp), inflation rate (infl) as well as policy interest rate (rate),

with both growth rate, inflation and rate of interest having statistically important negative and

positive signs.

Question 2

Using the engle-Granger the three variables growth rate (gdp), inflation rate (infl) as well as

policy interest rate (rate) can be modeled to test for counteraction. As shown in the following

figure, the p-values of these three variables are greater than (0.05) and that uhat equals to zero

(0).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TIME SERIES ANALYSIS 5

There is evidence for a cointegrating relationship if:

(a) The unit-root hypothesis is not rejected for the individual variables, and

(b) The unit-root hypothesis is rejected for the residuals (uhat) from the cointegrating regression.

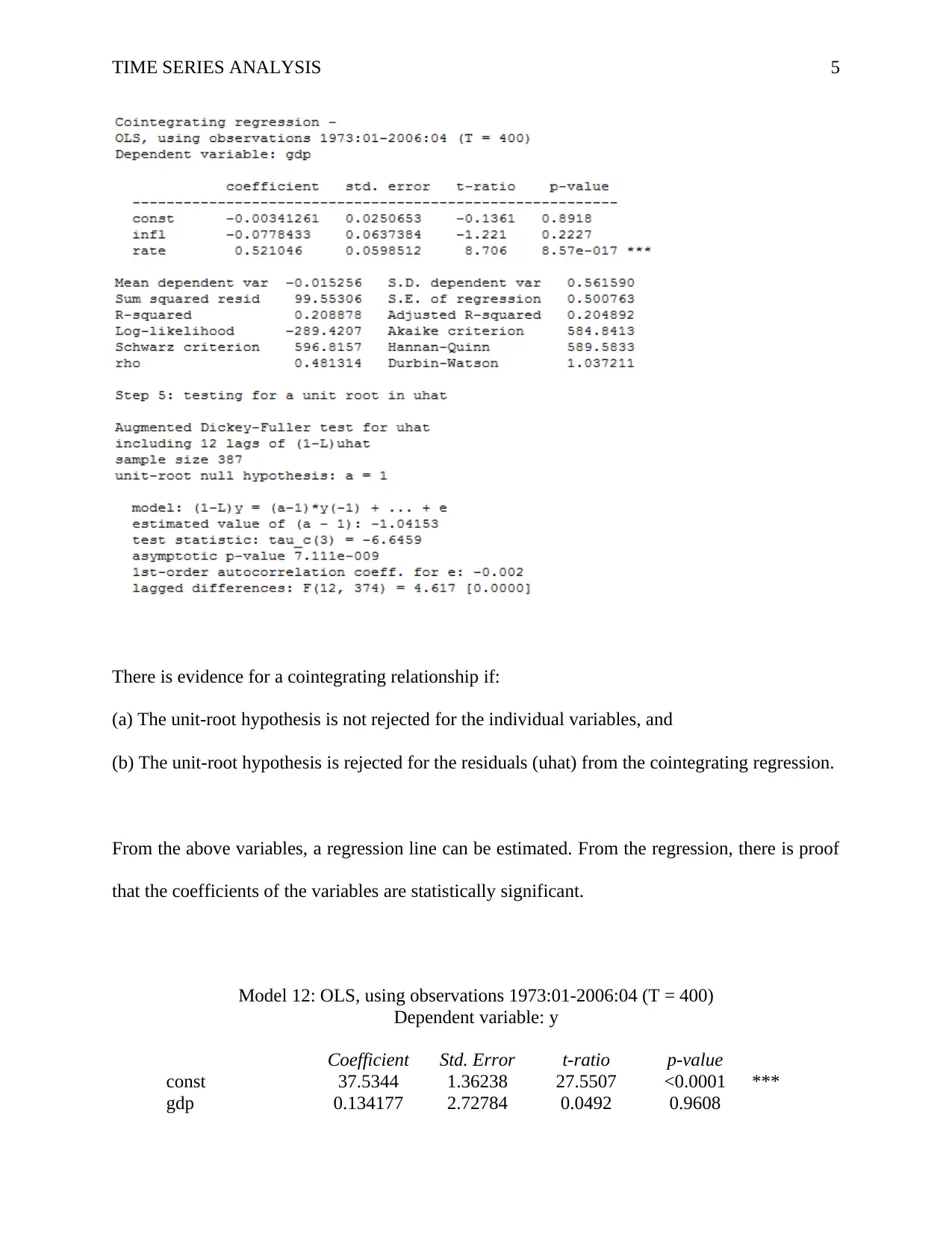

From the above variables, a regression line can be estimated. From the regression, there is proof

that the coefficients of the variables are statistically significant.

Model 12: OLS, using observations 1973:01-2006:04 (T = 400)

Dependent variable: y

Coefficient Std. Error t-ratio p-value

const 37.5344 1.36238 27.5507 <0.0001 ***

gdp 0.134177 2.72784 0.0492 0.9608

There is evidence for a cointegrating relationship if:

(a) The unit-root hypothesis is not rejected for the individual variables, and

(b) The unit-root hypothesis is rejected for the residuals (uhat) from the cointegrating regression.

From the above variables, a regression line can be estimated. From the regression, there is proof

that the coefficients of the variables are statistically significant.

Model 12: OLS, using observations 1973:01-2006:04 (T = 400)

Dependent variable: y

Coefficient Std. Error t-ratio p-value

const 37.5344 1.36238 27.5507 <0.0001 ***

gdp 0.134177 2.72784 0.0492 0.9608

TIME SERIES ANALYSIS 6

infl −4.48177 3.47081 −1.2913 0.1974

rate 9.26226 3.54998 2.6091 0.0094 ***

Mean dependent var 37.36758 S.D. dependent var 27.40879

Sum squared resid 293352.0 S.E. of regression 27.21742

R-squared 0.021329 Adjusted R-squared 0.013915

F(3, 396) 2.876853 P-value(F) 0.035935

Log-likelihood −1887.108 Akaike criterion 3782.216

Schwarz criterion 3798.182 Hannan-Quinn 3788.539

rho 0.995326 Durbin-Watson 0.021327

However, running an ADF test on these variables shows the presence of unit root because of the

high p-value amount for all the variables which in particular show that the residuals are

stationary as shown below. This is a further evidence of cointegartion due to the fact that there is

a stationary process starting with non-stationary variables.

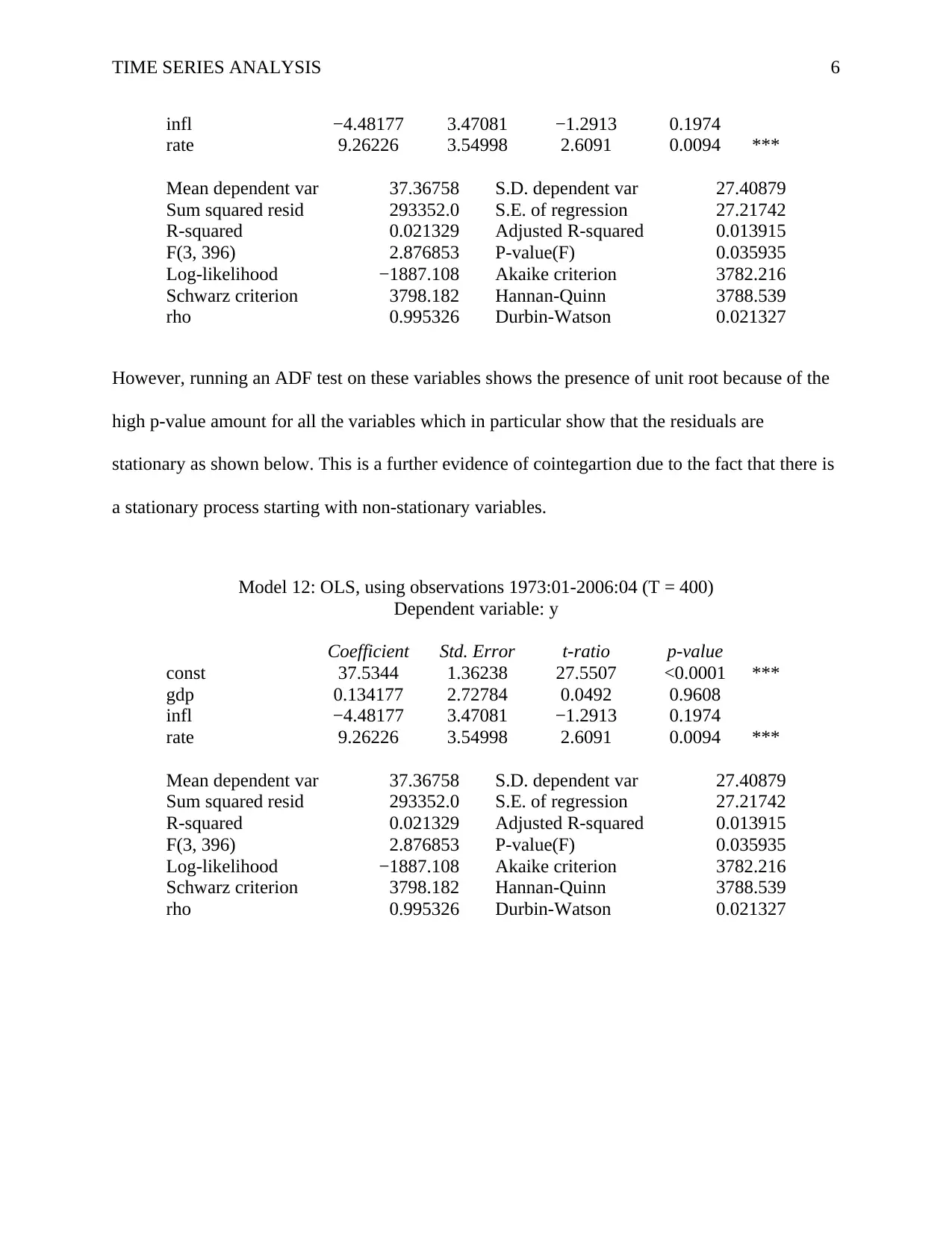

Model 12: OLS, using observations 1973:01-2006:04 (T = 400)

Dependent variable: y

Coefficient Std. Error t-ratio p-value

const 37.5344 1.36238 27.5507 <0.0001 ***

gdp 0.134177 2.72784 0.0492 0.9608

infl −4.48177 3.47081 −1.2913 0.1974

rate 9.26226 3.54998 2.6091 0.0094 ***

Mean dependent var 37.36758 S.D. dependent var 27.40879

Sum squared resid 293352.0 S.E. of regression 27.21742

R-squared 0.021329 Adjusted R-squared 0.013915

F(3, 396) 2.876853 P-value(F) 0.035935

Log-likelihood −1887.108 Akaike criterion 3782.216

Schwarz criterion 3798.182 Hannan-Quinn 3788.539

rho 0.995326 Durbin-Watson 0.021327

infl −4.48177 3.47081 −1.2913 0.1974

rate 9.26226 3.54998 2.6091 0.0094 ***

Mean dependent var 37.36758 S.D. dependent var 27.40879

Sum squared resid 293352.0 S.E. of regression 27.21742

R-squared 0.021329 Adjusted R-squared 0.013915

F(3, 396) 2.876853 P-value(F) 0.035935

Log-likelihood −1887.108 Akaike criterion 3782.216

Schwarz criterion 3798.182 Hannan-Quinn 3788.539

rho 0.995326 Durbin-Watson 0.021327

However, running an ADF test on these variables shows the presence of unit root because of the

high p-value amount for all the variables which in particular show that the residuals are

stationary as shown below. This is a further evidence of cointegartion due to the fact that there is

a stationary process starting with non-stationary variables.

Model 12: OLS, using observations 1973:01-2006:04 (T = 400)

Dependent variable: y

Coefficient Std. Error t-ratio p-value

const 37.5344 1.36238 27.5507 <0.0001 ***

gdp 0.134177 2.72784 0.0492 0.9608

infl −4.48177 3.47081 −1.2913 0.1974

rate 9.26226 3.54998 2.6091 0.0094 ***

Mean dependent var 37.36758 S.D. dependent var 27.40879

Sum squared resid 293352.0 S.E. of regression 27.21742

R-squared 0.021329 Adjusted R-squared 0.013915

F(3, 396) 2.876853 P-value(F) 0.035935

Log-likelihood −1887.108 Akaike criterion 3782.216

Schwarz criterion 3798.182 Hannan-Quinn 3788.539

rho 0.995326 Durbin-Watson 0.021327

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TIME SERIES ANALYSIS 7

Picture 1

-2

-1.5

-1

-0.5

0

0.5

1

1.5

2

1973 1981 1989 1997 2005

gdp

-2

-1.5

-1

-0.5

0

0.5

1

1.5

2

1973 1981 1989 1997 2005

infl

-2

-1.5

-1

-0.5

0

0.5

1

1.5

1973 1981 1989 1997 2005

rate

Picture 1

-2

-1.5

-1

-0.5

0

0.5

1

1.5

2

1973 1981 1989 1997 2005

gdp

-2

-1.5

-1

-0.5

0

0.5

1

1.5

2

1973 1981 1989 1997 2005

infl

-2

-1.5

-1

-0.5

0

0.5

1

1.5

1973 1981 1989 1997 2005

rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TIME SERIES ANALYSIS 8

Picture 2

Picture 2

TIME SERIES ANALYSIS 9

Picture 3

Table 1

VAR system, maximum lag order 24

Picture 3

Table 1

VAR system, maximum lag order 24

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TIME SERIES ANALYSIS

10

The asterisks below indicate the best (that is, minimized) values of the respective information

criteria, AIC = Akaike criterion, BIC = Schwarz Bayesian criterion and HQC = Hannan-Quinn

criterion.

lags loglik p(LR) AIC BIC HQC

1 -122.40133 0.714901* 0.840313* 0.764685*

2 -117.68075 0.39759 0.737664 0.957135 0.824786

3 -108.75059 0.03683 0.738035 1.051566 0.862496

4 -101.09654 0.08281 0.745194 1.152785 0.906994

5 -91.53547 0.02417 0.742210 1.243860 0.941347

6 -87.38090 0.50332 0.767984 1.363693 1.004459

7 -86.34810 0.99039 0.810362 1.500131 1.084176

8 -84.87042 0.96604 0.850375 1.634202 1.161527

9 -74.51644 0.01401 0.843173 1.721059 1.191663

10 -69.87123 0.41091 0.866336 1.838283 1.252165

11 -68.18882 0.94806 0.905260 1.971265 1.328427

12 -65.54147 0.80790 0.939050 2.099115 1.399556

13 -63.56066 0.91392 0.976387 2.230511 1.474230

14 -56.59186 0.12456 0.987191 2.335374 1.522373

15 -51.10477 0.27748 1.005876 2.448119 1.578397

16 -45.87199 0.31412 1.025915 2.562217 1.635773

17 -43.28258 0.81845 1.060014 2.690375 1.707210

18 -40.94936 0.86236 1.095475 2.819896 1.780010

19 -35.88154 0.33962 1.116391 2.934871 1.838264

20 -31.19518 0.40360 1.139336 3.051875 1.898547

10

The asterisks below indicate the best (that is, minimized) values of the respective information

criteria, AIC = Akaike criterion, BIC = Schwarz Bayesian criterion and HQC = Hannan-Quinn

criterion.

lags loglik p(LR) AIC BIC HQC

1 -122.40133 0.714901* 0.840313* 0.764685*

2 -117.68075 0.39759 0.737664 0.957135 0.824786

3 -108.75059 0.03683 0.738035 1.051566 0.862496

4 -101.09654 0.08281 0.745194 1.152785 0.906994

5 -91.53547 0.02417 0.742210 1.243860 0.941347

6 -87.38090 0.50332 0.767984 1.363693 1.004459

7 -86.34810 0.99039 0.810362 1.500131 1.084176

8 -84.87042 0.96604 0.850375 1.634202 1.161527

9 -74.51644 0.01401 0.843173 1.721059 1.191663

10 -69.87123 0.41091 0.866336 1.838283 1.252165

11 -68.18882 0.94806 0.905260 1.971265 1.328427

12 -65.54147 0.80790 0.939050 2.099115 1.399556

13 -63.56066 0.91392 0.976387 2.230511 1.474230

14 -56.59186 0.12456 0.987191 2.335374 1.522373

15 -51.10477 0.27748 1.005876 2.448119 1.578397

16 -45.87199 0.31412 1.025915 2.562217 1.635773

17 -43.28258 0.81845 1.060014 2.690375 1.707210

18 -40.94936 0.86236 1.095475 2.819896 1.780010

19 -35.88154 0.33962 1.116391 2.934871 1.838264

20 -31.19518 0.40360 1.139336 3.051875 1.898547

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TIME SERIES ANALYSIS

11

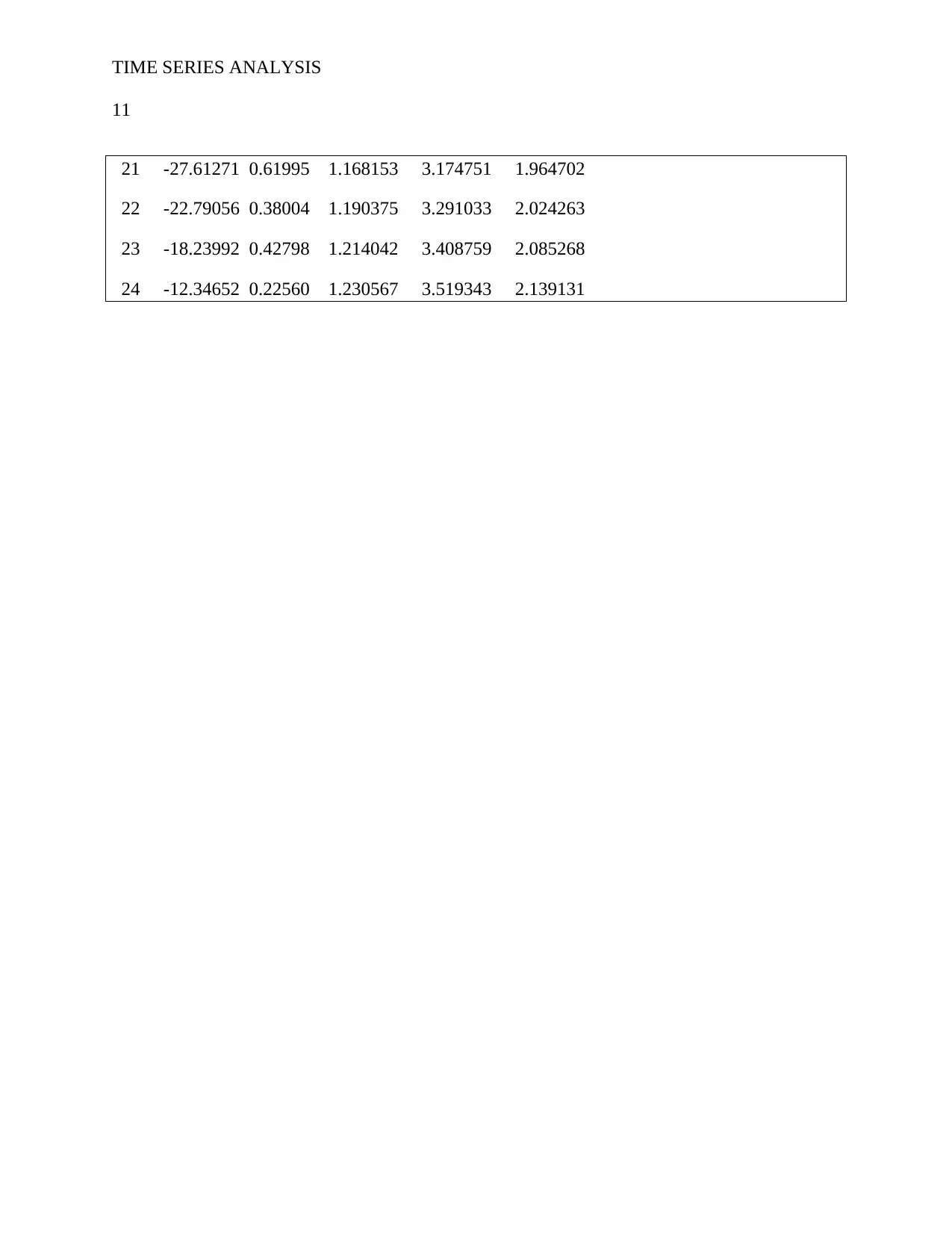

21 -27.61271 0.61995 1.168153 3.174751 1.964702

22 -22.79056 0.38004 1.190375 3.291033 2.024263

23 -18.23992 0.42798 1.214042 3.408759 2.085268

24 -12.34652 0.22560 1.230567 3.519343 2.139131

11

21 -27.61271 0.61995 1.168153 3.174751 1.964702

22 -22.79056 0.38004 1.190375 3.291033 2.024263

23 -18.23992 0.42798 1.214042 3.408759 2.085268

24 -12.34652 0.22560 1.230567 3.519343 2.139131

1 out of 11