Legal Environment, Business Contracts, Non-Corporate & Corporate Business Entities

VerifiedAdded on 2021/09/18

|21

|10942

|100

AI Summary

This study material covers various topics related to Legal Environment, Business Contracts, Non-Corporate & Corporate Business Entities. It includes lectures, caselets, and information on taxation, contracts, and business regulations. The material is suitable for students pursuing courses in law, business, and commerce.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

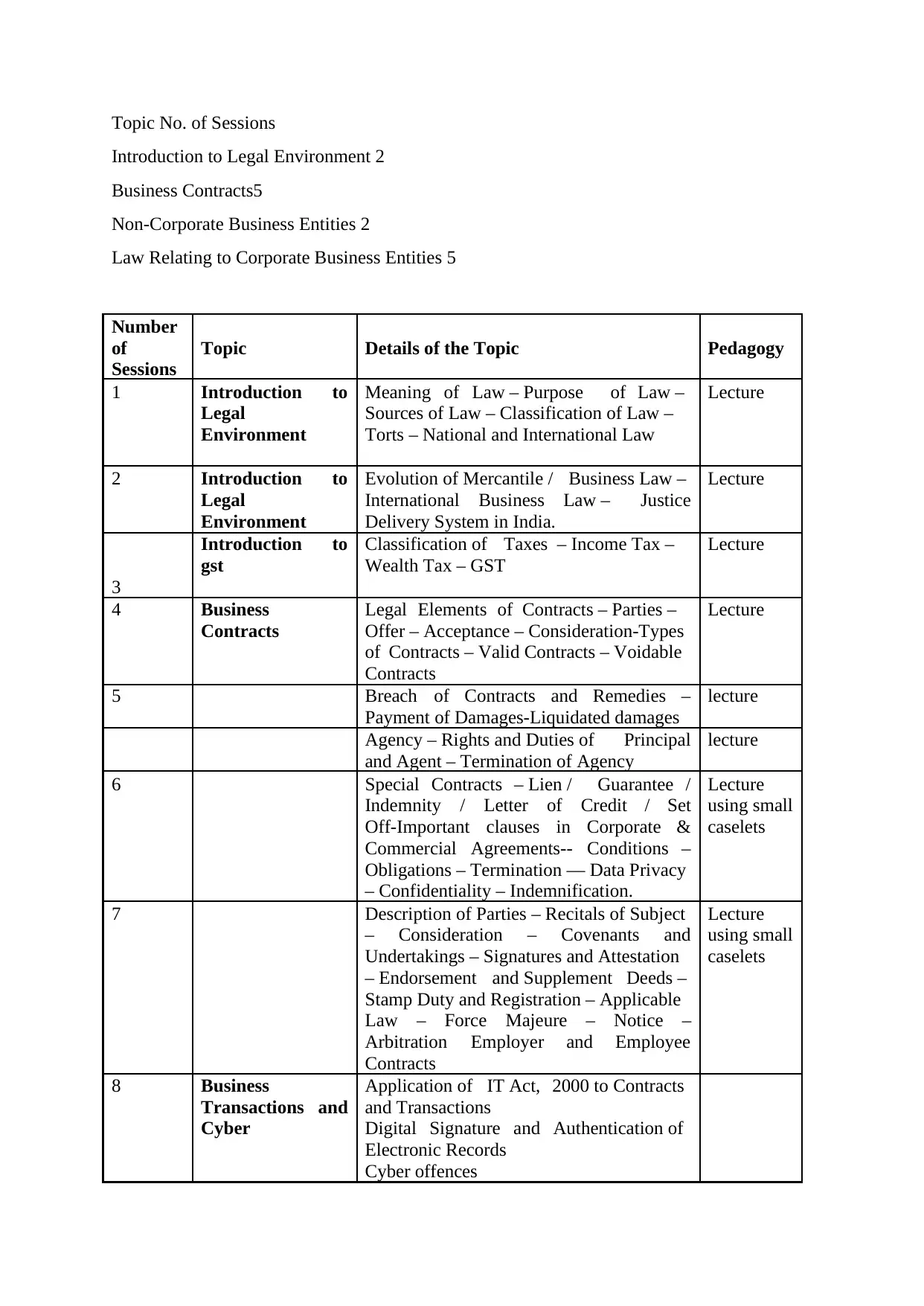

Topic No. of Sessions

Introduction to Legal Environment 2

Business Contracts5

Non-Corporate Business Entities 2

Law Relating to Corporate Business Entities 5

Number

of

Sessions

Topic Details of the Topic Pedagogy

1 Introduction to

Legal

Environment

Meaning of Law – Purpose of Law –

Sources of Law – Classification of Law –

Torts – National and International Law

Lecture

2 Introduction to

Legal

Environment

Evolution of Mercantile / Business Law –

International Business Law – Justice

Delivery System in India.

Lecture

3

Introduction to

gst

Classification of Taxes – Income Tax –

Wealth Tax – GST

Lecture

4 Business

Contracts

Legal Elements of Contracts – Parties –

Offer – Acceptance – Consideration-Types

of Contracts – Valid Contracts – Voidable

Contracts

Lecture

5 Breach of Contracts and Remedies –

Payment of Damages-Liquidated damages

lecture

Agency – Rights and Duties of Principal

and Agent – Termination of Agency

lecture

6 Special Contracts – Lien / Guarantee /

Indemnity / Letter of Credit / Set

Off-Important clauses in Corporate &

Commercial Agreements-- Conditions –

Obligations – Termination –– Data Privacy

– Confidentiality – Indemnification.

Lecture

using small

caselets

7 Description of Parties – Recitals of Subject

– Consideration – Covenants and

Undertakings – Signatures and Attestation

– Endorsement and Supplement Deeds –

Stamp Duty and Registration – Applicable

Law – Force Majeure – Notice –

Arbitration Employer and Employee

Contracts

Lecture

using small

caselets

8 Business

Transactions and

Cyber

Application of IT Act, 2000 to Contracts

and Transactions

Digital Signature and Authentication of

Electronic Records

Cyber offences

Introduction to Legal Environment 2

Business Contracts5

Non-Corporate Business Entities 2

Law Relating to Corporate Business Entities 5

Number

of

Sessions

Topic Details of the Topic Pedagogy

1 Introduction to

Legal

Environment

Meaning of Law – Purpose of Law –

Sources of Law – Classification of Law –

Torts – National and International Law

Lecture

2 Introduction to

Legal

Environment

Evolution of Mercantile / Business Law –

International Business Law – Justice

Delivery System in India.

Lecture

3

Introduction to

gst

Classification of Taxes – Income Tax –

Wealth Tax – GST

Lecture

4 Business

Contracts

Legal Elements of Contracts – Parties –

Offer – Acceptance – Consideration-Types

of Contracts – Valid Contracts – Voidable

Contracts

Lecture

5 Breach of Contracts and Remedies –

Payment of Damages-Liquidated damages

lecture

Agency – Rights and Duties of Principal

and Agent – Termination of Agency

lecture

6 Special Contracts – Lien / Guarantee /

Indemnity / Letter of Credit / Set

Off-Important clauses in Corporate &

Commercial Agreements-- Conditions –

Obligations – Termination –– Data Privacy

– Confidentiality – Indemnification.

Lecture

using small

caselets

7 Description of Parties – Recitals of Subject

– Consideration – Covenants and

Undertakings – Signatures and Attestation

– Endorsement and Supplement Deeds –

Stamp Duty and Registration – Applicable

Law – Force Majeure – Notice –

Arbitration Employer and Employee

Contracts

Lecture

using small

caselets

8 Business

Transactions and

Cyber

Application of IT Act, 2000 to Contracts

and Transactions

Digital Signature and Authentication of

Electronic Records

Cyber offences

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

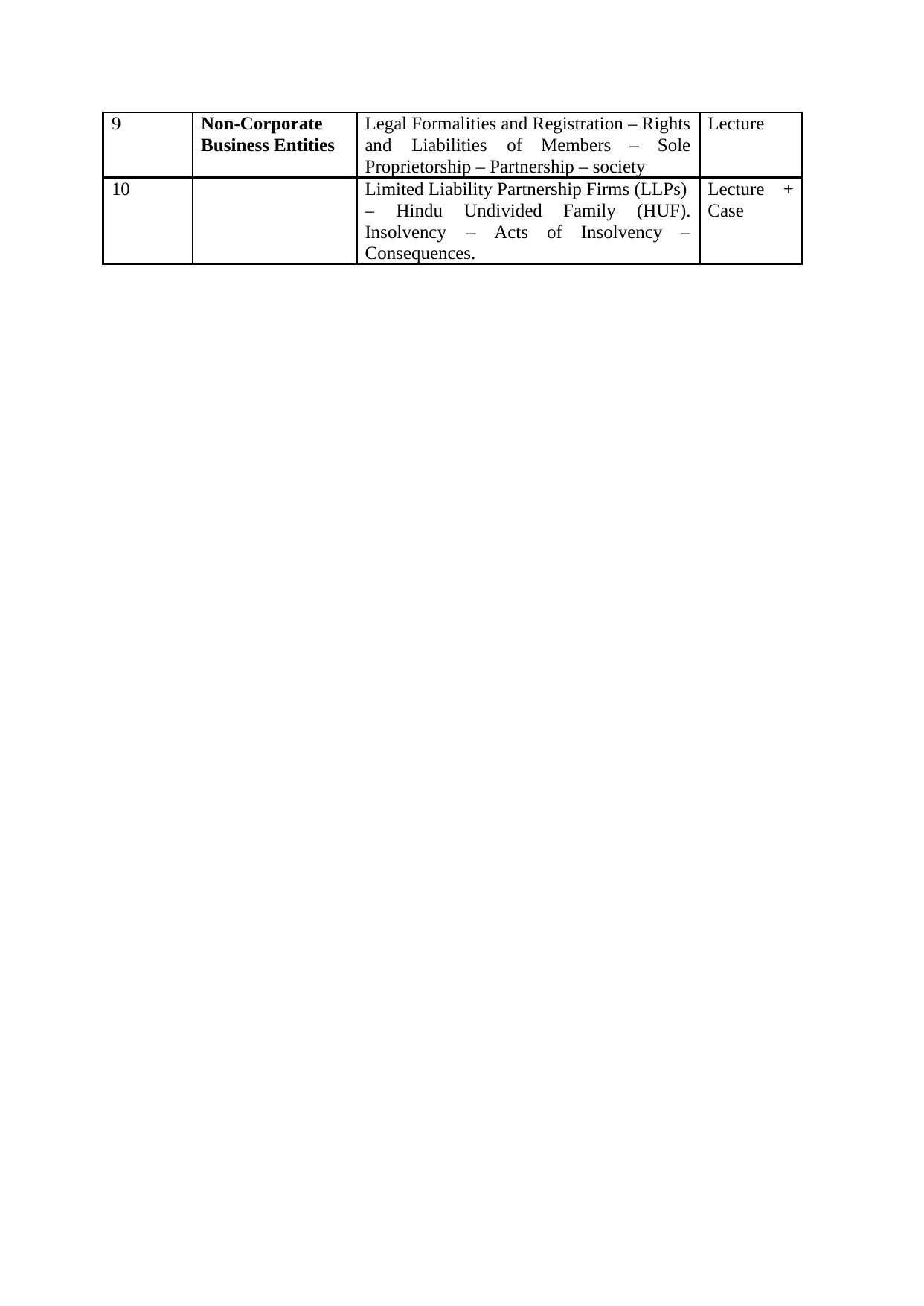

9 Non-Corporate

Business Entities

Legal Formalities and Registration – Rights

and Liabilities of Members – Sole

Proprietorship – Partnership – society

Lecture

10 Limited Liability Partnership Firms (LLPs)

– Hindu Undivided Family (HUF).

Insolvency – Acts of Insolvency –

Consequences.

Lecture +

Case

Business Entities

Legal Formalities and Registration – Rights

and Liabilities of Members – Sole

Proprietorship – Partnership – society

Lecture

10 Limited Liability Partnership Firms (LLPs)

– Hindu Undivided Family (HUF).

Insolvency – Acts of Insolvency –

Consequences.

Lecture +

Case

Chapter 1; Session 1:

A person is a social human being living in the group, called society. He has to do various

activities for his livelihood. Some activities are good or some are bad. In other words, some

are beneficial for the society and some are harmful to the society. To regulate the activities of

human behaviour a group of set activities is introduced by regulatory authorities so that no

one could harm the other one, this set of rules is called Law. Let us take a look at the meaning

of the law and a brief introduction to Indian Law.

Meaning of Law

In the real world, the law is an amorphous set of rules govern individuals and group

behaviour. We don’t even know about many of these rules or we understand them only

generally. For example, you don’t need to see a written law to know that it’s a crime to steal

or destroy someone else property.

In other words, the law is a system of rules that are created and enforced through the social or

governmental institution to regulate behaviour. Stamp that regulates and ensure that

individuals

SESSION 2

INTRODUCTION TO BUSINESS LAW MEANING AND DEFINITION OF BUSINESS

The term business may be understood as the organised efforts of enterprises to supply

consumers with goods and services and to earn profit in the process. Business is a broad term

and includes such varied activities as production, promotion, wholesaling, retailing,

distribution, transportation, warehousing, financing, insurance, consultancy, and the like. The

two definitions on business given below echo the same meaning. Business is a “complex field

of commerce and industry in which goods and services are created and distributed ... in the

hope of profit within a framework of laws and regulations.” Business “comprises all profit

seeking activities and enterprises that provide goods and services necessary to an economic

system. It is the economic pulse of a nation, striving to increase society’s standard of living.

Profits are a primary mechanism for motivating these activities. Business is as important as it

is vast in its scope. It is a unique institution which converts ideas into saleable products. From

the time we get up early in the morning till we go to bed in the nigh the products we consume

and the services we use are all supplied to us by business. Business offers innumerable

opportunities for us to earn money so that we can buy and enjoy the products. We depend so

much on business that except for six or seven hours we sleep every day the remaining hours

we spend for or on business. It is really shiver to imagine what would happen to us without

business. Indeed there is no life without business.

MEANING AND DEFINITION OF LAW Law refers to the principles and regulations

established by a Government and applicable to people, whether in the form of legislation or

of custom and policies recognised and enforced by judicial decision. A few definitions of law

are worth quoting in this context. According to BLACKSTONE “Law in its most general and

comprehensive sense signifise a rule of action and is applied indiscriminately to all kinds of

A person is a social human being living in the group, called society. He has to do various

activities for his livelihood. Some activities are good or some are bad. In other words, some

are beneficial for the society and some are harmful to the society. To regulate the activities of

human behaviour a group of set activities is introduced by regulatory authorities so that no

one could harm the other one, this set of rules is called Law. Let us take a look at the meaning

of the law and a brief introduction to Indian Law.

Meaning of Law

In the real world, the law is an amorphous set of rules govern individuals and group

behaviour. We don’t even know about many of these rules or we understand them only

generally. For example, you don’t need to see a written law to know that it’s a crime to steal

or destroy someone else property.

In other words, the law is a system of rules that are created and enforced through the social or

governmental institution to regulate behaviour. Stamp that regulates and ensure that

individuals

SESSION 2

INTRODUCTION TO BUSINESS LAW MEANING AND DEFINITION OF BUSINESS

The term business may be understood as the organised efforts of enterprises to supply

consumers with goods and services and to earn profit in the process. Business is a broad term

and includes such varied activities as production, promotion, wholesaling, retailing,

distribution, transportation, warehousing, financing, insurance, consultancy, and the like. The

two definitions on business given below echo the same meaning. Business is a “complex field

of commerce and industry in which goods and services are created and distributed ... in the

hope of profit within a framework of laws and regulations.” Business “comprises all profit

seeking activities and enterprises that provide goods and services necessary to an economic

system. It is the economic pulse of a nation, striving to increase society’s standard of living.

Profits are a primary mechanism for motivating these activities. Business is as important as it

is vast in its scope. It is a unique institution which converts ideas into saleable products. From

the time we get up early in the morning till we go to bed in the nigh the products we consume

and the services we use are all supplied to us by business. Business offers innumerable

opportunities for us to earn money so that we can buy and enjoy the products. We depend so

much on business that except for six or seven hours we sleep every day the remaining hours

we spend for or on business. It is really shiver to imagine what would happen to us without

business. Indeed there is no life without business.

MEANING AND DEFINITION OF LAW Law refers to the principles and regulations

established by a Government and applicable to people, whether in the form of legislation or

of custom and policies recognised and enforced by judicial decision. A few definitions of law

are worth quoting in this context. According to BLACKSTONE “Law in its most general and

comprehensive sense signifise a rule of action and is applied indiscriminately to all kinds of

actions whether animate or in animate, rational or irrational.” Salmond defines law as the

“body or principles recognised and applied by the State in the administration of Justice.”

Woodrow Wilson defines law as “that portion of the established habit and thought of mankind

which has gained distinct and formal recognitions in the shape of uniform of rules backed by

the authority and power of the Government.” Definitions of law frequently emphasis the

coercive power of the State which stands behind the rules. And it is true of many rules that

failure to comply with them may lead to the use of coercion by officials. Thus, if a man

refuses to perform his/her obligations under a contract, he/she is sued in a ... Business

Regulations court of breach of contract, loses the suit and is ordered to pay damages. But

many rules of law merely grant permission to do creation things; and if a citizen does not do

what he/she is permitted to do, he/ she is not subject to any coercion. Moreover, the

government often induces people to do what it wants them to do by the lure of benefits. An

entrepreneur, for example, is assured of certain concessions if he/she were to set-up his/her

plant in a backward area. If he/she ignores the offer, he/she is not penalised, he/she simply

does not get the concessions.

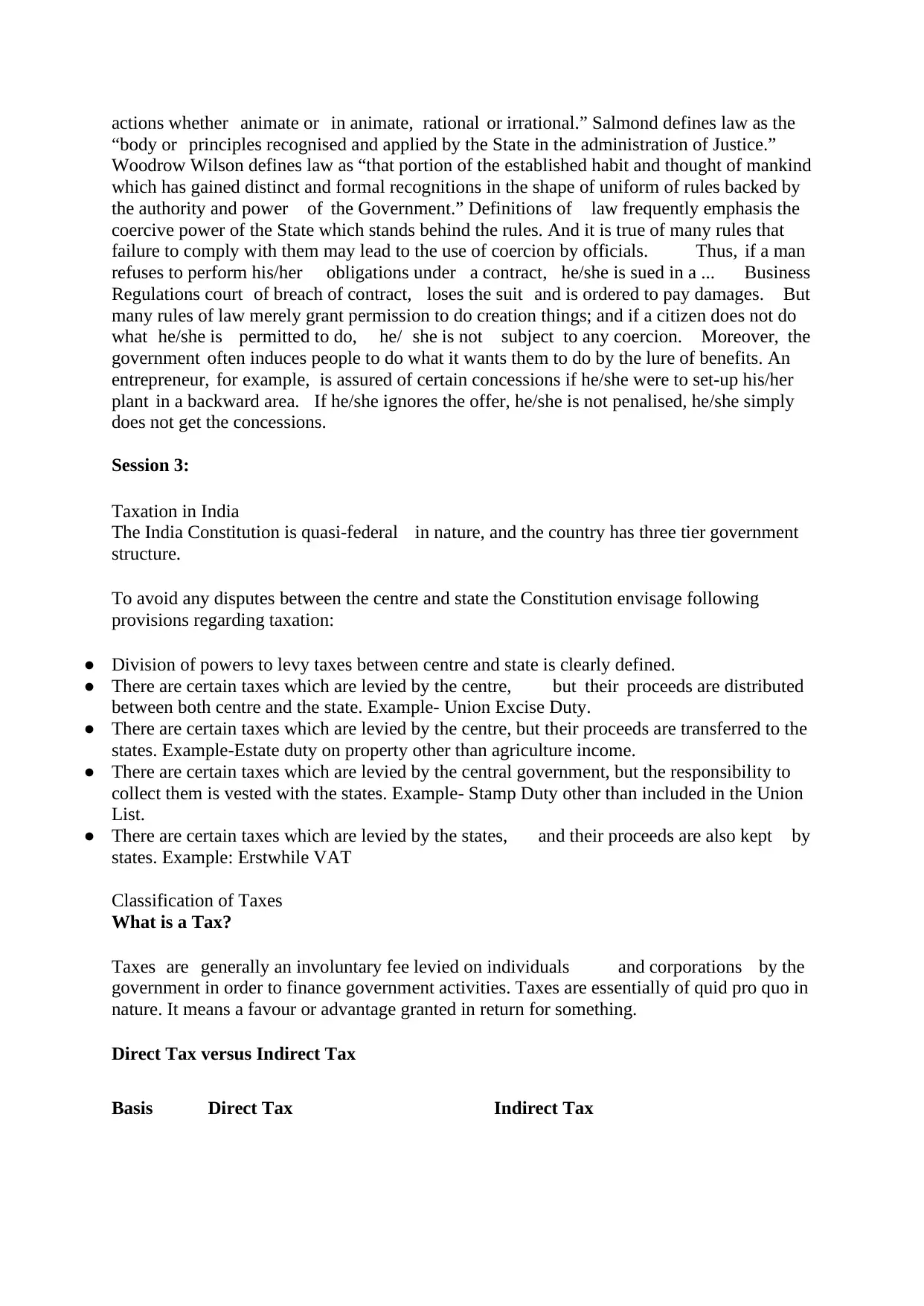

Session 3:

Taxation in India

The India Constitution is quasi-federal in nature, and the country has three tier government

structure.

To avoid any disputes between the centre and state the Constitution envisage following

provisions regarding taxation:

● Division of powers to levy taxes between centre and state is clearly defined.

● There are certain taxes which are levied by the centre, but their proceeds are distributed

between both centre and the state. Example- Union Excise Duty.

● There are certain taxes which are levied by the centre, but their proceeds are transferred to the

states. Example-Estate duty on property other than agriculture income.

● There are certain taxes which are levied by the central government, but the responsibility to

collect them is vested with the states. Example- Stamp Duty other than included in the Union

List.

● There are certain taxes which are levied by the states, and their proceeds are also kept by

states. Example: Erstwhile VAT

Classification of Taxes

What is a Tax?

Taxes are generally an involuntary fee levied on individuals and corporations by the

government in order to finance government activities. Taxes are essentially of quid pro quo in

nature. It means a favour or advantage granted in return for something.

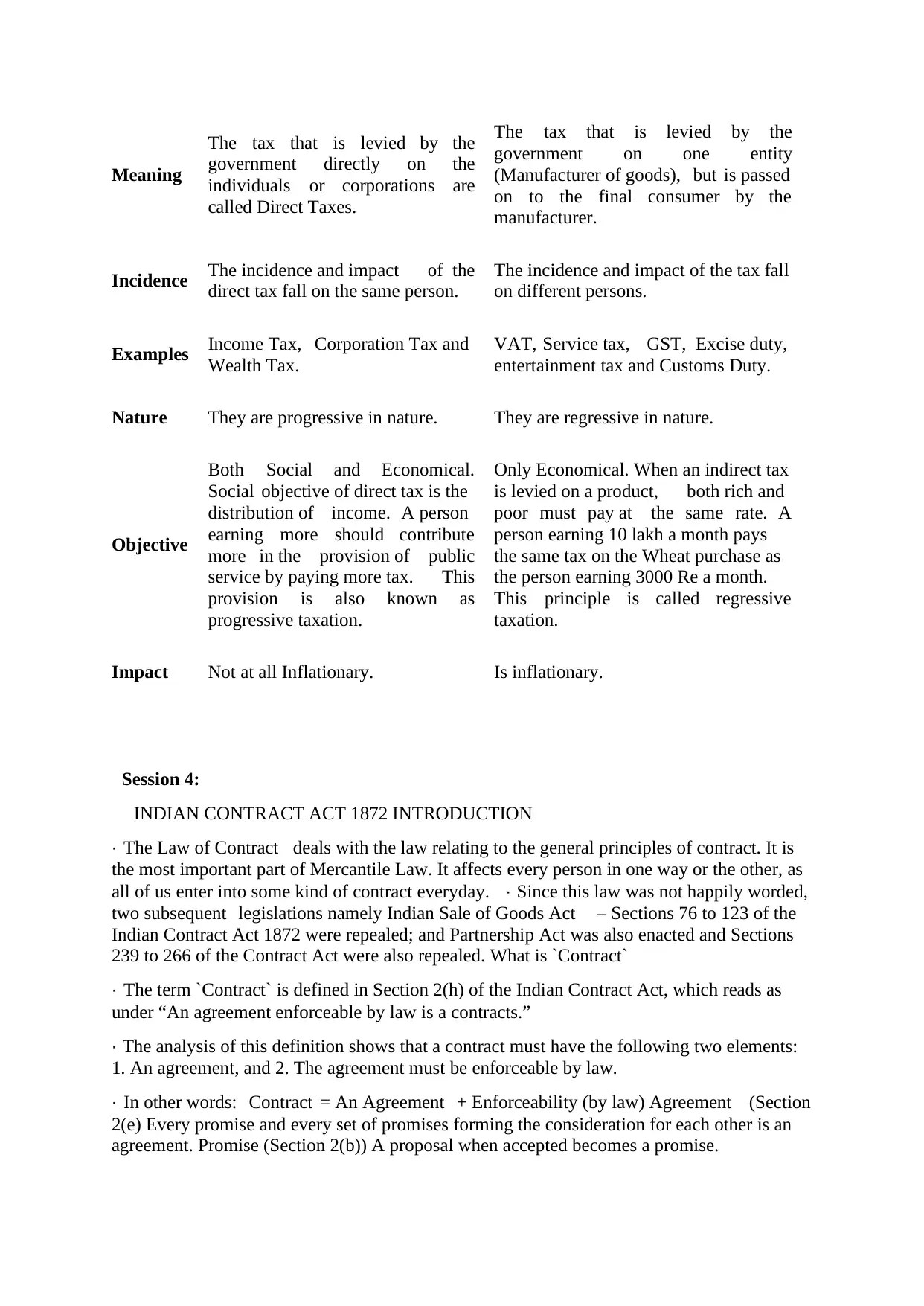

Direct Tax versus Indirect Tax

Basis Direct Tax Indirect Tax

“body or principles recognised and applied by the State in the administration of Justice.”

Woodrow Wilson defines law as “that portion of the established habit and thought of mankind

which has gained distinct and formal recognitions in the shape of uniform of rules backed by

the authority and power of the Government.” Definitions of law frequently emphasis the

coercive power of the State which stands behind the rules. And it is true of many rules that

failure to comply with them may lead to the use of coercion by officials. Thus, if a man

refuses to perform his/her obligations under a contract, he/she is sued in a ... Business

Regulations court of breach of contract, loses the suit and is ordered to pay damages. But

many rules of law merely grant permission to do creation things; and if a citizen does not do

what he/she is permitted to do, he/ she is not subject to any coercion. Moreover, the

government often induces people to do what it wants them to do by the lure of benefits. An

entrepreneur, for example, is assured of certain concessions if he/she were to set-up his/her

plant in a backward area. If he/she ignores the offer, he/she is not penalised, he/she simply

does not get the concessions.

Session 3:

Taxation in India

The India Constitution is quasi-federal in nature, and the country has three tier government

structure.

To avoid any disputes between the centre and state the Constitution envisage following

provisions regarding taxation:

● Division of powers to levy taxes between centre and state is clearly defined.

● There are certain taxes which are levied by the centre, but their proceeds are distributed

between both centre and the state. Example- Union Excise Duty.

● There are certain taxes which are levied by the centre, but their proceeds are transferred to the

states. Example-Estate duty on property other than agriculture income.

● There are certain taxes which are levied by the central government, but the responsibility to

collect them is vested with the states. Example- Stamp Duty other than included in the Union

List.

● There are certain taxes which are levied by the states, and their proceeds are also kept by

states. Example: Erstwhile VAT

Classification of Taxes

What is a Tax?

Taxes are generally an involuntary fee levied on individuals and corporations by the

government in order to finance government activities. Taxes are essentially of quid pro quo in

nature. It means a favour or advantage granted in return for something.

Direct Tax versus Indirect Tax

Basis Direct Tax Indirect Tax

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Meaning

The tax that is levied by the

government directly on the

individuals or corporations are

called Direct Taxes.

The tax that is levied by the

government on one entity

(Manufacturer of goods), but is passed

on to the final consumer by the

manufacturer.

Incidence The incidence and impact of the

direct tax fall on the same person.

The incidence and impact of the tax fall

on different persons.

Examples Income Tax, Corporation Tax and

Wealth Tax.

VAT, Service tax, GST, Excise duty,

entertainment tax and Customs Duty.

Nature They are progressive in nature. They are regressive in nature.

Objective

Both Social and Economical.

Social objective of direct tax is the

distribution of income. A person

earning more should contribute

more in the provision of public

service by paying more tax. This

provision is also known as

progressive taxation.

Only Economical. When an indirect tax

is levied on a product, both rich and

poor must pay at the same rate. A

person earning 10 lakh a month pays

the same tax on the Wheat purchase as

the person earning 3000 Re a month.

This principle is called regressive

taxation.

Impact Not at all Inflationary. Is inflationary.

Session 4:

INDIAN CONTRACT ACT 1872 INTRODUCTION

∙ The Law of Contract deals with the law relating to the general principles of contract. It is

the most important part of Mercantile Law. It affects every person in one way or the other, as

all of us enter into some kind of contract everyday. ∙ Since this law was not happily worded,

two subsequent legislations namely Indian Sale of Goods Act – Sections 76 to 123 of the

Indian Contract Act 1872 were repealed; and Partnership Act was also enacted and Sections

239 to 266 of the Contract Act were also repealed. What is `Contract`

∙ The term `Contract` is defined in Section 2(h) of the Indian Contract Act, which reads as

under “An agreement enforceable by law is a contracts.”

∙ The analysis of this definition shows that a contract must have the following two elements:

1. An agreement, and 2. The agreement must be enforceable by law.

∙ In other words: Contract = An Agreement + Enforceability (by law) Agreement (Section

2(e) Every promise and every set of promises forming the consideration for each other is an

agreement. Promise (Section 2(b)) A proposal when accepted becomes a promise.

The tax that is levied by the

government directly on the

individuals or corporations are

called Direct Taxes.

The tax that is levied by the

government on one entity

(Manufacturer of goods), but is passed

on to the final consumer by the

manufacturer.

Incidence The incidence and impact of the

direct tax fall on the same person.

The incidence and impact of the tax fall

on different persons.

Examples Income Tax, Corporation Tax and

Wealth Tax.

VAT, Service tax, GST, Excise duty,

entertainment tax and Customs Duty.

Nature They are progressive in nature. They are regressive in nature.

Objective

Both Social and Economical.

Social objective of direct tax is the

distribution of income. A person

earning more should contribute

more in the provision of public

service by paying more tax. This

provision is also known as

progressive taxation.

Only Economical. When an indirect tax

is levied on a product, both rich and

poor must pay at the same rate. A

person earning 10 lakh a month pays

the same tax on the Wheat purchase as

the person earning 3000 Re a month.

This principle is called regressive

taxation.

Impact Not at all Inflationary. Is inflationary.

Session 4:

INDIAN CONTRACT ACT 1872 INTRODUCTION

∙ The Law of Contract deals with the law relating to the general principles of contract. It is

the most important part of Mercantile Law. It affects every person in one way or the other, as

all of us enter into some kind of contract everyday. ∙ Since this law was not happily worded,

two subsequent legislations namely Indian Sale of Goods Act – Sections 76 to 123 of the

Indian Contract Act 1872 were repealed; and Partnership Act was also enacted and Sections

239 to 266 of the Contract Act were also repealed. What is `Contract`

∙ The term `Contract` is defined in Section 2(h) of the Indian Contract Act, which reads as

under “An agreement enforceable by law is a contracts.”

∙ The analysis of this definition shows that a contract must have the following two elements:

1. An agreement, and 2. The agreement must be enforceable by law.

∙ In other words: Contract = An Agreement + Enforceability (by law) Agreement (Section

2(e) Every promise and every set of promises forming the consideration for each other is an

agreement. Promise (Section 2(b)) A proposal when accepted becomes a promise.

∙ Every agreement is not a contract. When an agreement creates some legal obligations and is

enforceable by law, it is regarded as a contract.

2.1 ESSENTIAL ELEMENTS OF CONTRACT 1. Agreement 2. Intention to create legal

relationship 3. Free and genuine consent. 4. Parties competent to contract. 5. Lawful

consideration. 6. Lawful object. 7. Must be in writing. (Generally, oral contract is not

enforceable) 8. Agreement not declared void or illegal. 9. Certainty of meaning. 10.

Possibility of performance. 11. Necessary legal formalities.

Ex – Where 'A' who owns 2 cars x and y wishes to sell car 'x' for Rs. 30,000. 'B', an

acquaintance of 'A' does not know that' A' owns car 'x' also. He thinks that' A' owns only car

'y' and is offering to sell the same for the stated price. He gives his acceptance to buy the

same. There is no contract because the contracting parties have not agreed on the same thing

at the same time, 'A' offering to sell his car 'x' and 'B' agreeing to buy car or'. There is no

consensus-ad-idem.

LAW OF CONTRACT CREATES jus in personam ∙The term jus in personam means a “right

against or in respect of a specific person.” Thus, law of contract creates jus in personam and

not jus in rem. A jus in rem means a right against or a thing. CLASSIFICATION OF

CONTRACTS 1. Classification according to validity or enforceability. a) Valid b) Voidable c)

Void contracts or agreements d) Illegal. e) Unenforceable 2. Classification according to Mode

of formation (i) Express contract (ii) Implied contract 2. Classification according to

Performance

CONTRACT ACT (i) Executed contract (ii) Executory contract. (iii) Unilateral Contract (iv)

Bilateral Contract

2.2 OFFER AND ACCEPTANCE [Sections 3-9] OFFER What is `Offer/Proposal` ∙ A

Proposal is defined as quot;when one person signifies to another his willingness to do or to

abstain from doing anything, with a view to obtaining the assent of that other to such act or

abstinence, he is said to make a proposal.quot; [Section 2(a)]. How an Offer is made? ∙ An

offer can be made by (a) any act or (b) omission of the party proposing by which he intends

to communicate such proposal or which has the effect of communicating it to the other

(Section 3).

ESSENTIAL REQUIREMENTS OF A VALID OFFER ∙ An offer must have certain

essentials in order to constitute it a valid offer. These are: I. The offer must be made with a

view to obtain acceptance. 2. The offer must be made with the intention of creating legal

relations. [Balfour v. Balfour (1919) 2 K.B.57Il 2. The terms of offer must be definite,

unambiguous and certain or capable of being made certain. The terms of the offer must not

be loose, vague or ambiguous. 4. An offer must be distinguished from (a) a mere declaration

of intention or (b) an invitation to offer or to treat. An auctioneer, at the time of auction,

invites offers from the would-be-bidders. He is not making a proposal. A display of goods

with a price on them in a shop window is construed an invitation to offer and not an offer to

sell. Offer vis-a-vis Invitation to offer An offer must be distinguished from invitation to

offer. θ A prospectus issued by a company for subscription of its shares by the members of

the public, is an invitation θ to offer. The Letter of Offer issued by a company to its existing

shareholders is an offer. 5. The offer must be communicated to the offeree. An offer must be

communicated to the offeree before it can be accepted. This is true of specific as sell as

general offer. 6. The offer must not contain a term the non-compliance of which may be

assumed to amount to acceptance. Cross Offers ∙ Where two parties make identical offers to

each other, in ignorance of each other's offer, the offers are known as cross-offers and

enforceable by law, it is regarded as a contract.

2.1 ESSENTIAL ELEMENTS OF CONTRACT 1. Agreement 2. Intention to create legal

relationship 3. Free and genuine consent. 4. Parties competent to contract. 5. Lawful

consideration. 6. Lawful object. 7. Must be in writing. (Generally, oral contract is not

enforceable) 8. Agreement not declared void or illegal. 9. Certainty of meaning. 10.

Possibility of performance. 11. Necessary legal formalities.

Ex – Where 'A' who owns 2 cars x and y wishes to sell car 'x' for Rs. 30,000. 'B', an

acquaintance of 'A' does not know that' A' owns car 'x' also. He thinks that' A' owns only car

'y' and is offering to sell the same for the stated price. He gives his acceptance to buy the

same. There is no contract because the contracting parties have not agreed on the same thing

at the same time, 'A' offering to sell his car 'x' and 'B' agreeing to buy car or'. There is no

consensus-ad-idem.

LAW OF CONTRACT CREATES jus in personam ∙The term jus in personam means a “right

against or in respect of a specific person.” Thus, law of contract creates jus in personam and

not jus in rem. A jus in rem means a right against or a thing. CLASSIFICATION OF

CONTRACTS 1. Classification according to validity or enforceability. a) Valid b) Voidable c)

Void contracts or agreements d) Illegal. e) Unenforceable 2. Classification according to Mode

of formation (i) Express contract (ii) Implied contract 2. Classification according to

Performance

CONTRACT ACT (i) Executed contract (ii) Executory contract. (iii) Unilateral Contract (iv)

Bilateral Contract

2.2 OFFER AND ACCEPTANCE [Sections 3-9] OFFER What is `Offer/Proposal` ∙ A

Proposal is defined as quot;when one person signifies to another his willingness to do or to

abstain from doing anything, with a view to obtaining the assent of that other to such act or

abstinence, he is said to make a proposal.quot; [Section 2(a)]. How an Offer is made? ∙ An

offer can be made by (a) any act or (b) omission of the party proposing by which he intends

to communicate such proposal or which has the effect of communicating it to the other

(Section 3).

ESSENTIAL REQUIREMENTS OF A VALID OFFER ∙ An offer must have certain

essentials in order to constitute it a valid offer. These are: I. The offer must be made with a

view to obtain acceptance. 2. The offer must be made with the intention of creating legal

relations. [Balfour v. Balfour (1919) 2 K.B.57Il 2. The terms of offer must be definite,

unambiguous and certain or capable of being made certain. The terms of the offer must not

be loose, vague or ambiguous. 4. An offer must be distinguished from (a) a mere declaration

of intention or (b) an invitation to offer or to treat. An auctioneer, at the time of auction,

invites offers from the would-be-bidders. He is not making a proposal. A display of goods

with a price on them in a shop window is construed an invitation to offer and not an offer to

sell. Offer vis-a-vis Invitation to offer An offer must be distinguished from invitation to

offer. θ A prospectus issued by a company for subscription of its shares by the members of

the public, is an invitation θ to offer. The Letter of Offer issued by a company to its existing

shareholders is an offer. 5. The offer must be communicated to the offeree. An offer must be

communicated to the offeree before it can be accepted. This is true of specific as sell as

general offer. 6. The offer must not contain a term the non-compliance of which may be

assumed to amount to acceptance. Cross Offers ∙ Where two parties make identical offers to

each other, in ignorance of each other's offer, the offers are known as cross-offers and

neither of the two can be called an acceptance of the other and, therefore, there is no

contract.

TERMINATION OR LAPSE OF AN OFFER ∙ An offer is made with a view to obtain

assent thereto. As soon as the offer is accepted it becomes a contract. But before it is

accepted, it may lapse, or may be revoked. Also, the offeree may reject the offer. In these

cases, the offer will come to an end. 1) The offer lapses after stipulated or reasonable time

2) An offer lapses by the death or insanity of the offeror or the offeree before acceptance. 3)

An offer terminates when rejected by the offeree. 4) An offer terminates when revoked by

the offeror before acceptance. 5) An offer terminates by not being accepted in the mode

prescribed, or if no mode is prescribed, in some usual and reasonable manner. 6) A

conditional offer terminates when the condition is not accepted by the offeree. (7) Counter

Offer

TERMINATION OF AN OFFER 1. An offer lapses after stipulated or reasonable time. 2.

An offer lapses by the death or insanity of the offeror or the offeree before acceptance. 2.

An offer.CONTRACT ACT rejection. 4. An offer terminates when revoked. 5. It terminates

by counter-offer. 6. It terminates by not being accepted in the mode prescribed or in usual

and reasonable manner. 7. A conditional offer terminates when condition is not accepted.

ACCEPTANCE ∙Acceptance has been defined as quot;When the person to whom the

proposal is made signifies his assent thereto, the proposal is said to be accepted”.

Acceptance how made ∙Theofferee is deemed to have given his acceptance when he gives

his assent to the proposal. The assent may be express or implied. It is express when the

acceptance has been signified either in writing, or by word of mouth, or by performance of

some required act. Ex- A enters into a bus for going to his destination and takes a seat. From

the very nature, of the circumstance, the law will imply acceptance on the part of A.] ∙ In the

case of a general offer, it can be accepted by anyone by complying with the terms of the

offer.

ESSENTIALS OF A VALID ACCEPTANCE 1) Acceptance must be absolute and

unqualified. 2) Acceptance must be communicated to the offeror. 3) Acceptance must be

according to the mode prescribed. Ex- A sends an offer to B through post in the usual

course. B should make the acceptance in the quot;usual and reasonable mannerquot; as no

mode of acceptance is prescribed. He may accept the offer by sending a letter, through post,

in the ordinary course, within a reasonable time.

COMMUNICATION OF OFFER, ACCEPTANCE AND REVOCATION ∙ As mentioned

earlier that in order to be a valid offer and acceptance. (i) the offer must be communicated to

the offeree, and (ii) the acceptance must be communicated to the offeror. The

communication of acceptance is complete: (i) as against the proposer, when it is put into a

course of transmission to him, so as to be out of the power of the acceptor; (ii) as against the

acceptor, when it comes to the knowledge of the proposer. Ex- A proposes, by letter, to sell

a house to B at a certain price. B accepts A's proposal by a letter sent by post. The

communication of acceptance is complete: (i) as against A, when the letter is posted by B;

(ii) as against B, when the letter is received by A. The communication of a revocation (of an

offer or an acceptance) is complete: (1) as against the person who makes it, when it is put

into a course of transmission to the person to whom it is made, so as to be out of the power

of the person who makes it. (2) as against the person to whom it is made when it comes to

his knowledge. Ex- A revokes his proposal by telegram. The revocation is complete as

against A, when the telegram is dispatched. It is complete as against B, when B receives it.

Revocation of proposal and acceptance: ∙ A proposal may be revoked at any time before the

contract.

TERMINATION OR LAPSE OF AN OFFER ∙ An offer is made with a view to obtain

assent thereto. As soon as the offer is accepted it becomes a contract. But before it is

accepted, it may lapse, or may be revoked. Also, the offeree may reject the offer. In these

cases, the offer will come to an end. 1) The offer lapses after stipulated or reasonable time

2) An offer lapses by the death or insanity of the offeror or the offeree before acceptance. 3)

An offer terminates when rejected by the offeree. 4) An offer terminates when revoked by

the offeror before acceptance. 5) An offer terminates by not being accepted in the mode

prescribed, or if no mode is prescribed, in some usual and reasonable manner. 6) A

conditional offer terminates when the condition is not accepted by the offeree. (7) Counter

Offer

TERMINATION OF AN OFFER 1. An offer lapses after stipulated or reasonable time. 2.

An offer lapses by the death or insanity of the offeror or the offeree before acceptance. 2.

An offer.CONTRACT ACT rejection. 4. An offer terminates when revoked. 5. It terminates

by counter-offer. 6. It terminates by not being accepted in the mode prescribed or in usual

and reasonable manner. 7. A conditional offer terminates when condition is not accepted.

ACCEPTANCE ∙Acceptance has been defined as quot;When the person to whom the

proposal is made signifies his assent thereto, the proposal is said to be accepted”.

Acceptance how made ∙Theofferee is deemed to have given his acceptance when he gives

his assent to the proposal. The assent may be express or implied. It is express when the

acceptance has been signified either in writing, or by word of mouth, or by performance of

some required act. Ex- A enters into a bus for going to his destination and takes a seat. From

the very nature, of the circumstance, the law will imply acceptance on the part of A.] ∙ In the

case of a general offer, it can be accepted by anyone by complying with the terms of the

offer.

ESSENTIALS OF A VALID ACCEPTANCE 1) Acceptance must be absolute and

unqualified. 2) Acceptance must be communicated to the offeror. 3) Acceptance must be

according to the mode prescribed. Ex- A sends an offer to B through post in the usual

course. B should make the acceptance in the quot;usual and reasonable mannerquot; as no

mode of acceptance is prescribed. He may accept the offer by sending a letter, through post,

in the ordinary course, within a reasonable time.

COMMUNICATION OF OFFER, ACCEPTANCE AND REVOCATION ∙ As mentioned

earlier that in order to be a valid offer and acceptance. (i) the offer must be communicated to

the offeree, and (ii) the acceptance must be communicated to the offeror. The

communication of acceptance is complete: (i) as against the proposer, when it is put into a

course of transmission to him, so as to be out of the power of the acceptor; (ii) as against the

acceptor, when it comes to the knowledge of the proposer. Ex- A proposes, by letter, to sell

a house to B at a certain price. B accepts A's proposal by a letter sent by post. The

communication of acceptance is complete: (i) as against A, when the letter is posted by B;

(ii) as against B, when the letter is received by A. The communication of a revocation (of an

offer or an acceptance) is complete: (1) as against the person who makes it, when it is put

into a course of transmission to the person to whom it is made, so as to be out of the power

of the person who makes it. (2) as against the person to whom it is made when it comes to

his knowledge. Ex- A revokes his proposal by telegram. The revocation is complete as

against A, when the telegram is dispatched. It is complete as against B, when B receives it.

Revocation of proposal and acceptance: ∙ A proposal may be revoked at any time before the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

communication of its acceptance is complete as against the proposer, but not afterwards. Ex-

A proposes, by a letter sent by post, to sell his house to B. B accepts the proposal by a letter

sent by post. A may revoke his proposal at any time before or at the moment when B posts

his letter of acceptance, but not afterwards. B may revoke his acceptance at any time before

or at the moment when the letter communicating it reaches A, but not afterwards.

CAPACITY TO CONTRACT (Sections 10-12) WHO ARE NOT COMPETENT TO

CONTRACT ∙ The following are considered as incompetent to contract, in the eye of law: -

(1) Minor: - (i) A contract with or by a minor is void and a minor, therefore, cannot, bind

himself by a contract. (ii) A minor's agreement cannot be ratified by the minor on his

attaining majority.(iii) If a minor has received any benefit under a void contract, he cannot

be asked to refund the same. (iv) A minor cannot be a partner in a partnership firm. (v) A

minor's estate is liable to a person who supplies necessaries of life to a minor. CASE

EXAMPLE In 1903 the Privy Council in the leading case of MohiriBibi v.

DharmodasGhose (190,30 Ca. 539) held that in India minor's contracts are absolutely void

and not merely voidable. The facts of the case were: DharmodasGhose, a minor, entered

into a contract for borrowing a sum of Rs. 20,000 out of which the lender paid the minor a

sum of Rs. 8,000. The minor executed mortgage of property in favour of the lender.

Subsequently, the minor sued for setting aside the mortgage. The Privy Council had to

ascertain the validity of the mortgage. Under Section 7 of the Transfer of Property Act,

every person competent to contract is competent to mortgage. The Privy Council decided

that Sections 10 and 11 of the Indian Contract Act make the minor's contract void. The

mortgagee prayed for refund of Rs. 8,000 by the minor. The Privy Council further held that

as a minor's contract is void, any money advanced to a minor cannot be recovered. (2)

Mental Incompetence θA person is said to be of unsound mind for the purpose of making a

contract, if at the time when he makes it, he is incapable of understanding it, and of forming

a rational judgement as to its effect upon his interests. θ A person, who is usually of

unsound mind, but occasionally of sound mind, may make a contract when he is of sound

mind. Ex- A patient, in a lunatic asylum, who is at intervals, of sound mind; may contract

during those intervals. A sane man, who is delirious from fever or who is so drunk that he

cannot understand the terms of a contract or form a rational judgement as to its effect on his

interest, cannot contract whilst such delirium or drunkenness lasts. (3) Incompetence

through Status (i) Alien Enemy (Political Status) (ii) Foreign Sovereigns and Ambassadors

(iii) Company under the Companies Act or Statutory Corporation by passing Special Act of

Parliament (Corporate status) (iv) Insolvent Persons .

FREE CONSENT (Sections 10; 13-22) What is the meaning of `CONSENT` (SECTION

13) ∙ When two or more persons agree upon the same thing in the same sense, they are said

to consent. Ex- A agrees to sell his Fiat Car 1983 model for Rs. 80,000. B agrees to buy the

same. There is a valid contract since A and B have consented to the same subject matter.

What is meant by `Free Consent` ∙ Consent is said to be free when it is not caused by

Causes affecting contract Consequences 1. Coercion Contract voidable 2. Undue influence

Contract voidable 2. Fraud Contract voidable 4. Misrepresentation Contract voidable 5.

Mistake – (i) of fact (a) Bilateral Void (b) Unilateral Generally not invalid (ii) of Fact Void

Ex - (i) A railway company refuses to deliver certain goods to the consignee, except upon

the payment of an illegal charge for carriage. The consignee pays the sum charged in order

to obtain the goods. He is entitled to recover so much of the charge as was illegally

excessive. (ii) The directors of a Tramway Co. issued a prospectus stating that they had the

right to run tramcars with steam power instead of with horses as before. In fact, the Act

incorporating the company provided that such power might be used with the sanction of the

Board of Trade. But, the Board of Trade refused to give permission and the company had to

A proposes, by a letter sent by post, to sell his house to B. B accepts the proposal by a letter

sent by post. A may revoke his proposal at any time before or at the moment when B posts

his letter of acceptance, but not afterwards. B may revoke his acceptance at any time before

or at the moment when the letter communicating it reaches A, but not afterwards.

CAPACITY TO CONTRACT (Sections 10-12) WHO ARE NOT COMPETENT TO

CONTRACT ∙ The following are considered as incompetent to contract, in the eye of law: -

(1) Minor: - (i) A contract with or by a minor is void and a minor, therefore, cannot, bind

himself by a contract. (ii) A minor's agreement cannot be ratified by the minor on his

attaining majority.(iii) If a minor has received any benefit under a void contract, he cannot

be asked to refund the same. (iv) A minor cannot be a partner in a partnership firm. (v) A

minor's estate is liable to a person who supplies necessaries of life to a minor. CASE

EXAMPLE In 1903 the Privy Council in the leading case of MohiriBibi v.

DharmodasGhose (190,30 Ca. 539) held that in India minor's contracts are absolutely void

and not merely voidable. The facts of the case were: DharmodasGhose, a minor, entered

into a contract for borrowing a sum of Rs. 20,000 out of which the lender paid the minor a

sum of Rs. 8,000. The minor executed mortgage of property in favour of the lender.

Subsequently, the minor sued for setting aside the mortgage. The Privy Council had to

ascertain the validity of the mortgage. Under Section 7 of the Transfer of Property Act,

every person competent to contract is competent to mortgage. The Privy Council decided

that Sections 10 and 11 of the Indian Contract Act make the minor's contract void. The

mortgagee prayed for refund of Rs. 8,000 by the minor. The Privy Council further held that

as a minor's contract is void, any money advanced to a minor cannot be recovered. (2)

Mental Incompetence θA person is said to be of unsound mind for the purpose of making a

contract, if at the time when he makes it, he is incapable of understanding it, and of forming

a rational judgement as to its effect upon his interests. θ A person, who is usually of

unsound mind, but occasionally of sound mind, may make a contract when he is of sound

mind. Ex- A patient, in a lunatic asylum, who is at intervals, of sound mind; may contract

during those intervals. A sane man, who is delirious from fever or who is so drunk that he

cannot understand the terms of a contract or form a rational judgement as to its effect on his

interest, cannot contract whilst such delirium or drunkenness lasts. (3) Incompetence

through Status (i) Alien Enemy (Political Status) (ii) Foreign Sovereigns and Ambassadors

(iii) Company under the Companies Act or Statutory Corporation by passing Special Act of

Parliament (Corporate status) (iv) Insolvent Persons .

FREE CONSENT (Sections 10; 13-22) What is the meaning of `CONSENT` (SECTION

13) ∙ When two or more persons agree upon the same thing in the same sense, they are said

to consent. Ex- A agrees to sell his Fiat Car 1983 model for Rs. 80,000. B agrees to buy the

same. There is a valid contract since A and B have consented to the same subject matter.

What is meant by `Free Consent` ∙ Consent is said to be free when it is not caused by

Causes affecting contract Consequences 1. Coercion Contract voidable 2. Undue influence

Contract voidable 2. Fraud Contract voidable 4. Misrepresentation Contract voidable 5.

Mistake – (i) of fact (a) Bilateral Void (b) Unilateral Generally not invalid (ii) of Fact Void

Ex - (i) A railway company refuses to deliver certain goods to the consignee, except upon

the payment of an illegal charge for carriage. The consignee pays the sum charged in order

to obtain the goods. He is entitled to recover so much of the charge as was illegally

excessive. (ii) The directors of a Tramway Co. issued a prospectus stating that they had the

right to run tramcars with steam power instead of with horses as before. In fact, the Act

incorporating the company provided that such power might be used with the sanction of the

Board of Trade. But, the Board of Trade refused to give permission and the company had to

be wound up. P, a shareholder sued the directors for damages for fraud. The House of Lords

held that the directors were not liable in fraud because they honestly believed what they said

.

CONSIDERATION [Sections 2(d), 10,23-25, 148, 185] Definition ∙ Consideration is what a

promisor demands as the price for his promise. In simple words, it means 'something in

return.' ∙ Consideration has been defined as quot;When at the desire of the promisor, the

promisee or any other person has done or abstained from doing, or does or abstains from

doing, or promises to do or promises to abstain from doing something, such act or

abstinence or promise is called a consideration for the promise.quot;

IMPORTANCE OF CONSIDERATION ∙ A promise without consideration is purely

gratuitous and, however sacred and binding in honour it may be, cannot create a legal

obligation. ∙ A person who makes a promise to do or abstain from doing something usually

does so as a return or equivalent of some loss, damage, or inconvenience that may have

been occasioned to the other party in respect of the promise. The benefit so received and the

loss, damage or inconvenience so caused is regarded in law as the consideration for the

promise.

KINDS OF CONSIDERATION ∙ A consideration may be: 1. Executed or Present 2.

Executory or Future 2. Past 2.6 LEGALITY OF OBJECT (Sections 23, 24) ∙An agreement

will not be enforceable if its object or the consideration is unlawful. According to Section

23 of the Act, the consideration and the object of an agreement are unlawful in the

following cases: What consideration and objects are unlawful – agreement VOID 1. If it is

forbidden by law 2. If it is of such a nature that if permitted, it would defeat the provisions

of any law. 2. If it is fraudulent. An agreement with a view to defraud other is void. 4. If it

involves or implies injury to the person or property of another. If the object of an agreement

is to injure the person or property of another it is void. 5. If the Court regards it as immoral

or opposed to public policy. An agreement, whose object or consideration is immoral or is

opposed to the public policy, is void. Ex- A partnership entered into for the purpose of doing

business in arrack (local alcoholic drink) on a licence granted only to one of the partners, is

void ab-initio whether the partnership was entered into before the licence was granted or

afterwards as it involved a transfer of licence, which is forbidden and penalised by the

Akbari Act and the rules thereunder [VeluPayaychi v. Siva Sooriam, AIR (1950) Mad. 987].

2.7 VOID and VOIDABLE Agreements (Sections 26-30) Void agreement 1. The following

are the additional grounds declaring agreements as void: - (i) Agreements by person who are

not competent to contract. (ii) Agreements under a mutual mistake of fact material to the

agreement. (iii) Agreement with unlawful consideration. (iv) Agreement without

consideration. (Exception – if such an agreement is in writing and registered or for a past

consideration) (v) Agreement in restraint of marriage. (vi) Agreement in restraint of trade

(vii) Agreements in restrain of legal proceedings, (viii) Agreements void for uncertainty

(Agreements, the meaning of which is not certain, or capable of being made certain) (ix)

Agreements by way of wager (a promise to give money or money's worth upon the

determination or ascertainment of an uncertain event) (x) Agreements against Public Policy

.(xi) Agreements to do impossible act. Voidable agreements ∙An agreement, which has been

entered into by misrepresentation, fraud, coercion is voidable, at the option of the aggrieved

party.

2.8 CONTINGENT CONTRACTS (SECTIONS 31-36) ∙A contingent contract is a contract

to do or not to do something, if some event, collateral to such contract does or does not

happen. When a contingent contract may be enforced ∙ Contingent contracts may be

held that the directors were not liable in fraud because they honestly believed what they said

.

CONSIDERATION [Sections 2(d), 10,23-25, 148, 185] Definition ∙ Consideration is what a

promisor demands as the price for his promise. In simple words, it means 'something in

return.' ∙ Consideration has been defined as quot;When at the desire of the promisor, the

promisee or any other person has done or abstained from doing, or does or abstains from

doing, or promises to do or promises to abstain from doing something, such act or

abstinence or promise is called a consideration for the promise.quot;

IMPORTANCE OF CONSIDERATION ∙ A promise without consideration is purely

gratuitous and, however sacred and binding in honour it may be, cannot create a legal

obligation. ∙ A person who makes a promise to do or abstain from doing something usually

does so as a return or equivalent of some loss, damage, or inconvenience that may have

been occasioned to the other party in respect of the promise. The benefit so received and the

loss, damage or inconvenience so caused is regarded in law as the consideration for the

promise.

KINDS OF CONSIDERATION ∙ A consideration may be: 1. Executed or Present 2.

Executory or Future 2. Past 2.6 LEGALITY OF OBJECT (Sections 23, 24) ∙An agreement

will not be enforceable if its object or the consideration is unlawful. According to Section

23 of the Act, the consideration and the object of an agreement are unlawful in the

following cases: What consideration and objects are unlawful – agreement VOID 1. If it is

forbidden by law 2. If it is of such a nature that if permitted, it would defeat the provisions

of any law. 2. If it is fraudulent. An agreement with a view to defraud other is void. 4. If it

involves or implies injury to the person or property of another. If the object of an agreement

is to injure the person or property of another it is void. 5. If the Court regards it as immoral

or opposed to public policy. An agreement, whose object or consideration is immoral or is

opposed to the public policy, is void. Ex- A partnership entered into for the purpose of doing

business in arrack (local alcoholic drink) on a licence granted only to one of the partners, is

void ab-initio whether the partnership was entered into before the licence was granted or

afterwards as it involved a transfer of licence, which is forbidden and penalised by the

Akbari Act and the rules thereunder [VeluPayaychi v. Siva Sooriam, AIR (1950) Mad. 987].

2.7 VOID and VOIDABLE Agreements (Sections 26-30) Void agreement 1. The following

are the additional grounds declaring agreements as void: - (i) Agreements by person who are

not competent to contract. (ii) Agreements under a mutual mistake of fact material to the

agreement. (iii) Agreement with unlawful consideration. (iv) Agreement without

consideration. (Exception – if such an agreement is in writing and registered or for a past

consideration) (v) Agreement in restraint of marriage. (vi) Agreement in restraint of trade

(vii) Agreements in restrain of legal proceedings, (viii) Agreements void for uncertainty

(Agreements, the meaning of which is not certain, or capable of being made certain) (ix)

Agreements by way of wager (a promise to give money or money's worth upon the

determination or ascertainment of an uncertain event) (x) Agreements against Public Policy

.(xi) Agreements to do impossible act. Voidable agreements ∙An agreement, which has been

entered into by misrepresentation, fraud, coercion is voidable, at the option of the aggrieved

party.

2.8 CONTINGENT CONTRACTS (SECTIONS 31-36) ∙A contingent contract is a contract

to do or not to do something, if some event, collateral to such contract does or does not

happen. When a contingent contract may be enforced ∙ Contingent contracts may be

enforced when that uncertain future event has happened. If the event becomes impossible,

such contracts become void.

ESSENTIAL ELEMENTS OF A CONTINGENT CONTACT 1. There must be a valid

contract. 2. The performance of the contract must be conditional. 3. The even must be

uncertain. 4. The event must be collateral to the contact. 5. The event must be an act of the

party. 6. The event should not be the discretion of the promisor.

2.9 QUASI CONTRACTS [SECTIONS 68- 72] ∙ The term `quasi contract` may be defined

as a ` contract which resembles that created by a contract.` as a matter of fact, `quasi

contract` is not a contract in the strict sense of the term, because there is no real contract in

existence. Moreover, there is no intention of the parties to enter into a contract. It is an

obligation, which the law creates in the absence of any agreement. CIRCUMSTANCES OF

QUASI CONTRACTS ∙ Following are to be deemed Quasi-contracts. (i) Claim for

Necessaries Supplied to a person incapable of Contracting or on his account. (ii)

Reimbursement of person paying money due by another in payment of which he is

interested. Obligation of a person enjoying benefits of non-gratuitous act. (iii)

Responsibility of Finder of Goods (iv) Liability of person to whom money is paid, or thing

delivered by mistake or under coercion Ex- A, who supplies the wife and children of B, a

lunatic, with necessaries suitable to their conditions in life, is entitled to be reimbursed from

B's property.

2.10 PERFORMANCE OF CONTRACTS [SECTIONS 37-67] Offer to perform or tender

of performance ∙ According to Section 38, if a valid offer/tender is made and is not accepted

by the promisee, the promisor shall not be responsible for non-performance nor shall he lose

his rights under the contract. A tender or offer of performance to be valid must satisfy the

following conditions: 1. It must be unconditional. 2. It must be made at proper time and

place, and performed in the agreed manner.

WHO MUST PERFORM ∙ Promisor - The promise may be performed by promisor himself,

or his agent or by his legal representative. ∙ Agent - the promisor may employ a competent

person to perform it. ∙ Legal Representative - In case of death of the promisor, the Legal

representative must perform the promise unless a contrary intention appears from the

contract.

CONTRACTS, WHICH NEED NOT BE PERFORMED I. If the parties mutually agree to

substitute the original contract by a new one or to rescind or alter it 2. If the promisee

dispenses with or remits, wholly or in part the performance of the promise made to him or

extends the time for such performance or accepts any satisfaction for it. 2. If the person, at

whose option the contract is voidable, rescinds it. 4. If the promisee neglects or refuses to

afford the promisor reasonable facilities for the performance of his promise.

2.11 DISCHARGE OF CONTRACTS [Sections 73-75]

1. ∙ The cases in which a contract is discharged may be classified as follows: A. By

performance or tender B. By mutual consent θ A contract may terminate by mutual consent

in any of the following ways: - a. Novation (substitution) b. Recession (cancellation) c.

Alteration C. By subsequent impossibility D. By operation of law E. By breach

such contracts become void.

ESSENTIAL ELEMENTS OF A CONTINGENT CONTACT 1. There must be a valid

contract. 2. The performance of the contract must be conditional. 3. The even must be

uncertain. 4. The event must be collateral to the contact. 5. The event must be an act of the

party. 6. The event should not be the discretion of the promisor.

2.9 QUASI CONTRACTS [SECTIONS 68- 72] ∙ The term `quasi contract` may be defined

as a ` contract which resembles that created by a contract.` as a matter of fact, `quasi

contract` is not a contract in the strict sense of the term, because there is no real contract in

existence. Moreover, there is no intention of the parties to enter into a contract. It is an

obligation, which the law creates in the absence of any agreement. CIRCUMSTANCES OF

QUASI CONTRACTS ∙ Following are to be deemed Quasi-contracts. (i) Claim for

Necessaries Supplied to a person incapable of Contracting or on his account. (ii)

Reimbursement of person paying money due by another in payment of which he is

interested. Obligation of a person enjoying benefits of non-gratuitous act. (iii)

Responsibility of Finder of Goods (iv) Liability of person to whom money is paid, or thing

delivered by mistake or under coercion Ex- A, who supplies the wife and children of B, a

lunatic, with necessaries suitable to their conditions in life, is entitled to be reimbursed from

B's property.

2.10 PERFORMANCE OF CONTRACTS [SECTIONS 37-67] Offer to perform or tender

of performance ∙ According to Section 38, if a valid offer/tender is made and is not accepted

by the promisee, the promisor shall not be responsible for non-performance nor shall he lose

his rights under the contract. A tender or offer of performance to be valid must satisfy the

following conditions: 1. It must be unconditional. 2. It must be made at proper time and

place, and performed in the agreed manner.

WHO MUST PERFORM ∙ Promisor - The promise may be performed by promisor himself,

or his agent or by his legal representative. ∙ Agent - the promisor may employ a competent

person to perform it. ∙ Legal Representative - In case of death of the promisor, the Legal

representative must perform the promise unless a contrary intention appears from the

contract.

CONTRACTS, WHICH NEED NOT BE PERFORMED I. If the parties mutually agree to

substitute the original contract by a new one or to rescind or alter it 2. If the promisee

dispenses with or remits, wholly or in part the performance of the promise made to him or

extends the time for such performance or accepts any satisfaction for it. 2. If the person, at

whose option the contract is voidable, rescinds it. 4. If the promisee neglects or refuses to

afford the promisor reasonable facilities for the performance of his promise.

2.11 DISCHARGE OF CONTRACTS [Sections 73-75]

1. ∙ The cases in which a contract is discharged may be classified as follows: A. By

performance or tender B. By mutual consent θ A contract may terminate by mutual consent

in any of the following ways: - a. Novation (substitution) b. Recession (cancellation) c.

Alteration C. By subsequent impossibility D. By operation of law E. By breach

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

SESSION:5

REMEDIES FOR BREACH OF CONTRACT (SECTIONS 73-75) ∙ As soon as either party

commits a breach of the contract, the other party becomes entitled to any of the following

reliefs: - a) Recession of the contract b) Damages (monetary compensation) c) Specific

performance d) Injunction e) Quantum meruit Ex – A, a singer contracts with B, the manager

of a theatre, to sing at his theatre for two nights in every week during the next two months,

and B engages to pay her Rs. 100 for each night’s performance. On the sixth night, A wilfully

absents herself from the theatre and B in consequence, rescinds the contract. B is entitled to

claim compensation for the damages for which he has sustained through the non-fulfilment of

the contract. 2.13 CONTRACTS OF INDEMNITY [SECTIONS 124-125] What is contract

of indemnity ∙ A contract of indemnity is a contract whereby one party promises to save the

other from loss caused to him by the conduct of the promisor himself or by the conduct of

any other party. ∙ A contract of indemnity may arise either (1) by an express promise or (2) by

operation of law i.e. the duty of a principal to indemnify an agent from consequences of all

lawful acts done by him as an agent.

RIGHTS OF INDEMNIFIED (THE INDEMNITY HOLDER) ∙ The indemnity holder is

entitled to recover from the promisor a) All the damages which may be compelled to pay in

any suit in respect of any matter to which the promise to indemnify applies b) All costs of suit

which he may have to pay to such third party provided in bringing or defending the suit (i) he

acted under the authority of the indemnifier or (ii) he did not act in contravention of the

orders of the indemnifier and in such a such as a prudent man would act in his own case. c)

All sums which he may have paid under the terms of any compromise of any such suit, if the

compromise was not contrary to the orders of the indemnifier, and was one which it would

have been prudent for the promisee to make.

RIGHTS OF INDEMNIFIER ∙ The Contract Act makes no mention of the rights of the

indemnifier. It has been held in Jaswant Singh Vs. Section of State 14 Bom 299 that the

indemnifier becomes entitled to the benefit of all the securities, which the creditor has against

the principal debtor whether he was aware of them, or not.

REMEDIES FOR BREACH OF CONTRACT (SECTIONS 73-75) ∙ As soon as either party

commits a breach of the contract, the other party becomes entitled to any of the following

reliefs: - a) Recession of the contract b) Damages (monetary compensation) c) Specific

performance d) Injunction e) Quantum meruit Ex – A, a singer contracts with B, the manager

of a theatre, to sing at his theatre for two nights in every week during the next two months,

and B engages to pay her Rs. 100 for each night’s performance. On the sixth night, A wilfully

absents herself from the theatre and B in consequence, rescinds the contract. B is entitled to

claim compensation for the damages for which he has sustained through the non-fulfilment of

the contract. 2.13 CONTRACTS OF INDEMNITY [SECTIONS 124-125] What is contract

of indemnity ∙ A contract of indemnity is a contract whereby one party promises to save the

other from loss caused to him by the conduct of the promisor himself or by the conduct of

any other party. ∙ A contract of indemnity may arise either (1) by an express promise or (2) by

operation of law i.e. the duty of a principal to indemnify an agent from consequences of all

lawful acts done by him as an agent.

RIGHTS OF INDEMNIFIED (THE INDEMNITY HOLDER) ∙ The indemnity holder is

entitled to recover from the promisor a) All the damages which may be compelled to pay in

any suit in respect of any matter to which the promise to indemnify applies b) All costs of suit

which he may have to pay to such third party provided in bringing or defending the suit (i) he

acted under the authority of the indemnifier or (ii) he did not act in contravention of the

orders of the indemnifier and in such a such as a prudent man would act in his own case. c)

All sums which he may have paid under the terms of any compromise of any such suit, if the

compromise was not contrary to the orders of the indemnifier, and was one which it would

have been prudent for the promisee to make.

RIGHTS OF INDEMNIFIER ∙ The Contract Act makes no mention of the rights of the

indemnifier. It has been held in Jaswant Singh Vs. Section of State 14 Bom 299 that the

indemnifier becomes entitled to the benefit of all the securities, which the creditor has against

the principal debtor whether he was aware of them, or not.

SESSION :6

Special Contracts: Indemnity, Guarantee, Bailment and Pledge

The term Indemnity literally means “Security against loss". In a contract of indemnity one

party – i.e. the indemnifier promise to compensate the other party i.e. the indemnified against

the loss suffered by the other. The definition of a contract of indemnity as laid down in

Section 124 – “A contract by which one party promises to save the other from loss caused to

him by the conduct of the promisor himself, or by the conduct of any other person, is called a

contract of indemnity.

ILLUSTRATION A contracts to indemnify B against the consequences of any proceedings

which C may take against B in respect of a certain sum of 200 rupees. This is a contract of

indemnity. VALIDITY OF INDEMNITY AGREEMENT A contract of indemnity is one of

the species of contracts. The principles applicable to contracts in general are also applicable

to such contracts so much so that the rules such as free consent, legality of object, etc., are

equally applicable. Where the consent to an agreement is caused by coercion, fraud,

misrepresentation, the agreement is voidable at the option of the party whose consent was so

caused. As per the requirement of the Contract Act, the object of the agreement must be

lawful. An agreement, the object of which is opposed to the law or against the public policy,

is either unlawful or void depending upon the provision of the law to which it is subject.

RIGHT OF THE INDEMNITY HOLDER – (SECTION 125) • An indemnity holder (i.e.

indemnified) acting within the scope of his authority is entitled to the following rights 1.

Right to recover damages – he is entitled to recover all damages which he might have been

compelled to pay in any suit in respect of any matter covered by the contract. 2. Right to

recover costs – He is entitled to recover all costs incidental to the institution and defending of

the suit. 3. Right to recover sums paid under compromise – he is entitled to recover all

amounts which he had paid under the terms of the compromise of such suit. However, the

compensation must not be against the directions of the indemnifier. It must be prudent and

authorized by the indemnifier. •

RIGHT OF INDEMNIFIER – • Section 125 of the Act only lays down the rights of the

indemnified and is quite silent of the rights of indemnifier • as if the indemnifier has no rights

but only liability towards the indemnified.

CONTRACT OF GUARANTEE • A "contract of guarantee " is a contract to perform the

promise, or discharge the liability, of a third person in case of his default. The person who

gives the guarantee is called the " surety“. • the person in respect of whose default the

guarantee is given is called the " principal debtor ", and the person to whom the guarantee is

given is called the " creditor ". A guarantee may be either oral or written. •

WHO CAN EMPLOY AN AGENT ∙ Any person, who is capable to contract may appoint as

agent. Thus, a minor or lunatic cannot contract through an agent since they cannot contract

themselves personally either.

WHO MAY BE AN AGENT ∙In considering the contract of agency itself (i.e., the relation

between principal and agent), the contractual capacity of the agent becomes important.

HOW AGENCY IS CREATED ∙ A contract of agency may be created by in any of the

following three ways: - (1) Express Agency (2) Implied Agency (3) Agency by Estoppel (4)

Special Contracts: Indemnity, Guarantee, Bailment and Pledge

The term Indemnity literally means “Security against loss". In a contract of indemnity one

party – i.e. the indemnifier promise to compensate the other party i.e. the indemnified against

the loss suffered by the other. The definition of a contract of indemnity as laid down in

Section 124 – “A contract by which one party promises to save the other from loss caused to

him by the conduct of the promisor himself, or by the conduct of any other person, is called a

contract of indemnity.

ILLUSTRATION A contracts to indemnify B against the consequences of any proceedings

which C may take against B in respect of a certain sum of 200 rupees. This is a contract of

indemnity. VALIDITY OF INDEMNITY AGREEMENT A contract of indemnity is one of

the species of contracts. The principles applicable to contracts in general are also applicable

to such contracts so much so that the rules such as free consent, legality of object, etc., are

equally applicable. Where the consent to an agreement is caused by coercion, fraud,

misrepresentation, the agreement is voidable at the option of the party whose consent was so

caused. As per the requirement of the Contract Act, the object of the agreement must be

lawful. An agreement, the object of which is opposed to the law or against the public policy,

is either unlawful or void depending upon the provision of the law to which it is subject.

RIGHT OF THE INDEMNITY HOLDER – (SECTION 125) • An indemnity holder (i.e.

indemnified) acting within the scope of his authority is entitled to the following rights 1.

Right to recover damages – he is entitled to recover all damages which he might have been

compelled to pay in any suit in respect of any matter covered by the contract. 2. Right to

recover costs – He is entitled to recover all costs incidental to the institution and defending of

the suit. 3. Right to recover sums paid under compromise – he is entitled to recover all

amounts which he had paid under the terms of the compromise of such suit. However, the

compensation must not be against the directions of the indemnifier. It must be prudent and

authorized by the indemnifier. •

RIGHT OF INDEMNIFIER – • Section 125 of the Act only lays down the rights of the

indemnified and is quite silent of the rights of indemnifier • as if the indemnifier has no rights

but only liability towards the indemnified.

CONTRACT OF GUARANTEE • A "contract of guarantee " is a contract to perform the

promise, or discharge the liability, of a third person in case of his default. The person who

gives the guarantee is called the " surety“. • the person in respect of whose default the

guarantee is given is called the " principal debtor ", and the person to whom the guarantee is

given is called the " creditor ". A guarantee may be either oral or written. •

WHO CAN EMPLOY AN AGENT ∙ Any person, who is capable to contract may appoint as

agent. Thus, a minor or lunatic cannot contract through an agent since they cannot contract

themselves personally either.

WHO MAY BE AN AGENT ∙In considering the contract of agency itself (i.e., the relation

between principal and agent), the contractual capacity of the agent becomes important.

HOW AGENCY IS CREATED ∙ A contract of agency may be created by in any of the

following three ways: - (1) Express Agency (2) Implied Agency (3) Agency by Estoppel (4)

Agency by Holding Out (5) Agency of Necessity (6) Agency By Ratification DUTIES OF

AGENT 1. To conduct the business of agency according to the principal's directions 2. The

agent should conduct the business with the skill and diligence that is generally possessed by

persons engaged in similar business, except where the principal knows that the agent is

wanting in skill. 3. To render proper accounts. 4. To use all reasonable diligence, in

communicating with his principal, and in seeking to obtain his instructions. 5. Not to make

any secret profits 6. Not to deal on his own account 7. Agent not entitled to remuneration for

business misconducted. 8. An agent should not disclose confidential information supplied to

him by the principal [Weld Blundell v. Stephens (1920) AC. 1956]. 9. When an agency is

terminated by the principal dying or becoming of unsound mind, the agent is bound to take

on behalf of the representatives of his late principal, all reasonable steps for the protection

and preservation of the interests entrusted to him.

Session 7:

Representations, Warranties and Covenants: Back to the Basics in Contracts

“Representations,” “warranties” and “covenants” are so common in contracts that the words

are likely to be overlooked. They appear not only as nouns, but as verb forms as well.

Sometimes there is a separate section for each word, implying that they have distinct

meanings. Often they are grouped together as “represents and warrants” or “represents,

warrants and covenants.” Unfortunately, these repetitious phrases blur their meanings. Their

imprecise use does not frequently result in litigation, but there’s much to be said for reducing

redundancy and ambiguity.

These words are basic building blocks of contracts and have a long history. Each has

traditionally had a distinct meaning and purpose. The key difference among these words is

temporal – past and present for representations; past, present, but mainly future for

warranties; and mainly future for covenants. The remedies for a false representation, breach

of a warranty or violation of a covenant also have differed. Giving attention when drafting or

editing a contract to their backgrounds and the traditional distinctions among them will

promote clarity.

Representations

In traditional usage, a representation precedes and induces a contract. It is information by

which a contracting party decides whether to proceed with the contract. A representation is an

express or implied statement that one party to the contract makes to the other before or at the

time the contract is entered into regarding a past or existing fact. An example might be that a

seller of equipment represents that no notice of patent infringement had been received.

A representation traditionally was not part of a contract, and a claim for damages due to a

misrepresentation generally would not be allowed. Instead, a claim that a misrepresentation

induced a contract might be pursued in fraud, either to rescind the contract or for damages. In

some instances, a claim might be based on the tort of negligent misrepresentation.

If a representation was included as part of a contract, it typically would function as a

“condition” or “warranty.” A condition is a vital term going to the root of the contract (for

example, that a lawyer hired under an employment agreement must be licensed to practice

law), which, if the condition were false, would entitle the employer to repudiate the contract.

In contrast, a representation in a contract might be a “warranty,” which would be an

independent, subsidiary promise that did not go to the root of the contract (such as that the