Transactions - Week 1 | Manual Accounting Practice Set | Desklib

VerifiedAdded on 2023/06/15

|14

|4109

|114

AI Summary

This page is the feedback page for Transactions - Week 1 of the Manual Accounting Practice Set for Technology Boutique, Australasian Edition 3. It provides instructions on how to record transactions that occurred during the first week of June into the company's journals and post the appropriate entries to the ledger accounts. The page also includes additional instructions and tips for completing the practice set. Subject: Accounting, Course Code: N/A, Course Name: Manual Accounting Practice Set, College/University: Technology Boutique, Australasian Edition 3.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 1/14

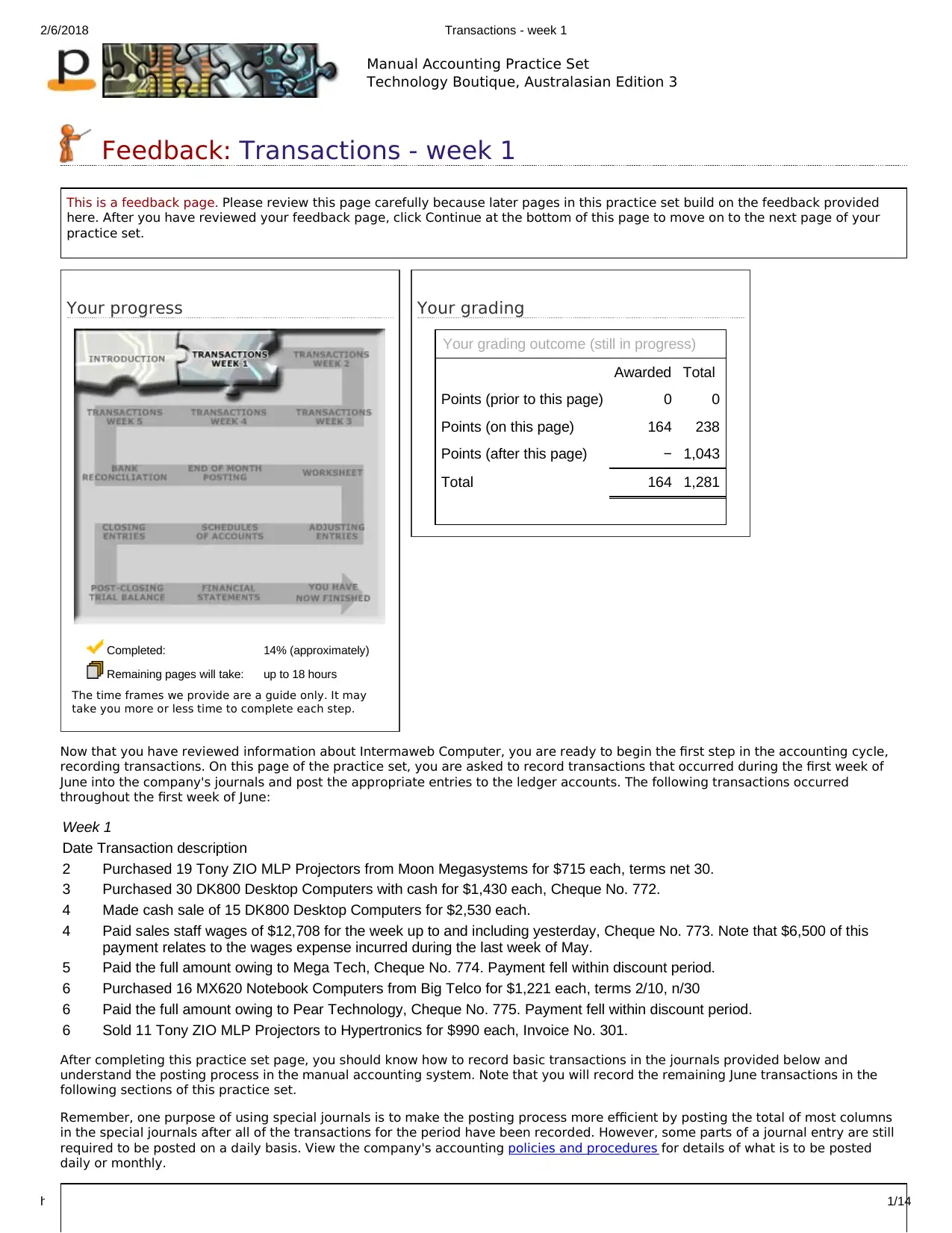

Your progress

Completed: 14% (approximately)

Remaining pages will take: up to 18 hours

The time frames we provide are a guide only. It may

take you more or less time to complete each step.

Your grading

Your grading outcome (still in progress)

Awarded Total

Points (prior to this page) 0 0

Points (on this page) 164 238

Points (after this page) − 1,043

Total 164 1,281

Manual Accounting Practice Set

Technology Boutique, Australasian Edition 3

Feedback: Transactions - week 1

This is a feedback page. Please review this page carefully because later pages in this practice set build on the feedback provided

here. After you have reviewed your feedback page, click Continue at the bottom of this page to move on to the next page of your

practice set.

Now that you have reviewed information about Intermaweb Computer, you are ready to begin the first step in the accounting cycle,

recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of

June into the company's journals and post the appropriate entries to the ledger accounts. The following transactions occurred

throughout the first week of June:

Week 1

Date Transaction description

2 Purchased 19 Tony ZIO MLP Projectors from Moon Megasystems for $715 each, terms net 30.

3 Purchased 30 DK800 Desktop Computers with cash for $1,430 each, Cheque No. 772.

4 Made cash sale of 15 DK800 Desktop Computers for $2,530 each.

4 Paid sales staff wages of $12,708 for the week up to and including yesterday, Cheque No. 773. Note that $6,500 of this

payment relates to the wages expense incurred during the last week of May.

5 Paid the full amount owing to Mega Tech, Cheque No. 774. Payment fell within discount period.

6 Purchased 16 MX620 Notebook Computers from Big Telco for $1,221 each, terms 2/10, n/30

6 Paid the full amount owing to Pear Technology, Cheque No. 775. Payment fell within discount period.

6 Sold 11 Tony ZIO MLP Projectors to Hypertronics for $990 each, Invoice No. 301.

After completing this practice set page, you should know how to record basic transactions in the journals provided below and

understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the

following sections of this practice set.

Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns

in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still

required to be posted on a daily basis. View the company's accounting policies and procedures for details of what is to be posted

daily or monthly.

https://www.perdisco.com/elms/qsam/html/qsam.aspx 1/14

Your progress

Completed: 14% (approximately)

Remaining pages will take: up to 18 hours

The time frames we provide are a guide only. It may

take you more or less time to complete each step.

Your grading

Your grading outcome (still in progress)

Awarded Total

Points (prior to this page) 0 0

Points (on this page) 164 238

Points (after this page) − 1,043

Total 164 1,281

Manual Accounting Practice Set

Technology Boutique, Australasian Edition 3

Feedback: Transactions - week 1

This is a feedback page. Please review this page carefully because later pages in this practice set build on the feedback provided

here. After you have reviewed your feedback page, click Continue at the bottom of this page to move on to the next page of your

practice set.

Now that you have reviewed information about Intermaweb Computer, you are ready to begin the first step in the accounting cycle,

recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of

June into the company's journals and post the appropriate entries to the ledger accounts. The following transactions occurred

throughout the first week of June:

Week 1

Date Transaction description

2 Purchased 19 Tony ZIO MLP Projectors from Moon Megasystems for $715 each, terms net 30.

3 Purchased 30 DK800 Desktop Computers with cash for $1,430 each, Cheque No. 772.

4 Made cash sale of 15 DK800 Desktop Computers for $2,530 each.

4 Paid sales staff wages of $12,708 for the week up to and including yesterday, Cheque No. 773. Note that $6,500 of this

payment relates to the wages expense incurred during the last week of May.

5 Paid the full amount owing to Mega Tech, Cheque No. 774. Payment fell within discount period.

6 Purchased 16 MX620 Notebook Computers from Big Telco for $1,221 each, terms 2/10, n/30

6 Paid the full amount owing to Pear Technology, Cheque No. 775. Payment fell within discount period.

6 Sold 11 Tony ZIO MLP Projectors to Hypertronics for $990 each, Invoice No. 301.

After completing this practice set page, you should know how to record basic transactions in the journals provided below and

understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the

following sections of this practice set.

Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns

in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still

required to be posted on a daily basis. View the company's accounting policies and procedures for details of what is to be posted

daily or monthly.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 2/14

Instructions for week 1

Record all week 1 transactions in the relevant journals.

Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should

be recorded in the general journal.

Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and

procedures.

Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You

will enter this after you prepare the Bank Reconciliation Statement.

Update inventory cards on a daily basis.

Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number,

round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original

amount.

Additional instructions

Displaying selected accounting records:

To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each

page you can access all accounting records necessary to answer the questions on that page.

There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you

may also select to view just one particular accounting record by selecting the appropriate tab.

If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you

have entered will remain in that accounting record and be displayed whenever you can see that accounting record.

Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting

records have been completed. You are required to complete all relevant accounting records before pressing the Submit

answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers.

Journals:

Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split

up the relevant transaction into more than one line in the special journal.

For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under

the column labeled Account. In this practice set you are required to select an account for each transaction in the special

journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name

for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name

selected will correspond to the heading of one of the columns in that special journal.

For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting

to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post

Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an

entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds

to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these

transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref.

column for these transactions.

You are required to enter the GST component of a transaction as a positive number into the journals. To record an amount

in a GST account, you need to enter that amount into the appropriate debit or credit column.

Note that in special journals, the Other Accounts column should not be used to record movements of inventory.

If a cheque number is not required, you need to fill the appropriate input box with an X.

When recording a transaction into the general journal, the amount recorded in one account may be the sum of the amounts

recorded in two or more accounts. For example, a journal entry may consist of a debit of $100 to Account A, a credit of $40

to Account B and a credit of $60 to Account C. For these types of transactions, you must not split the transaction into more

than one journal entry i.e. (1) Dr Account A $40, Cr Account B $40 and (2) Dr Account A $60, Cr Account C $60. Instead,

you must record the $100 debit to Account A in a single line.

There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these

cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the

subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the

reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you

should type '110/110-1' into the Post Ref. column.

General journal entries do NOT require a description of the journal entries.

Ledgers:

When posting a transaction to a ledger account, under the Description column, please type the description of the transaction

directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an

electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'.

For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop-down box provided in

order to receive full points.

If the balance of a ledger account is zero you do not need to select a debit or credit from the drop-down box.

Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not

split up the relevant transaction into more than one line in the subsidiary ledger.

Both journals and ledgers:

1)

2)

3)

https://www.perdisco.com/elms/qsam/html/qsam.aspx 2/14

Instructions for week 1

Record all week 1 transactions in the relevant journals.

Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should

be recorded in the general journal.

Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and

procedures.

Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You

will enter this after you prepare the Bank Reconciliation Statement.

Update inventory cards on a daily basis.

Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number,

round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original

amount.

Additional instructions

Displaying selected accounting records:

To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each

page you can access all accounting records necessary to answer the questions on that page.

There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you

may also select to view just one particular accounting record by selecting the appropriate tab.

If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you

have entered will remain in that accounting record and be displayed whenever you can see that accounting record.

Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting

records have been completed. You are required to complete all relevant accounting records before pressing the Submit

answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers.

Journals:

Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split

up the relevant transaction into more than one line in the special journal.

For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under

the column labeled Account. In this practice set you are required to select an account for each transaction in the special

journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name

for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name

selected will correspond to the heading of one of the columns in that special journal.

For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting

to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post

Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an

entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds

to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these

transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref.

column for these transactions.

You are required to enter the GST component of a transaction as a positive number into the journals. To record an amount

in a GST account, you need to enter that amount into the appropriate debit or credit column.

Note that in special journals, the Other Accounts column should not be used to record movements of inventory.

If a cheque number is not required, you need to fill the appropriate input box with an X.

When recording a transaction into the general journal, the amount recorded in one account may be the sum of the amounts

recorded in two or more accounts. For example, a journal entry may consist of a debit of $100 to Account A, a credit of $40

to Account B and a credit of $60 to Account C. For these types of transactions, you must not split the transaction into more

than one journal entry i.e. (1) Dr Account A $40, Cr Account B $40 and (2) Dr Account A $60, Cr Account C $60. Instead,

you must record the $100 debit to Account A in a single line.

There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these

cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the

subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the

reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you

should type '110/110-1' into the Post Ref. column.

General journal entries do NOT require a description of the journal entries.

Ledgers:

When posting a transaction to a ledger account, under the Description column, please type the description of the transaction

directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an

electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'.

For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop-down box provided in

order to receive full points.

If the balance of a ledger account is zero you do not need to select a debit or credit from the drop-down box.

Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not

split up the relevant transaction into more than one line in the subsidiary ledger.

Both journals and ledgers:

1)

2)

3)

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 3/14

ARC - Hypertronics

APC - Moon Megasystems

APC - Big Telco

Most journals and ledgers will have blank rows left at the end of this question.

Some journals and ledgers may not require any entries for this week.

When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to

the Inventory account in the general ledger on a daily basis.

Inventory cards:

Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record

a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required

depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost,

you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required

to use a separate line within the pair of lines provided for each different unit cost.

In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards ~

May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be

completed.

Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be

entered as positive numbers into the Unit Cost columns.

If you want to print this page, please read and follow the special printing information to ensure you can print the special journals in

full.

Special Journals General Journal Subsidiary Ledgers General Ledger Inventory

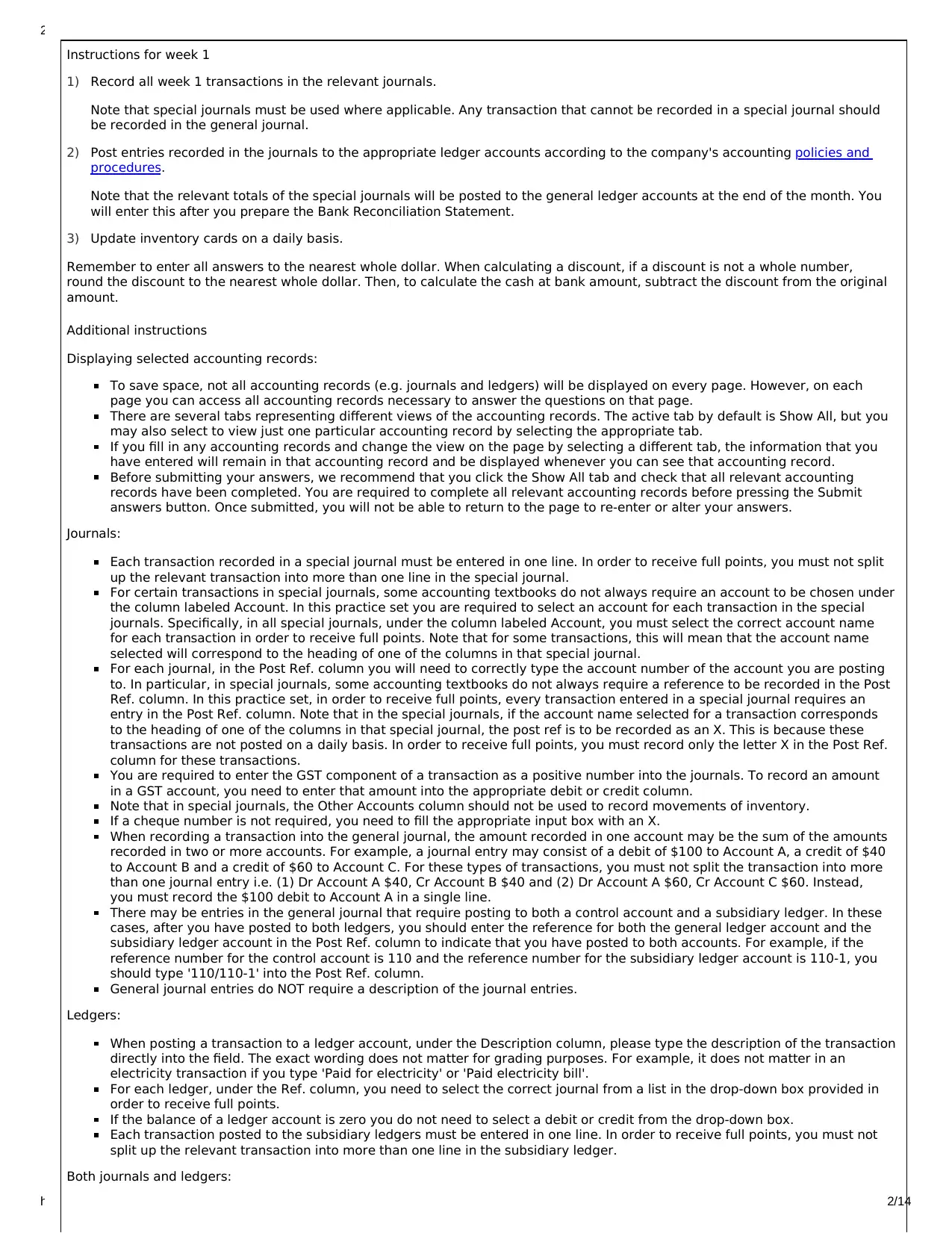

(Q=301.salesJournalWeek1)

SALES JOURNAL

Date Account Invoice

No.

Post

Ref.

Accounts

Receivable GST Sales

Revenue

Cost of

Sales

Jun 6 301 110-3 10890 990 9900 5500

Jun

Jun

Jun

Feedback

SALES JOURNAL

Date Account Invoice

No.

Post

Ref.

Accounts

Receivable GST Sales

Revenue

Cost of

Sales

Jun 6 ARC - Hypertronics 301 110-3 10,890 990 9,900 5,500

(Q=302.purchasesJournalWeek1)

PURCHASES JOURNAL

Date Account Terms Post

Ref. Inventory GST Accounts

Payable

Jun 2 net 30 210-3 12350 1235 13585

Jun 6 2/10 n/30 210-1 17760 1776 19536

Jun

Jun

Show All

https://www.perdisco.com/elms/qsam/html/qsam.aspx 3/14

ARC - Hypertronics

APC - Moon Megasystems

APC - Big Telco

Most journals and ledgers will have blank rows left at the end of this question.

Some journals and ledgers may not require any entries for this week.

When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to

the Inventory account in the general ledger on a daily basis.

Inventory cards:

Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record

a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required

depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost,

you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required

to use a separate line within the pair of lines provided for each different unit cost.

In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards ~

May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be

completed.

Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be

entered as positive numbers into the Unit Cost columns.

If you want to print this page, please read and follow the special printing information to ensure you can print the special journals in

full.

Special Journals General Journal Subsidiary Ledgers General Ledger Inventory

(Q=301.salesJournalWeek1)

SALES JOURNAL

Date Account Invoice

No.

Post

Ref.

Accounts

Receivable GST Sales

Revenue

Cost of

Sales

Jun 6 301 110-3 10890 990 9900 5500

Jun

Jun

Jun

Feedback

SALES JOURNAL

Date Account Invoice

No.

Post

Ref.

Accounts

Receivable GST Sales

Revenue

Cost of

Sales

Jun 6 ARC - Hypertronics 301 110-3 10,890 990 9,900 5,500

(Q=302.purchasesJournalWeek1)

PURCHASES JOURNAL

Date Account Terms Post

Ref. Inventory GST Accounts

Payable

Jun 2 net 30 210-3 12350 1235 13585

Jun 6 2/10 n/30 210-1 17760 1776 19536

Jun

Jun

Show All

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 4/14

Sales Revenue

Feedback

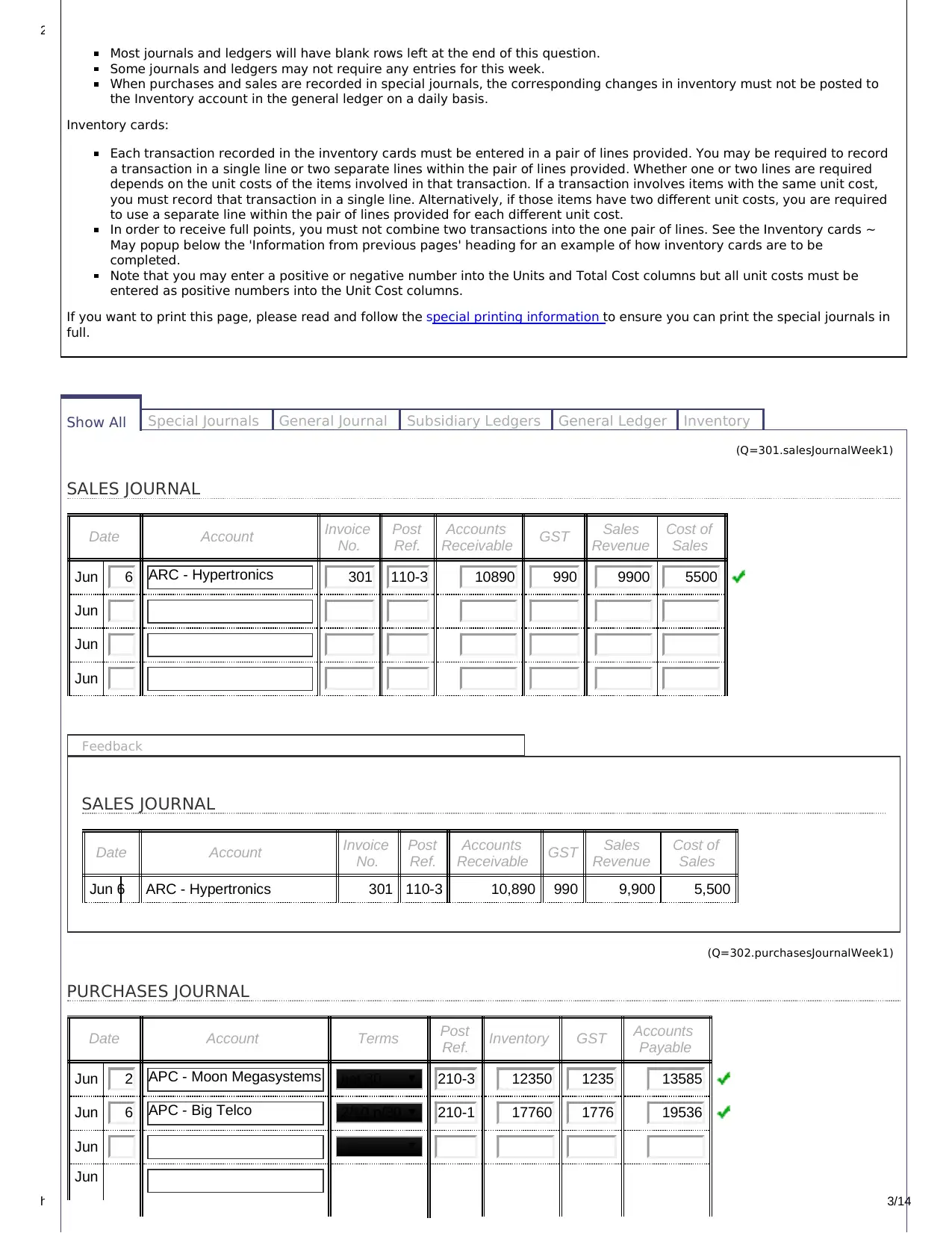

PURCHASES JOURNAL

Date Account Terms Post

Ref. Inventory GST Accounts

Payable

Jun 2 APC - Moon Megasystems net 30 210-3 12,350 1,235 13,585

Jun 6 APC - Big Telco 2/10, n/30 210-1 17,760 1,776 19,536

(Q=303.cashReceiptsJournalWeek1)

CASH RECEIPTS JOURNAL

Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as

indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are

asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of

transaction can be determined by the name of the account entered into this column.

The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to

applicable cash receipts).

Date Account Post

Ref.

Debit Credit Cost of

SalesCash at

Bank GST Discount

Allowed

Sales

Revenue GST Accounts

Receivable

Other

Accounts

Jun 4 37950 0 0 0 3450 34500 0 15600

Jun

Jun

Jun

Jun

Jun

Feedback

CASH RECEIPTS JOURNAL

Date Account Post

Ref.

Debit Credit Cost of

SalesCash at

Bank GST Discount

Allowed

Sales

Revenue GST Accounts

Receivable

Other

Accounts

Jun 4 Sales Revenue X 37,950 34,500 3,450 15,600

(Q=304.cashPaymentsJournalWeek1)

CASH PAYMENTS JOURNAL

Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as

indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are

https://www.perdisco.com/elms/qsam/html/qsam.aspx 4/14

Sales Revenue

Feedback

PURCHASES JOURNAL

Date Account Terms Post

Ref. Inventory GST Accounts

Payable

Jun 2 APC - Moon Megasystems net 30 210-3 12,350 1,235 13,585

Jun 6 APC - Big Telco 2/10, n/30 210-1 17,760 1,776 19,536

(Q=303.cashReceiptsJournalWeek1)

CASH RECEIPTS JOURNAL

Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as

indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are

asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of

transaction can be determined by the name of the account entered into this column.

The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to

applicable cash receipts).

Date Account Post

Ref.

Debit Credit Cost of

SalesCash at

Bank GST Discount

Allowed

Sales

Revenue GST Accounts

Receivable

Other

Accounts

Jun 4 37950 0 0 0 3450 34500 0 15600

Jun

Jun

Jun

Jun

Jun

Feedback

CASH RECEIPTS JOURNAL

Date Account Post

Ref.

Debit Credit Cost of

SalesCash at

Bank GST Discount

Allowed

Sales

Revenue GST Accounts

Receivable

Other

Accounts

Jun 4 Sales Revenue X 37,950 34,500 3,450 15,600

(Q=304.cashPaymentsJournalWeek1)

CASH PAYMENTS JOURNAL

Note: In order to receive full points, for each transaction you must select an account under the column labelled 'Account', as

indicated under the additional instructions above. Since all transactions in this journal affect the Cash at Bank account, you are

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 5/14

Inventory

Wages Payable

APC - Mega Tech

APC - Pear Technology

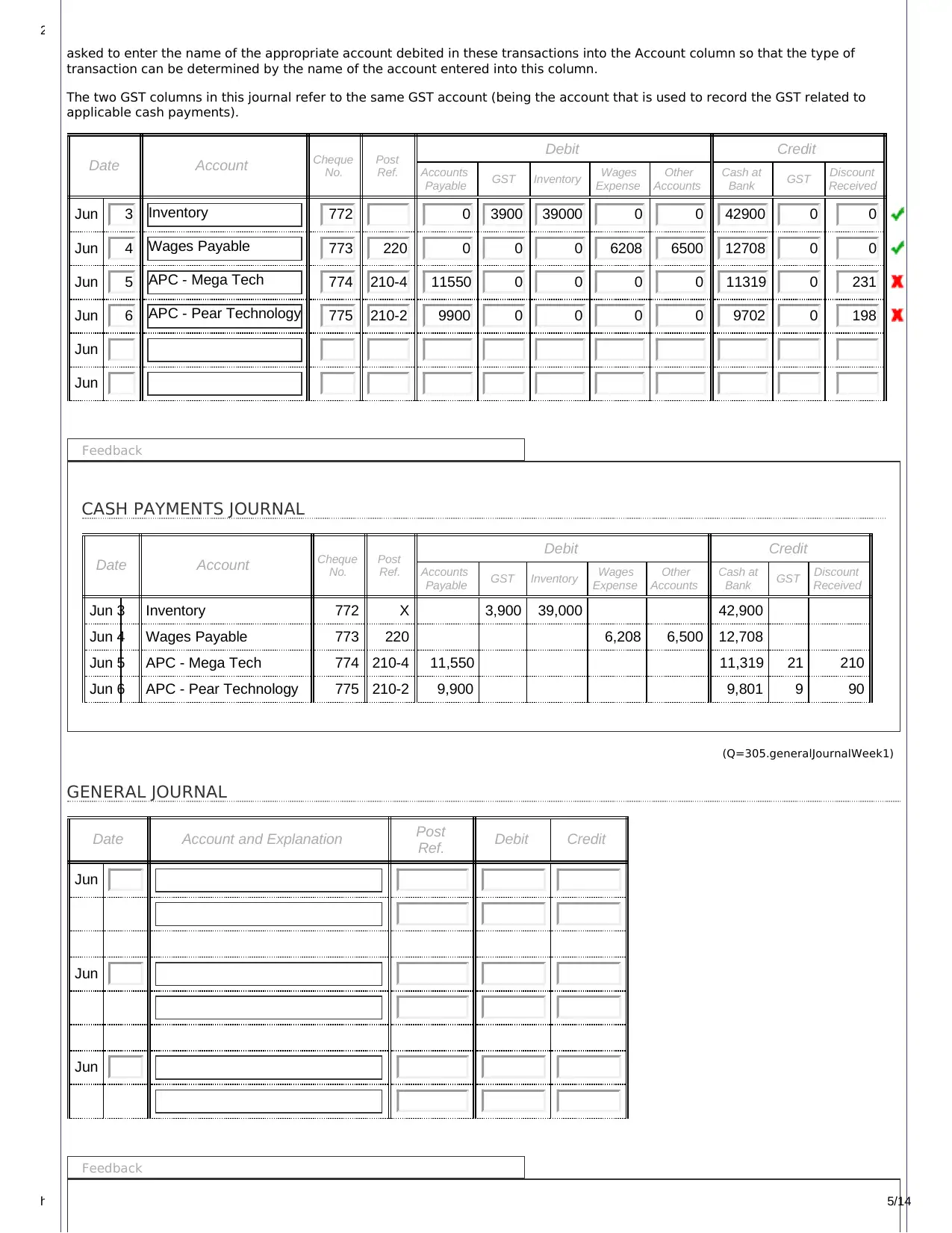

asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of

transaction can be determined by the name of the account entered into this column.

The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to

applicable cash payments).

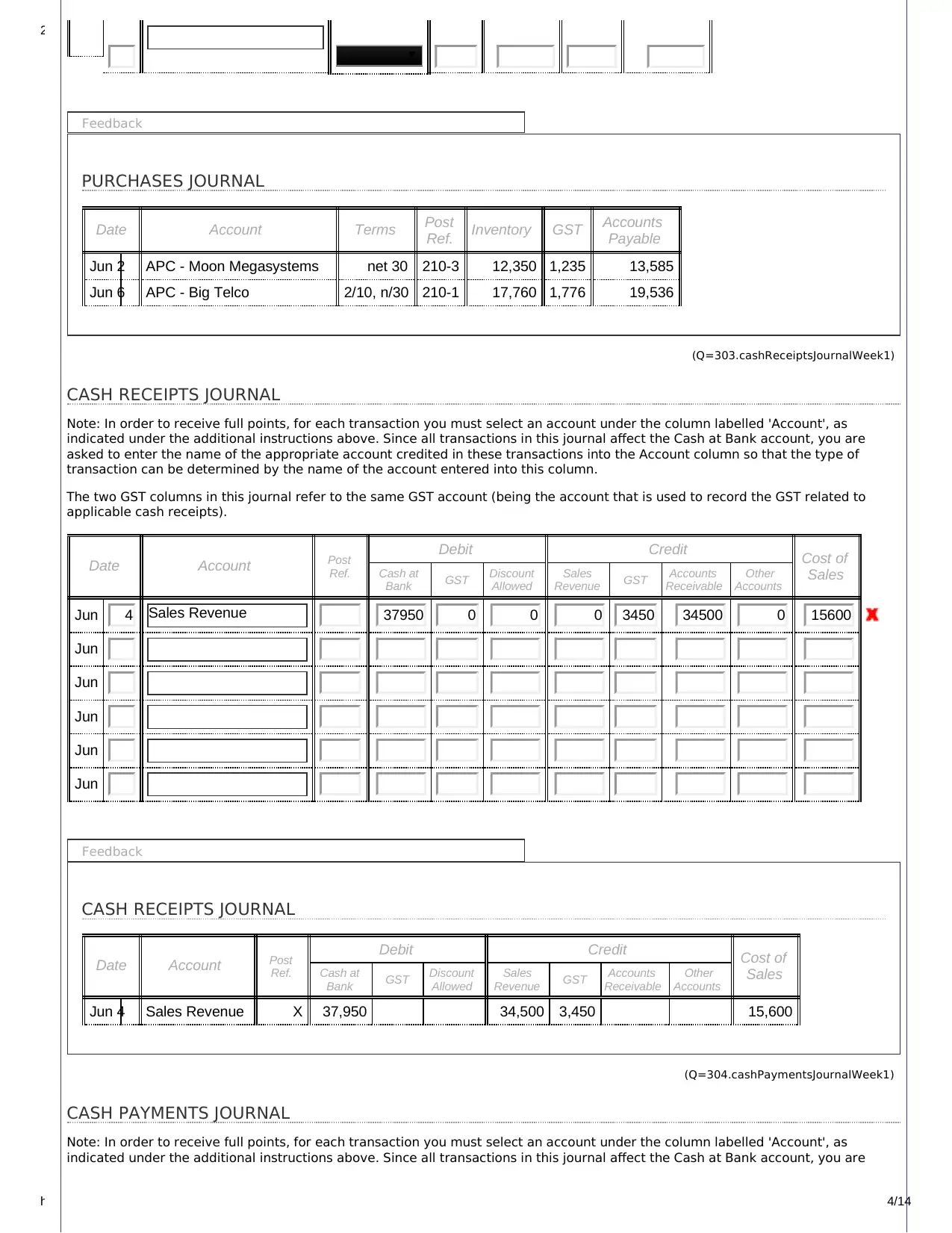

Date Account Cheque

No.

Post

Ref.

Debit Credit

Accounts

Payable GST Inventory Wages

Expense

Other

Accounts

Cash at

Bank GST Discount

Received

Jun 3 772 0 3900 39000 0 0 42900 0 0

Jun 4 773 220 0 0 0 6208 6500 12708 0 0

Jun 5 774 210-4 11550 0 0 0 0 11319 0 231

Jun 6 775 210-2 9900 0 0 0 0 9702 0 198

Jun

Jun

Feedback

CASH PAYMENTS JOURNAL

Date Account Cheque

No.

Post

Ref.

Debit Credit

Accounts

Payable GST Inventory Wages

Expense

Other

Accounts

Cash at

Bank GST Discount

Received

Jun 3 Inventory 772 X 3,900 39,000 42,900

Jun 4 Wages Payable 773 220 6,208 6,500 12,708

Jun 5 APC - Mega Tech 774 210-4 11,550 11,319 21 210

Jun 6 APC - Pear Technology 775 210-2 9,900 9,801 9 90

(Q=305.generalJournalWeek1)

GENERAL JOURNAL

Date Account and Explanation Post

Ref. Debit Credit

Jun

Jun

Jun

Feedback

https://www.perdisco.com/elms/qsam/html/qsam.aspx 5/14

Inventory

Wages Payable

APC - Mega Tech

APC - Pear Technology

asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of

transaction can be determined by the name of the account entered into this column.

The two GST columns in this journal refer to the same GST account (being the account that is used to record the GST related to

applicable cash payments).

Date Account Cheque

No.

Post

Ref.

Debit Credit

Accounts

Payable GST Inventory Wages

Expense

Other

Accounts

Cash at

Bank GST Discount

Received

Jun 3 772 0 3900 39000 0 0 42900 0 0

Jun 4 773 220 0 0 0 6208 6500 12708 0 0

Jun 5 774 210-4 11550 0 0 0 0 11319 0 231

Jun 6 775 210-2 9900 0 0 0 0 9702 0 198

Jun

Jun

Feedback

CASH PAYMENTS JOURNAL

Date Account Cheque

No.

Post

Ref.

Debit Credit

Accounts

Payable GST Inventory Wages

Expense

Other

Accounts

Cash at

Bank GST Discount

Received

Jun 3 Inventory 772 X 3,900 39,000 42,900

Jun 4 Wages Payable 773 220 6,208 6,500 12,708

Jun 5 APC - Mega Tech 774 210-4 11,550 11,319 21 210

Jun 6 APC - Pear Technology 775 210-2 9,900 9,801 9 90

(Q=305.generalJournalWeek1)

GENERAL JOURNAL

Date Account and Explanation Post

Ref. Debit Credit

Jun

Jun

Jun

Feedback

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 6/14

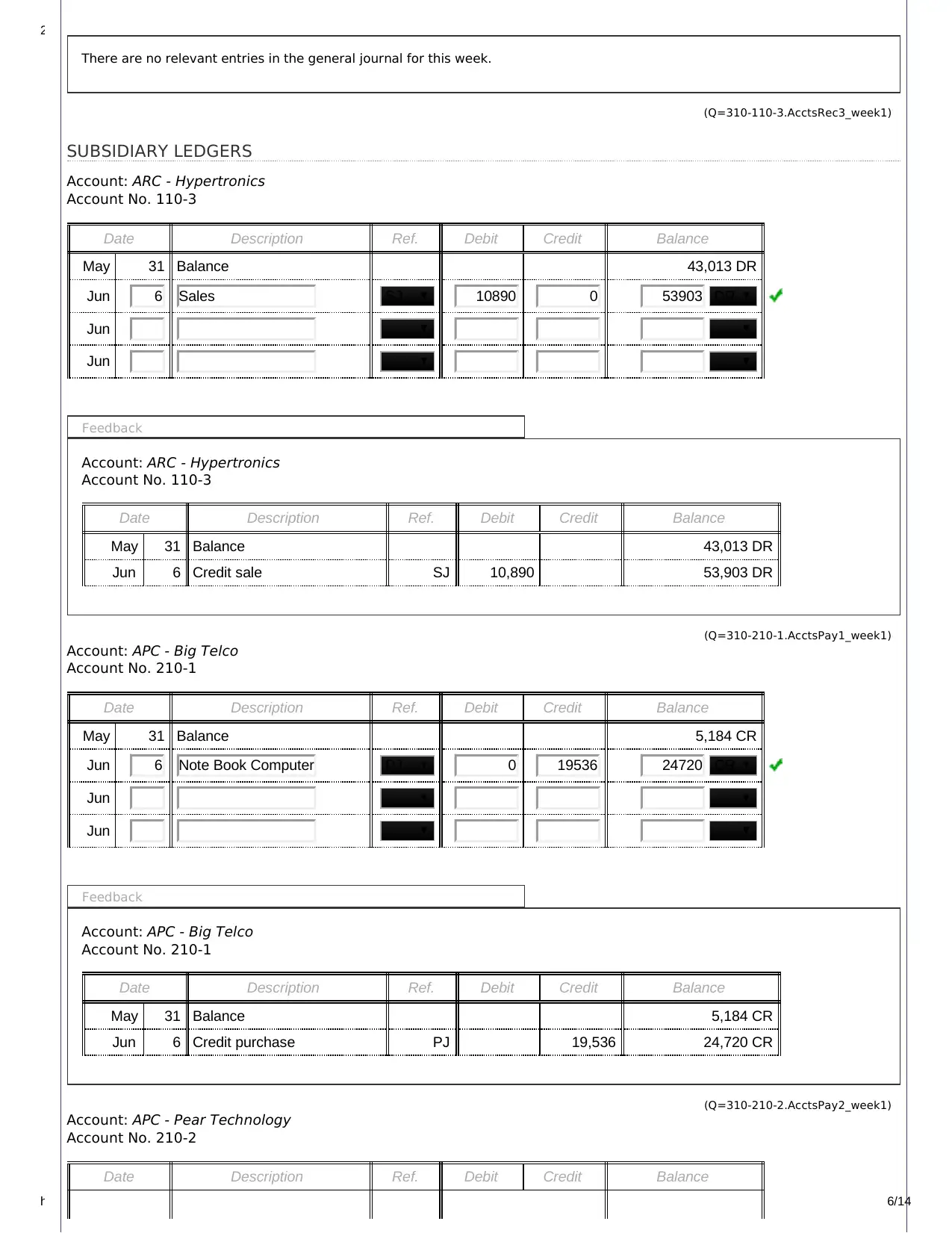

There are no relevant entries in the general journal for this week.

(Q=310-110-3.AcctsRec3_week1)

SUBSIDIARY LEDGERS

Account: ARC - Hypertronics

Account No. 110-3

Date Description Ref. Debit Credit Balance

May 31 Balance 43,013 DR

Jun 6 Sales SJ 10890 0 53903 DR

Jun

Jun

Feedback

Account: ARC - Hypertronics

Account No. 110-3

Date Description Ref. Debit Credit Balance

May 31 Balance 43,013 DR

Jun 6 Credit sale SJ 10,890 53,903 DR

(Q=310-210-1.AcctsPay1_week1)

Account: APC - Big Telco

Account No. 210-1

Date Description Ref. Debit Credit Balance

May 31 Balance 5,184 CR

Jun 6 PJ 0 19536 24720 CR

Jun

Jun

Feedback

Account: APC - Big Telco

Account No. 210-1

Date Description Ref. Debit Credit Balance

May 31 Balance 5,184 CR

Jun 6 Credit purchase PJ 19,536 24,720 CR

(Q=310-210-2.AcctsPay2_week1)

Account: APC - Pear Technology

Account No. 210-2

Date Description Ref. Debit Credit Balance

Note Book Computer

https://www.perdisco.com/elms/qsam/html/qsam.aspx 6/14

There are no relevant entries in the general journal for this week.

(Q=310-110-3.AcctsRec3_week1)

SUBSIDIARY LEDGERS

Account: ARC - Hypertronics

Account No. 110-3

Date Description Ref. Debit Credit Balance

May 31 Balance 43,013 DR

Jun 6 Sales SJ 10890 0 53903 DR

Jun

Jun

Feedback

Account: ARC - Hypertronics

Account No. 110-3

Date Description Ref. Debit Credit Balance

May 31 Balance 43,013 DR

Jun 6 Credit sale SJ 10,890 53,903 DR

(Q=310-210-1.AcctsPay1_week1)

Account: APC - Big Telco

Account No. 210-1

Date Description Ref. Debit Credit Balance

May 31 Balance 5,184 CR

Jun 6 PJ 0 19536 24720 CR

Jun

Jun

Feedback

Account: APC - Big Telco

Account No. 210-1

Date Description Ref. Debit Credit Balance

May 31 Balance 5,184 CR

Jun 6 Credit purchase PJ 19,536 24,720 CR

(Q=310-210-2.AcctsPay2_week1)

Account: APC - Pear Technology

Account No. 210-2

Date Description Ref. Debit Credit Balance

Note Book Computer

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 7/14

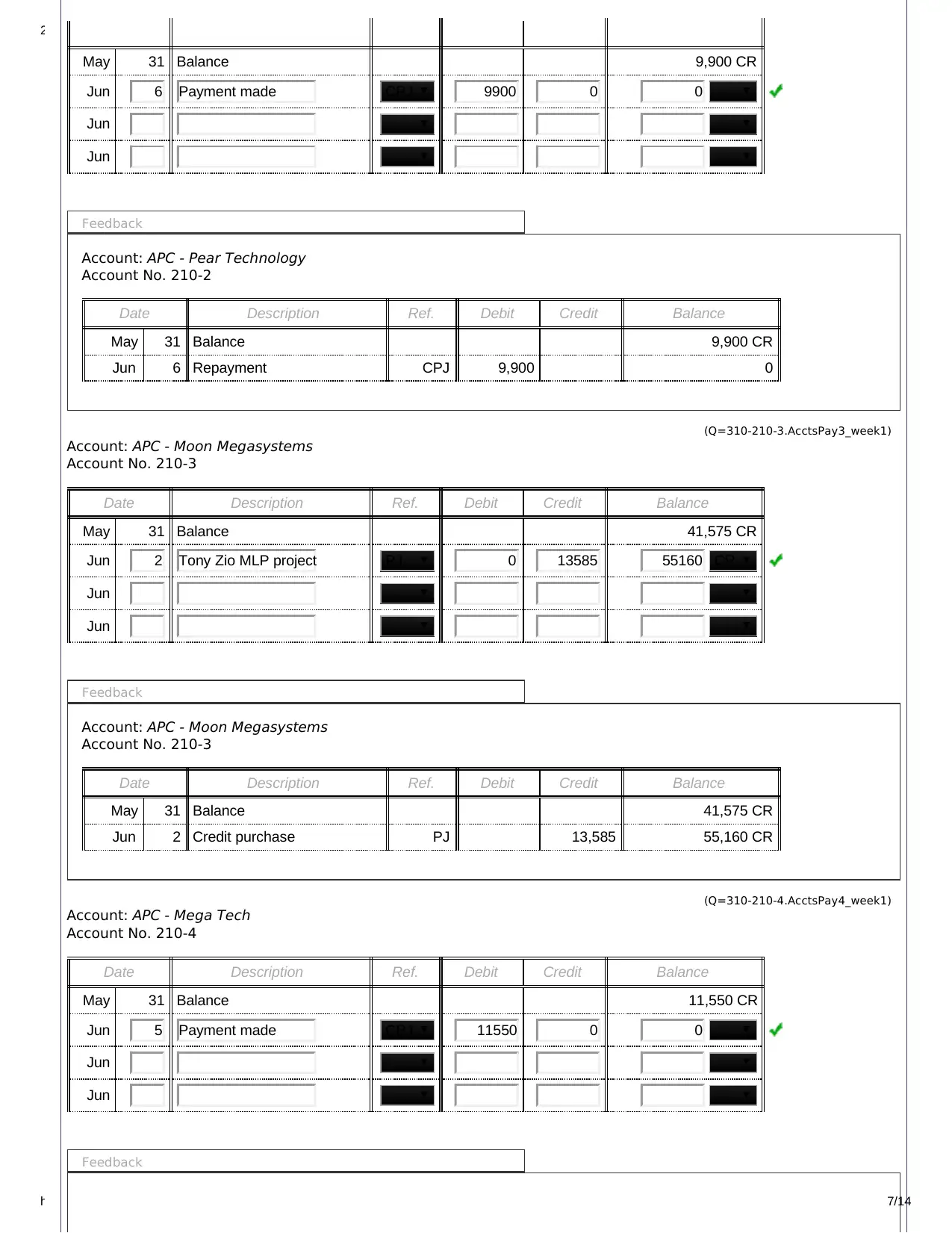

May 31 Balance 9,900 CR

Jun 6 Payment made CPJ 9900 0 0

Jun

Jun

Feedback

Account: APC - Pear Technology

Account No. 210-2

Date Description Ref. Debit Credit Balance

May 31 Balance 9,900 CR

Jun 6 Repayment CPJ 9,900 0

(Q=310-210-3.AcctsPay3_week1)

Account: APC - Moon Megasystems

Account No. 210-3

Date Description Ref. Debit Credit Balance

May 31 Balance 41,575 CR

Jun 2 PJ 0 13585 55160 CR

Jun

Jun

Feedback

Account: APC - Moon Megasystems

Account No. 210-3

Date Description Ref. Debit Credit Balance

May 31 Balance 41,575 CR

Jun 2 Credit purchase PJ 13,585 55,160 CR

(Q=310-210-4.AcctsPay4_week1)

Account: APC - Mega Tech

Account No. 210-4

Date Description Ref. Debit Credit Balance

May 31 Balance 11,550 CR

Jun 5 Payment made CPJ 11550 0 0

Jun

Jun

Feedback

Tony Zio MLP project

https://www.perdisco.com/elms/qsam/html/qsam.aspx 7/14

May 31 Balance 9,900 CR

Jun 6 Payment made CPJ 9900 0 0

Jun

Jun

Feedback

Account: APC - Pear Technology

Account No. 210-2

Date Description Ref. Debit Credit Balance

May 31 Balance 9,900 CR

Jun 6 Repayment CPJ 9,900 0

(Q=310-210-3.AcctsPay3_week1)

Account: APC - Moon Megasystems

Account No. 210-3

Date Description Ref. Debit Credit Balance

May 31 Balance 41,575 CR

Jun 2 PJ 0 13585 55160 CR

Jun

Jun

Feedback

Account: APC - Moon Megasystems

Account No. 210-3

Date Description Ref. Debit Credit Balance

May 31 Balance 41,575 CR

Jun 2 Credit purchase PJ 13,585 55,160 CR

(Q=310-210-4.AcctsPay4_week1)

Account: APC - Mega Tech

Account No. 210-4

Date Description Ref. Debit Credit Balance

May 31 Balance 11,550 CR

Jun 5 Payment made CPJ 11550 0 0

Jun

Jun

Feedback

Tony Zio MLP project

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 8/14

Account: APC - Mega Tech

Account No. 210-4

Date Description Ref. Debit Credit Balance

May 31 Balance 11,550 CR

Jun 5 Repayment CPJ 11,550 0

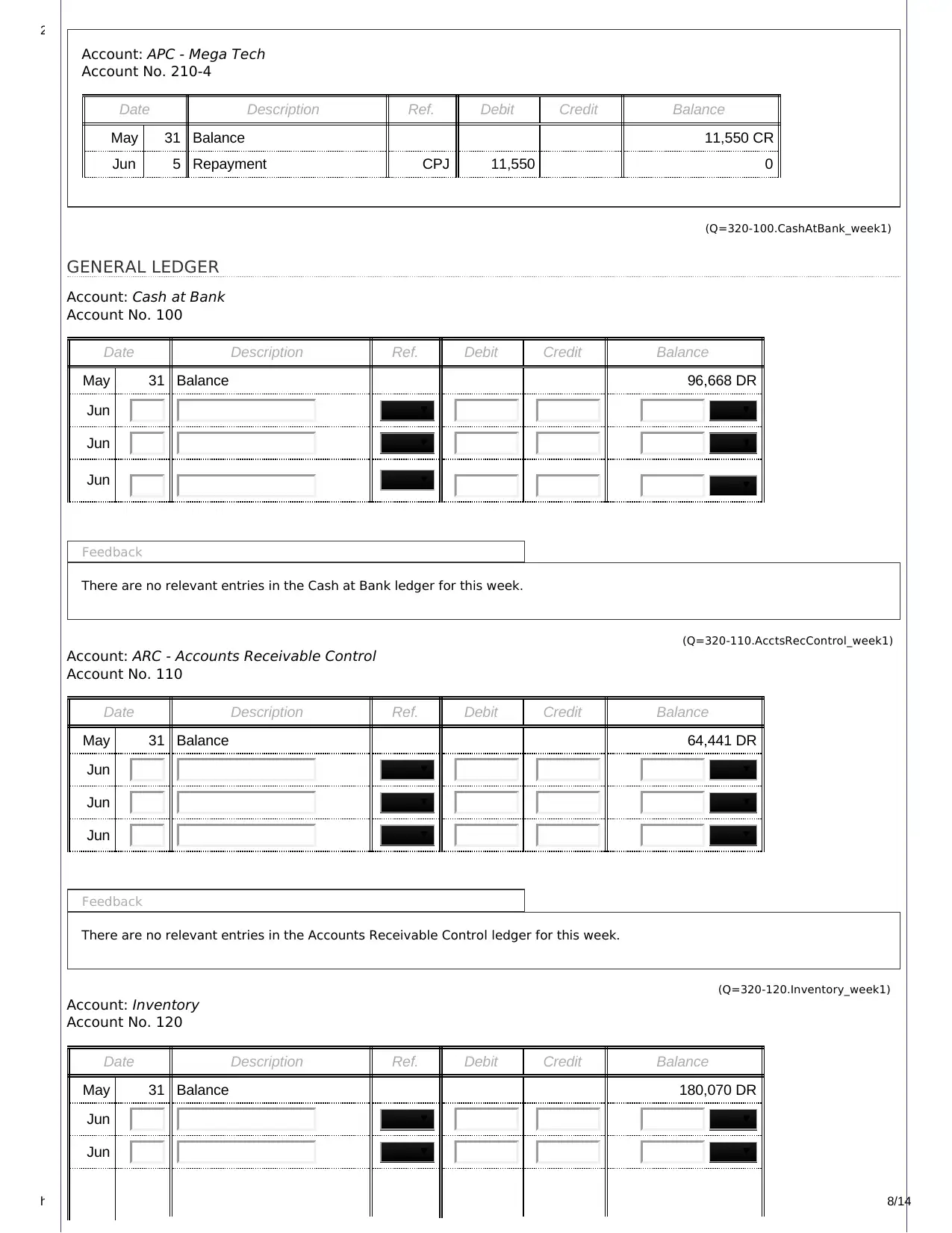

(Q=320-100.CashAtBank_week1)

GENERAL LEDGER

Account: Cash at Bank

Account No. 100

Date Description Ref. Debit Credit Balance

May 31 Balance 96,668 DR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Cash at Bank ledger for this week.

(Q=320-110.AcctsRecControl_week1)

Account: ARC - Accounts Receivable Control

Account No. 110

Date Description Ref. Debit Credit Balance

May 31 Balance 64,441 DR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Accounts Receivable Control ledger for this week.

(Q=320-120.Inventory_week1)

Account: Inventory

Account No. 120

Date Description Ref. Debit Credit Balance

May 31 Balance 180,070 DR

Jun

Jun

https://www.perdisco.com/elms/qsam/html/qsam.aspx 8/14

Account: APC - Mega Tech

Account No. 210-4

Date Description Ref. Debit Credit Balance

May 31 Balance 11,550 CR

Jun 5 Repayment CPJ 11,550 0

(Q=320-100.CashAtBank_week1)

GENERAL LEDGER

Account: Cash at Bank

Account No. 100

Date Description Ref. Debit Credit Balance

May 31 Balance 96,668 DR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Cash at Bank ledger for this week.

(Q=320-110.AcctsRecControl_week1)

Account: ARC - Accounts Receivable Control

Account No. 110

Date Description Ref. Debit Credit Balance

May 31 Balance 64,441 DR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Accounts Receivable Control ledger for this week.

(Q=320-120.Inventory_week1)

Account: Inventory

Account No. 120

Date Description Ref. Debit Credit Balance

May 31 Balance 180,070 DR

Jun

Jun

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 9/14

Jun

Feedback

There are no relevant entries in the Inventory ledger for this week.

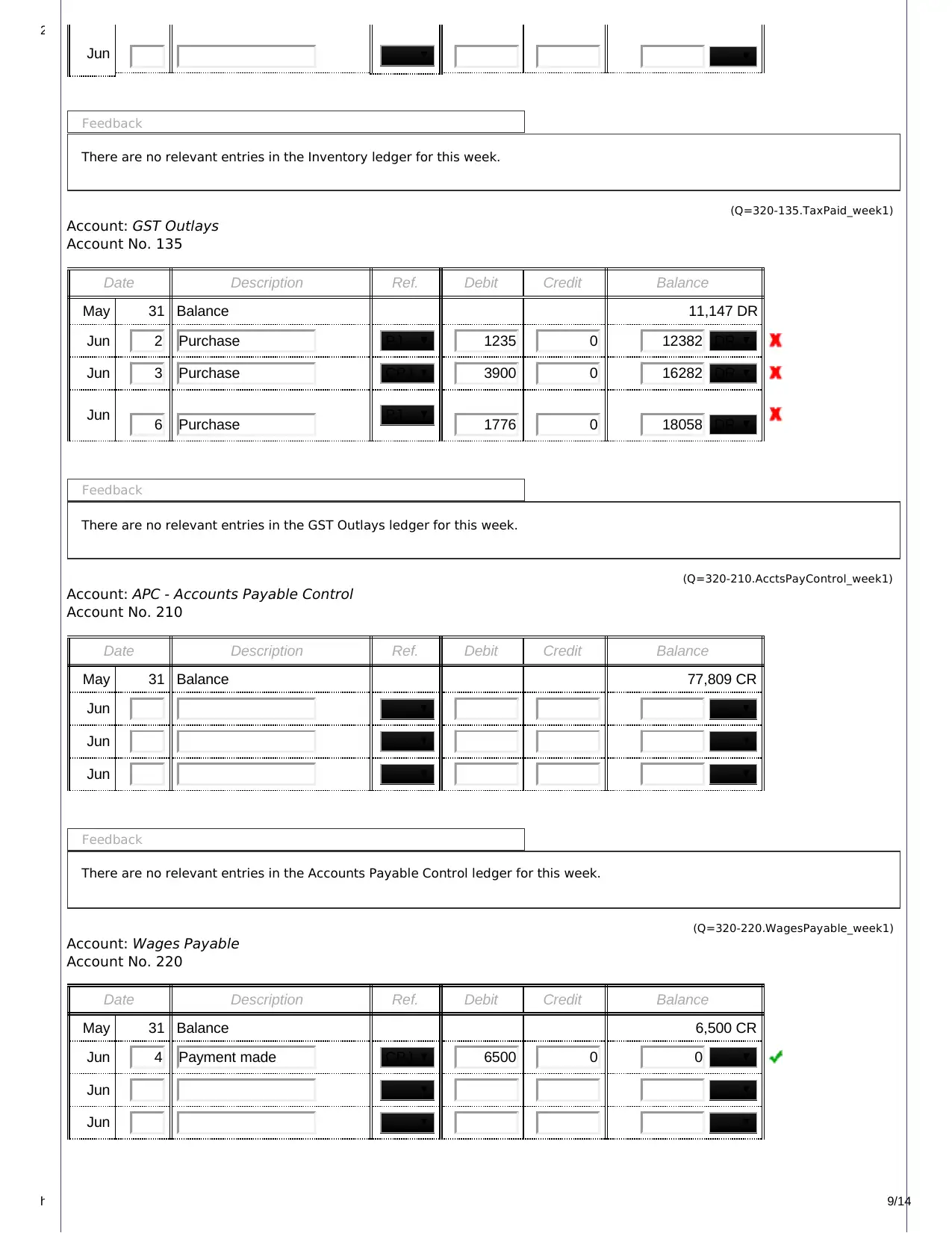

(Q=320-135.TaxPaid_week1)

Account: GST Outlays

Account No. 135

Date Description Ref. Debit Credit Balance

May 31 Balance 11,147 DR

Jun 2 Purchase PJ 1235 0 12382 DR

Jun 3 Purchase CPJ 3900 0 16282 DR

Jun 6 Purchase PJ 1776 0 18058 DR

Feedback

There are no relevant entries in the GST Outlays ledger for this week.

(Q=320-210.AcctsPayControl_week1)

Account: APC - Accounts Payable Control

Account No. 210

Date Description Ref. Debit Credit Balance

May 31 Balance 77,809 CR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Accounts Payable Control ledger for this week.

(Q=320-220.WagesPayable_week1)

Account: Wages Payable

Account No. 220

Date Description Ref. Debit Credit Balance

May 31 Balance 6,500 CR

Jun 4 Payment made CPJ 6500 0 0

Jun

Jun

https://www.perdisco.com/elms/qsam/html/qsam.aspx 9/14

Jun

Feedback

There are no relevant entries in the Inventory ledger for this week.

(Q=320-135.TaxPaid_week1)

Account: GST Outlays

Account No. 135

Date Description Ref. Debit Credit Balance

May 31 Balance 11,147 DR

Jun 2 Purchase PJ 1235 0 12382 DR

Jun 3 Purchase CPJ 3900 0 16282 DR

Jun 6 Purchase PJ 1776 0 18058 DR

Feedback

There are no relevant entries in the GST Outlays ledger for this week.

(Q=320-210.AcctsPayControl_week1)

Account: APC - Accounts Payable Control

Account No. 210

Date Description Ref. Debit Credit Balance

May 31 Balance 77,809 CR

Jun

Jun

Jun

Feedback

There are no relevant entries in the Accounts Payable Control ledger for this week.

(Q=320-220.WagesPayable_week1)

Account: Wages Payable

Account No. 220

Date Description Ref. Debit Credit Balance

May 31 Balance 6,500 CR

Jun 4 Payment made CPJ 6500 0 0

Jun

Jun

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 10/14

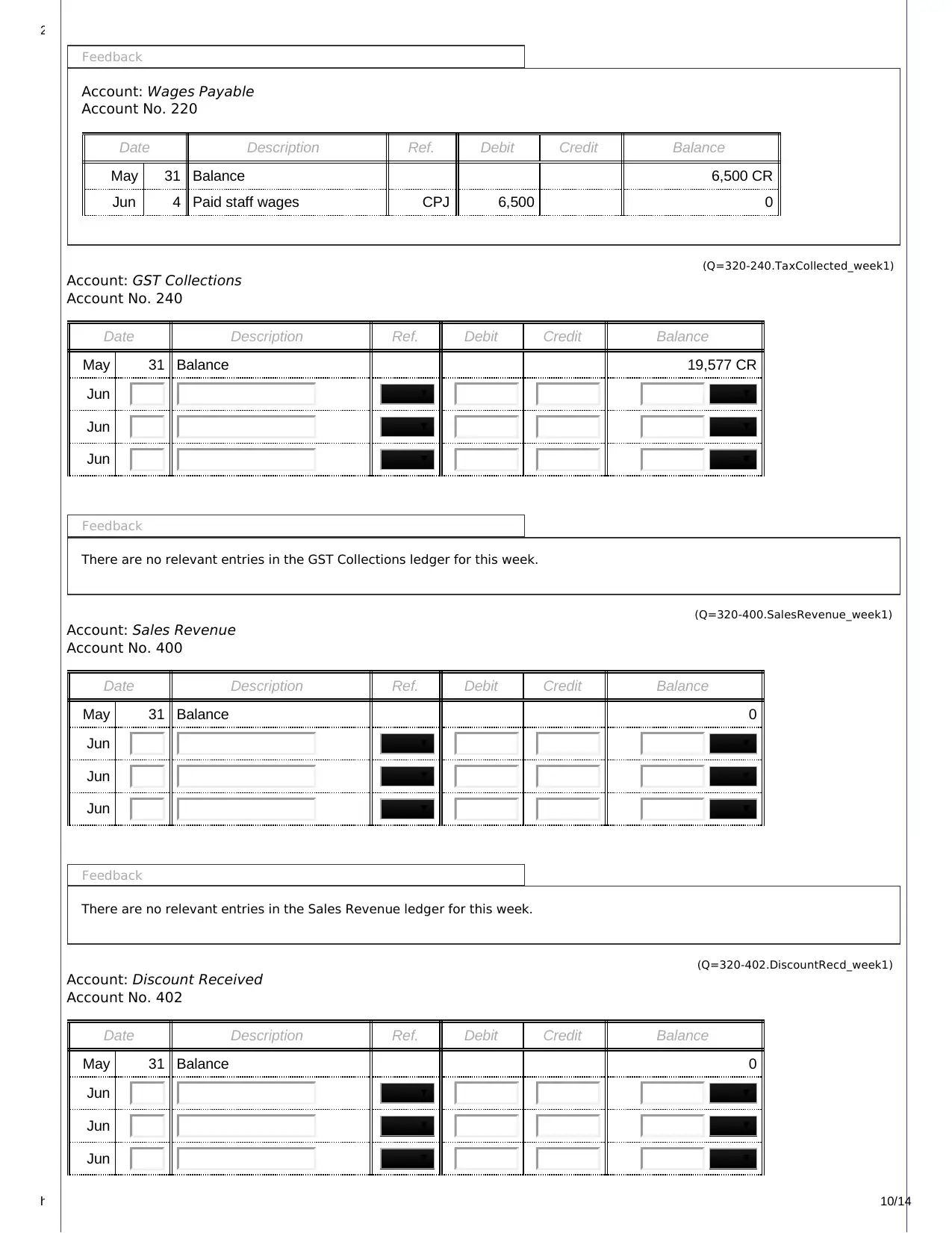

Feedback

Account: Wages Payable

Account No. 220

Date Description Ref. Debit Credit Balance

May 31 Balance 6,500 CR

Jun 4 Paid staff wages CPJ 6,500 0

(Q=320-240.TaxCollected_week1)

Account: GST Collections

Account No. 240

Date Description Ref. Debit Credit Balance

May 31 Balance 19,577 CR

Jun

Jun

Jun

Feedback

There are no relevant entries in the GST Collections ledger for this week.

(Q=320-400.SalesRevenue_week1)

Account: Sales Revenue

Account No. 400

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Sales Revenue ledger for this week.

(Q=320-402.DiscountRecd_week1)

Account: Discount Received

Account No. 402

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

https://www.perdisco.com/elms/qsam/html/qsam.aspx 10/14

Feedback

Account: Wages Payable

Account No. 220

Date Description Ref. Debit Credit Balance

May 31 Balance 6,500 CR

Jun 4 Paid staff wages CPJ 6,500 0

(Q=320-240.TaxCollected_week1)

Account: GST Collections

Account No. 240

Date Description Ref. Debit Credit Balance

May 31 Balance 19,577 CR

Jun

Jun

Jun

Feedback

There are no relevant entries in the GST Collections ledger for this week.

(Q=320-400.SalesRevenue_week1)

Account: Sales Revenue

Account No. 400

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Sales Revenue ledger for this week.

(Q=320-402.DiscountRecd_week1)

Account: Discount Received

Account No. 402

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 11/14

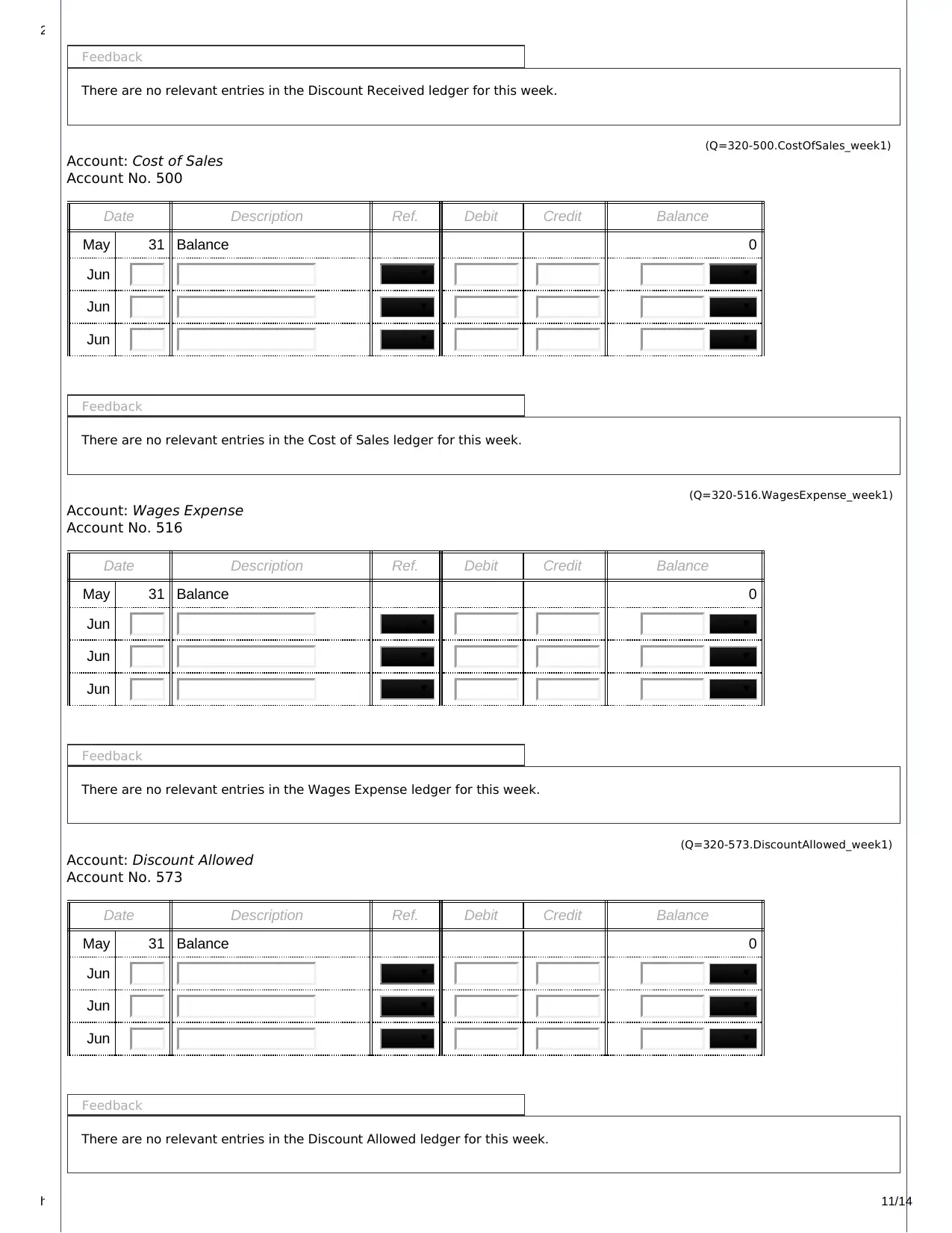

Feedback

There are no relevant entries in the Discount Received ledger for this week.

(Q=320-500.CostOfSales_week1)

Account: Cost of Sales

Account No. 500

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Cost of Sales ledger for this week.

(Q=320-516.WagesExpense_week1)

Account: Wages Expense

Account No. 516

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Wages Expense ledger for this week.

(Q=320-573.DiscountAllowed_week1)

Account: Discount Allowed

Account No. 573

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Discount Allowed ledger for this week.

https://www.perdisco.com/elms/qsam/html/qsam.aspx 11/14

Feedback

There are no relevant entries in the Discount Received ledger for this week.

(Q=320-500.CostOfSales_week1)

Account: Cost of Sales

Account No. 500

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Cost of Sales ledger for this week.

(Q=320-516.WagesExpense_week1)

Account: Wages Expense

Account No. 516

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Wages Expense ledger for this week.

(Q=320-573.DiscountAllowed_week1)

Account: Discount Allowed

Account No. 573

Date Description Ref. Debit Credit Balance

May 31 Balance 0

Jun

Jun

Jun

Feedback

There are no relevant entries in the Discount Allowed ledger for this week.

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 12/14

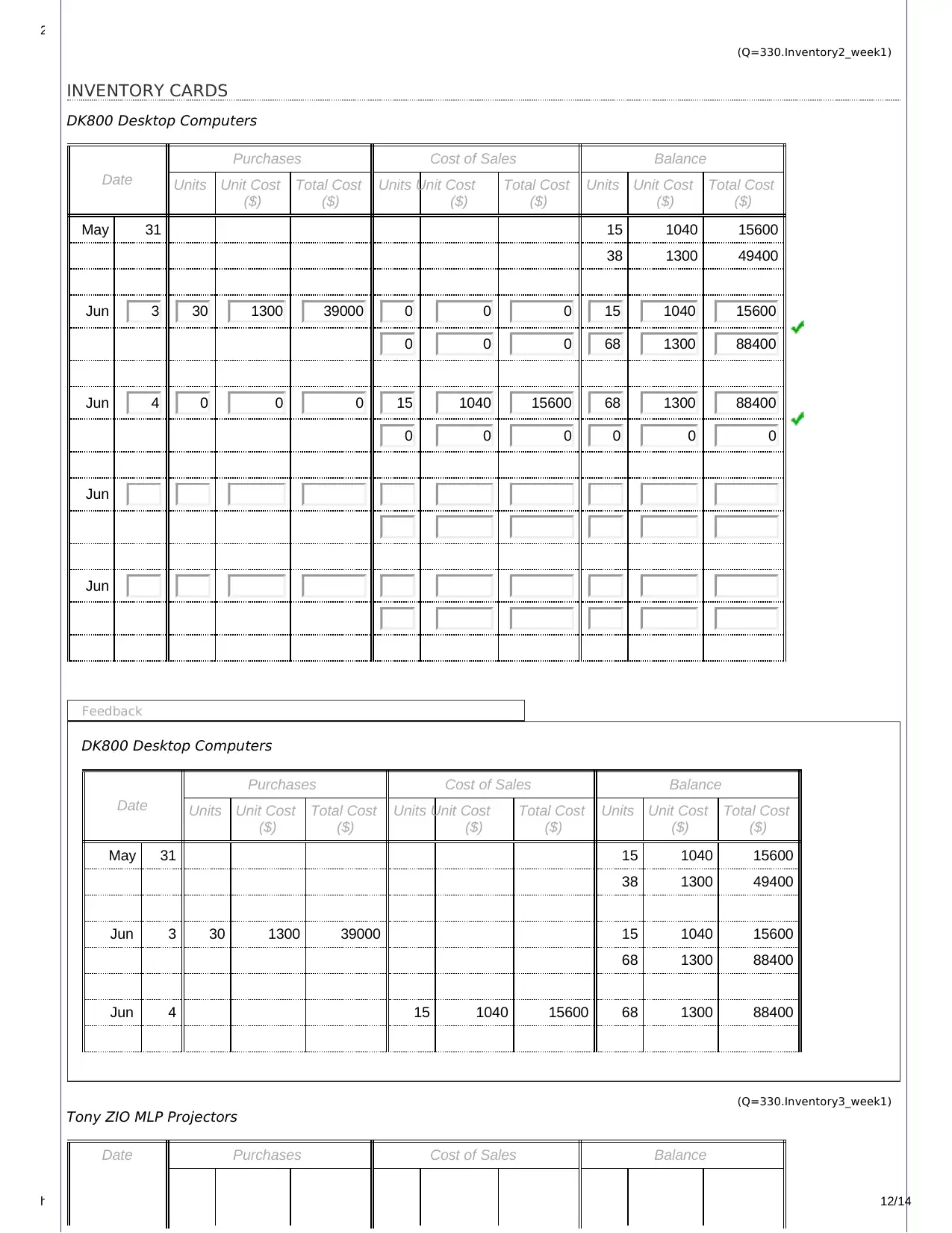

(Q=330.Inventory2_week1)

INVENTORY CARDS

DK800 Desktop Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 15 1040 15600

38 1300 49400

Jun 3 30 1300 39000 0 0 0 15 1040 15600

0 0 0 68 1300 88400

Jun 4 0 0 0 15 1040 15600 68 1300 88400

0 0 0 0 0 0

Jun

Jun

Feedback

DK800 Desktop Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 15 1040 15600

38 1300 49400

Jun 3 30 1300 39000 15 1040 15600

68 1300 88400

Jun 4 15 1040 15600 68 1300 88400

(Q=330.Inventory3_week1)

Tony ZIO MLP Projectors

Date Purchases Cost of Sales Balance

https://www.perdisco.com/elms/qsam/html/qsam.aspx 12/14

(Q=330.Inventory2_week1)

INVENTORY CARDS

DK800 Desktop Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 15 1040 15600

38 1300 49400

Jun 3 30 1300 39000 0 0 0 15 1040 15600

0 0 0 68 1300 88400

Jun 4 0 0 0 15 1040 15600 68 1300 88400

0 0 0 0 0 0

Jun

Jun

Feedback

DK800 Desktop Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 15 1040 15600

38 1300 49400

Jun 3 30 1300 39000 15 1040 15600

68 1300 88400

Jun 4 15 1040 15600 68 1300 88400

(Q=330.Inventory3_week1)

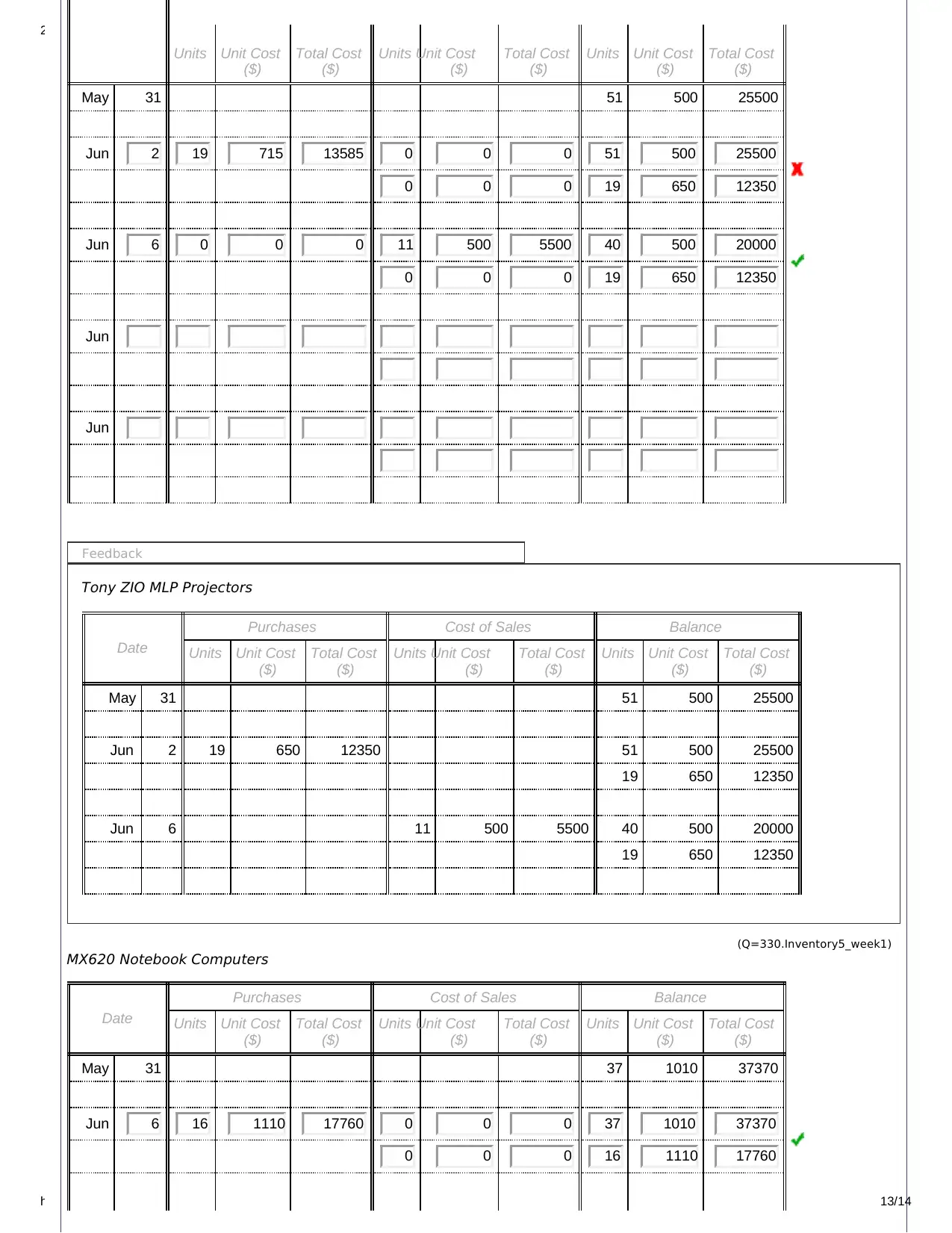

Tony ZIO MLP Projectors

Date Purchases Cost of Sales Balance

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 13/14

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 51 500 25500

Jun 2 19 715 13585 0 0 0 51 500 25500

0 0 0 19 650 12350

Jun 6 0 0 0 11 500 5500 40 500 20000

0 0 0 19 650 12350

Jun

Jun

Feedback

Tony ZIO MLP Projectors

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 51 500 25500

Jun 2 19 650 12350 51 500 25500

19 650 12350

Jun 6 11 500 5500 40 500 20000

19 650 12350

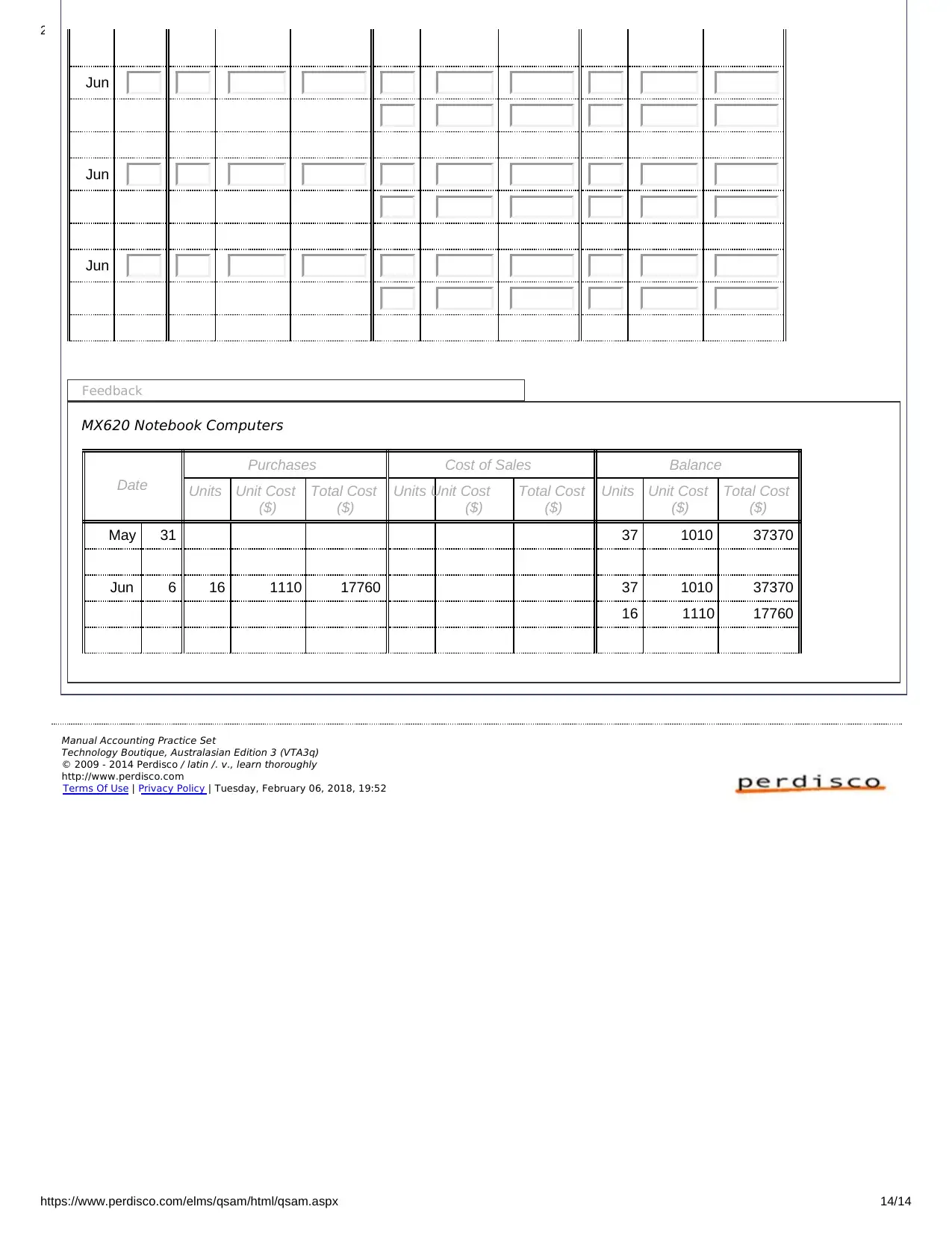

(Q=330.Inventory5_week1)

MX620 Notebook Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 37 1010 37370

Jun 6 16 1110 17760 0 0 0 37 1010 37370

0 0 0 16 1110 17760

https://www.perdisco.com/elms/qsam/html/qsam.aspx 13/14

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 51 500 25500

Jun 2 19 715 13585 0 0 0 51 500 25500

0 0 0 19 650 12350

Jun 6 0 0 0 11 500 5500 40 500 20000

0 0 0 19 650 12350

Jun

Jun

Feedback

Tony ZIO MLP Projectors

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 51 500 25500

Jun 2 19 650 12350 51 500 25500

19 650 12350

Jun 6 11 500 5500 40 500 20000

19 650 12350

(Q=330.Inventory5_week1)

MX620 Notebook Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 37 1010 37370

Jun 6 16 1110 17760 0 0 0 37 1010 37370

0 0 0 16 1110 17760

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2/6/2018 Transactions - week 1

https://www.perdisco.com/elms/qsam/html/qsam.aspx 14/14

Jun

Jun

Jun

Feedback

MX620 Notebook Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 37 1010 37370

Jun 6 16 1110 17760 37 1010 37370

16 1110 17760

Manual Accounting Practice Set

Technology Boutique, Australasian Edition 3 (VTA3q)

© 2009 - 2014 Perdisco / latin /. v., learn thoroughly

http://www.perdisco.com

Terms Of Use | Privacy Policy | Tuesday, February 06, 2018, 19:52

https://www.perdisco.com/elms/qsam/html/qsam.aspx 14/14

Jun

Jun

Jun

Feedback

MX620 Notebook Computers

Date

Purchases Cost of Sales Balance

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

Units Unit Cost

($)

Total Cost

($)

May 31 37 1010 37370

Jun 6 16 1110 17760 37 1010 37370

16 1110 17760

Manual Accounting Practice Set

Technology Boutique, Australasian Edition 3 (VTA3q)

© 2009 - 2014 Perdisco / latin /. v., learn thoroughly

http://www.perdisco.com

Terms Of Use | Privacy Policy | Tuesday, February 06, 2018, 19:52

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.