Importance of Trial Balance and Journal Entries in Preparing Financial Statements

VerifiedAdded on 2023/06/15

|16

|2936

|210

AI Summary

This report explains the significance of trial balance and journal entries in preparing financial statements. It also includes steps for adjustment transactions journal entries, posting of adjusting journal entries, income statement, journal entries closing the entries, changes in equity statement, and balance sheet. The purpose of creating the trial balance, adjusting journal entries, and writing the adjusted trial balance is also discussed.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: BUSINESS ACCOUNTING

Business accounting

Name of the student

Name of the university

Author note

Business accounting

Name of the student

Name of the university

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1BUSINESS ACCOUNTING

Executive summary

The main objective of the report is to state the importance of trial balance and journal entries

in preparing the financial statement of the company. The trial balance assists in posting the

transactions in appropriate statements like income statement and balance sheet. Further, the

journal entries assists in posting the adjustment that takes place after preparing the balance

sheet or for adjusting the prior period items.

Executive summary

The main objective of the report is to state the importance of trial balance and journal entries

in preparing the financial statement of the company. The trial balance assists in posting the

transactions in appropriate statements like income statement and balance sheet. Further, the

journal entries assists in posting the adjustment that takes place after preparing the balance

sheet or for adjusting the prior period items.

2BUSINESS ACCOUNTING

Table of Contents

Introduction................................................................................................................................3

Step 2 – Adjustment transactions journal entries.......................................................................3

Step 3 – Posting of adjusting journal entries and completion of the worksheet........................4

Step 4 – Income statement from worksheet...............................................................................5

Step 5 – Journal entries closing the entries................................................................................6

Step 6 – Changes in equity statement from worksheet..............................................................6

Step 7..........................................................................................................................................9

1) Trial balance and the purpose of creation....................................................................9

2) Adjusting journal entries and its purpose of recording.............................................10

3) Purpose of writing the adjusted trial balance............................................................11

4) Adjustment journal entries as against the closing journal entries.............................12

Conclusion................................................................................................................................13

References................................................................................................................................14

Table of Contents

Introduction................................................................................................................................3

Step 2 – Adjustment transactions journal entries.......................................................................3

Step 3 – Posting of adjusting journal entries and completion of the worksheet........................4

Step 4 – Income statement from worksheet...............................................................................5

Step 5 – Journal entries closing the entries................................................................................6

Step 6 – Changes in equity statement from worksheet..............................................................6

Step 7..........................................................................................................................................9

1) Trial balance and the purpose of creation....................................................................9

2) Adjusting journal entries and its purpose of recording.............................................10

3) Purpose of writing the adjusted trial balance............................................................11

4) Adjustment journal entries as against the closing journal entries.............................12

Conclusion................................................................................................................................13

References................................................................................................................................14

3BUSINESS ACCOUNTING

Introduction

Trial balance is generally prepared at closing of the accounting period and assists in

drafting the financial statements. It assures that every recorded debit entry has a

corresponding credit entry and is recorded in the account as per double entry accounting

concept. A journal entry refers to the financial transactions that have been incurred by the

business unit during a particular financial year (Warren and Jones 2018). On the other hand,

the adjusting journal entry refers to those particular journal entries that have been included in

the financial report at the end of a particular financial year as because the revenue or

expenses associated with those journal entries have not been recognized at the time of

generation.

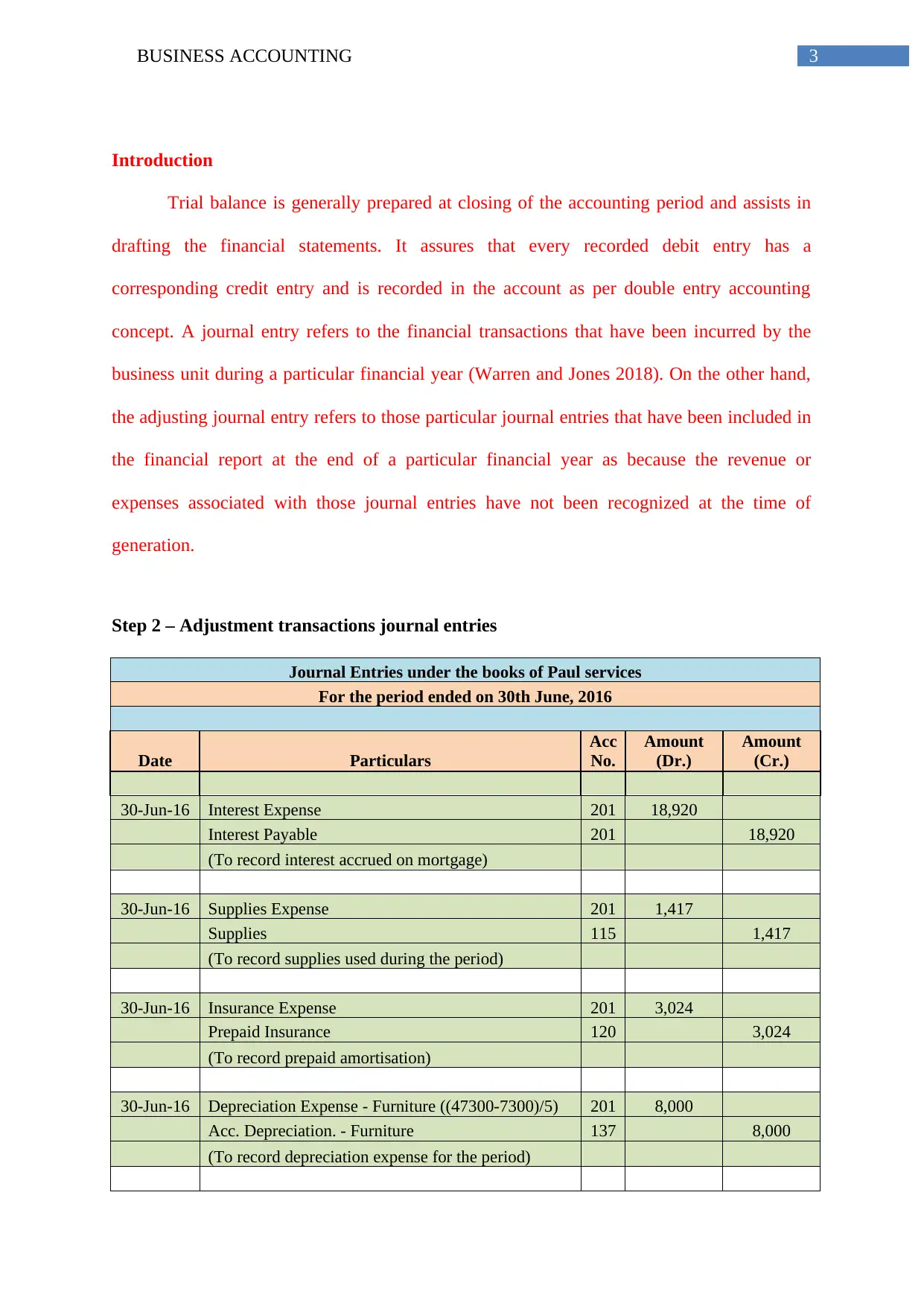

Step 2 – Adjustment transactions journal entries

Journal Entries under the books of Paul services

For the period ended on 30th June, 2016

Date Particulars

Acc

No.

Amount

(Dr.)

Amount

(Cr.)

30-Jun-16 Interest Expense 201 18,920

Interest Payable 201 18,920

(To record interest accrued on mortgage)

30-Jun-16 Supplies Expense 201 1,417

Supplies 115 1,417

(To record supplies used during the period)

30-Jun-16 Insurance Expense 201 3,024

Prepaid Insurance 120 3,024

(To record prepaid amortisation)

30-Jun-16 Depreciation Expense - Furniture ((47300-7300)/5) 201 8,000

Acc. Depreciation. - Furniture 137 8,000

(To record depreciation expense for the period)

Introduction

Trial balance is generally prepared at closing of the accounting period and assists in

drafting the financial statements. It assures that every recorded debit entry has a

corresponding credit entry and is recorded in the account as per double entry accounting

concept. A journal entry refers to the financial transactions that have been incurred by the

business unit during a particular financial year (Warren and Jones 2018). On the other hand,

the adjusting journal entry refers to those particular journal entries that have been included in

the financial report at the end of a particular financial year as because the revenue or

expenses associated with those journal entries have not been recognized at the time of

generation.

Step 2 – Adjustment transactions journal entries

Journal Entries under the books of Paul services

For the period ended on 30th June, 2016

Date Particulars

Acc

No.

Amount

(Dr.)

Amount

(Cr.)

30-Jun-16 Interest Expense 201 18,920

Interest Payable 201 18,920

(To record interest accrued on mortgage)

30-Jun-16 Supplies Expense 201 1,417

Supplies 115 1,417

(To record supplies used during the period)

30-Jun-16 Insurance Expense 201 3,024

Prepaid Insurance 120 3,024

(To record prepaid amortisation)

30-Jun-16 Depreciation Expense - Furniture ((47300-7300)/5) 201 8,000

Acc. Depreciation. - Furniture 137 8,000

(To record depreciation expense for the period)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4BUSINESS ACCOUNTING

30-Jun-16

Depreciation Expense - Office Equipment ((94600-

4600)/5) 201 18,000

Acc. Depreciation - Office Equipment 141 18,000

(To record depreciation expense for the period)

30-Jun-16

Depreciation Expense - Store Equipment ((141900-

1900)/10) 201 14,000

Acc. Depreciation - Store Equipment 146 14,000

(To record depreciation expense for the period)

30-Jun-16

Depreciation Expense - Automobile ((189200-

9200)/10) 201 18,000

Acc. Depreciation - Automobile 171 18,000

(To record depreciation expense for the period)

30-Jun-16 Unearned revenue 201 11,825

Revenue 201 11,825

(To record unearned revenue earned)

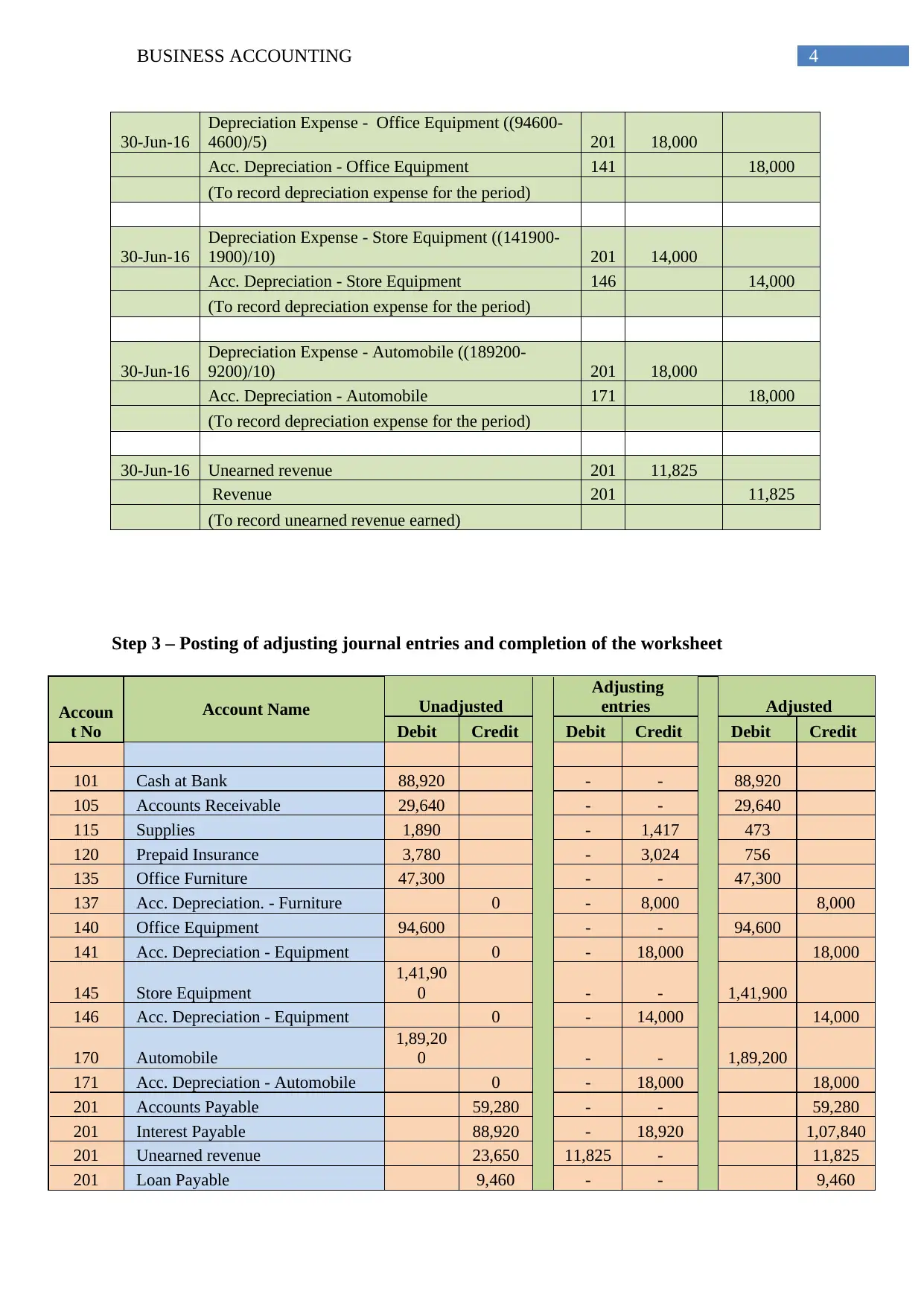

Step 3 – Posting of adjusting journal entries and completion of the worksheet

Accoun

t No

Account Name Unadjusted

Adjusting

entries Adjusted

Debit Credit Debit Credit Debit Credit

101 Cash at Bank 88,920 - - 88,920

105 Accounts Receivable 29,640 - - 29,640

115 Supplies 1,890 - 1,417 473

120 Prepaid Insurance 3,780 - 3,024 756

135 Office Furniture 47,300 - - 47,300

137 Acc. Depreciation. - Furniture 0 - 8,000 8,000

140 Office Equipment 94,600 - - 94,600

141 Acc. Depreciation - Equipment 0 - 18,000 18,000

145 Store Equipment

1,41,90

0 - - 1,41,900

146 Acc. Depreciation - Equipment 0 - 14,000 14,000

170 Automobile

1,89,20

0 - - 1,89,200

171 Acc. Depreciation - Automobile 0 - 18,000 18,000

201 Accounts Payable 59,280 - - 59,280

201 Interest Payable 88,920 - 18,920 1,07,840

201 Unearned revenue 23,650 11,825 - 11,825

201 Loan Payable 9,460 - - 9,460

30-Jun-16

Depreciation Expense - Office Equipment ((94600-

4600)/5) 201 18,000

Acc. Depreciation - Office Equipment 141 18,000

(To record depreciation expense for the period)

30-Jun-16

Depreciation Expense - Store Equipment ((141900-

1900)/10) 201 14,000

Acc. Depreciation - Store Equipment 146 14,000

(To record depreciation expense for the period)

30-Jun-16

Depreciation Expense - Automobile ((189200-

9200)/10) 201 18,000

Acc. Depreciation - Automobile 171 18,000

(To record depreciation expense for the period)

30-Jun-16 Unearned revenue 201 11,825

Revenue 201 11,825

(To record unearned revenue earned)

Step 3 – Posting of adjusting journal entries and completion of the worksheet

Accoun

t No

Account Name Unadjusted

Adjusting

entries Adjusted

Debit Credit Debit Credit Debit Credit

101 Cash at Bank 88,920 - - 88,920

105 Accounts Receivable 29,640 - - 29,640

115 Supplies 1,890 - 1,417 473

120 Prepaid Insurance 3,780 - 3,024 756

135 Office Furniture 47,300 - - 47,300

137 Acc. Depreciation. - Furniture 0 - 8,000 8,000

140 Office Equipment 94,600 - - 94,600

141 Acc. Depreciation - Equipment 0 - 18,000 18,000

145 Store Equipment

1,41,90

0 - - 1,41,900

146 Acc. Depreciation - Equipment 0 - 14,000 14,000

170 Automobile

1,89,20

0 - - 1,89,200

171 Acc. Depreciation - Automobile 0 - 18,000 18,000

201 Accounts Payable 59,280 - - 59,280

201 Interest Payable 88,920 - 18,920 1,07,840

201 Unearned revenue 23,650 11,825 - 11,825

201 Loan Payable 9,460 - - 9,460

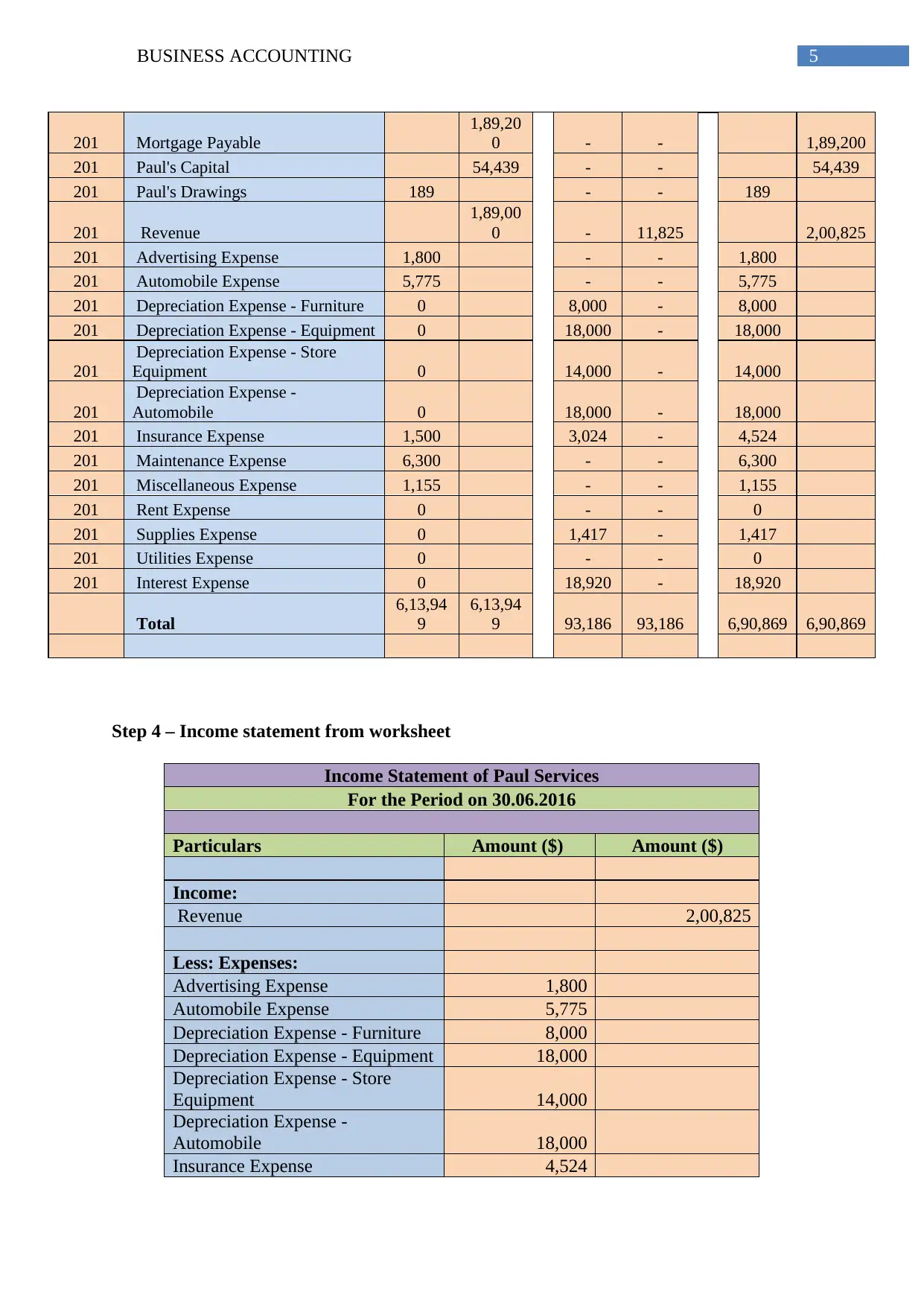

5BUSINESS ACCOUNTING

201 Mortgage Payable

1,89,20

0 - - 1,89,200

201 Paul's Capital 54,439 - - 54,439

201 Paul's Drawings 189 - - 189

201 Revenue

1,89,00

0 - 11,825 2,00,825

201 Advertising Expense 1,800 - - 1,800

201 Automobile Expense 5,775 - - 5,775

201 Depreciation Expense - Furniture 0 8,000 - 8,000

201 Depreciation Expense - Equipment 0 18,000 - 18,000

201

Depreciation Expense - Store

Equipment 0 14,000 - 14,000

201

Depreciation Expense -

Automobile 0 18,000 - 18,000

201 Insurance Expense 1,500 3,024 - 4,524

201 Maintenance Expense 6,300 - - 6,300

201 Miscellaneous Expense 1,155 - - 1,155

201 Rent Expense 0 - - 0

201 Supplies Expense 0 1,417 - 1,417

201 Utilities Expense 0 - - 0

201 Interest Expense 0 18,920 - 18,920

Total

6,13,94

9

6,13,94

9 93,186 93,186 6,90,869 6,90,869

Step 4 – Income statement from worksheet

Income Statement of Paul Services

For the Period on 30.06.2016

Particulars Amount ($) Amount ($)

Income:

Revenue 2,00,825

Less: Expenses:

Advertising Expense 1,800

Automobile Expense 5,775

Depreciation Expense - Furniture 8,000

Depreciation Expense - Equipment 18,000

Depreciation Expense - Store

Equipment 14,000

Depreciation Expense -

Automobile 18,000

Insurance Expense 4,524

201 Mortgage Payable

1,89,20

0 - - 1,89,200

201 Paul's Capital 54,439 - - 54,439

201 Paul's Drawings 189 - - 189

201 Revenue

1,89,00

0 - 11,825 2,00,825

201 Advertising Expense 1,800 - - 1,800

201 Automobile Expense 5,775 - - 5,775

201 Depreciation Expense - Furniture 0 8,000 - 8,000

201 Depreciation Expense - Equipment 0 18,000 - 18,000

201

Depreciation Expense - Store

Equipment 0 14,000 - 14,000

201

Depreciation Expense -

Automobile 0 18,000 - 18,000

201 Insurance Expense 1,500 3,024 - 4,524

201 Maintenance Expense 6,300 - - 6,300

201 Miscellaneous Expense 1,155 - - 1,155

201 Rent Expense 0 - - 0

201 Supplies Expense 0 1,417 - 1,417

201 Utilities Expense 0 - - 0

201 Interest Expense 0 18,920 - 18,920

Total

6,13,94

9

6,13,94

9 93,186 93,186 6,90,869 6,90,869

Step 4 – Income statement from worksheet

Income Statement of Paul Services

For the Period on 30.06.2016

Particulars Amount ($) Amount ($)

Income:

Revenue 2,00,825

Less: Expenses:

Advertising Expense 1,800

Automobile Expense 5,775

Depreciation Expense - Furniture 8,000

Depreciation Expense - Equipment 18,000

Depreciation Expense - Store

Equipment 14,000

Depreciation Expense -

Automobile 18,000

Insurance Expense 4,524

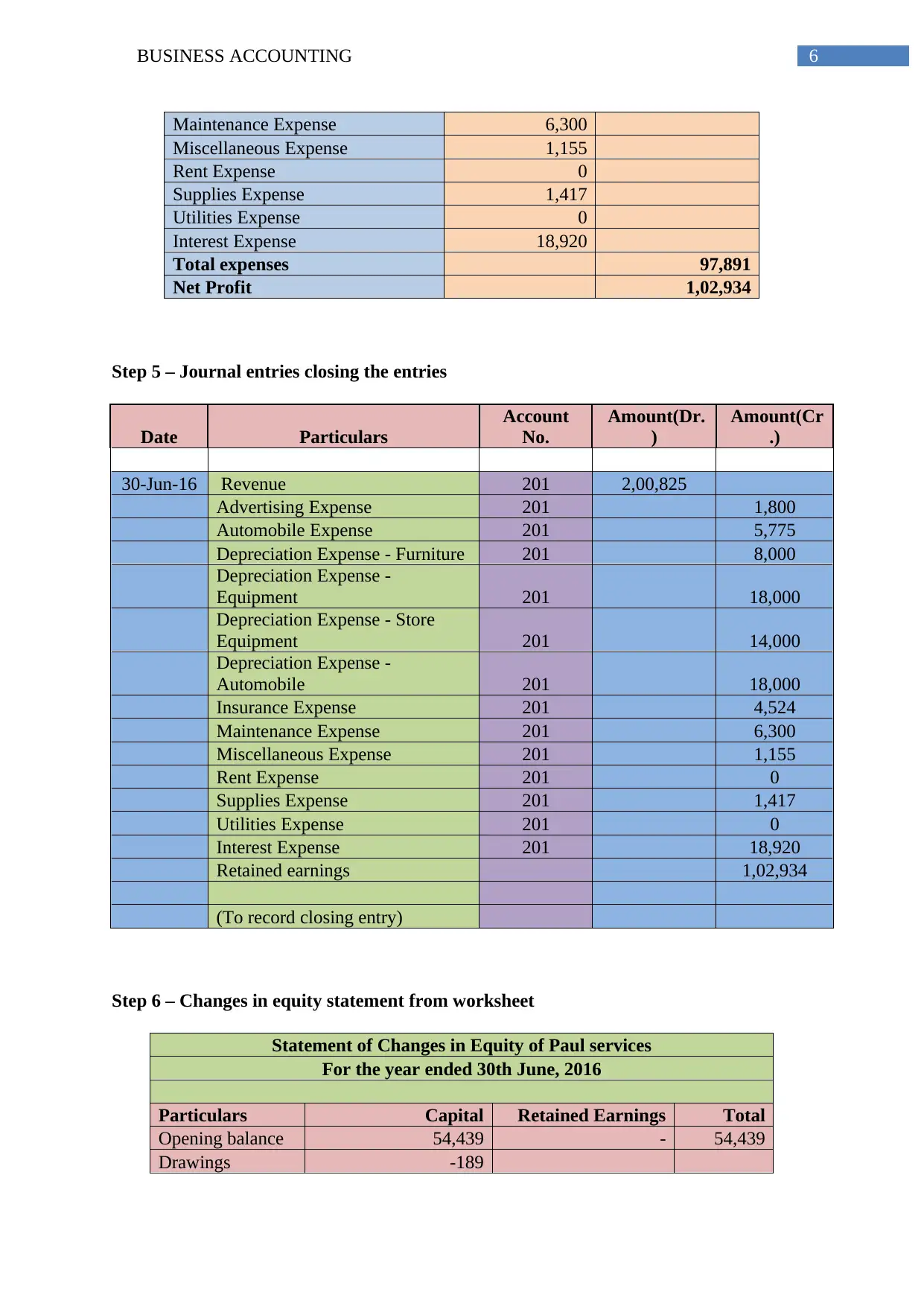

6BUSINESS ACCOUNTING

Maintenance Expense 6,300

Miscellaneous Expense 1,155

Rent Expense 0

Supplies Expense 1,417

Utilities Expense 0

Interest Expense 18,920

Total expenses 97,891

Net Profit 1,02,934

Step 5 – Journal entries closing the entries

Date Particulars

Account

No.

Amount(Dr.

)

Amount(Cr

.)

30-Jun-16 Revenue 201 2,00,825

Advertising Expense 201 1,800

Automobile Expense 201 5,775

Depreciation Expense - Furniture 201 8,000

Depreciation Expense -

Equipment 201 18,000

Depreciation Expense - Store

Equipment 201 14,000

Depreciation Expense -

Automobile 201 18,000

Insurance Expense 201 4,524

Maintenance Expense 201 6,300

Miscellaneous Expense 201 1,155

Rent Expense 201 0

Supplies Expense 201 1,417

Utilities Expense 201 0

Interest Expense 201 18,920

Retained earnings 1,02,934

(To record closing entry)

Step 6 – Changes in equity statement from worksheet

Statement of Changes in Equity of Paul services

For the year ended 30th June, 2016

Particulars Capital Retained Earnings Total

Opening balance 54,439 - 54,439

Drawings -189

Maintenance Expense 6,300

Miscellaneous Expense 1,155

Rent Expense 0

Supplies Expense 1,417

Utilities Expense 0

Interest Expense 18,920

Total expenses 97,891

Net Profit 1,02,934

Step 5 – Journal entries closing the entries

Date Particulars

Account

No.

Amount(Dr.

)

Amount(Cr

.)

30-Jun-16 Revenue 201 2,00,825

Advertising Expense 201 1,800

Automobile Expense 201 5,775

Depreciation Expense - Furniture 201 8,000

Depreciation Expense -

Equipment 201 18,000

Depreciation Expense - Store

Equipment 201 14,000

Depreciation Expense -

Automobile 201 18,000

Insurance Expense 201 4,524

Maintenance Expense 201 6,300

Miscellaneous Expense 201 1,155

Rent Expense 201 0

Supplies Expense 201 1,417

Utilities Expense 201 0

Interest Expense 201 18,920

Retained earnings 1,02,934

(To record closing entry)

Step 6 – Changes in equity statement from worksheet

Statement of Changes in Equity of Paul services

For the year ended 30th June, 2016

Particulars Capital Retained Earnings Total

Opening balance 54,439 - 54,439

Drawings -189

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

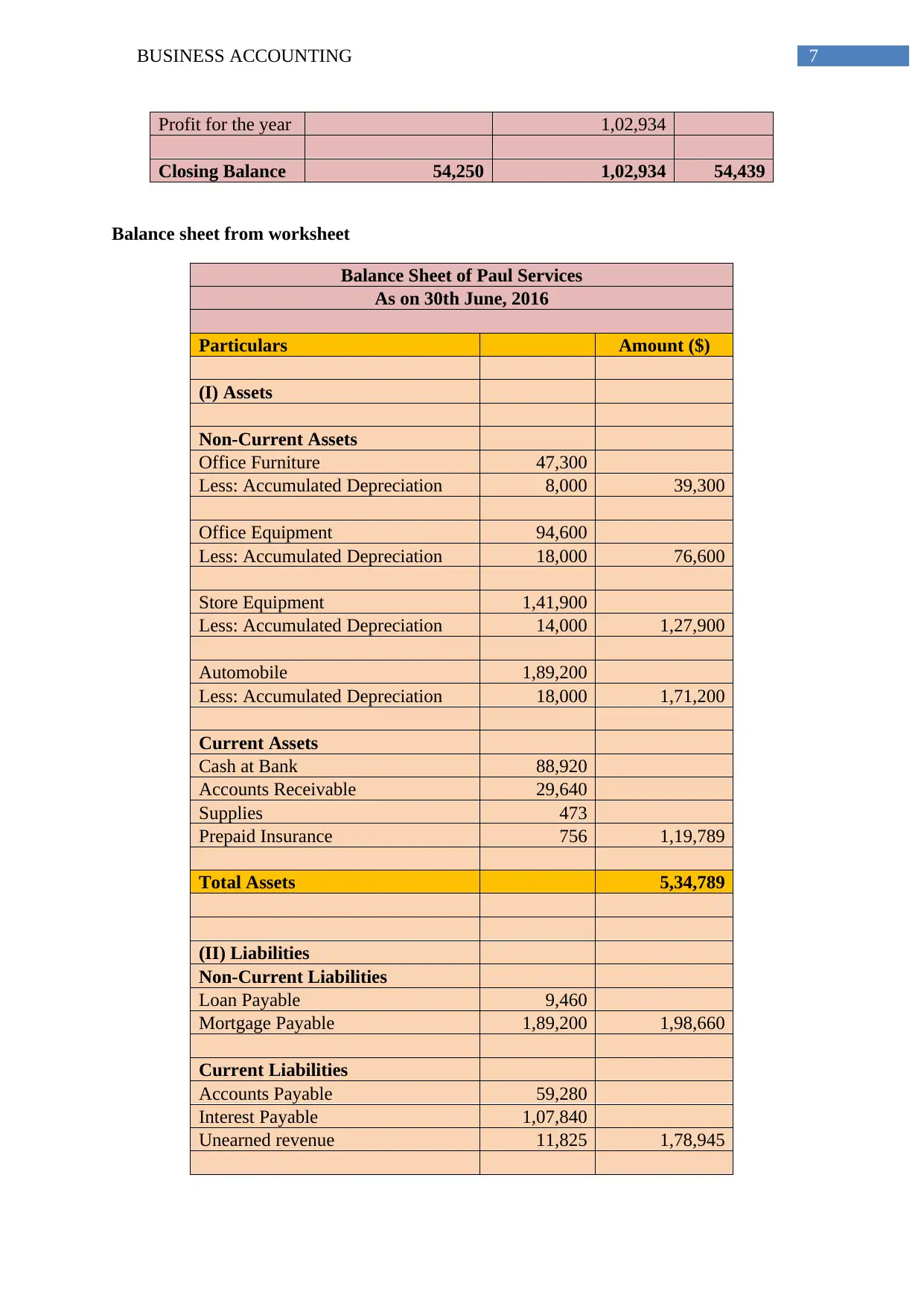

7BUSINESS ACCOUNTING

Profit for the year 1,02,934

Closing Balance 54,250 1,02,934 54,439

Balance sheet from worksheet

Balance Sheet of Paul Services

As on 30th June, 2016

Particulars Amount ($)

(I) Assets

Non-Current Assets

Office Furniture 47,300

Less: Accumulated Depreciation 8,000 39,300

Office Equipment 94,600

Less: Accumulated Depreciation 18,000 76,600

Store Equipment 1,41,900

Less: Accumulated Depreciation 14,000 1,27,900

Automobile 1,89,200

Less: Accumulated Depreciation 18,000 1,71,200

Current Assets

Cash at Bank 88,920

Accounts Receivable 29,640

Supplies 473

Prepaid Insurance 756 1,19,789

Total Assets 5,34,789

(II) Liabilities

Non-Current Liabilities

Loan Payable 9,460

Mortgage Payable 1,89,200 1,98,660

Current Liabilities

Accounts Payable 59,280

Interest Payable 1,07,840

Unearned revenue 11,825 1,78,945

Profit for the year 1,02,934

Closing Balance 54,250 1,02,934 54,439

Balance sheet from worksheet

Balance Sheet of Paul Services

As on 30th June, 2016

Particulars Amount ($)

(I) Assets

Non-Current Assets

Office Furniture 47,300

Less: Accumulated Depreciation 8,000 39,300

Office Equipment 94,600

Less: Accumulated Depreciation 18,000 76,600

Store Equipment 1,41,900

Less: Accumulated Depreciation 14,000 1,27,900

Automobile 1,89,200

Less: Accumulated Depreciation 18,000 1,71,200

Current Assets

Cash at Bank 88,920

Accounts Receivable 29,640

Supplies 473

Prepaid Insurance 756 1,19,789

Total Assets 5,34,789

(II) Liabilities

Non-Current Liabilities

Loan Payable 9,460

Mortgage Payable 1,89,200 1,98,660

Current Liabilities

Accounts Payable 59,280

Interest Payable 1,07,840

Unearned revenue 11,825 1,78,945

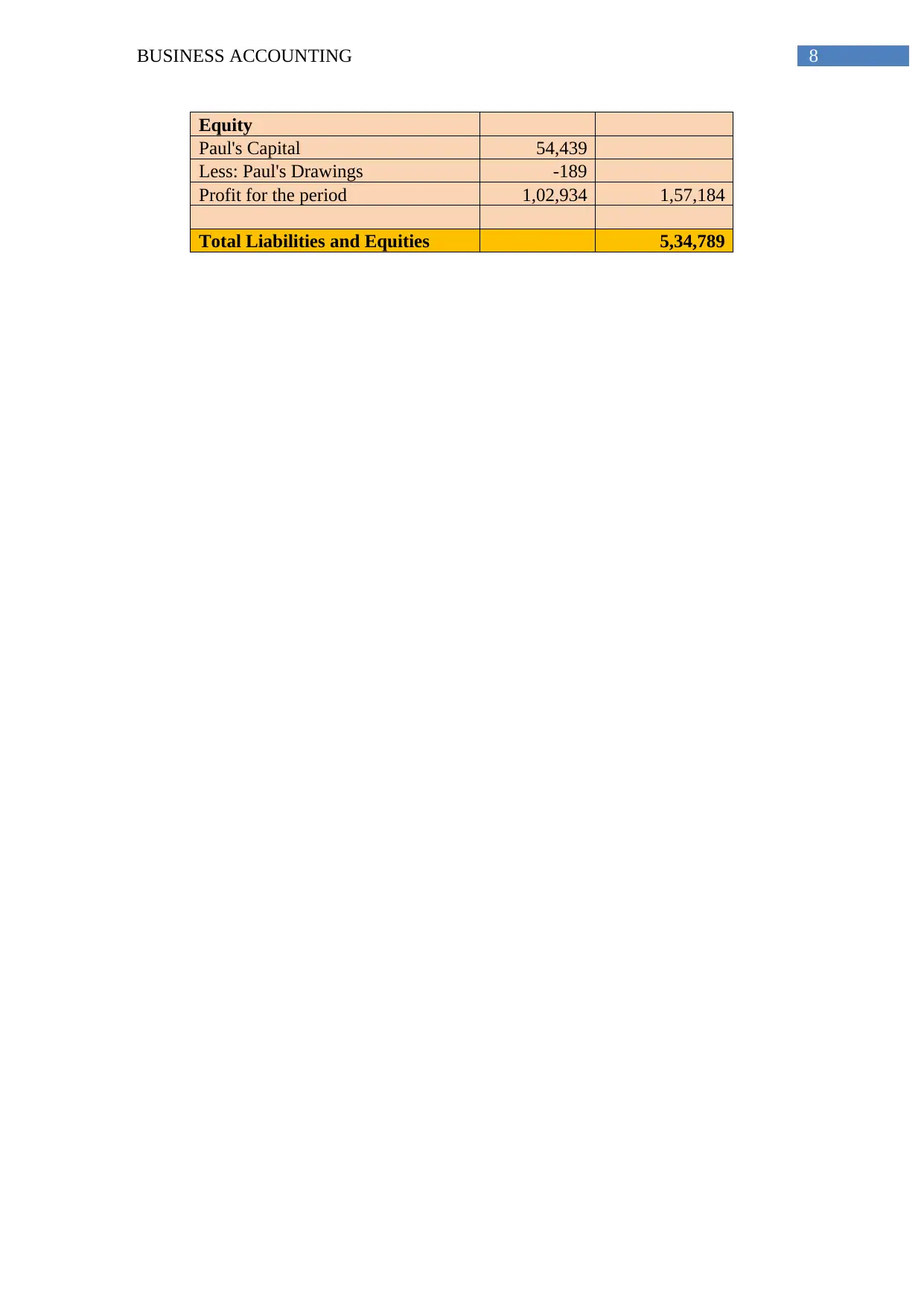

8BUSINESS ACCOUNTING

Equity

Paul's Capital 54,439

Less: Paul's Drawings -189

Profit for the period 1,02,934 1,57,184

Total Liabilities and Equities 5,34,789

Equity

Paul's Capital 54,439

Less: Paul's Drawings -189

Profit for the period 1,02,934 1,57,184

Total Liabilities and Equities 5,34,789

9BUSINESS ACCOUNTING

Step 7

1) Trial balance and the purpose of creation

Trial balance is the list for the closing ledger balances on a specific date and it is the

1st step towards preparation of the financial statements. Generally, it is prepared at closing of

the accounting period and assists in drafting the financial statements. The ledger balances are

segregated into the credit balance and debit balance. Expenses and assets are recorded under

the debit side and liabilities, incomes and capital accounts are recorded in the credit side

(Edwards 2013). When all the entries from the accounting transactions are correctly recorded

and all ledger balances are extracted accurately then the total debit balances will be equal to

the credit balances.

Purpose of creating the trial balance –

Trial balance is the internal report that runs at the closing of each accounting period

and lists the closing balance of each account. Primarily, the report is used for assuring that

total debit is equal to total credit balance. It is the 1st step in preparation of the financial

statement. It is the working paper that is used by the accountant as the basis at the time of

preparing the financial statement (Henderson et al. 2015). It assures that every recorded debit

entry has a corresponding credit entry and is recorded in the account as per double entry

accounting concept. If total of trial balance does not match then the difference shall be

investigated and errors shall be resolved before preparing the financial statement. Rectifying

the errors related to basic accounting can be lengthy procedure after preparation of the

financial statements as the required changes will demand rectification of the financial

statements. Further, the trial balance assists in rectification and identification of the errors

involved (Needles, Powers and Crosson 2013).

Step 7

1) Trial balance and the purpose of creation

Trial balance is the list for the closing ledger balances on a specific date and it is the

1st step towards preparation of the financial statements. Generally, it is prepared at closing of

the accounting period and assists in drafting the financial statements. The ledger balances are

segregated into the credit balance and debit balance. Expenses and assets are recorded under

the debit side and liabilities, incomes and capital accounts are recorded in the credit side

(Edwards 2013). When all the entries from the accounting transactions are correctly recorded

and all ledger balances are extracted accurately then the total debit balances will be equal to

the credit balances.

Purpose of creating the trial balance –

Trial balance is the internal report that runs at the closing of each accounting period

and lists the closing balance of each account. Primarily, the report is used for assuring that

total debit is equal to total credit balance. It is the 1st step in preparation of the financial

statement. It is the working paper that is used by the accountant as the basis at the time of

preparing the financial statement (Henderson et al. 2015). It assures that every recorded debit

entry has a corresponding credit entry and is recorded in the account as per double entry

accounting concept. If total of trial balance does not match then the difference shall be

investigated and errors shall be resolved before preparing the financial statement. Rectifying

the errors related to basic accounting can be lengthy procedure after preparation of the

financial statements as the required changes will demand rectification of the financial

statements. Further, the trial balance assists in rectification and identification of the errors

involved (Needles, Powers and Crosson 2013).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10BUSINESS ACCOUNTING

2) Adjusting journal entries and its purpose of recording

A journal is a fundamental step in the preparation of the accounting statements for any

business concern. A journal entry refers to the financial transactions that have been incurred

by the business unit during a particular financial year. The issue that has been presented in

the question is in regards to the adjusting journal entries. An adjusting journal entry refers to

those particular journal entries that have been included in the financial report at the end of a

particular financial year as because the revenue or expenses associated with those journal

entries have not been recognized at the time of generation (Weygandt, Kimmel and Kieso

2015). An adjusting journal entry might also be passed when a particular financial

transaction that had been started in the previous accounting period ends in the current

accounting period. Accounting errors are a common occurrence on the part of the company

accountant as he or she has to deal with a huge volume of financial transactions. Therefore,

such accounting errors can also be rectified with the help of adjusting journal entries (Ijiri

2014).

The adjusting journal entries are recorded in order to ensure the fact that the

accounting statements that are further prepared on the basis of these journal entries reflect a

genuine and fair image of the concerned organization. The recording of the adjusting journal

entries also help in tracing the cash that flows in and out of business during a particular

financial year. To be more precise, the adjusting journal entry helps in the identification of

the exact instances as to when the money goes out of business and the instances when it flows

into business. Moreover, they also facilitate the conversion of the real time accounting entries

into entries that can be suited into the accrual accounting system. There are precisely three

common types of adjusting journal entries, which are accruals, estimates and deferrals

(Dennis 2014).

2) Adjusting journal entries and its purpose of recording

A journal is a fundamental step in the preparation of the accounting statements for any

business concern. A journal entry refers to the financial transactions that have been incurred

by the business unit during a particular financial year. The issue that has been presented in

the question is in regards to the adjusting journal entries. An adjusting journal entry refers to

those particular journal entries that have been included in the financial report at the end of a

particular financial year as because the revenue or expenses associated with those journal

entries have not been recognized at the time of generation (Weygandt, Kimmel and Kieso

2015). An adjusting journal entry might also be passed when a particular financial

transaction that had been started in the previous accounting period ends in the current

accounting period. Accounting errors are a common occurrence on the part of the company

accountant as he or she has to deal with a huge volume of financial transactions. Therefore,

such accounting errors can also be rectified with the help of adjusting journal entries (Ijiri

2014).

The adjusting journal entries are recorded in order to ensure the fact that the

accounting statements that are further prepared on the basis of these journal entries reflect a

genuine and fair image of the concerned organization. The recording of the adjusting journal

entries also help in tracing the cash that flows in and out of business during a particular

financial year. To be more precise, the adjusting journal entry helps in the identification of

the exact instances as to when the money goes out of business and the instances when it flows

into business. Moreover, they also facilitate the conversion of the real time accounting entries

into entries that can be suited into the accrual accounting system. There are precisely three

common types of adjusting journal entries, which are accruals, estimates and deferrals

(Dennis 2014).

11BUSINESS ACCOUNTING

3) Purpose of writing the adjusted trial balance

The issue that has been presented in the question is in regards to the purpose for

writing an adjusted trial balance. However, before understanding the purpose of an adjusted

trial balance, the meaning of a trial balance must be understood. A trial balance refers to the

financial statement that is prepared prior to the preparation of the significant accounting

statements like the income statement and the balance sheet. A trial balance is essentially

prepared in order to check whether the net balance in the credit, accounts match with the net

balance in the debit accounts (Warren and Jones 2018). The current balance in each of the

credit or the debit accounts is recorded and then the total amount of each credit and debit

column is matched so that they represent the same balance. However, in case the

corresponding balances do not match, it represents the fact that there has been a mistake,

either in the account balances or in the computation of the total credit or debit balance. The

need for an adjusted trial balance arises at this point. An adjusted trial balance incorporates

the adjusting entries and then attempts to match the total debit and credit columns. The sole

purpose of preparing the adjusted journal entries revolves around the fact that the accuracy of

the accounting statements that are further deduced from the trial balance depends on the

correctness of the adjusted trial balance. The primary motive behind the preparation of the

financial statements of a particular organization is that the users of these statements like the

investors and other stakeholders of business get a clarified view into the financial

performance of the firm in order to make proper financial decisions. Thus, in case of any

accounting error in the trial balance will result in the generation of faulty accounting

statements. Hence, the role of adjusted trial balance is very important for an accountant

(Adejare 2014).

3) Purpose of writing the adjusted trial balance

The issue that has been presented in the question is in regards to the purpose for

writing an adjusted trial balance. However, before understanding the purpose of an adjusted

trial balance, the meaning of a trial balance must be understood. A trial balance refers to the

financial statement that is prepared prior to the preparation of the significant accounting

statements like the income statement and the balance sheet. A trial balance is essentially

prepared in order to check whether the net balance in the credit, accounts match with the net

balance in the debit accounts (Warren and Jones 2018). The current balance in each of the

credit or the debit accounts is recorded and then the total amount of each credit and debit

column is matched so that they represent the same balance. However, in case the

corresponding balances do not match, it represents the fact that there has been a mistake,

either in the account balances or in the computation of the total credit or debit balance. The

need for an adjusted trial balance arises at this point. An adjusted trial balance incorporates

the adjusting entries and then attempts to match the total debit and credit columns. The sole

purpose of preparing the adjusted journal entries revolves around the fact that the accuracy of

the accounting statements that are further deduced from the trial balance depends on the

correctness of the adjusted trial balance. The primary motive behind the preparation of the

financial statements of a particular organization is that the users of these statements like the

investors and other stakeholders of business get a clarified view into the financial

performance of the firm in order to make proper financial decisions. Thus, in case of any

accounting error in the trial balance will result in the generation of faulty accounting

statements. Hence, the role of adjusted trial balance is very important for an accountant

(Adejare 2014).

12BUSINESS ACCOUNTING

4) Adjustment journal entries as against the closing journal entries

At first glance the closing entries and adjustment entries are not easy to grasp. The

reason behind this is that the kind of transactions that requires adjustments that may not be

familiar. The main feature of this kind of transaction is the time of involvement. The

adjusting entries in other way are recorded through initial transaction (Apostolou et al. 2013).

However, for the subsequent events further entries required to be passed. Apart from this, the

adjustments are forced upon accountant as accounting cycle comes closure to end and

financial statements are required to be prepared. The adjustment entries are recorded at

closing of each accounting period and before the preparation of the financial statements.

Adjusting entries are the major part of the closing procedures as per the notes in accounting

cycle where the preliminary trial balances are transformed into the final trial balance.

Generally it is not possible to generate the financial statements that are fully complied with

the accounting standards without using the adjusting entries (Edmonds et al. 2013).

On the contrary, closing entries are the journal entries that are made at closing of the

accounting period for transferring the temporary to the permanent accounts. Permanent

accounts under which the balances get transferred depend on the business type. For example,

in case of sole proprietorship the balance is transferred to owner’s capital account and in case

of company the balance is transferred to retained earnings. The income summary account can

be used for showing balances among the expenses and revenues or they can be closed directly

against the retained earnings from where the payments for dividend will be deducted. This

procedure is used for resetting the temporary account balance to zero for the next period of

accounting.

4) Adjustment journal entries as against the closing journal entries

At first glance the closing entries and adjustment entries are not easy to grasp. The

reason behind this is that the kind of transactions that requires adjustments that may not be

familiar. The main feature of this kind of transaction is the time of involvement. The

adjusting entries in other way are recorded through initial transaction (Apostolou et al. 2013).

However, for the subsequent events further entries required to be passed. Apart from this, the

adjustments are forced upon accountant as accounting cycle comes closure to end and

financial statements are required to be prepared. The adjustment entries are recorded at

closing of each accounting period and before the preparation of the financial statements.

Adjusting entries are the major part of the closing procedures as per the notes in accounting

cycle where the preliminary trial balances are transformed into the final trial balance.

Generally it is not possible to generate the financial statements that are fully complied with

the accounting standards without using the adjusting entries (Edmonds et al. 2013).

On the contrary, closing entries are the journal entries that are made at closing of the

accounting period for transferring the temporary to the permanent accounts. Permanent

accounts under which the balances get transferred depend on the business type. For example,

in case of sole proprietorship the balance is transferred to owner’s capital account and in case

of company the balance is transferred to retained earnings. The income summary account can

be used for showing balances among the expenses and revenues or they can be closed directly

against the retained earnings from where the payments for dividend will be deducted. This

procedure is used for resetting the temporary account balance to zero for the next period of

accounting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13BUSINESS ACCOUNTING

Conclusion

From the above discussion it is concluded that the trial balance and the journal entries

along with the adjusting journal entries play major role while preparing the financial

statements of the company. The trial balance assures that every recorded debit entry has a

corresponding credit entry and is recorded in the account as per double entry accounting

concept. On the other hand, the adjusted journal entries revolves around the fact that the

accuracy of the accounting statements that are further deduced from the trial balance depends

on the correctness of the adjusted trial balance.

Conclusion

From the above discussion it is concluded that the trial balance and the journal entries

along with the adjusting journal entries play major role while preparing the financial

statements of the company. The trial balance assures that every recorded debit entry has a

corresponding credit entry and is recorded in the account as per double entry accounting

concept. On the other hand, the adjusted journal entries revolves around the fact that the

accuracy of the accounting statements that are further deduced from the trial balance depends

on the correctness of the adjusted trial balance.

14BUSINESS ACCOUNTING

References

Adejare, A.T., 2014. The analysis of the impact of accounting records keeping on the

performance of the small scale enterprises. International Journal of Academic Research in

Business and Social Sciences, 4(1), p.1.

Apostolou, B., Dorminey, J.W., Hassell, J.M. and Watson, S.F., 2013. Accounting education

literature review (2010–2012). Journal of Accounting Education, 31(2), pp.107-161.

Dennis, S., 2014. Systems and methods for providing computer-automated adjusting entries.

U.S. Patent Application 14/046,921.

Edmonds, T.P., McNair, F.M., Olds, P.R. and Milam, E.E., 2013. Fundamental financial

accounting concepts. New York, NY: McGraw-Hill Irwin.

Edwards, J.R., 2013. A history of financial accounting (RLE Accounting) (Vol. 29).

Routledge.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Ijiri, Y., 2014. The beauty of double-entry bookkeeping and its impact on the nature of

accounting information. Economie Notes by Monte dei Paschi di Siena, 22(2-1993), pp.265-

285.

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Financial and managerial accounting.

Cengage Learning.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

References

Adejare, A.T., 2014. The analysis of the impact of accounting records keeping on the

performance of the small scale enterprises. International Journal of Academic Research in

Business and Social Sciences, 4(1), p.1.

Apostolou, B., Dorminey, J.W., Hassell, J.M. and Watson, S.F., 2013. Accounting education

literature review (2010–2012). Journal of Accounting Education, 31(2), pp.107-161.

Dennis, S., 2014. Systems and methods for providing computer-automated adjusting entries.

U.S. Patent Application 14/046,921.

Edmonds, T.P., McNair, F.M., Olds, P.R. and Milam, E.E., 2013. Fundamental financial

accounting concepts. New York, NY: McGraw-Hill Irwin.

Edwards, J.R., 2013. A history of financial accounting (RLE Accounting) (Vol. 29).

Routledge.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Ijiri, Y., 2014. The beauty of double-entry bookkeeping and its impact on the nature of

accounting information. Economie Notes by Monte dei Paschi di Siena, 22(2-1993), pp.265-

285.

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Financial and managerial accounting.

Cengage Learning.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

15BUSINESS ACCOUNTING

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.