Development of UK Audit Committee for Effective and Good Governance

VerifiedAdded on 2023/06/18

|37

|13815

|493

AI Summary

This dissertation explores the development of the UK audit committee for effective and good governance in public sector organizations like Foundation Trusts (FTs). It examines the responsibilities and roles of the audit committee, the strategies and policies employed, and the composition of FTs. The study is based on Institutional Theory and adopts an explanatory and exploratory method.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

A CRITICAL ANALYSIS OF THE DEVELOPMENT OF THE ROLES AND

RESPONSIBILITIES OF THE UK AUDIT COMMITTEE FOR EFFECTIVE AND

GOOD GOVERNANCE

1

RESPONSIBILITIES OF THE UK AUDIT COMMITTEE FOR EFFECTIVE AND

GOOD GOVERNANCE

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Executive Summary........................................................................................................................5

CHAPTER ONE..............................................................................................................................6

Introduction......................................................................................................................................6

1.1 Background to the Study........................................................................................................6

1.2 Statement of Problem in research..........................................................................................7

1.3 Objectives..............................................................................................................................8

1.4 Research Questions................................................................................................................8

1.5 Justification............................................................................................................................8

1.7 Organisational context...........................................................................................................8

1.8 Summary................................................................................................................................9

CHAPTER TWO...........................................................................................................................10

Literature Review and Theoretical Framework.............................................................................10

2.1 Introduction..........................................................................................................................10

2.2 The UK Corporate Governance Code..................................................................................10

2.3 Evolution of the UK Corporate Governance Code..............................................................11

2.4 Principles of Good and Effective Corporate Governance....................................................13

2.5 The Importance of Good and Effective Corporate Governance .........................................14

2.6 Composition of the UK Audit Committee...........................................................................16

2.7 UK Audit committee............................................................................................................17

2.8 Objectives of the UK Audit Committee...............................................................................19

2.9 Context and Background to the UK Public Sector Audit Committee.................................19

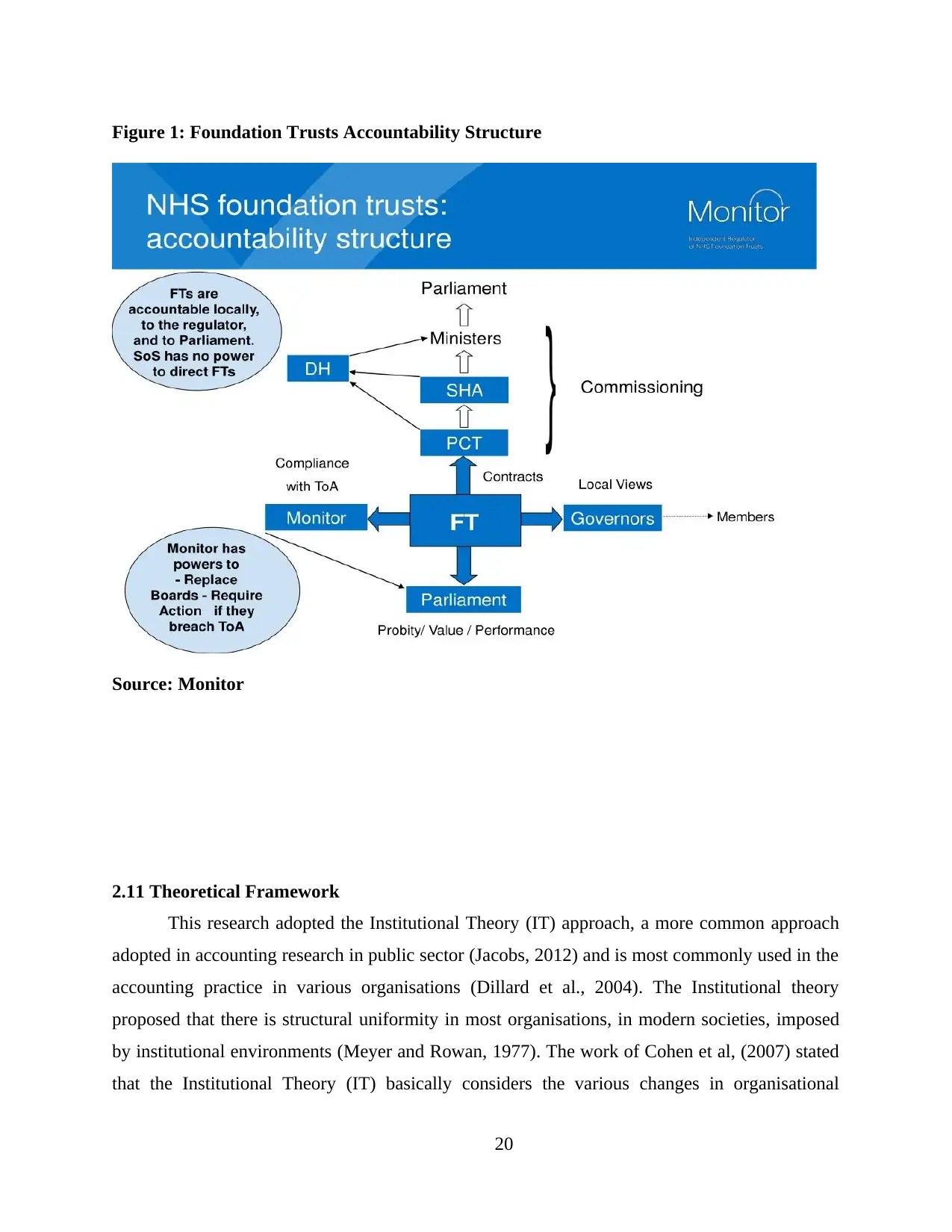

2.10 Foundation Trusts (FTs)....................................................................................................20

2.11 Theoretical Framework .....................................................................................................21

2.12 Summary............................................................................................................................22

CHAPTER THREE.......................................................................................................................23

RESEARCH METHODOLOGY...................................................................................................23

3.1 Introduction..........................................................................................................................23

3.2 Research Methodology .......................................................................................................23

3.3 Research Design ..................................................................................................................23

3.4 Research strategies ..............................................................................................................24

3.5 Data and Discussion.............................................................................................................24

2

Executive Summary........................................................................................................................5

CHAPTER ONE..............................................................................................................................6

Introduction......................................................................................................................................6

1.1 Background to the Study........................................................................................................6

1.2 Statement of Problem in research..........................................................................................7

1.3 Objectives..............................................................................................................................8

1.4 Research Questions................................................................................................................8

1.5 Justification............................................................................................................................8

1.7 Organisational context...........................................................................................................8

1.8 Summary................................................................................................................................9

CHAPTER TWO...........................................................................................................................10

Literature Review and Theoretical Framework.............................................................................10

2.1 Introduction..........................................................................................................................10

2.2 The UK Corporate Governance Code..................................................................................10

2.3 Evolution of the UK Corporate Governance Code..............................................................11

2.4 Principles of Good and Effective Corporate Governance....................................................13

2.5 The Importance of Good and Effective Corporate Governance .........................................14

2.6 Composition of the UK Audit Committee...........................................................................16

2.7 UK Audit committee............................................................................................................17

2.8 Objectives of the UK Audit Committee...............................................................................19

2.9 Context and Background to the UK Public Sector Audit Committee.................................19

2.10 Foundation Trusts (FTs)....................................................................................................20

2.11 Theoretical Framework .....................................................................................................21

2.12 Summary............................................................................................................................22

CHAPTER THREE.......................................................................................................................23

RESEARCH METHODOLOGY...................................................................................................23

3.1 Introduction..........................................................................................................................23

3.2 Research Methodology .......................................................................................................23

3.3 Research Design ..................................................................................................................23

3.4 Research strategies ..............................................................................................................24

3.5 Data and Discussion.............................................................................................................24

2

3.6 Summary..............................................................................................................................25

CHAPTER FOUR..........................................................................................................................26

PRESENTATION AND ANALYSIS OF DATA.........................................................................26

4.1 UK Audit Committee and Foundation Trusts Financial Performance.................................26

4.1.1 Income and Expenditure...................................................................................................26

4.2 Discussion of Results ..........................................................................................................29

4.3 Summary..............................................................................................................................31

CHAPTER FIVE...........................................................................................................................32

SUMMARY, CONCLUSION AND RECOMMENDATIONS....................................................32

5.1 Summary of the Findings.....................................................................................................32

5.2 Conclusion...........................................................................................................................33

5.3 Recommendations................................................................................................................34

References......................................................................................................................................35

.......................................................................................................................................................38

3

CHAPTER FOUR..........................................................................................................................26

PRESENTATION AND ANALYSIS OF DATA.........................................................................26

4.1 UK Audit Committee and Foundation Trusts Financial Performance.................................26

4.1.1 Income and Expenditure...................................................................................................26

4.2 Discussion of Results ..........................................................................................................29

4.3 Summary..............................................................................................................................31

CHAPTER FIVE...........................................................................................................................32

SUMMARY, CONCLUSION AND RECOMMENDATIONS....................................................32

5.1 Summary of the Findings.....................................................................................................32

5.2 Conclusion...........................................................................................................................33

5.3 Recommendations................................................................................................................34

References......................................................................................................................................35

.......................................................................................................................................................38

3

Executive Summary

Main purpose of this dissertation is to identify responsibilities and roles of the UK audit

commission on the effectiveness of public corporations in the UK. Sir Robert Smith produced

‘The Smith Guidance on Audit Committees’ that is subjoined to the UK Corporate Governance

Code. The audit administrative body is designed to oversee the financial process of the

companies and the organisations with the objective of getting accurate, reliable, and valid reports

to the stakeholders. Though there have been innovations in the role for audit administrative unit,

the committee is designed deal with the current and the emerging issues of sustainability,

adherence to the ethical and legal laws and the environmental considerations. The study is

exploratory and explanatory in nature. The study is related to make motivated with the dearth of

conformable studies as compared to the backstage sector. The conflicting and complex nature of

the accounting expectation underscores the constraint on how the corporate administration

mechanism contributes to the effectiveness and efficiency of the public sector performance. The

findings show that the audit committee’s functions are effective, although still developing and

with some challenges. It was recommended that training programs should be organized for

associate of the audit commission in order to boost their efficiency. Auditors must be honest and

fair in their dealings and being more professional in carrying out their duties. Auditors should

encourage cordial relationship with the management for a better result. The audit committee

needs interact more frequently with the management of Foundation Trust (FTs) in order to

develop a reliable and quality accounting report.

4

Main purpose of this dissertation is to identify responsibilities and roles of the UK audit

commission on the effectiveness of public corporations in the UK. Sir Robert Smith produced

‘The Smith Guidance on Audit Committees’ that is subjoined to the UK Corporate Governance

Code. The audit administrative body is designed to oversee the financial process of the

companies and the organisations with the objective of getting accurate, reliable, and valid reports

to the stakeholders. Though there have been innovations in the role for audit administrative unit,

the committee is designed deal with the current and the emerging issues of sustainability,

adherence to the ethical and legal laws and the environmental considerations. The study is

exploratory and explanatory in nature. The study is related to make motivated with the dearth of

conformable studies as compared to the backstage sector. The conflicting and complex nature of

the accounting expectation underscores the constraint on how the corporate administration

mechanism contributes to the effectiveness and efficiency of the public sector performance. The

findings show that the audit committee’s functions are effective, although still developing and

with some challenges. It was recommended that training programs should be organized for

associate of the audit commission in order to boost their efficiency. Auditors must be honest and

fair in their dealings and being more professional in carrying out their duties. Auditors should

encourage cordial relationship with the management for a better result. The audit committee

needs interact more frequently with the management of Foundation Trust (FTs) in order to

develop a reliable and quality accounting report.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CHAPTER ONE

Introduction

1.1 Background to the Study

A Foundation trust introduces to the semi-autonomous organisational unite in national

health work in United Kingdom. An inaccurate financial information possesses the potential to

ruin a company and damage its reputation and goodwill. This is one of the major reason due to

which the responsibilities and roles of the UK audit committee cannot be overemphasized when

it comes to effective and efficient corporate governance. Foundation trust is the organisation that

is supported by central government. These trusts are helpful for accountable and make local

population, patients and other staff of the government. These are appointed by the stakeholder’s

analysis and are elected for the growth of trust within the organisation. Foundation trust is

helpful to make a local involvement, local employment and different type of partnerships for the

growth of different auditors and financial controls for the growth of ventral government. The UK

audit commission is anticipated to provide the essential and relevant review process. It is

necessary for a sound corporate administration and to enable direction and focus of its attention

on the review process as a check, so that the credibility of the financial statements can be ensured

(Zhou and Maggina,, 2018.). This will be very helpful for generating effective techniques and

make systematic changes in the foundation trust for analysing UK CGC. UK Corporate

Governance Code exist for the UK organisations to own an audit administrative body, and the

services of the extraneous auditors are still much needed by the public organisations. The reports

were lacking credibility and this made the Institute of Chartered Accountants of England

declared an audit plans to be carried out in order to know the standards that were adopted to

analyse the financial statements whether they comply with the IFRS or GAAP accounting

principles.

This project provides a deep understanding of the major changes in the UK auditor

administrative body to monitor the financial matters, the risks, and the issues of sustainability

(Bravo and Alvarado, 2019).

The rising level of corruption have been responsible for the collapse of major

corporations and also as an indicator of weak and poor governance. To this light, there is a great

need for transparency and accountability to shield all the stakeholders and investors (Glaum et

5

Introduction

1.1 Background to the Study

A Foundation trust introduces to the semi-autonomous organisational unite in national

health work in United Kingdom. An inaccurate financial information possesses the potential to

ruin a company and damage its reputation and goodwill. This is one of the major reason due to

which the responsibilities and roles of the UK audit committee cannot be overemphasized when

it comes to effective and efficient corporate governance. Foundation trust is the organisation that

is supported by central government. These trusts are helpful for accountable and make local

population, patients and other staff of the government. These are appointed by the stakeholder’s

analysis and are elected for the growth of trust within the organisation. Foundation trust is

helpful to make a local involvement, local employment and different type of partnerships for the

growth of different auditors and financial controls for the growth of ventral government. The UK

audit commission is anticipated to provide the essential and relevant review process. It is

necessary for a sound corporate administration and to enable direction and focus of its attention

on the review process as a check, so that the credibility of the financial statements can be ensured

(Zhou and Maggina,, 2018.). This will be very helpful for generating effective techniques and

make systematic changes in the foundation trust for analysing UK CGC. UK Corporate

Governance Code exist for the UK organisations to own an audit administrative body, and the

services of the extraneous auditors are still much needed by the public organisations. The reports

were lacking credibility and this made the Institute of Chartered Accountants of England

declared an audit plans to be carried out in order to know the standards that were adopted to

analyse the financial statements whether they comply with the IFRS or GAAP accounting

principles.

This project provides a deep understanding of the major changes in the UK auditor

administrative body to monitor the financial matters, the risks, and the issues of sustainability

(Bravo and Alvarado, 2019).

The rising level of corruption have been responsible for the collapse of major

corporations and also as an indicator of weak and poor governance. To this light, there is a great

need for transparency and accountability to shield all the stakeholders and investors (Glaum et

5

al., 2004; Fearnley and Beattie, 2004). The role of the governments of the Western world have

come up with relevant initiatives which include the UK Combined Code and the Sarbanes Oxley

Act (SOX) (2002) (FRC, 2003), that clearly state and make governance mechanisms to assist

boards of directors and other stakeholders of different organisations promote the management of

firms and avoid their liquidation. For instance, the study carried out by Fichtner (2010) revealed

the collapse of Enron made various regulators and governments from developed countries to give

new attending to the audit committee as a major administration mechanism. The study of Rustam

et al. (2013) revealed that the current corporate use of scandals that have given birth to the

corporate governance guidelines that give a crucial function to the UK audit committee.

However, the expectations surrounding audit committees in advanced countries has a quite. The

study of Okpara (2011), for example, in Nigeria found series of bottlenecks that hinder the

promotion and implementation of corporate governance which include non-existent or weak

institutions like weak law enforcement framework and the absence of disclosure and

transparency. This may lead to adverse effects on their practice and effectiveness as a

mechanism of corporate governance.

1.2 Statement of Problem in research

This research is actuated by the dearth of empirical survey of the UK voluntary sector

administration structures and performance as compared to backstage sector corporate governance

inquiry (Broadbent and Guthrie, 2008). The issues of the UK public sector corporate governance

go further than of private sector. The stewardship of UK state-supported funds is prioritised and

due process requirements only mean that transparency surpasses the requirements of the

corporate plane figure. Furthermore, most projects are usually more convoluted given the wonder

of the shareholders different conflicting but legitimate answerability expectations (Evans and

Freeman, 1990). The complex requirements, structures and processes in the context of a UK

public plane figure and the paucity of studies in this area deformation our perceptive of how the

mechanism of corporate governance contribute to the UK public sector performance and

consequently, creating a vacuum for further research (Pollitt, 2011). However, the few studies

that exist about the audit committee in the UK public sector context revealed why the UK public

sector audit committees are very typical in they exist in different structures and forms

(Boardsource, 2010), A poor cognition exist about the structure of the UK audit committee and

its broad responsibilities. Besides, there exist no comparative study on audit committees in the

6

come up with relevant initiatives which include the UK Combined Code and the Sarbanes Oxley

Act (SOX) (2002) (FRC, 2003), that clearly state and make governance mechanisms to assist

boards of directors and other stakeholders of different organisations promote the management of

firms and avoid their liquidation. For instance, the study carried out by Fichtner (2010) revealed

the collapse of Enron made various regulators and governments from developed countries to give

new attending to the audit committee as a major administration mechanism. The study of Rustam

et al. (2013) revealed that the current corporate use of scandals that have given birth to the

corporate governance guidelines that give a crucial function to the UK audit committee.

However, the expectations surrounding audit committees in advanced countries has a quite. The

study of Okpara (2011), for example, in Nigeria found series of bottlenecks that hinder the

promotion and implementation of corporate governance which include non-existent or weak

institutions like weak law enforcement framework and the absence of disclosure and

transparency. This may lead to adverse effects on their practice and effectiveness as a

mechanism of corporate governance.

1.2 Statement of Problem in research

This research is actuated by the dearth of empirical survey of the UK voluntary sector

administration structures and performance as compared to backstage sector corporate governance

inquiry (Broadbent and Guthrie, 2008). The issues of the UK public sector corporate governance

go further than of private sector. The stewardship of UK state-supported funds is prioritised and

due process requirements only mean that transparency surpasses the requirements of the

corporate plane figure. Furthermore, most projects are usually more convoluted given the wonder

of the shareholders different conflicting but legitimate answerability expectations (Evans and

Freeman, 1990). The complex requirements, structures and processes in the context of a UK

public plane figure and the paucity of studies in this area deformation our perceptive of how the

mechanism of corporate governance contribute to the UK public sector performance and

consequently, creating a vacuum for further research (Pollitt, 2011). However, the few studies

that exist about the audit committee in the UK public sector context revealed why the UK public

sector audit committees are very typical in they exist in different structures and forms

(Boardsource, 2010), A poor cognition exist about the structure of the UK audit committee and

its broad responsibilities. Besides, there exist no comparative study on audit committees in the

6

context of a UK national sector as the existing few survey examine the audit committees

isolation to institutional setting or organisational context (Chien et al., 2010).

1.3 Objectives

The main purpose of this research is to investigate the set-up of Audit Committee (AC),

responsibilities, development and roles in Foundation Trusts (FTs), a UK public sector

organisation. The study adopted an approach that is based on Institutional Theory (IT). The

approach explains how the Audit Committees (ACs) have come to be adoptive into public sector

organize through Code of Corporate Administration implementation that was copied from the

consecutive UK Codes of Firm Administration. The specific objectives include to:

(i) Examine the responsibilities and roles for UK audit committee on the effectivity of

voluntary sector in the UK

(ii) Ascertain the strategies and policies employed by the UK audit committee in

achieving its aims and objectives as it relates to good and effective governance.

1.4 Research Questions

The study develops two research questions as follows:

(i) What is the composition including appointment, size and membership of Foundation

Trusts (FTs) as it relates to good and effective governance?

(ii) How have the roles and works of the audit committee developed in Foundation Trusts

(FTs) as it relates to good and effective governance?

1.5 Justification

This is deliberately investigates how and why UK audit committee has developed in a

public sector framework. The NHS Foundation Trusts (FTs), within health, represents a good

sample of adopting the NPM techniques to the UK public people. The NHS Foundation Trusts

(FTs) came into existence and set up as an independent and separate legal entity. With a

centralised top-down direction structure, the UK corporate governing body structure and model

is similar to a private sector corporate governance model. Their board of politician is elected by

associate of the Foundation Trusts (FTs) of who is part of those serving in the audit committee.

7

isolation to institutional setting or organisational context (Chien et al., 2010).

1.3 Objectives

The main purpose of this research is to investigate the set-up of Audit Committee (AC),

responsibilities, development and roles in Foundation Trusts (FTs), a UK public sector

organisation. The study adopted an approach that is based on Institutional Theory (IT). The

approach explains how the Audit Committees (ACs) have come to be adoptive into public sector

organize through Code of Corporate Administration implementation that was copied from the

consecutive UK Codes of Firm Administration. The specific objectives include to:

(i) Examine the responsibilities and roles for UK audit committee on the effectivity of

voluntary sector in the UK

(ii) Ascertain the strategies and policies employed by the UK audit committee in

achieving its aims and objectives as it relates to good and effective governance.

1.4 Research Questions

The study develops two research questions as follows:

(i) What is the composition including appointment, size and membership of Foundation

Trusts (FTs) as it relates to good and effective governance?

(ii) How have the roles and works of the audit committee developed in Foundation Trusts

(FTs) as it relates to good and effective governance?

1.5 Justification

This is deliberately investigates how and why UK audit committee has developed in a

public sector framework. The NHS Foundation Trusts (FTs), within health, represents a good

sample of adopting the NPM techniques to the UK public people. The NHS Foundation Trusts

(FTs) came into existence and set up as an independent and separate legal entity. With a

centralised top-down direction structure, the UK corporate governing body structure and model

is similar to a private sector corporate governance model. Their board of politician is elected by

associate of the Foundation Trusts (FTs) of who is part of those serving in the audit committee.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.7 Organisational context

The first chapter captures an introduction to the study while chapter two reviews relevant

and related literature which analyze audit committees in different organization framework and

organizational contexts as it relates to good and effective corporate governance. This chapter

examines the theoretical framework approaches. Chapter three covers the research methodology,

including the method of data aggregation and beginning of information from Foundation Trusts

(FTs). Chapter four analyses the data and discussion of the results while chapter five concludes,

made some empirical findings, summarise, and make some recommendations for the study.

1.8 Summary

It presents a clear view to a critical analysis of the development of the responsibilities and

roles of the UK audit committee for effective and good corporate governance in Foundation

Trusts (FTs), a public sector entity. The study is actuated by the complex nature of UK public

sector with different legitimate but conflicting accountability expectations. The study adopted an

approach that is based on Institutional Theory (IT) and is justified by the fact that the health

sector has a complex process, characteristics and history and is one of the biggest public sectors

in the UK. The study adopted an explanatory and exploratory methods and a qualitative –case

study approach including document reviews.

8

The first chapter captures an introduction to the study while chapter two reviews relevant

and related literature which analyze audit committees in different organization framework and

organizational contexts as it relates to good and effective corporate governance. This chapter

examines the theoretical framework approaches. Chapter three covers the research methodology,

including the method of data aggregation and beginning of information from Foundation Trusts

(FTs). Chapter four analyses the data and discussion of the results while chapter five concludes,

made some empirical findings, summarise, and make some recommendations for the study.

1.8 Summary

It presents a clear view to a critical analysis of the development of the responsibilities and

roles of the UK audit committee for effective and good corporate governance in Foundation

Trusts (FTs), a public sector entity. The study is actuated by the complex nature of UK public

sector with different legitimate but conflicting accountability expectations. The study adopted an

approach that is based on Institutional Theory (IT) and is justified by the fact that the health

sector has a complex process, characteristics and history and is one of the biggest public sectors

in the UK. The study adopted an explanatory and exploratory methods and a qualitative –case

study approach including document reviews.

8

CHAPTER TWO

Literature Review and the Theoretical Framework

2.1 Introduction

This is related to carried out by Lubna, (2018) opined that the audit and its committee are

associated to perform a role that tends to be crucial and additional making for the growth of the

environment right in terms of the auditing and its quality. Furthermore, it is also the obligation of

the audit committees to nurture for an environment that includes open nature in the culture that

belongs to honestest; transparency and regard which is between the auditors and the

management. Additionally, the important purpose of the UK audit administrative body is to

deliver supervision of the process regarding the reporting which is related to the finances

(Rustam et al, 2013). The Audit Committees (ACs) and the boards are expected to consider and

which will review the effectiveness as well. Since 1940, the SEC has noted the significance of

the audit committee which means that it can serve in a beneficial way and will eventually be

essential in their role in guaranteeing of publicly listed corporations that belong to the financial

reporting in an effective manner (Saunders et al, 2009).

2.2 The UK Corporate Governance Code

The United Kingdom Corporate Governance Code was initially called the Concerted

Code which actually set out for the growth of corking practices and used for companies in the

effective development and auditors aspect. The UK CGC, published in July 2018 that is helpful

for the future growth by the Financial Reporting Council (FRC), is applicable to accounting

periods starting on or after January 1st 2019. The Code places greater emphasis on relationships

that exist among stakeholders, shareholders and companies (Suchan, 2004). The Code also

stresses and encourages the need of formulating a firm culture that aligns with the growing

business activities and used strategies, promotes integrity, company purpose and values diversity

(Christopher, 2012). To show how companies have applied the code, the List Rules requires

institution with a Premium Listing of assets shares in the UK to report in their yearly report. It is

very important for the group with clear and meaningful explanation to choose for the growth of

the company. With the help of above mentioned provisions company and their stakeholders are

able to complete their approaches and make explanation for the growth of poor governance.

With the major impact and growth in the basic activities are helpful for generating effective

changes for the growth of comprehensive plan in UK. This is related to the FRC which make a

9

Literature Review and the Theoretical Framework

2.1 Introduction

This is related to carried out by Lubna, (2018) opined that the audit and its committee are

associated to perform a role that tends to be crucial and additional making for the growth of the

environment right in terms of the auditing and its quality. Furthermore, it is also the obligation of

the audit committees to nurture for an environment that includes open nature in the culture that

belongs to honestest; transparency and regard which is between the auditors and the

management. Additionally, the important purpose of the UK audit administrative body is to

deliver supervision of the process regarding the reporting which is related to the finances

(Rustam et al, 2013). The Audit Committees (ACs) and the boards are expected to consider and

which will review the effectiveness as well. Since 1940, the SEC has noted the significance of

the audit committee which means that it can serve in a beneficial way and will eventually be

essential in their role in guaranteeing of publicly listed corporations that belong to the financial

reporting in an effective manner (Saunders et al, 2009).

2.2 The UK Corporate Governance Code

The United Kingdom Corporate Governance Code was initially called the Concerted

Code which actually set out for the growth of corking practices and used for companies in the

effective development and auditors aspect. The UK CGC, published in July 2018 that is helpful

for the future growth by the Financial Reporting Council (FRC), is applicable to accounting

periods starting on or after January 1st 2019. The Code places greater emphasis on relationships

that exist among stakeholders, shareholders and companies (Suchan, 2004). The Code also

stresses and encourages the need of formulating a firm culture that aligns with the growing

business activities and used strategies, promotes integrity, company purpose and values diversity

(Christopher, 2012). To show how companies have applied the code, the List Rules requires

institution with a Premium Listing of assets shares in the UK to report in their yearly report. It is

very important for the group with clear and meaningful explanation to choose for the growth of

the company. With the help of above mentioned provisions company and their stakeholders are

able to complete their approaches and make explanation for the growth of poor governance.

With the major impact and growth in the basic activities are helpful for generating effective

changes for the growth of comprehensive plan in UK. This is related to the FRC which make a

9

responsible data for promoting and majority success at the high quality and significant aspect of

corporative governance.

The UK Corporate Governance Code focuses on the reporting on outcomes achieved and

application of the principles. Under the provisions of the Code, companies are expected to

disclose how they have complied with these codes or provide explanations that are relevant to

their individual company circumstances. Corporate governance pattern and argumentation

coupled with a high level of opacity. That can result to improved levels of trust on the part of the

shareholders. Investors will be pleased to make more reasoned view of brass of the company,

especially where relevant account have furnish growth in future activities (Stewart, 2006). The

explanations should clearly explicate about the company that is fulfilling the necessary principle

of Code and to check if the statistic from its victuals is time bound. Normally, explanations

should be adequately inundated to meet all the needs of the company’s shareholders (Iriyadi,

2019). The FRC announced plans, in February 2017, which make a comprehensive plan in

United Kingdom CGC. It will be helpful fro generating a draft and used as per the devised code

and strengthen the nature which is helpful for conducting codes and used over the last 25 years.

The Code also reasoned for the growth and make systematic and the necessary balance between

the Provisions and Principles and the growing economic process on the corporate administration

framework. All of these provisions are helpful for generating effective growth and make

collective responsible changes for having long term success in the company. There are different

sector and growth in major access and achieve the unfettered power of decision-making growth

in basic activities of the business performance. The supporting principle for the entrepreneurial

changes and leadership have their own access and framework for prudent and effective control

on the growth of company's aim and objectives.

2.3 Evolution of the UK Corporate Governance Code

The UK Corporate Governance Code was promulgated by the Financial Reporting

Council (FRC) in 2008, previously known as the Concerted Code, contains the basic modular of

good and ethical practice for listed companies on board composition and remuneration,

development, accountability, stockholder audit and associate. This is the committee which make

the financial aspect and growth in the corporative governance in 1991 and make a standard

response for analysing major changes and provide suitable changes in financial and

10

corporative governance.

The UK Corporate Governance Code focuses on the reporting on outcomes achieved and

application of the principles. Under the provisions of the Code, companies are expected to

disclose how they have complied with these codes or provide explanations that are relevant to

their individual company circumstances. Corporate governance pattern and argumentation

coupled with a high level of opacity. That can result to improved levels of trust on the part of the

shareholders. Investors will be pleased to make more reasoned view of brass of the company,

especially where relevant account have furnish growth in future activities (Stewart, 2006). The

explanations should clearly explicate about the company that is fulfilling the necessary principle

of Code and to check if the statistic from its victuals is time bound. Normally, explanations

should be adequately inundated to meet all the needs of the company’s shareholders (Iriyadi,

2019). The FRC announced plans, in February 2017, which make a comprehensive plan in

United Kingdom CGC. It will be helpful fro generating a draft and used as per the devised code

and strengthen the nature which is helpful for conducting codes and used over the last 25 years.

The Code also reasoned for the growth and make systematic and the necessary balance between

the Provisions and Principles and the growing economic process on the corporate administration

framework. All of these provisions are helpful for generating effective growth and make

collective responsible changes for having long term success in the company. There are different

sector and growth in major access and achieve the unfettered power of decision-making growth

in basic activities of the business performance. The supporting principle for the entrepreneurial

changes and leadership have their own access and framework for prudent and effective control

on the growth of company's aim and objectives.

2.3 Evolution of the UK Corporate Governance Code

The UK Corporate Governance Code was promulgated by the Financial Reporting

Council (FRC) in 2008, previously known as the Concerted Code, contains the basic modular of

good and ethical practice for listed companies on board composition and remuneration,

development, accountability, stockholder audit and associate. This is the committee which make

the financial aspect and growth in the corporative governance in 1991 and make a standard

response for analysing major changes and provide suitable changes in financial and

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

accountability report. This is helpful for completing effective major changes and make comply

and explain growth in the major activities.

The FRC website published the altered version of the Concerted Code precisely on 27

June 2008 but was effective from 29 June 2008. The FRC publication titled ‘Alteration to the

Combined for the growth and make systematic Code’ list the changes made the earlier

interpretation of the Joint Code. Further development was made to the Combined Code of June

2008 in 2009. Precisely, in December 2009, the FRC reviewed the Combined Code and

published their final report. This final report was proclaimed in a press statement the aforesaid

day. On March 5, 2010 a consultation on the revised UK CGC closed. A development report on

the review of the effectiveness of the Joint Code that was issued by the FRC on July 28, 2009

which explicitly summarised the research carried out and the results of the consultations. The

report was published and proclaimed on a press statement the same year. In May 2009, the

London Stock Exchange made propositions and idea for improving the business activity of the

Combined Code after publishing a consequence to the FRC review in a way which is associated

with they acknowledge that the present economic conditions have withstood the efficacy of the

Code. The London Stock Exchange aims to ‘explain or comply and reinforce the success of the

principles-based approach’ and supports the FRC to consider this review in the context of the

broader marketplace. The review of the Concerted Code that was launched and in March 2009

and the complete textual matter of the audience paper was published while the consultation

period closed on May 29, 2009. In May 28, 2010 the FRC published a revised version of the UK

Firm Administration Codification that was containing changes from the earlier version of the

Combined Code, and this was announced in a press release and the Code was effective from June

29, 2010. Furthermore, in December 2011 there was a development in corporate governance

which gave birth to ‘The Impact and Execution of the UK Firm Governance and Stewardship

Codes’. The FRC analysed the implementation of the Codes and published the report in

December 2011. In October 2011, the FRC amended the UK corporate Administration Code

with the aim of transformation the principle on council chamber diversity, present into Code in

June 2010 for the first clip. ‘The Feedback Argument: Gender Diverseness on Boards’ contains a

summary of the FRC determination, reasons for those determination and their responses. There

were consultations on proposed changes to the Code which were incorporate in an updated

11

and explain growth in the major activities.

The FRC website published the altered version of the Concerted Code precisely on 27

June 2008 but was effective from 29 June 2008. The FRC publication titled ‘Alteration to the

Combined for the growth and make systematic Code’ list the changes made the earlier

interpretation of the Joint Code. Further development was made to the Combined Code of June

2008 in 2009. Precisely, in December 2009, the FRC reviewed the Combined Code and

published their final report. This final report was proclaimed in a press statement the aforesaid

day. On March 5, 2010 a consultation on the revised UK CGC closed. A development report on

the review of the effectiveness of the Joint Code that was issued by the FRC on July 28, 2009

which explicitly summarised the research carried out and the results of the consultations. The

report was published and proclaimed on a press statement the same year. In May 2009, the

London Stock Exchange made propositions and idea for improving the business activity of the

Combined Code after publishing a consequence to the FRC review in a way which is associated

with they acknowledge that the present economic conditions have withstood the efficacy of the

Code. The London Stock Exchange aims to ‘explain or comply and reinforce the success of the

principles-based approach’ and supports the FRC to consider this review in the context of the

broader marketplace. The review of the Concerted Code that was launched and in March 2009

and the complete textual matter of the audience paper was published while the consultation

period closed on May 29, 2009. In May 28, 2010 the FRC published a revised version of the UK

Firm Administration Codification that was containing changes from the earlier version of the

Combined Code, and this was announced in a press release and the Code was effective from June

29, 2010. Furthermore, in December 2011 there was a development in corporate governance

which gave birth to ‘The Impact and Execution of the UK Firm Governance and Stewardship

Codes’. The FRC analysed the implementation of the Codes and published the report in

December 2011. In October 2011, the FRC amended the UK corporate Administration Code

with the aim of transformation the principle on council chamber diversity, present into Code in

June 2010 for the first clip. ‘The Feedback Argument: Gender Diverseness on Boards’ contains a

summary of the FRC determination, reasons for those determination and their responses. There

were consultations on proposed changes to the Code which were incorporate in an updated

11

version of the Codification that was publicized in 2012. These changes applied to financial years

starting from October 1, 2012. However, the FRC strongly encouraged companies to adopt its

recommendations early. A further review on the Code made by the FRC in September, 2012 and

on November 6 of the same year a collection of essays was published by the FRC to mark the

20th anniversary of the Cad-bury Code. The UK’s majorly ‘comply or explicate’ for the growth to

make a approach that was introduced to monitor best practices. In the corporate boardrooms of

organize and their dealings with stockholder and the publication was proclaimed in a press

argument titled ‘FRC observe 20 years of the United Kingdom Corporate Governance Code’.

In September 2015, a new consultation that incorporates the feedbacks on ethical

standards and auditing was officially opened by the FRC. The consultation contains projected

changes to the UK CG framework which closed on Dec 11, 2015 after which a feedback

statement was issued in April 2016. A closing draft update to United Kingdom that is related to

make a Corporate Governance Code was published on April 27, 2016 by the FRC and was

announced in a press statement with a primary aim to follow with the new and updated

European Union modulate. The new draft make a name for the growth and achieve that came

with the new altered ethical standard of 2016. The final draft that is sent for the content on audit

committee that was formally issued on June 17, 2016. The reappraisal of the UK Firm

Governance Code and commencement of an audience on its proposal was proclaimed by the

FRC in February 2017. This was based on the consequence of the reappraisal and the Greenish

Paper consequence of the Government. On 2019, the FRC also published the UK stewardship

code for the growth of 2020 which is helpful for considering effective changes and make

adoption of the techniques and listed for the effective services providers and make effective

spaces for more challenging approaches.

2.4 Principles of Good and Effective Corporate Governance

There are different organisational concepts that help the company to promote for

improving and considering the major climatic changes. This is helpful for generating effective

roles and make responsibilities to work and achieve audit committees behaviour for the growth

of corporate government and possibilities to make effective principles in order to operate

effective operational activities. There are different principles which is useful for generating

12

starting from October 1, 2012. However, the FRC strongly encouraged companies to adopt its

recommendations early. A further review on the Code made by the FRC in September, 2012 and

on November 6 of the same year a collection of essays was published by the FRC to mark the

20th anniversary of the Cad-bury Code. The UK’s majorly ‘comply or explicate’ for the growth to

make a approach that was introduced to monitor best practices. In the corporate boardrooms of

organize and their dealings with stockholder and the publication was proclaimed in a press

argument titled ‘FRC observe 20 years of the United Kingdom Corporate Governance Code’.

In September 2015, a new consultation that incorporates the feedbacks on ethical

standards and auditing was officially opened by the FRC. The consultation contains projected

changes to the UK CG framework which closed on Dec 11, 2015 after which a feedback

statement was issued in April 2016. A closing draft update to United Kingdom that is related to

make a Corporate Governance Code was published on April 27, 2016 by the FRC and was

announced in a press statement with a primary aim to follow with the new and updated

European Union modulate. The new draft make a name for the growth and achieve that came

with the new altered ethical standard of 2016. The final draft that is sent for the content on audit

committee that was formally issued on June 17, 2016. The reappraisal of the UK Firm

Governance Code and commencement of an audience on its proposal was proclaimed by the

FRC in February 2017. This was based on the consequence of the reappraisal and the Greenish

Paper consequence of the Government. On 2019, the FRC also published the UK stewardship

code for the growth of 2020 which is helpful for considering effective changes and make

adoption of the techniques and listed for the effective services providers and make effective

spaces for more challenging approaches.

2.4 Principles of Good and Effective Corporate Governance

There are different organisational concepts that help the company to promote for

improving and considering the major climatic changes. This is helpful for generating effective

roles and make responsibilities to work and achieve audit committees behaviour for the growth

of corporate government and possibilities to make effective principles in order to operate

effective operational activities. There are different principles which is useful for generating

12

integrity, respect and make a corporative culture for the growth of an individual and market

growth. There ten major principle are related to; effective solid foundation for the growth of

management and oversight behavioural activities. This is helpful for analysing board vales and

their progress, promote ethical and responsible to make effective decision-making process in the

UK market. Another principle is related to timely balanced promotion and make suitable changes

for respecting girls and reduce the discrimination to make suitable challenges in the market. All

is related to make legitimate interest of their stakeholders and achieve higher value in the market.

The study of Okpara (2011) suggested that an organisation must clearly spell out its roles

and responsibilities if it aspires to achieve effectiveness and efficiency in its governance. This

means that the organisation must explicitly portray its short and long term goals, including

stakeholders’ expectations, roles of the executives and other management staff and individual

responsibilities. To maintain a sound structure and composition of the organisation the executive

committee must work closely with the right group of people that are result oriented with a

positive mind set and have a good background of each individual, experience and required skills,

and the impact of employing an additional worker on the overall productivity of the organisation

and the effective functioning of the committee (Dillard et al., 2004). The executive committee

can help facilitate the likelihood that their organisations will deliver on their purpose (Dart,

2004). An effective and good governance of an organization will require the executive

committee to effectively determine and assess the appropriate performance, indicators and

categories for the organization. It is quite pertinent that the executive committee ensures a free

and timely flow of relevant information to the executive board that helps in making useful

decisions (Bravo et al, 2019). There must be accountability and transparency for external

stakeholders to enable know that their resources are being utilized in more effective and efficient

manner. Furthermore, the financial statement of the organization must reflect integrity and

safeguard other relevant information. For an effective and good governance to be achieved the

executive committee must ensure to sustain and enhance the capabilities and capacity of the

organization in which they serve (Cohen et al, 2007).

2.5 The Importance of Good and the Effective Corporate Governance

If effectively and efficiently carried out, corporate governance will create an open and

honest business environment which will encourage structure in terms of speed of execution,

planning, and also encourages the executive committees and board members to allocate more

13

growth. There ten major principle are related to; effective solid foundation for the growth of

management and oversight behavioural activities. This is helpful for analysing board vales and

their progress, promote ethical and responsible to make effective decision-making process in the

UK market. Another principle is related to timely balanced promotion and make suitable changes

for respecting girls and reduce the discrimination to make suitable challenges in the market. All

is related to make legitimate interest of their stakeholders and achieve higher value in the market.

The study of Okpara (2011) suggested that an organisation must clearly spell out its roles

and responsibilities if it aspires to achieve effectiveness and efficiency in its governance. This

means that the organisation must explicitly portray its short and long term goals, including

stakeholders’ expectations, roles of the executives and other management staff and individual

responsibilities. To maintain a sound structure and composition of the organisation the executive

committee must work closely with the right group of people that are result oriented with a

positive mind set and have a good background of each individual, experience and required skills,

and the impact of employing an additional worker on the overall productivity of the organisation

and the effective functioning of the committee (Dillard et al., 2004). The executive committee

can help facilitate the likelihood that their organisations will deliver on their purpose (Dart,

2004). An effective and good governance of an organization will require the executive

committee to effectively determine and assess the appropriate performance, indicators and

categories for the organization. It is quite pertinent that the executive committee ensures a free

and timely flow of relevant information to the executive board that helps in making useful

decisions (Bravo et al, 2019). There must be accountability and transparency for external

stakeholders to enable know that their resources are being utilized in more effective and efficient

manner. Furthermore, the financial statement of the organization must reflect integrity and

safeguard other relevant information. For an effective and good governance to be achieved the

executive committee must ensure to sustain and enhance the capabilities and capacity of the

organization in which they serve (Cohen et al, 2007).

2.5 The Importance of Good and the Effective Corporate Governance

If effectively and efficiently carried out, corporate governance will create an open and

honest business environment which will encourage structure in terms of speed of execution,

planning, and also encourages the executive committees and board members to allocate more

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

resources for the innovation and growth of the corporation. Sound judgment, good and ethical

behaviour of those charged with running the affairs of an organisation, are prerequisites of good

and effective governance (Cohen, et al 2007).

A business firm is work without good governance can be work like to a train without a

track. Strong and effective changes are helpful for generating effective process to make the

corporate governance and make an effective culture for the sustainable and overall changes to

avoid as per the occurrence in the possibilities. Thus, a system, is no matter know its potentials in

terms of human and material resources, cannot achieve its corporate goals without good and

effectual administration. Without having the good and effective governance which is make and

work for the growth is used to be almost hopeless for an organisation to achieve the needed

transmutation process needed to get to where it privation (Larcker, et al 2007). However, a

number of reforms were issued by the Sarbanes-Oxley Act intended to prevent fraud and

ultimately improve corporate responsibility. The widespread disruption created in markets was

caused by the widespread fraud that led to bankrupt of WorldCom and Enron but for the changes

mandated by the Act. Investors were at the high risk of misplace their finances and be able to

analyse their long term perspective to change the organisational changes. If the organizations

experienced a continuous misdirection of their funds and expend due to poor and ineffective

corporate governance (CIPFA, 2007). The language for work into the law of Sarbanes-Oxley Act

brought mental wellness in large group & capitalist started feeling more homelike zone.

However, good and effective corporate governance goes beyond investors’ security in modern

terms but the need for the corporations to survive in a competitive atmosphere. Poor and

ineffective corporate governance will lead to higher failure in corporate strategies and project

management which in turn scares investors away and make the existing ones withdraw or

transfer their investments where possible (Turley and Zaman, 2004).

The study of Evans and Edward-Freeman (1996) opined that a comprehensive organizational

framework is required as a tool for the prevention of risk in order to make effective and efficient

decisions. Once an organisation establishes its modus operandi and rules of governance, steering

executives, board members and managers should be able to define their roles and responsibilities

and how they fit into the overall structure of the organization. Good and effective governance

strengthens every stakeholder's position to enable them adhere to the vision and mission of the

organisation (Christopher, 2012). Good and effective corporate governance structures points out

14

behaviour of those charged with running the affairs of an organisation, are prerequisites of good

and effective governance (Cohen, et al 2007).

A business firm is work without good governance can be work like to a train without a

track. Strong and effective changes are helpful for generating effective process to make the

corporate governance and make an effective culture for the sustainable and overall changes to

avoid as per the occurrence in the possibilities. Thus, a system, is no matter know its potentials in

terms of human and material resources, cannot achieve its corporate goals without good and

effectual administration. Without having the good and effective governance which is make and

work for the growth is used to be almost hopeless for an organisation to achieve the needed

transmutation process needed to get to where it privation (Larcker, et al 2007). However, a

number of reforms were issued by the Sarbanes-Oxley Act intended to prevent fraud and

ultimately improve corporate responsibility. The widespread disruption created in markets was

caused by the widespread fraud that led to bankrupt of WorldCom and Enron but for the changes

mandated by the Act. Investors were at the high risk of misplace their finances and be able to

analyse their long term perspective to change the organisational changes. If the organizations

experienced a continuous misdirection of their funds and expend due to poor and ineffective

corporate governance (CIPFA, 2007). The language for work into the law of Sarbanes-Oxley Act

brought mental wellness in large group & capitalist started feeling more homelike zone.

However, good and effective corporate governance goes beyond investors’ security in modern

terms but the need for the corporations to survive in a competitive atmosphere. Poor and

ineffective corporate governance will lead to higher failure in corporate strategies and project

management which in turn scares investors away and make the existing ones withdraw or

transfer their investments where possible (Turley and Zaman, 2004).

The study of Evans and Edward-Freeman (1996) opined that a comprehensive organizational

framework is required as a tool for the prevention of risk in order to make effective and efficient

decisions. Once an organisation establishes its modus operandi and rules of governance, steering

executives, board members and managers should be able to define their roles and responsibilities

and how they fit into the overall structure of the organization. Good and effective governance

strengthens every stakeholder's position to enable them adhere to the vision and mission of the

organisation (Christopher, 2012). Good and effective corporate governance structures points out

14

the division of responsibilities & rights among shareholders in organization and states clearly all

procedures and rules for taking rational decisions in corporate affairs.

In a summary, some of the major benefits are helpful for gain the perspective to change the

nature of good and effective corporate administration in an organization. This will be includes to

make a better plans and use effective organizational strategies. Further, the changes in improved

process and operational efficiency and affectivity, improved bringing and project governance. In

addition to that the company and their progress are more efficient and effective regulatory

compliance. Prudent risk management and the financial management are two main and good

improved flow of communication among members and employee/stakeholder engagement,

increased speed to which an organization can put to death and deliver on its goals and purpose.

This will be helpful for generating effective corporative governance to make a permit and make

effective values within the market and their equitable interest (Cohen et al, 2007). Furthermore,

good and effective corporate governance requires quality thought and time from committed and

dedicated leaders who comprehends the advantages of aligning every level of an organization in

order to achieve targeted goals. Furthermore, good and efficient corporate governance requires

that the business environment is transparent and fair and that staff can be held responsible for

their actions. Conversely, weak and ineffective corporate governance may result to

mismanagement of investors’ resources, waste and corruption. Regardless of the venture type,

only good and effective corporate governance can produce solid and sustainable business

performance (Larcker et al, 2007).

2.6 Composition of the UK Audit Committee

According to the UK's corporate governance, the committee of audit comprises minimum

of two independent non-executive board of directors for organisation outside the FTSE 350 or

three independent non-executive board of directors for companies within the FTSE 350. The

committee may also include the chairman of a small company, only if he was independent as at

when recruited chairman but he is not qualified to head Board committee. The Code further

stated that committee must ‘satisfy itself’ by constituting at least one member who possesses

relevant and recent financial experience which according to Sir Robert Smith refers to a

professional degree or qualification from any recognized bodies of accountancy. Failure to meet

these requirements is needs to be disclose in company reports during stating their compliance to

Code (Abbott et al, 2004). The major size, skills and balance of the audit will be helpful for

15

procedures and rules for taking rational decisions in corporate affairs.

In a summary, some of the major benefits are helpful for gain the perspective to change the

nature of good and effective corporate administration in an organization. This will be includes to

make a better plans and use effective organizational strategies. Further, the changes in improved

process and operational efficiency and affectivity, improved bringing and project governance. In

addition to that the company and their progress are more efficient and effective regulatory

compliance. Prudent risk management and the financial management are two main and good

improved flow of communication among members and employee/stakeholder engagement,

increased speed to which an organization can put to death and deliver on its goals and purpose.

This will be helpful for generating effective corporative governance to make a permit and make

effective values within the market and their equitable interest (Cohen et al, 2007). Furthermore,

good and effective corporate governance requires quality thought and time from committed and

dedicated leaders who comprehends the advantages of aligning every level of an organization in

order to achieve targeted goals. Furthermore, good and efficient corporate governance requires

that the business environment is transparent and fair and that staff can be held responsible for

their actions. Conversely, weak and ineffective corporate governance may result to

mismanagement of investors’ resources, waste and corruption. Regardless of the venture type,

only good and effective corporate governance can produce solid and sustainable business

performance (Larcker et al, 2007).

2.6 Composition of the UK Audit Committee

According to the UK's corporate governance, the committee of audit comprises minimum

of two independent non-executive board of directors for organisation outside the FTSE 350 or

three independent non-executive board of directors for companies within the FTSE 350. The

committee may also include the chairman of a small company, only if he was independent as at

when recruited chairman but he is not qualified to head Board committee. The Code further

stated that committee must ‘satisfy itself’ by constituting at least one member who possesses

relevant and recent financial experience which according to Sir Robert Smith refers to a

professional degree or qualification from any recognized bodies of accountancy. Failure to meet

these requirements is needs to be disclose in company reports during stating their compliance to

Code (Abbott et al, 2004). The major size, skills and balance of the audit will be helpful for

15

generating an adequate deals to manage and work for considering effective approaches to

analyse systematic changes for the growth of an audit report. As these are related to work and

make effective growth in different training session, management and abilities to work and play a

role for the successful growth. Often, the ‘expert’ is said that it is to be a retired commercial

enterprise director from a latter partner of a business firm or another institution. To operate

within the jurisdiction of the Code’s present for independence, the committee must bar its own

former attender and commercial enterprise directors and this indispensable be justified in the

firm’s annual report (Suchan, 2004). It is paramount that the committee associate experience

proper training and observance due to the complex nature of issues democratic to the audit

commission.

2.7 UK Audit committee

A major role of the committees is to closely helpful for monitoring the skill and make

systematic changes in the integrity to work and make company's announcement. In simple

words, UK's committee of audit is responsible for the integrity of a company’s financial

performance and statements (Buallay and Al-Ajmi, 2019). The committee must be contented

with the reliable and accurate financial report presented to shareholders and the outside world.

This committee must understand the financial report and how they are made up, given the

complicated nature of accounting standards. The committee must also monitor activities of

external directors & finance director during preparation of draft accounts. The committee must

be persistent and ask the appropriate questions if an intelligible and satisfactory answer is not

presented (Buallay, 2018).

The analysis of the committee is to make responsible for managing and analysing systematic

growth in the system. Further, for the change different risk and make important role and make

reviewing their own professional changes and make effective exist role in the company. This

means audit committee has an important part in reviewing their operations & checking

organisation's internal financial control & also ensuring the appropriate risk management which

are carried out (Bedard and Gendron, 2010). The audit committee must extend its monitoring

roles to the internal auditors, where it has an internal audit function. The risk committee may

perform some of these roles in line with the recommendations in Walker Report – two

committees complementing each other.

16

analyse systematic changes for the growth of an audit report. As these are related to work and

make effective growth in different training session, management and abilities to work and play a

role for the successful growth. Often, the ‘expert’ is said that it is to be a retired commercial

enterprise director from a latter partner of a business firm or another institution. To operate

within the jurisdiction of the Code’s present for independence, the committee must bar its own

former attender and commercial enterprise directors and this indispensable be justified in the

firm’s annual report (Suchan, 2004). It is paramount that the committee associate experience

proper training and observance due to the complex nature of issues democratic to the audit

commission.

2.7 UK Audit committee

A major role of the committees is to closely helpful for monitoring the skill and make

systematic changes in the integrity to work and make company's announcement. In simple

words, UK's committee of audit is responsible for the integrity of a company’s financial

performance and statements (Buallay and Al-Ajmi, 2019). The committee must be contented

with the reliable and accurate financial report presented to shareholders and the outside world.

This committee must understand the financial report and how they are made up, given the

complicated nature of accounting standards. The committee must also monitor activities of

external directors & finance director during preparation of draft accounts. The committee must

be persistent and ask the appropriate questions if an intelligible and satisfactory answer is not

presented (Buallay, 2018).

The analysis of the committee is to make responsible for managing and analysing systematic