UK Taxation System: Principles and Practices

VerifiedAdded on 2020/02/05

|19

|5319

|27

AI Summary

The assignment delves into the intricacies of the UK taxation system. It explores different tax categories like income tax, capital gains tax, and property taxes, analyzing their structures, rates, and implications for individuals and businesses. The document also examines relevant legislation, forms (P45, P60, P11D), and practical examples to illustrate key concepts.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

TAXATION

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

AC 1.1 Describe the UK tax environment..................................................................................3

AC 1.2 Analyze the role and responsibilities of the tax practitioner..........................................5

AC 1.3 Tax obligations of tax payers or their agents and the implications of noncompliance...5

TASK 2............................................................................................................................................6

AC 2.1 Calculate relevant income, expenses and allowances.....................................................6

AC 2.2 Calculate taxable amounts for the employment at Supermarket and also calculate the

self-employment income with payment dates.............................................................................7

AC 2.3.........................................................................................................................................8

TASK 3............................................................................................................................................9

AC 3.1 Calculate the chargeable profit for the company............................................................9

2. Deduction for allowances of plant and machinery ...............................................................10

3. Property business profit.........................................................................................................11

4.1 Identify chargeable assets...................................................................................................12

4.2 Calculation of capital gains and losses................................................................................13

4.3 Calculation of capital gains tax payable..............................................................................13

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

AC 1.1 Describe the UK tax environment..................................................................................3

AC 1.2 Analyze the role and responsibilities of the tax practitioner..........................................5

AC 1.3 Tax obligations of tax payers or their agents and the implications of noncompliance...5

TASK 2............................................................................................................................................6

AC 2.1 Calculate relevant income, expenses and allowances.....................................................6

AC 2.2 Calculate taxable amounts for the employment at Supermarket and also calculate the

self-employment income with payment dates.............................................................................7

AC 2.3.........................................................................................................................................8

TASK 3............................................................................................................................................9

AC 3.1 Calculate the chargeable profit for the company............................................................9

2. Deduction for allowances of plant and machinery ...............................................................10

3. Property business profit.........................................................................................................11

4.1 Identify chargeable assets...................................................................................................12

4.2 Calculation of capital gains and losses................................................................................13

4.3 Calculation of capital gains tax payable..............................................................................13

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

INTRODUCTION

Tax is denoted as a compulsory monetary contribution of people which is earned in the

form of state's revenue. In other words, Tax is an obligation for legal entities and individuasl

against their respective incomes and gains (Kaplow, 2011). The government of country is

responsible to assess and impose taxes on the activities, expenditure on individuals as well as

business entities. The fund raised from taxation activities are used for the welfare of society and

government causes. The report deals with describing the UK tax environment and shows an

analysis of the role and responsibilities of the tax practitioner. Along with this, tax obligations of

tax payers or their agents in relation to their implications of non-compliance are discussed in the

following unit (Gee, Haller and Nobes, 2010). Here, the report includes calculations of relevant

income, expenses and allowances, taxable amount in accordance with given case scenarios. The

sections also reflects the workings on the calculations of capital gains tax payable for a business.

TASK 1

AC 1.1 Describe the UK tax environment

The UK economy has a highly competitive corporate tax system, further, the taxation

policies are simpler, and transparent therefore, suits with modern business practice (Capital

gains tax for individuals on the disposal of shares, 2015). The government believes that

corporate tax system is an asset for the United Kingdom which improves business environment

and helps in attracting multinational companies to invest (A guide to UK taxation. 2013). The

UK government wants to make its taxation system as the most competitive tax regime in the

G20, in this regard, the corporate tax of the UK is declined to 20% in 2015 which is the lowest in

the G7and joint lowest in G20, even, in the lowest in the United Kingdom’s history (UK Tax

Environment 2014-2015, 2016). Including this, the country’s tax system is moved to territorial

system from system of worldwide taxation. As a support to creative sectors, government is

introducing significant tax reliefs. The government of the UK impose various taxes on

individuals and organizations which are as follows:

Personal Taxes and Income Tax: The major source of income for the UK government

is income tax, however, it has different slabs. The tax free income / free personal allowance is up

to GBP 10,500, further, on the income between GBP 10,500 to GBP 31,865 individuals have to

pay 20% tax (UK Tax Environment 2014-2015, 2016). The next level rate is 40% which is to be

Tax is denoted as a compulsory monetary contribution of people which is earned in the

form of state's revenue. In other words, Tax is an obligation for legal entities and individuasl

against their respective incomes and gains (Kaplow, 2011). The government of country is

responsible to assess and impose taxes on the activities, expenditure on individuals as well as

business entities. The fund raised from taxation activities are used for the welfare of society and

government causes. The report deals with describing the UK tax environment and shows an

analysis of the role and responsibilities of the tax practitioner. Along with this, tax obligations of

tax payers or their agents in relation to their implications of non-compliance are discussed in the

following unit (Gee, Haller and Nobes, 2010). Here, the report includes calculations of relevant

income, expenses and allowances, taxable amount in accordance with given case scenarios. The

sections also reflects the workings on the calculations of capital gains tax payable for a business.

TASK 1

AC 1.1 Describe the UK tax environment

The UK economy has a highly competitive corporate tax system, further, the taxation

policies are simpler, and transparent therefore, suits with modern business practice (Capital

gains tax for individuals on the disposal of shares, 2015). The government believes that

corporate tax system is an asset for the United Kingdom which improves business environment

and helps in attracting multinational companies to invest (A guide to UK taxation. 2013). The

UK government wants to make its taxation system as the most competitive tax regime in the

G20, in this regard, the corporate tax of the UK is declined to 20% in 2015 which is the lowest in

the G7and joint lowest in G20, even, in the lowest in the United Kingdom’s history (UK Tax

Environment 2014-2015, 2016). Including this, the country’s tax system is moved to territorial

system from system of worldwide taxation. As a support to creative sectors, government is

introducing significant tax reliefs. The government of the UK impose various taxes on

individuals and organizations which are as follows:

Personal Taxes and Income Tax: The major source of income for the UK government

is income tax, however, it has different slabs. The tax free income / free personal allowance is up

to GBP 10,500, further, on the income between GBP 10,500 to GBP 31,865 individuals have to

pay 20% tax (UK Tax Environment 2014-2015, 2016). The next level rate is 40% which is to be

paid up to GBP 150,000. Above GBP 150,000 the individuals have to pay 45% tax on taxable

income (UK Tax Environment 2014-2015, 2016). In addition to that personnel also pay social

costs against salary, for which, up to GBP 7956c individual gets free allowance, then up to GBP

41,860, 12.0% tax is paid (Kaplow, 2011). Corporation tax: This tax is paid by limited

companies including other organizations such as clubs, societies, associations etc. The rate

of corporate tax is reduced from 23% to 20% in 2015, which is lower since till date and

makes it easier to develop competitive tax environment.

VAT Tax: In addition to other taxes, VAT tax is another measure in the UK to earn

government revenues (King and Fullerton, 2010). The current rate of VAT Tax is 20%.

However, there are certain essential goods which are exempted from tax such as public transport,

books and newspapers, children’s clothing, etc. The corporate entities who have annual sales of

more than GBP 81,000 must register themselves for VAT.

Capital gains tax: Capital Gains Tax is imposed on the profits when sell or give

away something that has increased value (King and Fullerton, 2010). This tax is paid by

individuals who are normally resident in the UK, PRs, trustees and partners. The CGT

rate is too low in the UK as the highest rate is 28 per cent. Till the amount £10,900, the goods

are exempted from tax pay.

HMRC (HM Revenue & Customs) is accountable for protecting and maintaining UK’s

tax system while keeping eye on both direct and indirect taxes (McLaughlin, 2013). The entity is

also responsible for tax collection on the behalf of Government of UK. The main method of

paying tax is through PAYE scheme however, some of the individuals have to pay taxes via self-

assessment tax return. The use of this system facilitates automatic deduction of taxes from the

earning of employees, nonetheless, two main situations are there in which payment through self-

assessment tax return is needed. One is when individual is self-employed and other one in which

individual receive rental or foreign income. Including this, at the time when, it becomes difficult

to collect taxes via PAYE scheme, then self-assessment tax return system is used (Melville,

2013). The HM Revenue & Customs is also accountable for providing guidelines for the

assessment of tax practitioners and looking eye whether they are fulfilling tax obligations or not.

The new amendment in taxation system are to be included under HMRC (Gee, Haller and Nobes,

2010).

income (UK Tax Environment 2014-2015, 2016). In addition to that personnel also pay social

costs against salary, for which, up to GBP 7956c individual gets free allowance, then up to GBP

41,860, 12.0% tax is paid (Kaplow, 2011). Corporation tax: This tax is paid by limited

companies including other organizations such as clubs, societies, associations etc. The rate

of corporate tax is reduced from 23% to 20% in 2015, which is lower since till date and

makes it easier to develop competitive tax environment.

VAT Tax: In addition to other taxes, VAT tax is another measure in the UK to earn

government revenues (King and Fullerton, 2010). The current rate of VAT Tax is 20%.

However, there are certain essential goods which are exempted from tax such as public transport,

books and newspapers, children’s clothing, etc. The corporate entities who have annual sales of

more than GBP 81,000 must register themselves for VAT.

Capital gains tax: Capital Gains Tax is imposed on the profits when sell or give

away something that has increased value (King and Fullerton, 2010). This tax is paid by

individuals who are normally resident in the UK, PRs, trustees and partners. The CGT

rate is too low in the UK as the highest rate is 28 per cent. Till the amount £10,900, the goods

are exempted from tax pay.

HMRC (HM Revenue & Customs) is accountable for protecting and maintaining UK’s

tax system while keeping eye on both direct and indirect taxes (McLaughlin, 2013). The entity is

also responsible for tax collection on the behalf of Government of UK. The main method of

paying tax is through PAYE scheme however, some of the individuals have to pay taxes via self-

assessment tax return. The use of this system facilitates automatic deduction of taxes from the

earning of employees, nonetheless, two main situations are there in which payment through self-

assessment tax return is needed. One is when individual is self-employed and other one in which

individual receive rental or foreign income. Including this, at the time when, it becomes difficult

to collect taxes via PAYE scheme, then self-assessment tax return system is used (Melville,

2013). The HM Revenue & Customs is also accountable for providing guidelines for the

assessment of tax practitioners and looking eye whether they are fulfilling tax obligations or not.

The new amendment in taxation system are to be included under HMRC (Gee, Haller and Nobes,

2010).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

AC 1.2 Analyze the role and responsibilities of the tax practitioner

Tax practitioners have a significant role in voluntary compliance system of tax payments,

but it is important to notice that tax practitioner are not accountants (Salanie, 2011). However,

the person having knowledge of accounting are not surly eligible to answer the tax questions and

prepare tax returns. The tax practitioners are facilitated with different licences and certification

which varies from region to region. Nonetheless, there is a similar procedure under which tax

practitioners need to go through an exam and must work under the guidance of a licensed or

certified accountant (Salanie, 2011). The tax practitioners need to derive required qualification

and degree so as to give legal advice to clients. The responsibilities of individual tax practitioner

is relied on their value in business whether they are certified public accountant or are licensed tax

expert. They are responsible for providing tax advice as well as arranging tax returns for their

clients of corporate entities. These individuals help tax payer in lowering down tax liabilities by

availing ambiguous characteristics of the law (Liapis, and et. al., 2014). Nonetheless, tax payers

must be familiarized with professional responsibilities and ethics. There are number of other

responsibilities on tax payers which must be fulfilled by them including communicating

effectively with clients, educating tax payers, must follow integrity, enforcing standards of tax

payments (UK Tax Environment 2014-2015, 2016.). The tax practitioners are responsible for

following principles of diligence and accuracy so that correct income and gains can be accessed

from relevant sources to calculate tax amount. The misleading information is to be avoided from

client and different tax matter must be given appropriately. They have to avoid penalties and

charges on the behalf of tax payers and must help them in properly filling returns.

AC 1.3 Tax obligations of tax payers or their agents and the implications of noncompliance

Tax payers are obliged for paying their taxes on time however, following points include

major obligations of Tax payers:

l The tax payers have to be honest for tax payments on time

l They must be cooperative and have to be honest in offering correct information

and documents on time

l The tax payers should maintain records of tax payments (Melville, 2013)

These are some obligations which need to be fulfilled by the tax payers in order to be safe

from government penalties and negative effects (Lymer and Oats, 2009). In case, tax payers do

Tax practitioners have a significant role in voluntary compliance system of tax payments,

but it is important to notice that tax practitioner are not accountants (Salanie, 2011). However,

the person having knowledge of accounting are not surly eligible to answer the tax questions and

prepare tax returns. The tax practitioners are facilitated with different licences and certification

which varies from region to region. Nonetheless, there is a similar procedure under which tax

practitioners need to go through an exam and must work under the guidance of a licensed or

certified accountant (Salanie, 2011). The tax practitioners need to derive required qualification

and degree so as to give legal advice to clients. The responsibilities of individual tax practitioner

is relied on their value in business whether they are certified public accountant or are licensed tax

expert. They are responsible for providing tax advice as well as arranging tax returns for their

clients of corporate entities. These individuals help tax payer in lowering down tax liabilities by

availing ambiguous characteristics of the law (Liapis, and et. al., 2014). Nonetheless, tax payers

must be familiarized with professional responsibilities and ethics. There are number of other

responsibilities on tax payers which must be fulfilled by them including communicating

effectively with clients, educating tax payers, must follow integrity, enforcing standards of tax

payments (UK Tax Environment 2014-2015, 2016.). The tax practitioners are responsible for

following principles of diligence and accuracy so that correct income and gains can be accessed

from relevant sources to calculate tax amount. The misleading information is to be avoided from

client and different tax matter must be given appropriately. They have to avoid penalties and

charges on the behalf of tax payers and must help them in properly filling returns.

AC 1.3 Tax obligations of tax payers or their agents and the implications of noncompliance

Tax payers are obliged for paying their taxes on time however, following points include

major obligations of Tax payers:

l The tax payers have to be honest for tax payments on time

l They must be cooperative and have to be honest in offering correct information

and documents on time

l The tax payers should maintain records of tax payments (Melville, 2013)

These are some obligations which need to be fulfilled by the tax payers in order to be safe

from government penalties and negative effects (Lymer and Oats, 2009). In case, tax payers do

not pay taxes on time then nation could come under strain. The negative impact is that the

government become unable to access finance to fulfil nation’s welfare demands. Honesty is the

major obligation of tax payers under which they must be very imperative (Gee, Haller and

Nobes, 2010). However, non-compliances of obligation by tax payers forces them to pay charges

and penalties, but, if they fulfil all the obligations then they can access support from government.

The tax payers must be cooperative which helps the government in operating tax system at

comparatively lower cost as well as reduces the unessential interference of the third parties in the

affairs of the tax payers (McLaughlin, 2013). The tax payers have to keep some records in

relation to tax payments and other events and transactions, so that effective taxation system can

be maintained. The payment of taxes must be on time within relevant taxing jurisdictions. They

are bounded with the professional responsibilities of paying taxes on time and following other

guidelines. They must not provide false and misleading information to the agents and must not

conduct the activities which are unfavourable to the tax system of the country. The non-

compliance of taxations system will lead tax payers to pay penalties and sanctions.

TASK 2

AC 2.1 Calculate relevant income, expenses and allowances

According to the given case scenario, Susan is working at the till machine however,

calculations of income, expenses and allowances are based on following assumed information:

Net profit: £30000

Transportation expenses:

l Vehicle 1 use: £10000

l Vehicle 2 use: £15000

l Other expenses: £2590

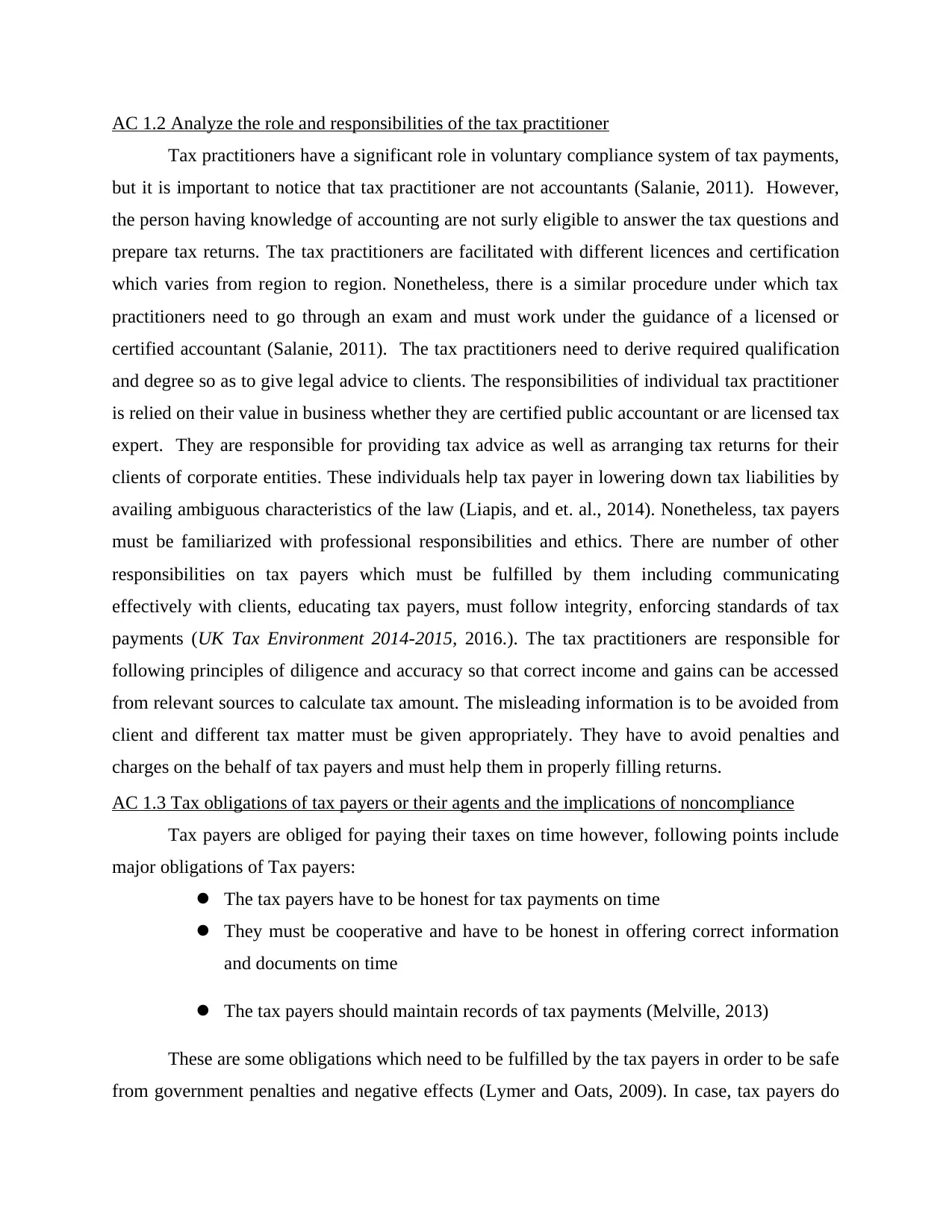

Table 1: Computation of Net adjusted profit of Susan 2015-2016

Net profit 30000

Add: Disallowed expenses

(I) Transportation expenses 3700

(iv) Other expenses 2590 6290 6290

government become unable to access finance to fulfil nation’s welfare demands. Honesty is the

major obligation of tax payers under which they must be very imperative (Gee, Haller and

Nobes, 2010). However, non-compliances of obligation by tax payers forces them to pay charges

and penalties, but, if they fulfil all the obligations then they can access support from government.

The tax payers must be cooperative which helps the government in operating tax system at

comparatively lower cost as well as reduces the unessential interference of the third parties in the

affairs of the tax payers (McLaughlin, 2013). The tax payers have to keep some records in

relation to tax payments and other events and transactions, so that effective taxation system can

be maintained. The payment of taxes must be on time within relevant taxing jurisdictions. They

are bounded with the professional responsibilities of paying taxes on time and following other

guidelines. They must not provide false and misleading information to the agents and must not

conduct the activities which are unfavourable to the tax system of the country. The non-

compliance of taxations system will lead tax payers to pay penalties and sanctions.

TASK 2

AC 2.1 Calculate relevant income, expenses and allowances

According to the given case scenario, Susan is working at the till machine however,

calculations of income, expenses and allowances are based on following assumed information:

Net profit: £30000

Transportation expenses:

l Vehicle 1 use: £10000

l Vehicle 2 use: £15000

l Other expenses: £2590

Table 1: Computation of Net adjusted profit of Susan 2015-2016

Net profit 30000

Add: Disallowed expenses

(I) Transportation expenses 3700

(iv) Other expenses 2590 6290 6290

Less: allowable expenses

(i) Capital allowance 3864 3864 -1831

Less: Disallowed income

Add: Allowable income

Adjusted profit or loss 34459

The calculation shown in the above section represents the value of Net adjusted profit of

Susan for the financial year 2015-16 (Based on hypothetical information). Form the information,

it is evident that Susan is earning profits of £34459 after the deduction of allowances paid him on

business. (Working note 1).

Working notes

Working Note 1

Personal use of motor car 3000

Personal use assets 500

Parking fines 200

3700

Capital allowance for the year ended

Main pool £

Special rate

pool £ Allowances £

Addition qualifying for FYA

Transportation vehicle 1 10000

Transportation vehicle 2 15000

WDA- 18% -1800 2520

WDA-8% -1200 1344

WDV carried forward 8200 13800

Total allowances 3864

(i) Capital allowance 3864 3864 -1831

Less: Disallowed income

Add: Allowable income

Adjusted profit or loss 34459

The calculation shown in the above section represents the value of Net adjusted profit of

Susan for the financial year 2015-16 (Based on hypothetical information). Form the information,

it is evident that Susan is earning profits of £34459 after the deduction of allowances paid him on

business. (Working note 1).

Working notes

Working Note 1

Personal use of motor car 3000

Personal use assets 500

Parking fines 200

3700

Capital allowance for the year ended

Main pool £

Special rate

pool £ Allowances £

Addition qualifying for FYA

Transportation vehicle 1 10000

Transportation vehicle 2 15000

WDA- 18% -1800 2520

WDA-8% -1200 1344

WDV carried forward 8200 13800

Total allowances 3864

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The above table represents the capital allowance of business. The rate of written down

allowances for both the transportation vehicles are 18% and 8% respectively (Schwarz, 2014).

The written down value carried forward is £3864.

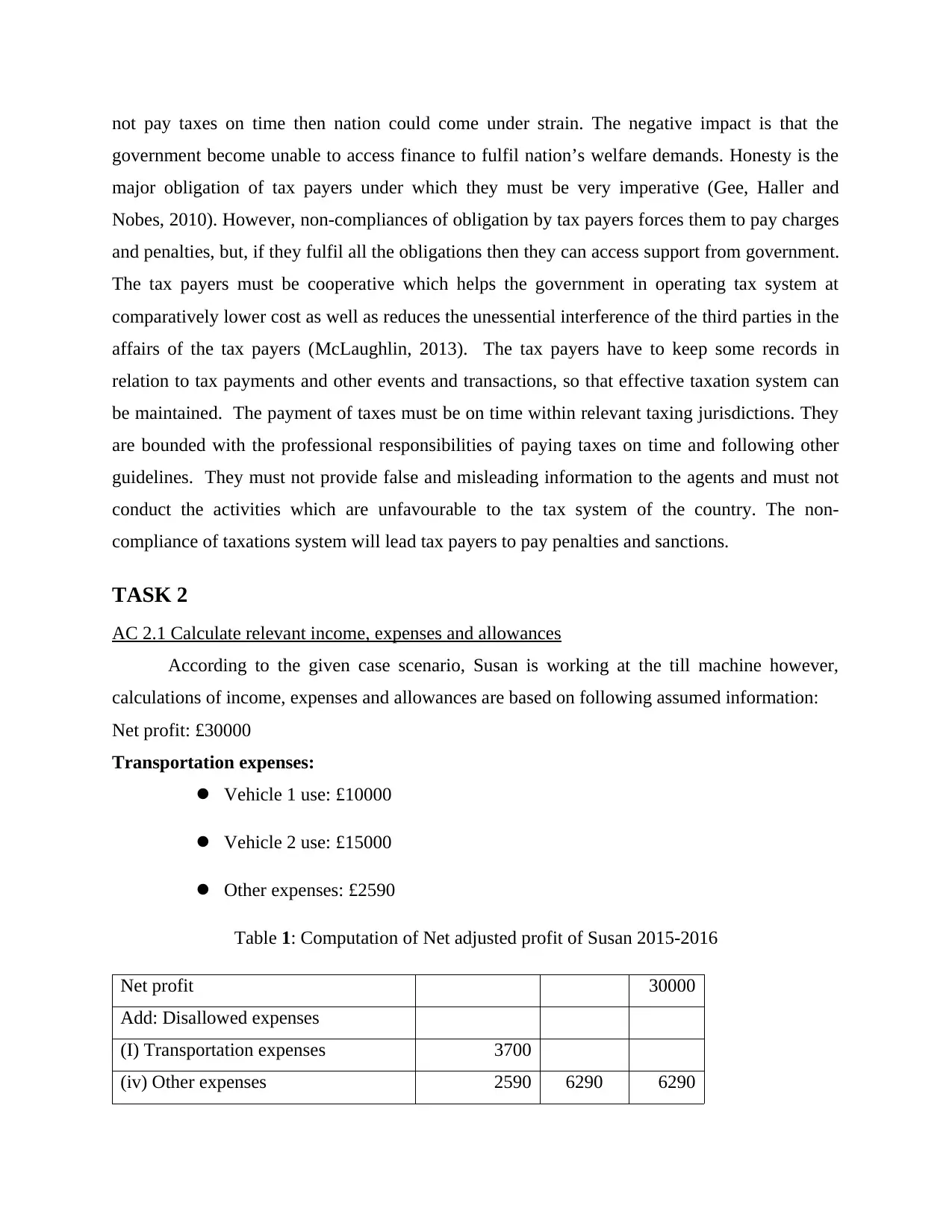

AC 2.2 Calculate taxable amounts for the employment at Supermarket and also calculate the

self-employment income with payment dates

Taxable amounts when Susan

is salaried employee at

supermarket

Salary amount 28,000

Deduction allowed as per act 9449

(annually)

Deduction provided

according for period worked

by them 9449

(employed for 12 months)

Taxable amount 18,551

income tax due by each

employee 3710.2

Self-employed gross income from a

designing greeting cards business is

£40,000

Gross income 40,000

deduction allowed as per act 9449

(annually)

Deduction provided

according for period worked

by them 9449

(employed for 12 months)

Taxable amount 30,551

income tax due by each

employee 6110.2

allowances for both the transportation vehicles are 18% and 8% respectively (Schwarz, 2014).

The written down value carried forward is £3864.

AC 2.2 Calculate taxable amounts for the employment at Supermarket and also calculate the

self-employment income with payment dates

Taxable amounts when Susan

is salaried employee at

supermarket

Salary amount 28,000

Deduction allowed as per act 9449

(annually)

Deduction provided

according for period worked

by them 9449

(employed for 12 months)

Taxable amount 18,551

income tax due by each

employee 3710.2

Self-employed gross income from a

designing greeting cards business is

£40,000

Gross income 40,000

deduction allowed as per act 9449

(annually)

Deduction provided

according for period worked

by them 9449

(employed for 12 months)

Taxable amount 30,551

income tax due by each

employee 6110.2

AC 2.3

Relevant document - The assesses is required to completed formalities which relates to

perfectibilities condition of tax payer. This may be different as type of person. Therefore, Susan

who has generated income from business and salary (Simser, 2008). Therefore, different

provision has applicable such individual as government provision which has describing at regular

time period.

Business and profession income tax – This type of tax has been charged on income which has

generated from business. Therefore, in this case, tax payer has Owen designing greeting cards

business which has earned of £40,000 so that this amount will be chargeable under income tax

legislation (A guide to UK taxation, 2013). Hence, there is Susan has to submit following

document when he submits income tax return. Like, financial statement, inventory, audit report,

supportive document, debit and credit note etc. on the other hand, competent authority can called

any document for investigation purpose (UK Tax Environment 2014-2015, 2016). Apart from

this, he has to fulfilled income tax form with self attested by him.

Salary – Susan is also engaged in job who earned as salary of amount of £28,000. Therefore, he

has to paid tax as basis of slab rate basis. He has to full file the rerun form with proper manner

with self attested. Along with, he to submit a salary slip which has received from employer

(Capital gains tax for individuals on the disposal of shares, 2015). On the other hand, supporting

document for availing document is also important for demanding deduction with legal manner.

For example:

Relevant document - The assesses is required to completed formalities which relates to

perfectibilities condition of tax payer. This may be different as type of person. Therefore, Susan

who has generated income from business and salary (Simser, 2008). Therefore, different

provision has applicable such individual as government provision which has describing at regular

time period.

Business and profession income tax – This type of tax has been charged on income which has

generated from business. Therefore, in this case, tax payer has Owen designing greeting cards

business which has earned of £40,000 so that this amount will be chargeable under income tax

legislation (A guide to UK taxation, 2013). Hence, there is Susan has to submit following

document when he submits income tax return. Like, financial statement, inventory, audit report,

supportive document, debit and credit note etc. on the other hand, competent authority can called

any document for investigation purpose (UK Tax Environment 2014-2015, 2016). Apart from

this, he has to fulfilled income tax form with self attested by him.

Salary – Susan is also engaged in job who earned as salary of amount of £28,000. Therefore, he

has to paid tax as basis of slab rate basis. He has to full file the rerun form with proper manner

with self attested. Along with, he to submit a salary slip which has received from employer

(Capital gains tax for individuals on the disposal of shares, 2015). On the other hand, supporting

document for availing document is also important for demanding deduction with legal manner.

For example:

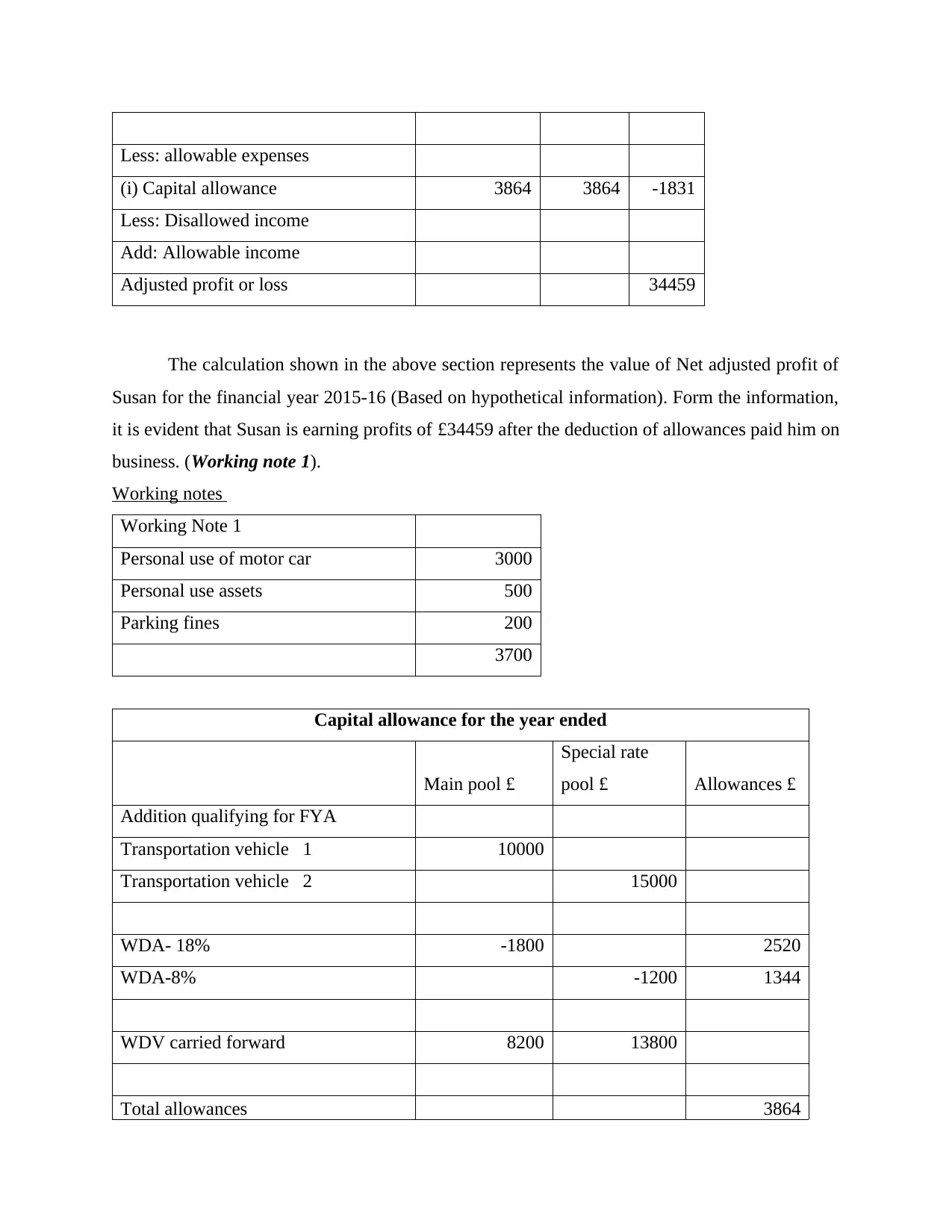

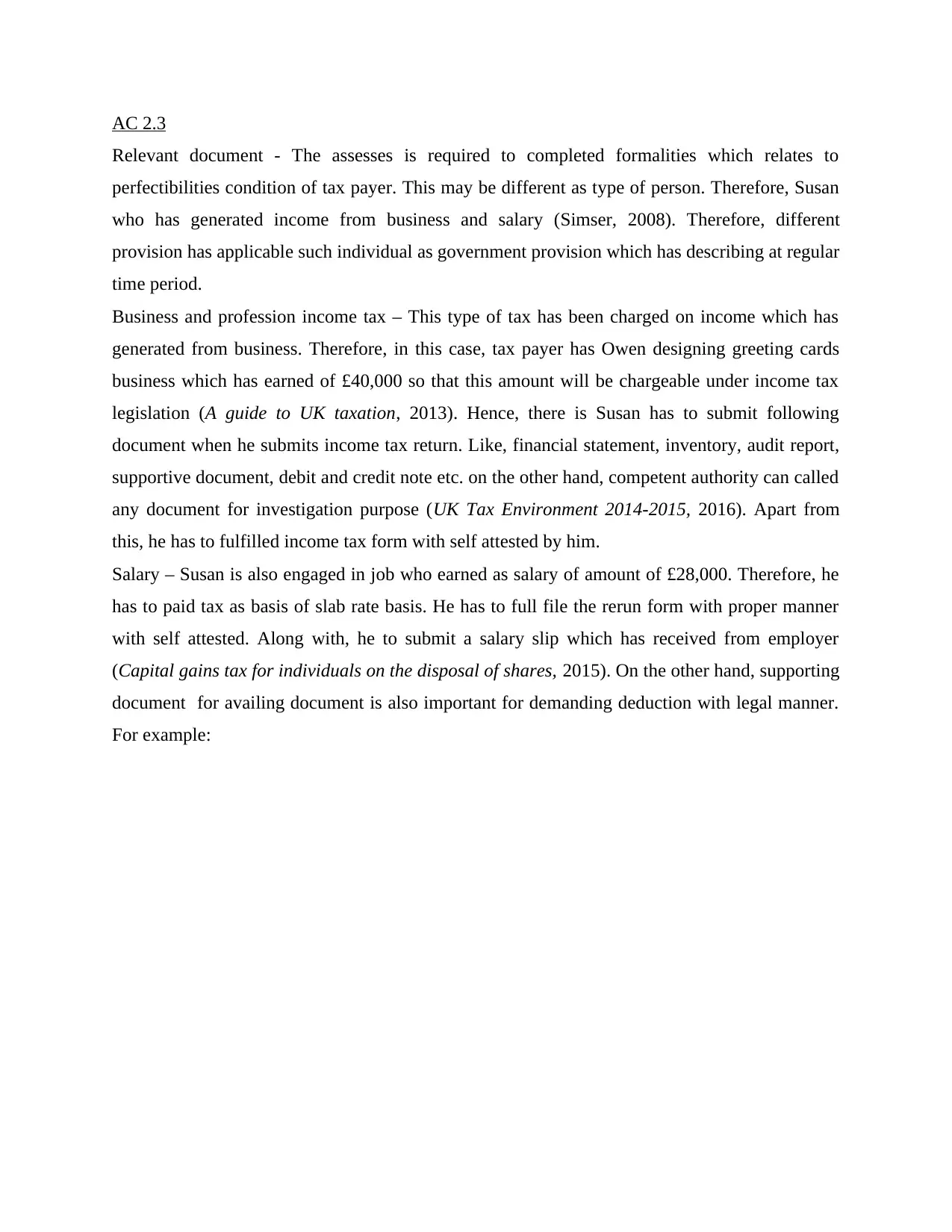

P45 form – The employer is responsible for paid tax on behalf of their employee but when

subordinate decided to leave job then higher authority issue this form to worker. It is the legal

form which help finished the liabilities of employer for paid tax. Therefore, in case, Susan leaves

jobs from supermarket then employer issue this form to Susan for purpose of free from tax

liabilities. Therefore, he earned £28000 as a salary on which total tax has been paid by employer

as tax deducted at souces so this form is just inform to government that susan has not employee

Illustration 1: Form P45 Part 1 Format Example

subordinate decided to leave job then higher authority issue this form to worker. It is the legal

form which help finished the liabilities of employer for paid tax. Therefore, in case, Susan leaves

jobs from supermarket then employer issue this form to Susan for purpose of free from tax

liabilities. Therefore, he earned £28000 as a salary on which total tax has been paid by employer

as tax deducted at souces so this form is just inform to government that susan has not employee

Illustration 1: Form P45 Part 1 Format Example

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

of supermarket so that he is not liable for paid tax in future. Apart from this, if supermarket is

liable to paid 5% tax at end of each year then without fullfilng this form liable to employer to

paid even he is not still work in supermarket. Hence, it free to supermarket for paid tax.

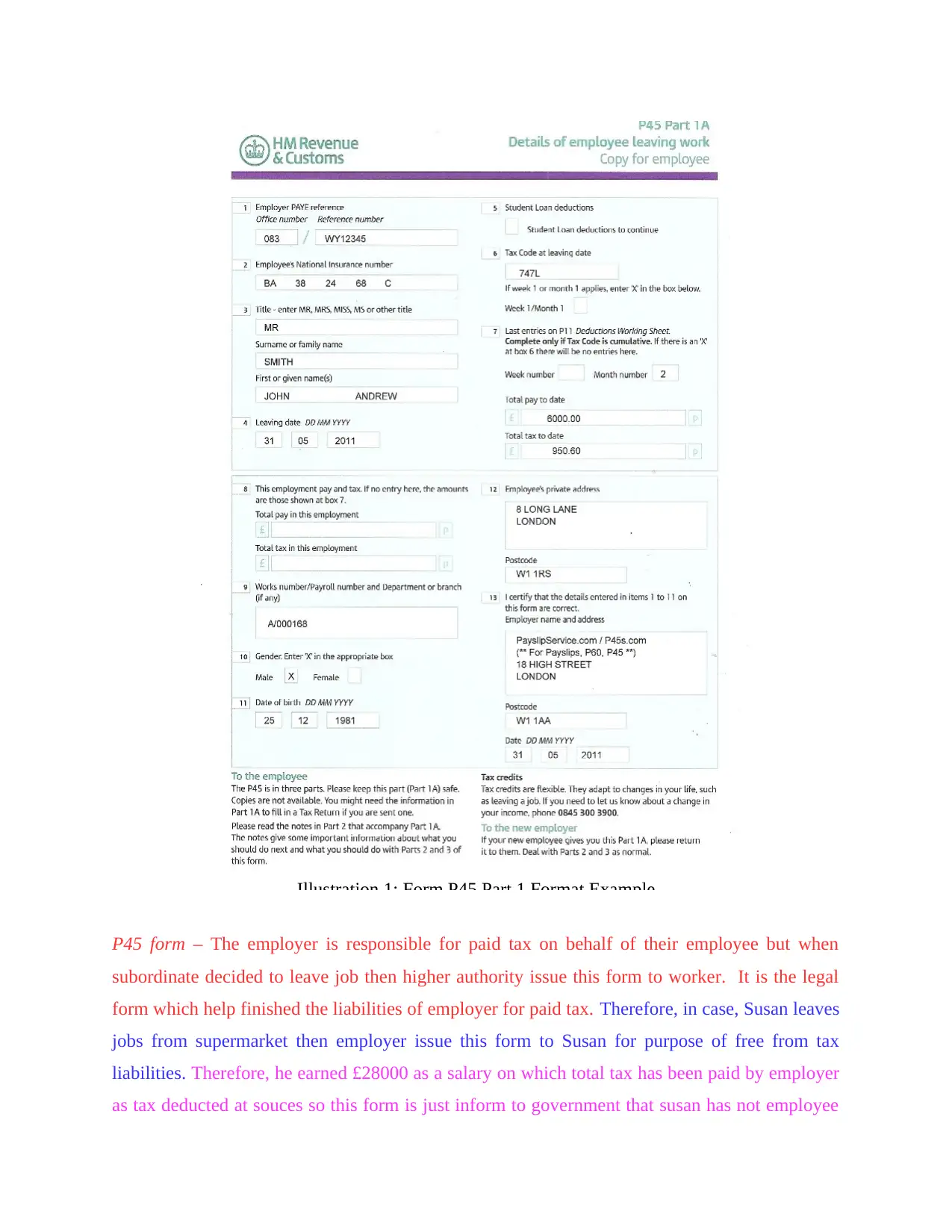

P60 form - This form has been fulfilled by employee during paying of tax. Further, it

consists full detail of tax liabilities which is required to be paid for subordinate during the year.

Therefore, overpaid tax can be demand back by the helps of this document. The Susan is

required to fulfilled this form at the end of tax year with all required detail and document.

Illustration 2: Form P60 Format Example

liable to paid 5% tax at end of each year then without fullfilng this form liable to employer to

paid even he is not still work in supermarket. Hence, it free to supermarket for paid tax.

P60 form - This form has been fulfilled by employee during paying of tax. Further, it

consists full detail of tax liabilities which is required to be paid for subordinate during the year.

Therefore, overpaid tax can be demand back by the helps of this document. The Susan is

required to fulfilled this form at the end of tax year with all required detail and document.

Illustration 2: Form P60 Format Example

Indeed, susan earned £28000 from salary and £40000 from business so that Susan is requred to

fullfied this form by giving full detail. In addition, on the basis of this form he can demand

deduction from paid tax. He is also eligible for demand tax deduction for requred expenss which

tax law has declared exemted. Apart from this, if portion of amount donate by susan then it

should be noted in this docment with recipt attachment for eligible for deductions.

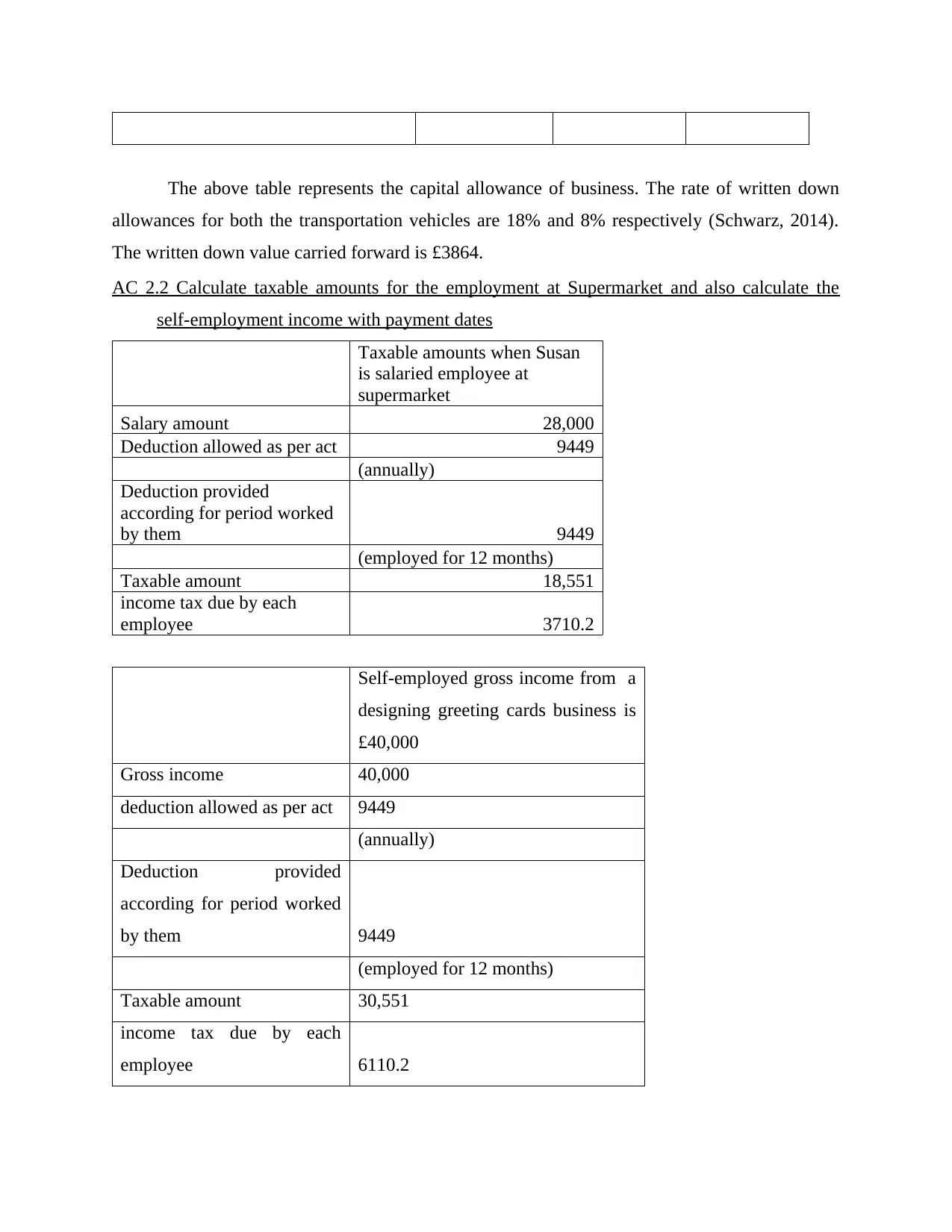

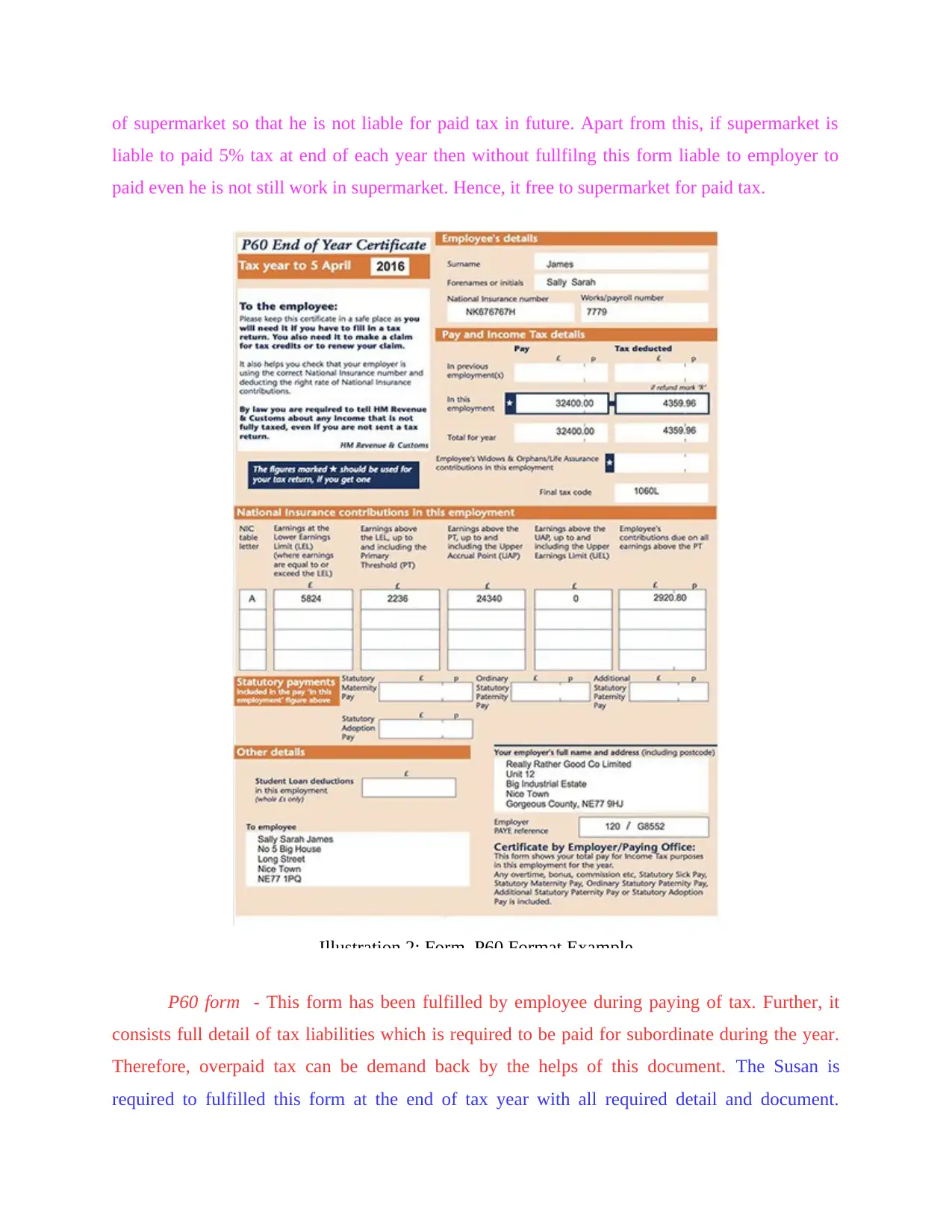

P11D form – This form has been fulfilled when employer received benefits in kind

therefore, this form has to be fulfilled. It is compulsorily required to fulfilled when worker

earned at least £8,500 or more (including the value of company benefits) in the financial year.

Therefore, Susan has to fulfilled this form when he gets benefits in kind from supermarket. If it

is not fullfiled than whole tax liabilities has convert to supermarket. On the other hand, he also

valued every kind thing with proper calculation. For example: interst free loan received by susan

from supermarket then he should fullfiled this form and fullfiling whole detail as requrement.

Hence, he has to paid tax on the basis of slab rate which calculated by net profit.

TASK 3

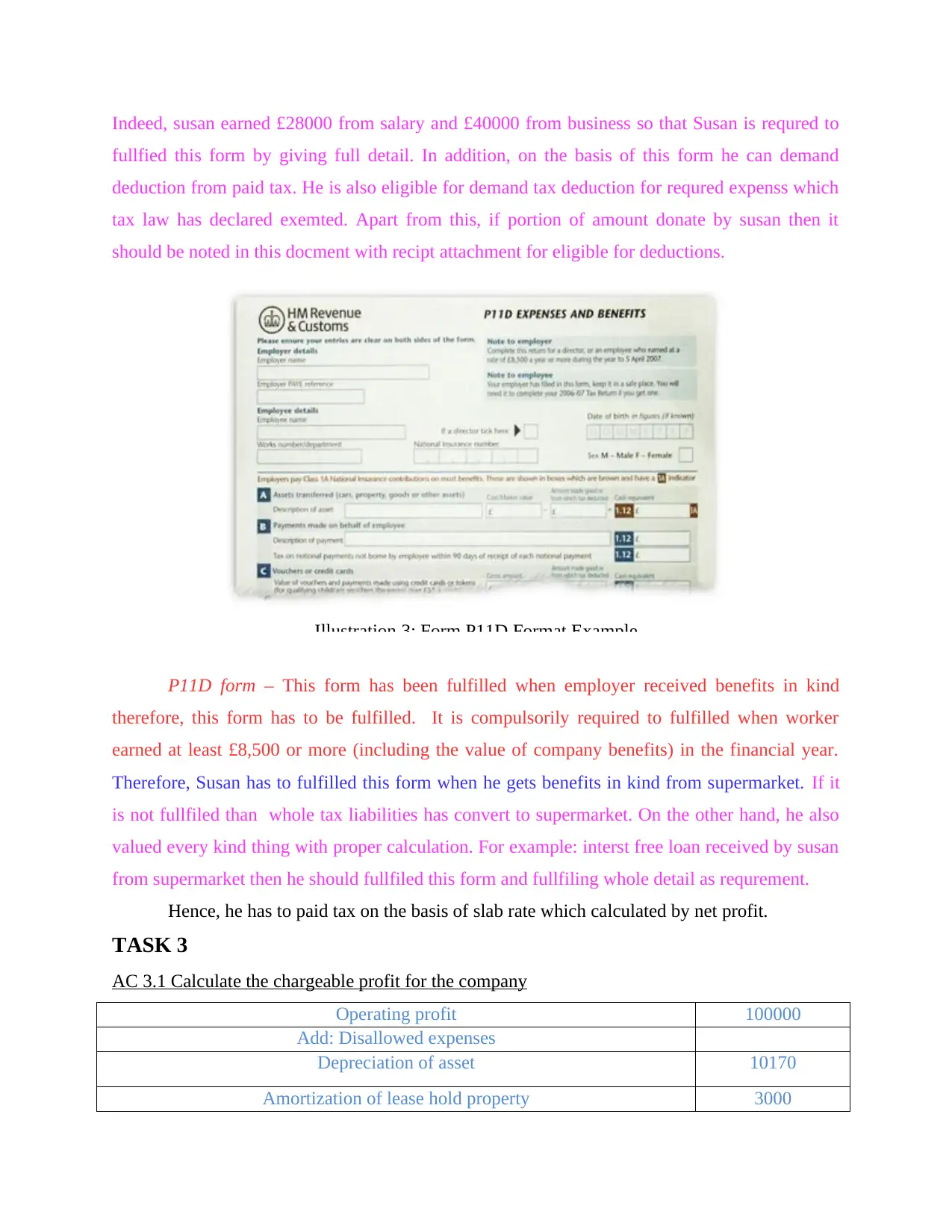

AC 3.1 Calculate the chargeable profit for the company

Operating profit 100000

Add: Disallowed expenses

Depreciation of asset 10170

Amortization of lease hold property 3000

Illustration 3: Form P11D Format Example

fullfied this form by giving full detail. In addition, on the basis of this form he can demand

deduction from paid tax. He is also eligible for demand tax deduction for requred expenss which

tax law has declared exemted. Apart from this, if portion of amount donate by susan then it

should be noted in this docment with recipt attachment for eligible for deductions.

P11D form – This form has been fulfilled when employer received benefits in kind

therefore, this form has to be fulfilled. It is compulsorily required to fulfilled when worker

earned at least £8,500 or more (including the value of company benefits) in the financial year.

Therefore, Susan has to fulfilled this form when he gets benefits in kind from supermarket. If it

is not fullfiled than whole tax liabilities has convert to supermarket. On the other hand, he also

valued every kind thing with proper calculation. For example: interst free loan received by susan

from supermarket then he should fullfiled this form and fullfiling whole detail as requrement.

Hence, he has to paid tax on the basis of slab rate which calculated by net profit.

TASK 3

AC 3.1 Calculate the chargeable profit for the company

Operating profit 100000

Add: Disallowed expenses

Depreciation of asset 10170

Amortization of lease hold property 3000

Illustration 3: Form P11D Format Example

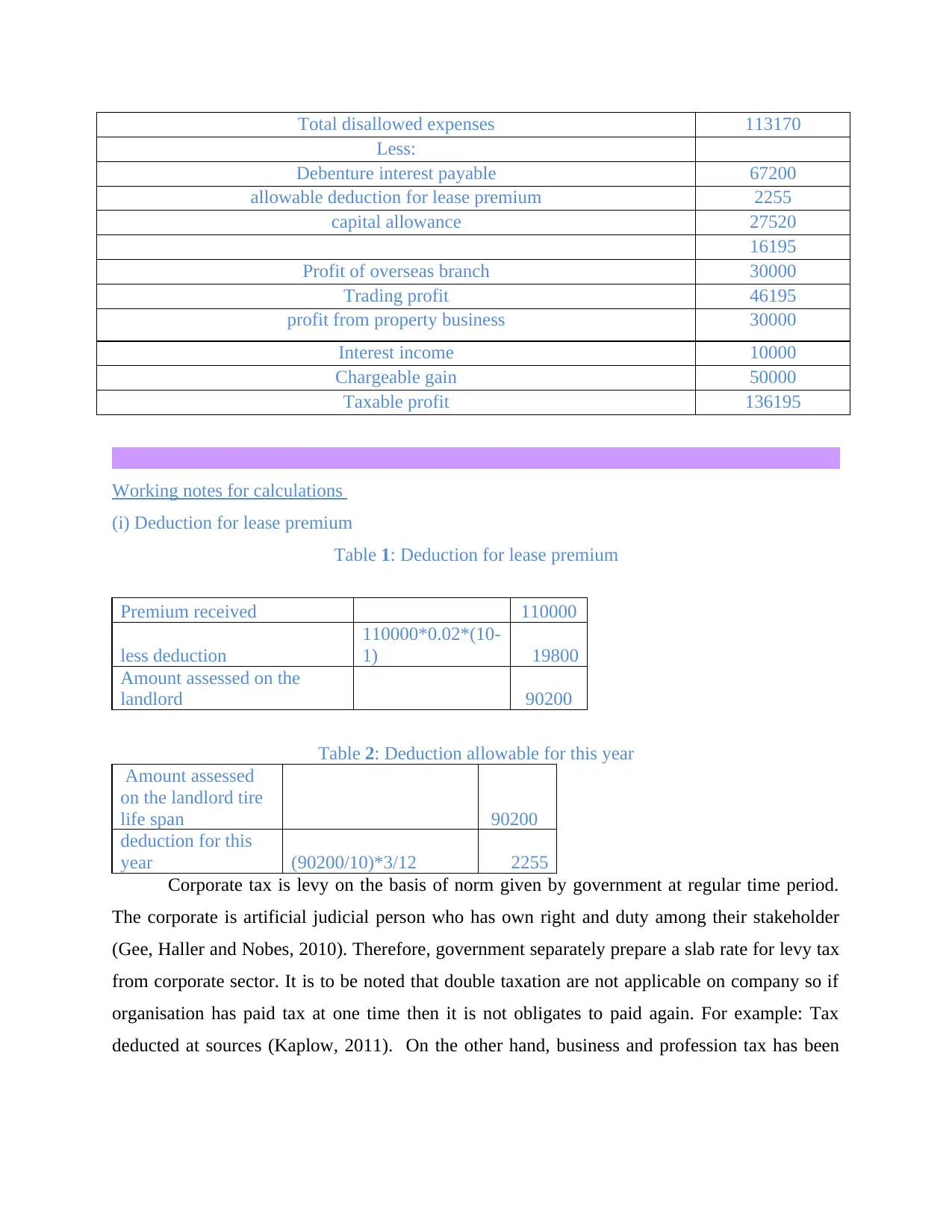

Total disallowed expenses 113170

Less:

Debenture interest payable 67200

allowable deduction for lease premium 2255

capital allowance 27520

16195

Profit of overseas branch 30000

Trading profit 46195

profit from property business 30000

Interest income 10000

Chargeable gain 50000

Taxable profit 136195

Working notes for calculations

(i) Deduction for lease premium

Table 1: Deduction for lease premium

Premium received 110000

less deduction

110000*0.02*(10-

1) 19800

Amount assessed on the

landlord 90200

Table 2: Deduction allowable for this year

Amount assessed

on the landlord tire

life span 90200

deduction for this

year (90200/10)*3/12 2255

Corporate tax is levy on the basis of norm given by government at regular time period.

The corporate is artificial judicial person who has own right and duty among their stakeholder

(Gee, Haller and Nobes, 2010). Therefore, government separately prepare a slab rate for levy tax

from corporate sector. It is to be noted that double taxation are not applicable on company so if

organisation has paid tax at one time then it is not obligates to paid again. For example: Tax

deducted at sources (Kaplow, 2011). On the other hand, business and profession tax has been

Less:

Debenture interest payable 67200

allowable deduction for lease premium 2255

capital allowance 27520

16195

Profit of overseas branch 30000

Trading profit 46195

profit from property business 30000

Interest income 10000

Chargeable gain 50000

Taxable profit 136195

Working notes for calculations

(i) Deduction for lease premium

Table 1: Deduction for lease premium

Premium received 110000

less deduction

110000*0.02*(10-

1) 19800

Amount assessed on the

landlord 90200

Table 2: Deduction allowable for this year

Amount assessed

on the landlord tire

life span 90200

deduction for this

year (90200/10)*3/12 2255

Corporate tax is levy on the basis of norm given by government at regular time period.

The corporate is artificial judicial person who has own right and duty among their stakeholder

(Gee, Haller and Nobes, 2010). Therefore, government separately prepare a slab rate for levy tax

from corporate sector. It is to be noted that double taxation are not applicable on company so if

organisation has paid tax at one time then it is not obligates to paid again. For example: Tax

deducted at sources (Kaplow, 2011). On the other hand, business and profession tax has been

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

charged on operational income only so that it is not levy on other type of sources like lease

property etc.

The income tax provision also gives exemption on lease premium with fair manner.

Therefore, in this case assess received a premium with amount of £100000 so legal provision

gives exemption at 2% of total amount received (King and Fullerton, 2010). The above table

shows calculation of tax liabilities. Thus, he has to paid £18000 as tax on total lease

amount receive.

On the other hand, the whole lease amount is not amortization in one

year only. Therefore, deduction has been provides by propionate basis,

hence, it is divided on quarterly basis as shown in table 2 (McLaughlin,

2013). Thus, deduction is allowed as proportionate basis as number of year

divided.

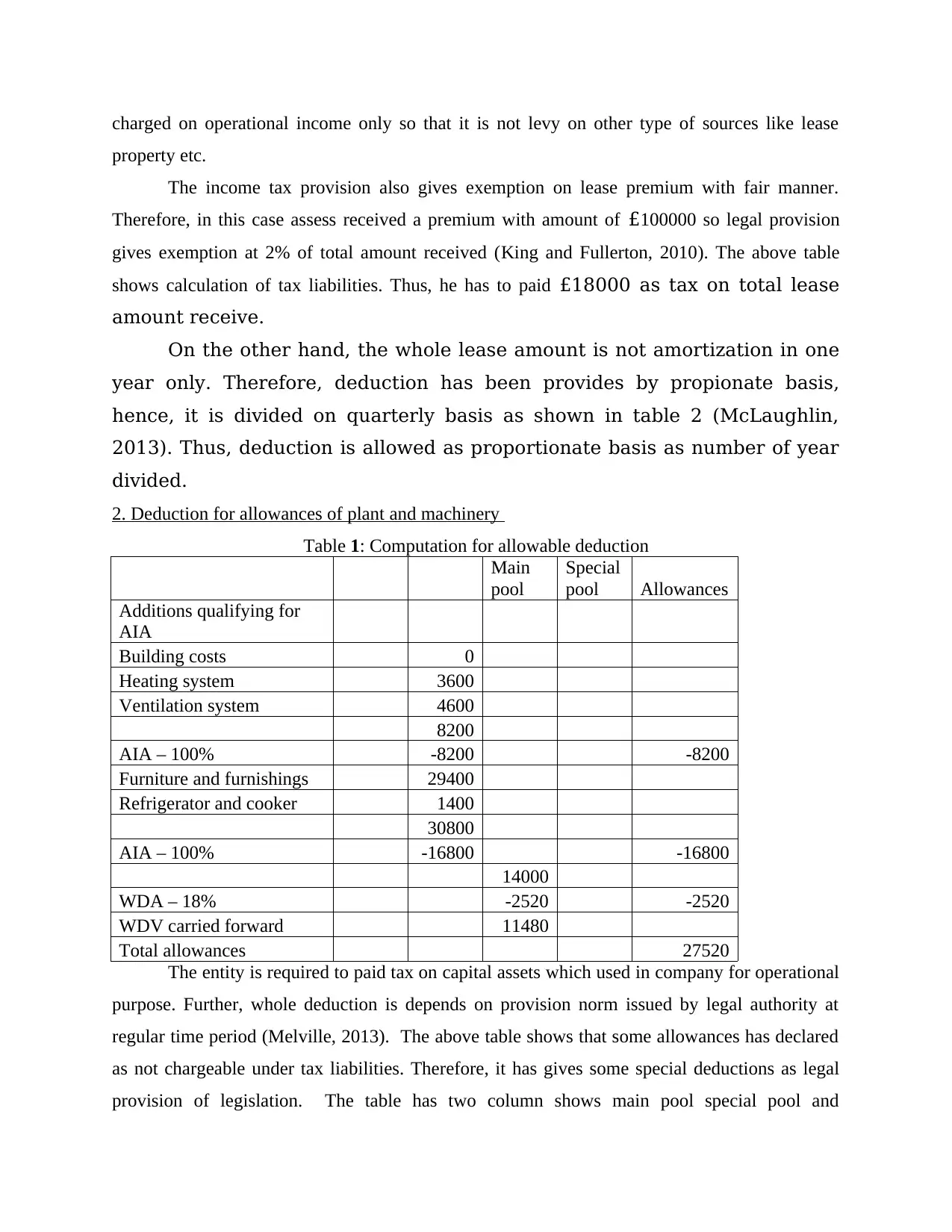

2. Deduction for allowances of plant and machinery

Table 1: Computation for allowable deduction

Main

pool

Special

pool Allowances

Additions qualifying for

AIA

Building costs 0

Heating system 3600

Ventilation system 4600

8200

AIA – 100% -8200 -8200

Furniture and furnishings 29400

Refrigerator and cooker 1400

30800

AIA – 100% -16800 -16800

14000

WDA – 18% -2520 -2520

WDV carried forward 11480

Total allowances 27520

The entity is required to paid tax on capital assets which used in company for operational

purpose. Further, whole deduction is depends on provision norm issued by legal authority at

regular time period (Melville, 2013). The above table shows that some allowances has declared

as not chargeable under tax liabilities. Therefore, it has gives some special deductions as legal

provision of legislation. The table has two column shows main pool special pool and

property etc.

The income tax provision also gives exemption on lease premium with fair manner.

Therefore, in this case assess received a premium with amount of £100000 so legal provision

gives exemption at 2% of total amount received (King and Fullerton, 2010). The above table

shows calculation of tax liabilities. Thus, he has to paid £18000 as tax on total lease

amount receive.

On the other hand, the whole lease amount is not amortization in one

year only. Therefore, deduction has been provides by propionate basis,

hence, it is divided on quarterly basis as shown in table 2 (McLaughlin,

2013). Thus, deduction is allowed as proportionate basis as number of year

divided.

2. Deduction for allowances of plant and machinery

Table 1: Computation for allowable deduction

Main

pool

Special

pool Allowances

Additions qualifying for

AIA

Building costs 0

Heating system 3600

Ventilation system 4600

8200

AIA – 100% -8200 -8200

Furniture and furnishings 29400

Refrigerator and cooker 1400

30800

AIA – 100% -16800 -16800

14000

WDA – 18% -2520 -2520

WDV carried forward 11480

Total allowances 27520

The entity is required to paid tax on capital assets which used in company for operational

purpose. Further, whole deduction is depends on provision norm issued by legal authority at

regular time period (Melville, 2013). The above table shows that some allowances has declared

as not chargeable under tax liabilities. Therefore, it has gives some special deductions as legal

provision of legislation. The table has two column shows main pool special pool and

allowances. Hence, it is the sufficient for understand the deduction of allowances amount with

fair manner. Capital expenditure will be not eligible for deductions for term manner. But

government gives some exemption for purpose of promote to some business entity. Hence, the

heating system and Ventilation system are allowed as 100% tax deduction. So that it is not

charged any taxed on this item. It is the fully depreciate item and also helps to manage

environment with effective manner (Salanie, 2011). The cost of furniture and refrigerator also

eligible to deduction which as proportionate manner. The deduction is on the basis of proportion

basis as life of machinery. But term and condition must be fulfilled as norm of legal authority. So

that 16800 is allowed as deduction for company. The 18% of total amount is allowed as

deduction in these assets which are shown in the table content (Capital gains tax for individuals

on the disposal of shares, 2015). It is to be noted that capital amount is not eligible for deduction

fully at one time.

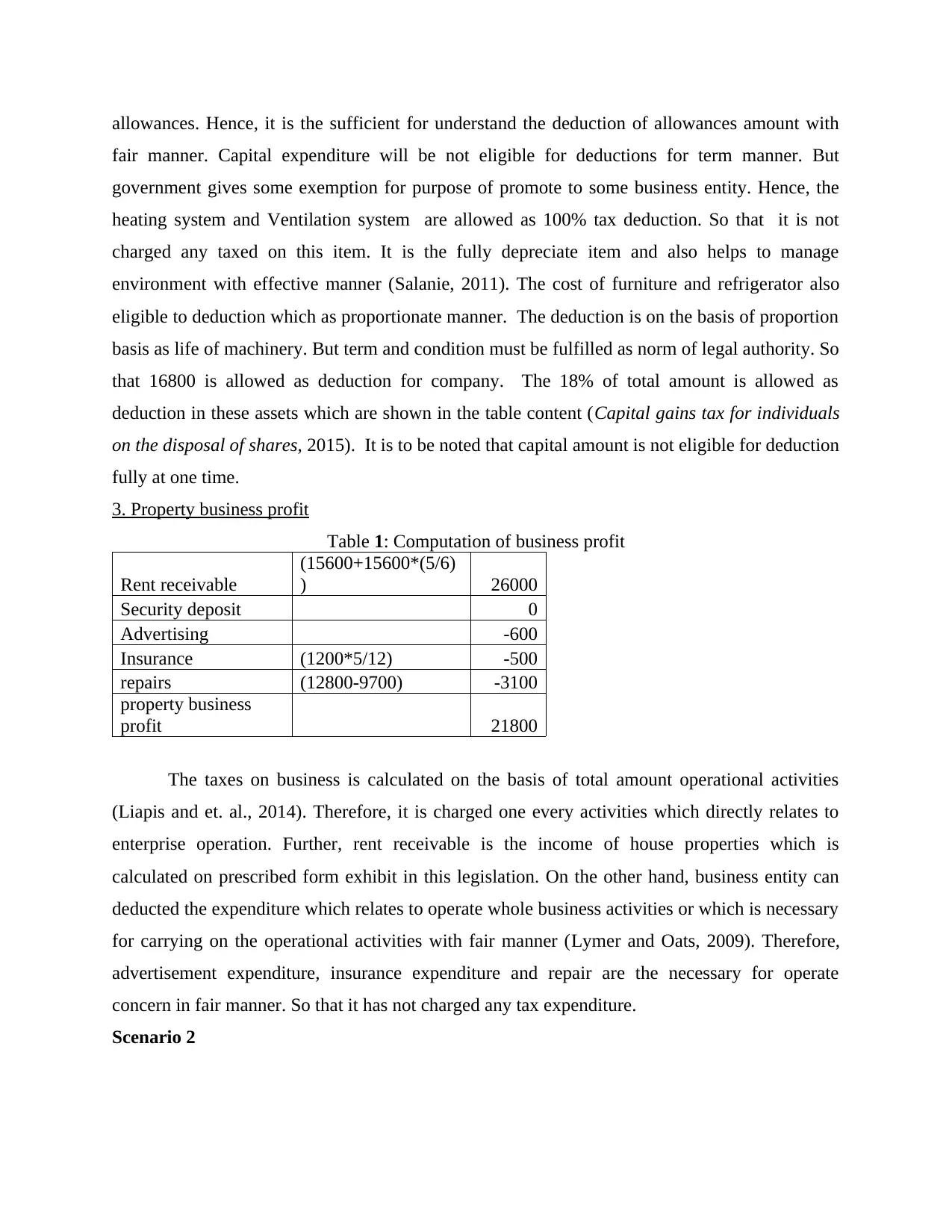

3. Property business profit

Table 1: Computation of business profit

Rent receivable

(15600+15600*(5/6)

) 26000

Security deposit 0

Advertising -600

Insurance (1200*5/12) -500

repairs (12800-9700) -3100

property business

profit 21800

The taxes on business is calculated on the basis of total amount operational activities

(Liapis and et. al., 2014). Therefore, it is charged one every activities which directly relates to

enterprise operation. Further, rent receivable is the income of house properties which is

calculated on prescribed form exhibit in this legislation. On the other hand, business entity can

deducted the expenditure which relates to operate whole business activities or which is necessary

for carrying on the operational activities with fair manner (Lymer and Oats, 2009). Therefore,

advertisement expenditure, insurance expenditure and repair are the necessary for operate

concern in fair manner. So that it has not charged any tax expenditure.

Scenario 2

fair manner. Capital expenditure will be not eligible for deductions for term manner. But

government gives some exemption for purpose of promote to some business entity. Hence, the

heating system and Ventilation system are allowed as 100% tax deduction. So that it is not

charged any taxed on this item. It is the fully depreciate item and also helps to manage

environment with effective manner (Salanie, 2011). The cost of furniture and refrigerator also

eligible to deduction which as proportionate manner. The deduction is on the basis of proportion

basis as life of machinery. But term and condition must be fulfilled as norm of legal authority. So

that 16800 is allowed as deduction for company. The 18% of total amount is allowed as

deduction in these assets which are shown in the table content (Capital gains tax for individuals

on the disposal of shares, 2015). It is to be noted that capital amount is not eligible for deduction

fully at one time.

3. Property business profit

Table 1: Computation of business profit

Rent receivable

(15600+15600*(5/6)

) 26000

Security deposit 0

Advertising -600

Insurance (1200*5/12) -500

repairs (12800-9700) -3100

property business

profit 21800

The taxes on business is calculated on the basis of total amount operational activities

(Liapis and et. al., 2014). Therefore, it is charged one every activities which directly relates to

enterprise operation. Further, rent receivable is the income of house properties which is

calculated on prescribed form exhibit in this legislation. On the other hand, business entity can

deducted the expenditure which relates to operate whole business activities or which is necessary

for carrying on the operational activities with fair manner (Lymer and Oats, 2009). Therefore,

advertisement expenditure, insurance expenditure and repair are the necessary for operate

concern in fair manner. So that it has not charged any tax expenditure.

Scenario 2

4.1 Identify chargeable assets

The capital gain tax is levied by the government on the capital profit generated by an

individual or an organization from the sales of chargeable assets (Social Market Foundation

2006). Taxation of Chargeable Gains Act, 1992 includes is imposed by the government to

success all the activities of CGT. There are some of exempted assets which have been included

in the assets. These are all the assets on which seller don’t have to pay tax (Schwarz, 2014). Such

assets include: lotteries, prizes, government securities, life insurance policies, tangible movable

properties etc. The list of capital and long tern assists are mentioned here as under in the

following points:

Trading

Commercial assets

Old things or antic items

Jewellery and ornaments

Land, buildings and fixed assets

Goodwill of company

Shares and bonds stocks

Paintings items and art

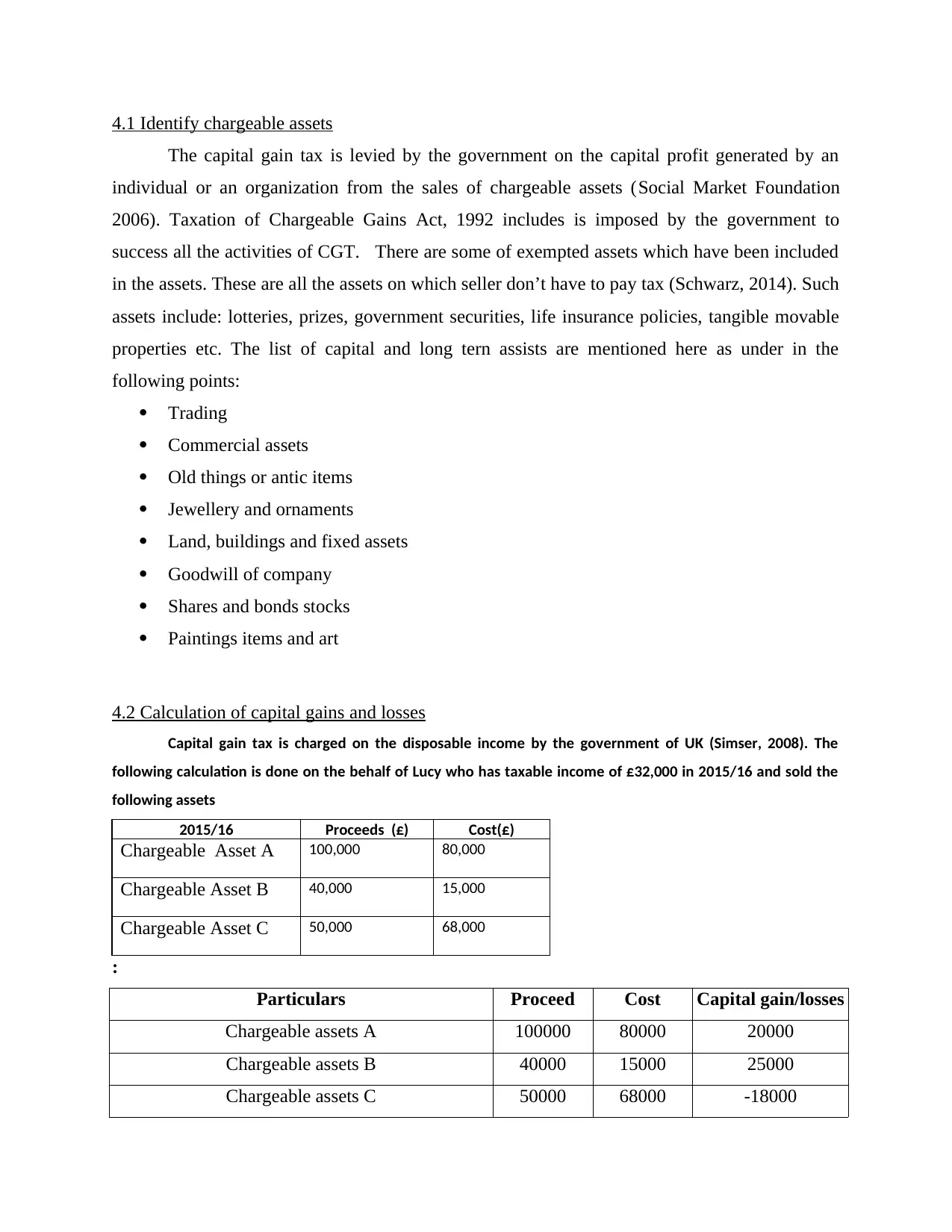

4.2 Calculation of capital gains and losses

Capital gain tax is charged on the disposable income by the government of UK (Simser, 2008). The

following calculation is done on the behalf of Lucy who has taxable income of £32,000 in 2015/16 and sold the

following assets

2015/16 Proceeds (£) Cost(£)

Chargeable Asset A 100,000 80,000

Chargeable Asset B 40,000 15,000

Chargeable Asset C 50,000 68,000

:

Particulars Proceed Cost Capital gain/losses

Chargeable assets A 100000 80000 20000

Chargeable assets B 40000 15000 25000

Chargeable assets C 50000 68000 -18000

The capital gain tax is levied by the government on the capital profit generated by an

individual or an organization from the sales of chargeable assets (Social Market Foundation

2006). Taxation of Chargeable Gains Act, 1992 includes is imposed by the government to

success all the activities of CGT. There are some of exempted assets which have been included

in the assets. These are all the assets on which seller don’t have to pay tax (Schwarz, 2014). Such

assets include: lotteries, prizes, government securities, life insurance policies, tangible movable

properties etc. The list of capital and long tern assists are mentioned here as under in the

following points:

Trading

Commercial assets

Old things or antic items

Jewellery and ornaments

Land, buildings and fixed assets

Goodwill of company

Shares and bonds stocks

Paintings items and art

4.2 Calculation of capital gains and losses

Capital gain tax is charged on the disposable income by the government of UK (Simser, 2008). The

following calculation is done on the behalf of Lucy who has taxable income of £32,000 in 2015/16 and sold the

following assets

2015/16 Proceeds (£) Cost(£)

Chargeable Asset A 100,000 80,000

Chargeable Asset B 40,000 15,000

Chargeable Asset C 50,000 68,000

:

Particulars Proceed Cost Capital gain/losses

Chargeable assets A 100000 80000 20000

Chargeable assets B 40000 15000 25000

Chargeable assets C 50000 68000 -18000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Total capital gains through disposal of

chargeable assets 27000

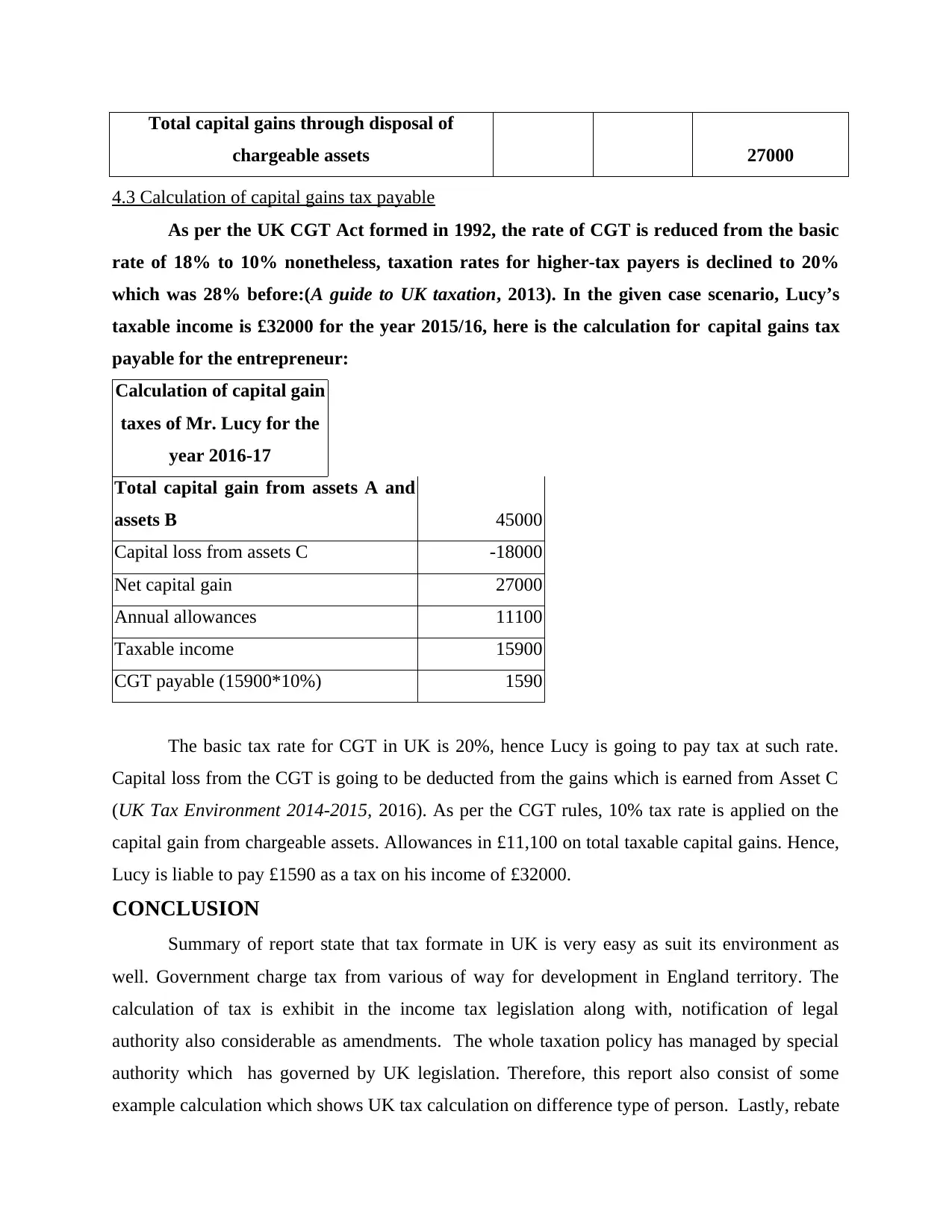

4.3 Calculation of capital gains tax payable

As per the UK CGT Act formed in 1992, the rate of CGT is reduced from the basic

rate of 18% to 10% nonetheless, taxation rates for higher-tax payers is declined to 20%

which was 28% before:(A guide to UK taxation, 2013). In the given case scenario, Lucy’s

taxable income is £32000 for the year 2015/16, here is the calculation for capital gains tax

payable for the entrepreneur:

Calculation of capital gain

taxes of Mr. Lucy for the

year 2016-17

Total capital gain from assets A and

assets B 45000

Capital loss from assets C -18000

Net capital gain 27000

Annual allowances 11100

Taxable income 15900

CGT payable (15900*10%) 1590

The basic tax rate for CGT in UK is 20%, hence Lucy is going to pay tax at such rate.

Capital loss from the CGT is going to be deducted from the gains which is earned from Asset C

(UK Tax Environment 2014-2015, 2016). As per the CGT rules, 10% tax rate is applied on the

capital gain from chargeable assets. Allowances in £11,100 on total taxable capital gains. Hence,

Lucy is liable to pay £1590 as a tax on his income of £32000.

CONCLUSION

Summary of report state that tax formate in UK is very easy as suit its environment as

well. Government charge tax from various of way for development in England territory. The

calculation of tax is exhibit in the income tax legislation along with, notification of legal

authority also considerable as amendments. The whole taxation policy has managed by special

authority which has governed by UK legislation. Therefore, this report also consist of some

example calculation which shows UK tax calculation on difference type of person. Lastly, rebate

chargeable assets 27000

4.3 Calculation of capital gains tax payable

As per the UK CGT Act formed in 1992, the rate of CGT is reduced from the basic

rate of 18% to 10% nonetheless, taxation rates for higher-tax payers is declined to 20%

which was 28% before:(A guide to UK taxation, 2013). In the given case scenario, Lucy’s

taxable income is £32000 for the year 2015/16, here is the calculation for capital gains tax

payable for the entrepreneur:

Calculation of capital gain

taxes of Mr. Lucy for the

year 2016-17

Total capital gain from assets A and

assets B 45000

Capital loss from assets C -18000

Net capital gain 27000

Annual allowances 11100

Taxable income 15900

CGT payable (15900*10%) 1590

The basic tax rate for CGT in UK is 20%, hence Lucy is going to pay tax at such rate.

Capital loss from the CGT is going to be deducted from the gains which is earned from Asset C

(UK Tax Environment 2014-2015, 2016). As per the CGT rules, 10% tax rate is applied on the

capital gain from chargeable assets. Allowances in £11,100 on total taxable capital gains. Hence,

Lucy is liable to pay £1590 as a tax on his income of £32000.

CONCLUSION

Summary of report state that tax formate in UK is very easy as suit its environment as

well. Government charge tax from various of way for development in England territory. The

calculation of tax is exhibit in the income tax legislation along with, notification of legal

authority also considerable as amendments. The whole taxation policy has managed by special

authority which has governed by UK legislation. Therefore, this report also consist of some

example calculation which shows UK tax calculation on difference type of person. Lastly, rebate

provide on tax is also mentioned in this legislation therefore, advantages of this tax deduction is

also called as tax planning. Apart from this, the whole report shows that tax determination policy

of UK is too easy than other nation because its considered each part of income of type of person.

Therefore, they are liable to paid only those part of income which is necessary. For example: in

case person donate their income then it is not chargeable as income tax. Thus, it covers whole

part for determine the income part of individual.

also called as tax planning. Apart from this, the whole report shows that tax determination policy

of UK is too easy than other nation because its considered each part of income of type of person.

Therefore, they are liable to paid only those part of income which is necessary. For example: in

case person donate their income then it is not chargeable as income tax. Thus, it covers whole

part for determine the income part of individual.

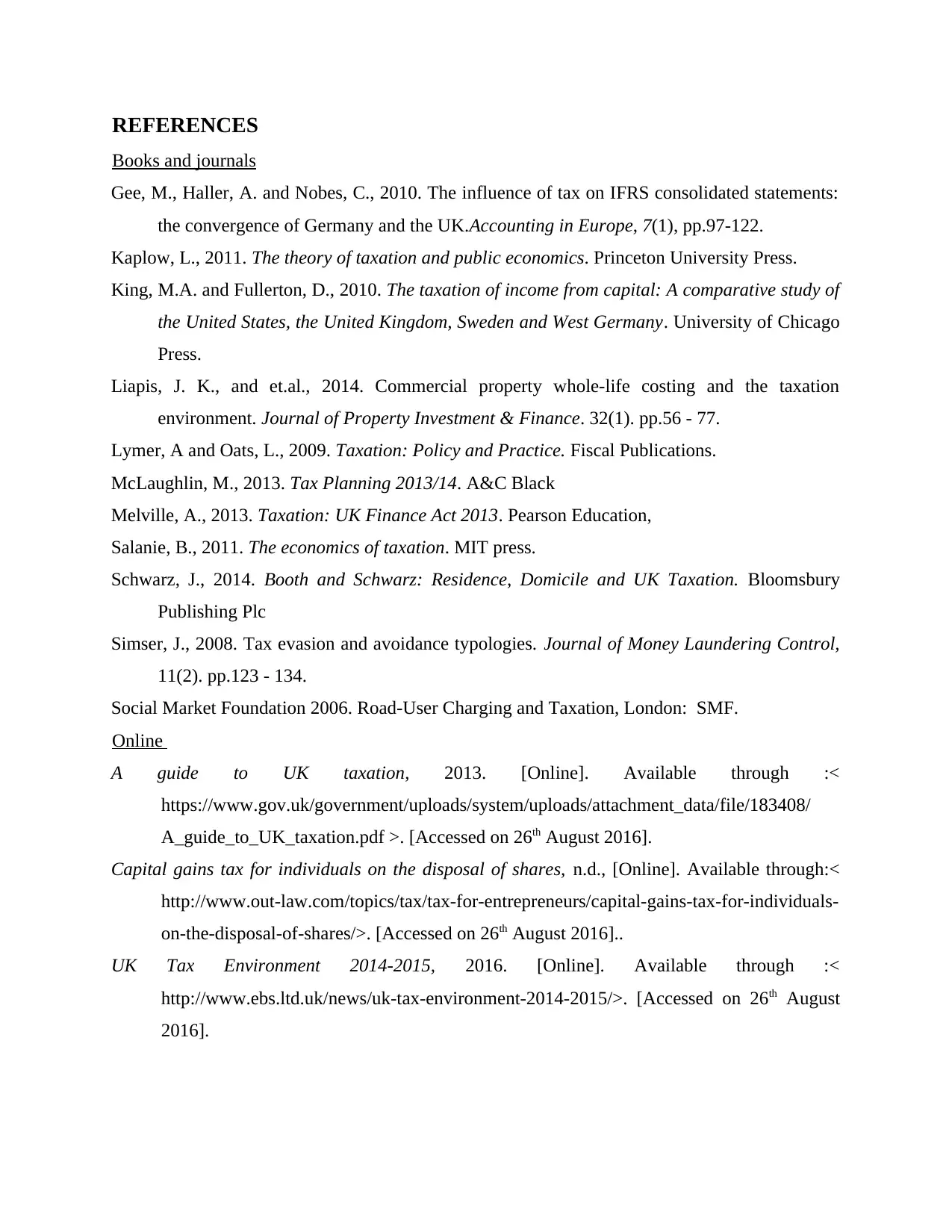

REFERENCES

Books and journals

Gee, M., Haller, A. and Nobes, C., 2010. The influence of tax on IFRS consolidated statements:

the convergence of Germany and the UK.Accounting in Europe, 7(1), pp.97-122.

Kaplow, L., 2011. The theory of taxation and public economics. Princeton University Press.

King, M.A. and Fullerton, D., 2010. The taxation of income from capital: A comparative study of

the United States, the United Kingdom, Sweden and West Germany. University of Chicago

Press.

Liapis, J. K., and et.al., 2014. Commercial property whole-life costing and the taxation

environment. Journal of Property Investment & Finance. 32(1). pp.56 - 77.

Lymer, A and Oats, L., 2009. Taxation: Policy and Practice. Fiscal Publications.

McLaughlin, M., 2013. Tax Planning 2013/14. A&C Black

Melville, A., 2013. Taxation: UK Finance Act 2013. Pearson Education,

Salanie, B., 2011. The economics of taxation. MIT press.

Schwarz, J., 2014. Booth and Schwarz: Residence, Domicile and UK Taxation. Bloomsbury

Publishing Plc

Simser, J., 2008. Tax evasion and avoidance typologies. Journal of Money Laundering Control,

11(2). pp.123 - 134.

Social Market Foundation 2006. Road-User Charging and Taxation, London: SMF.

Online

A guide to UK taxation, 2013. [Online]. Available through :<

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/183408/

A_guide_to_UK_taxation.pdf >. [Accessed on 26th August 2016].

Capital gains tax for individuals on the disposal of shares, n.d., [Online]. Available through:<

http://www.out-law.com/topics/tax/tax-for-entrepreneurs/capital-gains-tax-for-individuals-

on-the-disposal-of-shares/>. [Accessed on 26th August 2016]..

UK Tax Environment 2014-2015, 2016. [Online]. Available through :<

http://www.ebs.ltd.uk/news/uk-tax-environment-2014-2015/>. [Accessed on 26th August

2016].

Books and journals

Gee, M., Haller, A. and Nobes, C., 2010. The influence of tax on IFRS consolidated statements:

the convergence of Germany and the UK.Accounting in Europe, 7(1), pp.97-122.

Kaplow, L., 2011. The theory of taxation and public economics. Princeton University Press.

King, M.A. and Fullerton, D., 2010. The taxation of income from capital: A comparative study of

the United States, the United Kingdom, Sweden and West Germany. University of Chicago

Press.

Liapis, J. K., and et.al., 2014. Commercial property whole-life costing and the taxation

environment. Journal of Property Investment & Finance. 32(1). pp.56 - 77.

Lymer, A and Oats, L., 2009. Taxation: Policy and Practice. Fiscal Publications.

McLaughlin, M., 2013. Tax Planning 2013/14. A&C Black

Melville, A., 2013. Taxation: UK Finance Act 2013. Pearson Education,

Salanie, B., 2011. The economics of taxation. MIT press.

Schwarz, J., 2014. Booth and Schwarz: Residence, Domicile and UK Taxation. Bloomsbury

Publishing Plc

Simser, J., 2008. Tax evasion and avoidance typologies. Journal of Money Laundering Control,

11(2). pp.123 - 134.

Social Market Foundation 2006. Road-User Charging and Taxation, London: SMF.

Online

A guide to UK taxation, 2013. [Online]. Available through :<

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/183408/

A_guide_to_UK_taxation.pdf >. [Accessed on 26th August 2016].

Capital gains tax for individuals on the disposal of shares, n.d., [Online]. Available through:<

http://www.out-law.com/topics/tax/tax-for-entrepreneurs/capital-gains-tax-for-individuals-

on-the-disposal-of-shares/>. [Accessed on 26th August 2016]..

UK Tax Environment 2014-2015, 2016. [Online]. Available through :<

http://www.ebs.ltd.uk/news/uk-tax-environment-2014-2015/>. [Accessed on 26th August

2016].

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.