Taxation and its Impact on a Country

VerifiedAdded on 2019/10/16

|6

|1395

|168

Essay

AI Summary

The article emphasizes the importance of preparing and submitting tax returns, including statements of income tax liabilities for group companies. It highlights the moral and social duty of responsible citizens to contribute to their country's national income through taxation. The government uses tax records to determine expenditure and provides a platform for taxpayers to claim refunds and relief. The preparation of tax statements is crucial for both individual and corporate taxpayers, as it allows them to participate in the nation's economic development and contributes to the appraisal of the national economy.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: UK TAX SYSTEM 1

Title

Assignment: UK TAX SYSTEM

1 | P a g e

Title

Assignment: UK TAX SYSTEM

1 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

UK TAX SYSTEM 2

Brief History on UK Tax System

Before we discuss the historical background of the UK taxation we can define taxes as a

compulsory levy, enforced by the government, on income or expenditure.

Income Tax was the first tax in British history to be levied directly on people's earnings. It

was introduced in 1798 by the then Prime Minister William Pitt the Younger, as a

temporary measure to cover the cost of the Napoleonic Wars. Pitt's income tax was levied

from 1799 to 1802, the income tax was reintroduced by Addington in 1803 but abolished in

1816 & again But it was reintroduced in 1842 by Sir Robert Peel (Freedman and Vella,

2017).

Corporation tax, Finance Act 1965 replaced this structure for companies and associations

with a single corporate tax, which took its basic structure and rules from the income tax

system. These changes were consolidated by the Income and Corporation Taxes Act 1970.

Also the schedules under which tax is levied have changed (Gov.uk., 2017a).

The tax year commences on 6 April and ends on the following 5 April in the United

Kingdom. Statement of Income Tax liabilities that is filed with the HM Revenue &

Customs declaring liability for taxation. SA 100 is for individuals paying Income Tax &

CT600 for corporation (SimpleTax, 2017).

Element in Statement of Income Tax Liabilities For Individuals (SA 100)

Personal Details b) Income earned in Employment c) Income Earned from Self Employed

Business d) Income Earned as partner in Partnership Business e) Capital Gain f) Income

Earned as trustee g) Foreign Income h) Interest and dividends from UK Banks, Building

societies i) UK Pensions, annuities and other state benefits received j) Tax Reliefs k)

Charitable giving l) Information about Student loan repayments (Gov.uk., 2017b).

***Other Important Points

1. Your Personal Allowance goes down by £1 for every £2 that your adjusted net income is

above £100,000. This means your allowance is zero if your income is £123,000 or above.

2. There is no tax on saving Interest & Dividend Income.

2 | P a g e

Brief History on UK Tax System

Before we discuss the historical background of the UK taxation we can define taxes as a

compulsory levy, enforced by the government, on income or expenditure.

Income Tax was the first tax in British history to be levied directly on people's earnings. It

was introduced in 1798 by the then Prime Minister William Pitt the Younger, as a

temporary measure to cover the cost of the Napoleonic Wars. Pitt's income tax was levied

from 1799 to 1802, the income tax was reintroduced by Addington in 1803 but abolished in

1816 & again But it was reintroduced in 1842 by Sir Robert Peel (Freedman and Vella,

2017).

Corporation tax, Finance Act 1965 replaced this structure for companies and associations

with a single corporate tax, which took its basic structure and rules from the income tax

system. These changes were consolidated by the Income and Corporation Taxes Act 1970.

Also the schedules under which tax is levied have changed (Gov.uk., 2017a).

The tax year commences on 6 April and ends on the following 5 April in the United

Kingdom. Statement of Income Tax liabilities that is filed with the HM Revenue &

Customs declaring liability for taxation. SA 100 is for individuals paying Income Tax &

CT600 for corporation (SimpleTax, 2017).

Element in Statement of Income Tax Liabilities For Individuals (SA 100)

Personal Details b) Income earned in Employment c) Income Earned from Self Employed

Business d) Income Earned as partner in Partnership Business e) Capital Gain f) Income

Earned as trustee g) Foreign Income h) Interest and dividends from UK Banks, Building

societies i) UK Pensions, annuities and other state benefits received j) Tax Reliefs k)

Charitable giving l) Information about Student loan repayments (Gov.uk., 2017b).

***Other Important Points

1. Your Personal Allowance goes down by £1 for every £2 that your adjusted net income is

above £100,000. This means your allowance is zero if your income is £123,000 or above.

2. There is no tax on saving Interest & Dividend Income.

2 | P a g e

UK TAX SYSTEM 3

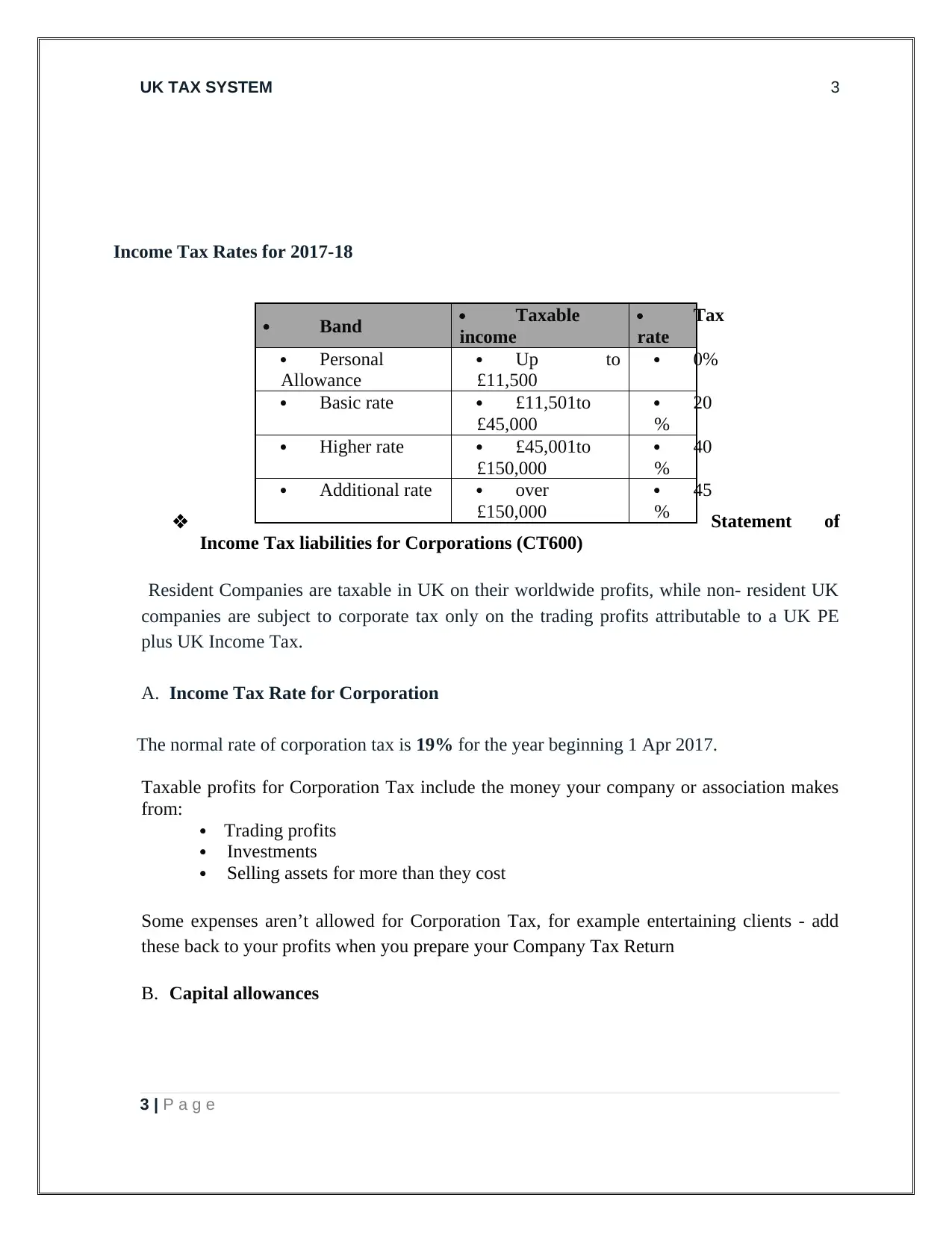

Income Tax Rates for 2017-18

Statement of

Income Tax liabilities for Corporations (CT600)

Resident Companies are taxable in UK on their worldwide profits, while non- resident UK

companies are subject to corporate tax only on the trading profits attributable to a UK PE

plus UK Income Tax.

A. Income Tax Rate for Corporation

The normal rate of corporation tax is 19% for the year beginning 1 Apr 2017.

Taxable profits for Corporation Tax include the money your company or association makes

from:

Trading profits

Investments

Selling assets for more than they cost

Some expenses aren’t allowed for Corporation Tax, for example entertaining clients - add

these back to your profits when you prepare your Company Tax Return

B. Capital allowances

3 | P a g e

Band Taxable

income

Tax

rate

Personal

Allowance

Up to

£11,500

0%

Basic rate £11,501to

£45,000

20

%

Higher rate £45,001to

£150,000

40

%

Additional rate over

£150,000

45

%

Income Tax Rates for 2017-18

Statement of

Income Tax liabilities for Corporations (CT600)

Resident Companies are taxable in UK on their worldwide profits, while non- resident UK

companies are subject to corporate tax only on the trading profits attributable to a UK PE

plus UK Income Tax.

A. Income Tax Rate for Corporation

The normal rate of corporation tax is 19% for the year beginning 1 Apr 2017.

Taxable profits for Corporation Tax include the money your company or association makes

from:

Trading profits

Investments

Selling assets for more than they cost

Some expenses aren’t allowed for Corporation Tax, for example entertaining clients - add

these back to your profits when you prepare your Company Tax Return

B. Capital allowances

3 | P a g e

Band Taxable

income

Tax

rate

Personal

Allowance

Up to

£11,500

0%

Basic rate £11,501to

£45,000

20

%

Higher rate £45,001to

£150,000

40

%

Additional rate over

£150,000

45

%

UK TAX SYSTEM 4

Claim capital allowances if you buy assets that you keep to use in your business, for

example- equipment, machinery business vehicles, for example cars, vans, lorries.

C. Other reliefs

You may be able to make a claim for:

a) Research and Development (R&D) Relief

b) The Patent Box if your company makes a profit from patented inventions

c) Reliefs for creative industries (CITR) if your company makes a profit from theatre,

film, television, animation or video games

D. Marginal Relief

You can only claim Marginal Relief if your company had profits between £300,000 and £1.5

million.

E. Other Important Points

a) You must still send a return if you make a loss or have no Corporation Tax to pay.\

b) The deadline for your tax return is 12 months after the end of the accounting period it

covers.

Rationale Behind Preparing Statements of Income Tax liabilities

Preparation & filling the income tax Statements is an annual activity seen as a moral and

social duty of every responsible citizen of the country. It is the basis for the government to

determine the amount and means of expenditure of the citizens and provides a platform for

the assesse to claim refund, among other forms of relief from time to time.

Any Transaction can be legally entered into because the government is having records of

income and it is collecting the tax on it. Payment of taxes helps every citizen to participate in

the contribution towards national income and consequently in the appraisal of the national

economy (Wallace, 2017 ).

Preparation of statement of income tax liabilities for the group companies is also an

important aspect in corporation tax.

A company is called group company or associated company if

4 | P a g e

Claim capital allowances if you buy assets that you keep to use in your business, for

example- equipment, machinery business vehicles, for example cars, vans, lorries.

C. Other reliefs

You may be able to make a claim for:

a) Research and Development (R&D) Relief

b) The Patent Box if your company makes a profit from patented inventions

c) Reliefs for creative industries (CITR) if your company makes a profit from theatre,

film, television, animation or video games

D. Marginal Relief

You can only claim Marginal Relief if your company had profits between £300,000 and £1.5

million.

E. Other Important Points

a) You must still send a return if you make a loss or have no Corporation Tax to pay.\

b) The deadline for your tax return is 12 months after the end of the accounting period it

covers.

Rationale Behind Preparing Statements of Income Tax liabilities

Preparation & filling the income tax Statements is an annual activity seen as a moral and

social duty of every responsible citizen of the country. It is the basis for the government to

determine the amount and means of expenditure of the citizens and provides a platform for

the assesse to claim refund, among other forms of relief from time to time.

Any Transaction can be legally entered into because the government is having records of

income and it is collecting the tax on it. Payment of taxes helps every citizen to participate in

the contribution towards national income and consequently in the appraisal of the national

economy (Wallace, 2017 ).

Preparation of statement of income tax liabilities for the group companies is also an

important aspect in corporation tax.

A company is called group company or associated company if

4 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

UK TAX SYSTEM 5

One company is associated with another if either:

One company controls the other

Both companies are controlled by the same companies or people

Statement of income tax for group companies allows investors, financial analysts, business

owners and other interested parties to get a complete overview of the parent company. At a

glance, they can view the overall health of the business and how each subsidiary impacts the

parent company.

Impact on a Country if does not impose taxes

The primary purpose of taxation is to raise revenue to meet huge public expenditure. Most

governmental activities must be financed by taxation. But it is not the only goal. In other

words, taxation policy has some non-revenue objectives. In the modern world, taxation is

used as an instrument of economic policy. It affects the total volume of production,

consumption, investment, choice of industrial location and techniques, balance of payments,

distribution of income, etc. Taxes impact the development of a country for the following

main factors

1. Economic Development: By raising the existing rate of taxes or by imposing new

taxes, the process of capital formation can be made smooth. One of the important

elements of economic development is the raising of savings- income ratio which

can be effectively raised through taxation policy.

2. Full Employment: Since the level of employment depends on effective demand,

a country desirous of achieving the goal of full employment must cut down the

rate of taxes. Consequently, disposable income will rise and, hence, demand for

goods and services will rise. Increased demand will stimulate investment leading

to a rise in income and employment through the multiplier mechanism.

3. Price Stability: By raising the rate of direct taxes, private spending can be

controlled. Naturally, the pressure on the commodity market is reduced. But

indirect taxes imposed on commodities fuel inflationary tendencies. Finally,

another extra-revenue or non-revenue objective of taxation is the reduction of

inequalities in income and wealth.

5 | P a g e

One company is associated with another if either:

One company controls the other

Both companies are controlled by the same companies or people

Statement of income tax for group companies allows investors, financial analysts, business

owners and other interested parties to get a complete overview of the parent company. At a

glance, they can view the overall health of the business and how each subsidiary impacts the

parent company.

Impact on a Country if does not impose taxes

The primary purpose of taxation is to raise revenue to meet huge public expenditure. Most

governmental activities must be financed by taxation. But it is not the only goal. In other

words, taxation policy has some non-revenue objectives. In the modern world, taxation is

used as an instrument of economic policy. It affects the total volume of production,

consumption, investment, choice of industrial location and techniques, balance of payments,

distribution of income, etc. Taxes impact the development of a country for the following

main factors

1. Economic Development: By raising the existing rate of taxes or by imposing new

taxes, the process of capital formation can be made smooth. One of the important

elements of economic development is the raising of savings- income ratio which

can be effectively raised through taxation policy.

2. Full Employment: Since the level of employment depends on effective demand,

a country desirous of achieving the goal of full employment must cut down the

rate of taxes. Consequently, disposable income will rise and, hence, demand for

goods and services will rise. Increased demand will stimulate investment leading

to a rise in income and employment through the multiplier mechanism.

3. Price Stability: By raising the rate of direct taxes, private spending can be

controlled. Naturally, the pressure on the commodity market is reduced. But

indirect taxes imposed on commodities fuel inflationary tendencies. Finally,

another extra-revenue or non-revenue objective of taxation is the reduction of

inequalities in income and wealth.

5 | P a g e

UK TAX SYSTEM 6

6 | P a g e

6 | P a g e

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.