A Comprehensive Report on Managing Financial Resources and Decisions

VerifiedAdded on 2020/01/28

|17

|4787

|64

Report

AI Summary

This report provides a comprehensive overview of financial resource management and decision-making processes. It begins by identifying and analyzing various sources of finance, including equity and debt, and assesses their associated costs and implications. The report then delves into investment appraisal techniques, such as calculating the cost of equity and debt, and evaluating projects using methods like ARR, NPV, payback period, and IRR. It emphasizes the importance of financial planning and the information needs of different decision-makers, including managers, employees, and creditors. The report also examines the appropriateness of different sources of finance based on economic indicators and analyzes the impact of finance on financial statements. Ratio analysis is performed on Apple Ltd., and the report concludes with project evaluation techniques to determine project viability. The report covers topics such as financial planning, investment appraisal, financial statements, and economic indicators, offering a detailed analysis of financial management principles and practices.

MANAGING FINANCIAL RESOURCES AND

DECISION

DECISION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

INVESTMENT APPRAISAL 1......................................................................................................1

1.1 & 2.1 Identifying different sources of finance and analysis of their cost.........................1

1.2 Implications of different sources of finance.....................................................................2

INVESTMENT APPRAISAL 2......................................................................................................3

2.2 & 2.3 Importance of financial planning and information needs of different decision

makers.....................................................................................................................................3

1.3 Appropriateness of source of finance...............................................................................4

2.4 Impact of finance on financial statements........................................................................6

4.1 & 4.2 Main financial statements and their appropriateness for different business

organizations...........................................................................................................................6

4.3 Calculation of ratios of Apple Ltd....................................................................................7

3.1 & 3.2 Analysis of budget and calculation of unit cost.....................................................9

3.3 Project evaluation techniques.........................................................................................10

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

INVESTMENT APPRAISAL 1......................................................................................................1

1.1 & 2.1 Identifying different sources of finance and analysis of their cost.........................1

1.2 Implications of different sources of finance.....................................................................2

INVESTMENT APPRAISAL 2......................................................................................................3

2.2 & 2.3 Importance of financial planning and information needs of different decision

makers.....................................................................................................................................3

1.3 Appropriateness of source of finance...............................................................................4

2.4 Impact of finance on financial statements........................................................................6

4.1 & 4.2 Main financial statements and their appropriateness for different business

organizations...........................................................................................................................6

4.3 Calculation of ratios of Apple Ltd....................................................................................7

3.1 & 3.2 Analysis of budget and calculation of unit cost.....................................................9

3.3 Project evaluation techniques.........................................................................................10

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INDEX OF TABLES

Table 1: Comparison of economic performance of world leading economies................................4

Table 2: Ratio analysis of Apple Ltd...............................................................................................7

Table 3: Cash budget.......................................................................................................................9

Table 4: Calculation of per unit cost..............................................................................................10

Table 5: Calculation of ARR.........................................................................................................10

Table 6: Calculation of NPV.........................................................................................................11

Table 7: Calculation of payback period.........................................................................................12

Table 8: Calculation of IRR...........................................................................................................12

ILLUSTRATION INDEX

Illustration 1: China, USA and UK PMI.........................................................................................5

Illustration 2: China, USA and UK GDP.........................................................................................5

Table 1: Comparison of economic performance of world leading economies................................4

Table 2: Ratio analysis of Apple Ltd...............................................................................................7

Table 3: Cash budget.......................................................................................................................9

Table 4: Calculation of per unit cost..............................................................................................10

Table 5: Calculation of ARR.........................................................................................................10

Table 6: Calculation of NPV.........................................................................................................11

Table 7: Calculation of payback period.........................................................................................12

Table 8: Calculation of IRR...........................................................................................................12

ILLUSTRATION INDEX

Illustration 1: China, USA and UK PMI.........................................................................................5

Illustration 2: China, USA and UK GDP.........................................................................................5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

This report is prepared to create a broad understanding about the source of finance among

readers. In relation to this, implications of different sources of finance are also described in

detail. In order to comprehend the suitability of source of finance, economic indicators are also

used and their data is interpreted. Apart from this, ratio analysis is also done and their results are

interpreted to understand the economic condition of Apple Ltd. At the end of report, project

evaluation techniques are applied and viability of project is determined on the behalf of results of

various techniques of project evaluation.

INVESTMENT APPRAISAL 1

1.1 & 2.1 Identifying different sources of finance and analysis of their cost

In today’s era, raising finance is a basic problem for every company. Along with this,

selection of specific source of finance is a complicated task. Mainly, all sources of finance falls

in two categories namely equity and debt. This source of finance and their sub categories are

described as below:

Equity:

1. IPO or FPO- Firm can raise the capital by issuing shares through IPO or FPO. It is a

common source of finance for large sized firms. However, this source of finance has

some merits and demerits. Therefore, firms must cautiously use this source of finance

(Du and Girma, 2012).

2. Private equity- In order to raise the capital through IPO, firms needs to fulfil all

eligibility criteria of listing stock market indices. Firm uses this source of finance when

their fundamentals are strong but they are not eligible to raise the capital. Under this

mode of finance, private equity firm provides capital to the firm by purchasing stock in

the organization that approaches PE firm for equity.

Debt:

1. Long term and short term debt- Under this mode of finance, firms take a loan for long

and short term from banks and NBFC'S. In return, firm has to give debt at fixed or

floating interest rate.

1

This report is prepared to create a broad understanding about the source of finance among

readers. In relation to this, implications of different sources of finance are also described in

detail. In order to comprehend the suitability of source of finance, economic indicators are also

used and their data is interpreted. Apart from this, ratio analysis is also done and their results are

interpreted to understand the economic condition of Apple Ltd. At the end of report, project

evaluation techniques are applied and viability of project is determined on the behalf of results of

various techniques of project evaluation.

INVESTMENT APPRAISAL 1

1.1 & 2.1 Identifying different sources of finance and analysis of their cost

In today’s era, raising finance is a basic problem for every company. Along with this,

selection of specific source of finance is a complicated task. Mainly, all sources of finance falls

in two categories namely equity and debt. This source of finance and their sub categories are

described as below:

Equity:

1. IPO or FPO- Firm can raise the capital by issuing shares through IPO or FPO. It is a

common source of finance for large sized firms. However, this source of finance has

some merits and demerits. Therefore, firms must cautiously use this source of finance

(Du and Girma, 2012).

2. Private equity- In order to raise the capital through IPO, firms needs to fulfil all

eligibility criteria of listing stock market indices. Firm uses this source of finance when

their fundamentals are strong but they are not eligible to raise the capital. Under this

mode of finance, private equity firm provides capital to the firm by purchasing stock in

the organization that approaches PE firm for equity.

Debt:

1. Long term and short term debt- Under this mode of finance, firms take a loan for long

and short term from banks and NBFC'S. In return, firm has to give debt at fixed or

floating interest rate.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. Consortium finance – It is a new mode of finance under which a cartel is formed by the

banks and they collectively provide debt to the firm (Collier, Hoeffler, 2004). One of

these banks acts as a lead bank and coordinates all activities regarding allotment and

monitoring of loan.

Cost of finance:

1. Cost of equity- It refers to the cost that firm has to bear in order to raise the capital from

equity. Firm pays dividend as a percentage of net profit to its shareholders either half

yearly or annually. Therefore, it is termed as the cost of equity. Cost of equity is also

calculated by using CAPM model. Under this model, minimum return that an investor

must earn on its investment is calculated. It is also termed as the cost of equity.

2. Cost of debt- Firm pays interest to the banks, NBFC'S and creditors for the loan that these

entities give to the firm for specific duration. Interest may be given at a fixed cost of

floating interest rate. Sometimes, problems prompted due to change in domestic and

international interest rate structure. In order to protect itself from negative change in the

interest rates, firms (large size) take their positions in forward and future contracts

(Auerbach and Hassett, 2003). But sometimes, perception proves to be wrong and firm

faces a heavy loss in its business. Therefore, it is recommended that firms must raise loan

at floating interest rate after considering their financial conditions.

1.2 Implications of different sources of finance

Basis Equity Debt

Downturn in

economy

In any case if firm raises capital from

equity and if economic downturn

happens then it is not compelled to

pay dividend to its shareholders.

Hence, burden of cost of finance is

not created on the firm in case of

equity (Carlin and Mayer, 2003).

In case of downturn in economy,

central banks many times change their

interest rates and this cause change in

the bank’s interest rate. In case of

floating interest rate, such changes

sometimes escalate the cost of finance

for the firm.

Strict payment In case of equity as mentioned above,

payment of dividend depends on the

But in case of debt, firm has to pay

interest in every condition irrespective

2

banks and they collectively provide debt to the firm (Collier, Hoeffler, 2004). One of

these banks acts as a lead bank and coordinates all activities regarding allotment and

monitoring of loan.

Cost of finance:

1. Cost of equity- It refers to the cost that firm has to bear in order to raise the capital from

equity. Firm pays dividend as a percentage of net profit to its shareholders either half

yearly or annually. Therefore, it is termed as the cost of equity. Cost of equity is also

calculated by using CAPM model. Under this model, minimum return that an investor

must earn on its investment is calculated. It is also termed as the cost of equity.

2. Cost of debt- Firm pays interest to the banks, NBFC'S and creditors for the loan that these

entities give to the firm for specific duration. Interest may be given at a fixed cost of

floating interest rate. Sometimes, problems prompted due to change in domestic and

international interest rate structure. In order to protect itself from negative change in the

interest rates, firms (large size) take their positions in forward and future contracts

(Auerbach and Hassett, 2003). But sometimes, perception proves to be wrong and firm

faces a heavy loss in its business. Therefore, it is recommended that firms must raise loan

at floating interest rate after considering their financial conditions.

1.2 Implications of different sources of finance

Basis Equity Debt

Downturn in

economy

In any case if firm raises capital from

equity and if economic downturn

happens then it is not compelled to

pay dividend to its shareholders.

Hence, burden of cost of finance is

not created on the firm in case of

equity (Carlin and Mayer, 2003).

In case of downturn in economy,

central banks many times change their

interest rates and this cause change in

the bank’s interest rate. In case of

floating interest rate, such changes

sometimes escalate the cost of finance

for the firm.

Strict payment In case of equity as mentioned above,

payment of dividend depends on the

But in case of debt, firm has to pay

interest in every condition irrespective

2

firm’s discretion. of its profitability.

Dilution of

control

Issue of shares dilute the control of

existing shareholders and their

decision making power gets reduced.

In case of debt, this problem do not

come in existence and decision

making power completely lie in the

hands of top management.

Debt equity

proportion

Firms must review their current

capital structure before taking finance

related decisions. If proportion of

equity in the firm capital structure is

already high then further issue of

shares can be said as wise decision

because issue of shares reduce the

control of existing shareholders in the

firm.

If proportion of debt is already high

and economic conditions are also not

favourable then further taking debt

will certainly make debt problem

cumbersome in nature (Tarca, Morris.

and Moy, 2013). Hence, by

considering the current debt, equity

mix firm must make its finance related

decisions.

INVESTMENT APPRAISAL 2

2.2 & 2.3 Importance of financial planning and information needs of different decision makers

Financial planning plays an important role in the utilisation of funds. Money is a resource

for the firm which needs allocation and utilization in a prudent manner. Under financial

planning, firm needs to prepare plan under which it will determine the sources from which funds

can be raised and channels will also be determined where it needs to be utilised. Large sized

firms purchase huge amount of metals for the production of goods (Galia and Legros, 2004).

Fluctuation in their prices at international level affects the prices of commodity in domestic

market. Therefore, these firms create hedging position by buying contracts in future and options

of commodity. In financial planning, firms also prepare a plan about the amount that will be

needed for the investment in these derivative contracts. Every year, these firms allocate huge

amount of fund in this regard. Similarly, firms make allocation of fund in various activities of an

organization (Auerbach and Hassett, 2003). Mostly firms on the basis of their priority determine

the amount for each individual activity and also plan a way in which these allocated funds will

be utilised for an individual activity.

3

Dilution of

control

Issue of shares dilute the control of

existing shareholders and their

decision making power gets reduced.

In case of debt, this problem do not

come in existence and decision

making power completely lie in the

hands of top management.

Debt equity

proportion

Firms must review their current

capital structure before taking finance

related decisions. If proportion of

equity in the firm capital structure is

already high then further issue of

shares can be said as wise decision

because issue of shares reduce the

control of existing shareholders in the

firm.

If proportion of debt is already high

and economic conditions are also not

favourable then further taking debt

will certainly make debt problem

cumbersome in nature (Tarca, Morris.

and Moy, 2013). Hence, by

considering the current debt, equity

mix firm must make its finance related

decisions.

INVESTMENT APPRAISAL 2

2.2 & 2.3 Importance of financial planning and information needs of different decision makers

Financial planning plays an important role in the utilisation of funds. Money is a resource

for the firm which needs allocation and utilization in a prudent manner. Under financial

planning, firm needs to prepare plan under which it will determine the sources from which funds

can be raised and channels will also be determined where it needs to be utilised. Large sized

firms purchase huge amount of metals for the production of goods (Galia and Legros, 2004).

Fluctuation in their prices at international level affects the prices of commodity in domestic

market. Therefore, these firms create hedging position by buying contracts in future and options

of commodity. In financial planning, firms also prepare a plan about the amount that will be

needed for the investment in these derivative contracts. Every year, these firms allocate huge

amount of fund in this regard. Similarly, firms make allocation of fund in various activities of an

organization (Auerbach and Hassett, 2003). Mostly firms on the basis of their priority determine

the amount for each individual activity and also plan a way in which these allocated funds will

be utilised for an individual activity.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Information needs of different decision makers

1. Managers- Managers need various kinds of financial statements like balance sheet, P&L

and cash flow statement in order to take financial as well as strategic decisions (Carlin

and Mayer, 2003). Review of these statements attracts the attention of firm towards

current problems and issues that may create hindrances in the growth of organization in

the upcoming time period.

2. Employees- Employees are an important resource of firm and they are interested in

knowing about the firm’s condition especially when it is severely sick. Many times, due

to consistent loss and failure of measures, organization compelled to cut its cost in order

to extend its survival period (Tarca, Morris and Moy, 2013). Under this policy, firm

sometimes do not pay salary to its employees. By reviewing financial statements,

employees can determine and predict the management action regarding their salary.

3. Creditors- Creditors are always interested in getting information about the firm’s

financial condition because on the basis of these statements, suppliers determine the

firm’s capability to pay amount for which firm apply before supplier. In this regard, firm

conducts ratio analysis and on the basis of results, they take debt related decisions.

1.3 Appropriateness of source of finance

Every source of finance has some pros and cons and selection of any specific source of

finance or multiple source of finance depends on the firm current debt equity mix, current debt

burden, finance cost and prediction about movement in the domestic and international economy.

In order to access the economic environment at domestic and global level, firm can use following

economic information:

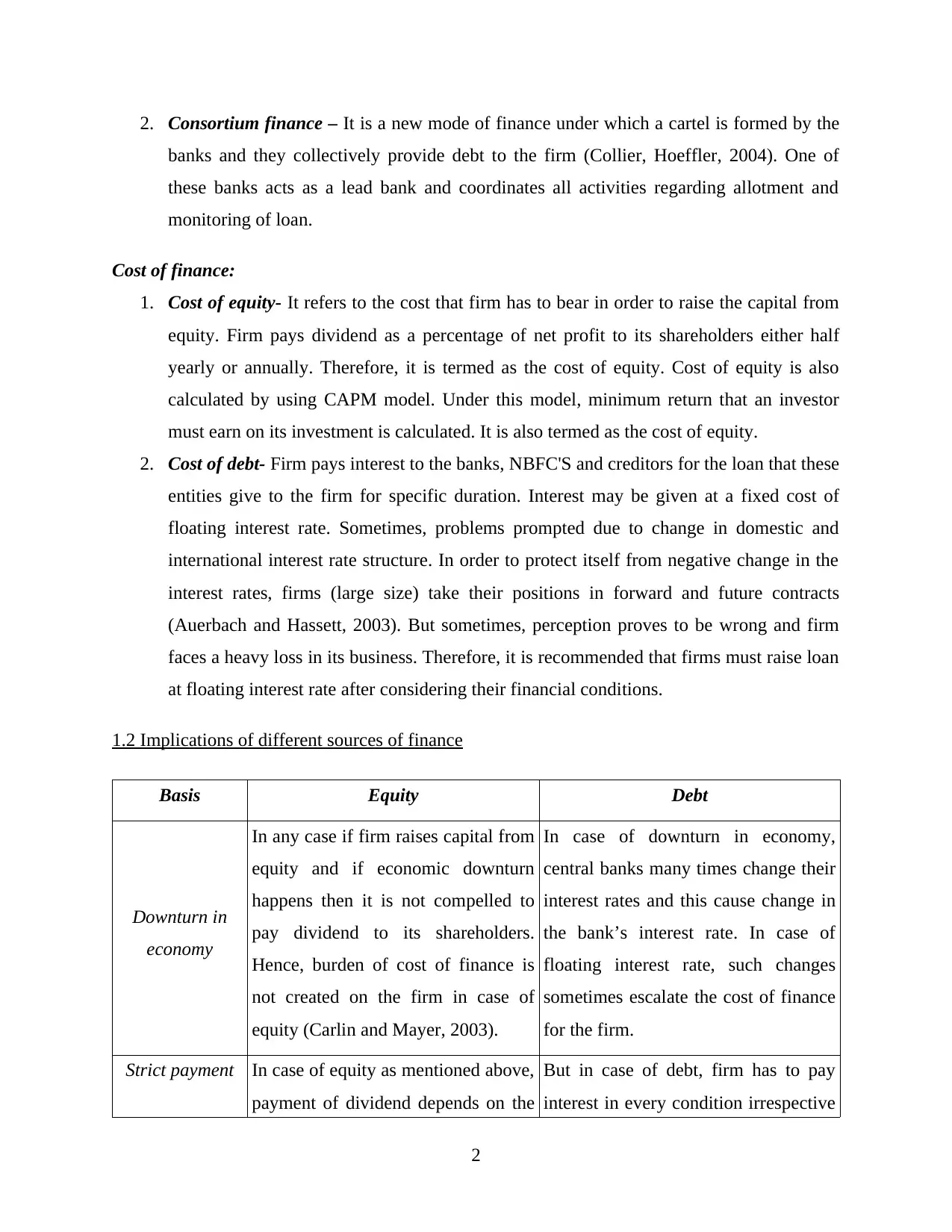

Table 1: Comparison of economic performance of world leading economies

China USA UK

PMI 47 53 51

GDP 7 3.7 0.7

4

1. Managers- Managers need various kinds of financial statements like balance sheet, P&L

and cash flow statement in order to take financial as well as strategic decisions (Carlin

and Mayer, 2003). Review of these statements attracts the attention of firm towards

current problems and issues that may create hindrances in the growth of organization in

the upcoming time period.

2. Employees- Employees are an important resource of firm and they are interested in

knowing about the firm’s condition especially when it is severely sick. Many times, due

to consistent loss and failure of measures, organization compelled to cut its cost in order

to extend its survival period (Tarca, Morris and Moy, 2013). Under this policy, firm

sometimes do not pay salary to its employees. By reviewing financial statements,

employees can determine and predict the management action regarding their salary.

3. Creditors- Creditors are always interested in getting information about the firm’s

financial condition because on the basis of these statements, suppliers determine the

firm’s capability to pay amount for which firm apply before supplier. In this regard, firm

conducts ratio analysis and on the basis of results, they take debt related decisions.

1.3 Appropriateness of source of finance

Every source of finance has some pros and cons and selection of any specific source of

finance or multiple source of finance depends on the firm current debt equity mix, current debt

burden, finance cost and prediction about movement in the domestic and international economy.

In order to access the economic environment at domestic and global level, firm can use following

economic information:

Table 1: Comparison of economic performance of world leading economies

China USA UK

PMI 47 53 51

GDP 7 3.7 0.7

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

China

USA

UK

44 45 46 47 48 49 50 51 52 53

PMI

Illustration 1: China, USA and UK PMI

China USA UK

0

1

2

3

4

5

6

7

GDP

Illustration 2: China, USA and UK GDP

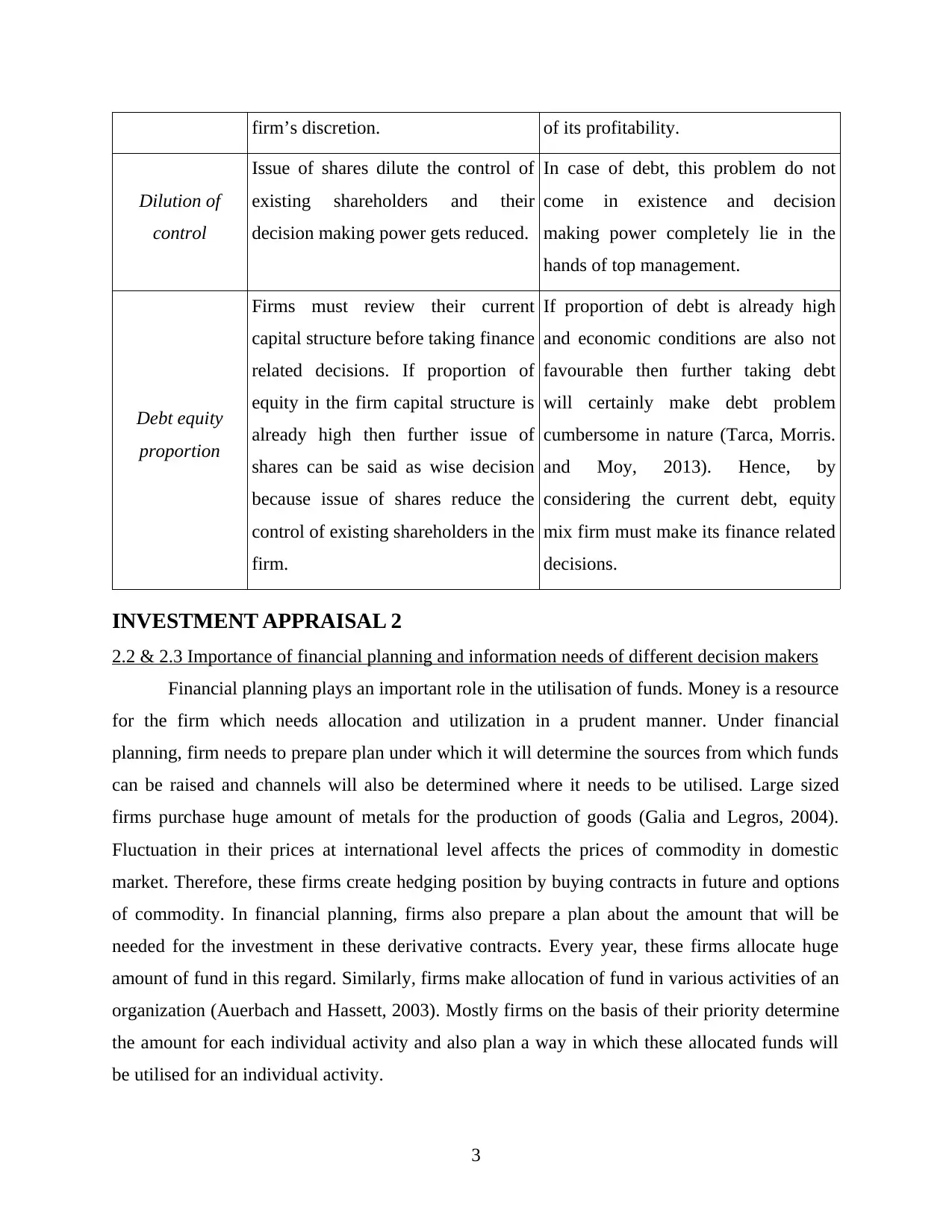

From the above report, it can be seen that PMI of China is below 50 and this reflects that

manufacturing activity in China contracts in comparison to previous quarter whereas, in USA

and UK, situation is quite good. In front of GDP, China performs well and USA also has high

growth in its GDP from 0.6 to 3.7. But GDP in UK is very low (UK GDP growth rate, 2015).

Further, negative change in China’s economy may create a lot of problems in the international

market for other countries. Consequently, firm’s profitability may erode if China and UK

economic conditions become worse in the upcoming quarters.

1. Equity- Suppose, firm plans to bring its IPO in UK and economic conditions become

worse due to weakness in Eurozone and China fundamentals (low PMI and estimation of

fall in GDP by credit rating agencies) then in such kind of case, it is possible that firm’s

IPO would remain unsubscribe or after IPO, existing shareholders sell their stake in

5

USA

UK

44 45 46 47 48 49 50 51 52 53

PMI

Illustration 1: China, USA and UK PMI

China USA UK

0

1

2

3

4

5

6

7

GDP

Illustration 2: China, USA and UK GDP

From the above report, it can be seen that PMI of China is below 50 and this reflects that

manufacturing activity in China contracts in comparison to previous quarter whereas, in USA

and UK, situation is quite good. In front of GDP, China performs well and USA also has high

growth in its GDP from 0.6 to 3.7. But GDP in UK is very low (UK GDP growth rate, 2015).

Further, negative change in China’s economy may create a lot of problems in the international

market for other countries. Consequently, firm’s profitability may erode if China and UK

economic conditions become worse in the upcoming quarters.

1. Equity- Suppose, firm plans to bring its IPO in UK and economic conditions become

worse due to weakness in Eurozone and China fundamentals (low PMI and estimation of

fall in GDP by credit rating agencies) then in such kind of case, it is possible that firm’s

IPO would remain unsubscribe or after IPO, existing shareholders sell their stake in

5

company (Galia and Legros, 2004). If such thing happens then all efforts will get waste in

terms of time and money. This mode of finance is appropriate only when there is stability

in the domestic and international economy. Therefore, firm needs to identify a perfect

time for bringing its IPO in the primary market.

2. Debt- It is a source of finance that is commonly used by the firms irrespective of their

size and business. In every company’s balance sheet, this name can be seen even if it

earns good amount of profit in its business consistently. This source of finance is readily

available but sometimes, it creates a lot of problems for company specially when debt is

taken at floating interest rate and economic condition of country is not in favour of the

firm’s profitability. So, this source of finance is appropriate for everyone but it needs to

be taken from financial institutes after considering the firm’s condition and

macroeconomic data of country.

2.4 Impact of finance on financial statements

Finance to a large extent brings changes in the financial statements. When any firm takes

loan or raises capital through IPO then it has to pay return on it. These two variables bring

change in the financial statements. When firm takes loan, value of creditors increased in the

balance sheet and amount of interest that is paid on loan is mentioned in the debit side of P&L

account (Pacione, 2001). As a result, firm’s net profit gets reduced. If firm issues equity shares

through FPO or IPO then amount of shareholder’s equity gets increased and dividend paid on it

is shown in the debit side of P&L account.

4.1 & 4.2 Main financial statements and their appropriateness for different business

organizations

Following are the major financial statements that firms use for taking financial decisions:

1. P&L account- It is a financial statement that indicates the income and expenses which a

firm earns and incurred during entire financial year. Mostly expenses cover a specific

percentage of revenue in P&L account (Mitchell and Utkus, 2004). But sometimes, this

percentage gets enhanced. By taking a look at these expenses, management easily

identified expenses on which it makes extravagance. After identification of increase in

expenses, management takes an action to curb the traction in specific expenses for the

next financial year.

6

terms of time and money. This mode of finance is appropriate only when there is stability

in the domestic and international economy. Therefore, firm needs to identify a perfect

time for bringing its IPO in the primary market.

2. Debt- It is a source of finance that is commonly used by the firms irrespective of their

size and business. In every company’s balance sheet, this name can be seen even if it

earns good amount of profit in its business consistently. This source of finance is readily

available but sometimes, it creates a lot of problems for company specially when debt is

taken at floating interest rate and economic condition of country is not in favour of the

firm’s profitability. So, this source of finance is appropriate for everyone but it needs to

be taken from financial institutes after considering the firm’s condition and

macroeconomic data of country.

2.4 Impact of finance on financial statements

Finance to a large extent brings changes in the financial statements. When any firm takes

loan or raises capital through IPO then it has to pay return on it. These two variables bring

change in the financial statements. When firm takes loan, value of creditors increased in the

balance sheet and amount of interest that is paid on loan is mentioned in the debit side of P&L

account (Pacione, 2001). As a result, firm’s net profit gets reduced. If firm issues equity shares

through FPO or IPO then amount of shareholder’s equity gets increased and dividend paid on it

is shown in the debit side of P&L account.

4.1 & 4.2 Main financial statements and their appropriateness for different business

organizations

Following are the major financial statements that firms use for taking financial decisions:

1. P&L account- It is a financial statement that indicates the income and expenses which a

firm earns and incurred during entire financial year. Mostly expenses cover a specific

percentage of revenue in P&L account (Mitchell and Utkus, 2004). But sometimes, this

percentage gets enhanced. By taking a look at these expenses, management easily

identified expenses on which it makes extravagance. After identification of increase in

expenses, management takes an action to curb the traction in specific expenses for the

next financial year.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Balance sheet – It is a statement that indicates the financial position of firm at the end of

financial year. By reviewing the balance sheet, firm gets information about the loan that it

takes and gives to the firm (Oostenbrink, Koopmanschap and Rutten, 2002). By applying

the ratio analysis, firms analyse their business from various angels and takes financial

decisions to improve their condition in the upcoming financial year.

3. Cash flow statements- It is a statement that indicates firm’s operations related to

operating, investing and financing activity (Pierce and O'Dea, 2003). This statement

reflects the firm’s cash and cash equivalents at the beginning and end of year. In other

words, it can also be said that cash flow statement indicates the steps that firm takes to

improve its business performance in the entire year.

Appropriateness for different organization

1. Sole trader – Normally, business of sole trader is small in size and due to this reason, he

is always keep an eye on the income and expenses amount that is revealed in the P&L

account (Edmunds and Morris, 2000). Therefore, sole trader gives priority to P&L

account in comparison to the balance sheet and cash flow statement.

2. Partnership- In partnership, business partners share profit and loss in the agreed

proportion. Hence, they give importance to the balance sheet in comparison to P&L

account and cash flow statement.

3. Public company- It is large in size and they give importance to the balance sheet, P&L

statement and cash flow statement (Mitton, 2002). Through analysis of these statements,

management measures the performance from various angels.

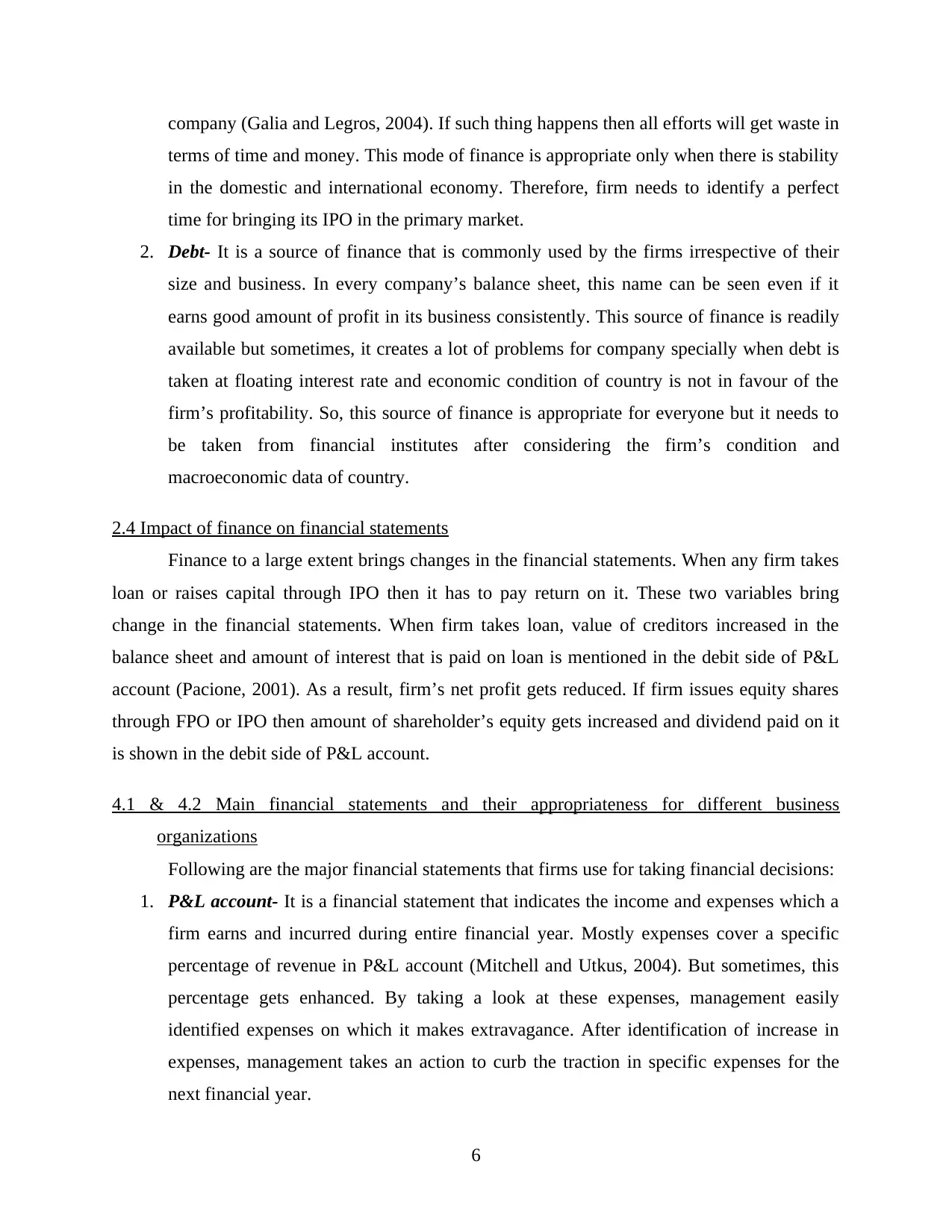

4.3 Calculation of ratios of Apple Ltd.

Table 2: Ratio analysis of Apple Ltd

2012 2013 2014

Current assets 57653 73286 68531

Current liabilities 38542 43658 63448

Current ratio 1.50 1.68 1.08

Net income 41733 37037 39510

Shareholder equity 118210 123549 111547

7

financial year. By reviewing the balance sheet, firm gets information about the loan that it

takes and gives to the firm (Oostenbrink, Koopmanschap and Rutten, 2002). By applying

the ratio analysis, firms analyse their business from various angels and takes financial

decisions to improve their condition in the upcoming financial year.

3. Cash flow statements- It is a statement that indicates firm’s operations related to

operating, investing and financing activity (Pierce and O'Dea, 2003). This statement

reflects the firm’s cash and cash equivalents at the beginning and end of year. In other

words, it can also be said that cash flow statement indicates the steps that firm takes to

improve its business performance in the entire year.

Appropriateness for different organization

1. Sole trader – Normally, business of sole trader is small in size and due to this reason, he

is always keep an eye on the income and expenses amount that is revealed in the P&L

account (Edmunds and Morris, 2000). Therefore, sole trader gives priority to P&L

account in comparison to the balance sheet and cash flow statement.

2. Partnership- In partnership, business partners share profit and loss in the agreed

proportion. Hence, they give importance to the balance sheet in comparison to P&L

account and cash flow statement.

3. Public company- It is large in size and they give importance to the balance sheet, P&L

statement and cash flow statement (Mitton, 2002). Through analysis of these statements,

management measures the performance from various angels.

4.3 Calculation of ratios of Apple Ltd.

Table 2: Ratio analysis of Apple Ltd

2012 2013 2014

Current assets 57653 73286 68531

Current liabilities 38542 43658 63448

Current ratio 1.50 1.68 1.08

Net income 41733 37037 39510

Shareholder equity 118210 123549 111547

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

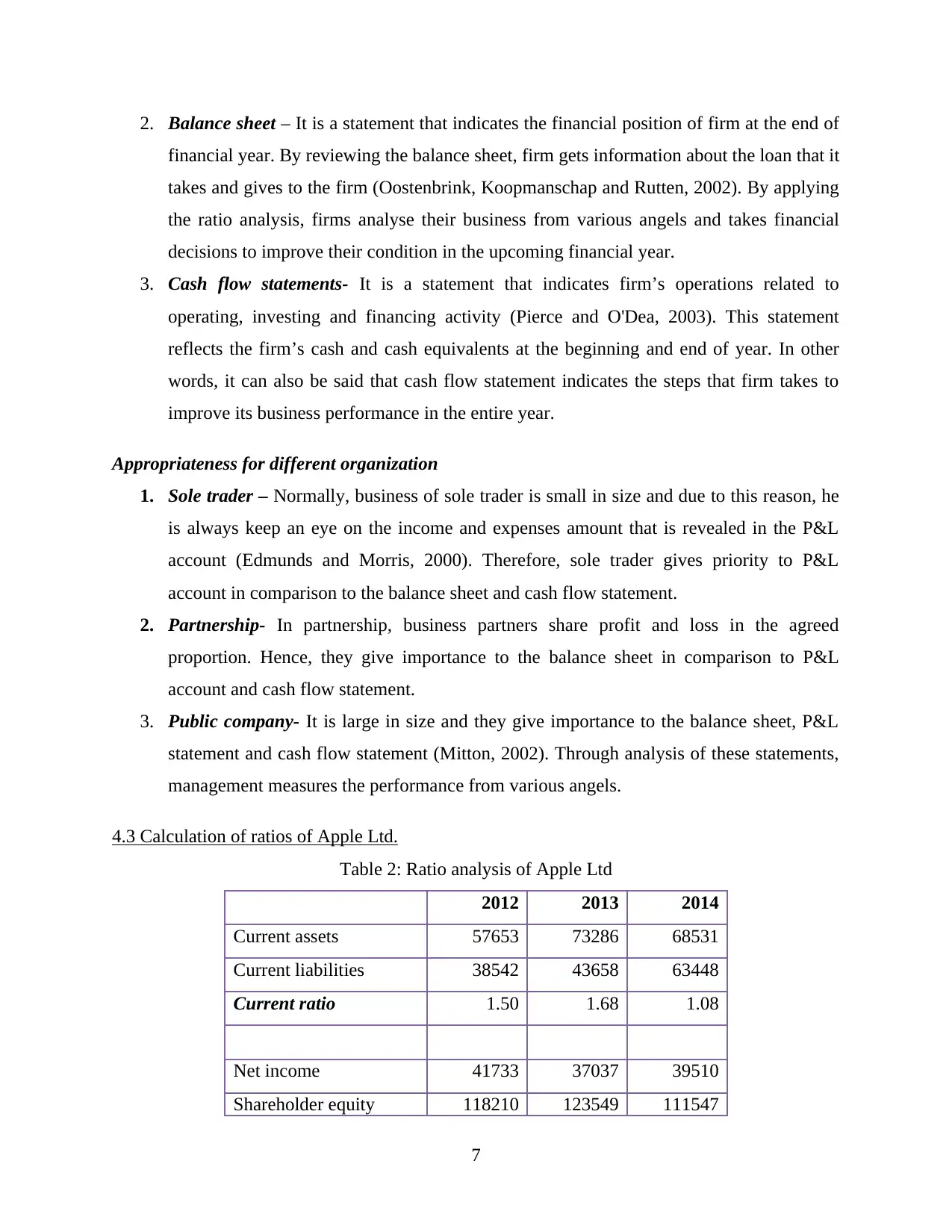

ROE 0.35 0.29 0.35

Debt 57854 83451 120292

Equity 118210 123549 111547

Debt equity ratio 0.48 0.67 1.07

Revenue 156508 170910 182795

Average inventory 783 1277 1937

Inventory turnover

ratio

199.8 133.8 94.37

Gross profit 68662 64304 70537

Net sales 156508 170910 182795

Gross margin ratio 43.87 37.62 38.58

Net profit 41733 37037 39510

Net sales 156508 170910 182795

Net profit ratio 26.67 21.67 21.61

Interpretation

1. Current ratio- Current ratio indicates the firm’s capability to pay its current liabilities by

using the available amount of current assets. In all three consecutive years, firm’s current

ratio was above one and this indicates that firm has sufficient amount of current assets

and it can easily pay its current liability on time (Current ratio, 2013). However, in FY

2014, this ratio has declined to some extent to 1.08 from previous figure that was 1.68.

But even though, it is not a matter of concern.

2. ROE- ROE is also known as return on equity and this ratio indicates the return that firm

gives to its shareholders on the investment that they made in the firm’s equity. ROE is

steadily revolving in a range of 0.29 to 0.35 and it reflects that there is stability in return

that organization gives to its shareholders.

8

Debt 57854 83451 120292

Equity 118210 123549 111547

Debt equity ratio 0.48 0.67 1.07

Revenue 156508 170910 182795

Average inventory 783 1277 1937

Inventory turnover

ratio

199.8 133.8 94.37

Gross profit 68662 64304 70537

Net sales 156508 170910 182795

Gross margin ratio 43.87 37.62 38.58

Net profit 41733 37037 39510

Net sales 156508 170910 182795

Net profit ratio 26.67 21.67 21.61

Interpretation

1. Current ratio- Current ratio indicates the firm’s capability to pay its current liabilities by

using the available amount of current assets. In all three consecutive years, firm’s current

ratio was above one and this indicates that firm has sufficient amount of current assets

and it can easily pay its current liability on time (Current ratio, 2013). However, in FY

2014, this ratio has declined to some extent to 1.08 from previous figure that was 1.68.

But even though, it is not a matter of concern.

2. ROE- ROE is also known as return on equity and this ratio indicates the return that firm

gives to its shareholders on the investment that they made in the firm’s equity. ROE is

steadily revolving in a range of 0.29 to 0.35 and it reflects that there is stability in return

that organization gives to its shareholders.

8

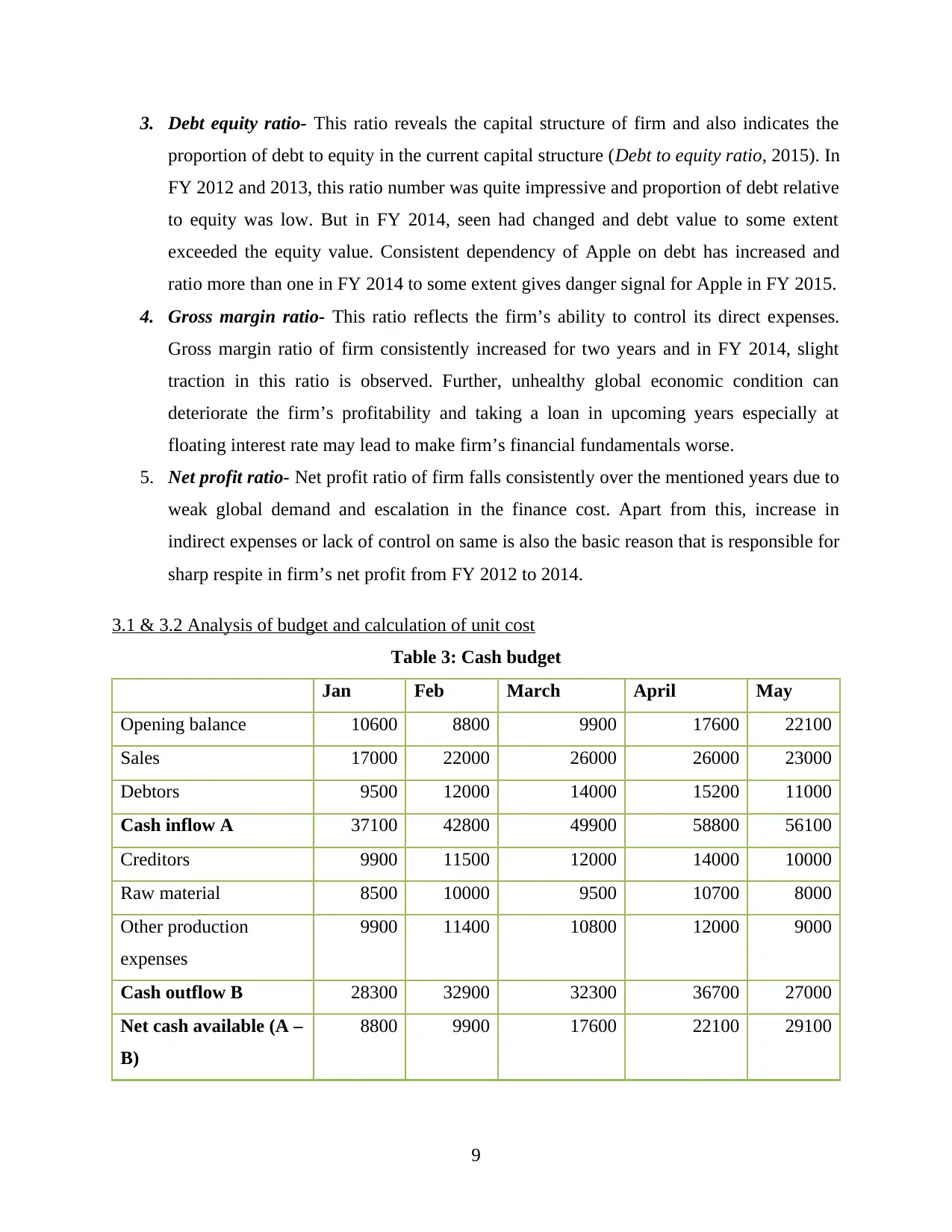

3. Debt equity ratio- This ratio reveals the capital structure of firm and also indicates the

proportion of debt to equity in the current capital structure (Debt to equity ratio, 2015). In

FY 2012 and 2013, this ratio number was quite impressive and proportion of debt relative

to equity was low. But in FY 2014, seen had changed and debt value to some extent

exceeded the equity value. Consistent dependency of Apple on debt has increased and

ratio more than one in FY 2014 to some extent gives danger signal for Apple in FY 2015.

4. Gross margin ratio- This ratio reflects the firm’s ability to control its direct expenses.

Gross margin ratio of firm consistently increased for two years and in FY 2014, slight

traction in this ratio is observed. Further, unhealthy global economic condition can

deteriorate the firm’s profitability and taking a loan in upcoming years especially at

floating interest rate may lead to make firm’s financial fundamentals worse.

5. Net profit ratio- Net profit ratio of firm falls consistently over the mentioned years due to

weak global demand and escalation in the finance cost. Apart from this, increase in

indirect expenses or lack of control on same is also the basic reason that is responsible for

sharp respite in firm’s net profit from FY 2012 to 2014.

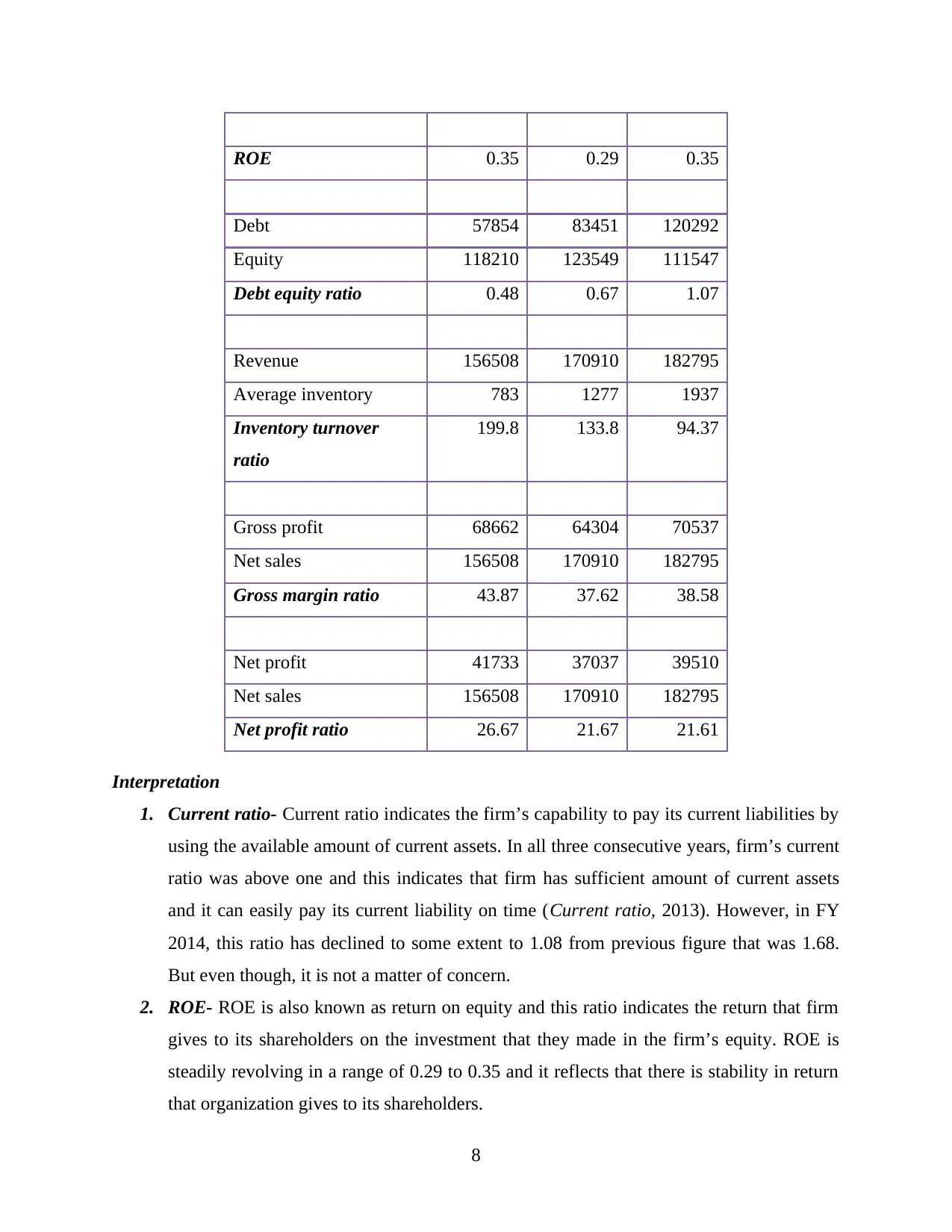

3.1 & 3.2 Analysis of budget and calculation of unit cost

Table 3: Cash budget

Jan Feb March April May

Opening balance 10600 8800 9900 17600 22100

Sales 17000 22000 26000 26000 23000

Debtors 9500 12000 14000 15200 11000

Cash inflow A 37100 42800 49900 58800 56100

Creditors 9900 11500 12000 14000 10000

Raw material 8500 10000 9500 10700 8000

Other production

expenses

9900 11400 10800 12000 9000

Cash outflow B 28300 32900 32300 36700 27000

Net cash available (A –

B)

8800 9900 17600 22100 29100

9

proportion of debt to equity in the current capital structure (Debt to equity ratio, 2015). In

FY 2012 and 2013, this ratio number was quite impressive and proportion of debt relative

to equity was low. But in FY 2014, seen had changed and debt value to some extent

exceeded the equity value. Consistent dependency of Apple on debt has increased and

ratio more than one in FY 2014 to some extent gives danger signal for Apple in FY 2015.

4. Gross margin ratio- This ratio reflects the firm’s ability to control its direct expenses.

Gross margin ratio of firm consistently increased for two years and in FY 2014, slight

traction in this ratio is observed. Further, unhealthy global economic condition can

deteriorate the firm’s profitability and taking a loan in upcoming years especially at

floating interest rate may lead to make firm’s financial fundamentals worse.

5. Net profit ratio- Net profit ratio of firm falls consistently over the mentioned years due to

weak global demand and escalation in the finance cost. Apart from this, increase in

indirect expenses or lack of control on same is also the basic reason that is responsible for

sharp respite in firm’s net profit from FY 2012 to 2014.

3.1 & 3.2 Analysis of budget and calculation of unit cost

Table 3: Cash budget

Jan Feb March April May

Opening balance 10600 8800 9900 17600 22100

Sales 17000 22000 26000 26000 23000

Debtors 9500 12000 14000 15200 11000

Cash inflow A 37100 42800 49900 58800 56100

Creditors 9900 11500 12000 14000 10000

Raw material 8500 10000 9500 10700 8000

Other production

expenses

9900 11400 10800 12000 9000

Cash outflow B 28300 32900 32300 36700 27000

Net cash available (A –

B)

8800 9900 17600 22100 29100

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17