Role of Financial Management in Decision Making - Tesco plc

VerifiedAdded on 2023/01/07

|20

|5048

|59

AI Summary

This report discusses the role of financial management in decision making and strategies for fraud reduction in Tesco plc. It covers topics such as management accounting techniques, stakeholder management, cost control, fraud detection, and ethical decision making. The report provides insights into the importance of financial data in taking operational and strategic decisions and offers practical implications for Tesco plc.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Unit 15: Financial

Management

Management

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Scenario A:..............................................................................................................................................3

Scenario B:..............................................................................................................................................9

CONCLUSION.........................................................................................................................................17

REFERENCES..........................................................................................................................................19

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Scenario A:..............................................................................................................................................3

Scenario B:..............................................................................................................................................9

CONCLUSION.........................................................................................................................................17

REFERENCES..........................................................................................................................................19

INTRODUCTION

Financial management is a concept that needs to be discussed in order to help create

better business choices and assess the revenue and expense within an organization or entity. It

plays a key role in order to better utilization of available monetary resources of a company

(Shapiro and Hanouna, 2019). For effective financial management there are a range of principles

which are adopted by companies. These principles provide a way through which companies

implement strategies for better outcome. A Company that is Tesco plc has been chosen in this

project study. The business is headquartered in the UK and offers a wide range of products for

daily usage. There are two parts of the project study. Part one focuses on analysis and the role of

strategies in fraud reduction for ethical decision-making in the context of financial aspect. The

second section of the study further includes details on the numerous financial strategies and their

relevance for long-term decision-making.

MAIN BODY

Scenario A:

Overview: In this scenario of report, a detailed report of 2000 words has been presented in which

information of role of different kinds of management accounting techniques and their role is

explained. This explanation has been done in relevance with above mentioned organization.

1. Evaluation of techniques, approaches and factors for better decision making.

A decision is an action plan that is intentionally selected for a desirable outcome

from a selection of alternatives (Chandra, 2020). It implies that choices are made as there

are many alternatives. This becomes essential for companies to take decisions in an

effective manner so that they can achieve their goals and objectives. In the regards to

above mentioned company some techniques, approaches and factors for effective

decision making are explained in such manner:

Financial management is a concept that needs to be discussed in order to help create

better business choices and assess the revenue and expense within an organization or entity. It

plays a key role in order to better utilization of available monetary resources of a company

(Shapiro and Hanouna, 2019). For effective financial management there are a range of principles

which are adopted by companies. These principles provide a way through which companies

implement strategies for better outcome. A Company that is Tesco plc has been chosen in this

project study. The business is headquartered in the UK and offers a wide range of products for

daily usage. There are two parts of the project study. Part one focuses on analysis and the role of

strategies in fraud reduction for ethical decision-making in the context of financial aspect. The

second section of the study further includes details on the numerous financial strategies and their

relevance for long-term decision-making.

MAIN BODY

Scenario A:

Overview: In this scenario of report, a detailed report of 2000 words has been presented in which

information of role of different kinds of management accounting techniques and their role is

explained. This explanation has been done in relevance with above mentioned organization.

1. Evaluation of techniques, approaches and factors for better decision making.

A decision is an action plan that is intentionally selected for a desirable outcome

from a selection of alternatives (Chandra, 2020). It implies that choices are made as there

are many alternatives. This becomes essential for companies to take decisions in an

effective manner so that they can achieve their goals and objectives. In the regards to

above mentioned company some techniques, approaches and factors for effective

decision making are explained in such manner:

Approaches: There are different kinds of approaches which are used by managers in

order to take accurate decisions and some of them are mentioned in such manner:

Rational-Analytical Approach- Rational analytically approach believes that the

decision maker is a "single person who acts intelligently and rationally." He is

well informed of the potential options available and takes the options and the

implications into consideration and agrees upon the solution that guarantees

optimal benefit. Many managers want to consider themselves as rational decision

makers. In reality, a variety of experts suggest that managers must try to take

actions as rationally as practicable. It is founded on the premise that management

is reasonable and practical that they take actions which are in the group's best

interests. This approach consists a detailed process that is as follows:

(a) Policy makers have comprehensive details and potential solutions on the

decision scenario.

(b) In order to make a decision, ambiguity can be easily minimized.

(c) Critically and rationally, they consider all facets of the decision scenario.

In regards to above Tesco plc, their managers can apply this process in order to

take effective decisions on the basis of own skills and competencies.

Political-Behavioral Approach- This model implies that actual decision-makers

need to consider a variety of demands from others influenced by their act

(Madura, 2020). In interdependent exchange relations, a company communicates

with multiple stakeholders. Every party or individual who may influence or be

influenced by the accomplishment of the intent of an entity. More influential

shareholders have a stronger effect on decision-making as the company depends

most on these members. As in the aspect of above Tesco plc, this is important for

their managers to consider this approach when they take decisions. They have to

consider the interest of major stakeholders such as employees, customers and

many more.

Techniques used in decision making: Along with approaches there are some techniques

which can be used for better decision making that are as follows:

order to take accurate decisions and some of them are mentioned in such manner:

Rational-Analytical Approach- Rational analytically approach believes that the

decision maker is a "single person who acts intelligently and rationally." He is

well informed of the potential options available and takes the options and the

implications into consideration and agrees upon the solution that guarantees

optimal benefit. Many managers want to consider themselves as rational decision

makers. In reality, a variety of experts suggest that managers must try to take

actions as rationally as practicable. It is founded on the premise that management

is reasonable and practical that they take actions which are in the group's best

interests. This approach consists a detailed process that is as follows:

(a) Policy makers have comprehensive details and potential solutions on the

decision scenario.

(b) In order to make a decision, ambiguity can be easily minimized.

(c) Critically and rationally, they consider all facets of the decision scenario.

In regards to above Tesco plc, their managers can apply this process in order to

take effective decisions on the basis of own skills and competencies.

Political-Behavioral Approach- This model implies that actual decision-makers

need to consider a variety of demands from others influenced by their act

(Madura, 2020). In interdependent exchange relations, a company communicates

with multiple stakeholders. Every party or individual who may influence or be

influenced by the accomplishment of the intent of an entity. More influential

shareholders have a stronger effect on decision-making as the company depends

most on these members. As in the aspect of above Tesco plc, this is important for

their managers to consider this approach when they take decisions. They have to

consider the interest of major stakeholders such as employees, customers and

many more.

Techniques used in decision making: Along with approaches there are some techniques

which can be used for better decision making that are as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial analysis technique- This analysis method helps the feasibility of an

expenditure to be measured, the payback duration (the time span required to

compensate for financial gains with the actual expense of the project) to be

determined and cash inflows and capital outflows to be evaluated. Cash inflows

and capital outflows should be measured to determine investment choices. Under

it some other techniques are also used which can be useful for better decision

making in the context of above company.

Break even analysis- This method helps a decision maker to compare the options

available on the basis of size, fixed and variable unit costs. Analysis of break-

even is a calculation to assess the amount of revenue needed to pay all fixed costs.

The decision-maker can use this method to evaluate the break-even point for the

whole organization and all of its goods. Gross income is proportional to the

overall expense at the lowest stage and benefit is zero.

Factors affecting decision making: There are a range of factors which can affect decision

making in an organization and some of them are mentioned below:

Political factor- It is one of the main factor that impact the decision making. This

is so because if political conditions in a nation are not stable then it may lead to

change the entire policies of a company (Mitchell and Calabrese, 2019). Such as

in the case of above company if political conditions in UK are not favorable then

they has to take decisions accordingly. They cannot make larger investment at the

time of unstable political condition.

Economic factor- This factor include interest rate, exchange rate, inflation rate

and many more. It becomes essential for companies to take decisions by

considering these aspects. It is so because in the case when interest rate is higher

than companies cannot take decision for taking financial assistance from banks.

So these are some major factors, apart from these there are some other factors too as

social factor, technological and many more which need to be consider. Though above

mentioned factors are too crucial as compared to others.

expenditure to be measured, the payback duration (the time span required to

compensate for financial gains with the actual expense of the project) to be

determined and cash inflows and capital outflows to be evaluated. Cash inflows

and capital outflows should be measured to determine investment choices. Under

it some other techniques are also used which can be useful for better decision

making in the context of above company.

Break even analysis- This method helps a decision maker to compare the options

available on the basis of size, fixed and variable unit costs. Analysis of break-

even is a calculation to assess the amount of revenue needed to pay all fixed costs.

The decision-maker can use this method to evaluate the break-even point for the

whole organization and all of its goods. Gross income is proportional to the

overall expense at the lowest stage and benefit is zero.

Factors affecting decision making: There are a range of factors which can affect decision

making in an organization and some of them are mentioned below:

Political factor- It is one of the main factor that impact the decision making. This

is so because if political conditions in a nation are not stable then it may lead to

change the entire policies of a company (Mitchell and Calabrese, 2019). Such as

in the case of above company if political conditions in UK are not favorable then

they has to take decisions accordingly. They cannot make larger investment at the

time of unstable political condition.

Economic factor- This factor include interest rate, exchange rate, inflation rate

and many more. It becomes essential for companies to take decisions by

considering these aspects. It is so because in the case when interest rate is higher

than companies cannot take decision for taking financial assistance from banks.

So these are some major factors, apart from these there are some other factors too as

social factor, technological and many more which need to be consider. Though above

mentioned factors are too crucial as compared to others.

2. Stakeholder management and management of conflict objective of stakeholder groups.

Stakeholder management- A crucial factor in the successful implementation of each

initiative, strategy or activities is stakeholder management (Apte and Kapshe, 2020). In

other words, this linked to applying those strategies which can manage interest of

stakeholders in a company. Every individual, group or institution that is controlled,

impacted or deemed to be affected by a program of a company is a stakeholder. There are

a range of strategies for stakeholder management which are as follows:

Stakeholder mapping- Stakeholder mapping is the visual method through which a

company, initiative or proposal may be displayed to all parties concerned. The

key benefit of a stakeholder map is to visually show all those individuals that can

affect and link with company objectives. As in the aspect of above company, this

is essential for the managers to do mapping with consideration of stakeholder’s

interest.

Identifications of triggers- Stakeholders may respond in different ways to

numerous acts of a company, but avoidable grievances by recognizing causes and

mitigating steps can be helpful to manage stakeholder. Perhaps it is the transition

or the aspirations of an organization and its behavior that can contribute to

reactions among stakeholders but proper communication can be useful for both to

the stakeholders and company. As in the above company, it is important for them

to consider issues of stakeholders from each step taken by managers so that

stakeholders can maintain their interest.

Management of conflict objective of stakeholder groups:

Different stakeholders have specific priorities. The interests of different concerned parties

can conflict-

Stakeholder management- A crucial factor in the successful implementation of each

initiative, strategy or activities is stakeholder management (Apte and Kapshe, 2020). In

other words, this linked to applying those strategies which can manage interest of

stakeholders in a company. Every individual, group or institution that is controlled,

impacted or deemed to be affected by a program of a company is a stakeholder. There are

a range of strategies for stakeholder management which are as follows:

Stakeholder mapping- Stakeholder mapping is the visual method through which a

company, initiative or proposal may be displayed to all parties concerned. The

key benefit of a stakeholder map is to visually show all those individuals that can

affect and link with company objectives. As in the aspect of above company, this

is essential for the managers to do mapping with consideration of stakeholder’s

interest.

Identifications of triggers- Stakeholders may respond in different ways to

numerous acts of a company, but avoidable grievances by recognizing causes and

mitigating steps can be helpful to manage stakeholder. Perhaps it is the transition

or the aspirations of an organization and its behavior that can contribute to

reactions among stakeholders but proper communication can be useful for both to

the stakeholders and company. As in the above company, it is important for them

to consider issues of stakeholders from each step taken by managers so that

stakeholders can maintain their interest.

Management of conflict objective of stakeholder groups:

Different stakeholders have specific priorities. The interests of different concerned parties

can conflict-

In general, shareholders expect good payouts and this might be reluctant for

organization to offer workers large wages.

A decision by the organization to move production overseas will reduce staffing

costs. This is not only helpful to the owners, but also to those affected by current

workers who lose their employment.

These conflicts of stakeholders need to manage in an effective manner so that they can

contribute to companies’ objectives (Valaskova, Bartosova and Kubala, 2020). It can be done

by proper communication between stakeholders and manager that they are satisfied with

companies’ policies or not. As well as it can be done by considering stakeholders in each step

of decision making so that they can become aware about what is going on inside a company.

So these are some key ways to manage conflict of objectives of stakeholders that can be

applied by above Tesco plc.

3. Value of management accounting in cost control.

The management accounting is one of the key approaches that play a key role for each

and every aspect of a company. It is linked with process of preparation of different kinds

of internal reports which consists information about financial and non financial aspects.

Managers of company utilize key information from these reports which lead to better

decision making about cost control (Spearman, 2019). Eventually, it is important for

companies to keep their expenses as much as possible. It can be done by applying

appropriate methods of cost control and under management accounting different types of

techniques are included. Cost accounting system is one of the main tools for cost control

in the management accounting that is explained below:

Cost accounting system- A cost accounting method is a mechanism utilized for

organizations to measure costs of a commodity through production analyses, inventory

reviews and expense management. The system is defined as the product expense

accounting system or costing scheme (Yuniningsih and Purwanto, 2019). It is important

to determine the exact cost of goods for productive activities. Under it, cost of each

activity is specified separately so that managers can become aware about performance of

their operations can be evaluated. In the aspect of above company, they can apply this

organization to offer workers large wages.

A decision by the organization to move production overseas will reduce staffing

costs. This is not only helpful to the owners, but also to those affected by current

workers who lose their employment.

These conflicts of stakeholders need to manage in an effective manner so that they can

contribute to companies’ objectives (Valaskova, Bartosova and Kubala, 2020). It can be done

by proper communication between stakeholders and manager that they are satisfied with

companies’ policies or not. As well as it can be done by considering stakeholders in each step

of decision making so that they can become aware about what is going on inside a company.

So these are some key ways to manage conflict of objectives of stakeholders that can be

applied by above Tesco plc.

3. Value of management accounting in cost control.

The management accounting is one of the key approaches that play a key role for each

and every aspect of a company. It is linked with process of preparation of different kinds

of internal reports which consists information about financial and non financial aspects.

Managers of company utilize key information from these reports which lead to better

decision making about cost control (Spearman, 2019). Eventually, it is important for

companies to keep their expenses as much as possible. It can be done by applying

appropriate methods of cost control and under management accounting different types of

techniques are included. Cost accounting system is one of the main tools for cost control

in the management accounting that is explained below:

Cost accounting system- A cost accounting method is a mechanism utilized for

organizations to measure costs of a commodity through production analyses, inventory

reviews and expense management. The system is defined as the product expense

accounting system or costing scheme (Yuniningsih and Purwanto, 2019). It is important

to determine the exact cost of goods for productive activities. Under it, cost of each

activity is specified separately so that managers can become aware about performance of

their operations can be evaluated. In the aspect of above company, they can apply this

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

model in order to manage their overall cost by help of above mentioned accounting

system.

4. Techniques for fraud detection and prevention.

Fraud must be detected as it may adversely affect the entire business. Companies are

faced with one million issues due to this. It is important that policies of fraud prevention

must be implemented to discourage risk in order to stop theft at an early level. One of the

strategies in order to prevent fraud is auditing that is explained in such manner:

Auditing- The word audit usually refers to an analysis of the records. An accurate audit

and review of the organization's financial statements is to insure the financial reports

reflect the activities they appear to be representing in a reasonable and correct manner

(Dermit-Richard, Scelles and Morrow, 2019). The examination may be conducted

remotely by company staff or independently by an authorized Certified Public

Accountant Corporation (CPA). The main objective behind applying this technique is to

find out those areas in which companies’ performance is unusual due to manipulation of

data. It the aspect of above company, this technique can be used in order to overcome

from fraud in their financial statements.

Approach to ethical decision making: There are a range of approaches which can be

applied in order to take decisions in an ethical manner. Below explanation of some

approaches is done in such manner:

Rights approach: It is focused on behavior founded on free will and derives from

Immanuel Kant et al’s Theory. This method encourages the freedom of people to

openly choose what to do with their lives and to have an inherent moral right to

do so. Everything that is legal consideration for the fundamental right. In the

context of above company, this can be applied from managers by providing

freedom to employees about expressing their views and opinions about a

particular aspect.

Justice approach- This approach is based on a concept that all individuals should

be treated in a common way during process of decision making. It can be done by

system.

4. Techniques for fraud detection and prevention.

Fraud must be detected as it may adversely affect the entire business. Companies are

faced with one million issues due to this. It is important that policies of fraud prevention

must be implemented to discourage risk in order to stop theft at an early level. One of the

strategies in order to prevent fraud is auditing that is explained in such manner:

Auditing- The word audit usually refers to an analysis of the records. An accurate audit

and review of the organization's financial statements is to insure the financial reports

reflect the activities they appear to be representing in a reasonable and correct manner

(Dermit-Richard, Scelles and Morrow, 2019). The examination may be conducted

remotely by company staff or independently by an authorized Certified Public

Accountant Corporation (CPA). The main objective behind applying this technique is to

find out those areas in which companies’ performance is unusual due to manipulation of

data. It the aspect of above company, this technique can be used in order to overcome

from fraud in their financial statements.

Approach to ethical decision making: There are a range of approaches which can be

applied in order to take decisions in an ethical manner. Below explanation of some

approaches is done in such manner:

Rights approach: It is focused on behavior founded on free will and derives from

Immanuel Kant et al’s Theory. This method encourages the freedom of people to

openly choose what to do with their lives and to have an inherent moral right to

do so. Everything that is legal consideration for the fundamental right. In the

context of above company, this can be applied from managers by providing

freedom to employees about expressing their views and opinions about a

particular aspect.

Justice approach- This approach is based on a concept that all individuals should

be treated in a common way during process of decision making. It can be done by

taking equal opinion from each member of an organization during decision

making by managers.

5. Reflective analysis:

In order to take corrective measures, the project was related to the understanding of

different methods and techniques. I certainly faced some problems and have learned how

to handle different issues in this task:

Issues- The main difficulty that I encountered was the analysis of the ideas and activities

involved during this project. I used to search engines to locate useful details, but too

many alternatives were more difficult to me. That is because the period to finish the

project was too limited.

Things which I learn- I learn extraordinary knowledge, which will benefit me in the

future, in addition way to deal with the challenges in this project. For example, I learn

from online outlets how to locate the related facts. Along with my understanding of the

stakeholder management concept also increased after this project.

Scenario B:

1. Explanation of how financial data help in taking operational and strategic decisions.

In order to take better decisions, financial data plays a key role that is provided by

financial accounting. This accounting consists a way by which all types of data are arranged in a

systematic manner. Financial accounting is a way for organizations to monitor and provide an

analysis of fiscal viability of their activities. The business can provide more leverage for

investors and creditors in their assessments through a series of records, such as a balance sheet

and a statement of income. In the financial accounting a range of methods and techniques are

included and ratio analysis is one of the main technique. The explanation of this technique has

been done below in such manner along with practical implication in relation to above company:

Ratio analysis- A ratio is a proportional size of two chosen numerical quantities obtained from

the financial records of an entity (Rudani, 2020). Also used in accounting the general financial

making by managers.

5. Reflective analysis:

In order to take corrective measures, the project was related to the understanding of

different methods and techniques. I certainly faced some problems and have learned how

to handle different issues in this task:

Issues- The main difficulty that I encountered was the analysis of the ideas and activities

involved during this project. I used to search engines to locate useful details, but too

many alternatives were more difficult to me. That is because the period to finish the

project was too limited.

Things which I learn- I learn extraordinary knowledge, which will benefit me in the

future, in addition way to deal with the challenges in this project. For example, I learn

from online outlets how to locate the related facts. Along with my understanding of the

stakeholder management concept also increased after this project.

Scenario B:

1. Explanation of how financial data help in taking operational and strategic decisions.

In order to take better decisions, financial data plays a key role that is provided by

financial accounting. This accounting consists a way by which all types of data are arranged in a

systematic manner. Financial accounting is a way for organizations to monitor and provide an

analysis of fiscal viability of their activities. The business can provide more leverage for

investors and creditors in their assessments through a series of records, such as a balance sheet

and a statement of income. In the financial accounting a range of methods and techniques are

included and ratio analysis is one of the main technique. The explanation of this technique has

been done below in such manner along with practical implication in relation to above company:

Ratio analysis- A ratio is a proportional size of two chosen numerical quantities obtained from

the financial records of an entity (Rudani, 2020). Also used in accounting the general financial

position of a company or other entity is determined by a set of regular ratios. Ratio evaluations

are a predictive approach of analyzing their accounting documents such as the balance sheet and

the income statement, and gives visibility into liquidity, operating performance and productivity.

The ratio analysis is a basic element of the equity analysis. In the context of above Tesco plc,

different types of ratios are calculated in order to understand role of data for decision making:

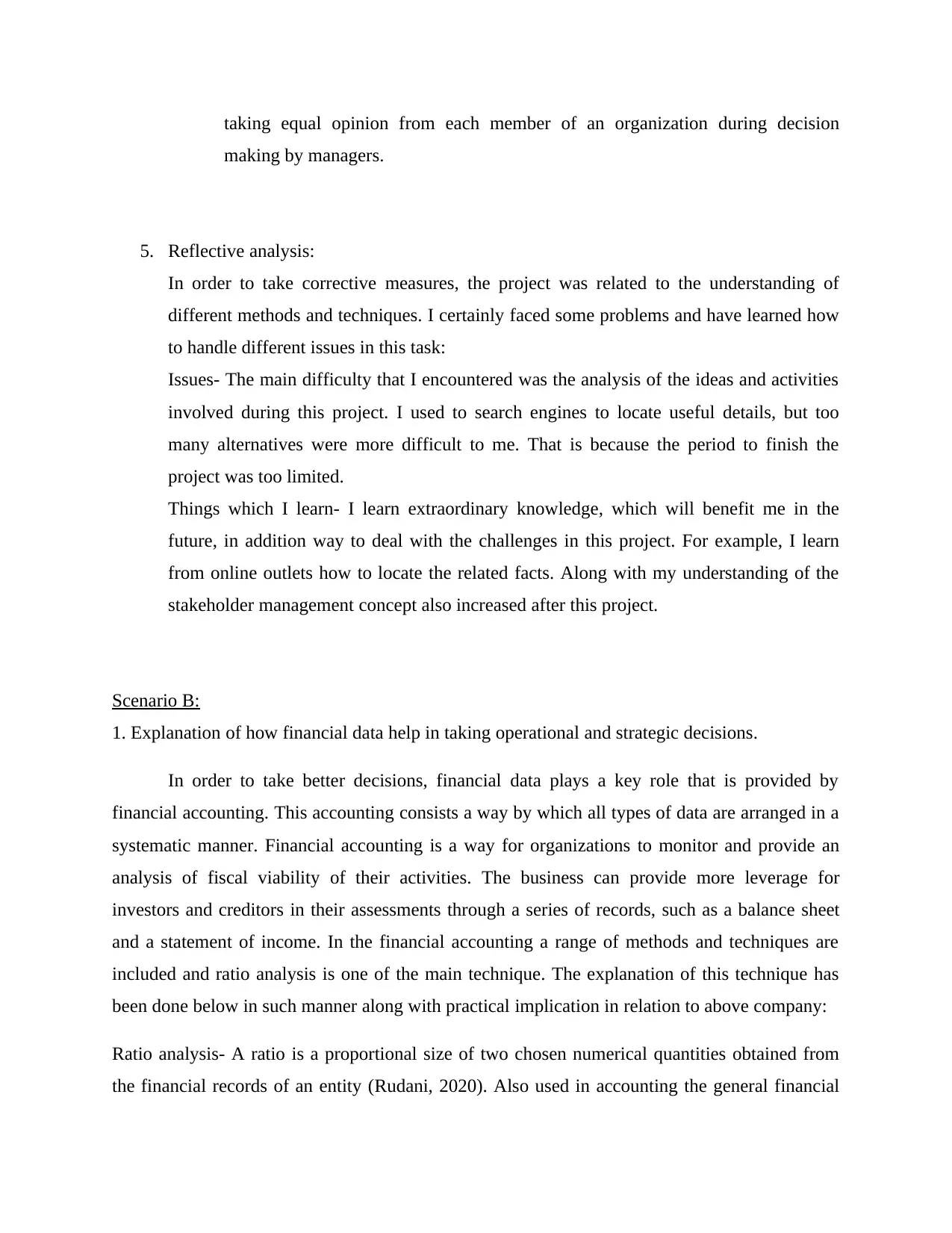

Profitability ratio: Profitability ratios are a category of financial measure which is used to

evaluate the ability of a company to produce profits in support of its revenues, operational

expenses, balance sheet assets or debt, utilizing data from a particular point of time. It includes

some ratios:

Gross profit ratio: Gross profit/net sales*100

All data in £ Million except Gross

profit margin

2017 2018

Sales 55,917 57,491

Gross profit 2, 902 3,350

Calculation 2902/55917*100 3350/57491*100

Gross profit margin 5.19% 5.83%

Net profit ratio: Net profit/net sales

All data in £ Million except Net profit

margin

2017 2018

Sales 55,917 57,491

Net profit -40 1206

Calculation -40/55917*100 1206/57491*100

Net profit margin -0.07% 2.09%

The above mentioned data of profitability ratio can be used in order to take crucial

decision about investment and other aspects. Such as above value of gross and net

margin, this can be find out that company’s performance was better in year 2018 as

compared to year 2017.

are a predictive approach of analyzing their accounting documents such as the balance sheet and

the income statement, and gives visibility into liquidity, operating performance and productivity.

The ratio analysis is a basic element of the equity analysis. In the context of above Tesco plc,

different types of ratios are calculated in order to understand role of data for decision making:

Profitability ratio: Profitability ratios are a category of financial measure which is used to

evaluate the ability of a company to produce profits in support of its revenues, operational

expenses, balance sheet assets or debt, utilizing data from a particular point of time. It includes

some ratios:

Gross profit ratio: Gross profit/net sales*100

All data in £ Million except Gross

profit margin

2017 2018

Sales 55,917 57,491

Gross profit 2, 902 3,350

Calculation 2902/55917*100 3350/57491*100

Gross profit margin 5.19% 5.83%

Net profit ratio: Net profit/net sales

All data in £ Million except Net profit

margin

2017 2018

Sales 55,917 57,491

Net profit -40 1206

Calculation -40/55917*100 1206/57491*100

Net profit margin -0.07% 2.09%

The above mentioned data of profitability ratio can be used in order to take crucial

decision about investment and other aspects. Such as above value of gross and net

margin, this can be find out that company’s performance was better in year 2018 as

compared to year 2017.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

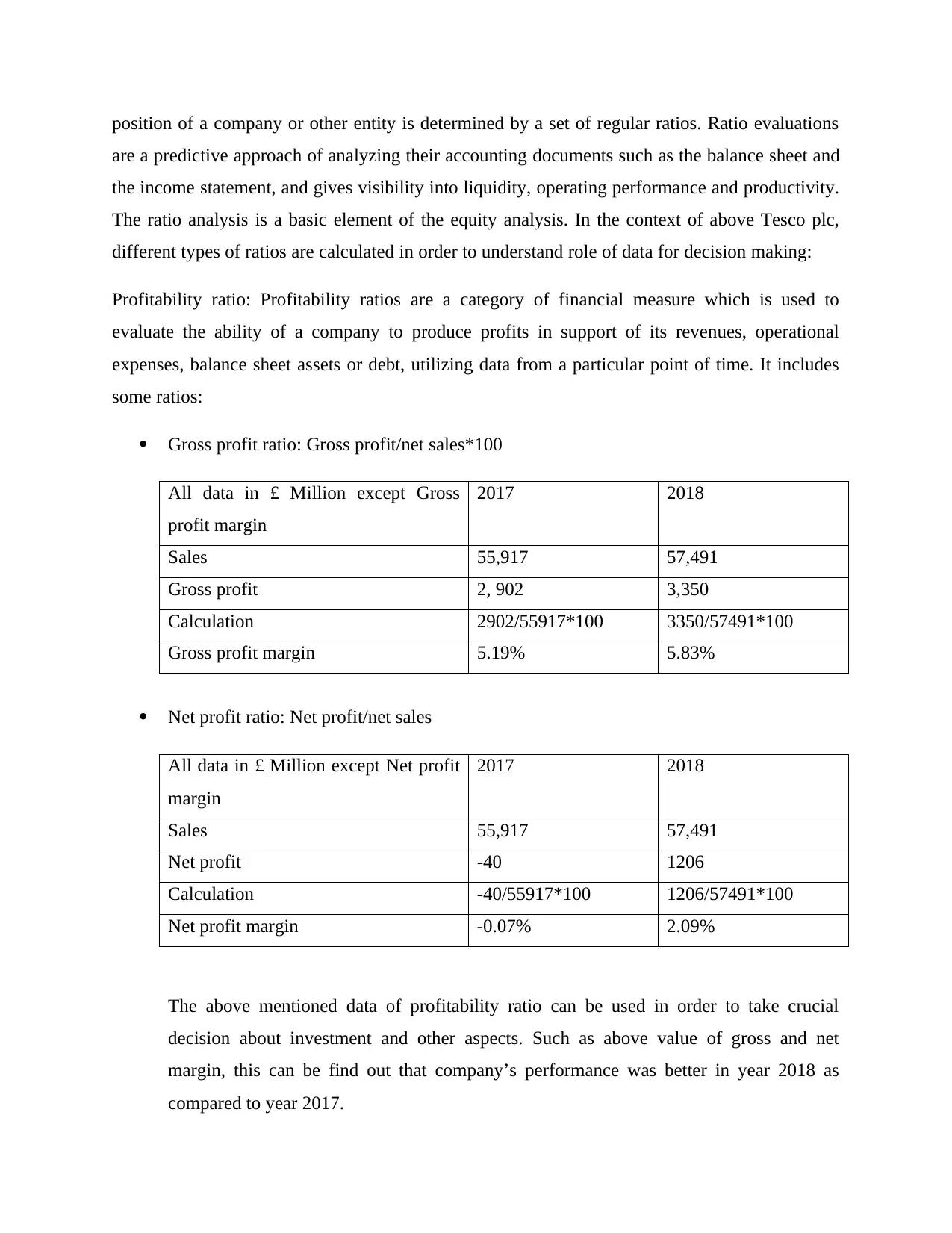

Liquidity ratio: The liquidity ratios lead from the short-term loans and current liabilities

separating capital and other liquid assets. It indicates how many times cash and financial assets

support short-term debt commitments (Naumenkova, Mishchenko and Dorofeiev, 2019).

Whether the amount is higher than 1 that implies maximum coverage of short-term

commitments. It consists two types of ratios which are explained in such manner in relation to

Tesco plc:

Current ratio: Current assets/current liabilities

All data in £ Million except current

ratio

2017 2018

Current assets 15417 13726

Current liabilities 19405 19238

Calculation 15417/19405 13726/19238

Current ratio 0.79 times 0.71 times

Quick ratio: Quick assets/current liabilities

All data in £ Million except quick ratio 2017 2018

Quick assets 13116 11463

Current liabilities 19405 19238

Calculation 13116/19405 11463/19238

Quick ratio 0.67 times 0.59 times

From above mentioned data, this can be found out that these data can be used in order to

take decision about liquidity of a company. Such as above Tesco plc can take decision

related to increasing their current assets so that their ratio can be improved. This is so

because their current assets are lower as compared to current liabilities as their ratio is

getting lower year by year.

separating capital and other liquid assets. It indicates how many times cash and financial assets

support short-term debt commitments (Naumenkova, Mishchenko and Dorofeiev, 2019).

Whether the amount is higher than 1 that implies maximum coverage of short-term

commitments. It consists two types of ratios which are explained in such manner in relation to

Tesco plc:

Current ratio: Current assets/current liabilities

All data in £ Million except current

ratio

2017 2018

Current assets 15417 13726

Current liabilities 19405 19238

Calculation 15417/19405 13726/19238

Current ratio 0.79 times 0.71 times

Quick ratio: Quick assets/current liabilities

All data in £ Million except quick ratio 2017 2018

Quick assets 13116 11463

Current liabilities 19405 19238

Calculation 13116/19405 11463/19238

Quick ratio 0.67 times 0.59 times

From above mentioned data, this can be found out that these data can be used in order to

take decision about liquidity of a company. Such as above Tesco plc can take decision

related to increasing their current assets so that their ratio can be improved. This is so

because their current assets are lower as compared to current liabilities as their ratio is

getting lower year by year.

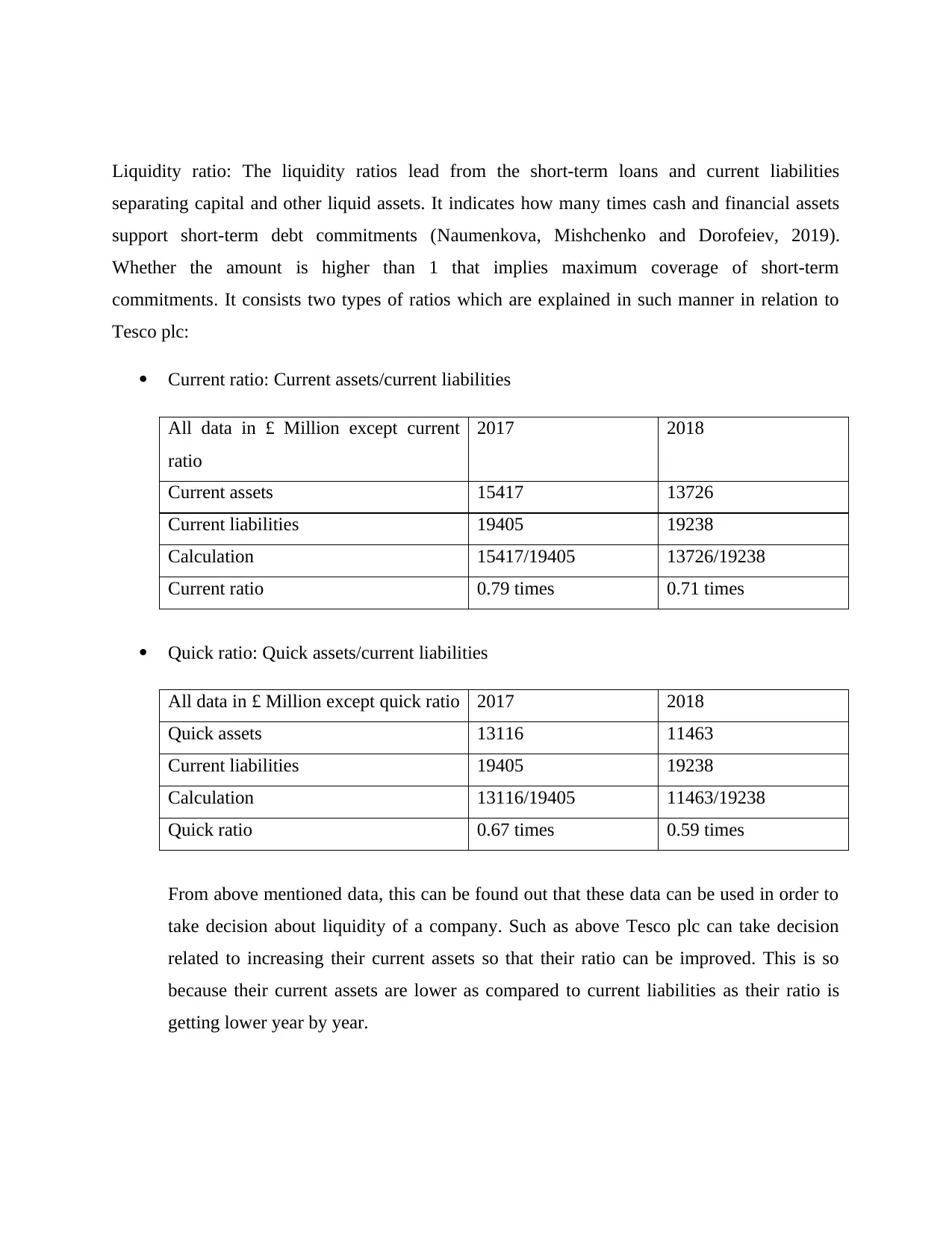

Investment ratio: These are defined as a form of ratio which is used in order to take

decision about making investment in a company. It is used in the companies’ by investors

to do invest in businesses. Below some types of ratios are explained related to above

companies:

Return on equity ratio: Net profit/Shareholders’ equity*100

All data in £ Million except return on

equity ratio

2017 2018

Net profit -40 1206

Shareholders’ equity 6438 10480

Calculation -40/6438*100 1206/10480*100

Return on equity ratio -0.62% 11.51%

Debt to equity ratio: Equity/debt

All data in £ Million except debt to

equity ratio

2017 2018

Equity 6438 10480

Debt 11879 8499

Calculation 6438/11879 10480/8499

Debt to equity ratio 0.54 1.23

These above mentioned data are showing information about efficiency of company about

debt amount and equity value. On the basis of this information, companies take decisions

about loan from financial institutions.

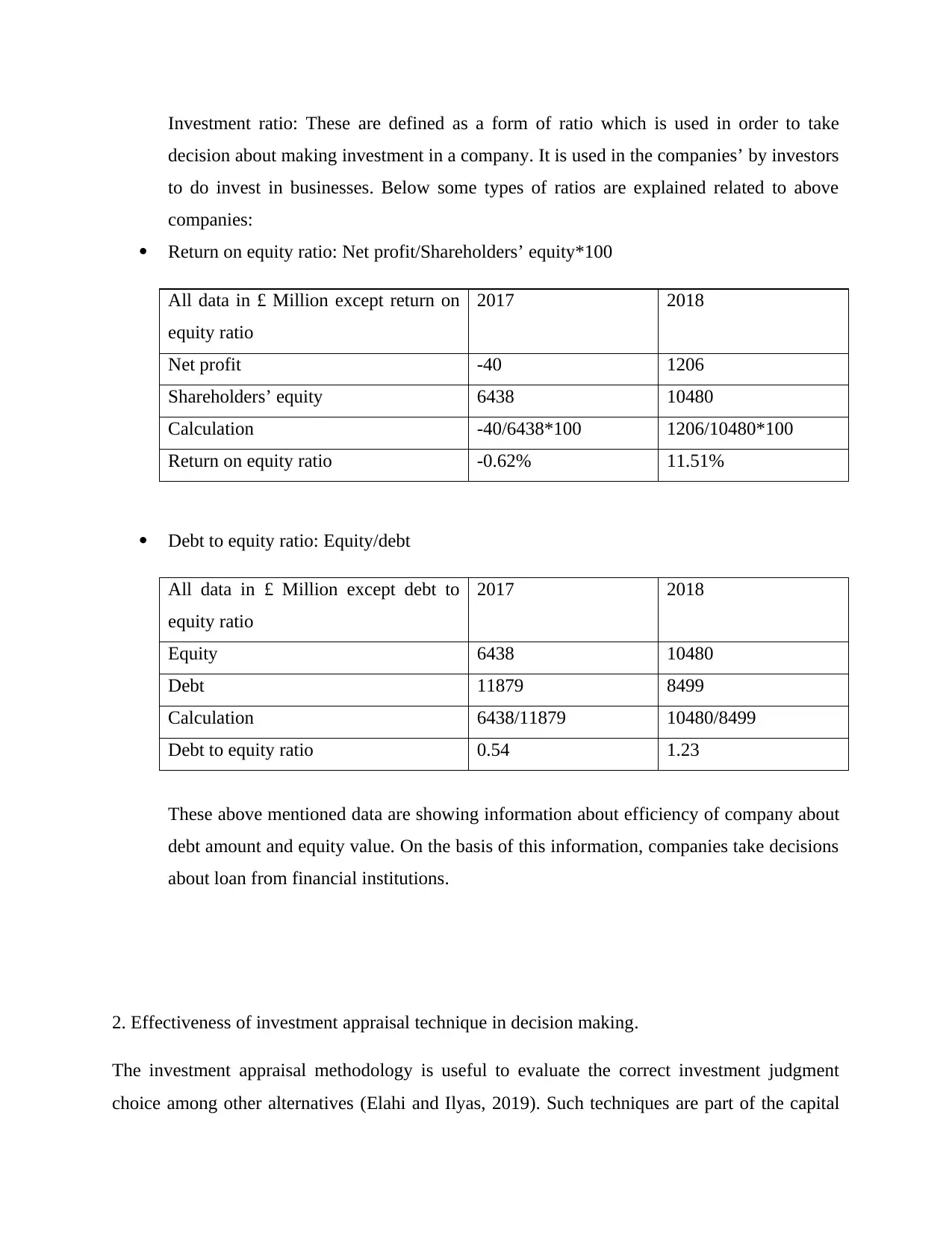

2. Effectiveness of investment appraisal technique in decision making.

The investment appraisal methodology is useful to evaluate the correct investment judgment

choice among other alternatives (Elahi and Ilyas, 2019). Such techniques are part of the capital

decision about making investment in a company. It is used in the companies’ by investors

to do invest in businesses. Below some types of ratios are explained related to above

companies:

Return on equity ratio: Net profit/Shareholders’ equity*100

All data in £ Million except return on

equity ratio

2017 2018

Net profit -40 1206

Shareholders’ equity 6438 10480

Calculation -40/6438*100 1206/10480*100

Return on equity ratio -0.62% 11.51%

Debt to equity ratio: Equity/debt

All data in £ Million except debt to

equity ratio

2017 2018

Equity 6438 10480

Debt 11879 8499

Calculation 6438/11879 10480/8499

Debt to equity ratio 0.54 1.23

These above mentioned data are showing information about efficiency of company about

debt amount and equity value. On the basis of this information, companies take decisions

about loan from financial institutions.

2. Effectiveness of investment appraisal technique in decision making.

The investment appraisal methodology is useful to evaluate the correct investment judgment

choice among other alternatives (Elahi and Ilyas, 2019). Such techniques are part of the capital

budgeting approach. This method is used by the Tesco plc’s manager to assess possible potential

ventures. Under it, a range of techniques are included and each of them plays a key role. Herein,

below some key techniques are mentioned that are as follows:

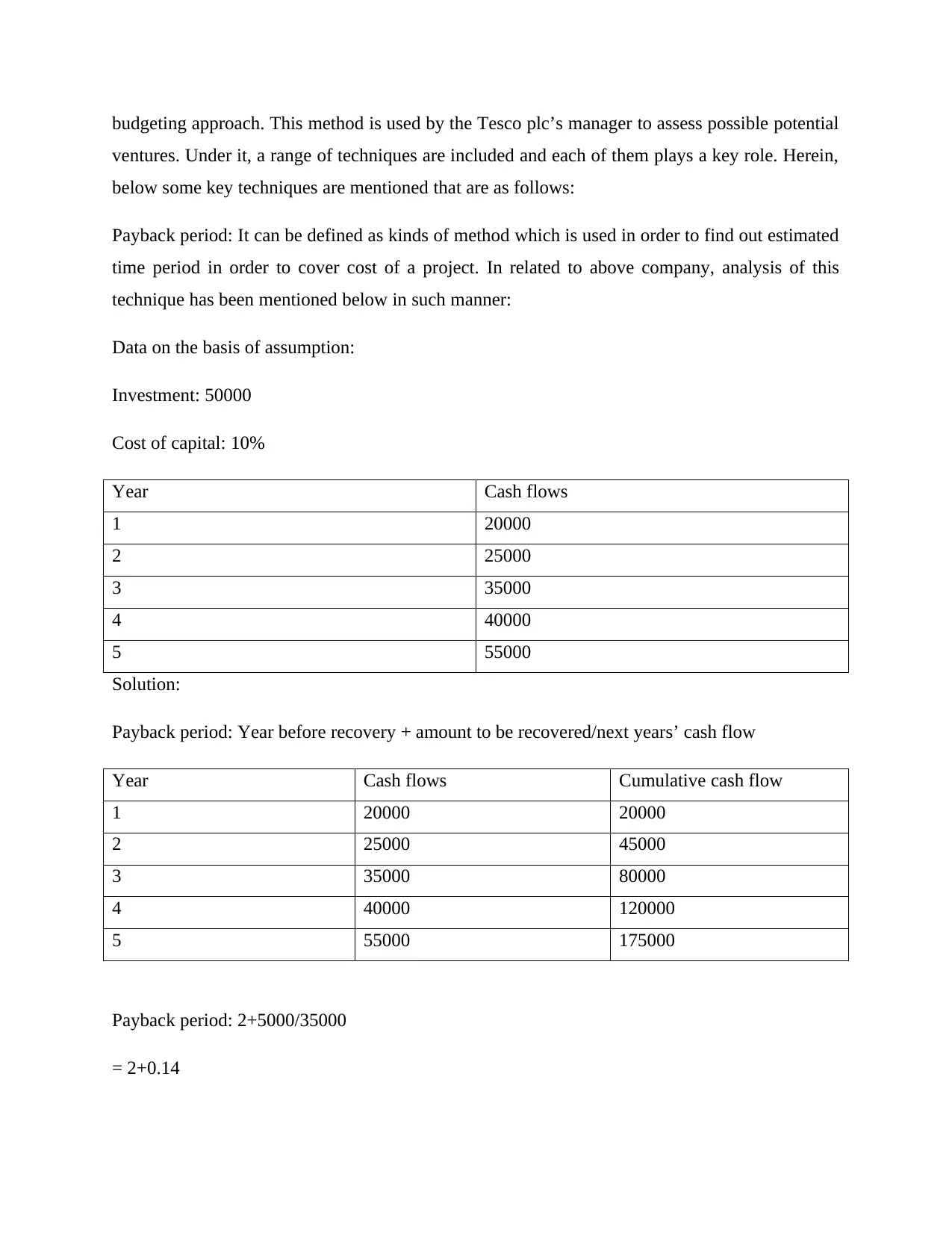

Payback period: It can be defined as kinds of method which is used in order to find out estimated

time period in order to cover cost of a project. In related to above company, analysis of this

technique has been mentioned below in such manner:

Data on the basis of assumption:

Investment: 50000

Cost of capital: 10%

Year Cash flows

1 20000

2 25000

3 35000

4 40000

5 55000

Solution:

Payback period: Year before recovery + amount to be recovered/next years’ cash flow

Year Cash flows Cumulative cash flow

1 20000 20000

2 25000 45000

3 35000 80000

4 40000 120000

5 55000 175000

Payback period: 2+5000/35000

= 2+0.14

ventures. Under it, a range of techniques are included and each of them plays a key role. Herein,

below some key techniques are mentioned that are as follows:

Payback period: It can be defined as kinds of method which is used in order to find out estimated

time period in order to cover cost of a project. In related to above company, analysis of this

technique has been mentioned below in such manner:

Data on the basis of assumption:

Investment: 50000

Cost of capital: 10%

Year Cash flows

1 20000

2 25000

3 35000

4 40000

5 55000

Solution:

Payback period: Year before recovery + amount to be recovered/next years’ cash flow

Year Cash flows Cumulative cash flow

1 20000 20000

2 25000 45000

3 35000 80000

4 40000 120000

5 55000 175000

Payback period: 2+5000/35000

= 2+0.14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

= 2.14 years

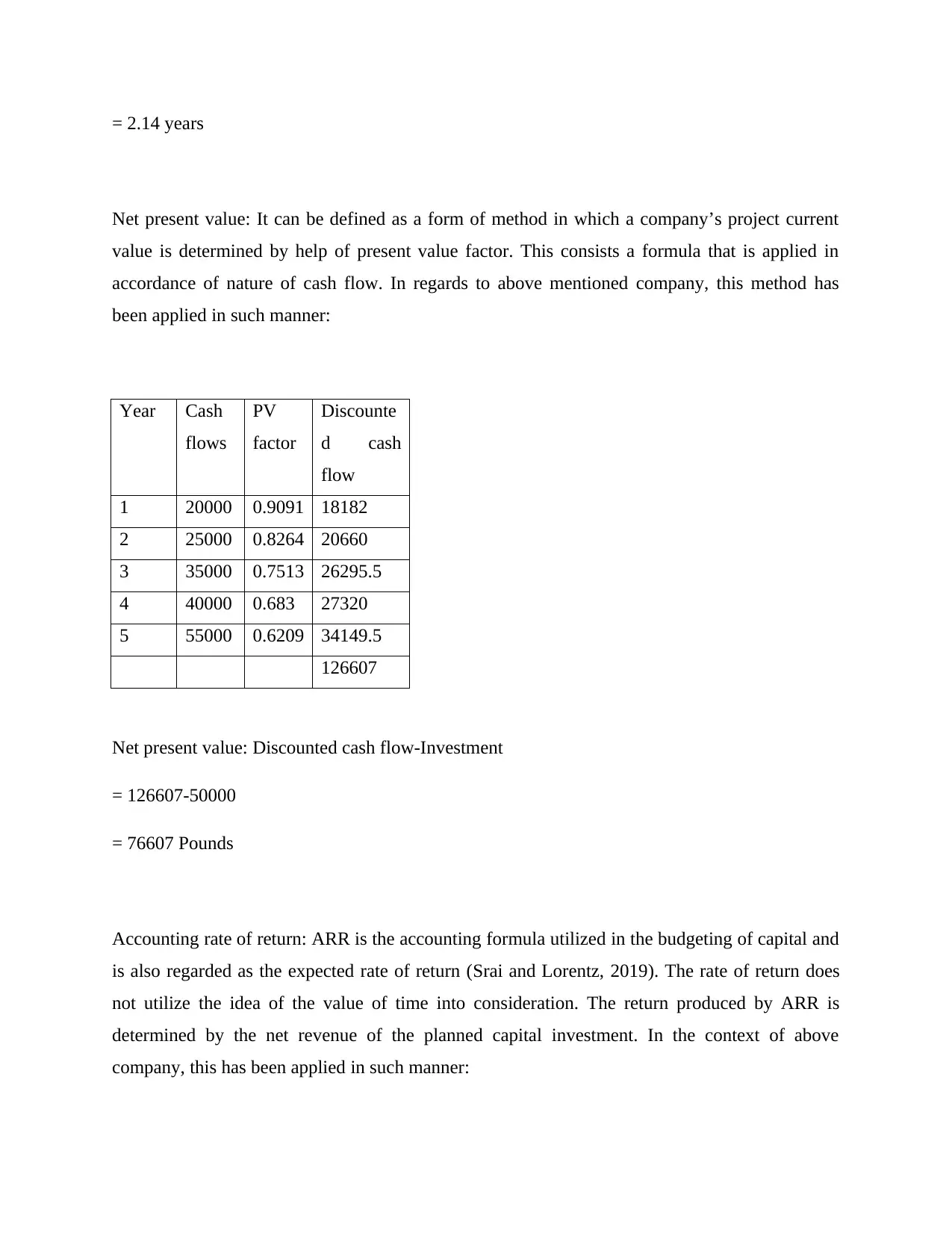

Net present value: It can be defined as a form of method in which a company’s project current

value is determined by help of present value factor. This consists a formula that is applied in

accordance of nature of cash flow. In regards to above mentioned company, this method has

been applied in such manner:

Year Cash

flows

PV

factor

Discounte

d cash

flow

1 20000 0.9091 18182

2 25000 0.8264 20660

3 35000 0.7513 26295.5

4 40000 0.683 27320

5 55000 0.6209 34149.5

126607

Net present value: Discounted cash flow-Investment

= 126607-50000

= 76607 Pounds

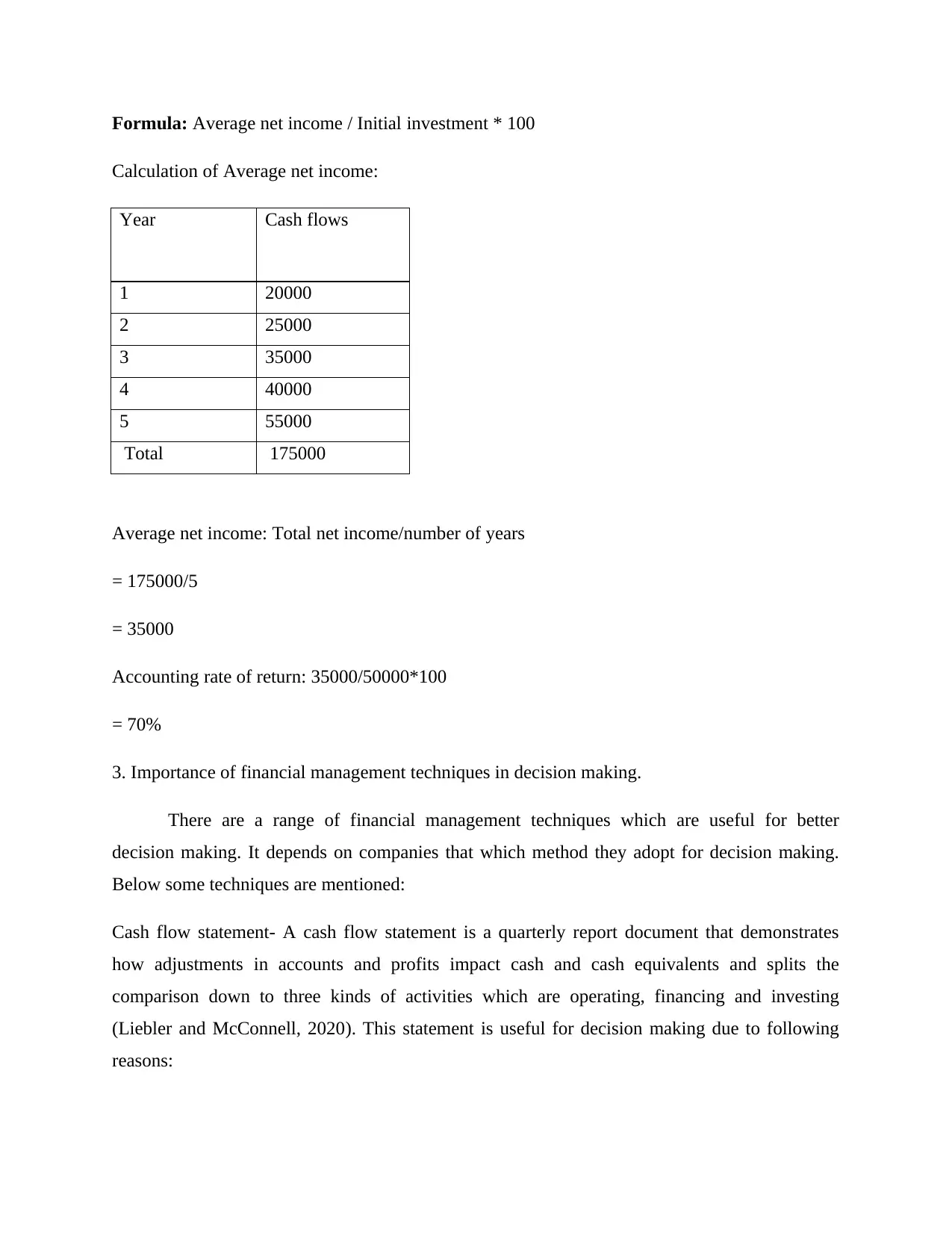

Accounting rate of return: ARR is the accounting formula utilized in the budgeting of capital and

is also regarded as the expected rate of return (Srai and Lorentz, 2019). The rate of return does

not utilize the idea of the value of time into consideration. The return produced by ARR is

determined by the net revenue of the planned capital investment. In the context of above

company, this has been applied in such manner:

Net present value: It can be defined as a form of method in which a company’s project current

value is determined by help of present value factor. This consists a formula that is applied in

accordance of nature of cash flow. In regards to above mentioned company, this method has

been applied in such manner:

Year Cash

flows

PV

factor

Discounte

d cash

flow

1 20000 0.9091 18182

2 25000 0.8264 20660

3 35000 0.7513 26295.5

4 40000 0.683 27320

5 55000 0.6209 34149.5

126607

Net present value: Discounted cash flow-Investment

= 126607-50000

= 76607 Pounds

Accounting rate of return: ARR is the accounting formula utilized in the budgeting of capital and

is also regarded as the expected rate of return (Srai and Lorentz, 2019). The rate of return does

not utilize the idea of the value of time into consideration. The return produced by ARR is

determined by the net revenue of the planned capital investment. In the context of above

company, this has been applied in such manner:

Formula: Average net income / Initial investment * 100

Calculation of Average net income:

Year Cash flows

1 20000

2 25000

3 35000

4 40000

5 55000

Total 175000

Average net income: Total net income/number of years

= 175000/5

= 35000

Accounting rate of return: 35000/50000*100

= 70%

3. Importance of financial management techniques in decision making.

There are a range of financial management techniques which are useful for better

decision making. It depends on companies that which method they adopt for decision making.

Below some techniques are mentioned:

Cash flow statement- A cash flow statement is a quarterly report document that demonstrates

how adjustments in accounts and profits impact cash and cash equivalents and splits the

comparison down to three kinds of activities which are operating, financing and investing

(Liebler and McConnell, 2020). This statement is useful for decision making due to following

reasons:

Calculation of Average net income:

Year Cash flows

1 20000

2 25000

3 35000

4 40000

5 55000

Total 175000

Average net income: Total net income/number of years

= 175000/5

= 35000

Accounting rate of return: 35000/50000*100

= 70%

3. Importance of financial management techniques in decision making.

There are a range of financial management techniques which are useful for better

decision making. It depends on companies that which method they adopt for decision making.

Below some techniques are mentioned:

Cash flow statement- A cash flow statement is a quarterly report document that demonstrates

how adjustments in accounts and profits impact cash and cash equivalents and splits the

comparison down to three kinds of activities which are operating, financing and investing

(Liebler and McConnell, 2020). This statement is useful for decision making due to following

reasons:

Short term planning- For the purpose of short-term preparation and maintaining cash

control the Cash Flow Statement is seen as a convenient, critical tool for the success of

the organization. Each business organization has to retain a adequate quantity of liquid

assets to satisfy its different responsibilities to pay the same sum as and when necessary.

This improves the finance manager to project cash flow in the coming years through

using past cash inflow and outflow information. This is done by the cash flow statement.

As in above company, their managers can use information from cash flow statement in

order to take short term decisions.

Provide details about where money is spent- The statement of cash flow is often relevant

as the Company allows various expenditures that are not expressed in the corporation's

statement of income and loss although the same is expressed in the statement of cash

flow. It includes the specific fields on which funds are invested by the organization. Like

in the context of above Tesco plc, their managers can useful information from cash flow

related to allocations of funds into different operations.

Breakeven analysis: The break-even analysis is a tool that is utilized by most organizations to

create, at various rates of production, a connection between expenses, revenue and earnings

(Bush, Bell and Middlewood, 2019). It helps to assess whether the income is equivalent to

expenses or not. This is useful for better decision making to companies in such manner:

The business or the owner knows how many units they need to sell to pay the

expenses by using a break-even analysis. In order to assess the break-even analysis,

the indirect expenses and the sales price of the products and its total costs are needed.

As in the above company, their managers take decisions about producing units to

cover costs.

This makes it easier for an organization or the manager to set a target and set the

expenditure for the business appropriately to the point where businesses can break-

even. This assessment can also be done to set an accurate company target.

4. Importance of financial decision making to maintaining long term sustainability.

control the Cash Flow Statement is seen as a convenient, critical tool for the success of

the organization. Each business organization has to retain a adequate quantity of liquid

assets to satisfy its different responsibilities to pay the same sum as and when necessary.

This improves the finance manager to project cash flow in the coming years through

using past cash inflow and outflow information. This is done by the cash flow statement.

As in above company, their managers can use information from cash flow statement in

order to take short term decisions.

Provide details about where money is spent- The statement of cash flow is often relevant

as the Company allows various expenditures that are not expressed in the corporation's

statement of income and loss although the same is expressed in the statement of cash

flow. It includes the specific fields on which funds are invested by the organization. Like

in the context of above Tesco plc, their managers can useful information from cash flow

related to allocations of funds into different operations.

Breakeven analysis: The break-even analysis is a tool that is utilized by most organizations to

create, at various rates of production, a connection between expenses, revenue and earnings

(Bush, Bell and Middlewood, 2019). It helps to assess whether the income is equivalent to

expenses or not. This is useful for better decision making to companies in such manner:

The business or the owner knows how many units they need to sell to pay the

expenses by using a break-even analysis. In order to assess the break-even analysis,

the indirect expenses and the sales price of the products and its total costs are needed.

As in the above company, their managers take decisions about producing units to

cover costs.

This makes it easier for an organization or the manager to set a target and set the

expenditure for the business appropriately to the point where businesses can break-

even. This assessment can also be done to set an accurate company target.

4. Importance of financial decision making to maintaining long term sustainability.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial decision-making is a method of taking important financial decisions for the company's

potential development (Dissanayake, Dissabandara and Ajward, 2019). Management teams'

abilities rely on their willingness to formulate an acquisition plan that can continue to boost the

company's potential performance. The financial decision is made to ensure the business

company's long-term economic growth. Managers make choices on capital, revenue, corporate

policy, asset ownership practices, resource allocation choices, and their institution's sustainability

management. The primary objective of a managed company is to preserve its long-lasting market

sustainability. It is necessary to take this crucial economic decision.

So a company can succeed in competitive markets for long because it has an effective operating

framework so good financial practices. Throughout the world economy, businesses cannot

effectively acquire incorrect investments or creative technology. How well a corporation

conducts its corporate operations financially relies on the performance of a product. It involves

keeping a strong position on the sector and safeguarding rivalry. Organizations use the successful

strategies to manage staff of the organization and take financial steps. The managing director of

Tesco plc adopts an effective corporate approach that enhances their profitability and provides

competitive advantages to ensure the viability of their activities.

5. Recommendations for how management accounting can be used to improve financial

sustainability.

Many companies do not currently use management accounting techniques to help inform

decision-making and influence sustainability practices. This will negatively impact the output of

companies. This is because it is critical to correctly collect and make this possible through

management consulting to improve the performance of businesses. Firms should therefore use

these accounting methods to take corrective measures. All their managers should use this

financial reporting in regards to Tesco plc.

potential development (Dissanayake, Dissabandara and Ajward, 2019). Management teams'

abilities rely on their willingness to formulate an acquisition plan that can continue to boost the

company's potential performance. The financial decision is made to ensure the business

company's long-term economic growth. Managers make choices on capital, revenue, corporate

policy, asset ownership practices, resource allocation choices, and their institution's sustainability

management. The primary objective of a managed company is to preserve its long-lasting market

sustainability. It is necessary to take this crucial economic decision.

So a company can succeed in competitive markets for long because it has an effective operating

framework so good financial practices. Throughout the world economy, businesses cannot

effectively acquire incorrect investments or creative technology. How well a corporation

conducts its corporate operations financially relies on the performance of a product. It involves

keeping a strong position on the sector and safeguarding rivalry. Organizations use the successful

strategies to manage staff of the organization and take financial steps. The managing director of

Tesco plc adopts an effective corporate approach that enhances their profitability and provides

competitive advantages to ensure the viability of their activities.

5. Recommendations for how management accounting can be used to improve financial

sustainability.

Many companies do not currently use management accounting techniques to help inform

decision-making and influence sustainability practices. This will negatively impact the output of

companies. This is because it is critical to correctly collect and make this possible through

management consulting to improve the performance of businesses. Firms should therefore use

these accounting methods to take corrective measures. All their managers should use this

financial reporting in regards to Tesco plc.

CONCLUSION

Based on the above project report, financial management may be inferred that it is one of

the key terms for the companies to recognize. There are a variety of principles that businesses

ought to take into consideration. The report focuses on different processes, methods and primary

decision-making considerations. In addition to stakeholder analysis, it is important for firms such

as to evaluate the financial performance of the firm. The second section of the study states that

numerous financial strategies may be valuable for definitive decision-making. A variety of

technologies is available, including the analysis of ratios, investment valuations and much more.

The study explains, for example, net present value, payback period and accounting cost of return,

continental apparel restricted, on behalf of the selected company. The next part of the report

summarizes the positions of long-term decision-making financial strategies. The final portion of

this report addresses a guideline on management accounting strategies for enterprises.

Based on the above project report, financial management may be inferred that it is one of

the key terms for the companies to recognize. There are a variety of principles that businesses

ought to take into consideration. The report focuses on different processes, methods and primary

decision-making considerations. In addition to stakeholder analysis, it is important for firms such

as to evaluate the financial performance of the firm. The second section of the study states that

numerous financial strategies may be valuable for definitive decision-making. A variety of

technologies is available, including the analysis of ratios, investment valuations and much more.

The study explains, for example, net present value, payback period and accounting cost of return,

continental apparel restricted, on behalf of the selected company. The next part of the report

summarizes the positions of long-term decision-making financial strategies. The final portion of

this report addresses a guideline on management accounting strategies for enterprises.

REFERENCES

Books and journal:

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. John Wiley & Sons.

Chandra, P., 2020. Fundamentals of Financial Management|. McGraw-Hill Education.

Madura, J., 2020. International financial management. Cengage Learning.

Mitchell, G.E. and Calabrese, T.D., 2019. Proverbs of nonprofit financial management. The

American Review of Public Administration, 49(6), pp.649-661.

Apte, P.G. and Kapshe, S., 2020. International Financial Management|. McGraw-Hill

Education.

Valaskova, K., Bartosova, V. and Kubala, P., 2019. Behavioural aspects of the financial

decision-making. Organizacija, 52(1), pp.22-31.

Spearman, K., 2019. Financial management for local government (Vol. 1). Routledge.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2), pp.205-

216.

Dermit-Richard, N., Scelles, N. and Morrow, S., 2019. French DNCG management control

versus UEFA Financial Fair Play: a divergent conception of financial regulation

objectives. Soccer & Society, 20(3), pp.408-430.

Rudani, R.B., 2020. Principles of management. McGraw-Hill Education.

Naumenkova, S., Mishchenko, S. and Dorofeiev, D., 2019. Digital financial inclusion: Evidence

from Ukraine. Investment Management and Financial Innovations, 16(3), pp.194-205.

Elahi, F. and Ilyas, M., 2019. Quality management principles and school quality. The TQM

Journal.

Liebler, J.G. and McConnell, C.R., 2020. Management principles for health professionals. Jones

& Bartlett Learning.

Dissanayake, H., Dissabandara, H. and Ajward, R., 2019. Compliance With Disclosure

Principles and Financial Performance: Empirical Evidence From Sri Lankan Listed

Companies. Available at SSRN 3497536.

Bush, T., Bell, L. and Middlewood, D. eds., 2019. Principles of Educational Leadership &

Management. SAGE Publications Limited.

Books and journal:

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. John Wiley & Sons.

Chandra, P., 2020. Fundamentals of Financial Management|. McGraw-Hill Education.

Madura, J., 2020. International financial management. Cengage Learning.

Mitchell, G.E. and Calabrese, T.D., 2019. Proverbs of nonprofit financial management. The

American Review of Public Administration, 49(6), pp.649-661.

Apte, P.G. and Kapshe, S., 2020. International Financial Management|. McGraw-Hill

Education.

Valaskova, K., Bartosova, V. and Kubala, P., 2019. Behavioural aspects of the financial

decision-making. Organizacija, 52(1), pp.22-31.

Spearman, K., 2019. Financial management for local government (Vol. 1). Routledge.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2), pp.205-

216.

Dermit-Richard, N., Scelles, N. and Morrow, S., 2019. French DNCG management control

versus UEFA Financial Fair Play: a divergent conception of financial regulation

objectives. Soccer & Society, 20(3), pp.408-430.

Rudani, R.B., 2020. Principles of management. McGraw-Hill Education.

Naumenkova, S., Mishchenko, S. and Dorofeiev, D., 2019. Digital financial inclusion: Evidence

from Ukraine. Investment Management and Financial Innovations, 16(3), pp.194-205.

Elahi, F. and Ilyas, M., 2019. Quality management principles and school quality. The TQM

Journal.

Liebler, J.G. and McConnell, C.R., 2020. Management principles for health professionals. Jones

& Bartlett Learning.

Dissanayake, H., Dissabandara, H. and Ajward, R., 2019. Compliance With Disclosure

Principles and Financial Performance: Empirical Evidence From Sri Lankan Listed

Companies. Available at SSRN 3497536.

Bush, T., Bell, L. and Middlewood, D. eds., 2019. Principles of Educational Leadership &

Management. SAGE Publications Limited.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Srai, J.S. and Lorentz, H., 2019. Developing design principles for the digitalisation of purchasing

and supply management. Journal of Purchasing and Supply Management, 25(1), pp.78-

98.

and supply management. Journal of Purchasing and Supply Management, 25(1), pp.78-

98.

1 out of 20

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)