Evaluating Management Process and Planning Tools

VerifiedAdded on 2019/12/28

|18

|5092

|433

Report

AI Summary

The assignment content evaluates the management process and planning tools in a company, considering various references from books, journals, and online sources. The references include studies and articles on management accounting, control systems, decision making, strategy implementation, and organizational change. The content highlights the importance of management accounting in facilitating effective management processes and planning tools, with a focus on organizational and sociological approaches. It also explores issues related to theory and practice in management accounting, as well as validation techniques in interpretive research.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION:..........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Function of management accounting ....................................................................................3

M1:benefits of management accounting systems.......................................................................5

D1 process of the management accounting systems .................................................................5

P2 Type of management accounting system and its use to each and every department in the

context of Imda tech....................................................................................................................5

Task 2...............................................................................................................................................7

P3 Preparation of income statement of Imda tech using marginal and absorption costing .......7

M2 Techniques and reconcile the profit......................................................................................9

D2 data of the business activities................................................................................................9

TASK 3............................................................................................................................................9

P4 Planning tool with the discussion on budget and pricing strategy in the context of Imda

tech limited..................................................................................................................................9

M3 preparing and forecasting budgets......................................................................................12

D3 planning tools of the accounting in financial problem........................................................13

TASK 4..........................................................................................................................................13

P5 Balance scorecard and its implementation to improve the performance ............................13

M4 financial problems, management accounting ....................................................................14

D4 planning tools for accounting .............................................................................................15

CONCLUSION:.............................................................................................................................15

REFERENCES:.............................................................................................................................17

INTRODUCTION:..........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Function of management accounting ....................................................................................3

M1:benefits of management accounting systems.......................................................................5

D1 process of the management accounting systems .................................................................5

P2 Type of management accounting system and its use to each and every department in the

context of Imda tech....................................................................................................................5

Task 2...............................................................................................................................................7

P3 Preparation of income statement of Imda tech using marginal and absorption costing .......7

M2 Techniques and reconcile the profit......................................................................................9

D2 data of the business activities................................................................................................9

TASK 3............................................................................................................................................9

P4 Planning tool with the discussion on budget and pricing strategy in the context of Imda

tech limited..................................................................................................................................9

M3 preparing and forecasting budgets......................................................................................12

D3 planning tools of the accounting in financial problem........................................................13

TASK 4..........................................................................................................................................13

P5 Balance scorecard and its implementation to improve the performance ............................13

M4 financial problems, management accounting ....................................................................14

D4 planning tools for accounting .............................................................................................15

CONCLUSION:.............................................................................................................................15

REFERENCES:.............................................................................................................................17

INTRODUCTION:

The management accounting help the manager to making the best decision and

developing the alternative resources of the financial accounting. The management accounting

create the types of the cost accounting. Management also determine the many process in this

organisation. This process create the planning, organising, staffing and controlling process,

decision making, controlling performance, financial analysis and iterpretation. The accounting is

the system of the company. This system create the company best budget and data. The Imda tech

company dealing the mobile telephone and other product. This accounting is the best method of

the financial statement and create the pricing strategies, develop the best budget. This is the

provision of the financial and non financial statement of the decision making. This is also create

the company objectives and goals. The Imda Tech company manager create the best financial

report and formulating the pricing strategy. This accounting consists the many scope including

the strategies, performance and risk management (Zimmerman and Yahya-Zadeh , 2011). This

accounting define the many skill and knowledge in the presentation the company financial

budget.

TASK 1

P1 Function of management accounting

The function of the management accounting provide the help in preparing the data of the

company and create the best decision. This function also define the decision making process.

Management accounting developing the many function related to the planning, organising,

staffing and controlling. This function creating the alternative budget and cost of the production.

The function of the management accounting create the best function in the organisation. This

function developing the best decision making process in the organisation. The function also

develop the best plan and innovative ideas in the organisation.

Planing function: This process create the best function of the accounting management. The

planing determine the best budget, alternative sources, best product of the company. This is

prepare the person development process in this organisation. This is the first stage of the

accounting function. This function provide the alternative sources and alternative plan related

the company profile. This is also develop the best strategies and techniques in the

company(Macintosh and Quattrone , 2010).

The management accounting help the manager to making the best decision and

developing the alternative resources of the financial accounting. The management accounting

create the types of the cost accounting. Management also determine the many process in this

organisation. This process create the planning, organising, staffing and controlling process,

decision making, controlling performance, financial analysis and iterpretation. The accounting is

the system of the company. This system create the company best budget and data. The Imda tech

company dealing the mobile telephone and other product. This accounting is the best method of

the financial statement and create the pricing strategies, develop the best budget. This is the

provision of the financial and non financial statement of the decision making. This is also create

the company objectives and goals. The Imda Tech company manager create the best financial

report and formulating the pricing strategy. This accounting consists the many scope including

the strategies, performance and risk management (Zimmerman and Yahya-Zadeh , 2011). This

accounting define the many skill and knowledge in the presentation the company financial

budget.

TASK 1

P1 Function of management accounting

The function of the management accounting provide the help in preparing the data of the

company and create the best decision. This function also define the decision making process.

Management accounting developing the many function related to the planning, organising,

staffing and controlling. This function creating the alternative budget and cost of the production.

The function of the management accounting create the best function in the organisation. This

function developing the best decision making process in the organisation. The function also

develop the best plan and innovative ideas in the organisation.

Planing function: This process create the best function of the accounting management. The

planing determine the best budget, alternative sources, best product of the company. This is

prepare the person development process in this organisation. This is the first stage of the

accounting function. This function provide the alternative sources and alternative plan related

the company profile. This is also develop the best strategies and techniques in the

company(Macintosh and Quattrone , 2010).

Organising function : This process define the integration, balance and coordinating activities.

This process of the management accounting are best process. This process define the many steps

of the company including the fixing the company objectives. The Imda tech company identify

the many activities to achieving the organisational objectives. The next step create the grouping

activity and provide the responsibility of the each employees. This process create the authority of

the employees and determine the relationship between the superiors and subordinates. This

process is create the possibility of the large number of the people and develop the best

environment.

Staffing process: This function define the many process in this organisation. The process of the

strafing create comparison of the employees and selection of the employees. This is also

developing the person personality in this organisation. The management accounting determine

the budget process and pricing strategies. This process of the management accounting system

create the human resources management planing. This function provide the best sources and best

plan(Simons , 2013).

Controlling function: This function determine the many process of the control. This process

create the standers and measuring the performance of the standers. This also creating the standers

and innovative plan in the organisation. This function of the management accounting reducing

the risk factor and uncertainty of the risk. This function reducing the variance of the company.

The financial and management accounting create the final report in the whole process of the

accounting function.

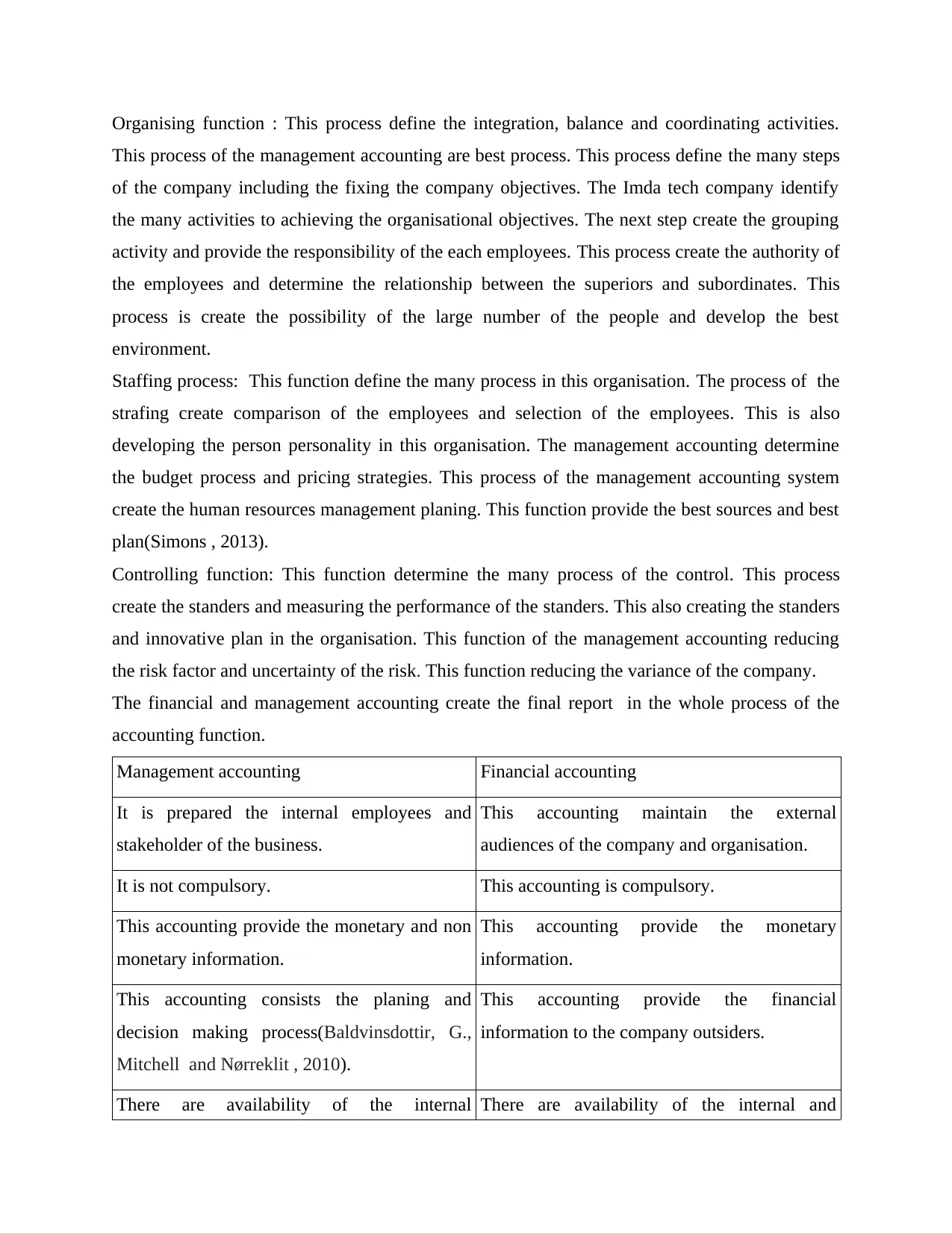

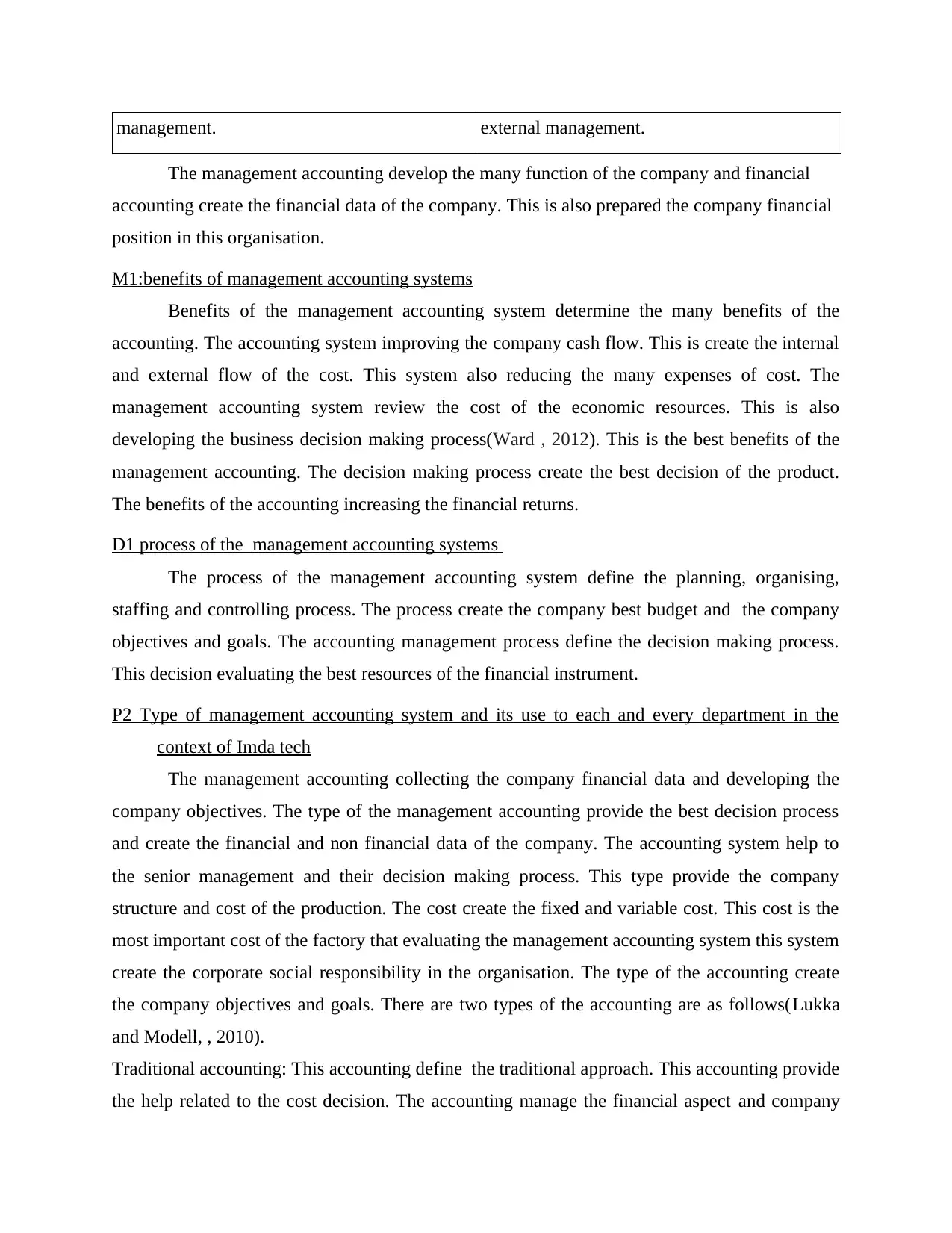

Management accounting Financial accounting

It is prepared the internal employees and

stakeholder of the business.

This accounting maintain the external

audiences of the company and organisation.

It is not compulsory. This accounting is compulsory.

This accounting provide the monetary and non

monetary information.

This accounting provide the monetary

information.

This accounting consists the planing and

decision making process(Baldvinsdottir, G.,

Mitchell and Nørreklit , 2010).

This accounting provide the financial

information to the company outsiders.

There are availability of the internal There are availability of the internal and

This process of the management accounting are best process. This process define the many steps

of the company including the fixing the company objectives. The Imda tech company identify

the many activities to achieving the organisational objectives. The next step create the grouping

activity and provide the responsibility of the each employees. This process create the authority of

the employees and determine the relationship between the superiors and subordinates. This

process is create the possibility of the large number of the people and develop the best

environment.

Staffing process: This function define the many process in this organisation. The process of the

strafing create comparison of the employees and selection of the employees. This is also

developing the person personality in this organisation. The management accounting determine

the budget process and pricing strategies. This process of the management accounting system

create the human resources management planing. This function provide the best sources and best

plan(Simons , 2013).

Controlling function: This function determine the many process of the control. This process

create the standers and measuring the performance of the standers. This also creating the standers

and innovative plan in the organisation. This function of the management accounting reducing

the risk factor and uncertainty of the risk. This function reducing the variance of the company.

The financial and management accounting create the final report in the whole process of the

accounting function.

Management accounting Financial accounting

It is prepared the internal employees and

stakeholder of the business.

This accounting maintain the external

audiences of the company and organisation.

It is not compulsory. This accounting is compulsory.

This accounting provide the monetary and non

monetary information.

This accounting provide the monetary

information.

This accounting consists the planing and

decision making process(Baldvinsdottir, G.,

Mitchell and Nørreklit , 2010).

This accounting provide the financial

information to the company outsiders.

There are availability of the internal There are availability of the internal and

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

management. external management.

The management accounting develop the many function of the company and financial

accounting create the financial data of the company. This is also prepared the company financial

position in this organisation.

M1:benefits of management accounting systems

Benefits of the management accounting system determine the many benefits of the

accounting. The accounting system improving the company cash flow. This is create the internal

and external flow of the cost. This system also reducing the many expenses of cost. The

management accounting system review the cost of the economic resources. This is also

developing the business decision making process(Ward , 2012). This is the best benefits of the

management accounting. The decision making process create the best decision of the product.

The benefits of the accounting increasing the financial returns.

D1 process of the management accounting systems

The process of the management accounting system define the planning, organising,

staffing and controlling process. The process create the company best budget and the company

objectives and goals. The accounting management process define the decision making process.

This decision evaluating the best resources of the financial instrument.

P2 Type of management accounting system and its use to each and every department in the

context of Imda tech

The management accounting collecting the company financial data and developing the

company objectives. The type of the management accounting provide the best decision process

and create the financial and non financial data of the company. The accounting system help to

the senior management and their decision making process. This type provide the company

structure and cost of the production. The cost create the fixed and variable cost. This cost is the

most important cost of the factory that evaluating the management accounting system this system

create the corporate social responsibility in the organisation. The type of the accounting create

the company objectives and goals. There are two types of the accounting are as follows(Lukka

and Modell, , 2010).

Traditional accounting: This accounting define the traditional approach. This accounting provide

the help related to the cost decision. The accounting manage the financial aspect and company

The management accounting develop the many function of the company and financial

accounting create the financial data of the company. This is also prepared the company financial

position in this organisation.

M1:benefits of management accounting systems

Benefits of the management accounting system determine the many benefits of the

accounting. The accounting system improving the company cash flow. This is create the internal

and external flow of the cost. This system also reducing the many expenses of cost. The

management accounting system review the cost of the economic resources. This is also

developing the business decision making process(Ward , 2012). This is the best benefits of the

management accounting. The decision making process create the best decision of the product.

The benefits of the accounting increasing the financial returns.

D1 process of the management accounting systems

The process of the management accounting system define the planning, organising,

staffing and controlling process. The process create the company best budget and the company

objectives and goals. The accounting management process define the decision making process.

This decision evaluating the best resources of the financial instrument.

P2 Type of management accounting system and its use to each and every department in the

context of Imda tech

The management accounting collecting the company financial data and developing the

company objectives. The type of the management accounting provide the best decision process

and create the financial and non financial data of the company. The accounting system help to

the senior management and their decision making process. This type provide the company

structure and cost of the production. The cost create the fixed and variable cost. This cost is the

most important cost of the factory that evaluating the management accounting system this system

create the corporate social responsibility in the organisation. The type of the accounting create

the company objectives and goals. There are two types of the accounting are as follows(Lukka

and Modell, , 2010).

Traditional accounting: This accounting define the traditional approach. This accounting provide

the help related to the cost decision. The accounting manage the financial aspect and company

data. The system of the management accounting calculating the company maximum profit and

reducing the risk factor. The system take the direct and indirect cost of the Imda Tech company

product. The direct cost of the company maintain the materials and manufacturing process, cost

of the wages and different product. The indirect cost of the company including the many

expenses and revenues. This costing related to the activity based costing and determine the

inaccuracy problems. The system calculating the total cost of the production. Traditional

accounting based on the number of the process.

Lean accounting: This accounting define the many large number of the firm. This firm create the

many profit in this methods of lean accounting .This accounting reducing the wastage resources

and risk factor. The management accounting also create the lean enterprise as well as business

strategies. This accounting is the best method to create the economic enterprise. The type of the

management accounting also define the many types related to the Imda Tech company mobile

and telephone manufacture product. This company introducing the many types are as

follows(Bodie, Z., 2013).

Cost accounting system: This system is the based on the traditional system. This system

estimated the cost of the product and their profitability ratio of the company. This system create

the cost of the product and value of the inventory. This accounting control the abnormal cost and

estimated the cost of the product. This system is a frame work of the company and create the

company cost structure.

Inventory management system: This system evaluating the stock value of the company. The

inventory management create the management process of the planing, organising, staffing and

controlling process. The Imda company create the management process in the inventory control.

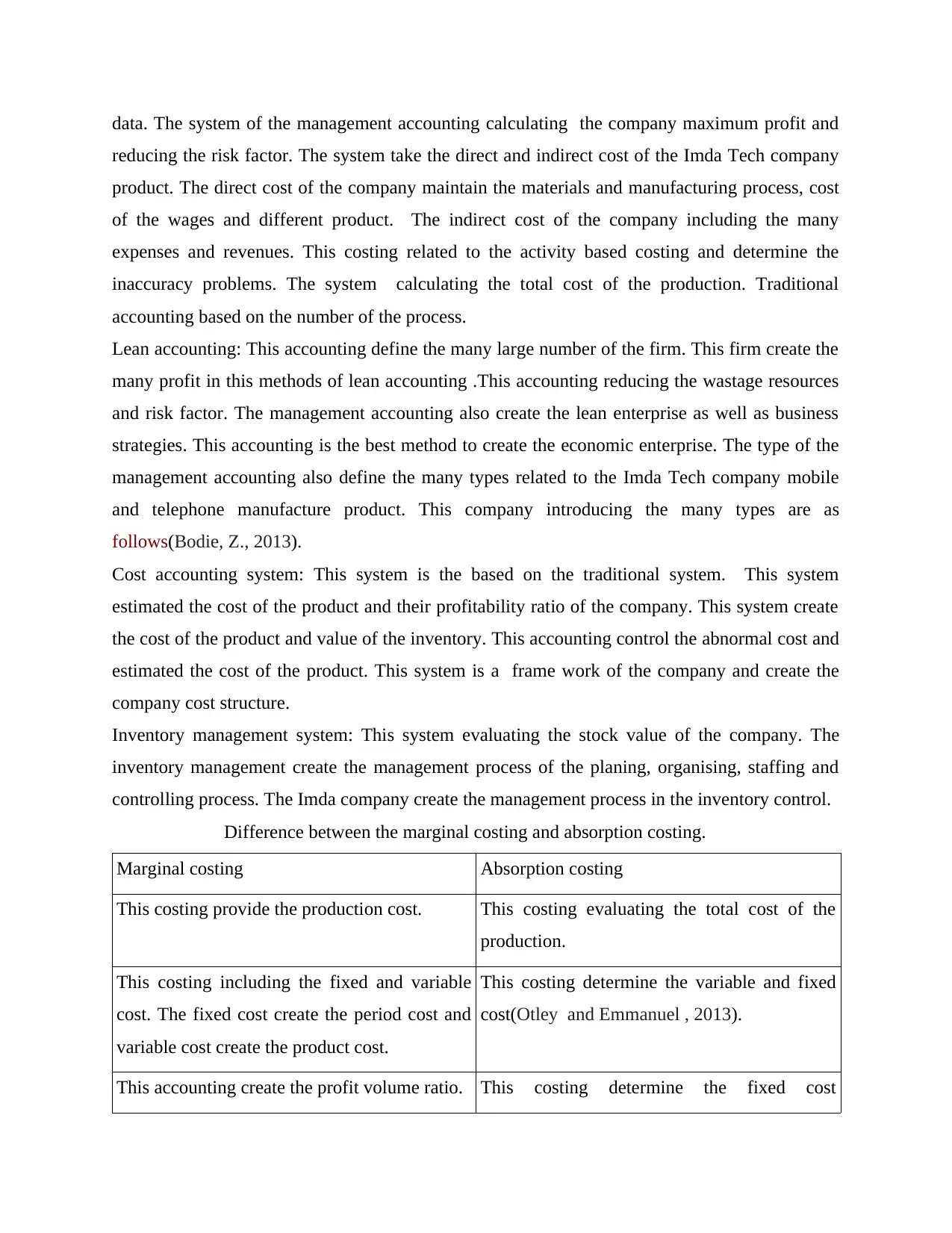

Difference between the marginal costing and absorption costing.

Marginal costing Absorption costing

This costing provide the production cost. This costing evaluating the total cost of the

production.

This costing including the fixed and variable

cost. The fixed cost create the period cost and

variable cost create the product cost.

This costing determine the variable and fixed

cost(Otley and Emmanuel , 2013).

This accounting create the profit volume ratio. This costing determine the fixed cost

reducing the risk factor. The system take the direct and indirect cost of the Imda Tech company

product. The direct cost of the company maintain the materials and manufacturing process, cost

of the wages and different product. The indirect cost of the company including the many

expenses and revenues. This costing related to the activity based costing and determine the

inaccuracy problems. The system calculating the total cost of the production. Traditional

accounting based on the number of the process.

Lean accounting: This accounting define the many large number of the firm. This firm create the

many profit in this methods of lean accounting .This accounting reducing the wastage resources

and risk factor. The management accounting also create the lean enterprise as well as business

strategies. This accounting is the best method to create the economic enterprise. The type of the

management accounting also define the many types related to the Imda Tech company mobile

and telephone manufacture product. This company introducing the many types are as

follows(Bodie, Z., 2013).

Cost accounting system: This system is the based on the traditional system. This system

estimated the cost of the product and their profitability ratio of the company. This system create

the cost of the product and value of the inventory. This accounting control the abnormal cost and

estimated the cost of the product. This system is a frame work of the company and create the

company cost structure.

Inventory management system: This system evaluating the stock value of the company. The

inventory management create the management process of the planing, organising, staffing and

controlling process. The Imda company create the management process in the inventory control.

Difference between the marginal costing and absorption costing.

Marginal costing Absorption costing

This costing provide the production cost. This costing evaluating the total cost of the

production.

This costing including the fixed and variable

cost. The fixed cost create the period cost and

variable cost create the product cost.

This costing determine the variable and fixed

cost(Otley and Emmanuel , 2013).

This accounting create the profit volume ratio. This costing determine the fixed cost

production.

This system related to the fixed and variable

overhead.

This system create the selling and distribution

over head.

Task 2

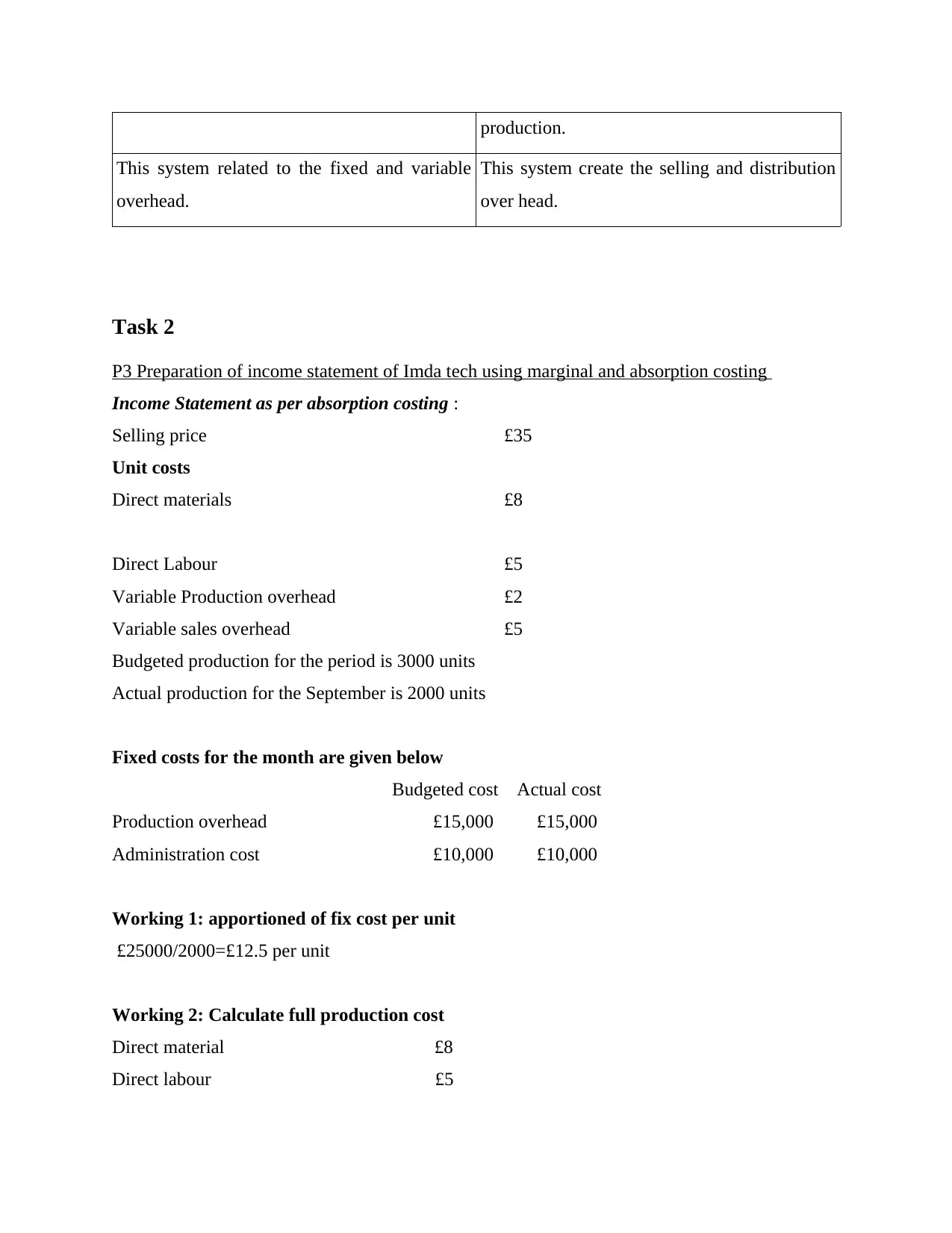

P3 Preparation of income statement of Imda tech using marginal and absorption costing

Income Statement as per absorption costing :

Selling price £35

Unit costs

Direct materials £8

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £5

Budgeted production for the period is 3000 units

Actual production for the September is 2000 units

Fixed costs for the month are given below

Budgeted cost Actual cost

Production overhead £15,000 £15,000

Administration cost £10,000 £10,000

Working 1: apportioned of fix cost per unit

£25000/2000=£12.5 per unit

Working 2: Calculate full production cost

Direct material £8

Direct labour £5

This system related to the fixed and variable

overhead.

This system create the selling and distribution

over head.

Task 2

P3 Preparation of income statement of Imda tech using marginal and absorption costing

Income Statement as per absorption costing :

Selling price £35

Unit costs

Direct materials £8

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £5

Budgeted production for the period is 3000 units

Actual production for the September is 2000 units

Fixed costs for the month are given below

Budgeted cost Actual cost

Production overhead £15,000 £15,000

Administration cost £10,000 £10,000

Working 1: apportioned of fix cost per unit

£25000/2000=£12.5 per unit

Working 2: Calculate full production cost

Direct material £8

Direct labour £5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

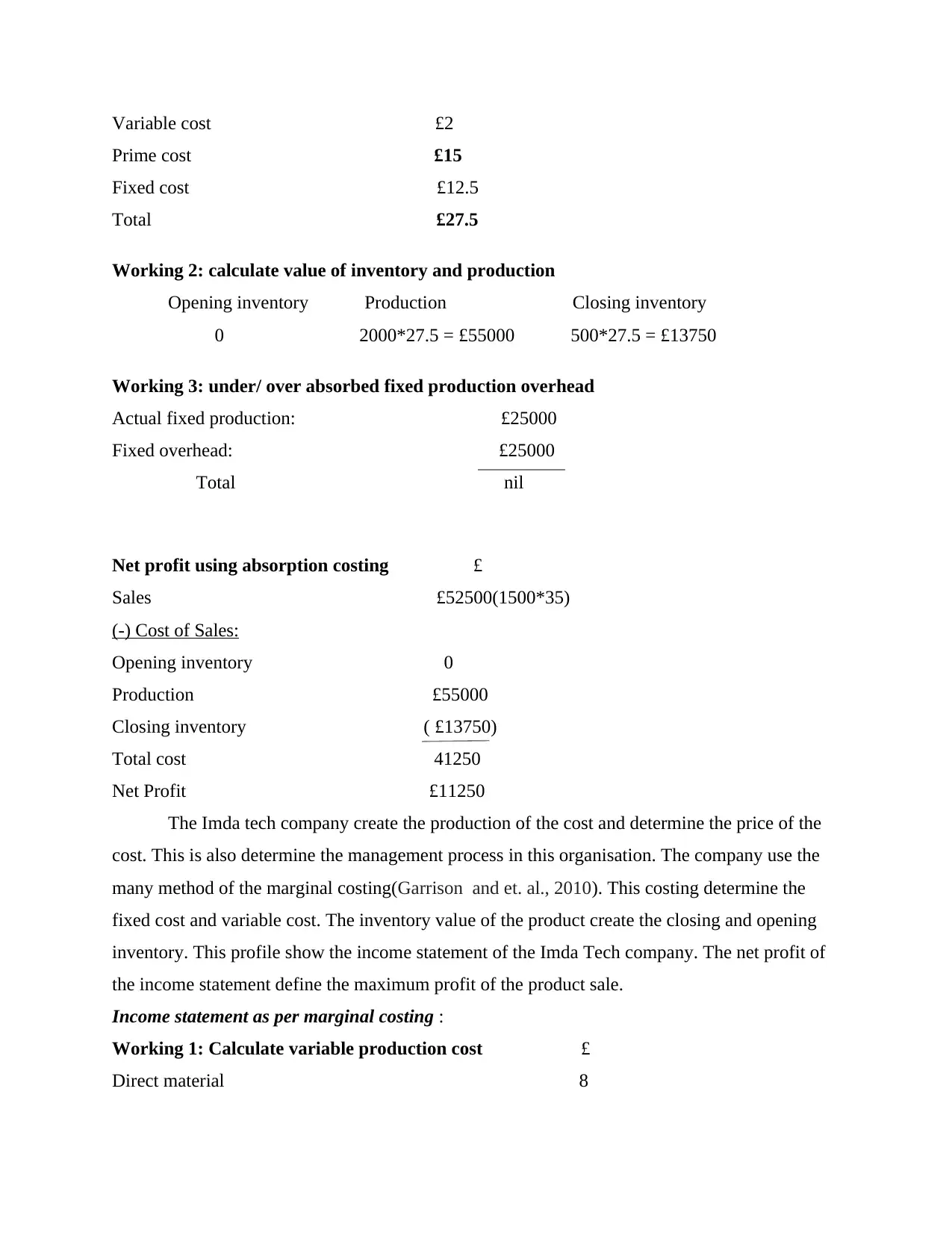

Variable cost £2

Prime cost £15

Fixed cost £12.5

Total £27.5

Working 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*27.5 = £55000 500*27.5 = £13750

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £25000

Fixed overhead: £25000

Total nil

Net profit using absorption costing £

Sales £52500(1500*35)

(-) Cost of Sales:

Opening inventory 0

Production £55000

Closing inventory ( £13750)

Total cost 41250

Net Profit £11250

The Imda tech company create the production of the cost and determine the price of the

cost. This is also determine the management process in this organisation. The company use the

many method of the marginal costing(Garrison and et. al., 2010). This costing determine the

fixed cost and variable cost. The inventory value of the product create the closing and opening

inventory. This profile show the income statement of the Imda Tech company. The net profit of

the income statement define the maximum profit of the product sale.

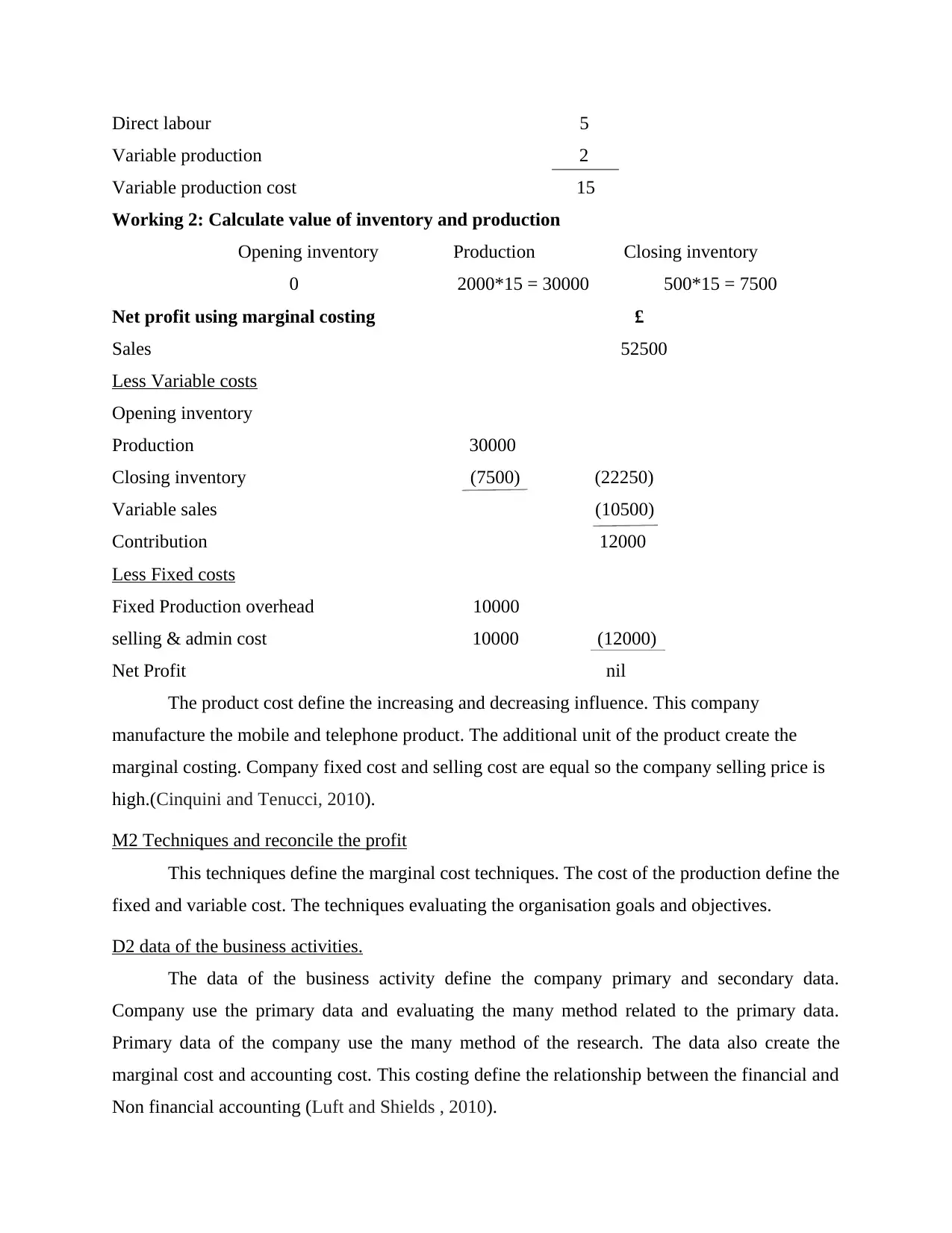

Income statement as per marginal costing :

Working 1: Calculate variable production cost £

Direct material 8

Prime cost £15

Fixed cost £12.5

Total £27.5

Working 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*27.5 = £55000 500*27.5 = £13750

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £25000

Fixed overhead: £25000

Total nil

Net profit using absorption costing £

Sales £52500(1500*35)

(-) Cost of Sales:

Opening inventory 0

Production £55000

Closing inventory ( £13750)

Total cost 41250

Net Profit £11250

The Imda tech company create the production of the cost and determine the price of the

cost. This is also determine the management process in this organisation. The company use the

many method of the marginal costing(Garrison and et. al., 2010). This costing determine the

fixed cost and variable cost. The inventory value of the product create the closing and opening

inventory. This profile show the income statement of the Imda Tech company. The net profit of

the income statement define the maximum profit of the product sale.

Income statement as per marginal costing :

Working 1: Calculate variable production cost £

Direct material 8

Direct labour 5

Variable production 2

Variable production cost 15

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*15 = 30000 500*15 = 7500

Net profit using marginal costing £

Sales 52500

Less Variable costs

Opening inventory

Production 30000

Closing inventory (7500) (22250)

Variable sales (10500)

Contribution 12000

Less Fixed costs

Fixed Production overhead 10000

selling & admin cost 10000 (12000)

Net Profit nil

The product cost define the increasing and decreasing influence. This company

manufacture the mobile and telephone product. The additional unit of the product create the

marginal costing. Company fixed cost and selling cost are equal so the company selling price is

high.(Cinquini and Tenucci, 2010).

M2 Techniques and reconcile the profit

This techniques define the marginal cost techniques. The cost of the production define the

fixed and variable cost. The techniques evaluating the organisation goals and objectives.

D2 data of the business activities.

The data of the business activity define the company primary and secondary data.

Company use the primary data and evaluating the many method related to the primary data.

Primary data of the company use the many method of the research. The data also create the

marginal cost and accounting cost. This costing define the relationship between the financial and

Non financial accounting (Luft and Shields , 2010).

Variable production 2

Variable production cost 15

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*15 = 30000 500*15 = 7500

Net profit using marginal costing £

Sales 52500

Less Variable costs

Opening inventory

Production 30000

Closing inventory (7500) (22250)

Variable sales (10500)

Contribution 12000

Less Fixed costs

Fixed Production overhead 10000

selling & admin cost 10000 (12000)

Net Profit nil

The product cost define the increasing and decreasing influence. This company

manufacture the mobile and telephone product. The additional unit of the product create the

marginal costing. Company fixed cost and selling cost are equal so the company selling price is

high.(Cinquini and Tenucci, 2010).

M2 Techniques and reconcile the profit

This techniques define the marginal cost techniques. The cost of the production define the

fixed and variable cost. The techniques evaluating the organisation goals and objectives.

D2 data of the business activities.

The data of the business activity define the company primary and secondary data.

Company use the primary data and evaluating the many method related to the primary data.

Primary data of the company use the many method of the research. The data also create the

marginal cost and accounting cost. This costing define the relationship between the financial and

Non financial accounting (Luft and Shields , 2010).

TASK 3

P4 Planning tool with the discussion on budget and pricing strategy in the context of Imda tech

limited

A) Different types of budgets and their advantages and disadvantages

Budget : A budget is the pre determine financial plan for a defined period of time. A budget is a

quantitative approach for every business planned sale, revenue, resource quantity, expenses,

costs, assets, liabilities and cash flows are the part of budget. Budget is a well managed plan for

any business or an organisation.

Types of budget :

Master Budget : Master budget is also called the continuous budgeting. It is one year budgeting

plan for firm and organisation. If any organisation plan for master budget it passes from year to

year then normally a month is added to the end of the budget to planning.

Advantages :

The first and important reason of creating master budget is it gives the overview of the

company's budget to the business owner and company executives(Scapens and Bromwich

, 2010G).

Master budget tell the overall earning and spending of the business.

Disadvantages :

The major disadvantage is it is very difficult to update the detail.

In this different numbers and categories are included that is why it is difficult to perform.

Operating Budget: Operating budget is the annual budget of the organisation. It determines the

estimated value of the value of resources required for the performance.

Advantages:

This budget provides the detailed analysis of future and current proposed expense pattern

control.

It removes unnecessary costs and focuses on value adding activities.

Disadvantage :

Operating budgeting is very time consuming method of budgeting because of large

number of transactions.

It is in accurate in nature.

P4 Planning tool with the discussion on budget and pricing strategy in the context of Imda tech

limited

A) Different types of budgets and their advantages and disadvantages

Budget : A budget is the pre determine financial plan for a defined period of time. A budget is a

quantitative approach for every business planned sale, revenue, resource quantity, expenses,

costs, assets, liabilities and cash flows are the part of budget. Budget is a well managed plan for

any business or an organisation.

Types of budget :

Master Budget : Master budget is also called the continuous budgeting. It is one year budgeting

plan for firm and organisation. If any organisation plan for master budget it passes from year to

year then normally a month is added to the end of the budget to planning.

Advantages :

The first and important reason of creating master budget is it gives the overview of the

company's budget to the business owner and company executives(Scapens and Bromwich

, 2010G).

Master budget tell the overall earning and spending of the business.

Disadvantages :

The major disadvantage is it is very difficult to update the detail.

In this different numbers and categories are included that is why it is difficult to perform.

Operating Budget: Operating budget is the annual budget of the organisation. It determines the

estimated value of the value of resources required for the performance.

Advantages:

This budget provides the detailed analysis of future and current proposed expense pattern

control.

It removes unnecessary costs and focuses on value adding activities.

Disadvantage :

Operating budgeting is very time consuming method of budgeting because of large

number of transactions.

It is in accurate in nature.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Static budget : Static budget evaluates the anticipated value about input and output or the firm. It

is quite different form the actual result.

Advantages :

It compare the actual sale figure with the expected sale figure(iovannoni and et.al, 2011).

It is flexible in nature.

Disadvantage :

Its main weakness is its strength.

This budget is only controlling the business cost it does not adjust its volume during the

year of performance.

Cash flow budget : Cash flow budget is an estimation of total cash inflows and total cash out

flows during a particular year. In this the records can be made monthly, quarterly and yearly.

Advantages :

It describe the actual position of the business. It allows the business to take a loan or

other any other type of finance.

It prepare the future unexpected bills and payments.

Disadvantage :

It is not accurate because of rough estimate.

It maintain accounts for short period of time(.Soin and Collier , 2013).

b) The process of preparing budgets.

Gather information : For making a budget the basic step is to collect the information regarding

source of income or expense. The organisation need to know how much is going out from the

organisation and how much is coming in the organisation.

Record all of your source of income : The organisation need to keep records of all the resource of

income like self employed, employment, loans, grants, scholarship and keep the record of out

side resource of income as well.

Create a list of monthly expenses : The firm should kept record of total monthly expected

expenses. In this rent, transportation, insurance, groceries, junk food, utilities, entertainment,

clothes, books supplies, internet, photocopy, laundry, are included.

Break expenses into categories: The organisation keep the record of total fixed expenses and

total variable expenses in a particular period of time. This expenses arises time to t8ime in the

organisation.

is quite different form the actual result.

Advantages :

It compare the actual sale figure with the expected sale figure(iovannoni and et.al, 2011).

It is flexible in nature.

Disadvantage :

Its main weakness is its strength.

This budget is only controlling the business cost it does not adjust its volume during the

year of performance.

Cash flow budget : Cash flow budget is an estimation of total cash inflows and total cash out

flows during a particular year. In this the records can be made monthly, quarterly and yearly.

Advantages :

It describe the actual position of the business. It allows the business to take a loan or

other any other type of finance.

It prepare the future unexpected bills and payments.

Disadvantage :

It is not accurate because of rough estimate.

It maintain accounts for short period of time(.Soin and Collier , 2013).

b) The process of preparing budgets.

Gather information : For making a budget the basic step is to collect the information regarding

source of income or expense. The organisation need to know how much is going out from the

organisation and how much is coming in the organisation.

Record all of your source of income : The organisation need to keep records of all the resource of

income like self employed, employment, loans, grants, scholarship and keep the record of out

side resource of income as well.

Create a list of monthly expenses : The firm should kept record of total monthly expected

expenses. In this rent, transportation, insurance, groceries, junk food, utilities, entertainment,

clothes, books supplies, internet, photocopy, laundry, are included.

Break expenses into categories: The organisation keep the record of total fixed expenses and

total variable expenses in a particular period of time. This expenses arises time to t8ime in the

organisation.

Total your monthly income and monthly expenses : At the end of the year if your income is more

then the expenses then it is the situation of profit and if the expenses are more then the income

then it is a loss situation(van der Steen , 2011).

Make adjustment to expenses : The firm need to keep the all income and expense together in a

equal column. This explains the all income is accounted for budgeted for expenses.

Cut spending : If the expenses are more then the money then the firm needs to find out the area

where they can make cut of their expenses.

Review your budget monthly: The organisation need to review the budget at regular basis for

satisfaction of work. After a month the firm need to compare the actual expenses with the

created budget.

Plan for occasional expenses : If there is any time to time expenses such as clothing, gifts,

vacation etc. all are include in budget plan.

Budgets are for saving too : Budget is also call the savings because if some amount of rupee is

left after paying any bills and add this money in the savings of the organisations. The

achievement of goals is depends on the saving.

Balance your budget : It is the final step of the budgeting process if the organisation is new to

budgeting it is possible that the budget may not be balance at that time the organisation find the

place where they can spend less and make adjustment for the loss(Li and et. al., 2012).

pricing strategy :

Every different organisations use various pricing strategies. Imda Tech is a

communication authority company it uses so many different kind of pricing strategy . A well

pricing strategy helps the organisation to maximise the profit on sale of product and services. For

setting a price the Imda Tech consider production, distribution cost, competitor offerings,

positioning strategies etc.

Some following strategies used by Imda Tech :

Pricing at premium : The organisation set the premium price for those products which are new

at market place and there is not any competitor available in the market. Business set cost more

then the competitors it is arises at the situation of products new life cycle.

Penetration pricing: This strategies define the price of the product. This is reducing the product

cost and evaluating the company sales profit. This is also define the market share price of the

product.

then the expenses then it is the situation of profit and if the expenses are more then the income

then it is a loss situation(van der Steen , 2011).

Make adjustment to expenses : The firm need to keep the all income and expense together in a

equal column. This explains the all income is accounted for budgeted for expenses.

Cut spending : If the expenses are more then the money then the firm needs to find out the area

where they can make cut of their expenses.

Review your budget monthly: The organisation need to review the budget at regular basis for

satisfaction of work. After a month the firm need to compare the actual expenses with the

created budget.

Plan for occasional expenses : If there is any time to time expenses such as clothing, gifts,

vacation etc. all are include in budget plan.

Budgets are for saving too : Budget is also call the savings because if some amount of rupee is

left after paying any bills and add this money in the savings of the organisations. The

achievement of goals is depends on the saving.

Balance your budget : It is the final step of the budgeting process if the organisation is new to

budgeting it is possible that the budget may not be balance at that time the organisation find the

place where they can spend less and make adjustment for the loss(Li and et. al., 2012).

pricing strategy :

Every different organisations use various pricing strategies. Imda Tech is a

communication authority company it uses so many different kind of pricing strategy . A well

pricing strategy helps the organisation to maximise the profit on sale of product and services. For

setting a price the Imda Tech consider production, distribution cost, competitor offerings,

positioning strategies etc.

Some following strategies used by Imda Tech :

Pricing at premium : The organisation set the premium price for those products which are new

at market place and there is not any competitor available in the market. Business set cost more

then the competitors it is arises at the situation of products new life cycle.

Penetration pricing: This strategies define the price of the product. This is reducing the product

cost and evaluating the company sales profit. This is also define the market share price of the

product.

M3 preparing and forecasting budgets

The company applying the many process of the budget preparing. Update the budget

information and create the availability of the funding. Company create the budget packages and

issue the budget. Company update the budget modal(Herzig and et. al., 2012).

D3 planning tools of the accounting in financial problem

The planning tools of the accounting determine the many tools of the company. This

tools including the net profit margin, SWOT analysis, rolling forecasting, overhead forecasting,

gross margin, strategies planning, variance analysis, cash forecasting. The management

accounting create the net profit and margin. This tool create the company strength, weakness,

opportunity and thread.

TASK 4

P5 Balance scorecard and its implementation to improve the performance

The balance score card determine the report and research of the above information. This

is the important factor to measuring the company performance. The Imda Tech company create

the many budget and their policies. The company improve the cost of the product and create the

market share in the accounting system. The company measuring the performance of the

employment. This is measuring the performance of the past year performance define the

company vision and mission and also developing the organisation objectives. It also providing

the help to measuring the company strategies. The Imda Tech company use the many

performance chart and identify the company data(DRURY , 2013). This performance also

maintain the good behaviour of the customers. There are many information to create the

company profile related to the financial, internal business process, learning and growth and

customer.

Balance scorecard also help in the performance of the employees.

Implementation of balance scorecard: the Imda tech company provide the help to increasing the

company product. This report also help in the employees motivation and their selection process.

The balance record create the mini research of the company project. It also provide the help to

measuring the traditional financial performance. It define the competitive environment and

improve the innovation plan and innovative ideas. The manager of the Imda Tech company

The company applying the many process of the budget preparing. Update the budget

information and create the availability of the funding. Company create the budget packages and

issue the budget. Company update the budget modal(Herzig and et. al., 2012).

D3 planning tools of the accounting in financial problem

The planning tools of the accounting determine the many tools of the company. This

tools including the net profit margin, SWOT analysis, rolling forecasting, overhead forecasting,

gross margin, strategies planning, variance analysis, cash forecasting. The management

accounting create the net profit and margin. This tool create the company strength, weakness,

opportunity and thread.

TASK 4

P5 Balance scorecard and its implementation to improve the performance

The balance score card determine the report and research of the above information. This

is the important factor to measuring the company performance. The Imda Tech company create

the many budget and their policies. The company improve the cost of the product and create the

market share in the accounting system. The company measuring the performance of the

employment. This is measuring the performance of the past year performance define the

company vision and mission and also developing the organisation objectives. It also providing

the help to measuring the company strategies. The Imda Tech company use the many

performance chart and identify the company data(DRURY , 2013). This performance also

maintain the good behaviour of the customers. There are many information to create the

company profile related to the financial, internal business process, learning and growth and

customer.

Balance scorecard also help in the performance of the employees.

Implementation of balance scorecard: the Imda tech company provide the help to increasing the

company product. This report also help in the employees motivation and their selection process.

The balance record create the mini research of the company project. It also provide the help to

measuring the traditional financial performance. It define the competitive environment and

improve the innovation plan and innovative ideas. The manager of the Imda Tech company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

measure the customer satisfaction and internal process of the organisation. The balance scored

create the company budget and pricing strategies.

it also improve the company budget and determine the best budget in the company. The report

also create the company structure in the organisation. The balance determine the financial and

non financial process and create the development and research in the Imda company(Scapens

and Bromwich , 2010.).

M4 financial problems, management accounting

The financial problem of the accounting system determine the many problems in the

management process. The problems including the adaptability. This is create the management

accounting proceeder. The adaptability is the best advantages of the Imda Tech company. This

accounting create the best report of the accounting. This accounting help in benchmarking and

comparing the performance of the manager. The Imda Tech company produce the mobiles

product. The second problem is reliability that define the decision making of the manager of the

business. The reliability create the real and current position of the company. This is also help in

the management accounting system for the present position of the Imda Tech company. The

most important feature of the quality information and product information. The cost is also

effecting the management accounting process. The cost create the design, time, monitor and

create the company budget and pricing strategies.

it also improve the company budget and determine the best budget in the company. The report

also create the company structure in the organisation. The balance determine the financial and

non financial process and create the development and research in the Imda company(Scapens

and Bromwich , 2010.).

M4 financial problems, management accounting

The financial problem of the accounting system determine the many problems in the

management process. The problems including the adaptability. This is create the management

accounting proceeder. The adaptability is the best advantages of the Imda Tech company. This

accounting create the best report of the accounting. This accounting help in benchmarking and

comparing the performance of the manager. The Imda Tech company produce the mobiles

product. The second problem is reliability that define the decision making of the manager of the

business. The reliability create the real and current position of the company. This is also help in

the management accounting system for the present position of the Imda Tech company. The

most important feature of the quality information and product information. The cost is also

effecting the management accounting process. The cost create the design, time, monitor and

evaluating the company product. The company adopting the activity based accounting and

develop the best product design and company report.

D4 planning tools for accounting

Planning tool of the accounting determine the best tools and techniques to evaluating the

managerial accounting. The tool create the cost of the production and calculating the best budget.

The Imda Tech company only create the master budget and pricing strategies(Luft and Shields ,

2010). This budget is the best budget to calculating the company product productivity and

production cost. The management accounting tools create the best tools of the company. The

Imda Tech company create the framework, structure, and process of the accounting. Tools

increasing and improving the performance and decision making of the manager. The tools of the

company also supporting and providing the strategies goals and objectives and evaluating the

values or the company.

The accounting tools create the top management in the business.

Help in the management accounting and selecting the appropriate tool. This tool create

the company budget process and pricing strategies.

Help in the best practise and implementing the effective tool.

The costing tool create the price of the product and manufacture of the product.

Pricing tool is the best tool of the accounting management because this tool create the

Imda Tech company product price.

Budgeting tool create the best budget of the company product. The budget evaluating the

many budget including the master budget, operating budget, functional budget, cost and

static budget.

Investment decision making tool is very important of the Imda Tech company because

this tool create the best decision related to the product and manager performance.

Decision making process adopt the every company to increasing the company sales and

create the best policy(Cinquini and Tenucci , 2010 ).

CONCLUSION:

As per the mention report determine the Imda Tech company product productivity and

create the many function of the management accounting. This report consists the relationship

between the financial and management accounting. The company use the many importance of

the management accounting and develop the best decision making process. The manager of the

develop the best product design and company report.

D4 planning tools for accounting

Planning tool of the accounting determine the best tools and techniques to evaluating the

managerial accounting. The tool create the cost of the production and calculating the best budget.

The Imda Tech company only create the master budget and pricing strategies(Luft and Shields ,

2010). This budget is the best budget to calculating the company product productivity and

production cost. The management accounting tools create the best tools of the company. The

Imda Tech company create the framework, structure, and process of the accounting. Tools

increasing and improving the performance and decision making of the manager. The tools of the

company also supporting and providing the strategies goals and objectives and evaluating the

values or the company.

The accounting tools create the top management in the business.

Help in the management accounting and selecting the appropriate tool. This tool create

the company budget process and pricing strategies.

Help in the best practise and implementing the effective tool.

The costing tool create the price of the product and manufacture of the product.

Pricing tool is the best tool of the accounting management because this tool create the

Imda Tech company product price.

Budgeting tool create the best budget of the company product. The budget evaluating the

many budget including the master budget, operating budget, functional budget, cost and

static budget.

Investment decision making tool is very important of the Imda Tech company because

this tool create the best decision related to the product and manager performance.

Decision making process adopt the every company to increasing the company sales and

create the best policy(Cinquini and Tenucci , 2010 ).

CONCLUSION:

As per the mention report determine the Imda Tech company product productivity and

create the many function of the management accounting. This report consists the relationship

between the financial and management accounting. The company use the many importance of

the management accounting and develop the best decision making process. The manager of the

company improve their report and product and evaluating the many system of the accounting.

This system improving company report and system define the actual, normal and standard cost

accounting. This report evaluating the many budget , pricing strategies and developing the

process of the budget preparation. The Imda Tech company define their report of the September.

This data is the define the company labour, material, variable and fixed overhead. Manager of

the company create the income statement of the report this statement provide the information

related to the mobile and telephone. Company also define their balance score card. This is create

the many performance and position of the company. The manager of the company evaluating the

management process and planning tools.

This system improving company report and system define the actual, normal and standard cost

accounting. This report evaluating the many budget , pricing strategies and developing the

process of the budget preparation. The Imda Tech company define their report of the September.

This data is the define the company labour, material, variable and fixed overhead. Manager of

the company create the income statement of the report this statement provide the information

related to the mobile and telephone. Company also define their balance score card. This is create

the many performance and position of the company. The manager of the company evaluating the

management process and planning tools.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES:

Books and journals

Zimmerman, J.L and Yahya-Zadeh, M., 2011. Accounting for decision making and control.

Issues in Accounting Education. 26(1). pp.258-259.

Macintosh, N.B and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Simons, R., 2013. Performance Measurement and Control Systems for Implementing Strategy

Text and Cases: Pearson New International Edition. Pearson Higher Ed.

Baldvinsdottir, G., Mitchell, F and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2). pp.79-82.

Ward, K., 2012. Strategic management accounting. Routledge.

Lukka, K and Modell, S., 2010. Validation in interpretive management accounting research.

Accounting, Organizations and Society. 35(4). pp.462-477.

Bodie, Z., 2013. Investments. McGraw-Hill.

Otley, D and Emmanuel, K.M.C., 2013. Readings in accounting for management control.

Springer.

Garrison, R.H., and et. al., 2010. Managerial accounting. Issues in Accounting Education. 25(4).

pp.792-793.

Cinquini, L and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Luft, J and Shields, M.D., 2010. Psychology models of management accounting. Foundations

and Trends® in Accounting. 4(3–4). pp.199-345.

Scapens, R.W and Bromwich, M., 2010. Management accounting research: 20 years on.

Giovannoni, E., Maraghini, M.P and Riccaboni, A., 2011. Transmitting knowledge across

generations: the role of management accounting practices. Family Business Review.

p.0894486511406722.

Soin, K and Collier, P., 2013. Risk and risk management in management accounting and control.

van der Steen, M., 2011. The emergence and change of management accounting routines.

Accounting, Auditing & Accountability Journal. 24(4). pp.502-547.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Books and journals

Zimmerman, J.L and Yahya-Zadeh, M., 2011. Accounting for decision making and control.

Issues in Accounting Education. 26(1). pp.258-259.

Macintosh, N.B and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Simons, R., 2013. Performance Measurement and Control Systems for Implementing Strategy

Text and Cases: Pearson New International Edition. Pearson Higher Ed.

Baldvinsdottir, G., Mitchell, F and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2). pp.79-82.

Ward, K., 2012. Strategic management accounting. Routledge.

Lukka, K and Modell, S., 2010. Validation in interpretive management accounting research.

Accounting, Organizations and Society. 35(4). pp.462-477.

Bodie, Z., 2013. Investments. McGraw-Hill.

Otley, D and Emmanuel, K.M.C., 2013. Readings in accounting for management control.

Springer.

Garrison, R.H., and et. al., 2010. Managerial accounting. Issues in Accounting Education. 25(4).

pp.792-793.

Cinquini, L and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Luft, J and Shields, M.D., 2010. Psychology models of management accounting. Foundations

and Trends® in Accounting. 4(3–4). pp.199-345.

Scapens, R.W and Bromwich, M., 2010. Management accounting research: 20 years on.

Giovannoni, E., Maraghini, M.P and Riccaboni, A., 2011. Transmitting knowledge across

generations: the role of management accounting practices. Family Business Review.

p.0894486511406722.

Soin, K and Collier, P., 2013. Risk and risk management in management accounting and control.

van der Steen, M., 2011. The emergence and change of management accounting routines.

Accounting, Auditing & Accountability Journal. 24(4). pp.502-547.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Li, X., and et. al., 2012. A comparative analysis of management accounting systems’ impact on

lean implementation. International Journal of Technology Management. 57(1/2/3). pp.33-48.

Herzig, C., and et. al., 2012. Environmental management accounting: case studies of South-East

Asian Companies. Routledge.

Online

Functions of Management Accounting . 2016. [Online]. Available

through:<http:www.yourarticlelibrary.com/accountingmanagement-accountingfunctions-of-

management-accounting-4-functions52467/>. [Accessed on 3rd May 2017].

What are the Different Types of Management Accounting Systems? 2017. [Online]. Available

through:<http://www.wisegeek.com/what-are-the-different-types-of-management-accounting-

systems.htm>. [Accessed on 3rd May 2017].

lean implementation. International Journal of Technology Management. 57(1/2/3). pp.33-48.

Herzig, C., and et. al., 2012. Environmental management accounting: case studies of South-East

Asian Companies. Routledge.

Online

Functions of Management Accounting . 2016. [Online]. Available

through:<http:www.yourarticlelibrary.com/accountingmanagement-accountingfunctions-of-

management-accounting-4-functions52467/>. [Accessed on 3rd May 2017].

What are the Different Types of Management Accounting Systems? 2017. [Online]. Available

through:<http://www.wisegeek.com/what-are-the-different-types-of-management-accounting-

systems.htm>. [Accessed on 3rd May 2017].

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.