Planning for Growth: Analysis and Justification of Key Considerations for Evaluating Growth Opportunities

VerifiedAdded on 2022/12/28

|22

|5722

|38

AI Summary

This report discusses the key considerations for evaluating growth opportunities for Vectair Holdings, a small and medium enterprise in the UK. It covers business resource analysis, PESTLE analysis, Porter's Generic Strategy, and Ansoff growth matrix. It also assesses different sources of funding along with their advantages and disadvantages.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PLANNING FOR

GROWTH

1

GROWTH

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

INTRODUCTION

The term Planning comprises of a progressive thinking and formulating plans for

different functioning in an organisation which are meant to achieve company's goals and

objectives. Planning for growth means formulating plans and objectives for company's growth as

well as success in near future in a market (Adyana and Hanani, 2020). SME's stands for small

and medium enterprises that operate at small or medium level along with a minimum amount of

capital and employees in a firm. Such firms functions at small level but contributes at large in

development of UK's economic condition. In the present report Vectair Holdings Company has

been chosen for planning its growth which offers hygiene products to its customers. The report

will discuss about opportunities available to company for its growth, various sources of funding

from where it will raise money for expansion backed by several benefits and loopholes present in

it. Vectair Holdings business plan will be maid which includes strategic objectives, financial

statements, vision, mission, etc. Further in the report, exit plan for company will also be

discussed as in case if it wants to leave expanded market.

TASK

P1: Analysis and justification of key considerations for evaluating growth opportunities.

Vectair Holdings is a small and medium enterprise in Basingstoke, United Kingdom.

The company offers a broad range of hygiene and air-care products to its customers. Vectair

Holdings possess a great opportunity for growth and expansion via their existing offerings in the

market. Since society is always concerns about hygiene and safety at each place so company

wishes to grow and make public aware about hygienic products which are available for them.

This plan for growth and expansion surely proves a profitable decision for the company (De las

Rivas Sanz and et. al., 2020). Things to be considered while analysing growth option for Vectair

Holdings are listed below:

BUSINESS RESOURCE ANALYSIS:

Business resource refers to all those supporting assets of company that helps organisation

in fulfilling business objectives and smooth functioning of its operations. Resources such as in

form of physical, financial or human resource contributes to the success and achievement of

organisational goal in effective manner.

3

The term Planning comprises of a progressive thinking and formulating plans for

different functioning in an organisation which are meant to achieve company's goals and

objectives. Planning for growth means formulating plans and objectives for company's growth as

well as success in near future in a market (Adyana and Hanani, 2020). SME's stands for small

and medium enterprises that operate at small or medium level along with a minimum amount of

capital and employees in a firm. Such firms functions at small level but contributes at large in

development of UK's economic condition. In the present report Vectair Holdings Company has

been chosen for planning its growth which offers hygiene products to its customers. The report

will discuss about opportunities available to company for its growth, various sources of funding

from where it will raise money for expansion backed by several benefits and loopholes present in

it. Vectair Holdings business plan will be maid which includes strategic objectives, financial

statements, vision, mission, etc. Further in the report, exit plan for company will also be

discussed as in case if it wants to leave expanded market.

TASK

P1: Analysis and justification of key considerations for evaluating growth opportunities.

Vectair Holdings is a small and medium enterprise in Basingstoke, United Kingdom.

The company offers a broad range of hygiene and air-care products to its customers. Vectair

Holdings possess a great opportunity for growth and expansion via their existing offerings in the

market. Since society is always concerns about hygiene and safety at each place so company

wishes to grow and make public aware about hygienic products which are available for them.

This plan for growth and expansion surely proves a profitable decision for the company (De las

Rivas Sanz and et. al., 2020). Things to be considered while analysing growth option for Vectair

Holdings are listed below:

BUSINESS RESOURCE ANALYSIS:

Business resource refers to all those supporting assets of company that helps organisation

in fulfilling business objectives and smooth functioning of its operations. Resources such as in

form of physical, financial or human resource contributes to the success and achievement of

organisational goal in effective manner.

3

Physical Resource: This comprises of such assets that can be touched by anyone in the

company used for accomplishment of business target. It includes plant and machinery,

furniture and fixtures, office premises, factory, etc. that contributes business in

manufacturing and selling of company's product or services to potential customers.

Vectair Holdings physical resources involves its office, equipments those are used in

manufacturing of Air care or hygine products, warehouse for storing produced items, etc.

Financial Resource: This comprises of monetary assets or real cash that is used in

business to run daily operations of company, working capital management or used for the

purpose of making further investment which will generate revenue for the company in

return.

For Vectair Holdings its financial resources comprises of investments raised by the company,

reserves, profits made from the sale of products, etc.

Human Resource: The human resource includes man power, employees or workers of

company who performs their job in organisation to make its plan and ideas a real

experience. This involves all those employees whether placed at top management or at

medium or low level of management in organisation structure.

Vectair Holdings comprises of its human resources such as managers, leaders, employees,

workers, and other support staff.

PESTLE ANALYSIS:

PESTLE is a short form for external environmental analysis. The acronym comprises

certain forces that come from Political, Economic, Social, Technological, Legal and

Environmental factors which effects and impacts on company's behaviour and operations. The

forces of this environment are external but hinder internal workings of a company. These factors

are uncontrollable in nature by the firms hence they need to adjust themselves according to the

impact of such factors (Keeler, Keeler and Keeler, 2020). The discussion on each element of

environment is done below:

4

company used for accomplishment of business target. It includes plant and machinery,

furniture and fixtures, office premises, factory, etc. that contributes business in

manufacturing and selling of company's product or services to potential customers.

Vectair Holdings physical resources involves its office, equipments those are used in

manufacturing of Air care or hygine products, warehouse for storing produced items, etc.

Financial Resource: This comprises of monetary assets or real cash that is used in

business to run daily operations of company, working capital management or used for the

purpose of making further investment which will generate revenue for the company in

return.

For Vectair Holdings its financial resources comprises of investments raised by the company,

reserves, profits made from the sale of products, etc.

Human Resource: The human resource includes man power, employees or workers of

company who performs their job in organisation to make its plan and ideas a real

experience. This involves all those employees whether placed at top management or at

medium or low level of management in organisation structure.

Vectair Holdings comprises of its human resources such as managers, leaders, employees,

workers, and other support staff.

PESTLE ANALYSIS:

PESTLE is a short form for external environmental analysis. The acronym comprises

certain forces that come from Political, Economic, Social, Technological, Legal and

Environmental factors which effects and impacts on company's behaviour and operations. The

forces of this environment are external but hinder internal workings of a company. These factors

are uncontrollable in nature by the firms hence they need to adjust themselves according to the

impact of such factors (Keeler, Keeler and Keeler, 2020). The discussion on each element of

environment is done below:

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PESTLE Framework

Political Environment: This factor includes some political interference by government.

This involves restrictions on trade, tax regulations, long term survival of political party,

etc. The political stability of UK government helps Vectair Holdings to operate with less

negative effects on its performance and provides support to the company.

Economical: This involves country's economic condition such as inflation or deflation,

Foreign Direct Investment, exchange or interest rate fluctuations, etc. After the issue of

Brexit UK's economic condition became stable which offers scope of great opportunities

for the firms to expand and grow its business.

Social: This relates to the societal culture, people perceptions, ethics and moral principles

which society possess. People of UK are much more concern about their hygiene so

prefers hygienic products, this practice by society will help company Vectair Holdings to

expand its business and ultimately leads to growth of the firm.

Technological: The factor discusses concepts like technological changes or innovation in

product or services which is offered to the customers. Vectair Holdings installs latest

technology in its operations and provides niche products into market. This technological

adoption helps company to grow its business.

Environmental: This external factor analysis environmental concern such as green

environment, less pollution and chemical, ozone, etc. Vectair Holdings by providing

5

Political Environment: This factor includes some political interference by government.

This involves restrictions on trade, tax regulations, long term survival of political party,

etc. The political stability of UK government helps Vectair Holdings to operate with less

negative effects on its performance and provides support to the company.

Economical: This involves country's economic condition such as inflation or deflation,

Foreign Direct Investment, exchange or interest rate fluctuations, etc. After the issue of

Brexit UK's economic condition became stable which offers scope of great opportunities

for the firms to expand and grow its business.

Social: This relates to the societal culture, people perceptions, ethics and moral principles

which society possess. People of UK are much more concern about their hygiene so

prefers hygienic products, this practice by society will help company Vectair Holdings to

expand its business and ultimately leads to growth of the firm.

Technological: The factor discusses concepts like technological changes or innovation in

product or services which is offered to the customers. Vectair Holdings installs latest

technology in its operations and provides niche products into market. This technological

adoption helps company to grow its business.

Environmental: This external factor analysis environmental concern such as green

environment, less pollution and chemical, ozone, etc. Vectair Holdings by providing

5

hygienic products to its buyers supports environment which helps company to expand his

business.

Legal: This includes some legal rules and regulations which are imposed on companies

mandatory to follow them (FreireTrigo, 2020). UK supports small and medium

enterprises to expand which helps Vectair Holdings to grow its business operations by

proper adoption of legal policies and guidelines of UK.

Porter's Generic Strategy:

The strategy enlists some ways which can be adopted by companies to achieve its

competitive advantage over competitors surviving in industry. This strategy includes four

different elements which can be implemented by an organisation for its expansion and growth.

The elements of Porter’s Generic strategy are discussed below:

Cost Focus: This element of strategy stats that company should offer its products and

services at lowest possible prices in its existing market (Hassanpour and Giti Nejad,

2020). For instance Vectair Holdings can adopt cost focus strategy to cater more buyers

by offering its products at cheaper price in market.

Differentiation Focus: This element of strategy involves offering different product and

services to customers indicating unique feature from competitors (Irina, 2020. For

instance, Vectair Holdings can apply this concept in order to gain big market share and

high brand image in front of its loyal buyers. Cost Leadership: The next element in generic strategy is termed as cost leadership. The

component says that company should provide its products and services to its customers at

cheaper prices by enriching high quality into it for having competitive advantage over

rival firms in the market (Jian, 2021). For instance Vectair Holdings can win over its

competitors by providing their best quality products at lesser price which can be made by

reducing either labour or operational cost in production.

6

business.

Legal: This includes some legal rules and regulations which are imposed on companies

mandatory to follow them (FreireTrigo, 2020). UK supports small and medium

enterprises to expand which helps Vectair Holdings to grow its business operations by

proper adoption of legal policies and guidelines of UK.

Porter's Generic Strategy:

The strategy enlists some ways which can be adopted by companies to achieve its

competitive advantage over competitors surviving in industry. This strategy includes four

different elements which can be implemented by an organisation for its expansion and growth.

The elements of Porter’s Generic strategy are discussed below:

Cost Focus: This element of strategy stats that company should offer its products and

services at lowest possible prices in its existing market (Hassanpour and Giti Nejad,

2020). For instance Vectair Holdings can adopt cost focus strategy to cater more buyers

by offering its products at cheaper price in market.

Differentiation Focus: This element of strategy involves offering different product and

services to customers indicating unique feature from competitors (Irina, 2020. For

instance, Vectair Holdings can apply this concept in order to gain big market share and

high brand image in front of its loyal buyers. Cost Leadership: The next element in generic strategy is termed as cost leadership. The

component says that company should provide its products and services to its customers at

cheaper prices by enriching high quality into it for having competitive advantage over

rival firms in the market (Jian, 2021). For instance Vectair Holdings can win over its

competitors by providing their best quality products at lesser price which can be made by

reducing either labour or operational cost in production.

6

Porters Generic Strategy Model

Differentiation: This involves providing a unique and different product and services

along with a combination of high quality features to customers which is not present in

market. This will incudes innovation in product which will require huge research and

proper market study (Katsarski, 2020). Vectair Holdings can apply this by bringing new

product which makes hygiene more beneficial with fewer chemicals.

Vectair Holdings can adopt cost leadership strategy in its operations. This will help

company to win over rival firms by providing quality product at low price which will cater more

customers in market. Product at low prices attracts public to buy more and more products of

company. Through this company can expand its business effectively and can achieve competitive

advantage along with high growth in market.

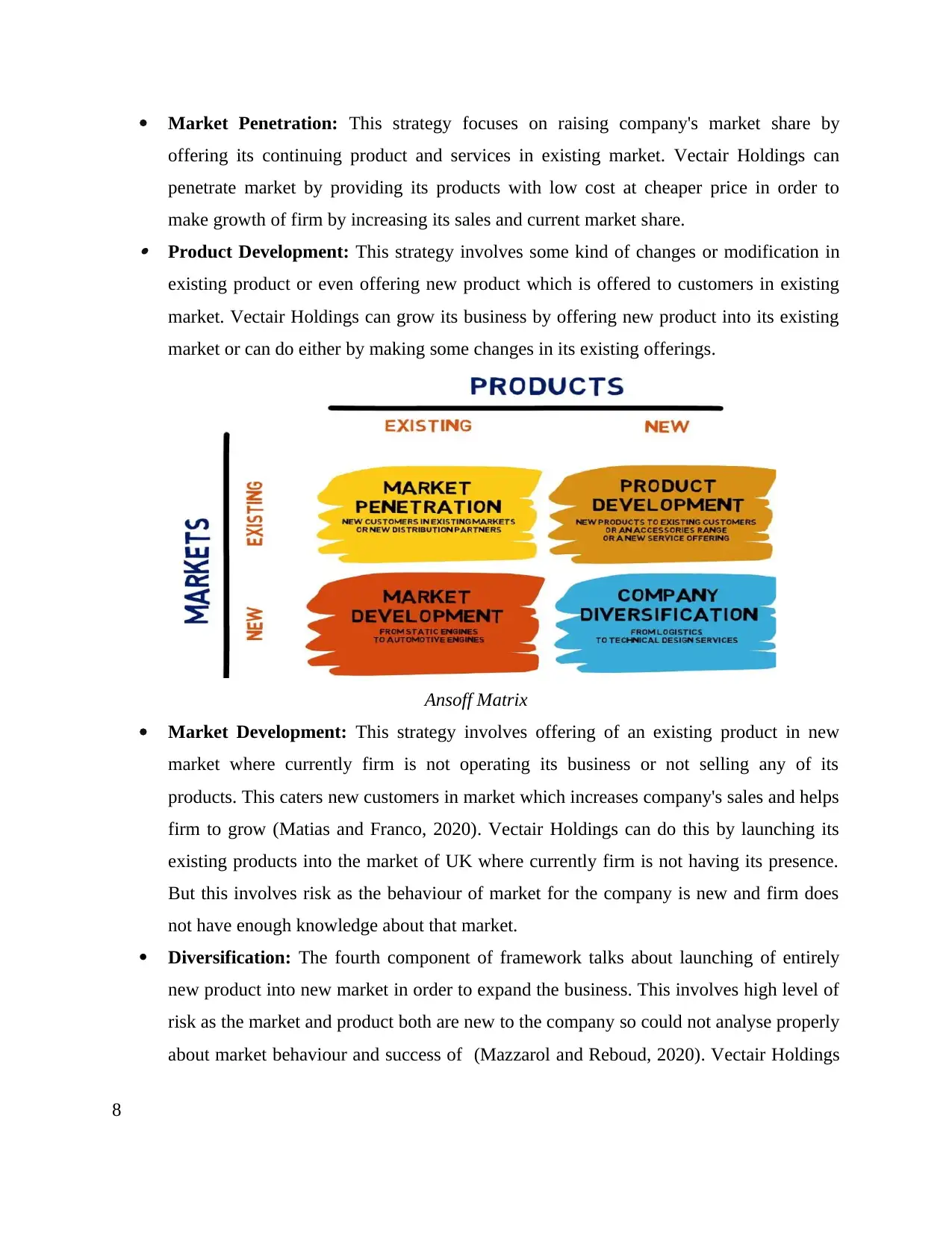

P2: Evaluation of growth opportunities using Ansoff growth matrix.

Ansoff Growth Matrix is a framework applied for strategic plan which presents a

clear picture of company for further decision making. It shows whether it is good for firm

to grow or not and to implement which strategy is best suitable for it (Lee and Jung,

2020). It provides proper analyses about the expansion opportunities availability for

company to expand business in market. This is a strategic model which supports Vectair

Holdings to have proper analysis for company's growth. The framework comprises of

four different strategic which helps companies to grow. These four strategies are

described below:

7

Differentiation: This involves providing a unique and different product and services

along with a combination of high quality features to customers which is not present in

market. This will incudes innovation in product which will require huge research and

proper market study (Katsarski, 2020). Vectair Holdings can apply this by bringing new

product which makes hygiene more beneficial with fewer chemicals.

Vectair Holdings can adopt cost leadership strategy in its operations. This will help

company to win over rival firms by providing quality product at low price which will cater more

customers in market. Product at low prices attracts public to buy more and more products of

company. Through this company can expand its business effectively and can achieve competitive

advantage along with high growth in market.

P2: Evaluation of growth opportunities using Ansoff growth matrix.

Ansoff Growth Matrix is a framework applied for strategic plan which presents a

clear picture of company for further decision making. It shows whether it is good for firm

to grow or not and to implement which strategy is best suitable for it (Lee and Jung,

2020). It provides proper analyses about the expansion opportunities availability for

company to expand business in market. This is a strategic model which supports Vectair

Holdings to have proper analysis for company's growth. The framework comprises of

four different strategic which helps companies to grow. These four strategies are

described below:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Market Penetration: This strategy focuses on raising company's market share by

offering its continuing product and services in existing market. Vectair Holdings can

penetrate market by providing its products with low cost at cheaper price in order to

make growth of firm by increasing its sales and current market share. Product Development: This strategy involves some kind of changes or modification in

existing product or even offering new product which is offered to customers in existing

market. Vectair Holdings can grow its business by offering new product into its existing

market or can do either by making some changes in its existing offerings.

Ansoff Matrix

Market Development: This strategy involves offering of an existing product in new

market where currently firm is not operating its business or not selling any of its

products. This caters new customers in market which increases company's sales and helps

firm to grow (Matias and Franco, 2020). Vectair Holdings can do this by launching its

existing products into the market of UK where currently firm is not having its presence.

But this involves risk as the behaviour of market for the company is new and firm does

not have enough knowledge about that market.

Diversification: The fourth component of framework talks about launching of entirely

new product into new market in order to expand the business. This involves high level of

risk as the market and product both are new to the company so could not analyse properly

about market behaviour and success of (Mazzarol and Reboud, 2020). Vectair Holdings

8

offering its continuing product and services in existing market. Vectair Holdings can

penetrate market by providing its products with low cost at cheaper price in order to

make growth of firm by increasing its sales and current market share. Product Development: This strategy involves some kind of changes or modification in

existing product or even offering new product which is offered to customers in existing

market. Vectair Holdings can grow its business by offering new product into its existing

market or can do either by making some changes in its existing offerings.

Ansoff Matrix

Market Development: This strategy involves offering of an existing product in new

market where currently firm is not operating its business or not selling any of its

products. This caters new customers in market which increases company's sales and helps

firm to grow (Matias and Franco, 2020). Vectair Holdings can do this by launching its

existing products into the market of UK where currently firm is not having its presence.

But this involves risk as the behaviour of market for the company is new and firm does

not have enough knowledge about that market.

Diversification: The fourth component of framework talks about launching of entirely

new product into new market in order to expand the business. This involves high level of

risk as the market and product both are new to the company so could not analyse properly

about market behaviour and success of (Mazzarol and Reboud, 2020). Vectair Holdings

8

can bring its new product in new market where the customers are entirely new for

business.

For Vectair Holdings Market Development strategy is best suitable in order to make growth of

the company and expand its business in UK. In this strategy firm does not bears a risk of its

products as it is selling its existing to the customers. Entering into new market in UK is

beneficial for Vectair Holdings to grow its business as it provides opportunity to cater new

customers.

TASK 2

P3: Assessment of sources of funding along with advantages and disadvantages.

Funding involves positioning of cash by a firm to meet its necessary expenses or

to fulfil its objectives. Company arranges this fund either internally or from outside the

business by providing some return to investors who helps organisation to grow its

business (Moyle and et. al., 2020). Vectair Holdings has an estimation of worth £20,000

million for investing in growth opportunity but requires £3, 00,000 million in real terms

in order to expand its business in UK. Company is having option to raise this fund from

internal and external sources both through which Vectair Holdings can arrange the deficit

funds that is worth £2,80,000 million. The available sources for raising funds are

mentioned below:

Internal Funding: This includes getting funds from internal sources of organisation by

selling some capital assets such as sale of unused furniture, decreasing working capital of

the firm, raising money form board of directors or from any other internal source.

Company through this can save acquiring cost which will help company to use this

expense in some necessary investment. This allows firm in using acquisition cost into

some other field that can bring returns for them. The major disadvantage of internal

funding that company will lose its retained earnings or reserves which was kept for

critical situations.

External Funding: This provides option to firm in raising of funds from outside the

boundaries of business such as crowd funding, equity shares, bonds, angel financing,

venture capitalist, government support, etc. This will help company in attracting more

9

business.

For Vectair Holdings Market Development strategy is best suitable in order to make growth of

the company and expand its business in UK. In this strategy firm does not bears a risk of its

products as it is selling its existing to the customers. Entering into new market in UK is

beneficial for Vectair Holdings to grow its business as it provides opportunity to cater new

customers.

TASK 2

P3: Assessment of sources of funding along with advantages and disadvantages.

Funding involves positioning of cash by a firm to meet its necessary expenses or

to fulfil its objectives. Company arranges this fund either internally or from outside the

business by providing some return to investors who helps organisation to grow its

business (Moyle and et. al., 2020). Vectair Holdings has an estimation of worth £20,000

million for investing in growth opportunity but requires £3, 00,000 million in real terms

in order to expand its business in UK. Company is having option to raise this fund from

internal and external sources both through which Vectair Holdings can arrange the deficit

funds that is worth £2,80,000 million. The available sources for raising funds are

mentioned below:

Internal Funding: This includes getting funds from internal sources of organisation by

selling some capital assets such as sale of unused furniture, decreasing working capital of

the firm, raising money form board of directors or from any other internal source.

Company through this can save acquiring cost which will help company to use this

expense in some necessary investment. This allows firm in using acquisition cost into

some other field that can bring returns for them. The major disadvantage of internal

funding that company will lose its retained earnings or reserves which was kept for

critical situations.

External Funding: This provides option to firm in raising of funds from outside the

boundaries of business such as crowd funding, equity shares, bonds, angel financing,

venture capitalist, government support, etc. This will help company in attracting more

9

and more investors and strengthen its market position via sale of its shares into market.

Getting funds from external parties will increase cost of acquisition or process expenses

which are involved in getting funds from those external parties.

Crowd Funding: This mode of raising finance is majorly adopted by new firms in

industry to arrange their funds. This involves collection of small amount of money from

large audience in the market. It increases company's brand image and gains media as well

as society attention. The major drawback of this option in that it involves a complex

process as backed by numerous legal formalities.

Angel Financing: This mode of financing involves investment by large entities in small

and medium firms and getting position in company's equity and board. The investors of

such mode guide and provide support to firms whenever required. In these companies

receives some expert insights and expert knowledge from investors. But firm needs to

share is board and decision making power with investors which can be a disadvantage for

the firm.

Business Support Grant during COVID-19: This is a financial support form the side of

UK government for businesses to run and sustain their business operations in a manner

which it was before Covid-19 period. The motive behind such grant is to support small,

medium size and large businesses based on UK which ads for country's development.

The main purpose of this financial grant is to make regular payments in terms of salaries

to company employees, workers, continuous payment of tax. It helps businesses to save

their businesses from the negative impact of covid-19 pandemic setback.

Bank Loans: Raising of finance from banks or financial institutions in a form of loan is

termed as bank loans. This method of raising finance is very common to businesses as it

provides secure transaction and is easy process. In this mode bank imposes some charges

and interest rate in against of amount of loan provided to business (Namada, 2020). For

Vectair Holdings raising finance from bank is best suitable way as this provides a secure

and long term fund. The risk involved in such mode is very low or is null which a best

decision for small and medium enterprises is as they can’t bear huge risk. The advantage

of getting bank loan is that firm is aware about its rate of return (interest rate) and time

up-to which it has to return whole amount of money. On the other hand most important

10

Getting funds from external parties will increase cost of acquisition or process expenses

which are involved in getting funds from those external parties.

Crowd Funding: This mode of raising finance is majorly adopted by new firms in

industry to arrange their funds. This involves collection of small amount of money from

large audience in the market. It increases company's brand image and gains media as well

as society attention. The major drawback of this option in that it involves a complex

process as backed by numerous legal formalities.

Angel Financing: This mode of financing involves investment by large entities in small

and medium firms and getting position in company's equity and board. The investors of

such mode guide and provide support to firms whenever required. In these companies

receives some expert insights and expert knowledge from investors. But firm needs to

share is board and decision making power with investors which can be a disadvantage for

the firm.

Business Support Grant during COVID-19: This is a financial support form the side of

UK government for businesses to run and sustain their business operations in a manner

which it was before Covid-19 period. The motive behind such grant is to support small,

medium size and large businesses based on UK which ads for country's development.

The main purpose of this financial grant is to make regular payments in terms of salaries

to company employees, workers, continuous payment of tax. It helps businesses to save

their businesses from the negative impact of covid-19 pandemic setback.

Bank Loans: Raising of finance from banks or financial institutions in a form of loan is

termed as bank loans. This method of raising finance is very common to businesses as it

provides secure transaction and is easy process. In this mode bank imposes some charges

and interest rate in against of amount of loan provided to business (Namada, 2020). For

Vectair Holdings raising finance from bank is best suitable way as this provides a secure

and long term fund. The risk involved in such mode is very low or is null which a best

decision for small and medium enterprises is as they can’t bear huge risk. The advantage

of getting bank loan is that firm is aware about its rate of return (interest rate) and time

up-to which it has to return whole amount of money. On the other hand most important

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

disadvantage of this is that firm needs to submit some security against of loan in a form

of collateral.

TASK 3

P4: Business plan for growth including financial information and strategic objectives for scaling

up a business.

Business plan is one of the key elements of the entire organisation as it covers all the

main areas that are being included in the working of the company. The business organisation has

been more focused on various areas that are being settled out. It is mainly a document that is

being proposed by the organisations which covers all the strategies and the policies which are

being adapted by the company and is being used by them in order to maintain the company’s

image and productivity in the market. The Vectair holdings has to prepare a perfect business plan

as in order to elaborate its mission, vision, its goals, objectives and also the financial stats of the

company. Through the business plans companies can make the future eradication and goals in

order to make it variedly easy for all. Through the business plans the company has a clear

objective that in which direction they will have to work and they can time to time make that easy

for all the employees to know about the target and the goals of the company. The companies

when needed to get the big investment make it clear in all the way by making a proper business

plan. As the organisation use to raise various areas and teams with the help of heads and the

stakeholders that how affectively a business plan can be made, and the areas in which the

business can be let out in the market that they increase the value of the product in there mere cost

of time. This implies to provide an affective image of the product in the market and make it clear

in all the segments by getting equal opportunists. The main reason behind making the business

plan is to attract the investors and the stakeholders so that they may make more investment with

the company and make covers the great benefit. As they help in the growth of the company and

also to increase the market image. Executive Summary- The Vectair holdings is a company based from London, UK. It

mainly covers the products that are being important for the hygiene of the individuals. As

in it makes various products for the sanitization of homes and the personal well-being of

the individual. The company is there by introducing the new product named Germicide

11

of collateral.

TASK 3

P4: Business plan for growth including financial information and strategic objectives for scaling

up a business.

Business plan is one of the key elements of the entire organisation as it covers all the

main areas that are being included in the working of the company. The business organisation has

been more focused on various areas that are being settled out. It is mainly a document that is

being proposed by the organisations which covers all the strategies and the policies which are

being adapted by the company and is being used by them in order to maintain the company’s

image and productivity in the market. The Vectair holdings has to prepare a perfect business plan

as in order to elaborate its mission, vision, its goals, objectives and also the financial stats of the

company. Through the business plans companies can make the future eradication and goals in

order to make it variedly easy for all. Through the business plans the company has a clear

objective that in which direction they will have to work and they can time to time make that easy

for all the employees to know about the target and the goals of the company. The companies

when needed to get the big investment make it clear in all the way by making a proper business

plan. As the organisation use to raise various areas and teams with the help of heads and the

stakeholders that how affectively a business plan can be made, and the areas in which the

business can be let out in the market that they increase the value of the product in there mere cost

of time. This implies to provide an affective image of the product in the market and make it clear

in all the segments by getting equal opportunists. The main reason behind making the business

plan is to attract the investors and the stakeholders so that they may make more investment with

the company and make covers the great benefit. As they help in the growth of the company and

also to increase the market image. Executive Summary- The Vectair holdings is a company based from London, UK. It

mainly covers the products that are being important for the hygiene of the individuals. As

in it makes various products for the sanitization of homes and the personal well-being of

the individual. The company is there by introducing the new product named Germicide

11

room freshener which will help out to make the air fresh by adding the fragrance and with

that will kill all the bacteria of that room. Business details- the company is there by holding the new product named Germicide

room freshener which will help in room freshener as well as lays out to kill germs. Industry and Market analysis- This product is based on the health and hygiene industry

and with that it calculates to cover all the age group of people as according to it in

COVID all the age group are being required for this product. And it covers all the age

groups in UK. Market Strategy- The company shall use the product diversification strategy as in order

to enter in the market with new product and increase their growth in the market. Operation Plan- The Company use to serve the products in UK as they helps out to

maintain all the areas on the market in order for further expansion. Management team and company structure- The company Vectairs holdings use the

hierarchical structure as there has been made all the lower and the upper level employees

and they work in the proper management and directions as being mentioned and

stimulated to maintain the growth. Resources- The company will require all the human resource and with that various

essence and alcohol with various disinfectants.

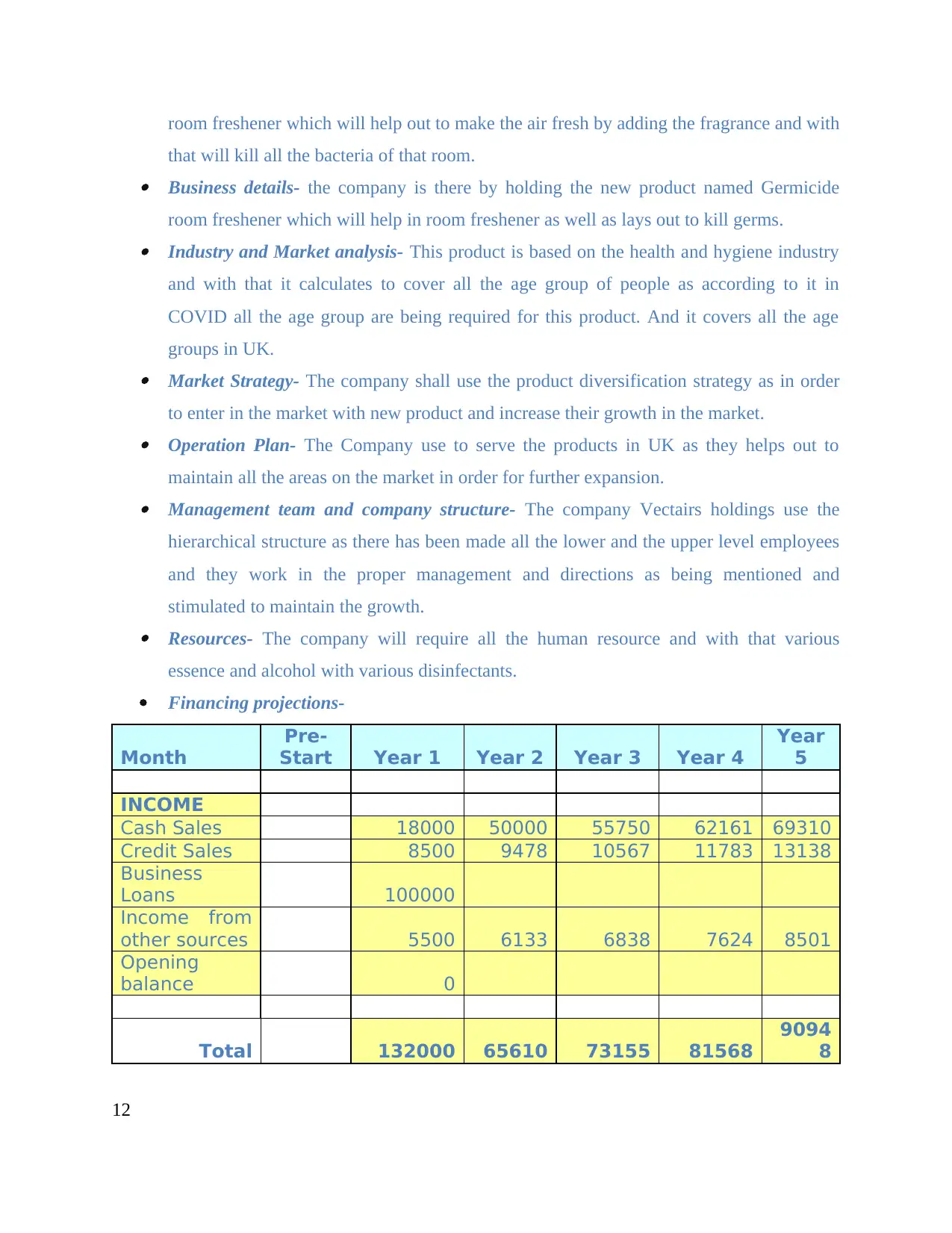

Financing projections-

Month

Pre-

Start Year 1 Year 2 Year 3 Year 4

Year

5

INCOME

Cash Sales 18000 50000 55750 62161 69310

Credit Sales 8500 9478 10567 11783 13138

Business

Loans 100000

Income from

other sources 5500 6133 6838 7624 8501

Opening

balance 0

Total 132000 65610 73155 81568

9094

8

12

that will kill all the bacteria of that room. Business details- the company is there by holding the new product named Germicide

room freshener which will help in room freshener as well as lays out to kill germs. Industry and Market analysis- This product is based on the health and hygiene industry

and with that it calculates to cover all the age group of people as according to it in

COVID all the age group are being required for this product. And it covers all the age

groups in UK. Market Strategy- The company shall use the product diversification strategy as in order

to enter in the market with new product and increase their growth in the market. Operation Plan- The Company use to serve the products in UK as they helps out to

maintain all the areas on the market in order for further expansion. Management team and company structure- The company Vectairs holdings use the

hierarchical structure as there has been made all the lower and the upper level employees

and they work in the proper management and directions as being mentioned and

stimulated to maintain the growth. Resources- The company will require all the human resource and with that various

essence and alcohol with various disinfectants.

Financing projections-

Month

Pre-

Start Year 1 Year 2 Year 3 Year 4

Year

5

INCOME

Cash Sales 18000 50000 55750 62161 69310

Credit Sales 8500 9478 10567 11783 13138

Business

Loans 100000

Income from

other sources 5500 6133 6838 7624 8501

Opening

balance 0

Total 132000 65610 73155 81568

9094

8

12

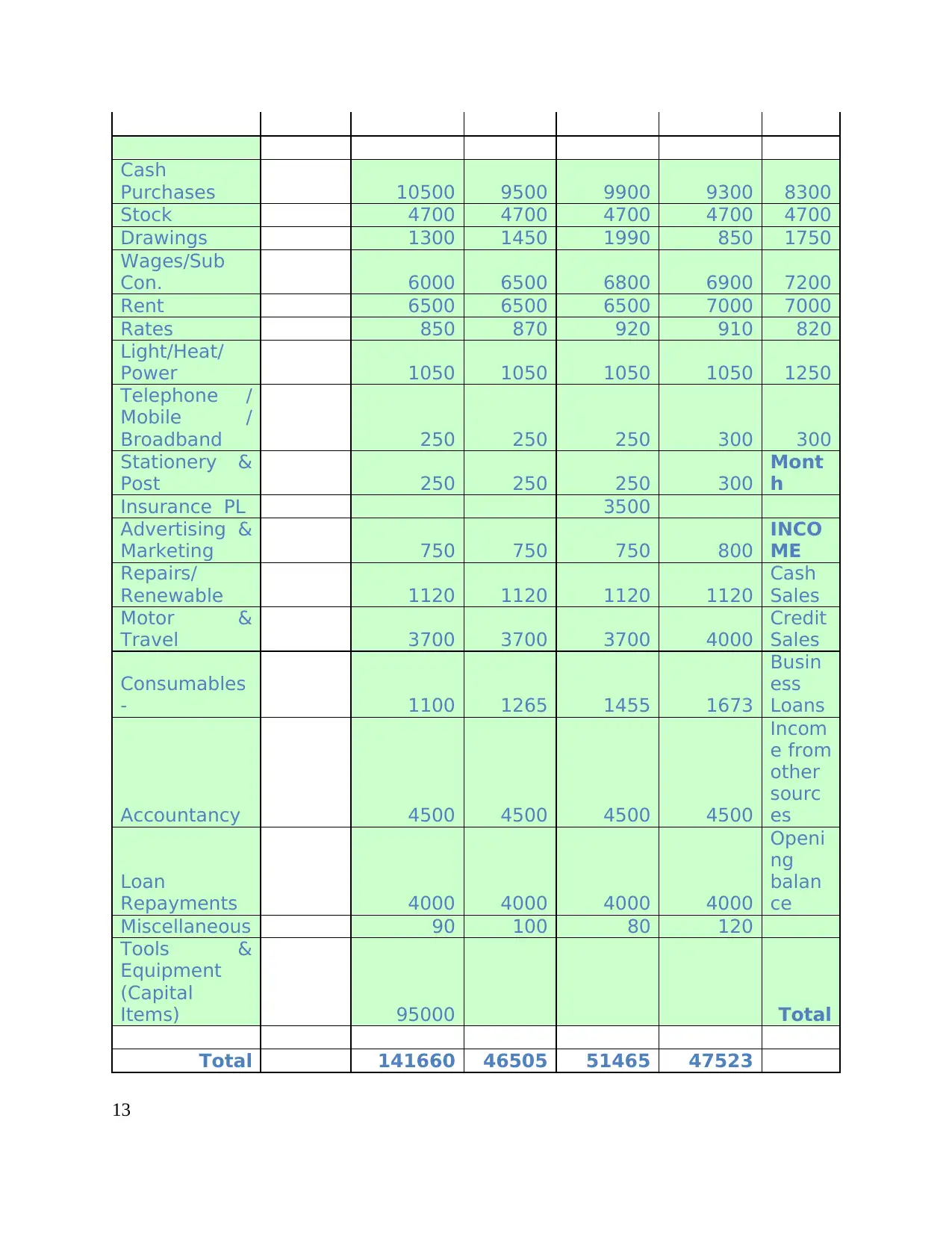

Cash

Purchases 10500 9500 9900 9300 8300

Stock 4700 4700 4700 4700 4700

Drawings 1300 1450 1990 850 1750

Wages/Sub

Con. 6000 6500 6800 6900 7200

Rent 6500 6500 6500 7000 7000

Rates 850 870 920 910 820

Light/Heat/

Power 1050 1050 1050 1050 1250

Telephone /

Mobile /

Broadband 250 250 250 300 300

Stationery &

Post 250 250 250 300

Mont

h

Insurance PL 3500

Advertising &

Marketing 750 750 750 800

INCO

ME

Repairs/

Renewable 1120 1120 1120 1120

Cash

Sales

Motor &

Travel 3700 3700 3700 4000

Credit

Sales

Consumables

- 1100 1265 1455 1673

Busin

ess

Loans

Accountancy 4500 4500 4500 4500

Incom

e from

other

sourc

es

Loan

Repayments 4000 4000 4000 4000

Openi

ng

balan

ce

Miscellaneous 90 100 80 120

Tools &

Equipment

(Capital

Items) 95000 Total

Total 141660 46505 51465 47523

13

Purchases 10500 9500 9900 9300 8300

Stock 4700 4700 4700 4700 4700

Drawings 1300 1450 1990 850 1750

Wages/Sub

Con. 6000 6500 6800 6900 7200

Rent 6500 6500 6500 7000 7000

Rates 850 870 920 910 820

Light/Heat/

Power 1050 1050 1050 1050 1250

Telephone /

Mobile /

Broadband 250 250 250 300 300

Stationery &

Post 250 250 250 300

Mont

h

Insurance PL 3500

Advertising &

Marketing 750 750 750 800

INCO

ME

Repairs/

Renewable 1120 1120 1120 1120

Cash

Sales

Motor &

Travel 3700 3700 3700 4000

Credit

Sales

Consumables

- 1100 1265 1455 1673

Busin

ess

Loans

Accountancy 4500 4500 4500 4500

Incom

e from

other

sourc

es

Loan

Repayments 4000 4000 4000 4000

Openi

ng

balan

ce

Miscellaneous 90 100 80 120

Tools &

Equipment

(Capital

Items) 95000 Total

Total 141660 46505 51465 47523

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash

Purch

ases

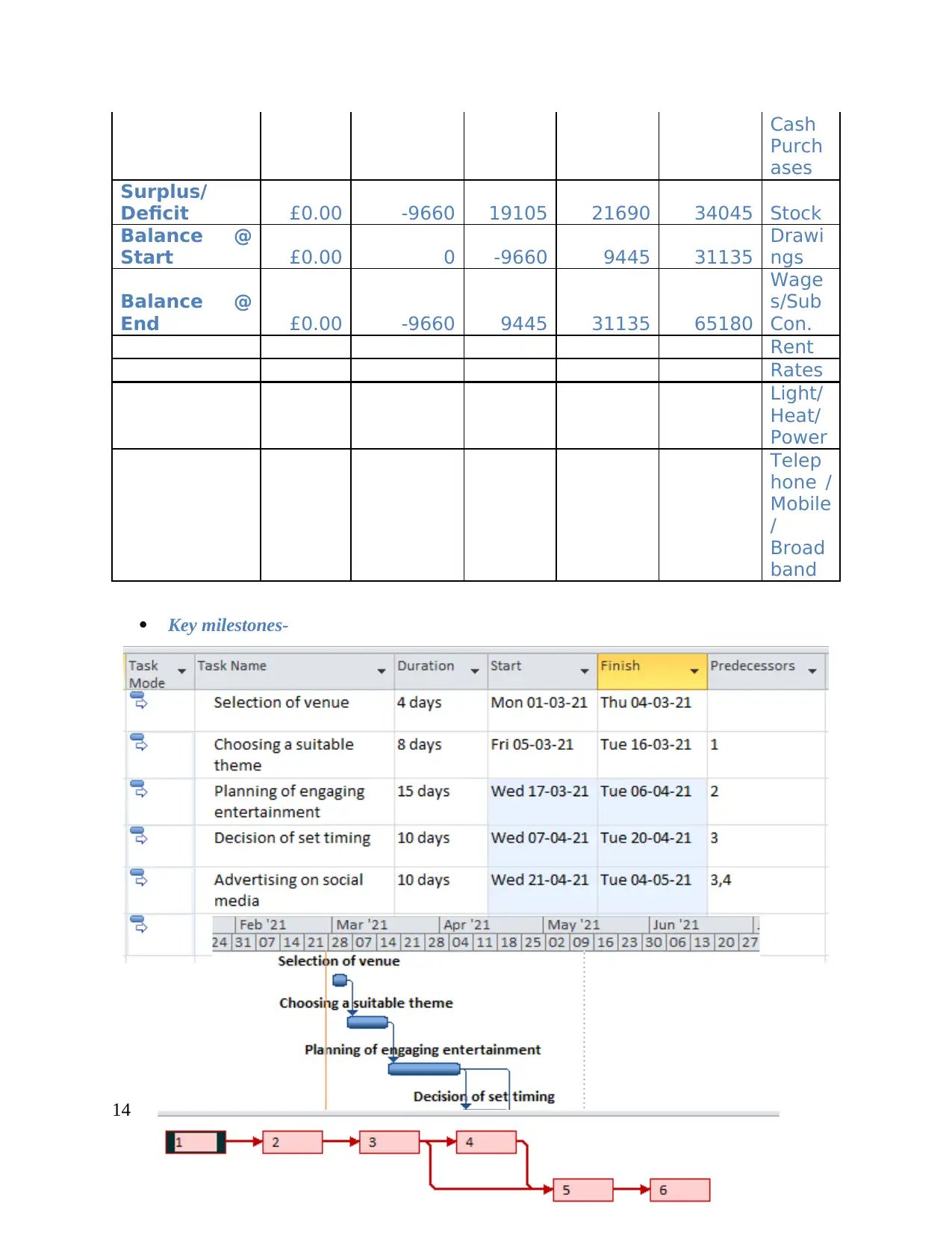

Surplus/

Deficit £0.00 -9660 19105 21690 34045 Stock

Balance @

Start £0.00 0 -9660 9445 31135

Drawi

ngs

Balance @

End £0.00 -9660 9445 31135 65180

Wage

s/Sub

Con.

Rent

Rates

Light/

Heat/

Power

Telep

hone /

Mobile

/

Broad

band

Key milestones-

14

Purch

ases

Surplus/

Deficit £0.00 -9660 19105 21690 34045 Stock

Balance @

Start £0.00 0 -9660 9445 31135

Drawi

ngs

Balance @

End £0.00 -9660 9445 31135 65180

Wage

s/Sub

Con.

Rent

Rates

Light/

Heat/

Power

Telep

hone /

Mobile

/

Broad

band

Key milestones-

14

Financial information- The Vectair holding is trying to make various new launching in

all the household hygienic products and form that they are being trying to make certain

obligations which provide the roles and the variables for the market. The company

focuses on targeting the market and raising more funds through the investors. They are

using various online platforms in order to gain the market value.

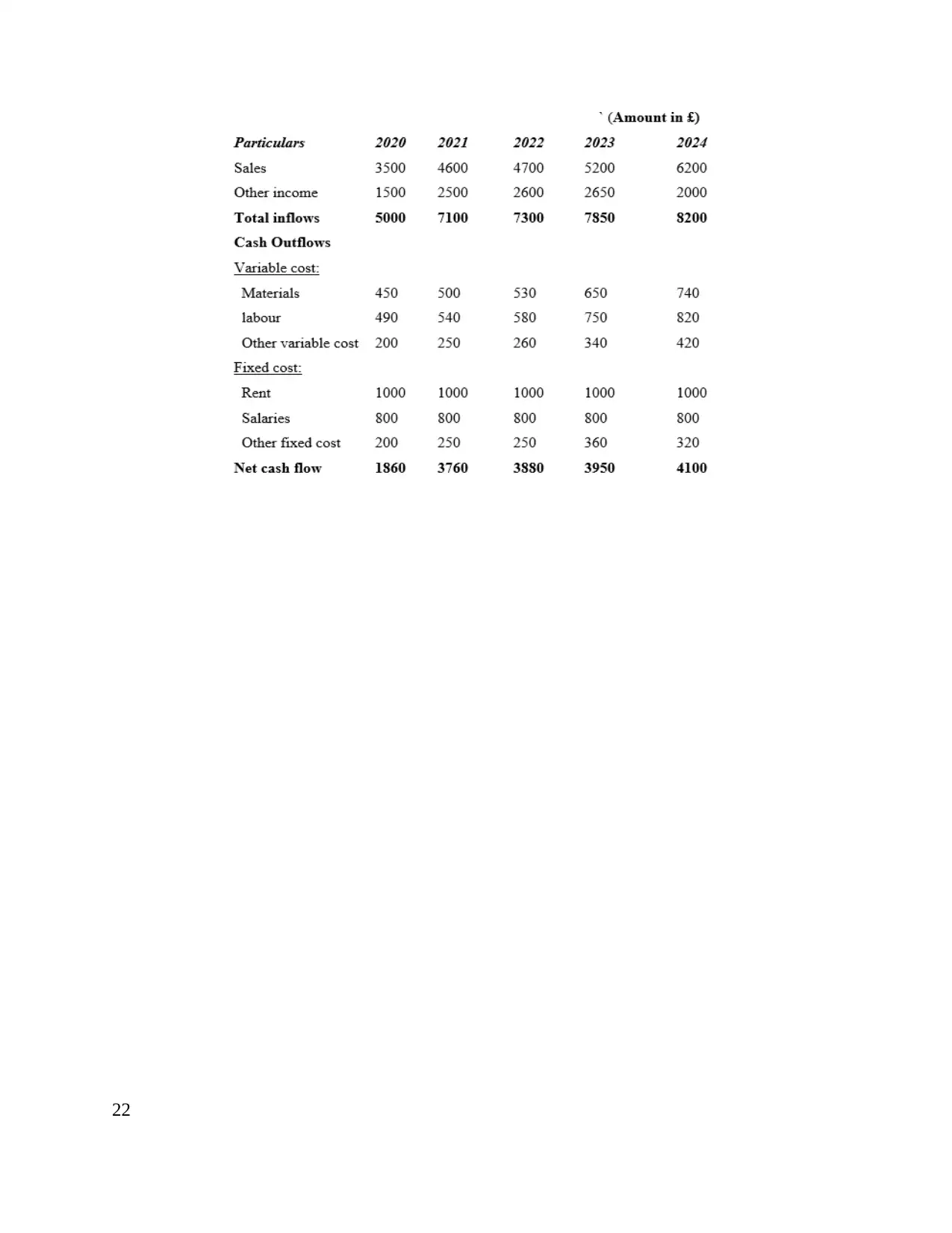

From the statement of Vectair Holdings, it is clearly shown that company bears enough cash for

meeting its debts. The company is required to pay other fixed cost which gets change yearly.

Vectair Holdings estimates cash in its hand from year 2020 to year 2024 which is £1860, £3760,

£3880, £3950 and £4100 respectively. The average income of company is approx £72,001 for five

considered years. Mission- The mission of the Vectair holding is to develop such products in the market

that will help to add value added health and also the hygiene in the market in the

affordable prices. Vision- the main vision of the Vectair holdings is to improve the standard of living of

people by giving them proper hygienic products and to promote their brand in the market

with the best quality of hygienic products supplies.

Objectives- The main objective of the company is to provide various expansion of the

Vectair holding in the market. The company though focuses on making some variant and

cultural hygienic products that will there by helps in order to grow the company’s

requirement and to gain more customers. As in UK the vectair holding covers large

amount of hygienic products by following the SMART objectives. Through this strategy

the companies tries to make various goals and objectives that are measurable and is being

accomplished, practical that has to be done in the specific period of time. The company

aims to make the new product so as to create the advancement and make it clear for all

the customers by making the room freshener that will help them out to kill the germs.

This will develop the company to increase their growth in various market and in the

customers. The vectair holding is making various new sanitizing products and in the time

of COVID this is being most helpful as most of the groups of people are radically being

using this and there is the maximum sale occurs in this recent time.

15

all the household hygienic products and form that they are being trying to make certain

obligations which provide the roles and the variables for the market. The company

focuses on targeting the market and raising more funds through the investors. They are

using various online platforms in order to gain the market value.

From the statement of Vectair Holdings, it is clearly shown that company bears enough cash for

meeting its debts. The company is required to pay other fixed cost which gets change yearly.

Vectair Holdings estimates cash in its hand from year 2020 to year 2024 which is £1860, £3760,

£3880, £3950 and £4100 respectively. The average income of company is approx £72,001 for five

considered years. Mission- The mission of the Vectair holding is to develop such products in the market

that will help to add value added health and also the hygiene in the market in the

affordable prices. Vision- the main vision of the Vectair holdings is to improve the standard of living of

people by giving them proper hygienic products and to promote their brand in the market

with the best quality of hygienic products supplies.

Objectives- The main objective of the company is to provide various expansion of the

Vectair holding in the market. The company though focuses on making some variant and

cultural hygienic products that will there by helps in order to grow the company’s

requirement and to gain more customers. As in UK the vectair holding covers large

amount of hygienic products by following the SMART objectives. Through this strategy

the companies tries to make various goals and objectives that are measurable and is being

accomplished, practical that has to be done in the specific period of time. The company

aims to make the new product so as to create the advancement and make it clear for all

the customers by making the room freshener that will help them out to kill the germs.

This will develop the company to increase their growth in various market and in the

customers. The vectair holding is making various new sanitizing products and in the time

of COVID this is being most helpful as most of the groups of people are radically being

using this and there is the maximum sale occurs in this recent time.

15

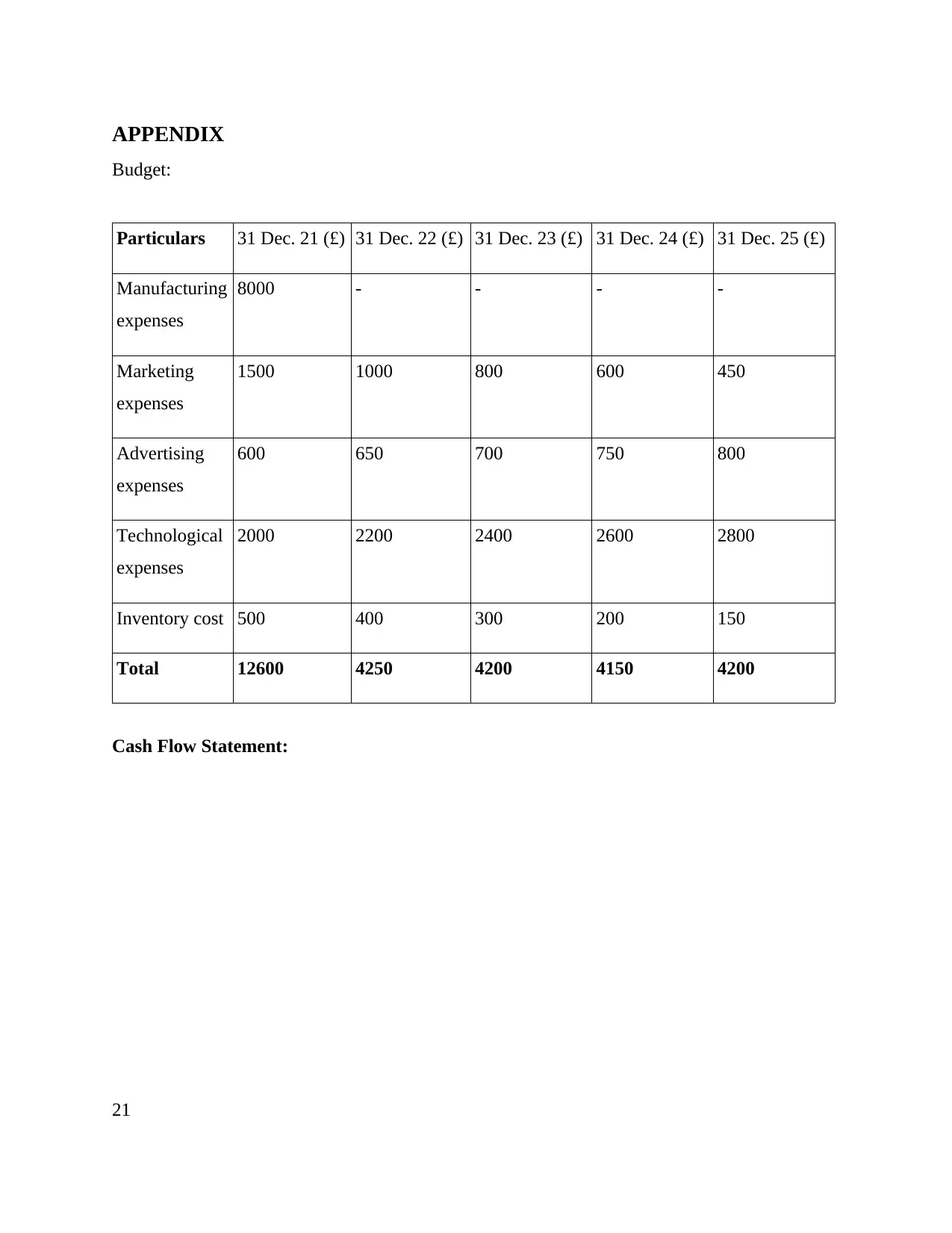

Budget- A budget is being analysed in order tom make the market value of the product

and also the Vectair holding has made certain potential areas in which the targeted

customers are being covered and the areas in which the money can there by being

invested. The financial informations helps the companies to give them an adequate

information that helps to provide various means and working and also implies that all the

investment and the fund can only be raised by the help of accurate financial plans. There

is being analysed that all the financial information helps to give a clear idea about the

company and its working.

Strategy- The Vectair holding will there by use the model Ansoff matrix and that model

helps out to know the advantages and the position of the company in varies areas and

with that it frames out the method through which the market and the production can be

increased in any organisation. Thus there are Market penetration, Product development,

Market development and diversification and in that the Vectair holding can take the

Product development as they can take the help by making the new product that is

Germicide room freshener in the existing market in order to increase the market value.

Risk- As by the increase in competition it is a high risk that the product will there by

succeed when there has been framed that in all the methods and the areas there complies

the areas through which this can be framed, and as all the customers use to rely on the

brand and the product they are already using so it is quite difficult for them to switch on

the new one. So the company will face this risk in all there new launching.

TASK 4

P5: Succession and exit plan for small business with its advantages and disadvantages.

The term business environment is very tedious in its characteristics which comprises of

different factors that influences workings of organisation. These factors act as forces which

creates problem and challenges in coping up with those hindrances (Smith, 2020). For Vectair

Holdings the forces of business environment affects its new product business due to dynamic

environment which affects company’s profitability ratio and sustainability in market. Company

is not able to meet its losses and due to this Vectair Holdings chooses to exit the market. The

ways through which company can exit the market is under:

16

and also the Vectair holding has made certain potential areas in which the targeted

customers are being covered and the areas in which the money can there by being

invested. The financial informations helps the companies to give them an adequate

information that helps to provide various means and working and also implies that all the

investment and the fund can only be raised by the help of accurate financial plans. There

is being analysed that all the financial information helps to give a clear idea about the

company and its working.

Strategy- The Vectair holding will there by use the model Ansoff matrix and that model

helps out to know the advantages and the position of the company in varies areas and

with that it frames out the method through which the market and the production can be

increased in any organisation. Thus there are Market penetration, Product development,

Market development and diversification and in that the Vectair holding can take the

Product development as they can take the help by making the new product that is

Germicide room freshener in the existing market in order to increase the market value.

Risk- As by the increase in competition it is a high risk that the product will there by

succeed when there has been framed that in all the methods and the areas there complies

the areas through which this can be framed, and as all the customers use to rely on the

brand and the product they are already using so it is quite difficult for them to switch on

the new one. So the company will face this risk in all there new launching.

TASK 4

P5: Succession and exit plan for small business with its advantages and disadvantages.

The term business environment is very tedious in its characteristics which comprises of

different factors that influences workings of organisation. These factors act as forces which

creates problem and challenges in coping up with those hindrances (Smith, 2020). For Vectair

Holdings the forces of business environment affects its new product business due to dynamic

environment which affects company’s profitability ratio and sustainability in market. Company

is not able to meet its losses and due to this Vectair Holdings chooses to exit the market. The

ways through which company can exit the market is under:

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Liquidation: Under this mode company becomes insolvent and brings an end to the

business by disposing firm’s assets and liabilities based on the priority of settlement

(Sorensen, 2020). Company need not to bear any loss or liabilities after liquidation.

Business no longer will be treated as owner of sold assets.

Selling of business in open market: This involve transferring all rights and

responsibilities of business to some another person in market in against of some one time

consideration. The motive of business remains same instead of giving a full stop to

business it only changes owners. It becomes easy to continue business operations further

by new owner as the employees are existing and they are well familiar with its functions.

There is a possibility of low valuation at the time of sell.

Transferring Business to Family Members: This method of exiting from a current

business involves transferring all rights, powers, responsibility, assets and liabilities of

company to a family member who is ready to take up such business and all things

associated with it. A seller of business can possess control even after sale till full payment

of business consideration to him. Transferring of business to non-competent family

member can take business to face loss and experience negative outcomes.

Merger and Acquisition: This involves merging with a large firm in order to operate as

a single firm. Acquiring firm in this case will be more superior and will possess decision

making power as well control in management board. The firm which gets merged

receives some consideration based on market or historical value of its assets and

liabilities from acquiring firm.

Transferring business to family member is best suitable for Vectair Holdings because

company will have its control on business until full payment of consideration. Transfer

of business to family also saves company's secrecy and unique organizational culture

which would not left secret after selling business to external party. Through transferring

to family member business owners will get benefit in saving tax and also transferor will

be rest assured in maintaining business ethics and code of conduct as the successor is

known to the seller. Vectair Holdings will be able to enjoy profits form the business even

after sale because the next owner of the company will be a family member and earning

through a family member is helpful for whole family.

17

business by disposing firm’s assets and liabilities based on the priority of settlement

(Sorensen, 2020). Company need not to bear any loss or liabilities after liquidation.

Business no longer will be treated as owner of sold assets.

Selling of business in open market: This involve transferring all rights and

responsibilities of business to some another person in market in against of some one time

consideration. The motive of business remains same instead of giving a full stop to

business it only changes owners. It becomes easy to continue business operations further

by new owner as the employees are existing and they are well familiar with its functions.

There is a possibility of low valuation at the time of sell.

Transferring Business to Family Members: This method of exiting from a current

business involves transferring all rights, powers, responsibility, assets and liabilities of

company to a family member who is ready to take up such business and all things

associated with it. A seller of business can possess control even after sale till full payment

of business consideration to him. Transferring of business to non-competent family

member can take business to face loss and experience negative outcomes.

Merger and Acquisition: This involves merging with a large firm in order to operate as

a single firm. Acquiring firm in this case will be more superior and will possess decision

making power as well control in management board. The firm which gets merged

receives some consideration based on market or historical value of its assets and

liabilities from acquiring firm.

Transferring business to family member is best suitable for Vectair Holdings because

company will have its control on business until full payment of consideration. Transfer

of business to family also saves company's secrecy and unique organizational culture

which would not left secret after selling business to external party. Through transferring

to family member business owners will get benefit in saving tax and also transferor will

be rest assured in maintaining business ethics and code of conduct as the successor is

known to the seller. Vectair Holdings will be able to enjoy profits form the business even

after sale because the next owner of the company will be a family member and earning

through a family member is helpful for whole family.

17

CONCLUSION

In this report it is being concluded that the planning is an important aspect for all the

business entities and that implies to provide all the growth and success to the companies in the

market. The companies has to identify various goals and the factors that are being important in

the business as the external sources are there by being more important and Pestle and Ansoff

matrix will help to know about the company. There are various sources which are like bank

loans, financing, crowd funding etc. which helps in getting more investment for the organisation.

The business plan plays a very crucial part in the success of the company as it clarify the ideas of

the company on which they are going to focus and attracts the investors to invest on there

products. When company does not able to pay its debts or recover losses in changing

environment then it is better for company to leave the market and make an exit from it. Vectair

Holdings chooses to exit market when it is suffering losses and is unable to survive in dynamic

environment. From the above report it is founded that Vectair Holdings goes for the process of

liquidation while planning to exit market.

18

In this report it is being concluded that the planning is an important aspect for all the

business entities and that implies to provide all the growth and success to the companies in the

market. The companies has to identify various goals and the factors that are being important in

the business as the external sources are there by being more important and Pestle and Ansoff

matrix will help to know about the company. There are various sources which are like bank

loans, financing, crowd funding etc. which helps in getting more investment for the organisation.

The business plan plays a very crucial part in the success of the company as it clarify the ideas of

the company on which they are going to focus and attracts the investors to invest on there

products. When company does not able to pay its debts or recover losses in changing

environment then it is better for company to leave the market and make an exit from it. Vectair

Holdings chooses to exit market when it is suffering losses and is unable to survive in dynamic

environment. From the above report it is founded that Vectair Holdings goes for the process of

liquidation while planning to exit market.

18

REFERENCES

Books and Journals

Adyana, A.A. and Hanani, A.D., 2020, September. SBH strategic planning of new business

development. In Contemporary Research on Business and Management: Proceedings of

the International Seminar of Contemporary Research on Business and Management

(ISCRBM 2019), 27-29 November, 2019, Jakarta, Indonesia (p. 32). CRC Press.

De las Rivas Sanz and et. al., 2020. Planning for Growth: Contradictions in the Framework of

Economic and Urban Development from the “Spanish Miracle”(1959-1973). Journal of

Urban History, p.0096144220983336.

Freire Trigo, S., 2020. Vacant land in London: a planning tool to create land for

growth. International Planning Studies. 25(3). pp.261-276.

Hassanpour, I. and Giti Nejad, M.R., 2020. Regional Planning in Developing an Entrepreneurial

Marketing Pattern in Innovative Iranian Innovative Companies. Geography (Regional

Planning). 10(2-3). pp.577-588.

Irina, H., 2020. Bussiness-planning system approach. sustainable development.

Jian ., 2021. Business creation, innovation, and economic growth: Evidence from China’s

economic transition, 1978–2017. Economic Modelling. 96. pp.371-378.

Katsarski, N., 2020. STRATEGIC INTEGRATED BUSINESS PLANNING IN THE

CONTEXT OF CONVERGENCE OF BALKAN COUNTRIES. International

Multidisciplinary Scientific GeoConference: SGEM. 20(5.2). pp.479-487.

Lee, J. and Jung, S., 2020. Industrial land use planning and the growth of knowledge industry:

Location pattern of knowledge-intensive services and their determinants in the Seoul

metropolitan area. Land Use Policy. 95. p.104632.

Matias, C. and Franco, M., 2020. The role of the family council and protocol in planning the

succession process in family firms. Journal of Family Business Management.

Mazzarol, T. and Reboud, S., 2020. Planning, Business Models and Strategy.

In Entrepreneurship and Innovation (pp. 191-225). Springer, Singapore.

Moyle and et. al., 2020. Entrepreneurial strategies and tourism industry growth. Tourism

Management Perspectives. 35. p.100708.

19

Books and Journals

Adyana, A.A. and Hanani, A.D., 2020, September. SBH strategic planning of new business

development. In Contemporary Research on Business and Management: Proceedings of

the International Seminar of Contemporary Research on Business and Management

(ISCRBM 2019), 27-29 November, 2019, Jakarta, Indonesia (p. 32). CRC Press.

De las Rivas Sanz and et. al., 2020. Planning for Growth: Contradictions in the Framework of

Economic and Urban Development from the “Spanish Miracle”(1959-1973). Journal of

Urban History, p.0096144220983336.

Freire Trigo, S., 2020. Vacant land in London: a planning tool to create land for

growth. International Planning Studies. 25(3). pp.261-276.

Hassanpour, I. and Giti Nejad, M.R., 2020. Regional Planning in Developing an Entrepreneurial

Marketing Pattern in Innovative Iranian Innovative Companies. Geography (Regional

Planning). 10(2-3). pp.577-588.

Irina, H., 2020. Bussiness-planning system approach. sustainable development.

Jian ., 2021. Business creation, innovation, and economic growth: Evidence from China’s

economic transition, 1978–2017. Economic Modelling. 96. pp.371-378.

Katsarski, N., 2020. STRATEGIC INTEGRATED BUSINESS PLANNING IN THE

CONTEXT OF CONVERGENCE OF BALKAN COUNTRIES. International

Multidisciplinary Scientific GeoConference: SGEM. 20(5.2). pp.479-487.

Lee, J. and Jung, S., 2020. Industrial land use planning and the growth of knowledge industry:

Location pattern of knowledge-intensive services and their determinants in the Seoul

metropolitan area. Land Use Policy. 95. p.104632.

Matias, C. and Franco, M., 2020. The role of the family council and protocol in planning the

succession process in family firms. Journal of Family Business Management.

Mazzarol, T. and Reboud, S., 2020. Planning, Business Models and Strategy.

In Entrepreneurship and Innovation (pp. 191-225). Springer, Singapore.

Moyle and et. al., 2020. Entrepreneurial strategies and tourism industry growth. Tourism

Management Perspectives. 35. p.100708.

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Namada, J.M., 2020. The Role of Strategy Implementation in the Relationship Between Strategic

Planning Systems and Performance. International Journal of Business Strategy and

Automation (IJBSA). 1(1). pp.1-23.

Owen, N. and Taylor, W., 2020. Succession planning for family-owned wineries: Sale as an

option within the succession plan. Australian and New Zealand Grapegrower and

Winemaker. (672). p.79.

Prezioso, M., 2020. Planning regional growth through cultural heritage. Planning regional

growth through cultural heritage, pp.47-49.

Vorobec and et. al., 2020. Simulation Model of Planning Financial and Economic Indicators of

an Enterprise on the Basis of Business Model Formalization. In Data-Centric Business

and Applications (pp. 299-318). Springer, Cham.

20

Planning Systems and Performance. International Journal of Business Strategy and

Automation (IJBSA). 1(1). pp.1-23.

Owen, N. and Taylor, W., 2020. Succession planning for family-owned wineries: Sale as an

option within the succession plan. Australian and New Zealand Grapegrower and

Winemaker. (672). p.79.

Prezioso, M., 2020. Planning regional growth through cultural heritage. Planning regional

growth through cultural heritage, pp.47-49.

Vorobec and et. al., 2020. Simulation Model of Planning Financial and Economic Indicators of

an Enterprise on the Basis of Business Model Formalization. In Data-Centric Business

and Applications (pp. 299-318). Springer, Cham.

20

APPENDIX

Budget:

Particulars 31 Dec. 21 (£) 31 Dec. 22 (£) 31 Dec. 23 (£) 31 Dec. 24 (£) 31 Dec. 25 (£)

Manufacturing

expenses

8000 - - - -

Marketing

expenses

1500 1000 800 600 450

Advertising

expenses

600 650 700 750 800

Technological

expenses

2000 2200 2400 2600 2800

Inventory cost 500 400 300 200 150

Total 12600 4250 4200 4150 4200

Cash Flow Statement:

21

Budget:

Particulars 31 Dec. 21 (£) 31 Dec. 22 (£) 31 Dec. 23 (£) 31 Dec. 24 (£) 31 Dec. 25 (£)

Manufacturing

expenses

8000 - - - -

Marketing

expenses

1500 1000 800 600 450

Advertising

expenses

600 650 700 750 800

Technological

expenses

2000 2200 2400 2600 2800

Inventory cost 500 400 300 200 150

Total 12600 4250 4200 4150 4200

Cash Flow Statement:

21

22

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.