BTEC Higher National Diploma: Management Accounting Report - Unit 5

VerifiedAdded on 2023/01/05

|19

|4536

|59

Report

AI Summary

This report delves into the realm of management accounting, focusing on its practical applications within Capital Joinery Ltd. It begins by outlining various management accounting systems, including cost accounting, inventory management, job order costing, and price optimization systems. The report then explores management accounting reporting, detailing cost reports, departmental reports, performance assessments, and budget reports. The core of the report involves cost calculation techniques, comparing absorption and marginal costing, and analyzing material variances using the LIFO method and average cost methods. Furthermore, the report examines the benefits of management accounting systems and provides a critical evaluation of their implementation. Planning tools are discussed and analyzed, and a comparative analysis of how organizations utilize management accounting systems to solve financial problems is presented. The report concludes with an evaluation of planning tools and offers a concise summary of the key findings and recommendations.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

P1: Management accounting systems......................................................................................................3

P2: Management accounting reporting....................................................................................................5

M1: Benefits of Management accounting systems...................................................................................6

D1: Critical evaluation of Management accounting systems...................................................................6

TASK 2.......................................................................................................................................................7

P3: Calculation of costs...........................................................................................................................7

M2: Accurate application of management accounting techniques...........................................................8

D2: Producing of financial reports for accurate analysis and interpretation of data.................................8

TASK 3.......................................................................................................................................................9

P4: Advantages and Disadvantages of planning tools..............................................................................9

M3: Analysis of the use of planning tools.............................................................................................10

TASK 4.....................................................................................................................................................11

P5: Comparison of organizations in their usage of management accounting systems to solve financial

problems................................................................................................................................................11

M4: Analysis of response to financial problems....................................................................................12

D3: Evaluation of planning tools...........................................................................................................13

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

P1: Management accounting systems......................................................................................................3

P2: Management accounting reporting....................................................................................................5

M1: Benefits of Management accounting systems...................................................................................6

D1: Critical evaluation of Management accounting systems...................................................................6

TASK 2.......................................................................................................................................................7

P3: Calculation of costs...........................................................................................................................7

M2: Accurate application of management accounting techniques...........................................................8

D2: Producing of financial reports for accurate analysis and interpretation of data.................................8

TASK 3.......................................................................................................................................................9

P4: Advantages and Disadvantages of planning tools..............................................................................9

M3: Analysis of the use of planning tools.............................................................................................10

TASK 4.....................................................................................................................................................11

P5: Comparison of organizations in their usage of management accounting systems to solve financial

problems................................................................................................................................................11

M4: Analysis of response to financial problems....................................................................................12

D3: Evaluation of planning tools...........................................................................................................13

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION

Management Accounting means the process in which administrators make use of financial

statistics, evidence and knowledge provided within an entity so that they can accurately and

reliably make smaller, medium to long choices in the future (Otley, 2016). It will be very

effective to use this strategy so that managers can promote the completion of goals and priorities

in the future. Capital Joinery Ltd will be the subject of this article. It is a business that

manufactures joinery, produced gates, frames, etc. The specific emphasis of this study would be

on showing the interpretation of management accounting practices, measuring costs using

relevant methods, and explaining the application of forecasting tools. In particular, as phase of

this effort, a contrast of the ways in which firms use accounting systems to address financial

issues would be addressed.

MAIN BODY

P1: Management accounting systems

There are various types of schemes of management accounting that are used to effectively and

successfully evaluate and handle financial data. In Capital Joinery Ltd. the following schemes

are used—

Cost accounting system-It is a system wherein inside the company a calculation of expenses is

produced. They are able to make sure how they can promote a decrease in these expenses by

incorporating suitable procedures and strategies in their use. Capital Joinery Ltd. will allow use

of such a framework so that it is important to directly quantify the impact and to use tools and

approaches to lower the costs.

Essential requirements-

In this scheme, input estimation must be used such that the firm's inputs are evaluated.

This method also should insure that expenses are accurately estimated and adequately

divided in the organizations so that they're being allocated as per the amount of costs

generated by each respective department.

Management Accounting means the process in which administrators make use of financial

statistics, evidence and knowledge provided within an entity so that they can accurately and

reliably make smaller, medium to long choices in the future (Otley, 2016). It will be very

effective to use this strategy so that managers can promote the completion of goals and priorities

in the future. Capital Joinery Ltd will be the subject of this article. It is a business that

manufactures joinery, produced gates, frames, etc. The specific emphasis of this study would be

on showing the interpretation of management accounting practices, measuring costs using

relevant methods, and explaining the application of forecasting tools. In particular, as phase of

this effort, a contrast of the ways in which firms use accounting systems to address financial

issues would be addressed.

MAIN BODY

P1: Management accounting systems

There are various types of schemes of management accounting that are used to effectively and

successfully evaluate and handle financial data. In Capital Joinery Ltd. the following schemes

are used—

Cost accounting system-It is a system wherein inside the company a calculation of expenses is

produced. They are able to make sure how they can promote a decrease in these expenses by

incorporating suitable procedures and strategies in their use. Capital Joinery Ltd. will allow use

of such a framework so that it is important to directly quantify the impact and to use tools and

approaches to lower the costs.

Essential requirements-

In this scheme, input estimation must be used such that the firm's inputs are evaluated.

This method also should insure that expenses are accurately estimated and adequately

divided in the organizations so that they're being allocated as per the amount of costs

generated by each respective department.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory management system- The application of strategies and practices must be used in this

process so the inventory volume can be calculated within organizations (Maas, Schaltegger and

Crutzen, 2016). Companies are now able to measure the extent of their stock accurately and

reliably when making use of everything. Thus it is critical, in the sense of Capital Joinery Ltd.,

the use of this method is made transparent to the organization so that it can reduce the expense of

its stock levels and thereby ensure maximization of the total level of income.

Essential requirements -

In this scheme, measures such as LIFO, FIFO, Weighted Rate, etc. must be used so that

the inventory volume can be measured and recorded in the correct way.

This method can allow companies to insure that a decrease of inventory cost of

maintenance can be accomplished, thereby helping to minimize the total amount of

spending and increase income.

Job order costing-It is a method that provides multiple methods and methods to estimate the

inflows of work order in order to identify and pay the amount of the job. Companies such as

Capital Joinery Ltd. can benefit by making use of this method. It is because it is a production

industry and the use of this method provides different kinds of advantages for industrial

companies. To increase profits, they should insure that they are using strategies and procedures

to will job costs.

Essential requirements -

There must be a use of a variable in this method from which the expenses of work can be

measured. In this way employers can guarantee that a decrease in the amount of earnings

can be achieved by recognizing the expense of the work.

This method would provide a clear list of the various work orders such that it is possible

to accurately do their accounting.

Price optimization system- This is a system in which it would be possible to predict costs to be

fixed for the potential so that the business can gain better income in the future (Bromwich and

Scapens, 2016). Usage of this method should be rendered in the sense of Capital Joinery Ltd. so

process so the inventory volume can be calculated within organizations (Maas, Schaltegger and

Crutzen, 2016). Companies are now able to measure the extent of their stock accurately and

reliably when making use of everything. Thus it is critical, in the sense of Capital Joinery Ltd.,

the use of this method is made transparent to the organization so that it can reduce the expense of

its stock levels and thereby ensure maximization of the total level of income.

Essential requirements -

In this scheme, measures such as LIFO, FIFO, Weighted Rate, etc. must be used so that

the inventory volume can be measured and recorded in the correct way.

This method can allow companies to insure that a decrease of inventory cost of

maintenance can be accomplished, thereby helping to minimize the total amount of

spending and increase income.

Job order costing-It is a method that provides multiple methods and methods to estimate the

inflows of work order in order to identify and pay the amount of the job. Companies such as

Capital Joinery Ltd. can benefit by making use of this method. It is because it is a production

industry and the use of this method provides different kinds of advantages for industrial

companies. To increase profits, they should insure that they are using strategies and procedures

to will job costs.

Essential requirements -

There must be a use of a variable in this method from which the expenses of work can be

measured. In this way employers can guarantee that a decrease in the amount of earnings

can be achieved by recognizing the expense of the work.

This method would provide a clear list of the various work orders such that it is possible

to accurately do their accounting.

Price optimization system- This is a system in which it would be possible to predict costs to be

fixed for the potential so that the business can gain better income in the future (Bromwich and

Scapens, 2016). Usage of this method should be rendered in the sense of Capital Joinery Ltd. so

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

that the business can accurately predict the costs and thereby encourage a decrease in the total

price cost.

Essential requirements -

Computational and quantitative approaches and procedures must be used with this

scheme in order to be able to create an accurate price prediction.

A corporation must be sure to establish the price with the use of this method, which

allows it a chance of achieving higher revenue amounts.

P2: Management accounting reporting

Management accounting analysis is a methodology that helps managers to clearly analyze and

understand the fiscal data supplied, thereby contributing to assumptions and guidance being

derived. It is therefore necessary for Capital Joinery Ltd. to make use of these papers. It will use

the records that follow—

Cost report- These are the reports covering the total expenses generated within an entity.

Managers should continue to be able to determine the duration accurately and reliably by making

use of them (Quattrone, 2016). These may be relevant in the sense of Capital Joinery Ltd. since it

is a manufacturing plant which needs to take control of its investments to focus on reducing them

to boost revenue.

Departmental report- There is numerous divisions in an organization. This can include

production, HR, banking, advertising, distribution, etc. Consequently, if these studies find an

issue with their divisions, a business such as Capital Joinery Ltd. needs to consider implementing

the requisite changes in these divisions. In this way, an organization must ensure that the points

of change that are existing in its divisions can be established so that the appropriate changes can

be implemented to help meet future targets and priorities. This would be beneficial in raising

both the total level of efficacy and performance.

Performance assessments- These reports are useful in making sure the company can carry out a

comprehensive evaluation of the current level of quality. Capital Joinery Ltd. administrators

should make use of it so that they can know that the average output quality can be increased. In

price cost.

Essential requirements -

Computational and quantitative approaches and procedures must be used with this

scheme in order to be able to create an accurate price prediction.

A corporation must be sure to establish the price with the use of this method, which

allows it a chance of achieving higher revenue amounts.

P2: Management accounting reporting

Management accounting analysis is a methodology that helps managers to clearly analyze and

understand the fiscal data supplied, thereby contributing to assumptions and guidance being

derived. It is therefore necessary for Capital Joinery Ltd. to make use of these papers. It will use

the records that follow—

Cost report- These are the reports covering the total expenses generated within an entity.

Managers should continue to be able to determine the duration accurately and reliably by making

use of them (Quattrone, 2016). These may be relevant in the sense of Capital Joinery Ltd. since it

is a manufacturing plant which needs to take control of its investments to focus on reducing them

to boost revenue.

Departmental report- There is numerous divisions in an organization. This can include

production, HR, banking, advertising, distribution, etc. Consequently, if these studies find an

issue with their divisions, a business such as Capital Joinery Ltd. needs to consider implementing

the requisite changes in these divisions. In this way, an organization must ensure that the points

of change that are existing in its divisions can be established so that the appropriate changes can

be implemented to help meet future targets and priorities. This would be beneficial in raising

both the total level of efficacy and performance.

Performance assessments- These reports are useful in making sure the company can carry out a

comprehensive evaluation of the current level of quality. Capital Joinery Ltd. administrators

should make use of it so that they can know that the average output quality can be increased. In

addition, anomalies and performance issues will be detected by using these documents and

appropriate actions and initiatives can be taken to eradicate them that would encourage an

increase in the overall performance standard.

Budget reports-A review of the numerous expenditures that are produced in an entity can be

provided in these documents. This budget will assist the organization in managing its costs by

using these documents and thereby attempting to increase the amount of earnings. The

administration of Capital Joinery Ltd. will define the places where the total amount of

expenditure has risen and how these expenditures can be compared by using these studies.

M1: Benefits of Management accounting systems

The method of cost accounting is useful for calculating the average amount of costs. By doing it,

companies can also discover ways to minimize costs by using it (Cooper, Ezzamel and Qu,

2017). The inventory control framework will be used by businesses to indicate that they can

accurately and reliably calculate the inventory levels. They are also able to facilitate a decrease

in the net cost of running the stock by allowing use of it. In calculating work costs, the Job

Costing Method may be helpful. It could also be used so that companies can keep a

comprehensive past record of their individual task orders. The method of price optimization can

be beneficial in deciding the value to be set. It could also be used such that perhaps the price can

be adjusted in such a manner that can further increase profits. Each of these structures will then

produce advantages for Capital Joinery Ltd in this manner.

D1: Critical evaluation of Management accounting systems

Management accounting frameworks must be incorporated within organizations in order to allow

the full use of them. It is also necessary for the managers of Capital Joinery Ltd. to be able to

accurately evaluate the need for systems. These technologies will then be incorporated into the

processes correctly, and this would therefore benefit a lot to ensure that the priorities and targets

will be achieved.

TASK 2

P3: Calculation of costs

appropriate actions and initiatives can be taken to eradicate them that would encourage an

increase in the overall performance standard.

Budget reports-A review of the numerous expenditures that are produced in an entity can be

provided in these documents. This budget will assist the organization in managing its costs by

using these documents and thereby attempting to increase the amount of earnings. The

administration of Capital Joinery Ltd. will define the places where the total amount of

expenditure has risen and how these expenditures can be compared by using these studies.

M1: Benefits of Management accounting systems

The method of cost accounting is useful for calculating the average amount of costs. By doing it,

companies can also discover ways to minimize costs by using it (Cooper, Ezzamel and Qu,

2017). The inventory control framework will be used by businesses to indicate that they can

accurately and reliably calculate the inventory levels. They are also able to facilitate a decrease

in the net cost of running the stock by allowing use of it. In calculating work costs, the Job

Costing Method may be helpful. It could also be used so that companies can keep a

comprehensive past record of their individual task orders. The method of price optimization can

be beneficial in deciding the value to be set. It could also be used such that perhaps the price can

be adjusted in such a manner that can further increase profits. Each of these structures will then

produce advantages for Capital Joinery Ltd in this manner.

D1: Critical evaluation of Management accounting systems

Management accounting frameworks must be incorporated within organizations in order to allow

the full use of them. It is also necessary for the managers of Capital Joinery Ltd. to be able to

accurately evaluate the need for systems. These technologies will then be incorporated into the

processes correctly, and this would therefore benefit a lot to ensure that the priorities and targets

will be achieved.

TASK 2

P3: Calculation of costs

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

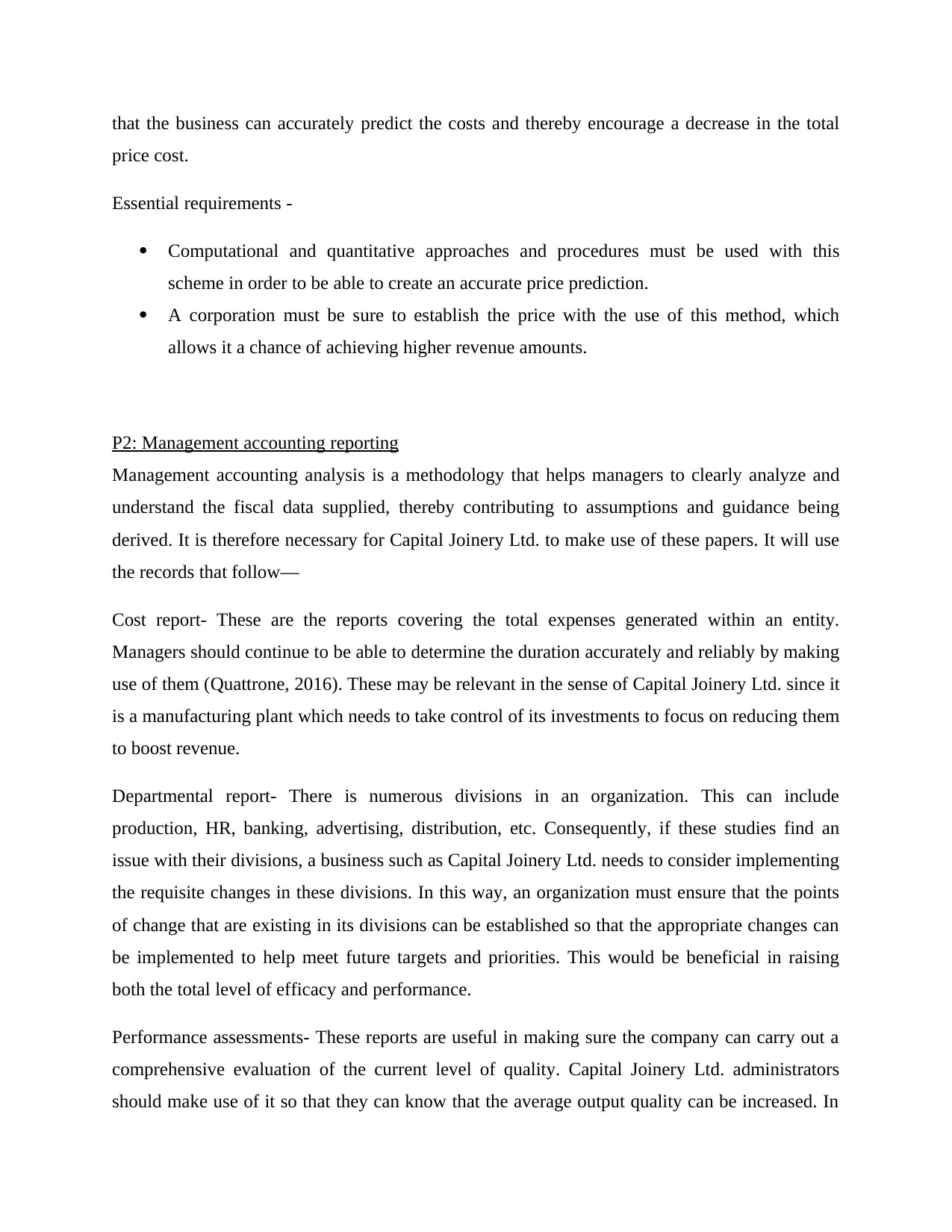

Absorption costing:

Total cost of production:

Direct materials 60

Direct labor 40

Variable production cost 20

Fixed production cost 20

Full production cost 140

Income statement:

Particulars May June

Sales 25000 18750

Less: Cost of sales

Direct materials 6000 4800

Direct labor 4000 3200

Variable production cost 2000 1600

Fixed production cost 2000 1600

Opening stock 0 0

Closing stock 0 700

Under/Over absorption 0 400

Gross profit 11000 7850

Less: Expenses

Variable sales commission 500 375

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3475

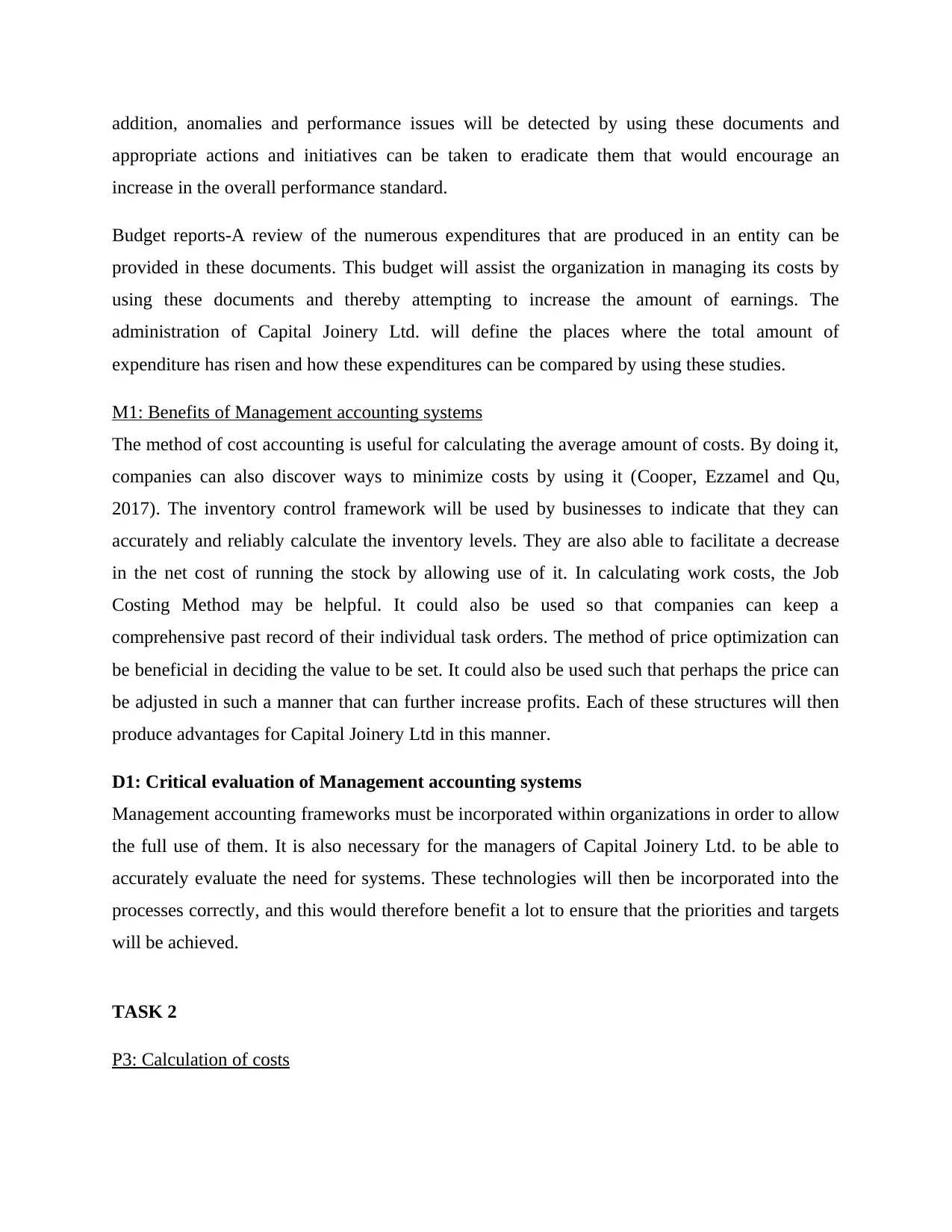

Marginal costing:

Total cost of production:

Total cost of production:

Direct materials 60

Direct labor 40

Variable production cost 20

Fixed production cost 20

Full production cost 140

Income statement:

Particulars May June

Sales 25000 18750

Less: Cost of sales

Direct materials 6000 4800

Direct labor 4000 3200

Variable production cost 2000 1600

Fixed production cost 2000 1600

Opening stock 0 0

Closing stock 0 700

Under/Over absorption 0 400

Gross profit 11000 7850

Less: Expenses

Variable sales commission 500 375

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3475

Marginal costing:

Total cost of production:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct materials 60

Direct labor 40

Variable production cost 20

Full production cost 120

Income statement:

Particulars May June

sales 25000 18750

Less: Variable cost

Direct materials 6000 4800

Direct labor 4000 3200

Variable production cost 2000 1600

Opening stock 0 0

Closing stock 0 600

Variable sales commission 500 375

Contribution 12500 9375

Less: Fixed cost

Fixed production 2000 2000

Fixed administration 3000 3000

Fixed selling 1000 1000

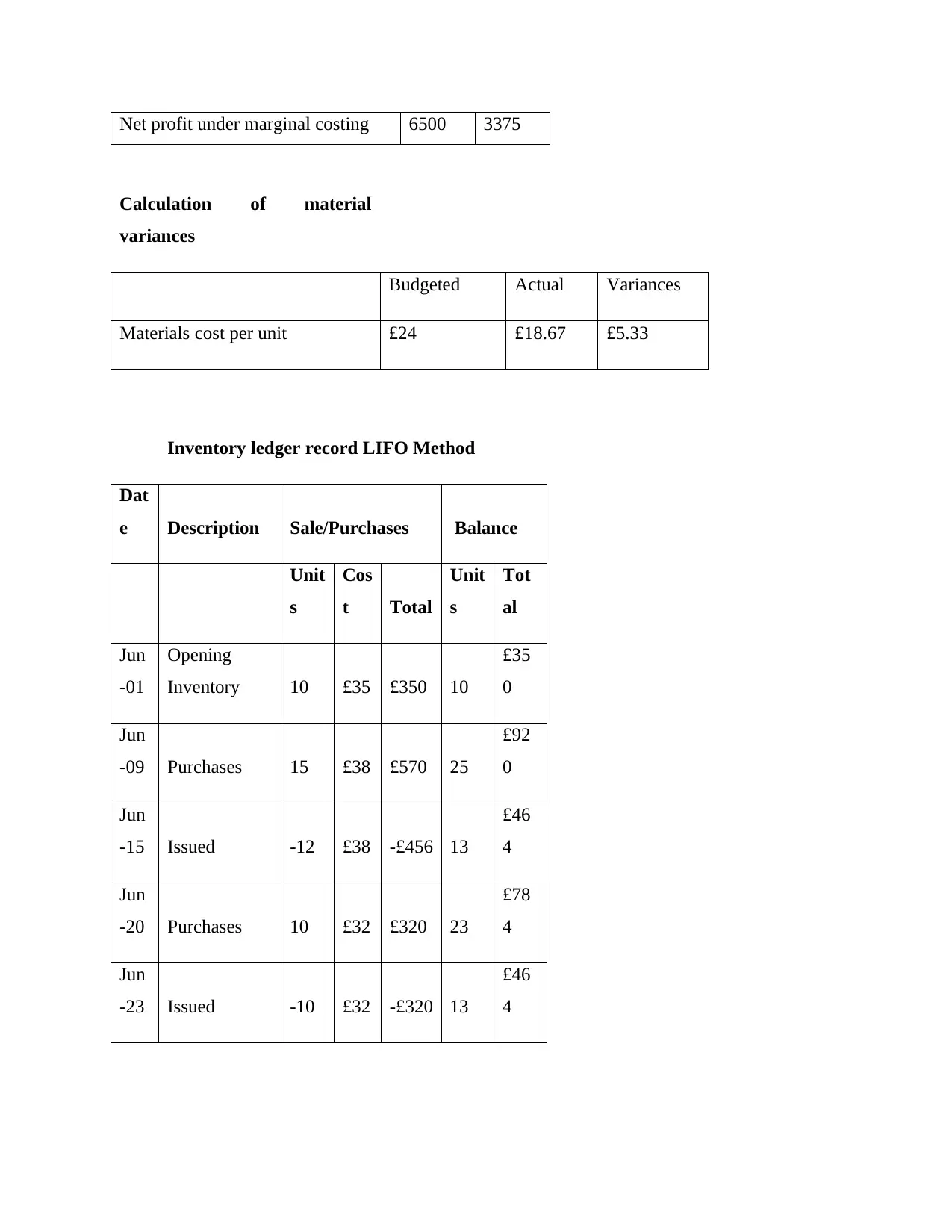

Net profit 6500 3375

Reconciliation statement:

Particulars May June

Net profit under absorption costing 6500 3475

Add/Less: Closing stock 0 (100)

Direct labor 40

Variable production cost 20

Full production cost 120

Income statement:

Particulars May June

sales 25000 18750

Less: Variable cost

Direct materials 6000 4800

Direct labor 4000 3200

Variable production cost 2000 1600

Opening stock 0 0

Closing stock 0 600

Variable sales commission 500 375

Contribution 12500 9375

Less: Fixed cost

Fixed production 2000 2000

Fixed administration 3000 3000

Fixed selling 1000 1000

Net profit 6500 3375

Reconciliation statement:

Particulars May June

Net profit under absorption costing 6500 3475

Add/Less: Closing stock 0 (100)

Net profit under marginal costing 6500 3375

Calculation of material

variances

Budgeted Actual Variances

Materials cost per unit £24 £18.67 £5.33

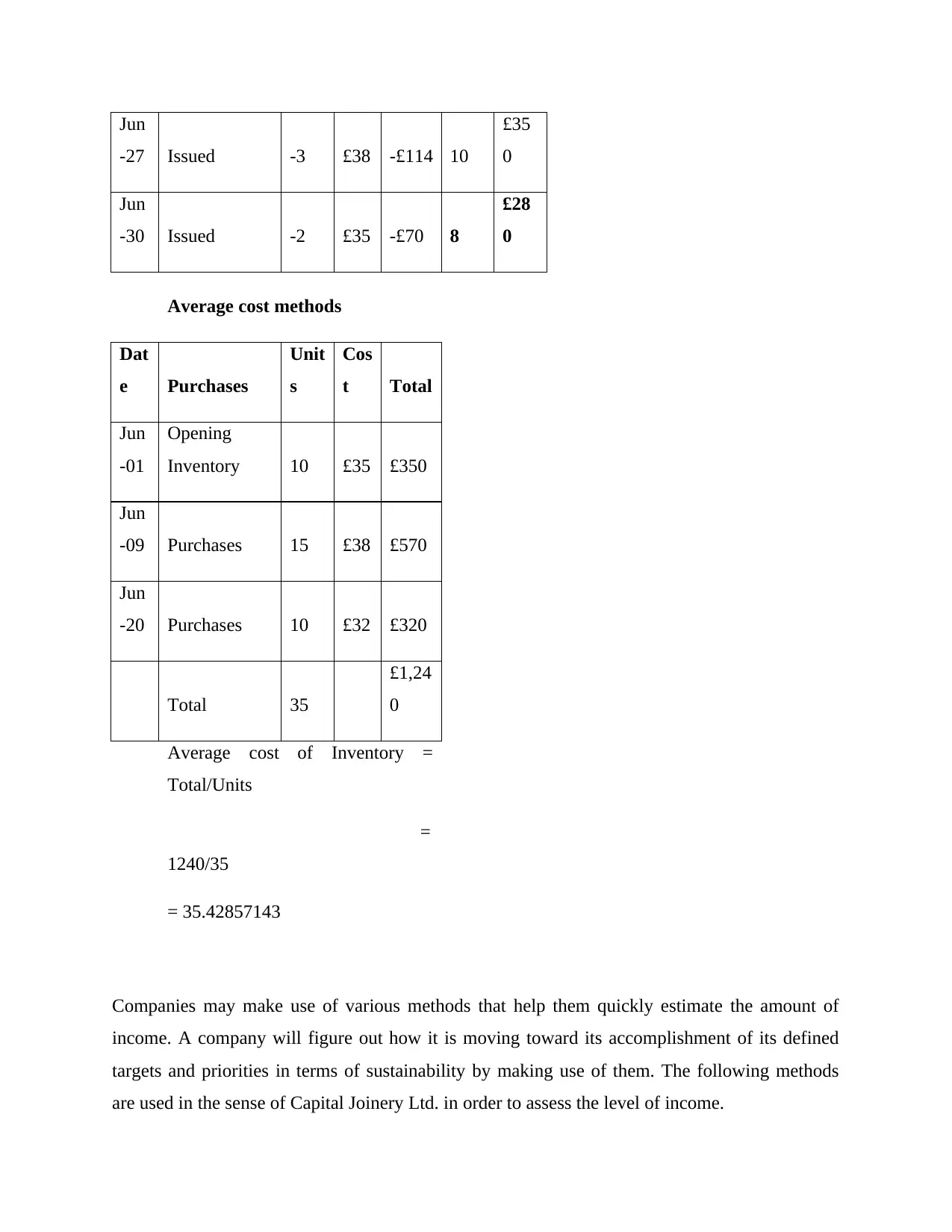

Inventory ledger record LIFO Method

Dat

e Description Sale/Purchases Balance

Unit

s

Cos

t Total

Unit

s

Tot

al

Jun

-01

Opening

Inventory 10 £35 £350 10

£35

0

Jun

-09 Purchases 15 £38 £570 25

£92

0

Jun

-15 Issued -12 £38 -£456 13

£46

4

Jun

-20 Purchases 10 £32 £320 23

£78

4

Jun

-23 Issued -10 £32 -£320 13

£46

4

Calculation of material

variances

Budgeted Actual Variances

Materials cost per unit £24 £18.67 £5.33

Inventory ledger record LIFO Method

Dat

e Description Sale/Purchases Balance

Unit

s

Cos

t Total

Unit

s

Tot

al

Jun

-01

Opening

Inventory 10 £35 £350 10

£35

0

Jun

-09 Purchases 15 £38 £570 25

£92

0

Jun

-15 Issued -12 £38 -£456 13

£46

4

Jun

-20 Purchases 10 £32 £320 23

£78

4

Jun

-23 Issued -10 £32 -£320 13

£46

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

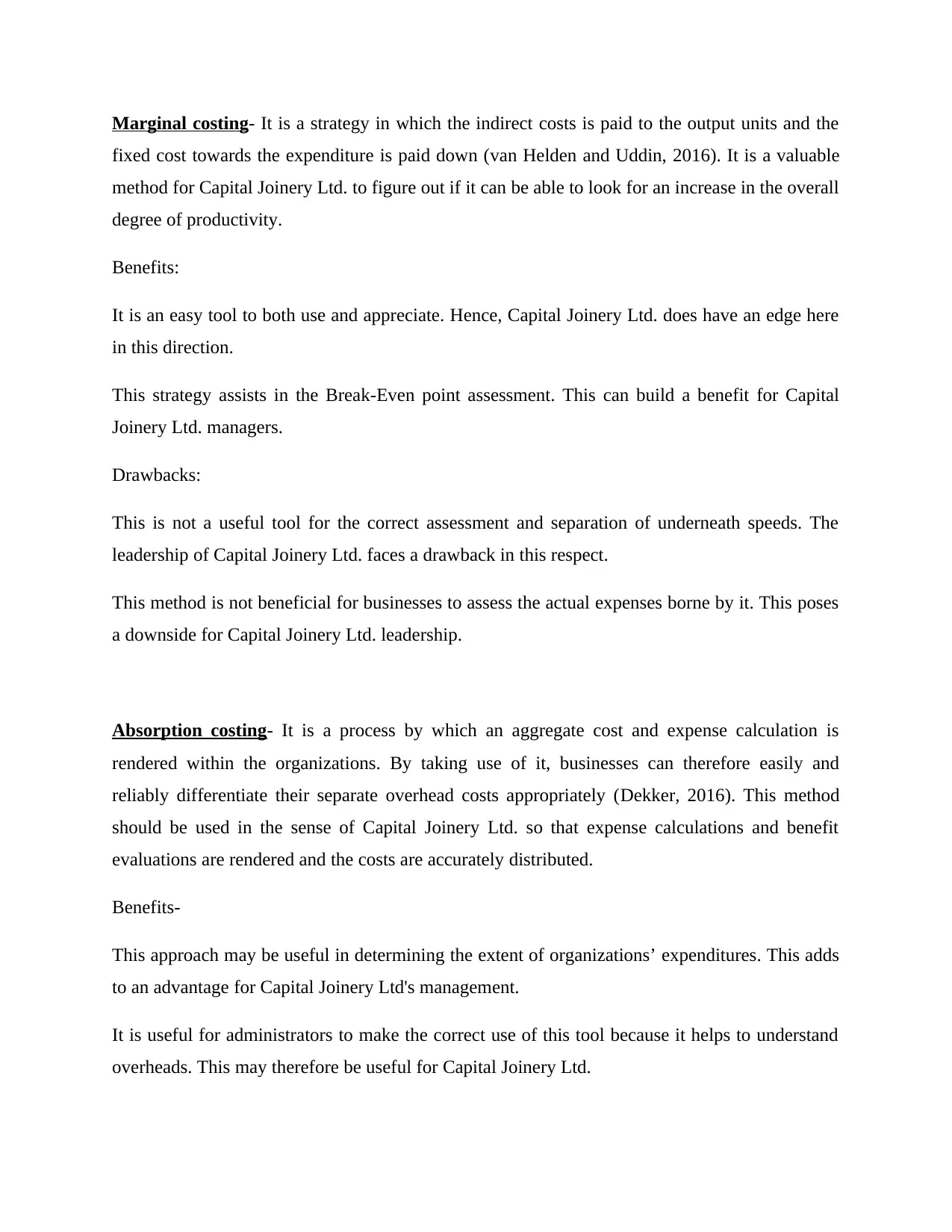

Jun

-27 Issued -3 £38 -£114 10

£35

0

Jun

-30 Issued -2 £35 -£70 8

£28

0

Average cost methods

Dat

e Purchases

Unit

s

Cos

t Total

Jun

-01

Opening

Inventory 10 £35 £350

Jun

-09 Purchases 15 £38 £570

Jun

-20 Purchases 10 £32 £320

Total 35

£1,24

0

Average cost of Inventory =

Total/Units

=

1240/35

= 35.42857143

Companies may make use of various methods that help them quickly estimate the amount of

income. A company will figure out how it is moving toward its accomplishment of its defined

targets and priorities in terms of sustainability by making use of them. The following methods

are used in the sense of Capital Joinery Ltd. in order to assess the level of income.

-27 Issued -3 £38 -£114 10

£35

0

Jun

-30 Issued -2 £35 -£70 8

£28

0

Average cost methods

Dat

e Purchases

Unit

s

Cos

t Total

Jun

-01

Opening

Inventory 10 £35 £350

Jun

-09 Purchases 15 £38 £570

Jun

-20 Purchases 10 £32 £320

Total 35

£1,24

0

Average cost of Inventory =

Total/Units

=

1240/35

= 35.42857143

Companies may make use of various methods that help them quickly estimate the amount of

income. A company will figure out how it is moving toward its accomplishment of its defined

targets and priorities in terms of sustainability by making use of them. The following methods

are used in the sense of Capital Joinery Ltd. in order to assess the level of income.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Marginal costing- It is a strategy in which the indirect costs is paid to the output units and the

fixed cost towards the expenditure is paid down (van Helden and Uddin, 2016). It is a valuable

method for Capital Joinery Ltd. to figure out if it can be able to look for an increase in the overall

degree of productivity.

Benefits:

It is an easy tool to both use and appreciate. Hence, Capital Joinery Ltd. does have an edge here

in this direction.

This strategy assists in the Break-Even point assessment. This can build a benefit for Capital

Joinery Ltd. managers.

Drawbacks:

This is not a useful tool for the correct assessment and separation of underneath speeds. The

leadership of Capital Joinery Ltd. faces a drawback in this respect.

This method is not beneficial for businesses to assess the actual expenses borne by it. This poses

a downside for Capital Joinery Ltd. leadership.

Absorption costing- It is a process by which an aggregate cost and expense calculation is

rendered within the organizations. By taking use of it, businesses can therefore easily and

reliably differentiate their separate overhead costs appropriately (Dekker, 2016). This method

should be used in the sense of Capital Joinery Ltd. so that expense calculations and benefit

evaluations are rendered and the costs are accurately distributed.

Benefits-

This approach may be useful in determining the extent of organizations’ expenditures. This adds

to an advantage for Capital Joinery Ltd's management.

It is useful for administrators to make the correct use of this tool because it helps to understand

overheads. This may therefore be useful for Capital Joinery Ltd.

fixed cost towards the expenditure is paid down (van Helden and Uddin, 2016). It is a valuable

method for Capital Joinery Ltd. to figure out if it can be able to look for an increase in the overall

degree of productivity.

Benefits:

It is an easy tool to both use and appreciate. Hence, Capital Joinery Ltd. does have an edge here

in this direction.

This strategy assists in the Break-Even point assessment. This can build a benefit for Capital

Joinery Ltd. managers.

Drawbacks:

This is not a useful tool for the correct assessment and separation of underneath speeds. The

leadership of Capital Joinery Ltd. faces a drawback in this respect.

This method is not beneficial for businesses to assess the actual expenses borne by it. This poses

a downside for Capital Joinery Ltd. leadership.

Absorption costing- It is a process by which an aggregate cost and expense calculation is

rendered within the organizations. By taking use of it, businesses can therefore easily and

reliably differentiate their separate overhead costs appropriately (Dekker, 2016). This method

should be used in the sense of Capital Joinery Ltd. so that expense calculations and benefit

evaluations are rendered and the costs are accurately distributed.

Benefits-

This approach may be useful in determining the extent of organizations’ expenditures. This adds

to an advantage for Capital Joinery Ltd's management.

It is useful for administrators to make the correct use of this tool because it helps to understand

overheads. This may therefore be useful for Capital Joinery Ltd.

Drawbacks-

This approach should not be used for comparative purposes and therefore does not assist

organizations to enhance in some fields. Therefore in this sense, businesses are unable to equate

their average success standard with the rival and point out the differences and differences in it to

promote performance level enhancement. This offers a downside for Capital Joinery Ltd.

The application of this technique means using higher-level expertise. This can create a downside

for Capital Joinery Ltd. if its executives do not have these skills.

M2: Accurate application of management accounting techniques

For companies, management accounting methods are very effective and they can measure the

way they would be able to move in the right direction by making use of them. Thus it is

important for a company such as Capital Joinery Ltd. that such maintaining control use of the

costing strategies of both Marginal and Absorption. By using these methods, they would be able

to determine the income in order to conduct the research and analysis necessary.

D2: Producing of financial reports for accurate analysis and interpretation of data

Financial statements are those documents that summaries the financial statistics, facts and

statistics accessible to organizations and will guarantee that suggestions and conclusions are

drawn from the monetary data provided to allow decisions and actions to be taken (Joshi and Li,

2016). The management of Capital Joinery Ltd. can use these and they'll use the knowledge

required to make decisions.

TASK 3

P4: Advantages and Disadvantages of planning tools

The strategy methods are helpful for managers to be able to present better goals and ambitions in

the small, long-term. In Capital Joinery Ltd., the reviews methods are used—

Zero-based budget- It is a tool used in financial planning in which expenditures are needed for a

certain amount of time to be explained (Tucker and Schaltegger, 2016). It helps the owner to

start anew next year and not to use it as a base year the estimates of any specific year. Its usage

This approach should not be used for comparative purposes and therefore does not assist

organizations to enhance in some fields. Therefore in this sense, businesses are unable to equate

their average success standard with the rival and point out the differences and differences in it to

promote performance level enhancement. This offers a downside for Capital Joinery Ltd.

The application of this technique means using higher-level expertise. This can create a downside

for Capital Joinery Ltd. if its executives do not have these skills.

M2: Accurate application of management accounting techniques

For companies, management accounting methods are very effective and they can measure the

way they would be able to move in the right direction by making use of them. Thus it is

important for a company such as Capital Joinery Ltd. that such maintaining control use of the

costing strategies of both Marginal and Absorption. By using these methods, they would be able

to determine the income in order to conduct the research and analysis necessary.

D2: Producing of financial reports for accurate analysis and interpretation of data

Financial statements are those documents that summaries the financial statistics, facts and

statistics accessible to organizations and will guarantee that suggestions and conclusions are

drawn from the monetary data provided to allow decisions and actions to be taken (Joshi and Li,

2016). The management of Capital Joinery Ltd. can use these and they'll use the knowledge

required to make decisions.

TASK 3

P4: Advantages and Disadvantages of planning tools

The strategy methods are helpful for managers to be able to present better goals and ambitions in

the small, long-term. In Capital Joinery Ltd., the reviews methods are used—

Zero-based budget- It is a tool used in financial planning in which expenditures are needed for a

certain amount of time to be explained (Tucker and Schaltegger, 2016). It helps the owner to

start anew next year and not to use it as a base year the estimates of any specific year. Its usage

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.