Management Accounting Report: Analysis of Alpha Limited's Financials

VerifiedAdded on 2023/01/13

|23

|3989

|20

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices within Alpha Limited, a mid-sized manufacturing corporation. It delves into the core principles of management accounting, exploring various systems such as cost accounting, inventory management, job costing, and price optimization. The report examines different management accounting reports, including cost reports, performance reports, inventory reports, and accounts receivable aging reports, highlighting their significance in decision-making. Furthermore, it analyzes the benefits of these systems and their integration within organizational processes. The report also includes the preparation and interpretation of income statements using absorption and marginal costing methods, along with a case study on a machine installation decision. Finally, it discusses the advantages and disadvantages of different planning tools used for budgetary control, such as cash budgets, and provides an overview of their application in Alpha Limited. The report emphasizes the role of management accounting in enhancing operational and financial efficiency.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Each company wishes to achieve their individual goals and targets in the present

competitive corporate environment in order to maintain market share. Management Accounting

is a central process that allows companies to successfully accomplish their objectives. As its

name suggests it includes various accounting mechanism and management components. It

provides a comprehensive and efficient mechanism for improving operational and financial

efficiency, as it comprises of appropriate methods of reporting relevant data to upper

management in order to make important decisions (Burritt, 2017). The primary responsibility for

creating managerial accounting framework rests with managing personnel.

This study evaluates different fundamental aspects of managerial accounting such as

multiple systems, system's requirements, reporting approaches and planning tools in context of

Alpha Limited. This corporation belongs to mid-size manufacturing corporation It involve

application of various distinct-distinct techniques and how these help in responding to financial

problems. Study also contains comparative analysis of adaption of MA in order to respond to

different financial-problems.

TASK 1.

P1. Management accounting and its types.

MA relates to explicit management framework which establishes cooperation between

management accounting operations with the aim of transmitting substantive and pertinent

information to top-level management to help them in decision-making processes (Schaltegger,

2018). It is a key mechanism that enables managers to determine organizational goals and

objectives. Organizational leadership is key people for implementing the whole accounting

management system. This is a broader dimension that encompasses all basic principles and

practices that allow organizations to track their overall performance and achieve goals. MA plays

a valuable role in gathering, expressly recording and reporting corporate budgetary and financial

information and evaluating enterprise budgets. It also plays a major role in assigning resources

and arranging funds to improve efficiency of business.

Management Accounting Systems: Management accounting draws up various systems to meet

specific organizational necessities. Different organizations adopt these systems as per their

needs. MA systems are structural frameworks that handle various internal procedures to support

Each company wishes to achieve their individual goals and targets in the present

competitive corporate environment in order to maintain market share. Management Accounting

is a central process that allows companies to successfully accomplish their objectives. As its

name suggests it includes various accounting mechanism and management components. It

provides a comprehensive and efficient mechanism for improving operational and financial

efficiency, as it comprises of appropriate methods of reporting relevant data to upper

management in order to make important decisions (Burritt, 2017). The primary responsibility for

creating managerial accounting framework rests with managing personnel.

This study evaluates different fundamental aspects of managerial accounting such as

multiple systems, system's requirements, reporting approaches and planning tools in context of

Alpha Limited. This corporation belongs to mid-size manufacturing corporation It involve

application of various distinct-distinct techniques and how these help in responding to financial

problems. Study also contains comparative analysis of adaption of MA in order to respond to

different financial-problems.

TASK 1.

P1. Management accounting and its types.

MA relates to explicit management framework which establishes cooperation between

management accounting operations with the aim of transmitting substantive and pertinent

information to top-level management to help them in decision-making processes (Schaltegger,

2018). It is a key mechanism that enables managers to determine organizational goals and

objectives. Organizational leadership is key people for implementing the whole accounting

management system. This is a broader dimension that encompasses all basic principles and

practices that allow organizations to track their overall performance and achieve goals. MA plays

a valuable role in gathering, expressly recording and reporting corporate budgetary and financial

information and evaluating enterprise budgets. It also plays a major role in assigning resources

and arranging funds to improve efficiency of business.

Management Accounting Systems: Management accounting draws up various systems to meet

specific organizational necessities. Different organizations adopt these systems as per their

needs. MA systems are structural frameworks that handle various internal procedures to support

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

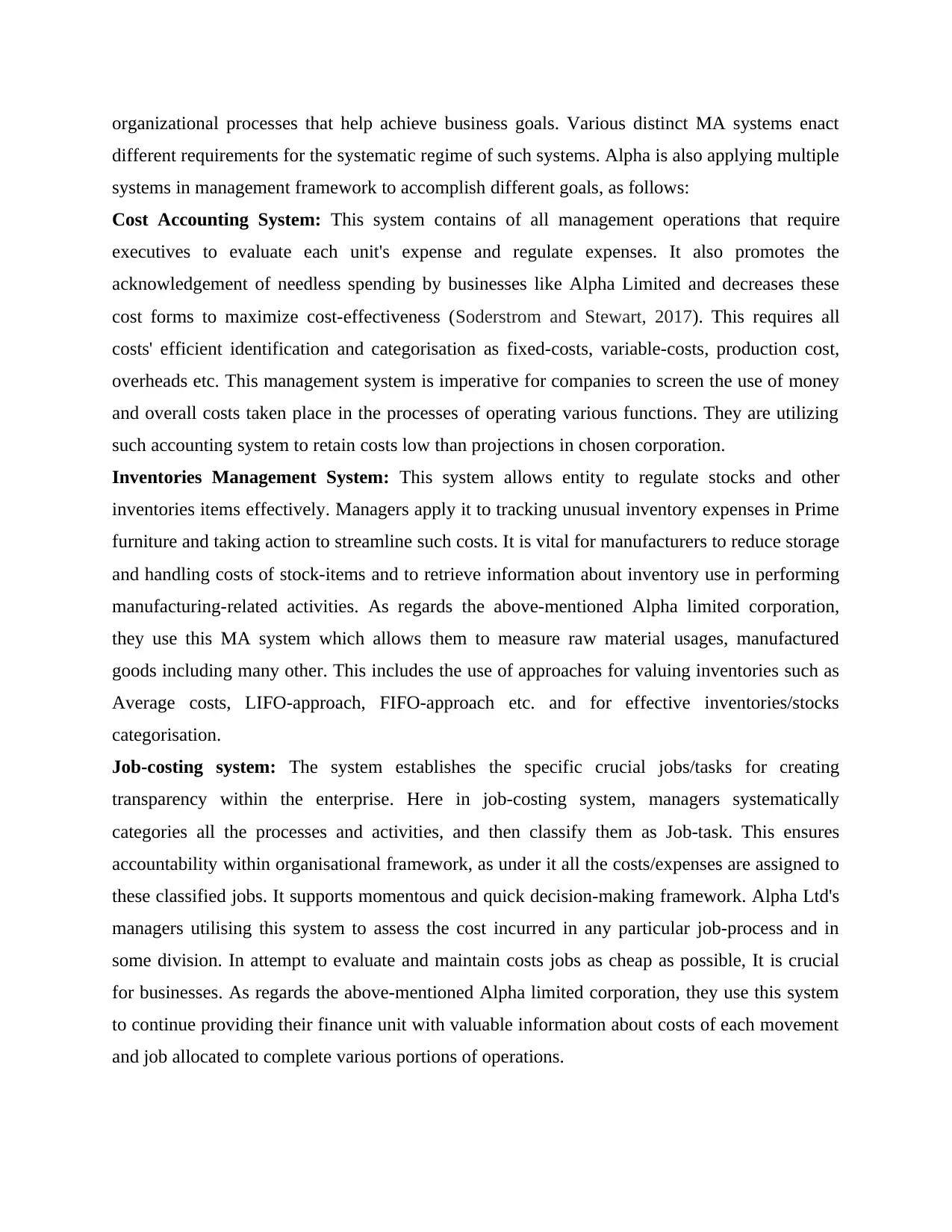

organizational processes that help achieve business goals. Various distinct MA systems enact

different requirements for the systematic regime of such systems. Alpha is also applying multiple

systems in management framework to accomplish different goals, as follows:

Cost Accounting System: This system contains of all management operations that require

executives to evaluate each unit's expense and regulate expenses. It also promotes the

acknowledgement of needless spending by businesses like Alpha Limited and decreases these

cost forms to maximize cost-effectiveness (Soderstrom and Stewart, 2017). This requires all

costs' efficient identification and categorisation as fixed-costs, variable-costs, production cost,

overheads etc. This management system is imperative for companies to screen the use of money

and overall costs taken place in the processes of operating various functions. They are utilizing

such accounting system to retain costs low than projections in chosen corporation.

Inventories Management System: This system allows entity to regulate stocks and other

inventories items effectively. Managers apply it to tracking unusual inventory expenses in Prime

furniture and taking action to streamline such costs. It is vital for manufacturers to reduce storage

and handling costs of stock-items and to retrieve information about inventory use in performing

manufacturing-related activities. As regards the above-mentioned Alpha limited corporation,

they use this MA system which allows them to measure raw material usages, manufactured

goods including many other. This includes the use of approaches for valuing inventories such as

Average costs, LIFO-approach, FIFO-approach etc. and for effective inventories/stocks

categorisation.

Job-costing system: The system establishes the specific crucial jobs/tasks for creating

transparency within the enterprise. Here in job-costing system, managers systematically

categories all the processes and activities, and then classify them as Job-task. This ensures

accountability within organisational framework, as under it all the costs/expenses are assigned to

these classified jobs. It supports momentous and quick decision-making framework. Alpha Ltd's

managers utilising this system to assess the cost incurred in any particular job-process and in

some division. In attempt to evaluate and maintain costs jobs as cheap as possible, It is crucial

for businesses. As regards the above-mentioned Alpha limited corporation, they use this system

to continue providing their finance unit with valuable information about costs of each movement

and job allocated to complete various portions of operations.

different requirements for the systematic regime of such systems. Alpha is also applying multiple

systems in management framework to accomplish different goals, as follows:

Cost Accounting System: This system contains of all management operations that require

executives to evaluate each unit's expense and regulate expenses. It also promotes the

acknowledgement of needless spending by businesses like Alpha Limited and decreases these

cost forms to maximize cost-effectiveness (Soderstrom and Stewart, 2017). This requires all

costs' efficient identification and categorisation as fixed-costs, variable-costs, production cost,

overheads etc. This management system is imperative for companies to screen the use of money

and overall costs taken place in the processes of operating various functions. They are utilizing

such accounting system to retain costs low than projections in chosen corporation.

Inventories Management System: This system allows entity to regulate stocks and other

inventories items effectively. Managers apply it to tracking unusual inventory expenses in Prime

furniture and taking action to streamline such costs. It is vital for manufacturers to reduce storage

and handling costs of stock-items and to retrieve information about inventory use in performing

manufacturing-related activities. As regards the above-mentioned Alpha limited corporation,

they use this MA system which allows them to measure raw material usages, manufactured

goods including many other. This includes the use of approaches for valuing inventories such as

Average costs, LIFO-approach, FIFO-approach etc. and for effective inventories/stocks

categorisation.

Job-costing system: The system establishes the specific crucial jobs/tasks for creating

transparency within the enterprise. Here in job-costing system, managers systematically

categories all the processes and activities, and then classify them as Job-task. This ensures

accountability within organisational framework, as under it all the costs/expenses are assigned to

these classified jobs. It supports momentous and quick decision-making framework. Alpha Ltd's

managers utilising this system to assess the cost incurred in any particular job-process and in

some division. In attempt to evaluate and maintain costs jobs as cheap as possible, It is crucial

for businesses. As regards the above-mentioned Alpha limited corporation, they use this system

to continue providing their finance unit with valuable information about costs of each movement

and job allocated to complete various portions of operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Price optimisation system: This mechanism makes it smoother to controlling and monitoring

the prices of products while keeping the demand and profits at same or greater level (Nuhu,

Baird and Appuhamilage, 2017). This system allows managing staff to determine the connection

between demands and price of various products as they provide business competitive benefits.

Price of Pizza and other beverages are determined applied this system in Alpha corporation.

Managers under it determines factors which affects price and demand of its products directly or

indirectly. This system defines the unique correlation between price and demand of products,

which eventually assist in setting goals and objectives.

P2. Management Accounting Reports:

Each function of a business enterprise relies on core information or the facts condensed.

Management decisions and other operations are carried out in business centred on various kinds

of information so that any minor error or misunderstanding in information will result in incorrect

decision making. Reporting of business related information is critical task, thus managers in

corporation like Alpha limited relies on multiple methods of reporting prescribed under MA

systems. Management's decisions are purely depending on reporting approach and

comprehensiveness. In this regard, here following is discussion on multiple reports of MA, as

follows:

Cost Report: In this method, reports prepared are comprises of extensive, standardized

information of costs/expenses incurred through various tasks and procedures. Using this report,

unit of finance may be ready to find variation among actual and projected efficiency. Managers

create it in sense of above-mentioned Alpha to document deviations and to maintain an

additional sheet of eye on overall performance. This determines each pizza and other product

item' cost which help them in assessing the overall cost effectiveness of operations. It

summarises all the costs as per their significance, extent of relevancy and nature that assist

managers in controlling different costs.

Performance Report: This report emphasises on reporting of human-resources and personnel

engaged in different organisational activities. Objective of report is to assess the performance

and efficiencies of personnel across the enterprise and allocation of works among employees

efficaciously (Quinn, Strauss and Kristandl, 2014). This enables managers to optimise utilisation

of human resources. To control employee turnover ratio management in Alpha, use this report as

it offers comprehensive information about each employee personnel and support evaluation of

the prices of products while keeping the demand and profits at same or greater level (Nuhu,

Baird and Appuhamilage, 2017). This system allows managing staff to determine the connection

between demands and price of various products as they provide business competitive benefits.

Price of Pizza and other beverages are determined applied this system in Alpha corporation.

Managers under it determines factors which affects price and demand of its products directly or

indirectly. This system defines the unique correlation between price and demand of products,

which eventually assist in setting goals and objectives.

P2. Management Accounting Reports:

Each function of a business enterprise relies on core information or the facts condensed.

Management decisions and other operations are carried out in business centred on various kinds

of information so that any minor error or misunderstanding in information will result in incorrect

decision making. Reporting of business related information is critical task, thus managers in

corporation like Alpha limited relies on multiple methods of reporting prescribed under MA

systems. Management's decisions are purely depending on reporting approach and

comprehensiveness. In this regard, here following is discussion on multiple reports of MA, as

follows:

Cost Report: In this method, reports prepared are comprises of extensive, standardized

information of costs/expenses incurred through various tasks and procedures. Using this report,

unit of finance may be ready to find variation among actual and projected efficiency. Managers

create it in sense of above-mentioned Alpha to document deviations and to maintain an

additional sheet of eye on overall performance. This determines each pizza and other product

item' cost which help them in assessing the overall cost effectiveness of operations. It

summarises all the costs as per their significance, extent of relevancy and nature that assist

managers in controlling different costs.

Performance Report: This report emphasises on reporting of human-resources and personnel

engaged in different organisational activities. Objective of report is to assess the performance

and efficiencies of personnel across the enterprise and allocation of works among employees

efficaciously (Quinn, Strauss and Kristandl, 2014). This enables managers to optimise utilisation

of human resources. To control employee turnover ratio management in Alpha, use this report as

it offers comprehensive information about each employee personnel and support evaluation of

performances within enterprise over the specific timespan. This report further assists in

determining appraisal policies and other employee benefits.

Inventory reports: It specifically records and offers inventories details. Management apply this

report to take decision regarding order placement, re order level, inventories maintenance. This is

critical report which shows how much inventories are in stock as well as ascertain the

requirements of inventories and stock-items. As in Alpha, inventories managers list all the raw

items of food and other related materials which are essential for production of Pizza along with

costs and number of items stored as inventories. They also maintain inventories register which

help in preparation of inventory report. Also production managers determine how much stock in

process and processed. Both inventory and production managers, with coordination frame such

report.

Accounts receivable ageing report: For ensuring the timely collection of debtors and

receivables, this report is as it holds all the essential data which help managers in assessing the

average period of collection (Johnstone, 2018). One of key features of such report is that data is

systematically reported under it, such that managers can effectively target the portion of debts to

be recovered. In Alpha limited corporation, they use this report to concentrate on those clients

whose sum is to be receivable within one year. This is main report which assist in maintaining

the working capital by ensuring regular receipt of amounts. In Alpha this report also help to

maintain cash flows of entity since managing staff with assistance of this report collects all the

sums within reasonable time.

M1. Benefits of MAS.

MAS Benefits

Cost accounting system It is consistent with mechanism to reduce costs under requirements

for different operations and functions. It is being implemented to

monitor the expense for each activity as part of the Alpha limited

company and to maintain direct control of expenses.

Price optimisation system This concerns the process of setting prices of products in keeping

with the appropriateness of various external actors. Their sales team

employs this management system for the price of their produced

determining appraisal policies and other employee benefits.

Inventory reports: It specifically records and offers inventories details. Management apply this

report to take decision regarding order placement, re order level, inventories maintenance. This is

critical report which shows how much inventories are in stock as well as ascertain the

requirements of inventories and stock-items. As in Alpha, inventories managers list all the raw

items of food and other related materials which are essential for production of Pizza along with

costs and number of items stored as inventories. They also maintain inventories register which

help in preparation of inventory report. Also production managers determine how much stock in

process and processed. Both inventory and production managers, with coordination frame such

report.

Accounts receivable ageing report: For ensuring the timely collection of debtors and

receivables, this report is as it holds all the essential data which help managers in assessing the

average period of collection (Johnstone, 2018). One of key features of such report is that data is

systematically reported under it, such that managers can effectively target the portion of debts to

be recovered. In Alpha limited corporation, they use this report to concentrate on those clients

whose sum is to be receivable within one year. This is main report which assist in maintaining

the working capital by ensuring regular receipt of amounts. In Alpha this report also help to

maintain cash flows of entity since managing staff with assistance of this report collects all the

sums within reasonable time.

M1. Benefits of MAS.

MAS Benefits

Cost accounting system It is consistent with mechanism to reduce costs under requirements

for different operations and functions. It is being implemented to

monitor the expense for each activity as part of the Alpha limited

company and to maintain direct control of expenses.

Price optimisation system This concerns the process of setting prices of products in keeping

with the appropriateness of various external actors. Their sales team

employs this management system for the price of their produced

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

pizzas in the Alpha limited company.

Inventory management

system

This is linked to the successful control of the quantity of inventory

stored in stores. They employ this management system for the best

use of their processed raw resources under Alpha Limited

Company.

Job costing system I allows the independent monitoring of expenses for each task. This

accounting system is used by the above firm to determine the cost of

jobs assigned to various operations and tasks.

D1. Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes:

Integration of described systems in corporate processes and primary role is critical for

successful adoption and adaptation of various MA systems (Krumwiede and Charles, 2014).

Such Integration encourages effective alignment among systems and various practices that

enables staff management to develop direct control over important tasks. As in corporation

Alpha, their revenue division is incorporated within system of price optimization and inventory

management to enhance their revenue level. Therefore, their procurement department uses

relevant inventory data reports and the accounting department even analyses essential

information from cash receivable ageing report etc.

TASK 2

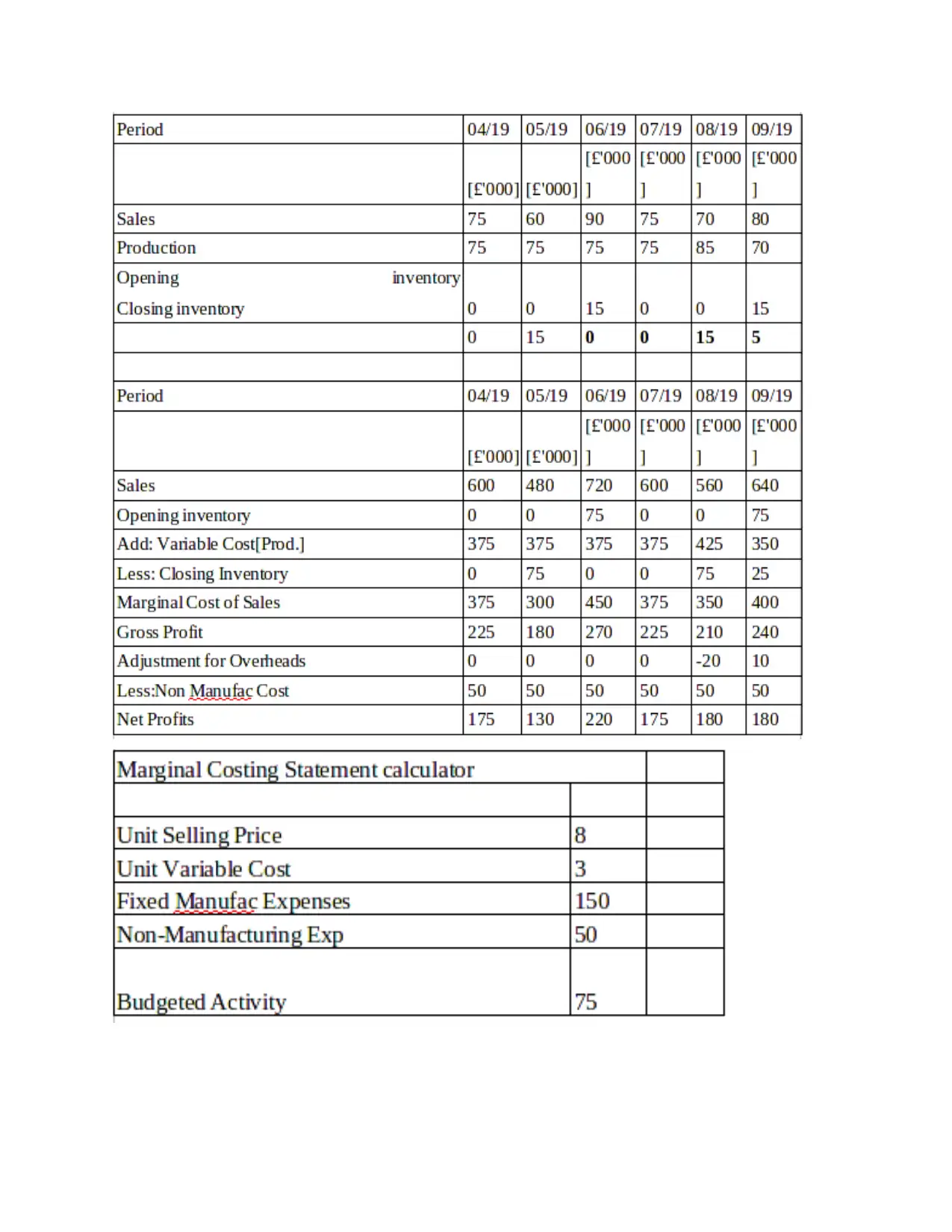

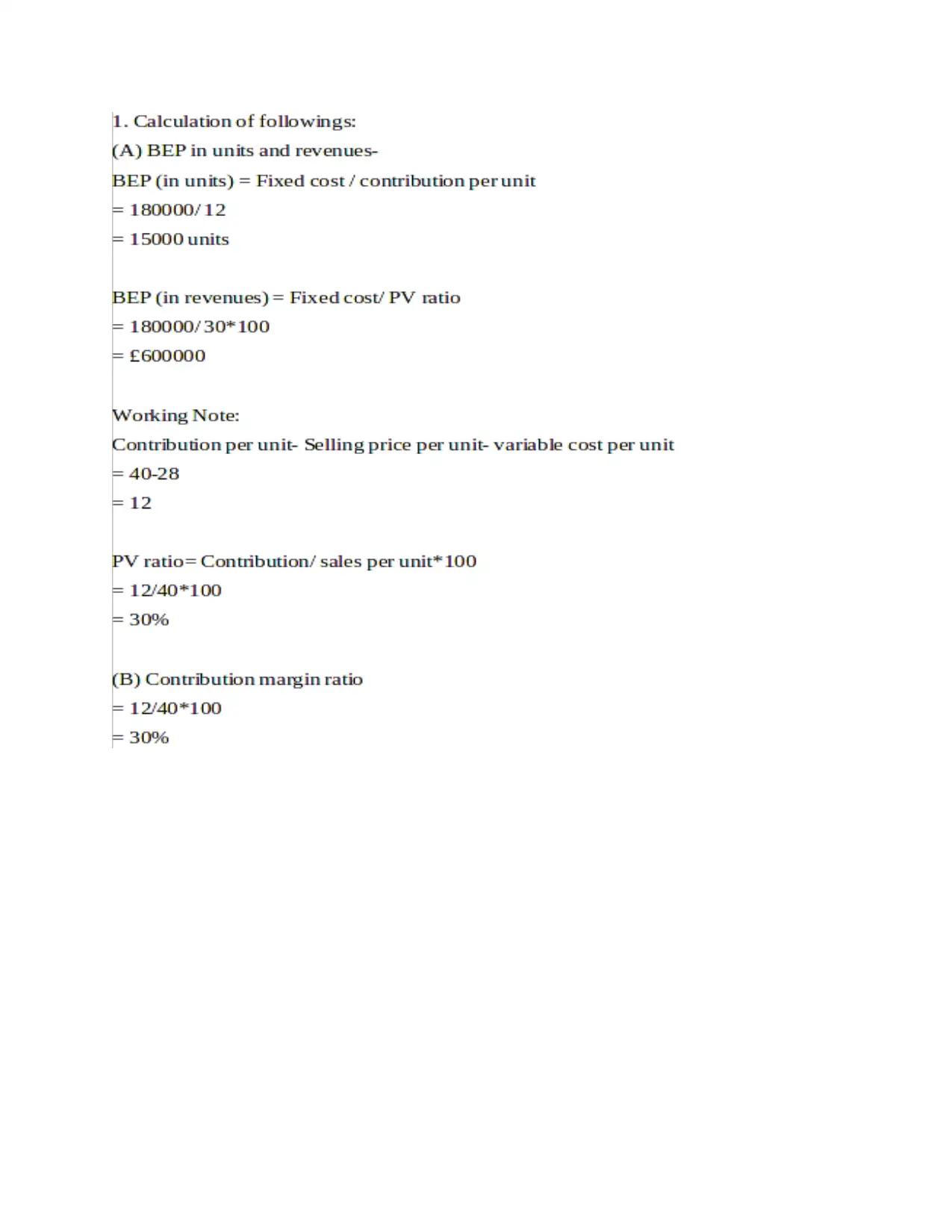

P3. Preparation of income statement by help of absorption and marginal costing.

Problem 1.

Inventory management

system

This is linked to the successful control of the quantity of inventory

stored in stores. They employ this management system for the best

use of their processed raw resources under Alpha Limited

Company.

Job costing system I allows the independent monitoring of expenses for each task. This

accounting system is used by the above firm to determine the cost of

jobs assigned to various operations and tasks.

D1. Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes:

Integration of described systems in corporate processes and primary role is critical for

successful adoption and adaptation of various MA systems (Krumwiede and Charles, 2014).

Such Integration encourages effective alignment among systems and various practices that

enables staff management to develop direct control over important tasks. As in corporation

Alpha, their revenue division is incorporated within system of price optimization and inventory

management to enhance their revenue level. Therefore, their procurement department uses

relevant inventory data reports and the accounting department even analyses essential

information from cash receivable ageing report etc.

TASK 2

P3. Preparation of income statement by help of absorption and marginal costing.

Problem 1.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Problem 2a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.