Management Accounting and its Types

VerifiedAdded on 2023/01/18

|21

|5617

|25

AI Summary

This document provides an overview of management accounting and its types. It discusses the benefits of different management accounting systems and their integration with business processes. The document also includes the preparation of income statements using absorption and marginal costing techniques.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1 ...........................................................................................................................................3

P1. MA and its types...................................................................................................................3

P2. Different methods of MA reports.........................................................................................4

M1. Benefits of MAS..................................................................................................................5

D1. Integration of MAS and MA reports with business process................................................6

TASK 2 ...........................................................................................................................................6

P3. Preparation of income statement by help of absorption and marginal costing.....................6

M2 Accounting techniques to produce financial statements.....................................................12

D2. Interpretation of produced financial statements.................................................................12

TASK 3..........................................................................................................................................12

P4. Advantages and disadvantages of different planning tools of budgetary control...............12

M3. Role of planning tools in order to make accurate forecasting and preparing the budgets.14

TASK 4..........................................................................................................................................14

P5. Difference between enterprises in order to sort financial issues by help of different MAS.

...................................................................................................................................................14

M4. Importance of MAS in the context of solving financial problems....................................16

D3. Role of planning tools in overcoming from monetary issues.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1 ...........................................................................................................................................3

P1. MA and its types...................................................................................................................3

P2. Different methods of MA reports.........................................................................................4

M1. Benefits of MAS..................................................................................................................5

D1. Integration of MAS and MA reports with business process................................................6

TASK 2 ...........................................................................................................................................6

P3. Preparation of income statement by help of absorption and marginal costing.....................6

M2 Accounting techniques to produce financial statements.....................................................12

D2. Interpretation of produced financial statements.................................................................12

TASK 3..........................................................................................................................................12

P4. Advantages and disadvantages of different planning tools of budgetary control...............12

M3. Role of planning tools in order to make accurate forecasting and preparing the budgets.14

TASK 4..........................................................................................................................................14

P5. Difference between enterprises in order to sort financial issues by help of different MAS.

...................................................................................................................................................14

M4. Importance of MAS in the context of solving financial problems....................................16

D3. Role of planning tools in overcoming from monetary issues.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Accounting is a major aspect of corporations in order to help monitor financial

transactions. The MA is one of the major components of accounting. It is connected to the

process of acquiring financial and non-financial information in order to prepare internal

statements when administrators need it (Siverbo, 2014). Only the internal investors are provided

with these reports. The goal of the project report is to examine the position of this company

accounting. Alpha limited company, which is headquartered in the United Kingdom and

specializes in the production of pizzas, has been selected in the report. The report contains

comprehensive information on various MAS, MA reports and instruments for planning, etc.

Furthermore, the report also mentions the role of different MAS in the monetary problem

filtering aspect.

MAIN BODY

TASK 1

P1. MA and its types.

MA- It is characterized as a form of accounting that functions in the process of gathering

qualitative and quantitative data so that inner reports can be prepared by the accountant. These

documents provide the supervisors with a comprehensive structure for making important internal

decisions. Several forms of MA are shown below, such as:

Cost accounting system - It is an accounting system that is applied with finance

department with the goal of making revolutionary budget estimates. Through having

estimates of additional costs, it then becomes easier for administrators to take appropriate

action to allocate funds as an arrangement of need in order to minimize costs (Granlund

and Lukka, 2017). This accounting system is important for companies to monitor the use

of funds and the total cost of running various functions performed. They use this

accounting system in the sense of the above-mentioned Alpha limited company to keep

costs lower than projections.

Essential requirement- This accounting system is essential for companies to track the

volume of cost of various kinds of operations and activities. On the basis of it, companies

take accurate decisions regards to allocation of funds into various tasks.

Accounting is a major aspect of corporations in order to help monitor financial

transactions. The MA is one of the major components of accounting. It is connected to the

process of acquiring financial and non-financial information in order to prepare internal

statements when administrators need it (Siverbo, 2014). Only the internal investors are provided

with these reports. The goal of the project report is to examine the position of this company

accounting. Alpha limited company, which is headquartered in the United Kingdom and

specializes in the production of pizzas, has been selected in the report. The report contains

comprehensive information on various MAS, MA reports and instruments for planning, etc.

Furthermore, the report also mentions the role of different MAS in the monetary problem

filtering aspect.

MAIN BODY

TASK 1

P1. MA and its types.

MA- It is characterized as a form of accounting that functions in the process of gathering

qualitative and quantitative data so that inner reports can be prepared by the accountant. These

documents provide the supervisors with a comprehensive structure for making important internal

decisions. Several forms of MA are shown below, such as:

Cost accounting system - It is an accounting system that is applied with finance

department with the goal of making revolutionary budget estimates. Through having

estimates of additional costs, it then becomes easier for administrators to take appropriate

action to allocate funds as an arrangement of need in order to minimize costs (Granlund

and Lukka, 2017). This accounting system is important for companies to monitor the use

of funds and the total cost of running various functions performed. They use this

accounting system in the sense of the above-mentioned Alpha limited company to keep

costs lower than projections.

Essential requirement- This accounting system is essential for companies to track the

volume of cost of various kinds of operations and activities. On the basis of it, companies

take accurate decisions regards to allocation of funds into various tasks.

Inventory management system- This is a form of accounting system correlated with the

process of monitoring regular stock value usage for the production of new goods. It is

entirely based on techniques of valuation such as last and first step, first method in first

method out and much more. It is important for companies to cut the storage costs as well

as to obtain information about the use of stock in undertaking manufacturing operations.

It is used in the dimension of the above-mentioned Alpha limited company, which allows

them to determine material use, finished products and many more.

Essential requirement- It is essential for manufacturing companies to compute cost and

quantity of stored stock. It determines about how much stock is remained in the

warehouses at the end of month or quarter that leads to better decision for managers.

Price optimisation system- It can be described as a form of management system that is

effectively related to the process of pricing goods and services. It becomes feasible

because key information about consumer understanding, reviews as well as potential

market is used by sales team. Based on this, they set prices of different products for

different parts of the market and clients. It is important for corporations to adjust prices of

products in line with market research. Their sales team, like in the Alpha limited

company, set Pizzas rates according to market dominance and customer needs.

Essential requirement- It is essential for keeping prices of products and services at a level

from which companies cannot get any lose. This becomes possible because under it

prices are set in accordance of market research.

Job order costing system- This is a form of cost system that uses the allocated number of

jobs to calculate the cost of each event (Kastberg and Siverbo, 2016). It is implemented

in those business entities in which portfolio of products is too larger because by help of

this they can assess cost of each performed functions individually. For instance in the

Alpha limited company, their managers implement this accounting system with an aim of

keeping control over the cost of job aligned to different number of activities and

operations.

Essential requirement- This is essential for determining cost of each output or product

produced by a company. Under it, cost is calculated in accordance of job cost aligned

with completing different activities.

process of monitoring regular stock value usage for the production of new goods. It is

entirely based on techniques of valuation such as last and first step, first method in first

method out and much more. It is important for companies to cut the storage costs as well

as to obtain information about the use of stock in undertaking manufacturing operations.

It is used in the dimension of the above-mentioned Alpha limited company, which allows

them to determine material use, finished products and many more.

Essential requirement- It is essential for manufacturing companies to compute cost and

quantity of stored stock. It determines about how much stock is remained in the

warehouses at the end of month or quarter that leads to better decision for managers.

Price optimisation system- It can be described as a form of management system that is

effectively related to the process of pricing goods and services. It becomes feasible

because key information about consumer understanding, reviews as well as potential

market is used by sales team. Based on this, they set prices of different products for

different parts of the market and clients. It is important for corporations to adjust prices of

products in line with market research. Their sales team, like in the Alpha limited

company, set Pizzas rates according to market dominance and customer needs.

Essential requirement- It is essential for keeping prices of products and services at a level

from which companies cannot get any lose. This becomes possible because under it

prices are set in accordance of market research.

Job order costing system- This is a form of cost system that uses the allocated number of

jobs to calculate the cost of each event (Kastberg and Siverbo, 2016). It is implemented

in those business entities in which portfolio of products is too larger because by help of

this they can assess cost of each performed functions individually. For instance in the

Alpha limited company, their managers implement this accounting system with an aim of

keeping control over the cost of job aligned to different number of activities and

operations.

Essential requirement- This is essential for determining cost of each output or product

produced by a company. Under it, cost is calculated in accordance of job cost aligned

with completing different activities.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Characteristics of financial information:

Reliability- This is essential for companies that their financial information should be

reliable as per the nature and activities of business.

Accuracy- As well as financial information needs to be accurate so that accountant can

produce correct financial statements at the end of financial year.

Timeliness- In addition, financial information needs to be presented to external and

internal stakeholders at the end of financial year. Any kinds of delay may lead to lose of

company.

P2. Different methods of MA reports.

MA reports – The term MA reports can be described as records that encompass important

information pertaining to all financial and anti-financial aspects. They prepare different kinds of

reports in the sense of the above-mentioned Alpha limited company, such as:

Inventory report- It can be described as a type of report that includes key information

related to the opened and closed of the balance of various forms of inventory, including

raw resources, completed goods etc. This report includes all types of data in order to

assess stock quantities under LIFO, FIFO and the weighted average method. Managers

use this report in the above-mentioned Alpha limited company with the aim of staying in

touch to how much material they have at the end of a specific day.

Performance report - This is a form of document that contains in depth key performance-

related information about each and every element. It's used by organization executives to

make logical decisions on employee growth. The overall performance of workers can be

hidden in the lack of this report. In addition to employee performance data, it offers key

details such as performance of various functions and tasks conducted, etc. The

accountants are conducting this document in the sense of the above-mentioned Alpha

limited company in order to ensure sustainable economic growth in different aspects.

Budget report- It is a document that provides specific information about the performance

of the plan and the actual output (Hirsch, Seubert and Sohn, 2015). Using this document,

the division of finance becomes able to evaluate the difference between actual and

projected performance. The accountants generate this report in the scope of the above-

mentioned Alpha limited company to monitor variances and to maintain an extra finger

on actual performance.

Reliability- This is essential for companies that their financial information should be

reliable as per the nature and activities of business.

Accuracy- As well as financial information needs to be accurate so that accountant can

produce correct financial statements at the end of financial year.

Timeliness- In addition, financial information needs to be presented to external and

internal stakeholders at the end of financial year. Any kinds of delay may lead to lose of

company.

P2. Different methods of MA reports.

MA reports – The term MA reports can be described as records that encompass important

information pertaining to all financial and anti-financial aspects. They prepare different kinds of

reports in the sense of the above-mentioned Alpha limited company, such as:

Inventory report- It can be described as a type of report that includes key information

related to the opened and closed of the balance of various forms of inventory, including

raw resources, completed goods etc. This report includes all types of data in order to

assess stock quantities under LIFO, FIFO and the weighted average method. Managers

use this report in the above-mentioned Alpha limited company with the aim of staying in

touch to how much material they have at the end of a specific day.

Performance report - This is a form of document that contains in depth key performance-

related information about each and every element. It's used by organization executives to

make logical decisions on employee growth. The overall performance of workers can be

hidden in the lack of this report. In addition to employee performance data, it offers key

details such as performance of various functions and tasks conducted, etc. The

accountants are conducting this document in the sense of the above-mentioned Alpha

limited company in order to ensure sustainable economic growth in different aspects.

Budget report- It is a document that provides specific information about the performance

of the plan and the actual output (Hirsch, Seubert and Sohn, 2015). Using this document,

the division of finance becomes able to evaluate the difference between actual and

projected performance. The accountants generate this report in the scope of the above-

mentioned Alpha limited company to monitor variances and to maintain an extra finger

on actual performance.

Accounts receivable ageing report - This can be described as a document which provides

comprehensive information on the maximum value of debt that will need to be

accumulated in the forthcoming period. Finance managers make further preparations as to

the need for funds to complete operations and events in conjunction with this report. One

of it's key features is that info is systematically reported under it so that executives can

easily check the debt level. In the Alpha limited company, they prepare this report and

their finance department collects funds according to information provided by report.

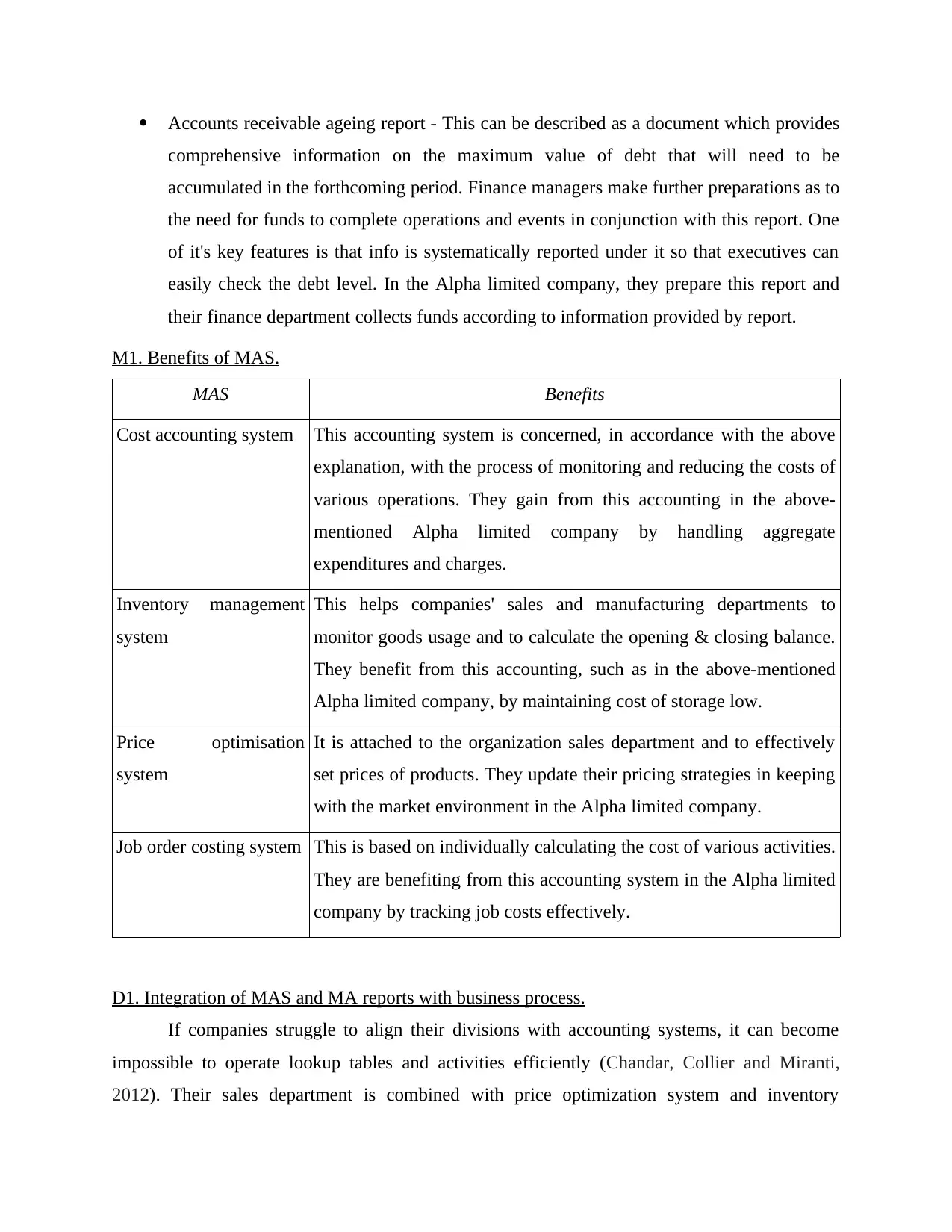

M1. Benefits of MAS.

MAS Benefits

Cost accounting system This accounting system is concerned, in accordance with the above

explanation, with the process of monitoring and reducing the costs of

various operations. They gain from this accounting in the above-

mentioned Alpha limited company by handling aggregate

expenditures and charges.

Inventory management

system

This helps companies' sales and manufacturing departments to

monitor goods usage and to calculate the opening & closing balance.

They benefit from this accounting, such as in the above-mentioned

Alpha limited company, by maintaining cost of storage low.

Price optimisation

system

It is attached to the organization sales department and to effectively

set prices of products. They update their pricing strategies in keeping

with the market environment in the Alpha limited company.

Job order costing system This is based on individually calculating the cost of various activities.

They are benefiting from this accounting system in the Alpha limited

company by tracking job costs effectively.

D1. Integration of MAS and MA reports with business process.

If companies struggle to align their divisions with accounting systems, it can become

impossible to operate lookup tables and activities efficiently (Chandar, Collier and Miranti,

2012). Their sales department is combined with price optimization system and inventory

comprehensive information on the maximum value of debt that will need to be

accumulated in the forthcoming period. Finance managers make further preparations as to

the need for funds to complete operations and events in conjunction with this report. One

of it's key features is that info is systematically reported under it so that executives can

easily check the debt level. In the Alpha limited company, they prepare this report and

their finance department collects funds according to information provided by report.

M1. Benefits of MAS.

MAS Benefits

Cost accounting system This accounting system is concerned, in accordance with the above

explanation, with the process of monitoring and reducing the costs of

various operations. They gain from this accounting in the above-

mentioned Alpha limited company by handling aggregate

expenditures and charges.

Inventory management

system

This helps companies' sales and manufacturing departments to

monitor goods usage and to calculate the opening & closing balance.

They benefit from this accounting, such as in the above-mentioned

Alpha limited company, by maintaining cost of storage low.

Price optimisation

system

It is attached to the organization sales department and to effectively

set prices of products. They update their pricing strategies in keeping

with the market environment in the Alpha limited company.

Job order costing system This is based on individually calculating the cost of various activities.

They are benefiting from this accounting system in the Alpha limited

company by tracking job costs effectively.

D1. Integration of MAS and MA reports with business process.

If companies struggle to align their divisions with accounting systems, it can become

impossible to operate lookup tables and activities efficiently (Chandar, Collier and Miranti,

2012). Their sales department is combined with price optimization system and inventory

management system, as in the Alpha limited company. Furthermore, their manufacturing

department uses important stock management report information and the accounting department

also evaluates important information from the account receivable ageing report.

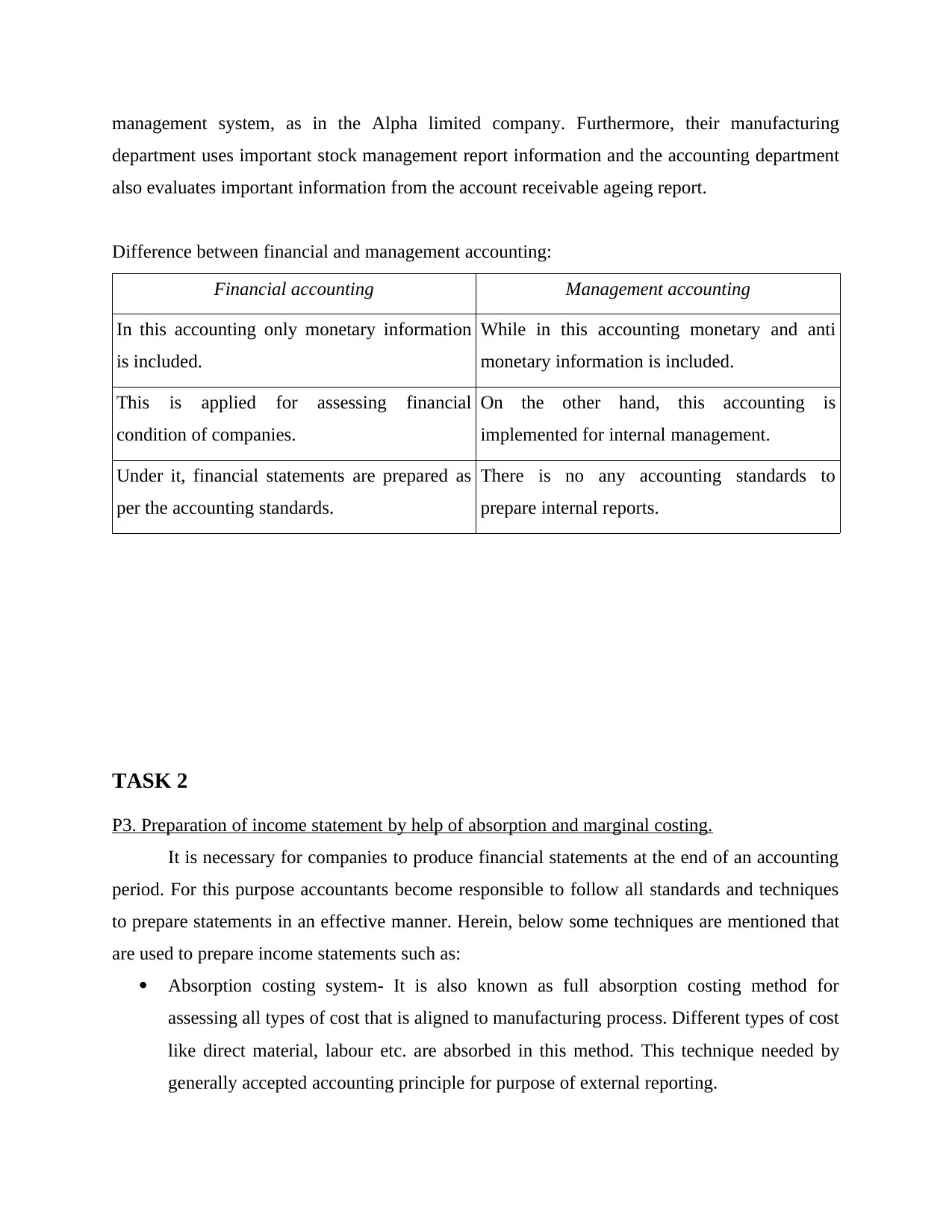

Difference between financial and management accounting:

Financial accounting Management accounting

In this accounting only monetary information

is included.

While in this accounting monetary and anti

monetary information is included.

This is applied for assessing financial

condition of companies.

On the other hand, this accounting is

implemented for internal management.

Under it, financial statements are prepared as

per the accounting standards.

There is no any accounting standards to

prepare internal reports.

TASK 2

P3. Preparation of income statement by help of absorption and marginal costing.

It is necessary for companies to produce financial statements at the end of an accounting

period. For this purpose accountants become responsible to follow all standards and techniques

to prepare statements in an effective manner. Herein, below some techniques are mentioned that

are used to prepare income statements such as:

Absorption costing system- It is also known as full absorption costing method for

assessing all types of cost that is aligned to manufacturing process. Different types of cost

like direct material, labour etc. are absorbed in this method. This technique needed by

generally accepted accounting principle for purpose of external reporting.

department uses important stock management report information and the accounting department

also evaluates important information from the account receivable ageing report.

Difference between financial and management accounting:

Financial accounting Management accounting

In this accounting only monetary information

is included.

While in this accounting monetary and anti

monetary information is included.

This is applied for assessing financial

condition of companies.

On the other hand, this accounting is

implemented for internal management.

Under it, financial statements are prepared as

per the accounting standards.

There is no any accounting standards to

prepare internal reports.

TASK 2

P3. Preparation of income statement by help of absorption and marginal costing.

It is necessary for companies to produce financial statements at the end of an accounting

period. For this purpose accountants become responsible to follow all standards and techniques

to prepare statements in an effective manner. Herein, below some techniques are mentioned that

are used to prepare income statements such as:

Absorption costing system- It is also known as full absorption costing method for

assessing all types of cost that is aligned to manufacturing process. Different types of cost

like direct material, labour etc. are absorbed in this method. This technique needed by

generally accepted accounting principle for purpose of external reporting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

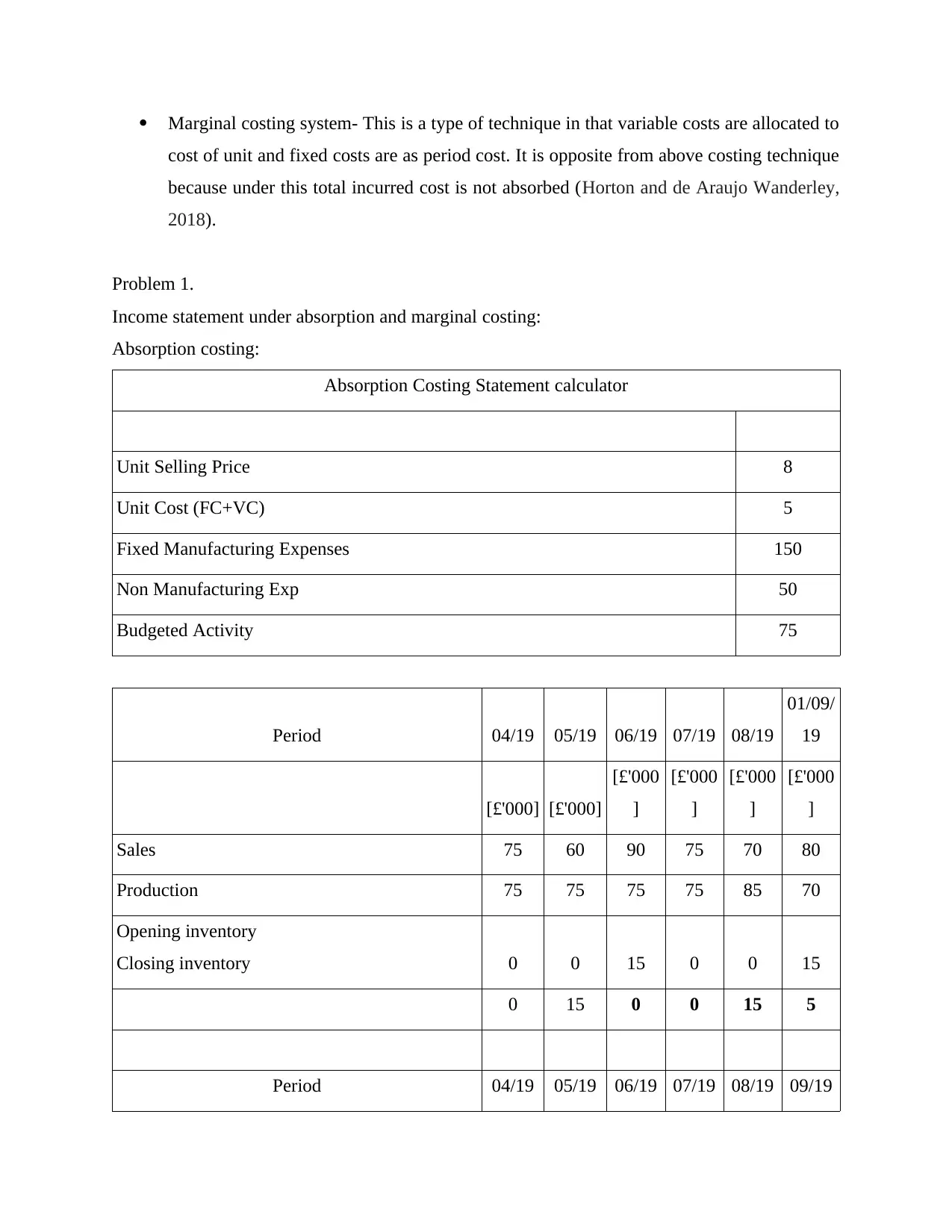

Marginal costing system- This is a type of technique in that variable costs are allocated to

cost of unit and fixed costs are as period cost. It is opposite from above costing technique

because under this total incurred cost is not absorbed (Horton and de Araujo Wanderley,

2018).

Problem 1.

Income statement under absorption and marginal costing:

Absorption costing:

Absorption Costing Statement calculator

Unit Selling Price 8

Unit Cost (FC+VC) 5

Fixed Manufacturing Expenses 150

Non Manufacturing Exp 50

Budgeted Activity 75

Period 04/19 05/19 06/19 07/19 08/19

01/09/

19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 75 60 90 75 70 80

Production 75 75 75 75 85 70

Opening inventory

Closing inventory 0 0 15 0 0 15

0 15 0 0 15 5

Period 04/19 05/19 06/19 07/19 08/19 09/19

cost of unit and fixed costs are as period cost. It is opposite from above costing technique

because under this total incurred cost is not absorbed (Horton and de Araujo Wanderley,

2018).

Problem 1.

Income statement under absorption and marginal costing:

Absorption costing:

Absorption Costing Statement calculator

Unit Selling Price 8

Unit Cost (FC+VC) 5

Fixed Manufacturing Expenses 150

Non Manufacturing Exp 50

Budgeted Activity 75

Period 04/19 05/19 06/19 07/19 08/19

01/09/

19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 75 60 90 75 70 80

Production 75 75 75 75 85 70

Opening inventory

Closing inventory 0 0 15 0 0 15

0 15 0 0 15 5

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

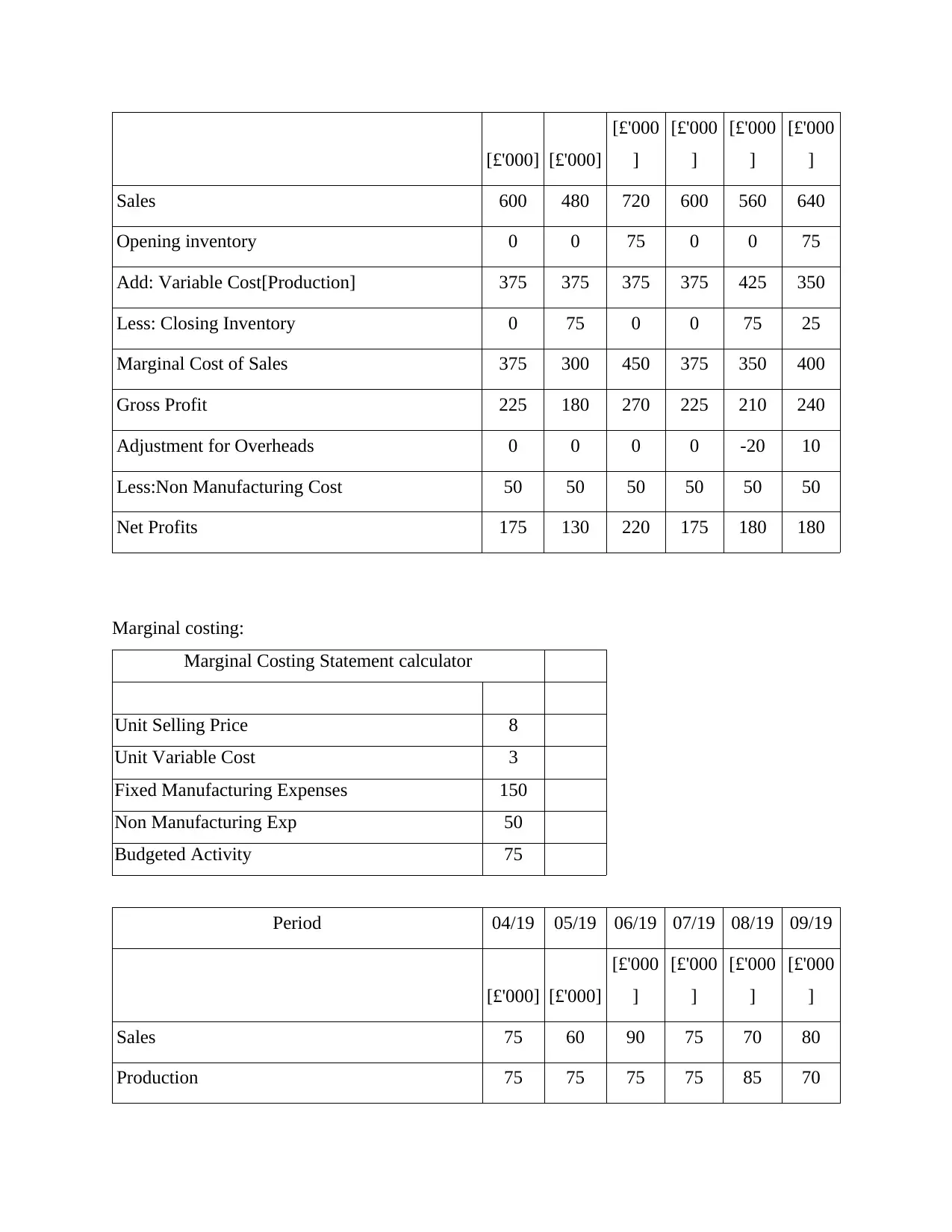

Sales 600 480 720 600 560 640

Opening inventory 0 0 75 0 0 75

Add: Variable Cost[Production] 375 375 375 375 425 350

Less: Closing Inventory 0 75 0 0 75 25

Marginal Cost of Sales 375 300 450 375 350 400

Gross Profit 225 180 270 225 210 240

Adjustment for Overheads 0 0 0 0 -20 10

Less:Non Manufacturing Cost 50 50 50 50 50 50

Net Profits 175 130 220 175 180 180

Marginal costing:

Marginal Costing Statement calculator

Unit Selling Price 8

Unit Variable Cost 3

Fixed Manufacturing Expenses 150

Non Manufacturing Exp 50

Budgeted Activity 75

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 75 60 90 75 70 80

Production 75 75 75 75 85 70

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 600 480 720 600 560 640

Opening inventory 0 0 75 0 0 75

Add: Variable Cost[Production] 375 375 375 375 425 350

Less: Closing Inventory 0 75 0 0 75 25

Marginal Cost of Sales 375 300 450 375 350 400

Gross Profit 225 180 270 225 210 240

Adjustment for Overheads 0 0 0 0 -20 10

Less:Non Manufacturing Cost 50 50 50 50 50 50

Net Profits 175 130 220 175 180 180

Marginal costing:

Marginal Costing Statement calculator

Unit Selling Price 8

Unit Variable Cost 3

Fixed Manufacturing Expenses 150

Non Manufacturing Exp 50

Budgeted Activity 75

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 75 60 90 75 70 80

Production 75 75 75 75 85 70

Opening inventory

Closing inventory 0 0 15 0 0 15

0 15 0 0 15 5

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

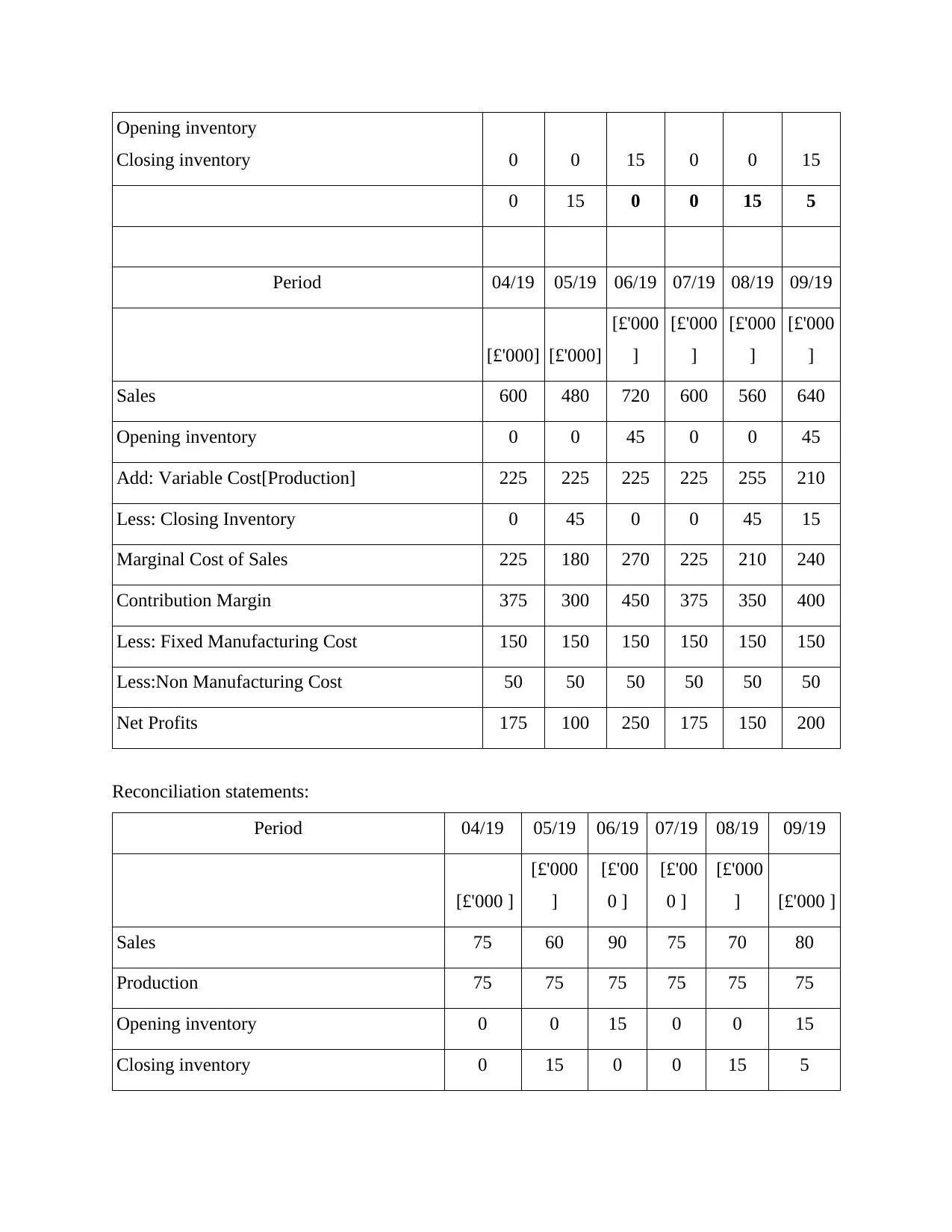

Sales 600 480 720 600 560 640

Opening inventory 0 0 45 0 0 45

Add: Variable Cost[Production] 225 225 225 225 255 210

Less: Closing Inventory 0 45 0 0 45 15

Marginal Cost of Sales 225 180 270 225 210 240

Contribution Margin 375 300 450 375 350 400

Less: Fixed Manufacturing Cost 150 150 150 150 150 150

Less:Non Manufacturing Cost 50 50 50 50 50 50

Net Profits 175 100 250 175 150 200

Reconciliation statements:

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000 ]

[£'000

]

[£'00

0 ]

[£'00

0 ]

[£'000

] [£'000 ]

Sales 75 60 90 75 70 80

Production 75 75 75 75 75 75

Opening inventory 0 0 15 0 0 15

Closing inventory 0 15 0 0 15 5

Closing inventory 0 0 15 0 0 15

0 15 0 0 15 5

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000] [£'000]

[£'000

]

[£'000

]

[£'000

]

[£'000

]

Sales 600 480 720 600 560 640

Opening inventory 0 0 45 0 0 45

Add: Variable Cost[Production] 225 225 225 225 255 210

Less: Closing Inventory 0 45 0 0 45 15

Marginal Cost of Sales 225 180 270 225 210 240

Contribution Margin 375 300 450 375 350 400

Less: Fixed Manufacturing Cost 150 150 150 150 150 150

Less:Non Manufacturing Cost 50 50 50 50 50 50

Net Profits 175 100 250 175 150 200

Reconciliation statements:

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000 ]

[£'000

]

[£'00

0 ]

[£'00

0 ]

[£'000

] [£'000 ]

Sales 75 60 90 75 70 80

Production 75 75 75 75 75 75

Opening inventory 0 0 15 0 0 15

Closing inventory 0 15 0 0 15 5

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Period 04/19 05/19 06/19 07/19 08/19 09/19

[£'000 ]

[£'000

]

[£'00

0 ]

[£'00

0 ]

[£'000

] [£'000 ]

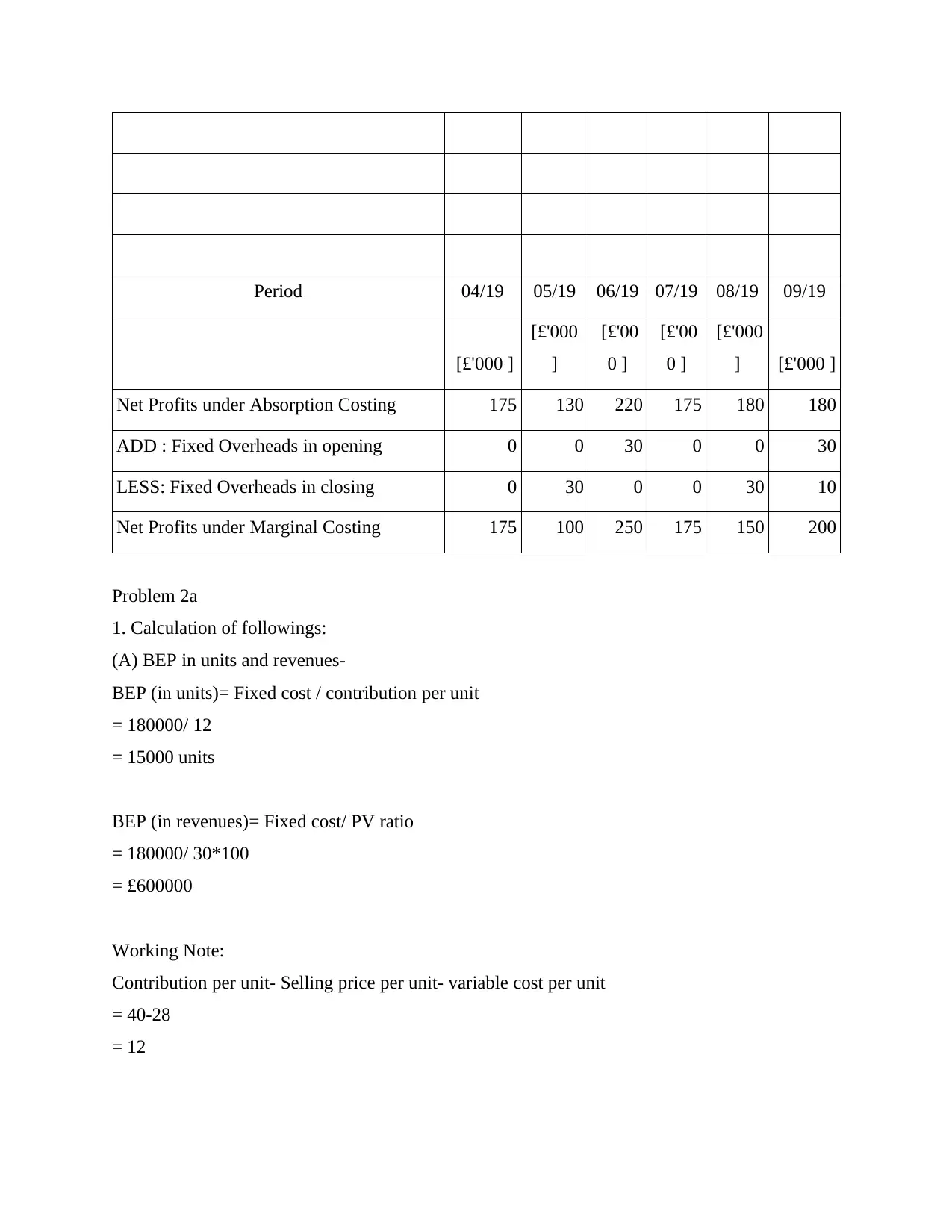

Net Profits under Absorption Costing 175 130 220 175 180 180

ADD : Fixed Overheads in opening 0 0 30 0 0 30

LESS: Fixed Overheads in closing 0 30 0 0 30 10

Net Profits under Marginal Costing 175 100 250 175 150 200

Problem 2a

1. Calculation of followings:

(A) BEP in units and revenues-

BEP (in units)= Fixed cost / contribution per unit

= 180000/ 12

= 15000 units

BEP (in revenues)= Fixed cost/ PV ratio

= 180000/ 30*100

= £600000

Working Note:

Contribution per unit- Selling price per unit- variable cost per unit

= 40-28

= 12

[£'000 ]

[£'000

]

[£'00

0 ]

[£'00

0 ]

[£'000

] [£'000 ]

Net Profits under Absorption Costing 175 130 220 175 180 180

ADD : Fixed Overheads in opening 0 0 30 0 0 30

LESS: Fixed Overheads in closing 0 30 0 0 30 10

Net Profits under Marginal Costing 175 100 250 175 150 200

Problem 2a

1. Calculation of followings:

(A) BEP in units and revenues-

BEP (in units)= Fixed cost / contribution per unit

= 180000/ 12

= 15000 units

BEP (in revenues)= Fixed cost/ PV ratio

= 180000/ 30*100

= £600000

Working Note:

Contribution per unit- Selling price per unit- variable cost per unit

= 40-28

= 12

PV ratio= Contribution/ sales per unit*100

= 12/40*100

= 30%

(B) Contribution margin ratio

= 12/40*100

= 30%

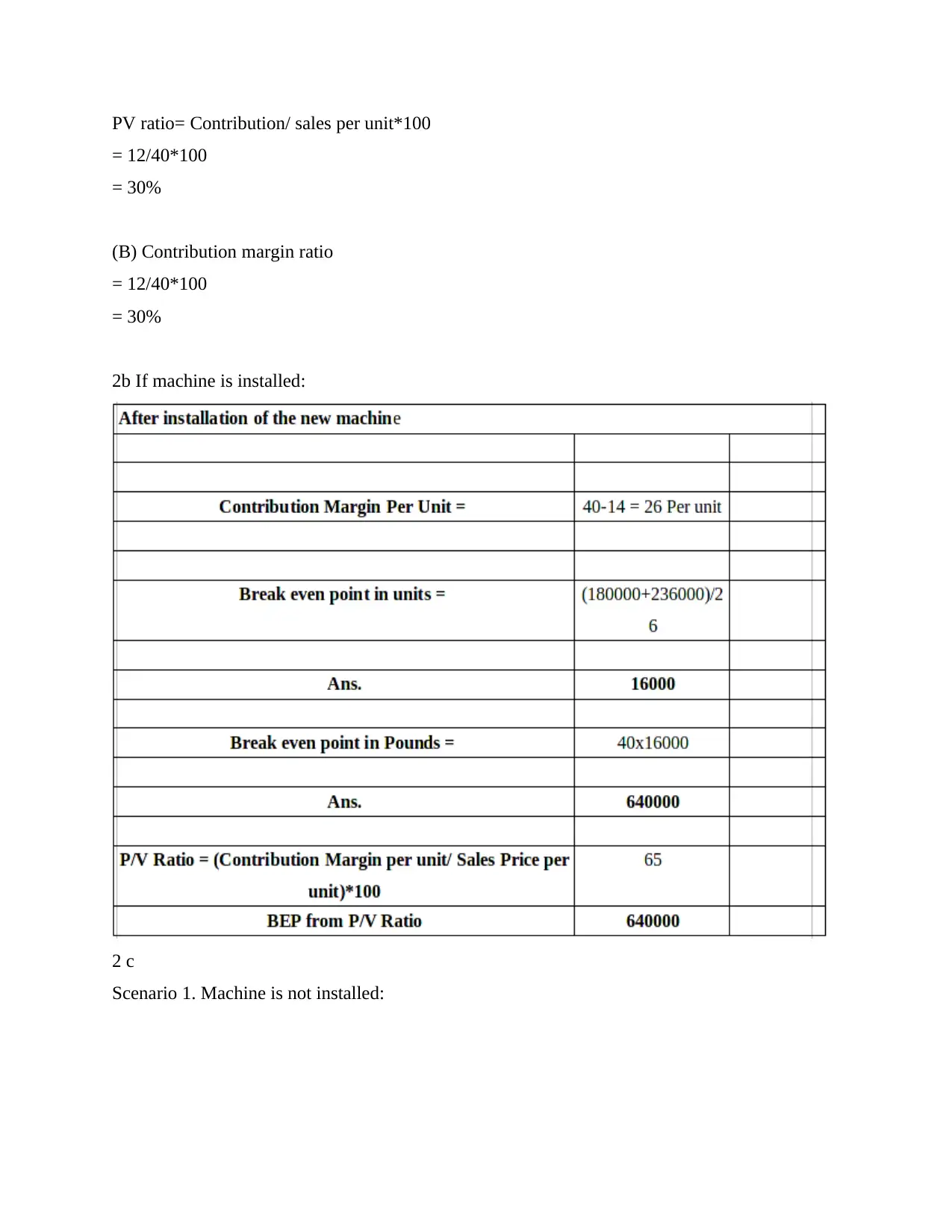

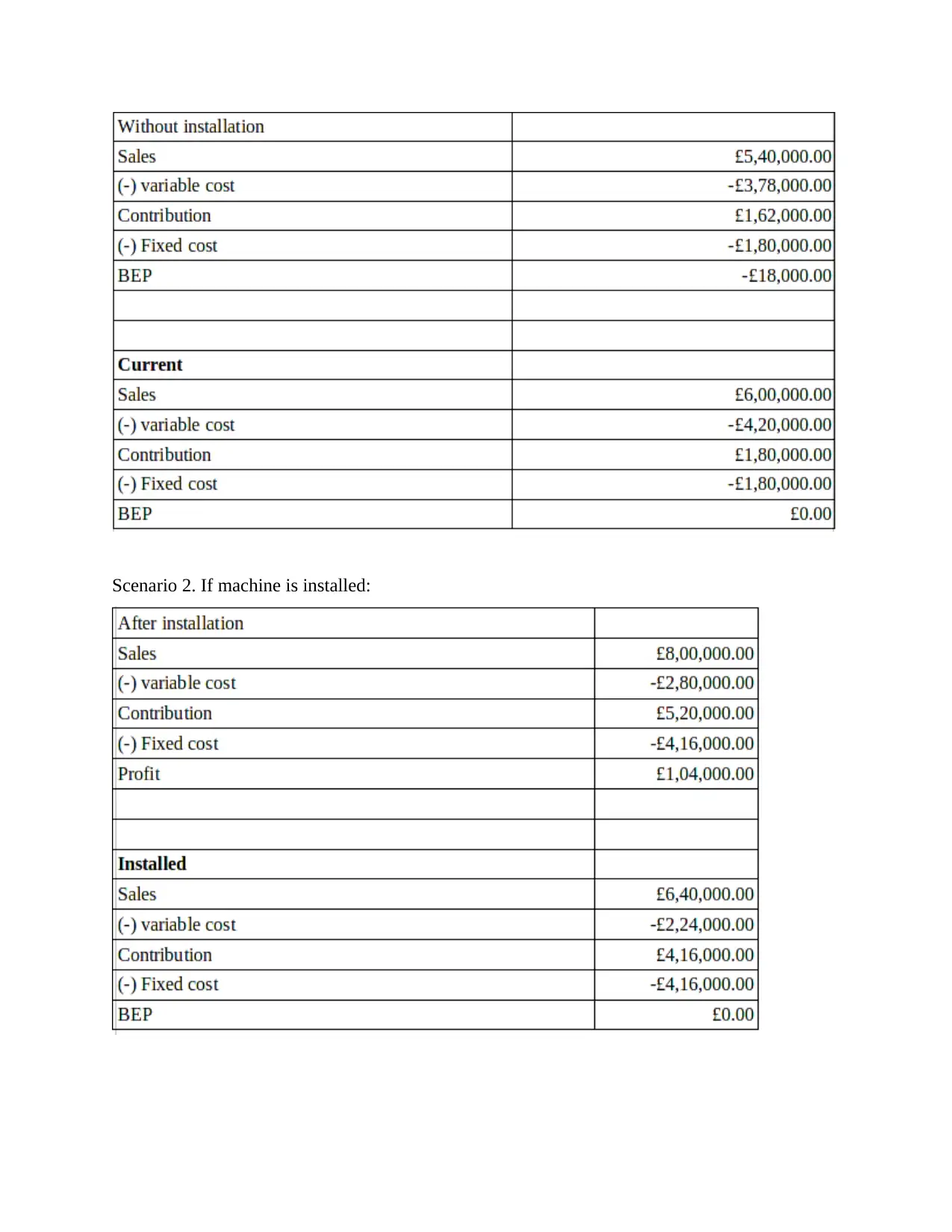

2b If machine is installed:

2 c

Scenario 1. Machine is not installed:

= 12/40*100

= 30%

(B) Contribution margin ratio

= 12/40*100

= 30%

2b If machine is installed:

2 c

Scenario 1. Machine is not installed:

Scenario 2. If machine is installed:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2d. Should company install machine?

The above calculated data shows that installation of machinery can be beneficial for

company. It is so because computed data presents that there will be profit of 104000 pounds, if

they install machine. On the other side if they do not install the machine, then they may face the

loss of -18000 pounds.

M2 Accounting techniques to produce financial statements.

Accountants use various types of methods and practices to prepare financial statements in

companies. In compliance with two costing methods, which are absorption and marginal costing,

income statements are generated in the above task (Fiondella, Spanò, 2016). To addition with

the above methods, accountants also use other methods to compile financial statements such as

regular costing, activity-based costing, etc.

D2. Interpretation of produced financial statements.

This may be found to vary the amount of total profit in both costing methods in

compliance with the above formulated income statements. Like in the context of absorption

costing method, it can be find out that value of net profit is of 175000, 220000, 175000, 180000

and 180000 pounds for month of April, May, June, July, August and September. On the other

hand, in the marginal costing method, the net profit is of 175000, 100000, 250000, 175000,

150000 and 200000 pounds for above mentioned time period.

TASK 3

P4. Advantages and disadvantages of different planning tools of budgetary control.

In Alpha organisation in order to control the overall cost of the firm does use of various

budgets. These are the planning tools through which the targets are achieved within eh limits

given against the distinct operations. Some of these in context of the company are as follows:

Capital budget – This is one of the most important limit which is used for the

maintenance of big expenses of the company. It includes the cost of land, tools and construction.

Under this the top management also takes the decisions for future investment and gets the

consent on same (Teittinen, Pellinen and Järvenpää, 2013). In Alpha limited company, this

budget is produced by their accountant to manage cost of capital expenditures and for taking

wise decision regards to investment.

The above calculated data shows that installation of machinery can be beneficial for

company. It is so because computed data presents that there will be profit of 104000 pounds, if

they install machine. On the other side if they do not install the machine, then they may face the

loss of -18000 pounds.

M2 Accounting techniques to produce financial statements.

Accountants use various types of methods and practices to prepare financial statements in

companies. In compliance with two costing methods, which are absorption and marginal costing,

income statements are generated in the above task (Fiondella, Spanò, 2016). To addition with

the above methods, accountants also use other methods to compile financial statements such as

regular costing, activity-based costing, etc.

D2. Interpretation of produced financial statements.

This may be found to vary the amount of total profit in both costing methods in

compliance with the above formulated income statements. Like in the context of absorption

costing method, it can be find out that value of net profit is of 175000, 220000, 175000, 180000

and 180000 pounds for month of April, May, June, July, August and September. On the other

hand, in the marginal costing method, the net profit is of 175000, 100000, 250000, 175000,

150000 and 200000 pounds for above mentioned time period.

TASK 3

P4. Advantages and disadvantages of different planning tools of budgetary control.

In Alpha organisation in order to control the overall cost of the firm does use of various

budgets. These are the planning tools through which the targets are achieved within eh limits

given against the distinct operations. Some of these in context of the company are as follows:

Capital budget – This is one of the most important limit which is used for the

maintenance of big expenses of the company. It includes the cost of land, tools and construction.

Under this the top management also takes the decisions for future investment and gets the

consent on same (Teittinen, Pellinen and Järvenpää, 2013). In Alpha limited company, this

budget is produced by their accountant to manage cost of capital expenditures and for taking

wise decision regards to investment.

Advantages

It helps organisation with long duration capital planning. Provide great assistance in taking judgements regarding which investment option to opt

for.

Disadvantages

These are rigid decisions and cannot be altered easily if required.

Such budgets cannot be prepared without experts.

Production budget – This is a separate budget in which it is estimated that how much

units will be produced in a particular time duration. It is derived from the sales and the planned

fixed units that has to be produced in coming time. In the Alpha limited company, their

accountant produce this budget to help their manufacturing department. It becomes possible

because by help of production budget, managers take suitable action regards to better use of

stored raw materials.

Advantages

Full capacity utilisation of resources is made which further helps in maximising the

profit.

The work force is made to work to a great extent as they have the targets to achieve and

therefore do not afford to delay. The wastage cost is eliminated as when budget is given it becomes necessary that the task

is completed in the given limits only.

Disadvantages

This is a very time consuming process as lot of prior work has to be done before setting

the budget for a particular time duration.

This budget only focusses on the results which can be calculated in terms of finance. It

avoids the quality criteria which is again very important.

Master budget – It is associated with the lower level limits that are formed in an enterprise

which includes different areas like budgeted financial statements, planning finance etc. It has a

number of components like the net income or loss, overhead and production and many more

(Prencipe, Bar-Yosef and Dekker, 2014). In Alpha limited company, this budget is used in order

to track the performance of different aspects and departments.

Advantages

It helps organisation with long duration capital planning. Provide great assistance in taking judgements regarding which investment option to opt

for.

Disadvantages

These are rigid decisions and cannot be altered easily if required.

Such budgets cannot be prepared without experts.

Production budget – This is a separate budget in which it is estimated that how much

units will be produced in a particular time duration. It is derived from the sales and the planned

fixed units that has to be produced in coming time. In the Alpha limited company, their

accountant produce this budget to help their manufacturing department. It becomes possible

because by help of production budget, managers take suitable action regards to better use of

stored raw materials.

Advantages

Full capacity utilisation of resources is made which further helps in maximising the

profit.

The work force is made to work to a great extent as they have the targets to achieve and

therefore do not afford to delay. The wastage cost is eliminated as when budget is given it becomes necessary that the task

is completed in the given limits only.

Disadvantages

This is a very time consuming process as lot of prior work has to be done before setting

the budget for a particular time duration.

This budget only focusses on the results which can be calculated in terms of finance. It

avoids the quality criteria which is again very important.

Master budget – It is associated with the lower level limits that are formed in an enterprise

which includes different areas like budgeted financial statements, planning finance etc. It has a

number of components like the net income or loss, overhead and production and many more

(Prencipe, Bar-Yosef and Dekker, 2014). In Alpha limited company, this budget is used in order

to track the performance of different aspects and departments.

Advantages

It helps an enterprise in recognising the possible issues of the enterprise which further

assist in planning the solution for same. It helps in evaluating the different departments that weather they are performing well or

is under performance.

Disadvantage

Lots of different limits are included in this particular account and therefore it lacks the

quality of being specific. It is difficult to find out the performances of separate

departments.

The other issue with this variety is that it is not easy to read and modify this budget as

lots of data is written all together which are also descriptive. Hence it is difficult to

interpret the information by a common person.

The above discussion shows that Alpha limited company has various options to make its budget

and as per the need and availability of resources it can make use of each and can bring control

over its overall expenditure of the firm.

How competitors set the prices?

The competitors set their prices in accordance of activities of customers. This is so

because if demand of product is higher then prices are kept high. On the other hand, if demand is

low then prices should be lower.

Balance score card- The balanced scorecard is a policy performance improvement tool – a semi-

standard standardized report that supervisors can use to track and evaluate the impact of these

decisions on the implementation of operations by staff. This technique is being used in order to

track and manage overall performance of companies in terms of monetary and non monetary

aspects.

M3. Role of planning tools in order to make accurate forecasting and preparing the budgets.

The budget is an extrapolation of financial elements for a given period of time. Distinct

planning tools play an important role in this context to make to effectively estimate the revenue

and investment of further timespan (Serena Chiucchi, 2013). There are different types of

assist in planning the solution for same. It helps in evaluating the different departments that weather they are performing well or

is under performance.

Disadvantage

Lots of different limits are included in this particular account and therefore it lacks the

quality of being specific. It is difficult to find out the performances of separate

departments.

The other issue with this variety is that it is not easy to read and modify this budget as

lots of data is written all together which are also descriptive. Hence it is difficult to

interpret the information by a common person.

The above discussion shows that Alpha limited company has various options to make its budget

and as per the need and availability of resources it can make use of each and can bring control

over its overall expenditure of the firm.

How competitors set the prices?

The competitors set their prices in accordance of activities of customers. This is so

because if demand of product is higher then prices are kept high. On the other hand, if demand is

low then prices should be lower.

Balance score card- The balanced scorecard is a policy performance improvement tool – a semi-

standard standardized report that supervisors can use to track and evaluate the impact of these

decisions on the implementation of operations by staff. This technique is being used in order to

track and manage overall performance of companies in terms of monetary and non monetary

aspects.

M3. Role of planning tools in order to make accurate forecasting and preparing the budgets.

The budget is an extrapolation of financial elements for a given period of time. Distinct

planning tools play an important role in this context to make to effectively estimate the revenue

and investment of further timespan (Serena Chiucchi, 2013). There are different types of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

planning techniques, such as capital budgeting, dynamic financial planning, and much more. For

example, their bookkeepers use numerous plan tools called cash budgeting, zero-based

budgeting, etc. in Alpha limited company. We all benefit from these methods in order to predict

future budgets. They benefit from all these tools to predict future futuristic budgets. This

becomes feasible because comprehensive info about possible operations that arise in the

forthcoming timeline under these scheduling tools.

TASK 4

P5. Difference between enterprises in order to sort financial issues by help of different MAS.

Financial problem - There are a variety of issues in the perspective of corporations that hinder

their productivity and growth. In fact, they need to address the financial problem in much less

time so that depletion of funding can be prevented. Simply, financial problems arise in

corporations due to inefficient management of monetary resources. As a result, businesses find it

difficult to fulfil any need for funds to achieve goals.

Decreasing in efficiency of generating revenue - It is a sort of financial problem that

arises in businesses as the value of overall sales profits declines (Leotta, Rizza and

Ruggeri, 2017). Because of this financial problem, making payment of miscellaneous

expenses becomes challenging for corporations. As well as they get unable to manage

overall monetary resources in an effective manner. As with Tesco plc, they are facing this

financial problem as their overall sales profits have been significantly reduced.

Increasing in total expenditures- This can be defined as a problem faced by businesses

due to inefficient control over total expenditure. It mainly affects the profits and

advancement of corporations in a negative way. Their departments face the problem of

higher operating costs in the Sainsburry plc.

Methods to identify financial issues:

Key performance indicator – This is a strategy that focuses on those elements whose

output is below or above the standard. This makes easier for executives to discover out

the overall shortfall level (Schaltegger, Viere and Zvezdov, 2012). There are both

financial and non financial performance indicators. Under financial KPI's profits, cost etc.

are included and in the non financial KPI's employee relation, suppliers relation etc. are

example, their bookkeepers use numerous plan tools called cash budgeting, zero-based

budgeting, etc. in Alpha limited company. We all benefit from these methods in order to predict

future budgets. They benefit from all these tools to predict future futuristic budgets. This

becomes feasible because comprehensive info about possible operations that arise in the

forthcoming timeline under these scheduling tools.

TASK 4

P5. Difference between enterprises in order to sort financial issues by help of different MAS.

Financial problem - There are a variety of issues in the perspective of corporations that hinder

their productivity and growth. In fact, they need to address the financial problem in much less

time so that depletion of funding can be prevented. Simply, financial problems arise in

corporations due to inefficient management of monetary resources. As a result, businesses find it

difficult to fulfil any need for funds to achieve goals.

Decreasing in efficiency of generating revenue - It is a sort of financial problem that

arises in businesses as the value of overall sales profits declines (Leotta, Rizza and

Ruggeri, 2017). Because of this financial problem, making payment of miscellaneous

expenses becomes challenging for corporations. As well as they get unable to manage

overall monetary resources in an effective manner. As with Tesco plc, they are facing this

financial problem as their overall sales profits have been significantly reduced.

Increasing in total expenditures- This can be defined as a problem faced by businesses

due to inefficient control over total expenditure. It mainly affects the profits and

advancement of corporations in a negative way. Their departments face the problem of

higher operating costs in the Sainsburry plc.

Methods to identify financial issues:

Key performance indicator – This is a strategy that focuses on those elements whose

output is below or above the standard. This makes easier for executives to discover out

the overall shortfall level (Schaltegger, Viere and Zvezdov, 2012). There are both

financial and non financial performance indicators. Under financial KPI's profits, cost etc.

are included and in the non financial KPI's employee relation, suppliers relation etc. are

covered. This program is used in the context of the above Tesco plc to determine the

actual level of problem.

Benchmarking - This is a method in which financial side equate two corporate entities

between each other. Comparison is aimed at finding out those elements where the

company's performance is weaker and needs to improve. Like in the Sainsburry, they use

this strategy to find the real financial problem. As well as they find alternatives to sorting

out issues.

Financial governance -This is a type of method that focuses on the purposeful recording of

money transactions. The aim of this method is to continue to focus on those elements that are

causing in businesses as a financial issue. This technique is being used by companies in order to

overcome monetary issues. It becomes possible because under this, financial transactions are

recorded in an effective manner. As a result, financial managers become able to act as a

monitoring strategy to sort out issues.

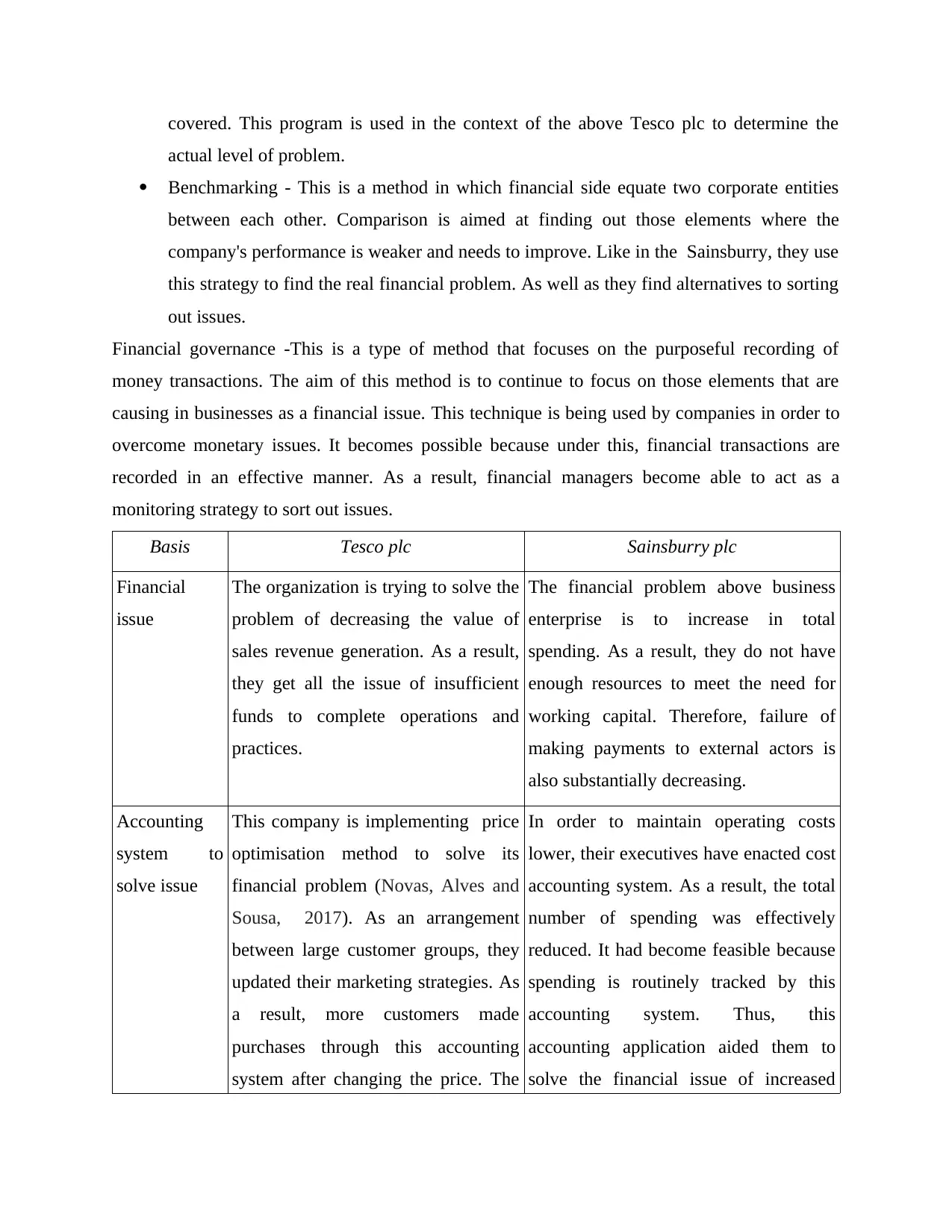

Basis Tesco plc Sainsburry plc

Financial

issue

The organization is trying to solve the

problem of decreasing the value of

sales revenue generation. As a result,

they get all the issue of insufficient

funds to complete operations and

practices.

The financial problem above business

enterprise is to increase in total

spending. As a result, they do not have

enough resources to meet the need for

working capital. Therefore, failure of

making payments to external actors is

also substantially decreasing.

Accounting

system to

solve issue

This company is implementing price

optimisation method to solve its

financial problem (Novas, Alves and

Sousa, 2017). As an arrangement

between large customer groups, they

updated their marketing strategies. As

a result, more customers made

purchases through this accounting

system after changing the price. The

In order to maintain operating costs

lower, their executives have enacted cost

accounting system. As a result, the total

number of spending was effectively

reduced. It had become feasible because

spending is routinely tracked by this

accounting system. Thus, this

accounting application aided them to

solve the financial issue of increased

actual level of problem.

Benchmarking - This is a method in which financial side equate two corporate entities

between each other. Comparison is aimed at finding out those elements where the

company's performance is weaker and needs to improve. Like in the Sainsburry, they use

this strategy to find the real financial problem. As well as they find alternatives to sorting

out issues.

Financial governance -This is a type of method that focuses on the purposeful recording of

money transactions. The aim of this method is to continue to focus on those elements that are

causing in businesses as a financial issue. This technique is being used by companies in order to

overcome monetary issues. It becomes possible because under this, financial transactions are

recorded in an effective manner. As a result, financial managers become able to act as a

monitoring strategy to sort out issues.

Basis Tesco plc Sainsburry plc

Financial

issue

The organization is trying to solve the

problem of decreasing the value of

sales revenue generation. As a result,

they get all the issue of insufficient

funds to complete operations and

practices.

The financial problem above business

enterprise is to increase in total

spending. As a result, they do not have

enough resources to meet the need for

working capital. Therefore, failure of

making payments to external actors is

also substantially decreasing.

Accounting

system to

solve issue

This company is implementing price

optimisation method to solve its

financial problem (Novas, Alves and

Sousa, 2017). As an arrangement

between large customer groups, they

updated their marketing strategies. As

a result, more customers made

purchases through this accounting

system after changing the price. The

In order to maintain operating costs

lower, their executives have enacted cost

accounting system. As a result, the total

number of spending was effectively

reduced. It had become feasible because

spending is routinely tracked by this

accounting system. Thus, this

accounting application aided them to

solve the financial issue of increased

issue of lower revenue has therefore

been resolved as after an increase in

total sales revenue.

spending volumes.

M4. Importance of MAS in the context of solving financial problems.

Businesses that address their financial problem in less time are able to generate higher

sales in this competitive marketplace. The function of accounting systems in this aspect is too

essential. This is because the executives become able to assign funds effectively by adopting

these systems (Kober, Subraamanniam and Watson, 2012). These accounting systems also lead

businesses in discovering the actual level of issues and options to sorting the problem in much

less time and cost. Different accounting systems such as cost accounting system, price

optimization system, job costing system and many others are used in Alpha limited company.

Their separate departments are interconnected with each other by means of these management

system. Furthermore, above-mentioned stores such as Tesco plc and Sainsburry plc are using

cost and price optimization system that helped them to effectively sort financial concerns.

D3. Role of planning tools in overcoming from monetary issues.

The planning tools also contribute in a similar manner as MAS in regards to sorting

monetary issues. In the above business, their accountants implement various types of planning

tools like capital budgeting, master budget etc. In addition to these planning tools, organizations

are provided with a structure to recognize financial concerns and execute effective methods to

resolve financial problems (Hoque, Covaleski and Gooneratne, 2013). As in the above-

mentioned Alpha limited company, this can be noticed that they are using different types of

planning methods such as cash budgeting, zero-based budgeting and many others that can help

solve financial difficulties.

CONCLUSION

As accordance of above project report, it has been articulated that businesses can not

control and manage overall activities in an effective manner in the absence of applying MA. This

is so because by help of it, various number of department gets linked with each other. Under the

been resolved as after an increase in

total sales revenue.

spending volumes.

M4. Importance of MAS in the context of solving financial problems.

Businesses that address their financial problem in less time are able to generate higher

sales in this competitive marketplace. The function of accounting systems in this aspect is too

essential. This is because the executives become able to assign funds effectively by adopting

these systems (Kober, Subraamanniam and Watson, 2012). These accounting systems also lead

businesses in discovering the actual level of issues and options to sorting the problem in much

less time and cost. Different accounting systems such as cost accounting system, price

optimization system, job costing system and many others are used in Alpha limited company.

Their separate departments are interconnected with each other by means of these management

system. Furthermore, above-mentioned stores such as Tesco plc and Sainsburry plc are using

cost and price optimization system that helped them to effectively sort financial concerns.

D3. Role of planning tools in overcoming from monetary issues.

The planning tools also contribute in a similar manner as MAS in regards to sorting

monetary issues. In the above business, their accountants implement various types of planning

tools like capital budgeting, master budget etc. In addition to these planning tools, organizations

are provided with a structure to recognize financial concerns and execute effective methods to

resolve financial problems (Hoque, Covaleski and Gooneratne, 2013). As in the above-

mentioned Alpha limited company, this can be noticed that they are using different types of

planning methods such as cash budgeting, zero-based budgeting and many others that can help

solve financial difficulties.

CONCLUSION

As accordance of above project report, it has been articulated that businesses can not

control and manage overall activities in an effective manner in the absence of applying MA. This

is so because by help of it, various number of department gets linked with each other. Under the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

project different number of accounting systems namely as stock management system, job order

costing system etc. are described along with their importance. In addition, MA reports like

performance report, stock report etc. are also concluded. The further part of report concludes

regards to preparation of income statements on behalf of given data and about planning like

capital budget, master budget etc. As well as it can be concluded that installation of machinery

will be beneficial for company in compare to not installing. In the end part of report, two

enterprises are compared with each other with an objective of determining way by which they

overcome from their issues.

costing system etc. are described along with their importance. In addition, MA reports like

performance report, stock report etc. are also concluded. The further part of report concludes

regards to preparation of income statements on behalf of given data and about planning like

capital budget, master budget etc. As well as it can be concluded that installation of machinery

will be beneficial for company in compare to not installing. In the end part of report, two

enterprises are compared with each other with an objective of determining way by which they

overcome from their issues.

REFERENCES

Books and journal:

Siverbo, S., 2014. The implementation and use of benchmarking in local government: a case

study of the translation of a management accounting innovation. Financial

Accountability & Management. 30(2). pp.121-149.

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Kastberg, G. and Siverbo, S., 2016. The role of management accounting and control in making

professional organizations horizontal. Accounting, Auditing & Accountability Journal.

29(3). pp.428-451.

Hirsch, B., Seubert, A. and Sohn, M., 2015. Visualisation of data in management accounting

reports: How supplementary graphs improve every-day management

judgments. Journal of Applied Accounting Research. 16(2). pp.221-239.

Chandar, N., Collier, D. and Miranti, P., 2012. Graph standardization and management

accounting at AT&T during the 1920s. Accounting History. 17(1). pp.35-62.

Horton, K. E. and de Araujo Wanderley, C., 2018. Identity conflict and the paradox of embedded

agency in the management accounting profession: Adding a new piece to the theoretical

jigsaw. Management Accounting Research. 38. pp.39-50.

Fiondella, C., Macchioni, R., Maffei, M. and Spanò, R., 2016, September. Successful changes in

management accounting systems: A healthcare case study. In Accounting Forum (Vol.

40, No. 3, pp. 186-204). Taylor & Francis.

Teittinen, H., Pellinen, J. and Järvenpää, M., 2013. ERP in action—Challenges and benefits for

management control in SME context. International Journal of Accounting Information

Systems. 14(4). pp.278-296.

Prencipe, A., Bar-Yosef, S. and Dekker, H .C., 2014. Accounting research in family firms:

Theoretical and empirical challenges. European Accounting Review. 23(3). pp.361-385.

Serena Chiucchi, M., 2013. Intellectual capital accounting in action: enhancing learning through

interventionist research. Journal of Intellectual Capital. 14(1). pp.48-68.

Leotta, A., Rizza, C. and Ruggeri, D., 2017. Management accounting and leadership

construction in family firms. Qualitative Research in Accounting & Management. 14(2).

pp.189-207.

Schaltegger, S., Viere, T. and Zvezdov, D., 2012. Tapping environmental accounting potentials

of beer brewing: Information needs for successful cleaner production. Journal of

Cleaner Production. 29. pp.1-10.

Novas, J. C., Alves, M. D. C. G. and Sousa, A., 2017. The role of management accounting

systems in the development of intellectual capital. Journal of Intellectual Capital. 18(2).

pp.286-315.

Kober, R., Subraamanniam, T. and Watson, J., 2012. The impact of total quality management

adoption on small and medium enterprises’ financial performance. Accounting &

Finance. 52(2). pp.421-438.

Hoque, Z., A. Covaleski, M. and N. Gooneratne, T., 2013. Theoretical triangulation and

pluralism in research methods in organizational and accounting research. Accounting,

Auditing & Accountability Journal. 26(7). pp.1170-1198.

Books and journal:

Siverbo, S., 2014. The implementation and use of benchmarking in local government: a case

study of the translation of a management accounting innovation. Financial

Accountability & Management. 30(2). pp.121-149.

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Kastberg, G. and Siverbo, S., 2016. The role of management accounting and control in making

professional organizations horizontal. Accounting, Auditing & Accountability Journal.

29(3). pp.428-451.

Hirsch, B., Seubert, A. and Sohn, M., 2015. Visualisation of data in management accounting

reports: How supplementary graphs improve every-day management

judgments. Journal of Applied Accounting Research. 16(2). pp.221-239.

Chandar, N., Collier, D. and Miranti, P., 2012. Graph standardization and management

accounting at AT&T during the 1920s. Accounting History. 17(1). pp.35-62.

Horton, K. E. and de Araujo Wanderley, C., 2018. Identity conflict and the paradox of embedded

agency in the management accounting profession: Adding a new piece to the theoretical

jigsaw. Management Accounting Research. 38. pp.39-50.

Fiondella, C., Macchioni, R., Maffei, M. and Spanò, R., 2016, September. Successful changes in

management accounting systems: A healthcare case study. In Accounting Forum (Vol.

40, No. 3, pp. 186-204). Taylor & Francis.

Teittinen, H., Pellinen, J. and Järvenpää, M., 2013. ERP in action—Challenges and benefits for

management control in SME context. International Journal of Accounting Information

Systems. 14(4). pp.278-296.

Prencipe, A., Bar-Yosef, S. and Dekker, H .C., 2014. Accounting research in family firms:

Theoretical and empirical challenges. European Accounting Review. 23(3). pp.361-385.

Serena Chiucchi, M., 2013. Intellectual capital accounting in action: enhancing learning through

interventionist research. Journal of Intellectual Capital. 14(1). pp.48-68.

Leotta, A., Rizza, C. and Ruggeri, D., 2017. Management accounting and leadership

construction in family firms. Qualitative Research in Accounting & Management. 14(2).

pp.189-207.

Schaltegger, S., Viere, T. and Zvezdov, D., 2012. Tapping environmental accounting potentials

of beer brewing: Information needs for successful cleaner production. Journal of

Cleaner Production. 29. pp.1-10.

Novas, J. C., Alves, M. D. C. G. and Sousa, A., 2017. The role of management accounting

systems in the development of intellectual capital. Journal of Intellectual Capital. 18(2).

pp.286-315.

Kober, R., Subraamanniam, T. and Watson, J., 2012. The impact of total quality management

adoption on small and medium enterprises’ financial performance. Accounting &

Finance. 52(2). pp.421-438.

Hoque, Z., A. Covaleski, M. and N. Gooneratne, T., 2013. Theoretical triangulation and

pluralism in research methods in organizational and accounting research. Accounting,

Auditing & Accountability Journal. 26(7). pp.1170-1198.

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.