Managerial Accounting: Essential Requirements and Methods

VerifiedAdded on 2023/01/11

|16

|5631

|74

AI Summary

This document provides an introduction to managerial accounting and its importance in decision making. It explains the essential requirements of different types of managerial accounting systems and discusses various methods used for management accounting reporting. The document also covers the advantages and disadvantages of planning tools used for budgetary control. Additionally, it includes a calculation of costs using appropriate techniques of cost analysis to prepare an income statement using marginal and absorption costs.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Managerial

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION.......................................................................................................................................3

LO 1............................................................................................................................................................3

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.............................................................................................................3

P2 Explain different methods used for management accounting reporting..............................................5

D1 Critically evaluate how management accounting systems and management accounting reporting is

integrated within organisational processes...............................................................................................7

LO 2............................................................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement using

marginal and absorption costs..................................................................................................................7

D2 Produce financial reports that accurately apply and interpret data for a range of business activities.

...............................................................................................................................................................10

LO 3..........................................................................................................................................................10

P4 Explain the advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................................10

LO 4..........................................................................................................................................................12

P5 Compare how organizations are adapting management accounting systems to respond to financial

problems................................................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial problems to

lead organisations to sustainable success...............................................................................................13

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION.......................................................................................................................................3

LO 1............................................................................................................................................................3

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.............................................................................................................3

P2 Explain different methods used for management accounting reporting..............................................5

D1 Critically evaluate how management accounting systems and management accounting reporting is

integrated within organisational processes...............................................................................................7

LO 2............................................................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement using

marginal and absorption costs..................................................................................................................7

D2 Produce financial reports that accurately apply and interpret data for a range of business activities.

...............................................................................................................................................................10

LO 3..........................................................................................................................................................10

P4 Explain the advantages and disadvantages of different types of planning tools used for budgetary

control...................................................................................................................................................10

LO 4..........................................................................................................................................................12

P5 Compare how organizations are adapting management accounting systems to respond to financial

problems................................................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial problems to

lead organisations to sustainable success...............................................................................................13

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION

Managerial accounting which is also known as management accounting is a process of

identifying, analyzing and interpretation of results or output to the managers so that they can

view that result for making decisions for their organization. Managerial accounting reports are

only for the internal people of organization. These reports company does not show to the outer

people as it is totally for the use of organization only. From these reports managers view the

actual performance of their department and this helps them in making better decisions about their

department for future. Managerial accounting helps in showing the true and fair financial as well

as managerial position and soundness of business. For reference purpose, this report has taken an

example of an accounting firm, Ernst & Young LLP. E&Y is an accounting firm which is at 3rd

position throughout the world for chartered accountant (Appelbaum, Kogan, Vasarhelyi and Yan,

2017). The company was established in 1849 and has its headquarters in London. E&Y comes

into the category of Big 4 companies. The company offers advisory, tax, financial services, real

estate and the so forth. In this report E&Y is doing the audit of famous bakery, Hart’s Bakery.

The bakery has many stores and is very much famous for its food and bakery items.

This report discuss about managerial accounting and its importance to the company along

with the essential requirements of different types of managerial accounting systems. The report

also includes different methods of managerial accounting report. And apart from it, the report

also includes the advantages and disadvantages of planning tools used for budgetary control.

LO 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Managerial accounting refers to the identifying, measuring, analyzing and delivering the

information about the performance of the company to the managers so that they can better and

rational decisions. The managerial accounting is different from financial accounting as financial

accounting is shown to the outer people also but managerial accounting is for the internal use

only. People working within the organization get the information for the managerial accounting

reports. These reports helps the organization in better decision making and these decisions are

made by rationally by the better understanding of the performance and financial soundness of the

business. The techniques which are used in managerial accounting are not as same which is

directed in financial accounting, they are different. Also the presentation of managerial

accounting can be modified according to the use and want of the managers. These managerial

Managerial accounting which is also known as management accounting is a process of

identifying, analyzing and interpretation of results or output to the managers so that they can

view that result for making decisions for their organization. Managerial accounting reports are

only for the internal people of organization. These reports company does not show to the outer

people as it is totally for the use of organization only. From these reports managers view the

actual performance of their department and this helps them in making better decisions about their

department for future. Managerial accounting helps in showing the true and fair financial as well

as managerial position and soundness of business. For reference purpose, this report has taken an

example of an accounting firm, Ernst & Young LLP. E&Y is an accounting firm which is at 3rd

position throughout the world for chartered accountant (Appelbaum, Kogan, Vasarhelyi and Yan,

2017). The company was established in 1849 and has its headquarters in London. E&Y comes

into the category of Big 4 companies. The company offers advisory, tax, financial services, real

estate and the so forth. In this report E&Y is doing the audit of famous bakery, Hart’s Bakery.

The bakery has many stores and is very much famous for its food and bakery items.

This report discuss about managerial accounting and its importance to the company along

with the essential requirements of different types of managerial accounting systems. The report

also includes different methods of managerial accounting report. And apart from it, the report

also includes the advantages and disadvantages of planning tools used for budgetary control.

LO 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Managerial accounting refers to the identifying, measuring, analyzing and delivering the

information about the performance of the company to the managers so that they can better and

rational decisions. The managerial accounting is different from financial accounting as financial

accounting is shown to the outer people also but managerial accounting is for the internal use

only. People working within the organization get the information for the managerial accounting

reports. These reports helps the organization in better decision making and these decisions are

made by rationally by the better understanding of the performance and financial soundness of the

business. The techniques which are used in managerial accounting are not as same which is

directed in financial accounting, they are different. Also the presentation of managerial

accounting can be modified according to the use and want of the managers. These managerial

accounting reports show the performances of the departments which can help the managers in

detecting the defects into their working. After detecting the loop holes managers can make

decisions accordingly which can help him in the attainment of the specific or desired objectives

(Bargate, 2012). It includes many other elements such as costing, budgeting, forecasting, and

other financial analysis. The managerial accounting is important for the following reasons:

Decision making: The managerial accounting is useful in better decision making for the

department or for the organization. After analyzing the reports or information, a manger go

through it and makes rational decisions. It has been said that a good decision is which when

taken after undertaking the whole performance and information because after this a manger has a

more better understanding about the position at which his department is in.

Setting objectives: The managerial accounting also used in setting the objectives for the

business. The objective for a department or for an organization is set only after going through its

previous performance. Through managerial accounting reports a manager can go through the

performances of his department and can set its objectives accordingly. The set objectives should

be such that it could be attain by the people or department. It should not be made by irrational

assumptions.

The main purpose of the managerial accounting is to extract the internal information

about the company’s performance and financial soundness with the help of various sources and

then available that information to managers. The information provided helps the mangers in

taking the critical decisions which is related to price, cost, budget, strategies and much more. The

essential requirements of managerial accounting system include:

Management Style: The system which is adopted by the organization do affects the managerial

accounting style (Brewer, Garrison and Noreen, 2015). It is very much necessary to follow a

certain type of managerial style as it indicates what and to whom the information needs to get

transfer for decisions or for future process. Management style can be of two types:

Autocratic Style: In this type of style, the information is passed to only those people who

make the decisions. These people are generally top level of management. These people take the

decisions by themselves without involving other people ideas or opinions.

Democratic Style: In this type of style, the information is passed to all the people and not

only top level management people takes the decisions but they involve the other people also in

contributing in decision making process by putting their own thoughts and opinions upon that

topic. This style also includes the people from lower level of management.

Organization Structure: The structure of organization also defines the managerial accounting.

The managerial accounting style should be apt for organization structure. The organization

structure can be of two types:

detecting the defects into their working. After detecting the loop holes managers can make

decisions accordingly which can help him in the attainment of the specific or desired objectives

(Bargate, 2012). It includes many other elements such as costing, budgeting, forecasting, and

other financial analysis. The managerial accounting is important for the following reasons:

Decision making: The managerial accounting is useful in better decision making for the

department or for the organization. After analyzing the reports or information, a manger go

through it and makes rational decisions. It has been said that a good decision is which when

taken after undertaking the whole performance and information because after this a manger has a

more better understanding about the position at which his department is in.

Setting objectives: The managerial accounting also used in setting the objectives for the

business. The objective for a department or for an organization is set only after going through its

previous performance. Through managerial accounting reports a manager can go through the

performances of his department and can set its objectives accordingly. The set objectives should

be such that it could be attain by the people or department. It should not be made by irrational

assumptions.

The main purpose of the managerial accounting is to extract the internal information

about the company’s performance and financial soundness with the help of various sources and

then available that information to managers. The information provided helps the mangers in

taking the critical decisions which is related to price, cost, budget, strategies and much more. The

essential requirements of managerial accounting system include:

Management Style: The system which is adopted by the organization do affects the managerial

accounting style (Brewer, Garrison and Noreen, 2015). It is very much necessary to follow a

certain type of managerial style as it indicates what and to whom the information needs to get

transfer for decisions or for future process. Management style can be of two types:

Autocratic Style: In this type of style, the information is passed to only those people who

make the decisions. These people are generally top level of management. These people take the

decisions by themselves without involving other people ideas or opinions.

Democratic Style: In this type of style, the information is passed to all the people and not

only top level management people takes the decisions but they involve the other people also in

contributing in decision making process by putting their own thoughts and opinions upon that

topic. This style also includes the people from lower level of management.

Organization Structure: The structure of organization also defines the managerial accounting.

The managerial accounting style should be apt for organization structure. The organization

structure can be of two types:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Functional Structure: In this structure, the mangers are provided with the information

which is only related to his department or functional area (Butler and Ghosh, 2015). No extra or

other information is provided to him.

Flat Structure: In this type of structure, the wide range of information is provided to the

managers so that they can take decisions by identifying the critical information of the

organization.

Information: They say information is the key. Information or data helps the organization for

better understanding of things and performances. Through getting true and fair information

managers can take the further steps or decisions. But information also should be classified into

some categories which are as follows:

What, who, How: This refers to what information is needing to a person, does he want

the performance information about his department or does he want the information about his

team members and the like. Who wants the information, is manager wants the information or

executive director wants the information and How refers to the purpose of getting the

information.

Sources: Sources refers to the place from where the information is get extracted. This

may include the primary or secondary sources.

Relevancy: The information provided should be relevant to the need of person. The

information would be useful only and only if it will be relevant to the user.

Accuracy: The information provided should be accurate enough that a person can rely

upon it (Datar and Rajan, 2014).

P2 Explain different methods used for management accounting reporting.

Generally, a budget is a financial statement which says about the future financial

requirements into a project or for attaining any particular target. Financial document includes

both the income and expenses. For example if Hart’s bakery wants to produce the cakes and their

other bakery item so for that they will first make the rational assumptions about the sales which

they will going to have in a particular time period. Along with this they would calculate the

production which they need to undertake which satisfies their assumed sales. When the

production level is decided, the company will make a fair list consisting of resources they would

be needing along with the prices associated with them. Through this the company can a budget

of their financial requirements. Budget includes the cost of raw materials, labor costs and other

over heads which gives a true and fair look to companies about their budget under which they

need to complete their whole task (Demski, 2013). The departments try their best to complete the

task or project within the budget allotted to them and they sometime also tries to save amount

from budgets allotted. Budget helps the organization in making the comparison between the

actual cost or income and standard cost or income.

which is only related to his department or functional area (Butler and Ghosh, 2015). No extra or

other information is provided to him.

Flat Structure: In this type of structure, the wide range of information is provided to the

managers so that they can take decisions by identifying the critical information of the

organization.

Information: They say information is the key. Information or data helps the organization for

better understanding of things and performances. Through getting true and fair information

managers can take the further steps or decisions. But information also should be classified into

some categories which are as follows:

What, who, How: This refers to what information is needing to a person, does he want

the performance information about his department or does he want the information about his

team members and the like. Who wants the information, is manager wants the information or

executive director wants the information and How refers to the purpose of getting the

information.

Sources: Sources refers to the place from where the information is get extracted. This

may include the primary or secondary sources.

Relevancy: The information provided should be relevant to the need of person. The

information would be useful only and only if it will be relevant to the user.

Accuracy: The information provided should be accurate enough that a person can rely

upon it (Datar and Rajan, 2014).

P2 Explain different methods used for management accounting reporting.

Generally, a budget is a financial statement which says about the future financial

requirements into a project or for attaining any particular target. Financial document includes

both the income and expenses. For example if Hart’s bakery wants to produce the cakes and their

other bakery item so for that they will first make the rational assumptions about the sales which

they will going to have in a particular time period. Along with this they would calculate the

production which they need to undertake which satisfies their assumed sales. When the

production level is decided, the company will make a fair list consisting of resources they would

be needing along with the prices associated with them. Through this the company can a budget

of their financial requirements. Budget includes the cost of raw materials, labor costs and other

over heads which gives a true and fair look to companies about their budget under which they

need to complete their whole task (Demski, 2013). The departments try their best to complete the

task or project within the budget allotted to them and they sometime also tries to save amount

from budgets allotted. Budget helps the organization in making the comparison between the

actual cost or income and standard cost or income.

There are various methods which is used for management accounting reporting and some are

included as follows:

Cost Schedules: Budgets are usually based on the standard costs. In this the cost of raw material

per unit is estimated and then the total cost of whole the production is evaluated. Here standard

cost refers to the cost which is calculated by the company by estimating the cost of per unit.

Whereas actual cost refers to the cost which is actually incurred to the company production unit.

If the actual cost is more than the standard cost then the company should review their budget

review and necessary control measures should be taken by the managers. But if the actual budget

is equal or less than the standard budget then there is no need to get worry as it is said to be ar n

ideal situation for the company. In the case where actual budget is more than the standard

budget, the manager should evaluate the difference. When the difference is more or big then

necessary steps or control measures should be taken. But if the gap is under margin then the

company need not to get worry (Greenberg and Wilner, 2015).

Costing and budgets are getting prepared according to the marginal cost and budgets. The

basic aim of the company is to cover the costs because once the cost is covered the rest is

company’s profit.

Budget reports: Budget refers to the planning of activities which needs to be undertaken by an

organization along with their associated cost. Here the price or the cost plays an important role

into the budget. Before starting of any project or financial term, Hart’s Bakery make their

budgets on a quarterly basis. In the budget they make up the cost which he would be needing for

carrying out the activities such as production, marketing, supply chain, transport, raw materials,

labor and so on. The budgets are very important for any business. Budget sets a framework

within which organization carries their activities or operations.

Performance report: Performance report is the report which tells about the performances or

work of the organization which they have achieved so far or in a particular time period. From

performance report, an organization can evaluates the true and fair financial health and

soundness of the business. Performance report can be also of employees performance. In this the

performance or the contribution which is makes by the employees is included. From such report

a manager can make out about which employees has perform good or excellent and which

employee has not even performed up to the mark (Jiambalvo, 2019). From such reports a

manager can make the required decisions about training and development programs, promotions,

reward, appreciations, skills and knowledge program and the so forth which needs to given to

employees.

Variance analysis: Variance analysis refers to the attainment of the difference between the

actual and standard budgets or performances. As in the case with Hart’s bakery there variance

can be calculated by the taking out the differences between the actual cost and standard cost.

Variance is very easy in its calculations and can help the organization in finding out the area in

included as follows:

Cost Schedules: Budgets are usually based on the standard costs. In this the cost of raw material

per unit is estimated and then the total cost of whole the production is evaluated. Here standard

cost refers to the cost which is calculated by the company by estimating the cost of per unit.

Whereas actual cost refers to the cost which is actually incurred to the company production unit.

If the actual cost is more than the standard cost then the company should review their budget

review and necessary control measures should be taken by the managers. But if the actual budget

is equal or less than the standard budget then there is no need to get worry as it is said to be ar n

ideal situation for the company. In the case where actual budget is more than the standard

budget, the manager should evaluate the difference. When the difference is more or big then

necessary steps or control measures should be taken. But if the gap is under margin then the

company need not to get worry (Greenberg and Wilner, 2015).

Costing and budgets are getting prepared according to the marginal cost and budgets. The

basic aim of the company is to cover the costs because once the cost is covered the rest is

company’s profit.

Budget reports: Budget refers to the planning of activities which needs to be undertaken by an

organization along with their associated cost. Here the price or the cost plays an important role

into the budget. Before starting of any project or financial term, Hart’s Bakery make their

budgets on a quarterly basis. In the budget they make up the cost which he would be needing for

carrying out the activities such as production, marketing, supply chain, transport, raw materials,

labor and so on. The budgets are very important for any business. Budget sets a framework

within which organization carries their activities or operations.

Performance report: Performance report is the report which tells about the performances or

work of the organization which they have achieved so far or in a particular time period. From

performance report, an organization can evaluates the true and fair financial health and

soundness of the business. Performance report can be also of employees performance. In this the

performance or the contribution which is makes by the employees is included. From such report

a manager can make out about which employees has perform good or excellent and which

employee has not even performed up to the mark (Jiambalvo, 2019). From such reports a

manager can make the required decisions about training and development programs, promotions,

reward, appreciations, skills and knowledge program and the so forth which needs to given to

employees.

Variance analysis: Variance analysis refers to the attainment of the difference between the

actual and standard budgets or performances. As in the case with Hart’s bakery there variance

can be calculated by the taking out the differences between the actual cost and standard cost.

Variance is very easy in its calculations and can help the organization in finding out the area in

which the company has its loop hole. That loop hole can get filled by taking corrective actions

and detecting the place where the organization is making mistake while making their budget

reports.

These are some methods which is used in managerial accounting system in an

organization.

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.

The benefits of management according system are as follows:

Cost Schedules: The cost schedules helps an organization in staying at the track. From the cost

schedules the organization have an idea about their activities that they need to undertake for the

completion of project. It is a table which shows all the costs associated with activities.

Budget Report: The preparation of budget report helps the organization in the identification of

any sort of error. Through the identification corrective actions can be taken with time.

Performance Report: The performance reports has many benefits, such as, the organization has

the accountability for employee’s performance, help in examining the current situation,

transparency, good governance of activities and the so on.

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes.

Different organization adopt different management accounting system. As the ocst

accounting system regulations helps the organization in the integration of management

accounting system. The cost accounting system refers to a framework which is used by the

company for estimating the cost for their product for the purpose of profitability analysis,

inventory analysis and cost control.The regulations which are stated in it are given by an

authorized body which make sure that it has the capability for proper management accounting

reporting. The Cost accounting system helps the organization in integrating the financial as well

as managerial activities undertaken by them.

LO 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

Income statement under Marginal costing method for month of May & June

Preparation of income statement by Absorption costing:

Particulars May June

and detecting the place where the organization is making mistake while making their budget

reports.

These are some methods which is used in managerial accounting system in an

organization.

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.

The benefits of management according system are as follows:

Cost Schedules: The cost schedules helps an organization in staying at the track. From the cost

schedules the organization have an idea about their activities that they need to undertake for the

completion of project. It is a table which shows all the costs associated with activities.

Budget Report: The preparation of budget report helps the organization in the identification of

any sort of error. Through the identification corrective actions can be taken with time.

Performance Report: The performance reports has many benefits, such as, the organization has

the accountability for employee’s performance, help in examining the current situation,

transparency, good governance of activities and the so on.

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes.

Different organization adopt different management accounting system. As the ocst

accounting system regulations helps the organization in the integration of management

accounting system. The cost accounting system refers to a framework which is used by the

company for estimating the cost for their product for the purpose of profitability analysis,

inventory analysis and cost control.The regulations which are stated in it are given by an

authorized body which make sure that it has the capability for proper management accounting

reporting. The Cost accounting system helps the organization in integrating the financial as well

as managerial activities undertaken by them.

LO 2

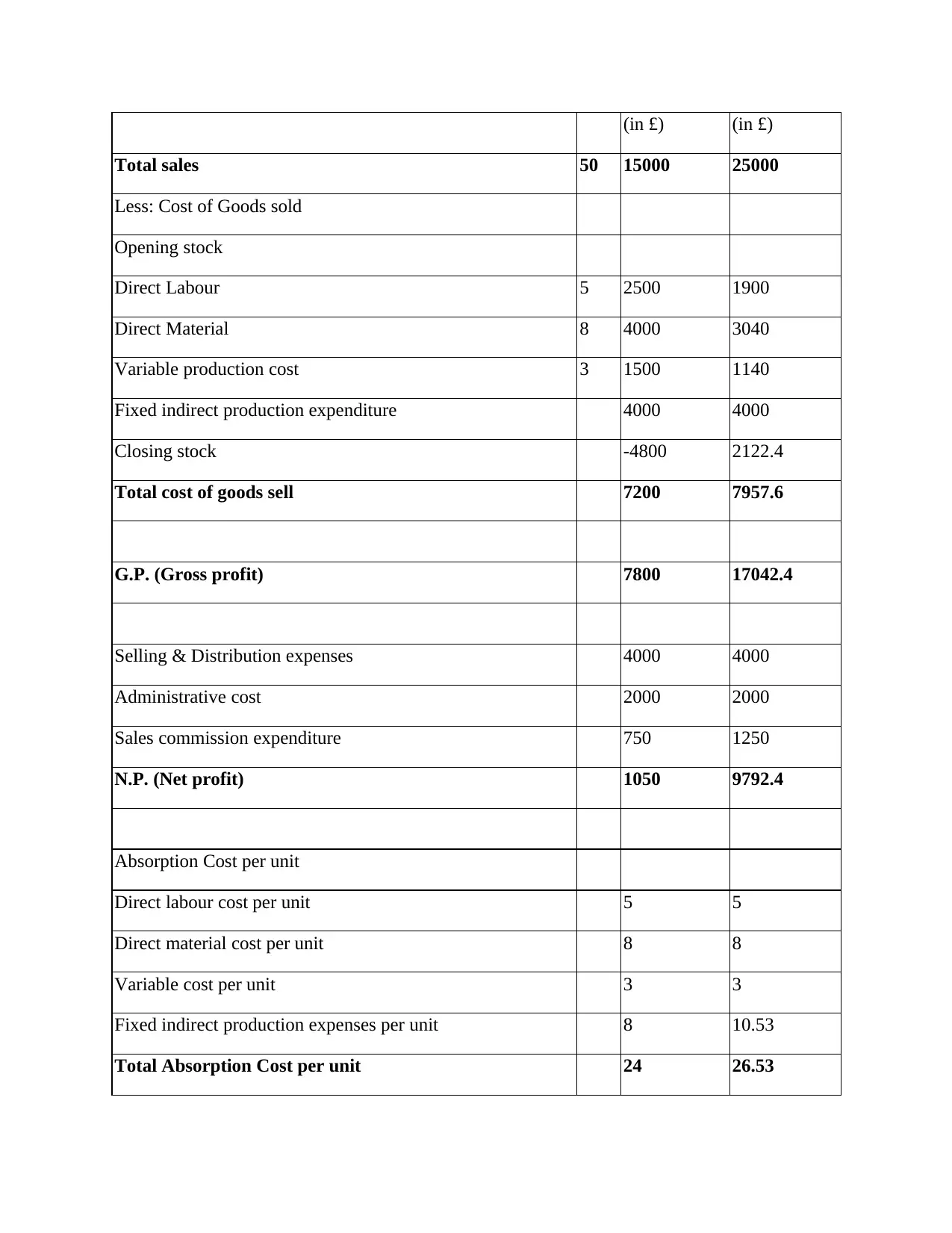

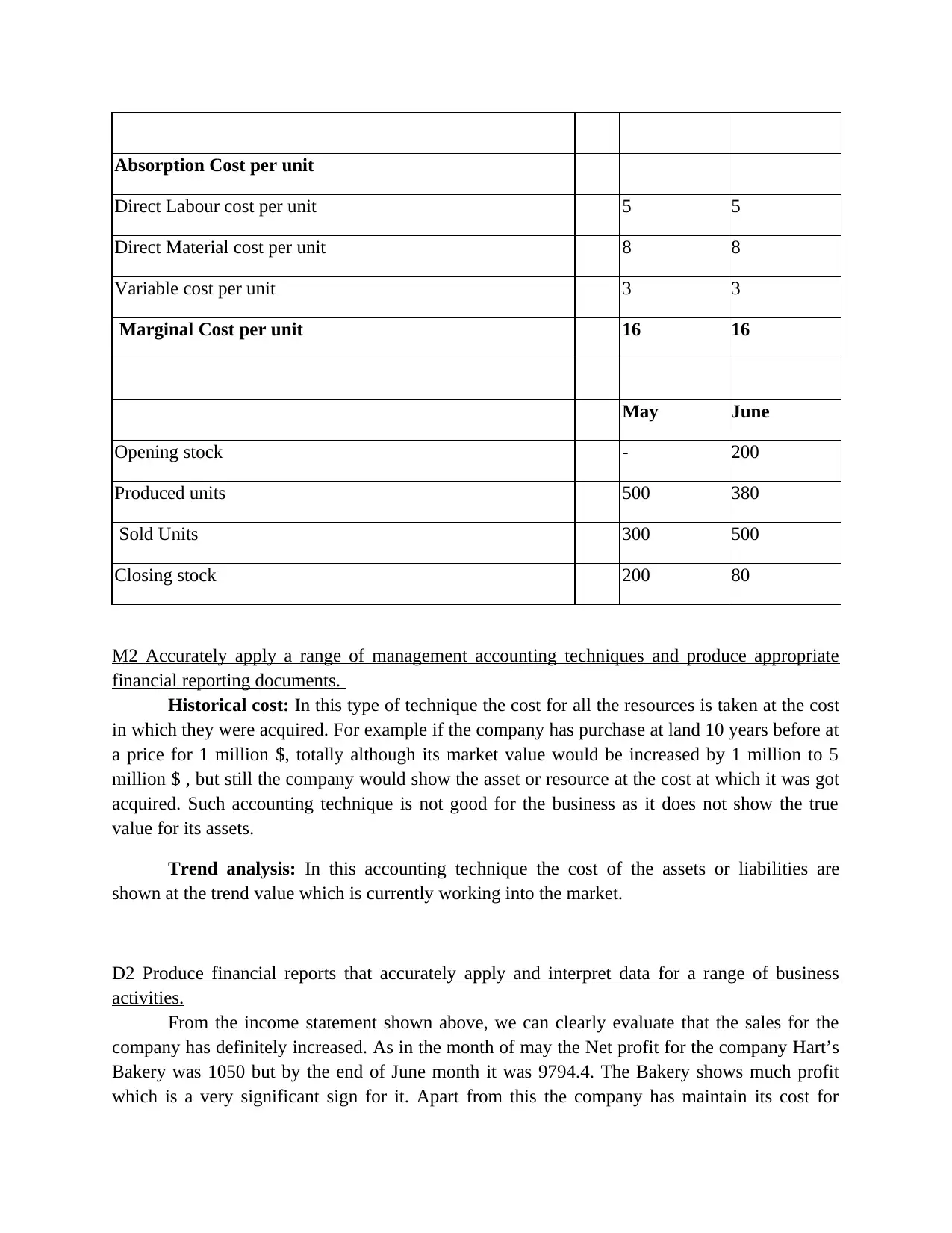

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

Income statement under Marginal costing method for month of May & June

Preparation of income statement by Absorption costing:

Particulars May June

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(in £) (in £)

Total sales 50 15000 25000

Less: Cost of Goods sold

Opening stock

Direct Labour 5 2500 1900

Direct Material 8 4000 3040

Variable production cost 3 1500 1140

Fixed indirect production expenditure 4000 4000

Closing stock -4800 2122.4

Total cost of goods sell 7200 7957.6

G.P. (Gross profit) 7800 17042.4

Selling & Distribution expenses 4000 4000

Administrative cost 2000 2000

Sales commission expenditure 750 1250

N.P. (Net profit) 1050 9792.4

Absorption Cost per unit

Direct labour cost per unit 5 5

Direct material cost per unit 8 8

Variable cost per unit 3 3

Fixed indirect production expenses per unit 8 10.53

Total Absorption Cost per unit 24 26.53

Total sales 50 15000 25000

Less: Cost of Goods sold

Opening stock

Direct Labour 5 2500 1900

Direct Material 8 4000 3040

Variable production cost 3 1500 1140

Fixed indirect production expenditure 4000 4000

Closing stock -4800 2122.4

Total cost of goods sell 7200 7957.6

G.P. (Gross profit) 7800 17042.4

Selling & Distribution expenses 4000 4000

Administrative cost 2000 2000

Sales commission expenditure 750 1250

N.P. (Net profit) 1050 9792.4

Absorption Cost per unit

Direct labour cost per unit 5 5

Direct material cost per unit 8 8

Variable cost per unit 3 3

Fixed indirect production expenses per unit 8 10.53

Total Absorption Cost per unit 24 26.53

May June

Opening stock - 200

Units produced 500 380

Sold units 300 500

Closing stock 200 80

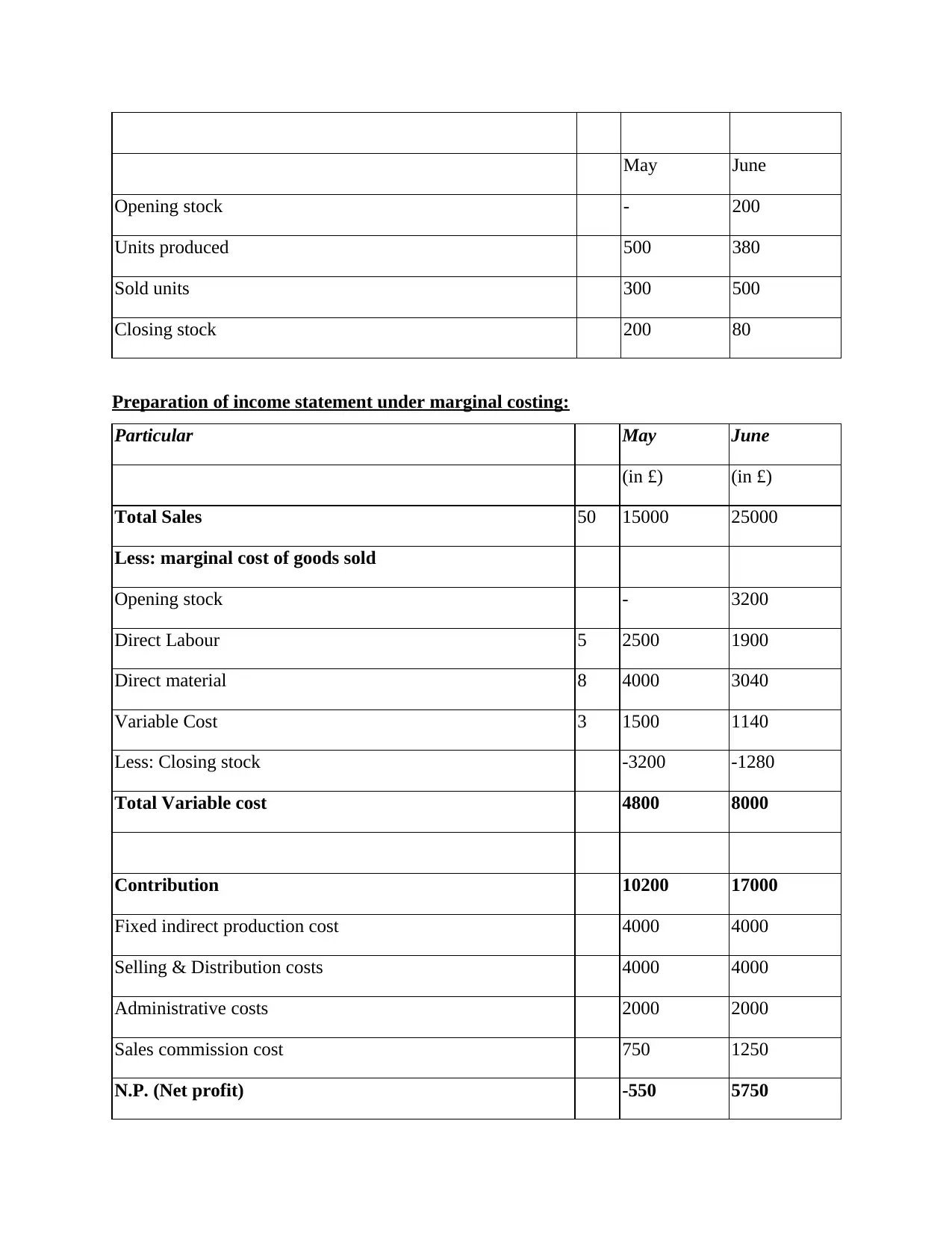

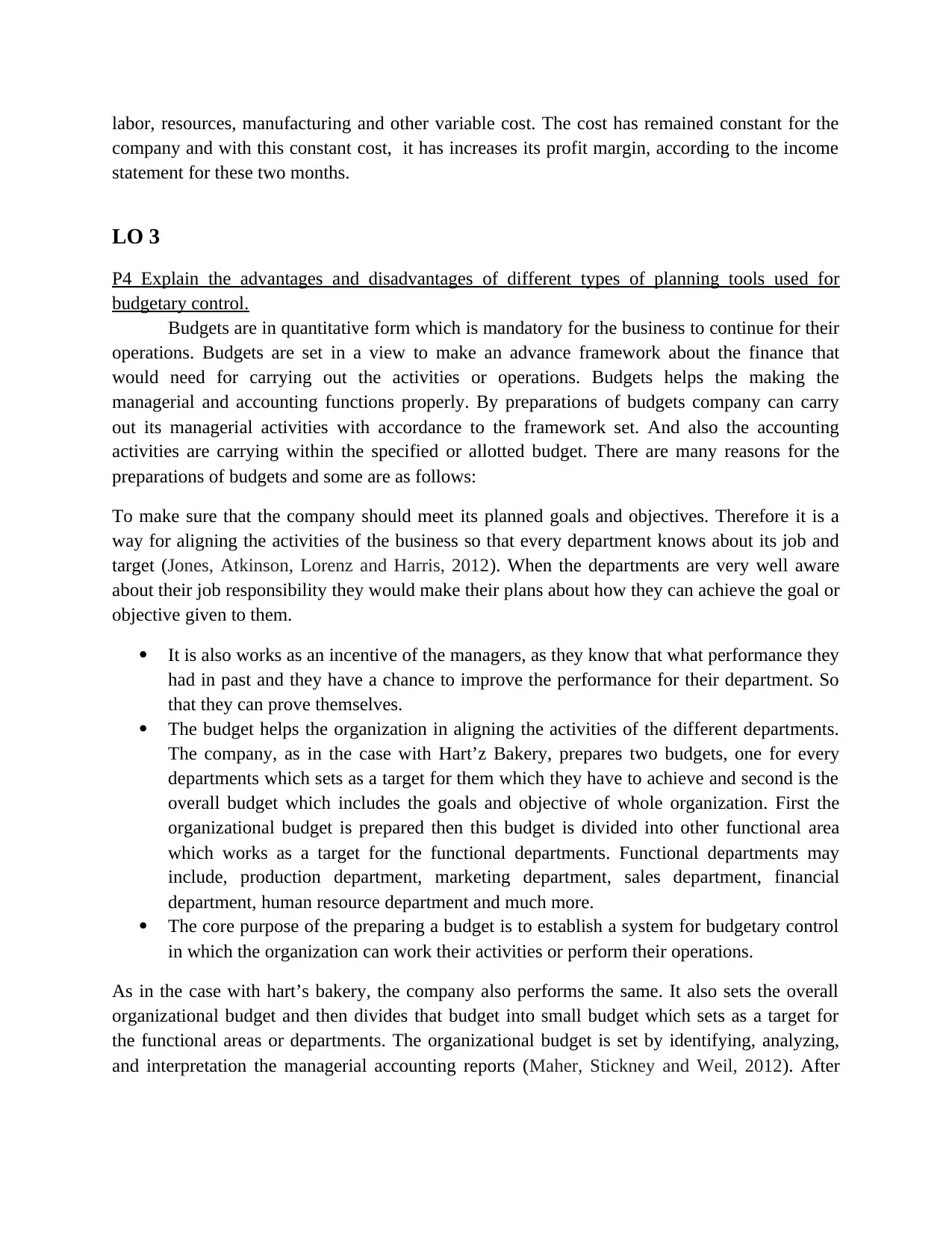

Preparation of income statement under marginal costing:

Particular May June

(in £) (in £)

Total Sales 50 15000 25000

Less: marginal cost of goods sold

Opening stock - 3200

Direct Labour 5 2500 1900

Direct material 8 4000 3040

Variable Cost 3 1500 1140

Less: Closing stock -3200 -1280

Total Variable cost 4800 8000

Contribution 10200 17000

Fixed indirect production cost 4000 4000

Selling & Distribution costs 4000 4000

Administrative costs 2000 2000

Sales commission cost 750 1250

N.P. (Net profit) -550 5750

Opening stock - 200

Units produced 500 380

Sold units 300 500

Closing stock 200 80

Preparation of income statement under marginal costing:

Particular May June

(in £) (in £)

Total Sales 50 15000 25000

Less: marginal cost of goods sold

Opening stock - 3200

Direct Labour 5 2500 1900

Direct material 8 4000 3040

Variable Cost 3 1500 1140

Less: Closing stock -3200 -1280

Total Variable cost 4800 8000

Contribution 10200 17000

Fixed indirect production cost 4000 4000

Selling & Distribution costs 4000 4000

Administrative costs 2000 2000

Sales commission cost 750 1250

N.P. (Net profit) -550 5750

Absorption Cost per unit

Direct Labour cost per unit 5 5

Direct Material cost per unit 8 8

Variable cost per unit 3 3

Marginal Cost per unit 16 16

May June

Opening stock - 200

Produced units 500 380

Sold Units 300 500

Closing stock 200 80

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

Historical cost: In this type of technique the cost for all the resources is taken at the cost

in which they were acquired. For example if the company has purchase at land 10 years before at

a price for 1 million $, totally although its market value would be increased by 1 million to 5

million $ , but still the company would show the asset or resource at the cost at which it was got

acquired. Such accounting technique is not good for the business as it does not show the true

value for its assets.

Trend analysis: In this accounting technique the cost of the assets or liabilities are

shown at the trend value which is currently working into the market.

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.

From the income statement shown above, we can clearly evaluate that the sales for the

company has definitely increased. As in the month of may the Net profit for the company Hart’s

Bakery was 1050 but by the end of June month it was 9794.4. The Bakery shows much profit

which is a very significant sign for it. Apart from this the company has maintain its cost for

Direct Labour cost per unit 5 5

Direct Material cost per unit 8 8

Variable cost per unit 3 3

Marginal Cost per unit 16 16

May June

Opening stock - 200

Produced units 500 380

Sold Units 300 500

Closing stock 200 80

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

Historical cost: In this type of technique the cost for all the resources is taken at the cost

in which they were acquired. For example if the company has purchase at land 10 years before at

a price for 1 million $, totally although its market value would be increased by 1 million to 5

million $ , but still the company would show the asset or resource at the cost at which it was got

acquired. Such accounting technique is not good for the business as it does not show the true

value for its assets.

Trend analysis: In this accounting technique the cost of the assets or liabilities are

shown at the trend value which is currently working into the market.

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.

From the income statement shown above, we can clearly evaluate that the sales for the

company has definitely increased. As in the month of may the Net profit for the company Hart’s

Bakery was 1050 but by the end of June month it was 9794.4. The Bakery shows much profit

which is a very significant sign for it. Apart from this the company has maintain its cost for

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

labor, resources, manufacturing and other variable cost. The cost has remained constant for the

company and with this constant cost, it has increases its profit margin, according to the income

statement for these two months.

LO 3

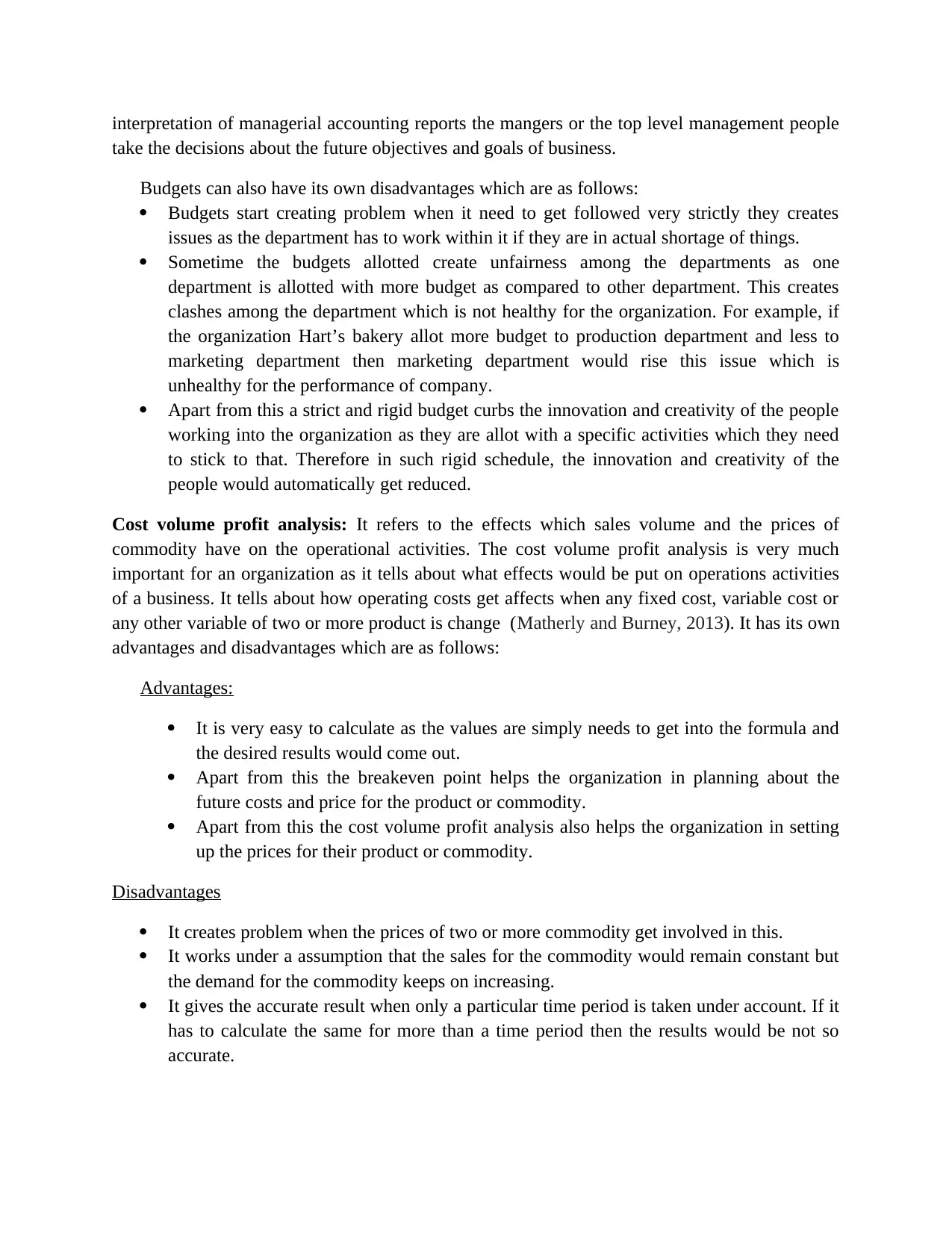

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.

Budgets are in quantitative form which is mandatory for the business to continue for their

operations. Budgets are set in a view to make an advance framework about the finance that

would need for carrying out the activities or operations. Budgets helps the making the

managerial and accounting functions properly. By preparations of budgets company can carry

out its managerial activities with accordance to the framework set. And also the accounting

activities are carrying within the specified or allotted budget. There are many reasons for the

preparations of budgets and some are as follows:

To make sure that the company should meet its planned goals and objectives. Therefore it is a

way for aligning the activities of the business so that every department knows about its job and

target (Jones, Atkinson, Lorenz and Harris, 2012). When the departments are very well aware

about their job responsibility they would make their plans about how they can achieve the goal or

objective given to them.

It is also works as an incentive of the managers, as they know that what performance they

had in past and they have a chance to improve the performance for their department. So

that they can prove themselves.

The budget helps the organization in aligning the activities of the different departments.

The company, as in the case with Hart’z Bakery, prepares two budgets, one for every

departments which sets as a target for them which they have to achieve and second is the

overall budget which includes the goals and objective of whole organization. First the

organizational budget is prepared then this budget is divided into other functional area

which works as a target for the functional departments. Functional departments may

include, production department, marketing department, sales department, financial

department, human resource department and much more.

The core purpose of the preparing a budget is to establish a system for budgetary control

in which the organization can work their activities or perform their operations.

As in the case with hart’s bakery, the company also performs the same. It also sets the overall

organizational budget and then divides that budget into small budget which sets as a target for

the functional areas or departments. The organizational budget is set by identifying, analyzing,

and interpretation the managerial accounting reports (Maher, Stickney and Weil, 2012). After

company and with this constant cost, it has increases its profit margin, according to the income

statement for these two months.

LO 3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.

Budgets are in quantitative form which is mandatory for the business to continue for their

operations. Budgets are set in a view to make an advance framework about the finance that

would need for carrying out the activities or operations. Budgets helps the making the

managerial and accounting functions properly. By preparations of budgets company can carry

out its managerial activities with accordance to the framework set. And also the accounting

activities are carrying within the specified or allotted budget. There are many reasons for the

preparations of budgets and some are as follows:

To make sure that the company should meet its planned goals and objectives. Therefore it is a

way for aligning the activities of the business so that every department knows about its job and

target (Jones, Atkinson, Lorenz and Harris, 2012). When the departments are very well aware

about their job responsibility they would make their plans about how they can achieve the goal or

objective given to them.

It is also works as an incentive of the managers, as they know that what performance they

had in past and they have a chance to improve the performance for their department. So

that they can prove themselves.

The budget helps the organization in aligning the activities of the different departments.

The company, as in the case with Hart’z Bakery, prepares two budgets, one for every

departments which sets as a target for them which they have to achieve and second is the

overall budget which includes the goals and objective of whole organization. First the

organizational budget is prepared then this budget is divided into other functional area

which works as a target for the functional departments. Functional departments may

include, production department, marketing department, sales department, financial

department, human resource department and much more.

The core purpose of the preparing a budget is to establish a system for budgetary control

in which the organization can work their activities or perform their operations.

As in the case with hart’s bakery, the company also performs the same. It also sets the overall

organizational budget and then divides that budget into small budget which sets as a target for

the functional areas or departments. The organizational budget is set by identifying, analyzing,

and interpretation the managerial accounting reports (Maher, Stickney and Weil, 2012). After

interpretation of managerial accounting reports the mangers or the top level management people

take the decisions about the future objectives and goals of business.

Budgets can also have its own disadvantages which are as follows:

Budgets start creating problem when it need to get followed very strictly they creates

issues as the department has to work within it if they are in actual shortage of things.

Sometime the budgets allotted create unfairness among the departments as one

department is allotted with more budget as compared to other department. This creates

clashes among the department which is not healthy for the organization. For example, if

the organization Hart’s bakery allot more budget to production department and less to

marketing department then marketing department would rise this issue which is

unhealthy for the performance of company.

Apart from this a strict and rigid budget curbs the innovation and creativity of the people

working into the organization as they are allot with a specific activities which they need

to stick to that. Therefore in such rigid schedule, the innovation and creativity of the

people would automatically get reduced.

Cost volume profit analysis: It refers to the effects which sales volume and the prices of

commodity have on the operational activities. The cost volume profit analysis is very much

important for an organization as it tells about what effects would be put on operations activities

of a business. It tells about how operating costs get affects when any fixed cost, variable cost or

any other variable of two or more product is change (Matherly and Burney, 2013). It has its own

advantages and disadvantages which are as follows:

Advantages:

It is very easy to calculate as the values are simply needs to get into the formula and

the desired results would come out.

Apart from this the breakeven point helps the organization in planning about the

future costs and price for the product or commodity.

Apart from this the cost volume profit analysis also helps the organization in setting

up the prices for their product or commodity.

Disadvantages

It creates problem when the prices of two or more commodity get involved in this.

It works under a assumption that the sales for the commodity would remain constant but

the demand for the commodity keeps on increasing.

It gives the accurate result when only a particular time period is taken under account. If it

has to calculate the same for more than a time period then the results would be not so

accurate.

take the decisions about the future objectives and goals of business.

Budgets can also have its own disadvantages which are as follows:

Budgets start creating problem when it need to get followed very strictly they creates

issues as the department has to work within it if they are in actual shortage of things.

Sometime the budgets allotted create unfairness among the departments as one

department is allotted with more budget as compared to other department. This creates

clashes among the department which is not healthy for the organization. For example, if

the organization Hart’s bakery allot more budget to production department and less to

marketing department then marketing department would rise this issue which is

unhealthy for the performance of company.

Apart from this a strict and rigid budget curbs the innovation and creativity of the people

working into the organization as they are allot with a specific activities which they need

to stick to that. Therefore in such rigid schedule, the innovation and creativity of the

people would automatically get reduced.

Cost volume profit analysis: It refers to the effects which sales volume and the prices of

commodity have on the operational activities. The cost volume profit analysis is very much

important for an organization as it tells about what effects would be put on operations activities

of a business. It tells about how operating costs get affects when any fixed cost, variable cost or

any other variable of two or more product is change (Matherly and Burney, 2013). It has its own

advantages and disadvantages which are as follows:

Advantages:

It is very easy to calculate as the values are simply needs to get into the formula and

the desired results would come out.

Apart from this the breakeven point helps the organization in planning about the

future costs and price for the product or commodity.

Apart from this the cost volume profit analysis also helps the organization in setting

up the prices for their product or commodity.

Disadvantages

It creates problem when the prices of two or more commodity get involved in this.

It works under a assumption that the sales for the commodity would remain constant but

the demand for the commodity keeps on increasing.

It gives the accurate result when only a particular time period is taken under account. If it

has to calculate the same for more than a time period then the results would be not so

accurate.

M3 Analyse the use of different planning tools and their application for preparing budgets and

forecasts.

The application of budgets and forecast are:

The budgets are prepared at the places where the organization has done the futuristic planning

about its goals and objectives. And it has already sets a path for activities about how it will going

to achieve that goal or objective. When the goal is divided into activities, the organization also

evaluate the other things associated with it, for example time taken in completing that activity,

finance or resources required in performing of that activity and much more. and by setting the

finance associated with activities, companies make a budget which they believe that under that

they can perform the project or given task.

LO 4

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems.

Corporations or the organizations are also confused about what management style,

structure, system or policies they adopt for their organization which suits best for their

operational activities. The system or policies should help the organization in better performance

of work and flow of information (Needles and Crosson, 2013). Choosing a perfect or suitable

management accounting system is a huge work because a perfect accounting system helps an

organization in the attainment of its objectives or goals. The managerial accounting should be

suited with the procedure which unable the organization in making the required changes with

accordance to the external environment. The external environments are the factors which directly

or indirectly affects the working and operations of an organization. These factors are independent

to each other and put great effects on the business. The organization, E&Y respond to their

financial problems through the following ways:

Identifying the financial issues: The issues can be solve by identifying them. By identifying the

financial issue into the managerial accounting system, company can take the corrective measures

and actions to solve them. Identification of the issue is the major task because many people get

failed into this. If the company has to analysis the financial problem of Hart’z bakery, they

would probably will go through the management accounting system of them and then identify

the issue, if they found out the issue they will come up with the solution which they likely to

suggest it to their clients i.e. Hart’z Bakery along with the alternative solution so that they can

choose among the given solution according which among the lot best suits their system.

Financial governance: Financial governance refers to how organization handles their financial

system in the organization. The financial governance of a company should be very strong as the

system helps the organization in the management of the financial system very well. The

company Hart’s bakery should be able to manage their financial system very well. A strong

forecasts.

The application of budgets and forecast are:

The budgets are prepared at the places where the organization has done the futuristic planning

about its goals and objectives. And it has already sets a path for activities about how it will going

to achieve that goal or objective. When the goal is divided into activities, the organization also

evaluate the other things associated with it, for example time taken in completing that activity,

finance or resources required in performing of that activity and much more. and by setting the

finance associated with activities, companies make a budget which they believe that under that

they can perform the project or given task.

LO 4

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems.

Corporations or the organizations are also confused about what management style,

structure, system or policies they adopt for their organization which suits best for their

operational activities. The system or policies should help the organization in better performance

of work and flow of information (Needles and Crosson, 2013). Choosing a perfect or suitable

management accounting system is a huge work because a perfect accounting system helps an

organization in the attainment of its objectives or goals. The managerial accounting should be

suited with the procedure which unable the organization in making the required changes with

accordance to the external environment. The external environments are the factors which directly

or indirectly affects the working and operations of an organization. These factors are independent

to each other and put great effects on the business. The organization, E&Y respond to their

financial problems through the following ways:

Identifying the financial issues: The issues can be solve by identifying them. By identifying the

financial issue into the managerial accounting system, company can take the corrective measures

and actions to solve them. Identification of the issue is the major task because many people get

failed into this. If the company has to analysis the financial problem of Hart’z bakery, they

would probably will go through the management accounting system of them and then identify

the issue, if they found out the issue they will come up with the solution which they likely to

suggest it to their clients i.e. Hart’z Bakery along with the alternative solution so that they can

choose among the given solution according which among the lot best suits their system.

Financial governance: Financial governance refers to how organization handles their financial

system in the organization. The financial governance of a company should be very strong as the

system helps the organization in the management of the financial system very well. The

company Hart’s bakery should be able to manage their financial system very well. A strong

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

financial system leads to profit and growth for the company (Otley and Emmanuel, 2013). The

audit company E&Y can help the bakery in making their financial governance apt and strong so

that they can handle their profits very well and yield profits and growth from them.

Managerial accounting skills set: The managing the financial problem the management people

should have accurate skills and knowledge to handle the tasks. Management is a huge task in

which the resources are need to manage which helps the organization in better management of

the resources and activities. As in the case with Harts bakery, the managers should have good

managerial skills to manage the activities (Songini, Gnan and Malmi, 2013). The managers of

every department has the responsibility to manage all the resources of their organization along

with the achievement of the target.

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success.

The company Hart’s Bakery faces a financial problem of recording the expenses which

they might incur that the year end or after closing of the accounting books. Here the company

gets confuse about where they have to record these transaction which does not create any

financial problem or issue to them. Because any problem can show false financial reports to the

company which can affect the future managerial decisions. To solve such issue or problem the

company needs to manage their financial governance properly. By maintaining the same they can

manage their transactions properly which helps them in showing the true position of their

organization.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

According to Greenberg, R. K, company should adopt the managerial accounting system

which slows the values of their assets and liabilities according to their present value. It should

not record the values of assets or liabilities at the rate in which they were acquired. The trend

analysis accounting system helps the company into the attainment of true and actual financial

position and soundness of business.

According to Matherly, the company should adopt a proper and fair financial governance

through which faces no issue in the recording of transactions. Transactions which are taken at the

year end and are recorded at the beginning of next year creates problem in attainment of true

financial reports. Therefore, adoption of proper financial governance is very important.

CONCLUSION

From the report discuss above, the managerial accounting and its importance has been

discussed. Managerial accounting refers to the identification, analysis and interpretation of the

information which enable the managers in taking better decisions for the organization. The

managerial accounting is important for better decision making, setting objectives and much

audit company E&Y can help the bakery in making their financial governance apt and strong so

that they can handle their profits very well and yield profits and growth from them.

Managerial accounting skills set: The managing the financial problem the management people

should have accurate skills and knowledge to handle the tasks. Management is a huge task in

which the resources are need to manage which helps the organization in better management of

the resources and activities. As in the case with Harts bakery, the managers should have good

managerial skills to manage the activities (Songini, Gnan and Malmi, 2013). The managers of

every department has the responsibility to manage all the resources of their organization along

with the achievement of the target.

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success.

The company Hart’s Bakery faces a financial problem of recording the expenses which

they might incur that the year end or after closing of the accounting books. Here the company

gets confuse about where they have to record these transaction which does not create any

financial problem or issue to them. Because any problem can show false financial reports to the

company which can affect the future managerial decisions. To solve such issue or problem the

company needs to manage their financial governance properly. By maintaining the same they can

manage their transactions properly which helps them in showing the true position of their

organization.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

According to Greenberg, R. K, company should adopt the managerial accounting system

which slows the values of their assets and liabilities according to their present value. It should

not record the values of assets or liabilities at the rate in which they were acquired. The trend

analysis accounting system helps the company into the attainment of true and actual financial

position and soundness of business.

According to Matherly, the company should adopt a proper and fair financial governance

through which faces no issue in the recording of transactions. Transactions which are taken at the

year end and are recorded at the beginning of next year creates problem in attainment of true

financial reports. Therefore, adoption of proper financial governance is very important.

CONCLUSION

From the report discuss above, the managerial accounting and its importance has been

discussed. Managerial accounting refers to the identification, analysis and interpretation of the

information which enable the managers in taking better decisions for the organization. The

managerial accounting is important for better decision making, setting objectives and much

more. The essential requirements of managerial accounting system include, Management Style,

Organization Structure, Information and etc. The report also includes the ways in which an

organization can solve their financial issue in managerial accounting system, some of the ways

may include, Identifying the financial issues, Financial governance, Managerial accounting skills

set and etc.

REFERENCES

Books and Journals

Appelbaum, D., Kogan, A., Vasarhelyi, M. and Yan, Z., 2017. Impact of business analytics and

enterprise systems on managerial accounting. International Journal of Accounting

Information Systems. 25. pp.29-44.

Bargate, K., 2012. The readability of managerial accounting and financial management

textbooks. Meditari Accountancy Research.

Brewer, P. C., Garrison, R. H. and Noreen, E. W., 2015.Introduction to managerial accounting.

McGraw-Hill Education.

Butler, S. A. and Ghosh, D., 2015. Individual differences in managerial accounting judgments

and decision making. The British Accounting Review. 47(1). pp.33-45.

Datar, S. M. and Rajan, M., 2014. Managerial accounting: Making decisions and motivating

performance.

Demski, J., 2013. Managerial uses of accounting information. Springer Science & Business

Media.

Greenberg, R. K. and Wilner, N. A., 2015. Using concept maps to provide an integrative

framework for teaching the cost or managerial accounting course. Journal of

Accounting Education. 33(1). pp.16-35.

Jiambalvo, J., 2019. Managerial accounting. John Wiley & Sons.

Jones, T., Atkinson, H., Lorenz, A. and Harris, P., 2012.Strategic managerial accounting:

hospitality, tourism & events applications. Goodfellow Publishers Limited.

Maher, M. W., Stickney, C. P. and Weil, R. L., 2012. Managerial accounting: An introduction to

concepts, methods and uses. Cengage Learning.

Organization Structure, Information and etc. The report also includes the ways in which an

organization can solve their financial issue in managerial accounting system, some of the ways

may include, Identifying the financial issues, Financial governance, Managerial accounting skills

set and etc.

REFERENCES

Books and Journals

Appelbaum, D., Kogan, A., Vasarhelyi, M. and Yan, Z., 2017. Impact of business analytics and

enterprise systems on managerial accounting. International Journal of Accounting

Information Systems. 25. pp.29-44.

Bargate, K., 2012. The readability of managerial accounting and financial management

textbooks. Meditari Accountancy Research.

Brewer, P. C., Garrison, R. H. and Noreen, E. W., 2015.Introduction to managerial accounting.

McGraw-Hill Education.

Butler, S. A. and Ghosh, D., 2015. Individual differences in managerial accounting judgments

and decision making. The British Accounting Review. 47(1). pp.33-45.

Datar, S. M. and Rajan, M., 2014. Managerial accounting: Making decisions and motivating

performance.

Demski, J., 2013. Managerial uses of accounting information. Springer Science & Business

Media.

Greenberg, R. K. and Wilner, N. A., 2015. Using concept maps to provide an integrative

framework for teaching the cost or managerial accounting course. Journal of

Accounting Education. 33(1). pp.16-35.

Jiambalvo, J., 2019. Managerial accounting. John Wiley & Sons.

Jones, T., Atkinson, H., Lorenz, A. and Harris, P., 2012.Strategic managerial accounting:

hospitality, tourism & events applications. Goodfellow Publishers Limited.

Maher, M. W., Stickney, C. P. and Weil, R. L., 2012. Managerial accounting: An introduction to

concepts, methods and uses. Cengage Learning.

Matherly, M. and Burney, L. L., 2013. Active learning activities to revitalize managerial

accounting principles. Issues in Accounting Education. 28(3). pp.653-680.

Needles, B. and Crosson, S., 2013. Managerial accounting. Cengage Learning.

Otley, D. and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Songini, L., Gnan, L. and Malmi, T., 2013. The role and impact of accounting in family

business. Journal of Family Business Strategy. 4(2). pp.71-83.

Tan, J., Satin, D. C. and Lubwama, C. W., 2013. A real-world business approach to teaching

MBA managerial accounting: Motivation, design, and implementation. Issues in

Accounting Education. 28(2). pp.375-402.

Warren, C., Reeve, J. M. and Duchac, J., 2013. Financial & managerial accounting. Cengage

Learning.

Weygandt, J. J., and et. al., 2018. Managerial Accounting: Tools for Business Decision-making.

John Wiley & Sons.

accounting principles. Issues in Accounting Education. 28(3). pp.653-680.

Needles, B. and Crosson, S., 2013. Managerial accounting. Cengage Learning.

Otley, D. and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Songini, L., Gnan, L. and Malmi, T., 2013. The role and impact of accounting in family

business. Journal of Family Business Strategy. 4(2). pp.71-83.

Tan, J., Satin, D. C. and Lubwama, C. W., 2013. A real-world business approach to teaching

MBA managerial accounting: Motivation, design, and implementation. Issues in

Accounting Education. 28(2). pp.375-402.

Warren, C., Reeve, J. M. and Duchac, J., 2013. Financial & managerial accounting. Cengage

Learning.

Weygandt, J. J., and et. al., 2018. Managerial Accounting: Tools for Business Decision-making.

John Wiley & Sons.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.