Accounting Principles: Financial Statement Analysis and Budgeting

VerifiedAdded on 2023/06/05

|14

|4317

|497

Report

AI Summary

This report provides a comprehensive analysis of accounting principles, focusing on their role in meeting organizational and societal requirements. It includes a critical evaluation of financial statements for partnerships, sole proprietorships, and not-for-profit organizations, using financial ratios and benchmarks to gauge organizational performance. The report also justifies budgetary control measures and their influence on organizational decision-making, discussing the advantages and restrictions of budgets, budgetary planning, and control. Furthermore, it presents a cash budget for Duck Café and justifies budgetary control measures for effective fund positioning. The analysis covers the importance of accounting functions in regulatory and ethical contexts, emphasizing the need for ethical financial reporting and adherence to accounting standards such as GAAP and IFRS. The report uses financial statements of Parcel Portal Ltd to derive and analyze financial ratios like gross profit margin, current ratio, and inventory days to assess the company's financial health and performance.

Unit 5 Accounting

Principles

Contents

Principles

Contents

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Analysing critically the role of accounting in complicated operating environment in meeting

societal requirements and organisational stakeholders requirements..............................................3

Making justified judgements through the critical analysis of financial accounts in order to gauge

organisational performance using a variety of measurements and benchmarks..............................5

Creating financial statements for partnerships, sole proprietorships and not for profit

organisations...........................................................................................................................5

a) Parcel Portal Ltd financial ratios for the years 2020 and 2021..........................................7

b) Evaluation of financial statements of Parcel Portal Ltd and financial ratios to assess the

performance of the company..................................................................................................7

Justification of budgetary control measures and their influence on organisational decision

making............................................................................................................................................11

a) The advantages and restrictions of budgets as well as budgetary planning and control for

the business...........................................................................................................................11

b) The cash budget for Duck Café for the 3 months ended 30 June 2022...........................12

c) Justifications of budgetary control measures for Duck Café and their influence on the

company to assure effective and efficient positioning of funds in the future......................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

MAIN BODY...................................................................................................................................3

Analysing critically the role of accounting in complicated operating environment in meeting

societal requirements and organisational stakeholders requirements..............................................3

Making justified judgements through the critical analysis of financial accounts in order to gauge

organisational performance using a variety of measurements and benchmarks..............................5

Creating financial statements for partnerships, sole proprietorships and not for profit

organisations...........................................................................................................................5

a) Parcel Portal Ltd financial ratios for the years 2020 and 2021..........................................7

b) Evaluation of financial statements of Parcel Portal Ltd and financial ratios to assess the

performance of the company..................................................................................................7

Justification of budgetary control measures and their influence on organisational decision

making............................................................................................................................................11

a) The advantages and restrictions of budgets as well as budgetary planning and control for

the business...........................................................................................................................11

b) The cash budget for Duck Café for the 3 months ended 30 June 2022...........................12

c) Justifications of budgetary control measures for Duck Café and their influence on the

company to assure effective and efficient positioning of funds in the future......................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Principles of accounting are the principles and guidelines which corporations should

follow while reporting financial information. Examination of financial data is easier assisted by

these guidelines by regulating the terms, conditions and approaches that the accountants must

utilise. The ultimate objective of a set of accounting rules is to assure that the financial

statements of the company are comprehensive, comparable and consistent. This makes analysing

and extracting useful data from financial statements easier for investors. This also assists

financial information comparisons among different companies (Croitoru, 2021). The critical

evaluation of financial statements to examine organisational performance using a variety of

measures and benchmarks to draw justified conclusions, the critical evaluation of budgetary

control solutions and their impact on organisational decision making to ensure efficient and

effective depreciation, and the critical evaluation of the accounting role in meeting organisational

and societal needs within complex operating environments are all included in the report. The

paper also discusses the advantages and disadvantages of budgets, budgetary planning, and

budgetary control, as well as identifying corrective measures for issues that the plan highlighted

for organisational decision-making.

MAIN BODY

Analysing critically the role of accounting in complicated operating

environment in meeting societal requirements and organisational

stakeholders requirements

The management act has always been crucial to the operations of human civilizations. The

calibre of a company's management procedures determines how effective it is. High-performance

management is required for this, which denotes competence and sane decisions. Decision-

making and managerial procedures can benefit from accounting. Delivering financial data on the

company under inquiry is the goal of an accounting system. Users utilise this data to make

judgments about the financial health of their companies and the success of their businesses. To

make management decisions that will help the firm accomplish its goals, it is necessary to

Principles of accounting are the principles and guidelines which corporations should

follow while reporting financial information. Examination of financial data is easier assisted by

these guidelines by regulating the terms, conditions and approaches that the accountants must

utilise. The ultimate objective of a set of accounting rules is to assure that the financial

statements of the company are comprehensive, comparable and consistent. This makes analysing

and extracting useful data from financial statements easier for investors. This also assists

financial information comparisons among different companies (Croitoru, 2021). The critical

evaluation of financial statements to examine organisational performance using a variety of

measures and benchmarks to draw justified conclusions, the critical evaluation of budgetary

control solutions and their impact on organisational decision making to ensure efficient and

effective depreciation, and the critical evaluation of the accounting role in meeting organisational

and societal needs within complex operating environments are all included in the report. The

paper also discusses the advantages and disadvantages of budgets, budgetary planning, and

budgetary control, as well as identifying corrective measures for issues that the plan highlighted

for organisational decision-making.

MAIN BODY

Analysing critically the role of accounting in complicated operating

environment in meeting societal requirements and organisational

stakeholders requirements

The management act has always been crucial to the operations of human civilizations. The

calibre of a company's management procedures determines how effective it is. High-performance

management is required for this, which denotes competence and sane decisions. Decision-

making and managerial procedures can benefit from accounting. Delivering financial data on the

company under inquiry is the goal of an accounting system. Users utilise this data to make

judgments about the financial health of their companies and the success of their businesses. To

make management decisions that will help the firm accomplish its goals, it is necessary to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

compare its condition to that of other businesses in the same industry or to earlier times (Cussatt,

Huang and Pollard, 2018).

The economy and society both depend on accountants. Accountants promote strategies for

cost reduction, revenue growth, and risk reduction to ensure efficient resource utilisation. The

level of services provided to this profession's members determines how good it is. The regulatory

environment in the accounting sector protects the quality and reliability of the services. As a

result, it follows that accountants need to uphold moral and professional norms. They must

represent the interests of their clients and other indirect users, including creditors and investors

(Duțescu, 2019).

Purpose of the accounting functions in context of regulatory and ethical constraints

Good accounting not only enables managers, investors, and regulators to compare

organisations side-by-side but also assists managers in maintaining control of their businesses. In

order to enable direct comparison of all accounting methods across all organisations, generally

accepted accounting principles (GAAP) were established as the foundation for accounting in the

United States. It is a set of rules and accounting principles used to report financial data. US

GAAP is used by publicly traded enterprises in the country. Most countries utilise International

Financial Reporting Standards (IFRS) (Heiling, 2020). But the US is also switching from US

GAAP to IFRS standards as a result of the convergence. Convergence aims to ensure that US

GAAP accurately reflects IFRS standards. These are the underlying ideas that corporations and

their accountants must adhere to while financial reporting.

The accountants frequently face a moral conundrum. They work to increase value through

cost cutting and revenue growth. While keeping the public interest in mind, they strive to

produce favourable results for the business or their clients. Consequently, financial information

must be given honestly and properly in order to be ethical (Khan, 2020). However, even if they

don't, accountants may feel pressure to provide favourable outcomes for the company. By

offering direction on how the problem should be handled, moral accounting approaches can be

used to help people make better decisions in both their personal and professional lives.

Accountants must follow the law. But not all circumstances have clear-cut regulations. This

Huang and Pollard, 2018).

The economy and society both depend on accountants. Accountants promote strategies for

cost reduction, revenue growth, and risk reduction to ensure efficient resource utilisation. The

level of services provided to this profession's members determines how good it is. The regulatory

environment in the accounting sector protects the quality and reliability of the services. As a

result, it follows that accountants need to uphold moral and professional norms. They must

represent the interests of their clients and other indirect users, including creditors and investors

(Duțescu, 2019).

Purpose of the accounting functions in context of regulatory and ethical constraints

Good accounting not only enables managers, investors, and regulators to compare

organisations side-by-side but also assists managers in maintaining control of their businesses. In

order to enable direct comparison of all accounting methods across all organisations, generally

accepted accounting principles (GAAP) were established as the foundation for accounting in the

United States. It is a set of rules and accounting principles used to report financial data. US

GAAP is used by publicly traded enterprises in the country. Most countries utilise International

Financial Reporting Standards (IFRS) (Heiling, 2020). But the US is also switching from US

GAAP to IFRS standards as a result of the convergence. Convergence aims to ensure that US

GAAP accurately reflects IFRS standards. These are the underlying ideas that corporations and

their accountants must adhere to while financial reporting.

The accountants frequently face a moral conundrum. They work to increase value through

cost cutting and revenue growth. While keeping the public interest in mind, they strive to

produce favourable results for the business or their clients. Consequently, financial information

must be given honestly and properly in order to be ethical (Khan, 2020). However, even if they

don't, accountants may feel pressure to provide favourable outcomes for the company. By

offering direction on how the problem should be handled, moral accounting approaches can be

used to help people make better decisions in both their personal and professional lives.

Accountants must follow the law. But not all circumstances have clear-cut regulations. This

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

suggests that accountants must behave in accordance with their best knowledge and beliefs on a

regular basis (Kumala, Mangruwa and Dewi, 2021).

Making justified judgements through the critical analysis of financial

accounts in order to gauge organisational performance using a variety of

measurements and benchmarks

Creating financial statements for partnerships, sole proprietorships and not for profit

organisations

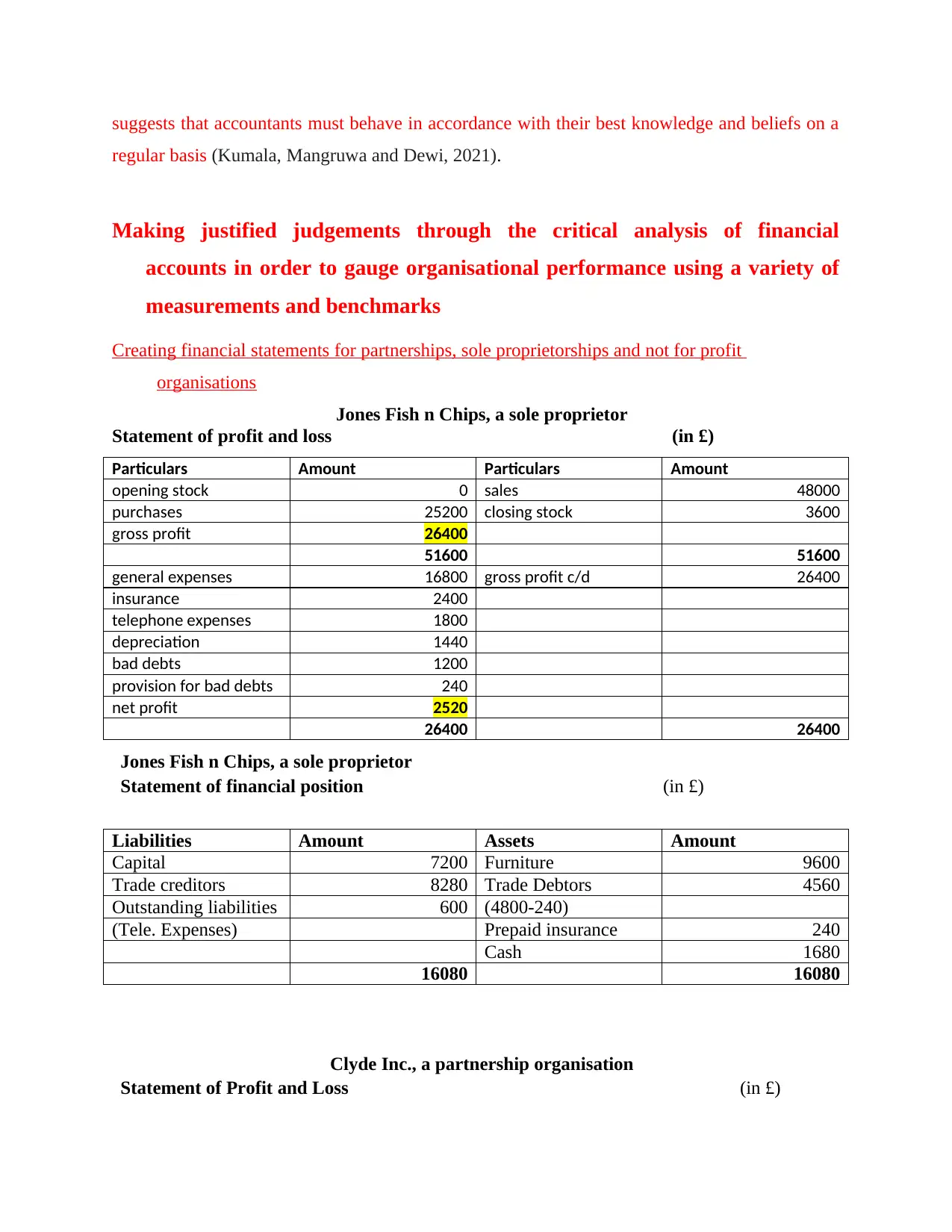

Jones Fish n Chips, a sole proprietor

Statement of profit and loss (in £)

Particulars Amount Particulars Amount

opening stock 0 sales 48000

purchases 25200 closing stock 3600

gross profit 26400

51600 51600

general expenses 16800 gross profit c/d 26400

insurance 2400

telephone expenses 1800

depreciation 1440

bad debts 1200

provision for bad debts 240

net profit 2520

26400 26400

Jones Fish n Chips, a sole proprietor

Statement of financial position (in £)

Liabilities Amount Assets Amount

Capital 7200 Furniture 9600

Trade creditors 8280 Trade Debtors 4560

Outstanding liabilities 600 (4800-240)

(Tele. Expenses) Prepaid insurance 240

Cash 1680

16080 16080

Clyde Inc., a partnership organisation

Statement of Profit and Loss (in £)

regular basis (Kumala, Mangruwa and Dewi, 2021).

Making justified judgements through the critical analysis of financial

accounts in order to gauge organisational performance using a variety of

measurements and benchmarks

Creating financial statements for partnerships, sole proprietorships and not for profit

organisations

Jones Fish n Chips, a sole proprietor

Statement of profit and loss (in £)

Particulars Amount Particulars Amount

opening stock 0 sales 48000

purchases 25200 closing stock 3600

gross profit 26400

51600 51600

general expenses 16800 gross profit c/d 26400

insurance 2400

telephone expenses 1800

depreciation 1440

bad debts 1200

provision for bad debts 240

net profit 2520

26400 26400

Jones Fish n Chips, a sole proprietor

Statement of financial position (in £)

Liabilities Amount Assets Amount

Capital 7200 Furniture 9600

Trade creditors 8280 Trade Debtors 4560

Outstanding liabilities 600 (4800-240)

(Tele. Expenses) Prepaid insurance 240

Cash 1680

16080 16080

Clyde Inc., a partnership organisation

Statement of Profit and Loss (in £)

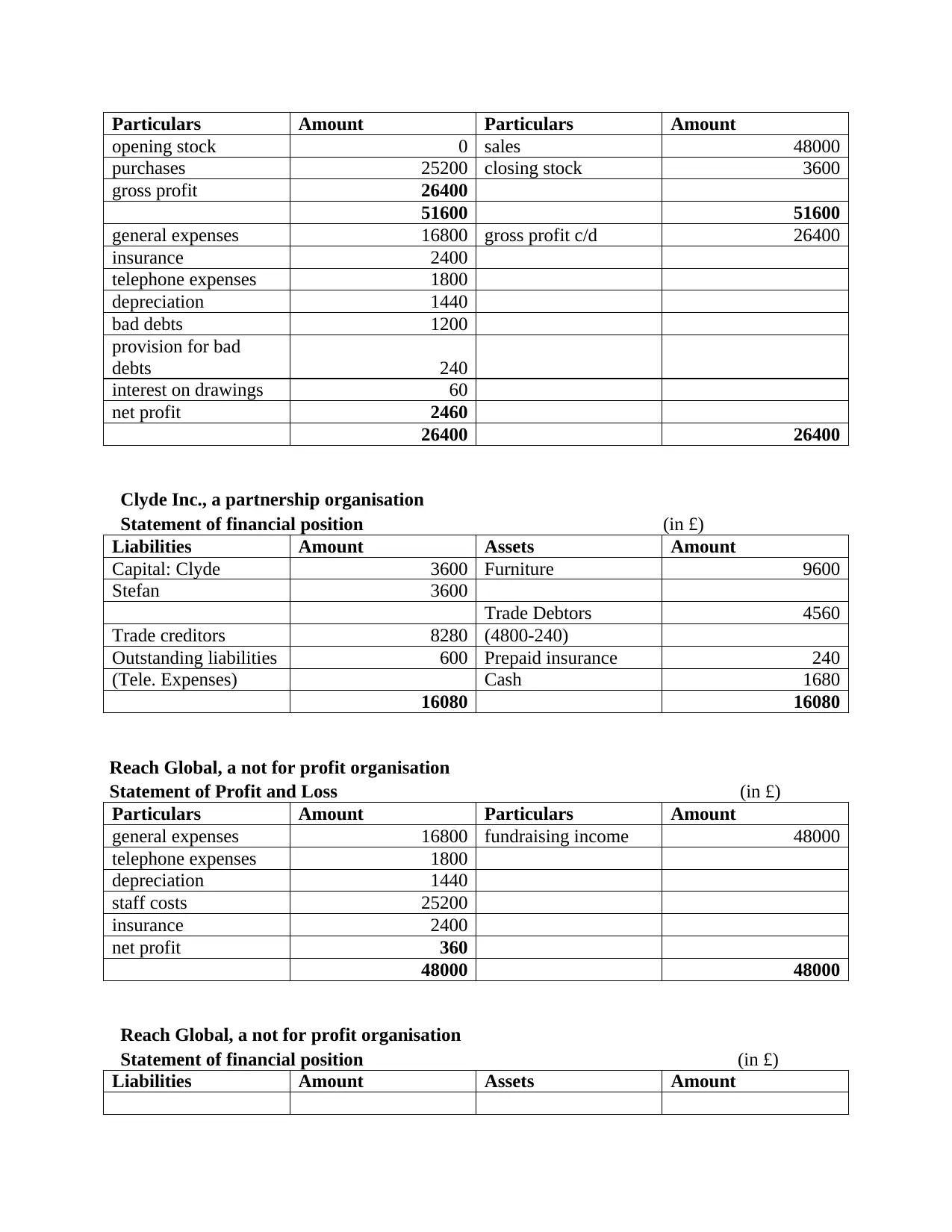

Particulars Amount Particulars Amount

opening stock 0 sales 48000

purchases 25200 closing stock 3600

gross profit 26400

51600 51600

general expenses 16800 gross profit c/d 26400

insurance 2400

telephone expenses 1800

depreciation 1440

bad debts 1200

provision for bad

debts 240

interest on drawings 60

net profit 2460

26400 26400

Clyde Inc., a partnership organisation

Statement of financial position (in £)

Liabilities Amount Assets Amount

Capital: Clyde 3600 Furniture 9600

Stefan 3600

Trade Debtors 4560

Trade creditors 8280 (4800-240)

Outstanding liabilities 600 Prepaid insurance 240

(Tele. Expenses) Cash 1680

16080 16080

Reach Global, a not for profit organisation

Statement of Profit and Loss (in £)

Particulars Amount Particulars Amount

general expenses 16800 fundraising income 48000

telephone expenses 1800

depreciation 1440

staff costs 25200

insurance 2400

net profit 360

48000 48000

Reach Global, a not for profit organisation

Statement of financial position (in £)

Liabilities Amount Assets Amount

opening stock 0 sales 48000

purchases 25200 closing stock 3600

gross profit 26400

51600 51600

general expenses 16800 gross profit c/d 26400

insurance 2400

telephone expenses 1800

depreciation 1440

bad debts 1200

provision for bad

debts 240

interest on drawings 60

net profit 2460

26400 26400

Clyde Inc., a partnership organisation

Statement of financial position (in £)

Liabilities Amount Assets Amount

Capital: Clyde 3600 Furniture 9600

Stefan 3600

Trade Debtors 4560

Trade creditors 8280 (4800-240)

Outstanding liabilities 600 Prepaid insurance 240

(Tele. Expenses) Cash 1680

16080 16080

Reach Global, a not for profit organisation

Statement of Profit and Loss (in £)

Particulars Amount Particulars Amount

general expenses 16800 fundraising income 48000

telephone expenses 1800

depreciation 1440

staff costs 25200

insurance 2400

net profit 360

48000 48000

Reach Global, a not for profit organisation

Statement of financial position (in £)

Liabilities Amount Assets Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

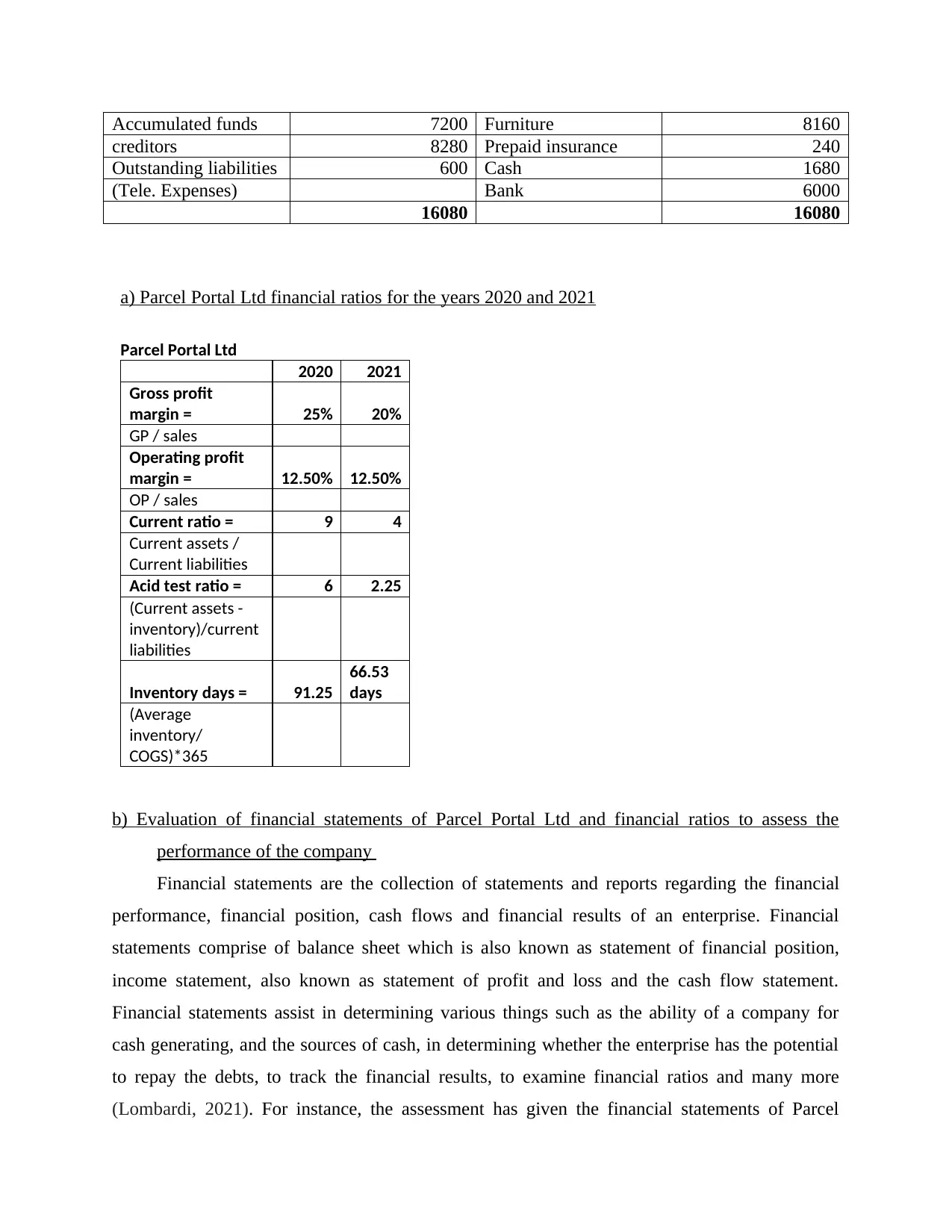

Accumulated funds 7200 Furniture 8160

creditors 8280 Prepaid insurance 240

Outstanding liabilities 600 Cash 1680

(Tele. Expenses) Bank 6000

16080 16080

a) Parcel Portal Ltd financial ratios for the years 2020 and 2021

Parcel Portal Ltd

2020 2021

Gross profit

margin = 25% 20%

GP / sales

Operating profit

margin = 12.50% 12.50%

OP / sales

Current ratio = 9 4

Current assets /

Current liabilities

Acid test ratio = 6 2.25

(Current assets -

inventory)/current

liabilities

Inventory days = 91.25

66.53

days

(Average

inventory/

COGS)*365

b) Evaluation of financial statements of Parcel Portal Ltd and financial ratios to assess the

performance of the company

Financial statements are the collection of statements and reports regarding the financial

performance, financial position, cash flows and financial results of an enterprise. Financial

statements comprise of balance sheet which is also known as statement of financial position,

income statement, also known as statement of profit and loss and the cash flow statement.

Financial statements assist in determining various things such as the ability of a company for

cash generating, and the sources of cash, in determining whether the enterprise has the potential

to repay the debts, to track the financial results, to examine financial ratios and many more

(Lombardi, 2021). For instance, the assessment has given the financial statements of Parcel

creditors 8280 Prepaid insurance 240

Outstanding liabilities 600 Cash 1680

(Tele. Expenses) Bank 6000

16080 16080

a) Parcel Portal Ltd financial ratios for the years 2020 and 2021

Parcel Portal Ltd

2020 2021

Gross profit

margin = 25% 20%

GP / sales

Operating profit

margin = 12.50% 12.50%

OP / sales

Current ratio = 9 4

Current assets /

Current liabilities

Acid test ratio = 6 2.25

(Current assets -

inventory)/current

liabilities

Inventory days = 91.25

66.53

days

(Average

inventory/

COGS)*365

b) Evaluation of financial statements of Parcel Portal Ltd and financial ratios to assess the

performance of the company

Financial statements are the collection of statements and reports regarding the financial

performance, financial position, cash flows and financial results of an enterprise. Financial

statements comprise of balance sheet which is also known as statement of financial position,

income statement, also known as statement of profit and loss and the cash flow statement.

Financial statements assist in determining various things such as the ability of a company for

cash generating, and the sources of cash, in determining whether the enterprise has the potential

to repay the debts, to track the financial results, to examine financial ratios and many more

(Lombardi, 2021). For instance, the assessment has given the financial statements of Parcel

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Portal Ltd for the years 2020 and 2021 which includes the income statements and statement of

financial position of the company. With the help of statements, various financial ratios like gross

profit margin, current ratio, inventory days has been derived and analysed.

Income statement: The investor look first at the income statement. It shows the performance of

the organisation over a period of time. Sales revenue is displayed at the top of this statement as

shown in the given case study which is £96000 in 2020 and £144000 in 2021. Then the cost of

sales is deducted and the result is gross profit that comes to £24000 in 2020 and £28800 in 2021.

Thereafter, gross profit is adjusted with operating income and expenses, the result at the end is

net profit for the business. In the given case, the net operating profit comes to £12000 in 2020

and it increased to £18000 in 2021. This statement uses accounting principles like accrual and

matching to represent amounts. Amounts are not represented on a cash basis. This statement is

utilised to evaluate profitability (Lommers and Xu, 2022). The increased net profit in the given

case study of Parcel Portal Ltd is a good sign for the company.

Balance sheet: This statement displays the assets, liabilities and equity of the company at a point

of time. These assets and liabilities are further categorised into the current and non-current type.

Noncurrent assets includes fixed tangible and intangible assets benefits from which can be

utilised over a long period of time. For instance, the given case study of Parcel Portal Ltd has

equipment amounting to £16800 as its non-current assets in 2021. Current assets are assets which

can be converted into cash shortly, say within a period of one year. Inventories, trade receivables

and bank totalling to £48000 are shown under the head of current assets in 2021 in the given case

study. Balance sheet has two sides which must balance (Oulasvirta, 2019. One is assets and

another one is equity and liabilities side. Total of liabilities and equity equals to total assets. The

given balance sheet of Parcel Portal Ltd has a total of £64800 at both the sides in 2021. Cash and

cash equivalents balance at the end of cash flow statement should be equal to the amount in the

balance sheet. Net income derived from the statement of profit and loss is taken into the balance

sheet as an adjustment in reserves.

Financial ratios

Calculation of financial ratios is assisted by the use of numerical figures taken from the financial

statements to derive meaningful facts about a company’s performance. The figures taken from

the financial statements are utilised to do quantitative analysis and examining the liquidity,

financial position of the company. With the help of statements, various financial ratios like gross

profit margin, current ratio, inventory days has been derived and analysed.

Income statement: The investor look first at the income statement. It shows the performance of

the organisation over a period of time. Sales revenue is displayed at the top of this statement as

shown in the given case study which is £96000 in 2020 and £144000 in 2021. Then the cost of

sales is deducted and the result is gross profit that comes to £24000 in 2020 and £28800 in 2021.

Thereafter, gross profit is adjusted with operating income and expenses, the result at the end is

net profit for the business. In the given case, the net operating profit comes to £12000 in 2020

and it increased to £18000 in 2021. This statement uses accounting principles like accrual and

matching to represent amounts. Amounts are not represented on a cash basis. This statement is

utilised to evaluate profitability (Lommers and Xu, 2022). The increased net profit in the given

case study of Parcel Portal Ltd is a good sign for the company.

Balance sheet: This statement displays the assets, liabilities and equity of the company at a point

of time. These assets and liabilities are further categorised into the current and non-current type.

Noncurrent assets includes fixed tangible and intangible assets benefits from which can be

utilised over a long period of time. For instance, the given case study of Parcel Portal Ltd has

equipment amounting to £16800 as its non-current assets in 2021. Current assets are assets which

can be converted into cash shortly, say within a period of one year. Inventories, trade receivables

and bank totalling to £48000 are shown under the head of current assets in 2021 in the given case

study. Balance sheet has two sides which must balance (Oulasvirta, 2019. One is assets and

another one is equity and liabilities side. Total of liabilities and equity equals to total assets. The

given balance sheet of Parcel Portal Ltd has a total of £64800 at both the sides in 2021. Cash and

cash equivalents balance at the end of cash flow statement should be equal to the amount in the

balance sheet. Net income derived from the statement of profit and loss is taken into the balance

sheet as an adjustment in reserves.

Financial ratios

Calculation of financial ratios is assisted by the use of numerical figures taken from the financial

statements to derive meaningful facts about a company’s performance. The figures taken from

the financial statements are utilised to do quantitative analysis and examining the liquidity,

solvency, leverage, margins, and growth, return rates, etc. regarding a company. Different ratios

implies the results, operating efficiency and financial risk of the company. Two main uses served

by the financial ratios are that these ratios assist tracking company performance and making

judgements comparative to industry average regarding performance of the company. Evaluating

ratios of every period helps in tracking the changes in values over time and to derive the trends

that may be emerging (Solomons, 2021). Comparing the company’s financial ratios with its

competitors in the industry helps in determining whether the performance of company is better or

worse than the average of industry. For instance, by comparing the return on assets of two

companies, an investor can get an understanding regarding which one of them is utilising their

assets most efficiently. Financial ratios assist both internal and external users to the company.

External users such as financial analyst, creditors, investors, regulatory authorities, etc. and

internal users includes employees, team of management and owners (Stănciulescu, 2021).

The following ratios are to be analysed for the company Parcel Portal Ltd for years 2020 and

2021:

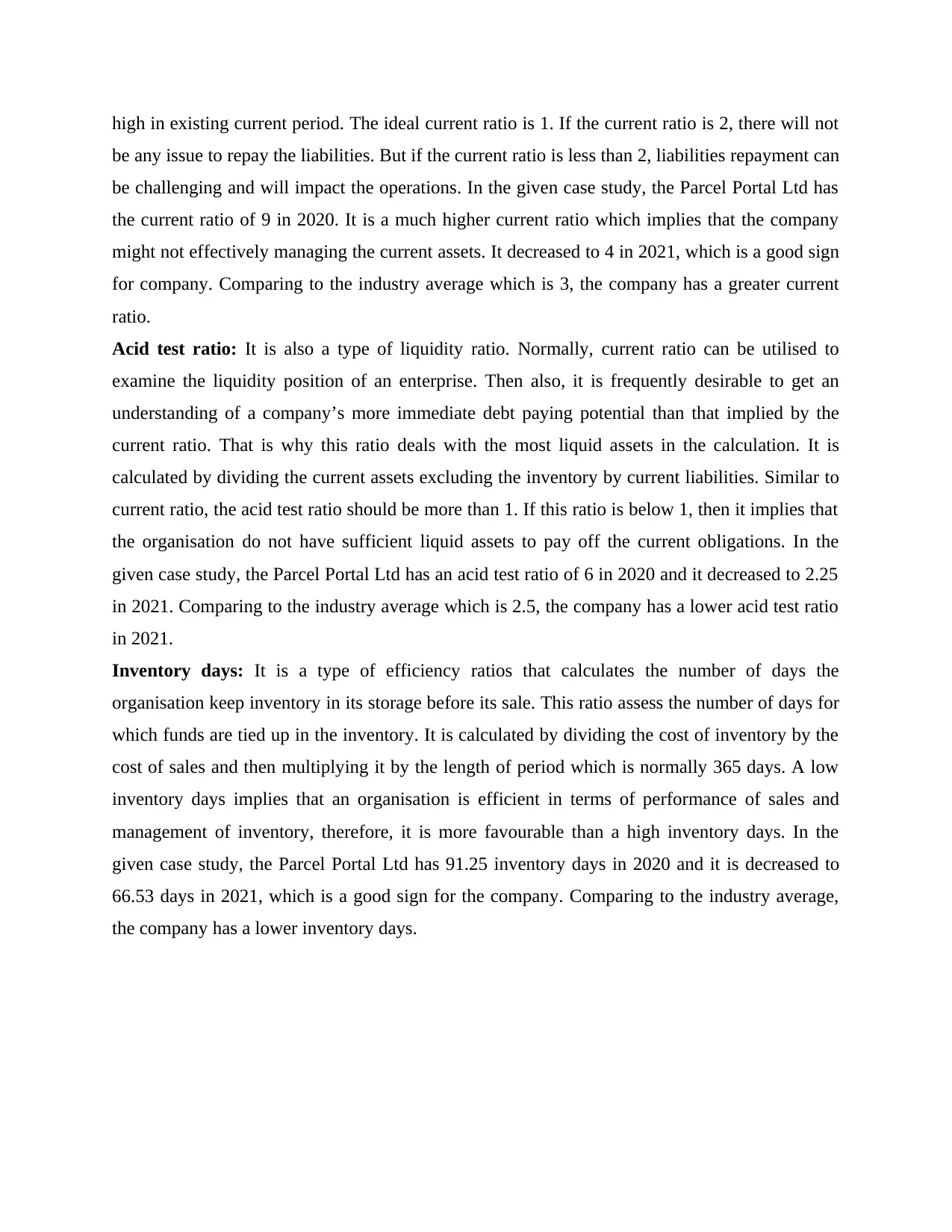

Gross profit margin: It is a type of profitability ratios. These ratios evaluate the company’s

potential to create income relative to sales, assets in balance sheet, equity and operating costs.

Gross profit margin represents the profit made by the company after paying the cost of sales. It

compares the gross profit relative to net sales. In the given case study, the Parcel Portal Ltd has

25% gross profit in 2020 and it decreased to 20% in 2021. It is not a good sign for the company.

However, comparing with industry average which is also 20%, it is not much low. But if it go

lower than industry average, then the company should improve its efficiency by reducing its cost

of sales.

Operating profit margin: This profit margin is calculated to evaluate operating efficiency. It

compares the operating income relative to net sales of the company. In the given case study, the

Parcel Portal Ltd has 12.5% in 2020 and it is same in 2021. There is no change in its operational

efficiency. Comparing to the industry average which is 10%, company has greater operating

profit margin. Hence, this is a good sign for the company.

Current ratio: It is a type of liquidity ratio. The other names for current ratio are banker’s ratio

or working capital ratio. It shows the relationship of current asset to current liability. It is

calculated by dividing total current assets by total current liabilities. Comparing the current ratio

of a company to its past current ratio will assist in determining whether the current ratio is low or

implies the results, operating efficiency and financial risk of the company. Two main uses served

by the financial ratios are that these ratios assist tracking company performance and making

judgements comparative to industry average regarding performance of the company. Evaluating

ratios of every period helps in tracking the changes in values over time and to derive the trends

that may be emerging (Solomons, 2021). Comparing the company’s financial ratios with its

competitors in the industry helps in determining whether the performance of company is better or

worse than the average of industry. For instance, by comparing the return on assets of two

companies, an investor can get an understanding regarding which one of them is utilising their

assets most efficiently. Financial ratios assist both internal and external users to the company.

External users such as financial analyst, creditors, investors, regulatory authorities, etc. and

internal users includes employees, team of management and owners (Stănciulescu, 2021).

The following ratios are to be analysed for the company Parcel Portal Ltd for years 2020 and

2021:

Gross profit margin: It is a type of profitability ratios. These ratios evaluate the company’s

potential to create income relative to sales, assets in balance sheet, equity and operating costs.

Gross profit margin represents the profit made by the company after paying the cost of sales. It

compares the gross profit relative to net sales. In the given case study, the Parcel Portal Ltd has

25% gross profit in 2020 and it decreased to 20% in 2021. It is not a good sign for the company.

However, comparing with industry average which is also 20%, it is not much low. But if it go

lower than industry average, then the company should improve its efficiency by reducing its cost

of sales.

Operating profit margin: This profit margin is calculated to evaluate operating efficiency. It

compares the operating income relative to net sales of the company. In the given case study, the

Parcel Portal Ltd has 12.5% in 2020 and it is same in 2021. There is no change in its operational

efficiency. Comparing to the industry average which is 10%, company has greater operating

profit margin. Hence, this is a good sign for the company.

Current ratio: It is a type of liquidity ratio. The other names for current ratio are banker’s ratio

or working capital ratio. It shows the relationship of current asset to current liability. It is

calculated by dividing total current assets by total current liabilities. Comparing the current ratio

of a company to its past current ratio will assist in determining whether the current ratio is low or

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

high in existing current period. The ideal current ratio is 1. If the current ratio is 2, there will not

be any issue to repay the liabilities. But if the current ratio is less than 2, liabilities repayment can

be challenging and will impact the operations. In the given case study, the Parcel Portal Ltd has

the current ratio of 9 in 2020. It is a much higher current ratio which implies that the company

might not effectively managing the current assets. It decreased to 4 in 2021, which is a good sign

for company. Comparing to the industry average which is 3, the company has a greater current

ratio.

Acid test ratio: It is also a type of liquidity ratio. Normally, current ratio can be utilised to

examine the liquidity position of an enterprise. Then also, it is frequently desirable to get an

understanding of a company’s more immediate debt paying potential than that implied by the

current ratio. That is why this ratio deals with the most liquid assets in the calculation. It is

calculated by dividing the current assets excluding the inventory by current liabilities. Similar to

current ratio, the acid test ratio should be more than 1. If this ratio is below 1, then it implies that

the organisation do not have sufficient liquid assets to pay off the current obligations. In the

given case study, the Parcel Portal Ltd has an acid test ratio of 6 in 2020 and it decreased to 2.25

in 2021. Comparing to the industry average which is 2.5, the company has a lower acid test ratio

in 2021.

Inventory days: It is a type of efficiency ratios that calculates the number of days the

organisation keep inventory in its storage before its sale. This ratio assess the number of days for

which funds are tied up in the inventory. It is calculated by dividing the cost of inventory by the

cost of sales and then multiplying it by the length of period which is normally 365 days. A low

inventory days implies that an organisation is efficient in terms of performance of sales and

management of inventory, therefore, it is more favourable than a high inventory days. In the

given case study, the Parcel Portal Ltd has 91.25 inventory days in 2020 and it is decreased to

66.53 days in 2021, which is a good sign for the company. Comparing to the industry average,

the company has a lower inventory days.

be any issue to repay the liabilities. But if the current ratio is less than 2, liabilities repayment can

be challenging and will impact the operations. In the given case study, the Parcel Portal Ltd has

the current ratio of 9 in 2020. It is a much higher current ratio which implies that the company

might not effectively managing the current assets. It decreased to 4 in 2021, which is a good sign

for company. Comparing to the industry average which is 3, the company has a greater current

ratio.

Acid test ratio: It is also a type of liquidity ratio. Normally, current ratio can be utilised to

examine the liquidity position of an enterprise. Then also, it is frequently desirable to get an

understanding of a company’s more immediate debt paying potential than that implied by the

current ratio. That is why this ratio deals with the most liquid assets in the calculation. It is

calculated by dividing the current assets excluding the inventory by current liabilities. Similar to

current ratio, the acid test ratio should be more than 1. If this ratio is below 1, then it implies that

the organisation do not have sufficient liquid assets to pay off the current obligations. In the

given case study, the Parcel Portal Ltd has an acid test ratio of 6 in 2020 and it decreased to 2.25

in 2021. Comparing to the industry average which is 2.5, the company has a lower acid test ratio

in 2021.

Inventory days: It is a type of efficiency ratios that calculates the number of days the

organisation keep inventory in its storage before its sale. This ratio assess the number of days for

which funds are tied up in the inventory. It is calculated by dividing the cost of inventory by the

cost of sales and then multiplying it by the length of period which is normally 365 days. A low

inventory days implies that an organisation is efficient in terms of performance of sales and

management of inventory, therefore, it is more favourable than a high inventory days. In the

given case study, the Parcel Portal Ltd has 91.25 inventory days in 2020 and it is decreased to

66.53 days in 2021, which is a good sign for the company. Comparing to the industry average,

the company has a lower inventory days.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

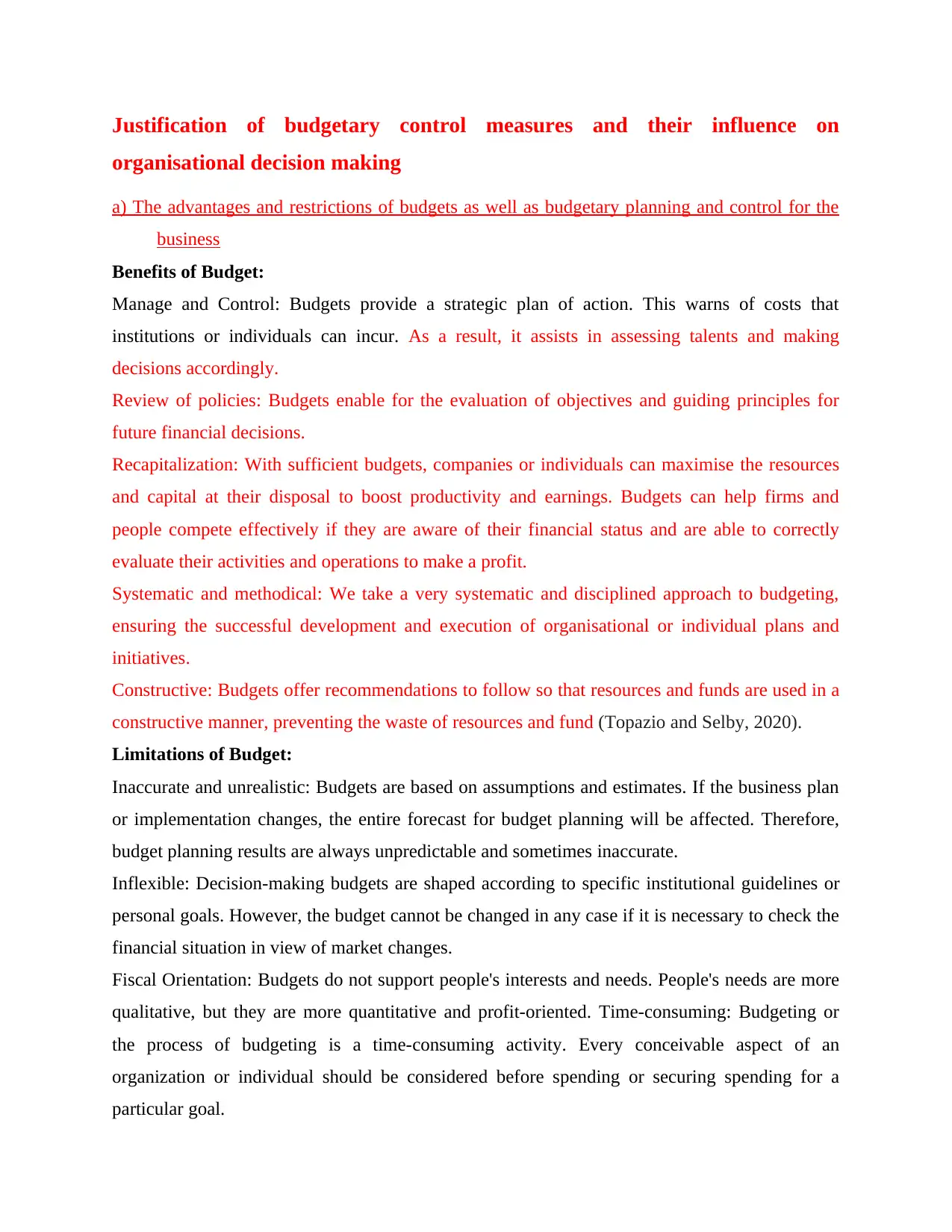

Justification of budgetary control measures and their influence on

organisational decision making

a) The advantages and restrictions of budgets as well as budgetary planning and control for the

business

Benefits of Budget:

Manage and Control: Budgets provide a strategic plan of action. This warns of costs that

institutions or individuals can incur. As a result, it assists in assessing talents and making

decisions accordingly.

Review of policies: Budgets enable for the evaluation of objectives and guiding principles for

future financial decisions.

Recapitalization: With sufficient budgets, companies or individuals can maximise the resources

and capital at their disposal to boost productivity and earnings. Budgets can help firms and

people compete effectively if they are aware of their financial status and are able to correctly

evaluate their activities and operations to make a profit.

Systematic and methodical: We take a very systematic and disciplined approach to budgeting,

ensuring the successful development and execution of organisational or individual plans and

initiatives.

Constructive: Budgets offer recommendations to follow so that resources and funds are used in a

constructive manner, preventing the waste of resources and fund (Topazio and Selby, 2020).

Limitations of Budget:

Inaccurate and unrealistic: Budgets are based on assumptions and estimates. If the business plan

or implementation changes, the entire forecast for budget planning will be affected. Therefore,

budget planning results are always unpredictable and sometimes inaccurate.

Inflexible: Decision-making budgets are shaped according to specific institutional guidelines or

personal goals. However, the budget cannot be changed in any case if it is necessary to check the

financial situation in view of market changes.

Fiscal Orientation: Budgets do not support people's interests and needs. People's needs are more

qualitative, but they are more quantitative and profit-oriented. Time-consuming: Budgeting or

the process of budgeting is a time-consuming activity. Every conceivable aspect of an

organization or individual should be considered before spending or securing spending for a

particular goal.

organisational decision making

a) The advantages and restrictions of budgets as well as budgetary planning and control for the

business

Benefits of Budget:

Manage and Control: Budgets provide a strategic plan of action. This warns of costs that

institutions or individuals can incur. As a result, it assists in assessing talents and making

decisions accordingly.

Review of policies: Budgets enable for the evaluation of objectives and guiding principles for

future financial decisions.

Recapitalization: With sufficient budgets, companies or individuals can maximise the resources

and capital at their disposal to boost productivity and earnings. Budgets can help firms and

people compete effectively if they are aware of their financial status and are able to correctly

evaluate their activities and operations to make a profit.

Systematic and methodical: We take a very systematic and disciplined approach to budgeting,

ensuring the successful development and execution of organisational or individual plans and

initiatives.

Constructive: Budgets offer recommendations to follow so that resources and funds are used in a

constructive manner, preventing the waste of resources and fund (Topazio and Selby, 2020).

Limitations of Budget:

Inaccurate and unrealistic: Budgets are based on assumptions and estimates. If the business plan

or implementation changes, the entire forecast for budget planning will be affected. Therefore,

budget planning results are always unpredictable and sometimes inaccurate.

Inflexible: Decision-making budgets are shaped according to specific institutional guidelines or

personal goals. However, the budget cannot be changed in any case if it is necessary to check the

financial situation in view of market changes.

Fiscal Orientation: Budgets do not support people's interests and needs. People's needs are more

qualitative, but they are more quantitative and profit-oriented. Time-consuming: Budgeting or

the process of budgeting is a time-consuming activity. Every conceivable aspect of an

organization or individual should be considered before spending or securing spending for a

particular goal.

Conflicts: A failed budget plan can create a lot of tension and rifts within an organization,

ultimately reflected in the inefficient operation of the organization.

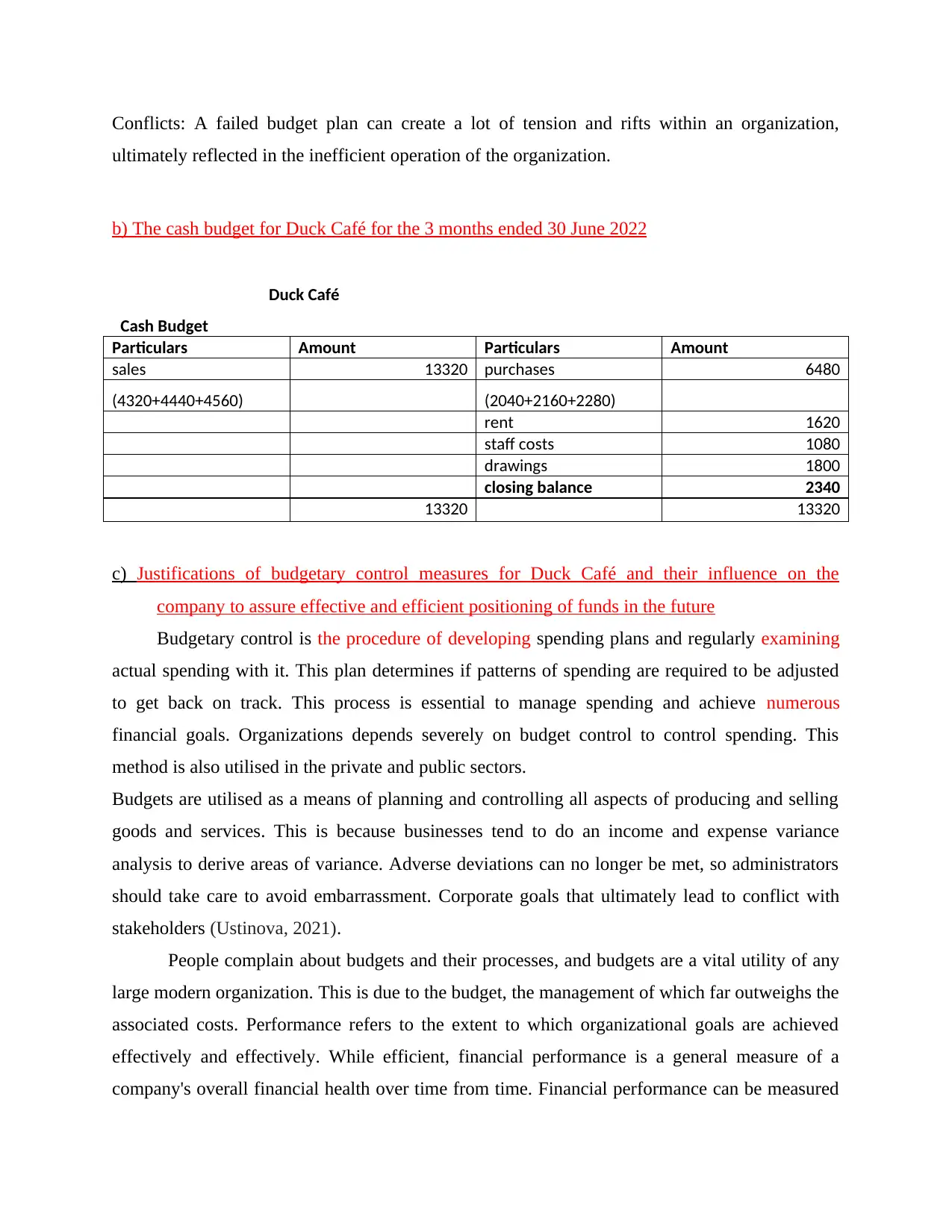

b) The cash budget for Duck Café for the 3 months ended 30 June 2022

Duck Café

Cash Budget

Particulars Amount Particulars Amount

sales 13320 purchases 6480

(4320+4440+4560) (2040+2160+2280)

rent 1620

staff costs 1080

drawings 1800

closing balance 2340

13320 13320

c) Justifications of budgetary control measures for Duck Café and their influence on the

company to assure effective and efficient positioning of funds in the future

Budgetary control is the procedure of developing spending plans and regularly examining

actual spending with it. This plan determines if patterns of spending are required to be adjusted

to get back on track. This process is essential to manage spending and achieve numerous

financial goals. Organizations depends severely on budget control to control spending. This

method is also utilised in the private and public sectors.

Budgets are utilised as a means of planning and controlling all aspects of producing and selling

goods and services. This is because businesses tend to do an income and expense variance

analysis to derive areas of variance. Adverse deviations can no longer be met, so administrators

should take care to avoid embarrassment. Corporate goals that ultimately lead to conflict with

stakeholders (Ustinova, 2021).

People complain about budgets and their processes, and budgets are a vital utility of any

large modern organization. This is due to the budget, the management of which far outweighs the

associated costs. Performance refers to the extent to which organizational goals are achieved

effectively and effectively. While efficient, financial performance is a general measure of a

company's overall financial health over time from time. Financial performance can be measured

ultimately reflected in the inefficient operation of the organization.

b) The cash budget for Duck Café for the 3 months ended 30 June 2022

Duck Café

Cash Budget

Particulars Amount Particulars Amount

sales 13320 purchases 6480

(4320+4440+4560) (2040+2160+2280)

rent 1620

staff costs 1080

drawings 1800

closing balance 2340

13320 13320

c) Justifications of budgetary control measures for Duck Café and their influence on the

company to assure effective and efficient positioning of funds in the future

Budgetary control is the procedure of developing spending plans and regularly examining

actual spending with it. This plan determines if patterns of spending are required to be adjusted

to get back on track. This process is essential to manage spending and achieve numerous

financial goals. Organizations depends severely on budget control to control spending. This

method is also utilised in the private and public sectors.

Budgets are utilised as a means of planning and controlling all aspects of producing and selling

goods and services. This is because businesses tend to do an income and expense variance

analysis to derive areas of variance. Adverse deviations can no longer be met, so administrators

should take care to avoid embarrassment. Corporate goals that ultimately lead to conflict with

stakeholders (Ustinova, 2021).

People complain about budgets and their processes, and budgets are a vital utility of any

large modern organization. This is due to the budget, the management of which far outweighs the

associated costs. Performance refers to the extent to which organizational goals are achieved

effectively and effectively. While efficient, financial performance is a general measure of a

company's overall financial health over time from time. Financial performance can be measured

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.