Unit 5 Accounting Principles: Financial Statements, Ratios, and Decision Making

VerifiedAdded on 2023/06/09

|19

|4347

|348

AI Summary

This report discusses the fundamentals of accounting principles and their role in decision making for businesses. It covers financial statements such as trading account, profit and loss account, balance sheet, and cash flow statement. It also includes the computation of financial ratios and their interpretation for BAJ Shop. Additionally, the report evaluates the ethical constraints of BAJ Shop and the function of accounting in informing decision making. Course code and college/university not mentioned.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Unit 5 Accounting

Principles

Principles

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................4

TASK ..............................................................................................................................................4

1. Determine the objective of accounting principles in meeting, societal, organizational ,

investors and shareholders necessity and belief in revealing business decision making within

in a dynamic surroundings......................................................................................................4

2. Evaluate the regulative and ethical constraints of BAJ shop.............................................5

3. Function of accounting in informing decision making to meet business enterprises, societal

and stakeholder requirement within a complex management system ...................................5

4. Computation of financial statement of BAJ Shop..............................................................7

4.1 Trading Account, Profit and Loss Account......................................................................7

4.2 Calculate the Financial Ratio ...........................................................................................9

4.3 Compare both the year financial ratio of BAJ Shop.......................................................13

4.4 Cash Budget ...................................................................................................................14

4.5 Demerits of Budgetary Planning, Budgetary Control and Budgets for BAJ shop.........15

5. Prepare the partnership trading accounting, profit & loss account and balance sheet.....16

6. Prepare an income statement and balance sheet of Creative Kids...................................18

CONCLUSION .............................................................................................................................18

REFERENCES..............................................................................................................................20

INTRODUCTION ..........................................................................................................................4

TASK ..............................................................................................................................................4

1. Determine the objective of accounting principles in meeting, societal, organizational ,

investors and shareholders necessity and belief in revealing business decision making within

in a dynamic surroundings......................................................................................................4

2. Evaluate the regulative and ethical constraints of BAJ shop.............................................5

3. Function of accounting in informing decision making to meet business enterprises, societal

and stakeholder requirement within a complex management system ...................................5

4. Computation of financial statement of BAJ Shop..............................................................7

4.1 Trading Account, Profit and Loss Account......................................................................7

4.2 Calculate the Financial Ratio ...........................................................................................9

4.3 Compare both the year financial ratio of BAJ Shop.......................................................13

4.4 Cash Budget ...................................................................................................................14

4.5 Demerits of Budgetary Planning, Budgetary Control and Budgets for BAJ shop.........15

5. Prepare the partnership trading accounting, profit & loss account and balance sheet.....16

6. Prepare an income statement and balance sheet of Creative Kids...................................18

CONCLUSION .............................................................................................................................18

REFERENCES..............................................................................................................................20

INTRODUCTION

Management accounting plays a huge role in every organization and enterprises for future

forecasting. It is like an occupation which helps to supports business management in terms of

planning, directing, managing performance and decision-making. Management accounting

regulate gives evaluation in financial control and reporting to assist the operation in the

regulation and formulation of an firm strategy by giving accurate financial data and undertaking

that relates the department of accounts. The main purpose of this report is to defining the

fundamentals of accounting principles within the financial operations or to assist better and

useful budgets and decision making (Jordan and Samuels., 2020). The following report contains

the both calculation and theories of accounting and business management methods that include

profit and loss accounts, trading account, balance sheet and cash flow statement. After that

financial ratio of the BAJ shop are calculated and their results are interpreted and compared for

analysing the performance of running business.

TASK

1. Determine the objective of accounting principles in meeting, societal, organizational ,

investors and shareholders necessity and belief in revealing business decision

making within in a dynamic surroundings

The main aim or objectives of financial statements are to give the accurate and

reliable information so that outsiders or stakeholder have belief on them. The word objective

in accounting indicated the collected data are free from error or unbiased and is subjects to

check and verify.

a) Recording of Financial transactions: It is a day to day financial transaction recordings

which is generally said as Bookkeeping that includes information of goods and services such

as receipts, purchases, payment and sales as well as movement of receivables and payables.

It is the first stage or foremost step that helps the business firm in making the financial

statement in the year ending (Rosa., 2018) . This practice is done by the every organization

department of accounts where they ensure to record the data without getting any mistake.

b) Reporting Financial information: All the organization include stakeholders in its business

which is basically two types such as internal or external whereas, internal include business

manager, director or employees and external stakeholders include investors, clients,

Management accounting plays a huge role in every organization and enterprises for future

forecasting. It is like an occupation which helps to supports business management in terms of

planning, directing, managing performance and decision-making. Management accounting

regulate gives evaluation in financial control and reporting to assist the operation in the

regulation and formulation of an firm strategy by giving accurate financial data and undertaking

that relates the department of accounts. The main purpose of this report is to defining the

fundamentals of accounting principles within the financial operations or to assist better and

useful budgets and decision making (Jordan and Samuels., 2020). The following report contains

the both calculation and theories of accounting and business management methods that include

profit and loss accounts, trading account, balance sheet and cash flow statement. After that

financial ratio of the BAJ shop are calculated and their results are interpreted and compared for

analysing the performance of running business.

TASK

1. Determine the objective of accounting principles in meeting, societal, organizational ,

investors and shareholders necessity and belief in revealing business decision

making within in a dynamic surroundings

The main aim or objectives of financial statements are to give the accurate and

reliable information so that outsiders or stakeholder have belief on them. The word objective

in accounting indicated the collected data are free from error or unbiased and is subjects to

check and verify.

a) Recording of Financial transactions: It is a day to day financial transaction recordings

which is generally said as Bookkeeping that includes information of goods and services such

as receipts, purchases, payment and sales as well as movement of receivables and payables.

It is the first stage or foremost step that helps the business firm in making the financial

statement in the year ending (Rosa., 2018) . This practice is done by the every organization

department of accounts where they ensure to record the data without getting any mistake.

b) Reporting Financial information: All the organization include stakeholders in its business

which is basically two types such as internal or external whereas, internal include business

manager, director or employees and external stakeholders include investors, clients,

shareholders and suppliers. Both the shareholder are connected with the company personally

through investments that is why they wanted to assess the company financial statement or

performance for calculating its profit or gains at the end of the year. This reporting is take

place in three ways in every company are monthly, yearly or quarterly period (Liu And et.al.,

2021). In context of organization, they used financial statement for decision making. In other

hand, the investor uses statement for making future investment decision on behalf of the

outcomes.

2. Evaluate the regulative and ethical constraints of BAJ shop

Ethics are seen to be the rule that the business needs to conform to so their working

should be completed in the orderly way. The office really should diagram and embrace

positive morals for their work space and should guarantee that their association should work

consequently by means of agreeing them. The bookkeeper of the endeavor should ensure

that business need to agree with all the lawbreaker and administrative consistence on due

time. The model might need to be that to record benefits expense form of the organization

and merchandise and supplier government form on ideal way, the undertaking assessment

ought to be saved to the local expert on customary premise and so on that in the long run

should that hard working attitude for the endeavor has been conformed to. Morals are

viewed as the moral ideas that show the way of behaving of a person towards the hobby they

are conveyed upon (Eldenburg And et.al., 2020) . Morals ought to be consented to at business

venture stage too through agreeing with every one of the regulations and prerequisite that

business endeavor oversees, making all around planned expense to the obligation holders

from whom business owes sure amount of asset, standard charge of compared month-to-

month portion to banks and public monetary association from which the business gain

monetary organization credits, etc.

3. Function of accounting in informing decision making to meet business enterprises,

societal and stakeholder requirement within a complex management system

Accounting plays a necessary role in the commercial enterprise decision-making

process. It maintains eyes on the economic things to do and documents them in a number

statement. These statements in addition used to measure the monetary function of the

company. Financial statements help a firm to measure the overall performance of every

department. This file is supplied to investors, stakeholders, and management to make

through investments that is why they wanted to assess the company financial statement or

performance for calculating its profit or gains at the end of the year. This reporting is take

place in three ways in every company are monthly, yearly or quarterly period (Liu And et.al.,

2021). In context of organization, they used financial statement for decision making. In other

hand, the investor uses statement for making future investment decision on behalf of the

outcomes.

2. Evaluate the regulative and ethical constraints of BAJ shop

Ethics are seen to be the rule that the business needs to conform to so their working

should be completed in the orderly way. The office really should diagram and embrace

positive morals for their work space and should guarantee that their association should work

consequently by means of agreeing them. The bookkeeper of the endeavor should ensure

that business need to agree with all the lawbreaker and administrative consistence on due

time. The model might need to be that to record benefits expense form of the organization

and merchandise and supplier government form on ideal way, the undertaking assessment

ought to be saved to the local expert on customary premise and so on that in the long run

should that hard working attitude for the endeavor has been conformed to. Morals are

viewed as the moral ideas that show the way of behaving of a person towards the hobby they

are conveyed upon (Eldenburg And et.al., 2020) . Morals ought to be consented to at business

venture stage too through agreeing with every one of the regulations and prerequisite that

business endeavor oversees, making all around planned expense to the obligation holders

from whom business owes sure amount of asset, standard charge of compared month-to-

month portion to banks and public monetary association from which the business gain

monetary organization credits, etc.

3. Function of accounting in informing decision making to meet business enterprises,

societal and stakeholder requirement within a complex management system

Accounting plays a necessary role in the commercial enterprise decision-making

process. It maintains eyes on the economic things to do and documents them in a number

statement. These statements in addition used to measure the monetary function of the

company. Financial statements help a firm to measure the overall performance of every

department. This file is supplied to investors, stakeholders, and management to make

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

decisions. Accounting helps the manager to manipulate fees and expenses incurred in the

commercial enterprise operations. There are some goals which furnish more support to above

subject matter are as follows:

Increased Regulation: In the creating economy, the requirement for bookkeeping

regulation is reliably expanding (Wasserman and Madrid-Morales., 2019) . There are

numerous outrages in the mid-2000s which harm the bookkeeping way and

methodology. It alludes to the criminal guideline, principles, and strategies which is

essential to continue in the strategy of bookkeeping.

IFRS Standard: IFRS is stand for International financial reporting standard and it

alludes to the arrangement of bookkeeping guidelines and rules which guide how

exact kind of leisure activity and exchange ought to be comprise of in money related

explanations. These necessities are formed and settled by the International

bookkeeping well known board (IASB). These norms are moulded to give financial

reports of every association to the merchants and other business undertaking which

assist them with looking at its money related audits to the various organizations.

Risk Management: It is a technique for assurance, size and acknowledgement of

risks or vulnerabilities in the business tasks. Risk is unbreakable construction of

return in a business. Risk imply in every single activity of an organization it

comprises of in excess of a couple of kinds of hazard, for example, subsidizing risk,

market risk, in general execution possibility and monetary possibility, etc.

Reputation: It alludes to the public enthusiasm for the organization and its exercises,

all together words it alludes to the organization's picture according to individuals. It

comprises of individuals' perspectives on the product and administrations, and they

may likewise be terrible or positive (Popkova And et.al., 2019) . The

acknowledgement of an organization changes after some time. It is an extremely

essential thing for any business to arrive at the most ideal job on the lookout. It

influences the endeavour tasks top expense increment the offer of the business

venture and furthermore captivate a generally number of individuals. It moreover

characterizes the accept and trust of the people in the organization.

Sustainability: It alludes to the ability to keep a system or position generally over a

period of time. With regards to big business association it alludes to the capacity to

commercial enterprise operations. There are some goals which furnish more support to above

subject matter are as follows:

Increased Regulation: In the creating economy, the requirement for bookkeeping

regulation is reliably expanding (Wasserman and Madrid-Morales., 2019) . There are

numerous outrages in the mid-2000s which harm the bookkeeping way and

methodology. It alludes to the criminal guideline, principles, and strategies which is

essential to continue in the strategy of bookkeeping.

IFRS Standard: IFRS is stand for International financial reporting standard and it

alludes to the arrangement of bookkeeping guidelines and rules which guide how

exact kind of leisure activity and exchange ought to be comprise of in money related

explanations. These necessities are formed and settled by the International

bookkeeping well known board (IASB). These norms are moulded to give financial

reports of every association to the merchants and other business undertaking which

assist them with looking at its money related audits to the various organizations.

Risk Management: It is a technique for assurance, size and acknowledgement of

risks or vulnerabilities in the business tasks. Risk is unbreakable construction of

return in a business. Risk imply in every single activity of an organization it

comprises of in excess of a couple of kinds of hazard, for example, subsidizing risk,

market risk, in general execution possibility and monetary possibility, etc.

Reputation: It alludes to the public enthusiasm for the organization and its exercises,

all together words it alludes to the organization's picture according to individuals. It

comprises of individuals' perspectives on the product and administrations, and they

may likewise be terrible or positive (Popkova And et.al., 2019) . The

acknowledgement of an organization changes after some time. It is an extremely

essential thing for any business to arrive at the most ideal job on the lookout. It

influences the endeavour tasks top expense increment the offer of the business

venture and furthermore captivate a generally number of individuals. It moreover

characterizes the accept and trust of the people in the organization.

Sustainability: It alludes to the ability to keep a system or position generally over a

period of time. With regards to big business association it alludes to the capacity to

stand firm on a district or foothold in the constant changing commercial center or

climate.

Governance: It is the mixture of guidelines, practices, rules, and approaches which

help association to control its activities (Dargent., 2020) . Leading body of executives

of an organization is ordinarily affecting the administration.

4. Computation of financial statement of BAJ Shop

4.1 Trading Account, Profit and Loss Account

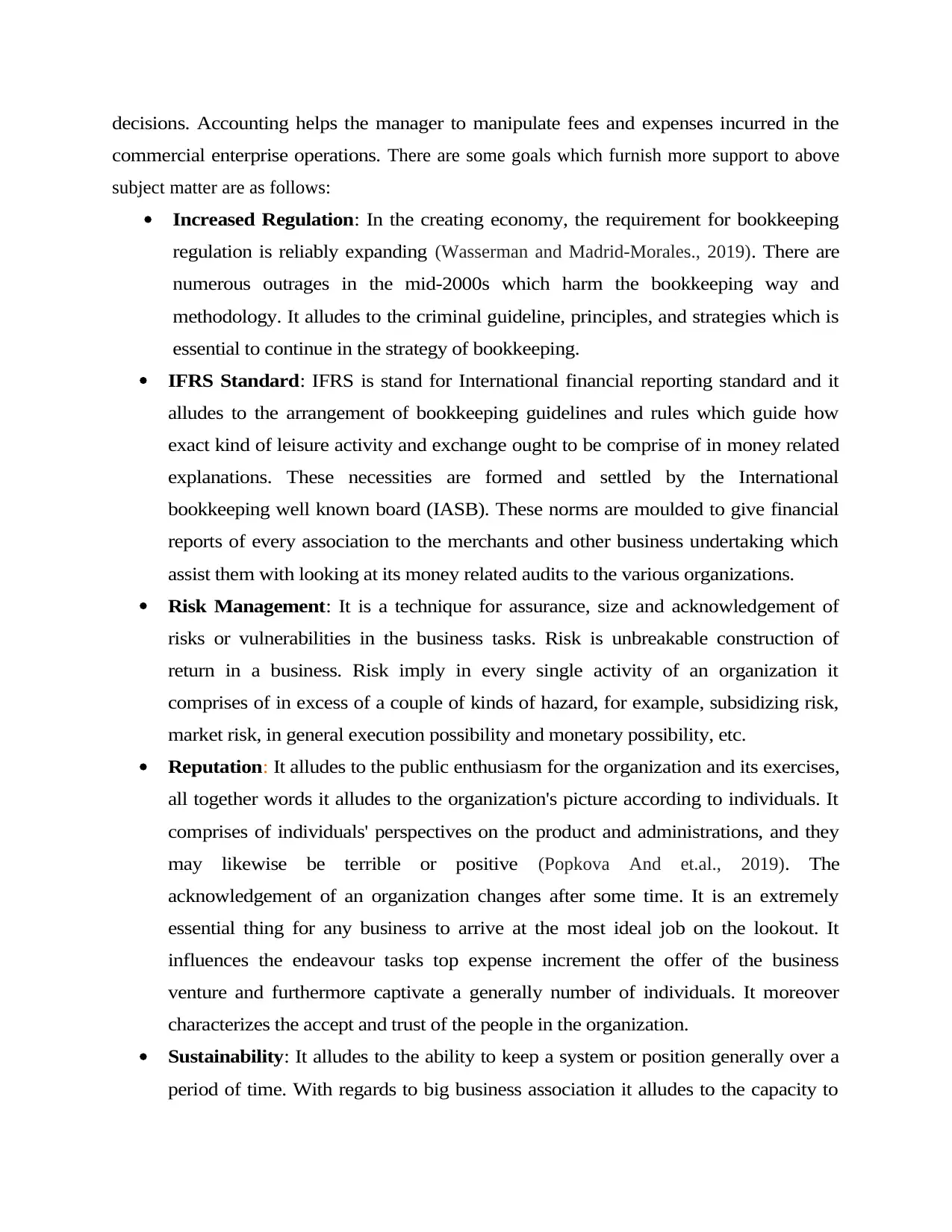

TRADING and P&L ACCOUNT

PARTICULARS AMOUNT (£’000) PARTICULARS AMOUNT (£’000)

Opening stock 400 Sales 10000

Purchases 2500 Closing stock 10

Wages 1225

Gross profit 5885

10010 10010

Rent 1000 Gross Profit 5885

Lighting and expenses 175

Insurance 20

Donation 100

Depreciation 370

Net profit 4220

5885 5885

BALANCE SHEET

PARTICULARS AMOUNT (£’000)

Assets

Current Assets

Cash & cash equivalents 4090

Accounts receivable 1200

Inventories 10

Insurance prepaid 5

Property, plant & equipment 7530

Total assets 12835

Equity and Liabilities

Capital 12260

Accounts payable 550

Wages accrued 25

climate.

Governance: It is the mixture of guidelines, practices, rules, and approaches which

help association to control its activities (Dargent., 2020) . Leading body of executives

of an organization is ordinarily affecting the administration.

4. Computation of financial statement of BAJ Shop

4.1 Trading Account, Profit and Loss Account

TRADING and P&L ACCOUNT

PARTICULARS AMOUNT (£’000) PARTICULARS AMOUNT (£’000)

Opening stock 400 Sales 10000

Purchases 2500 Closing stock 10

Wages 1225

Gross profit 5885

10010 10010

Rent 1000 Gross Profit 5885

Lighting and expenses 175

Insurance 20

Donation 100

Depreciation 370

Net profit 4220

5885 5885

BALANCE SHEET

PARTICULARS AMOUNT (£’000)

Assets

Current Assets

Cash & cash equivalents 4090

Accounts receivable 1200

Inventories 10

Insurance prepaid 5

Property, plant & equipment 7530

Total assets 12835

Equity and Liabilities

Capital 12260

Accounts payable 550

Wages accrued 25

Total liabilities 12835

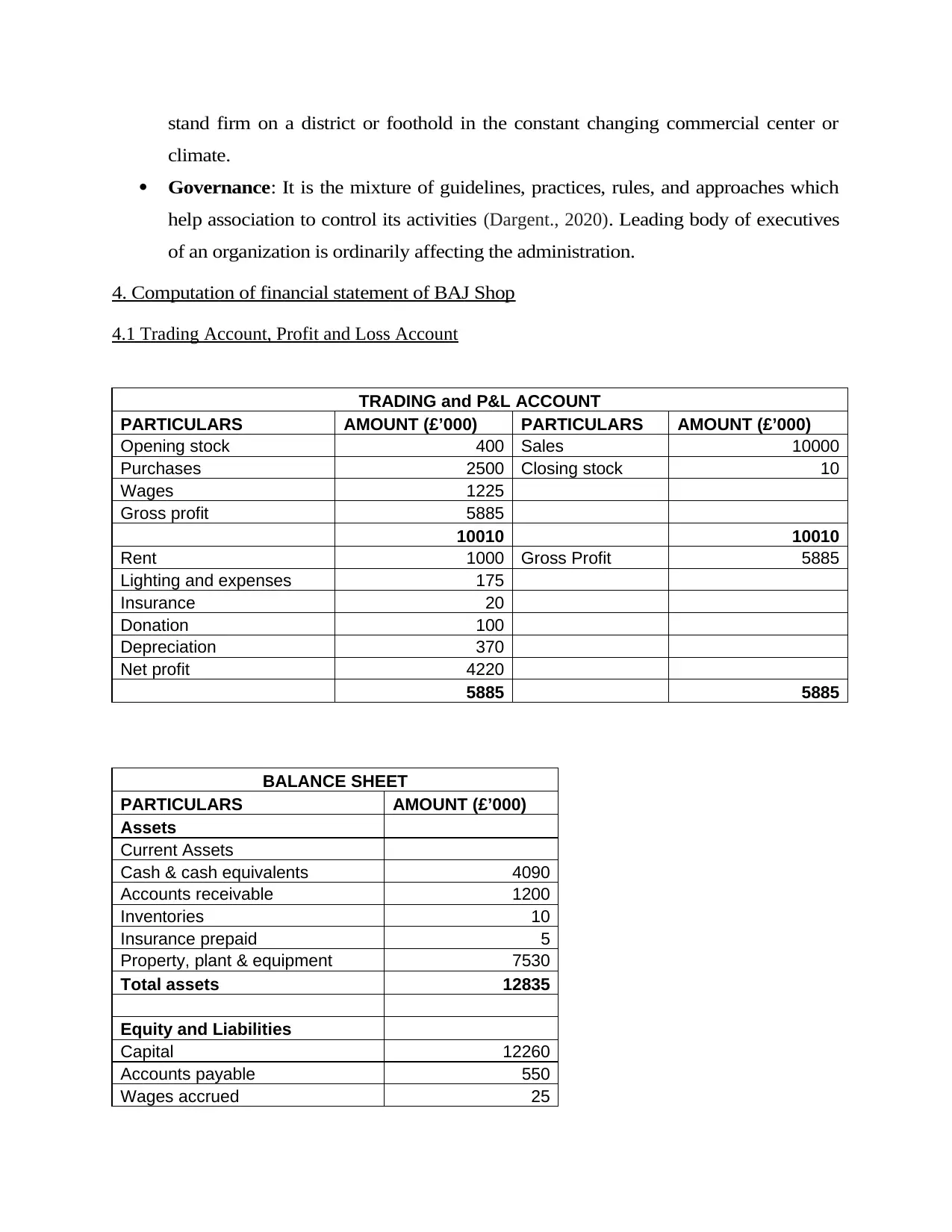

WORKING NOTES

Wages 1200

Add: Accrued wages 25

1225

Depreciation

Shop fixtures 150

Machinery & Equip 120

Motor Vehicle 100

370

Cash & cash equivalents

Cash 50

Bank 4040

4090

Property, plant &

equipment

Premises 4200

Depreciation 0

accumulated depreciation 0

4200

Shop fixtures 1950

Depreciation 150

accumulated depreciation 450

1350

Machinery & Equip 1560

Depreciation 120

accumulated depreciation 360

1080

Motor Vehicle 700

Depreciation 100

accumulated depreciation 300

300

Computer 600

Depreciation 0

accumulated depreciation 0

WORKING NOTES

Wages 1200

Add: Accrued wages 25

1225

Depreciation

Shop fixtures 150

Machinery & Equip 120

Motor Vehicle 100

370

Cash & cash equivalents

Cash 50

Bank 4040

4090

Property, plant &

equipment

Premises 4200

Depreciation 0

accumulated depreciation 0

4200

Shop fixtures 1950

Depreciation 150

accumulated depreciation 450

1350

Machinery & Equip 1560

Depreciation 120

accumulated depreciation 360

1080

Motor Vehicle 700

Depreciation 100

accumulated depreciation 300

300

Computer 600

Depreciation 0

accumulated depreciation 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

600

Total 7530

Capital 5000

Net profit 4220

Retained earnings 4290

Drawings 1250

12260

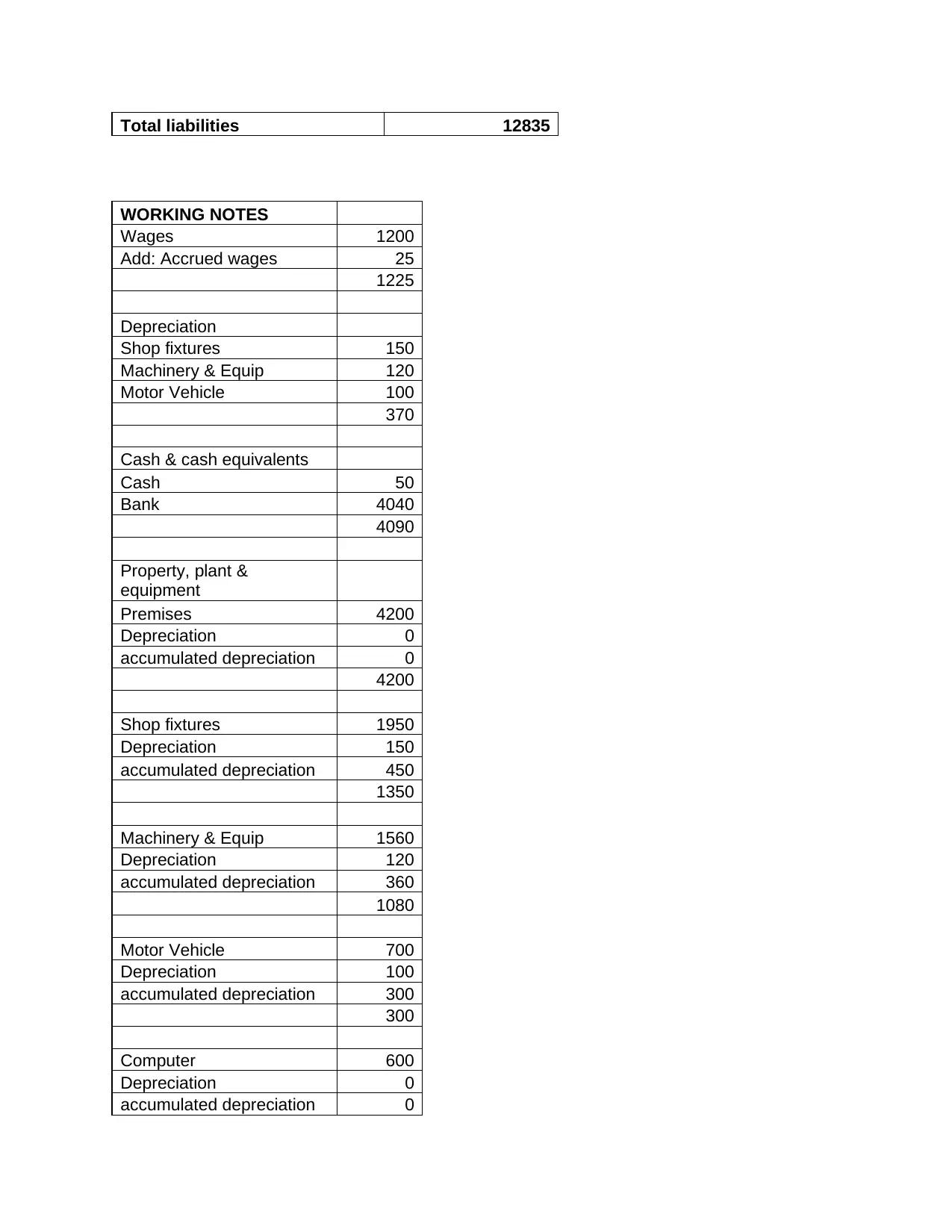

4.2 Calculate the Financial Ratio

a) Profitability Ratio

Profitability ratios are those ratios which help the business entity to assess its revenue

generating ability from the operations. These ratios indicate the business entity's ability to

create value for the stakeholders

Gross Profit: It measures the percentage of each sale in currency after payment of

goods sold. Gross profit margin depends on the relationship between sale price,

volume and costs (He and Kou., 2018) . A high gross profit margin is a favourable sign

of good management

Gross Profit Margin= (Revenue - COGS) / Revenue *100

(Amounts in £’000)

Years Revenue Cost of goods sold

2018 7565 3000

2019 7000 4000

2020 10000 2890

In the year 2018,

= (7565 - 3000) / 7565 * 100

= 60.34%

In the year 2019,

= (7000 - 4000) / 7000 * 100

= 42.86%

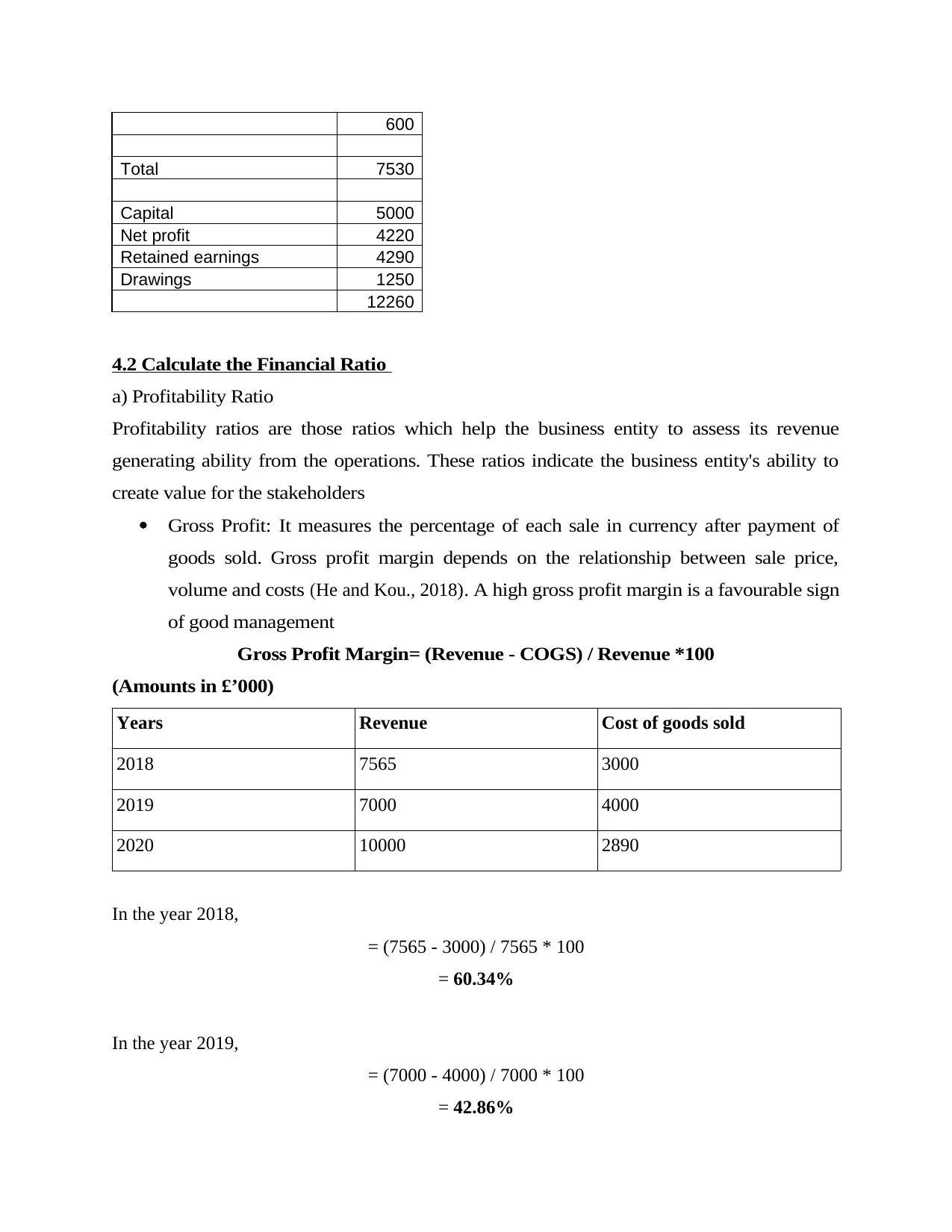

Total 7530

Capital 5000

Net profit 4220

Retained earnings 4290

Drawings 1250

12260

4.2 Calculate the Financial Ratio

a) Profitability Ratio

Profitability ratios are those ratios which help the business entity to assess its revenue

generating ability from the operations. These ratios indicate the business entity's ability to

create value for the stakeholders

Gross Profit: It measures the percentage of each sale in currency after payment of

goods sold. Gross profit margin depends on the relationship between sale price,

volume and costs (He and Kou., 2018) . A high gross profit margin is a favourable sign

of good management

Gross Profit Margin= (Revenue - COGS) / Revenue *100

(Amounts in £’000)

Years Revenue Cost of goods sold

2018 7565 3000

2019 7000 4000

2020 10000 2890

In the year 2018,

= (7565 - 3000) / 7565 * 100

= 60.34%

In the year 2019,

= (7000 - 4000) / 7000 * 100

= 42.86%

In the year 2020,

=(10000-2890) / 10000 * 100

= 71.1%

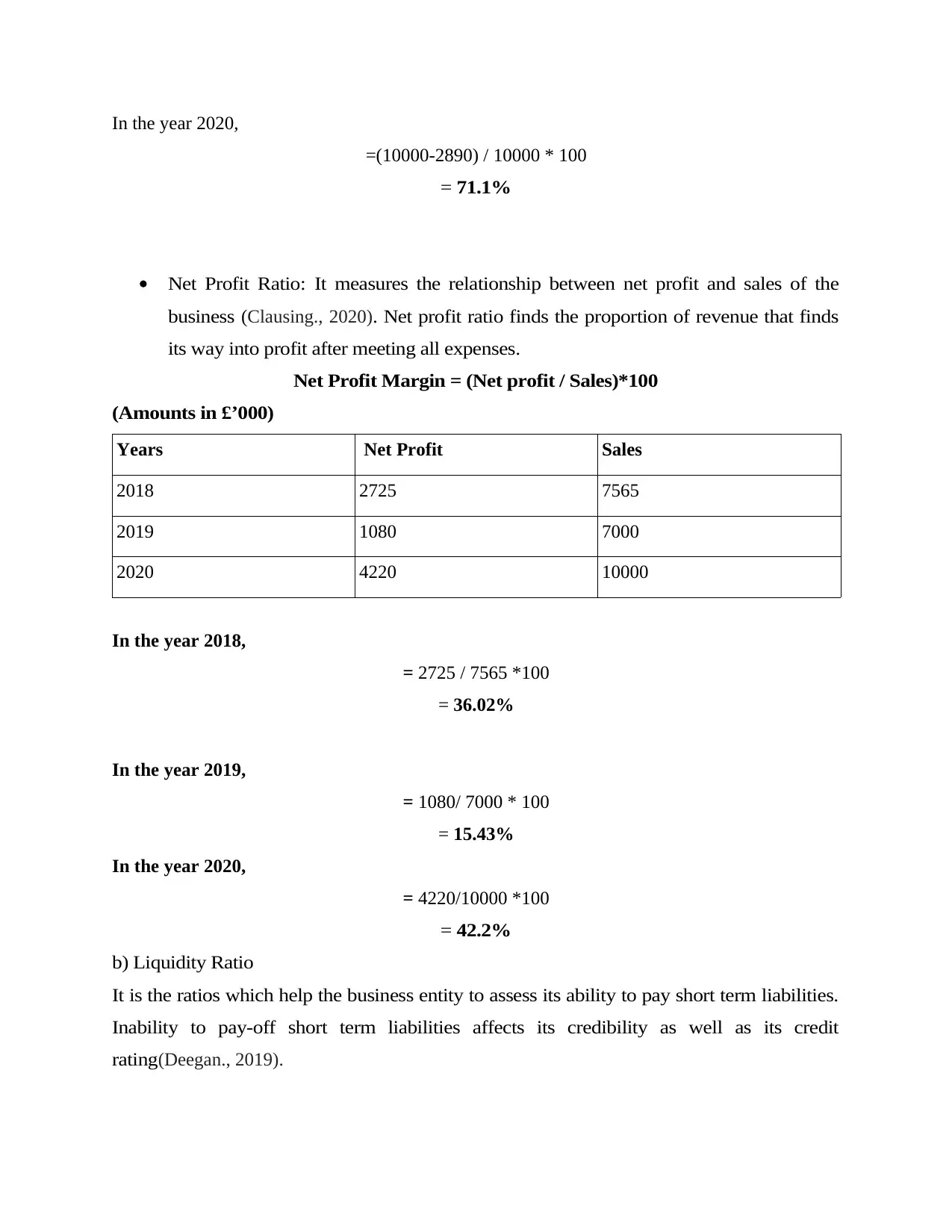

Net Profit Ratio: It measures the relationship between net profit and sales of the

business (Clausing., 2020) . Net profit ratio finds the proportion of revenue that finds

its way into profit after meeting all expenses.

Net Profit Margin = (Net profit / Sales)*100

(Amounts in £’000)

Years Net Profit Sales

2018 2725 7565

2019 1080 7000

2020 4220 10000

In the year 2018,

= 2725 / 7565 *100

= 36.02%

In the year 2019,

= 1080/ 7000 * 100

= 15.43%

In the year 2020,

= 4220/10000 *100

= 42.2%

b) Liquidity Ratio

It is the ratios which help the business entity to assess its ability to pay short term liabilities.

Inability to pay-off short term liabilities affects its credibility as well as its credit

rating(Deegan., 2019).

=(10000-2890) / 10000 * 100

= 71.1%

Net Profit Ratio: It measures the relationship between net profit and sales of the

business (Clausing., 2020) . Net profit ratio finds the proportion of revenue that finds

its way into profit after meeting all expenses.

Net Profit Margin = (Net profit / Sales)*100

(Amounts in £’000)

Years Net Profit Sales

2018 2725 7565

2019 1080 7000

2020 4220 10000

In the year 2018,

= 2725 / 7565 *100

= 36.02%

In the year 2019,

= 1080/ 7000 * 100

= 15.43%

In the year 2020,

= 4220/10000 *100

= 42.2%

b) Liquidity Ratio

It is the ratios which help the business entity to assess its ability to pay short term liabilities.

Inability to pay-off short term liabilities affects its credibility as well as its credit

rating(Deegan., 2019).

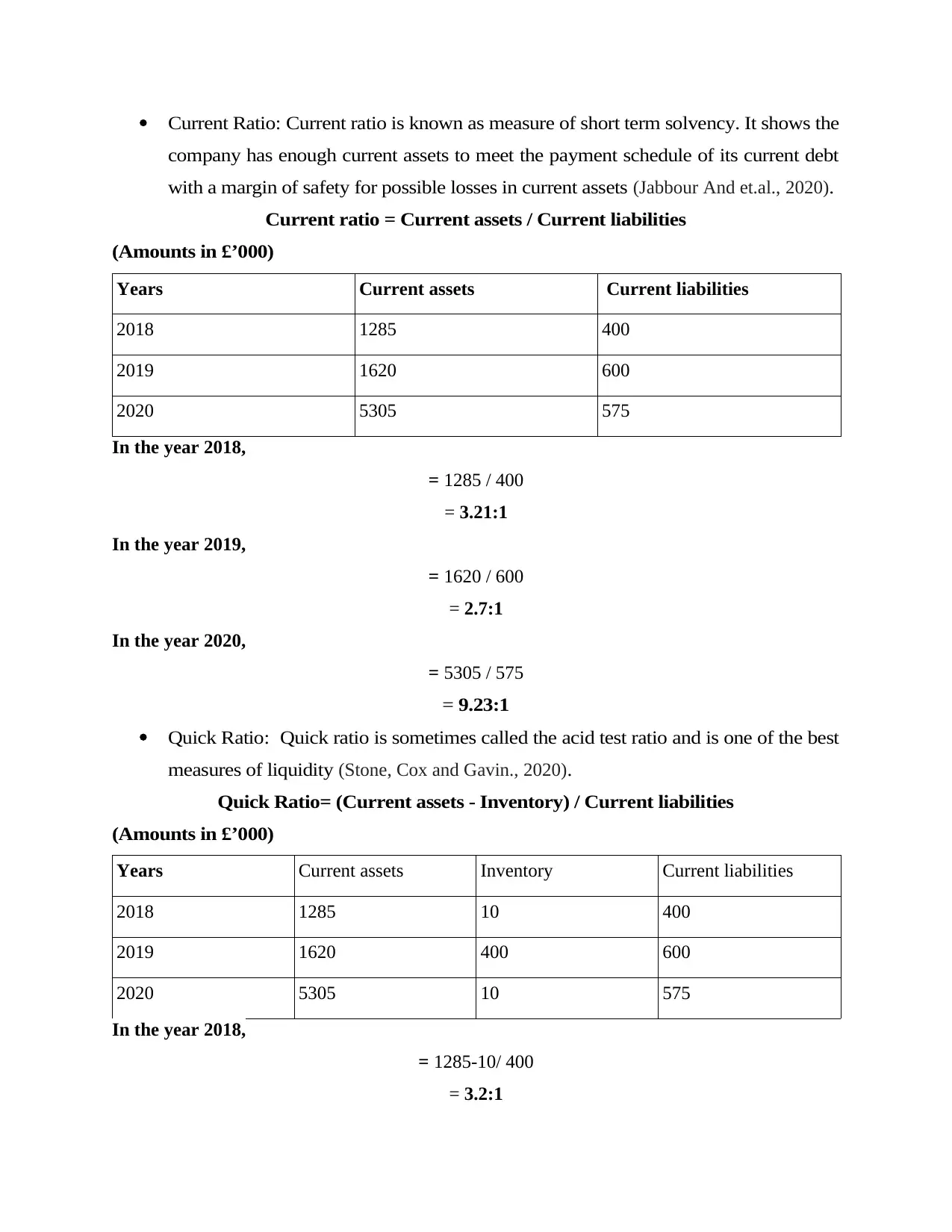

Current Ratio: Current ratio is known as measure of short term solvency. It shows the

company has enough current assets to meet the payment schedule of its current debt

with a margin of safety for possible losses in current assets (Jabbour And et.al., 2020) .

Current ratio = Current assets / Current liabilities

(Amounts in £’000)

Years Current assets Current liabilities

2018 1285 400

2019 1620 600

2020 5305 575

In the year 2018,

= 1285 / 400

= 3.21:1

In the year 2019,

= 1620 / 600

= 2.7:1

In the year 2020,

= 5305 / 575

= 9.23:1

Quick Ratio: Quick ratio is sometimes called the acid test ratio and is one of the best

measures of liquidity (Stone, Cox and Gavin., 2020) .

Quick Ratio= (Current assets - Inventory) / Current liabilities

(Amounts in £’000)

Years Current assets Inventory Current liabilities

2018 1285 10 400

2019 1620 400 600

2020 5305 10 575

In the year 2018,

= 1285-10/ 400

= 3.2:1

company has enough current assets to meet the payment schedule of its current debt

with a margin of safety for possible losses in current assets (Jabbour And et.al., 2020) .

Current ratio = Current assets / Current liabilities

(Amounts in £’000)

Years Current assets Current liabilities

2018 1285 400

2019 1620 600

2020 5305 575

In the year 2018,

= 1285 / 400

= 3.21:1

In the year 2019,

= 1620 / 600

= 2.7:1

In the year 2020,

= 5305 / 575

= 9.23:1

Quick Ratio: Quick ratio is sometimes called the acid test ratio and is one of the best

measures of liquidity (Stone, Cox and Gavin., 2020) .

Quick Ratio= (Current assets - Inventory) / Current liabilities

(Amounts in £’000)

Years Current assets Inventory Current liabilities

2018 1285 10 400

2019 1620 400 600

2020 5305 10 575

In the year 2018,

= 1285-10/ 400

= 3.2:1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

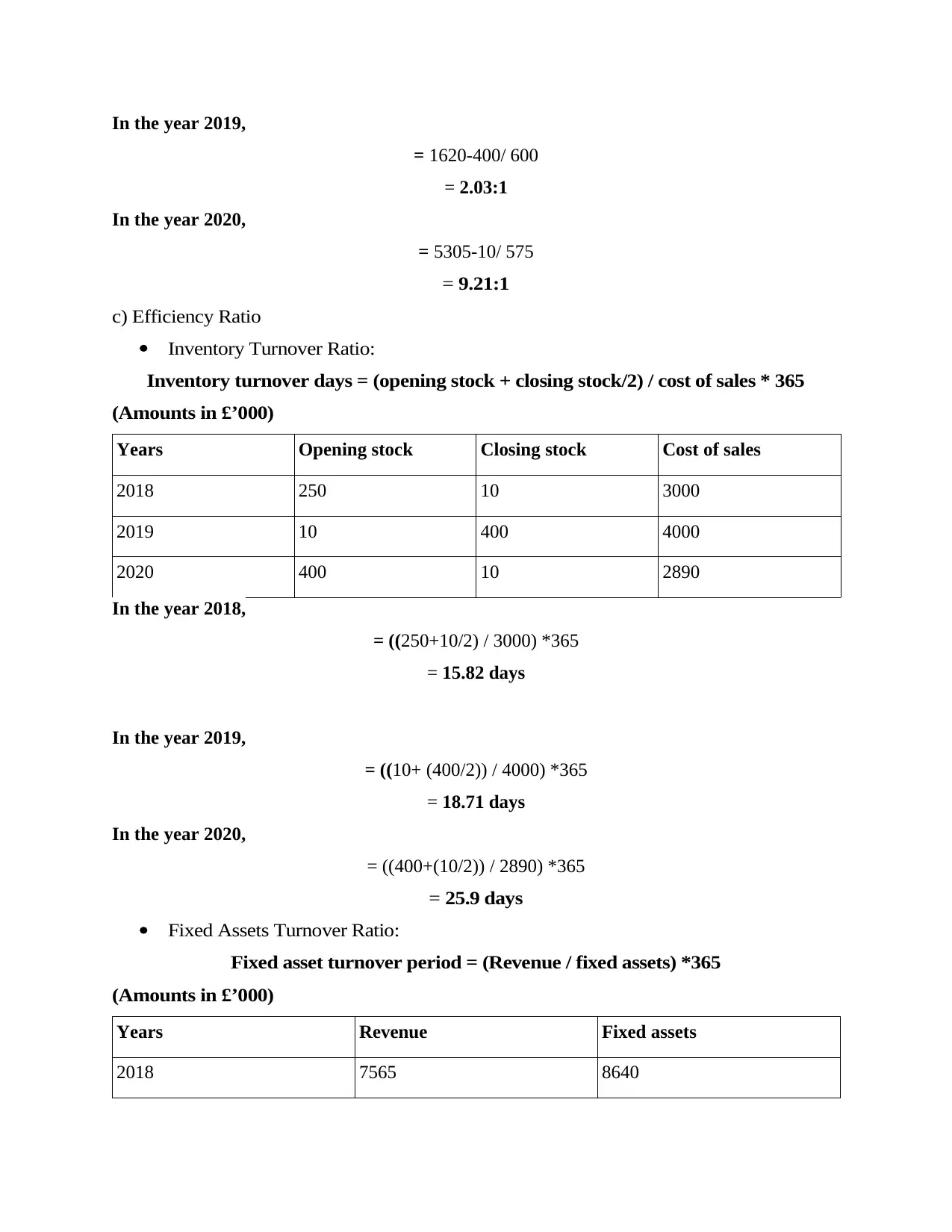

In the year 2019,

= 1620-400/ 600

= 2.03:1

In the year 2020,

= 5305-10/ 575

= 9.21:1

c) Efficiency Ratio

Inventory Turnover Ratio:

Inventory turnover days = (opening stock + closing stock/2) / cost of sales * 365

(Amounts in £’000)

Years Opening stock Closing stock Cost of sales

2018 250 10 3000

2019 10 400 4000

2020 400 10 2890

In the year 2018,

= ((250+10/2) / 3000) *365

= 15.82 days

In the year 2019,

= ((10+ (400/2)) / 4000) *365

= 18.71 days

In the year 2020,

= ((400+(10/2)) / 2890) *365

= 25.9 days

Fixed Assets Turnover Ratio:

Fixed asset turnover period = (Revenue / fixed assets) *365

(Amounts in £’000)

Years Revenue Fixed assets

2018 7565 8640

= 1620-400/ 600

= 2.03:1

In the year 2020,

= 5305-10/ 575

= 9.21:1

c) Efficiency Ratio

Inventory Turnover Ratio:

Inventory turnover days = (opening stock + closing stock/2) / cost of sales * 365

(Amounts in £’000)

Years Opening stock Closing stock Cost of sales

2018 250 10 3000

2019 10 400 4000

2020 400 10 2890

In the year 2018,

= ((250+10/2) / 3000) *365

= 15.82 days

In the year 2019,

= ((10+ (400/2)) / 4000) *365

= 18.71 days

In the year 2020,

= ((400+(10/2)) / 2890) *365

= 25.9 days

Fixed Assets Turnover Ratio:

Fixed asset turnover period = (Revenue / fixed assets) *365

(Amounts in £’000)

Years Revenue Fixed assets

2018 7565 8640

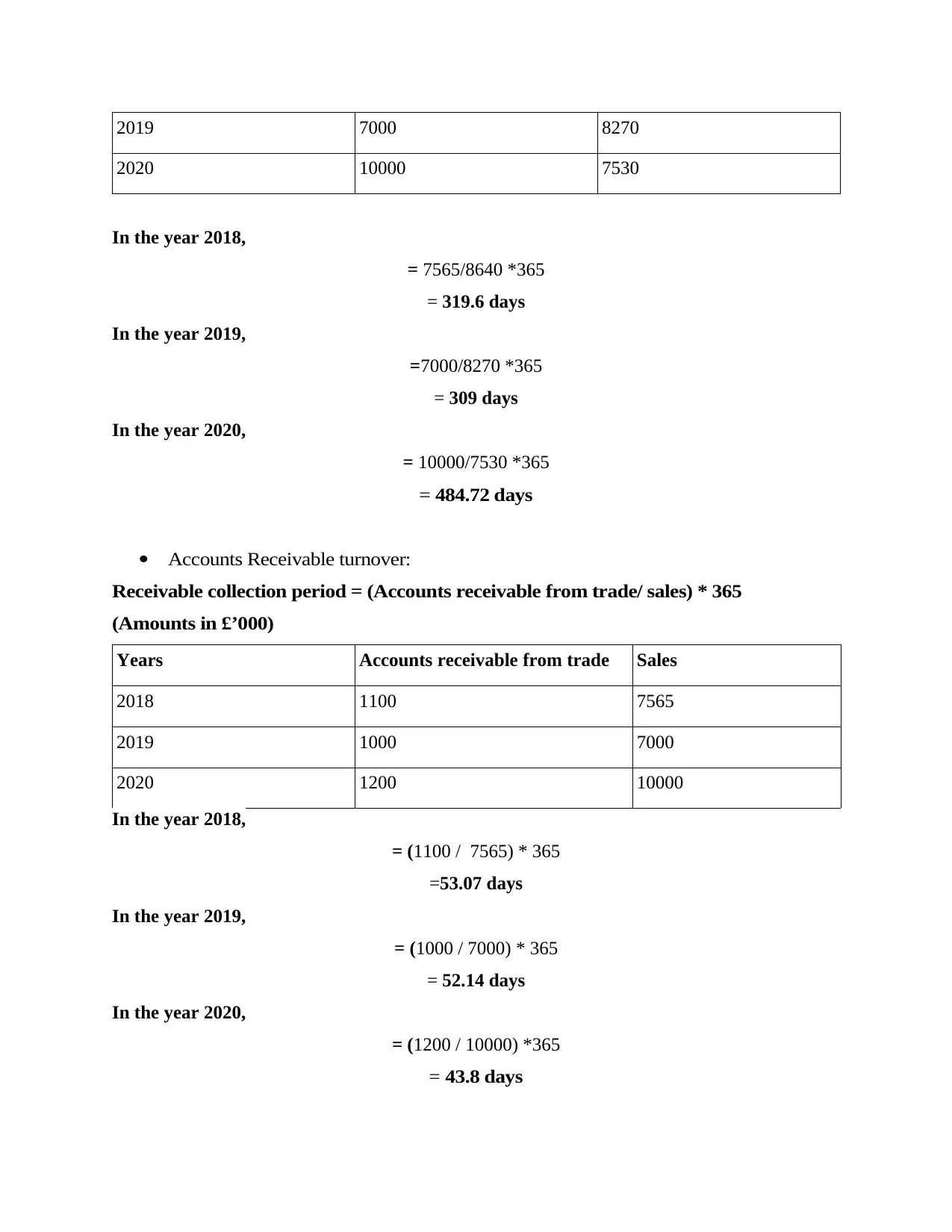

2019 7000 8270

2020 10000 7530

In the year 2018,

= 7565/8640 *365

= 319.6 days

In the year 2019,

=7000/8270 *365

= 309 days

In the year 2020,

= 10000/7530 *365

= 484.72 days

Accounts Receivable turnover:

Receivable collection period = (Accounts receivable from trade/ sales) * 365

(Amounts in £’000)

Years Accounts receivable from trade Sales

2018 1100 7565

2019 1000 7000

2020 1200 10000

In the year 2018,

= (1100 / 7565) * 365

=53.07 days

In the year 2019,

= (1000 / 7000) * 365

= 52.14 days

In the year 2020,

= (1200 / 10000) *365

= 43.8 days

2020 10000 7530

In the year 2018,

= 7565/8640 *365

= 319.6 days

In the year 2019,

=7000/8270 *365

= 309 days

In the year 2020,

= 10000/7530 *365

= 484.72 days

Accounts Receivable turnover:

Receivable collection period = (Accounts receivable from trade/ sales) * 365

(Amounts in £’000)

Years Accounts receivable from trade Sales

2018 1100 7565

2019 1000 7000

2020 1200 10000

In the year 2018,

= (1100 / 7565) * 365

=53.07 days

In the year 2019,

= (1000 / 7000) * 365

= 52.14 days

In the year 2020,

= (1200 / 10000) *365

= 43.8 days

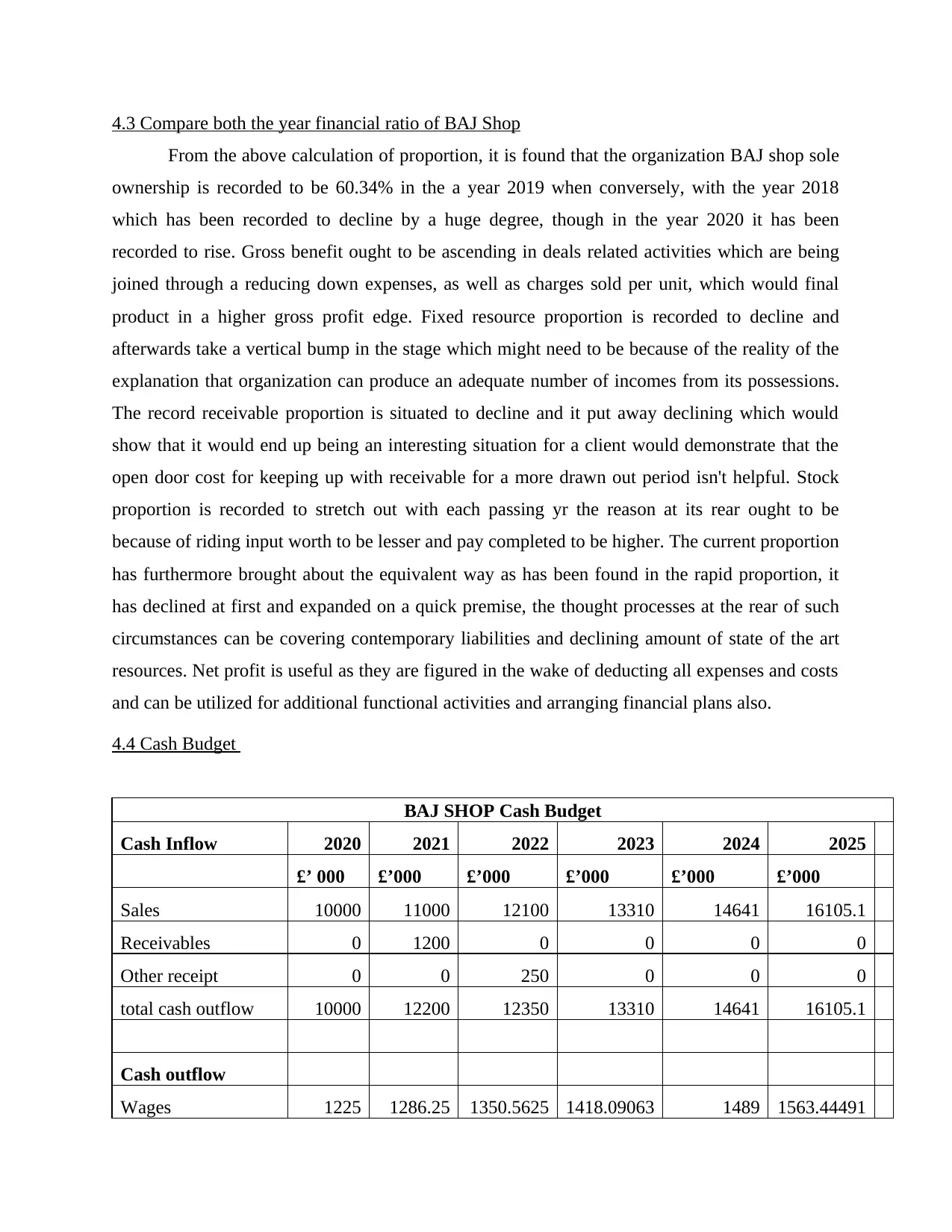

4.3 Compare both the year financial ratio of BAJ Shop

From the above calculation of proportion, it is found that the organization BAJ shop sole

ownership is recorded to be 60.34% in the a year 2019 when conversely, with the year 2018

which has been recorded to decline by a huge degree, though in the year 2020 it has been

recorded to rise. Gross benefit ought to be ascending in deals related activities which are being

joined through a reducing down expenses, as well as charges sold per unit, which would final

product in a higher gross profit edge. Fixed resource proportion is recorded to decline and

afterwards take a vertical bump in the stage which might need to be because of the reality of the

explanation that organization can produce an adequate number of incomes from its possessions.

The record receivable proportion is situated to decline and it put away declining which would

show that it would end up being an interesting situation for a client would demonstrate that the

open door cost for keeping up with receivable for a more drawn out period isn't helpful. Stock

proportion is recorded to stretch out with each passing yr the reason at its rear ought to be

because of riding input worth to be lesser and pay completed to be higher. The current proportion

has furthermore brought about the equivalent way as has been found in the rapid proportion, it

has declined at first and expanded on a quick premise, the thought processes at the rear of such

circumstances can be covering contemporary liabilities and declining amount of state of the art

resources. Net profit is useful as they are figured in the wake of deducting all expenses and costs

and can be utilized for additional functional activities and arranging financial plans also.

4.4 Cash Budget

BAJ SHOP Cash Budget

Cash Inflow 2020 2021 2022 2023 2024 2025

£’ 000 £’000 £’000 £’000 £’000 £’000

Sales 10000 11000 12100 13310 14641 16105.1

Receivables 0 1200 0 0 0 0

Other receipt 0 0 250 0 0 0

total cash outflow 10000 12200 12350 13310 14641 16105.1

Cash outflow

Wages 1225 1286.25 1350.5625 1418.09063 1489 1563.44491

From the above calculation of proportion, it is found that the organization BAJ shop sole

ownership is recorded to be 60.34% in the a year 2019 when conversely, with the year 2018

which has been recorded to decline by a huge degree, though in the year 2020 it has been

recorded to rise. Gross benefit ought to be ascending in deals related activities which are being

joined through a reducing down expenses, as well as charges sold per unit, which would final

product in a higher gross profit edge. Fixed resource proportion is recorded to decline and

afterwards take a vertical bump in the stage which might need to be because of the reality of the

explanation that organization can produce an adequate number of incomes from its possessions.

The record receivable proportion is situated to decline and it put away declining which would

show that it would end up being an interesting situation for a client would demonstrate that the

open door cost for keeping up with receivable for a more drawn out period isn't helpful. Stock

proportion is recorded to stretch out with each passing yr the reason at its rear ought to be

because of riding input worth to be lesser and pay completed to be higher. The current proportion

has furthermore brought about the equivalent way as has been found in the rapid proportion, it

has declined at first and expanded on a quick premise, the thought processes at the rear of such

circumstances can be covering contemporary liabilities and declining amount of state of the art

resources. Net profit is useful as they are figured in the wake of deducting all expenses and costs

and can be utilized for additional functional activities and arranging financial plans also.

4.4 Cash Budget

BAJ SHOP Cash Budget

Cash Inflow 2020 2021 2022 2023 2024 2025

£’ 000 £’000 £’000 £’000 £’000 £’000

Sales 10000 11000 12100 13310 14641 16105.1

Receivables 0 1200 0 0 0 0

Other receipt 0 0 250 0 0 0

total cash outflow 10000 12200 12350 13310 14641 16105.1

Cash outflow

Wages 1225 1286.25 1350.5625 1418.09063 1489 1563.44491

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

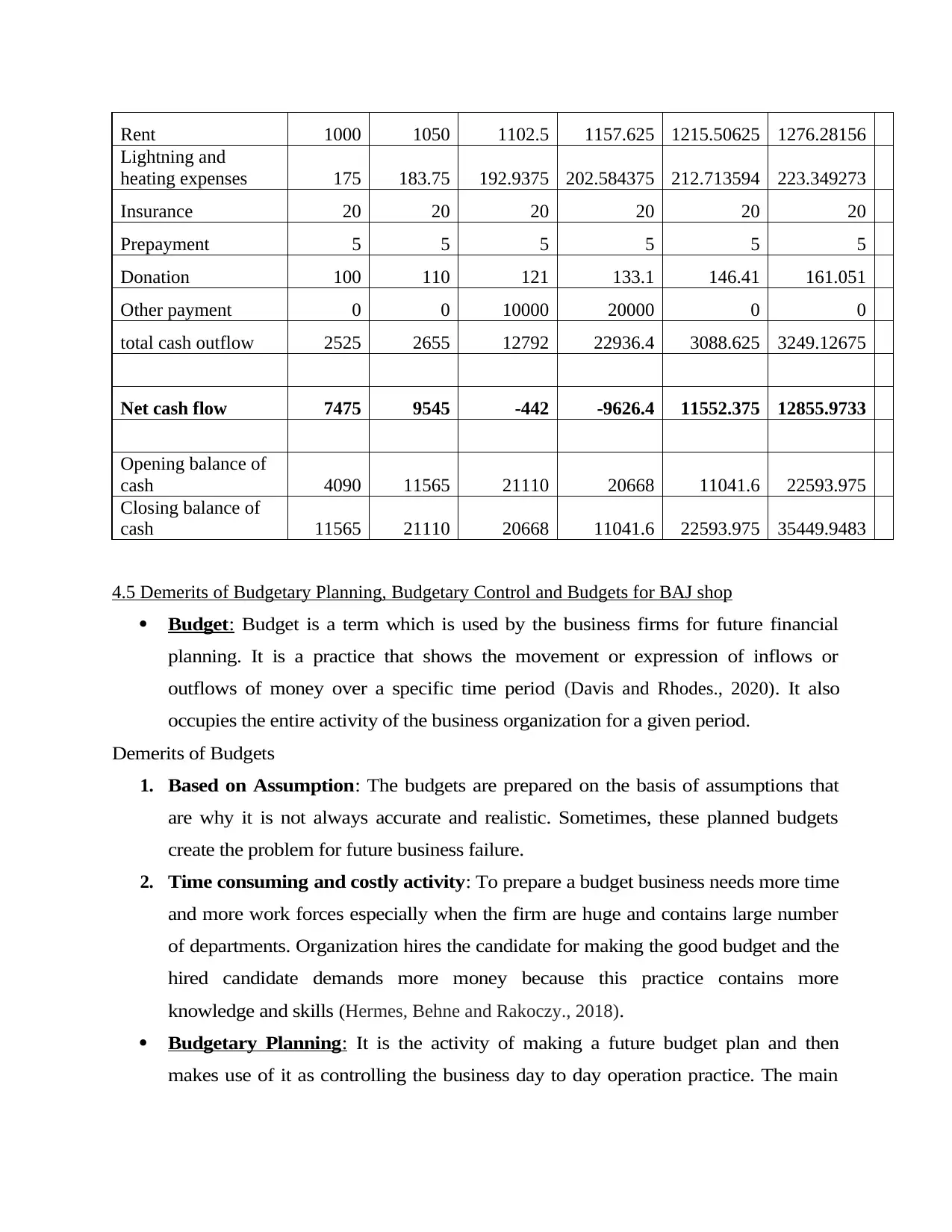

Rent 1000 1050 1102.5 1157.625 1215.50625 1276.28156

Lightning and

heating expenses 175 183.75 192.9375 202.584375 212.713594 223.349273

Insurance 20 20 20 20 20 20

Prepayment 5 5 5 5 5 5

Donation 100 110 121 133.1 146.41 161.051

Other payment 0 0 10000 20000 0 0

total cash outflow 2525 2655 12792 22936.4 3088.625 3249.12675

Net cash flow 7475 9545 -442 -9626.4 11552.375 12855.9733

Opening balance of

cash 4090 11565 21110 20668 11041.6 22593.975

Closing balance of

cash 11565 21110 20668 11041.6 22593.975 35449.9483

4.5 Demerits of Budgetary Planning, Budgetary Control and Budgets for BAJ shop

Budget: Budget is a term which is used by the business firms for future financial

planning. It is a practice that shows the movement or expression of inflows or

outflows of money over a specific time period (Davis and Rhodes., 2020) . It also

occupies the entire activity of the business organization for a given period.

Demerits of Budgets

1. Based on Assumption: The budgets are prepared on the basis of assumptions that

are why it is not always accurate and realistic. Sometimes, these planned budgets

create the problem for future business failure.

2. Time consuming and costly activity: To prepare a budget business needs more time

and more work forces especially when the firm are huge and contains large number

of departments. Organization hires the candidate for making the good budget and the

hired candidate demands more money because this practice contains more

knowledge and skills (Hermes, Behne and Rakoczy., 2018) .

Budgetary Planning: It is the activity of making a future budget plan and then

makes use of it as controlling the business day to day operation practice. The main

Lightning and

heating expenses 175 183.75 192.9375 202.584375 212.713594 223.349273

Insurance 20 20 20 20 20 20

Prepayment 5 5 5 5 5 5

Donation 100 110 121 133.1 146.41 161.051

Other payment 0 0 10000 20000 0 0

total cash outflow 2525 2655 12792 22936.4 3088.625 3249.12675

Net cash flow 7475 9545 -442 -9626.4 11552.375 12855.9733

Opening balance of

cash 4090 11565 21110 20668 11041.6 22593.975

Closing balance of

cash 11565 21110 20668 11041.6 22593.975 35449.9483

4.5 Demerits of Budgetary Planning, Budgetary Control and Budgets for BAJ shop

Budget: Budget is a term which is used by the business firms for future financial

planning. It is a practice that shows the movement or expression of inflows or

outflows of money over a specific time period (Davis and Rhodes., 2020) . It also

occupies the entire activity of the business organization for a given period.

Demerits of Budgets

1. Based on Assumption: The budgets are prepared on the basis of assumptions that

are why it is not always accurate and realistic. Sometimes, these planned budgets

create the problem for future business failure.

2. Time consuming and costly activity: To prepare a budget business needs more time

and more work forces especially when the firm are huge and contains large number

of departments. Organization hires the candidate for making the good budget and the

hired candidate demands more money because this practice contains more

knowledge and skills (Hermes, Behne and Rakoczy., 2018) .

Budgetary Planning: It is the activity of making a future budget plan and then

makes use of it as controlling the business day to day operation practice. The main

motive of budgetary planning is to reduce the risk which are faced by the company

financial statements or results.

Demerits of Budgetary Planning

1. Budgeting, planning or gauging is honestly not a cautious science; it makes use of

approximations and judgment which may additionally now not be penny percentage

precise.

2. Budgetary planning are not exact or flexible as per global or environmental changes

Budgetary control: Business organization generally refers budgetary control as

budgetary techniques because it provides the comparison or analysis between actual

and budgeted expenditures and also the accurate variations. Budgetary control is

done after the planning of budget (Hunter and Cook., 2018) . This practice involves

verifying cost, income or expenditure

Demerits of Budgetary control

1. It is Uncertain for the future because all the planning are prepared on behalf of the

assumption.

2. It creates the problem at the time of coordinating with other department person.

Coordination is the key to prepare the budgetary control without them failure are to

be made.

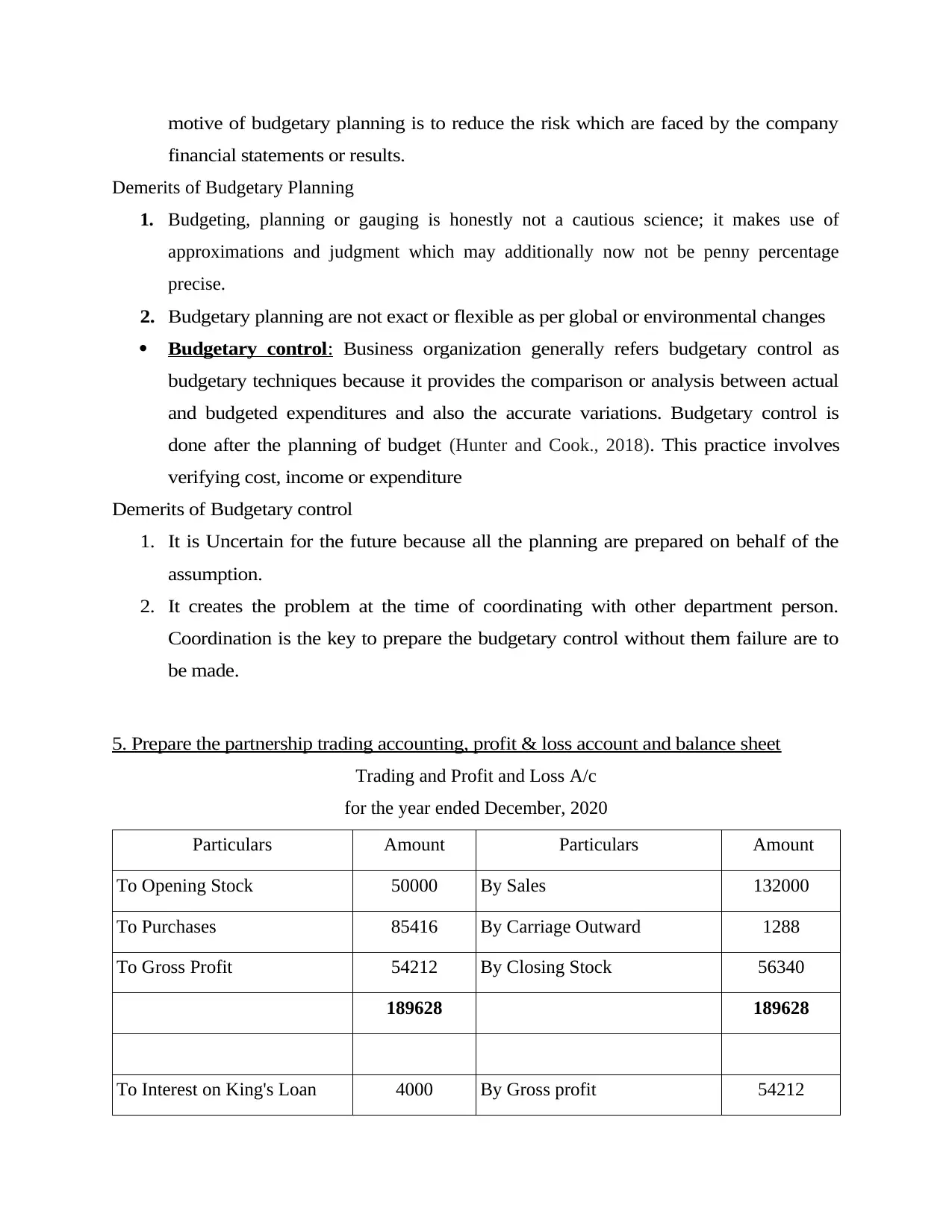

5. Prepare the partnership trading accounting, profit & loss account and balance sheet

Trading and Profit and Loss A/c

for the year ended December, 2020

Particulars Amount Particulars Amount

To Opening Stock 50000 By Sales 132000

To Purchases 85416 By Carriage Outward 1288

To Gross Profit 54212 By Closing Stock 56340

189628 189628

To Interest on King's Loan 4000 By Gross profit 54212

financial statements or results.

Demerits of Budgetary Planning

1. Budgeting, planning or gauging is honestly not a cautious science; it makes use of

approximations and judgment which may additionally now not be penny percentage

precise.

2. Budgetary planning are not exact or flexible as per global or environmental changes

Budgetary control: Business organization generally refers budgetary control as

budgetary techniques because it provides the comparison or analysis between actual

and budgeted expenditures and also the accurate variations. Budgetary control is

done after the planning of budget (Hunter and Cook., 2018) . This practice involves

verifying cost, income or expenditure

Demerits of Budgetary control

1. It is Uncertain for the future because all the planning are prepared on behalf of the

assumption.

2. It creates the problem at the time of coordinating with other department person.

Coordination is the key to prepare the budgetary control without them failure are to

be made.

5. Prepare the partnership trading accounting, profit & loss account and balance sheet

Trading and Profit and Loss A/c

for the year ended December, 2020

Particulars Amount Particulars Amount

To Opening Stock 50000 By Sales 132000

To Purchases 85416 By Carriage Outward 1288

To Gross Profit 54212 By Closing Stock 56340

189628 189628

To Interest on King's Loan 4000 By Gross profit 54212

To Interest on Capital

Matthew 3500

Mark 2950 6450

By provision for bad debts 80

To discount allowed 110 By Interest on Drawings

Matthew 180

Mark 120 300

To office expense 2550

Add : Accrued expense 96 2646

By provision for depreciation 3300

To Salary and Wages 18900

Add : Accrued Wages 200 19100

To bad debts 450

To depreciation

Fixtures 770

Buildings 1000 1770

To Salary to Matthew 800

To net profits 22566

57892 57892

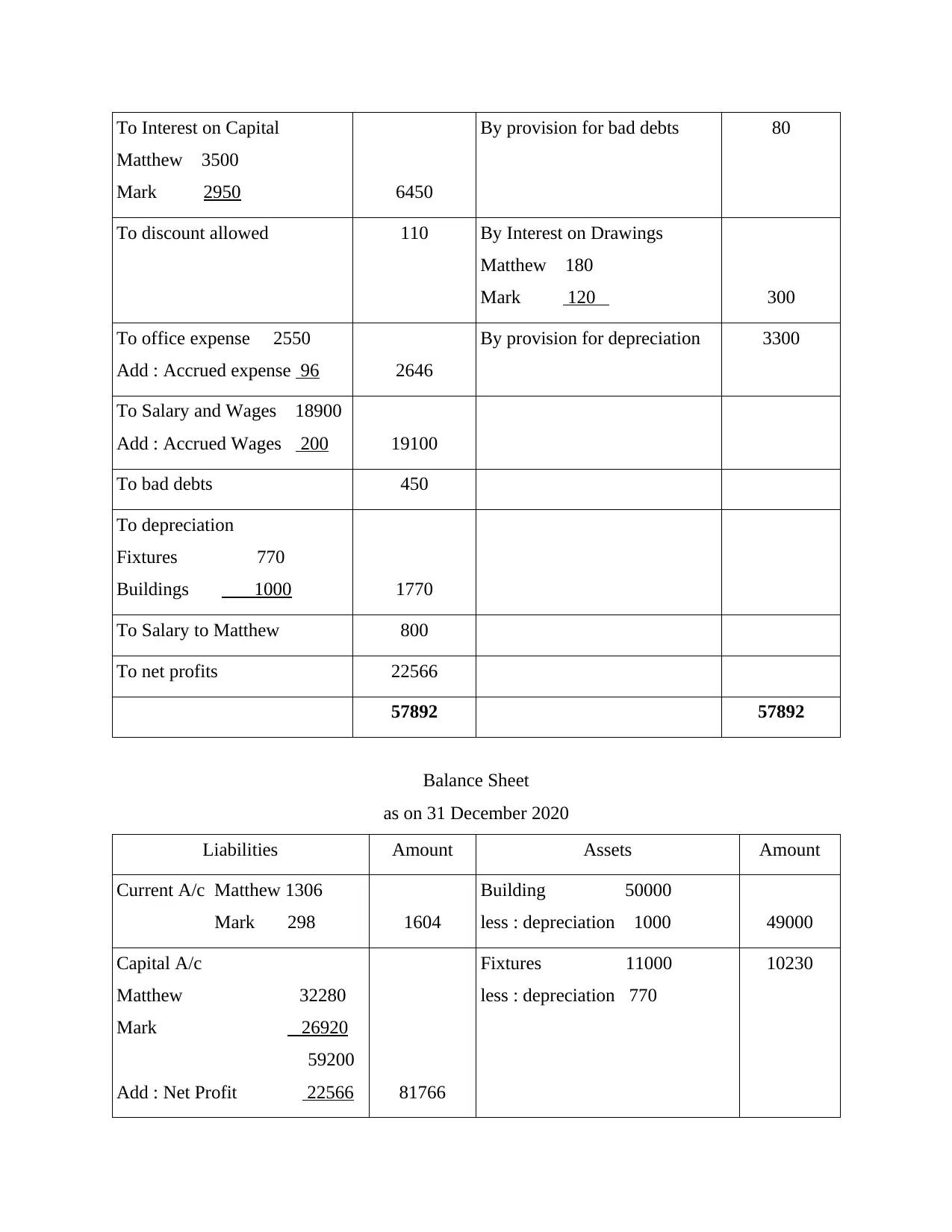

Balance Sheet

as on 31 December 2020

Liabilities Amount Assets Amount

Current A/c Matthew 1306

Mark 298 1604

Building 50000

less : depreciation 1000 49000

Capital A/c

Matthew 32280

Mark 26920

59200

Add : Net Profit 22566 81766

Fixtures 11000

less : depreciation 770

10230

Matthew 3500

Mark 2950 6450

By provision for bad debts 80

To discount allowed 110 By Interest on Drawings

Matthew 180

Mark 120 300

To office expense 2550

Add : Accrued expense 96 2646

By provision for depreciation 3300

To Salary and Wages 18900

Add : Accrued Wages 200 19100

To bad debts 450

To depreciation

Fixtures 770

Buildings 1000 1770

To Salary to Matthew 800

To net profits 22566

57892 57892

Balance Sheet

as on 31 December 2020

Liabilities Amount Assets Amount

Current A/c Matthew 1306

Mark 298 1604

Building 50000

less : depreciation 1000 49000

Capital A/c

Matthew 32280

Mark 26920

59200

Add : Net Profit 22566 81766

Fixtures 11000

less : depreciation 770

10230

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

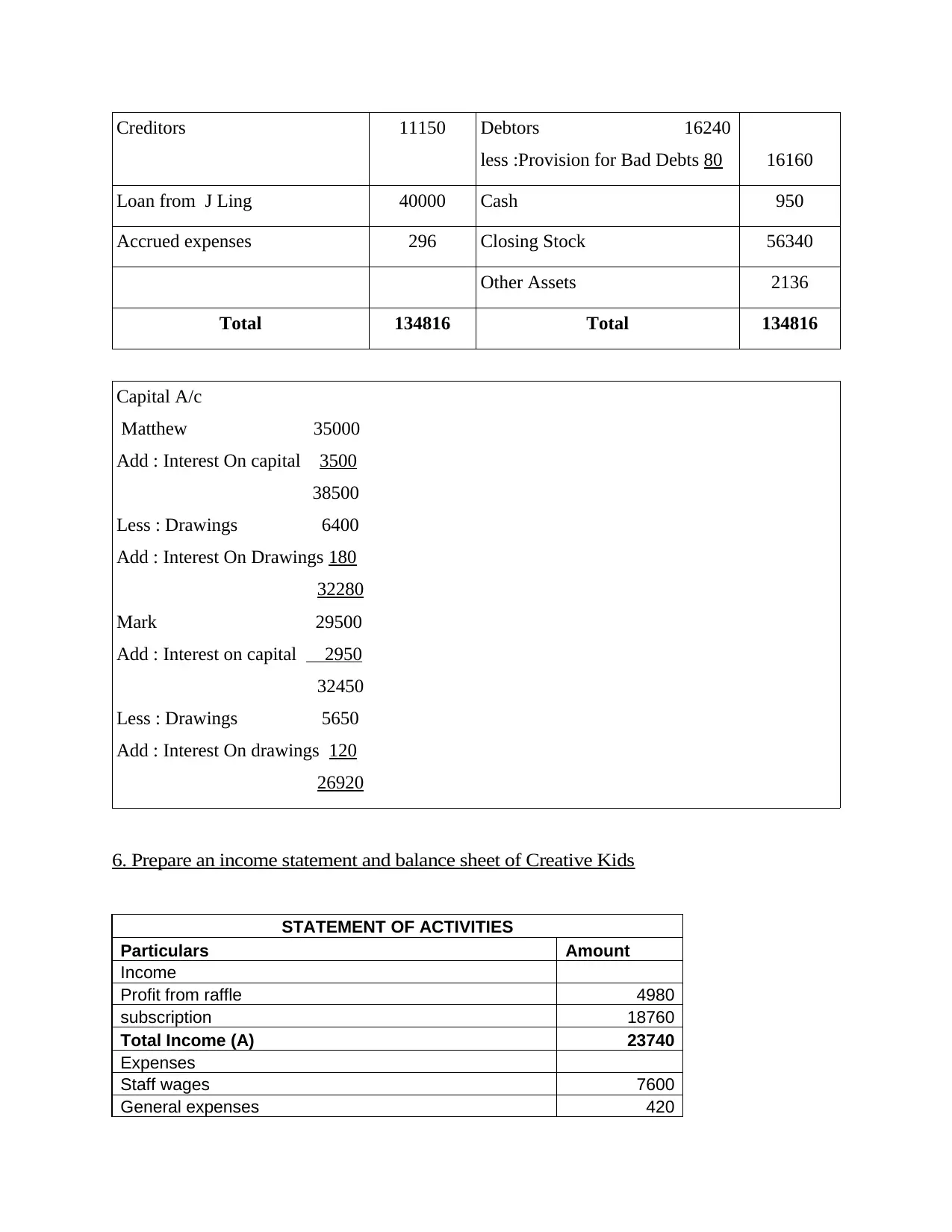

Creditors 11150 Debtors 16240

less :Provision for Bad Debts 80 16160

Loan from J Ling 40000 Cash 950

Accrued expenses 296 Closing Stock 56340

Other Assets 2136

Total 134816 Total 134816

Capital A/c

Matthew 35000

Add : Interest On capital 3500

38500

Less : Drawings 6400

Add : Interest On Drawings 180

32280

Mark 29500

Add : Interest on capital 2950

32450

Less : Drawings 5650

Add : Interest On drawings 120

26920

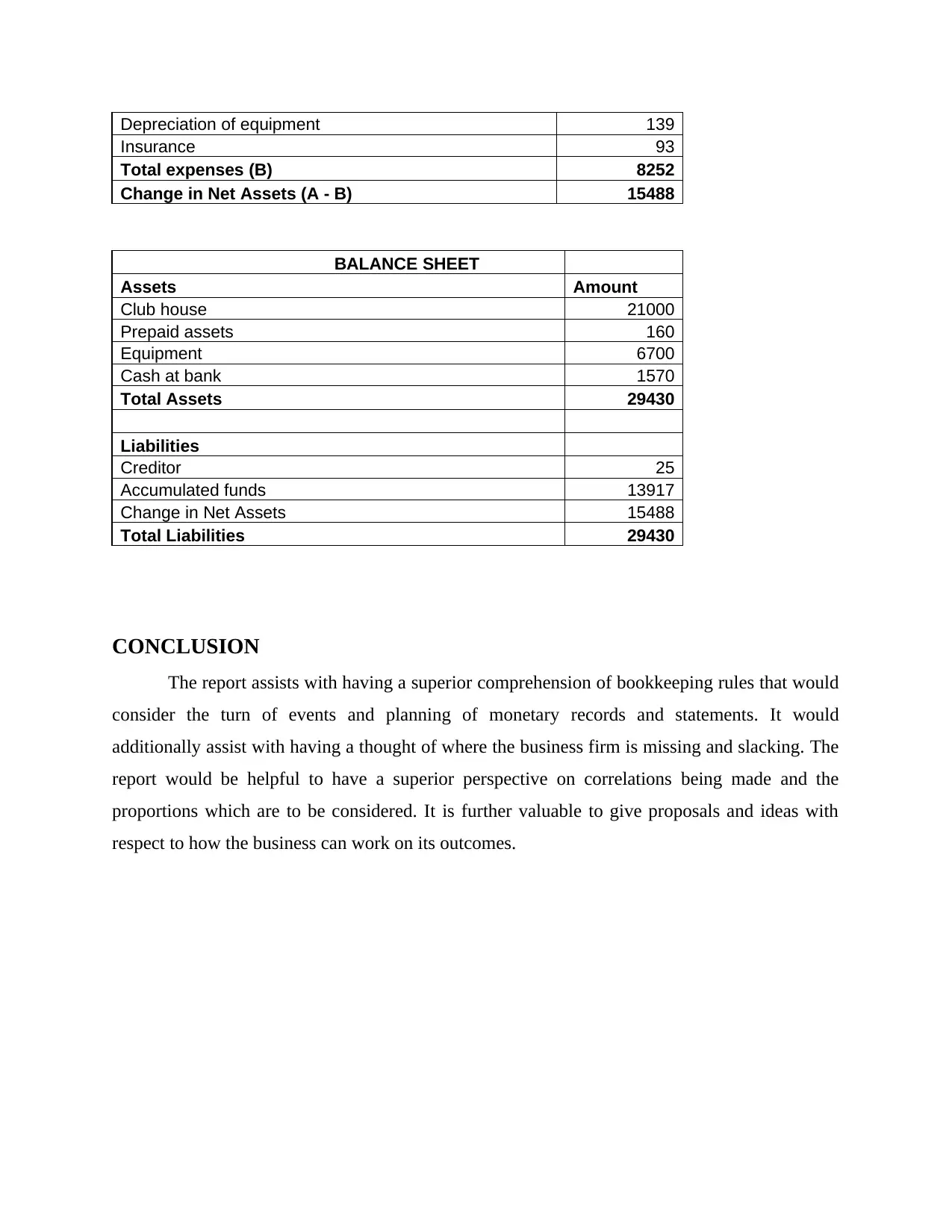

6. Prepare an income statement and balance sheet of Creative Kids

STATEMENT OF ACTIVITIES

Particulars Amount

Income

Profit from raffle 4980

subscription 18760

Total Income (A) 23740

Expenses

Staff wages 7600

General expenses 420

less :Provision for Bad Debts 80 16160

Loan from J Ling 40000 Cash 950

Accrued expenses 296 Closing Stock 56340

Other Assets 2136

Total 134816 Total 134816

Capital A/c

Matthew 35000

Add : Interest On capital 3500

38500

Less : Drawings 6400

Add : Interest On Drawings 180

32280

Mark 29500

Add : Interest on capital 2950

32450

Less : Drawings 5650

Add : Interest On drawings 120

26920

6. Prepare an income statement and balance sheet of Creative Kids

STATEMENT OF ACTIVITIES

Particulars Amount

Income

Profit from raffle 4980

subscription 18760

Total Income (A) 23740

Expenses

Staff wages 7600

General expenses 420

Depreciation of equipment 139

Insurance 93

Total expenses (B) 8252

Change in Net Assets (A - B) 15488

BALANCE SHEET

Assets Amount

Club house 21000

Prepaid assets 160

Equipment 6700

Cash at bank 1570

Total Assets 29430

Liabilities

Creditor 25

Accumulated funds 13917

Change in Net Assets 15488

Total Liabilities 29430

CONCLUSION

The report assists with having a superior comprehension of bookkeeping rules that would

consider the turn of events and planning of monetary records and statements. It would

additionally assist with having a thought of where the business firm is missing and slacking. The

report would be helpful to have a superior perspective on correlations being made and the

proportions which are to be considered. It is further valuable to give proposals and ideas with

respect to how the business can work on its outcomes.

Insurance 93

Total expenses (B) 8252

Change in Net Assets (A - B) 15488

BALANCE SHEET

Assets Amount

Club house 21000

Prepaid assets 160

Equipment 6700

Cash at bank 1570

Total Assets 29430

Liabilities

Creditor 25

Accumulated funds 13917

Change in Net Assets 15488

Total Liabilities 29430

CONCLUSION

The report assists with having a superior comprehension of bookkeeping rules that would

consider the turn of events and planning of monetary records and statements. It would

additionally assist with having a thought of where the business firm is missing and slacking. The

report would be helpful to have a superior perspective on correlations being made and the

proportions which are to be considered. It is further valuable to give proposals and ideas with

respect to how the business can work on its outcomes.

REFERENCES

Books and Journals

Clausing, K.A., 2020. Five Lessons on Profit Shifting from the US Country by Country

Data. Tax Notes Federal, 169(9), pp.925-940.

Dargent, E., 2020. Mathew Rhodes-Purdy, Regime Support Beyond the Balance Sheet:

Participation and Policy Performance in Latin America (Cambridge and New York:

Cambridge University Press, 2018), pp. xi+ 268,£ 75.00, hb. Journal of Latin American

Studies, 52(1), pp.204-206.

Davis, G. and Rhodes, R.A., 2020. From hierarchy to contracts and back again: reforming the

Australian public service. In Institutions on the Edge? (pp. 74-98). Routledge.

Deegan, C.M., 2019. Legitimacy theory: Despite its enduring popularity and contribution, time

is right for a necessary makeover. Accounting, Auditing & Accountability Journal.

Eldenburg, L.G. And et.al., 2020. Management accounting. John Wiley & Sons.

He, X.D. and Kou, S., 2018. Profit sharing in hedge funds. Mathematical Finance, 28(1), pp.50-

81.

Hermes, J., Behne, T. and Rakoczy, H., 2018. The development of selective trust: Prospects for a

dual‐process account. Child Development Perspectives, 12(2), pp.134-138.

Hunter, K. and Cook, C., 2018. Role‐modelling and the hidden curriculum: New graduate

nurses’ professional socialisation. Journal of clinical nursing, 27(15-16), pp.3157-3170.

Jabbour, C.J.C. And et.al., 2020. Digitally-enabled sustainable supply chains in the 21st century:

A review and a research agenda. Science of the total environment, 725, p.138177.

Jordan, E.E. and Samuels, J.A., 2020. Research initiatives in accounting education: Improving

learning effectiveness. Issues in Accounting Education, 35(4), pp.9-24.

Liu, J. And et.al., 2021. Optimization of a diesel/natural gas dual fuel engine under different

diesel substitution ratios. Fuel, 305, p.121522.

Popkova, E.G. And et.al., 2019. Industry 4.0: Industrial revolution of the 21st century (Vol. 169,

p. 249). New York: Springer.

Rosa, D., 2018. Pengaruh growth opportunity, leverage dan financial distress terhadap prudence

in accounting pada perusahaan manufaktur yang terdaftar pada Bursa Efek Indonesia

tahun 2013-2017. SKRIPSI-2018.

Stone, R.J., Cox, A. and Gavin, M., 2020. Human resource management. John Wiley & Sons.

Wasserman, H. and Madrid-Morales, D., 2019. An exploratory study of “fake news” and media

trust in Kenya, Nigeria and South Africa. African Journalism Studies, 40(1), pp.107-

123.

Books and Journals

Clausing, K.A., 2020. Five Lessons on Profit Shifting from the US Country by Country

Data. Tax Notes Federal, 169(9), pp.925-940.

Dargent, E., 2020. Mathew Rhodes-Purdy, Regime Support Beyond the Balance Sheet:

Participation and Policy Performance in Latin America (Cambridge and New York:

Cambridge University Press, 2018), pp. xi+ 268,£ 75.00, hb. Journal of Latin American

Studies, 52(1), pp.204-206.

Davis, G. and Rhodes, R.A., 2020. From hierarchy to contracts and back again: reforming the

Australian public service. In Institutions on the Edge? (pp. 74-98). Routledge.

Deegan, C.M., 2019. Legitimacy theory: Despite its enduring popularity and contribution, time

is right for a necessary makeover. Accounting, Auditing & Accountability Journal.

Eldenburg, L.G. And et.al., 2020. Management accounting. John Wiley & Sons.

He, X.D. and Kou, S., 2018. Profit sharing in hedge funds. Mathematical Finance, 28(1), pp.50-

81.

Hermes, J., Behne, T. and Rakoczy, H., 2018. The development of selective trust: Prospects for a

dual‐process account. Child Development Perspectives, 12(2), pp.134-138.

Hunter, K. and Cook, C., 2018. Role‐modelling and the hidden curriculum: New graduate

nurses’ professional socialisation. Journal of clinical nursing, 27(15-16), pp.3157-3170.

Jabbour, C.J.C. And et.al., 2020. Digitally-enabled sustainable supply chains in the 21st century:

A review and a research agenda. Science of the total environment, 725, p.138177.

Jordan, E.E. and Samuels, J.A., 2020. Research initiatives in accounting education: Improving

learning effectiveness. Issues in Accounting Education, 35(4), pp.9-24.

Liu, J. And et.al., 2021. Optimization of a diesel/natural gas dual fuel engine under different

diesel substitution ratios. Fuel, 305, p.121522.

Popkova, E.G. And et.al., 2019. Industry 4.0: Industrial revolution of the 21st century (Vol. 169,

p. 249). New York: Springer.

Rosa, D., 2018. Pengaruh growth opportunity, leverage dan financial distress terhadap prudence

in accounting pada perusahaan manufaktur yang terdaftar pada Bursa Efek Indonesia

tahun 2013-2017. SKRIPSI-2018.

Stone, R.J., Cox, A. and Gavin, M., 2020. Human resource management. John Wiley & Sons.

Wasserman, H. and Madrid-Morales, D., 2019. An exploratory study of “fake news” and media

trust in Kenya, Nigeria and South Africa. African Journalism Studies, 40(1), pp.107-

123.

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.