Unit 5 Accounting Principles: Financial Statements and Ratio Analysis

VerifiedAdded on 2023/02/07

|12

|2534

|99

Report

AI Summary

This report delves into the core concepts of accounting principles, emphasizing their application in preparing financial statements for sole traders, partnerships, and not-for-profit organizations. It covers the preparation of financial statements from a given trial balance, including necessary adjustments. Furthermore, the report examines the calculation and presentation of financial ratios, such as liquidity, leverage, profitability, and asset management ratios, using ARAMCO as a case study. The analysis extends to comparing a company's performance over time, evaluating financial statements, and assessing organizational performance using various measures and benchmarks. The report highlights the importance of financial ratio analysis in understanding a company's financial health and making informed conclusions. It also discusses accounting principles, conventions, and standards, like cost-based convention and the going concern convention, and their impact on financial statements. This report provides a comprehensive overview of financial statement analysis and accounting principles.

Unit 5: Accounting Principles

Accounting in Context and Budgetary Control

Part-2 (LO2&3)

Table of Contents

Accounting in Context and Budgetary Control

Part-2 (LO2&3)

Table of Contents

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction......................................................................................................................................3

Preparing financial statements from a given trial balance for sole traders, partnerships and not-

for-profit organizations, to meet accounting principles, conventions and standards......................3

Producing financial statements from a given trial balance, making appropriate adjustments.........5

Calculating and presenting financial ratios from a set of final accounts.........................................7

Financial ratios compare a company's performance over time......................................................10

The evaluation financial statements to assess organizational performance using a range of

measures and benchmarks to make justified conclusions..............................................................11

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

Introduction

The steps of recognizing, measuring, documenting, categorizing, summarizing, and evaluating

financial data are all part of the accounting process. The accounting department of a corporation

Preparing financial statements from a given trial balance for sole traders, partnerships and not-

for-profit organizations, to meet accounting principles, conventions and standards......................3

Producing financial statements from a given trial balance, making appropriate adjustments.........5

Calculating and presenting financial ratios from a set of final accounts.........................................7

Financial ratios compare a company's performance over time......................................................10

The evaluation financial statements to assess organizational performance using a range of

measures and benchmarks to make justified conclusions..............................................................11

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

Introduction

The steps of recognizing, measuring, documenting, categorizing, summarizing, and evaluating

financial data are all part of the accounting process. The accounting department of a corporation

is accountable for maintaining precise records of the firm's income and expenditures, in addition

to providing quantitative financial information.

Preparing financial statements from a given trial balance for sole traders,

partnerships and not-for-profit organizations, to meet accounting principles,

conventions and standards.

Sole traders, partnerships, and not-for-profit organizations are the three most common legal

forms of business in the United Kingdom. To get a handle on the status of the business, they'll

need to put together a set of financial statements.

Financial Statement: There are two types of financial statements: public and internal. The latter

is a public account of the company's financial performance. It gives a complete picture of the

company's performance, standing, operations, and so on (Murugan, 2021).

Income statement: When calculating a corporation's net income or loss, the income statement is

the best place to start.

The amount of "profit" a company makes varies greatly. Sole proprietorships and partnerships:

To put it simply, gross profit is the difference between what a company makes in sales and what

it pays out in expenses. The operational profit is calculated by subtracting the company's gross

profit from its overall operating expenses. Net profit is the consequence of deducting (or

growing) operating profit and deducting (or raising) finance costs.

When we emphasize not-profit-organization, it is achieved by subtracting (or raising) the

operating profit's financing charges from the operating profit. Taxes are deducted from operating

earnings to arrive at net profit. When calculating a company's yearly retained profit, dividends

given to shareholders are subtracted from the company's net profit after tax.

Balance sheet: The balance sheet is a snapshot that details all of an organization's assets,

liabilities, and shareholders' equity. Every asset must have the same value as the total liabilities

and equity held by shareholders. It indicates the whole value of the firm.

Cash Flows: All of the company's cash and cash equivalents are shown on this document, which

is known as a cash flow statement. Non-cash transactions are not shown. It displays the cash

flows of operational, financial, and investment operations (Murugan, 2021).

to providing quantitative financial information.

Preparing financial statements from a given trial balance for sole traders,

partnerships and not-for-profit organizations, to meet accounting principles,

conventions and standards.

Sole traders, partnerships, and not-for-profit organizations are the three most common legal

forms of business in the United Kingdom. To get a handle on the status of the business, they'll

need to put together a set of financial statements.

Financial Statement: There are two types of financial statements: public and internal. The latter

is a public account of the company's financial performance. It gives a complete picture of the

company's performance, standing, operations, and so on (Murugan, 2021).

Income statement: When calculating a corporation's net income or loss, the income statement is

the best place to start.

The amount of "profit" a company makes varies greatly. Sole proprietorships and partnerships:

To put it simply, gross profit is the difference between what a company makes in sales and what

it pays out in expenses. The operational profit is calculated by subtracting the company's gross

profit from its overall operating expenses. Net profit is the consequence of deducting (or

growing) operating profit and deducting (or raising) finance costs.

When we emphasize not-profit-organization, it is achieved by subtracting (or raising) the

operating profit's financing charges from the operating profit. Taxes are deducted from operating

earnings to arrive at net profit. When calculating a company's yearly retained profit, dividends

given to shareholders are subtracted from the company's net profit after tax.

Balance sheet: The balance sheet is a snapshot that details all of an organization's assets,

liabilities, and shareholders' equity. Every asset must have the same value as the total liabilities

and equity held by shareholders. It indicates the whole value of the firm.

Cash Flows: All of the company's cash and cash equivalents are shown on this document, which

is known as a cash flow statement. Non-cash transactions are not shown. It displays the cash

flows of operational, financial, and investment operations (Murugan, 2021).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting principles, conventions, and standards

To regulate financial accounting, a number of accounting principles, conventions, and standards

have emerged over time.

Controversial conventions with two sides: Financial statements are affected by two unique

components of every transaction in accordance with this standard. Getting a bank loan to expand

a firm's office space, for example, would raise both the assets and liabilities in the report of

financial condition of the organization in question.

Precedented cost-based convention: Consequently, assets are listed in the financial statement at

their historical performance. There are many who think the current market value of an asset

should be the primary consideration for valuing an asset. These efforts to appraise the assets at

their present values have been fruitless.

With the continuation of the business convention: When you observe this, you could reason

that the business will continue to operate out of the same location for some time to come. As a

consequence of making this assumption, assets will be evaluated at what they were worth in the

past. In order to successfully liquidate a business, all of the assets need to have their net

realizable value determined. A different approach will have to be used in order to create the

financial statements.

To regulate financial accounting, a number of accounting principles, conventions, and standards

have emerged over time.

Controversial conventions with two sides: Financial statements are affected by two unique

components of every transaction in accordance with this standard. Getting a bank loan to expand

a firm's office space, for example, would raise both the assets and liabilities in the report of

financial condition of the organization in question.

Precedented cost-based convention: Consequently, assets are listed in the financial statement at

their historical performance. There are many who think the current market value of an asset

should be the primary consideration for valuing an asset. These efforts to appraise the assets at

their present values have been fruitless.

With the continuation of the business convention: When you observe this, you could reason

that the business will continue to operate out of the same location for some time to come. As a

consequence of making this assumption, assets will be evaluated at what they were worth in the

past. In order to successfully liquidate a business, all of the assets need to have their net

realizable value determined. A different approach will have to be used in order to create the

financial statements.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

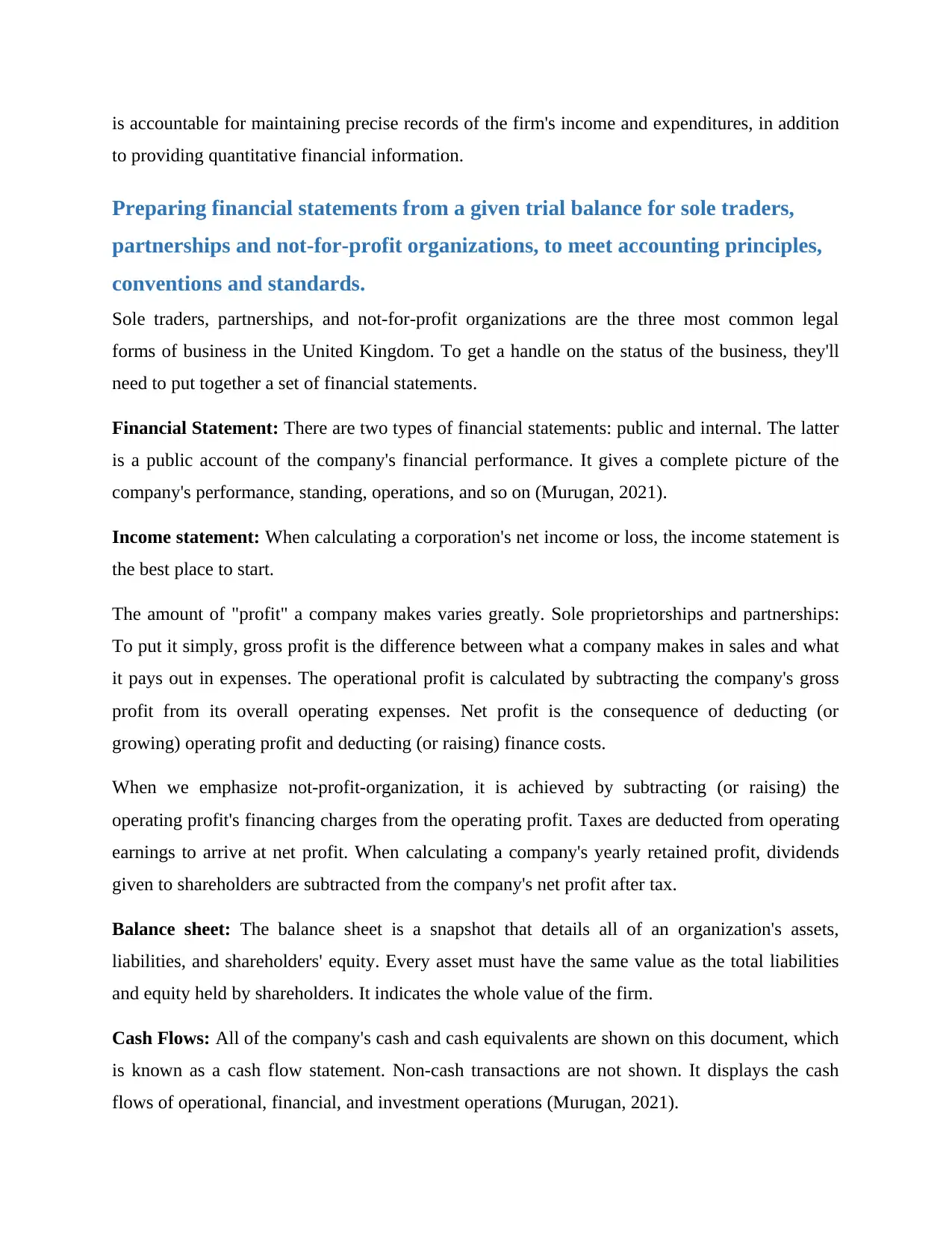

Producing financial statements from a given trial balance, making

appropriate adjustments.

Accounts Debit Credit

Sales 750,123$

Creditors 24,850$

Debtors 79,306$

Premises 220,850$

Fixtures and Fittings 42,100$

Wages 35,920$

Opening Stock 48,510$

Motor vehicle 42,000$

Miscellinuous Exp. 8,760$

Repairs 1,870$

Advertisinng 7,850$

Purchases 387,256$

Bank interest & Charges 560$

Phone & Internet 7,850$

Cash in Hand 1,250$

Stationary 2,750$

Drawings 45,400$

Bank 5,390$

Heat and Light 7,590$

Loan (All repayable 30 April 2022) 45,000$

Capital 130,379$

Insurance 15,920$

Total 955,742$ 955,742$

Trial Balance

The following further pieces of information have also been supplied:

The value of the closing stock as of December 31 was 47650. A December advertising campaign

that was not included in the above should have an additional advertising budget of 1,070 dollars

accumulated to cover its costs. The total amount paid for insurance throughout the year includes

$700 that is applied to the next year's premium.

appropriate adjustments.

Accounts Debit Credit

Sales 750,123$

Creditors 24,850$

Debtors 79,306$

Premises 220,850$

Fixtures and Fittings 42,100$

Wages 35,920$

Opening Stock 48,510$

Motor vehicle 42,000$

Miscellinuous Exp. 8,760$

Repairs 1,870$

Advertisinng 7,850$

Purchases 387,256$

Bank interest & Charges 560$

Phone & Internet 7,850$

Cash in Hand 1,250$

Stationary 2,750$

Drawings 45,400$

Bank 5,390$

Heat and Light 7,590$

Loan (All repayable 30 April 2022) 45,000$

Capital 130,379$

Insurance 15,920$

Total 955,742$ 955,742$

Trial Balance

The following further pieces of information have also been supplied:

The value of the closing stock as of December 31 was 47650. A December advertising campaign

that was not included in the above should have an additional advertising budget of 1,070 dollars

accumulated to cover its costs. The total amount paid for insurance throughout the year includes

$700 that is applied to the next year's premium.

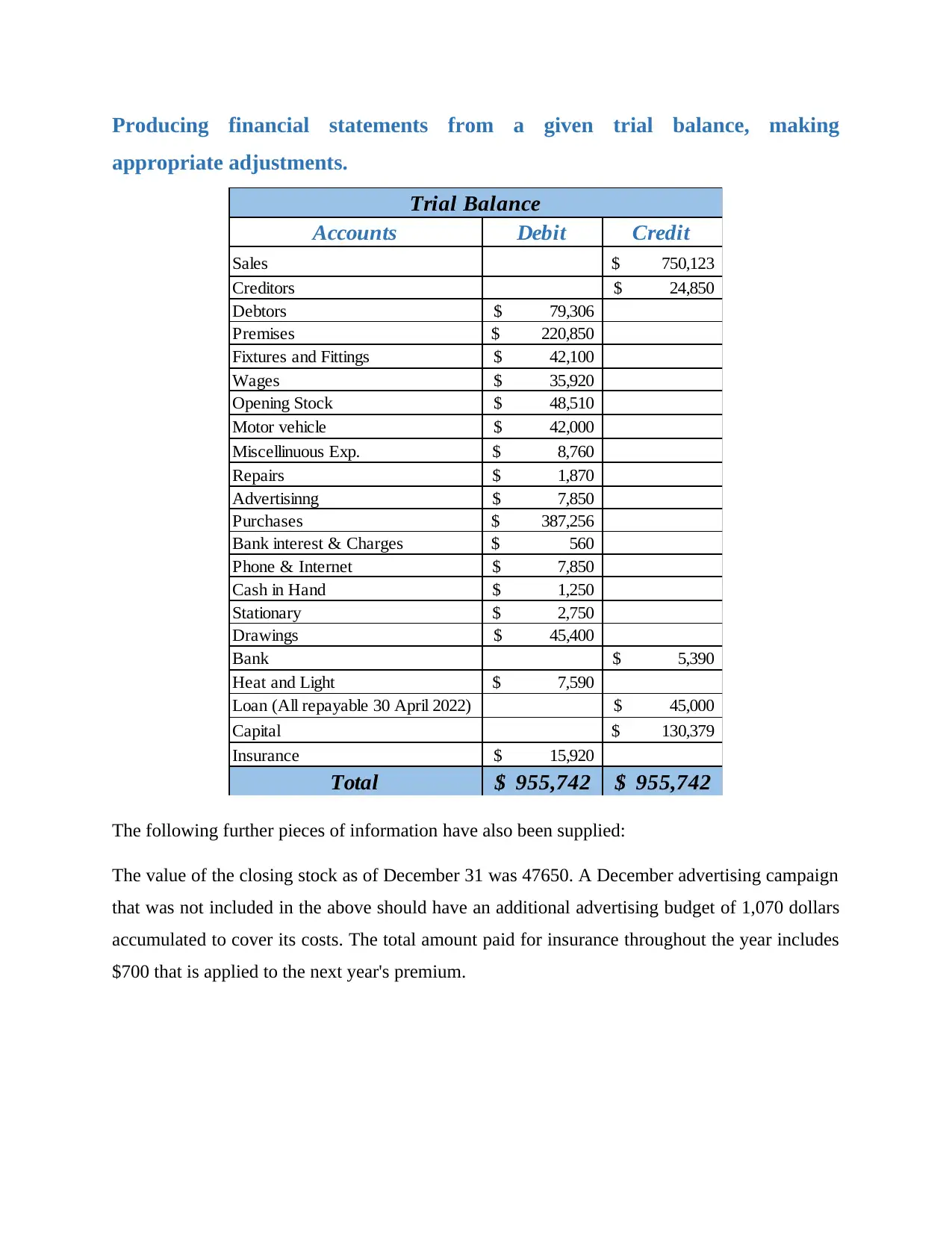

Accounts Amount Total

Sales 750,123$

Less: Cost of Goods Sold

Opening Stock 48,510$

Add: Purchases 387,256$

435,766$

Less: Closing Stock 47,650$

388,116$

362,007$

Wages 35,920$

Miscellinuous Exp. 8,760$

Repairs 1,870$

Advertising 8,920$

Bank interest & Charges 560$

Phone & Internet 7,850$

Stationary 2,750$

Heat and Light 7,590$

Insurance 15,170$

Total Expenses 89,390$

Net Profit 272,617$

Gross Profit

Income Statement (31 Dec.2022)

Less: Expenses

Stock 47,650$

Debtors 79,306$

Prepaid insurance 750$

Cash 1,250$

Current Assets 128,956$

Premises 220,850$

Fixtures and Fittings 42,100$

Motor vehicle 42,000$

Fixed Assets 304,950$

433,906$

Bank 5,390$

Accruals advertising 1,070$

Creditors 24,850$

31,310$

Long term Liabilities: Loan 45,000$

Capital 130,379$

Add: Profit 272,617$

402,996$

Less: Drawings 45,400$

357,596$

Total Liabilities & Equity 433,906$

Balance Sheet (31 Dec.,2022)

Total Assets

Liablilities and Owner's Equity

Current Liabilities

Equity

Sales 750,123$

Less: Cost of Goods Sold

Opening Stock 48,510$

Add: Purchases 387,256$

435,766$

Less: Closing Stock 47,650$

388,116$

362,007$

Wages 35,920$

Miscellinuous Exp. 8,760$

Repairs 1,870$

Advertising 8,920$

Bank interest & Charges 560$

Phone & Internet 7,850$

Stationary 2,750$

Heat and Light 7,590$

Insurance 15,170$

Total Expenses 89,390$

Net Profit 272,617$

Gross Profit

Income Statement (31 Dec.2022)

Less: Expenses

Stock 47,650$

Debtors 79,306$

Prepaid insurance 750$

Cash 1,250$

Current Assets 128,956$

Premises 220,850$

Fixtures and Fittings 42,100$

Motor vehicle 42,000$

Fixed Assets 304,950$

433,906$

Bank 5,390$

Accruals advertising 1,070$

Creditors 24,850$

31,310$

Long term Liabilities: Loan 45,000$

Capital 130,379$

Add: Profit 272,617$

402,996$

Less: Drawings 45,400$

357,596$

Total Liabilities & Equity 433,906$

Balance Sheet (31 Dec.,2022)

Total Assets

Liablilities and Owner's Equity

Current Liabilities

Equity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Calculating and presenting financial ratios from a set of final accounts.

Financial Ratio: The use of financial ratios simplifies the analysis and comparison of financial

relationships between accounts on the financial statements of a corporation. A company's

financial performance, an industry, or even a retail sector may be studied using these techniques.

Assessing a company's profitability, solvency, liquidity, etc. may be aided by doing a financial

ratio analysis. An evaluation of the firm's internal analysis, as well as its prospects for fiscal

growth in the industry, may be accomplished via ratio analysis (Carlson, 2020).

How Does Financial Ratio Analysis Work?

Simply glancing at the numbers in a company's financial records is not enough to provide us

with all of the information we want about how well the firm is performing. In most instances, a

length of time ranging from three months to one year is used to calculate ratios. The results of

these comparisons should then be weighed against those of other companies operating in the

same market sector. It is essential to make analogies and parallels. It is impossible for a financial

manager to draw any conclusions about the success of a company without first comparing the

company's financial figures to those of its rivals and to those of other businesses operating in the

same industry. Financial managers may be able to offer an accurate image of the success of the

firm by using the aforementioned calculations and comparisons.

A single computation of a ratio won't teach you anything much by itself. If management does not

compare the present debt-to-asset ratio to prior periods in the history of the firm, such as when

the debt-to-asset ratio was lower or bigger, then this does not provide an interesting narrative. In

this scenario, the debt-to-asset ratio reveals that debt is responsible for funding fifty percent of

the company's total assets. You won't be able to determine if that ratio is outstanding or terrible

unless you examine it in respect to other firms in the same industry or other companies in the

same industry.

In addition to using financial ratio analysis, financial managers may also employ common size

analysis and a more in-depth review of the statement of cash flows in order to get more insights

Financial Ratio: The use of financial ratios simplifies the analysis and comparison of financial

relationships between accounts on the financial statements of a corporation. A company's

financial performance, an industry, or even a retail sector may be studied using these techniques.

Assessing a company's profitability, solvency, liquidity, etc. may be aided by doing a financial

ratio analysis. An evaluation of the firm's internal analysis, as well as its prospects for fiscal

growth in the industry, may be accomplished via ratio analysis (Carlson, 2020).

How Does Financial Ratio Analysis Work?

Simply glancing at the numbers in a company's financial records is not enough to provide us

with all of the information we want about how well the firm is performing. In most instances, a

length of time ranging from three months to one year is used to calculate ratios. The results of

these comparisons should then be weighed against those of other companies operating in the

same market sector. It is essential to make analogies and parallels. It is impossible for a financial

manager to draw any conclusions about the success of a company without first comparing the

company's financial figures to those of its rivals and to those of other businesses operating in the

same industry. Financial managers may be able to offer an accurate image of the success of the

firm by using the aforementioned calculations and comparisons.

A single computation of a ratio won't teach you anything much by itself. If management does not

compare the present debt-to-asset ratio to prior periods in the history of the firm, such as when

the debt-to-asset ratio was lower or bigger, then this does not provide an interesting narrative. In

this scenario, the debt-to-asset ratio reveals that debt is responsible for funding fifty percent of

the company's total assets. You won't be able to determine if that ratio is outstanding or terrible

unless you examine it in respect to other firms in the same industry or other companies in the

same industry.

In addition to using financial ratio analysis, financial managers may also employ common size

analysis and a more in-depth review of the statement of cash flows in order to get more insights

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

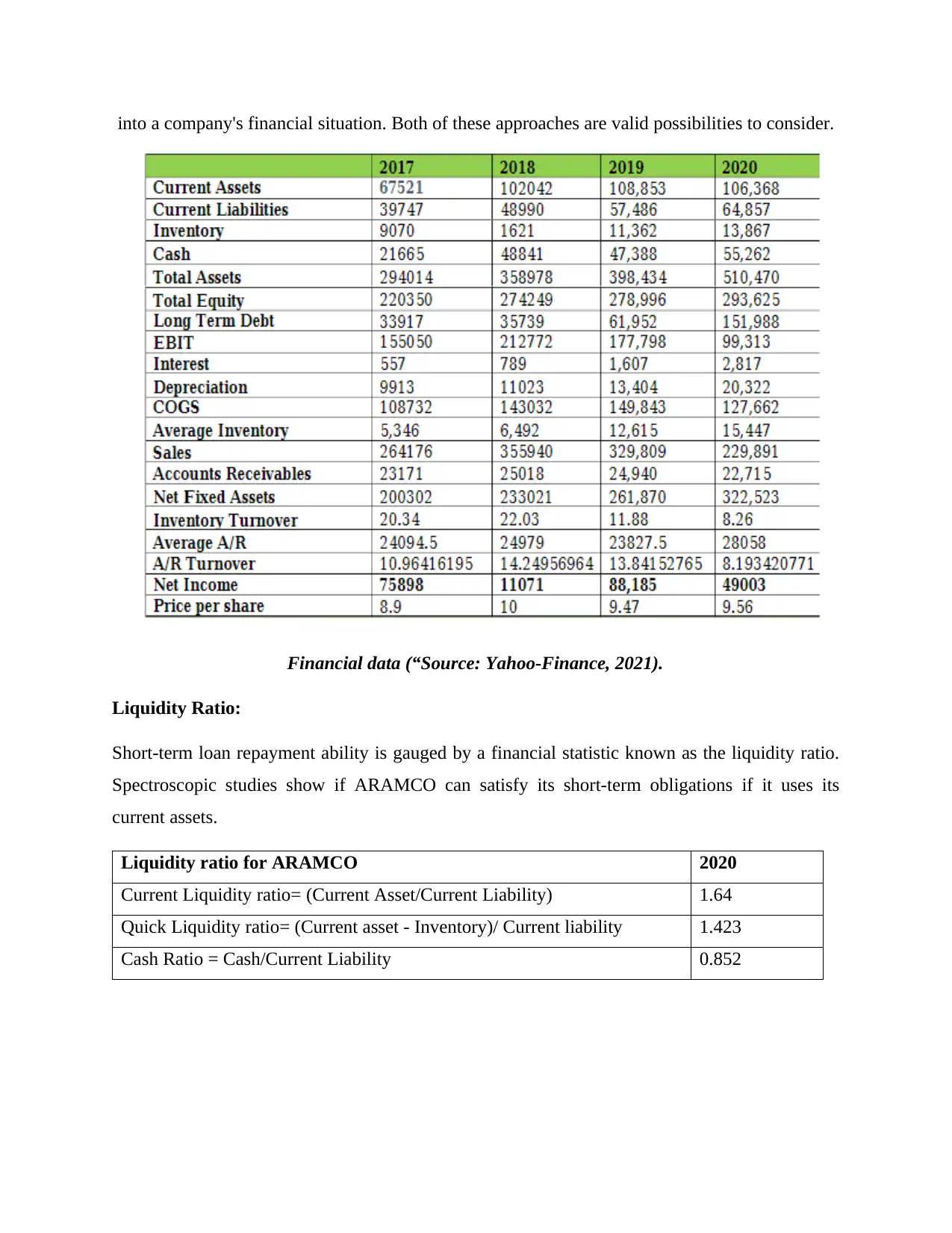

into a company's financial situation. Both of these approaches are valid possibilities to consider.

Financial data (“Source: Yahoo-Finance, 2021).

Liquidity Ratio:

Short-term loan repayment ability is gauged by a financial statistic known as the liquidity ratio.

Spectroscopic studies show if ARAMCO can satisfy its short-term obligations if it uses its

current assets.

Liquidity ratio for ARAMCO 2020

Current Liquidity ratio= (Current Asset/Current Liability) 1.64

Quick Liquidity ratio= (Current asset - Inventory)/ Current liability 1.423

Cash Ratio = Cash/Current Liability 0.852

Financial data (“Source: Yahoo-Finance, 2021).

Liquidity Ratio:

Short-term loan repayment ability is gauged by a financial statistic known as the liquidity ratio.

Spectroscopic studies show if ARAMCO can satisfy its short-term obligations if it uses its

current assets.

Liquidity ratio for ARAMCO 2020

Current Liquidity ratio= (Current Asset/Current Liability) 1.64

Quick Liquidity ratio= (Current asset - Inventory)/ Current liability 1.423

Cash Ratio = Cash/Current Liability 0.852

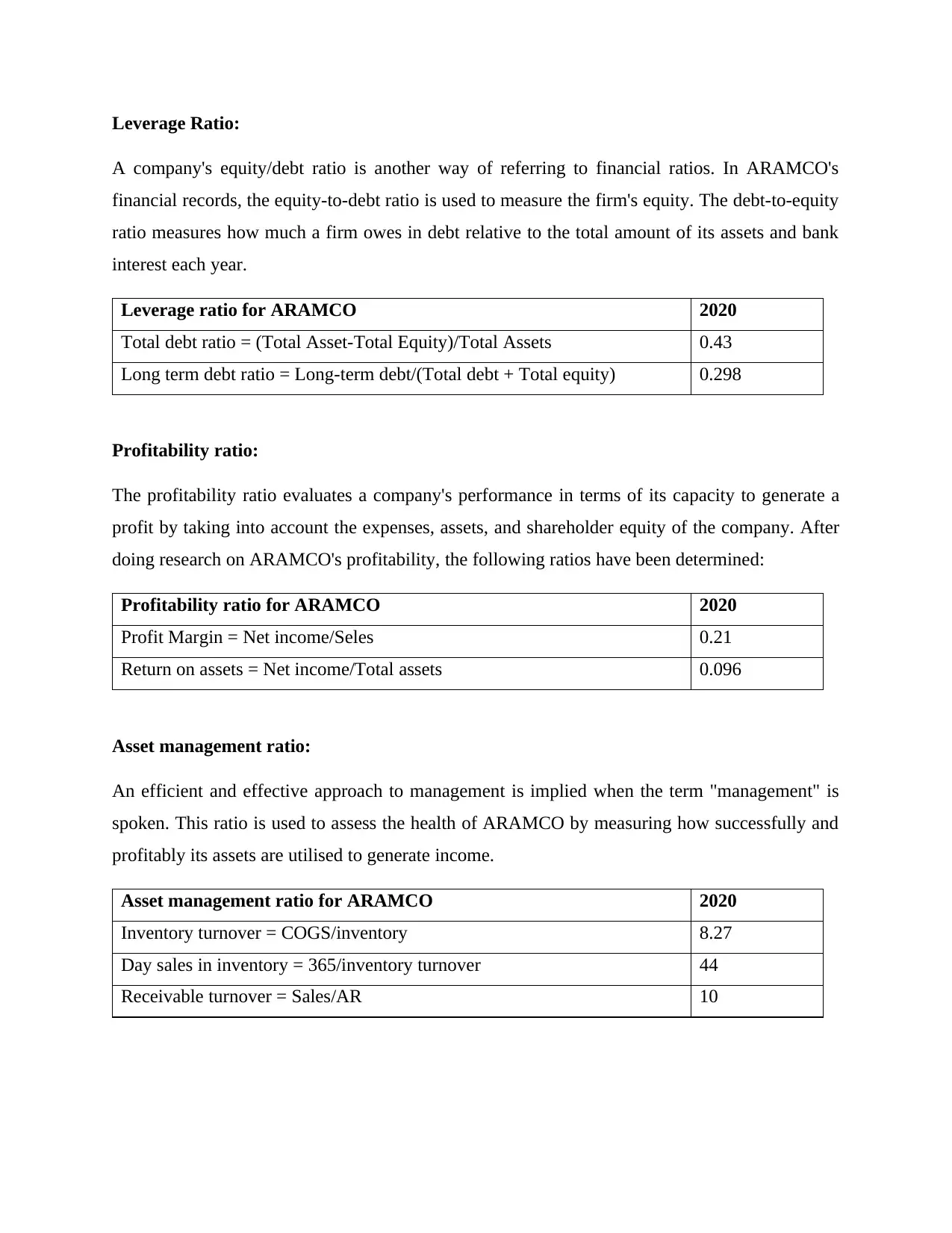

Leverage Ratio:

A company's equity/debt ratio is another way of referring to financial ratios. In ARAMCO's

financial records, the equity-to-debt ratio is used to measure the firm's equity. The debt-to-equity

ratio measures how much a firm owes in debt relative to the total amount of its assets and bank

interest each year.

Leverage ratio for ARAMCO 2020

Total debt ratio = (Total Asset-Total Equity)/Total Assets 0.43

Long term debt ratio = Long-term debt/(Total debt + Total equity) 0.298

Profitability ratio:

The profitability ratio evaluates a company's performance in terms of its capacity to generate a

profit by taking into account the expenses, assets, and shareholder equity of the company. After

doing research on ARAMCO's profitability, the following ratios have been determined:

Profitability ratio for ARAMCO 2020

Profit Margin = Net income/Seles 0.21

Return on assets = Net income/Total assets 0.096

Asset management ratio:

An efficient and effective approach to management is implied when the term "management" is

spoken. This ratio is used to assess the health of ARAMCO by measuring how successfully and

profitably its assets are utilised to generate income.

Asset management ratio for ARAMCO 2020

Inventory turnover = COGS/inventory 8.27

Day sales in inventory = 365/inventory turnover 44

Receivable turnover = Sales/AR 10

A company's equity/debt ratio is another way of referring to financial ratios. In ARAMCO's

financial records, the equity-to-debt ratio is used to measure the firm's equity. The debt-to-equity

ratio measures how much a firm owes in debt relative to the total amount of its assets and bank

interest each year.

Leverage ratio for ARAMCO 2020

Total debt ratio = (Total Asset-Total Equity)/Total Assets 0.43

Long term debt ratio = Long-term debt/(Total debt + Total equity) 0.298

Profitability ratio:

The profitability ratio evaluates a company's performance in terms of its capacity to generate a

profit by taking into account the expenses, assets, and shareholder equity of the company. After

doing research on ARAMCO's profitability, the following ratios have been determined:

Profitability ratio for ARAMCO 2020

Profit Margin = Net income/Seles 0.21

Return on assets = Net income/Total assets 0.096

Asset management ratio:

An efficient and effective approach to management is implied when the term "management" is

spoken. This ratio is used to assess the health of ARAMCO by measuring how successfully and

profitably its assets are utilised to generate income.

Asset management ratio for ARAMCO 2020

Inventory turnover = COGS/inventory 8.27

Day sales in inventory = 365/inventory turnover 44

Receivable turnover = Sales/AR 10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

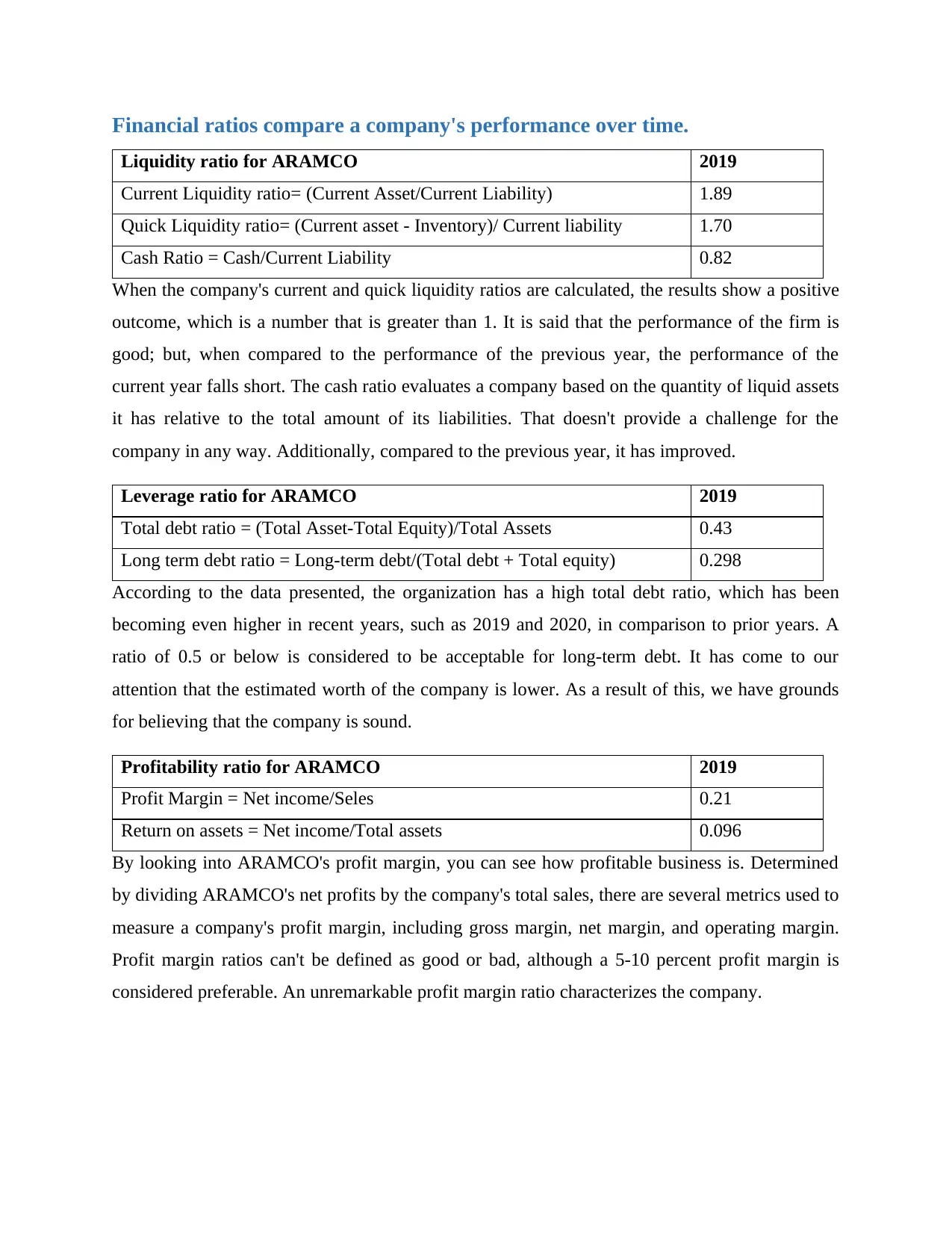

Financial ratios compare a company's performance over time.

Liquidity ratio for ARAMCO 2019

Current Liquidity ratio= (Current Asset/Current Liability) 1.89

Quick Liquidity ratio= (Current asset - Inventory)/ Current liability 1.70

Cash Ratio = Cash/Current Liability 0.82

When the company's current and quick liquidity ratios are calculated, the results show a positive

outcome, which is a number that is greater than 1. It is said that the performance of the firm is

good; but, when compared to the performance of the previous year, the performance of the

current year falls short. The cash ratio evaluates a company based on the quantity of liquid assets

it has relative to the total amount of its liabilities. That doesn't provide a challenge for the

company in any way. Additionally, compared to the previous year, it has improved.

Leverage ratio for ARAMCO 2019

Total debt ratio = (Total Asset-Total Equity)/Total Assets 0.43

Long term debt ratio = Long-term debt/(Total debt + Total equity) 0.298

According to the data presented, the organization has a high total debt ratio, which has been

becoming even higher in recent years, such as 2019 and 2020, in comparison to prior years. A

ratio of 0.5 or below is considered to be acceptable for long-term debt. It has come to our

attention that the estimated worth of the company is lower. As a result of this, we have grounds

for believing that the company is sound.

Profitability ratio for ARAMCO 2019

Profit Margin = Net income/Seles 0.21

Return on assets = Net income/Total assets 0.096

By looking into ARAMCO's profit margin, you can see how profitable business is. Determined

by dividing ARAMCO's net profits by the company's total sales, there are several metrics used to

measure a company's profit margin, including gross margin, net margin, and operating margin.

Profit margin ratios can't be defined as good or bad, although a 5-10 percent profit margin is

considered preferable. An unremarkable profit margin ratio characterizes the company.

Liquidity ratio for ARAMCO 2019

Current Liquidity ratio= (Current Asset/Current Liability) 1.89

Quick Liquidity ratio= (Current asset - Inventory)/ Current liability 1.70

Cash Ratio = Cash/Current Liability 0.82

When the company's current and quick liquidity ratios are calculated, the results show a positive

outcome, which is a number that is greater than 1. It is said that the performance of the firm is

good; but, when compared to the performance of the previous year, the performance of the

current year falls short. The cash ratio evaluates a company based on the quantity of liquid assets

it has relative to the total amount of its liabilities. That doesn't provide a challenge for the

company in any way. Additionally, compared to the previous year, it has improved.

Leverage ratio for ARAMCO 2019

Total debt ratio = (Total Asset-Total Equity)/Total Assets 0.43

Long term debt ratio = Long-term debt/(Total debt + Total equity) 0.298

According to the data presented, the organization has a high total debt ratio, which has been

becoming even higher in recent years, such as 2019 and 2020, in comparison to prior years. A

ratio of 0.5 or below is considered to be acceptable for long-term debt. It has come to our

attention that the estimated worth of the company is lower. As a result of this, we have grounds

for believing that the company is sound.

Profitability ratio for ARAMCO 2019

Profit Margin = Net income/Seles 0.21

Return on assets = Net income/Total assets 0.096

By looking into ARAMCO's profit margin, you can see how profitable business is. Determined

by dividing ARAMCO's net profits by the company's total sales, there are several metrics used to

measure a company's profit margin, including gross margin, net margin, and operating margin.

Profit margin ratios can't be defined as good or bad, although a 5-10 percent profit margin is

considered preferable. An unremarkable profit margin ratio characterizes the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

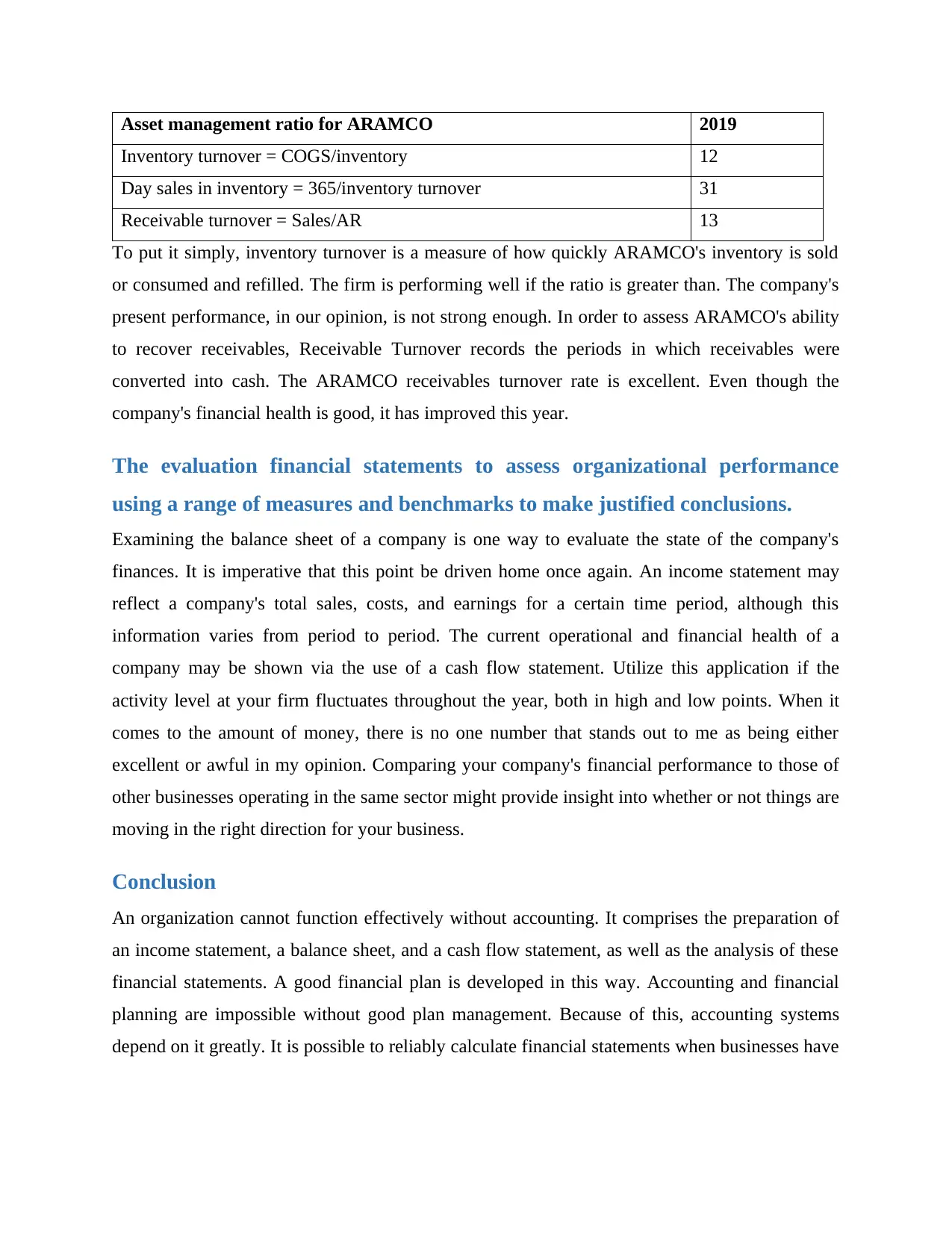

Asset management ratio for ARAMCO 2019

Inventory turnover = COGS/inventory 12

Day sales in inventory = 365/inventory turnover 31

Receivable turnover = Sales/AR 13

To put it simply, inventory turnover is a measure of how quickly ARAMCO's inventory is sold

or consumed and refilled. The firm is performing well if the ratio is greater than. The company's

present performance, in our opinion, is not strong enough. In order to assess ARAMCO's ability

to recover receivables, Receivable Turnover records the periods in which receivables were

converted into cash. The ARAMCO receivables turnover rate is excellent. Even though the

company's financial health is good, it has improved this year.

The evaluation financial statements to assess organizational performance

using a range of measures and benchmarks to make justified conclusions.

Examining the balance sheet of a company is one way to evaluate the state of the company's

finances. It is imperative that this point be driven home once again. An income statement may

reflect a company's total sales, costs, and earnings for a certain time period, although this

information varies from period to period. The current operational and financial health of a

company may be shown via the use of a cash flow statement. Utilize this application if the

activity level at your firm fluctuates throughout the year, both in high and low points. When it

comes to the amount of money, there is no one number that stands out to me as being either

excellent or awful in my opinion. Comparing your company's financial performance to those of

other businesses operating in the same sector might provide insight into whether or not things are

moving in the right direction for your business.

Conclusion

An organization cannot function effectively without accounting. It comprises the preparation of

an income statement, a balance sheet, and a cash flow statement, as well as the analysis of these

financial statements. A good financial plan is developed in this way. Accounting and financial

planning are impossible without good plan management. Because of this, accounting systems

depend on it greatly. It is possible to reliably calculate financial statements when businesses have

Inventory turnover = COGS/inventory 12

Day sales in inventory = 365/inventory turnover 31

Receivable turnover = Sales/AR 13

To put it simply, inventory turnover is a measure of how quickly ARAMCO's inventory is sold

or consumed and refilled. The firm is performing well if the ratio is greater than. The company's

present performance, in our opinion, is not strong enough. In order to assess ARAMCO's ability

to recover receivables, Receivable Turnover records the periods in which receivables were

converted into cash. The ARAMCO receivables turnover rate is excellent. Even though the

company's financial health is good, it has improved this year.

The evaluation financial statements to assess organizational performance

using a range of measures and benchmarks to make justified conclusions.

Examining the balance sheet of a company is one way to evaluate the state of the company's

finances. It is imperative that this point be driven home once again. An income statement may

reflect a company's total sales, costs, and earnings for a certain time period, although this

information varies from period to period. The current operational and financial health of a

company may be shown via the use of a cash flow statement. Utilize this application if the

activity level at your firm fluctuates throughout the year, both in high and low points. When it

comes to the amount of money, there is no one number that stands out to me as being either

excellent or awful in my opinion. Comparing your company's financial performance to those of

other businesses operating in the same sector might provide insight into whether or not things are

moving in the right direction for your business.

Conclusion

An organization cannot function effectively without accounting. It comprises the preparation of

an income statement, a balance sheet, and a cash flow statement, as well as the analysis of these

financial statements. A good financial plan is developed in this way. Accounting and financial

planning are impossible without good plan management. Because of this, accounting systems

depend on it greatly. It is possible to reliably calculate financial statements when businesses have

a structured framework in place for doing so. In order to make sure that a business' overall

reports are reliable.

References

Nandhini Murugan, (2021), what is the easiest way to learn how to analyze financial statements?

[Online] Available at: https://www.quora.com/What-is-the-easiest-way-to-learn-how-to-analyze-

financial-statements?q=what%20is%20financial%20statement, [Accessed on: 9 June 2022].

Rosemary Carlson, (2020), what is financial ratio analysis? [online] Available at:

https://www.thebalancesmb.com/what-is-financial-ratio-analysis-393186, [Accessed on: 10 June

2022].

Nandhini Murugan, (2021), what is the easiest way to learn how to analyze financial statements?

[Online] Available at: https://www.quora.com/What-is-the-easiest-way-to-learn-how-to-analyze-

financial-statements?q=what%20is%20financial%20statement, [Accessed on: 9 June 2022].

reports are reliable.

References

Nandhini Murugan, (2021), what is the easiest way to learn how to analyze financial statements?

[Online] Available at: https://www.quora.com/What-is-the-easiest-way-to-learn-how-to-analyze-

financial-statements?q=what%20is%20financial%20statement, [Accessed on: 9 June 2022].

Rosemary Carlson, (2020), what is financial ratio analysis? [online] Available at:

https://www.thebalancesmb.com/what-is-financial-ratio-analysis-393186, [Accessed on: 10 June

2022].

Nandhini Murugan, (2021), what is the easiest way to learn how to analyze financial statements?

[Online] Available at: https://www.quora.com/What-is-the-easiest-way-to-learn-how-to-analyze-

financial-statements?q=what%20is%20financial%20statement, [Accessed on: 9 June 2022].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.