Management Accounting and its Importance in Decision Making

VerifiedAdded on 2023/01/19

|16

|4851

|51

AI Summary

This article discusses the importance of management accounting in decision making and strategic planning. It explores different management accounting systems and reports used by Excite Entertainment Ltd, a company in the leisure and entertainment industry in the UK.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Management accounting is a profession that includes in management decision making,

strategic planning and performance management and provides expertise in formulation and

implementation of an organization's strategy. It is a part of accounting which presents financial

information in front of top management (Mitter and Hiebl, 2017). On the basis of management

information, managers take effective decisions for better planning and control. Management

accounting different from cost accounting and financial accounting. In the cost accounting focus

on cost centres and cost unit and financial accounting present information to outsider of people.

Management accounting present information to internal management to present actual picture of

company.

For the better understanding of the concepts, this project report choose the Excite

Entertainment Ltd which operates in leisure and entertainment industry in the UK. The presented

report focus on several kind of management accounting system and accounting reports.

Formulation of income statement with the help of absorption costing and marginal costing

methods defined with appropriate format. Along with, different planning tools for budgetary

control are also utilised and applied in effective manner. At last, different types of management

tool used to identify financial problem and management accounting system implemented to

resolve the financial problems.

MAIN BODY

TASK 1

P1 Management accounting and their requirement

Management accounting is a continuous procedure of preparing and presenting financial

and non-financial information to the board of directors. After analysing the reports and accounts

managers take effective decision and planning for further investment.

Management accounting system – It is an internal part of an organisation which is

prepared by the manager to measuring and determining the procedure of management. It deals

with the insider people such as employees, board of directors and many others (Brierley and

Gwilliam, 2017). These systems are developed by management accountant and applied in each

section to collect financial information.

1

Management accounting is a profession that includes in management decision making,

strategic planning and performance management and provides expertise in formulation and

implementation of an organization's strategy. It is a part of accounting which presents financial

information in front of top management (Mitter and Hiebl, 2017). On the basis of management

information, managers take effective decisions for better planning and control. Management

accounting different from cost accounting and financial accounting. In the cost accounting focus

on cost centres and cost unit and financial accounting present information to outsider of people.

Management accounting present information to internal management to present actual picture of

company.

For the better understanding of the concepts, this project report choose the Excite

Entertainment Ltd which operates in leisure and entertainment industry in the UK. The presented

report focus on several kind of management accounting system and accounting reports.

Formulation of income statement with the help of absorption costing and marginal costing

methods defined with appropriate format. Along with, different planning tools for budgetary

control are also utilised and applied in effective manner. At last, different types of management

tool used to identify financial problem and management accounting system implemented to

resolve the financial problems.

MAIN BODY

TASK 1

P1 Management accounting and their requirement

Management accounting is a continuous procedure of preparing and presenting financial

and non-financial information to the board of directors. After analysing the reports and accounts

managers take effective decision and planning for further investment.

Management accounting system – It is an internal part of an organisation which is

prepared by the manager to measuring and determining the procedure of management. It deals

with the insider people such as employees, board of directors and many others (Brierley and

Gwilliam, 2017). These systems are developed by management accountant and applied in each

section to collect financial information.

1

Cost accounting system – It is defined as an accounting method that is applied by the

Excite Entertainment Company to determine the amount of total cost of production. There is

analysing input cost of manufacturing process at each level. This system includes a set of forms,

processes, controls and reports that are developed to collective and report to management

regarding to revenues, costs and profitability. There are determining the cost of design of clothes.

In this manner, the accountant of the company firstly evaluated and record cost on individually

basis. After the comparison of input aspects determine the financial performance. It will help to

an enterprise to get information regarding the contribution of the clothes in profit generation of

business (Golyagina and Valuckas, 2016).

Direct costs: It include those expenses which are directly related to the operational

activities or increase or decrease in the cost will directly affect the production as well as

profit margin. In Excite Entertainment Ltd, managers face such costs while promoting the

concerts and festivals all around UK. Standard costing: It is the common technique which is used by the most of the

organizations. Excite Entertainment Ltd collect information and identify the factors

which provide the variation between standard and actual cost.

Inventory management system – It is important system which is mainly utilised by the

manufacturing company in order to track the level on stock, selling quantity, purchase order and

delivery place. Through this system collect information of work order, bills of material and other

manufacturing papers. It is applied by Excite Entertainment Company Ltd for manufacturing of

clothes. Through this system they track record of inventory and know that how much quantity

were produced and need to complete order. It covers everything from production to retail and

take better decision for the raw material availability and consumption. There are several types of

method of stock valuation such as LIFO, FIFO and AVCO. At present, EOQ method applied by

the company to determine the actual period of time when they have make re order of raw

material.

Price optimization system – The particular system has been utilised by the accountant of

Excite Entertainment Company limited to determine the behaviour of customer for price of their

products. This system utilised to discover the sales of clothes due to increase and decrease price.

It will help to management for ascertain the value of their products. They will take reviews from

2

Excite Entertainment Company to determine the amount of total cost of production. There is

analysing input cost of manufacturing process at each level. This system includes a set of forms,

processes, controls and reports that are developed to collective and report to management

regarding to revenues, costs and profitability. There are determining the cost of design of clothes.

In this manner, the accountant of the company firstly evaluated and record cost on individually

basis. After the comparison of input aspects determine the financial performance. It will help to

an enterprise to get information regarding the contribution of the clothes in profit generation of

business (Golyagina and Valuckas, 2016).

Direct costs: It include those expenses which are directly related to the operational

activities or increase or decrease in the cost will directly affect the production as well as

profit margin. In Excite Entertainment Ltd, managers face such costs while promoting the

concerts and festivals all around UK. Standard costing: It is the common technique which is used by the most of the

organizations. Excite Entertainment Ltd collect information and identify the factors

which provide the variation between standard and actual cost.

Inventory management system – It is important system which is mainly utilised by the

manufacturing company in order to track the level on stock, selling quantity, purchase order and

delivery place. Through this system collect information of work order, bills of material and other

manufacturing papers. It is applied by Excite Entertainment Company Ltd for manufacturing of

clothes. Through this system they track record of inventory and know that how much quantity

were produced and need to complete order. It covers everything from production to retail and

take better decision for the raw material availability and consumption. There are several types of

method of stock valuation such as LIFO, FIFO and AVCO. At present, EOQ method applied by

the company to determine the actual period of time when they have make re order of raw

material.

Price optimization system – The particular system has been utilised by the accountant of

Excite Entertainment Company limited to determine the behaviour of customer for price of their

products. This system utilised to discover the sales of clothes due to increase and decrease price.

It will help to management for ascertain the value of their products. They will take reviews from

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the customer regarding price structure after that change price structure. It will set in effective

manner to get maximum results in the context of sales revenues (Tan, 2016).

Job Costing system – The particular system utilised by the manufacturing company for

analysis the cost of several production activities and jobs. This system utilise by the accountant

for determine and track the cost and income create by particular job. It will further aid in find out

the price of revenue which is collected through effective performance of the job. It is applied by

the Excite Entertainment Company for increase the cost of particular production or service job. It

is allotted different job numbers to single items of revenues and expenditure. Through this

system get an opportunity to the management to keep track over the expenditure and take

appropriate decision for improve profit margin foe reducing in cost.

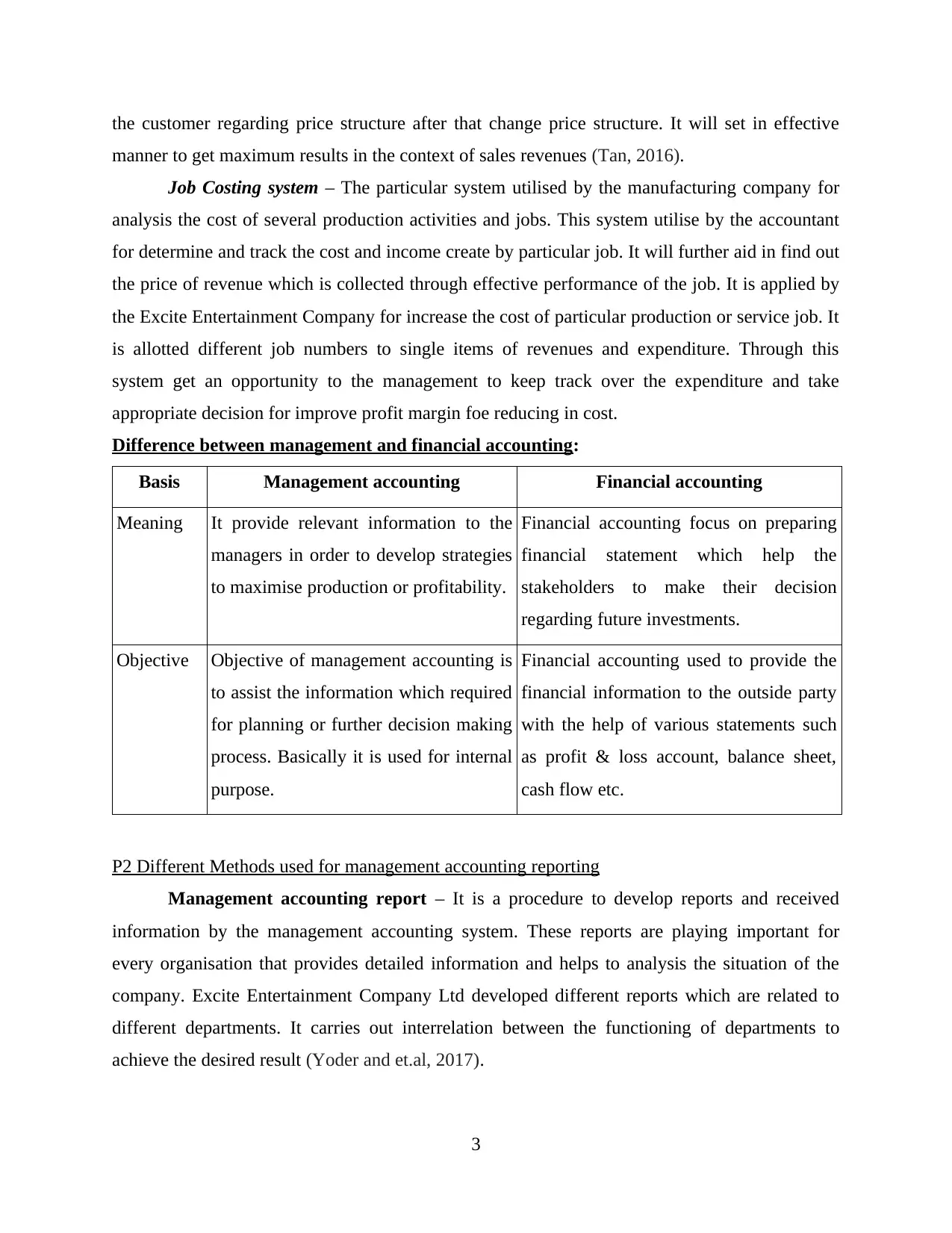

Difference between management and financial accounting:

Basis Management accounting Financial accounting

Meaning It provide relevant information to the

managers in order to develop strategies

to maximise production or profitability.

Financial accounting focus on preparing

financial statement which help the

stakeholders to make their decision

regarding future investments.

Objective Objective of management accounting is

to assist the information which required

for planning or further decision making

process. Basically it is used for internal

purpose.

Financial accounting used to provide the

financial information to the outside party

with the help of various statements such

as profit & loss account, balance sheet,

cash flow etc.

P2 Different Methods used for management accounting reporting

Management accounting report – It is a procedure to develop reports and received

information by the management accounting system. These reports are playing important for

every organisation that provides detailed information and helps to analysis the situation of the

company. Excite Entertainment Company Ltd developed different reports which are related to

different departments. It carries out interrelation between the functioning of departments to

achieve the desired result (Yoder and et.al, 2017).

3

manner to get maximum results in the context of sales revenues (Tan, 2016).

Job Costing system – The particular system utilised by the manufacturing company for

analysis the cost of several production activities and jobs. This system utilise by the accountant

for determine and track the cost and income create by particular job. It will further aid in find out

the price of revenue which is collected through effective performance of the job. It is applied by

the Excite Entertainment Company for increase the cost of particular production or service job. It

is allotted different job numbers to single items of revenues and expenditure. Through this

system get an opportunity to the management to keep track over the expenditure and take

appropriate decision for improve profit margin foe reducing in cost.

Difference between management and financial accounting:

Basis Management accounting Financial accounting

Meaning It provide relevant information to the

managers in order to develop strategies

to maximise production or profitability.

Financial accounting focus on preparing

financial statement which help the

stakeholders to make their decision

regarding future investments.

Objective Objective of management accounting is

to assist the information which required

for planning or further decision making

process. Basically it is used for internal

purpose.

Financial accounting used to provide the

financial information to the outside party

with the help of various statements such

as profit & loss account, balance sheet,

cash flow etc.

P2 Different Methods used for management accounting reporting

Management accounting report – It is a procedure to develop reports and received

information by the management accounting system. These reports are playing important for

every organisation that provides detailed information and helps to analysis the situation of the

company. Excite Entertainment Company Ltd developed different reports which are related to

different departments. It carries out interrelation between the functioning of departments to

achieve the desired result (Yoder and et.al, 2017).

3

Budget report – This report developed by the management of Excite Entertainment

Company which predict future activities regarding revenues and expenditure. After the

preparation of the report compare the actual outcome with the estimated targets. The budget

report defined as an internal report that is used by the company for performance management

and determines the problems. It is advantageous for a company because it provides instruction to

execute all the business activities in the allotted budget. Through this report, companies can

analysing the efficiency to meet the project objectives.

Inventory management report – This type of report prepared by a manufacturing

company to track the record of materials at each level. To produce goods, it is required to keep

information of different types of raw material for manufacturing procedures. The report defined

detail information of material and define how much stock require to fulfil the requirement. It is

beneficial for Excite Entertainment Company as it helps to keep a record of material such as a

warehouse, transit and delivered to clients (Feeney and Pierce, 2016).

Cost managerial report – It is a type of management report where consist of all the

information about cost. This report consists of different types of costs like material cost, direct

cost, operational cost, etc. Eventually, this report developed by the manager of Excite

Entertainment Company with the help of a cost accounting system. Cost managerial report

prepares by a company to determine different types of cost for project activities. It is beneficial

for the company because it provides the cost of different things and helps to analysis the actual

cost of project activities.

Explanation of why information presented should be accurate, relevant to the user, reliable

up to date and timely:

The information should be accurate, relevant and reliable and up to date because of

following reasons:

Accurate – Information should be accurate because it further helps the manager in

decision making process or formulating effective strategy.

Relevant- All the accounting information should be relevant to the daily transaction of

the company, if information is not relevant then it will difficult for investors to relay on the

financial information.

Reliable- Accounting information should be reliable to use for all managers because in

the absence of this feature, companies can not take corrective actions.

4

Company which predict future activities regarding revenues and expenditure. After the

preparation of the report compare the actual outcome with the estimated targets. The budget

report defined as an internal report that is used by the company for performance management

and determines the problems. It is advantageous for a company because it provides instruction to

execute all the business activities in the allotted budget. Through this report, companies can

analysing the efficiency to meet the project objectives.

Inventory management report – This type of report prepared by a manufacturing

company to track the record of materials at each level. To produce goods, it is required to keep

information of different types of raw material for manufacturing procedures. The report defined

detail information of material and define how much stock require to fulfil the requirement. It is

beneficial for Excite Entertainment Company as it helps to keep a record of material such as a

warehouse, transit and delivered to clients (Feeney and Pierce, 2016).

Cost managerial report – It is a type of management report where consist of all the

information about cost. This report consists of different types of costs like material cost, direct

cost, operational cost, etc. Eventually, this report developed by the manager of Excite

Entertainment Company with the help of a cost accounting system. Cost managerial report

prepares by a company to determine different types of cost for project activities. It is beneficial

for the company because it provides the cost of different things and helps to analysis the actual

cost of project activities.

Explanation of why information presented should be accurate, relevant to the user, reliable

up to date and timely:

The information should be accurate, relevant and reliable and up to date because of

following reasons:

Accurate – Information should be accurate because it further helps the manager in

decision making process or formulating effective strategy.

Relevant- All the accounting information should be relevant to the daily transaction of

the company, if information is not relevant then it will difficult for investors to relay on the

financial information.

Reliable- Accounting information should be reliable to use for all managers because in

the absence of this feature, companies can not take corrective actions.

4

Timely – Accounting information should be presented on right time such as annually,

quarterly which help the managers as well as shareholders to make their decisions.

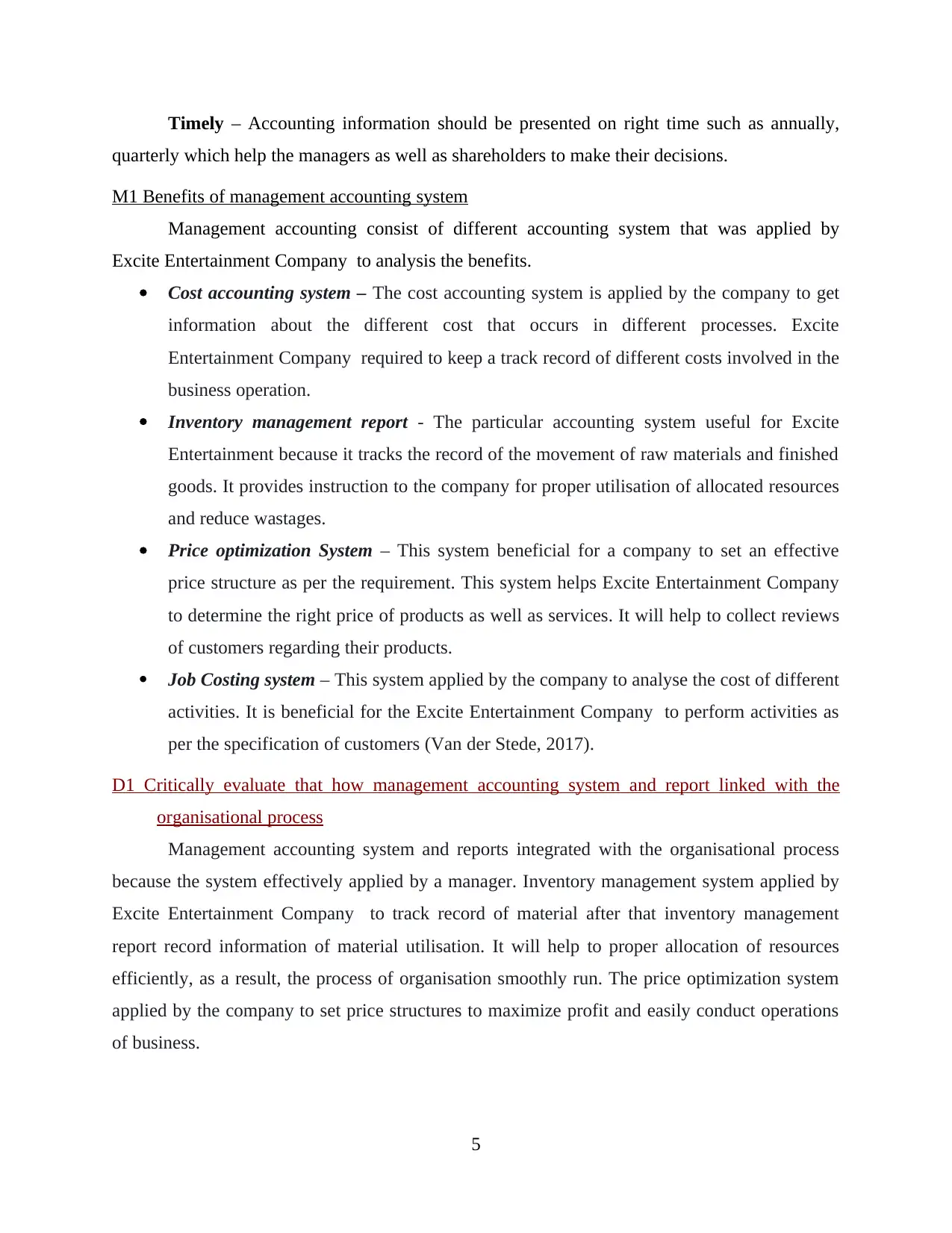

M1 Benefits of management accounting system

Management accounting consist of different accounting system that was applied by

Excite Entertainment Company to analysis the benefits.

Cost accounting system – The cost accounting system is applied by the company to get

information about the different cost that occurs in different processes. Excite

Entertainment Company required to keep a track record of different costs involved in the

business operation.

Inventory management report - The particular accounting system useful for Excite

Entertainment because it tracks the record of the movement of raw materials and finished

goods. It provides instruction to the company for proper utilisation of allocated resources

and reduce wastages.

Price optimization System – This system beneficial for a company to set an effective

price structure as per the requirement. This system helps Excite Entertainment Company

to determine the right price of products as well as services. It will help to collect reviews

of customers regarding their products.

Job Costing system – This system applied by the company to analyse the cost of different

activities. It is beneficial for the Excite Entertainment Company to perform activities as

per the specification of customers (Van der Stede, 2017).

D1 Critically evaluate that how management accounting system and report linked with the

organisational process

Management accounting system and reports integrated with the organisational process

because the system effectively applied by a manager. Inventory management system applied by

Excite Entertainment Company to track record of material after that inventory management

report record information of material utilisation. It will help to proper allocation of resources

efficiently, as a result, the process of organisation smoothly run. The price optimization system

applied by the company to set price structures to maximize profit and easily conduct operations

of business.

5

quarterly which help the managers as well as shareholders to make their decisions.

M1 Benefits of management accounting system

Management accounting consist of different accounting system that was applied by

Excite Entertainment Company to analysis the benefits.

Cost accounting system – The cost accounting system is applied by the company to get

information about the different cost that occurs in different processes. Excite

Entertainment Company required to keep a track record of different costs involved in the

business operation.

Inventory management report - The particular accounting system useful for Excite

Entertainment because it tracks the record of the movement of raw materials and finished

goods. It provides instruction to the company for proper utilisation of allocated resources

and reduce wastages.

Price optimization System – This system beneficial for a company to set an effective

price structure as per the requirement. This system helps Excite Entertainment Company

to determine the right price of products as well as services. It will help to collect reviews

of customers regarding their products.

Job Costing system – This system applied by the company to analyse the cost of different

activities. It is beneficial for the Excite Entertainment Company to perform activities as

per the specification of customers (Van der Stede, 2017).

D1 Critically evaluate that how management accounting system and report linked with the

organisational process

Management accounting system and reports integrated with the organisational process

because the system effectively applied by a manager. Inventory management system applied by

Excite Entertainment Company to track record of material after that inventory management

report record information of material utilisation. It will help to proper allocation of resources

efficiently, as a result, the process of organisation smoothly run. The price optimization system

applied by the company to set price structures to maximize profit and easily conduct operations

of business.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P3 Calculation of cost using appropriate techniques and formulation of income statement using

marginal and absorption costing

Costing – It is the value which organization have to bear at the time of manufacturing

any product. There various types of cost which included in the business operations, so manager

have to evaluate it and make sure to reduce the cost because it further increase the profit margin.

For presentation of suitably organized data for the purposes of control and guidance of

management (Singhvi and BODHANWALA, 2018).

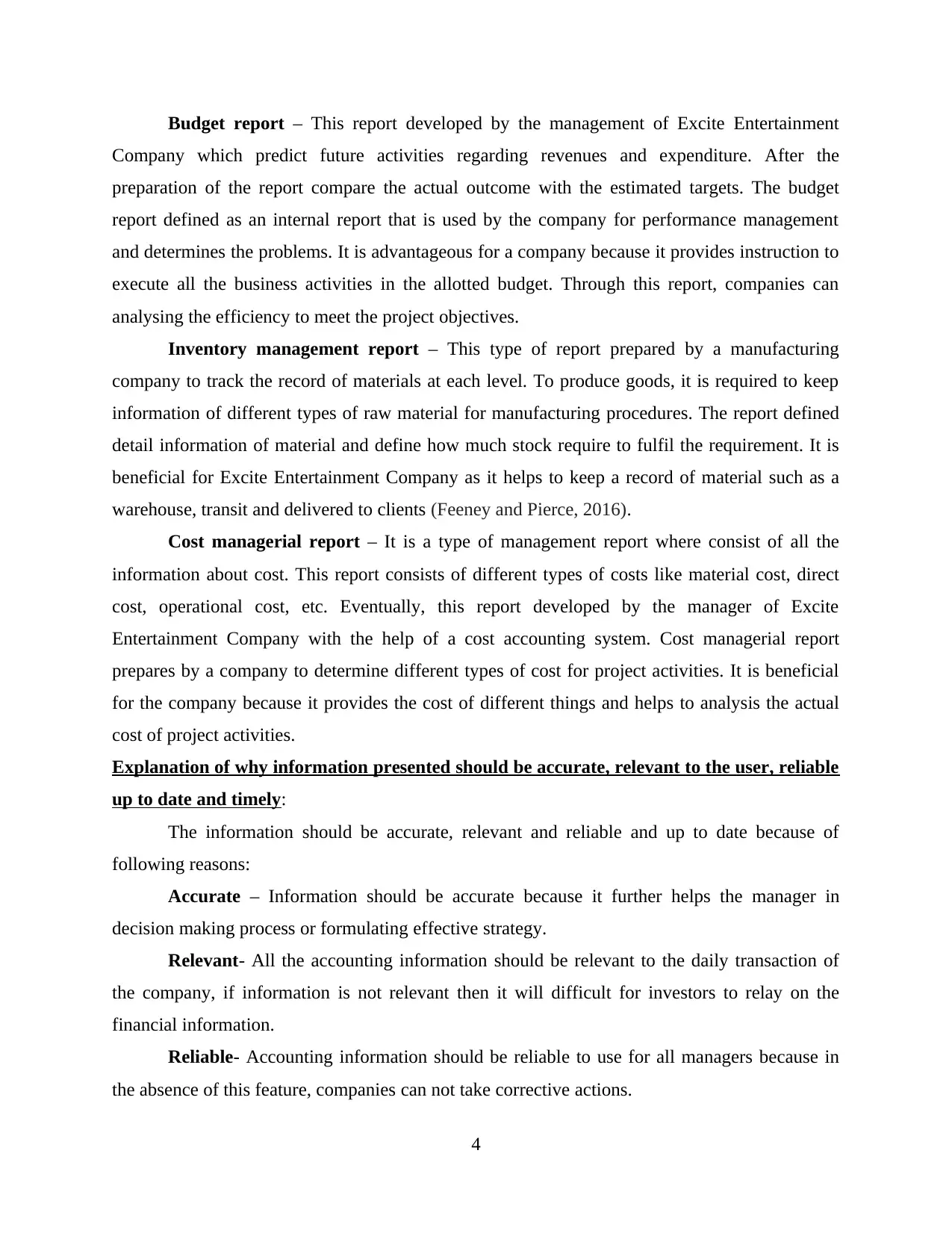

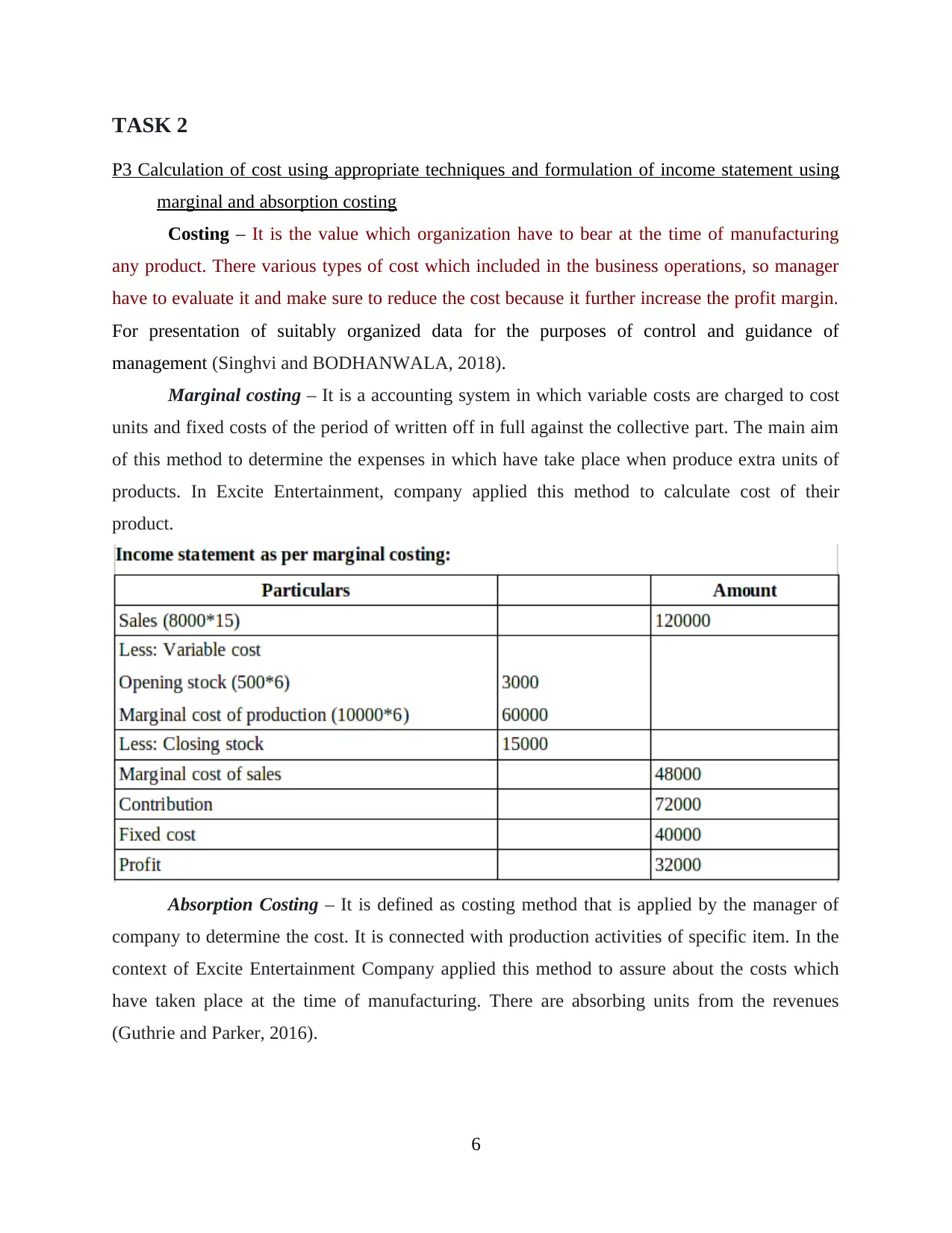

Marginal costing – It is a accounting system in which variable costs are charged to cost

units and fixed costs of the period of written off in full against the collective part. The main aim

of this method to determine the expenses in which have take place when produce extra units of

products. In Excite Entertainment, company applied this method to calculate cost of their

product.

Absorption Costing – It is defined as costing method that is applied by the manager of

company to determine the cost. It is connected with production activities of specific item. In the

context of Excite Entertainment Company applied this method to assure about the costs which

have taken place at the time of manufacturing. There are absorbing units from the revenues

(Guthrie and Parker, 2016).

6

P3 Calculation of cost using appropriate techniques and formulation of income statement using

marginal and absorption costing

Costing – It is the value which organization have to bear at the time of manufacturing

any product. There various types of cost which included in the business operations, so manager

have to evaluate it and make sure to reduce the cost because it further increase the profit margin.

For presentation of suitably organized data for the purposes of control and guidance of

management (Singhvi and BODHANWALA, 2018).

Marginal costing – It is a accounting system in which variable costs are charged to cost

units and fixed costs of the period of written off in full against the collective part. The main aim

of this method to determine the expenses in which have take place when produce extra units of

products. In Excite Entertainment, company applied this method to calculate cost of their

product.

Absorption Costing – It is defined as costing method that is applied by the manager of

company to determine the cost. It is connected with production activities of specific item. In the

context of Excite Entertainment Company applied this method to assure about the costs which

have taken place at the time of manufacturing. There are absorbing units from the revenues

(Guthrie and Parker, 2016).

6

M2 Application of range of management accounting techniques

There are several types of management techniques which is applied by the manager of

Excite Entertainment Company in order to determine the performance of company and the way

in which operations are carried out in suitable way or not. There is mentioned description of

techniques -

Standard costing – The particular method applied by the company in order to analysis

the variation between actual and budget sales. In Excite Entertainment Company find out the

reason of differences between current and standard costs (Pedro-Monzonís and et.al, 2016).

Historical costing – This technique defines that all the assets and liabilities are recoded

on actual amount in the accounting books. The manager of Excite Entertainment Company

record all the components in the financial statements on historical cost.

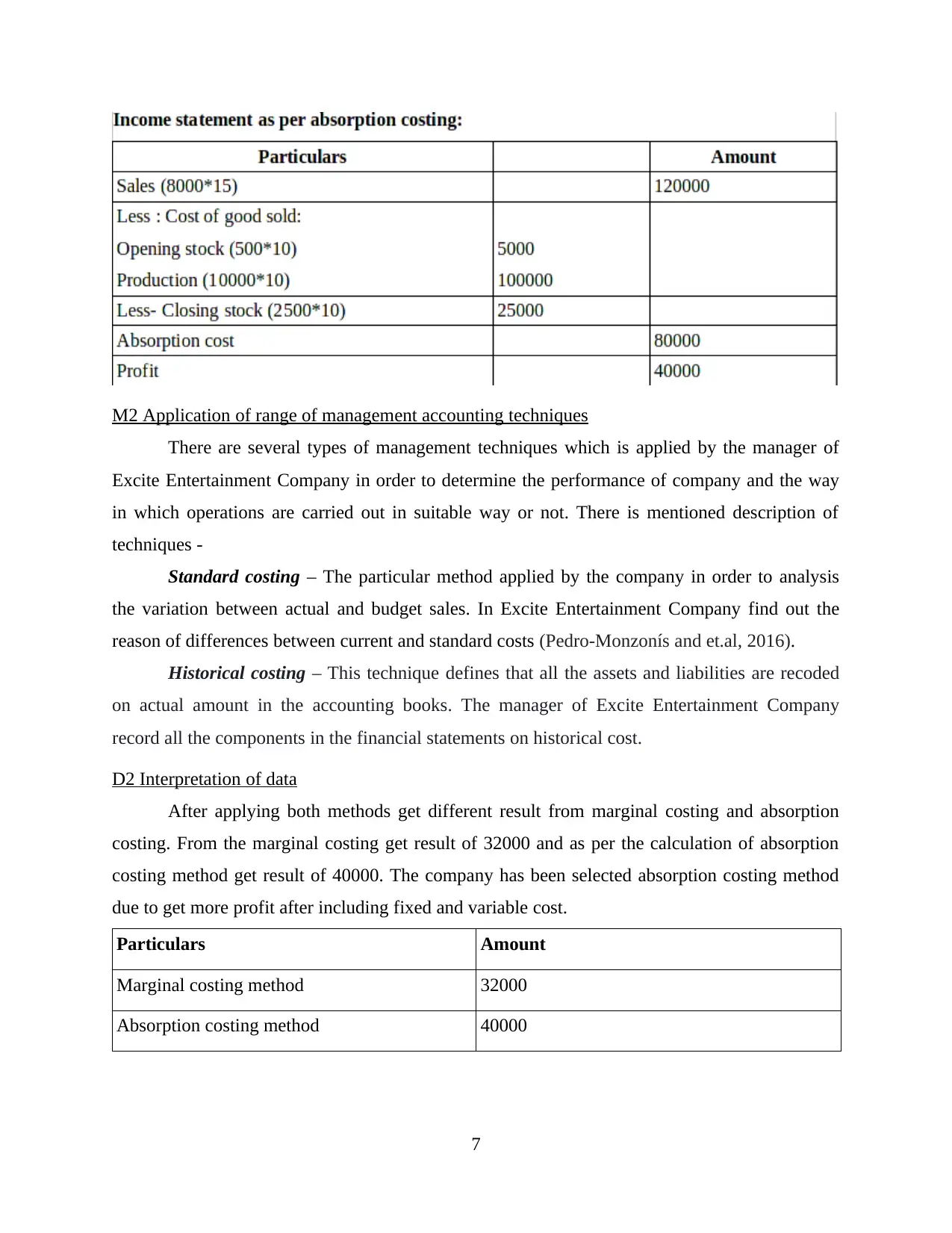

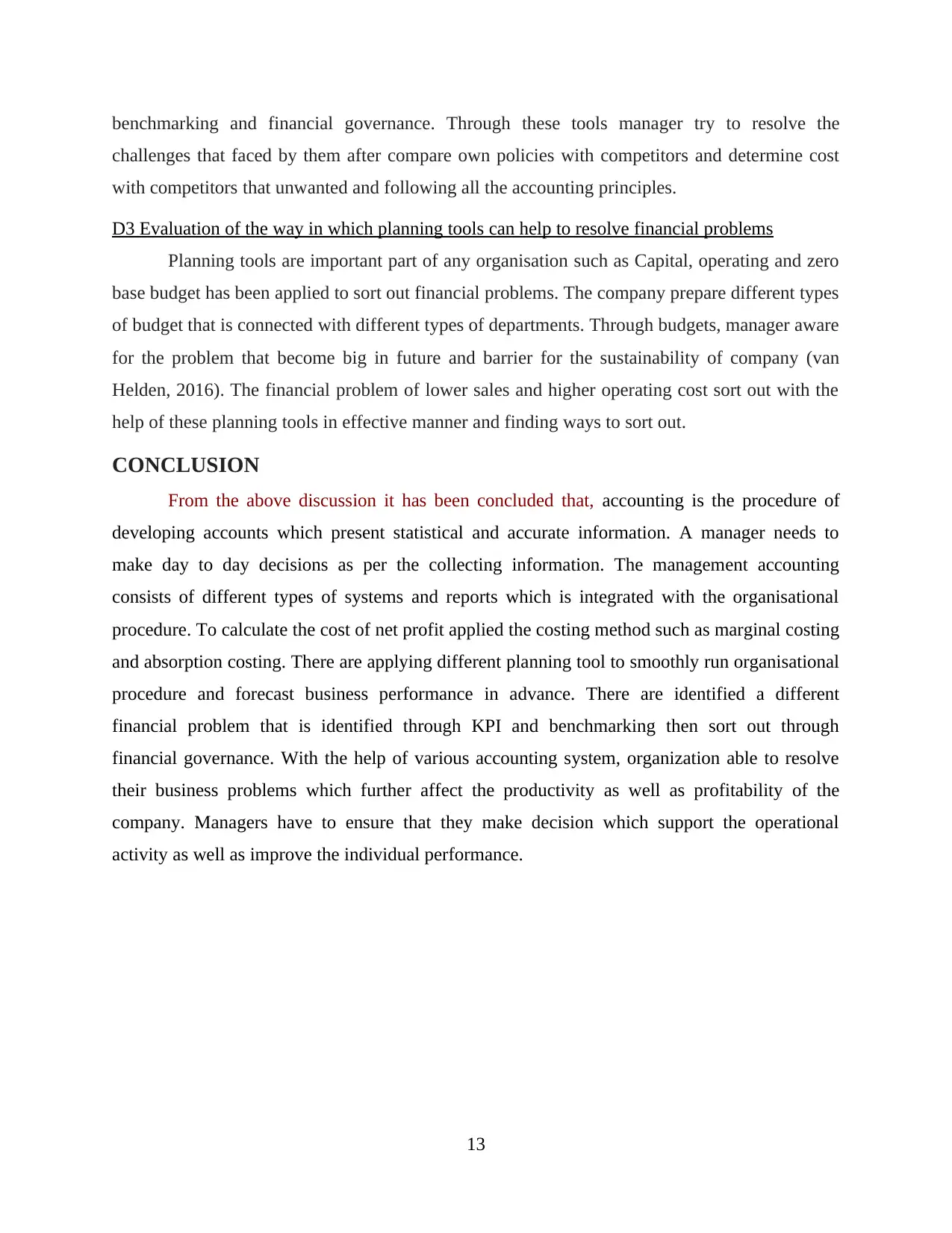

D2 Interpretation of data

After applying both methods get different result from marginal costing and absorption

costing. From the marginal costing get result of 32000 and as per the calculation of absorption

costing method get result of 40000. The company has been selected absorption costing method

due to get more profit after including fixed and variable cost.

Particulars Amount

Marginal costing method 32000

Absorption costing method 40000

7

There are several types of management techniques which is applied by the manager of

Excite Entertainment Company in order to determine the performance of company and the way

in which operations are carried out in suitable way or not. There is mentioned description of

techniques -

Standard costing – The particular method applied by the company in order to analysis

the variation between actual and budget sales. In Excite Entertainment Company find out the

reason of differences between current and standard costs (Pedro-Monzonís and et.al, 2016).

Historical costing – This technique defines that all the assets and liabilities are recoded

on actual amount in the accounting books. The manager of Excite Entertainment Company

record all the components in the financial statements on historical cost.

D2 Interpretation of data

After applying both methods get different result from marginal costing and absorption

costing. From the marginal costing get result of 32000 and as per the calculation of absorption

costing method get result of 40000. The company has been selected absorption costing method

due to get more profit after including fixed and variable cost.

Particulars Amount

Marginal costing method 32000

Absorption costing method 40000

7

TASK 3

P4 Evaluate the planning tool along with advantages and disadvantages of it and how it is used

for budgetary control

Budget – It is a written document plan which is developed by every organisation to

analysis the performance of the company in future. Through this plan a manager handle every

business activities in suitable manner. It is beneficial for every company to analysis actual status

and predict upcoming revenues and expenditure in order to meet business objectives and goals.

Budgetary Control – It is a procedure which is applied by the managers to set

performance objectives for the business organisation. With the help of this reduce amount of

unnecessary expenses and proper utilise resources as per the plan. There are properly utilising

monetary resources by Excite Entertainment to increase profitability as well as productivity of

company. It is also defined in most effective way to handle business activities to assure about the

utilisation of resources (Kihn and Näsi, 2017).

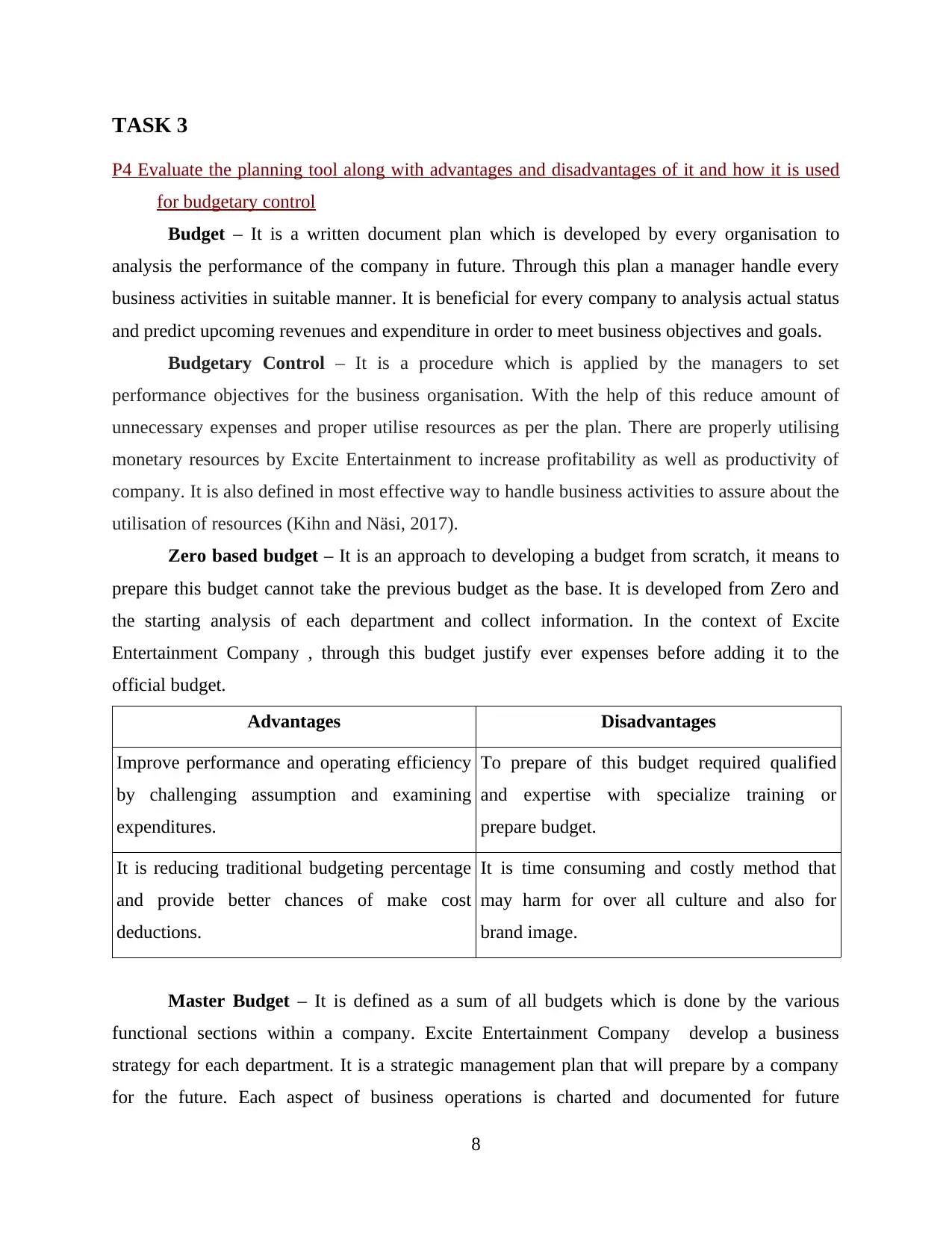

Zero based budget – It is an approach to developing a budget from scratch, it means to

prepare this budget cannot take the previous budget as the base. It is developed from Zero and

the starting analysis of each department and collect information. In the context of Excite

Entertainment Company , through this budget justify ever expenses before adding it to the

official budget.

Advantages Disadvantages

Improve performance and operating efficiency

by challenging assumption and examining

expenditures.

To prepare of this budget required qualified

and expertise with specialize training or

prepare budget.

It is reducing traditional budgeting percentage

and provide better chances of make cost

deductions.

It is time consuming and costly method that

may harm for over all culture and also for

brand image.

Master Budget – It is defined as a sum of all budgets which is done by the various

functional sections within a company. Excite Entertainment Company develop a business

strategy for each department. It is a strategic management plan that will prepare by a company

for the future. Each aspect of business operations is charted and documented for future

8

P4 Evaluate the planning tool along with advantages and disadvantages of it and how it is used

for budgetary control

Budget – It is a written document plan which is developed by every organisation to

analysis the performance of the company in future. Through this plan a manager handle every

business activities in suitable manner. It is beneficial for every company to analysis actual status

and predict upcoming revenues and expenditure in order to meet business objectives and goals.

Budgetary Control – It is a procedure which is applied by the managers to set

performance objectives for the business organisation. With the help of this reduce amount of

unnecessary expenses and proper utilise resources as per the plan. There are properly utilising

monetary resources by Excite Entertainment to increase profitability as well as productivity of

company. It is also defined in most effective way to handle business activities to assure about the

utilisation of resources (Kihn and Näsi, 2017).

Zero based budget – It is an approach to developing a budget from scratch, it means to

prepare this budget cannot take the previous budget as the base. It is developed from Zero and

the starting analysis of each department and collect information. In the context of Excite

Entertainment Company , through this budget justify ever expenses before adding it to the

official budget.

Advantages Disadvantages

Improve performance and operating efficiency

by challenging assumption and examining

expenditures.

To prepare of this budget required qualified

and expertise with specialize training or

prepare budget.

It is reducing traditional budgeting percentage

and provide better chances of make cost

deductions.

It is time consuming and costly method that

may harm for over all culture and also for

brand image.

Master Budget – It is defined as a sum of all budgets which is done by the various

functional sections within a company. Excite Entertainment Company develop a business

strategy for each department. It is a strategic management plan that will prepare by a company

for the future. Each aspect of business operations is charted and documented for future

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

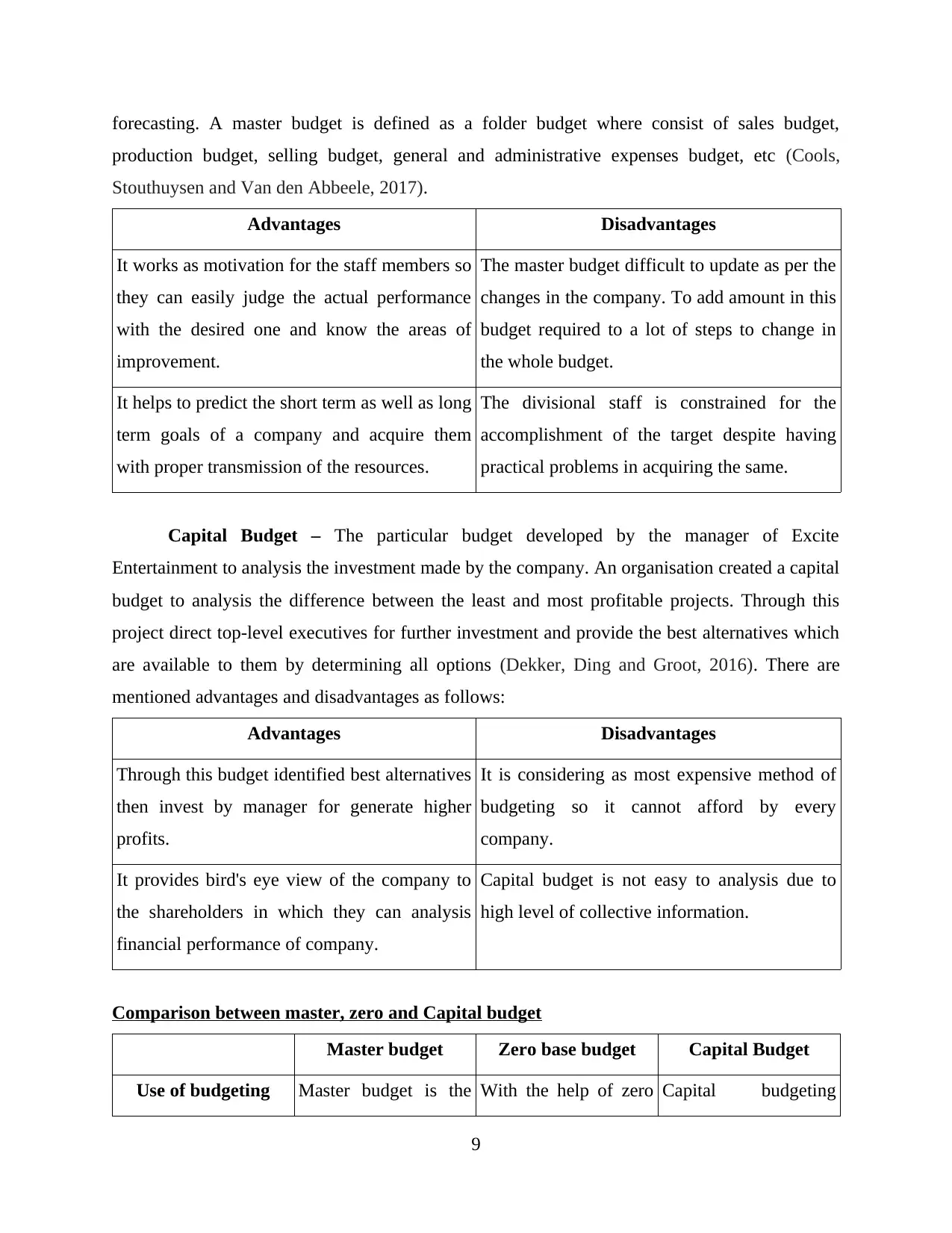

forecasting. A master budget is defined as a folder budget where consist of sales budget,

production budget, selling budget, general and administrative expenses budget, etc (Cools,

Stouthuysen and Van den Abbeele, 2017).

Advantages Disadvantages

It works as motivation for the staff members so

they can easily judge the actual performance

with the desired one and know the areas of

improvement.

The master budget difficult to update as per the

changes in the company. To add amount in this

budget required to a lot of steps to change in

the whole budget.

It helps to predict the short term as well as long

term goals of a company and acquire them

with proper transmission of the resources.

The divisional staff is constrained for the

accomplishment of the target despite having

practical problems in acquiring the same.

Capital Budget – The particular budget developed by the manager of Excite

Entertainment to analysis the investment made by the company. An organisation created a capital

budget to analysis the difference between the least and most profitable projects. Through this

project direct top-level executives for further investment and provide the best alternatives which

are available to them by determining all options (Dekker, Ding and Groot, 2016). There are

mentioned advantages and disadvantages as follows:

Advantages Disadvantages

Through this budget identified best alternatives

then invest by manager for generate higher

profits.

It is considering as most expensive method of

budgeting so it cannot afford by every

company.

It provides bird's eye view of the company to

the shareholders in which they can analysis

financial performance of company.

Capital budget is not easy to analysis due to

high level of collective information.

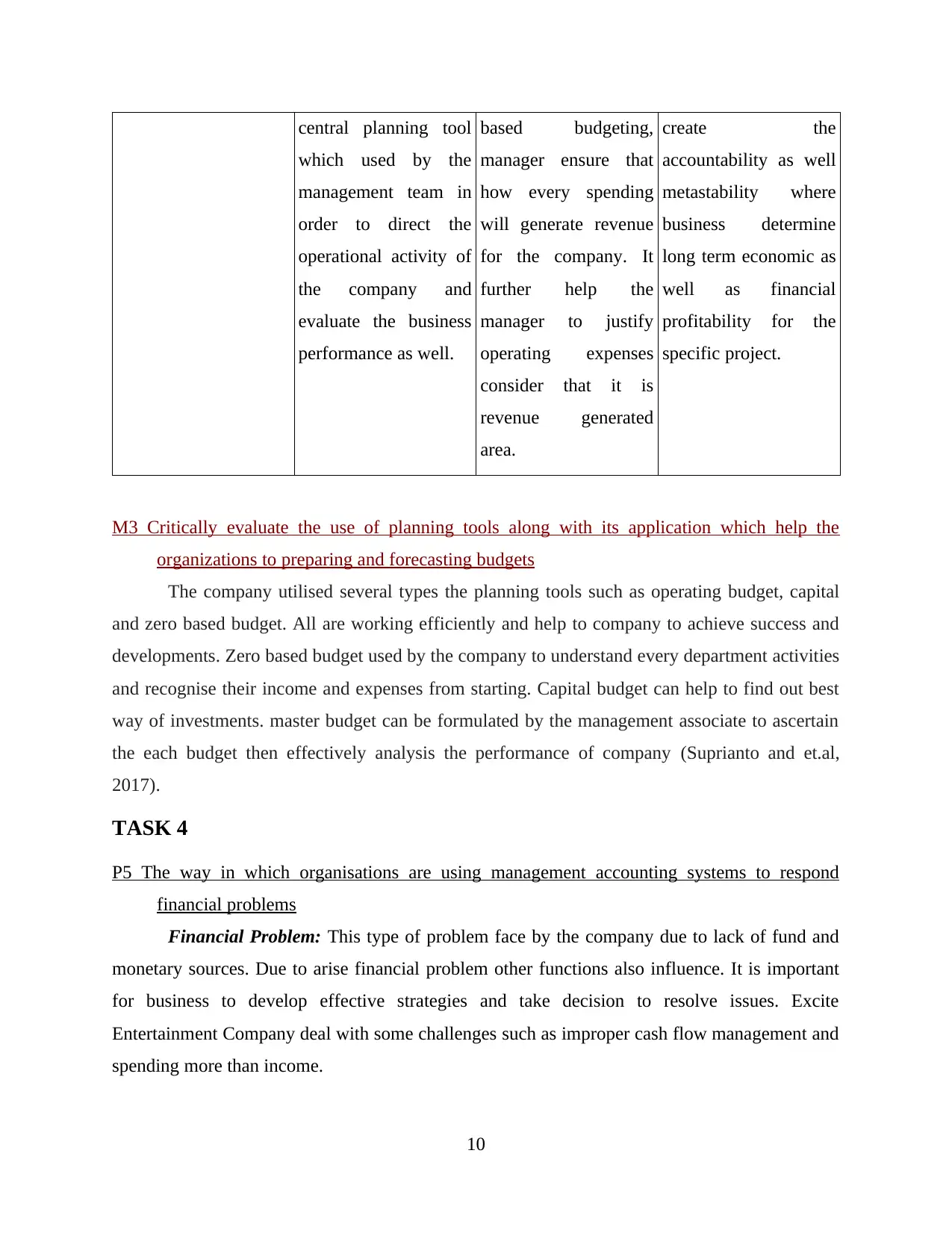

Comparison between master, zero and Capital budget

Master budget Zero base budget Capital Budget

Use of budgeting Master budget is the With the help of zero Capital budgeting

9

production budget, selling budget, general and administrative expenses budget, etc (Cools,

Stouthuysen and Van den Abbeele, 2017).

Advantages Disadvantages

It works as motivation for the staff members so

they can easily judge the actual performance

with the desired one and know the areas of

improvement.

The master budget difficult to update as per the

changes in the company. To add amount in this

budget required to a lot of steps to change in

the whole budget.

It helps to predict the short term as well as long

term goals of a company and acquire them

with proper transmission of the resources.

The divisional staff is constrained for the

accomplishment of the target despite having

practical problems in acquiring the same.

Capital Budget – The particular budget developed by the manager of Excite

Entertainment to analysis the investment made by the company. An organisation created a capital

budget to analysis the difference between the least and most profitable projects. Through this

project direct top-level executives for further investment and provide the best alternatives which

are available to them by determining all options (Dekker, Ding and Groot, 2016). There are

mentioned advantages and disadvantages as follows:

Advantages Disadvantages

Through this budget identified best alternatives

then invest by manager for generate higher

profits.

It is considering as most expensive method of

budgeting so it cannot afford by every

company.

It provides bird's eye view of the company to

the shareholders in which they can analysis

financial performance of company.

Capital budget is not easy to analysis due to

high level of collective information.

Comparison between master, zero and Capital budget

Master budget Zero base budget Capital Budget

Use of budgeting Master budget is the With the help of zero Capital budgeting

9

central planning tool

which used by the

management team in

order to direct the

operational activity of

the company and

evaluate the business

performance as well.

based budgeting,

manager ensure that

how every spending

will generate revenue

for the company. It

further help the

manager to justify

operating expenses

consider that it is

revenue generated

area.

create the

accountability as well

metastability where

business determine

long term economic as

well as financial

profitability for the

specific project.

M3 Critically evaluate the use of planning tools along with its application which help the

organizations to preparing and forecasting budgets

The company utilised several types the planning tools such as operating budget, capital

and zero based budget. All are working efficiently and help to company to achieve success and

developments. Zero based budget used by the company to understand every department activities

and recognise their income and expenses from starting. Capital budget can help to find out best

way of investments. master budget can be formulated by the management associate to ascertain

the each budget then effectively analysis the performance of company (Suprianto and et.al,

2017).

TASK 4

P5 The way in which organisations are using management accounting systems to respond

financial problems

Financial Problem: This type of problem face by the company due to lack of fund and

monetary sources. Due to arise financial problem other functions also influence. It is important

for business to develop effective strategies and take decision to resolve issues. Excite

Entertainment Company deal with some challenges such as improper cash flow management and

spending more than income.

10

which used by the

management team in

order to direct the

operational activity of

the company and

evaluate the business

performance as well.

based budgeting,

manager ensure that

how every spending

will generate revenue

for the company. It

further help the

manager to justify

operating expenses

consider that it is

revenue generated

area.

create the

accountability as well

metastability where

business determine

long term economic as

well as financial

profitability for the

specific project.

M3 Critically evaluate the use of planning tools along with its application which help the

organizations to preparing and forecasting budgets

The company utilised several types the planning tools such as operating budget, capital

and zero based budget. All are working efficiently and help to company to achieve success and

developments. Zero based budget used by the company to understand every department activities

and recognise their income and expenses from starting. Capital budget can help to find out best

way of investments. master budget can be formulated by the management associate to ascertain

the each budget then effectively analysis the performance of company (Suprianto and et.al,

2017).

TASK 4

P5 The way in which organisations are using management accounting systems to respond

financial problems

Financial Problem: This type of problem face by the company due to lack of fund and

monetary sources. Due to arise financial problem other functions also influence. It is important

for business to develop effective strategies and take decision to resolve issues. Excite

Entertainment Company deal with some challenges such as improper cash flow management and

spending more than income.

10

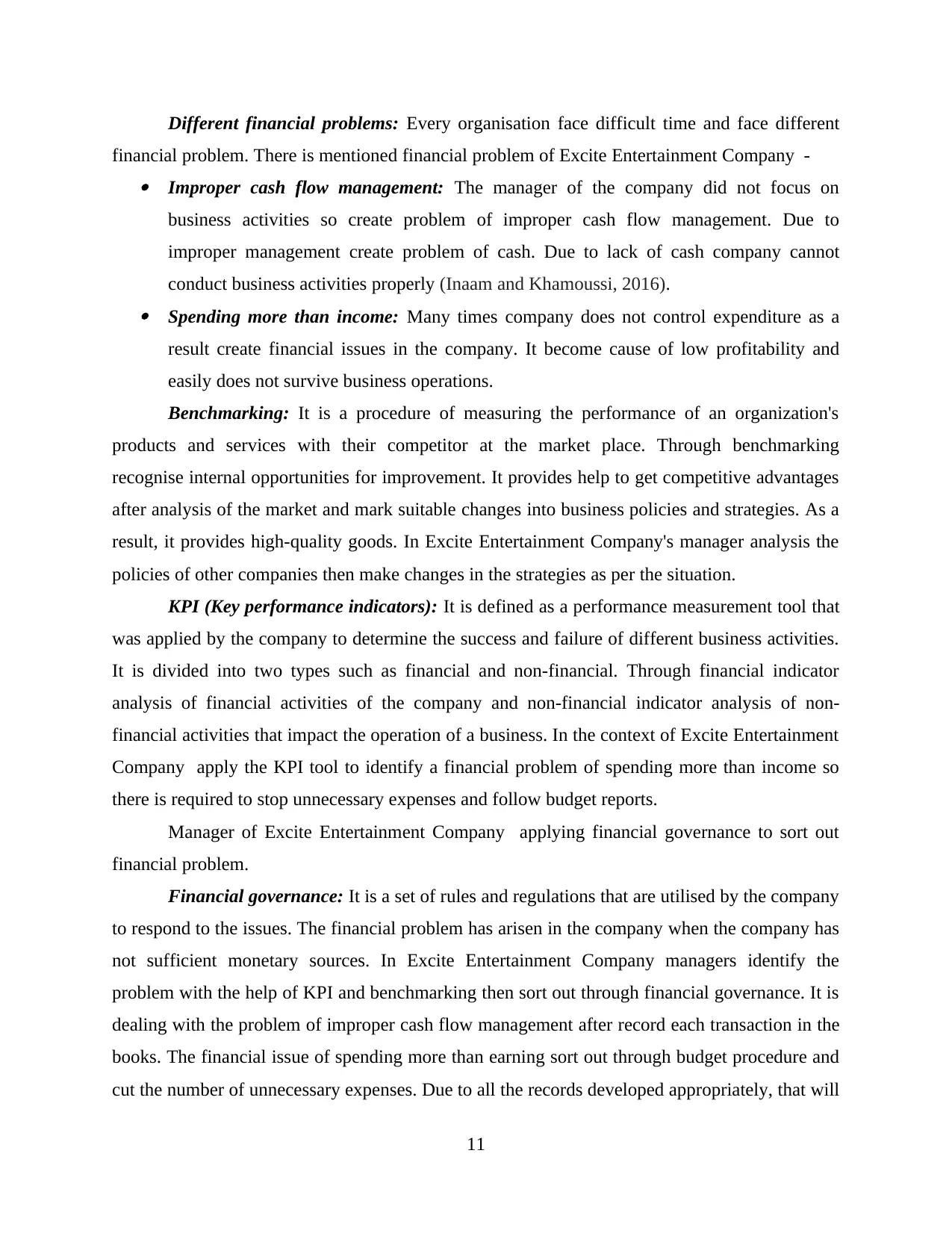

Different financial problems: Every organisation face difficult time and face different

financial problem. There is mentioned financial problem of Excite Entertainment Company - Improper cash flow management: The manager of the company did not focus on

business activities so create problem of improper cash flow management. Due to

improper management create problem of cash. Due to lack of cash company cannot

conduct business activities properly (Inaam and Khamoussi, 2016). Spending more than income: Many times company does not control expenditure as a

result create financial issues in the company. It become cause of low profitability and

easily does not survive business operations.

Benchmarking: It is a procedure of measuring the performance of an organization's

products and services with their competitor at the market place. Through benchmarking

recognise internal opportunities for improvement. It provides help to get competitive advantages

after analysis of the market and mark suitable changes into business policies and strategies. As a

result, it provides high-quality goods. In Excite Entertainment Company's manager analysis the

policies of other companies then make changes in the strategies as per the situation.

KPI (Key performance indicators): It is defined as a performance measurement tool that

was applied by the company to determine the success and failure of different business activities.

It is divided into two types such as financial and non-financial. Through financial indicator

analysis of financial activities of the company and non-financial indicator analysis of non-

financial activities that impact the operation of a business. In the context of Excite Entertainment

Company apply the KPI tool to identify a financial problem of spending more than income so

there is required to stop unnecessary expenses and follow budget reports.

Manager of Excite Entertainment Company applying financial governance to sort out

financial problem.

Financial governance: It is a set of rules and regulations that are utilised by the company

to respond to the issues. The financial problem has arisen in the company when the company has

not sufficient monetary sources. In Excite Entertainment Company managers identify the

problem with the help of KPI and benchmarking then sort out through financial governance. It is

dealing with the problem of improper cash flow management after record each transaction in the

books. The financial issue of spending more than earning sort out through budget procedure and

cut the number of unnecessary expenses. Due to all the records developed appropriately, that will

11

financial problem. There is mentioned financial problem of Excite Entertainment Company - Improper cash flow management: The manager of the company did not focus on

business activities so create problem of improper cash flow management. Due to

improper management create problem of cash. Due to lack of cash company cannot

conduct business activities properly (Inaam and Khamoussi, 2016). Spending more than income: Many times company does not control expenditure as a

result create financial issues in the company. It become cause of low profitability and

easily does not survive business operations.

Benchmarking: It is a procedure of measuring the performance of an organization's

products and services with their competitor at the market place. Through benchmarking

recognise internal opportunities for improvement. It provides help to get competitive advantages

after analysis of the market and mark suitable changes into business policies and strategies. As a

result, it provides high-quality goods. In Excite Entertainment Company's manager analysis the

policies of other companies then make changes in the strategies as per the situation.

KPI (Key performance indicators): It is defined as a performance measurement tool that

was applied by the company to determine the success and failure of different business activities.

It is divided into two types such as financial and non-financial. Through financial indicator

analysis of financial activities of the company and non-financial indicator analysis of non-

financial activities that impact the operation of a business. In the context of Excite Entertainment

Company apply the KPI tool to identify a financial problem of spending more than income so

there is required to stop unnecessary expenses and follow budget reports.

Manager of Excite Entertainment Company applying financial governance to sort out

financial problem.

Financial governance: It is a set of rules and regulations that are utilised by the company

to respond to the issues. The financial problem has arisen in the company when the company has

not sufficient monetary sources. In Excite Entertainment Company managers identify the

problem with the help of KPI and benchmarking then sort out through financial governance. It is

dealing with the problem of improper cash flow management after record each transaction in the

books. The financial issue of spending more than earning sort out through budget procedure and

cut the number of unnecessary expenses. Due to all the records developed appropriately, that will

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

help to develop budgets and face difficult situations effectively (Kumarasiri and Gunasekarage,

2017).

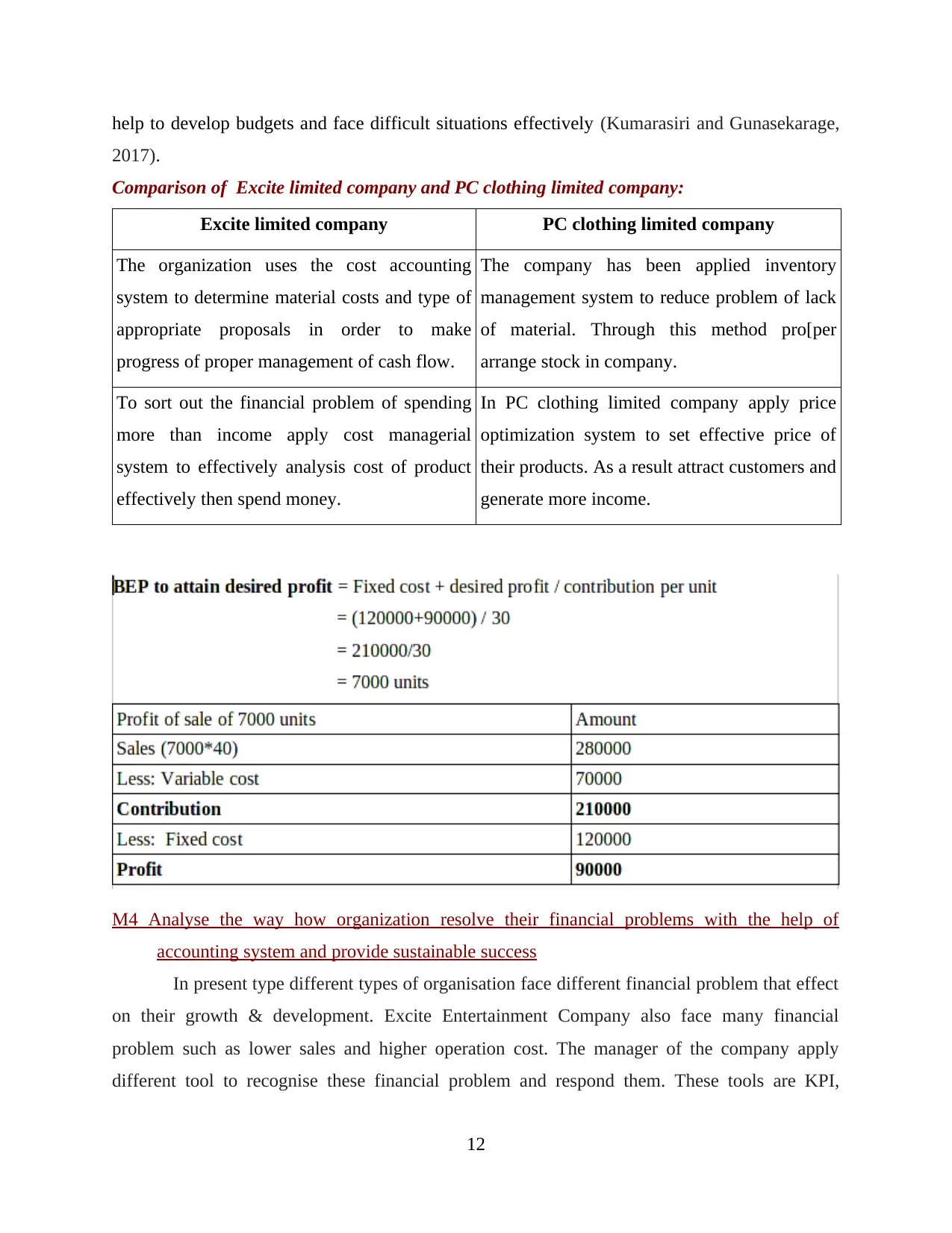

Comparison of Excite limited company and PC clothing limited company:

Excite limited company PC clothing limited company

The organization uses the cost accounting

system to determine material costs and type of

appropriate proposals in order to make

progress of proper management of cash flow.

The company has been applied inventory

management system to reduce problem of lack

of material. Through this method pro[per

arrange stock in company.

To sort out the financial problem of spending

more than income apply cost managerial

system to effectively analysis cost of product

effectively then spend money.

In PC clothing limited company apply price

optimization system to set effective price of

their products. As a result attract customers and

generate more income.

M4 Analyse the way how organization resolve their financial problems with the help of

accounting system and provide sustainable success

In present type different types of organisation face different financial problem that effect

on their growth & development. Excite Entertainment Company also face many financial

problem such as lower sales and higher operation cost. The manager of the company apply

different tool to recognise these financial problem and respond them. These tools are KPI,

12

2017).

Comparison of Excite limited company and PC clothing limited company:

Excite limited company PC clothing limited company

The organization uses the cost accounting

system to determine material costs and type of

appropriate proposals in order to make

progress of proper management of cash flow.

The company has been applied inventory

management system to reduce problem of lack

of material. Through this method pro[per

arrange stock in company.

To sort out the financial problem of spending

more than income apply cost managerial

system to effectively analysis cost of product

effectively then spend money.

In PC clothing limited company apply price

optimization system to set effective price of

their products. As a result attract customers and

generate more income.

M4 Analyse the way how organization resolve their financial problems with the help of

accounting system and provide sustainable success

In present type different types of organisation face different financial problem that effect

on their growth & development. Excite Entertainment Company also face many financial

problem such as lower sales and higher operation cost. The manager of the company apply

different tool to recognise these financial problem and respond them. These tools are KPI,

12

benchmarking and financial governance. Through these tools manager try to resolve the

challenges that faced by them after compare own policies with competitors and determine cost

with competitors that unwanted and following all the accounting principles.

D3 Evaluation of the way in which planning tools can help to resolve financial problems

Planning tools are important part of any organisation such as Capital, operating and zero

base budget has been applied to sort out financial problems. The company prepare different types

of budget that is connected with different types of departments. Through budgets, manager aware

for the problem that become big in future and barrier for the sustainability of company (van

Helden, 2016). The financial problem of lower sales and higher operating cost sort out with the

help of these planning tools in effective manner and finding ways to sort out.

CONCLUSION

From the above discussion it has been concluded that, accounting is the procedure of

developing accounts which present statistical and accurate information. A manager needs to

make day to day decisions as per the collecting information. The management accounting

consists of different types of systems and reports which is integrated with the organisational

procedure. To calculate the cost of net profit applied the costing method such as marginal costing

and absorption costing. There are applying different planning tool to smoothly run organisational

procedure and forecast business performance in advance. There are identified a different

financial problem that is identified through KPI and benchmarking then sort out through

financial governance. With the help of various accounting system, organization able to resolve

their business problems which further affect the productivity as well as profitability of the

company. Managers have to ensure that they make decision which support the operational

activity as well as improve the individual performance.

13

challenges that faced by them after compare own policies with competitors and determine cost

with competitors that unwanted and following all the accounting principles.

D3 Evaluation of the way in which planning tools can help to resolve financial problems

Planning tools are important part of any organisation such as Capital, operating and zero

base budget has been applied to sort out financial problems. The company prepare different types

of budget that is connected with different types of departments. Through budgets, manager aware

for the problem that become big in future and barrier for the sustainability of company (van

Helden, 2016). The financial problem of lower sales and higher operating cost sort out with the

help of these planning tools in effective manner and finding ways to sort out.

CONCLUSION

From the above discussion it has been concluded that, accounting is the procedure of

developing accounts which present statistical and accurate information. A manager needs to

make day to day decisions as per the collecting information. The management accounting

consists of different types of systems and reports which is integrated with the organisational

procedure. To calculate the cost of net profit applied the costing method such as marginal costing

and absorption costing. There are applying different planning tool to smoothly run organisational

procedure and forecast business performance in advance. There are identified a different

financial problem that is identified through KPI and benchmarking then sort out through

financial governance. With the help of various accounting system, organization able to resolve

their business problems which further affect the productivity as well as profitability of the

company. Managers have to ensure that they make decision which support the operational

activity as well as improve the individual performance.

13

REFERENCES

Books & Journals

Brierley, J. A. and Gwilliam, D., 2017. Human Resource Management Issues in Accounting and

Auditing Firms: A Research Perspective: A Research Perspective. Routledge.

Cools, M., Stouthuysen, K. and Van den Abbeele, A., 2017. Management control for stimulating

different types of creativity: The role of budgets. Journal of Management Accounting

Research. 29(3). pp.1-21.

Dekker, H. C., Ding, R. and Groot, T., 2016. Collaborative performance management in

interfirm relationships. Journal of Management Accounting Research. 28(3). pp.25-48.

Feeney, O. and Pierce, B., 2016. Strong structuration theory and accounting information: an

empirical study. Accounting, auditing & accountability journal. 29(7). pp.1152-1176.

Golyagina, A. and Valuckas, D., 2016. Representation of knowledge on some management

accounting techniques in textbooks. Accounting Education. 25(5). pp.479-501.

Guthrie, J. and Parker, L.D., 2016. Whither the accounting profession, accountants and

accounting researchers? Commentary and projections. Accounting, Auditing &

Accountability Journal. 29(1). pp.2-10.

Inaam, Z. and Khamoussi, H., 2016. Audit committee effectiveness, audit quality and earnings

management: a meta-analysis. International Journal of Law and Management. 58(2).

pp.179-196.

Kihn, L. A. and Näsi, S., 2017. Emerging diversity in management accounting research: The

case of Finnish doctoral dissertations, 1945-2015. Journal of accounting &

organizational change. 13(1). pp.131-160.

Kumarasiri, J. and Gunasekarage, A., 2017. Risk regulation, community pressure and the use of

management accounting in managing climate change risk: Australian evidence. The

British Accounting Review. 49(1). pp.25-38.

Mitter, C. and Hiebl, M. R., 2017. The role of management accounting in international

entrepreneurship. Journal of Accounting & Organizational Change. 13(3). pp.381-409.

Pedro-Monzonís, M. and et.al, 2016. Water accounting for stressed river basins based on water

resources management models. Science of the Total Environment. 565. pp.181-190.

Singhvi, N. M. and BODHANWALA, J. R., 2018. Management Accounting: Text and Cases.

PHI Learning Pvt. Ltd..

Suprianto, E. and et.al, 2017. Audit Committee Accounting Expert and Earnings Management

with “Status” Audit Committee as Moderating Variable. Indonesian Journal of

Sustainability Accounting and Management. 1(2). pp.49-58.

Tan, B. S., 2016. Accounting research for the management accounting profession. Journal of

Applied Management Accounting Research. 14(1). pp.69-77.

Van der Stede, W. A., 2017. “Global” management accounting research: some

reflections. Journal of International Accounting Research. 16(2). pp.1-8.

van Helden, J., 2016. Literature review and challenging research agenda on politicians’ use of

accounting information. Public Money & Management. 36(7). pp.531-538.

14

Books & Journals

Brierley, J. A. and Gwilliam, D., 2017. Human Resource Management Issues in Accounting and

Auditing Firms: A Research Perspective: A Research Perspective. Routledge.

Cools, M., Stouthuysen, K. and Van den Abbeele, A., 2017. Management control for stimulating

different types of creativity: The role of budgets. Journal of Management Accounting

Research. 29(3). pp.1-21.

Dekker, H. C., Ding, R. and Groot, T., 2016. Collaborative performance management in

interfirm relationships. Journal of Management Accounting Research. 28(3). pp.25-48.

Feeney, O. and Pierce, B., 2016. Strong structuration theory and accounting information: an

empirical study. Accounting, auditing & accountability journal. 29(7). pp.1152-1176.

Golyagina, A. and Valuckas, D., 2016. Representation of knowledge on some management

accounting techniques in textbooks. Accounting Education. 25(5). pp.479-501.

Guthrie, J. and Parker, L.D., 2016. Whither the accounting profession, accountants and

accounting researchers? Commentary and projections. Accounting, Auditing &

Accountability Journal. 29(1). pp.2-10.

Inaam, Z. and Khamoussi, H., 2016. Audit committee effectiveness, audit quality and earnings

management: a meta-analysis. International Journal of Law and Management. 58(2).

pp.179-196.

Kihn, L. A. and Näsi, S., 2017. Emerging diversity in management accounting research: The

case of Finnish doctoral dissertations, 1945-2015. Journal of accounting &

organizational change. 13(1). pp.131-160.

Kumarasiri, J. and Gunasekarage, A., 2017. Risk regulation, community pressure and the use of

management accounting in managing climate change risk: Australian evidence. The

British Accounting Review. 49(1). pp.25-38.

Mitter, C. and Hiebl, M. R., 2017. The role of management accounting in international

entrepreneurship. Journal of Accounting & Organizational Change. 13(3). pp.381-409.

Pedro-Monzonís, M. and et.al, 2016. Water accounting for stressed river basins based on water

resources management models. Science of the Total Environment. 565. pp.181-190.

Singhvi, N. M. and BODHANWALA, J. R., 2018. Management Accounting: Text and Cases.

PHI Learning Pvt. Ltd..

Suprianto, E. and et.al, 2017. Audit Committee Accounting Expert and Earnings Management

with “Status” Audit Committee as Moderating Variable. Indonesian Journal of

Sustainability Accounting and Management. 1(2). pp.49-58.

Tan, B. S., 2016. Accounting research for the management accounting profession. Journal of

Applied Management Accounting Research. 14(1). pp.69-77.

Van der Stede, W. A., 2017. “Global” management accounting research: some

reflections. Journal of International Accounting Research. 16(2). pp.1-8.

van Helden, J., 2016. Literature review and challenging research agenda on politicians’ use of

accounting information. Public Money & Management. 36(7). pp.531-538.

14

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.