Management Accounting Report: Systems, Costing, and Planning

VerifiedAdded on 2023/01/19

|18

|5305

|54

Report

AI Summary

This report delves into the realm of management accounting, focusing on various systems and methods used for internal financial analysis and decision-making within a manufacturing context. It explores different management accounting systems like cost accounting, inventory management, job costing, and price optimization systems, highlighting their merits and applications. The report further examines diverse management accounting reporting methods, including budget reports, cost reports, execution reports, inventory reports, manufacturing reports, job costing reports, performance reports, and accounts receivable reports, explaining their roles in providing insights for managerial decision-making. Additionally, the report provides a practical demonstration of cost calculation using marginal and absorption costing methods, offering a comparative analysis. The report also outlines different planning tools, discussing their benefits and drawbacks, and illustrates how management accounting techniques can aid in resolving financial problems, providing a comprehensive overview of the subject.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

P1 Management accounting requirement of different type of management accounting systems

.....................................................................................................................................................1

P2 Different methods used for management accounting reporting.............................................3

P3 Calculate cost using marginal and absorption costing method..............................................5

P4 Presenting planning tools along with their benefits and drawbacks......................................8

P5 Explaining how management accounting tools help in resolving financial problems.........10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................................13

Table 1Absorption costing method..................................................................................................5

Table 2Marginal costing method.....................................................................................................5

INTRODUCTION...........................................................................................................................1

P1 Management accounting requirement of different type of management accounting systems

.....................................................................................................................................................1

P2 Different methods used for management accounting reporting.............................................3

P3 Calculate cost using marginal and absorption costing method..............................................5

P4 Presenting planning tools along with their benefits and drawbacks......................................8

P5 Explaining how management accounting tools help in resolving financial problems.........10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................................13

Table 1Absorption costing method..................................................................................................5

Table 2Marginal costing method.....................................................................................................5

INTRODUCTION

Management accounting implies for the internal financial analysis which in turn provides

managers with input for business decision making. In the recent times, with the motive to reduce

cost and enhance profitability company prepares as well as analyzes financial reports. It assists

firms in assigning resources to the business activities effectually and facilitates better decision

making. The present report is based on ABC which is involved in manufacturing activities and

operations. In this report will provide information about various MA systems which can be

undertaken by ABC. Along with this, report will entail how managerial reports can be

undertaken for better decision making. Report will also develop understanding about costing

system namely marginal and absorption. It also depicts benefits and drawbacks associated with

different planning tools. It also entails how planning tools assist in making forecast about future

in financial terms. Report will also shed light on the way through which MA techniques can be

used for responding monetary problem.

P1 Management accounting requirement of different type of management accounting systems

Management accounting is the discipline where accounting related to cost is done by the

business firm. There are number of methods in the management accounting that are used for cost

evaluation like variance analysis etc. Major benefit of using management accounting is that by

using it managers easily identify areas where improvement in performance is required so that

cost can be kept in control and profitability can be enhanced to maximum possible extent. Time

to time managers receive cost related reports and, on that basis, they take actions in order to

analyse and control current situation (Trucco, 2015). There are number of management

accounting systems that are used by the business firms. Some of them are given below. Cost accounting system: Cost accounting system is the one of the most important

accounting system wherein all product line costing is done altogether and overall firm

performance is evaluated in terms of cost control. Further, cost related data is further

segregated in quarters and by analysing data managers come to know whether they lose

or have tight control over expenses in the business. Thus, it can be said that cost

accounting system play a vital role in providing inputs to the managers for making

business decisions. There are number of merits and demerits of the cost accounting

system. Merit is that it provides facts to make decisions and demerit is that it does not

provide in dept information of multiple product line. Cost accounting system is mostly

1

Management accounting implies for the internal financial analysis which in turn provides

managers with input for business decision making. In the recent times, with the motive to reduce

cost and enhance profitability company prepares as well as analyzes financial reports. It assists

firms in assigning resources to the business activities effectually and facilitates better decision

making. The present report is based on ABC which is involved in manufacturing activities and

operations. In this report will provide information about various MA systems which can be

undertaken by ABC. Along with this, report will entail how managerial reports can be

undertaken for better decision making. Report will also develop understanding about costing

system namely marginal and absorption. It also depicts benefits and drawbacks associated with

different planning tools. It also entails how planning tools assist in making forecast about future

in financial terms. Report will also shed light on the way through which MA techniques can be

used for responding monetary problem.

P1 Management accounting requirement of different type of management accounting systems

Management accounting is the discipline where accounting related to cost is done by the

business firm. There are number of methods in the management accounting that are used for cost

evaluation like variance analysis etc. Major benefit of using management accounting is that by

using it managers easily identify areas where improvement in performance is required so that

cost can be kept in control and profitability can be enhanced to maximum possible extent. Time

to time managers receive cost related reports and, on that basis, they take actions in order to

analyse and control current situation (Trucco, 2015). There are number of management

accounting systems that are used by the business firms. Some of them are given below. Cost accounting system: Cost accounting system is the one of the most important

accounting system wherein all product line costing is done altogether and overall firm

performance is evaluated in terms of cost control. Further, cost related data is further

segregated in quarters and by analysing data managers come to know whether they lose

or have tight control over expenses in the business. Thus, it can be said that cost

accounting system play a vital role in providing inputs to the managers for making

business decisions. There are number of merits and demerits of the cost accounting

system. Merit is that it provides facts to make decisions and demerit is that it does not

provide in dept information of multiple product line. Cost accounting system is mostly

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

used by the firms having single product line. However, with addition of new product firm

overnight can not change its entire cost accounting system. Hence, by following same

approach firm consistently make cost accounting decisions which lead to making of less

prudent decisions. Thus, cost accounting system must be used only by those firms that

have single product line. Inventory management system: Inventory management system is one under which

information related to inventory is stored. Facts in the inventory management system

provide management information about size of inventory they currently have (Jamil and

et.al., 2015). On basis of this information managers identify quantity of raw item that

they will need to purchase in future time period for production of units. Entire database is

available to the managers and on that basis, they identify trends that were prevailed in

past time period like average quantity of raw item that purchase in a month and quantity

of same which remain unused etc. Availability of such kind of information assist

managers in making prudent decisions which ultimately lead to improvement in

efficiency of business operations. Thus, it can be said that inventory management system

has due importance for the business firm. Job costing system: It is the accounting system where accounting related to multiple

product line is done individually. Thus, manager have information about each product

line individually. Manager know that which product line cost is in control or out of

control. Moreover, they also have information that which sort of cost increase at rapid

pace in overall cost of product line. Thus, if there are multiple product lines operated by

the firm then in that case job costing system is the one of best option. Many times, it

happened that in case of specific product performance is good and in case of other one

same is relatively bad (Malina, 2017). It is the job costing system which assist manager in

deep diving in to cost structure and identify actual areas where lot of work need to be

done so that cost of production can be minimized to maximum possible extent. Price optimization system: Under price optimization system mathematical models are

used because by using them business firm can determine optimum combination of goods

that must be manufacture in order to make best use of resource and to control cost of

production in the business. It also includes mathematical model which do sensitivity

analysis and indicate units that must be produced to achieve minimum possible cost in the

2

overnight can not change its entire cost accounting system. Hence, by following same

approach firm consistently make cost accounting decisions which lead to making of less

prudent decisions. Thus, cost accounting system must be used only by those firms that

have single product line. Inventory management system: Inventory management system is one under which

information related to inventory is stored. Facts in the inventory management system

provide management information about size of inventory they currently have (Jamil and

et.al., 2015). On basis of this information managers identify quantity of raw item that

they will need to purchase in future time period for production of units. Entire database is

available to the managers and on that basis, they identify trends that were prevailed in

past time period like average quantity of raw item that purchase in a month and quantity

of same which remain unused etc. Availability of such kind of information assist

managers in making prudent decisions which ultimately lead to improvement in

efficiency of business operations. Thus, it can be said that inventory management system

has due importance for the business firm. Job costing system: It is the accounting system where accounting related to multiple

product line is done individually. Thus, manager have information about each product

line individually. Manager know that which product line cost is in control or out of

control. Moreover, they also have information that which sort of cost increase at rapid

pace in overall cost of product line. Thus, if there are multiple product lines operated by

the firm then in that case job costing system is the one of best option. Many times, it

happened that in case of specific product performance is good and in case of other one

same is relatively bad (Malina, 2017). It is the job costing system which assist manager in

deep diving in to cost structure and identify actual areas where lot of work need to be

done so that cost of production can be minimized to maximum possible extent. Price optimization system: Under price optimization system mathematical models are

used because by using them business firm can determine optimum combination of goods

that must be manufacture in order to make best use of resource and to control cost of

production in the business. It also includes mathematical model which do sensitivity

analysis and indicate units that must be produced to achieve minimum possible cost in the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business. Thus, it can be said that there is huge significance of the price optimization

system for the business firms.

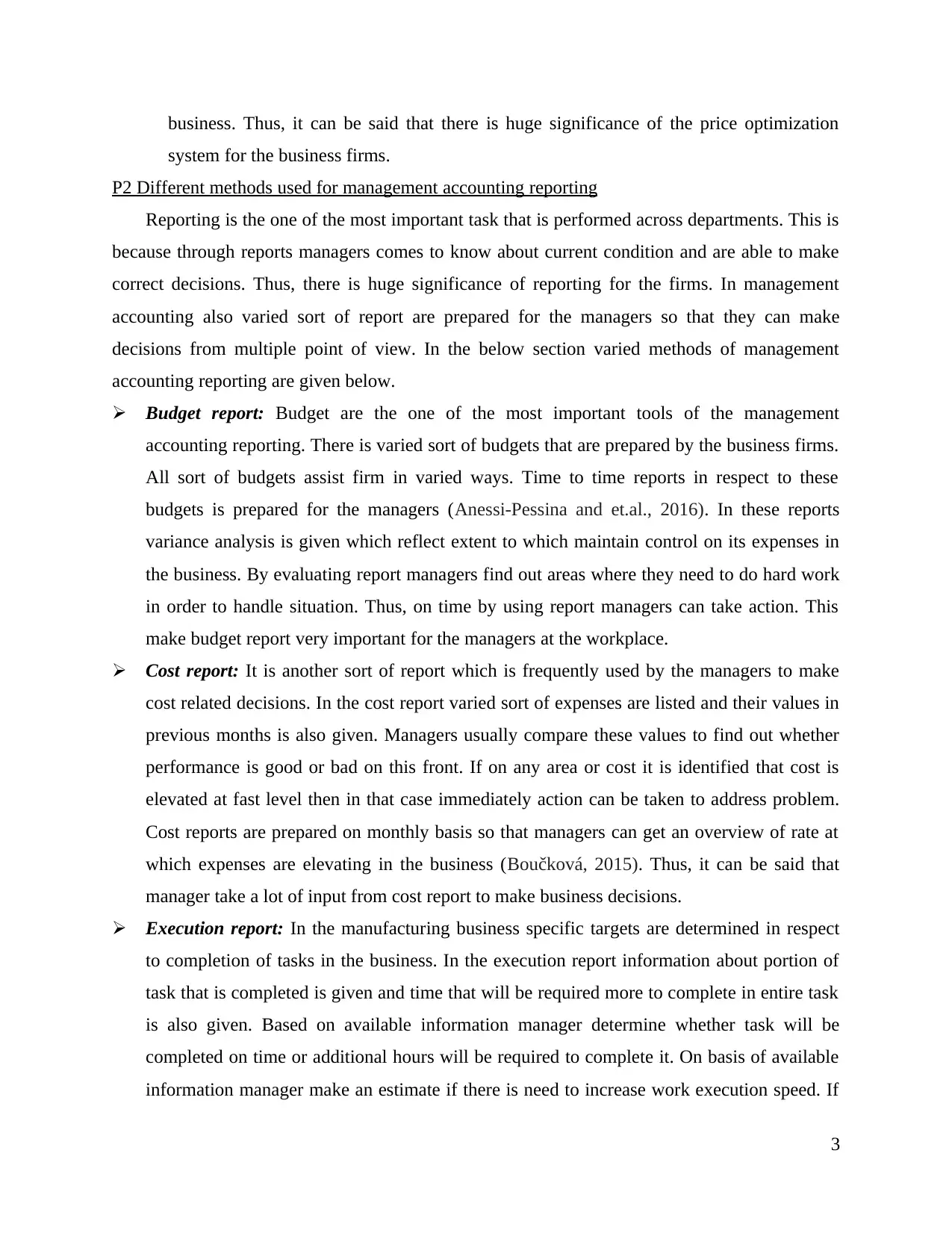

P2 Different methods used for management accounting reporting

Reporting is the one of the most important task that is performed across departments. This is

because through reports managers comes to know about current condition and are able to make

correct decisions. Thus, there is huge significance of reporting for the firms. In management

accounting also varied sort of report are prepared for the managers so that they can make

decisions from multiple point of view. In the below section varied methods of management

accounting reporting are given below.

Budget report: Budget are the one of the most important tools of the management

accounting reporting. There is varied sort of budgets that are prepared by the business firms.

All sort of budgets assist firm in varied ways. Time to time reports in respect to these

budgets is prepared for the managers (Anessi-Pessina and et.al., 2016). In these reports

variance analysis is given which reflect extent to which maintain control on its expenses in

the business. By evaluating report managers find out areas where they need to do hard work

in order to handle situation. Thus, on time by using report managers can take action. This

make budget report very important for the managers at the workplace.

Cost report: It is another sort of report which is frequently used by the managers to make

cost related decisions. In the cost report varied sort of expenses are listed and their values in

previous months is also given. Managers usually compare these values to find out whether

performance is good or bad on this front. If on any area or cost it is identified that cost is

elevated at fast level then in that case immediately action can be taken to address problem.

Cost reports are prepared on monthly basis so that managers can get an overview of rate at

which expenses are elevating in the business (Boučková, 2015). Thus, it can be said that

manager take a lot of input from cost report to make business decisions.

Execution report: In the manufacturing business specific targets are determined in respect

to completion of tasks in the business. In the execution report information about portion of

task that is completed is given and time that will be required more to complete in entire task

is also given. Based on available information manager determine whether task will be

completed on time or additional hours will be required to complete it. On basis of available

information manager make an estimate if there is need to increase work execution speed. If

3

system for the business firms.

P2 Different methods used for management accounting reporting

Reporting is the one of the most important task that is performed across departments. This is

because through reports managers comes to know about current condition and are able to make

correct decisions. Thus, there is huge significance of reporting for the firms. In management

accounting also varied sort of report are prepared for the managers so that they can make

decisions from multiple point of view. In the below section varied methods of management

accounting reporting are given below.

Budget report: Budget are the one of the most important tools of the management

accounting reporting. There is varied sort of budgets that are prepared by the business firms.

All sort of budgets assist firm in varied ways. Time to time reports in respect to these

budgets is prepared for the managers (Anessi-Pessina and et.al., 2016). In these reports

variance analysis is given which reflect extent to which maintain control on its expenses in

the business. By evaluating report managers find out areas where they need to do hard work

in order to handle situation. Thus, on time by using report managers can take action. This

make budget report very important for the managers at the workplace.

Cost report: It is another sort of report which is frequently used by the managers to make

cost related decisions. In the cost report varied sort of expenses are listed and their values in

previous months is also given. Managers usually compare these values to find out whether

performance is good or bad on this front. If on any area or cost it is identified that cost is

elevated at fast level then in that case immediately action can be taken to address problem.

Cost reports are prepared on monthly basis so that managers can get an overview of rate at

which expenses are elevating in the business (Boučková, 2015). Thus, it can be said that

manager take a lot of input from cost report to make business decisions.

Execution report: In the manufacturing business specific targets are determined in respect

to completion of tasks in the business. In the execution report information about portion of

task that is completed is given and time that will be required more to complete in entire task

is also given. Based on available information manager determine whether task will be

completed on time or additional hours will be required to complete it. On basis of available

information manager make an estimate if there is need to increase work execution speed. If

3

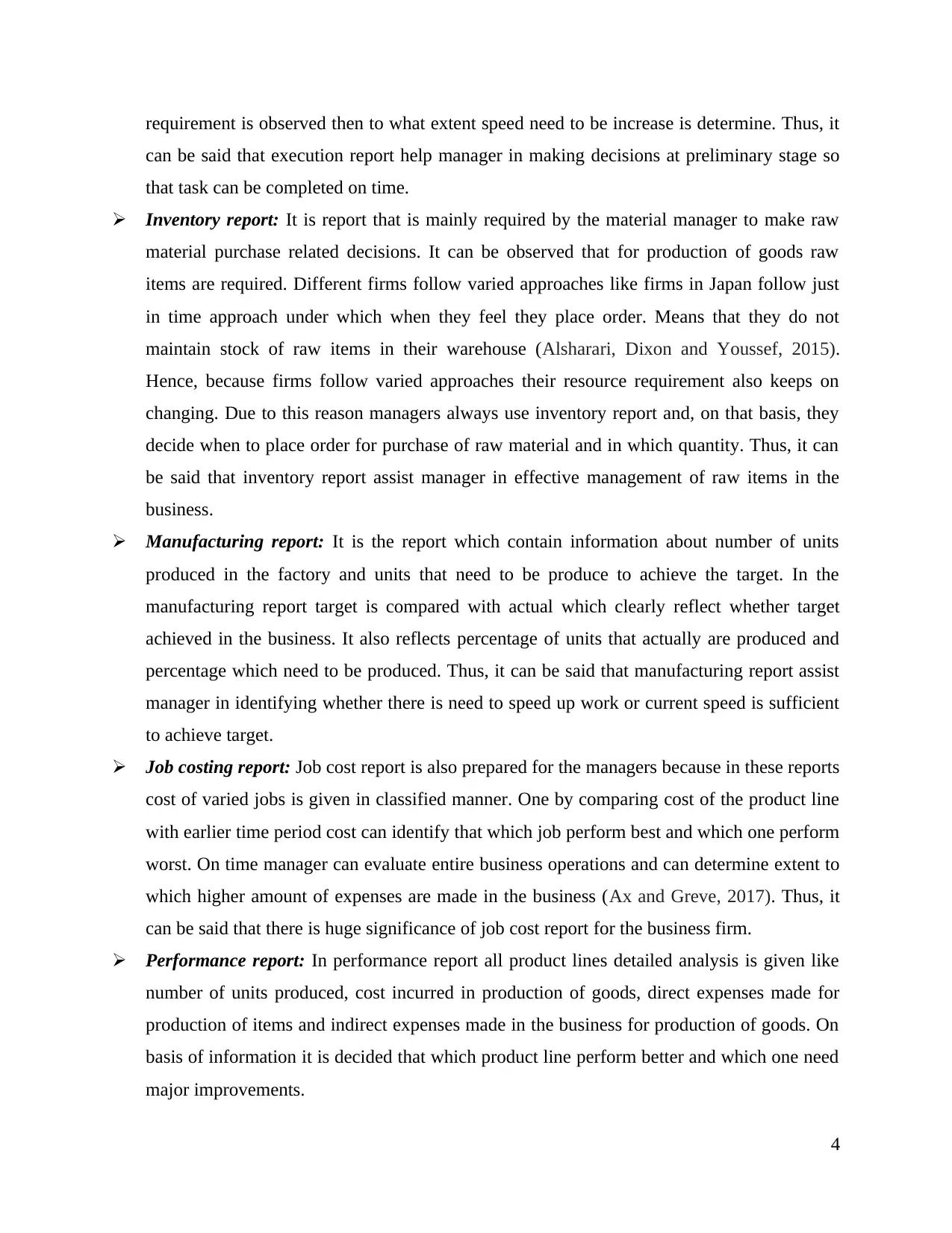

requirement is observed then to what extent speed need to be increase is determine. Thus, it

can be said that execution report help manager in making decisions at preliminary stage so

that task can be completed on time.

Inventory report: It is report that is mainly required by the material manager to make raw

material purchase related decisions. It can be observed that for production of goods raw

items are required. Different firms follow varied approaches like firms in Japan follow just

in time approach under which when they feel they place order. Means that they do not

maintain stock of raw items in their warehouse (Alsharari, Dixon and Youssef, 2015).

Hence, because firms follow varied approaches their resource requirement also keeps on

changing. Due to this reason managers always use inventory report and, on that basis, they

decide when to place order for purchase of raw material and in which quantity. Thus, it can

be said that inventory report assist manager in effective management of raw items in the

business.

Manufacturing report: It is the report which contain information about number of units

produced in the factory and units that need to be produce to achieve the target. In the

manufacturing report target is compared with actual which clearly reflect whether target

achieved in the business. It also reflects percentage of units that actually are produced and

percentage which need to be produced. Thus, it can be said that manufacturing report assist

manager in identifying whether there is need to speed up work or current speed is sufficient

to achieve target.

Job costing report: Job cost report is also prepared for the managers because in these reports

cost of varied jobs is given in classified manner. One by comparing cost of the product line

with earlier time period cost can identify that which job perform best and which one perform

worst. On time manager can evaluate entire business operations and can determine extent to

which higher amount of expenses are made in the business (Ax and Greve, 2017). Thus, it

can be said that there is huge significance of job cost report for the business firm.

Performance report: In performance report all product lines detailed analysis is given like

number of units produced, cost incurred in production of goods, direct expenses made for

production of items and indirect expenses made in the business for production of goods. On

basis of information it is decided that which product line perform better and which one need

major improvements.

4

can be said that execution report help manager in making decisions at preliminary stage so

that task can be completed on time.

Inventory report: It is report that is mainly required by the material manager to make raw

material purchase related decisions. It can be observed that for production of goods raw

items are required. Different firms follow varied approaches like firms in Japan follow just

in time approach under which when they feel they place order. Means that they do not

maintain stock of raw items in their warehouse (Alsharari, Dixon and Youssef, 2015).

Hence, because firms follow varied approaches their resource requirement also keeps on

changing. Due to this reason managers always use inventory report and, on that basis, they

decide when to place order for purchase of raw material and in which quantity. Thus, it can

be said that inventory report assist manager in effective management of raw items in the

business.

Manufacturing report: It is the report which contain information about number of units

produced in the factory and units that need to be produce to achieve the target. In the

manufacturing report target is compared with actual which clearly reflect whether target

achieved in the business. It also reflects percentage of units that actually are produced and

percentage which need to be produced. Thus, it can be said that manufacturing report assist

manager in identifying whether there is need to speed up work or current speed is sufficient

to achieve target.

Job costing report: Job cost report is also prepared for the managers because in these reports

cost of varied jobs is given in classified manner. One by comparing cost of the product line

with earlier time period cost can identify that which job perform best and which one perform

worst. On time manager can evaluate entire business operations and can determine extent to

which higher amount of expenses are made in the business (Ax and Greve, 2017). Thus, it

can be said that there is huge significance of job cost report for the business firm.

Performance report: In performance report all product lines detailed analysis is given like

number of units produced, cost incurred in production of goods, direct expenses made for

production of items and indirect expenses made in the business for production of goods. On

basis of information it is decided that which product line perform better and which one need

major improvements.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Account receivable report: Account receivable report indicate amount of goods that are sold

on credit basis to the customers. In context of management accounting its use is slightly

different. In case of management accounting account receivable indicate quantity of semi-

finished goods that are sold on credit basis to the customers. Managers need account

receivable report to identify customers to which large amount of goods are sold on credit

basis. On basis of such kind of information firm further ensure that sell of goods on credit

basis to the specific customer will be avoided (Carlsson-Wall, Kraus and Lind, 2015). This

is because if large quantity of goods will be sold on credit basis and debtor become default

then in that case large amount of cash will be blocked in the account receivable. So, time to

time managers prefer to make use of account receivable report to avoid such kind of

conditions in the business.

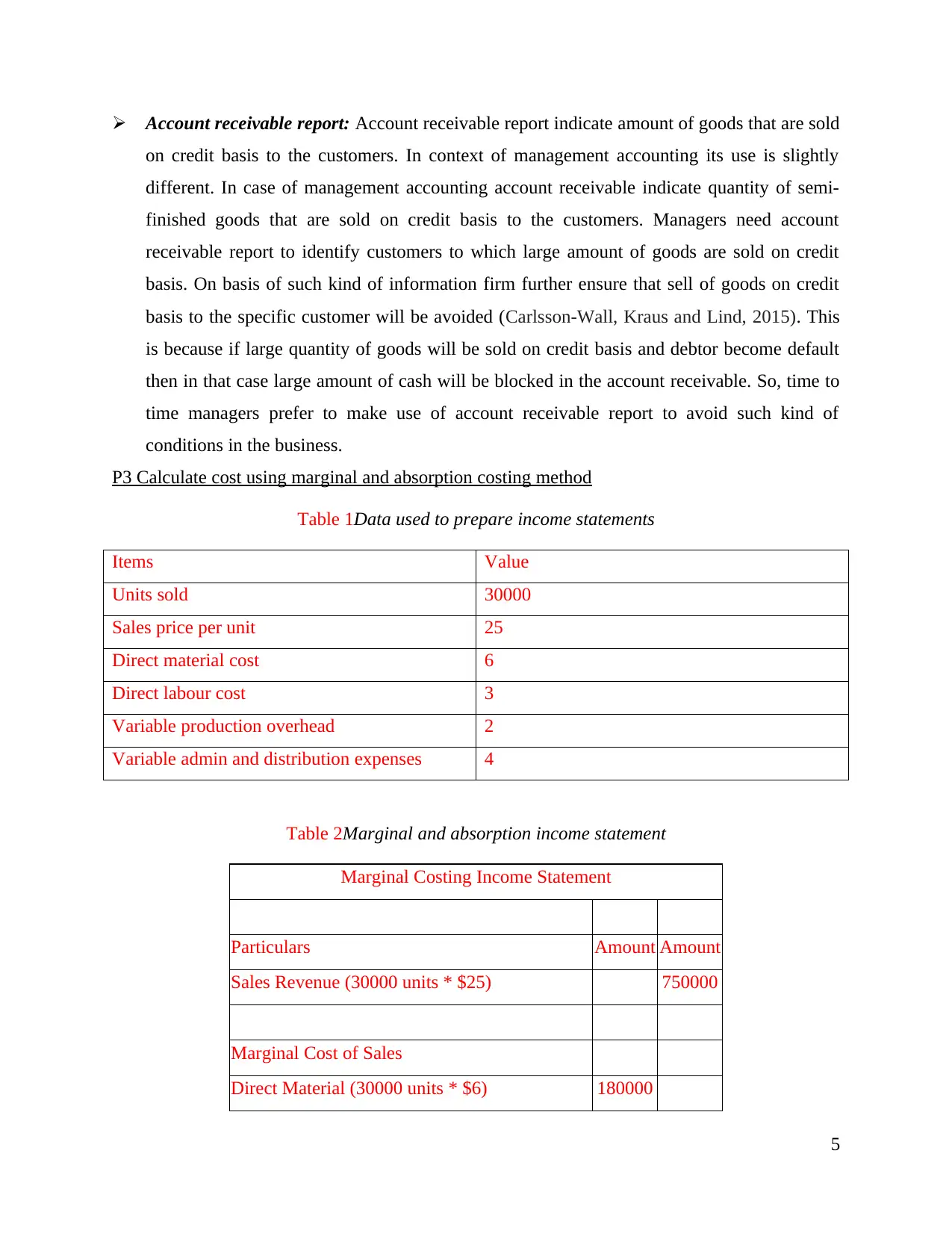

P3 Calculate cost using marginal and absorption costing method

Table 1Data used to prepare income statements

Items Value

Units sold 30000

Sales price per unit 25

Direct material cost 6

Direct labour cost 3

Variable production overhead 2

Variable admin and distribution expenses 4

Table 2Marginal and absorption income statement

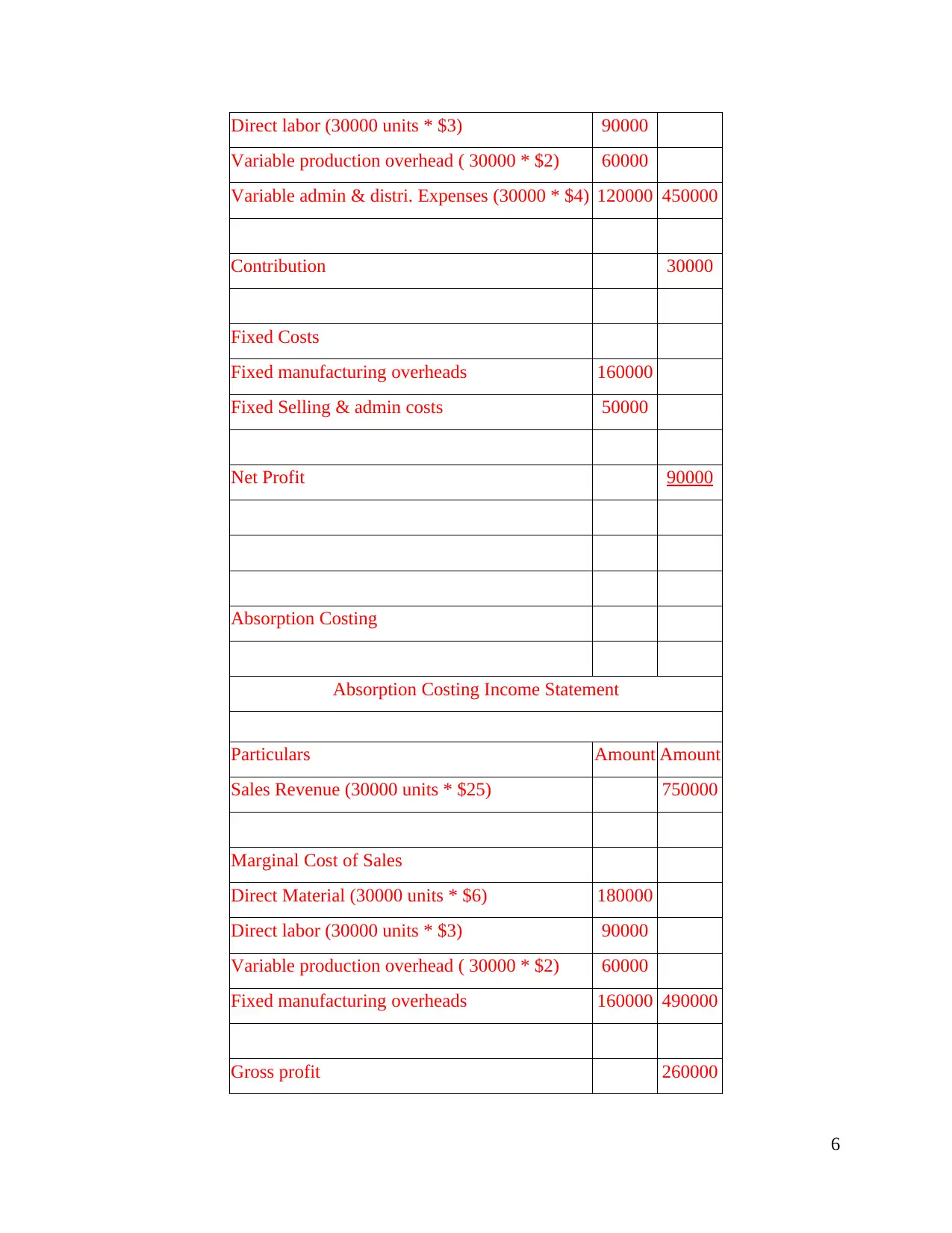

Marginal Costing Income Statement

Particulars Amount Amount

Sales Revenue (30000 units * $25) 750000

Marginal Cost of Sales

Direct Material (30000 units * $6) 180000

5

on credit basis to the customers. In context of management accounting its use is slightly

different. In case of management accounting account receivable indicate quantity of semi-

finished goods that are sold on credit basis to the customers. Managers need account

receivable report to identify customers to which large amount of goods are sold on credit

basis. On basis of such kind of information firm further ensure that sell of goods on credit

basis to the specific customer will be avoided (Carlsson-Wall, Kraus and Lind, 2015). This

is because if large quantity of goods will be sold on credit basis and debtor become default

then in that case large amount of cash will be blocked in the account receivable. So, time to

time managers prefer to make use of account receivable report to avoid such kind of

conditions in the business.

P3 Calculate cost using marginal and absorption costing method

Table 1Data used to prepare income statements

Items Value

Units sold 30000

Sales price per unit 25

Direct material cost 6

Direct labour cost 3

Variable production overhead 2

Variable admin and distribution expenses 4

Table 2Marginal and absorption income statement

Marginal Costing Income Statement

Particulars Amount Amount

Sales Revenue (30000 units * $25) 750000

Marginal Cost of Sales

Direct Material (30000 units * $6) 180000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct labor (30000 units * $3) 90000

Variable production overhead ( 30000 * $2) 60000

Variable admin & distri. Expenses (30000 * $4) 120000 450000

Contribution 30000

Fixed Costs

Fixed manufacturing overheads 160000

Fixed Selling & admin costs 50000

Net Profit 90000

Absorption Costing

Absorption Costing Income Statement

Particulars Amount Amount

Sales Revenue (30000 units * $25) 750000

Marginal Cost of Sales

Direct Material (30000 units * $6) 180000

Direct labor (30000 units * $3) 90000

Variable production overhead ( 30000 * $2) 60000

Fixed manufacturing overheads 160000 490000

Gross profit 260000

6

Variable production overhead ( 30000 * $2) 60000

Variable admin & distri. Expenses (30000 * $4) 120000 450000

Contribution 30000

Fixed Costs

Fixed manufacturing overheads 160000

Fixed Selling & admin costs 50000

Net Profit 90000

Absorption Costing

Absorption Costing Income Statement

Particulars Amount Amount

Sales Revenue (30000 units * $25) 750000

Marginal Cost of Sales

Direct Material (30000 units * $6) 180000

Direct labor (30000 units * $3) 90000

Variable production overhead ( 30000 * $2) 60000

Fixed manufacturing overheads 160000 490000

Gross profit 260000

6

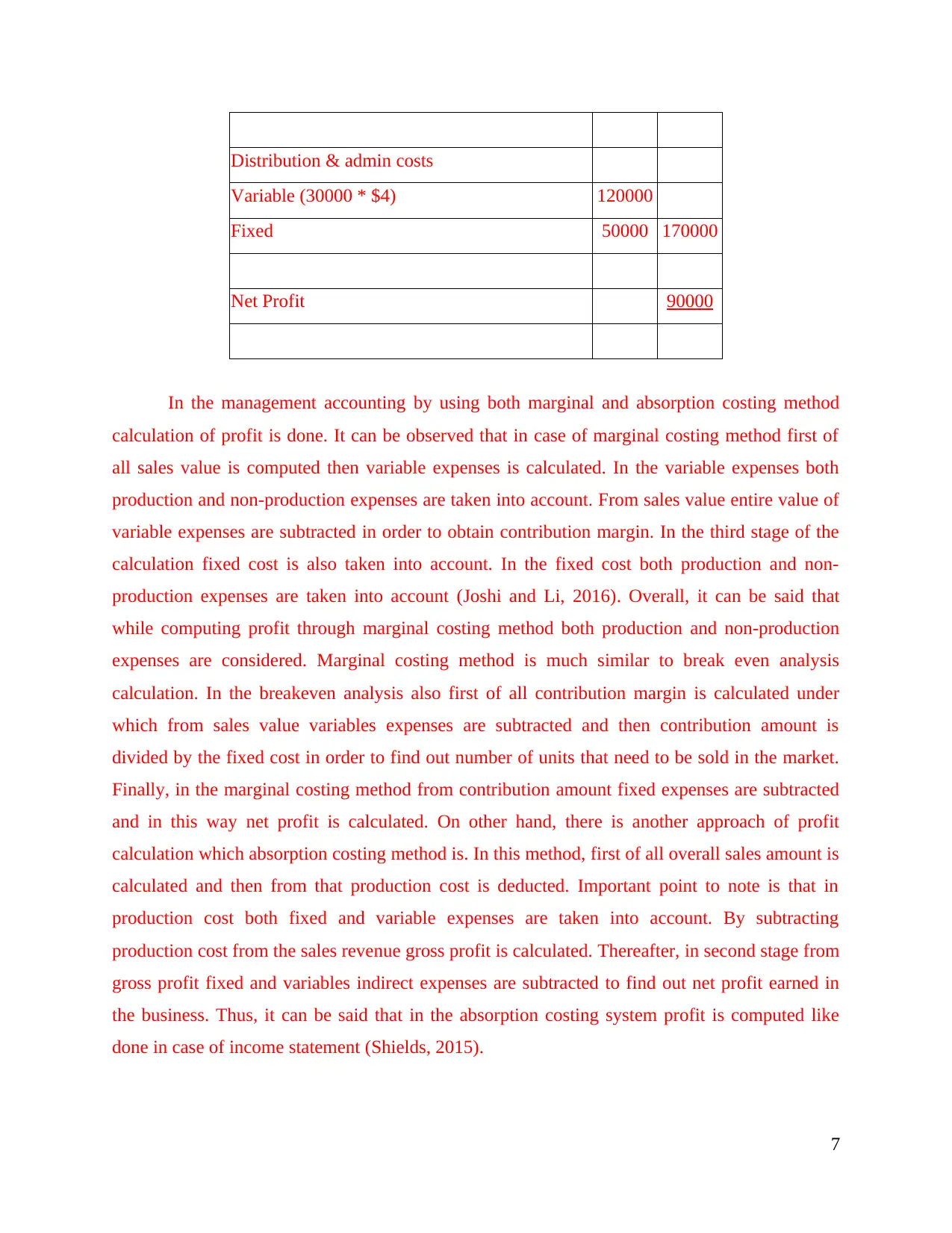

Distribution & admin costs

Variable (30000 * $4) 120000

Fixed 50000 170000

Net Profit 90000

In the management accounting by using both marginal and absorption costing method

calculation of profit is done. It can be observed that in case of marginal costing method first of

all sales value is computed then variable expenses is calculated. In the variable expenses both

production and non-production expenses are taken into account. From sales value entire value of

variable expenses are subtracted in order to obtain contribution margin. In the third stage of the

calculation fixed cost is also taken into account. In the fixed cost both production and non-

production expenses are taken into account (Joshi and Li, 2016). Overall, it can be said that

while computing profit through marginal costing method both production and non-production

expenses are considered. Marginal costing method is much similar to break even analysis

calculation. In the breakeven analysis also first of all contribution margin is calculated under

which from sales value variables expenses are subtracted and then contribution amount is

divided by the fixed cost in order to find out number of units that need to be sold in the market.

Finally, in the marginal costing method from contribution amount fixed expenses are subtracted

and in this way net profit is calculated. On other hand, there is another approach of profit

calculation which absorption costing method is. In this method, first of all overall sales amount is

calculated and then from that production cost is deducted. Important point to note is that in

production cost both fixed and variable expenses are taken into account. By subtracting

production cost from the sales revenue gross profit is calculated. Thereafter, in second stage from

gross profit fixed and variables indirect expenses are subtracted to find out net profit earned in

the business. Thus, it can be said that in the absorption costing system profit is computed like

done in case of income statement (Shields, 2015).

7

Variable (30000 * $4) 120000

Fixed 50000 170000

Net Profit 90000

In the management accounting by using both marginal and absorption costing method

calculation of profit is done. It can be observed that in case of marginal costing method first of

all sales value is computed then variable expenses is calculated. In the variable expenses both

production and non-production expenses are taken into account. From sales value entire value of

variable expenses are subtracted in order to obtain contribution margin. In the third stage of the

calculation fixed cost is also taken into account. In the fixed cost both production and non-

production expenses are taken into account (Joshi and Li, 2016). Overall, it can be said that

while computing profit through marginal costing method both production and non-production

expenses are considered. Marginal costing method is much similar to break even analysis

calculation. In the breakeven analysis also first of all contribution margin is calculated under

which from sales value variables expenses are subtracted and then contribution amount is

divided by the fixed cost in order to find out number of units that need to be sold in the market.

Finally, in the marginal costing method from contribution amount fixed expenses are subtracted

and in this way net profit is calculated. On other hand, there is another approach of profit

calculation which absorption costing method is. In this method, first of all overall sales amount is

calculated and then from that production cost is deducted. Important point to note is that in

production cost both fixed and variable expenses are taken into account. By subtracting

production cost from the sales revenue gross profit is calculated. Thereafter, in second stage from

gross profit fixed and variables indirect expenses are subtracted to find out net profit earned in

the business. Thus, it can be said that in the absorption costing system profit is computed like

done in case of income statement (Shields, 2015).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In case of absorption costing method, it can be seen from above table that sales of 750000

is made and in relation to that expenses of actual overhead 490000 is made. Table revealed that

30000 values of units are produced. Overall, gross profit earned in the business is equal to

260000. In sales and distribution expenses fixed expenses made are equal to 170000 and variable

expenses made are equal to 7875. Ultimately, overall sales and distribution expenses are equal to

120000. Hence, profit observed for the period is 90000 significantly. This fact is observed in

case of absorption costing method. On other hand, in case of marginal costing method, fixed cost

of 210000 is taken in to account because of which computed profit is equal to 90000. This

reflects that profit increased in case of marginal costing method. It can be said that fixed cost is

very high in the business specially manufacturing overhead.

P4 Presenting planning tools along with their benefits and drawbacks

Budget may be served as a financial plan which includes planned sales revenue,

expenditures and other expenditure Budgeting systems which help in making prediction about

future mainly includes cash, operating, activity and zero based budget. However, benefits and

drawbacks that associated with different budgeting systems are enumerated below:

Activity based budgeting

This method does not consider previous year’s budget for arriving at the current one.

Activity based method assists company in identifying and making better allocation of overhead

expenses. It brings efficiency in the operations because in this budgets are prepared after

justifying cost drivers. Hence, by using such method ABC can analyze cost deeply in line with

the resources allocated to an activity.

Advantages

Helps company in saving cost by eliminating unnecessary activities. Accordingly, by

offering products to the customers at lower prices company can get competitive

advantage.

Ensures elimination of bottlenecks because in this budgets are prepared after deep

research and analysis (Activity based budgeting benefits and drawbacks, 2019)

Assists in improving relationship with customers by providing them with products at

suitable prices.

8

is made and in relation to that expenses of actual overhead 490000 is made. Table revealed that

30000 values of units are produced. Overall, gross profit earned in the business is equal to

260000. In sales and distribution expenses fixed expenses made are equal to 170000 and variable

expenses made are equal to 7875. Ultimately, overall sales and distribution expenses are equal to

120000. Hence, profit observed for the period is 90000 significantly. This fact is observed in

case of absorption costing method. On other hand, in case of marginal costing method, fixed cost

of 210000 is taken in to account because of which computed profit is equal to 90000. This

reflects that profit increased in case of marginal costing method. It can be said that fixed cost is

very high in the business specially manufacturing overhead.

P4 Presenting planning tools along with their benefits and drawbacks

Budget may be served as a financial plan which includes planned sales revenue,

expenditures and other expenditure Budgeting systems which help in making prediction about

future mainly includes cash, operating, activity and zero based budget. However, benefits and

drawbacks that associated with different budgeting systems are enumerated below:

Activity based budgeting

This method does not consider previous year’s budget for arriving at the current one.

Activity based method assists company in identifying and making better allocation of overhead

expenses. It brings efficiency in the operations because in this budgets are prepared after

justifying cost drivers. Hence, by using such method ABC can analyze cost deeply in line with

the resources allocated to an activity.

Advantages

Helps company in saving cost by eliminating unnecessary activities. Accordingly, by

offering products to the customers at lower prices company can get competitive

advantage.

Ensures elimination of bottlenecks because in this budgets are prepared after deep

research and analysis (Activity based budgeting benefits and drawbacks, 2019)

Assists in improving relationship with customers by providing them with products at

suitable prices.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Disadvantages

In order to develop budget according to ABC individual must have deep understanding

about every functional area of business.

High complex due to the inclusion of various activities in operations

For drafting budget as per ABC business unit needs to appoint top and trained officials

for conducting analysis. This in turn imposes high cost in front of company.

Zero based budgeting

ABC can develop competent financial framework by undertaking such budgeting system.

Moreover, it emphasizes on making assessment of income and expenses according to the

activities that need to be performed during the specified period. In this, business unit makes

focus on identifying alternative ways for performing activities. In this, all the expenses and

income are clearly justified. Such budgeting framework starts with zero base and ignores

previous financial framework completely.

Advantages

Facilitates removal of unproductive activities from business operations and thereby

facilitates efficiency

It provides accurate view of financial aspects through identifying effectual ways of

performing operations (Zero based budgeting advantages and disadvantages, 2019).

Facilitates co-ordination and communication within business unit by allocating resources

efficiently.

Disadvantages

Highly time consuming process because each item of budget is revised and evaluated

Expensive in nature because firm needs to conduct training session for personnel

regarding the understanding of such budget.

High manpower is required because at every level activities are identified and evaluated

Cash budget

9

In order to develop budget according to ABC individual must have deep understanding

about every functional area of business.

High complex due to the inclusion of various activities in operations

For drafting budget as per ABC business unit needs to appoint top and trained officials

for conducting analysis. This in turn imposes high cost in front of company.

Zero based budgeting

ABC can develop competent financial framework by undertaking such budgeting system.

Moreover, it emphasizes on making assessment of income and expenses according to the

activities that need to be performed during the specified period. In this, business unit makes

focus on identifying alternative ways for performing activities. In this, all the expenses and

income are clearly justified. Such budgeting framework starts with zero base and ignores

previous financial framework completely.

Advantages

Facilitates removal of unproductive activities from business operations and thereby

facilitates efficiency

It provides accurate view of financial aspects through identifying effectual ways of

performing operations (Zero based budgeting advantages and disadvantages, 2019).

Facilitates co-ordination and communication within business unit by allocating resources

efficiently.

Disadvantages

Highly time consuming process because each item of budget is revised and evaluated

Expensive in nature because firm needs to conduct training session for personnel

regarding the understanding of such budget.

High manpower is required because at every level activities are identified and evaluated

Cash budget

9

This budgeting framework contains both cash inflows and outflows associated wit

business activities pertaining to the specific time.

Advantages

Helps in assessing whether cash balance is sufficient for fulfilling obligations or not.

Gives clear indication to the company in relation to allocating resources in the productive

activities.

It provides standards which can be used by ABC for analyzing variances. In other words,

by doing comparison of actual performance in against to the standards business unit can

identify areas where improvements are needed (What Are the Benefits of a Cash

Budget?.2019)

Disadvantages

It is based on estimation rather than reality

Lack of flexibility limits its significance

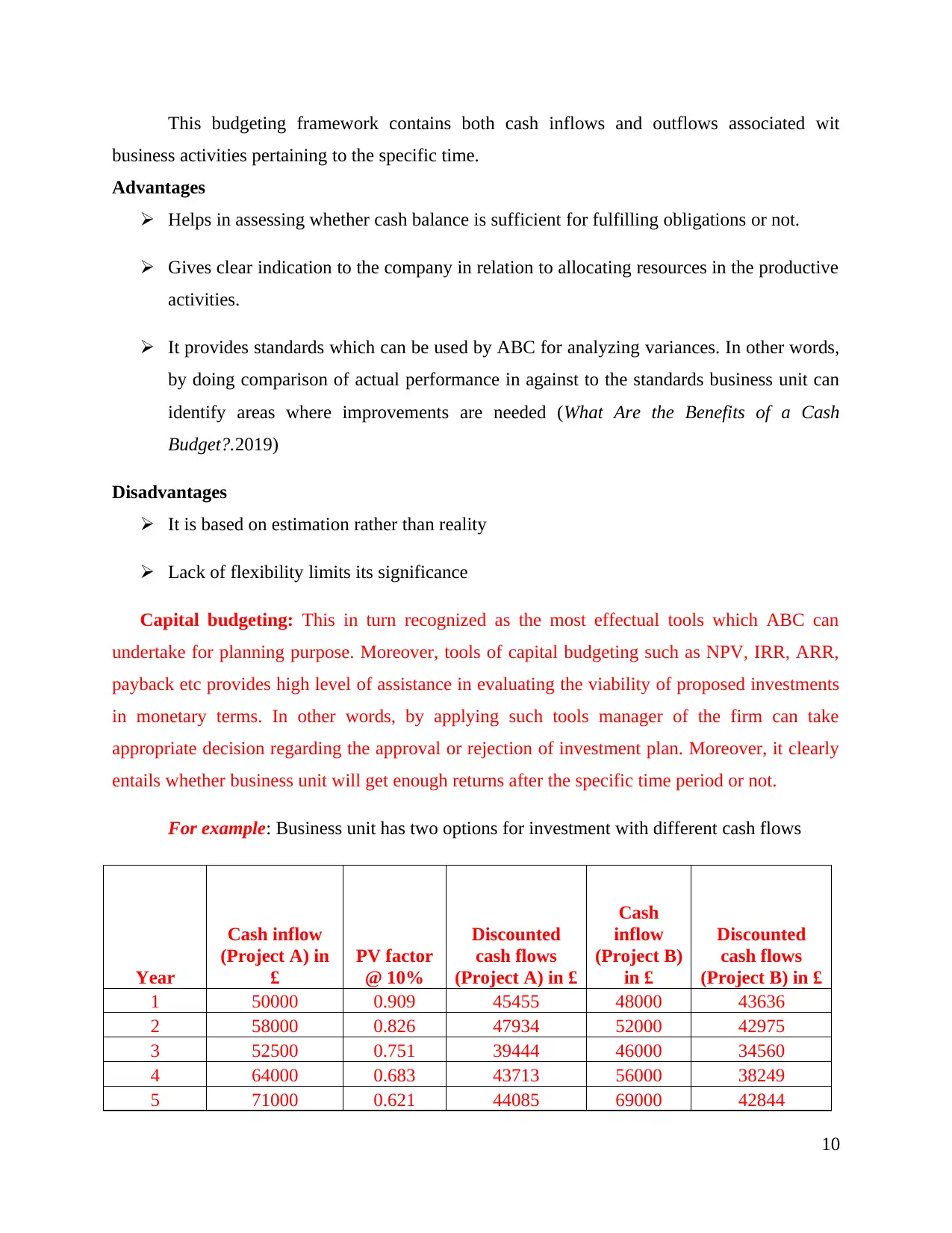

Capital budgeting: This in turn recognized as the most effectual tools which ABC can

undertake for planning purpose. Moreover, tools of capital budgeting such as NPV, IRR, ARR,

payback etc provides high level of assistance in evaluating the viability of proposed investments

in monetary terms. In other words, by applying such tools manager of the firm can take

appropriate decision regarding the approval or rejection of investment plan. Moreover, it clearly

entails whether business unit will get enough returns after the specific time period or not.

For example: Business unit has two options for investment with different cash flows

Year

Cash inflow

(Project A) in

£

PV factor

@ 10%

Discounted

cash flows

(Project A) in £

Cash

inflow

(Project B)

in £

Discounted

cash flows

(Project B) in £

1 50000 0.909 45455 48000 43636

2 58000 0.826 47934 52000 42975

3 52500 0.751 39444 46000 34560

4 64000 0.683 43713 56000 38249

5 71000 0.621 44085 69000 42844

10

business activities pertaining to the specific time.

Advantages

Helps in assessing whether cash balance is sufficient for fulfilling obligations or not.

Gives clear indication to the company in relation to allocating resources in the productive

activities.

It provides standards which can be used by ABC for analyzing variances. In other words,

by doing comparison of actual performance in against to the standards business unit can

identify areas where improvements are needed (What Are the Benefits of a Cash

Budget?.2019)

Disadvantages

It is based on estimation rather than reality

Lack of flexibility limits its significance

Capital budgeting: This in turn recognized as the most effectual tools which ABC can

undertake for planning purpose. Moreover, tools of capital budgeting such as NPV, IRR, ARR,

payback etc provides high level of assistance in evaluating the viability of proposed investments

in monetary terms. In other words, by applying such tools manager of the firm can take

appropriate decision regarding the approval or rejection of investment plan. Moreover, it clearly

entails whether business unit will get enough returns after the specific time period or not.

For example: Business unit has two options for investment with different cash flows

Year

Cash inflow

(Project A) in

£

PV factor

@ 10%

Discounted

cash flows

(Project A) in £

Cash

inflow

(Project B)

in £

Discounted

cash flows

(Project B) in £

1 50000 0.909 45455 48000 43636

2 58000 0.826 47934 52000 42975

3 52500 0.751 39444 46000 34560

4 64000 0.683 43713 56000 38249

5 71000 0.621 44085 69000 42844

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.